Free Photography Invoice Template in Word Format

Managing finances in any business requires accuracy and organization. One essential aspect of this is ensuring that your financial documents are clear, professional, and easily customizable. Having a structured document that clearly outlines the details of a transaction helps you maintain a solid relationship with clients and ensures timely payments.

Whether you are just starting out or have been in business for a while, using an editable format can save time and reduce errors. With the right tools, creating a document that reflects your brand and clearly communicates terms to clients becomes a streamlined task.

In this guide, we explore how to effectively create and customize a document suited to your specific needs. By utilizing simple yet powerful tools, you can easily craft a professional-looking document that suits your business style while keeping track of your payments.

Creating Professional Billing Documents

Effective financial documentation is essential for any business transaction. Whether you’re a freelancer or run a small business, using a customizable structure can help you maintain a clear and professional approach when it comes to handling payments. These documents should not only list services provided but also ensure that clients understand the terms of payment and the overall pricing structure.

Advantages of Using Editable Billing Documents

- Time-Saving: Editable documents allow you to quickly fill in client details and service descriptions, reducing manual work.

- Consistency: Having a uniform format ensures that your billing statements are always clear and professional, creating trust with your clients.

- Customizability: You can easily adjust the layout, style, and content of the document to reflect your branding and unique services.

- Accuracy: By using a standardized document, you reduce the chances of making mistakes or forgetting important details.

How to Get Started

To start creating professional billing documents, you don’t need advanced software. A simple editable file can give you the flexibility to generate high-quality documents while maintaining control over the details. All you need is a basic word processing tool that supports customization, and you can easily create a clean, structured, and effective billing statement.

- Download a pre-made structure to save time.

- Fill in your business details, such as name, contact information, and payment terms.

- Describe the services provided, including rates and additional fees, in a clear and concise manner.

- Include payment instructions to ensure your clients know exactly how to proceed.

Why Use an Invoice Template

Using a pre-designed document for billing can simplify your workflow and ensure consistency across all your financial communications. Instead of creating a new document from scratch each time, having a ready-made structure allows you to focus on the details of the transaction without worrying about formatting. This approach saves valuable time and reduces the chances of making errors.

Moreover, having a standardized format helps maintain professionalism in your business. Clients appreciate receiving clear, well-organized documentation that outlines the services provided, the agreed-upon rates, and payment terms. A clean layout can also improve your business’s credibility, showing that you are detail-oriented and reliable.

Key Benefits of Using a Pre-Formatted Billing Document:

- Efficiency: Quickly fill in the necessary information without having to set up the layout each time.

- Consistency: Ensure that all your billing documents follow a uniform style and structure, making it easier for clients to understand.

- Professionalism: Present your business in the best light by using a polished and well-organized document for financial transactions.

- Accuracy: Reduce human error by following a clear structure that ensures all essential details are included.

Benefits of Using Word for Invoices

Using a word processing program for your billing documents offers a variety of advantages that can streamline your workflow and enhance the professionalism of your business. This type of software allows for easy editing, formatting, and customization, providing you with the flexibility to create documents that meet your specific needs without the complexity of specialized accounting software.

One of the primary advantages is the accessibility and familiarity of such programs. Most users are already comfortable with basic word processing tools, making them ideal for quickly generating clear and organized financial documents. Additionally, these programs are widely available and compatible with various devices, ensuring that you can create and send documents on the go.

Key Advantages of Using a Word Processing Program:

- Ease of Use: Familiar interface and simple tools make creating and editing documents fast and intuitive.

- Customizability: Tailor your layout and design to fit your business needs, ensuring each document reflects your brand.

- Flexibility: Easily modify documents as needed without requiring complex technical skills.

- Compatibility: Files can be shared across multiple platforms and devices, ensuring smooth communication with clients.

- Cost-Effective: No need for expensive software or subscriptions, as most word processing tools are readily available and often included with standard office suites.

