Customizable Invoice Template with Your Logo for a Professional Touch

In today’s competitive market, it’s essential for businesses to present themselves professionally at every step, including the way they manage transactions. One simple yet effective way to achieve this is by customizing the documents you send to clients. A well-designed, personalized document helps establish credibility and reinforces your brand identity.

By integrating personalized design elements, businesses can make these documents more memorable. Including distinctive visual elements that reflect your brand’s unique style not only enhances professionalism but also builds trust with clients. It’s an opportunity to stand out while maintaining clarity and consistency in all communications.

Whether you are a freelancer or a large corporation, the right visual presentation can elevate the impact of your communication. With just a few design adjustments, you can transform a basic form into a powerful tool for strengthening your brand and improving client relationships.

Why Use an Invoice Template with Logo

Customizing your business documents can significantly enhance your professional image. By incorporating unique design elements, you not only create a visually appealing appearance but also establish a clear connection with your brand. When clients receive such documents, they instantly recognize your business, which helps build trust and reinforce your identity in the market.

Benefits of Personalization

Personalized designs convey attention to detail and professionalism. These custom documents set your business apart from others by creating a lasting impression on clients. A well-crafted design helps your business look more organized and trustworthy, ultimately fostering stronger client relationships.

Enhancing Brand Recognition

When your visual identity is consistent across all client-facing materials, it enhances recognition and makes your brand more memorable. This consistency helps ensure that your business is easily identified in a crowded market, which can lead to more opportunities for growth and client retention.

| Benefit | Impact |

|---|---|

| Professional Appearance | Builds trust and credibility |

| Brand Consistency | Improves recognition and recall |

| Clear Communication | Enhances the overall client experience |

Benefits of Personalized Invoices

Incorporating unique design elements into business documents can have a profound effect on your company’s image. Customizing your forms not only makes them more visually appealing but also strengthens your brand’s identity. These personalized documents create a lasting impression on clients, which can lead to increased trust and a more professional reputation.

Enhanced Brand Recognition: A well-designed document that reflects your brand’s colors, typography, and overall aesthetic ensures your business is easily identifiable. This consistency across all communications makes it easier for clients to remember your company, fostering loyalty and reinforcing brand recall.

Improved Client Perception: Personalized forms convey professionalism and attention to detail. Clients are more likely to view your business as organized and reliable, leading to stronger relationships and an increased sense of trust. The effort put into creating custom documents shows that you care about quality and the overall client experience.

Streamlined Business Operations: Custom designs can also make your documentation process more efficient. With a consistent structure, you can easily manage and organize your records, saving time and reducing errors. Additionally, a standardized layout ensures that all necessary information is included, eliminating confusion or omissions.

Overall, personalized designs help businesses look more credible, improve client interactions, and streamline internal processes, making them an essential part of any professional communication strategy.

How to Choose the Right Template

Selecting the right design for your business documents is crucial for maintaining a professional appearance and conveying the right message to your clients. The layout you choose should reflect your brand’s identity while also being functional and easy to understand. It’s important to consider both the aesthetic and practical aspects of the design to ensure it meets the needs of your business and impresses your clients.

Consider Your Brand Identity

Consistency is key. Your selected design should align with your brand’s visual elements, such as color scheme, fonts, and overall style. This ensures that all client-facing materials, from business cards to contracts, present a cohesive image. When selecting a design, ask yourself if it complements your logo, website, and other marketing materials. A unified look will make your business more recognizable and professional.

Focus on Functionality

Simplicity and clarity are essential when choosing the right format. The design should prioritize ease of use, ensuring that all critical details are easy to read and understand. Look for a layout that clearly separates different sections, such as client information, service details, and payment terms. Additionally, the format should be compatible with your preferred software, so you can easily edit and update the content when needed.

In the end, choosing a design that reflects your brand while offering clear and organized information will not only help maintain a professional image but also improve the client experience.

