Examples of Invoice Templates to Simplify Your Billing Process

Managing financial transactions efficiently is crucial for any business. Having the right structure for documenting services or products provided ensures clarity and professionalism, which in turn fosters trust with clients. A well-organized structure helps both the provider and recipient keep track of payments and maintain accurate records.

There are various options available for customizing your billing documents to suit specific needs. These structures can range from simple and minimalistic designs to more detailed layouts that include additional information such as tax calculations, discounts, and payment terms. Regardless of the complexity, having a consistent format simplifies the process and reduces the chances of errors.

In this guide, we explore a variety of designs that can be easily adapted for different industries. Whether you’re a freelancer, small business owner, or running a larger enterprise, you’ll find structures that meet your requirements and help you streamline your financial communications. The goal is to provide clear, professional documents that make transactions smoother for both parties.

Examples of Invoice Templates for Businesses

For any business, having a reliable document to record transactions is essential for maintaining accurate financial records. Whether you are a small enterprise or a large corporation, choosing the right format to outline the products or services provided ensures clear communication and smooth payment processes.

There are several designs available that cater to different business needs. These formats can be customized with specific details to meet the requirements of various industries. Some businesses may need simple layouts, while others might require more comprehensive options that include extra fields for tax information, payment terms, or delivery details.

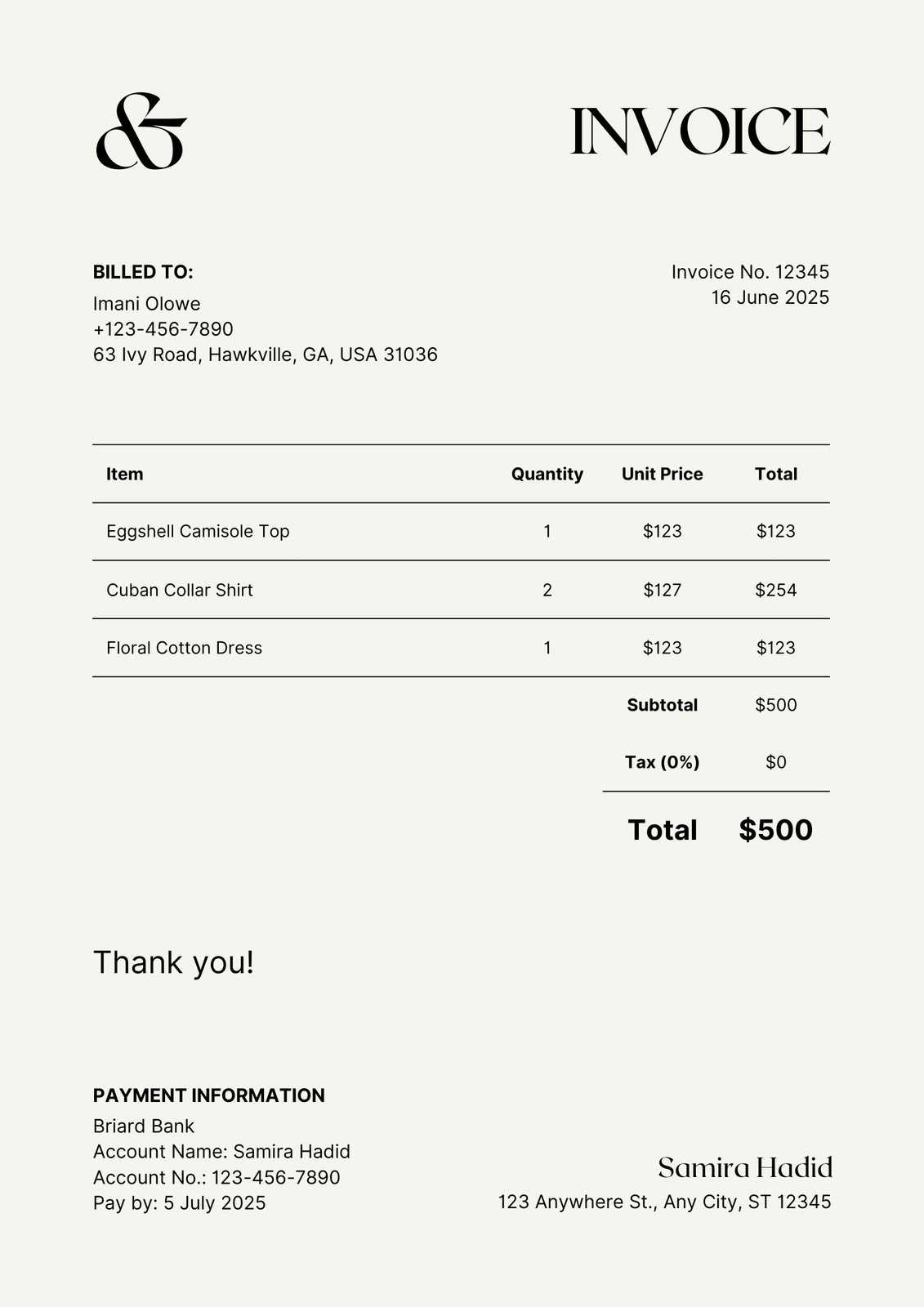

- Simple and Minimalist Format – Ideal for freelancers or small service-based businesses, focusing on the essential details without complexity.

