How to Use an Auto Invoice Template for Streamlined Billing

In today’s fast-paced business world, managing payments and maintaining proper financial records is essential for success. One of the most effective ways to streamline this process is through automated document generation tools that simplify the creation and management of billing statements. These tools are designed to save time, reduce errors, and enhance the overall efficiency of your financial workflow.

By automating routine tasks, such as generating and sending billing documents, businesses can focus on more critical aspects of operations. Whether you’re a freelancer or run a large corporation, automated solutions allow you to quickly create professional documents that meet your specific needs. These systems help ensure accuracy, consistency, and compliance with legal and tax requirements, all while cutting down on administrative workload.

Utilizing an automated solution for generating billing records not only improves the speed and accuracy of transactions but also ensures a smoother experience for clients. With customizable fields and easy-to-use features, this approach reduces the chances of mistakes, making it a valuable tool for both small businesses and large enterprises alike.

Understanding Auto Invoice Templates

Efficient management of billing documents is crucial for businesses of all sizes. A well-organized system for generating and handling financial records can significantly reduce administrative burden and minimize errors. Using digital tools designed to automate the creation of billing statements allows companies to save time, maintain consistency, and improve cash flow management.

What Makes Automated Billing Documents Effective?

Automated billing solutions are built to handle repetitive tasks such as populating fields with client details, transaction data, and payment terms. By pre-setting key information, these systems enable users to generate documents quickly and accurately. This approach not only reduces the time spent on manual data entry but also decreases the likelihood of mistakes, ensuring that all necessary information is included without overlooking crucial details.

The Role of Customization in Automated Billing

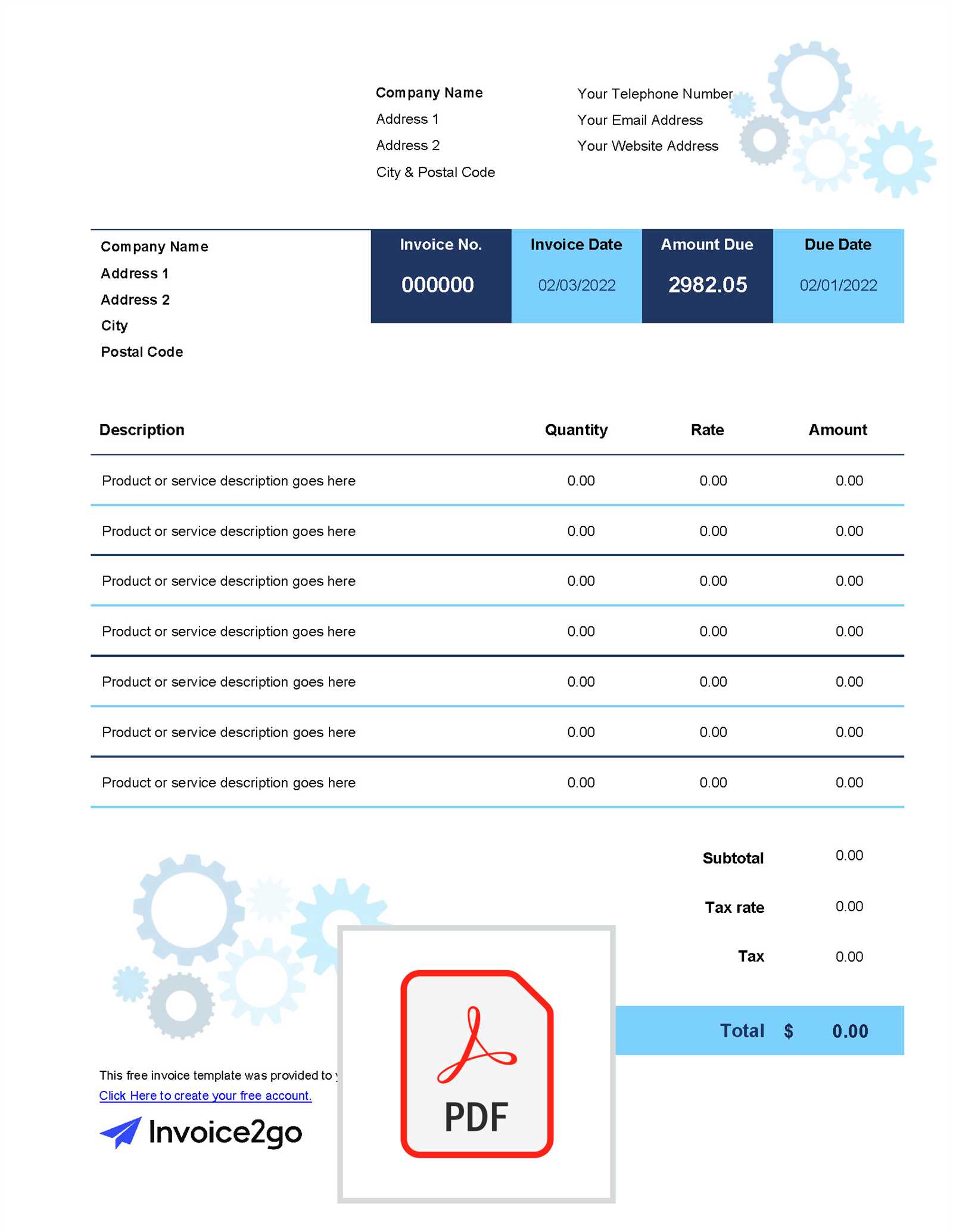

One of the most valuable features of digital billing systems is their level of customization. Businesses can tailor the structure and layout of each document to fit their specific needs. This might include branding elements such as logos, colors, or personalized messages, which can enhance the professionalism of the document. Furthermore, automated tools allow users to save different billing formats, ensuring that each client receives a document that is aligned with their expectations and business requirements.

What is an Auto Invoice Template?

An automated solution for creating billing documents is designed to simplify and speed up the process of generating financial records. By pre-configuring certain fields and sections, businesses can quickly produce consistent and accurate statements with minimal manual input. This system streamlines the process, making it more efficient and reducing the likelihood of errors that often occur with manual creation.

