Download Invoice Templates for Easy and Professional Billing

Managing payments efficiently is crucial for any business. Having a well-organized system to create and send billing documents can save time and reduce errors. Instead of designing these documents from scratch every time, there are ready-to-use solutions that can be easily customized to suit your needs. These solutions help ensure that all necessary details are included, providing a professional appearance and preventing confusion.

By utilizing pre-designed formats, you can quickly generate accurate statements for your clients, saving valuable time and focusing on your core business operations. Whether you are a freelancer, small business owner, or part of a large enterprise, having an easy way to issue professional documents is essential. These solutions are adaptable, flexible, and can cater to various industries, from retail to services.

Streamlining your administrative tasks with pre-made options can reduce the potential for mistakes and improve the overall experience for both you and your clients. Customizable features allow you to personalize these documents, making them reflect your brand while ensuring you meet all legal and financial requirements. With a few simple adjustments, you can have everything set for your next transaction.

Download Invoice Templates for Your Business

Running a business requires staying organized, especially when it comes to handling financial transactions. One of the most important documents in any business operation is the payment request form, which ensures clear communication between you and your clients. By using ready-made solutions, you can streamline the process, eliminate errors, and create consistent, professional-looking statements every time.

There are several benefits to using pre-made solutions for billing purposes. These documents are designed to be customizable, so they can fit the unique needs of your business. Whether you’re in retail, consulting, or any other industry, having access to such tools can make the process faster and more efficient.

Advantages of Using Pre-Designed Billing Forms

- Time-saving: Save valuable time by using a pre-made structure instead of starting from scratch each time you need to bill a client.

- Consistency: Maintain a uniform look and feel across all your transactions, which helps strengthen your brand identity.

- Customizability: Tailor each document to include necessary details such as payment terms, contact information, and specific line items.

- Accuracy: Pre-structured formats ensure that important data is not overlooked, minimizing the chances of errors or omissions.

How to Choose the Right Billing Solution for Your Business

When selecting a solution, consider the following factors to ensure you pick the right option for your needs:

- Industry-specific features: Make sure the form accommodates the specifics of your industry, whether it’s retail, consulting, or another field.

- Ease of use: The solution should be user-friendly, allowing you to fill out the necessary fields quickly without any hassle.

- Flexibility: Look for solutions that can be adapted for different clients or transactions and easily saved or shared.

- Compatibility: Ensure the file format works well with your preferred software or systems.

By incorporating these tools into your daily operations, you’ll be able to create professional and error-free documents, ultimately improving your business efficiency and customer experience.

Why Use Invoice Templates for Billing

Efficient billing is an essential part of maintaining a successful business. Having a standardized way to generate and send payment requests helps ensure accuracy, consistency, and professionalism. Instead of manually creating each statement from scratch, utilizing pre-designed documents allows you to automate and streamline this critical task, saving time and reducing the risk of errors.

By using ready-to-use solutions for financial transactions, you can focus more on running your business and less on administrative details. These ready-made formats offer numerous advantages that improve the overall efficiency of your operations.

Key Benefits of Using Pre-Made Billing Solutions

- Time Efficiency: Quickly create professional documents without the need to design each one from scratch.

- Consistency: Ensure that all your payment requests maintain a uniform look and structure, reinforcing your brand image.

- Accuracy: Pre-built structures reduce the risk of missing important details, ensuring that all relevant information is included.

- Professionalism: Provide your clients with polished, well-organized documents that reflect your business’s credibility.

How Pre-Made Billing Solutions Improve Accuracy

Using structured formats ensures that important fields like payment terms, dates, and client information are consistently filled out correctly. This minimizes mistakes such as missing amounts or incorrect contact details, which can lead to delays or confusion with payments.

Moreover, having a well-organized approach helps ensure compliance with tax regulations and legal requirements, as these documents are typically designed to meet standard industry practices.

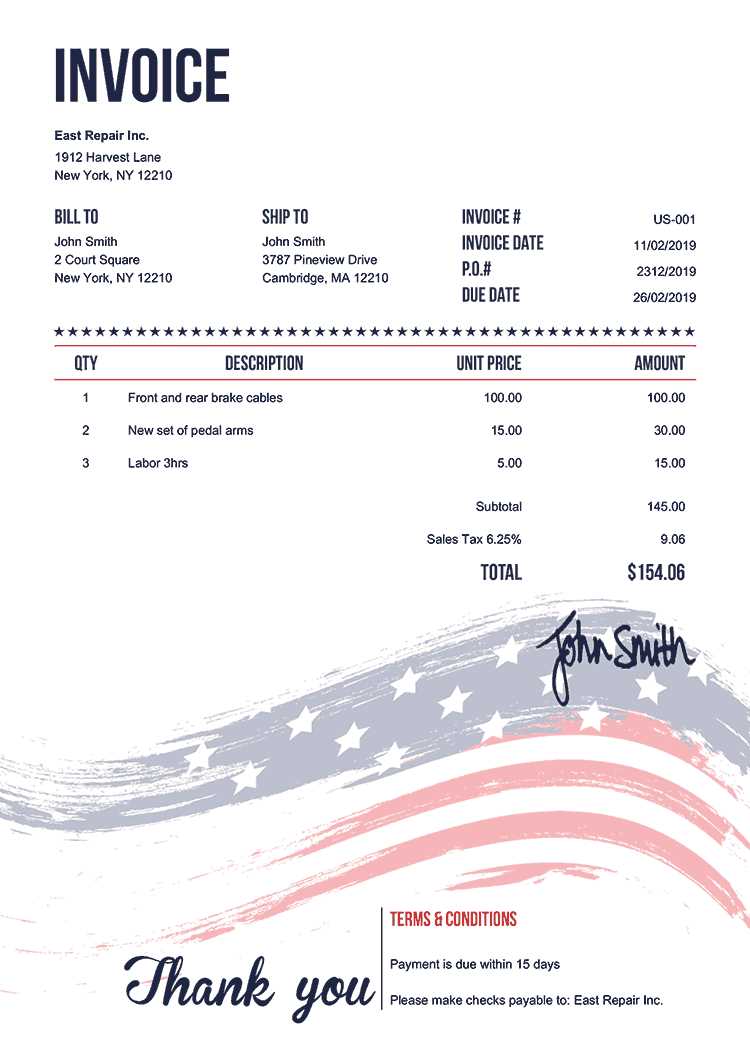

Benefits of Customizable Invoice Formats

Having the ability to tailor billing documents to your business needs offers significant advantages. Customizable solutions give you the flexibility to adjust the content, layout, and design of payment requests, making them more suited to your company’s branding and the specific requirements of each transaction. This level of personalization helps maintain professionalism while improving the overall efficiency of your billing process.

When you use a flexible structure, you can easily modify essential elements such as payment terms, product or service descriptions, and client details. This ensures that each statement is accurate and relevant, reducing the likelihood of confusion or disputes. The following highlights the key benefits of adapting payment request formats for your business.

Enhanced Professionalism and Branding

- Consistency: Customize the layout, font, and color scheme to align with your company’s branding, giving every document a professional look.

- Personalized Experience: Add your company logo, contact details, and other branding elements to enhance recognition and credibility.

- Tailored Content: Adjust the language and format to suit different clients or industries, ensuring the message is clear and appropriate for each audience.

Improved Accuracy and Efficiency

- Automatic Calculations: Some customizable solutions allow for automatic subtotal and tax calculations, reducing the chances of human error.

- Flexible Field Options: Easily adjust the fields to include specific information relevant to each job, making it simpler to track payments and manage records.

- Quick Updates: Make changes to your standard document format as needed without starting from scratch each time.

By utilizing a customizable structure, you not only make your billing process more efficient but also present a more polished and professional image to your clients, building trust and enhancing your brand’s credibility.

Choosing the Right Invoice Template

Selecting the appropriate structure for your billing documents is crucial for ensuring smooth transactions and maintaining professionalism. The right format can streamline your administrative work, improve clarity for your clients, and help you stay organized. With so many options available, it’s important to choose a design that not only meets the legal and business requirements but also aligns with your specific needs.

When choosing a suitable solution, consider the nature of your business, the type of services or products you offer, and how you want to present your brand. A good document format should be easy to use, flexible enough to accommodate various scenarios, and clear enough to leave no room for confusion. Here are some factors to keep in mind when making your selection.

