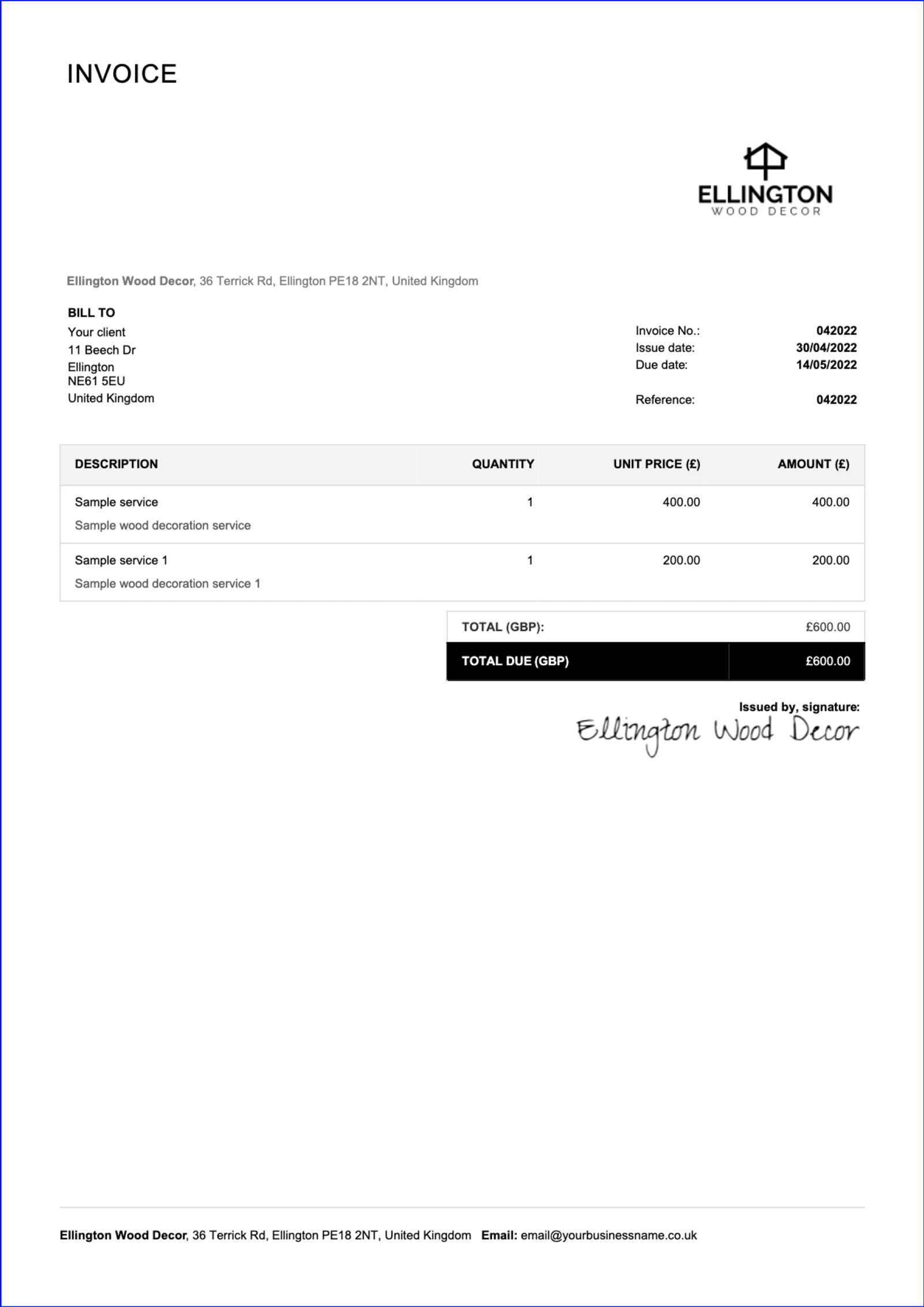

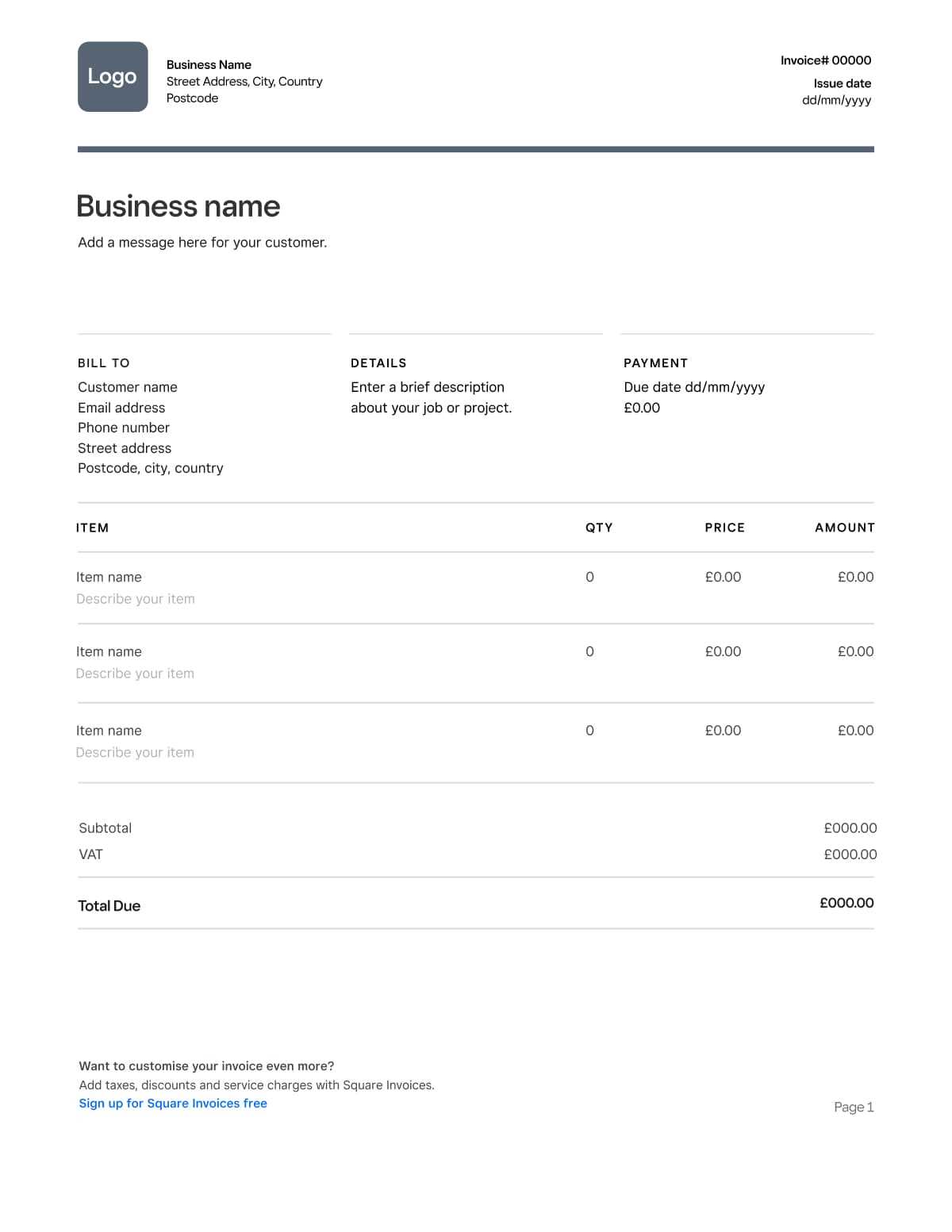

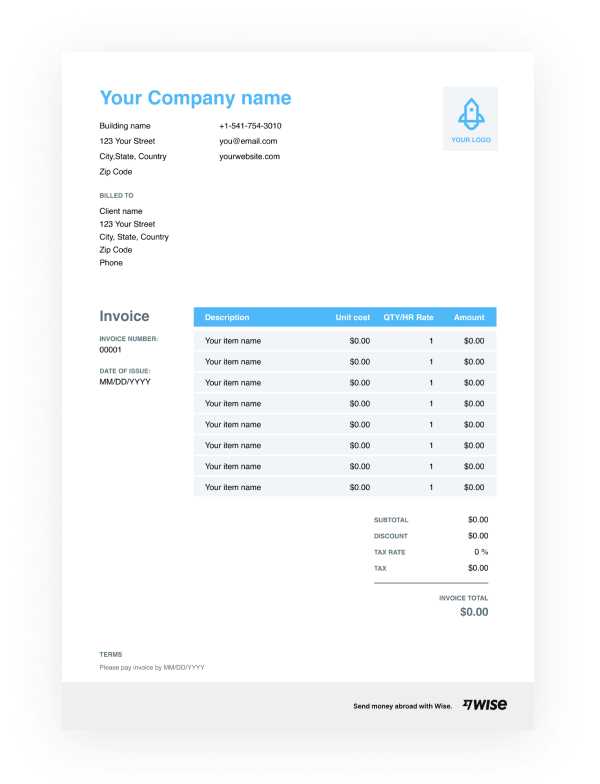

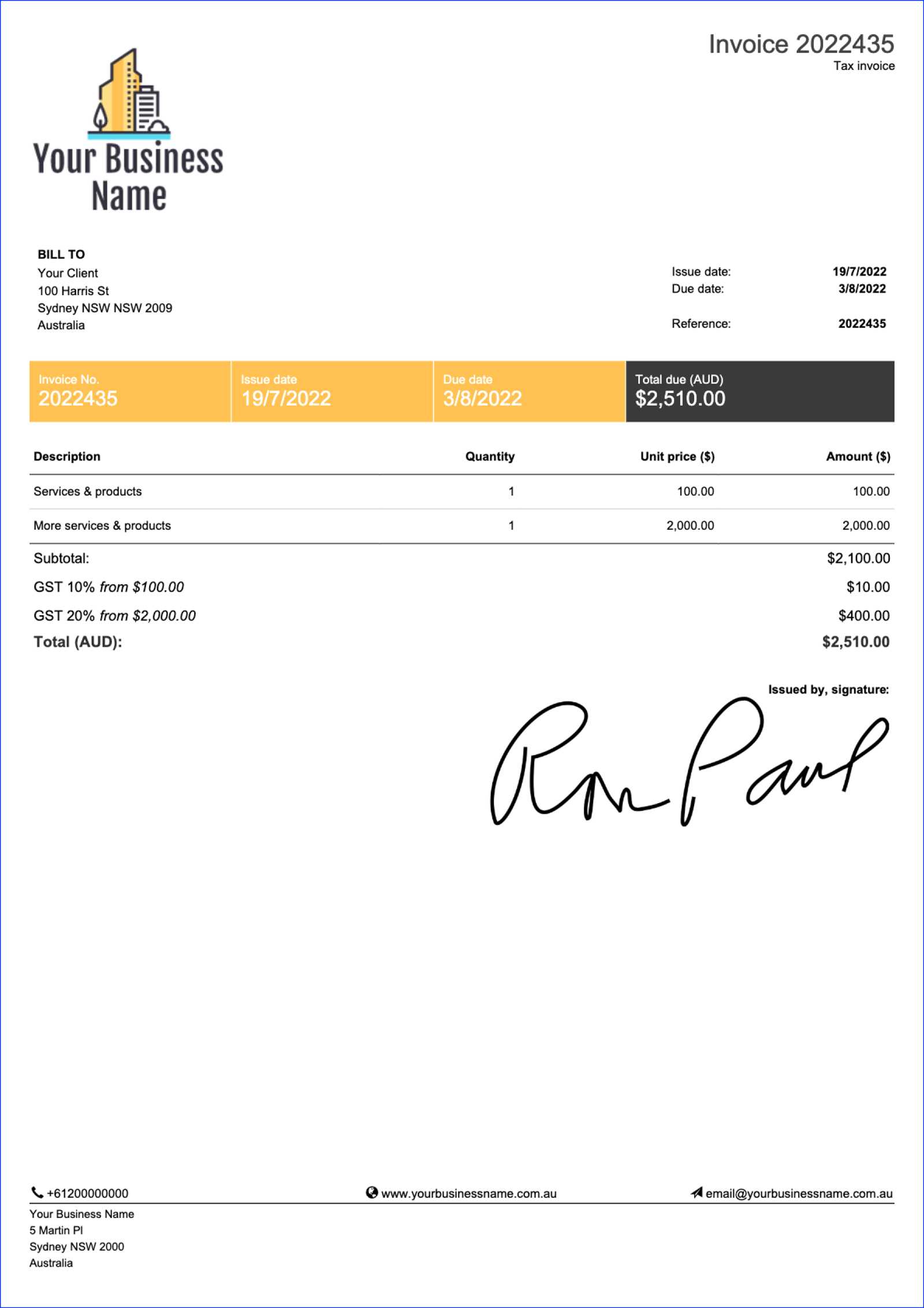

Free Online Invoice Template for Word Customizable and Easy to Use

Managing financial transactions efficiently is essential for any business, regardless of size. One of the most crucial steps in this process is creating professional documents that clearly outline the amounts owed by clients. Having an effective method to generate these records can save time and reduce errors, ensuring smooth operations and strong client relationships.

With the right tools, you can easily generate detailed and accurate statements that align with your branding and meet all necessary legal requirements. Customizable options allow you to adapt each document to your specific needs, from payment terms to contact information, helping to maintain consistency and professionalism in your communications.

In this guide, we’ll explore how to leverage ready-made formats for generating these important documents. You’ll discover how they can simplify the creation process, save valuable time, and provide flexibility for tailoring each document to fit various business requirements.

Why Use an Online Invoice Template

Creating professional documents for billing is a crucial part of running a business. It ensures clear communication with clients, maintains consistent records, and helps track financial transactions. Rather than manually designing each document from scratch, using a pre-designed solution can save time and reduce the likelihood of errors. This approach allows business owners to focus more on growing their enterprise rather than on administrative tasks.

Time Efficiency

One of the main reasons to adopt a ready-made solution is the significant time savings it offers. Instead of starting from a blank page, you can quickly select a format that suits your business needs and fill in the relevant details. This eliminates the need to reinvent the wheel each time you need to generate a statement.

