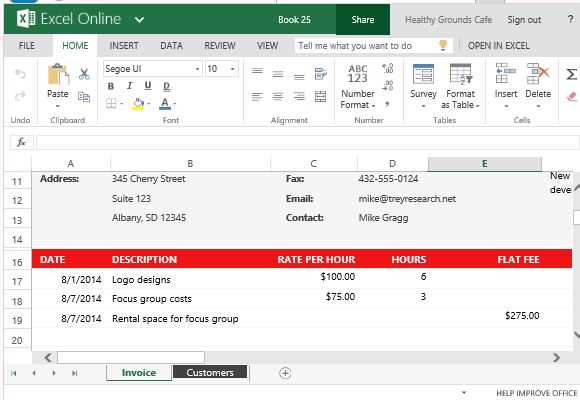

Free Sample Service Invoice Template in Excel Format

Managing payments efficiently is crucial for any business, whether large or small. Having a clear and organized system for creating requests for payment can save you time, reduce errors, and ensure prompt compensation for your work. Instead of manually tracking charges and calculations, using a structured approach can simplify the process significantly.

Digital solutions offer easy-to-use formats that help maintain accuracy and consistency in financial transactions. These formats allow you to quickly input relevant data, calculate totals, and present professional documents to your clients. Whether you’re handling one project or many, having a ready-made structure can help ensure nothing is overlooked.

By choosing the right software or tool, businesses can easily tailor their documents to fit their specific needs. With minimal effort, you can customize everything from the layout to the details included, ensuring clarity and professionalism with each transaction. In this guide, we’ll explore some of the best options available to help you stay organized and efficient in your financial dealings.

Why Use a Billing Document Structure

Having a consistent and well-organized method for generating payment requests is essential for any business. It not only enhances professionalism but also helps ensure that all necessary details are included. A predefined structure allows you to focus on the core aspects of your business while minimizing the risk of errors or missed information.

Time-Saving and Efficiency

Using a pre-designed document layout can save significant time. Instead of starting from scratch each time you need to create a new request, you can rely on a format that already contains the necessary fields and calculations. This allows you to:

- Quickly generate a document without needing to manually add details each time.

- Ensure consistency in the layout and information presented to clients.

- Focus on other aspects of your business, knowing the billing process is streamlined.

Accuracy and Professionalism

Prebuilt structures often include automated features that reduce human error. Automatic calculations for totals, taxes, and discounts help ensure the final amount is correct. Additionally, using a professional format with all required fields demonstrates to clients that your business is organized and trustworthy.

- Reduces chances of making costly mistakes.

- Improves your company’s credibility in the eyes of clients.

- Ensures that all necessary details, such as payment terms and due dates, are always included.

Benefits of Excel for Invoicing

Using a spreadsheet application for managing payment requests offers numerous advantages for businesses of all sizes. The flexibility and features available in such software make it an ideal tool for organizing, calculating, and customizing billing documents. With its user-friendly interface and powerful functions, this software can simplify complex financial tasks while ensuring accuracy and efficiency.

One of the key benefits is the ability to easily perform calculations, such as adding up totals, applying discounts, or calculating taxes automatically. This eliminates the need for manual math, reducing errors and saving valuable time. Additionally, the option to store and access past documents with just a few clicks makes it easier to track payments and maintain an organized record of transactions.

Another significant advantage is the customization it offers. Users can create unique designs, adjust layouts, and tailor the content to meet their specific needs. Whether you need to include additional fields or create a unique format for different clients, the application provides the flexibility to adapt without any coding knowledge required.

How to Customize Your Billing Document

Customizing your billing document allows you to align it with your business needs and ensure that all necessary details are clearly presented. Whether you’re dealing with different client types, offering varying services, or needing specific fields, tailoring your document can make the entire billing process more efficient and professional.

The first step in customization is adjusting the layout. Most spreadsheet programs allow you to modify the structure of your document, such as moving fields around, adding or removing sections, and resizing columns. This ensures that all the essential information, like item descriptions, quantities, and payment terms, is easy to read and logically organized.

Next, personalize the content by adding your company’s logo, contact information, and any other branding elements that reflect your business identity. This adds a professional touch and makes your documents instantly recognizable to clients.

For calculations, ensure that all the necessary formulas are set up correctly. You can automate tax calculations, apply discounts, and total up amounts with just a few clicks. This reduces the chances of errors and saves you time when processing payments.

Finally, consider creating different versions of your document for various purposes. For example, you might want one layout for standard services, another for projects with specific terms, or one with additional notes for clients who need detailed explanations. This flexibility allows you to handle a wide range of transactions with ease.

