Commercial Invoice Template for UK Businesses

For businesses in the UK, creating accurate and professional billing records is a key aspect of maintaining smooth financial operations. A well-structured document for billing serves not only as a request for payment but also as an important legal record for both the buyer and seller.

In this article, we will explore the process of creating a customized billing form, ensuring it includes all the necessary details that reflect the transaction terms. By understanding the elements of these documents, businesses can streamline their administrative tasks and maintain clarity in their financial communications.

Mastering the creation and use of these forms allows businesses to avoid common mistakes and ensures compliance with local regulations, making it easier to manage payments and reduce potential disputes. Whether you’re a small business or a larger corporation, implementing a well-organized record-keeping system is essential for success.

What is a Billing Document

A billing document is a formal record issued by a seller to a buyer, outlining the details of a transaction. It serves as a request for payment and provides both parties with a clear understanding of the terms agreed upon. This document plays a critical role in business operations, ensuring transparency and accountability.

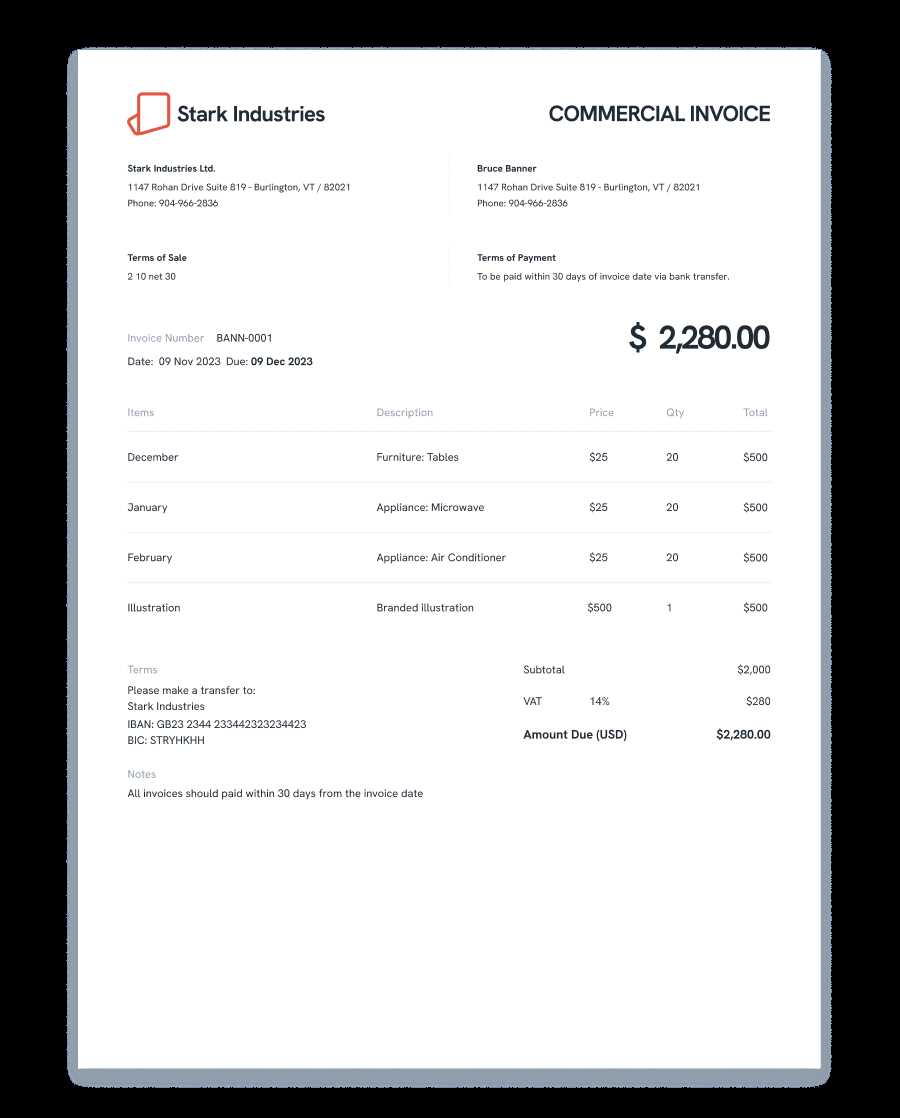

Typically, a well-structured billing document includes several key pieces of information:

- Seller and buyer details: Contact information of both parties involved in the transaction.

- Itemized list of goods or services: Description of the products or services being sold, including quantities and unit prices.

- Payment terms: The conditions under which payment is due, including deadlines and any applicable late fees.

- Tax information: Relevant taxes applied to the transaction, such as VAT in the UK.

- Total amount: The total sum to be paid, including all goods, services, and taxes.

This record not only facilitates the payment process but also ensures that businesses stay compliant with tax regulations and maintain organized financial documentation for future reference.

Why UK Businesses Need a Billing Document

For businesses operating in the UK, having a clear and professional method for documenting transactions is crucial for maintaining smooth financial operations. This formal document not only acts as a request for payment but also serves as a legal record, ensuring transparency and trust between both parties involved.

Here are some reasons why businesses in the UK should prioritize using a structured document for each sale:

- Legal Protection: A well-prepared document protects both the seller and the buyer in case of disputes, providing evidence of the agreed terms and conditions.