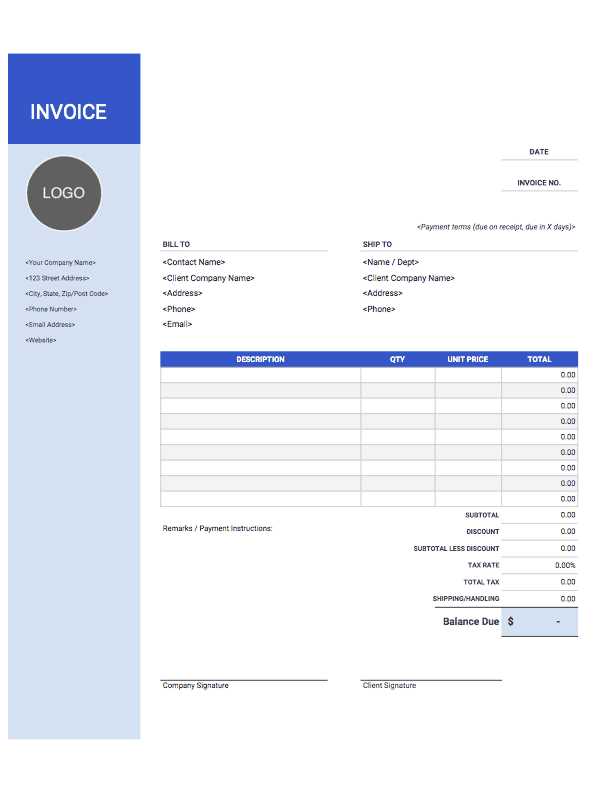

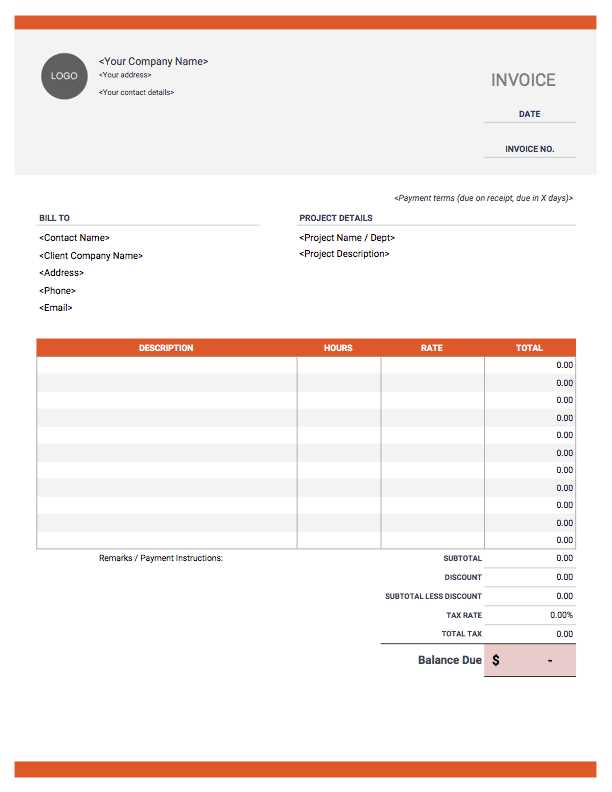

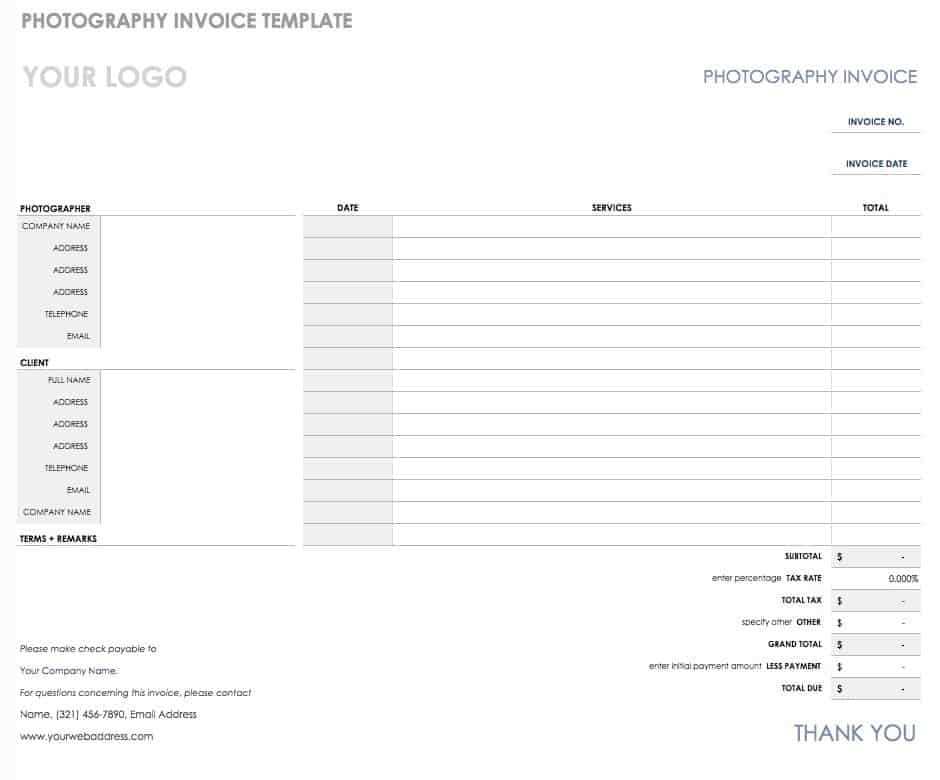

How to Customize Your Template

Customizing your billing document allows you to tailor it to your specific needs and ensure that it accurately represents your business. With a flexible document structure, you can adjust various elements, from the layout to the text, making sure that the final product reflects your style and professionalism. Personalization also ensures that clients receive a consistent and branded experience every time they receive a bill.

Adjusting Layout and Design

One of the first steps in customization is modifying the layout to suit your preferences. You can adjust margins, font sizes, and headings to ensure that the document is easy to read and aligns with your business’s visual identity. Consider incorporating your logo and choosing colors that match your branding. This not only enhances the document’s appearance but also reinforces your business’s image.

Editing Text and Details

Another important aspect of customization is editing the text to fit the services you provide. Make sure to clearly outline the items or services rendered, including pricing, payment terms, and any other relevant information. You can also add personalized notes or additional instructions to make the document more engaging for your clients. Ensure that all business details, such as your contact information, are accurate and up-to-date.