How Does an Automated Billing Solution Work?

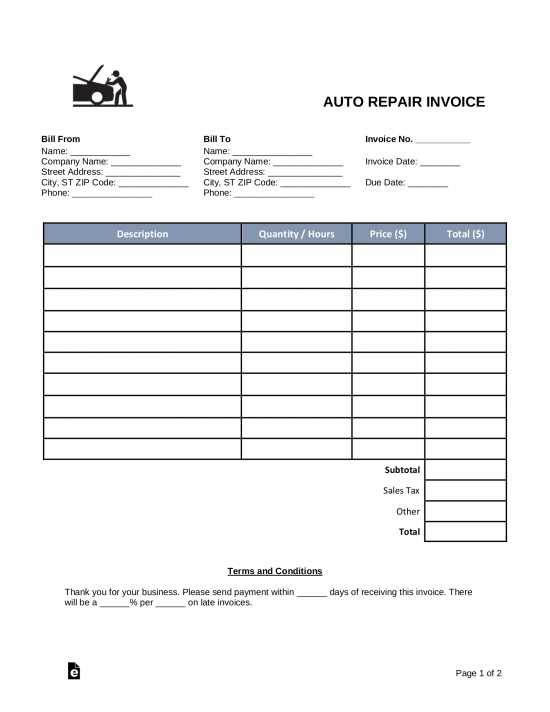

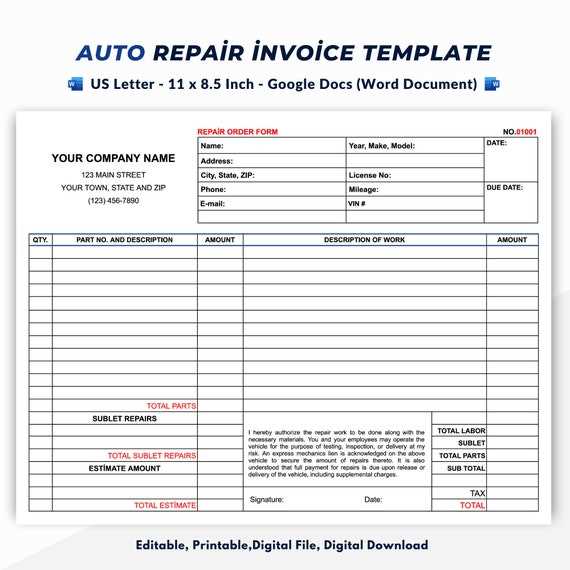

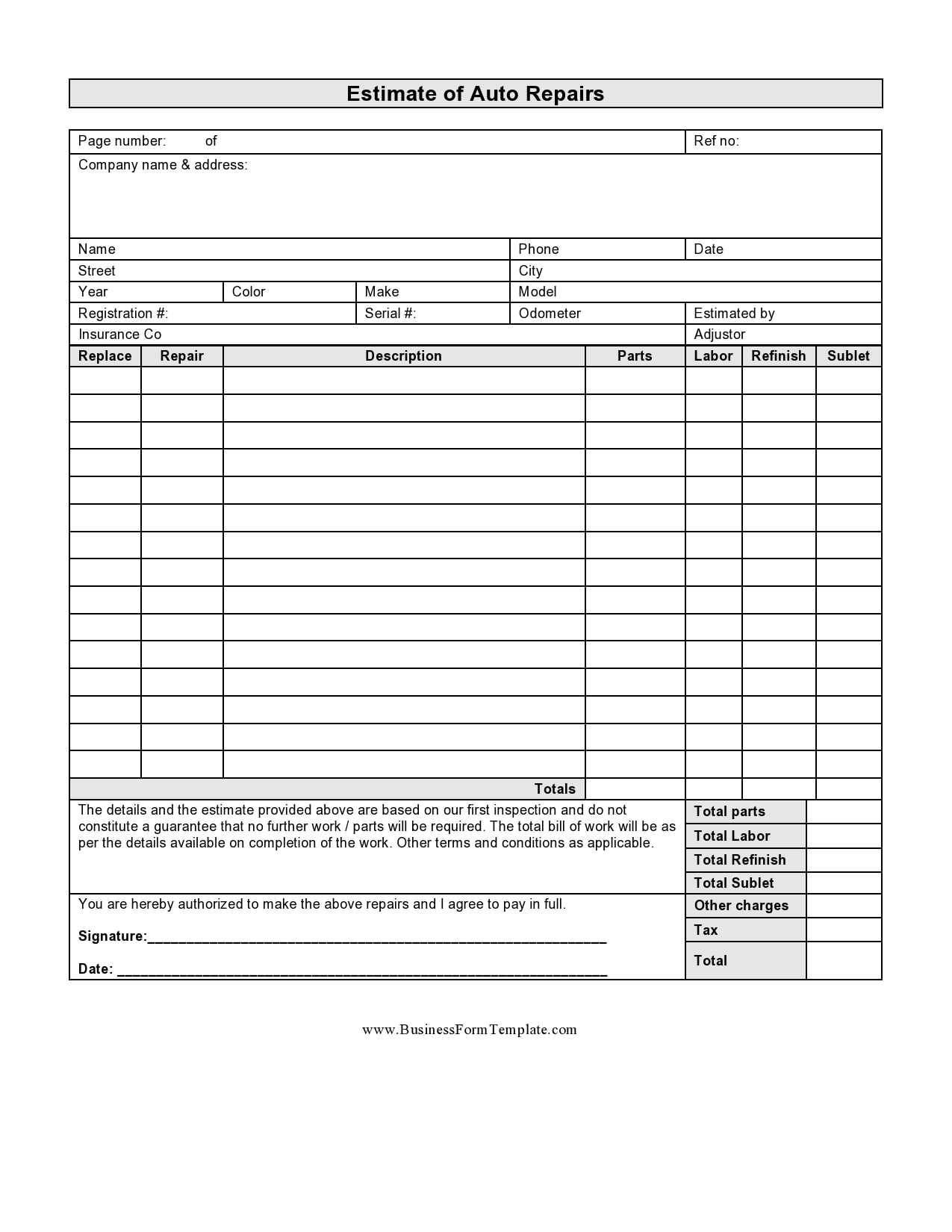

At its core, an automated billing system is a tool that uses pre-set formats and rules to generate professional documents quickly. These tools allow users to input essential details, such as customer information, amounts due, and payment terms, while the system automatically fills in the rest. The user can adjust specific fields as needed, but the overall structure and layout remain consistent across different documents.

