Free Odoo Invoice Template for Easy and Customizable Invoicing

Managing business transactions efficiently is a critical aspect of maintaining a smooth operation. Having the right tools at your disposal can significantly reduce manual work and improve accuracy when handling payments and financial records. Customizable billing solutions allow you to create professional, clear, and consistent documents in a fraction of the time, ensuring that you stay organized and focused on other important tasks.

There are many solutions available that enable users to generate professional-looking documents without the need for advanced skills or expensive software. These tools often come with a variety of features designed to simplify the creation process, such as automated calculations, customizable fields, and easy integration with other systems. Whether you’re running a small startup or managing a larger operation, having access to reliable and adaptable options can save both time and resources.

In this guide, we explore how you can get started with simple and efficient solutions to handle your billing needs. From downloading templates to customizing documents to match your business style, you’ll discover how easily you can start managing your financial workflows with minimal effort.

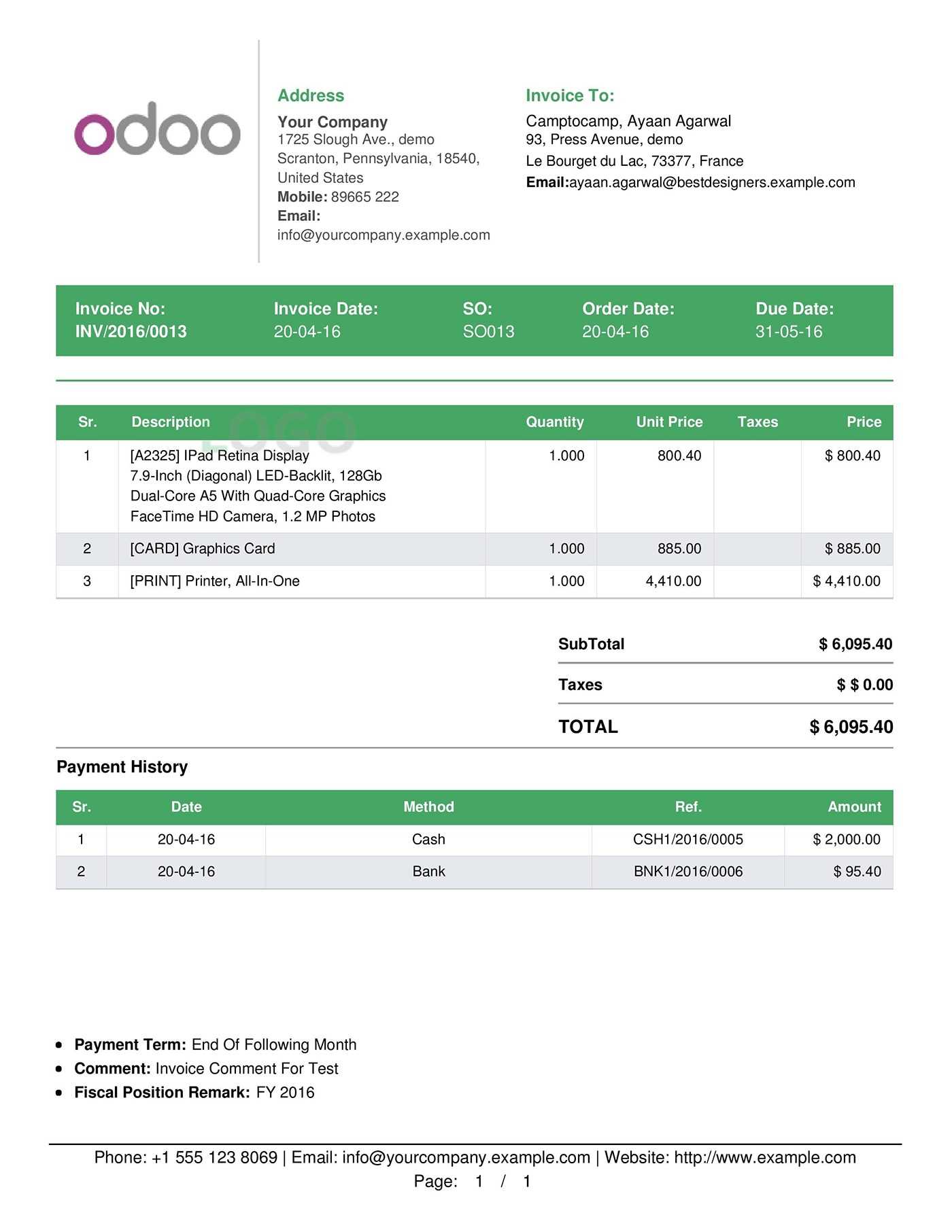

Free Odoo Invoice Template Overview

When it comes to managing business finances, having a system that simplifies the creation of payment requests and receipts is essential. Many solutions today offer pre-designed documents that can be easily customized to suit your specific needs, helping you maintain a professional appearance while saving valuable time. These tools are particularly useful for small businesses or freelancers who need reliable, yet straightforward methods for handling financial transactions.