- Quick and easy setup with minimal input required.

- Ready-made structures for common business information.

- Faster turnaround times for sending out bills and processing payments.

Consistency and Professionalism

Using a pre-designed structure ensures uniformity in your documentation. This consistency not only saves time but also adds a layer of professionalism to your business. Clients are more likely to trust and pay attention to properly formatted documents that reflect a well-established business image.

- Maintains uniformity across all transactions.

- Ensures all legal requirements and necessary details are included.

- Promotes a polished, professional image for your brand.

Benefits of Using Word for Invoices

When it comes to generating financial records, simplicity and flexibility are key. Using a word processing program for creating your billing documents offers numerous advantages, including ease of customization and the ability to quickly adjust your format as needed. This familiar software allows you to create professional-looking statements without the steep learning curve often associated with specialized tools.

Ease of Customization

One of the primary advantages of using word processing software for creating billing documents is the level of customization it offers. You can easily add, remove, or adjust fields according to your specific needs, whether it’s adding company branding or modifying the layout. This flexibility ensures that your documents are always aligned with your business’s requirements.

| Customization Features | Benefits |

|---|---|

| Adding logos and branding | Helps reinforce company identity |

| Adjusting layout and fonts | Improves readability and presentation |

| Editing fields and sections | Allows quick adaptation to client or project specifics |

Familiarity and Accessibility

Another key benefit is the widespread use and familiarity of word processing software. Most people are already comfortable with its basic features, which makes the learning process for creating professional documents far simpler. Additionally, this type of software is typically available on most computers, making it an accessible option for small businesses and freelancers alike.

How to Customize Your Billing Document

Customizing your billing documents is essential to ensure they meet your business needs while maintaining a professional appearance. Adjusting the layout, adding essential details, and personalizing the design can make your statements stand out and reflect your brand identity. Whether you need to modify existing fields or add new sections, the process is straightforward and can be done with minimal effort.

Adjusting Layout and Design

The first step in personalizing your document is to modify the layout. You can change the placement of text, logos, and other elements to create a clear and well-organized format. By adjusting margins, font sizes, and alignment, you ensure that your document is both visually appealing and easy to read.

- Change the header to include your business name and logo.

- Adjust the font style and size for readability.

- Reorganize sections to highlight key details like payment terms.

Adding Essential Information

Including all the necessary details is critical for clarity and professionalism. Ensure that you add your business’s contact information, the client’s details, and a clear breakdown of charges. You can also modify existing fields to include special notes or customize the payment terms according to your requirements.

- Contact Information: Include both your business and client details.

- Payment Instructions: Specify preferred payment methods and due dates.

- Additional Notes: Customize fields to add project-specific details or terms.

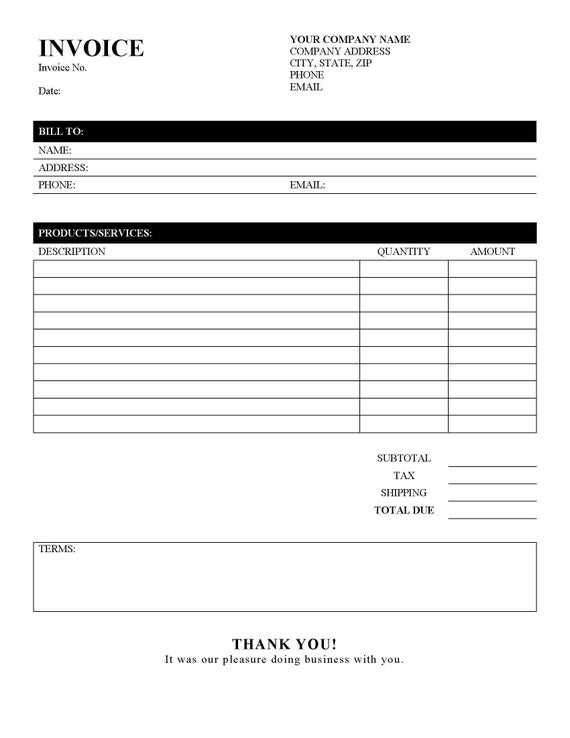

Top Features of a Good Billing Document

A high-quality billing document is essential for clear communication between businesses and clients. It should be well-structured, easy to understand, and capable of conveying all necessary details in a concise manner. The right features ensure accuracy, professionalism, and efficiency in processing payments. Below are some key elements that every good billing document should have to meet these standards.

Clear Layout and Design

A good document should be visually clear and easy to navigate. The design should not overwhelm the reader but rather guide them through the essential information. A clean layout with ample white space allows for easy reading and reduces confusion.

- Simple and intuitive structure.

- Clear headers and sections to organize details.

- Consistent fonts and size for readability.