Why Choose an Automated Document Solution?

Using a digital system to create financial records offers a range of benefits, including improved accuracy, faster processing times, and greater ease of use. Automation reduces the administrative load and frees up time for other essential tasks. It also ensures that every document produced adheres to the same format, maintaining professionalism and uniformity across all communications with clients or customers.

Benefits of Using Auto Invoice Templates

Implementing automated document generation tools offers numerous advantages for businesses looking to streamline their billing process. By reducing the time spent on manual data entry and eliminating common errors, these solutions enhance efficiency and consistency in financial communications. The following benefits highlight why so many businesses are adopting automated systems for their billing needs.

Time Savings

One of the key advantages of using automated solutions is the significant amount of time it saves. Rather than manually creating each document from scratch, users can quickly generate records by filling in a few key details. This reduction in time spent on document creation can be reinvested in other critical business operations. Some of the time-saving features include:

- Instant population of client and transaction data

- Customizable templates for different customer needs

- Quick updates for recurring payments or subscriptions

Improved Accuracy

Automated tools reduce the likelihood of human errors that can occur during manual document creation. With pre-set fields and calculations, businesses can ensure that their documents are consistently accurate, which helps to avoid costly mistakes or misunderstandings. Some of the accuracy benefits include:

- Automatic calculation of totals and taxes

- Consistent formatting and layout

- Reduction of missing or incomplete information

Professionalism and Branding

Automated billing systems allow businesses to create a uniform, professional look across all their financial documents. Customization options ensure that the documents align with company branding, adding a polished touch that enhances customer trust. Key benefits include:

- Customizable logos, colors, and fonts

- Uniform layout across all documents

- Ability to add personalized notes or terms

How Auto Invoices Save Time

Automating the creation of billing documents significantly reduces the time spent on repetitive tasks. With pre-designed formats and fields that auto-populate, businesses can generate and send financial statements in a fraction of the time it would take to create them manually. This allows employees to focus on more strategic tasks, boosting overall productivity and efficiency.

Eliminating Manual Data Entry

One of the most time-consuming aspects of creating billing documents is manually entering client information, transaction details, and payment terms. Automated solutions streamline this process by pulling data from integrated systems, such as customer databases or accounting software. This eliminates the need for:

- Entering repetitive information for each transaction

- Searching for customer details in multiple files

- Double-checking for inconsistencies in data

Quick Customization and Reusability

With automated systems, generating a document is not only faster but also customizable. Users can save different document formats tailored to specific needs, and simply adjust a few fields to suit the transaction at hand. This flexibility makes it easy to reuse templates for different clients, reducing the need to recreate documents from scratch each time. Some key time-saving features include:

- Ability to create recurring billing statements with minimal updates

- Pre-configured fields for payment terms, tax rates, and discounts

- Instant updates for bulk transactions or subscription renewals

Choosing the Right Template for Your Business

Selecting the right document generation system for your business is crucial for ensuring that financial records are both efficient and professional. The right solution should align with your specific needs, whether you’re dealing with one-time payments, recurring billing, or customized terms for different clients. Choosing the appropriate format not only simplifies the process but also enhances the presentation and clarity of the financial details you send to customers.

Factors to Consider

When choosing a document creation system, several factors should be taken into account to ensure that it meets the specific needs of your business. These include the type of transactions you handle, the level of customization required, and how the system integrates with your existing tools. Below is a table summarizing key considerations:

| Factor | Description |

|---|---|

| Type of Transactions | Consider whether you need a solution for one-time payments, subscriptions, or recurring billing. |

| Customization | Choose a system that allows you to adjust the layout, include branding elements, and personalize each document. |

| Integration | Ensure the tool can integrate with your accounting software or customer relationship management system for seamless data transfer. |

| Ease of Use | Select a solution that is user-friendly and does not require extensive training to operate efficiently. |

Customizing to Fit Your Needs

Once you’ve identified the right solution, customization plays an important role in ensuring that each document meets your business requirements. With the ability to include logos, adjust the layout, and set default terms, the right system allows you to create professional-looking records that are consistent and aligned with your branding. Customizable features will help you tailor documents for different clients, making the entire process smoother and more personalized.

Key Features of an Auto Invoice Template

When selecting a digital solution for generating billing documents, it’s important to understand the essential features that make these systems effective. The right tool should not only simplify document creation but also ensure that every record is accurate, professional, and tailored to the needs of your business. Below are some of the key features that can enhance your document management process.

