Download the Perfect Landlord Invoice Template for Rent Payments

When it comes to managing rental properties, staying organized is crucial for both property owners and tenants. Proper documentation helps ensure smooth transactions, avoids misunderstandings, and keeps financial records accurate. Using a structured payment request document can make this process much easier, offering clarity for both parties.

By utilizing a ready-made document for payment requests, property owners can simplify the billing process, making it easier to track and manage rent payments. These documents allow for customization, ensuring that each one aligns with the terms of the rental agreement and meets legal standards. Whether managing a single unit or multiple properties, having a standardized system is essential for maintaining professionalism and organization.

In this guide, we’ll explore how you can streamline the process of rent collection, what key details should be included, and how to best manage this important aspect of property ownership. The right format not only saves time but also ensures that all financial exchanges are documented clearly and efficiently.

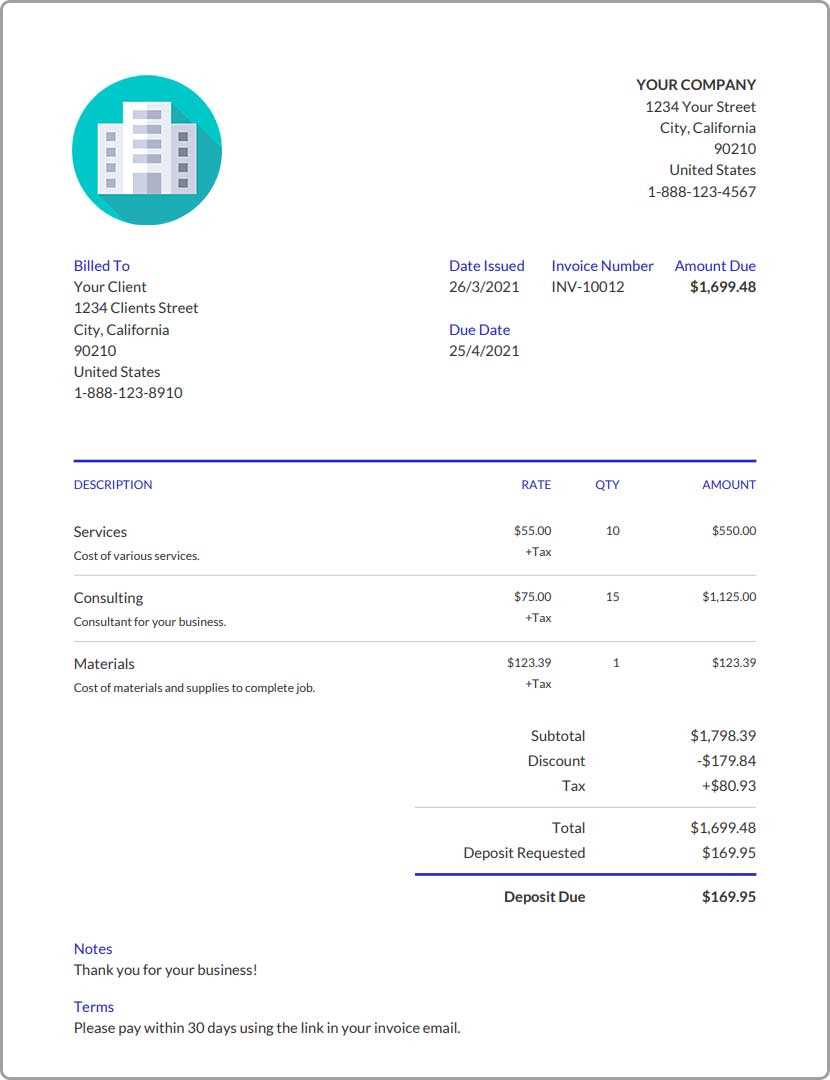

Rent Payment Request Document Overview

Managing rental payments effectively requires clear documentation that outlines the agreed-upon amounts, due dates, and other essential details. Having a consistent structure for payment requests helps ensure that both property owners and tenants are on the same page, reducing potential misunderstandings and delays. A well-constructed document is key to smooth financial transactions and proper record-keeping.

