Settlement Invoice Template for Easy Billing and Accurate Payments

When managing financial transactions, having a clear and well-organized billing document is essential. It ensures both parties are on the same page regarding amounts owed, payment terms, and due dates. A properly structured bill helps avoid misunderstandings and accelerates the payment process, contributing to smooth business operations.

Having a customizable framework for generating these documents can save time and reduce errors. This resource can be adapted to suit different industries, ensuring that each bill meets the specific needs of a transaction. Whether you’re a freelancer, a small business owner, or working within a larger corporation, using a standard layout for your financial statements simplifies the process of tracking and requesting payments.

In this guide, we will explore the key elements that make up an effective billing document. You will also learn how to personalize these structures to match your business style and meet legal requirements. With a professional approach, your billing process will become more efficient and organized, allowing you to focus on what matters most–growing your business.

Settlement Document Framework Overview

When it comes to managing financial transactions, having a standardized structure for billing is crucial. A well-designed framework allows businesses to create accurate, clear, and consistent statements that outline amounts due, payment terms, and other necessary details. This ensures that both parties involved in the transaction are aligned, reducing potential disputes and simplifying the entire payment process.

Key Features of a Standardized Billing Document

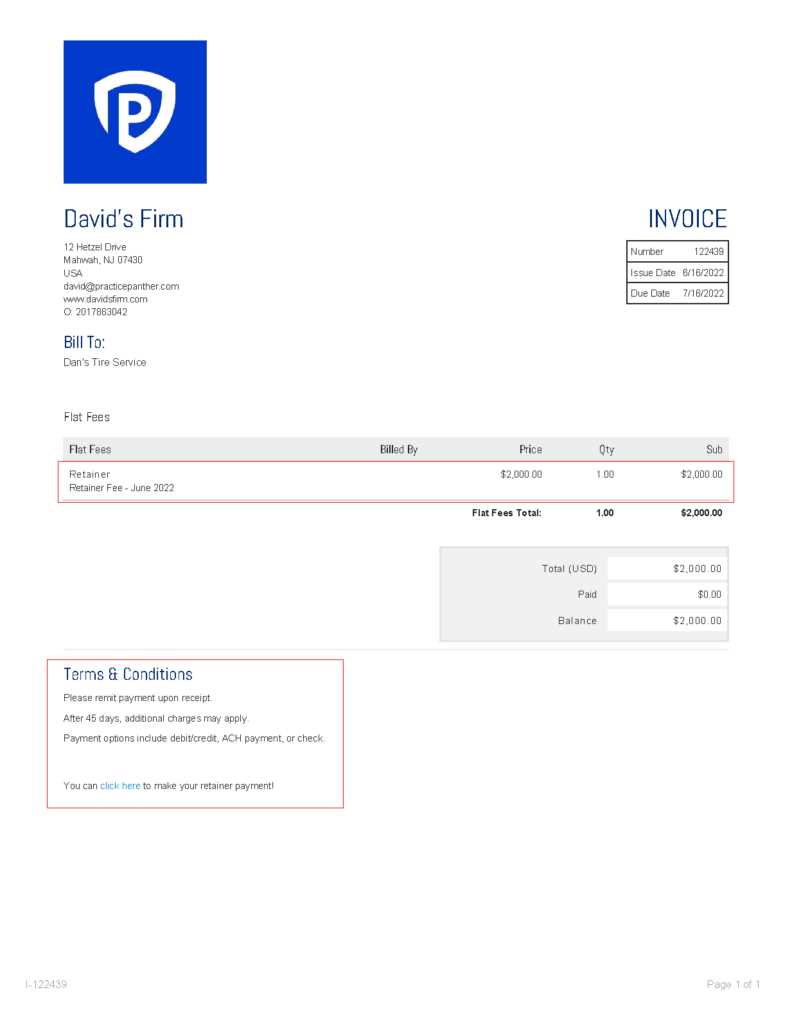

A well-organized financial document typically includes sections such as the payer and payee details, itemized charges, payment deadlines, and methods for submission. Additionally, it provides a reference number for tracking purposes, ensuring that all parties can easily locate the transaction in question. Customizing these documents to reflect your unique business needs can significantly streamline the billing process.

Benefits of Using a Standardized Framework

Using a pre-made structure for your financial documents brings several advantages. First, it saves time by reducing the need for manual creation of each document. Second, it helps ensure consistency, making it easier for clients to understand and process their payments. Lastly, it minimizes errors, which can lead to delays or complications. By having a reliable and adaptable framework, you can focus on growing your business while maintaining efficient billing practices.

What is a Billing Statement?

A billing statement is a document used to outline the details of a financial transaction between two parties. It serves as an official request for payment and includes important information such as the amounts owed, itemized charges, payment terms, and due dates. This document acts as a record of the transaction and helps ensure that both the seller and the buyer are clear on the terms of payment.

Typically, these documents are used in various industries to formalize the completion of a service or delivery of goods. They can be issued at the end of a project, after a sale, or when a business relationship reaches a specific point of agreement. The primary purpose of such a document is to facilitate the payment process while providing both parties with a clear reference of what is owed and when it should be paid.

For businesses, maintaining accurate records of financial agreements is crucial for ensuring cash flow and avoiding payment disputes. A well-structured billing statement not only promotes transparency but also helps businesses stay organized and compliant with their financial obligations.

Why You Need a Standardized Billing Structure

Having a standardized structure for your financial documents is essential for smooth business operations. It ensures consistency, reduces errors, and speeds up the billing process. Without a clear format, creating accurate statements can become time-consuming and prone to mistakes, which can lead to delays and confusion. A reliable framework helps businesses maintain professionalism and organization in their payment requests.

Here are a few reasons why using a predefined structure for your billing documents is beneficial:

- Efficiency: A consistent format saves time, allowing you to generate billing statements quickly without starting from scratch each time.

- Accuracy: Reduces the chances of missing important details or making errors in calculations, ensuring that the amounts requested are correct.

- Clarity: A clear and professional layout makes it easier for clients to understand the charges and payment terms, reducing misunderstandings.

- Organization: Keeps all financial records organized, making it easier to track payments and manage cash flow.

- Customization: You can tailor the structure to fit your specific needs, ensuring that all relevant information is included.

Using a standardized structure also helps you stay compliant with legal or industry-specific requirements, providing both you and your clients with a transparent and organized approach to transactions.

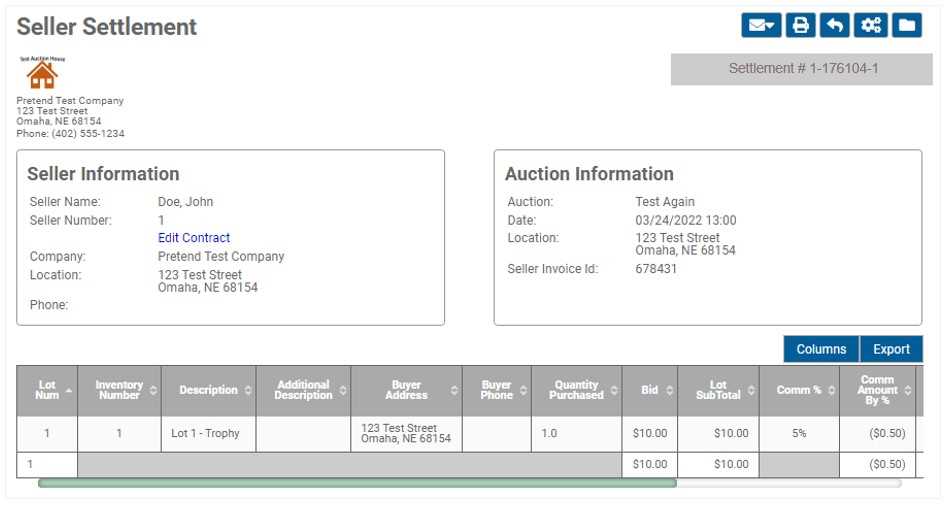

Key Components of a Billing Document

To create a well-structured financial statement, it’s important to include all the necessary details that ensure clarity and transparency between the payer and payee. Each section of the document serves a specific purpose, making it easier for both parties to understand the charges, payment expectations, and transaction history. Whether you are dealing with one-time payments or recurring charges, these essential components help to organize and formalize the request for payment.