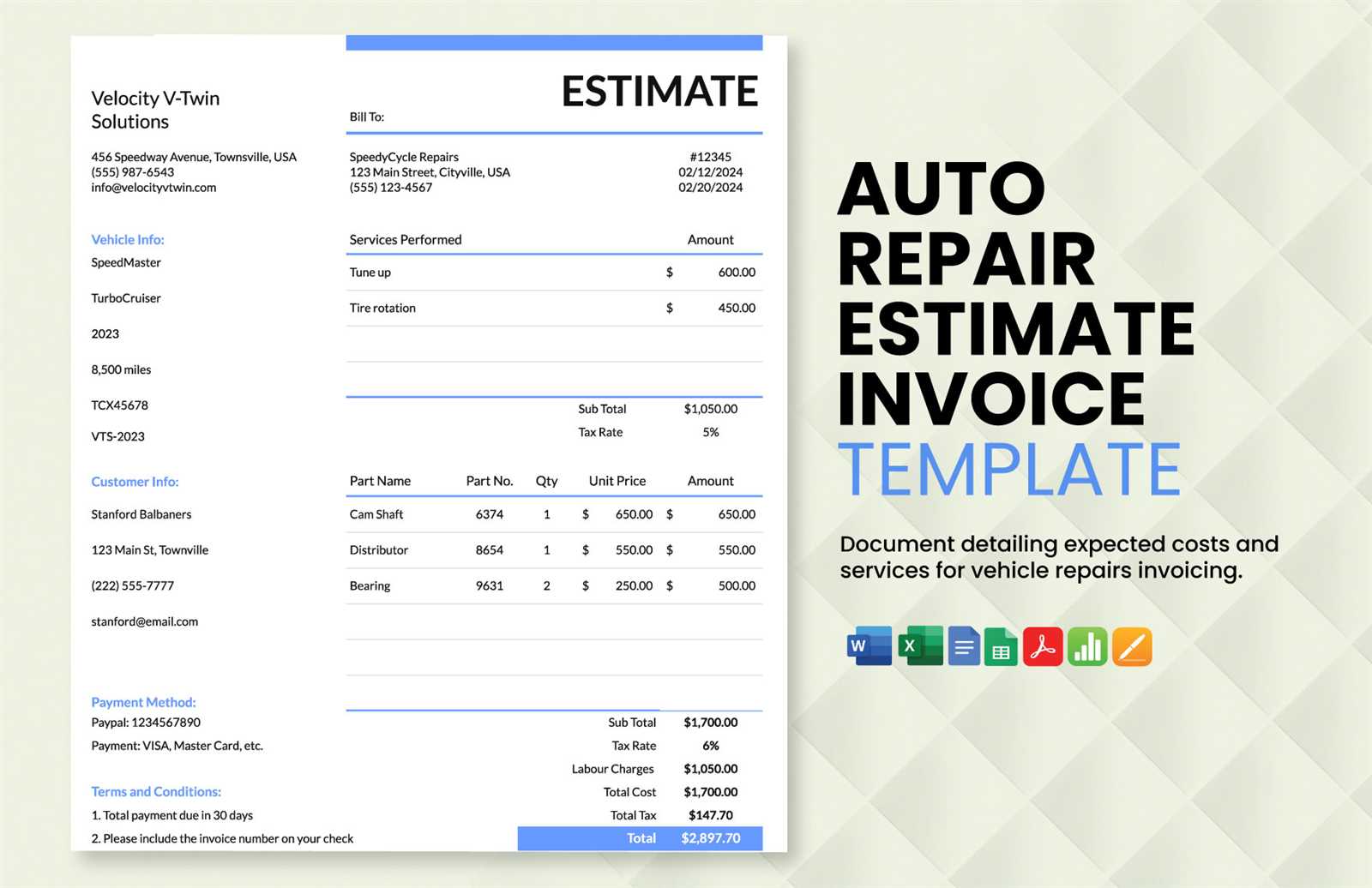

| Feature | Description |

|---|---|

| Pre-filled Fields | Automatically populates essential details such as client name, contact information, and transaction data, saving time and reducing errors. |

| Customization Options | Allows for branding, such as logos, colors, and personalized messages, to be incorporated into every document for a more professional appearance. |

| Recurring Billing Setup | Supports automatic generation of documents for subscription-based services or regular transactions, ensuring timely billing without additional effort. |

| Calculation Automation | Automatically calculates totals, taxes, and discounts, ensuring accuracy and consistency across all documents. |

| Cloud Storage and Access | Provides easy access to generated documents from anywhere, as well as secure cloud storage for future reference and sharing. |

These features contribute to creating a seamless billing process that minimizes manual work, reduces errors, and maintains consistency across all financial documents. By choosing a solution with these key capabilities, businesses can ensure smoother financial operations and a more professional relationship with clients.

How to Customize Auto Invoices

Customizing billing documents allows businesses to personalize their financial communications and maintain a professional appearance across all client interactions. A well-tailored document not only reflects your brand but also ensures that the information provided is clear and easy to understand. Customization features allow businesses to adjust layout, branding, and content to fit specific needs, enhancing both functionality and presentation.