Comprehensive Information Sections

It’s important that the document includes all necessary fields, from business and client details to the breakdown of services provided. A well-organized format ensures that all essential information is easily accessible and helps avoid errors or misunderstandings.

- Business details: Company name, address, and contact information.

- Client details: Name, address, and payment terms.

- Itemized list: Detailed description of services or products with prices.

- Total amount: Clearly stated charges and applicable taxes.

Flexibility for Customization

A great document should be flexible enough to be customized for different clients, services, or payment arrangements. This feature allows businesses to adapt the layout or content to meet specific needs without creating a new document from scratch each time.

- Editable fields for changing quantities, pricing, and descriptions.

- Customizable sections for adding payment instructions or terms.

- Options to include or exclude certain details based on the nature of the transaction.

How to Save Time with Templates

Creating billing documents from scratch every time can be time-consuming and inefficient. By using pre-designed formats, you can drastically reduce the amount of time spent on administrative tasks. These ready-made solutions allow you to quickly generate accurate and professional records, leaving more time to focus on growing your business.

Faster Document Creation

One of the most significant time-saving benefits is the ability to create documents quickly. Rather than starting from a blank page, a pre-designed format provides a foundation that only requires filling in the details. This efficiency ensures that you can generate records in a fraction of the time compared to creating them from scratch.

- Instantly available layout and structure.

- Pre-filled fields that only need minor adjustments.

- Fast document generation with fewer steps involved.

Reduced Errors and Adjustments

Another advantage is the reduction in errors. With predefined fields and standardized formatting, the chance of forgetting important details or making formatting mistakes is significantly lower. This streamlined process also makes it easier to spot and correct any issues quickly.

- Standardized fields minimize the risk of omissions.

- Easy to spot formatting errors before finalizing.

- Fewer revisions required, saving additional time.

Creating Professional Billing Documents in Word

When it comes to maintaining a professional image for your business, the quality of your financial documents plays a crucial role. Using a text-processing program allows you to easily create polished and visually appealing records that leave a lasting impression on clients. By customizing the layout, adding key details, and incorporating your branding, you can ensure that your statements look both professional and cohesive with the rest of your business communications.

Essential Elements of a Professional Record

To create a document that conveys professionalism, it’s important to include all necessary components in a well-organized manner. Your business information, client details, and a clear breakdown of services or products are just the beginning. A polished appearance and attention to detail can make a significant difference in how your documents are perceived.

- Company Information: Always include your full name, address, and contact details.

- Client Information: Ensure the client’s name, address, and relevant contact info are listed accurately.

- Itemized List: Provide a detailed breakdown of the services or products provided, with clear pricing.

- Payment Terms: Clearly state due dates, payment methods, and any late fees if applicable.

Enhancing Visual Appeal

Designing a visually appealing record is just as important as ensuring the content is accurate. Customizing the layout, choosing appropriate fonts, and using your branding elements can significantly elevate the overall look of your documents. A well-formatted document not only looks more professional but also enhances readability and makes important details stand out.

- Use clean fonts: Stick to easy-to-read fonts like Arial, Calibri, or Times New Roman.

- Align text neatly: Ensure proper alignment of headings, pricing, and item descriptions for clarity.

- Incorporate your logo: Adding your company’s logo helps reinforce brand identity.

Editable Fields in Billing Documents

Customizing financial documents is crucial for ensuring they meet your business’s unique needs. One of the most useful features of pre-designed formats is the ability to edit specific fields. Editable sections allow you to personalize each document quickly, making it easier to add or adjust information without altering the overall structure. This flexibility is especially important when dealing with different clients, services, or payment terms.

Key Editable Sections

The key advantage of editable fields is the ability to quickly tailor the document. Whether you need to adjust pricing, change contact details, or update project descriptions, the ability to make these changes easily helps streamline your billing process.

- Client Information: Name, address, and contact details can be modified for each transaction.

- Service Breakdown: Adjust item descriptions, quantities, and pricing according to the services provided.

- Payment Terms: Customize the payment method, due date, and any additional notes or terms as needed.

- Discounts or Taxes: Edit fields to include discounts, tax rates, or other additional charges.

Benefits of Editable Fields

Editable sections save you significant time by allowing for quick adjustments without having to redesign the entire document. This feature is particularly helpful for businesses that deal with a wide range of clients and services, ensuring that every document is both accurate and aligned with your branding.

- Quickly adapt documents for different clients or projects.

- Reduce errors by making it easier to adjust specific details.

- Maintain consistency while providing flexibility to accommodate special requests.

