Free Hourly Rate Invoice Template for Easy Billing

When working as a freelancer or running a small business, it’s essential to have a reliable method for documenting services provided and ensuring timely payments. A well-structured document can make all the difference in maintaining clear communication and securing payments on time. This guide will help you craft a detailed, professional record for your work hours and compensation that both you and your clients can reference with ease.

By using a customizable form, you can tailor your records to fit different types of work and various client needs. Whether you’re offering consulting, design, or any other service, it’s crucial to present your charges clearly and consistently. A well-designed record ensures transparency and helps avoid misunderstandings between you and your clients.

In this article, we will explore the key components of an effective billing document, the best practices for creating one, and the tools that can simplify the process. With the right approach, you’ll not only enhance your professional image but also streamline your business operations, making it easier to track payments and maintain positive client relationships.

Hourly Rate Invoice Template Overview

For any freelancer or small business owner, keeping a clear record of the time spent on client projects and the compensation due is crucial. A structured document that captures these details ensures that both parties are on the same page, minimizing the risk of confusion or delayed payments. This section provides an overview of how such a document can be set up, focusing on the key elements necessary for accurate billing.

The document serves as an official record for the hours worked, the tasks performed, and the corresponding fees. By organizing these details in a concise format, it not only makes it easier for clients to understand the charges but also simplifies the process of tracking and managing payments on the provider’s end. Having a consistent system in place helps maintain professionalism and fosters trust between you and your clients.