This organized document serves as a formal request for rent payment, providing both the tenant and property owner with a clear reference. It includes necessary information such as payment amounts, dates, and descriptions of services or terms. By using a standardized format, property owners can maintain professionalism and consistency across all rental agreements, simplifying the financial aspect of property management.

With the right approach, these payment request documents become an invaluable tool in ensuring timely payments and creating a transparent relationship between property owners and tenants. The customizable nature of such documents allows flexibility to meet different property types and leasing arrangements, ensuring they meet the specific needs of both parties involved.

Why Use a Payment Request Document

Having a standardized document for rent collection brings numerous advantages to property owners. It ensures consistency, reduces errors, and saves time in managing multiple tenants or properties. By using a ready-made format, property owners can eliminate the need to manually create payment details from scratch each time, which streamlines the entire billing process.

Such documents help maintain professionalism by presenting clear and accurate information. This not only boosts tenant confidence but also minimizes confusion about payment terms. With clearly defined payment schedules and amounts, both parties are more likely to stay organized and adhere to agreed timelines, leading to better financial management.

Furthermore, using a structured format enhances record-keeping. It becomes easier to track payments, document late fees, and maintain a comprehensive financial history for each property. This level of organization is essential for tax reporting and can provide valuable insights into cash flow and property management efficiency.

Benefits of Customizable Payment Request Formats

Using a flexible document format for rent collection provides significant advantages in adapting to various needs. Customizable structures allow property owners to adjust the layout, content, and appearance to better suit specific requirements. This adaptability makes it easier to align with different leasing agreements and client preferences, ensuring that all necessary information is included in a clear and concise manner.

Enhanced Flexibility

Customizable formats allow property owners to modify sections based on their preferences. Whether adding extra fields, changing the layout, or including specific payment terms, these adjustments can be made to meet unique circumstances. This flexibility is particularly helpful when managing multiple properties with varying lease terms or tenant agreements.

Improved Professionalism

A well-tailored document enhances the professional image of property management. Customizing the design and details to reflect the brand or personal style can leave a positive impression on tenants. Furthermore, the ability to include logos, color schemes, or specific terminology creates a consistent and polished communication tool that strengthens the landlord-tenant relationship.

| Benefit | Description |

|---|---|

| Clarity | Custom formats ensure that all necessary information is clearly presented, reducing misunderstandings. |

| Adaptability | Ability to modify fields and details based on individual property or tenant needs. |

| Consistency | Maintains a standardized approach across multiple properties, ensuring a uniform process. |

How to Create a Rent Payment Request

Creating a structured document for rent payments is essential for maintaining clear communication between tenants and property owners. A well-crafted payment request should include all necessary details such as the payment amount, due date, and any other relevant information. By following a systematic approach, property owners can ensure that each payment request is accurate and professional, which helps facilitate timely payments and avoids confusion.

Step-by-Step Process

To create a rent payment request, follow these key steps:

| Step | Action |

|---|---|

| 1 | Include tenant and property owner contact information. |

| 2 | Specify the payment amount and due date clearly. |

| 3 | Outline the terms of payment, including late fees or discounts if applicable. |

| 4 | List any additional charges or services provided, such as utilities or maintenance fees. |

| 5 | Include a section for payment methods and instructions. |

Finalizing the Document

Once all the relevant information is included, review the document for accuracy. Be sure to check for any typos or discrepancies, and make sure the format is clean and easy to read. A clear, professional document not only helps ensure timely payments but also strengthens the relationship between property owners and tenants.

Essential Information for Rent Payment Requests

When creating a document for rent payments, it is crucial to include all the necessary details to ensure transparency and prevent any confusion. Properly structured payment requests not only help in clearly outlining the terms of the agreement but also serve as important financial records. Including all the relevant information helps both property owners and tenants stay on track with payment schedules.

Key elements to include in each payment request are as follows:

- Tenant and Property Owner Details: Full names, addresses, and contact information for both parties are essential for clear communication.

- Amount Due: Clearly state the payment amount and ensure it reflects the agreed terms of the rental contract.

- Due Date: Specify the date by which payment should be made to avoid confusion about when the rent is expected.

- Description of Charges: Break down the rent and any additional fees, such as maintenance or utilities, so the tenant understands the total amount due.