Key Factors to Consider

- Industry Requirements: Different industries may require specific information or formatting. For example, service-based businesses might need detailed time logs, while retail businesses focus on itemized product lists.

- Customization Options: The structure should allow you to add or remove fields as needed, such as payment terms, discounts, or additional charges.

- Ease of Use: Choose a design that is simple to fill out and edit. You don’t want to spend excessive time adjusting the layout or inputting information.

- Clarity: The format should be easy to read and logically organized, with clear sections for each element of the transaction, such as pricing, taxes, and due dates.

How to Match Your Business Needs

Understanding your specific requirements will help you select the most suitable option. For instance, freelancers may need a simpler format that highlights their services and payment terms, while large businesses might benefit from more detailed billing systems that include project breakdowns and terms of service. Choose a structure that enhances your workflow, reduces errors, and provides a positive experience for your clients.

How to Access Free Billing Document Formats

Accessing ready-made solutions for your billing needs can save you both time and effort. There are many resources available online that offer free, customizable formats, making it easy to create professional documents without the need to design them from scratch. These free resources are especially useful for small businesses, freelancers, or anyone looking to streamline their payment request process.

To get started, follow these simple steps to find and use these free options effectively:

Steps to Access Free Billing Document Formats

- Search for Trusted Websites: Look for reputable websites that specialize in providing business tools, including payment request solutions. Many of these offer free downloads with no hidden costs.

- Choose the Right Format: Select a structure that suits your needs, whether you require a simple layout for freelance work or a more detailed one for large projects or services.

- Customize Your Document: After selecting the format, adjust the fields to match your specific business information. This might include adding your logo, adjusting payment terms, or including tax details.

- Save the File: Once you’re satisfied with the document, save it in your preferred file format, such as PDF or Word, for easy access and sharing with clients.

Where to Find Free Resources

- Business Resource Websites: Many sites dedicated to entrepreneurship or small businesses offer free downloads for essential documents, including billing solutions.

- Template Marketplaces: Platforms like Microsoft Office or Google Docs offer free pre-built solutions that can be quickly edited and used for your own needs.

- Accounting and Finance Blogs: Blogs related to finance or accounting often share free, downloadable resources as part of their value-added content.

By following these steps, you can easily access and customize professional billing formats that help you maintain consistency and professionalism in your business transactions.