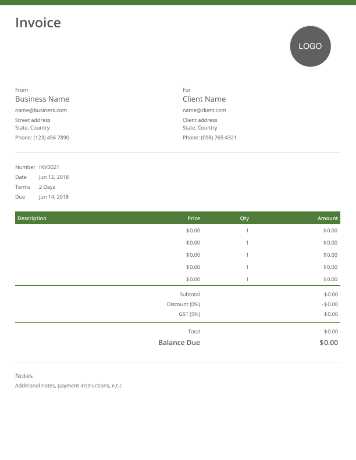

Essential Elements of a Billing Document

A well-crafted billing statement is not just a request for payment but a professional reflection of your business. It should clearly outline the services provided, associated costs, and payment terms in a way that leaves no room for confusion. Ensuring that these critical elements are included can help prevent misunderstandings and speed up the payment process.

Key Components of a Billing Statement

- Business Details: Include your name, contact information, and business address to ensure clients can reach you easily.

- Client Information: Add the client’s name, address, and other relevant contact details to personalize the document.

- Description of Services: Clearly list the services provided, including quantities, rates, and a brief explanation of each item.

- Total Amount: Provide a clear breakdown of the total cost, including taxes, fees, or any additional charges.

- Payment Terms: Include instructions for payment, including due dates, acceptable payment methods, and any late fees.

- Invoice Number: Assign a unique identification number for record-keeping and reference.

Additional Considerations

- Payment Instructions: Make it easy for clients to pay by providing simple and clear payment options.

- Thank You Note: Adding a courteous message can improve client relations and encourage prompt payments.

- Terms and Conditions: If applicable, outline any policies or terms relevant to your business practices.