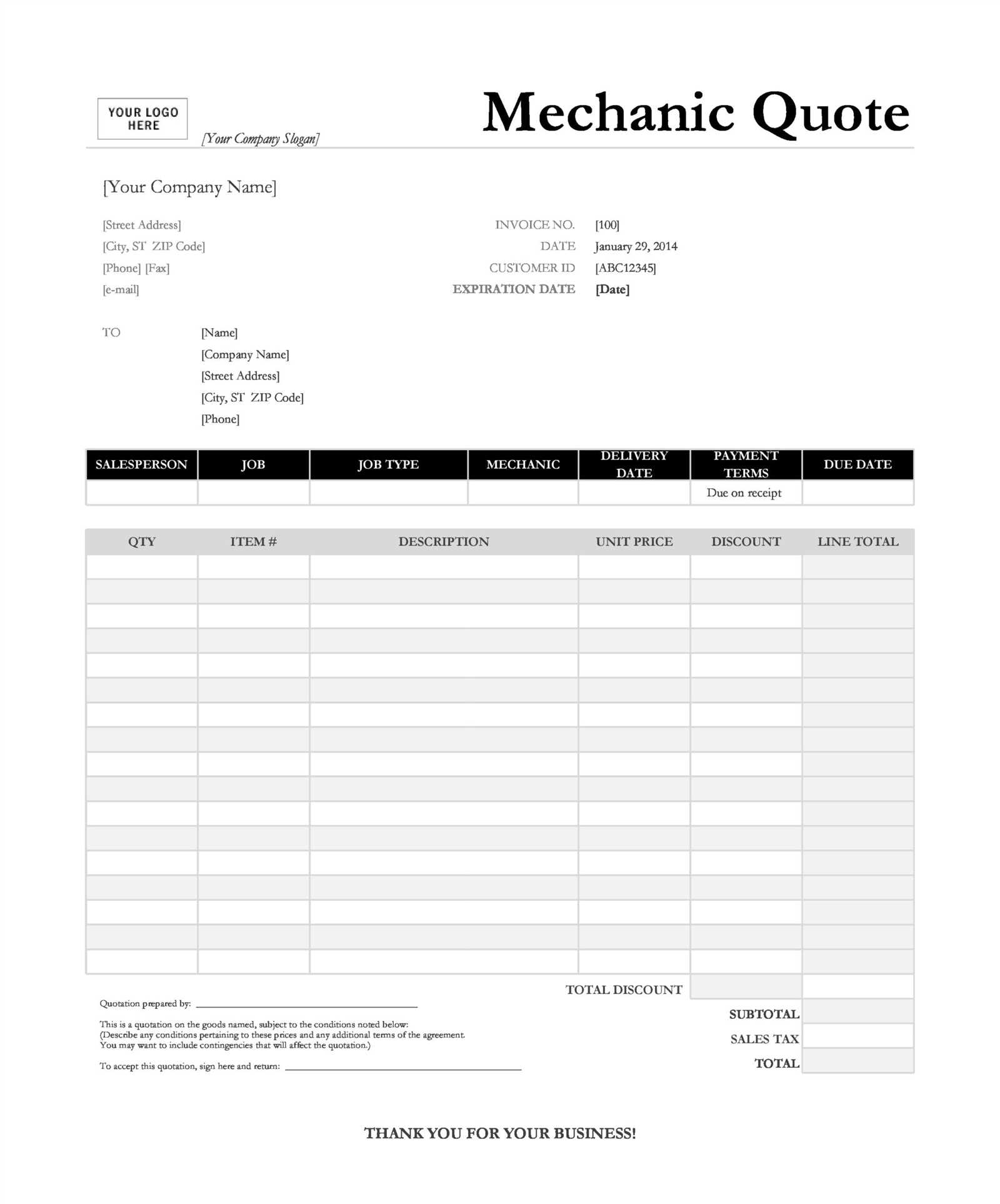

| Customization Area | How to Customize |

|---|---|

| Branding | Add your company’s logo, color scheme, and custom fonts to ensure your documents align with your brand identity. |

| Contact Information | Include business address, phone number, email, and website for easy communication with clients. |

| Payment Terms | Set default terms such as due dates, payment methods, and discounts for early payments, or customize them for each transaction. |

| Fields and Layout | Adjust the layout of key fields like item descriptions, quantities, and total amounts to fit your business model or client preferences. |

| Personalized Messages | Add personalized notes, reminders, or thank-you messages to strengthen client relationships and enhance communication. |

By customizing key areas of your billing documents, you can create a more personalized experience for your clients while also improving the clarity and accuracy of the information provided. Customization makes it easier to communicate specific terms, add business branding, and present financial details in a professional manner.

Common Mistakes in Auto Invoices

While automated document generation tools can significantly improve efficiency and accuracy, there are still several common mistakes businesses make when using them. These errors can lead to confusion, delayed payments, or even strained client relationships. Understanding and avoiding these pitfalls is key to ensuring that your billing process runs smoothly and professionally.

Some of the most frequent issues arise from incorrect or incomplete data, formatting inconsistencies, and failure to customize documents for specific clients. These mistakes can easily be avoided with careful attention to detail and proper configuration of the system.

1. Incorrect Client Information

One of the most common errors is the incorrect population of client details. Automated systems may pull outdated or inaccurate contact information if not regularly updated, leading to delivery issues or misunderstandings. To avoid this:

- Regularly verify and update client data in your database

- Ensure that automated fields pull the correct contact information

2. Missing Payment Terms

Another frequent mistake is failing to include the proper payment terms, such as due dates, late fees, or discounts. This can result in confusion for clients and delays in payments. To prevent this:

- Double-check that payment terms are correctly configured in each document

- Set default terms and customize them for specific clients when needed

3. Formatting Errors

Automated systems can sometimes produce documents with inconsistent formatting or misplaced fields. These errors can affect the document’s readability and professionalism. To ensure clean, professional-looking records:

- Regularly review and test the document layout

- Customize the layout for clarity and consistency

4. Failing to Include Relevant Information

Another issue businesses face is forgetting to include crucial information, such as a breakdown of charges or proper tax calculations. This omission can lead to disputes or delays. To avoid this:

- Ensure that all required fields are pre-filled and that necessary calculations are automatic

- Verify that every document contains itemized lists, taxes, and totals before sending

By taking these steps to avoid common mistakes, businesses can ensure smoother transactions and maintain a high level of professionalism in their financial dealings.

Integrating Auto Invoices with Accounting Software

Integrating your automated document generation system with accounting software can greatly enhance the efficiency and accuracy of your financial operations. By connecting these two systems, you eliminate the need for manual data entry, reduce the risk of errors, and ensure that all financial data is updated in real-time. This seamless flow of information not only saves time but also improves the consistency of your financial records.

Benefits of Integration

When automated billing tools are integrated with accounting systems, businesses experience several key advantages:

- Data Accuracy: Automatic synchronization ensures that all transaction details, including amounts and client information, are accurately transferred between systems.

- Time Savings: The integration eliminates the need to manually input data into both systems, allowing for faster document creation and financial tracking.

- Consistency: Ensures that records in both the accounting system and billing documents are always aligned, minimizing discrepancies and confusion.

How to Integrate Your Systems

To integrate your automated document generation solution with accounting software, follow these steps:

- Choose compatible systems: Ensure both your billing and accounting software support integration, either through built-in tools or third-party connectors.

- Map data fields: Align the fields in your billing system (e.g., client name, transaction amount) with the corresponding fields in your accounting software to ensure accurate data transfer.

- Test the connection: Before fully adopting the integration, conduct tests to verify that the data syncs correctly and that there are no discrepancies between the systems.