- Payment Instructions: Provide clear instructions on how payments should be made, including available methods and account details if applicable.

By including these crucial details in every payment request, both parties can ensure that all terms are clear, which promotes timely payments and fosters a professional relationship.

Free Rent Payment Request Forms Online

For property owners looking for a cost-effective solution, there are numerous online resources that offer free access to ready-made documents for rent collection. These resources can help save time and effort by providing professionally designed structures that can be easily customized to fit specific rental agreements. Whether you manage a single property or multiple units, these free options make it easier to stay organized and professional.

Where to Find Free Resources

- Online Marketplaces: Websites like Google Docs or Microsoft Office provide free, customizable options that can be downloaded and edited easily.

- Property Management Blogs: Many property management websites offer downloadable forms as part of their resources, often including additional tools for organizing payments.

- Template Libraries: Sites specializing in business and legal forms frequently offer free downloadable documents tailored to rent payments.

Benefits of Using Free Resources

- Cost Savings: Accessing free formats eliminates the need for costly software or custom designs.

- Ease of Customization: Most free options allow for easy editing, ensuring you can tailor each document to specific needs.

- Professional Appearance: These documents are often designed to meet industry standards, offering a polished look that reflects well on the property owner.

- Time Efficiency: By using pre-made formats, you can streamline the rent collection process without having to create documents from scratch.

Common Mistakes in Rent Payment Requests

When creating documents for rent collection, errors can easily occur that lead to confusion or delays in payment. These mistakes not only affect the relationship between property owners and tenants but can also cause administrative headaches. Recognizing and avoiding these common pitfalls can help ensure that payments are processed smoothly and efficiently.

Frequent Errors to Avoid

- Missing or Incorrect Payment Amount: Failing to clearly state the amount due or listing the wrong total can lead to misunderstandings and payment delays.

- Unclear Payment Terms: Not specifying the due date or any late fees can create confusion about the expectations for timely payment.

- Lack of Detailed Breakdown: A vague description of charges, such as rent and additional fees, may leave tenants unsure about what they are paying for, leading to disputes.

- Omitting Payment Instructions: Not providing clear directions on how to submit payment can cause unnecessary delays or mistakes, especially if the payment method is unfamiliar to the tenant.

- Forgetting to Include Contact Information: Failing to provide both parties’ contact details may cause difficulties in reaching out for clarifications or questions.

- Errors in Dates: Incorrect due dates or overlapping payment periods can confuse tenants and delay payments, especially if they rely on a consistent schedule.

How to Prevent These Mistakes

- Double-check all details: Always review the document for accuracy before sending it out.

- Use a standardized format: This ensures that you consistently include all necessary details, reducing the chances of forgetting important information.

- Provide clear instructions: Make sure payment methods and deadlines are easy to understand to avoid any confusion or mistakes.

How to Handle Late Payments

Late payments are a common challenge for property owners and can disrupt cash flow if not managed properly. It’s important to address overdue payments promptly while maintaining professionalism. Having a clear approach to late payments can help prevent confusion and ensure timely resolution, while also maintaining a positive relationship with tenants.

The first step in handling late payments is to have well-defined terms laid out in the rental agreement. Clear payment schedules and late fee policies will make it easier to enforce consequences if payments are not received on time. Here are some key strategies for dealing with delayed payments:

- Send a Reminder: As soon as the payment due date passes, send a polite reminder. This can be a simple email or phone call to ensure the tenant is aware that the payment is overdue.

- Enforce Late Fees: If your rental agreement includes a late fee, ensure that it’s applied consistently. Make tenants aware of the added charges if they miss the due date.

- Offer Payment Plans: If a tenant is facing financial difficulties, offering a structured payment plan can help them catch up on overdue amounts without causing further strain.

- Maintain Communication: Keep an open line of communication with the tenant to understand the reason behind the delay. Sometimes, issues can be resolved through simple conversation.

- Consider Legal Action: If payments continue to be missed, you may need to take more serious action, such as issuing a formal notice or seeking legal advice to recover the debt.

By taking a balanced and professional approach to late payments, property owners can reduce the negative impact of overdue rent while preserving tenant relationships.