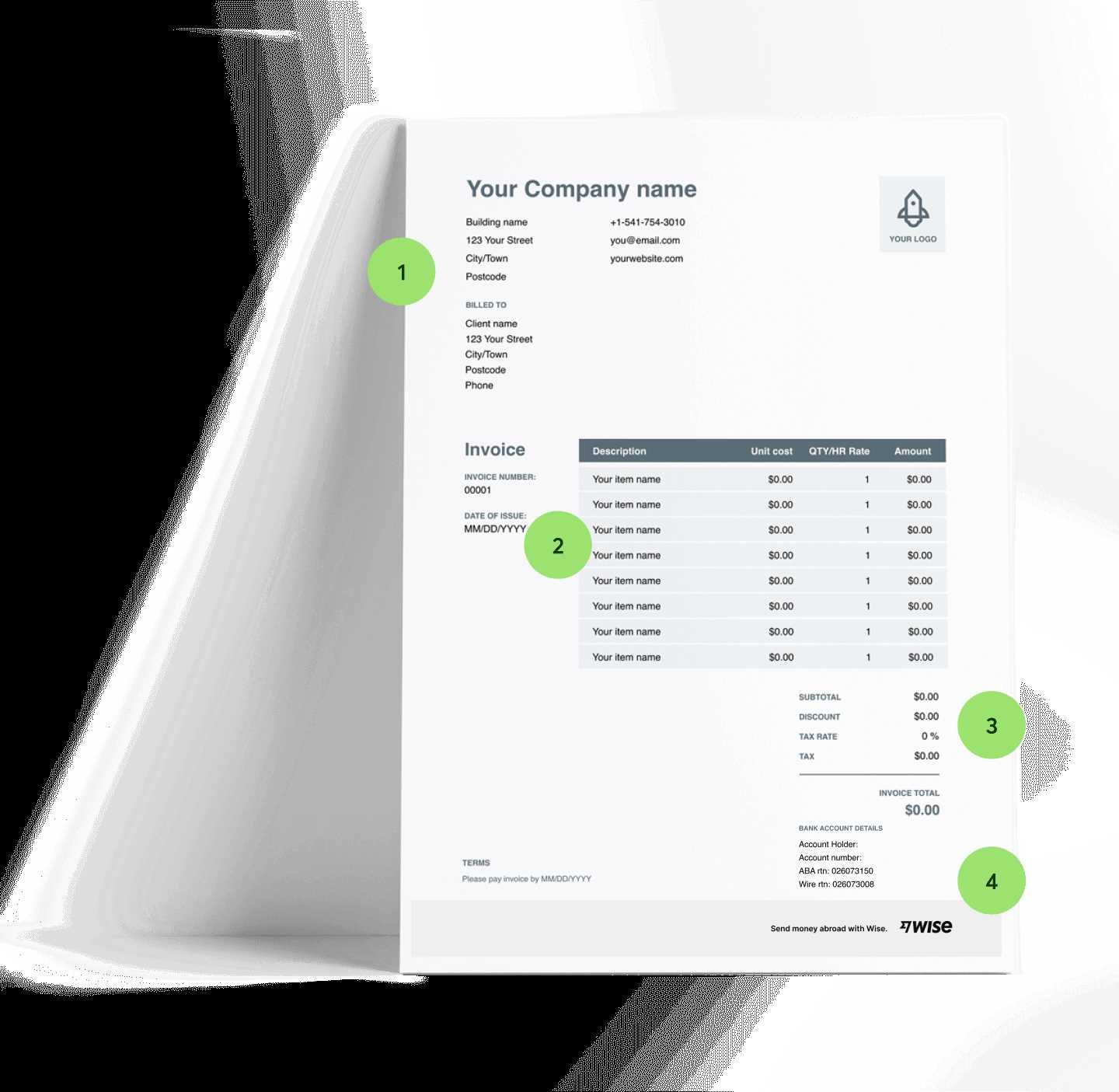

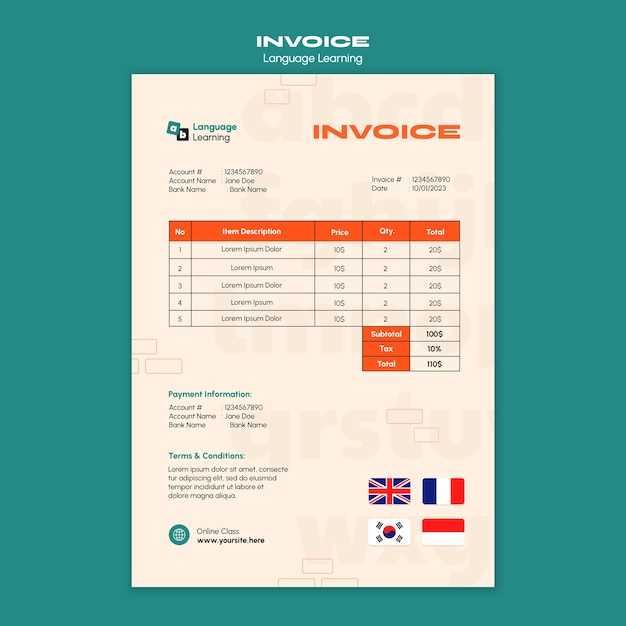

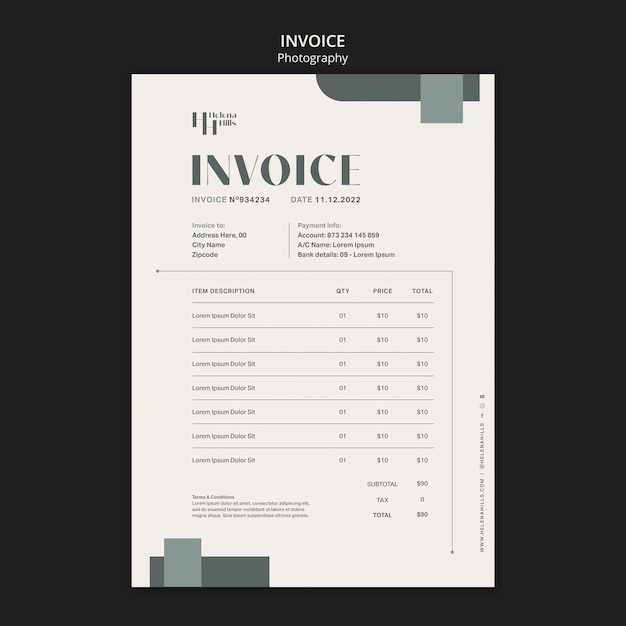

Choosing the Right Document Design

Selecting the appropriate layout for your billing document is crucial for making a strong professional impression. The design should not only be visually appealing but also functional, ensuring that all necessary information is clearly presented and easy to understand. A well-designed document can enhance your brand’s identity while also providing clients with a seamless experience when reviewing their charges.

Factors to Consider in Design

- Clarity and Readability: The primary goal of any document is to communicate information effectively. Choose a clean, simple layout that highlights the most important details, such as the services provided, rates, and payment terms.

- Brand Identity: Ensure that the design aligns with your brand’s colors, logo, and overall aesthetic. This creates consistency across all business communications.

- Structure and Flow: Organize information logically. Group related items together and use headings or bold text to guide the reader’s eye through the document.

- Space and Balance: Don’t overcrowd the document. Ample white space improves the readability and makes the content feel less cluttered.

Choosing the Right Format

- Simple and Clean: Opt for a minimalist design that avoids unnecessary graphics or decorations. This keeps the focus on the transaction details.

- Professional Style: Use a formal layout with clear sectioning to ensure the document looks polished and is easy to follow.

- Customizable Elements: Select a design that allows you to easily add or adjust details like client names, service descriptions, and payment terms.

Tips for Professional Document Presentation

Presenting your billing documents in a professional manner is essential for maintaining a strong business reputation. The way you structure and deliver your financial paperwork reflects your attention to detail and commitment to providing quality service. By following a few simple guidelines, you can ensure that your documents are not only clear but also leave a lasting impression on your clients.

Key Tips for Enhancing Presentation

- Consistent Branding: Ensure that the document aligns with your brand identity, including logo, colors, and fonts. This creates a cohesive look across all communications.

- Professional Language: Use clear, polite, and professional language throughout the document. Avoid overly casual or complex terms that could confuse clients.

- Clear Formatting: Structure the document in a way that makes it easy to follow. Highlight important details such as due dates, total amounts, and services provided.

- Easy-to-Follow Layout: Use headings, bullet points, and sections to organize the content logically. This helps clients quickly find the information they need.