By integrating your billing documents with accounting tools, you streamline your entire financial workflow, making it easier to track payments, manage invoices, and maintain accurate financial records.

Automating Invoice Creation for Small Businesses

For small businesses, time is often one of the most valuable resources. Managing daily operations, customer relationships, and financial tasks can be overwhelming, especially when it comes to creating and sending billing documents. Automating this process can significantly reduce the administrative burden, improve efficiency, and ensure that every transaction is handled professionally.

By implementing automated tools for generating financial records, small business owners can streamline the billing process, minimize errors, and free up time to focus on core business activities. Automation ensures that billing is consistent and accurate, while also improving cash flow by making it easier to issue and track payments.

Steps to Automate Billing for Small Businesses

Automating the creation of financial documents involves several key steps. Below are some actionable steps for small businesses looking to implement automation:

- Choose the Right Tool: Select a digital solution that integrates with your existing business systems, such as accounting software or CRM tools, for seamless data management.

- Set Up Templates: Customize document formats that can be easily filled with client details, transaction data, and payment terms. Save these as templates for repeated use.

- Input Client Information: Ensure that customer data, such as contact details and billing preferences, are stored in an easily accessible database for quick population of billing documents.

- Automate Recurring Billing: For businesses with subscription-based models or recurring services, set up automatic generation of billing records based on set intervals (weekly, monthly, etc.).

Benefits for Small Businesses

By automating billing, small businesses can experience several important benefits:

- Time Efficiency: Automating document creation frees up time that can be spent on more strategic tasks, such as growing the business or improving customer service.

- Improved Accuracy: Automation reduces the risk of human error, ensuring that financial records are consistently accurate and free from mistakes.

- Faster Payments: Automated tools can help ensure that billing is prompt and that reminders are sent when payments are due, improving cash flow and reducing late payments.

Incorporating automated solutions into the billing process not only boosts efficiency but also helps small businesses maintain a professional image and strengthen customer relationships.

How to Avoid Errors with Auto Invoices

Automated document generation tools can greatly improve efficiency and accuracy in the billing process, but they can also introduce errors if not properly set up or monitored. Common issues such as incorrect client information, calculation mistakes, or formatting inconsistencies can cause confusion and disrupt business operations. Taking a few preventive steps can ensure that your system remains error-free and your financial records are always accurate.

Key Tips for Avoiding Mistakes

To reduce the likelihood of errors when generating financial records, it is important to follow best practices in system setup, data management, and document review. Below are some key tips:

| Action | Best Practice |

|---|---|

| Review Data Regularly | Ensure that client information is accurate and up-to-date to avoid sending incorrect details. Implement automated checks to flag outdated or inconsistent data. |

| Use Clear and Consistent Formatting | Standardize the layout of your financial records to avoid confusing or misaligned fields. Test your formatting regularly to ensure clarity and consistency. |

| Check Calculations Automatically | Ensure that all automatic calculations (e.g., taxes, discounts, totals) are functioning correctly and consistently. Use systems that automatically update when data changes. |

| Test Templates Before Use | Before sending documents to clients, test your templates with sample data to verify that all fields are correctly populated and calculations are accurate. |

| Enable Notifications | Set up automatic reminders or alerts for clients when payments are due, and ensure that the system tracks payment statuses accurately to prevent oversight. |

Monitoring and Adjusting Your System

Even with an automated system, occasional manual checks are necessary to ensure the integrity of your billing process. Regularly review your system’s performance, monitor error logs, and adjust settings as needed to stay on top of any issues that may arise. By combining automation with thoughtful oversight, you can minimize errors and maintain a streamlined, professional billing process.

Improving Cash Flow with Auto Invoices

Maintaining a healthy cash flow is crucial for the success and growth of any business. One of the most effective ways to ensure timely payments and optimize cash flow is by automating the process of generating billing documents. By using automated systems, businesses can ensure that records are consistently sent on time, payment reminders are issued, and financial data is tracked accurately, all of which contribute to improving cash flow and reducing delays.

Automated document creation helps streamline the billing process, eliminating manual errors and reducing the time between completing a service or delivering a product and receiving payment. This leads to faster collections and better control over cash flow, which is especially important for small businesses and startups.

Strategies to Improve Cash Flow with Automation

Automating the billing process offers several strategies to help businesses improve their cash flow:

| Strategy | Description |

|---|---|

| Timely Billing | Automated systems can ensure that invoices are generated and sent promptly after the completion of a service or delivery, reducing the time between providing a service and receiving payment. |

| Recurring Billing | For subscription-based businesses, automated billing ensures that clients are billed on time every month, improving predictability of income and cash flow. |

| Payment Reminders | Automated systems can send reminders to clients when payment is due or overdue, helping to reduce late payments and encouraging faster collections. |

| Streamlined Payment Options | Automation often includes integrations with online payment systems, making it easier for clients to pay quickly, further accelerating the cash collection process. |

| Tracking and Reporting | Automated tools can provide real-time tracking of outstanding payments, offering businesses better insight into their cash flow and allowing them to take proactive action when necessary. |

By implementing automated billing systems, businesses can significantly reduce administrative time, minimize errors, and maintain better cash flow management. Consistently sending accurate, timely documents, along with automated reminders, not only keeps the revenue cycle moving smoothly but also helps businesses plan more effectively for the future.

Free vs Paid Auto Invoice Templates

When choosing a solution for generating billing documents, businesses often face the decision between using free tools or opting for a paid service. Both options have their advantages, but they also come with certain limitations that can impact the efficiency and quality of your financial records. Understanding the differences between free and paid solutions is essential for selecting the right option for your business needs.

Free solutions may seem like an attractive option for startups or small businesses with limited budgets, but they often come with restrictions such as limited customization options, fewer features, and the lack of ongoing support. On the other hand, paid services generally offer more robust features, enhanced customization, and customer support, but they come at a cost.