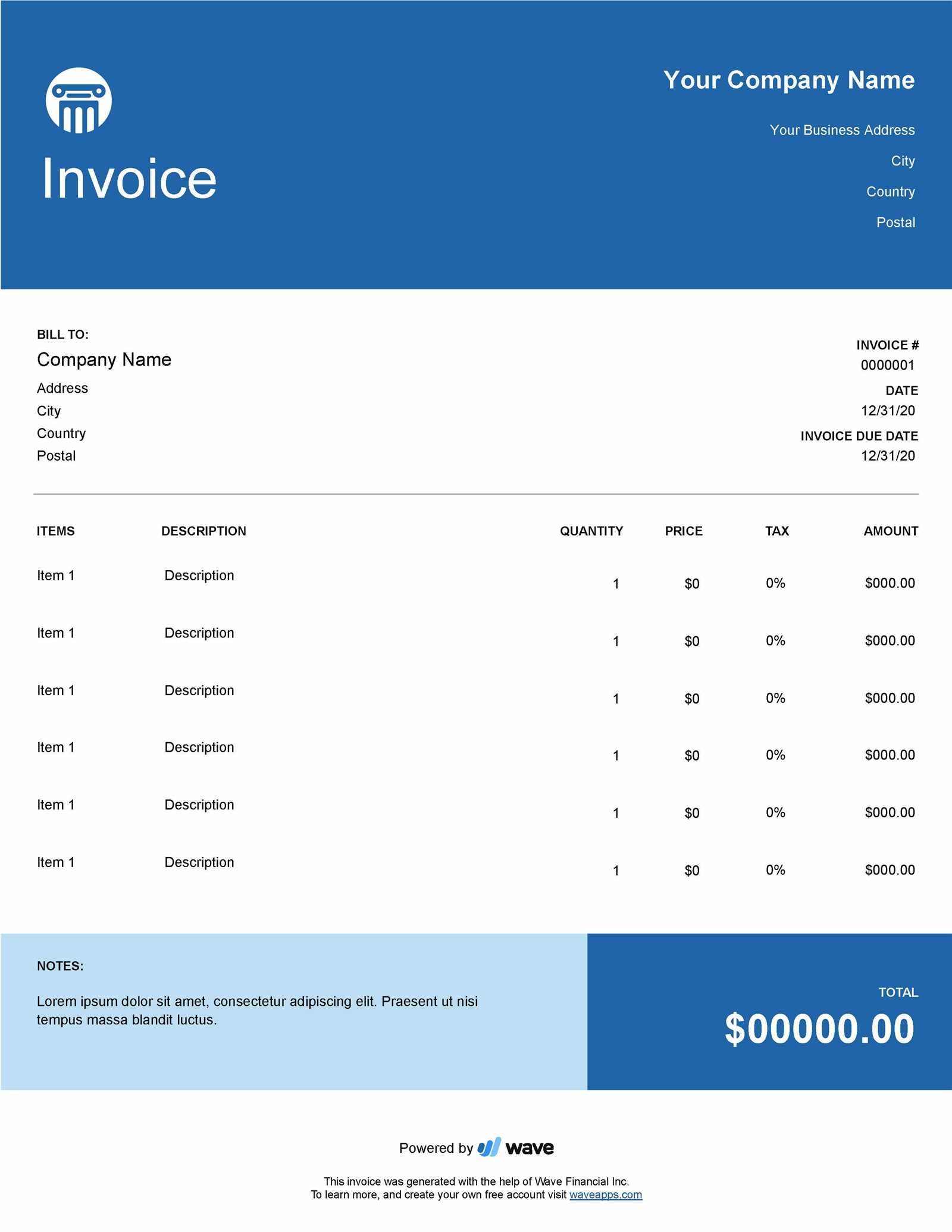

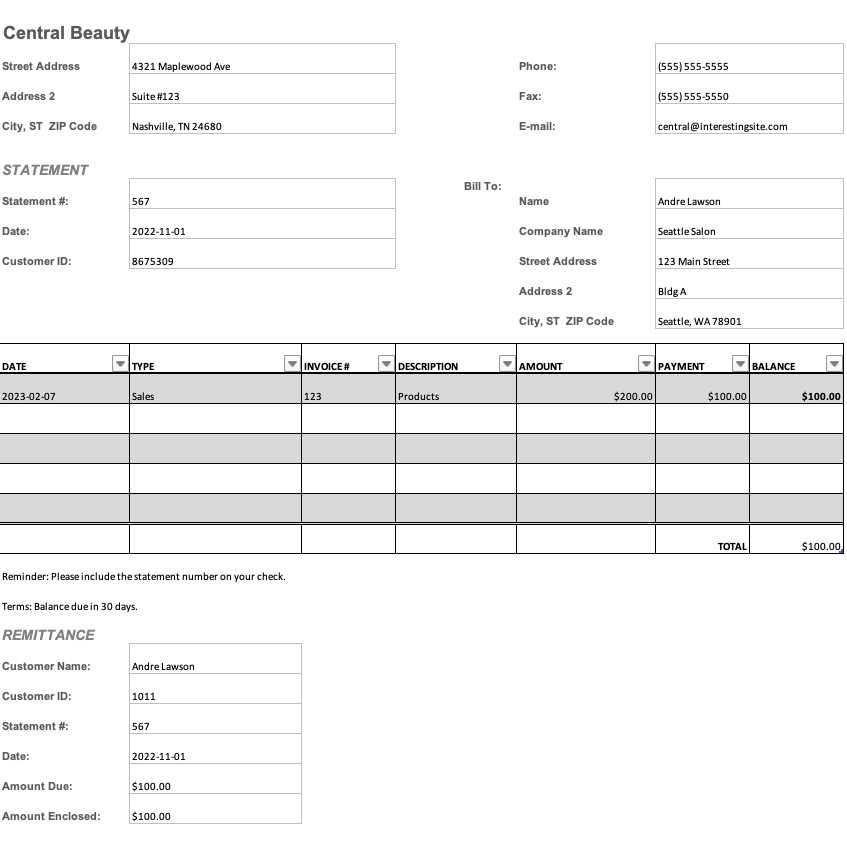

Key Features of a Billing Document

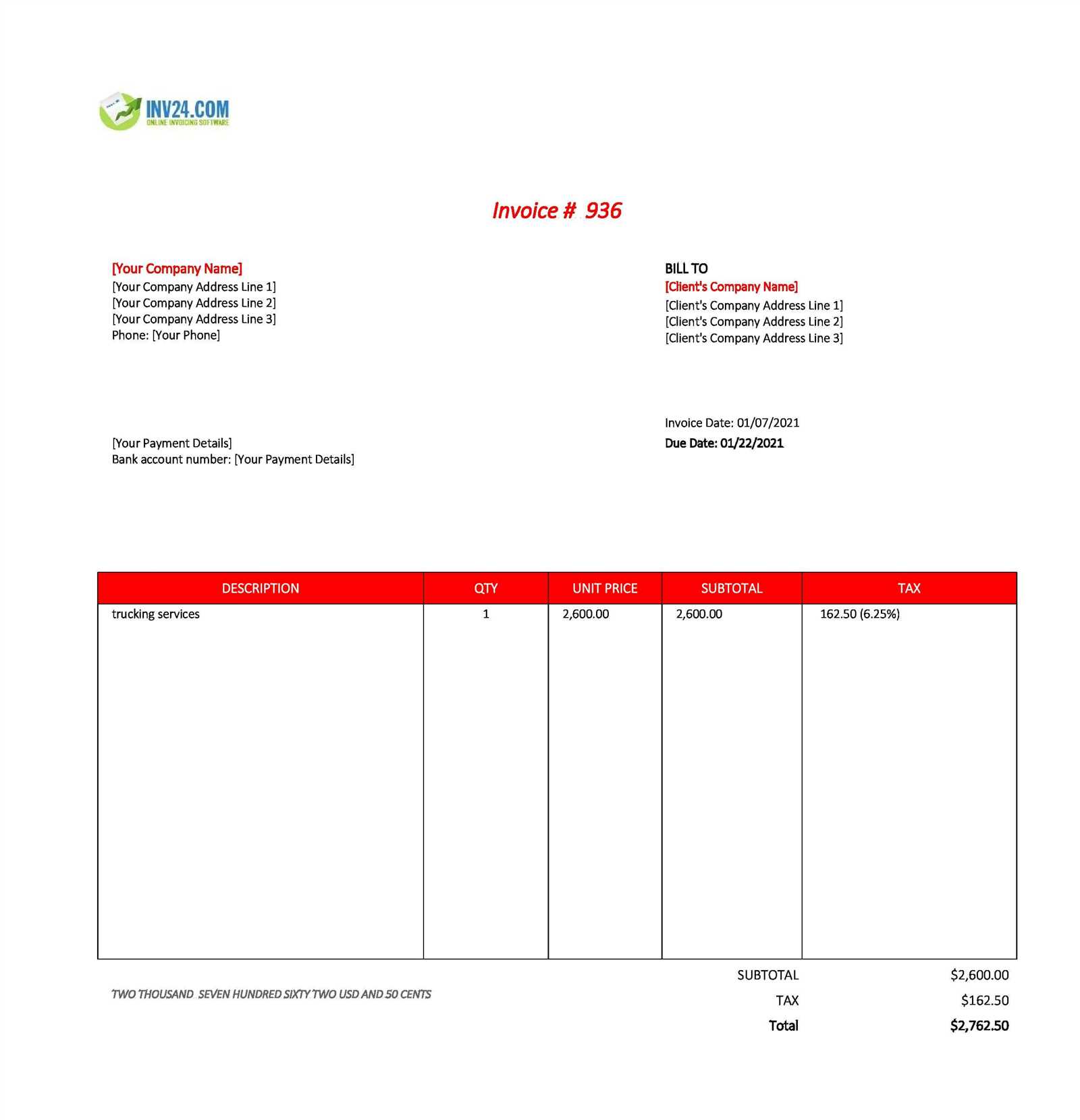

For any payment request to be clear and professional, it must contain certain essential elements. These features ensure that the client can easily understand the details of the transaction, including what services were provided, the agreed-upon costs, and the payment terms. A well-structured document helps avoid confusion and ensures that all necessary information is easily accessible for both parties.

One of the most important elements is a clear and comprehensive breakdown of the charges. This should include a description of the work completed, the quantity or hours worked, the rate applied, and the total cost. It’s important to provide enough detail so that the client can see exactly what they are being billed for, reducing the chances of disputes or questions.

Next, payment terms and deadlines should always be included. Clearly state the due date for the payment, as well as any late fees or penalties that may apply if the payment is not made on time. This helps manage expectations and encourages prompt payment.

Contact details are another vital feature. Your business name, address, phone number, and email should be easy to find on the document. This ensures that the client can reach out if they have any questions or issues with the transaction.