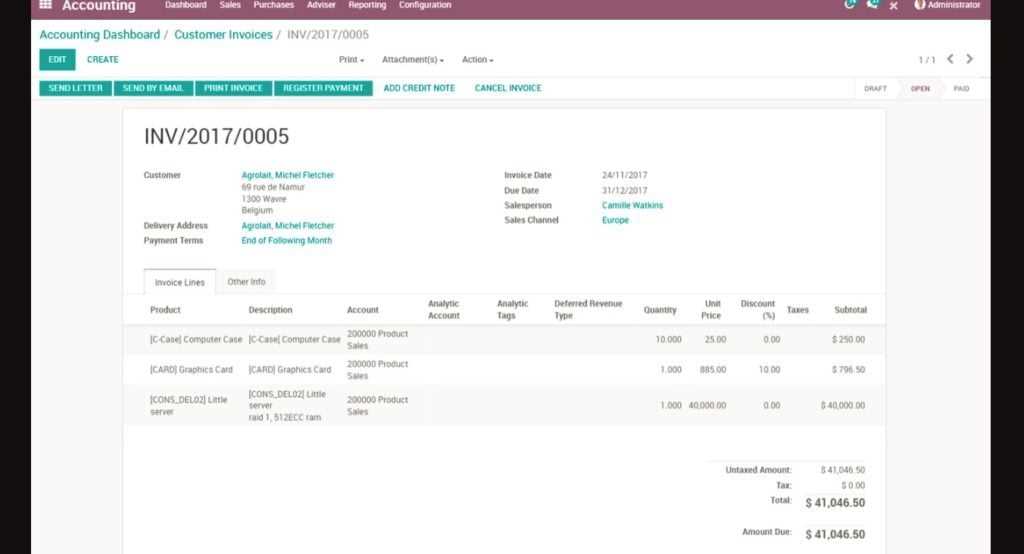

With the right software, you can generate detailed billing documents that include all the necessary fields such as client information, services rendered, and payment terms. These ready-made formats often come with built-in features that allow for quick modifications, enabling users to personalize the documents without starting from scratch. By utilizing these resources, businesses can focus more on their core operations while ensuring their financial records are well-organized and easily accessible.

Moreover, the ability to access such solutions at no cost provides a significant advantage, especially for those just starting out. It removes the barrier of expensive software subscriptions, offering an efficient alternative for managing business finances. This section will delve into how these accessible tools can improve your financial workflow and the various features they bring to the table.

Why Choose Odoo for Invoicing

When it comes to managing financial documentation and billing processes, having a robust and flexible solution is crucial for business success. The right platform can streamline administrative tasks, reduce human error, and ensure that records are always accurate and up to date. Opting for an integrated system that handles these needs efficiently can save both time and resources, especially for growing companies that require scalable solutions.

One of the main reasons businesses choose this particular software is its adaptability. It allows users to tailor their documents and workflows to fit their unique requirements, whether it’s customizing fields, adjusting payment terms, or adding branding elements. This level of flexibility ensures that every business can create documents that align with its specific needs without compromising on professionalism.

Additionally, its ease of use makes it an attractive choice for entrepreneurs and small business owners who may not have extensive technical knowledge. With its intuitive interface and automated features, users can generate and manage their financial paperwork without needing complex training or external support. Whether you’re looking to automate billing, track payments, or integrate with other business tools, this platform offers a comprehensive solution that grows with your business.

Benefits of Using Free Invoice Templates

Using pre-designed billing documents provides businesses with several key advantages. These ready-made solutions save time, ensure consistency, and reduce the likelihood of errors, making the financial management process smoother and more efficient. With customizable features, they cater to a wide range of industries, allowing for quick adjustments that match specific business needs without starting from scratch.