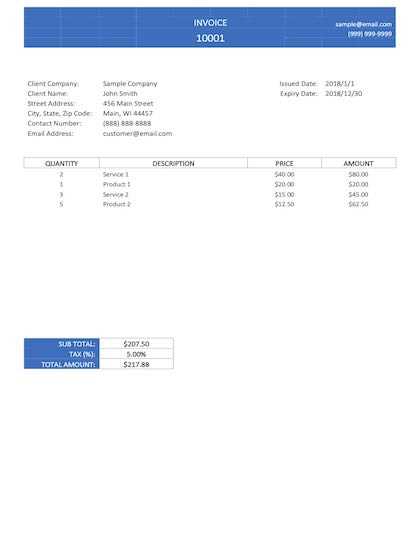

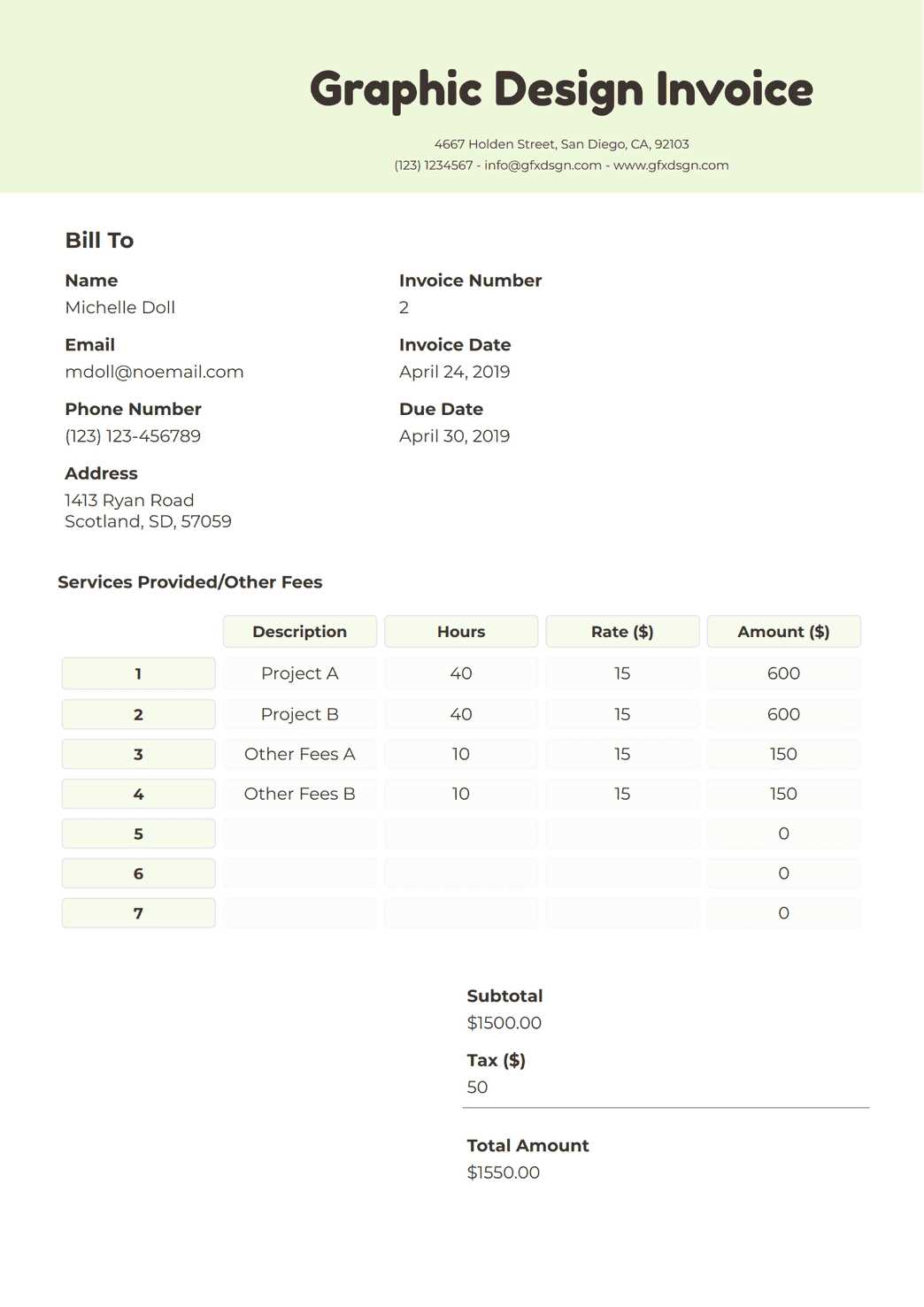

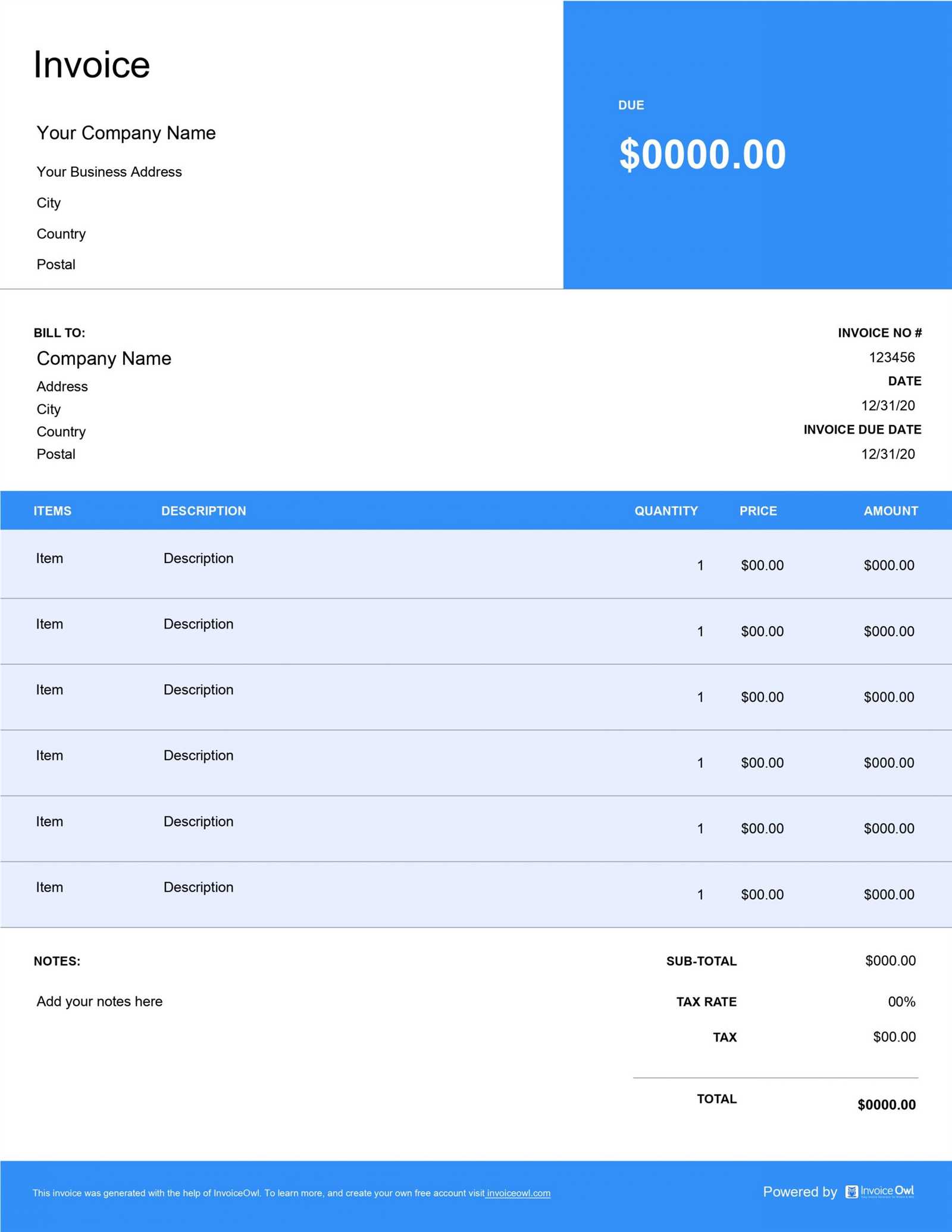

Here are the key elements that should be included in any billing document:

- Contact Information: This includes the names, addresses, and contact details of both the payer and the recipient. It ensures that both parties can easily reach each other if necessary.