Finally, a professional document should always include a unique reference number for tracking purposes. This can be especially useful for both the business and the client, allowing for easy identification of the document in future communications or accounting systems.

Creating Professional Billing Documents with Spreadsheet Software

When it comes to managing financial transactions, using a powerful spreadsheet application can simplify the process of generating professional-looking documents. These tools offer flexible features that allow you to create detailed and accurate billing records, while also ensuring that the final product looks polished and organized. By customizing the layout and automating calculations, you can save time and present your business in a more professional light.

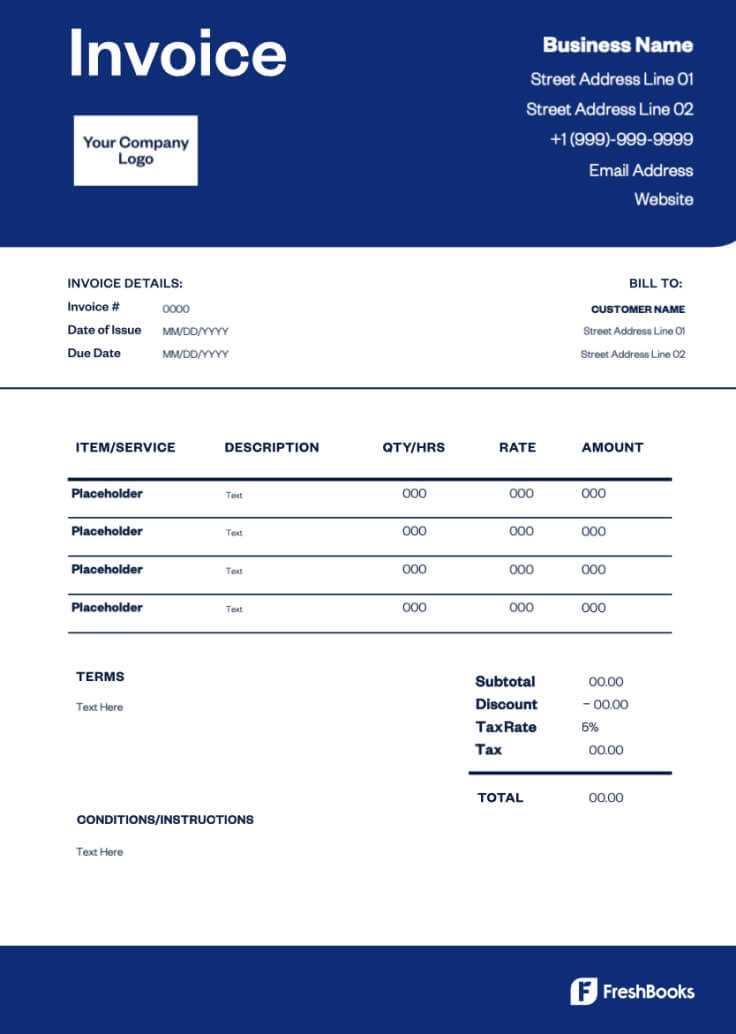

Designing Your Document Layout

The first step in creating a professional document is to design a clean and functional layout. A well-organized structure ensures that your client can quickly find the information they need. Start by including sections for your company details, the client’s information, a description of the work or products provided, and the total charges. Each of these sections should be clearly labeled and easy to read.