Here are some of the key benefits of utilizing these accessible solutions:

| Benefit | Description |

|---|---|

| Time-saving | Instantly create professional documents without having to design them from the ground up. |

| Consistency | Ensure all billing documents maintain a uniform format, improving professionalism and clarity. |

| Cost-effective | Eliminate the need for costly software or design services while still getting high-quality results. |

| Customization | Easily personalize each document to match your business branding and specific requirements. |

| Reduced Errors | Automated fields and calculations help minimize human mistakes and improve accuracy. |

These solutions are particularly useful for small businesses, freelancers, and startups who need an efficient way to manage financial documentation without investing in expensive tools. By using these templates, companies can focus on growing their operations rather than spending excessive time on administrative tasks.

How to Download an Odoo Invoice Template

Accessing pre-designed billing documents is simple and straightforward. These ready-to-use solutions can be quickly downloaded and implemented, making it easy for businesses to start managing their financial paperwork. The process generally involves selecting the right document format, downloading it to your system, and making any necessary adjustments to suit your specific needs.

Here’s a step-by-step guide on how to download and start using customizable billing documents:

- Step 1: Choose the Platform

First, visit a trusted provider or platform offering the desired pre-designed solutions. Many websites specialize in business tools that include customizable forms for various financial processes.

- Step 2: Select the Right Document

Browse through the available options and select the document that best fits your needs. Some platforms offer various styles or formats, so choose the one that aligns with your brand and the type of work you do.

- Step 3: Download the Document

Once you have selected the appropriate option, click the download button. The document will typically be available in a format such as PDF or Excel, ready for editing or printing.

- Step 4: Customize the Document

After downloading, open the file and make any necessary changes. Customize client details, services provided, payment terms, and add your logo or branding elements if required. These forms are designed to be easy to edit without the need for technical skills.

- Step 5: Save and Use

Once you’ve made the necessary adjustments, save the document and start using it for your billing needs. You can print, email, or store the document for future reference.

By following these simple steps, you can quickly download and start using professional documents for managing your business’s finances without any hassle.

Customizing Your Odoo Invoice Template

Personalizing your financial documents allows you to better reflect your brand and ensure that all necessary details are included for each transaction. Customization can range from adjusting the layout to adding specific business information, logos, and payment terms. By tailoring your documents, you can ensure consistency and professionalism in all communications with clients or partners.

The process of modifying these documents is simple and doesn’t require advanced technical skills. Most pre-designed formats offer editable fields, which make it easy to input custom information. Whether it’s adjusting fonts, colors, or adding extra sections such as notes or disclaimers, the flexibility of these tools means you can make the document uniquely yours.

Here are some common elements you can customize:

- Business Details – Update company name, address, contact information, and logo for a personalized touch.

- Document Layout – Adjust the structure and organization to match your preferred style or industry requirements.

- Payment Terms – Specify payment deadlines, methods, and any additional charges or discounts.

- Client Information – Ensure that client details such as name, address, and contact are clearly stated.

- Additional Sections – Add areas for notes, project details, or terms of service specific to each transaction.

Customizing your documents ensures that you maintain a professional image while tailoring them to your business’s specific needs. By adjusting these elements, you can provide a polished and efficient experience for your clients, improving your financial operations in the process.

Key Features of Odoo Invoice Templates

When selecting a document solution for managing financial transactions, it’s essential to focus on the features that will streamline your processes, ensure accuracy, and provide a professional presentation. The best tools offer several built-in features that not only simplify document creation but also enhance the efficiency of the overall workflow. These features help businesses save time and reduce errors while maintaining flexibility for customization.

Customization and Flexibility

One of the key benefits of using these solutions is their high level of customization. Users can easily adjust the layout, add or remove fields, and personalize sections to reflect their business’s unique needs. Whether you need to include special terms or additional information, these documents are designed to be flexible, ensuring they fit various industries and business models.

Automated Calculations

Another significant feature is the ability to automate calculations, which reduces the risk of human error and saves valuable time. By setting up formulas for taxes, totals, and discounts, users can quickly generate accurate documents without needing to manually perform any calculations. This automation ensures consistency and precision in every document created.