- Unique Reference Number: A unique identifier for each document makes it easier to track and reference specific transactions, helping to avoid confusion and maintain proper records.

- Description of Services or Goods: A detailed list of what was provided, including quantities, rates, and any relevant descriptions. This section ensures that both parties agree on the specifics of the transaction.

- Payment Amount: Clearly states the total amount due, including any applicable taxes, discounts, or additional charges. This section should leave no room for ambiguity.

- Payment Terms: Outlines when and how payment should be made. This includes the due date, accepted payment methods, and any penalties for late payments.

- Additional Notes or Terms: This area may include any special instructions, contractual terms, or information on dispute resolution in case there are issues with the payment.

Incorporating these components ensures that the billing document is comprehensive, professional, and easy to understand, reducing the risk of errors and disputes during the payment process.

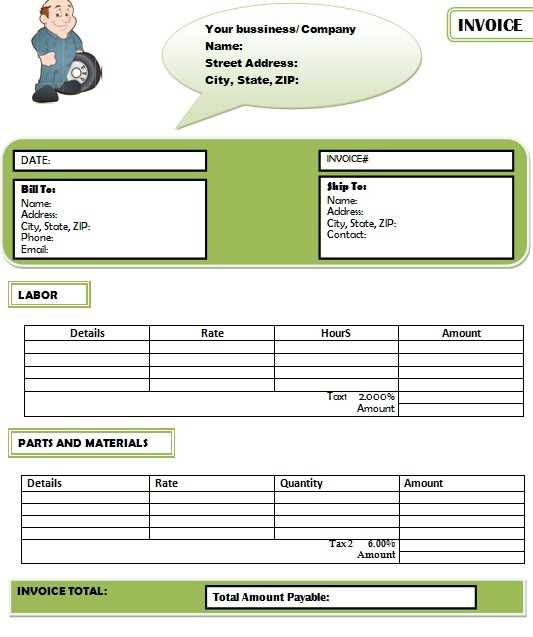

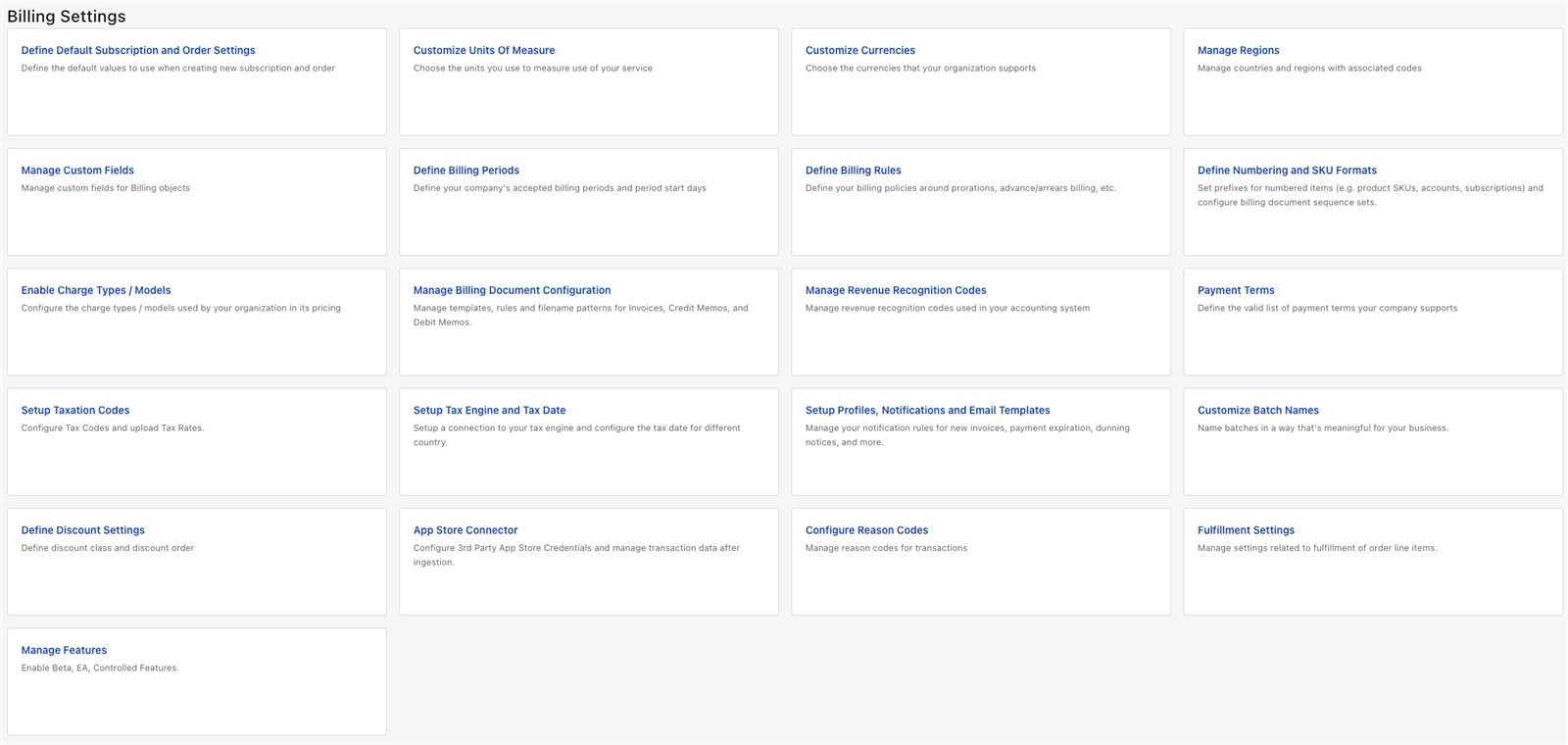

How to Customize Your Billing Document Framework

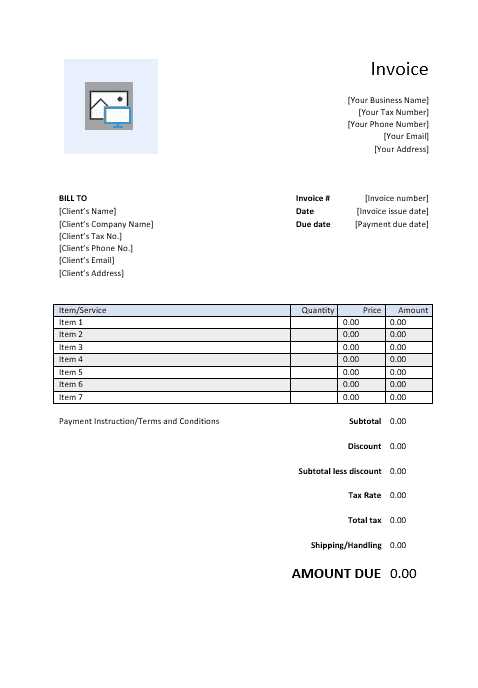

Customizing your financial document framework is essential for making it fit the specific needs of your business. A personalized structure helps ensure that all necessary details are included, while reflecting your brand’s identity. Tailoring the layout, content, and style makes the document more professional and easier to use, contributing to smoother transactions with clients.