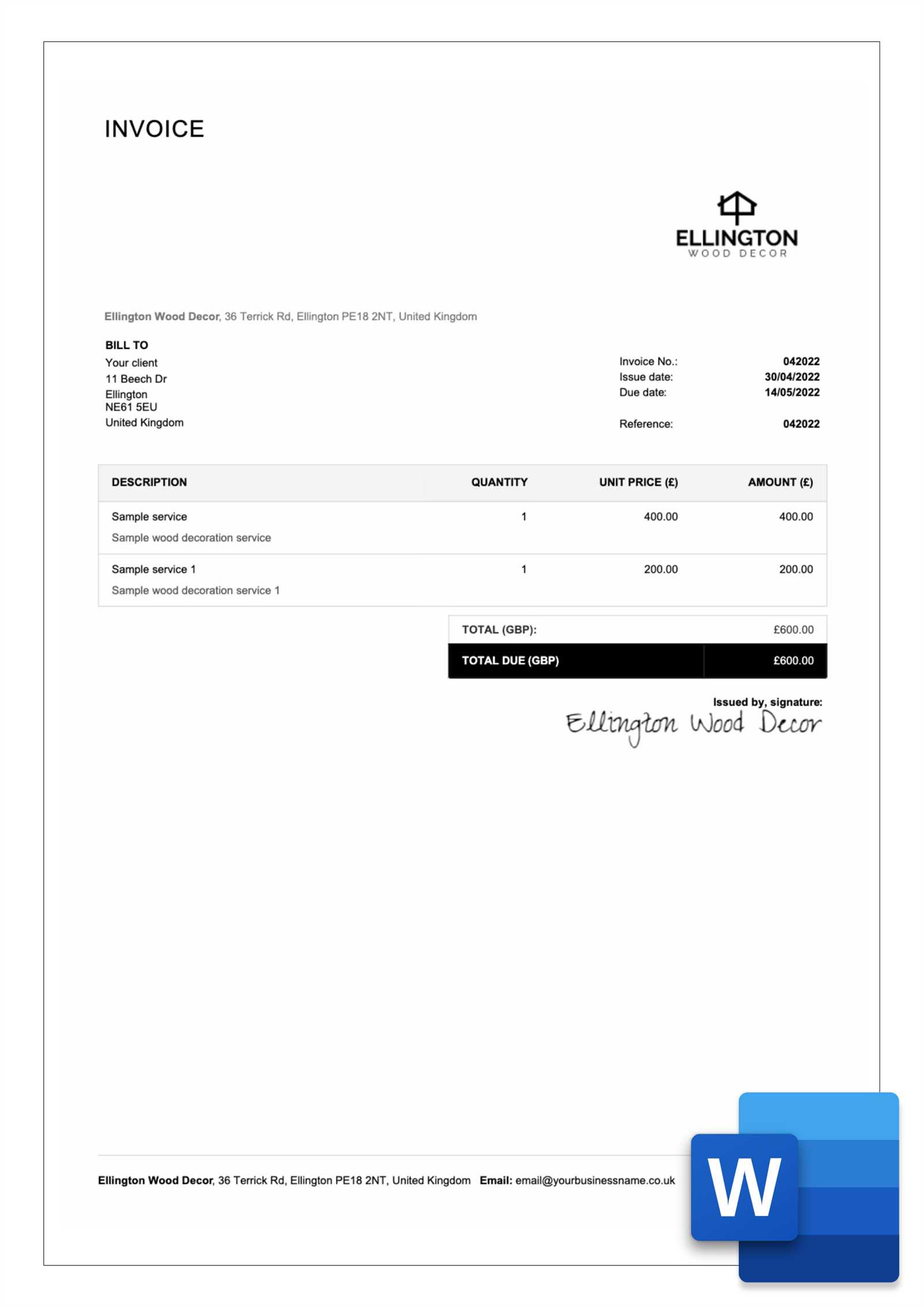

- Detailed Layout – Suitable for larger companies or those offering a wide range of products, with additional fields for item descriptions, taxes, and shipping information.

- Professional Design with Branding – Often used by businesses aiming to maintain a strong brand identity, incorporating logos, color schemes, and custom fonts.

- Digital Formats for Online Transactions – Perfect for e-commerce businesses, offering easy integration with online payment gateways and automated invoice generation.

- Customizable Fields for Industry-Specific Needs – Custom formats that allow specific adjustments for industries such as construction, consulting, or retail, ensuring all necessary information is captured.

Selecting the right format depends on the nature of your business, the level of detail required, and the preferred method of distribution. Whether it’s a basic document or a more advanced design, ensuring consistency and accuracy is key to maintaining professional relationships and a smooth billing process.

Simple Invoice Templates for Freelancers

Freelancers often require straightforward documents to bill clients for their work. These records should be clear and professional, detailing the services rendered and the corresponding amounts due. A clean, easy-to-understand format is essential for freelancers who need to quickly send out payment requests without unnecessary complexity.

For independent professionals, simplicity is key. The most effective layouts include only the necessary information, ensuring a smooth transaction process while still appearing polished and legitimate. Common elements include contact details, descriptions of services, dates, and total charges. These documents are designed to be completed quickly and easily, allowing freelancers to focus on their work instead of administrative tasks.