Organizing Your Financial Details

| Service Description | Rate | Quantity | Total |

|---|---|---|---|

| Consultation | $50 | 1 hour | $50 |

| Editing | $30 | 2 hours | $60 |

| Total Amount | $110 | ||

By organizing details in a table format, you make it easier for clients to understand the breakdown of services and costs. This clarity fosters trust and promotes timely payments.

How to Add Payment Terms to Your Billing Document

Clearly outlining payment terms in your billing statement is essential for ensuring a smooth transaction process. By specifying the deadlines, methods, and any additional conditions for payment, you help set expectations for your clients, reducing the likelihood of misunderstandings or delays. Well-defined terms also protect your business and encourage timely payments.

When adding payment terms, it’s important to be concise yet comprehensive. Clearly state when the payment is due, any late fees that may apply, and the acceptable forms of payment. This not only ensures transparency but also shows professionalism. The more straightforward and detailed your terms, the less likely there will be confusion regarding payment obligations.

Key Elements to Include in Payment Terms

- Due Date: Clearly state the specific date by which payment is expected. For example, “Payment is due within 30 days of receipt.”

- Late Fees: If applicable, mention any late fees or interest that will be charged if payment is not received on time. For example, “A late fee of 2% will be charged for payments made after the due date.”

- Accepted Payment Methods: List the methods by which clients can pay, such as bank transfer, credit card, or PayPal. For example, “Payments can be made via bank transfer or credit card.”

- Discounts for Early Payment: If you offer discounts for early settlement, specify the terms. For example, “A 5% discount will be applied for payments made within 10 days.”

Adding clear and professional payment terms will not only streamline the process but also reinforce your credibility as a business. Make sure your clients understand what is expected of them and when, and they will be more likely to follow through promptly.

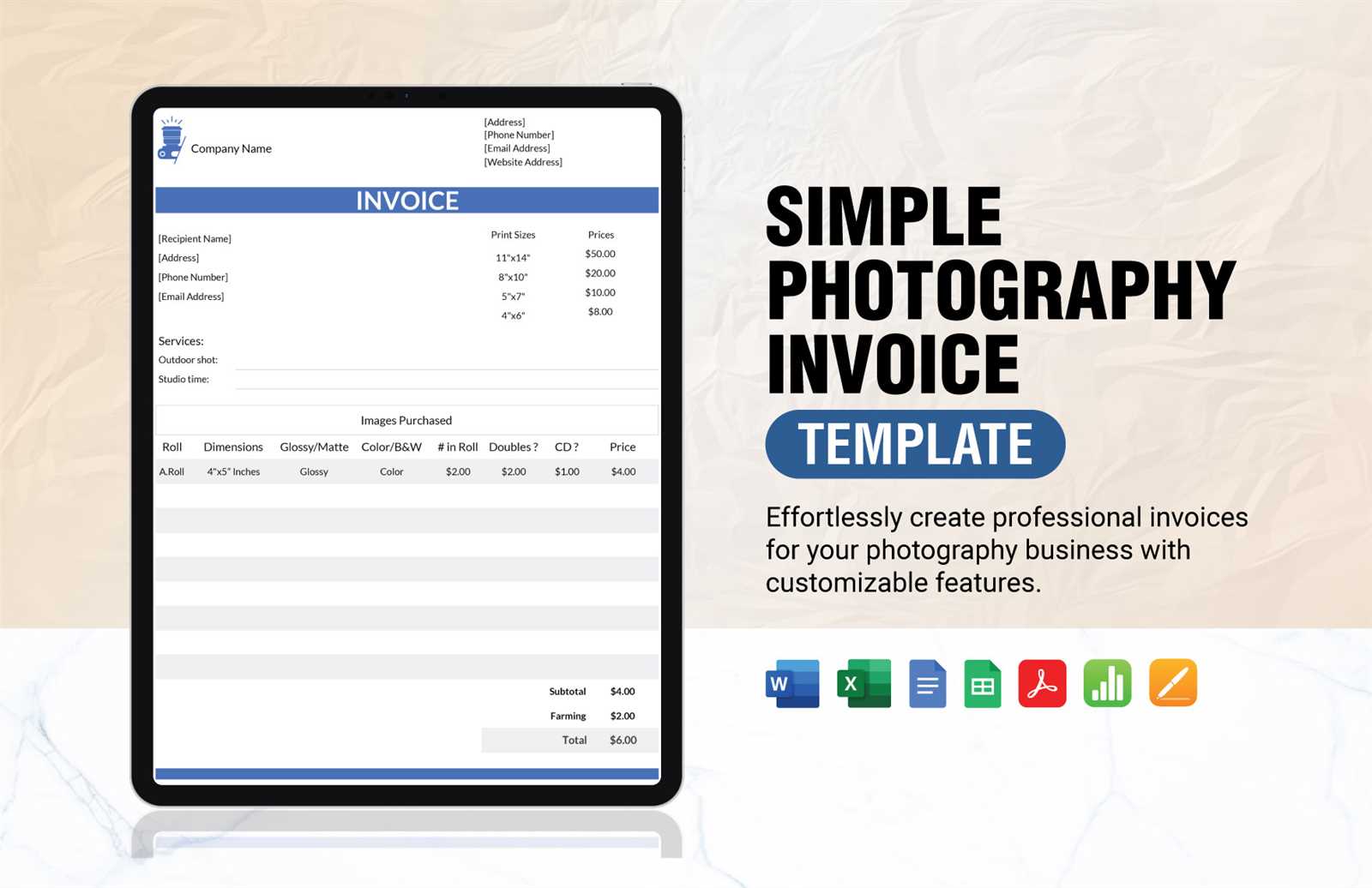

Free Resources for Billing Documents

Accessing quality resources for creating professional billing documents can make a significant difference in how your business is perceived. There are numerous platforms offering templates and tools that help streamline the process, ensuring that your documents are both clear and professional. Whether you’re just starting out or looking to improve your current methods, these resources can provide you with everything you need to manage your financial documentation effectively.