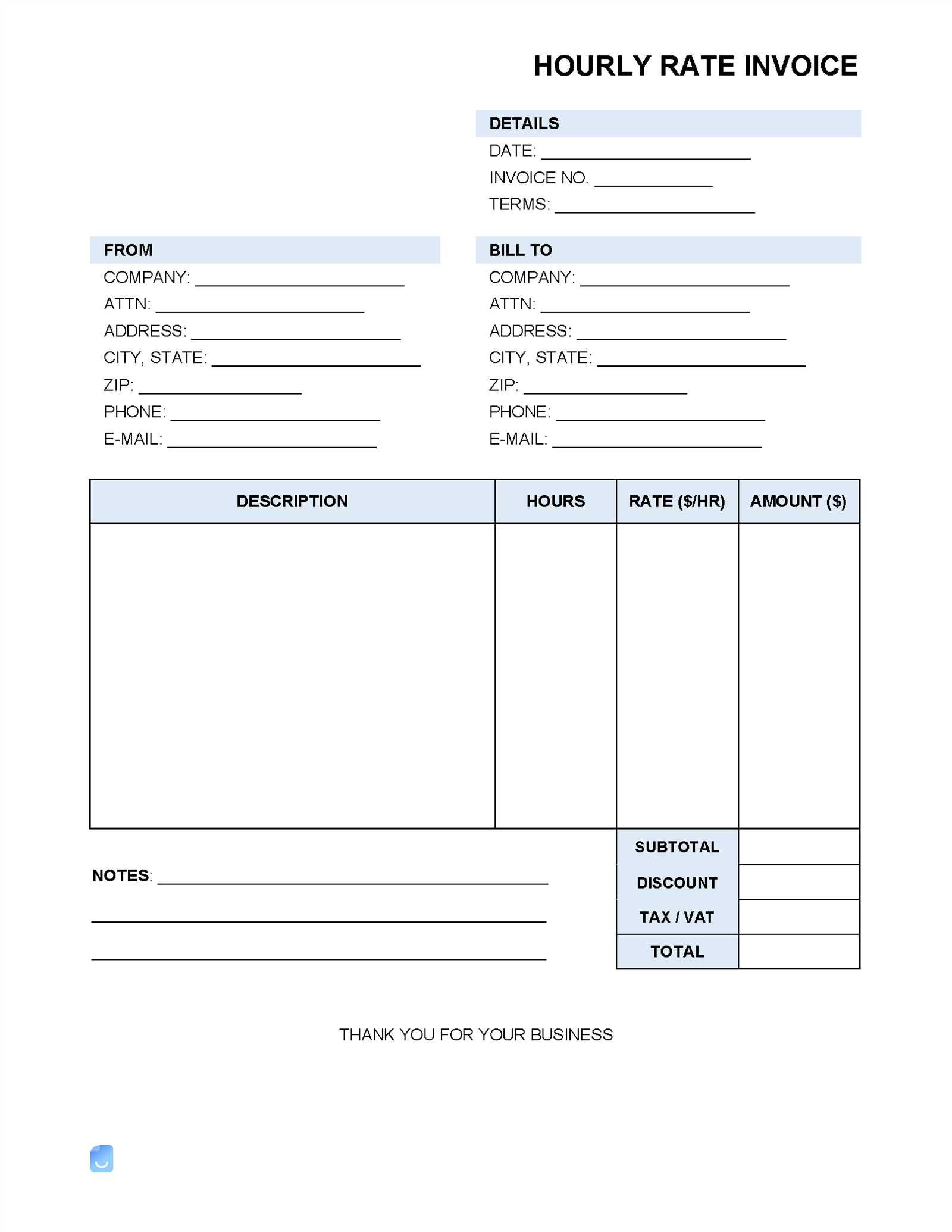

Key Components of a Billing Record

Every billing document should contain essential information that outlines the work done and the terms of payment. This includes the service description, the number of hours worked, the agreed-upon cost, and the payment deadline. It’s important to also include details like the client’s information and any additional terms or notes that may be relevant to the transaction.

Customizing the Document for Different Needs

Not all projects or clients are the same, which is why having the ability to customize the format is so important. A flexible structure allows you to adapt the document based on the nature of the work and the client’s preferences. Whether it’s for a one-off project or ongoing work, customizing your records helps ensure that all necessary details are included and that the document aligns with both parties’ expectations.

Why You Need an Hourly Invoice

For any service-based professional, accurately documenting the work performed and ensuring proper compensation is a fundamental part of the business process. A clear, structured document is crucial for both the provider and the client, as it ensures transparency, reduces the risk of disputes, and guarantees that payments are made on time. This section outlines why having a proper record for work done is essential for freelancers and small businesses alike.

Whether you’re working with multiple clients or managing a single project, an organized payment record helps you keep track of the time spent and the services provided. It provides a solid reference for both you and the client, preventing misunderstandings and fostering a smooth business relationship. Additionally, having such a document simplifies the accounting process and can be crucial for tax purposes.

Clarity and Transparency

Having a detailed record of work done ensures that clients understand exactly what they are paying for. A transparent breakdown of hours worked and services provided can prevent confusion and promote trust. Clear documentation helps clients see the value in your work, making it easier for them to approve payments without hesitation.

Streamlining Payment Collection

Using a professional billing record helps streamline the payment process. It provides a structured and organized format for clients to review and process payments promptly. Below is a sample of how different elements might be presented in a payment breakdown:

| Service Description | Hours Worked | Cost per Hour | Total |

|---|---|---|---|

| Consulting Services | 10 | $50 | $500 |

| Design Work | 15 | $45 | $675 |

By having this kind of format, clients can quickly verify the accuracy of the charges, leading to faster approval and smoother transactions.

How to Create an Hourly Invoice

Creating a clear and effective billing record requires a few key steps to ensure that both you and your client are on the same page. The goal is to accurately capture the work completed, the time spent, and the corresponding charges in a professional manner. This section will guide you through the process of building a well-organized document that helps you get paid on time and keeps your business running smoothly.

The first step is to include all the essential details such as the client’s information, the services provided, and the time spent on each task. It’s important to be specific and transparent about the work completed to avoid any confusion. Make sure that the document is easy to read and understand by organizing it logically, with clear headings and sections.

Steps to Follow:

1. Client Information: Include the name, address, and contact details of your client. This ensures there’s no ambiguity about who the payment is due from.

2. Description of Work: Break down the tasks performed in detail. This can include project milestones, specific deliverables, or general work completed during the billed period.

3. Time Spent: Clearly list the number of hours worked for each task or project segment. Be honest and precise when recording the time.

4. Payment Terms: Specify the payment due date, any late fees, and the payment methods accepted. Being clear about when and how payment should be made helps prevent delays.

5. Total Amount Due: Calculate the total amount owed based on the hours worked and the agreed-upon rate. This section should be straightforward, allowing the client to easily see the final amount.

By following these steps, you can create a straightforward, professional document that ensures clarity for both you and your client, making the payment process seamless and hassle-free.