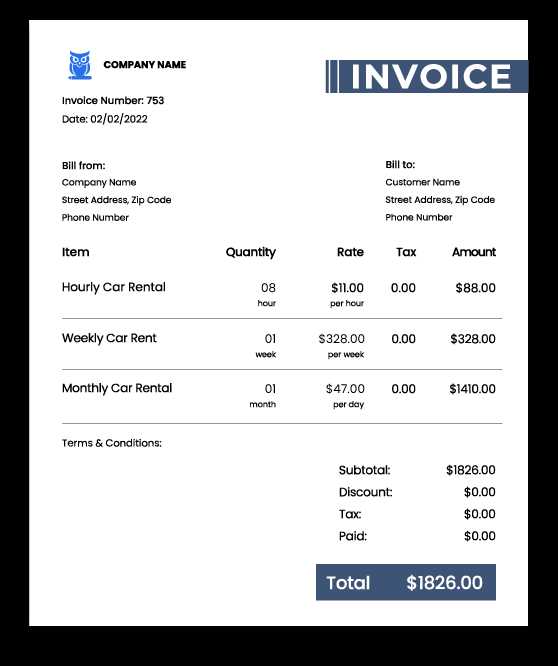

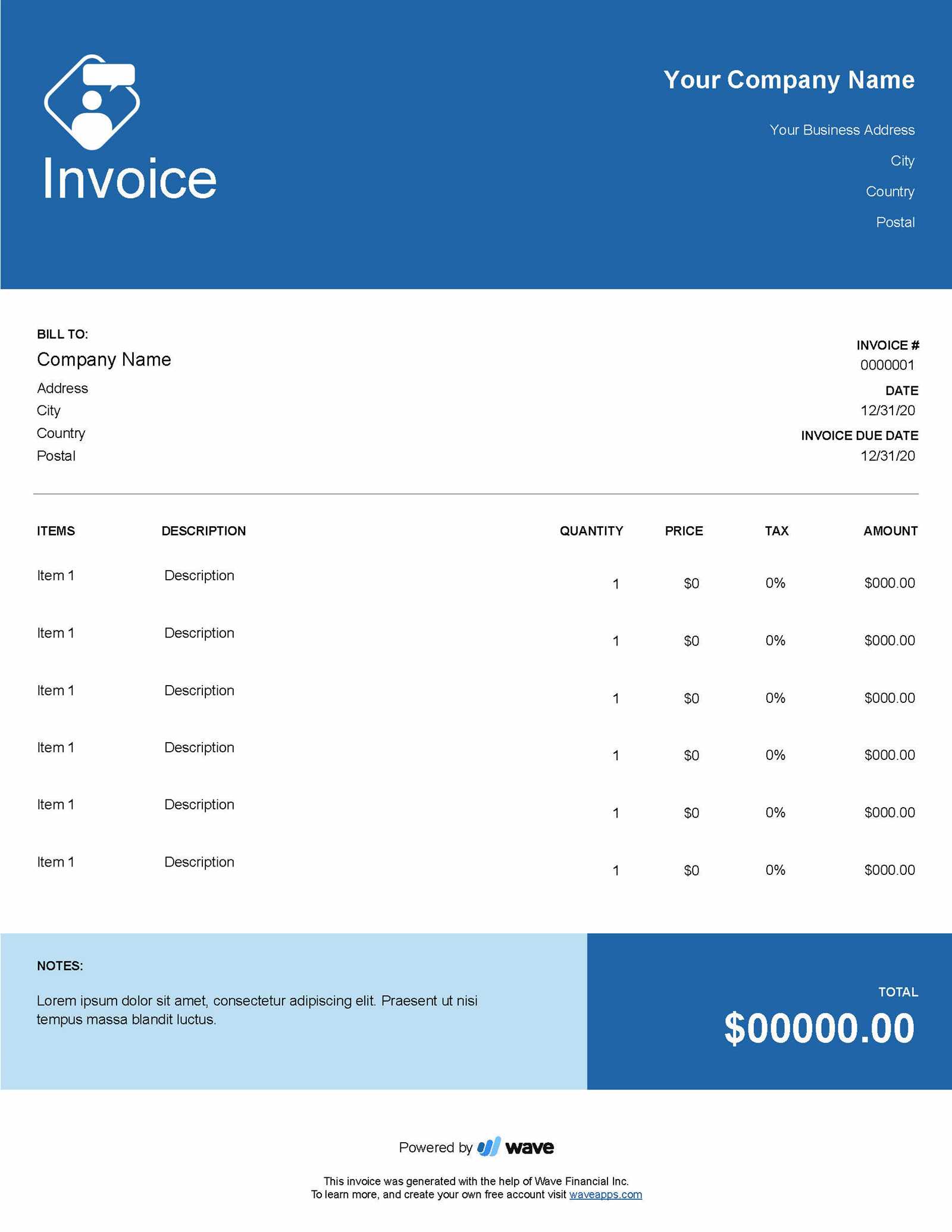

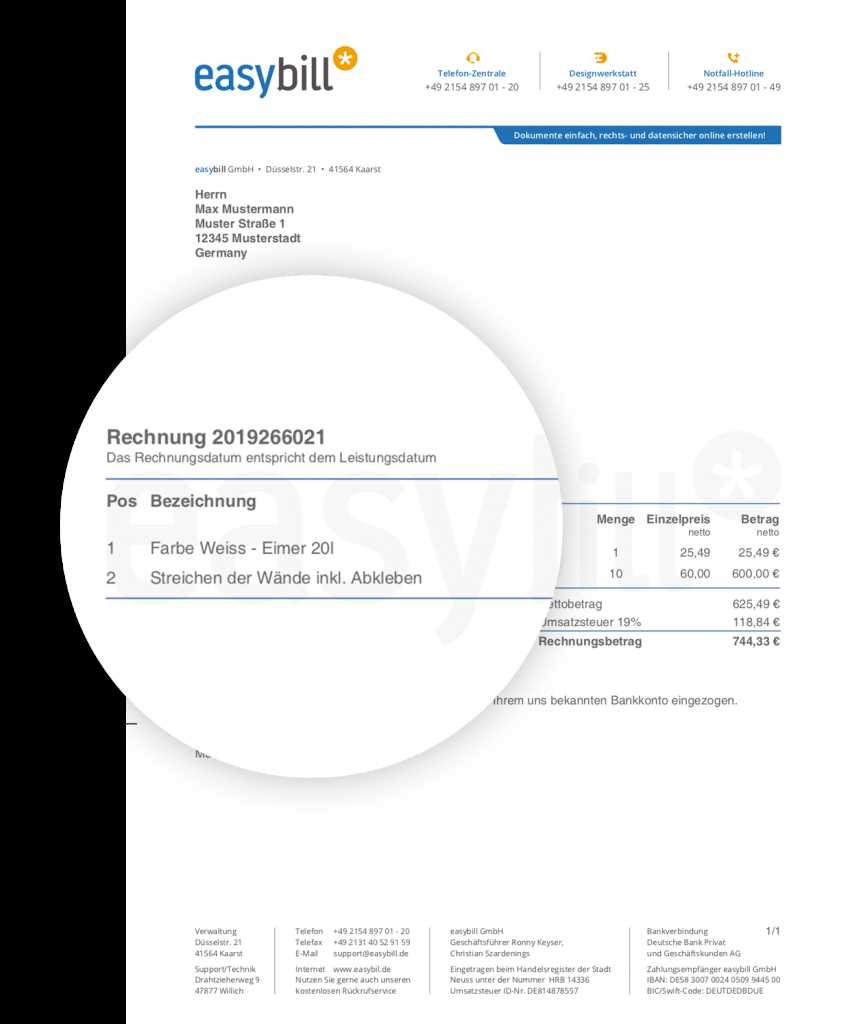

Top Features of Professional Invoice Templates

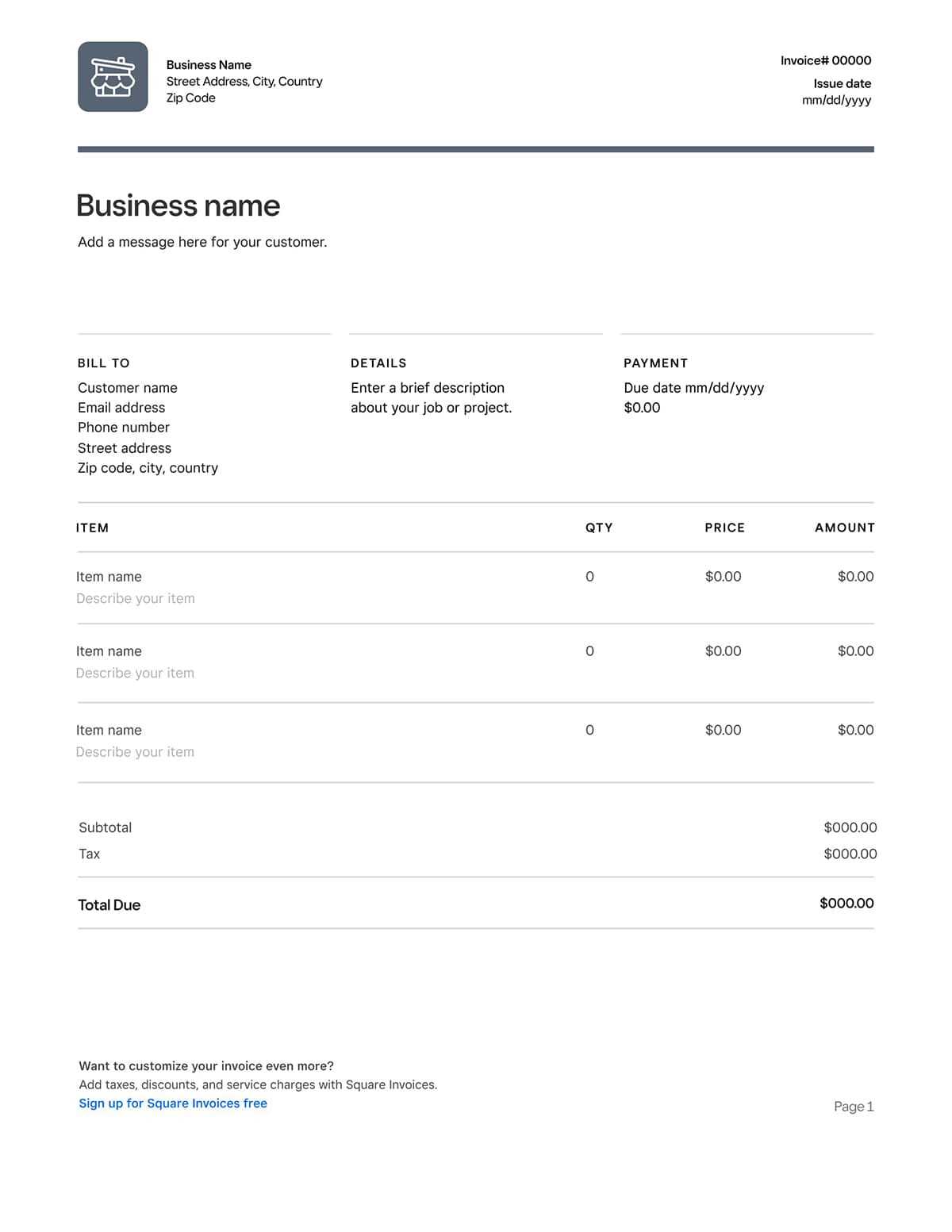

When creating billing documents for your business, it’s important to ensure that the final product looks professional, includes all necessary details, and is easy to understand. A well-designed format can improve the overall experience for both you and your clients, making transactions smoother and more efficient. The following features are essential for a high-quality, professional document that will leave a lasting impression.

Essential Features for a Professional Layout

- Clean and Organized Design: A structured, easy-to-follow layout ensures that all important details are visible and accessible at a glance.

- Company Branding: Customizable sections allow you to include your business logo, colors, and fonts, helping reinforce your brand identity.

- Itemized Breakdown: Detailed descriptions of services or products, along with individual pricing, help clients understand exactly what they are being charged for.

- Clear Payment Terms: Easily visible payment terms and due dates help avoid confusion and ensure timely payments.

- Tax and Discount Calculations: Pre-built fields for taxes, discounts, and additional fees help simplify complex calculations, reducing the risk of errors.

Additional Functional Features

- Automatic Calculations: Some formats include auto-calculation features for totals, taxes, and subtotals, saving you time and effort.

- Multiple Currency Support: The ability to display prices in different currencies is especially useful for international clients.

- Editable Sections: Custom fields allow you to adjust the content as needed, whether for a specific client or a particular project.

- Simple File Sharing: Many professional layouts are compatible with various file formats, such as PDF or Word, making it easy to share with clients via email or print.

By choosing a billing solution with these key features, you can streamline your billing process, ensure accuracy, and present your business in a polished, professional way.