Customizing Your Invoice Design

Creating a personalized design for your business documents allows you to reflect your unique brand identity while maintaining a professional appearance. By adjusting the layout and incorporating specific elements, you can ensure that your materials are both visually appealing and aligned with your company’s image. The right design not only improves the document’s aesthetics but also enhances the overall client experience.

Choosing the Right Color Scheme: Colors play a significant role in shaping perceptions. Select hues that complement your brand’s color palette to maintain consistency across all materials. Ensure that the colors used are not only visually pleasing but also functional. For example, a light background with dark text is easier to read and more professional than a dark background with light text.

Incorporating Essential Information: Personalization goes beyond visual elements. Make sure that key details, such as your business name, contact information, and payment terms, are prominently displayed. Adding these elements in a clear and organized manner enhances readability and ensures that clients can quickly access important information without confusion.

By customizing your document design, you ensure that it reflects your brand’s personality while effectively communicating all necessary details to your clients. A well-designed document can leave a lasting impression and reinforce your professionalism.

Logo Placement Tips for Invoices

Proper placement of your brand’s visual mark on business documents is crucial for both aesthetic appeal and brand recognition. Where you position this symbol can impact the overall look and feel of the document, ensuring that it stands out without overwhelming the layout. A well-placed mark helps reinforce your identity while keeping the document organized and easy to read.

Best Placement Options

Top-left corner: Placing your visual symbol in the top-left corner is a traditional yet effective choice. It ensures that your branding is one of the first things clients see without distracting from the main content. This spot also provides balance, especially for documents with a clear structure.

Top-center position: Positioning your brand mark in the center at the top is a bold approach, ensuring high visibility. This placement works well if you want to make a strong visual impact right away. However, it should be balanced with enough white space around it to maintain a clean, professional look.

What to Avoid

Bottom corners: While placing your visual mark at the bottom corners might seem like a good idea, it can reduce visibility. Since most people’s eyes are drawn to the top of a page first, this location may make it harder for clients to identify your brand quickly.

| Placement | Benefit |

|---|---|

| Top-left corner | Subtle and balanced, ensures visibility |

| Top-center | Bold, makes a strong visual impact |

| Bottom corners | Less visible, less effective |

In the end, finding the right spot for your brand mark depends on the layout and tone of your documents. Whether you choose a classic or bold placement, ensure it complements the rest of the design while keeping the overall look clean and professional.

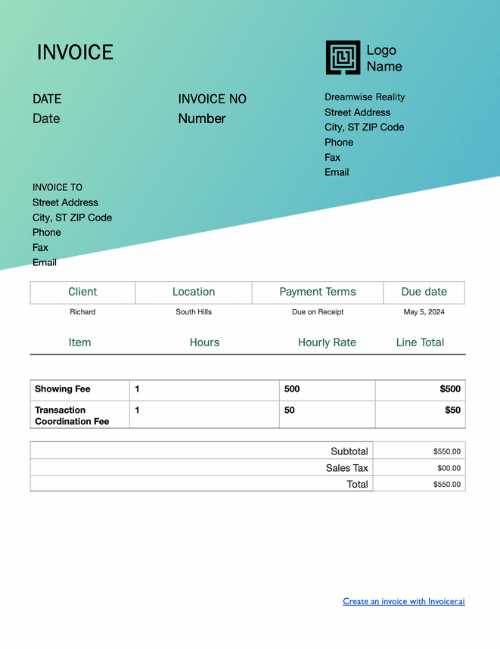

Essential Elements of a Professional Invoice

To maintain a polished and professional appearance, it’s important to ensure that your business documents contain all necessary details in a clear, organized manner. A well-structured document not only promotes transparency but also helps streamline your processes and fosters trust with your clients. Each section should serve a specific purpose, making it easy for both parties to understand and refer to the relevant information.