Essential Elements of an Invoice

Creating a detailed billing document requires certain key components to ensure that the payment process runs smoothly. Each part of the document plays a vital role in conveying important information to your client, ensuring both clarity and professionalism. Below are the essential elements that should be included in any billing record to ensure it is comprehensive and effective.

- Client Information: Always include the full name, address, and contact details of the client. This ensures there is no confusion about who is responsible for the payment.

- Service Description: A clear, detailed breakdown of the work performed, including the specific tasks or projects completed. This provides transparency and helps the client understand what they are being charged for.

- Work Hours: Clearly list the amount of time spent on each task or project. Accurate documentation of time spent is essential for avoiding disputes over the bill.

- Payment Terms: State the due date, accepted payment methods, and any penalties for late payments. Defining these terms up front helps manage expectations.

- Total Amount Due: The total amount owed based on the hours worked and the agreed-upon fee should be clearly displayed. This should be easy for the client to find and verify.

Including these key details helps ensure that your billing document is clear, professional, and free from misunderstandings. By providing this level of transparency, you improve your chances of receiving timely payments and maintaining a positive working relationship with your clients.

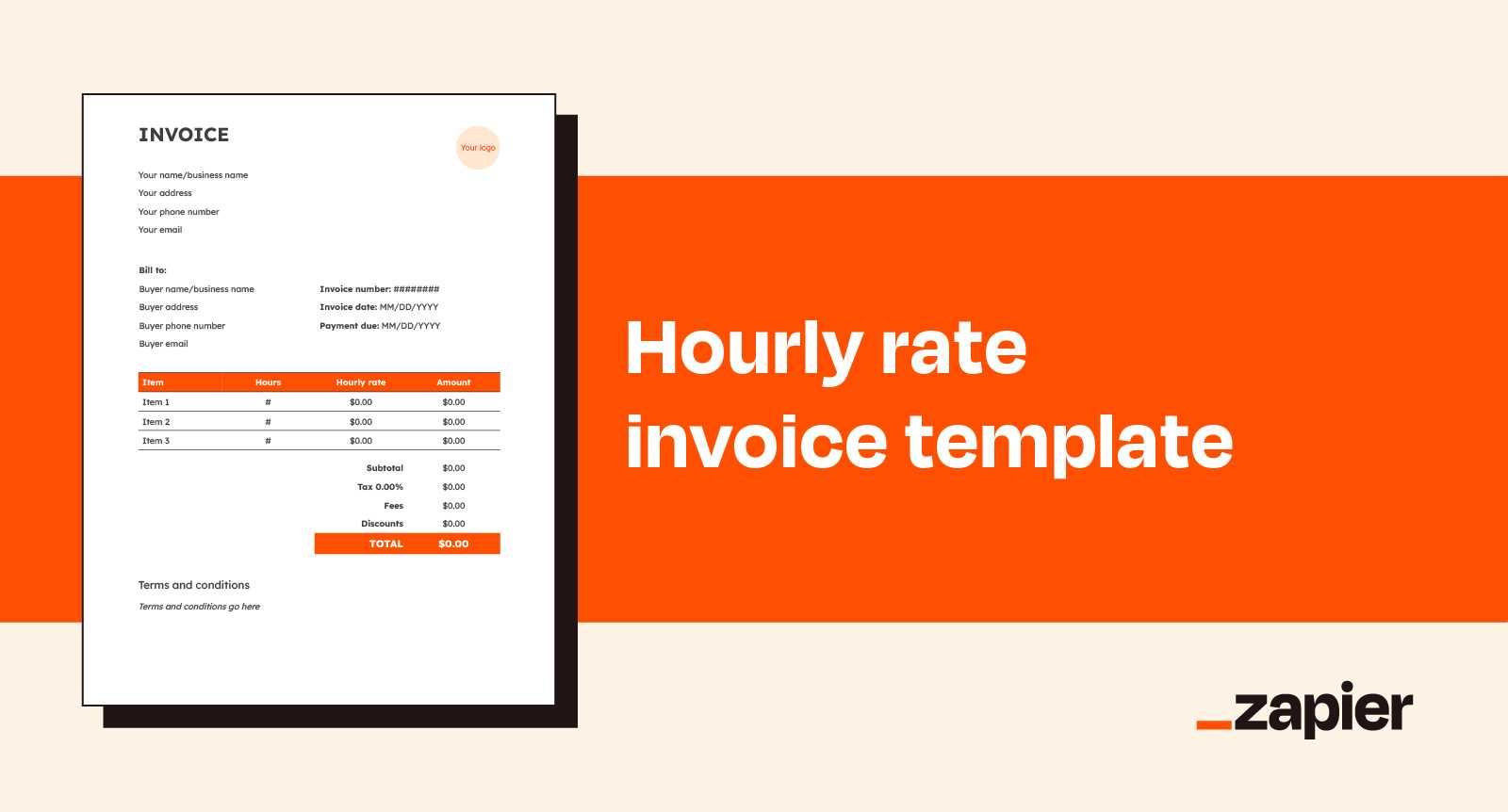

Benefits of Using a Template

Utilizing a pre-designed format for your billing documents offers numerous advantages that can significantly streamline the process of managing client payments. By using a ready-made structure, you can save time, reduce errors, and maintain a consistent professional appearance. In this section, we’ll explore some of the key benefits of using a structured format for your work-related billing.

Time Savings

One of the primary benefits of using a pre-built structure is the time it saves. Instead of creating a new document from scratch each time, you can quickly fill in the required details, allowing you to focus more on your actual work. A template reduces the need for repetitive formatting and ensures that each document follows the same structure, improving efficiency.

Consistency and Professionalism

- Uniformity: A consistent layout across all documents ensures that clients receive a polished, professional appearance every time, fostering trust and credibility.

- Accuracy: With a structured format, you can easily track and document key information without overlooking important details, reducing the risk of errors or omissions.

- Branding: A template can be customized to include your logo and business colors, helping reinforce your brand identity and making a lasting impression on clients.

Reduced Risk of Errors

By using a structured format, you are less likely to miss key elements or make common mistakes. Templates often come with built-in fields or placeholders, making it clear where to input specific details. This minimizes the chances of forgetting important data like payment terms or service descriptions, reducing potential disputes over billing.