Where to Find Useful Tools

- Online Template Libraries: Websites like Canva and Google Docs offer a variety of ready-to-use designs that can be easily customized to fit your business needs. These platforms often provide simple drag-and-drop functionality for easy customization.

- Accounting Software with Built-in Features: Many accounting tools, such as Wave or FreshBooks, provide free access to invoice generation tools that are both functional and visually appealing. These tools also help track payments and outstanding balances.

- PDF Templates: Numerous online PDF template providers offer customizable forms that you can download and use for creating billing statements. These are perfect for users who prefer working with documents offline.

How to Leverage These Tools

- Customization: Choose resources that allow for easy customization of the design and structure of your documents. Tailor the template to reflect your business brand by adjusting fonts, logos, and color schemes.

- Automation: Take advantage of any automated features offered by the tools, such as automatically filling in client details or recurring billing options.

- Consistency: Use the same resource across all your financial documents to maintain consistency in appearance and professionalism, which helps build trust with clients.

Common Mistakes in Billing Documents

When creating billing statements, small errors can lead to confusion, delays, and even lost payments. Many businesses, especially those just starting out, may overlook important details or fall into common traps when structuring their financial documents. Understanding these mistakes can help you avoid costly issues and ensure that your documents are clear, professional, and effective.

Typical Errors to Avoid

- Missing or Incorrect Contact Information: Failing to include accurate client and business details can cause delays in communication and payment. Always double-check phone numbers, email addresses, and business identifiers.

- Unclear Service Descriptions: Providing vague or unclear descriptions of services rendered can lead to misunderstandings. Clearly outline each service, including the scope and quantity, to ensure transparency.

- Unspecified Payment Terms: Omitting payment terms or leaving them vague can result in confusion. Be specific about the payment due date, late fees, and acceptable payment methods.

- Incorrect Calculations: Even simple math errors can cause discrepancies and disputes. Always double-check the numbers, including rates, quantities, and totals, before finalizing the document.

- Lack of Professional Design: A poorly formatted document can appear unprofessional. Use a clean, consistent layout that enhances readability and creates a positive impression.

How to Prevent These Mistakes

- Double-Check All Information: Before sending any document, verify all client and service details. Accuracy is key to maintaining a professional reputation.

- Use Clear and Simple Language: Avoid industry jargon or complex language that could confuse your clients. Keep descriptions straightforward and easy to understand.

- Proofread and Edit: Take time to review the document for any errors, both in terms of content and formatting. This will help prevent common mistakes from slipping through.

Tracking Payments with Billing Documents

Effectively managing and tracking payments is crucial for maintaining cash flow and financial clarity. Using well-organized documents that record each transaction allows businesses to easily monitor outstanding balances, identify overdue payments, and keep clients informed. Proper tracking systems also reduce the risk of missing payments and help ensure timely follow-ups.

How to Track Payments Effectively

- Include Payment Status Fields: Clearly mark whether a payment has been made, is pending, or is overdue. This makes it easy to identify the status of each transaction at a glance.

- Note Payment Dates: Add the exact payment date when a client settles an amount. This helps to track whether payments are made on time or if follow-up is required.

- Utilize Running Totals: Including a running balance or total amount due can keep both you and your client informed of how much is left to be paid. It helps prevent confusion and encourages prompt settlement.

Best Practices for Payment Tracking

- Use Accounting Software: Many accounting platforms offer automatic payment tracking, which reduces manual entry and helps keep track of all transactions in real time.

- Set Up Payment Reminders: For clients who have overdue balances, use reminders in your billing documents or automated emails to politely prompt for payment.

- Keep Detailed Records: Always ensure that each transaction is recorded accurately in your system, along with any relevant payment receipts or confirmations, to avoid discrepancies later on.

Best Practices for Billing in Visual Services

Effective billing practices are essential for ensuring smooth financial transactions and maintaining professional relationships with clients. Clear, accurate, and timely billing not only helps you get paid on time but also boosts your reputation as a reliable service provider. Implementing the right procedures and organization can help you avoid common issues such as late payments and misunderstandings.

Essential Guidelines for Effective Billing

- Clear Pricing Structure: Make sure your pricing is straightforward and easy to understand. List individual service rates and any additional fees so clients know exactly what to expect.

- Timely Issuance of Documents: Send your financial statements promptly after services are rendered. The sooner you provide the document, the quicker the payment process can begin.

- Detailed Service Breakdown: Always provide a breakdown of the services rendered. This increases transparency and reduces the chances of disputes over what was provided.