Advantages of Free Solutions

Free tools for creating financial documents can be a good starting point for businesses looking to automate their billing process without incurring extra expenses. Here are some of the benefits:

- No Initial Investment: Free solutions allow businesses to automate their processes without having to commit to upfront costs, which is beneficial for those on a tight budget.

- Basic Functionality: For businesses with simple billing needs, free tools often offer sufficient features, such as basic document generation and email delivery.

- Quick Setup: Free tools are often user-friendly and can be set up quickly, making them ideal for businesses that need to start generating documents immediately.

Benefits of Paid Solutions

Paid services for creating billing documents typically offer more advanced functionality and additional features that can help businesses scale. Here are some of the key advantages of choosing a paid solution:

- Advanced Customization: Paid tools often provide more options for personalizing documents to reflect your brand, such as custom logos, color schemes, and detailed layouts.

- Additional Features: Paid services may include integrated payment options, recurring billing, advanced reporting, and automated reminders, making the billing process more efficient.

- Customer Support: With paid solutions, businesses often have access to dedicated customer support, ensuring that any issues are addressed promptly and professionally.

- Security and Compliance: Paid services may offer enhanced data security and compliance features, which can be especially important for businesses handling sensitive financial information.

Ultimately, the choice between free and paid solutions depends on your business’s specific needs, budget, and the level of complexity required for your financial operations. For small businesses with simple needs, a free option may suffice, while larger or growing businesses may benefit from the more advanced features offered by paid solutions.

Legal Requirements for Invoices

When it comes to generating financial documents for your business, it’s essential to ensure that they meet legal and regulatory standards. In many jurisdictions, certain information must be included in each billing record to ensure compliance with tax laws and business regulations. Failing to include the required details could result in legal penalties or challenges in case of an audit.

In general, businesses are required to issue clear and accurate documents that outline the details of transactions, including the services or products provided, payment terms, and tax calculations. These documents serve not only as proof of the transaction but also as a means of ensuring that tax obligations are correctly reported to the authorities.

Key Legal Elements for Billing Records

To comply with legal requirements, certain details must always appear on your business records. These typically include:

- Business Information: The name, address, and contact details of both the seller and the buyer. This helps identify the parties involved in the transaction.

- Unique Document Number: Each financial record must have a unique identification number to track the transaction easily. This number helps avoid duplicate entries and ensures the correct record-keeping for audits.

- Description of Goods or Services: Clear descriptions of what was provided, including quantities, unit prices, and any discounts applied, so the customer understands what they are being charged for.

- Payment Terms: Terms including the total amount due, the payment due date, and any applicable late fees. These terms establish a clear agreement between the business and the client.

- Tax Information: Tax rates applied, the total tax amount, and whether tax is included in the price or charged separately. This is crucial for businesses to meet local tax reporting obligations.

- Payment Method: Indicate how the payment can be made, whether it is via bank transfer, credit card, or another method, to ensure both parties are clear on how the transaction will be settled.

Compliance Across Jurisdictions

It’s important to note that legal requirements may vary depending on the country or region in which your business operates. Some jurisdictions may have additional rules, such as the inclusion of VAT (Value Added Tax) numbers or specific formatting requirements. It’s essential to stay informed about the legal standards that apply in your location or the regions where you conduct business.

Ensuring that your documents meet all relevant legal requirements not only helps avoid potential legal issues but also fosters trust and professionalism with your clients. Always check the regulations in your jurisdiction or consult with a legal advisor to ensure full compliance with invoicing rules.

Tracking Payments with Auto Invoices

Effectively managing payment collections is a critical part of maintaining healthy cash flow for any business. Automated systems for generating billing records offer powerful tools for tracking payments, ensuring that businesses stay on top of outstanding balances, identify overdue accounts, and prevent missed transactions. With the right tools, payment tracking can be streamlined and simplified, making it easier to monitor finances and reduce administrative burdens.

By automating the creation and sending of billing documents, businesses can also set up systems that track when payments are received or remain unpaid, alerting both the business and clients to upcoming due dates. This can significantly improve the overall efficiency of cash management and reduce delays in receiving payments.

How Payment Tracking Works with Automation

Automated payment tracking allows businesses to track the status of each transaction from creation to settlement. Here’s how it generally works:

- Automatic Status Updates: As payments are received, the system automatically updates the status of each billing record, marking them as “paid” or “unpaid.” This allows business owners to quickly identify which transactions are still pending.

- Payment Reminders: For unpaid records, automated systems can send reminders to clients, notifying them of upcoming due dates or overdue payments, reducing the need for manual follow-up.

- Real-time Reporting: Automation provides real-time reporting on payments, allowing businesses to view detailed reports of incoming and outstanding payments, making it easier to manage finances and plan ahead.

- Integration with Payment Gateways: Many automated systems integrate with online payment platforms, allowing for seamless tracking of electronic payments. This can ensure that payments are processed accurately and quickly.

Benefits of Automating Payment Tracking

Automating payment tracking provides several important advantages for businesses:

- Improved Cash Flow Management: With automated tracking, businesses can easily identify and address unpaid balances, leading to faster collections and improved cash flow.

- Reduced Administrative Work: Automation eliminates the need for manual record-keeping and follow-ups, allowing business owners to focus on more strategic tasks.

- Increased Accuracy: Automated systems reduce human error, ensuring that payment statuses are updated correctly and that payment records are accurate and reliable.

- Better Client Communication: Automated reminders and payment status updates keep clients informed, reducing confusion and fostering professional relationships.

With automated systems for tracking payments, businesses can maintain better control over their finances, reduce the risk of missed payments, and improve the

Creating Recurring Invoices with Templates

For businesses that offer subscription-based services or ongoing products, managing repetitive billing can become a time-consuming task. Automating the process of creating recurring payment records ensures that businesses don’t miss any billing cycles, streamlining their operations and improving cash flow. By setting up automated solutions for regular billing, businesses can focus more on growth and customer service while maintaining efficient and accurate financial records.