- Basic Design – Clean and functional, with space for service descriptions, hourly rates, or flat fees, ideal for freelancers offering single services or projects.

- Minimal Layout – Focuses on just the essential details like the client’s name, payment amount, and due date, making it perfect for one-time or small-scale jobs.

- Time-Based Format – Ideal for those who charge by the hour, this design includes sections for hours worked, hourly rate, and total amount due.

- Flat Fee Document – Suitable for freelancers who offer fixed-price services, including brief descriptions of deliverables and agreed-upon amounts.

With a simple and effective format, freelancers can maintain a professional image while ensuring their clients understand the details of the transaction. A streamlined design not only saves time but also helps ensure prompt payment for services rendered.

Customizable Templates for Small Enterprises

Small businesses often require flexible billing documents that can be adapted to various needs. These documents should allow for quick customization while still maintaining a professional appearance. The ability to adjust details such as product descriptions, pricing, and payment terms ensures that each document reflects the unique nature of the transaction.

For small enterprises, it is essential to use a format that can evolve with the business’s changing requirements. Customizable layouts enable businesses to include specific elements such as promotional discounts, tax rates, or recurring payments. With these adaptable structures, small business owners can streamline their processes without having to create new documents from scratch every time.

- Flexible Design – Easily adjustable fields for adding or removing service descriptions, product details, or custom pricing structures.