Tips for Avoiding Common Issues

- Establish Payment Terms Upfront: Clearly define payment deadlines and preferred

How to Save Time on Billing

Streamlining the process of creating and managing financial documents is crucial for improving efficiency and reducing administrative workload. By automating key tasks and utilizing the right tools, you can save valuable time while ensuring accuracy in your billing process. Here are a few strategies to help you speed up your billing process without sacrificing quality or professionalism.

Time-Saving Strategies for Billing

- Use Automated Billing Tools: Leverage software or online platforms that automatically generate and send documents. These tools can help you create invoices quickly and reduce the chance of human error.

- Create Reusable Billing Formats: Design a consistent format that can be easily modified for different clients. This saves time by allowing you to update only the necessary details, such as client name, service description, and amount.

- Set Up Recurring Billing: If you have clients on a regular payment schedule, set up recurring billing to automatically charge them at agreed intervals. This eliminates the need to manually process each payment.

Best Practices for Reducing Administrative Tasks

- Store Client Information Efficiently: Keep a digital record of all client details, including payment history, so you can easily access and update any necessary information without starting from scratch.

- Use Payment Tracking Systems: Integrate payment tracking features into your billing system to automatically update the status of payments. This reduces the time spent manually checking and updating payment records.

- Send Reminders Automatically: Automate reminder emails for overdue payments to stay on top of collections an

Making Documents Mobile-Friendly

In today’s digital age, clients often access important documents on their mobile devices, making it essential to design them in a way that’s easy to read and interact with on smaller screens. Ensuring that your financial documents are optimized for mobile viewing can improve user experience and increase the chances of quicker payments. Here’s how you can make your documents mobile-friendly and improve accessibility for your clients.

Key Considerations for Mobile-Friendly Documents

- Simple Layout: Keep the design clean and straightforward, with a single-column layout that adapts to any screen size. Avoid clutter and unnecessary elements that could make the document harder to read on mobile devices.

- Readable Fonts: Use legible, web-safe fonts that are easy to read on small screens. Ensure text size is large enough for readability without zooming.

- Optimized Images: If your documents include images or logos, ensure they are optimized for mobile screens. Large image files may take longer to load, frustrating users on slower connections.

Best Practices for Enhancing Mobile Accessibility

- Responsive Design: Ensure that your document automatically adjusts to different screen sizes. Use responsive design principles to ensure that it looks good and functions well on both desktops and mobile devices.

- Clickable Links and Buttons: If your document includes payment links or calls to action, ensure they are large enough to be clicked easily on a mobile screen. Small buttons can be frustrating to use and may result in missed payments.

- Test on Different Devices: Before sending out your document, test it on a variety of mobile devices to make sure it’s displayed properly. This helps catch potential issues early and improves the user experience.

How to Protect Your Business

Running a business involves various risks, and it’s essential to take the necessary steps to safeguard both your reputation and your financial interests. By implementing the right strategies, you can protect yourself from potential disputes, ensure consistent income, and maintain a positive relationship with your clients. Here are a few crucial steps to help secure your operations.

Establish Clear Contracts

One of the most effective ways to protect your business is to have clear, detailed agreements with your clients. A contract should outline the services provided, payment terms, deadlines, and any other relevant conditions. This legal document ensures that both parties understand their responsibilities and helps avoid misunderstandings.

- Payment Terms: Specify how and when payments should be made, including late fees if applicable. This helps avoid delays and ensures smooth cash flow.

- Scope of Work: Clearly define what services will be provided, along with any limitations. This can prevent scope creep and avoid clients expecting more than what was agreed upon.

- Cancellation Policy: Include a cancellation clause outlining the process and any fees associated with last-minute changes or cancellations.

Use Insurance and Legal Protection

While a contract is a strong first step, having the right insurance can also provide peace of mind. Protect yourself from potential lawsuits, theft, or damage with appropriate business insurance. It’s also worth consulting with a lawyer to understand your rights and responsibilities, ensuring you’re well-prepared for any legal issues that may arise.

Maintain Financial Transparency

Proper financial management is key to safeguarding your business. Keep accurate records of all transactions and payments, and use professional tools for invoicing and bookkeeping. This not only helps you stay organized but also provides evidence in case of a dispute. Clear financial documentation helps build trust with clients and proves your professionalism.

How to Handle Late Payments

Late payments can be a frustrating challenge for any business owner. They can disrupt cash flow, delay future projects, and cause unnecessary stress. However, with the right approach, you can manage these situations professionally while maintaining a good relationship with your clients. Below are some key strategies to effectively handle overdue payments.

Set Clear Expectations from the Start

One of the best ways to avoid late payments is by setting clear expectations with your clients upfront. Be transparent about payment terms, including deadlines, accepted methods of payment, and any late fees that may apply. This clarity reduces the chances of misunderstandings and ensures your clients know what to expect.

- Payment Deadlines: Clearly state when payment is due. Whether it’s a set number of days after receiving the service or a fixed date, make it easy for the client to know when payment is expected.

- Late Fees: Outline any penalties for overdue payments, such as interest or additional charges. This can encourage clients to pay on time to avoid extra costs.

- Payment Methods: Provide multiple payment options to make it easier for clients to pay on time, whether through credit card, bank transfer, or online platforms.