Columns for itemized services should be aligned neatly, with enough space for both quantity and price information. Ensure that the date and reference number are prominently displayed to avoid confusion in future communications.

Automating Calculations for Accuracy

One of the major advantages of using spreadsheet software is the ability to automate calculations. You can set up formulas to automatically calculate totals, taxes, and discounts. This reduces the likelihood of errors and saves you time. Additionally, by setting fixed rates and applying them to your entries, you can ensure that all charges are consistent and accurate.

Make sure to review your formulas and test them with sample data to ensure everything is calculating correctly before you send the document to a client. This small step can prevent costly mistakes and create a seamless billing process.

Understanding Billing Document Layouts

Creating a well-organized layout for your payment requests is crucial for ensuring clarity and professionalism. A good design helps both the service provider and the client understand the key details of the transaction at a glance. By structuring your document in a way that highlights the most important information, you can avoid confusion and facilitate smoother communication.

Key Sections in a Billing Document

A typical billing document is divided into several sections, each serving a specific purpose. These sections help to keep the information organized and easy to follow. The main components often include:

- Header: Includes your business name, logo, and contact information.

- Client Information: Contains the name, address, and contact details of the recipient.

- Description of Goods/Services: A detailed breakdown of the work or products provided, including quantities and individual prices.

- Amount Due: A clear summary of the total cost, including taxes and any applicable discounts.

- Payment Terms: Information about payment due dates, late fees, and accepted payment methods.

Organizing the Information for Clarity

The layout should be simple and straightforward, with each section clearly separated. Ensure that the key elements, such as total cost and due date, are easy to locate. Using bold text or larger font sizes for headings can help draw attention to these important details.

Also, consider the alignment of your data. Properly aligned columns for the itemized list of services or products make the document easier to read and follow. Consistent formatting throughout the document ensures a clean and professional look.

Essential Fields in a Billing Document

When creating a payment request, it’s important to include specific fields that ensure all relevant details are clear and easy to understand. These essential elements help provide a comprehensive overview of the transaction, making it simple for both the business and the client to review the terms and process the payment smoothly. Without these key sections, the document may lack crucial information, leading to confusion or delays.

Key Information to Include

A well-structured document should contain the following essential fields:

- Business Details: The name, address, phone number, and email of the business sending the payment request. This ensures the client knows how to contact you if needed.

- Client Information: Name, address, and contact details of the recipient to ensure the document is correctly addressed.

- Unique Reference Number: A unique identifier for the transaction, which helps both parties track and reference the document in future communications.

- Date of Issue: The date when the document is created, which is crucial for determining the payment due date and for record-keeping purposes.

- Detailed Breakdown of Charges: A list of the products or services provided, including quantities, individual prices, and total amounts for each line item. This breakdown ensures the client knows exactly what they’re being charged for.

- Total Amount Due: The final amount to be paid, including taxes and discounts, clearly stated at the end of the document.

- Payment Terms: The payment deadline, late fees (if any), and accepted payment methods to clarify when and how payment should be made.

Formatting and Clarity

These fields should be clearly labeled and organized to ensure easy readability. Proper formatting, such as bold text for section headings or using tables for line items, will help create a document that is both professional and functional. A clean and structured layout allows the recipient to easily navigate the content and understand the payment details without unnecessary confusion.