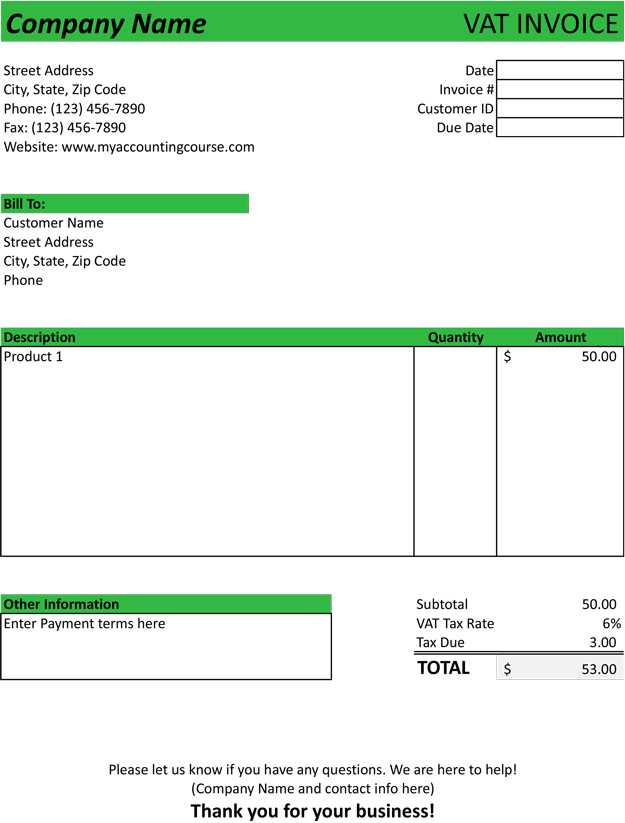

- Discount and Tax Fields – Space for including discounts, taxes, and other modifiers that apply to the transaction, allowing for greater precision in billing.

- Payment Terms Section – A customizable section for detailing payment due dates, methods of payment, and late fees, ensuring clarity in financial agreements.

- Recurring Billing Format – Ideal for subscription-based businesses, this layout allows for the addition of recurring charges and intervals.

With these adaptable designs, small enterprises can maintain consistency and professionalism while ensuring that each document accurately represents the terms of each agreement. Customizing billing records according to specific needs helps business owners stay organized and responsive to client requests.

Professional Invoice Designs for Large Companies

Large companies require sophisticated billing documents that reflect their scale and professionalism. These documents need to incorporate a variety of details, such as multiple items or services, client account information, payment terms, and tax calculations. A polished design not only enhances the company’s brand but also ensures smooth financial transactions.

For corporations, having a professional layout that is both comprehensive and visually appealing is crucial. The format should accommodate detailed information without becoming cluttered, ensuring that clients can easily understand the charges and payment conditions. Additionally, these designs often include company branding, such as logos, color schemes, and other elements that strengthen the company’s identity.

- Corporate Branding Integration – A polished design that includes logos, custom fonts, and brand colors to create a consistent and professional appearance.

- Detailed Itemization – Space for listing multiple products or services, with individual pricing, taxes, and totals for each item or category.

- Custom Payment Terms – Clear sections outlining payment deadlines, available payment methods, and penalties for late payments, providing transparency to clients.

- Tax Breakdown – Areas to list applicable tax rates, government fees, or other charges, ensuring compliance with local laws and regulations.

- Multi-Page Format – Ideal for businesses with extensive lists of services or large projects, this layout allows for multiple pages while maintaining a clean, structured design.

These sophisticated documents are essential for large businesses to maintain a professional image and ensure all transactional details are clearly communicated. By using a format that is both customizable and visually appealing, companies can enhance their relationships with clients while promoting efficient financial management.

How to Choose the Right Invoice Format

Selecting the correct format for your billing documents is crucial for maintaining clarity, professionalism, and efficiency. The ideal format will depend on factors such as the size of your business, the complexity of your transactions, and the level of detail required. A well-chosen format not only facilitates smooth payment processing but also strengthens your brand image.

When deciding on a layout, it is important to consider several key aspects. For example, businesses offering a wide variety of services or products might need more detailed formats with space for itemization and additional charges, while freelancers or small businesses may prefer a simpler, more straightforward design. Below is a table outlining some common formats and their key features to help guide your choice:

| Business Type | Recommended Layout | Key Features |

|---|---|---|

| Freelancers | Simple Layout | Basic details, hourly rate or flat fee, payment terms |

| Small Businesses | Flexible Design | Customizable fields, discounts, tax calculations |

| Large Corporations | Professional Format | Branding integration, detailed itemization, tax breakdown |

| Subscription Services | Recurring Billing Layout | Clear breakdown of recurring charges, payment frequency |

Choosing the right format involves balancing simplicity with functionality. It is essential to ensure that the format fits the nature of your business while offering all necessary details to avoid confusion. Consider how the document will be used and what your clients might expect to see, making sure to adapt the design as needed to meet their needs.