Key Features Include:

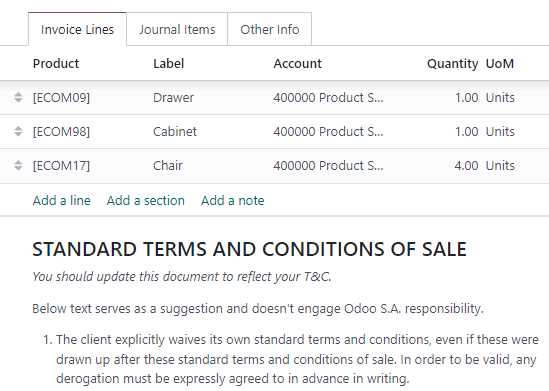

- Pre-Formatted Layouts – Ready-to-use designs that require minimal adjustments, helping users create professional documents quickly.

- Client Information Fields – Easily add or update customer details such as names, addresses, and contact info.

- Branding Options – The ability to add logos, colors, and other elements to match your business’s branding.

- Multi-Currency Support – Flexibility to handle multiple currencies, making it easier to work with international clients.

- Terms and Conditions Sections – Include detailed payment terms and conditions to clearly communicate expectations with clients.

- PDF Export – The ability to export completed documents in PDF format for easy sharing or printing.

By leveraging these features, businesses can efficiently manage their billing tasks, improve professionalism, and maintain consistency across all financial documents. These tools are designed to save time, reduce errors, and provide a reliable solution for handling day-to-day administrative needs.

How Odoo Streamlines Billing Processes

Efficient billing processes are essential for any business, as they ensure timely payments, reduce administrative burdens, and improve cash flow management. A robust platform that automates many of the manual tasks involved in creating, managing, and tracking financial documents can significantly simplify the process. This automation not only saves time but also ensures accuracy, helping businesses avoid common mistakes that can lead to delays or misunderstandings with clients.

Key Automation Features

The most significant advantage of using an integrated billing solution is the automation of repetitive tasks. From generating and sending documents to calculating taxes and totals, these tools reduce the need for manual intervention, making the process faster and more reliable.

Streamlined Workflow

Businesses can further streamline their billing processes by integrating their financial tools with other key systems such as inventory, sales, and accounting. This integration ensures seamless data flow between departments, reducing the chances of discrepancies and improving overall efficiency.

| Process | Automation Benefit |

|---|---|

| Document Creation | Automatically generate professional-looking documents based on pre-set templates and client details. |

| Tax Calculations | Automatically calculate taxes and apply discounts, ensuring accuracy and compliance. |

| Client Notifications | Send automatic notifications or reminders to clients regarding upcoming payments or overdue balances. |

| Payment Tracking | Track payments in real-time, reducing manual oversight and improving cash flow management. |

By automating these tasks, businesses can save valuable time, reduce errors, and ensure that all financial records are consistent and up-to-date. This streamlined workflow allows teams to focus on higher-priority tasks, improving overall productivity and enhancing the customer experience.

Free vs Paid Odoo Invoice Templates

When choosing a solution for creating business documents, one of the key decisions is whether to go with a no-cost option or invest in a premium service. Both free and paid solutions offer their own advantages, depending on the needs and size of the business. While free resources can be appealing due to their cost-effectiveness, paid tools often come with additional features that can further enhance productivity, customization, and support.

Benefits of Free Solutions

Free resources are typically the go-to choice for small businesses or freelancers who are just getting started and need to save on costs. These options usually come with basic features that allow users to quickly create functional documents without investing in expensive software. For many, these features are enough to get started with managing financial paperwork efficiently.

Advantages of Paid Solutions

On the other hand, paid options usually provide more advanced features such as better customization, integrations with other business tools, and higher-quality customer support. Businesses that are scaling up or need more flexibility in their documents may find that the additional investment pays off in terms of time savings, professional appearance, and overall functionality.

| Feature | Free Option | Paid Option |

|---|---|---|

| Customization | Limited, basic adjustments | Extensive customization for branding and specific needs |

| Automation | Basic calculations and data entry | Advanced automation for payment tracking, notifications, and more |

| Support | Minimal or community-based support | Priority customer service and dedicated support channels |

| Integration | Basic features, limited integration | Seamless integration with other business tools and platforms |

Choosing between free and paid solutions ultimately depends on the complexity of your needs and the resources available to your business. While free tools can work well for those just starting out, paid options can provide added value as your business grows and requires more robust features and support.

Best Practices for Invoicing with Odoo

Creating and managing billing documents is a crucial aspect of maintaining a healthy business operation. Ensuring that these documents are accurate, timely, and professional can lead to better client relationships and smoother financial processes. By following a few best practices, businesses can improve efficiency, reduce errors, and enhance the overall experience for both clients and staff. A systematic approach to generating and managing these financial records can save time and avoid common pitfalls.