Overall, using a pre-designed document format is an efficient, professional, and reliable way to handle your client payments. It simplifies the process, improves accuracy, and helps build a more consistent and trusted client experience.

How to Calculate Your Hourly Rate

Determining how much to charge for your time and expertise is an essential step in ensuring that your work is fairly compensated. Properly calculating the amount you should earn per hour takes into account various factors, including your experience, industry standards, and personal expenses. This section will guide you through the process of setting a fair and sustainable compensation structure for your services.

Consider Your Costs and Expenses

The first step in calculating a fair fee is to consider all of your business and personal expenses. This includes overhead costs like software, equipment, office space, and utilities, as well as personal costs such as living expenses, taxes, and healthcare. Understanding these costs will help you ensure that your fees cover not only your time but also your operating expenses.

Factor in Experience and Market Demand

Your level of expertise and the demand for your services also play a significant role in setting your charges. If you have specialized skills or experience in a high-demand area, you can charge more for your time. Researching industry standards and seeing what others in your field are charging can help you assess whether your fees are competitive, yet fair.

Once you’ve accounted for your expenses and industry standards, it’s time to establish a fee that ensures you are compensated for your time and covers your costs. By calculating a sustainable price based on these factors, you’ll be able to maintain a profitable business while providing value to your clients.

Designing a Professional Invoice

Creating a visually appealing and well-organized billing document is key to presenting a professional image to your clients. A well-designed document not only ensures that all necessary information is communicated clearly but also helps maintain a sense of professionalism that can build trust and credibility. In this section, we’ll explore essential design elements to consider when crafting a polished and effective document for your services.

Clarity and Readability: The most important aspect of any billing document is that it’s easy to read and understand. Use a clean, simple layout with clear headings and ample white space. Break up sections logically, so that clients can quickly find important details like the services provided, time worked, and payment terms. Avoid clutter and unnecessary graphics that may distract from the key information.

Brand Consistency: Incorporating your brand’s logo, color scheme, and font styles into your billing documents adds a personal touch and reinforces your identity. Consistency in design across all your business materials strengthens your brand presence and helps your documents look more polished and professional.