- Tax Compliance: It ensures that all applicable taxes, such as VAT, are properly calculated and recorded, helping businesses comply with local tax regulations.

- Professionalism: A clearly organized document helps to establish a professional image, enhancing trust and reliability with clients and partners.

- Payment Tracking: It serves as a tool for tracking payments, making it easier for businesses to follow up on outstanding balances and manage cash flow effectively.

- Financial Records: It contributes to keeping accurate financial records, which are essential for accounting, audits, and business growth planning.

Without this essential document, businesses may face difficulties in managing payments, taxes, and legal issues, which can disrupt their operations and affect their reputation.

Key Elements of a Billing Document

To ensure accuracy and clarity, a billing document should include several important components. These elements not only make the document easy to understand but also help in keeping track of transactions, ensuring both parties are on the same page regarding payment terms.

Here are the key components that should be included in every billing document:

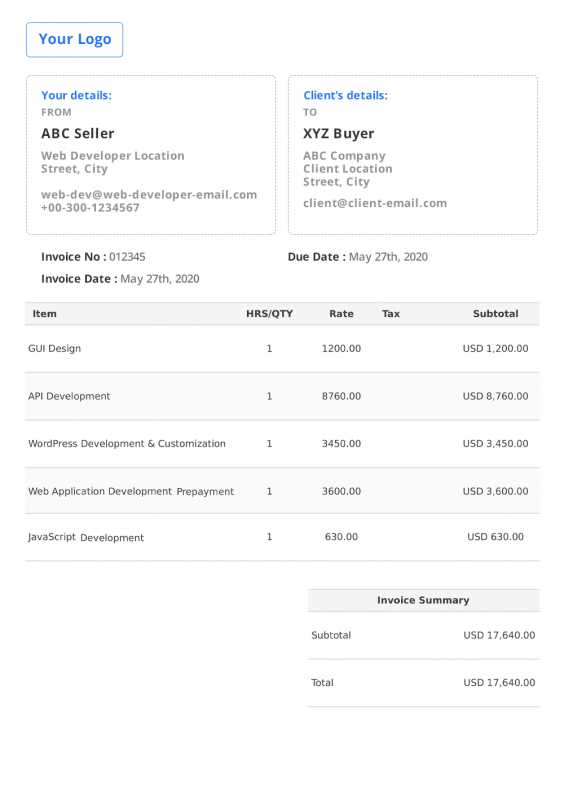

- Seller and Buyer Information: This includes the names, addresses, and contact details of both the buyer and seller, ensuring clear identification of both parties.

- Unique Reference Number: Each document should have a unique reference or identification number for easy tracking and record-keeping.

- Transaction Date: The date the goods or services were provided, as well as the date the payment is due, helps to establish clear payment timelines.

- Description of Goods or Services: A detailed list of what is being sold, including quantities, unit prices, and any applicable product codes.

- Payment Terms: Clear instructions on how and when the payment should be made, including any discounts for early payment or penalties for late payment.

- Taxes and Fees: The tax rate applied to the transaction, such as VAT, should be listed separately from the total cost, ensuring compliance with local tax laws.

- Total Amount: The total sum payable, including all charges, taxes, and any other fees, should be clearly stated to avoid confusion.

Including these details ensures that both parties are aware of their responsibilities and helps to prevent any misunderstandings or disputes regarding payments.

How to Create a Billing Document Format

Creating a structured billing document is an essential step for businesses to maintain organization and ensure clarity in financial transactions. A well-designed format ensures that all necessary details are included, streamlining the payment process and preventing errors.