Key Practices for Efficient Billing

When using digital tools for managing billing, it’s important to follow guidelines that help maintain organization and accuracy. Standardizing certain processes ensures that all documents are consistent, easily trackable, and meet legal or regulatory requirements.

| Practice | Benefit |

|---|---|

| Standardize Document Layouts | Ensure a uniform, professional look across all business documents for consistency and brand recognition. |

| Automate Calculations | Reduce manual errors by automating total amounts, taxes, and discounts. |

| Include Clear Payment Terms | Make payment expectations clear to clients, minimizing misunderstandings and late payments. |

| Use Digital Record-Keeping | Store documents digitally for easy retrieval, ensuring accuracy and improving accessibility. |

| Set Payment Reminders | Reduce late payments by sending automated reminders, improving cash flow and reducing administrative effort. |

Additional Tips for Streamlined Processes

Besides the basic practices listed above, there are additional strategies that can help optimize your financial documentation workflow:

- Use Unique Identifiers – Assigning unique reference numbers to each document helps with tracking and managing records efficiently.

- Review Before Sending – Always double-check all details such as amounts, client information, and payment terms before sending to avoid any mistakes.

- Integrate with Accounting Tools – Sync your billing solution with accounting software to ensure all financial data is in sync and accurate.

- Offer Multiple Payment Options – Make it easier for clients to pay by providing various methods, including online payment systems.

By incorporating these best practices into your billing workflow, you can enhance efficiency, improve client satisfaction, and maintain a smoother cash flow for your business.

How to Automate Invoices in Odoo

Automating the creation and management of billing documents can greatly enhance the efficiency of business operations. Automation eliminates the need for manual data entry, reduces human error, and ensures that invoices are generated and sent on time. With the right system in place, businesses can save time, improve accuracy, and maintain better control over their financial processes.

Steps to Automate Billing Documents

Setting up automated billing documents involves configuring specific rules, templates, and triggers within your system to generate and send documents with minimal manual input. Here’s how to get started:

- Set Up Client and Product Data – Make sure all client and product details are stored in the system, including payment terms, contact information, and product/service pricing. Accurate data is key to automating the process.

- Create Billing Rules – Define billing cycles, payment terms, and other rules such as discounts, taxes, and late fees. These rules will automatically apply to each generated document based on the client’s information.

- Use Predefined Document Layouts – Select or design preformatted document layouts that will be applied automatically to each generated billing document. These layouts can include logos, address fields, and other essential business details.

- Automate Payment Reminders – Set up automatic reminders that will be sent to clients based on payment deadlines. This helps reduce late payments and keeps cash flow on track.

- Integrate with Accounting Tools – Connect your document system to accounting software to automatically track payments, apply credits, and reconcile accounts. Integration ensures seamless financial management and data consistency.

Additional Features for Automation

To further streamline the process, you can take advantage of several additional features:

- Recurring Billing – Automate regular billing for subscription-based services or ongoing projects, eliminating the need to create new documents manually each time.

- Real-Time Updates – Automatically update client data, payment status, and financial records in real time to ensure that everything is up-to-date.

- Digital Document Delivery – Set up automated email delivery of completed documents, ensuring clients receive their statements without additional manual steps.

- Tax Calculation Automation – Automatically calculate applicable taxes and apply them to the final amounts based on the rules and regulations for each client.

By automating the creation and management of billing documents, businesses can significantly reduce the time and effort spent on manual administrative tasks, while ensuring consistency and accuracy across all financial processes.

Integrating Odoo Invoice Templates with Accounting

Integrating financial document generation with accounting systems is essential for maintaining seamless financial operations. By linking billing documents to your accounting software, you can ensure accurate records, automate transaction updates, and improve financial reporting. This integration helps reduce manual data entry, minimizes errors, and provides real-time insights into your cash flow, ensuring that everything is tracked and managed efficiently.

Steps to Integrate Billing Documents with Accounting

Integrating your billing system with accounting tools involves connecting the two platforms so that financial data is shared automatically. This integration helps streamline the entire process, from generating billing documents to updating your ledgers. Here’s how to integrate them:

- Connect Your Systems – Ensure that your billing software and accounting platform are connected via API or built-in integration features. This allows for automatic data transfer between the two systems.

- Sync Customer Data – Sync client information, including payment terms, contact details, and tax information, across both platforms to avoid discrepancies and ensure consistency.