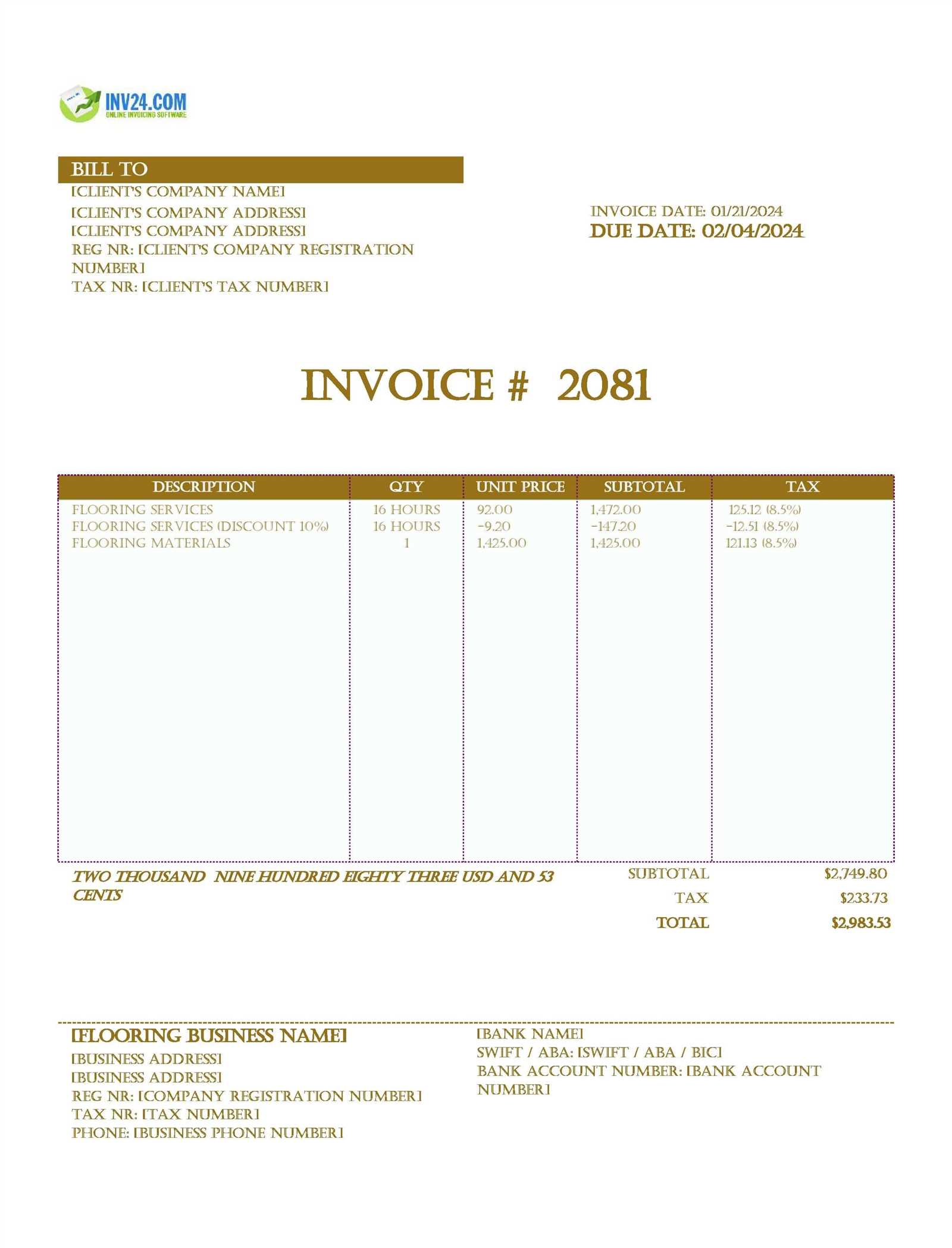

Creating Detailed Invoices with Templates

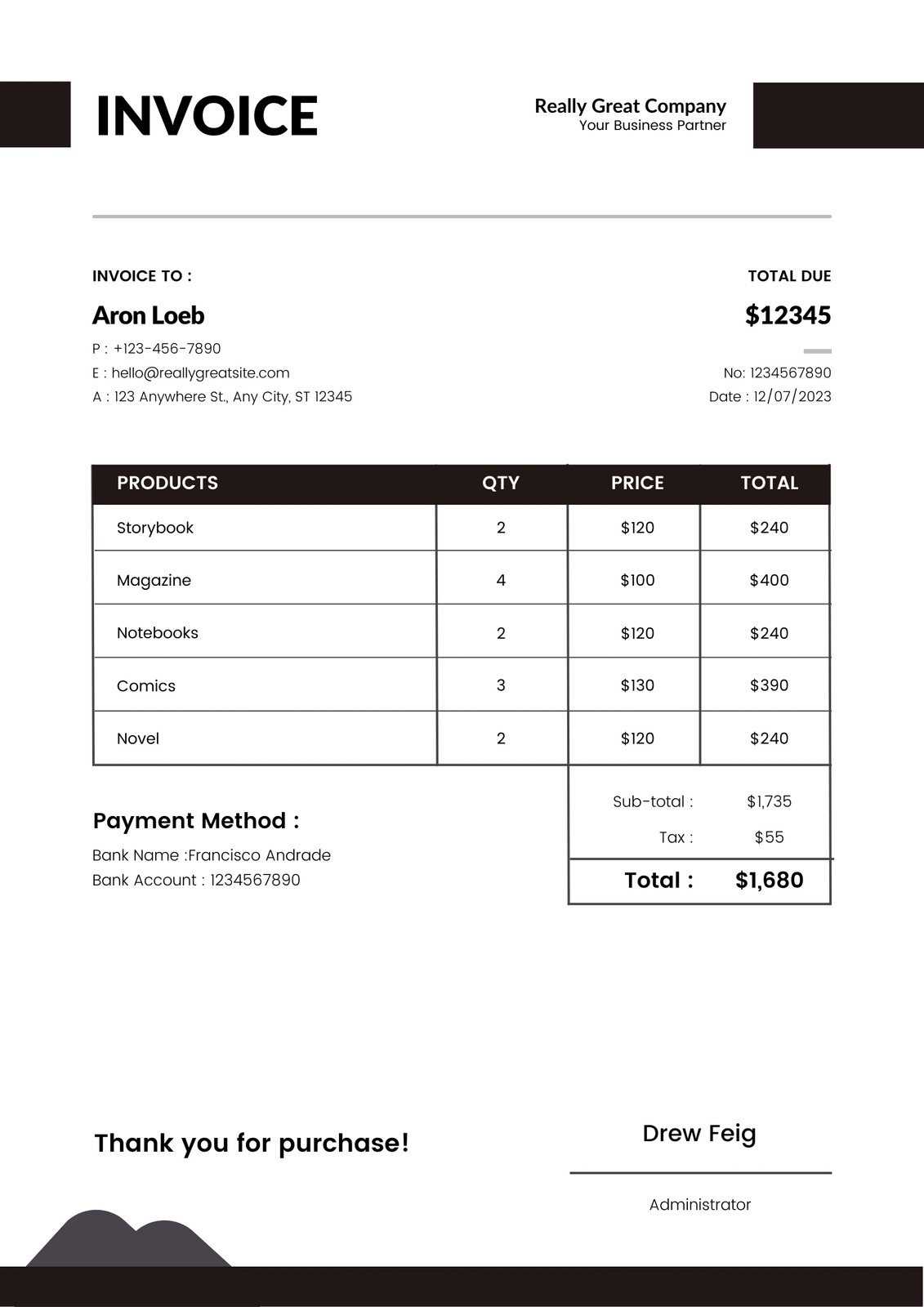

When managing payments for your business, it’s essential to create comprehensive documents that clearly outline the services or products provided, along with any terms, pricing, and taxes. By using a structured format, you can ensure that all necessary details are included and easy to understand. A well-crafted document helps avoid confusion, improves communication with clients, and ensures timely payments.

One of the most effective ways to achieve this is by utilizing pre-designed solutions that allow you to include specific information in a clear and organized manner. These formats typically have sections for itemized lists, payment terms, taxes, and any additional charges, making it easier to present a thorough and accurate statement to your clients.

Example of a Detailed Billing Document

| Description | Quantity | Unit Price | Total |

|---|---|---|---|

| Web Design Services | 1 | $2,000.00 | $2,000.00 |

| SEO Optimization | 1 | $500.00 | $500.00 |

| Subtotal | $2,500.00 | ||

| Sales Tax (8%) | $200.00 | ||

| Total Due | $2,700.00 |

This is just one example of how a structured document can break down the costs in a way that is both transparent and professional. By including detailed line items, taxes, and payment instructions, your clients will have a clear understanding of what they are paying for, reducing the likelihood of disputes and improving overall payment efficiency.

By using a customizable solution, you can quickly adjust and adapt the content for different clients or projects, ensuring accuracy and consistency in all your transactions.

Common Invoice Template Formats Explained

When it comes to managing your business’s billing process, choosing the right document format can greatly enhance clarity and efficiency. Different formats are suited for different types of transactions, industries, and business sizes. Understanding the most commonly used layouts helps ensure that you select one that meets your needs, whether you’re dealing with straightforward product sales or more complex service agreements.