Step 1: Choose a Suitable Structure

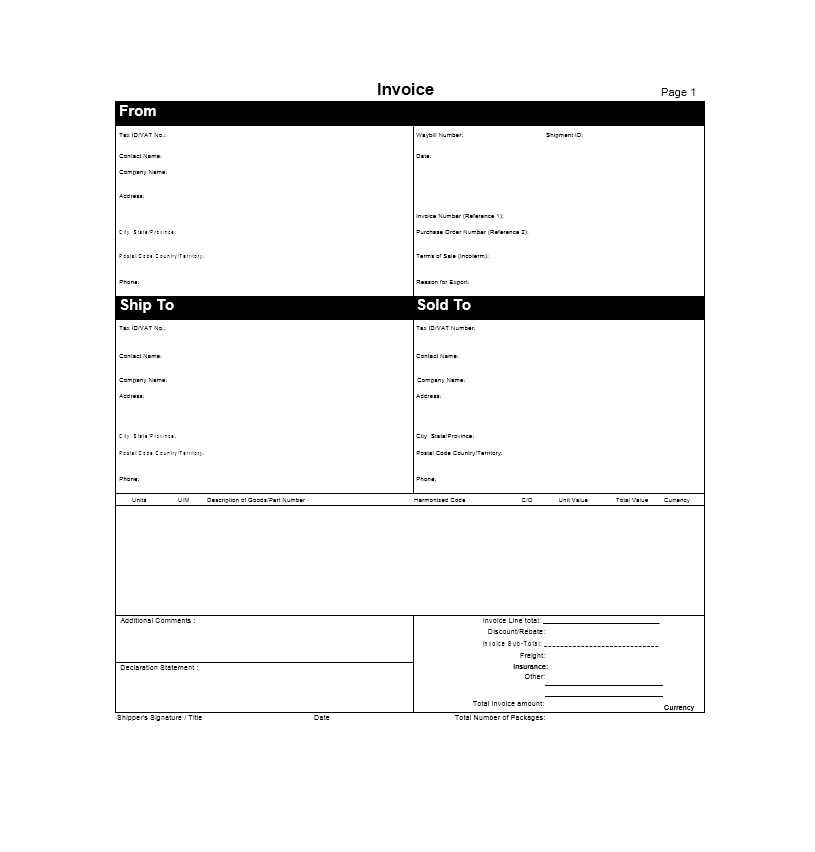

Begin by determining the layout of the document. It should be simple yet comprehensive, with sections that are easy to read and navigate. Use headings and clearly defined areas for each component of the transaction. The following is an example structure for a standard billing document:

| Section | Description |

|---|---|

| Header | Include business name, logo, and contact details for both parties. |

| Transaction Information | Include transaction date, unique reference number, and due date for payment. |

| Itemized List | Provide details of the products or services, including prices and quantities. |

| Taxes and Fees | Clearly indicate applicable taxes, such as VAT, and any additional charges. |

| Total Amount | Sum up the total cost, including all items, taxes, and any extra fees. |

| Payment Terms | Specify payment methods and due dates, including discounts or penalties. |

Step 2: Select the Right Format

Once the structure is determined, choose a format that suits your business. You can create a document manually or use software to automate the process. For businesses that handle numerous transactions, using a digital tool or software that generates the document based on inputted data is an efficient way to streamline the process.

Having a standardized format helps maintain consistency across all transactions and ensures that every detail is included, minimizing the chance of errors or disputes.

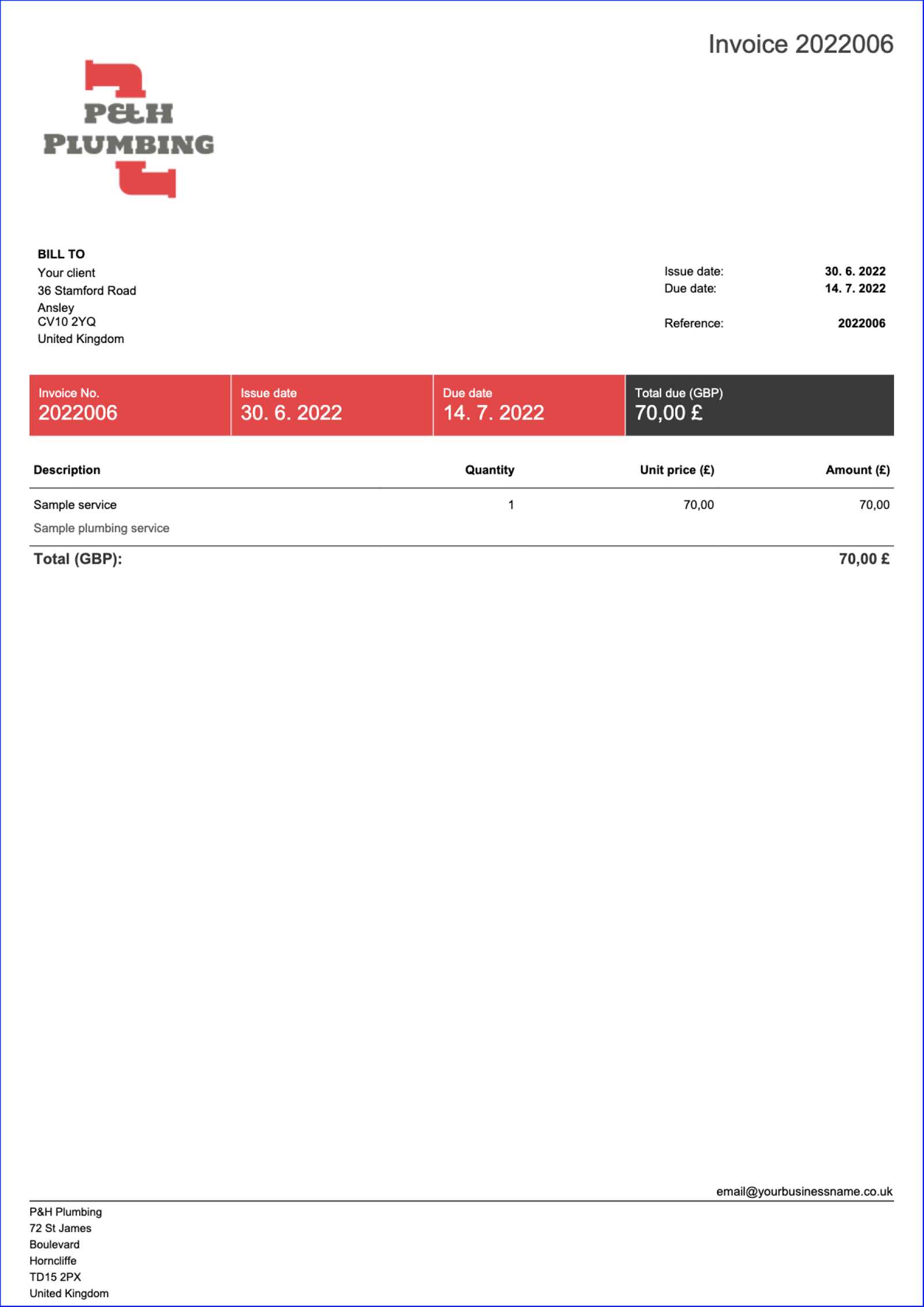

Best Practices for Billing Document Formatting

Creating a well-structured and clear billing document is essential for businesses to ensure smooth transactions and maintain professionalism. A properly formatted document not only facilitates timely payments but also reduces the risk of errors and confusion. By following best practices, you can create a document that is both easy to read and legally sound.