Free Invoice Templates for Quick Use

For those in need of fast and efficient billing solutions, free options are a valuable resource. These ready-to-use documents allow businesses to streamline their processes and generate professional records without the need for complicated setups. Whether you’re a freelancer or a small business owner, these free solutions can help you get started quickly and effectively.

Benefits of Using Free Billing Documents

Free billing documents provide an easy way to create professional records with minimal effort. They are especially helpful for those who need to send out documents immediately or don’t want to invest in custom-made solutions. These formats are typically simple, yet customizable enough to include the essential details like pricing, payment terms, and client information.

- Time-saving: Quickly fill in the necessary details and send them off to clients without wasting time on design.

- No Cost: Perfect for small businesses or freelancers looking to save on operational expenses.

- Easy to Use: Most free solutions are user-friendly, requiring no advanced knowledge of design or accounting software.

Where to Find Free Billing Documents

Many websites and platforms offer free templates that can be downloaded and customized to fit your specific needs. These resources can be especially beneficial when working with clients for the first time or during busy periods when you need to quickly generate accurate documents.

- Online platforms: Several websites provide downloadable files in various formats, including Word, Excel, and PDF.

- Accounting software: Some accounting tools offer free templates as part of their basic features.

- Cloud-based tools: Free templates can also be found on cloud platforms, offering real-time access from anywhere.

Utilizing free billing formats can help ensure timely payments while maintaining a professional approach without additional costs. With a bit of customization, these documents can be perfectly suited to your business needs.

Essential Features of an Invoice Template

When creating a document for billing purposes, there are several important elements that must be included to ensure clarity, professionalism, and effective communication with clients. These key features not only help ensure that all necessary details are covered but also promote smooth transactions and timely payments. A well-structured document serves as both a record for the client and a reminder for the business.

Key Elements to Include

- Business Information: Your company name, address, phone number, and email address should be clearly visible at the top of the document.

- Client Details: Always include the client’s full name, company name (if applicable), and contact information.

- Unique Identification Number: Each document should have a unique number to easily identify and reference it in the future.

- Date of Issue: Clearly state the date the document is issued to help track payment schedules.

- Payment Terms: Specify the agreed-upon payment terms, including the due date, late fees, or discounts for early payment.

Additional Useful Features

- Itemized List: Provide a breakdown of products or services provided, including quantities, individual prices, and total amounts.

- Tax Information: Include any relevant taxes or VAT charges for transparency and accuracy.

- Total Amount Due: Ensure the total due is prominently displayed to avoid confusion.

- Payment Methods: Clearly list the acceptable payment options (bank transfer, credit card, etc.) for client convenience.

Incorporating these essential features ensures that your documents are clear, professional, and comprehensive. This not only helps in maintaining good client relationships but also streamlines the payment process for both parties.

Editable Invoice Templates for Word and Excel

Customizable billing documents for popular office software like Word and Excel offer an efficient way to manage payments and maintain a professional appearance. These documents can be easily tailored to meet the specific needs of businesses, providing a flexible solution for different industries. Whether you prefer a simple layout or a more detailed one, these editable files allow for quick adjustments to fit each transaction.

Advantages of Using Word and Excel Formats

- Customization: Easily modify text, fields, and layouts to suit your business requirements or client preferences.

- Convenience: Word and Excel are widely accessible and familiar to most users, making them easy to use without the need for specialized software.

- Reusability: Save and reuse your files for different clients, maintaining consistency across your documents.

- Compatibility: These formats can be shared with clients through email or printed out, ensuring that everyone can access them with ease.

Features of Editable Documents

- Predefined Fields: Fields like name, date, and amounts are clearly labeled, making it simple to input the necessary details.

- Formula Support: Excel documents allow for automatic calculations, reducing the risk of errors in totaling amounts or applying taxes.

- Design Flexibility: Word documents provide a wide range of formatting options, allowing businesses to create professional-looking files with their unique branding.

- Ease of Sharing: Both formats allow for quick sharing via email or file transfer, making the process faster and more efficient.