The most common formats are designed to organize essential details in a logical, easy-to-read manner. Each format serves a different purpose, but all aim to provide a professional and transparent record of the transaction. Below, we’ll explore some of the most popular formats used in business today.

Common Formats and Their Use Cases

| Format | Best For | Key Features |

|---|---|---|

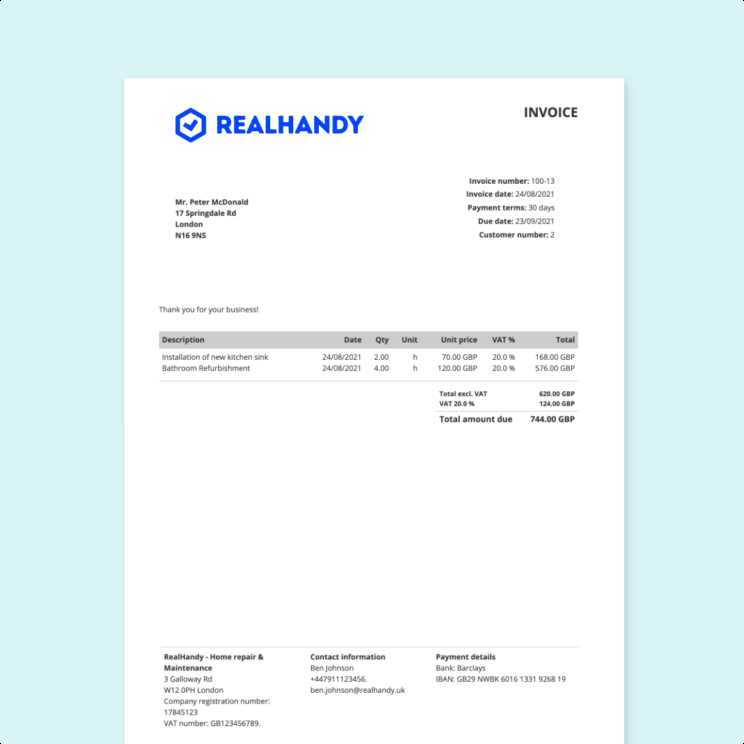

| Basic Billing | Small businesses or freelancers | Simple layout, single item or service listed, quick to create, typically no complex calculations |

| Itemized List | Retail or product-based businesses | Detailed breakdown of products or services with quantities and unit prices, subtotal and total calculated |

| Time-Based Billing | Consultants, contractors, or service providers | Breakdown of hours worked, hourly rate, and total cost, often with sections for project milestones |

| Recurring Billing | Subscription services or clients with ongoing contracts | Details of recurring payments, billing cycle, and payment due dates |