Key Considerations for Clear Formatting

When designing your billing document, it’s important to focus on the layout and organization. Here are some best practices to follow:

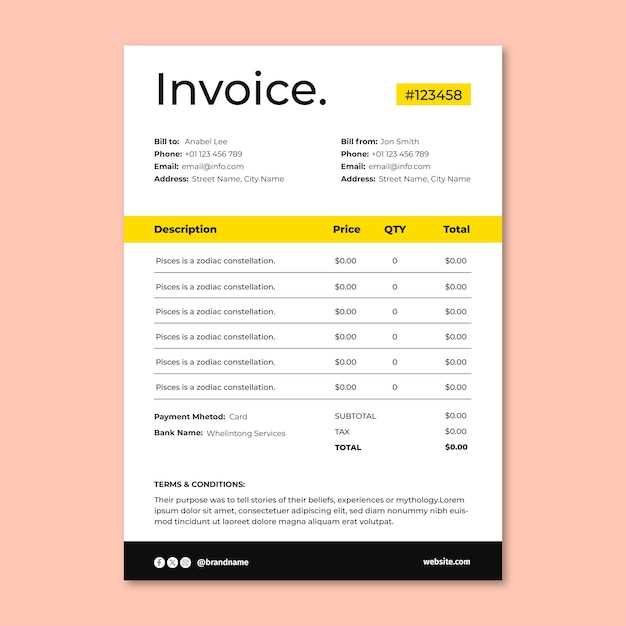

- Use a Clean Layout: Ensure that the document is neat and easy to read, with plenty of white space between sections.

- Include Clear Headings: Organize the content into clearly defined sections such as seller details, buyer details, transaction summary, and payment terms.

- Be Consistent with Fonts and Styles: Choose a professional font and use it consistently throughout the document. Avoid using too many different fonts or colors.

- Provide Itemized Information: List products or services with precise descriptions, quantities, and unit prices to avoid misunderstandings.

- Highlight Important Dates and Amounts: Make sure that the due date and total amount due stand out clearly so there’s no confusion about when payment is expected.

- Ensure Readable Tax Information: Clearly display tax rates and total tax amounts so that the client understands the charges fully.

Tips for Professional Presentation

- Use Company Branding: Include your logo and contact details prominently at the top of the document to give it a professional look.

- Provide Payment Instructions: Clearly specify payment methods, terms, and any penalties for late payment.

- Proofread for Accuracy: Before sending out any document, make sure to proofread for spelling, grammar, and calculation errors to maintain professionalism.

By following these best practices, you can ensure that your billing documents are well-organized, professional, and easy for clients to understand, leading to smoother transactions and improved business relationships.

Customizing Your Billing Document Format

Adapting your billing document format to meet specific business needs and client requirements is a key step in maintaining clarity and professionalism. A customized layout can streamline your financial processes, ensure compliance, and provide a more personalized experience for your clients. With a few adjustments, you can create a format that reflects your business’s identity and enhances the overall user experience.

Steps to Tailor Your Document

To make your billing document stand out and fit your business needs, follow these steps:

- Incorporate Your Branding: Add your company’s logo, color scheme, and contact details to the document to give it a professional and personalized touch.

- Modify Section Layouts: Depending on your industry, you might need to rearrange sections such as shipping details, payment terms, or item descriptions to fit your needs.

- Include Special Instructions: If you offer specific terms like discounts, promotional offers, or return policies, make sure to clearly state them within the document.

- Adjust for Local Taxation: Customize your format to include tax rates and other local charges relevant to your region or business type.

- Add Unique Identifiers: Use unique reference numbers or codes for transactions to make tracking and organization easier.

Additional Customization Tips

- Use Digital Tools: Leverage software to automate repetitive tasks, such as populating customer details or calculating totals, making the process more efficient.

- Customize for Different Clients: If you serve clients from multiple industries, tailor the document’s content to reflect the specifics of each transaction.

- Ensure Consistent Formatting: Keep a consistent style across all documents to maintain professionalism and avoid confusion.

By customizing your billing format, you not only create a professional appearance but also improve your efficiency in handling financial transactions. A personalized format that aligns with your brand and client expectations can make a significant impact on your business operations.

Invoice Format Options for UK Companies

UK businesses have various options when it comes to creating billing documents. The right format can simplify the payment process, ensure compliance with local regulations, and present a professional image to clients. Understanding the different formats available allows businesses to choose the one best suited to their needs, whether for domestic or international transactions.

Popular Options for UK Businesses

There are several formats that UK companies commonly use for billing purposes. These include:

- Standardized Format: This is the most common format, often created using spreadsheet software or accounting tools. It includes essential elements like buyer and seller details, item descriptions, and payment terms.