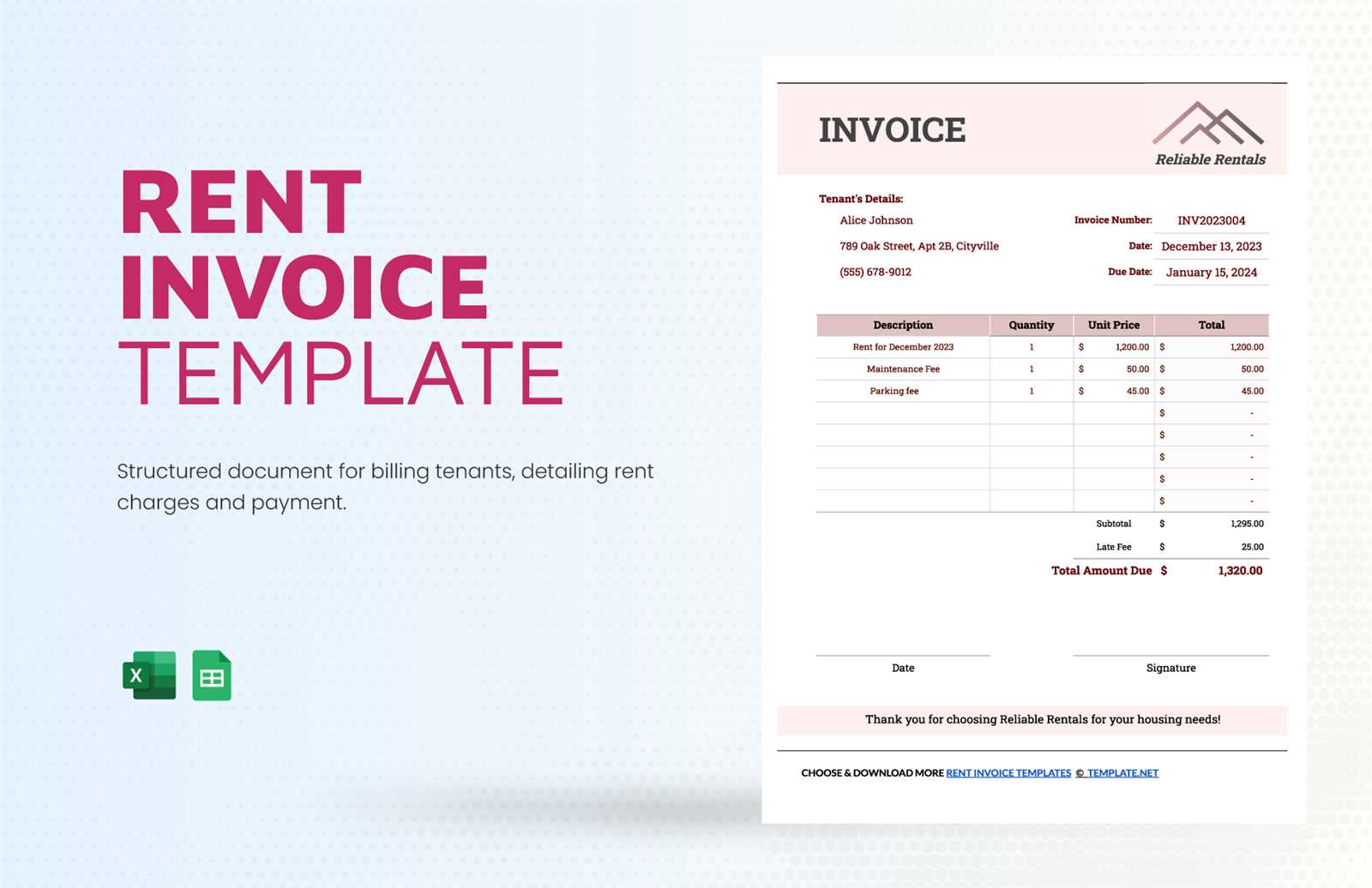

Design Tips for a Professional Payment Request

Creating a well-designed payment document is key to making a strong impression and ensuring clarity. A professional-looking document not only improves the presentation but also makes the details easier to understand. With careful design, you can enhance readability, avoid confusion, and ensure that all essential information is included.