Essential Information Placement: Place key details like your contact information, the client’s contact details, and the breakdown of services at the top or in easily identifiable sections. This allows the reader to quickly understand the document’s purpose without having to search for essential information.

With careful attention to layout, color, and content organization, you can design a professional billing document that not only helps you maintain a consistent brand image but also ensures smooth communication with your clients.

Customizing Your Invoice Template

Personalizing your billing document is an important step in creating a professional and unique appearance that aligns with your business needs. Customizing the structure and design allows you to ensure that the document reflects your brand, meets specific client requirements, and includes all necessary details for accurate and timely payment processing. This section will guide you through the customization process to help you tailor your documents to your specific needs.

Key Areas to Customize

- Branding Elements: Add your logo, company colors, and font styles to maintain consistency with your brand. This makes your billing records instantly recognizable and helps reinforce your business identity.

- Service Descriptions: Adjust the section that outlines the services provided, ensuring each task or project is described clearly. This helps clients understand exactly what they are being charged for and reduces any confusion.

- Payment Terms: Modify the payment terms section to fit your specific arrangements with clients, such as due dates, discounts, late fees, and acceptable payment methods. This ensures that all financial expectations are clearly communicated.

- Client Information: Customize the client details section to include any necessary information specific to the client, such as project codes or reference numbers, to make the document easier to track and manage.

- Additional Notes: Include any other relevant information, such as project milestones, reminders, or terms of agreement. Customizing this section ensures that clients have all the information they need in one place.

Using Digital Tools for Customization

Many digital tools and software programs offer customizable templates, allowing you to create and save personalized billing documents easily. These tools often provide options to adjust layout, colors, fonts, and field placements, giving you full control over the final design. By using these tools, you can quickly generate personalized documents that maintain a professional appearance with minimal effort.

By customizing your billing records, you not only make them more visually appealing but also ensure that all necessary information is presented in a way that best suits your business and client needs.

Common Mistakes to Avoid

When preparing billing records for clients, it’s easy to overlook small details that can lead to misunderstandings or payment delays. Even minor errors in the document can affect your professionalism and cause confusion for both you and your clients. This section highlights some of the most common mistakes that can occur and offers tips for avoiding them to ensure smooth and efficient payment processing.

Typical Mistakes to Watch Out For

- Incorrect Client Details: Always double-check the client’s contact information, including their name, address, and email. Mistakes in this section can cause delays in communication or payment issues.

- Missing Payment Terms: Be sure to clearly state your payment terms, such as the due date, late fees, and acceptable payment methods. Failing to include these details can lead to confusion about when payment is expected.

- Omitting Service Descriptions: A vague or incomplete description of services can leave clients unsure about what they are being charged for. Clearly outline each task or deliverable to prevent misunderstandings.

- Wrong Calculations: Double-check your math to ensure that the total amount due is accurate. Mistakes in calculations can make you look unprofessional and lead to disputes over payment.

- Unprofessional Design: A cluttered or poorly formatted document can make a negative impression. Keep the layout clean, simple, and easy to read to maintain a professional appearance.

Tips for Avoiding Mistakes

- Review Before Sending: Always review your document for errors before submitting it to a client. Take the time to ensure that all fields are filled correctly and the calculations are accurate.

- Use Templates: Consider using a pre-designed format that guides you through the necessary steps and ensures that no important details are left out.

- Automate When Possible: If you’re managing multiple clients, consider using software to automate the creation of billing records. Many tools can help prevent common errors like missing information or incorrect calculations.

Avoiding these common mistakes ensures that your billing process is smooth and professional, helping you maintain strong relationships with your clients and reducing the risk of delays in payment.