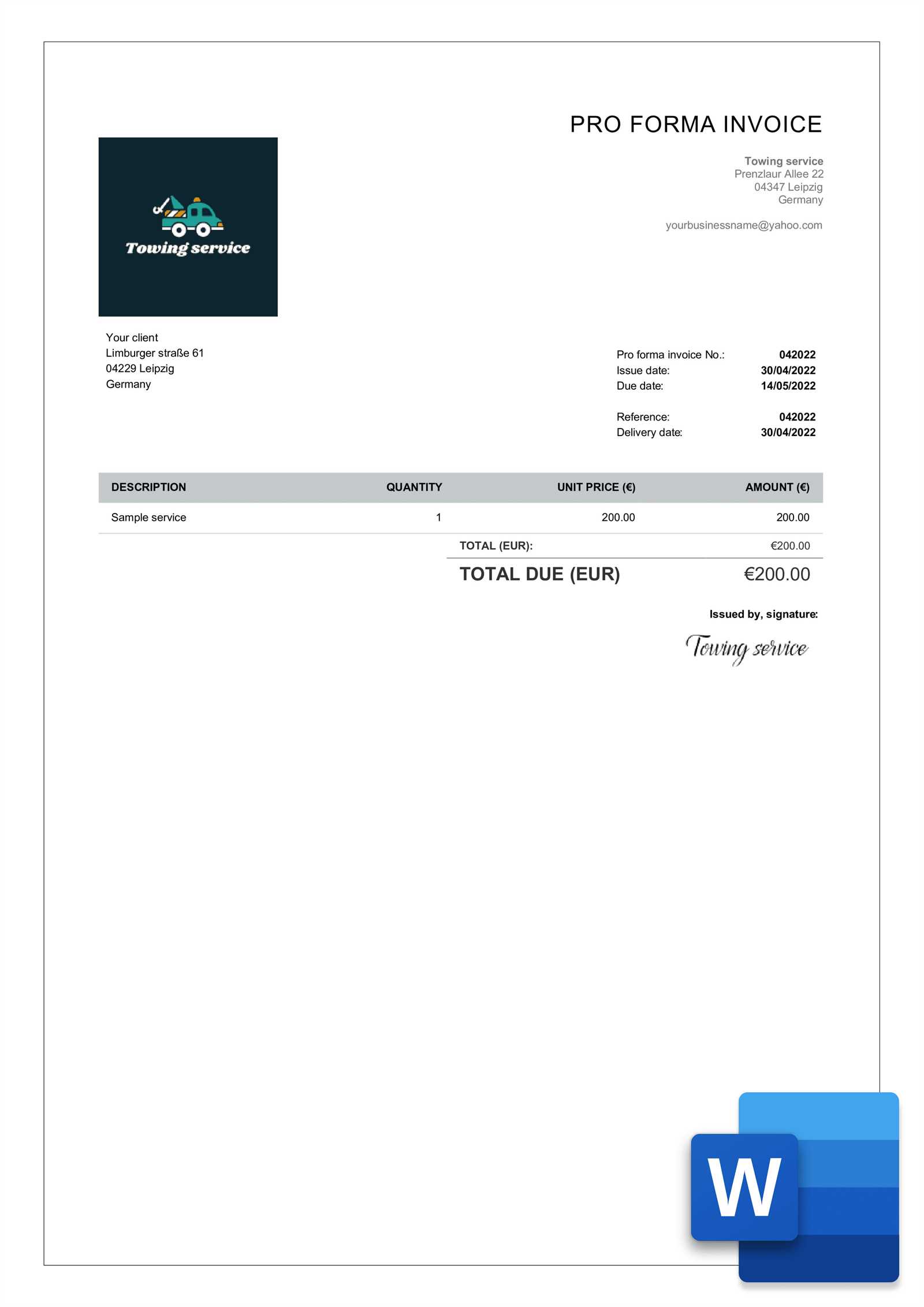

How to Include Tax Information on Billing Documents

Including accurate tax information in your billing documents is essential for maintaining compliance with tax regulations and ensuring transparency in financial transactions. Whether you are charging sales tax, value-added tax (VAT), or other applicable taxes, clearly stating these details helps both you and your clients understand the total amount due. Properly formatting tax information can also prevent errors and potential disputes.

To include tax details effectively, it’s important to clearly separate the taxable amount from the total. This helps clients easily identify the tax portion and understand how it affects the final price. Most billing documents should include a section where the tax rate, taxable amount, and total tax charged are outlined separately from the goods or services provided.

- Tax Rate: Clearly specify the percentage rate applied to the total cost of goods or services.

- Taxable Amount: Display the value of goods or services that are subject to taxation.

- Total Tax: Show the final tax amount to be added to the base price.

- Grand Total: List the final amount due, including the tax.

By following this structure, you can ensure that all tax-related information is clearly communicated to your clients. It’s also essential to be aware of the specific tax laws in your region to ensure accurate calculations and avoid legal complications.