- Customizable Software Solutions: Many businesses opt for specialized invoicing software that offers pre-designed formats with the flexibility to adjust fields, add logos, and tailor the layout for specific client needs.

- Online Invoice Generators: These are web-based tools that provide a simple interface for creating and downloading professional billing documents quickly. Many options are free or offer paid features for enhanced functionality.

- Manual Documents: Some businesses prefer to create and print billing documents by hand, especially for small-scale operations or bespoke transactions. While time-consuming, this method ensures complete control over the design and content.

Choosing the Right Format

When selecting a format for your business, consider the following factors:

- Ease of Use: Choose a format that is simple to create and understand for both you and your clients.

- Legal Compliance: Ensure that the format complies with UK tax regulations, including VAT details and other mandatory information.

- Integration with Accounting Systems: Some businesses prefer formats that integrate directly with accounting software to simplify record-keeping and financial reporting.

By selecting the right format, UK companies can streamline their billing process, maintain professionalism, and enhance their overall business operations.

How to Include Taxes in a Billing Document

When creating billing documents for transactions, it’s crucial to account for taxes in a transparent and accurate way. Including the correct tax information ensures that both businesses and clients understand the total cost and comply with local regulations. Whether it’s VAT or other applicable taxes, following proper guidelines will help maintain clarity and avoid confusion.

Steps to Add Taxes to Your Billing Document

To include taxes correctly, follow these simple steps:

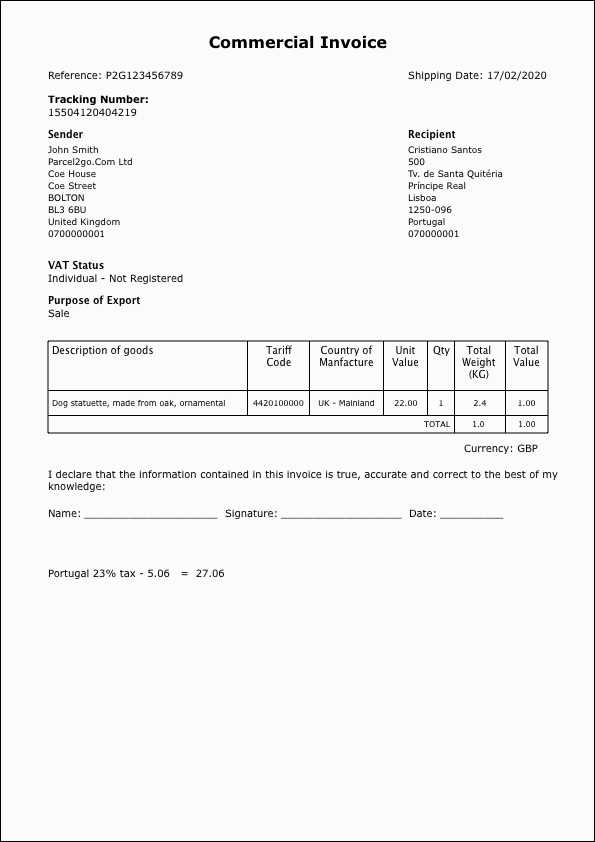

- Determine Applicable Tax Rates: Identify the relevant tax rate for your business and location. For UK businesses, VAT is commonly used, but certain goods and services may have different rates.

- Calculate the Tax Amount: Multiply the subtotal by the applicable tax rate to calculate the amount of tax to add to the total. Ensure that this calculation is clear and easy to verify.

- Clearly Separate Tax Amounts: In your document, list the tax as a separate line item. This helps clients understand the tax portion of the total cost.

- Include Tax Identification Information: Some billing documents require businesses to list their tax registration number or VAT number. Ensure that this information is included if needed.

Common Tax Scenarios in Billing Documents

- VAT Included: If the listed price includes tax, indicate this clearly on the document (e.g., “Total amount including VAT”).

- Tax Exemption: If a product or service is tax-exempt, make sure to specify this and include the reason for exemption to avoid misunderstandings.

- Multiple Tax Rates: Some businesses may need to apply different tax rates to different items. Clearly list each item with its corresponding tax rate for transparency.

By following these steps, you can ensure that taxes are properly included in your billing documents, helping to avoid confusion and ensuring compliance with local laws.

Common Mistakes to Avoid When Invoicing

Creating accurate billing documents is essential for smooth business operations. However, even experienced professionals can overlook certain details, leading to errors that can cause delays in payments or disputes. It’s important to be aware of common pitfalls to ensure that your documents are clear, professional, and legally compliant.

Here are some of the most frequent mistakes businesses make when preparing billing documents:

- Incorrect Contact Information: Failing to include up-to-date contact details, such as the correct business address, phone number, and email, can lead to communication issues and delayed payments.

- Missing Payment Terms: Not specifying clear payment terms, such as due dates and accepted payment methods, can cause confusion and result in late payments.

- Omitting Tax Information: Forgetting to add taxes or not displaying them clearly can lead to misunderstandings with clients and potential legal issues with tax authorities.

- Ambiguous Descriptions: Vague descriptions of goods or services provided can create confusion. Always provide a clear, detailed description to ensure the client understands what they are being billed for.