Here are some important design tips to help make your payment request look polished and professional:

- Keep It Simple: A clean, minimalist layout with plenty of white space makes the document easy to read. Avoid clutter and unnecessary graphics that might distract from the key details.

- Use Clear, Readable Fonts: Choose simple, professional fonts that are easy to read both on screen and in print. Avoid overly decorative fonts that may compromise legibility.

- Organize Information Logically: Place the most important information (e.g., payment amount, due date, and contact information) at the top. Group related details together to improve the document’s flow.

- Highlight Key Details: Use bold text or colors to emphasize crucial information like the total amount due or payment deadline. This draws attention to important sections.

- Include Your Branding: Incorporating your logo and business name into the document gives it a professional touch and reinforces your brand’s identity.

- Ensure Consistency: Consistent use of fonts, colors, and alignment makes the document look more cohesive and well-organized. Stick to a uniform style throughout.

By following these design tips, you can create a payment request that is both professional and effective, making it easier for tenants to understand and for you to manage payments efficiently.

Best Practices for Payment Request Delivery

Proper delivery of payment documents plays a significant role in ensuring timely and accurate payments. Whether you’re sending a request electronically or via traditional mail, the method you choose should be reliable and clear. Establishing best practices for delivery helps avoid misunderstandings and ensures that your document reaches the recipient in a timely manner.

Here are some key practices to follow for delivering payment requests effectively:

- Choose the Right Delivery Method: Depending on the recipient’s preferences, decide whether to send the document via email, postal service, or through a secure online platform. For faster communication, email is often the most efficient option.

- Send Early: Give tenants ample time to process the request by sending it well in advance of the due date. This reduces the chances of late payments and shows professionalism.

- Ensure Readability: When sending the document digitally, use clear file formats such as PDF that preserve the layout and ensure that the document is accessible on different devices.

- Confirm Receipt: Ask for acknowledgment when sending documents electronically. Request a read receipt or follow up to confirm that the tenant has received and understood the payment request.

- Keep a Record: Maintain a copy of all sent payment requests for your records. This can be helpful in case of disputes or to track payment history.

- Be Consistent: Use the same delivery method and schedule for all payment requests to streamline the process. Consistency helps tenants know what to expect and makes the process more efficient for both parties.

By following these best practices, you can ensure that your payment documents are delivered effectively, leading to a smoother payment process and fewer delays.

Managing Multiple Properties with Payment Requests

Managing several rental units or properties can quickly become complex, especially when it comes to tracking payments and organizing financial documents. Properly managing payments for multiple properties requires clear documentation for each unit, ensuring that records are kept accurate and up-to-date. By establishing a systematic approach to handling payment requests, you can simplify the process and stay on top of finances across all properties.

Here are some strategies to efficiently manage payments across multiple properties:

- Use a Consistent Format: Keep the format of your payment documents uniform for all properties. This helps in quickly identifying key details and ensures that tenants receive clear, professional documents.

- Track Payments by Property: Create a separate record for each property, with detailed logs of all payments, due dates, and outstanding balances. This can help you quickly access payment histories for each unit.

- Automate Where Possible: Use accounting software or online platforms to streamline payment tracking. These tools can automatically generate payment requests, track overdue amounts, and send reminders to tenants.

- Maintain Clear Communication: Ensure that tenants are well-informed about the payment schedule for each property. Regular communi

Automating Rent Requests with Software

Managing rental payments manually can be time-consuming and prone to errors. Fortunately, there are software solutions designed to automate the creation and distribution of payment requests. By utilizing automation tools, property managers can streamline the entire process, reduce administrative workload, and ensure that tenants receive timely reminders and accurate payment details.

Here are some of the benefits and features of using software to automate rent-related tasks:

Key Benefits of Automation

- Time-Saving: Automating rent requests eliminates the need for manual entry, allowing property owners to focus on other important aspects of property management.

- Accuracy: Automation minimizes human error, ensuring that all details, such as payment amounts and due dates, are correct every time.

- Consistency: Automated systems ensure that payment requests are sent on time, every time, which reduces the likelihood of missed or delayed payments.

- Convenience: Many software solutions offer cloud-based services, making it easy to access payment data and track tenant history from any location.

Features of Rent Automation Software

- Recurring Payments: Set up automatic payment requests for tenants, ensuring they are billed on the same day every month.