Adjusting Layout and Design

The first step in customizing a billing structure is adjusting its layout. You can choose to add your logo, change fonts, and modify the color scheme to match your company’s branding. While design should remain professional and clean, small design changes can make the document feel more aligned with your business identity. Ensure that the layout remains easy to read and that key information stands out.

Adding Business-Specific Information

Every business has unique needs and requirements. For instance, you might want to add specific payment instructions or legal disclaimers. Customize the content to reflect your services or products accurately. If you frequently offer discounts, payment plans, or need to include tax information, be sure to adjust the framework to accommodate these elements. Adding sections like “Late Fee” policies or “Early Payment Discounts” can also improve clarity and help with timely payments.

By customizing your document layout and content, you can streamline the billing process and create a more organized and professional appearance for your business, leading to improved client relations and fewer disputes.

Common Errors in Billing Documents

Creating accurate financial documents is crucial to avoid misunderstandings and delays in payment. Even small mistakes can lead to confusion, disputes, and client dissatisfaction. Common errors often occur in the details or structure, and while they might seem minor, they can cause significant issues for both the business and its clients. Understanding and addressing these mistakes can improve the efficiency and professionalism of the billing process.

Frequent Mistakes in Billing Documents

- Incorrect Payment Amount: One of the most common errors is listing the wrong amount due, either by miscalculating totals or forgetting to add taxes or discounts.

- Missing or Inaccurate Contact Information: Failing to include accurate contact details for both parties can cause delays and prevent timely communication regarding payments.

- Failure to Include Payment Terms: Not specifying due dates, accepted payment methods, or penalties for late payments can lead to confusion and delayed settlements.

- Omitting Reference Numbers: Without a unique reference number, tracking and identifying specific transactions becomes difficult, leading to organizational problems.

- Inconsistent Formatting: Disorganized or inconsistent layouts can make it hard for clients to read and understand the document, potentially causing delays in processing payments.

How to Avoid These Mistakes

To minimize errors, double-check all details before sending the document. Verify that the payment amount is correct, confirm contact information, and ensure that the payment terms are clearly stated. Using a standardized structure can also help prevent formatting issues and improve overall clarity. Additionally, incorporating a reference number will make tracking and follow-up much easier.

By addressing these common errors, you can maintain a smooth billing process and reduce the risk of complications that may arise from overlooked details.

Benefits of Using a Structured Billing Format

Using a pre-designed framework for creating financial documents offers numerous advantages. It streamlines the process, ensures consistency, and minimizes errors, all of which contribute to a more efficient and professional approach to managing payments. By relying on a standard layout, businesses can save time, improve accuracy, and maintain clear communication with clients.

Time and Efficiency

One of the biggest benefits of using a pre-built structure is the time saved. Rather than creating a new document from scratch each time, you can quickly fill in the necessary details, ensuring that the document is ready to be sent in a fraction of the time. This efficiency allows businesses to handle multiple transactions simultaneously without delays.

Consistency and Professionalism

When you use a consistent format, each document looks professional and follows the same organizational structure. This consistency helps clients easily understand the details, including payment amounts, due dates, and terms. It also promotes a more organized approach to managing finances, which is important for maintaining a positive business reputation.

Moreover, using a standard format reduces the likelihood of mistakes such as missing information or inconsistent layouts. The structure provides clear guidelines on what to include, ensuring that every document is complete and accurate.

By implementing a standardized system for generating financial documents, you can focus on your core business operations while maintaining clear, organized, and efficient billing practices.