- Not Including a Unique Identifier: Without a unique reference number for each billing document, it can become difficult to track and follow up on payments, especially for large businesses or multiple transactions.

- Errors in Amounts: Simple calculation mistakes in the total amount or missing discounts can cause trust issues with clients. Always double-check the figures before sending the document.

By avoiding these common mistakes, businesses can ensure that their billing processes are efficient, professional, and smooth. Attention to detail not only helps in maintaining positive client relationships but also supports timely payments and compliance with regulations.

How to Add Payment Terms on Invoices

Setting clear payment conditions in your billing documents is essential for maintaining a smooth cash flow and avoiding payment delays. By specifying payment terms, you provide your clients with a clear understanding of when and how they should settle their balances, ensuring transparency and professionalism.

Here are the key steps to include payment terms effectively in your documents:

- Specify Due Dates: Always mention a clear due date for payment, such as “Due within 30 days” or “Payment due on [specific date].” This helps set expectations and encourages timely payment.

- Define Payment Methods: Clearly state the accepted forms of payment, such as bank transfer, credit card, or online payment platforms. Providing several options can make it easier for clients to pay promptly.

- Include Late Payment Fees: To avoid late payments, consider including a clause about late fees or interest charges. For example, “A 5% late fee will be applied for payments received after [due date].”

- Offer Early Payment Discounts: To incentivize early payments, offer discounts like “2% discount for payments made within 10 days.” This encourages clients to pay ahead of schedule.

- Provide Clear Instructions: If your payment terms involve specific instructions, such as bank account details or reference numbers, ensure that these are easily visible and accessible on the document.

By clearly stating payment terms, you set expectations upfront, helping clients understand when payment is expected and how to proceed. Clear and professional payment terms not only promote timely payments but also foster positive business relationships with your clients.

Understanding Invoice Currency Requirements

When conducting business internationally or with clients from different countries, it is essential to understand how to handle currency in your billing documents. The currency used in a transaction affects not only the payment process but also the clarity and efficiency of cross-border trade. Establishing the correct currency requirements helps prevent confusion and ensures both parties are on the same page regarding the amounts owed.

Here are the key considerations for handling currency in billing documents:

- Choose the Right Currency: Depending on the location of your business and your client, choose a currency that is suitable for both parties. For example, if you’re dealing with a client in the United States, using US dollars (USD) may be appropriate, while working with European clients might require Euros (EUR).

- Specify Currency Clearly: Always indicate the currency being used in your documents clearly. It should be placed next to the amount to avoid any misunderstanding. For example, write “£500” for British pounds or “$300” for US dollars.

- Consider Currency Conversion: If the transaction involves multiple currencies, be sure to specify how the exchange rate is calculated. You may choose to fix the rate on the invoice date or allow for fluctuations based on market conditions.

- Indicate Payment Method: Different payment methods may have varying exchange rates or transaction fees. If applicable, outline the payment methods available (e.g., bank transfer, PayPal) and any additional fees that may apply for currency conversion.

- Legal Requirements: Some countries have specific regulations regarding currency in business transactions. It’s important to familiarize yourself with the laws governing the use of foreign currencies in your client’s country to ensure compliance.

By understanding the currency requirements for your transactions and clearly specifying them, you can avoid any confusion or issues with payments. It ensures that both your business and your clients are aligned on the financial terms of the agreement.

Managing Multiple Invoice Templates

Running a business often requires handling a variety of billing documents to meet the needs of different clients and transaction types. When dealing with multiple types of agreements, services, or industries, it’s important to create and manage different formats to ensure that each document is tailored to the specific needs of the business relationship. Efficiently managing these various forms helps maintain professionalism and reduces errors in financial documentation.

Here are some strategies for managing several billing forms effectively:

- Organize by Client Type: Create different formats for various client categories, such as corporate clients, individual customers, or international transactions. Each group may require different details or structures in the document.

- Standardize Key Information: While there are different formats, ensure that key details like the business name, contact information, and payment terms remain consistent across all documents. This standardization maintains professionalism and reduces confusion.

- Use Digital Solutions: Utilize accounting or invoicing software that allows for the storage and easy customization of various billing documents. Many platforms offer the ability to quickly switch between different templates while keeping track of which format was used for each transaction.

- Keep Track of Changes: Maintain version control for different documents, especially when updates or revisions are necessary. This ensures that the correct format is being used and prevents outdated forms from being sent to clients.

- Regularly Review for Compliance: Different types of transactions might have different regulatory or legal requirements. Periodically review all formats to ensure they comply with any local laws, tax regulations, and industry standards.

By organizing and efficiently managing your various billing forms, you can ensure that each client receives a tailored, accurate, and professional document, streamlining your business operations and reducing the risk of errors.

Legal Considerations for UK Invoices

When issuing billing documents in the UK, it is important to ensure that they meet certain legal requirements. These legal obligations are crucial for both the seller and the buyer, ensuring transparency, fairness, and compliance with tax regulations. Businesses must adhere to these rules to avoid legal disputes, fines, and penalties. Understanding the key legal considerations is vital for any business operating in the UK.

Key Legal Requirements

In the UK, there are several legal aspects to consider when creating billing documents, such as:

- VAT Details: If your business is VAT-registered, you must include the VAT registration number on each document. Additionally, the amount of VAT charged should be clearly stated.