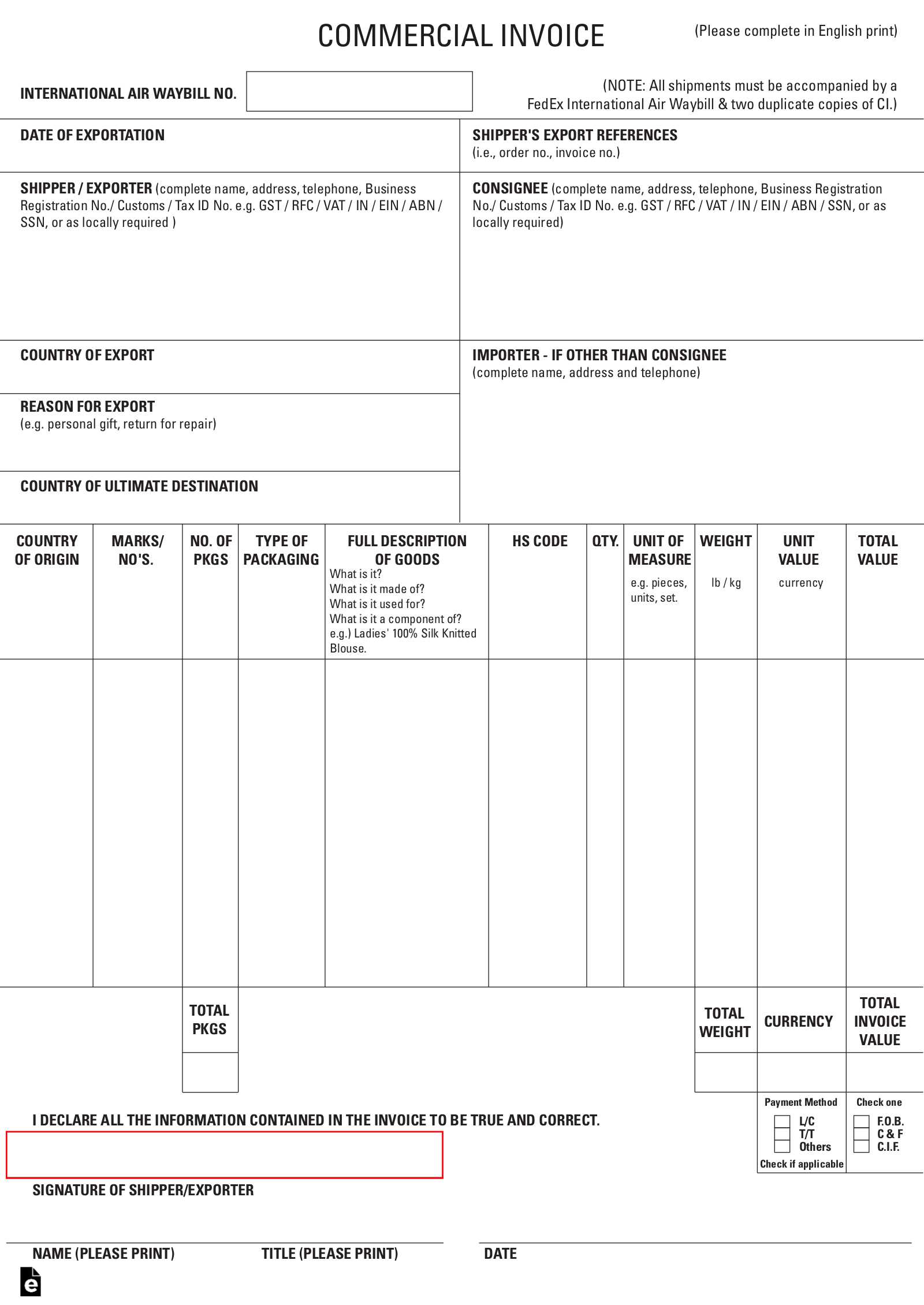

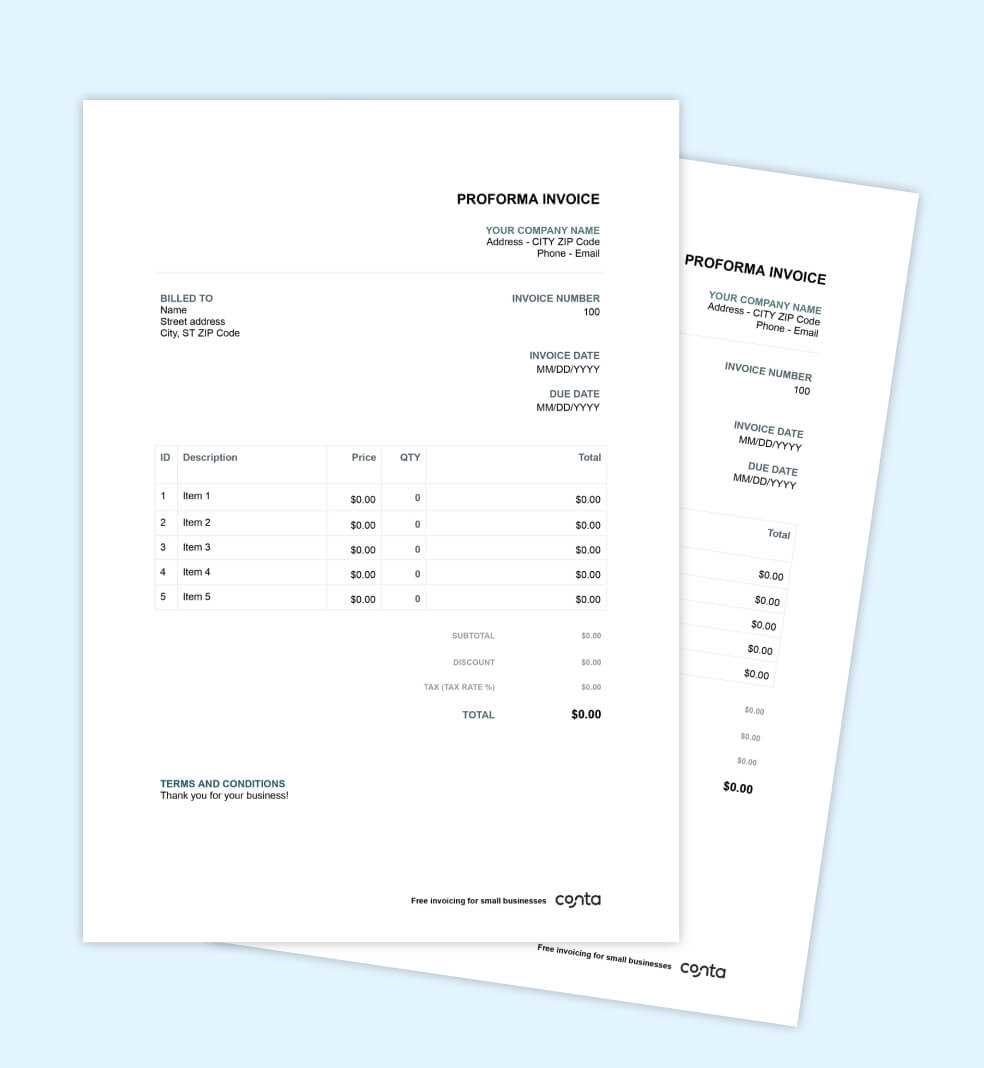

| Proforma Billing | International transactions, advance payments | Preliminary bill with expected costs, often used for quotations before actual transactions |

Each format provides a structured way to present key information, which is essential for maintaining transparency and professionalism. For instance, itemized layouts are great for businesses that sell multiple products or services, while time-based formats are best for those offering consulting or hourly services. Similarly, recurring billing formats are ideal for subscription-based businesses, ensuring clients know exactly when their next payment is due.

By choosing the correct layout for your business, you ensure both you and your clients are on the same page, minimizing confusion and fostering smooth transactions.

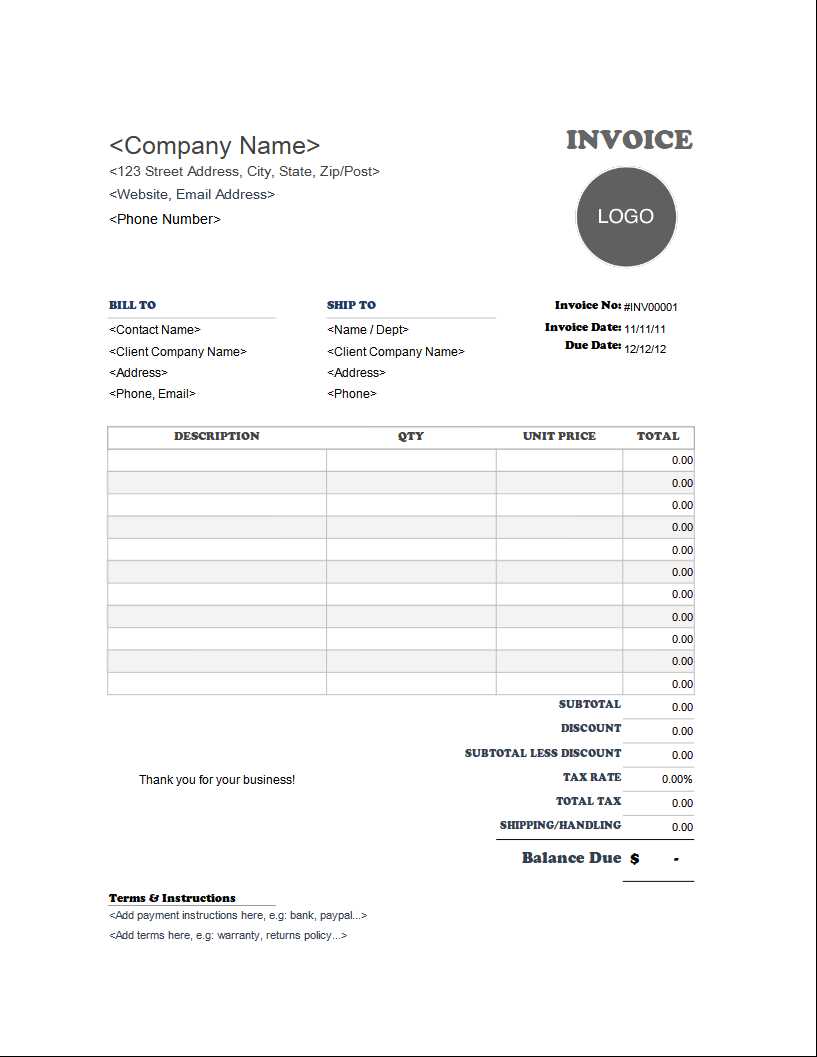

How to Edit and Customize Templates

Once you’ve chosen a pre-designed solution for your billing needs, the next step is to make it your own. Customizing the layout and content allows you to tailor the document to fit your business’s branding, the specific requirements of each client, and any unique billing details. This flexibility is one of the key advantages of using a pre-built structure, as it saves time while still allowing for personalization.

Editing these formats is typically a straightforward process, especially if you’re using a word processor or a spreadsheet application. Whether you’re adjusting text, adding logos, or modifying sections to reflect specific payment terms, customization ensures that each document accurately represents your business and meets client expectations.

Steps to Edit and Personalize Your Billing Document

- Open the Document: Start by opening the selected format in your preferred software (Word, Excel, or Google Docs).

- Update Your Branding: Add your business logo, change the colors to match your brand, and adjust fonts to maintain consistency.

- Adjust Content Sections: Modify fields such as client information, payment terms, and descriptions of goods or services. Ensure that all the relevant details are included.

- Include Custom Fields: If necessary, add custom sections for specific fees, taxes, discounts, or any other information that might apply to the transaction.

- Save and Export: Once you’re satisfied with the customizations, save the document in your preferred file format (PDF, DOCX, etc.) for easy sharing or printing.

Example of Customization: Payment Details

| Description | Amount |

|---|---|

| Web Development Services | $2,000.00 |

| Sales Tax (8%) | $160.00 |

| Total Due | $2,160.00 |

For example, you can edit the payment breakdown to fit the specific services or products you’ve provided, and adjust the total to reflect any taxes or discounts. Custom fields help make sure your documents are always accurate and aligned with client expectations.

By following these simple steps, you can quickly edit and customize any pre-designed format to suit your business needs, ensuring that every transaction is professional, clear, and tailored to your requirements.

Invoice Templates for Different Industries

Each business industry has unique billing needs, and customizing your billing documents accordingly is key to ensuring clarity and professionalism. Different sectors may require specific information to be highlighted, such as hourly rates for service industries or itemized product lists for retail businesses. Understanding the specific requirements of your industry can help you select or design a format that meets your needs while maintaining a streamlined and efficient billing process.

Below are some common industries and the key features their billing documents should include to cater to their specific requirements.

Billing Solutions for Various Industries

- Freelancers and Consultants:

- Hourly rate breakdowns for time-based services

- Clear descriptions of project milestones or deliverables

- Payment terms with deposits and balance due

- Retail Businesses:

- Itemized lists of products with prices and quantities

- Subtotal, sales tax, and total amount clearly indicated

- Return policies or terms of service for customer reference

- Contractors and Builders:

- Detailed project breakdowns with materials, labor, and expenses

- Payment schedule, including deposits and final payments

- Terms regarding project completion and additional costs

- Subscription-Based Services:

- Recurring charges and billing cycles clearly defined

- Discounts or promotional offers for long-term clients

- Cancellation terms and renewal policies

- Creative Agencies:

- Service descriptions with detailed pricing for each phase of a project

- Copyright and usage terms for creative work

- Detailed payment schedules based on project milestones or completion dates

By selecting a solution that is tailored to the specific needs of your industry, you ensure that all necessary details are included, making the document both professional and efficient. This approach not only helps keep your business organized but also improves transparency and trust with clients, making your billing process smoother and more reliable.