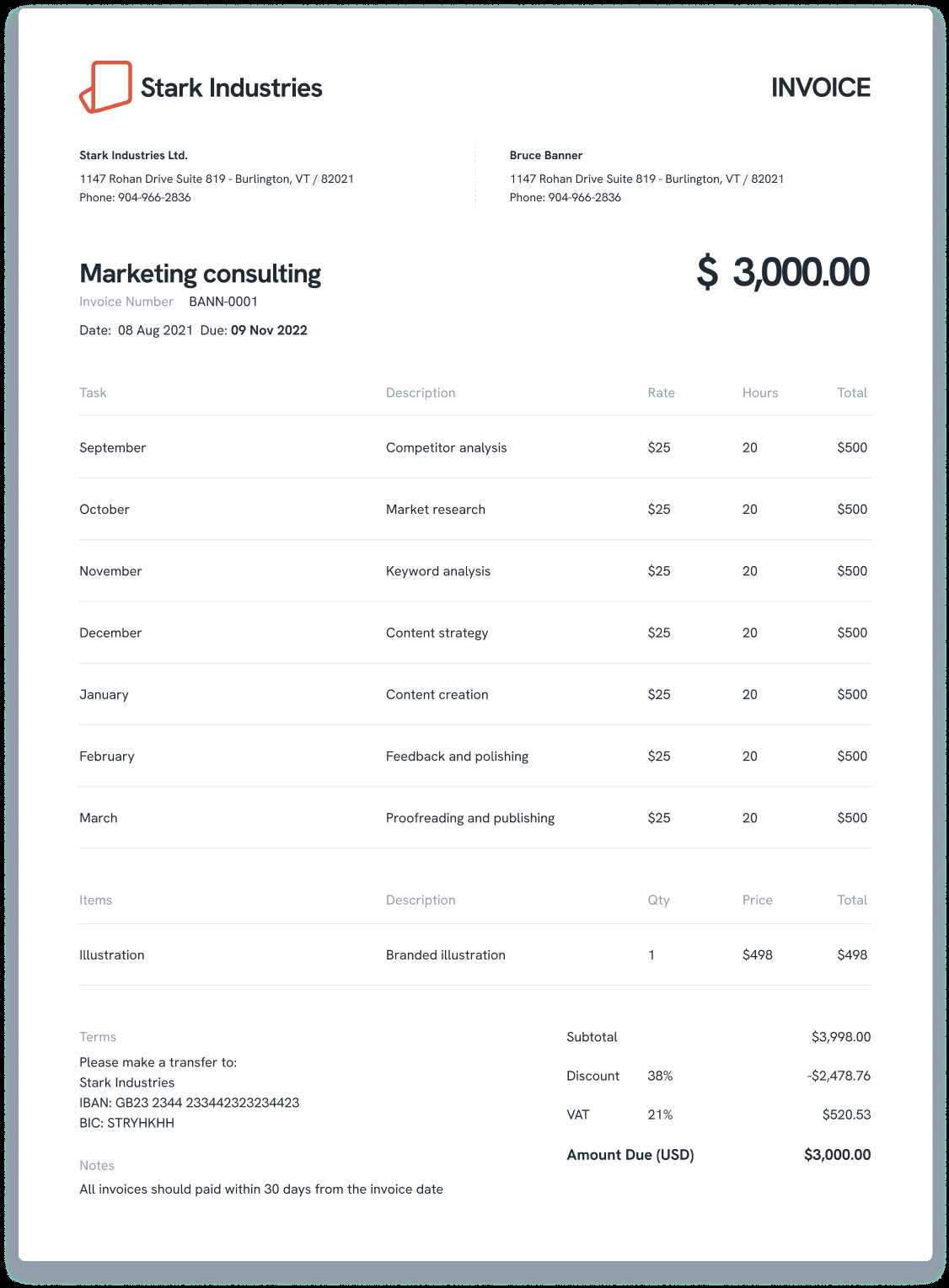

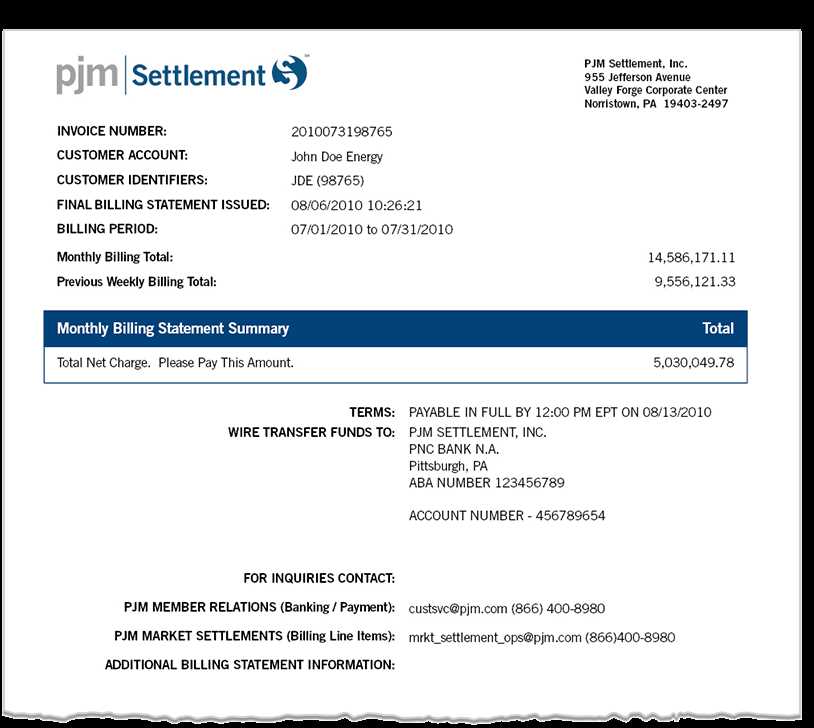

How to Format a Billing Document

Properly formatting your financial document is essential for clarity and ease of use. A well-structured layout ensures that all necessary details are presented clearly and logically. The format should be clean, organized, and easy to read, allowing both the sender and the recipient to quickly review the document and understand the terms. Proper formatting not only promotes professionalism but also reduces the risk of errors and confusion.

Here is a simple approach to organizing the content of your billing document:

| Section | Description |

|---|---|

| Header | Include your business name, logo, and contact information at the top, along with the recipient’s details. |

| Document Reference | Provide a unique reference number for tracking purposes, ensuring that both parties can easily identify the document. |

| Description of Goods/Services | Clearly list what was provided, including quantities, unit prices, and a brief description for clarity. |

| Payment Amount | State the total amount due, including any applicable taxes, discounts, or additional charges. |

| Payment Terms | Specify when the payment is due, acceptable methods of payment, and any penalties for late payments. |

| Footer | Include any additional notes, legal disclaimers, or instructions for the recipient, along with your business’s payment instructions. |

By following this straightforward structure, you ensure that all key information is easy to locate and understand, making the payment process smoother for both parties.

Free Billing Document Resources

Accessing free resources for creating professional financial documents can significantly simplify the process for businesses, especially for those just starting out or working with limited resources. There are a variety of websites and platforms that offer customizable layouts, making it easy to generate and send billing documents without the need for complicated software or design skills. These resources can help ensure that your documents are clear, accurate, and consistent.

Here are some popular sources where you can find free frameworks for creating your billing statements:

| Resource | Description |

|---|---|

| Microsoft Office | Offers free, downloadable billing document formats for Word and Excel, which you can easily customize to your needs. |

| Google Docs | Provides free templates that can be edited and stored online, allowing easy access and sharing with clients. |

| Canva | Includes a variety of customizable designs for billing statements that are easy to personalize with drag-and-drop features. |

| Invoice Generator | A free online tool that lets you quickly generate and download simple billing documents with the necessary fields. |

| Zoho Invoice | Offers a free version of their billing software that allows businesses to create and send professional documents to clients. |

By taking advantage of these free resources, you can streamline your billing process and maintain a professional approach, all without the need for expensive software or complex design tools.

How to Add Payment Terms to Your Billing Document

Including clear and concise payment terms in your financial documents is essential for setting expectations between you and your clients. Payment terms define how and when the payment should be made, providing a clear agreement on the due date, accepted payment methods, and any penalties for late payments. Properly outlining these terms ensures that there is no confusion about the payment process, helping to avoid delays and disputes.

Here are the key elements to include when adding payment terms to your billing document:

- Due Date: Clearly state the date by which the payment is expected. This helps set a firm timeline for both parties.

- Accepted Payment Methods: Specify the types of payments you accept (e.g., bank transfer, credit card, PayPal), along with any necessary account details.

- Late Payment Penalties: If applicable, include a note about penalties for late payments, such as interest charges or flat fees, to encourage timely settlements.

- Discounts for Early Payment: Offering a discount for early payment can incentivize clients to settle their accounts faster. Clearly state the percentage or amount that will be discounted.

- Payment Plans: If you offer installment payments or payment plans, make sure to outline the schedule and amounts due for each installment.

By incorporating these terms, you can set clear expectations, reduce the risk of late payments, and ensure that your business maintains a steady cash flow. Make sure the payment terms are easy to find in your document and worded clearly so that there is no ambiguity for the recipient.