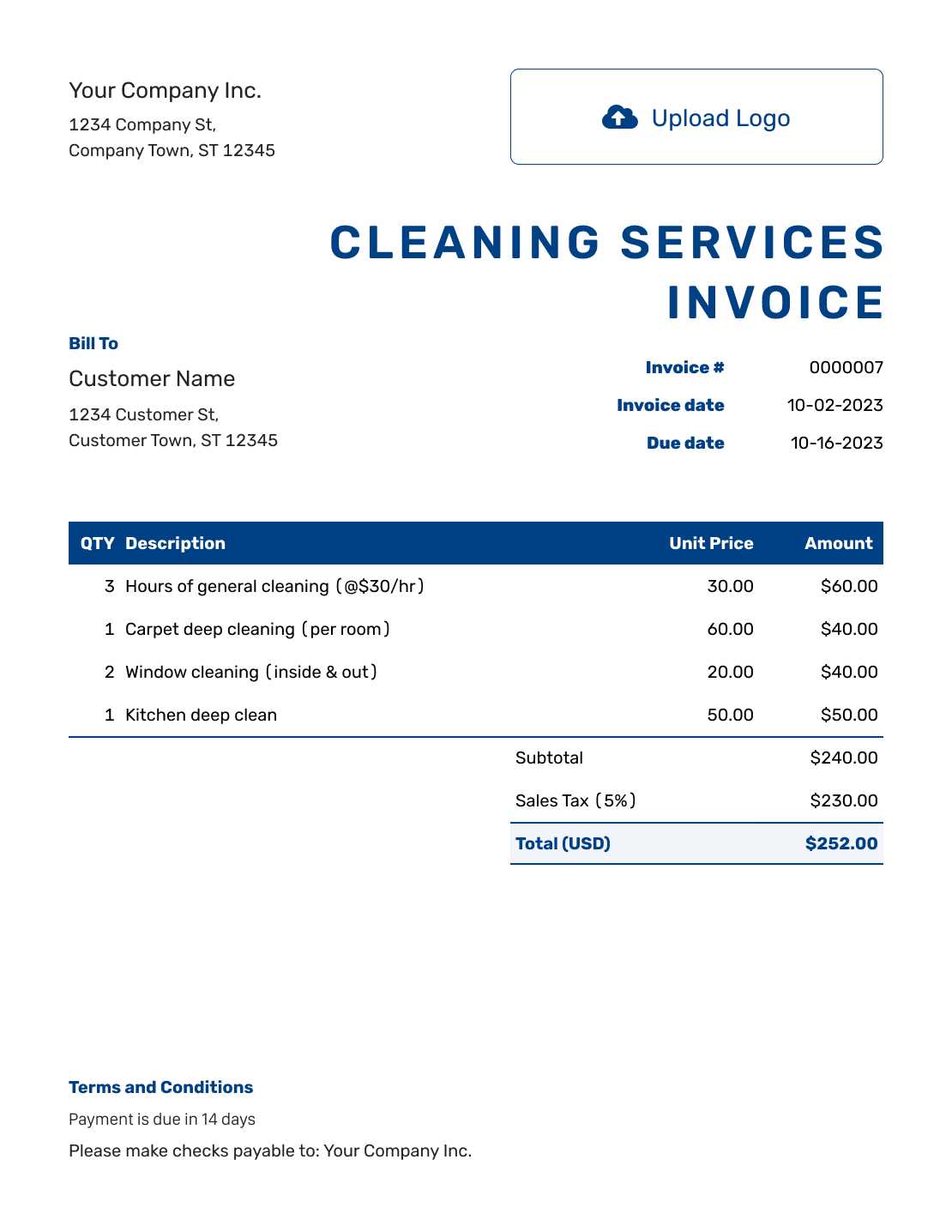

How to Calculate Billing Totals Automatically

Automating the calculation of totals in your financial documents not only saves time but also reduces the chance of human error. By setting up formulas within your document, you can easily calculate individual charges, taxes, and discounts, ensuring that the final amount is always accurate. This automation streamlines the entire billing process, making it more efficient and reliable.

Setting Up Basic Calculations

The first step is to define the basic calculations for your billing document. Typically, this includes:

- Unit Price x Quantity: Multiply the cost of each item or service by the number of units provided to get the subtotal for each line item.

- Subtotal Calculation: Add up all line item totals to get the overall subtotal before taxes and discounts.

- Tax Calculation: Apply the appropriate tax rate to the subtotal, ensuring that you have the correct percentage entered for the specific region or service type.

- Discounts: If applicable, calculate any discounts by subtracting the agreed-upon percentage or fixed amount from the subtotal or total after taxes.

Using Formulas for Automation

Most spreadsheet applications provide built-in formulas to help automate these calculations:

- SUM: This formula is used to quickly add up a range of numbers, such as the individual item totals, to calculate the subtotal.

- PRODUCT: Use this to multiply unit price and quantity for each line item.

- PERCENTAGE: To calculate tax or discounts, apply the percentage formula to the subtotal or total, making sure the percentage is entered as a decimal (e.g., 10% = 0.10).

- SUMIF: This can be used to sum only specific entries that meet certain conditions, like applying a discount only to certain items.

By setting up these formulas in advance, the calculation process becomes fully automated. Whenever you need to create a new document, all you need to do is input the necessary data, and the software will take care of the rest. This eliminates the risk of manual errors and ensures consistency across all your financial records.

How to Add Discounts and Taxes

When creating a payment request, it’s essential to accurately apply both discounts and taxes to ensure the final amount is correct. Many billing systems allow you to automate these calculations, which helps streamline the process and avoid errors. Understanding how to correctly set up these features can improve your efficiency and ensure transparency in your financial documents.

Adding Discounts

Discounts can be applied in several ways, depending on your pricing structure. They can be given as a percentage off the total amount or a fixed amount deducted from the subtotal. To add discounts to your document:

- Percentage Discount: Calculate the discount by multiplying the subtotal by the discount rate (e.g., 10% = 0.10). Subtract the resulting value from the subtotal to get the discounted amount.

- Fixed Amount Discount: If a flat discount is offered (e.g., $20 off), simply subtract this amount from the subtotal before calculating taxes or adding the final total.

- Conditional Discounts: You may want to offer discounts only when certain conditions are met, such as for bulk purchases or for early payments. In these cases, set up formulas or use conditional logic to apply discounts only when those criteria are fulfilled.

Applying Taxes

Taxes are an important aspect of billing, especially for businesses operating in regions with sales tax or VAT requirements. To properly apply taxes:

- Determine the Tax Rate: Identify the applicable tax rate for your region or service type. For example, if the tax rate is 5%, the tax formula would use 0.05 as the multiplier.

- Calculate the Tax Amount: Multiply the amount before tax by the tax rate. For example, if the subtotal is $100 and the tax rate is 5%, multiply 100 by 0.05 to get $5.

- Add Tax to Subtotal: After calculating the tax amount, add it to the subtotal or adjusted total (if discounts were applied) to get the final amount due.

Automating these calculations through formulas or pre-set fields within your system helps eliminate errors and ensures that the correct amounts are always applied to each transaction. By properly setting up discounts and taxes, you create a transparent and professional billing process that both you and your clients can trust.