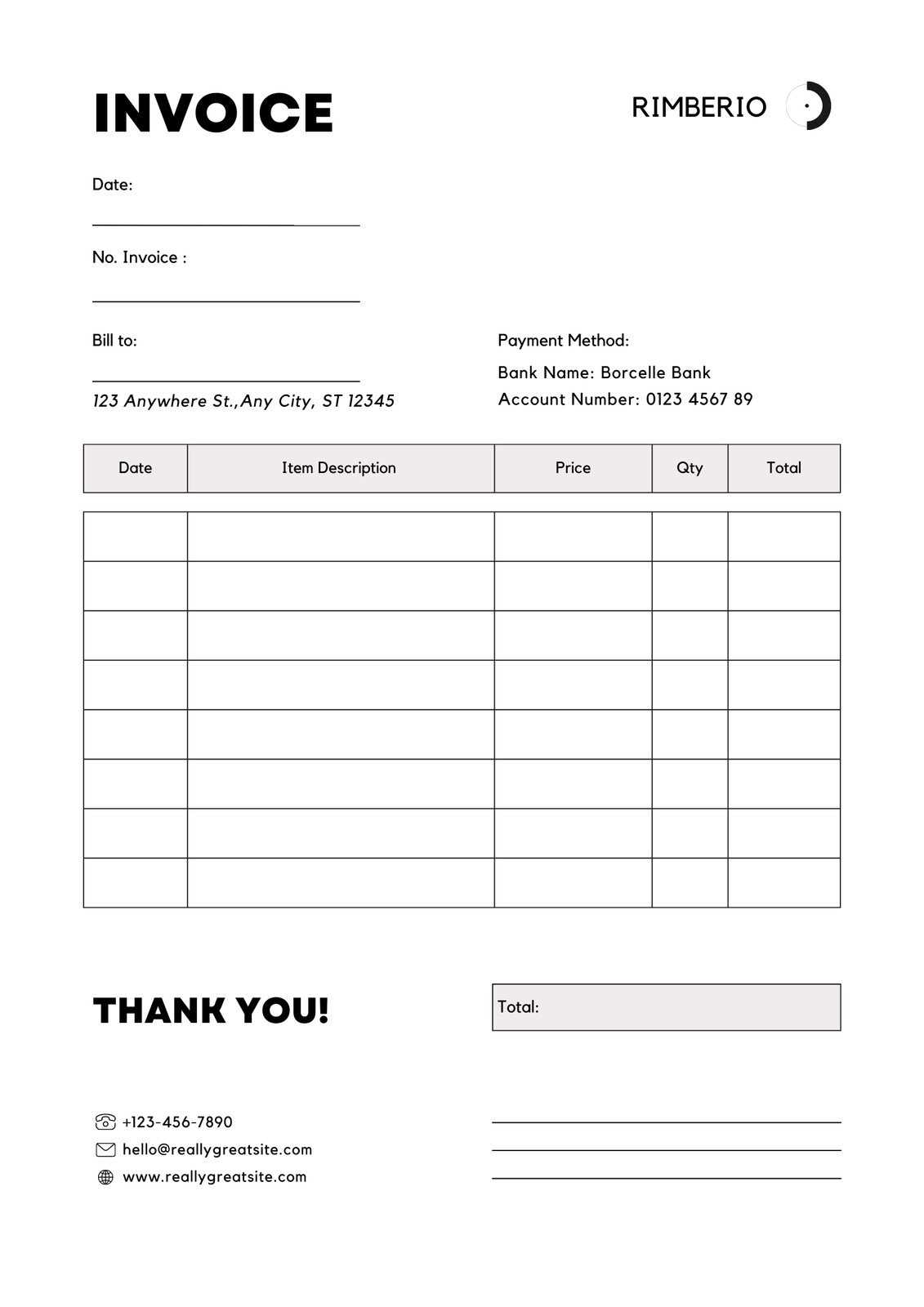

Understanding Invoice Template Design Principles

Creating effective billing documents requires more than just filling in numbers. The design of the document plays a critical role in ensuring that all relevant information is communicated clearly and professionally. A well-structured layout improves the readability of the document, reduces the likelihood of errors, and makes it easier for clients to understand the terms of the transaction. By following certain design principles, you can create documents that not only look professional but also enhance the client experience.

Below are key design principles to consider when creating or selecting a suitable structure for your business:

Core Design Principles for Professional Billing Documents

- Clarity and Simplicity:

- Avoid clutter by keeping the layout clean and organized.

- Use simple fonts and clear headings to ensure key information is easy to find.

- Consistency:

- Maintain a consistent design throughout, from font choices to color schemes.

- Ensure that your branding (logo, colors, fonts) is aligned with your company identity.

- Logical Structure:

- Organize the content in a logical sequence, starting with contact information, followed by the itemized list, subtotal, taxes, and total due.

- Group related information together, such as payment terms and billing dates.

- Whitespace Usage:

- Use whitespace effectively to create balance and guide the reader’s eye through the document.

- Avoid overcrowding sections with too much text or numbers, which can overwhelm the client.

- Legibility:

- Choose fonts that are easy to read and avoid using too many different font styles.

- Ensure sufficient contrast between text and background colors for better readability.

- Responsive Design:

- Ensure the design works well across various devices, particularly if the document is to be viewed or edited digitally.

- Check that all key information, such as payment due dates and amounts, is visible even on smaller screens.

By following these design principles, you can create billing documents that are not only functional but also easy to navigate and visually appealing. A well-designed document reflects professionalism and can contribute to a smoother transaction process, helping build trust and credibility with clients.

Saving Time with Pre-Formatted Invoice Templates

Creating billing documents from scratch every time can be time-consuming and prone to mistakes, especially when managing multiple clients or projects. Pre-designed formats allow businesses to quickly generate accurate and professional documents without starting from square one each time. By using a ready-made structure, you can eliminate the repetitive task of formatting and focus more on the content, making the billing process faster and more efficient.

Here are several ways using a pre-formatted solution can help you save valuable time and streamline your business operations:

Benefits of Using Pre-Formatted Billing Documents

- Faster Creation Process:

- Pre-made formats have sections already set up for essential details, allowing you to quickly fill in client and transaction information.

- Eliminate the need to recreate standard elements such as payment terms, dates, and line items for each new document.

- Consistency Across Documents:

- By using the same layout each time, you maintain consistency in design and content, which improves your brand identity and client recognition.

- Ensures that all necessary information is included every time, reducing the risk of missing important details.

- Customization Flexibility:

- Even though the format is pre-designed, you can easily customize the fields to fit each unique transaction, adjusting the products, services, or rates as needed.

- With a few clicks, you can tailor payment terms or adjust subtotals, saving the time it would take to design a new format for every client.

- Streamlined Client Management:

- Pre-set fields for client information, such as contact details and billing addresses, mean less time spent on data entry for each new document.

- Easy access to previously used formats helps maintain an organized database of past transactions, speeding up future edits and re-use.

- Reduced Risk of Errors:

- Since the format is structured, the likelihood of overlooking important details such as tax rates or total due is minimized.

- Pre-designed calculations or fields for totals, taxes, and discounts reduce manual entry errors, saving you time spent correcting mistakes.

By using pre-fo

Free vs Paid Invoice Templates: What’s Best?

When it comes to creating billing documents for your business, one of the first decisions you’ll face is whether to use a free or a paid solution. Both options have their advantages and limitations, depending on your needs and the complexity of your business. Understanding the differences between the two can help you make an informed choice that aligns with your requirements, budget, and long-term goals.

Free options often provide basic designs and minimal customization, making them a good choice for small businesses or freelancers with straightforward needs. On the other hand, paid solutions typically offer advanced features, more customization, and additional support, which can be beneficial for larger businesses or those requiring more sophisticated billing systems. Below, we compare the key differences to help you decide which is the best fit for your needs.