Here are the key components that should be included:

| Element | Description |

|---|---|

| Business Details | Include your company name, contact information, and address for identification purposes. |

| Client Information | Clearly list the client’s name, company (if applicable), and contact details. |

| Unique Reference Number | Assign a unique identifier to each document to keep track of transactions easily. |

| Service Description | Provide a detailed list of the services or products provided, including quantities, rates, and individual costs. |

| Total Amount Due | Clearly indicate the final amount owed, including any taxes or additional fees. |

| Payment Terms | State the due date, acceptable payment methods, and any late fees or discounts for early payment. |

Clarity and completeness in each of these sections will ensure that your client understands exactly what is expected and when, reducing the likelihood of confusion or disputes. A well-crafted document reflects professionalism and can help streamline business operations, making the overall process more efficient for both parties.

Free vs Paid Invoice Templates

When it comes to selecting a design for your business documents, one of the key decisions is whether to choose a free or premium option. Both types offer their own advantages and drawbacks, depending on your needs and the level of customization you require. While free designs can be a good starting point, paid solutions often offer more advanced features and flexibility that could be worth the investment for a growing business.

Advantages of Free Designs

Cost-effective: Free designs provide an accessible way to start creating professional-looking documents without any upfront costs. They are ideal for small businesses, freelancers, or startups with tight budgets. Many free resources are available online, allowing you to quickly download and use them for immediate needs.

Simple and easy to use: Free designs are often straightforward, providing a basic structure that can be easily filled out and customized. They are perfect for businesses that don’t require advanced features and just need a simple layout to get started.

Benefits of Paid Solutions

Customization and flexibility: Premium options often provide a much higher degree of customization, allowing you to tailor each document to better align with your brand’s identity. Paid designs also tend to offer more advanced features, such as automated calculations, integration with accounting software, and multiple format options.

Professional appeal: Paid resources typically offer polished, high-quality designs that help elevate the overall look of your documents. These designs often come with professional-grade elements like custom fonts, color schemes, and more sophisticated layouts, helping you stand out and leave a positive impression on clients.

Choosing between free and paid options depends on your business’s unique needs. If you require basic functionality and have limited resources, free designs may be a good fit. However, for more extensive customization and a polished, professional appearance, investing in a paid solution can pay off in the long run.

Best Software for Custom Invoices

When creating personalized documents for your business, the right software can make a significant difference in both efficiency and design quality. The ideal tool should not only allow for easy customization but also streamline the process, providing you with flexibility and saving you time. Several programs are available that cater to different needs, whether you’re looking for simple solutions or more advanced features.

Top Tools for Easy Customization

Canva: Known for its user-friendly interface, Canva allows you to create stunning documents with ease. It offers a wide range of templates, fonts, and design elements that can be customized to fit your brand’s style. Canva’s drag-and-drop features make it perfect for users with no design experience who want to quickly create professional documents.

Zoho Invoice: This cloud-based software offers extensive customization options, including the ability to add custom fields, select from a variety of designs, and integrate your branding elements. Zoho Invoice also provides automated reminders and invoice tracking, making it a great option for small to medium-sized businesses.

Advanced Solutions for Larger Businesses

QuickBooks: QuickBooks offers a robust suite of features, including customizable document designs, automated billing, and integration with accounting and finance systems. It’s ideal for businesses that need a more comprehensive solution that combines document creation with financial management.

FreshBooks: This software is designed to make invoicing easy while offering customization options that cater to professional branding. FreshBooks also includes features such as time tracking, client management, and expense tracking, making it a great choice for freelancers and small businesses looking for an all-in-one solution.

The right software can simplify your document creation process while ensuring that your business looks polished and professional. Choose a tool that suits your specific needs and level of expertise to streamline your workflow and improve client interactions.

How to Add a Logo to Templates

Incorporating your brand’s visual mark into your business documents adds a personal touch and reinforces your company identity. The process of including this element into your designs is straightforward and can be done through various tools and methods, depending on the software you use. Whether you are working with a pre-made layout or starting from scratch, placing your visual symbol correctly ensures it enhances your document’s overall professionalism.