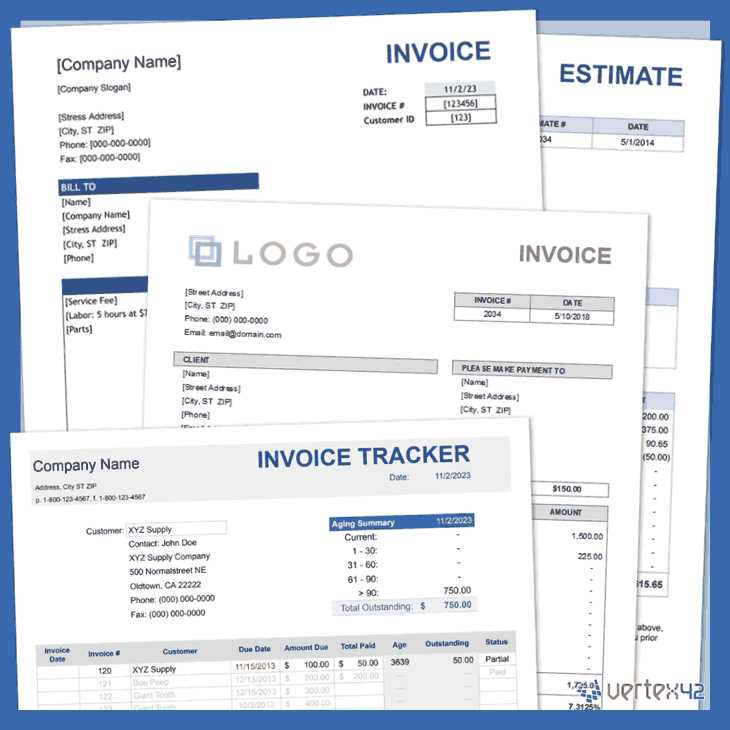

Best Tools for Invoice Creation

In today’s digital age, there are numerous tools available that simplify the process of creating billing documents. These tools not only save time but also help maintain consistency, reduce errors, and improve the overall professionalism of your documents. Whether you are a freelancer or a small business owner, choosing the right tool can make a significant difference in how you manage payments and client interactions. In this section, we will explore some of the best tools for generating customized billing records with ease and efficiency.

Top Software for Billing Documents

Many software solutions are designed specifically for generating professional-looking billing records. These tools often come with customizable features, allowing you to add your business branding and streamline the process of creating and sending records. Some of the top options include:

- QuickBooks: A popular choice for small businesses, QuickBooks offers a range of features that allow you to create, customize, and manage billing records. It also includes accounting tools to track payments and expenses, making it an all-in-one solution for your business.

- FreshBooks: Known for its user-friendly interface, FreshBooks allows you to easily create personalized billing documents, track time, and manage client communications. It also integrates with other financial tools, simplifying your accounting workflow.

- Zoho Invoice: This tool offers a range of templates and customization options, making it ideal for freelancers and small businesses. Zoho Invoice also allows you to automate payment reminders and integrate with other Zoho software.

Online Tools for Quick and Easy Creation

If you’re looking for more straightforward, web-based solutions, several online tools provide fast and simple document creation without the need for complicated software. These are perfect for individuals who need to generate documents on the go:

- Wave: A free and simple tool for creating billing records, Wave allows you to generate professional-looking documents and track payments. It also includes financial management features, ideal for small businesses.

- Invoice Generator: A no-frills online tool that allows you to quickly create a billing document by filling in the necessary fields. It’s a great option for those who need something simple and quick without unnecessary features.

- AND.CO: This tool is particularly useful for freelancers, offering easy-to-use templates, time tracking, and expense management, all in one place. It also integrates with payment processors to help clients pay quickly.

With these tools at your disposal, creating and managing billing records becomes a much simpler and more efficient process, allowing you to focus more on your work and less on paperwork.

How to Track Billable Hours

Accurately tracking the time spent on client projects is essential for ensuring that you’re paid fairly for the work you do. Effective time management and recording practices help you stay organized, avoid overwork, and ensure you charge clients appropriately for your efforts. In this section, we’ll explore various methods and tools to track the time you spend on tasks that are eligible for payment.

Methods for Time Tracking

There are several ways to track the time you spend on work, depending on your preferences and the tools you have at your disposal. Below are a few popular methods for recording your time:

- Manual Tracking: You can track time using a simple pen and paper or spreadsheet. While this method is low-tech, it requires consistency and attention to detail to ensure accuracy.

- Time Tracking Apps: Apps like Toggl, Clockify, or Harvest allow you to log hours in real-time, helping you avoid inaccuracies and making it easier to see how much time you’ve spent on each project.

- Project Management Software: Many project management tools, such as Asana or Trello, include built-in time tracking features. These platforms enable you to manage tasks and monitor time simultaneously, streamlining both tracking and project coordination.