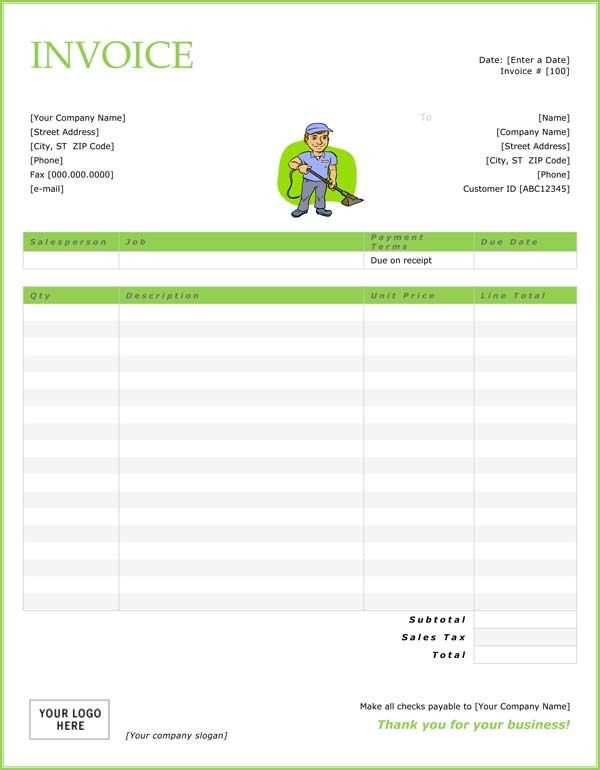

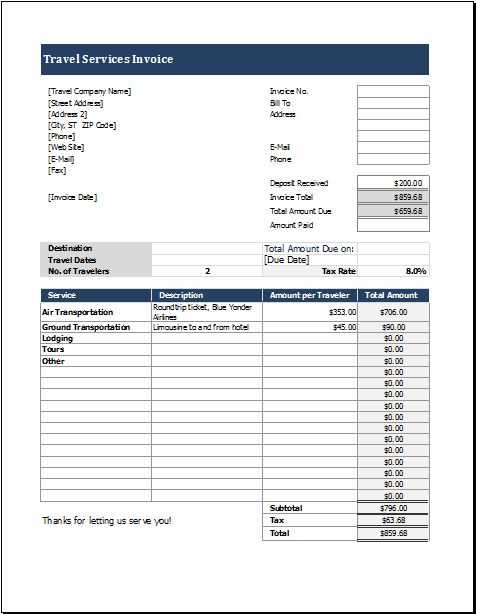

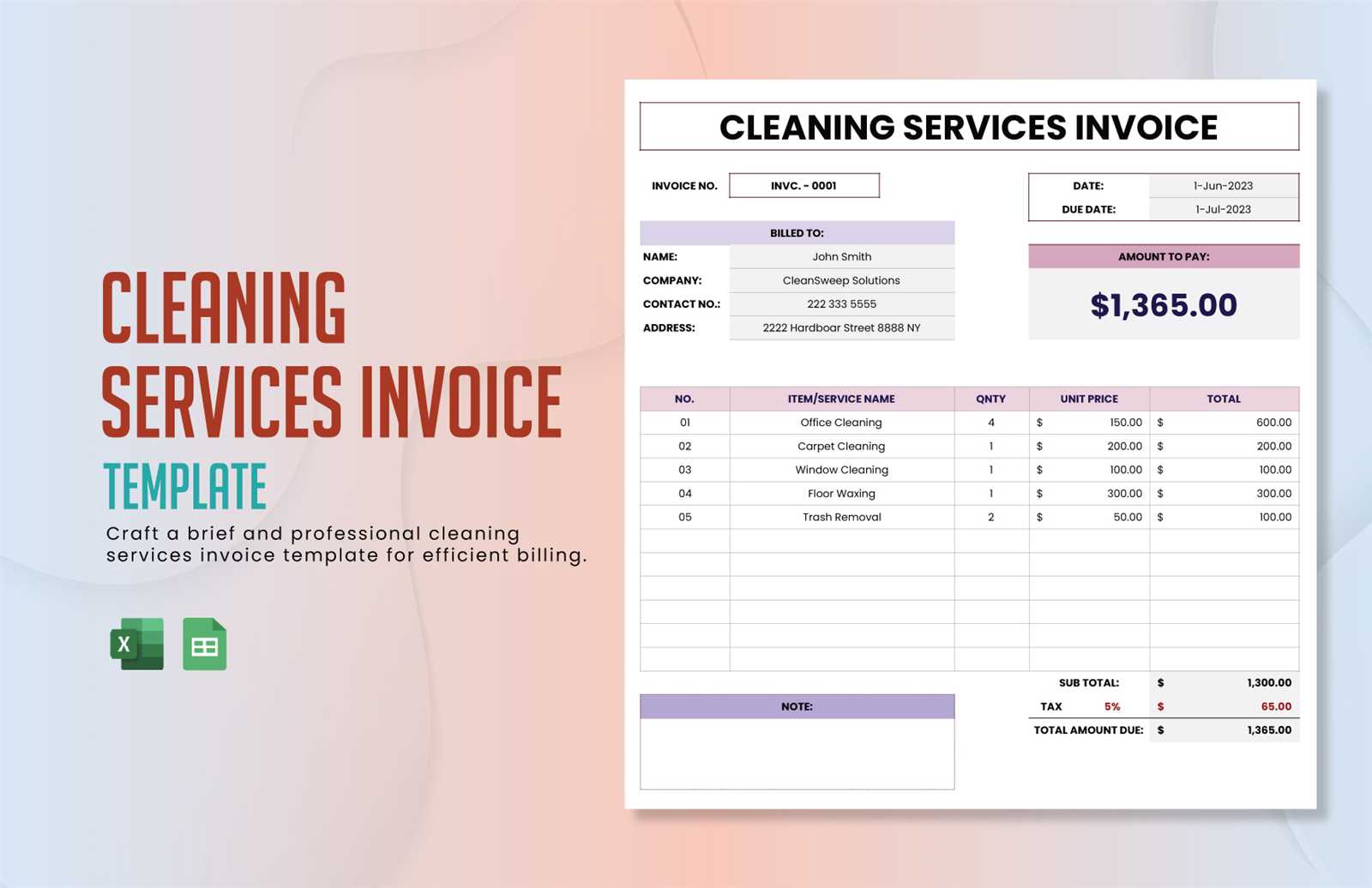

Billing Document for Different Services

Each business may have specific needs when it comes to structuring financial documents, especially if they offer a wide range of services or products. Depending on the type of work being done, the required information may vary. A flexible format allows for easy customization, ensuring that the correct details are presented clearly to clients, regardless of the services provided.

Customizing for Different Types of Work

When tailoring your document for various types of transactions, consider the following adjustments based on the nature of your offerings:

- Hourly Work: For services billed by the hour, include the number of hours worked, the hourly rate, and the total hours for each task. Ensure that the rate is clearly stated and that the final amount reflects the time spent.

- Project-Based Work: For larger, one-off projects, list the different stages or milestones, and the agreed price for each phase. This can help clients see how their payment is broken down and track the progress of the work.

- Product Sales: When selling physical or digital products, include item descriptions, quantities, and individual prices. For bulk orders, ensure that the volume and price per unit are clearly displayed.

- Subscription-Based Services: For ongoing, recurring services, include the billing cycle (e.g., monthly, quarterly) and the total due for each period. Clearly state the start and end dates for each cycle.

- Consultation Fees: For one-time consultations, ensure the nature of the consultation is clearly stated, along with the agreed-upon fee. You may also wish to list the time spent or any special terms that apply to the consultation.

Incorporating Additional Information

Beyond the basic charges, some industries may require additional fields to ensure that all necessary details are included. For example:

- Special Terms and Conditions: If there are specific payment terms, such as deposits or milestones, include these clearly at the bottom of the document.