Steps for Adding a Symbol to Your Document

Step 1: Choose the correct file format for your symbol. Ideally, you should use a high-quality image file (such as PNG or SVG) to ensure clarity and avoid pixelation. Vector files (like SVG) are recommended because they maintain quality at any size.

Step 2: Open your document editor and locate the section where you want to place the image. It is often best to position the symbol near the top, either in the center or on the left side, depending on the layout of your document.

Step 3: Insert the image. Most design and document-editing tools have an option to upload or insert images. Once your image is in place, resize it proportionally to fit well with the surrounding text and layout.

Tips for Proper Placement

Alignment: Ensure that your visual mark is aligned with other elements such as your company name, contact details, and other key information. Misalignment can create a cluttered look and detract from the professionalism of the document.

Spacing: Leave enough white space around the visual symbol to allow it to stand out without overwhelming the rest of the content. This helps maintain a clean and balanced design.

| Placement | Tip | |||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Top-left corner |

| Solution | Key Feature |

|---|---|

| Microsoft Word or Google Docs | Simple to use, widely accessible, customizable design options |

| Wave Accounting | Free and easy-to-use online tool for businesses with basic needs |

| Zoho Invoice | Customizable layout, integrates with other business management tools |

| FreshBooks | Professional templates, simple interface, and automatic billing features |

Flexibility: Many free and low-cost solutions offer flexible customization options, allowing you to tailor the design to match your brand identity. By including your company’s colors, fonts, and other design elements, you can maintain consistency across all your business documents.

Efficiency: Ready-made forms can save valuable time. They simplify the process of sending out payment requests and tracking transactions. Automated features in paid options can help you stay organized by sending reminders and tracking overdue payments.

Whether you choose a free or premium solution, having a streamlined, professional-looking document for your business is essential. The right layout ensures clarity for both you and your clients, helping build trust and improving your overall financial operations.

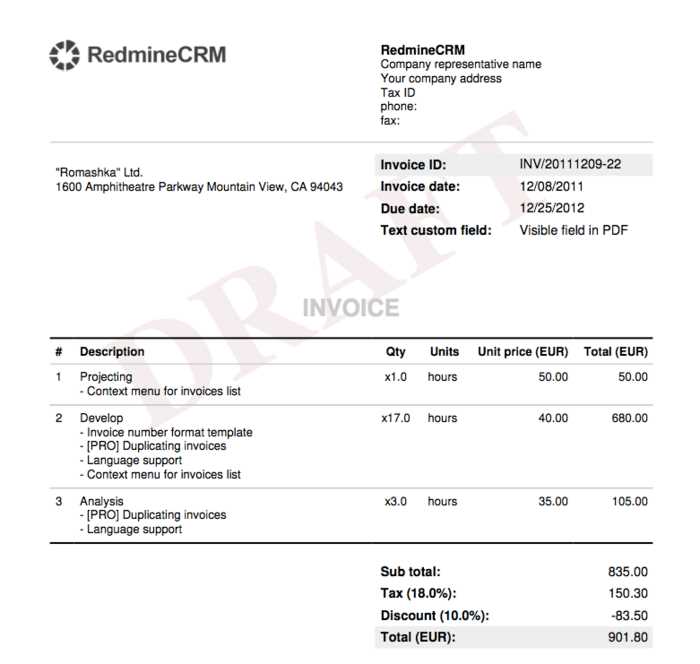

Creating Invoices for Different Industries

Each industry has its own unique requirements when it comes to creating professional documents for payment. Whether you’re in retail, freelance services, construction, or hospitality, understanding the specific needs of your sector can help you design forms that are both effective and tailored to your clients. Customizing your documents according to industry standards ensures clarity and promotes smoother transactions.

Industry-Specific Requirements

Retail: For retail businesses, clear product descriptions, quantities, and prices are essential. You should also include sales tax information and any potential discounts. A clean, organized layout helps customers easily review their purchases, and integrating your brand’s visual identity adds professionalism.