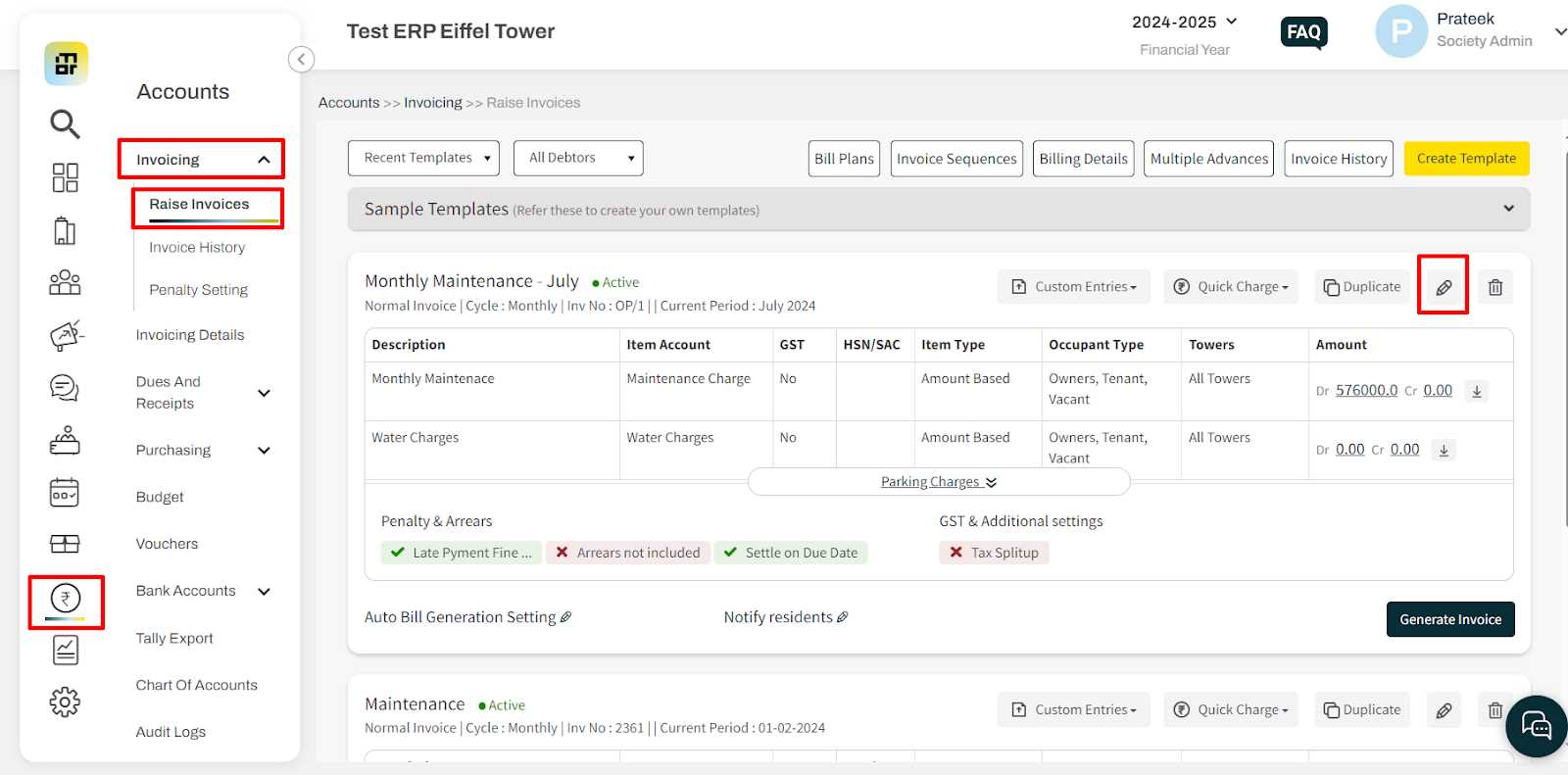

Understanding Document Numbering Systems

A clear and consistent numbering system for your financial documents is essential for maintaining organization and ensuring proper record-keeping. Unique reference numbers help track transactions, streamline communication, and simplify accounting. By using an efficient numbering system, you can quickly locate specific documents, avoid duplication, and maintain a transparent, systematic approach to managing payments.

Here are a few key points to consider when implementing a numbering system for your documents:

- Sequential Numbering: Most businesses use a simple sequential numbering system, where each document receives a unique number that follows a logical order (e.g., 001, 002, 003, etc.). This method makes it easy to track the flow of documents and ensures no numbers are skipped or repeated.

- Yearly Numbering: Another common approach is to reset the numbering each year. For example, documents issued in 2024 could be numbered starting from 2024-001, 2024-002, and so on. This system is useful for annual accounting and helps differentiate documents from different years.

- Client-Specific Numbering: For businesses with many clients, adding a client-specific identifier (such as a client code or name abbreviation) can help organize documents. For example, a document for Client A could be numbered as A-001, A-002, making it easier to associate documents with specific clients.

- Prefix or Suffix Codes: Adding prefixes or suffixes to your reference numbers (such as “S” for services or “P” for products) can help categorize documents based on the type of transaction or product involved. This is useful for businesses that handle a wide range of services or goods.

By implementing a clear and structured numbering system, you ensure that all documents are easily identifiable, which simplifies both internal record-keeping and external communication. A well-organized numbering system is a key component in maintaining an efficient business operation and avoiding mistakes.

Best Practices for Creating Accurate Billing Documents

Creating accurate and professional billing documents is crucial for maintaining smooth business operations. Errors in these documents can lead to delays in payment, misunderstandings with clients, and potential legal issues. To ensure that your billing process is efficient, it’s important to follow best practices that promote clarity, accuracy, and professionalism.

Here are some best practices for creating billing documents that are precise and reliable:

| Best Practice | Description |

|---|---|

| Double-Check Details | Always review the details before sending. Confirm that the client’s information, amounts, dates, and payment terms are correct to avoid costly mistakes. |

| Provide Clear Descriptions | Clearly describe the services or products provided, including quantities, rates, and item numbers, to avoid confusion. A well-explained list helps clients understand exactly what they’re paying for. |

| Include Payment Terms | Clearly outline the payment methods, due date, and any penalties for late payment. This ensures both parties know the expectations and timelines for the transaction. |

| Use a Consistent Layout | Stick to a consistent format for your financial documents. This helps maintain professionalism and makes it easier for both you and your clients to track payments and details. |

| Keep a Record | Always keep a copy of the billing document for your records. This is essential for accounting purposes and for resolving any disputes that may arise later. |

By following these best practices, you can ensure that your billing documents are accurate, professional, and easy for clients to understand, reducing the chances of errors and promoting timely payments.

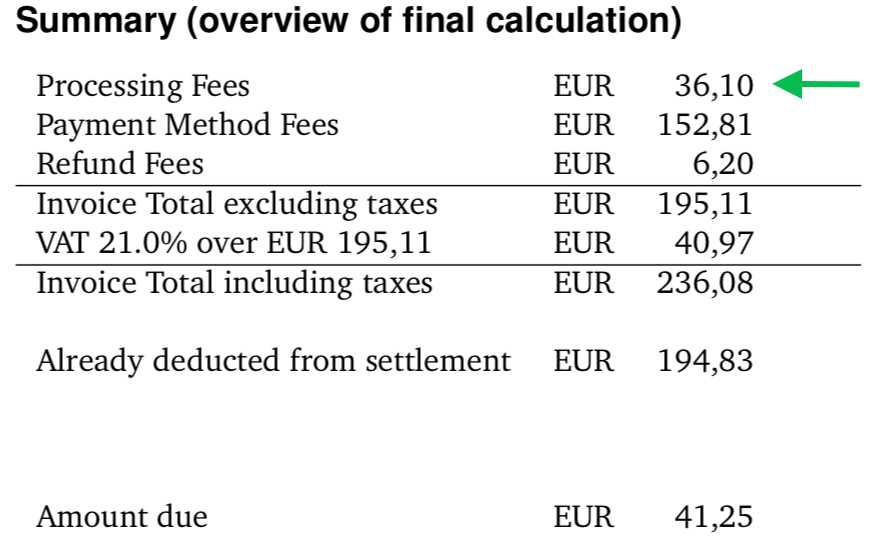

Legal Requirements for Billing Documents

When creating billing documents, it is essential to be aware of the legal requirements that govern these records. Different jurisdictions may have specific laws that dictate what information must be included in these documents to ensure compliance with tax laws, business regulations, and contractual obligations. Understanding these legal requirements helps protect both the business and the client by ensuring transparency and accountability in financial transactions.

Below are some common legal requirements that should be considered when preparing billing documents:

| Legal Requirement | Description |

|---|---|

| Identification Details | Both the business and the client’s names, addresses, and contact information should be included to ensure that both parties are clearly identified. |

| Unique Document Number | A unique reference number must be assigned to each document. This helps track the transaction and provides an official record for both parties. |

| Date of Issue | The date the document is issued must be clearly stated. This is important for setting payment due dates and for record-keeping purposes. |

| Detailed Description of Goods/Services | The products or services provided should be itemized with clear descriptions, quantities, and pricing to avoid any ambiguity. |

| Tax Information | If applicable, the document must include tax rates and the amount of tax charged. This is particularly important for VAT or sales tax compliance in many jurisdictions. |

| Payment Terms | Terms related to payment methods, deadlines, and penalties for late payment must be clearly stated to protect both the business and the client. |

By ensuring that all the required details are present and accurate, you can ensure that your billing documents are legally compliant, reducing the risk of disputes or legal challenges down the line.

How to Handle Disputed Billing Documents

Disputes over financial documents are a common issue in business transactions. Whether it’s due to incorrect charges, misunderstandings, or disagreements over the terms, handling disputes quickly and professionally is essential for maintaining good relationships with clients. Addressing these issues effectively can prevent escalation and ensure that payments are processed in a timely manner.