- Materials or Expenses: If any additional expenses (such as materials or travel costs) were incurred, these should be itemized separately with clear explanations.

- Taxes and Discounts: If applicable, apply the correct tax rates and clearly indicate any discounts or promotional rates offered to the client.

By adjusting the layout and content based on the type of work being billed, you ensure that the document is tailored to both your business needs and the client’s expectations. This attention to detail can help improve professionalism and enhance client relationships.

Free vs Paid Billing Documents

When choosing a document layout for financial transactions, businesses often face the decision of using free or paid options. While free tools may offer basic functionality, paid options usually provide advanced features and customization. The right choice depends on your business needs, budget, and the level of professionalism you want to achieve in your documents.

Comparing Features

Below is a comparison of the key differences between free and paid options:

| Feature | Free Options | Paid Options |

|---|---|---|

| Customization | Basic layout with limited customization options. | Advanced customization, including logos, fonts, and branding. |

| Automation | Limited or no automation for calculations and totals. | Full automation for taxes, discounts, and totals, reducing manual work. |

| Design Quality | Basic and functional design, often with a standard, unbranded look. | Professional, polished designs tailored to your business needs. |

| Support | No or limited customer support for issues or questions. | Access to customer support, tutorials, and assistance from the service provider. |

| Cost | Free of charge. | Requires a subscription or one-time payment. |

Which Option is Right for You?

Free layouts are a good starting point for small businesses or individuals who need a simple solution without investing in paid software. However, as your business grows or if you require more advanced features, upgrading to a paid solution may provide better value. Paid tools often include time-saving features, higher customization, and better customer support, making them a worthwhile investment for businesses aiming for higher efficiency and professionalism.

Tips for Avoiding Billing Errors

Accurate billing is crucial for maintaining trust with clients and ensuring timely payments. Errors in your financial documents can lead to confusion, delays, and potentially damage client relationships. By implementing a few best practices, you can minimize the risk of mistakes and create professional, error-free documents every time.

Common Billing Errors and How to Avoid Them

Below are some of the most common mistakes made in financial documents and tips for avoiding them:

| Error | Prevention Tip |

|---|---|

| Incorrect Calculations | Double-check all math, or use automated formulas to ensure accuracy. |

| Missing or Incorrect Client Information | Always verify client details before finalizing the document, and update records regularly. |

| Failure to Apply Discounts or Taxes | Use consistent formulas for tax rates and discounts, and review each document before sending it out. |

| Not Including a Due Date | Clearly state payment due dates on every document to avoid confusion over deadlines. |

| Unclear Descriptions of Services | Provide detailed, concise descriptions for each product or service to avoid misinterpretation. |

Final Tips for Error-Free Documents

Beyond double-checking the details, here are some additional tips for avoiding billing mistakes:

- Standardize Your Format: Use the same layout for all documents, making it easier to spot any inconsistencies.

- Review Before Sending: Always take a final look at the document to ensure all information is accurate and complete.

- Use Automated Tools: Many tools are available that can handle calculations, track payments, and even flag errors for you.

- Keep Records Updated: Ensure all product or service pricing, client details, and payment terms are kept current to avoid discrepancies.

By taking the time to carefully prepare and check your documents, you can prevent errors that could delay payments or damage your professional reputation.

How to Save and Reuse Billing Documents

Creating financial documents from scratch for each transaction can be time-consuming. However, once you have a well-designed layout, saving it for future use can significantly streamline your workflow. By reusing your document structure, you can save time on formatting and focus on the content, ensuring consistency across all your transactions.

Saving Your Document for Future Use

To make your document reusable, follow these simple steps:

- Save a Master Copy: Create a master version of your document with all the fields and formulas set up. This version should have placeholders for client information, amounts, and other dynamic data.

- Save in Multiple Formats: Depending on your needs, save the document in various formats. For example, saving it as a PDF ensures it can be shared easily, while saving it as a spreadsheet allows you to continue editing and updating it later.

- Use Cloud Storage: Storing your file in the cloud allows easy access from anywhere and ensures you always have the latest version available across multiple devices.

Reusing Your Documents

Reusing your saved documents is straightforward. Here are some tips for efficient reuse:

- Duplicate the Master File: Instead of editing the original document, create a copy for each new transaction. This prevents accidental overwriting of your master copy.

- Update Client Details: Replace the placeholders with specific information for each client, including names, addresses, and payment terms.

- Adjust Amounts and Services: Change the quantities, prices, or items to match the new work being billed. Ensure all calculations are correct and up-to-date.

- Track Changes: If you make significant changes to your document, such as adding new sections or updating formulas, remember to save the updated version for future use.

By following these simple steps to save and reuse your documents, you can ensure consistency, save time, and streamline the billing process for every client. With a reusable structure in place, you’ll have a professional document ready for use at any time.

Functions for Billing Management

When managing financial documents, using the right functions can help automate calculations, reduce errors, and increase efficiency. Spreadsheet software offers a variety of built-in tools that can simplify tasks such as totaling amounts, applying taxes, calculating discounts, and more. These functions not only save time but also ensure accuracy across all your transactions.

Key Functions to Enhance Efficiency

Here are some essential functions that can make managing your billing documents faster and more accurate:

- SUM: This basic function allows you to quickly calculate the total amount by adding up a range of numbers. It’s perfect for summing line items or totals in your document.

- IF: The IF function allows you to apply conditional logic. For example, you can set up rules for applying discounts or calculating taxes based on specific conditions (e.g., if the total exceeds a certain amount, apply a discount).

- VLOOKUP: Use VLOOKUP to automatically search for data from a different table and pull it into your document. This is useful for fetching client details, pricing, or other standard information from a separate list.

- PMT: For subscription or recurring billing, the PMT function helps calculate fixed payments over a specified period. This can be helpful for calculating monthly payments or installment plans.

- ROUND: Ensure that numbers are rounded to the desired decimal places using the ROUND function. This is particularly useful for rounding amounts like taxes or total costs to the nearest cent.

- TEXT: The TEXT function is handy for formatting dates, times, or numbers in a readable and consistent way, such as displaying the date in a specific format or currency with the correct symbols.