Freelance Services: Freelancers need to include detailed descriptions of the work performed, hourly rates (if applicable), and payment terms. It’s also common to provide a breakdown of services, along with clear due dates, as these documents often serve as a formal contract for payment.

Key Elements Across Industries

Construction: For construction businesses, invoices should include materials used, hours worked, and any subcontractor charges. It’s also important to outline the progress of a project, so clients are clear on what work has been completed and what remains outstanding.

Hospitality: In the hospitality sector, clear itemization of services such as room charges, food, and additional amenities is critical. Be sure to include any taxes or service fees, and use a simple, easy-to-read format for the convenience of the client.

| Industry | Key Features |

|---|---|

| Retail | Product details, quantities, taxes, and discounts |

| Freelance | Hourly rates, service breakdowns, and clear payment terms |

| Construction | Materials, labor hours, project progress |

| Hospitality | Room charges, food services, taxes, and fees |

By customizing your documents based on industry standards, you ensure they meet the needs of your clients and make your business appear more professional. This attention to detail not only streamlines the payment process but also builds trust and strengthens relationships with your customers.

Streamlining Your Billing Process

Efficient billing is essential for maintaining smooth operations in any business. A streamlined payment system reduces the chances of errors, speeds up the collection of payments, and helps establish trust with clients. By optimizing the way you create, send, and manage your payment requests, you can save time, avoid confusion, and ensure timely payments.

Automating Key Steps

Automated Reminders: One of the most effective ways to streamline the billing process is by setting up automated reminders for clients. These can be scheduled to alert customers of upcoming or overdue payments. This saves you time while also reducing the chances of forgetting to follow up.

Recurring Payments: For businesses that offer subscription services or regular work, automating recurring payments can significantly reduce the manual effort required. Set up an automated system that generates and sends payment requests at regular intervals, ensuring timely and consistent cash flow.

Leveraging Software for Efficiency

Integrated Tools: Using accounting or billing software that integrates with other business management tools (such as CRM or project management software) can save a lot of time. These tools can automatically generate payment requests based on project completion or hours worked, and even track payment status.

Customizable Formats: Most modern platforms allow you to create customizable documents that include your business details, payment terms, and branding. This helps maintain a professional look and feel without the need for repetitive manual work.

By automating routine tasks, integrating software, and designing clear, easy-to-follow payment requests, you can simplify your billing process and focus more on growing your business rather than managing paperwork. A streamlined system not only boosts your efficiency but also improves client satisfaction by making the process smooth and predictable.

Legal Requirements for Invoices

When creating formal documents for billing purposes, it’s crucial to ensure compliance with local laws and regulations. Various jurisdictions require specific details to be included in these documents to protect both businesses and consumers. Failing to adhere to legal requirements can lead to disputes, penalties, or delayed payments. Understanding the essential legal components can help your business remain compliant and reduce the risk of errors.

Key Legal Elements to Include

Depending on your location, there may be specific requirements for what must be included in each billing document. Here are the most common elements that are legally required in many regions:

- Business Information: Your business name, address, and tax identification number (TIN) are typically required. This identifies your company in the transaction and ensures the document is recognized by tax authorities.

- Client Information: Including the client’s full name and address is often necessary for legal documentation purposes.

- Unique Identifier: Each document should have a unique reference number or code. This helps with record-keeping and tracking.

- Date of Issue: The date the document is created and issued is usually required for accurate record-keeping and tax reporting.

- Description of Goods/Services: A clear breakdown of the products or services provided is crucial. This should include quantities, unit prices, and descriptions.

- Payment Terms: This section typically includes due dates, late fees (if applicable), and accepted payment methods.

- Tax Information: If applicable, tax rates, total tax amount, and the total sum after tax should be specified.

Regional Variations

While the above points cover general requirements, different countries or states may have additional or slightly different rules. Some of the common variations include:

- VAT/GST Numbers: In some regions, businesses are required to display their VAT or GST registration number.

- Currency: Depending on the location, the currency used in the transaction must be clearly specified.