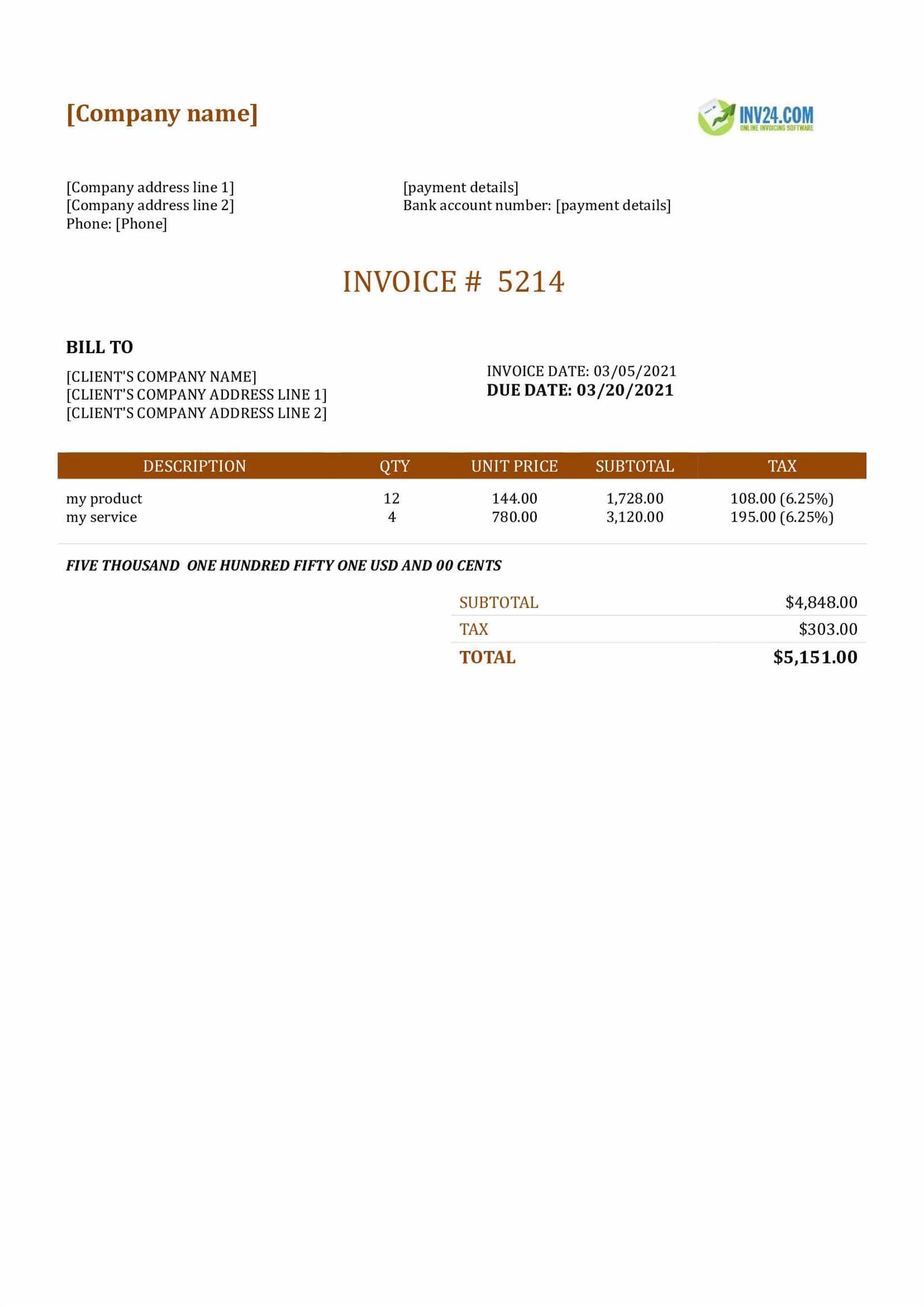

Free Billing Document Templates for Word

For businesses looking to streamline their administrative processes, using pre-designed formats can save time and effort. Fortunately, there are many free options available for creating professional records that meet your business needs. These ready-to-use solutions can be easily customized to fit specific client requirements, and they help ensure consistency across all your financial communications.

Where to Find Free Templates

There are numerous websites offering free downloadable formats that can be customized for your business. These resources often include a variety of designs and structures, allowing you to choose the one that best fits your company’s style and needs. Many of these are available in popular formats, such as Microsoft Office documents, making them easy to edit and adapt.

- Official software providers: Many software programs offer free templates as part of their basic package.

- Third-party websites: Numerous online platforms provide a selection of free billing document formats designed for different industries.

- Industry-specific designs: Some sources offer templates tailored to particular sectors, such as retail, consulting, or construction.

Customizing Free Templates

Once you have downloaded your chosen document, customization is quick and easy. These ready-made solutions allow you to input your business details, add descriptions of services, and adjust payment terms without the need for extensive technical skills. Simply fill in the required fields, and your document is ready to be sent to clients.