- Clear Terms of Payment: All payment terms should be unambiguous, including due dates and any penalties for late payments. This helps prevent misunderstandings and protects both parties legally.

- Accurate Product/Service Descriptions: Ensure that the products or services provided are described in full, including quantities, prices, and any applicable discounts. This is essential for transparency and prevents potential legal issues.

- Invoice Numbering: Each document should have a unique identifier, also known as a reference number, for record-keeping purposes. Sequential numbering is typically required for tax reporting and auditing purposes.

- Business Information: You must include essential details about your business, such as your registered name, address, and contact information. This is crucial in case of disputes or inquiries.

Regulatory Compliance

It’s important to stay compliant with UK business regulations, which may evolve over time. For example, tax rules and VAT rates are subject to change, and failing to update your documents accordingly could lead to compliance issues. Regular reviews of your processes can help ensure that all legal obligations are met and that your billing documents remain accurate and compliant.

By understanding and following these legal requirements, businesses in the UK can protect themselves from potential disputes and ensure smooth transactions with clients.

Benefits of Using an Automated Template

Implementing automated systems for creating billing documents can bring significant advantages to businesses. Automation streamlines the process, ensuring that all necessary details are included without the need for manual input. This not only saves time but also reduces the likelihood of errors, making the process more efficient and reliable. Companies of all sizes can benefit from this approach, enhancing productivity and accuracy.

| Benefit | Description |

|---|---|

| Time Efficiency | Automation speeds up the creation process, reducing the time spent on manual entry. This allows businesses to handle more tasks in less time. |

| Consistency and Accuracy | With automated systems, businesses can ensure that each document is formatted consistently and accurately, minimizing human error. |

| Cost Savings | By eliminating the need for manual input and reducing the time required for document preparation, businesses can save on operational costs. |

| Improved Compliance | Automated systems can be updated to reflect current legal and tax requirements, ensuring that documents comply with all relevant regulations. |

| Easy Integration | Automated systems can be integrated with other business software, such as accounting or CRM tools, making it easier to manage financial data. |

Using an automated system to create billing documents provides many advantages that contribute to the overall efficiency of a business. By reducing errors, saving time, and ensuring compliance, companies can focus more on growth and less on administrative tasks.

How to Send and Track Invoices

Sending and monitoring billing documents effectively is crucial for ensuring timely payments and maintaining a smooth financial workflow. By adopting the right methods and tools, businesses can ensure their transactions are processed efficiently, reducing the risk of missed payments or errors. Knowing how to send these documents securely and track their status is key to improving cash flow and financial management.

There are several methods businesses can use to send their documents, including email, postal services, or automated systems. Once sent, it’s important to keep track of the status to ensure payments are made promptly. This can be done using tracking tools, reminders, or integrated software solutions that provide real-time updates on payment statuses.

| Step | Description |

|---|---|

| Step 1: Choose a Sending Method | Decide whether to send the documents electronically (via email or online platforms) or through traditional mail, depending on client preferences. |

| Step 2: Include Necessary Information | Ensure all relevant details such as due dates, amounts, and services/products provided are included for clarity. |

| Step 3: Use Tracking Tools | Use software or online tools to track the status of the documents, ensuring that you are notified when they are opened or paid. |

| Step 4: Set Up Payment Reminders | Automate reminders to be sent at regular intervals, such as a few days before or after the due date. |

| Step 5: Confirm Payment | Once payment is made, verify the transaction and mark the document as paid in your records or software system. |

By following these steps and using available tools, businesses can ensure a smooth process for sending and tracking their billing documents. This helps maintain healthy cash flow and reduces administrative overhead.