- Automate Transaction Entries – Once a document is created and sent, automate the creation of corresponding entries in your accounting system. This ensures that sales, taxes, and payments are tracked in real-time without manual input.

- Track Payments and Outstanding Balances – By integrating your systems, payments can be tracked automatically. Any payments received or overdue balances can be reflected in the accounting software, making it easier to manage cash flow.

Benefits of Integration

Integrating billing documents with your accounting platform offers several advantages:

- Real-Time Updates – All transactions are updated instantly, ensuring that both the billing and accounting systems are in sync, without requiring manual intervention.

- Reduced Errors – By automating data transfer, the chances of errors caused by manual data entry are minimized, ensuring accuracy in financial reporting.

- Improved Financial Reporting – Integration allows for more accurate and up-to-date financial reports, making it easier to track revenue, expenses, and profitability.

- Better Cash Flow Management – Automatic tracking of payments and outstanding invoices allows businesses to stay on top of their cash flow and make informed decisions.

- Faster Reconciliation – With automatic updates, reconciling bank statements, accounts receivable, and other financial data becomes a more efficient and less time-consuming process.

By integrating your billing documents with accounting software, you streamline financial operations, reduce manual work, and enhance the accuracy and speed of your financial processes. This integration ultimately contributes to better financial management, faster decision-making, and improved business efficiency.

Common Issues with Odoo Invoice Templates

While digital solutions for creating business documents have many advantages, users may encounter a range of issues that can disrupt the workflow. These problems often stem from incorrect configurations, software bugs, or a lack of understanding of the system’s features. Recognizing and addressing common challenges early on can help businesses maintain a smooth and efficient billing process.

Frequent Challenges

Despite their flexibility and automation, billing solutions can sometimes lead to frustrations if not set up properly or if the system isn’t fully compatible with a business’s needs. Some of the most common issues include formatting errors, integration problems, or incorrect data mapping.

- Incorrect Calculation of Totals – One of the most frustrating issues is when the system fails to calculate totals, taxes, or discounts correctly. This can result from misconfigured rules or formulas, leading to billing errors.

- Data Synchronization Problems – If the platform isn’t properly integrated with other systems (like CRM or accounting software), data such as client details, payment history, or tax information may not sync, leading to inconsistencies and errors.

- Template Layout Issues – Sometimes, the document layout might not render correctly, causing information to appear out of place, misaligned, or incomplete. This could be due to customization settings or the platform’s limitations in handling design adjustments.

- Missing Client Information – Missing or incorrect client data, such as billing addresses or payment terms, can lead to confusion and delays in payment. This issue may arise if the system isn’t set to auto-fill or retrieve accurate client details from linked records.

- Failed Document Delivery – Automated email sending features may fail to deliver documents to clients on time. This could be due to configuration problems, email server issues, or restrictions from email providers.

- Incompatibility with Custom Features – Custom features or add-ons sometimes don’t integrate well with the core system, leading to conflicts or errors when generating documents or updating financial records.

How to Address These Issues

Most issues can be avoided or corrected by following best practices and regularly maintaining your system. Here are a few solutions to help troubleshoot common challenges:

- Check and Update Software – Ensure that your system and any integrated add-ons or features are up-to-date. Regular updates often fix bugs and improve performance.

- Review Configuration Settings – Double-check your setup for calculations, data mapping, and integration settings. Ensure all fields are properly configured to prevent errors in generated documents.

- Test Templates – Before sending out any documents, test them to ensure that the layout and content appear correctly. Adjust the design settings as necessary to accommodate all information properly.

- Monitor Integration Points – Regularly monitor the integration between your document system and other software to ensure smooth data transfer and avoid synchronization issues.

- Provide Adequate Training – Make sure your team is well-trained in using the system. Understanding how to use the tools and troubleshoot basic problems can prevent many common issues from arising.

By identifying and resolving these common issues, businesses can optimize their billing process, maintain accuracy, and ensure that documents are sent on time, leading to better customer relatio

Securing Your Odoo Invoice Data

Protecting sensitive business and financial information is critical in today’s digital environment. The data associated with creating and managing business documents, such as client details, payment terms, and financial transactions, must be safeguarded against potential threats. Ensuring that this information is stored, transmitted, and accessed securely is essential for maintaining privacy, preventing fraud, and complying with data protection regulations.

Best Practices for Securing Financial Data

There are several best practices that businesses can adopt to protect the sensitive information in their billing systems. From encryption to user access control, each measure contributes to a comprehensive security strategy.