- Customizable Documents: Customize payment requests to match your business style, while ensuring all necessary information is included.

- Automatic Reminders: Set up email or SMS reminders to notify tenants of upcoming or overdue payments, helping reduce late fees.

- Payment Tracking: Track payments in real-time, with reports generated automatically to help you stay on top of your cash flow.

By implementing automation software for rent requests, property managers can simplify their workflow, improve tenant satisfaction, and ensure that payments are handled efficiently and on time.

Understanding Payment Terms for Rental Requests

Payment terms are essential for ensuring clarity between property owners and tenants regarding the expectations for rent payments. These terms outline when payments are due, any applicable late fees, and the conditions under which payments should be made. A well-defined payment structure helps avoid confusion and encourages timely payments, which is critical for both parties to maintain a smooth financial relationship.

Key Elements of Payment Terms

- Due Date: The due date is the date by which tenants are expected to make their payment. Clearly defining this in the agreement ensures that there are no misunderstandings regarding when the payment should be made.

- Late Fees: Many agreements include provisions for late fees if the payment is not received by the due date. These fees serve as an incentive for tenants to pay on time.

- Grace Period: Some arrangements may offer a grace period, which allows tenants a certain number of days after the due date before a late fee is applied.

- Payment Method: Specify how payments can be made, whether through bank transfer, checks, online platforms, or other methods.

- Early Payment Discounts: In some cases, property owners may offer a discount for early payments, providing tenants with an incentive to pay ahead of schedule.

Why Payment Terms Matter

Clearly defined payment terms help maintain a professional relationship between property owners and tenants. They ensure that tenants understand their financial obligations, reducing the likelihood of disputes. For property owners, clear terms make it easier to track payments, maintain cash flow, and avoid potential legal issues related to missed or delayed payments.

Using Rental Payment Documents for Tax Reporting

Proper record-keeping is crucial for managing rental income and expenses, especially when it comes to tax reporting. Payment documentation plays a key role in tracking income and deductions, helping property owners accurately report their earnings to tax authorities. By maintaining organized records of payments, owners can ensure compliance with tax regulations and avoid potential legal issues.

Importance of Accurate Record-Keeping

Accurate records allow property owners to easily calculate rental income and claim allowable deductions, such as property maintenance or repairs. By keeping detailed and organized payment documents, owners can track all rental transactions, ensuring that they meet the necessary tax requirements.

Using Payment Records for Deductions

- Rental Income: All payments received for renting out a property should be recorded as income. These records can help owners report their earnings at the end of the year for tax purposes.

- Expense Deductions: Property owners may be able to deduct expenses like repairs, maintenance, or property management fees from their taxable income. Properly recorded expenses allow owners to take advantage of these tax-saving opportunities.

- Depreciation: The depreciation of property can also be deducted, and payment records that show the length of time a property has been rented out can help owners calculate this deduction accurately.

By utilizing payment records for tax reporting, property owners can ensure that they are meeting legal obligations, while also maximizing their potential deductions. Keeping accurate and detailed records will simplify the tax filing process and provide a clear, comprehensive overview of rental income and related expenses.

Payment Tracking for Better Organization

Efficient management of rental payments is essential for maintaining organization and avoiding confusion. By keeping track of all payments and related transactions, property owners can ensure they stay on top of their financial obligations and deadlines. A well-structured tracking system helps streamline processes, reduce errors, and makes it easier to monitor outstanding payments and generate accurate financial records.

Key Aspects of Payment Tracking

- Tracking Due Dates: Keeping an eye on due dates ensures that payments are collected on time and helps avoid late fees or disputes with tenants.

- Monitoring Payment Status: Knowing which payments have been received and which are still pending allows property owners to quickly follow up and maintain cash flow.

- Detailed Record-Keeping: Tracking every payment, including partial payments or adjustments, provides a complete picture of the financial relationship with tenants.

- Organizing Documentation: Organizing payment details in a clear and consistent format helps with quick access to information when needed, especially during tax season or audits.

Benefits of a Tracking System

With a reliable tracking system, property owners can streamline their operations and avoid the chaos that often accompanies managing multiple payments. Whether done manually or with software, consistent tracking ensures no payments are overlooked, making it easier to stay organized and focused on other aspects of property management.