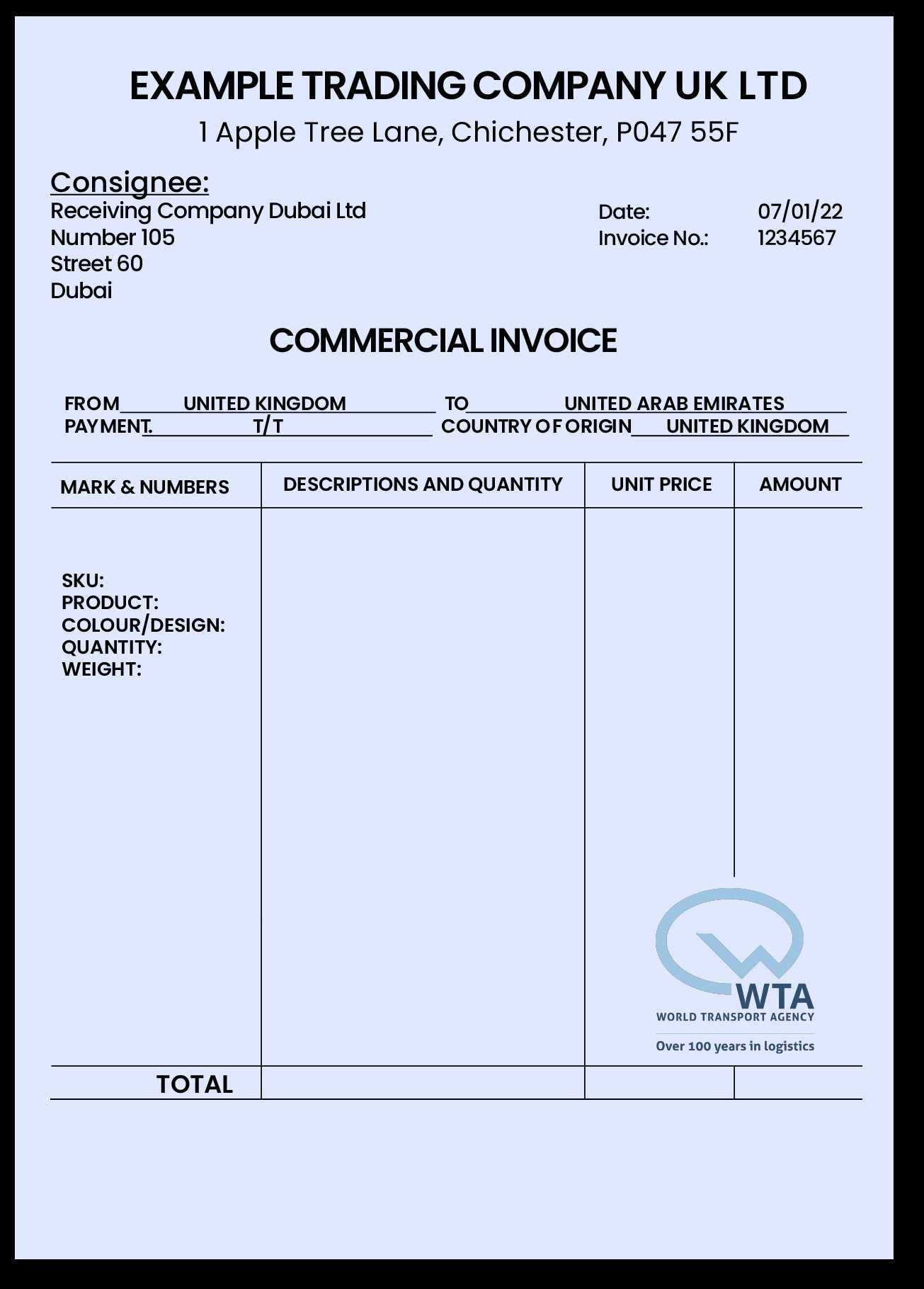

How to Adjust for International Transactions

When conducting business across borders, it’s essential to adapt your documentation and processes to account for the unique aspects of international transactions. These include different currencies, legal requirements, tax rates, and varying payment methods. Properly adjusting for these factors ensures smooth processing, compliance with local regulations, and timely payments, making international trade more efficient.

Key Adjustments for Global Transactions

- Currency Conversion: Always ensure that the currency is clearly stated and converted according to the correct exchange rate at the time of the transaction.

- Tax Rates: Consider the tax laws of the buyer’s country, including VAT or other sales taxes. Ensure you apply the correct rates for international clients.

- Payment Methods: Accept a variety of international payment options, such as wire transfers, credit cards, and international payment platforms like PayPal or Stripe.

- Customs and Duties: In some cases, you may need to provide information about the shipment and its value to comply with customs regulations. It’s important to outline which party is responsible for paying these fees.

- Language and Clarity: Ensure all documentation is clear and understandable for your international customers. It may be helpful to translate the documents or include additional explanatory notes.

Tracking and Reporting for International Sales

- Use Global Tracking Systems: Leverage tools that help monitor international payments and shipments, ensuring that transactions are processed smoothly and any delays are addressed quickly.

- International Legal Compliance: Familiarize yourself with international trade laws to avoid any legal issues related to foreign transactions.

- Timely Communication: Keep your clients informed about any changes to shipping schedules, customs requirements, or payment status. This transparency builds trust in international business relationships.

Adapting your practices for international transactions can seem complex, but by considering these key factors, you can streamline your processes, reduce risk, and ensure successful global trade operations.

Free vs Paid Invoice Solutions

When managing business documentation, particularly for billing purposes, companies have the option to choose between free and paid solutions. Each option has its advantages and limitations, and understanding these differences can help you select the best approach for your needs. The decision often depends on the complexity of your requirements, budget, and the level of customization you require for your documents.

Benefits of Free Solutions

- Cost-Effective: As expected, free solutions come with no upfront costs, making them an attractive option for small businesses or startups with limited budgets.

- Easy to Use: Many free options are simple to implement, providing an easy way to create professional documents without a steep learning curve.

- Basic Functionality: For businesses with straightforward billing needs, free tools often offer just the right amount of features, such as basic templates and simple customization.

Advantages of Paid Solutions

- Advanced Features: Paid options tend to offer more robust features, such as automatic calculations, detailed customization, and integration with accounting systems, which can improve workflow efficiency.

- Higher Customization: With a paid plan, you often gain access to more templates, design flexibility, and branding options to align with your company’s identity.

- Customer Support: Most paid services offer dedicated customer support, which can be essential for businesses requiring ongoing assistance or troubleshooting.

Ultimately, the choice between free and paid options depends on the size of your business, your specific needs, and the level of functionality you require. While free solutions are perfect for those just starting out or with simple requirements, paid options offer greater flexibility and advanced tools that can scale with your business as it grows.