- Data Encryption – Encrypt all sensitive information both at rest (when stored) and in transit (when being transmitted across networks). This ensures that even if data is intercepted, it remains unreadable to unauthorized individuals.

- User Access Control – Restrict access to sensitive information based on roles and responsibilities within the organization. Only authorized personnel should be able to view or modify financial data, minimizing the risk of unauthorized access.

- Regular Software Updates – Ensure that your system is regularly updated to address known security vulnerabilities. This includes patching security holes, fixing bugs, and improving overall system resilience against threats.

- Secure Authentication Methods – Implement strong authentication methods, such as multi-factor authentication (MFA), to ensure that only authorized users can log into the system and access confidential data.

- Data Backups – Regularly back up your data to ensure that in the event of a system failure, ransomware attack, or data corruption, you can recover critical financial records quickly and securely.

- Compliance with Regulations – Ensure that your system complies with relevant data protection laws and industry standards, such as GDPR, HIPAA, or PCI-DSS, to avoid legal issues and ensure that customer data is protected in accordance with best practices.

Securing Documents and Transactions

Beyond securing data, it’s important to focus on the security of individual documents and transactions. Here are some additional tips to ensure the integrity and confidentiality of the documents you generate:

- Audit Trails – Implement logging and monitoring features to track who accesses, edits, or approves business documents. Audit trails help identify suspicious activity and ensure accountability.

- Document Locking – Lock documents once they are finalized to prevent unauthorized changes or tampering after they have been generated and sent to clients.

- Use Secure Storage – Store all sensitive financial records in a secure cloud or on-premise environment that is protected by strong firewalls, encryption, and access controls.

- Digital Signatures – Use digital signatures to authenticate documents, ensuring that they have not been altered after being issued and verifying the legitimacy of the sender.

By implementing these strategies, businesses can significantly reduce the risks associated with handling sensitive financial data. Secure practices not only protect against cyber threats but also build trust with clients by demonstrating a commitment to safeguarding their personal and financial information.

Optimizing Your Odoo Invoice Workflow

Efficient document management is crucial for streamlining the billing process and improving overall business productivity. By optimizing the workflow related to creating, sending, and tracking financial documents, businesses can reduce errors, save time, and improve client satisfaction. A well-organized system can automate repetitive tasks, provide real-time updates, and ensure that payments are processed promptly and accurately.

Key Strategies for Streamlining Your Workflow

There are several strategies that can help enhance the workflow of document creation and management. By addressing areas such as automation, data accuracy, and integration with other systems, businesses can create a more efficient and effective billing process.

- Automate Document Creation – Set up automatic generation of financial records based on predefined client information and payment terms. This reduces the time spent on manually creating documents and minimizes the risk of human error.

- Use Predefined Layouts and Structures – Implement standardized document layouts that automatically pull in client and transaction data. This ensures consistency across all documents, making it easier to track payments and maintain accurate records.

- Set Up Automatic Payment Reminders – Configure the system to automatically send reminders to clients about upcoming or overdue payments. This helps reduce late payments and keeps cash flow on track.

- Integrate with Accounting Systems – Connect your billing system to your accounting software to ensure that all transactions are recorded and reconciled automatically. This reduces the need for manual entry and ensures that financial data is consistent across platforms.

- Optimize Approval Processes – Automate the approval process by defining clear workflows for document review and approval. This helps ensure that no document is overlooked and that there are no delays in finalizing transactions.

Best Practices for Improved Workflow Efficiency

In addition to automating key processes, there are several best practices that can further improve the efficiency of your document management system:

- Regularly Review System Settings – Periodically check system configurations to ensure that workflows are still aligned with current business needs. Adjust rules, templates, and triggers as necessary to account for any changes in your processes or customer requirements.

- Leverage Cloud Solutions – Use cloud-based platforms to store and manage documents. Cloud storage provides greater accessibility, backup options, and enhanced collaboration between team members.

- Track Key Metrics – Monitor key performance indicators (KPIs) such as document creation times, payment turnaround times, and outstanding balances. This data can help you identify bottlenecks and areas for improvement in your workflow.

- Provide Team Training – Ensure that your team is well-versed in the tools and processes for document management. Regular training helps avoid common mistakes and ensures that everyone is using the system as efficiently as possible.

- Maintain Data Accuracy – Make sure that client information and transaction details are regularly updated and accurate.