Automating Common Calculations

Using the right functions, you can automate some of the most common calculations in billing documents, such as:

- Tax Calculation: Set up a function to automatically calculate sales tax based on the subtotal and tax rate, ensuring consistent and accurate calculations every time.

- Discounts: Create a formula to apply a percentage discount on the total amount based on predefined conditions, reducing manual calculations.

- Subtotal and Total: With the SUM function, you can easily calculate the subtotal for your services or products, and then use additional functions to calculate the final total after tax and discounts.

By leveraging these functions, you can create a more streamlined and professional billing process that not only saves time but also reduces the likelihood of errors. These tools are invaluable for anyone looking to manage their finances more efficiently.

Common Mistakes in Billing

Inaccurate or incomplete billing can lead to confusion, payment delays, and strained client relationships. It’s essential to be mindful of common errors when preparing financial documents to ensure clarity and accuracy. Even small mistakes can create unnecessary complications for both you and your clients.

Typical Errors in Financial Documents

Below are some of the most frequent mistakes that occur during the billing process and tips on how to avoid them:

| Common Mistake | How to Avoid It |

|---|---|

| Incorrect Client Information | Always double-check client details like names, addresses, and contact information before finalizing the document. |

| Missing or Wrong Payment Terms | Clearly outline the payment due date, any late fees, and accepted payment methods to avoid misunderstandings. |

| Calculation Errors | Use built-in formulas to automatically calculate totals, taxes, and discounts to minimize human error. |

| Unclear or Vague Descriptions | Provide clear, detailed descriptions of the goods or services provided, including quantity, rate, and duration. |

| Failure to Include Taxes and Fees | Ensure that applicable taxes and any additional fees are clearly listed and included in the final amount. |

| Missing or Incorrect Invoice Number | Always include a unique identification number to keep track of documents and maintain organization. |

Additional Tips for Error-Free Billing

Beyond the common mistakes listed above, here are some additional practices to help avoid errors:

- Review Before Sending: Always take a final look at your document before submitting it to ensure all information is accurate and complete.

- Use Templates: Start with a professional layout that you can customize for each client. This ensures consistency and helps prevent missing fields.

- Automate Where Possible: Use software or spreadsheet formulas to automate calculations for greater accuracy and efficiency.

- Stay Organized: Keep detailed records of all transactions, including drafts, final versions, and payment history, to avoid confusion and errors later on.

By staying vigilant and following these best practices, you can significantly reduce the risk of er

How to Share and Print Your Billing Document

Once your financial document is ready, it’s essential to share it with the client in a professional manner and ensure that it’s easy to print when needed. Whether you choose to send it electronically or via traditional mail, there are several methods to make the document easily accessible while maintaining its professional appearance.

Sharing Your Document with Clients

When sending your document electronically, there are a few best practices to follow:

- Save as PDF: Exporting your document as a PDF ensures that the layout and formatting remain consistent across different devices. It’s the preferred format for most clients, as it’s universally accessible and looks professional.

- Email the Document: Attach the PDF file to an email, clearly stating in the subject line and body of the email that you are sending the billing document. Always include a polite message thanking the client for their business and confirming the due date for payment.

- Use Cloud Storage: For clients who prefer accessing documents through cloud-based systems, upload your file to platforms like Google Drive or Dropbox. Share a link to the document along with necessary instructions for accessing and downloading it.

Printing Your Document

If your client prefers a physical copy or if you need to keep a hard copy for your records, follow these steps to print your document properly:

- Check Page Layout: Before printing, ensure that the layout is set to fit the page size. You can adjust the margins, headers, and footers to ensure that no important information gets cut off.

- Use High-Quality Paper: For a professional appearance, print your document on high-quality paper, preferably with a clean white finish. This will make the document look more polished when presented to the client.

- Review Before Printing: Always preview the document before sending it to the printer. This will help you spot any formatting issues, alignment problems, or missing details that need to be corrected before printing.

- Save a Digital Copy: Even when printing, it’s a good idea to save a digital copy of the document for your records and future reference.

By following these guidelines, you can share and print your billing document in a way that is both efficient and professional, ensuring clear communication with your clients and maintaining a high standard of business practice.

Why Excel is Ideal for Small Businesses

For small businesses, managing finances, client records, and billing can often feel overwhelming due to limited resources and staff. However, having access to the right tools can make a significant difference. One such tool that is particularly beneficial for small business owners is spreadsheet software. It offers a versatile, cost-effective solution that simplifies various administrative tasks, from budgeting to client management, without the need for expensive software or training.

Affordability and Accessibility

One of the biggest advantages of using spreadsheet software for small businesses is its affordability. Most businesses already have access to this software as part of their office suite, and many free alternatives are available as well. This means that even businesses with limited budgets can take advantage of powerful features without the upfront costs associated with specialized business software.

Flexibility and Customization

Another reason spreadsheet software is ideal for small businesses is its incredible flexibility. Whether you need to track finances, manage inventory, or create documents for clients, spreadsheets allow you to customize your layout and formulas to meet your specific needs. You can easily create personalized layouts and automate calculations without the need for coding or technical expertise.

Ease of Use and Learning Curve

Spreadsheet programs are user-friendly and widely available, making them accessible to anyone, even those with minimal technical experience. The learning curve is relatively short, and there are plenty of resources, tutorials, and templates available online to help you get started. Small business owners can quickly learn how to use spreadsheets for various tasks, from tracking expenses to generating simple financial reports.

Automated Calculations and Efficiency

One of the greatest time-saving features of spreadsheets is the ability to automate calculations. By using built-in formulas, small business owners can avoid manual errors and ensure consistency across all documents. For example, you can set up automated calculations for totals, taxes, and discounts, significantly reducing the time spent on paperwork and increasing overall efficiency.

Data Management and Organization

Spreadsheets provide a structured way to store and organize important business data. You can easily sort and filter information, making it quick to find specific records, whether it’s a customer’s contact information or a list of past transactions. Additionally, the ability to link different sheets together allows for more advanced data management, which is ideal for businesses that are growing and need to maintain accurate records.

In conclusion, spreadsheet software offers small businesses an efficient, affordable, and flexible solution to managing their day-to-day operations. Whether you’re handling billing, accounting, or client communications, it provides a simple yet powerful way to streamline processes, save time, and ensure accuracy in your business practices.