Tracking Method Advantages Manual Tracking Cost-effective, easy to start, great for small-scale operations. Automated Software Time-saving, accurate, scalable for larger portfolios, helps generate reports easily. Whether opting for manual tracking or using specialized software, a good system ensures that property owners remain organized, prepared, and efficient in managing all their rental payment activities.

Legal Requirements for Rent Invoices

When managing rental agreements, it’s crucial to ensure that all payment requests comply with legal regulations. These guidelines help protect both property owners and tenants by setting clear expectations for financial transactions. A proper document outlining payment terms not only facilitates smooth interactions but also ensures transparency and accountability in the relationship.

The requirements can vary based on location, but some general elements are universally important. Below are the key components that must be included in any document related to rent payments to ensure compliance with local laws:

- Clear Identification: The name and contact details of the property owner and the tenant should be clearly stated.

- Accurate Dates: The rental period covered by the payment must be specified, along with the date the payment is due.

- Itemized Charges: A breakdown of the charges, including rent amount, any additional fees, and applicable taxes, must be included.

- Payment Methods: It’s important to state acceptable payment methods, such as bank transfer, check, or online payments.

- Late Fees and Penalties: If applicable, the document should mention any penalties for late payments or missed deadlines.

- Legal Compliance: The payment request should reference any local regulations that apply to rental payments, such as maximum allowable late fees or required disclosures.

Ensuring these elements are included helps avoid potential disputes and guarantees that both parties are well-informed about their rights and obligations.

While these guidelines may seem straightforward, they are essential for maintaining a lawful and professional operation, especially for those managing multiple rental units or commercial properties.