Creating Professional Invoices in Odoo

Creating polished and professional business documents is key to establishing credibility and trust with clients. A well-structured document not only reflects your business’s attention to detail but also ensures clear communication of payment terms, services, and expectations. By utilizing efficient tools and following best practices, businesses can generate high-quality documents that are both visually appealing and legally compliant.

To create professional documents, it is essential to focus on several aspects: the layout, the accuracy of information, and the inclusion of key details such as payment terms, taxes, and due dates. Using streamlined systems allows for automatic population of these fields, reducing the chances of errors and saving valuable time. Additionally, customization options give you the flexibility to adjust the document design and content to match your brand identity and client preferences.

When creating business documents, consistency in format is crucial. Ensuring that all records follow a consistent structure makes it easier for both the business and the client to track transactions, understand terms, and make payments on time. A professional-looking document with clear, organized information sets the tone for a positive business relationship and can contribute to better customer retention and improved cash flow management.

How Odoo Enhances Invoice Accuracy

Ensuring that business documents are accurate is essential for maintaining professional relationships and managing finances effectively. Mistakes in billing can lead to payment delays, client dissatisfaction, and even legal disputes. A robust system can significantly reduce human errors by automating calculations, pulling in consistent data, and providing real-time updates. This not only improves accuracy but also speeds up the process of generating documents, enabling businesses to focus on growth and customer service.

A well-integrated system can minimize discrepancies and provide a seamless experience for both the business and its clients. By automating repetitive tasks such as calculating totals, taxes, and discounts, the platform ensures that all figures are accurate and up to date. Furthermore, data synchronization with other tools ensures consistency across all business records, preventing common mistakes like double entries or outdated information.

Key Features Contributing to Accuracy

Several key features of an advanced system help to eliminate errors and enhance the accuracy of business documents:

Feature How It Enhances Accuracy Automated Calculations Automatically calculates totals, taxes, and discounts based on predefined rules, reducing the risk of manual errors. Data Integration Syncs data with other business systems (e.g., CRM, accounting software) to ensure consistency and prevent errors caused by outdated or missing information. Customizable Fields Allows users to define and customize fields to meet specific business needs, ensuring that the correct information is captured every time. Template Consistency Standardized templates ensure that all documents follow the same layout and structure, minimizing inconsistencies in presentation and data placement. Real-Time Updates Automatically updates business records in real time, reducing the risk of errors due to outdated or incomplete data. By leveraging these features, businesses can create accurate documents that are both professional and efficient. Enhanced accuracy not only saves time and reduces financial risk, but it also builds trust with clients by ensuring that every transaction is recorded correctly and transparently.

Free Odoo Invoice Templates for Small Businesses

For small businesses, managing financial documents efficiently can be a challenge. Without the right tools, the process of creating and tracking bills, managing payments, and ensuring accuracy can become time-consuming and prone to errors. Thankfully, there are solutions available that provide ready-made business document layouts that are both cost-effective and highly functional. These solutions allow small business owners to focus more on their core operations while ensuring that their financial documentation remains professional and compliant.

Benefits of Using Pre-designed Business Document Layouts

Using pre-made business document layouts offers several advantages, particularly for small businesses. These layouts are designed to be customizable and easy to use, offering a wide range of options that cater to different business needs. By adopting such tools, businesses can significantly improve the speed and accuracy of their documentation processes.

Benefit Description Cost-Effective Pre-designed layouts are typically available at no cost, allowing small businesses to avoid additional software or development expenses. Customization These systems allow for easy customization, enabling business owners to tailor documents to their specific branding and client requirements. Time Savings Pre-built layouts eliminate the need for creating business documents from scratch, significantly reducing the time spent on document creation. Consistency Ready-made designs ensure that all business records follow a consistent structure, promoting professionalism and reducing errors. Easy Integration These tools often integrate with other systems (like accounting or client management tools), ensuring that data is synchronized across platforms and minimizing the risk of mistakes. How Small Businesses Can Benefit

For small business owners, adopting an effective document management system can simplify daily tasks and reduce the workload involved in billing and financial reporting. Pre-made business record layouts are an ideal solution for businesses that need professional documentation without the complexity of expensive software or lengthy setup processes.

By using these efficient tools, businesses can streamline their billing workflows, improve financial accuracy, and present a more polished image to clients, all while keeping operational costs low. Ultimately, these solutions help small businesses maintain a competitive edge in a fast-paced marketplace.