- Legal Terms: Certain jurisdictions may require specific legal phrases or disclaimers to protect both parties in the transaction.

- Electronic Invoices: In some countries, businesses may need to comply with e-invoicing regulations, ensuring that electronic records meet certain standards of security and validity.

By ensuring that your formal documents include all required legal details, you protect your business from potential legal issues while making sure your clients have all the necessary information for their records. Stay informed about the regulations in your area to ensure compliance a

How to Export and Send Invoices

Once your billing document is ready, it’s essential to understand how to efficiently export and send it to your clients. This process not only ensures smooth transactions but also helps maintain professionalism and record-keeping. Knowing the best formats and tools for exporting, along with the most secure and convenient methods for delivery, can save time and reduce errors.

Choosing the Right Format for Export

The first step in sending your billing request is choosing the correct format. The right format depends on your needs, the software you’re using, and your client’s preferences. Here are the most commonly used options:

- PDF: This is the most widely used format for sending formal documents. It preserves the layout and design, making it ideal for professional presentation. Most accounting software and tools allow you to export documents directly as PDFs.

- Excel or CSV: If your client needs to work with the document data, exporting it as an Excel file or CSV can allow them to easily manipulate numbers or update records.

- Word: In some cases, you may choose to export your document as a Word file, especially if the document requires further editing or customization before sending it to the client.

Sending Documents Securely

Once you’ve exported the document, the next step is delivering it securely to your client. It’s important to ensure that the process is both reliable and professional. Here are some best practices for sending your documents:

- Email: The most common method for sending business documents is via email. Ensure that the document is attached in a secure format (such as PDF) and that the email contains a clear, polite message. Be sure to double-check the recipient’s email address to avoid sending it to the wrong person.

- Cloud Storage: If the document is large or contains sensitive information, consider using cloud storage services like Google Drive or Dropbox. You can upload the document and share a secure link with your client, ensuring that the file is protected with access permissions.

- Invoicing Software: Many invoicing platforms allow you to send payment requests directly to your clients from within the software. These platforms often track the status of the document, making it easier for you to follow up.

Tracking and Managing Sent Documents

Once the document has been sent, it’s important to track its status to ensure that it has been received and acted upon. Some software solutions provide features like:

- Read Receipts: Some platforms enable you to track whether the recipient has opened the document. This fe

Common Mistakes to Avoid in Invoices

When preparing formal documents for billing purposes, it’s easy to overlook small details that can have a significant impact on your business. Mistakes in these documents can lead to delays in payment, misunderstandings with clients, or even legal issues. By being aware of common errors and taking steps to avoid them, you can ensure that your payment requests are clear, accurate, and professional.

1. Missing or Incorrect Contact Information

Accurate Details: One of the most common errors is failing to include complete contact information, either for your business or your client. Always ensure that the full names, addresses, and contact details are included. Missing or incorrect information can cause delays and create confusion, especially when payments are processed or when a client needs to contact you.

2. Not Including a Unique Reference Number

Tracking and Record-Keeping: A reference number is essential for tracking and organizing your payment requests. Without a unique identifier, both you and your client might have trouble locating a specific document in the future. This can lead to payment disputes or errors in record-keeping. Always assign a unique number to each document to simplify tracking.

3. Incorrect Calculation of Totals

Double-Check Your Math: Simple errors in adding totals, calculating taxes, or applying discounts can lead to serious misunderstandings and delayed payments. Always double-check the math and, if possible, use automated tools or formulas in your software to avoid human errors. Clear breakdowns of all costs can also help clients easily verify the amounts.

4. Lack of Clear Payment Terms

Clarity is Key: If payment terms are unclear, clients may delay payment or misunderstand when the funds are due. Always include a clear payment due date, specify the payment methods you accept, and outline any penalties for late payments. This helps set clear expectations for both parties.