Using editable billing documents in Word and Excel offers a quick, easy, and customizable solution for businesses to handle transactions professionally while saving time on formatting and design. With these documents, you can create accurate and personalized records in minutes.

Creating a Personalized Invoice Template

Designing a customized document to handle payments is essential for establishing a professional and cohesive business image. By incorporating specific elements tailored to your brand, you can create a personalized billing format that aligns with your business’s identity and workflow. A personalized approach ensures that all necessary information is included while maintaining clarity and ease of use for both you and your clients.

Key Elements for Personalization

- Branding: Incorporate your company logo, colors, and fonts to make the document reflect your business identity.

- Client Information: Include fields for client names, addresses, and contact details to keep each record organized.

- Itemized List: Add detailed descriptions of products or services provided, including quantity, unit price, and total amounts for each item.

- Terms and Conditions: Clearly state payment terms, including due dates, late fees, and preferred payment methods.

Steps to Create a Customized Billing Document

| Step | Description |

|---|---|

| 1. Choose a Format | Select a file format that suits your needs, such as a Word document, Excel spreadsheet, or PDF. |

| 2. Set Up Layout | Arrange sections for your business name, client details, services/products, and total amount to ensure easy readability. |

| 3. Customize Fields | Add editable fields to input specific details, such as payment terms, dates, and item descriptions. |

| 4. Include Additional Information | Consider adding a thank-you note, your contact details, and a return policy for a more personalized touch. |

| 5. Review and Save | Ensure that all information is correct, then save the document in an accessible format for future use. |

By following these steps and incorporating key details, you can create a fully personalized document that meets your business’s needs and maintains a professional image in every transaction.

Printable Invoice Templates for Offline Use

Having a printed version of your billing document can be crucial for businesses that operate without relying on digital systems. Whether you’re working on-site, in meetings, or simply prefer paper records, printed documents offer a tangible way to keep track of transactions. These physical formats allow for easy distribution and filing, ensuring that you can maintain records and deliver payment requests efficiently.

Benefits of Printable Billing Documents

- Accessibility: Printed formats allow you to keep hard copies of important financial records without relying on electronic devices.

- Convenience: Perfect for face-to-face transactions, where sending electronic files may not be an option.

- Record Keeping: Paper records provide a reliable backup in case of technical issues with digital files or systems.

- Professionalism: Physical documents can be presented in a neat, organized manner that leaves a lasting impression on clients.

Creating Printable Billing Formats

To create an efficient, printable document for offline use, follow these key steps:

- Choose the Right Software: Use programs like Microsoft Word or Excel, which allow easy creation and customization of print-friendly documents.

- Set Paper Size: Choose a standard paper size (such as A4 or Letter) to ensure your document prints correctly on most printers.

- Design Layout: Organize the content logically, such as business and client information, itemized products or services, and payment details.

- Include Required Information: Be sure to include payment terms, due dates, and clear descriptions of the goods or services provided.

- Optimize for Print: Adjust margins, font sizes, and spacing to ensure everything fits neatly on the page without overcrowding.

By following these steps, businesses can create professional and efficient printed documents that are easy to distribute and maintain for offline use.

Invoices for E-commerce Businesses

For online stores and digital businesses, creating clear and professional billing statements is essential for smooth transactions. These documents not only help businesses track sales and payments but also ensure customers have all the necessary details about their purchases. With the rise of e-commerce, a reliable and efficient billing system is crucial for maintaining customer trust and ensuring financial accuracy.

Key Components of E-commerce Billing Documents

- Order Details: A comprehensive list of purchased items, including product names, quantities, and prices.

- Transaction Information: Include order numbers, dates, and payment methods used to make the purchase.

- Shipping Information: Provide details such as delivery address, shipping method, and tracking numbers if applicable.

- Tax Breakdown: Ensure clear separation of tax rates and amounts, especially for businesses operating across different regions or countries.

- Return and Refund Policies: Clearly outline the terms for returns, exchanges, or refunds in case of issues with the order.

How E-commerce Businesses Benefit from Proper Billing Documents

- Improved Customer Experience: Transparent and well-organized billing statements help customers feel confident in their purchases.