Best Practices for Accurate Tracking

Tracking time accurately is crucial for ensuring you are fairly compensated and maintaining transparency with clients. Below are some best practices to keep in mind:

- Log Time in Real-Time: Whenever possible, log your hours as you work. This minimizes the chance of forgetting important details and ensures the time recorded is accurate.

- Break Tasks into Specific Segments: Instead of tracking broad blocks of time, break down your work into smaller, more specific tasks. This way, your billing record will clearly reflect what you spent time on, avoiding any ambiguity.

- Use Time Rounding Rules: Some professionals round time to the nearest quarter-hour. Decide on a time rounding rule for your business and apply it consistently across all tasks to maintain fairness and clarity.

Example Time Tracking Table

Here’s an example of how you might track time on a client project using a simple table format:

| Task | Start Time | End Time | Total Hours | |||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Initial Consultation | 10:00 AM | 11:00 AM | 1 | |||||||||||||||||||||||

| Design Work | 11:30 AM | 2:00 PM | 3.5 |

| Task | Start Time | End Time | Total Hours |

|---|---|---|---|

| Initial Consultation | 10:00 AM | 11:00 AM | 1 |

| Design Work | 11:30 AM | 2:00 PM | 3.5 |

| Client Revisions | 2:15 PM | 3:00 PM | 0.75 |

By using an organized table like the one above, you can easily track and calculate the total time spent on each task for accurate billing.

Tracking billable hours efficiently helps ensure that your work is properly compensated and allows you to maintain transparent and professional relationships with your clients.

Automating Your Invoicing Process

Automating the process of creating and sending billing documents can save you time, reduce human error, and ensure that your clients receive accurate and timely statements. By streamlining this part of your workflow, you can focus more on delivering quality services and less on administrative tasks. In this section, we’ll explore ways to automate your billing procedures, from generating documents to sending reminders and processing payments.

How Automation Simplifies Your Workflow

By automating your billing process, you can eliminate the need for manual data entry, minimize mistakes, and reduce the time spent preparing and tracking payments. There are a variety of software solutions and tools that can help automate various aspects of your business, from creating documents to following up with clients. Below are some key steps to integrate automation into your billing process:

- Automatic Document Generation: Set up software that creates billing documents automatically after completing a service or project. These tools can pull data from time tracking or project management systems and generate a detailed, error-free document ready to be sent.

- Scheduled Sending: With automation, you can schedule billing documents to be sent at regular intervals, such as monthly or upon completion of specific milestones. This removes the manual step of remembering to send out your records.

- Recurring Billing: For clients with ongoing contracts, automation tools can set up recurring billing, ensuring they are automatically charged at regular intervals without you needing to create new documents each time.

- Payment Reminders: Automating payment reminders helps ensure clients pay on time. Set up systems that automatically send gentle reminders when payments are due, which reduces the chance of missed payments or overdue accounts.

Example of Automated Billing Process

The following table outlines a simple workflow for automating your billing process using tools and software:

| Step | Action | Tool Used | ||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 1 | Track time and tasks | Time tracking software (e.g., Toggl, Harvest) | ||||||||||||||||||||||||

| 2 | Generate billing record | Billing software (e.g., QuickBooks, FreshBooks) | ||||||||||||||||||||||||

| 3 | Send billing record to client | Email automation (e.g., Zapier, Mailchimp) |

| Required Information | Explanation |

|---|---|

| Business Details | Your full business name, address, contact details, and any registration number or VAT ID, if applicable. |

| Client Information | The name, address, and contact details of the client or company being billed. |

| Description of Services | A clear description of the work provided or goods delivered, including dates or time periods when the service was rendered. |

| Amount Due | The total amount being charged, including any applicable taxes, discounts, or fees. |

| Payment Terms | The due date for payment, including any late fees or penalties if applicable, and the acceptable payment methods. |

| Tax Information | If applicable, details about sales tax, VAT, or other tax obligations, along with the relevant tax rates and amounts. |

Compliance with Local Laws

Depending on where you are located or where your clients are based, there may be specific legal requirements regarding tax reporting, payment deadlines, and even the method of delivering the billing documents. It is important to stay informed about the following:

- Taxation Regulations: Ensure that your billing documents comply with local tax laws, including VAT or sales tax. Different countries have different thresholds for when tax must be applied, and these laws change frequently.