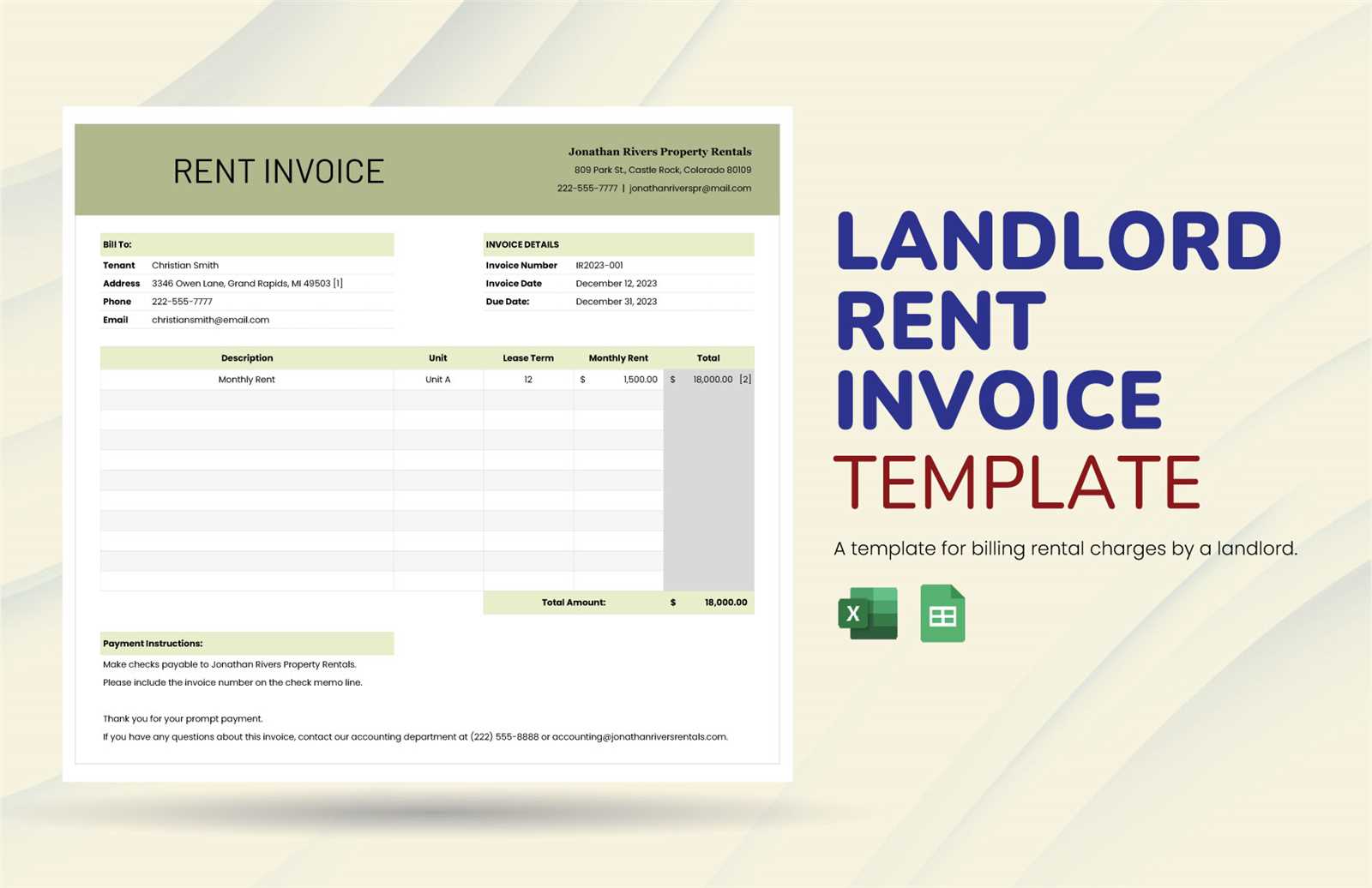

How to Edit a Template Easily

Editing a document for billing purposes can be simple and efficient, especially when you have the right tools and a clear structure to follow. Whether you’re customizing an existing form or creating a new one, knowing how to quickly modify the necessary sections can save you time and ensure accuracy. Here are some easy steps to help you get started.

Step 1: Choose the Right Software

To begin, select a software that allows you to edit your form easily. Many users prefer simple tools like Microsoft Word, Google Docs, or spreadsheet programs such as Excel or Google Sheets. These applications provide user-friendly interfaces that allow you to quickly adjust the format and content without needing advanced technical skills.

Step 2: Modify Key Details

After opening your document, focus on the parts that need to be customized. The main elements to update typically include:

- Contact Information: Update the names, addresses, and contact details of both parties involved.

- Payment Information: Adjust the payment amounts, due dates, and any special terms or conditions relevant to the current billing period.

- Additional Charges: Add or remove fees, such as late charges or maintenance costs, depending on your requirements.

- Tax Information: Ensure the correct tax rates or exemptions are applied, based on the applicable local laws.

With these adjustments, your document will be tailored to fit your current needs and ready for use.

Editing your forms regularly ensures that your billing process stays efficient and accurate, while minimizing the chances of mistakes or confusion for the recipient.

Why Timely Invoices Improve Cash Flow

Ensuring that payment requests are sent promptly can significantly enhance the financial health of any business. By maintaining a consistent and timely approach to requesting payments, businesses can reduce delays and improve their cash flow. When payment demands are issued promptly, it helps create a predictable income stream, which is crucial for managing operating expenses and investments.

Benefits of Timely Payment Requests

Sending out payment requests without delay provides several key benefits:

- Faster Payments: When requests are sent promptly, it increases the likelihood of receiving payments on time, improving overall liquidity.

- Reduced Administrative Burden: By staying on schedule, businesses can avoid the hassle of chasing overdue payments or dealing with late fees and penalties.

- Stronger Relationships: Consistently requesting payments on time fosters professionalism and reliability, which strengthens relationships with clients and customers.

- Better Financial Planning: Timely payment requests make it easier to forecast cash flow, allowing businesses to plan their expenditures and investments more effectively.

Strategies for Ensuring Timeliness

To ensure that payments are requested on time, consider these best practices:

- Set Clear Deadlines: Make sure that due dates are clearly stated on all documents, so there is no confusion about when payment is expected.

- Automate Reminders: Use automated systems or software to send payment reminders to clients, reducing the risk of oversight.

- Establish Regular Billing Cycles: Set up consistent billing periods to ensure that payments are requested at predictable intervals.

By focusing on timely payment requests, businesses can not only enhance their cash flow but also build stronger financial foundations that support long-term growth and stability.