- Legal Protection: A detailed record of transactions can help protect both the business and the customer in case of disputes or audits.

- Streamlined Accounting: Accurate billing helps simplify the reconciliation of payments and inventory, allowing businesses to maintain better financial control.

- Brand Professionalism: Customizable and professional documents enhance the overall image of the e-commerce brand, increasing customer loyalty.

By integrating these essential elements, e-commerce businesses can create billing documents that not only fulfill legal and operational requirements but also foster trust and enhance the customer experience.

Digital Invoice Templates for Modern Payments

With the rapid growth of digital transactions, businesses are increasingly moving towards automated systems for billing. These electronic documents offer a streamlined way to manage sales, payments, and financial records. By adopting digital solutions, businesses can ensure faster processing, minimize errors, and provide a more efficient experience for both themselves and their clients.

Advantages of Using Digital Billing Documents

- Speed and Efficiency: Digital formats enable faster delivery and easier tracking of transactions, reducing administrative time.

- Automated Updates: These documents can automatically calculate totals, taxes, and discounts, ensuring accuracy every time.

- Easy Integration: Digital systems can easily integrate with accounting software, enabling seamless financial management.

- Environmental Benefits: Going paperless reduces waste and contributes to a more sustainable business practice.

- Secure Transactions: Modern digital systems use encryption to protect sensitive financial data, minimizing the risk of fraud or errors.

Customizing Digital Documents for Your Business Needs

- Branding: Customizable elements allow businesses to add logos, colors, and other design features to maintain a professional appearance.

- Payment Methods: Digital forms can support a variety of payment methods, including credit cards, digital wallets, and bank transfers.

- Notifications: Automated notifications can alert customers when their documents are ready or when payments are due, improving communication.

By embracing digital solutions, businesses can not only improve the accuracy and speed of their transactions but also offer customers a modern, seamless payment experience.

Invoice Templates with Tax Calculation

For businesses that need to manage sales transactions and taxes, automated systems that calculate taxes directly on billing documents can save valuable time and reduce the risk of errors. These tools simplify the process of ensuring that the correct tax rates are applied to each sale, making it easier for businesses to remain compliant with tax regulations while also providing clear, accurate records for their customers.

Incorporating tax calculation into the design of these documents can be especially beneficial for businesses that operate in multiple regions with varying tax rates. By using this method, the final amount is adjusted automatically to include the correct taxes, streamlining the entire process from sale to payment.

Key Features of Tax-Enabled Billing Documents

- Automatic Tax Calculation: These systems automatically apply the correct tax percentage based on the region, product type, or service, ensuring accurate billing.

- Multiple Tax Rates: Allows for the inclusion of various tax rates for different regions or types of goods and services.

- Clear Breakdown: A detailed breakdown of the subtotal, tax, and total amount helps ensure transparency for customers.

- Compliance with Local Laws: Helps businesses stay in compliance with local tax laws by adjusting to new tax regulations automatically.

Example Layout for Tax Calculations

| Item Description | Quantity | Unit Price | Tax Rate | Tax Amount | Total |

|---|---|---|---|---|---|

| Product A | 2 | $50.00 | 10% | $10.00 | $110.00 |

| Service B | 1 | $100.00 | 5% | $5.00 | $105.00 |

| Total Amount | $215.00 | ||||

By integrating tax calculations into your sales documents, you can simplify your accounting process, ensure accurate records, and provide a more professional and efficient experience for your clients.

Incorporating Branding into Your Invoice

For businesses looking to maintain a consistent brand identity, it’s important that every communication, including billing documents, reflects their unique style. Customizing these documents with logos, brand colors, and fonts not only creates a professional appearance but also reinforces brand recognition with every transaction. Adding these personal touches ensures that customers associate the transaction with the company’s identity, promoting brand loyalty and trust.

Elements to Consider for Branding

- Logo: Displaying your logo at the top of the document makes it immediately recognizable and associates your business with the communication.

- Brand Colors: Incorporating your brand’s color palette throughout the document can create a cohesive look that aligns with your marketing materials.

- Custom Fonts: Using specific fonts that align with your brand’s design guidelines helps maintain consistency in all written communications.

- Tagline or Mission Statement: Adding a short tagline or business mission statement can provide context about your brand’s values and reinforce your message.