Recurring billing is especially beneficial for businesses that have long-term clients or customers with monthly, quarterly, or annual payment plans. Automated systems can ensure that customers are billed correctly and consistently without requiring manual intervention each time a payment is due.

Setting Up Recurring Billing

To set up recurring payments, automated systems allow businesses to create billing schedules based on specific intervals. This helps ensure that customers are invoiced at regular intervals without the need for manual tracking. Here’s how recurring billing typically works:

- Set Billing Frequency: Choose the interval at which the customer should be billed, such as weekly, monthly, or yearly.

- Define Payment Amounts: Specify the amount to be charged for each billing cycle, whether it’s a fixed amount or based on usage.

- Choose Start and End Dates: Define the start date for the recurring cycle and set the end date if the contract has a fixed term.

- Automate Delivery: Once the recurring schedule is set, the system will automatically generate and send billing records according to the defined frequency, ensuring timely payments.

Advantages of Recurring Billing Automation

There are several key benefits to automating the creation and delivery of recurring billing records:

- Consistency and Accuracy: By automating the process, you can avoid errors such as missed billing cycles or incorrect payment amounts, ensuring accuracy in every transaction.

- Time-Saving: Setting up automated recurring billing frees up time that would otherwise be spent manually creating and sending records every billing cycle.

- Improved Cash Flow: Regular, predictable payments help businesses manage their cash flow more effectively, reducing the risk of late or missed payments.

- Convenience for Clients: Customers benefit from not having to manually process each payment. They can trust that their accounts will be billed automatically, leading to greater satisfaction.

By automating recurring billing, businesses can maintain strong, ongoing relationships with their clients, reduce administrative overhead, and ensure that payments are always timely and accurate.

Why Auto Invoices Boost Professionalism

For any business, maintaining a professional image is essential to building trust and credibility with clients. One of the simplest yet most effective ways to achieve this is through the use of automated billing solutions. When businesses adopt automated systems for generating financial records, it not only streamlines operations but also enhances the overall perception of the business’s professionalism. Automated processes show clients that the company is organized, efficient, and committed to providing reliable services.

Consistent, timely, and accurate billing can make a significant difference in how clients perceive a business. When customers receive professionally crafted, automated payment records, it demonstrates attention to detail and ensures that the financial aspects of the business are handled smoothly and without delays. This level of efficiency builds confidence and strengthens client relationships.

Key Benefits of Automated Billing for Professionalism

Here are some of the key ways that automated billing can elevate a business’s professional image:

- Consistency: Automated systems ensure that every billing record is created and delivered in a timely manner, which reinforces reliability and fosters a sense of dependability in clients.

- Accuracy: Automation reduces the risk of human error, ensuring that the details of each transaction are correct, from pricing to payment terms. This attention to detail builds trust with clients.

- Customization: Automated billing solutions often allow businesses to tailor records with logos, branding, and specific client information. This personal touch makes the business appear more professional and aligned with the client’s expectations.

- Efficiency: Clients appreciate businesses that streamline operations. Automated systems ensure that billing is done quickly, without delays, which makes interactions smoother and less time-consuming for both parties.

- Transparency: When clients receive clear, itemized billing records that are automatically generated, it eliminates confusion and enhances transparency. This clarity contributes to a professional image.

Building Client Trust Through Automation

Clients expect their business partners to be efficient, transparent, and trustworthy. By automating billing processes, businesses can provide a consistent experience that reflects these qualities. When payments are handled professionally and promptly, it builds trust and strengthens relationships with clients, making them more likely to return and recommend the service to others.

Incorporating automated solutions for generating financial records is not only about improving internal efficiency but also about presenting your business as a forward-thinking, professional organization. It’s a simple yet impactful way to create a lasting impression and ensure ongoing client satisfaction.

Best Practices for Using Auto Invoices

Automated billing solutions offer numerous advantages, including time savings, accuracy, and efficiency. However, to maximize these benefits, it’s essential to follow best practices when setting up and using automated systems for generating payment records. By applying the right strategies, businesses can ensure that their billing processes remain smooth, professional, and compliant with industry standards.

Effective management of recurring payments, accurate documentation, and clear communication with clients are all crucial components of a successful automated billing system. Below are some best practices to help businesses optimize their automated billing workflows and avoid common pitfalls.

Key Best Practices for Automated Billing

- Set Clear Payment Terms: Make sure that payment terms are clearly defined in all billing records. Specify due dates, late fees, and any applicable discounts to avoid confusion and ensure that clients understand the expectations.

- Regularly Review Billing Settings: Periodically review your automated system settings to ensure they align with your current business needs. This includes updating pricing, payment schedules, and client-specific details as necessary.

- Maintain Accurate Client Information: Keep client data up-to-date, including billing addresses, contact information, and payment methods. Incorrect or outdated information can lead to billing errors and delays in payment collection.

- Monitor Payment Statuses: Regularly check the status of outgoing and incoming payments to catch any discrepancies. Automated systems often offer reporting tools that allow you to track unpaid or overdue accounts efficiently.

- Offer Multiple Payment Methods: Provide clients with various payment options, such as credit cards, bank transfers, and online payment platforms. Offering flexibility increases the likelihood of timely payments and improves customer satisfaction.

- Customize Billing Records: Tailor your automated billing documents with your company’s logo, branding, and any necessary legal information. Personalizing your billing records helps create a professional image and enhances customer trust.

- Set Up Reminders and Notifications: Configure automated reminders for upcoming or overdue payments. Timely notifications can reduce late payments and encourage clients to settle their balances quickly.

Ensuring Compliance and Accuracy

To avoid legal or tax issues, ensure that your automated billing system complies with local regulations and tax laws. Make sure that each record includes necessary details such as tax rates, business registration numbers, and accurate itemization of goods or services provided. Automated systems should also be regularly updated to reflect any changes in tax laws or business policies.

By following these best practices, businesses can ensure that their automated billing processes run smoothly, minimizing the chances of errors and improving customer relationships. With the right approach, automated billing can become a powerful tool for growth and operational efficiency.