When a client disputes a billing document, it’s important to follow a systematic approach to resolve the issue. Below are some key steps to take when addressing a disputed financial document:

Steps for Resolving Disputed Documents

| Step | Action |

|---|---|

| Review the Dispute | Carefully examine the dispute and verify the details of the document. Cross-check the charges, dates, services, and quantities to identify any discrepancies. |

| Communicate with the Client | Reach out to the client to discuss the issue. Keep the communication polite and professional, and ask for specific details about their concerns. |

| Provide Documentation | Supply any supporting documentation that clarifies the issue, such as contracts, delivery receipts, or previous correspondence. This helps to resolve misunderstandings and can validate the charges. |

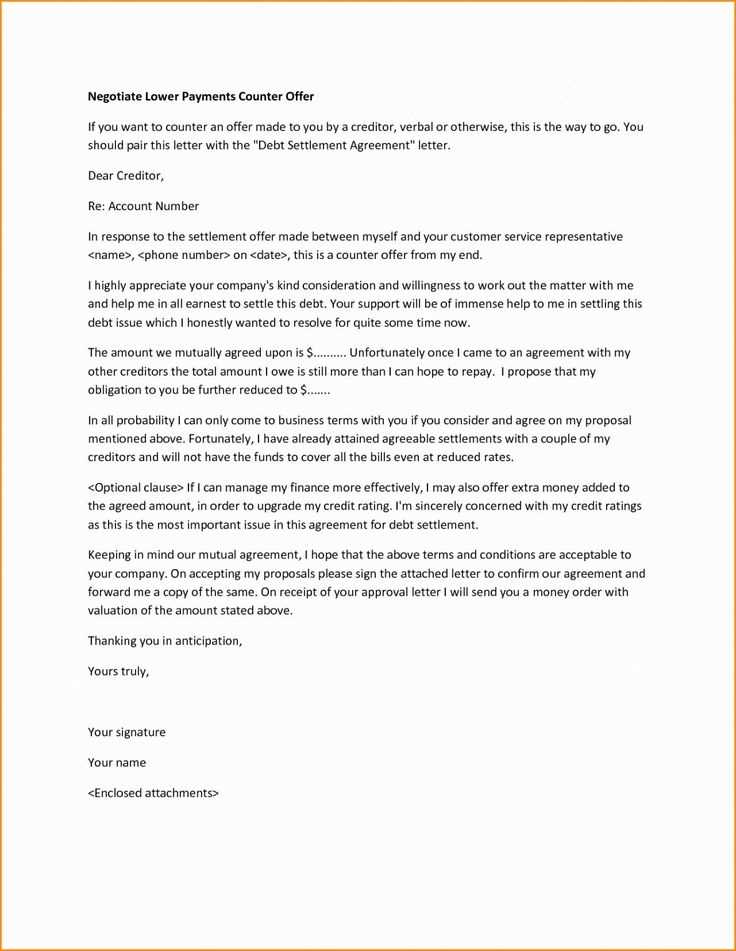

| Negotiate a Resolution | If the dispute is valid, work with the client to agree on a fair solution, such as adjusting the charges or offering a discount. Be flexible but firm in protecting your business interests. |

| Update the Document | If a correction is made, update the financial document and send a revised version to the client. Ensure the new document accurately reflects the agreed-upon terms. |

| Document the Resolution | Once the issue is resolved, document the resolution for future reference. Keep a record of all communications and the final agreement. |

Tips for Preventing Future Disputes

While disputes are inevitable in business, there are several practices that can help reduce their frequency and severity:

- Clear Communication: Make sure all terms, expectations, and charges are communicated clearly to the client from the outset.

- Detailed Records: Always provide detailed descriptions of the goods or services provided, including any additional costs, to minimize misunderstandings.

- Regular Follow-Ups: Send reminders and follow up with clients before pay

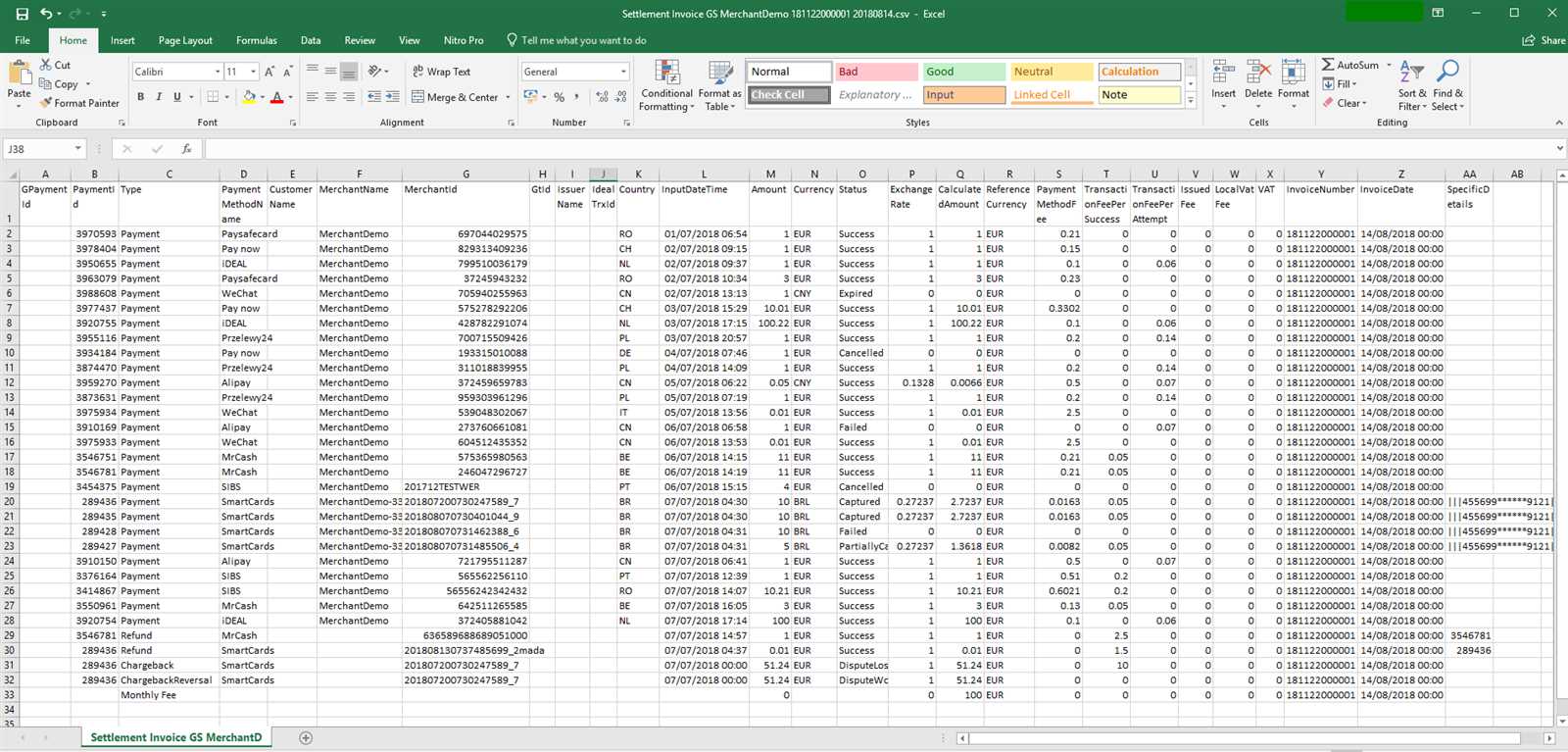

Integration with Accounting Software

Integrating your financial documentation system with accounting software can significantly streamline your business operations. By automating the process of generating, tracking, and recording payments, you can reduce manual errors, save time, and ensure consistency across all your financial records. This integration allows your business to easily track transactions, maintain up-to-date records, and generate reports without the need for redundant data entry.

Here are some key benefits and ways to integrate your financial documents with accounting systems:

Benefit Description Improved Accuracy Automating the process helps eliminate human error, ensuring that all details, such as amounts, dates, and client information, are correctly entered into the system. Time Efficiency Integration allows for automatic updates and synchronization between your financial records and accounting software, reducing the time spent on manual data entry. Real-Time Data With integration, your financial records are updated in real-time, making it easier to track payments and outstanding balances instantly. Easy Reporting Accounting software often includes built-in reporting features that can generate detailed financial reports, which can be customized based on specific needs (e.g., tax reports, revenue analysis). Centralized Record Keeping All your financial documents are stored in one system, reducing the risk of misplaced records and making it easier to manage and retrieve them as needed. Many accounting platforms, such as QuickBooks, Xero, or FreshBooks, offer built-in tools for integrating with your business’s financial documents. These integrations often include the ability to automatically import data from external sources, making it easier to manage your entire financial workflow from a single interface.