Practical Examples of Branding Elements

- Place your logo in the header section, making sure it’s clearly visible.

- Use your brand’s primary colors for headings, borders, and other prominent sections to visually tie the document to your brand identity.

- Ensure that any text, including the item description or payment terms, is in the same font family used on your website and other promotional materials.

By incorporating these elements into your business communications, you elevate the professionalism and consistency of your brand, while also creating a lasting impression on your customers.

Invoice Formats for Service Providers

For service-oriented businesses, creating a detailed and clear billing document is crucial for maintaining professionalism and ensuring timely payments. These documents should accurately represent the work performed, including the hours spent, services provided, and associated costs. A well-organized format helps clients easily understand what they are paying for, creating transparency and reducing the risk of disputes.

Key Elements for Service Providers

- Detailed Service Description: Clearly outline each service or task completed, ensuring that clients understand exactly what they are being charged for.

- Hourly Rates or Flat Fees: Specify whether the charges are based on hourly rates or flat fees for specific tasks, and list the corresponding amounts.

- Time Tracking: If applicable, include the hours worked and any related time breakdowns, such as start and end times, to provide clarity on the time spent on each service.

- Payment Terms: Include clear payment terms, such as due dates, late fees, or available payment methods, to avoid confusion and encourage timely payment.

Best Practices for Service Billing Documents

- Use clear and concise descriptions of each service to avoid any ambiguity.

- Ensure that the format is clean and organized, with distinct sections for services, amounts, and payment details.

- Make sure all calculations are accurate and easy to verify, helping to maintain trust with clients.

By focusing on these key elements and maintaining a clear, professional layout, service providers can streamline their billing process and enhance their client relationships.

Billing Formats for Product Sales

For businesses that sell physical products, creating an efficient and professional billing document is essential for both tracking sales and maintaining customer relationships. A well-structured format ensures that all the necessary details about the products purchased are included, making it easier for customers to understand their purchase and payment obligations. This also helps businesses maintain organized records for inventory and accounting purposes.

Key Components for Product Sales

- Product Description: List each item sold, including essential details such as name, quantity, and unit price. This ensures transparency and reduces the chance of errors or misunderstandings.

- Subtotal and Total: Clearly display the subtotal for the products and the overall total, including any applicable taxes or discounts.

- Payment Methods: Specify the payment options available to customers, such as credit cards, online payments, or bank transfers.

- Shipping Information: Include details about shipping costs, delivery method, and estimated arrival time if applicable.

Best Practices for Product Billing Documents

- Ensure that all calculations are clear and easy to follow, particularly for total costs and taxes.

- Use a clean layout with separate sections for each part of the sale, including product details, payment, and shipping information.

- Include contact information for customer support in case of queries or issues with the transaction.

By including these key components and following best practices, businesses selling products can streamline their transaction process and foster trust with their customers, ensuring clear communication and efficient record-keeping.

How to Export and Share Invoices Easily

Efficiently exporting and sharing billing documents is a key part of streamlining your business operations. By selecting the right methods and tools, you can ensure that these important records are shared securely and promptly with clients or colleagues. Whether you need to send them via email, upload to cloud storage, or integrate with accounting software, there are simple ways to handle this task with ease.

Common Export Formats

- PDF Format: One of the most widely used formats for sharing billing details, PDFs maintain their formatting across all devices and are easy to send as attachments via email.

- Excel or CSV: These formats are helpful when you need to manage or analyze financial data. They can be easily imported into accounting software or spreadsheets for further review.

- Word Documents: If you need to include additional notes or explanations, exporting as a Word document allows for easy editing and customization before sharing.

Methods to Share Billing Documents

- Email: A quick and secure way to send records directly to clients. Attach the document in your preferred format and include a brief message for context.

- Cloud Storage: Services like Google Drive, Dropbox, or OneDrive provide a convenient way to upload documents and share a link with clients, ensuring easy access and collaboration.

- Accounting Software: If you’re using specialized software for managing finances, these platforms often have built-in options to directly email or share billing documents with clients.

By utilizing these methods, sharing important business documents becomes a straightforward process, saving time and improving communication with clients or partners.