Follow Up Professionally

If a payment is missed, it’s important to follow up promptly and professionally. A polite reminder via email or phone call can often resolve the issue. When reaching out, maintain a respectful tone, acknowledge any potential issues the client may be facing, and reiterate your agreed-upon payment terms.

- Send a Reminder: Send a friendly reminder a few days before the payment is due, then a more formal reminder if the payment is overdue.

- Offer Solutions: If the client is facing financial difficulties, consider offering a payment plan or extending the deadline. This can help maintain a positive working relationship.

Implement a Collection Process

In cases where payments remain overdue for an extended period, having a formal collection process can help recover funds. This may include sending more formal notices or seeking the assistance of a collection agency if necessary. Make sure that your collection policy is clearly defined in your agreements with clients.

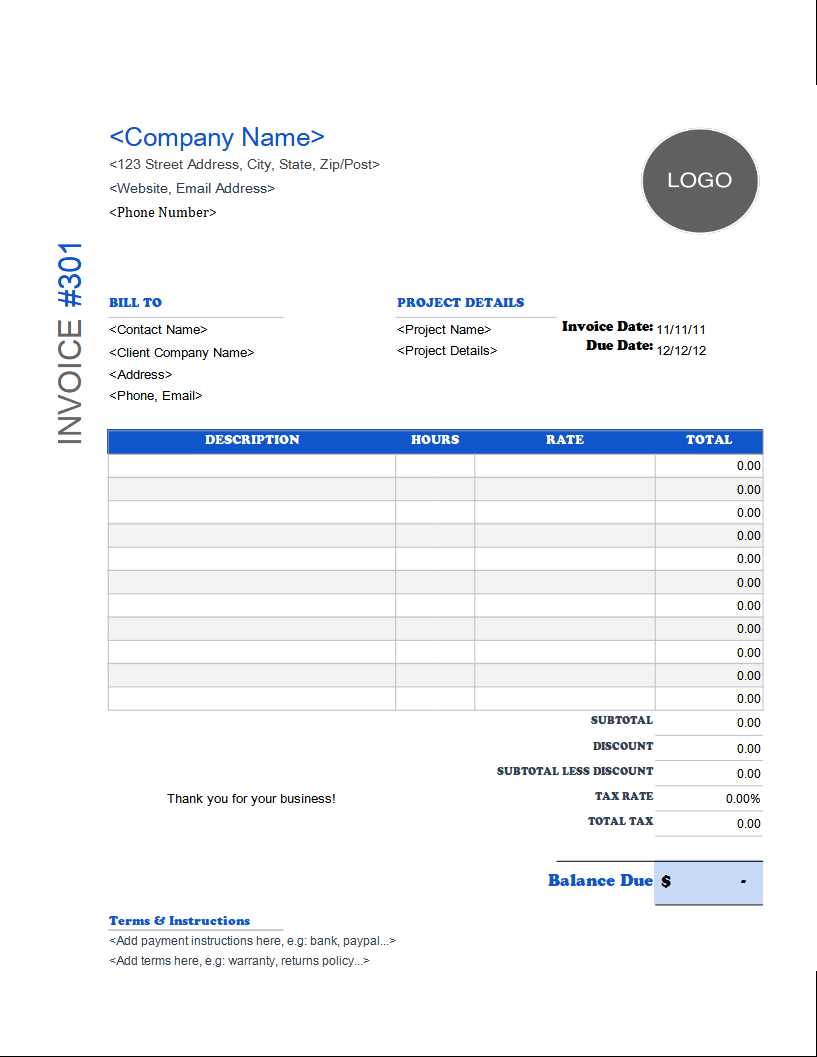

How to Update Your Invoice Template

Keeping your billing documents up to date is essential for maintaining a professional appearance and ensuring that all necessary information is included. Updating your forms can help reflect changes in your business, improve clarity, and comply with evolving legal or financial standards. Below are steps to update your documents and make them more efficient for both you and your clients.

Review Your Current Document

Before making any changes, review your existing format to ensure that all required fields are accurate and relevant. This allows you to identify any outdated information or areas for improvement.

- Business Information: Ensure that your company name, address, phone number, and email address are correct and up to date.

- Client Information: Double-check that your client’s name, billing address, and contact information are accurate.

- Payment Details: Verify that your payment terms, methods, and due dates are clearly stated.

Incorporate Necessary Changes

Once you have identified areas for improvement, implement the required updates. These could involve modifying the layout, adding new fields, or including specific details based on your business needs.

- Customize the Layout: Adjust the design to ensure it is easy to read and visually appealing. Consider adding your logo or adjusting the font size for better clarity.

- Include Payment Terms: Add or revise payment terms, such as late fees, discounts for early payments, or installment options if applicable.

- Legal and Tax Information: If there have been changes in your region’s tax laws or business regulations, ensure your documents comply with the latest requirements.

Test and Save the Updated Document

After making the necessary changes, it’s important to test the updated format. This ensures that all the information displays correctly and that the document is functional for clients to review and pay their dues.

- Check Formatting: Make sure that all text is aligned properly, and that the sections are easy to follow.

- Save Multiple Versions: Save your updated document in various formats for different uses, such as PDF for sharing and editable formats for future updates.