By integrating your billing system with accounting software, you can streamline your business processes, improve financial visibility, and ensure that your operations run smoothly and efficiently.

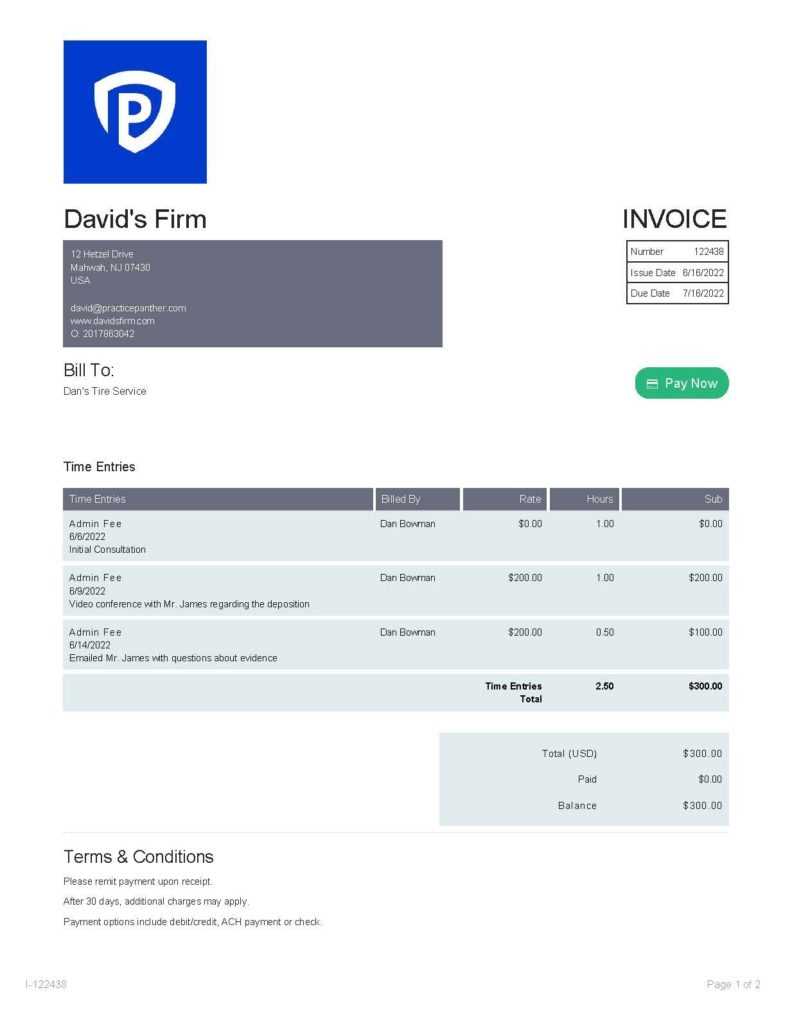

How to Send a Billing Document Professionally

Sending financial documents in a professional manner is crucial for maintaining a good business relationship and ensuring prompt payment. The way you deliver these documents reflects on your business and can impact your client’s perception of your services. A well-prepared and properly sent document fosters trust and encourages timely action.

To ensure your document is sent in a professional and efficient way, follow these best practices:

Steps for Sending a Billing Document

- Double-Check the Document: Before sending, review the document to ensure all details are correct. Verify client information, amounts, dates, services or products provided, and payment terms.

- Choose the Right Delivery Method: Depending on the client’s preferences, you can send the document via email, postal mail, or through an online payment platform. Email is typically the quickest and most professional method, but some clients may require physical copies.

- Personalize the Message: When sending the document via email, include a brief, professional message that explains the document’s purpose, includes key details (like the payment due date), and thanks the client for their business.

- Attach the Document Correctly: Always attach the document as a PDF to ensure it cannot be edited and is easy to open. Avoid sending documents in formats that might be incompatible with the client’s software.

- Set a Clear Subject Line: If sending the document by email, make sure the subject line is clear and to the point. Example: “Billing Document for [Your Business Name] – [Invoice/Document Number]” makes it easy for the client to identify the document immediately.

Tips for Enhancing Professionalism

- Maintain Consistent Branding: Use your company’s branding, logo, and contact information at the top of the document to maintain a professional appearance.

- Set Clear Payment Instructions: Ensure that payment instructions are easy to understand. Include your preferred payment methods and any necessary account or transaction details.

- Follow Up Promptly: If payment is not received by the due date, follow up with a polite reminder. A courteous but firm follow-up will help ensure timely payment while maintaining professionalism.

By following these steps, you can ensure that your financial documents are delivered in a manner that reinforces your professionalism and strengthens your business relationships.

Common Mistakes to Avoid with Billing Documents

Creating accurate and professional financial documents is crucial for maintaining healthy business operations. Even small errors can lead to confusion, delays in payments, or damaged client relationships. Understanding the common mistakes that occur in billing documents can help you avoid them and streamline your financial processes.

Below are some common mistakes to watch out for when preparing financial documents:

Common Errors in Billing Documents

Mistake Consequences Incorrect Client Information Providing inaccurate details (name, address, contact info) can delay payments and lead to confusion. Always verify client information before sending any document. Missing or Incorrect Dates Without clear issue and due dates, clients may struggle to understand when payments are expected, leading to late or missed payments. Ambiguous Descriptions of Services or Products Failure to clearly describe the products or services provided can create disputes or confusion, making it harder to justify charges. Failure to Include Payment Terms If payment terms are unclear or missing, clients may not know the accepted payment methods or deadlines, causing delays. Not Double-Checking for Errors Even minor errors in amounts or calculations can damage your credibility. Always double-check the document before sending it. Sending Documents Without Proper Formatting A poorly formatted document can make it hard for clients to quickly find essential information, leading to confusion or frustration. How to Avoid These Mistakes

- Review Everything Carefully: Always double-check client details, calculations, and descriptions before sending any documents.

- Use Clear Language: Be concise and clear in your descriptions to avoid misunderstandings. Avoid jargon or ambiguous terms.

- Implement a Standardized Format: Use a consistent format for all your documents to make it easier for clients to understand and for you to track.

- Set Clear Payment Terms: Ensure that payment terms, such as due dates and methods, are explicitly stated on the document.

By avoiding these common mistakes, you can ensure that your billing documents are accurate, professional, and lead to faster payments without unnecessary complications.

When to Update Your Billing Document Format

As your business evolves, so too should the documents you use to manage transactions. Regularly updating your financial document layout and structure is essential for ensuring that it stays relevant, compliant, and effective in communicating key details to your clients. Whether it’s due to changes in your services, legal requirements, or software updates, knowing when and how to update your billing system is crucial.

There are several key moments when you should consider making updates to your billing document format:

- When Your Business Expands: As your product or service offerings change, it’s important to ensure that your documents reflect these new offerings clearly and accurately. Adding new services or pricing changes may require adjusting your document layout or content.

- Changes in Tax Laws: Any updates in local, state, or international tax laws will require you to modify your financial documents to comply with legal requirements. This may include adding tax fields or updating tax rates.

- Software Integration or Updates: If you switch accounting software or integrate new tools, your documents may need to be adjusted to work with the new system. Updates may include automated fields for calculations, client data, or payment processing methods.

- Legal or Regulatory Changes: New regulations or industry standards may require modifications to the content and structure of your documents. For example, you may need to include specific disclosures or terms to remain compliant with financial reporting laws.

- Feedback from Clients: If clients have trouble understanding or using your documents, it may be time to simplify or reorganize the layout. Taking feedback into consideration can help improve clarity and reduce disputes.

- Periodic Review for Consistency: Over time, formatting and language preferences may evolve. Regularly reviewing and updating your documents ensures they align with your current brand image and messaging.

By staying proactive and reviewing your documents regularly, you can ensure that they continue to meet the needs of your business and clients while also staying compliant with industry standards and regulations.