Comparison of Free vs Paid Billing Solutions

| Feature | Free Option | Paid Option |

|---|---|---|

| Customization | Basic customization options, limited flexibility | Highly customizable, more control over design and layout |

| Design Quality | Simple, generic designs suitable for basic use | Professional, polished designs that align with brand identity |

| Support | Limited or no support, often community-based | Access to customer service or technical support, more reliable assistance |

| Advanced Features | Minimal features, mainly focused on basic information | Advanced features such as tax calculation, recurring billing, and payment reminders |

| Security | Basic security, may not include encrypted storage | Enhanced security, with options for encrypted data storage and secure payments |

| Cost | Free, no upfront or ongoing costs | One-time purchase or subscription cost, ongoing payments may apply |

As the table shows, while free options can work well for small businesses or individuals just starting out, paid solutions offer a range of benefits such as better design quality, more robust features, and improved security. If you need extra functionality or a more polished look, investing in a paid solution may be the better choice for long

How to Automate Invoice Generation with Templates

Automating the billing process can save businesses significant time and effort, especially when handling a large number of transactions. By using pre-designed structures that can be easily modified, businesses can streamline the process of generating documents, reduce manual errors, and ensure consistency. Automation allows you to quickly create and send professional documents without the need for repetitive data entry, making the process faster and more efficient.

Here’s how you can set up an automated system for generating your billing documents:

Steps to Automate Your Billing Process

- Choose a Software or Platform: Select an invoicing software or platform that offers automation features. Many platforms allow you to set up pre-configured formats that automatically fill in details such as client information, dates, and amounts.

- Input Client and Product Information: Create a database of client details and product or service offerings. This database will be used to automatically populate fields in your billing document each time you need to generate a new one.

- Set Up Recurring Billing: For businesses with repeat clients or subscription-based services, set up recurring billing options that automatically generate documents at regular intervals, such as monthly or quarterly.

- Integrate with Payment Systems: Integrate your billing system with payment gateways, so once the document is sent, the payment status can be automatically updated, saving you the hassle of manual follow-ups.

- Use Automated Reminders: Many platforms allow you to send automated reminders to clients for pending payments. This ensures timely follow-up without any manual effort.

Benefits of Automating Billing with Pre-Designed Solutions

- Efficiency: Automation significantly reduces the time spent on manual document creation, allowing you to focus on other tasks.

- Accuracy: Automatic population of client and transaction details ensures there are fewer errors in the document, which can help avoid misunderstandings and payment delays.

- Consistency: Using the same pre-designed format every time guarantees consistency across all documents, helping maintain professionalism.

- Scalability: Automated billing systems allow you to scale your business easily without increasing the administrative workload.

By implementing an automated billing process, businesses can save time, reduce errors, and improve the overall client experience. Whether you are a small business or managing a larger operation, automation offers a more efficient and reliable way to h

Ensuring Accuracy with Invoice Templates

Ensuring the accuracy of billing documents is crucial for both businesses and their clients. Even a small mistake in a document can lead to misunderstandings, delayed payments, or legal disputes. By using well-structured billing formats, you can significantly reduce the chances of errors. These formats guide you through the essential elements, ensuring that all necessary information is included and presented correctly. Automated calculations and consistent structures further enhance the precision of your documents.

Here are some key strategies to ensure accuracy when creating and using pre-designed solutions for generating financial documents:

Key Practices for Accurate Billing Documents

- Standardized Structure:

- Using a predefined layout helps avoid missing key elements like due dates, payment terms, and itemized services or products.

- A consistent structure ensures that all documents are formatted the same way, reducing confusion or errors that may arise from inconsistent presentations.

- Automatic Calculations:

- Pre-designed formats often include automated fields for calculating totals, taxes, and discounts, minimizing human error in number entry.

- By relying on automated functions, you can ensure that figures such as tax percentages or shipping fees are applied correctly every time.

- Pre-filled Client Data:

- Storing recurring client information, such as contact details and billing preferences, helps ensure that accurate data is automatically inserted into each document.

- By reducing the need for manual data entry, you lower the risk of input errors and ensure client details are up to date.

- Review and Double-Check:

- While automation helps reduce errors, it’s still important to review the final document before sending it. A final check ensures everything is correct, such as verifying the amounts, payment terms, and due dates.

Benefits of Using Structured Billing Solutions

- Consistency: Pre-designed formats ensure that every document follows the same structure, which leads to fewer discrepancies between different billing periods or clients.

- Speed: Automation and pre-set fields allow for faster document generation without compromising on quality or precision.

- Professionalism: A well-structured document reflects positively on your business, showing that you pay attention to detail and care about providing accurate, reliable billing to clients.

By using structured and automated billing solutions, businesses can reduce errors, save time, and create professional documents with confidence. The accuracy of each document is essential for maintaining strong client relationships and ensuring smooth financial transactions.

How to Share Invoices Created from Templates

Once your billing documents are ready, the next important step is sharing them with clients in a timely and secure manner. Whether you’re working with a local customer or someone across the globe, it’s crucial to choose the right method for sending the documents to ensure they are received promptly and accurately. Digital delivery offers convenience, while also providing tracking and confirmation of receipt. Understanding the best ways to share these documents will help you streamline your payment processes and maintain clear communication with clients.

Here are some efficient ways to share your billing documents with clients:

Effective Methods for Sharing Billing Documents

- Email:

- Email is one of the most common ways to share professional documents. You can easily attach the file in formats like PDF, Word, or Excel, ensuring the document remains readable on any device.

- Make sure to include a polite message explaining the document’s purpose, along with payment instructions and due dates.

- Cloud Storage Links:

- For larger or multiple documents, cloud storage services like Google Drive, Dropbox, or OneDrive allow you to upload and share a link to the file.

- These services ensure that the client has access to the latest version and can download or view the document as needed.

- Online Payment Systems:

- If you’re using an online billing platform that integrates payment features, you can send a direct link to the document along with an option to pay online. This is especially useful for clients who prefer paying immediately after reviewing the document.

- Systems like PayPal, Stripe, or FreshBooks allow seamless sharing and payment processing in one step.

- Postal Mail (Physical Copies):

- While less common in today’s digital age, some businesses may still need to send physical copies for clients who prefer hard copies or for legal purposes.

- Make sure the document is printed clearly, signed if necessary, and packaged securely to prevent damage during transit.

Best Practices for Sharing Billing Documents

- Use Password Protection: When sending sensitive information, it’s a good idea to encrypt the document or password-protect the file. This ensures that only the intended recipient can access the content.

- Confirm Receipt: Whether you’re sending via email or cloud storage, always confirm with your client that they’ve received the document. A quick follow-up ensures there are no issues with delivery.

- Provide Payment Details: Be clear about how the client can pay, whether via bank transfer, credit card, or other methods. Include any necessary payment references to ensure th

Invoice Templates for Small Businesses

For small businesses, managing financial documentation efficiently is crucial for maintaining smooth operations. Having a well-structured system for creating billing documents ensures professionalism, reduces errors, and helps keep track of payments. Pre-designed formats are particularly useful for small business owners who need an easy way to generate accurate documents without investing too much time or effort. These solutions can be easily customized to reflect the business’s unique branding and provide clients with clear and concise payment information.

Using pre-designed formats offers several benefits for small businesses. They allow for consistency in billing, which is essential for building trust with clients. Moreover, these systems often come with built-in features like automatic calculations for totals, taxes, and discounts, helping ensure accuracy while saving time. Whether you’re invoicing for products, services, or project-based work, these ready-made structures make it easier to maintain organized financial records and meet the needs of clients efficiently.

With the right tools, small businesses can manage their billing processes effectively, ensuring timely payments and keeping their financial operations on track.

Integrating Invoice Templates with Accounting Software

Integrating pre-designed billing formats with accounting software can significantly streamline your financial processes. By connecting your billing system to your accounting platform, you can automate the transfer of data, reducing manual entry errors and saving valuable time. This integration ensures that all financial records are accurate, up-to-date, and accessible in one place, providing a clearer view of your business’s financial health.

With this integration, as soon as you generate a document, the relevant information–such as transaction amounts, taxes, and payment statuses–can be automatically recorded in your accounting system. This eliminates the need for duplicate data entry, helping to maintain consistency and reducing the risk of discrepancies between your billing and accounting records. Additionally, it enables you to track outstanding payments, send reminders, and generate reports with just a few clicks.

By connecting your billing system to your accounting software, you enhance efficiency and accuracy while ensuring seamless financial management for your business.