- Late Payment Penalties: Some jurisdictions require that you specify payment terms clearly, including penalties for late payments, to protect your business interests.

- Record Retention: Many regions have laws that require businesses to retain records of transactions for a

Tips for Effective Client Communication

Clear and effective communication with clients is key to building strong, long-term business relationships. Whether you’re discussing the scope of work, outlining payment terms, or addressing any concerns, how you communicate can significantly impact the success of your projects. In this section, we will explore essential strategies for maintaining transparent, professional, and positive communication with your clients throughout the process.

Key Strategies for Clear Communication

To ensure smooth and effective communication, consider adopting these strategies when interacting with clients:

- Be Clear and Concise: Avoid ambiguity by providing clear, straightforward information. This helps clients understand what to expect and minimizes the chance of misunderstandings.

- Set Expectations Early: From the start of your relationship, outline project timelines, deliverables, and payment terms. Clear expectations create a foundation for successful collaboration and prevent confusion later on.

- Respond Promptly: Timely responses are crucial in maintaining trust. Whether it’s addressing a question, providing updates, or responding to concerns, make sure to reply promptly to show that you value their time and business.

- Use Professional Language: Always maintain a polite, professional tone, even when addressing difficult topics such as missed payments or delays. Professional communication reinforces trust and respect between both parties.

Effective Communication Tools

Using the right tools can significantly enhance your communication efficiency. Here are some tools that can help improve your client interactions:

Communication Tool Advantages Email Ideal for formal, documented communication. Emails can be referred back to later and are great for sending important documents or updates. Messaging Apps (e.g., Slack, WhatsApp) Faster, informal communication for quick updates or questions. Useful for maintaining an ongoing conversation without delay. Project Management Software (e.g., Trello, Asana) Helps organize tasks, track progress, and share important documents. These platforms can also provide updates on deadlines and deliverables in real-time. Phone Calls or Video Conferencing Effective for more personal or urgent matters that may require detailed explanations or face-to-face discussions. Common Pitfalls to Avoid

To maintain a positive relationship with your clients, it’s important to avoid common communication mistakes. Here are some pitfalls to watch out for:

- Overpromising and Under-delivering: Be realistic

When to Update Your Billing Document

Maintaining an up-to-date billing document is essential for ensuring that your financial records remain accurate and comply with legal requirements. Over time, your business may change, and so should the way you manage and present client charges. Whether you’re updating for legal reasons, adjusting your pricing structure, or introducing new services, knowing when to refresh your billing format is crucial for smooth operations. In this section, we’ll discuss when and why you should revise your billing document.

Key Reasons to Update Your Billing Document

There are several common situations where it becomes necessary to revise your billing document:

- Changes in Pricing: If you adjust your prices, whether due to inflation, market conditions, or new pricing strategies, it’s important to reflect these changes in your billing documents. This ensures transparency and accuracy in what you’re charging clients.

- New Services or Products: When you expand your offerings, you’ll need to include these new services or products in your billing documents. Make sure your document is updated to list new items clearly and with correct descriptions.

- Tax Rate Adjustments: Changes in sales tax or VAT rates may require an update to your billing documents to ensure compliance with local tax laws. Failure to include the correct tax rates could result in financial penalties or client disputes.

- Legal and Regulatory Updates: Laws and regulations regarding billing, such as required information or payment deadlines, may change. Stay informed about legal requirements in your region and update your documents accordingly to remain compliant.

- Improvement in Branding or Professionalism: As your business grows, you may want to revise your billing documents to better reflect your brand’s identity. A more polished, professional look can enhance your business image and improve client relations.

Signs That It’s Time for an Update

Here are some indicators that suggest your billing document may need a revision:

- Outdated Information: If any contact information, business details, or client instructions are no longer accurate, it’s time to make updates.

- Client Feedback: If clients are asking for clarification or expressing confusion about your billing format or charges, it’s a sign that improvements are needed.

- Software Integration: If you begin using new accounting or billing software, the format of your document may need to be adjusted to fit with the new system’s requirements.

- Business Growth: As your business expands, the scope of your projects may change, and so should your billing documents. Ensure that your document accommodates larger, more complex transactions.

By regularly reviewing and updating your billing document, you can maintain accuracy, legal compliance, and a professional image, ensuring a smooth