5. Failure to Account for Taxes

Tax Compliance: Not including taxes or failing to calculate them correctly is a common mistake that can lead to compliance issues. Depending on your location, certain tax rates may apply. Be sure to research and apply the correct rates, and specify the tax amounts separately if required by law. Not including taxes, or including the wrong tax rate, can create confusion and legal complications.

6. Missing Due Dates

Clear Deadlines: Without a clearly stated due date, clients

How to Update Your Invoice Templates

As your business evolves, it’s important to regularly review and update the documents you use for requesting payments. These changes can be driven by new services or products, shifts in payment terms, or updates in legal requirements. Keeping your payment requests up-to-date not only ensures compliance but also helps maintain a professional and organized appearance in the eyes of your clients.

1. Review Your Business Information

Ensure Accuracy: Your contact information, business name, and tax identification number should be updated whenever there is a change. If you have relocated, rebranded, or made other adjustments to your business identity, make sure these updates are reflected in all your documents. This prevents confusion and helps maintain your professional image.

2. Update Payment Terms and Conditions

Reflect New Policies: If you’ve adjusted your payment terms, such as the due date, discounts for early payment, or penalties for late payments, be sure to incorporate these changes into your documents. Updating this section regularly ensures that both you and your clients are clear on the expectations and terms of the transaction.

3. Add or Modify Tax Information

Tax Compliance: As tax laws change, it’s important to update any relevant tax information. If you’ve expanded to new regions or countries, you may need to include different tax rates or other specific requirements. Make sure these updates are consistent across all your billing documents to avoid errors and ensure legal compliance.

4. Customize Your Design for Fresh Branding

Keep It Consistent: If your business undergoes a rebranding, be sure to update the design elements in your payment requests. This might include new color schemes, fonts, or layouts to reflect your updated branding. Consistency in design helps to reinforce your identity and makes your documents instantly recognizable to clients.

5. Add New Features or Services

Keep It Relevant: As your business grows, you may introduce new products, services, or pricing structures. These updates should be reflected in your billing documents, ensuring that clients have all the necessary information to make payments without confusion. A clear description of the new offerings will also help your clients understand what they are being charged for.

6. Test the Updated Versions

Ensure Functionality: Before you start sending out your updated pa

Boosting Client Trust with Professional Invoices

Establishing credibility with clients is essential for long-term business success. One of the simplest yet most effective ways to foster trust is through clear, well-structured payment documents. These documents are often the first formal interaction between your business and the client, and they can leave a lasting impression. When prepared professionally, they demonstrate attention to detail, reliability, and a commitment to quality–key elements that enhance client confidence.

1. Clear and Detailed Information

Transparency: A professional payment document should include all the necessary details in a clear and organized manner. This includes the full names and addresses of both parties, a detailed description of the goods or services provided, and an accurate breakdown of the costs. When clients can easily understand what they are being charged for, they feel more secure in their transaction.

2. Consistent Branding

Brand Recognition: Using a consistent and professional design across all payment requests helps reinforce your business’s branding and creates a sense of familiarity for your clients. This consistency builds trust by showing that your company is well-established and pays attention to every detail, no matter how small. Incorporating elements such as your company’s colors, fonts, and even the business name in a prominent position gives your document a polished look.

3. Professional Language and Tone

Clear Communication: The tone of your payment documents should be professional and courteous, reflecting your business’s professionalism. Avoid using overly casual language, and make sure to be polite and respectful in your wording. A positive and clear tone will show clients that you value their business and are committed to delivering high-quality service.

4. Payment Terms and Conditions

Setting Expectations: Clear payment terms help avoid misunderstandings and establish expectations upfront. Include important information such as payment deadlines, acceptable payment methods, and any applicable fees for late payments. Providing this transparency ensures that clients feel confident in the transaction, knowing exactly what to expect and when to pay.

5. Accuracy and Consistency

Minimizing Errors: Accuracy is crucial when preparing formal documents. Mistakes in pricing, contact details, or product descriptions can damage your reputation and cause confusion. Ensuring that all information is correct not only helps prevent disputes but also demonstrates that you take your work seriously. Doub