- Adjust business and client details: Personalize the format by adding your company logo, contact details, and the client’s information.

- Modify itemized lists: Add or remove services, change quantities, and update pricing as needed.

- Update payment information: Tailor payment instructions and due dates to suit specific agreements.

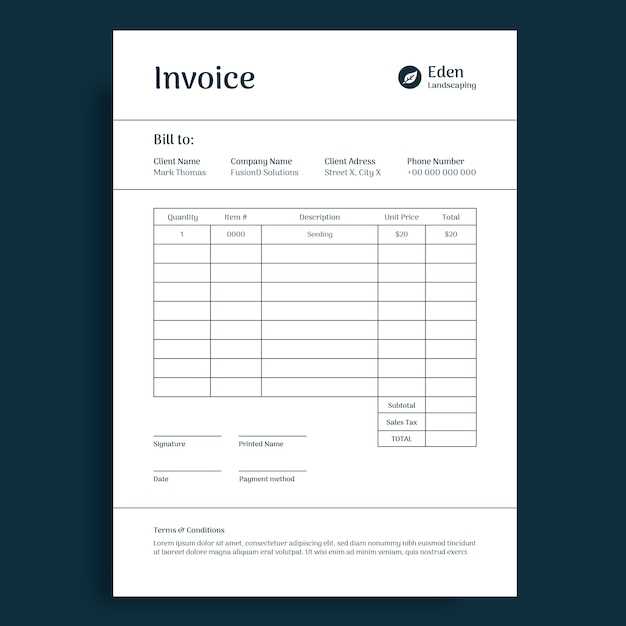

Billing Document for Small Businesses

For small businesses, managing finances effectively is crucial to maintaining cash flow and ensuring smooth operations. Using a well-organized document to detail payments due helps prevent errors and ensures clients understand the charges clearly. A simple, yet professional, format can streamline the billing process, making it easier to track and follow up on payments.

Small business owners often require flexible solutions that can easily be customized based on specific services or client needs. A streamlined, easy-to-use document can be a powerful tool for billing, enabling entrepreneurs to quickly generate accurate statements without spending too much time on administrative tasks.

- Clear structure: A straightforward design that includes essential details like business name, client information, services provided, and amounts due.

- Customizable fields: The ability to adjust itemized charges, payment terms, and taxes according to each specific transaction.

- Professional appearance: Maintaining a clean and formal format that reflects the business’s credibility and enhances trust with clients.

By using a basic yet effective document, small business owners can create professional-looking bills that align with their brand and ensure clarity in all financial transactions. This not only helps build stronger relationships with clients but also ensures that payments are processed in a timely manner.

How to Add Payment Terms on Billing Documents

Including clear payment terms in your financial documents is essential for setting expectations and ensuring timely transactions. These terms outline when and how clients should make payments, helping to avoid misunderstandings and delays. By specifying due dates, payment methods, and any late fees, you create a transparent and professional approach to managing your business finances.

Essential Elements of Payment Terms

Payment terms should be simple and easy to understand, ensuring both you and your client are on the same page. Common elements include due dates, payment methods, and penalties for late payments. Clearly defining these details upfront can prevent confusion and encourage prompt payments.

- Due Date: Specify the exact date by which the payment must be made, such as “Due within 30 days from the date of issue.”

- Accepted Payment Methods: Indicate which payment methods you accept, such as bank transfers, credit cards, or checks.

- Late Fees: Outline any penalties for late payments, such as a fixed percentage per day or a flat fee after a certain period.

Formatting Payment Terms for Clarity

To ensure your payment terms are easily understood, it’s important to format them clearly and place them in a prominent section of your document. Typically, these details are included at the bottom or in a separate section labeled “Payment Terms” or “Terms and Conditions.” By highlighting these terms, clients are more likely to notice and follow them.

- Bold headings: Make sure the “Payment Terms” section stands out for quick reference.

- Concise language: Use clear, direct language to avoid any confusion about payment deadlines or fees.

- Highlight key points: Use bullet points or numbered lists for easy readability.

Organizing Client Details in Billing Documents

Properly organizing client details in financial documents is essential for maintaining clear communication and ensuring accuracy. By structuring client information in a logical and consistent way, you make it easier to track transactions, identify clients, and prevent errors. A well-organized document allows you to quickly reference essential details when needed, contributing to smoother business operations.

Key Elements to Include

To ensure that client information is presented clearly, include the most relevant details that will help identify the client and track the transaction. This section should be placed at the top of the document or in a dedicated space where it is easy to find. Here are the critical elements to include:

- Client Name: Full name or company name to ensure the document is personalized.

- Address: Business or billing address to clarify the location associated with the transaction.

- Contact Information: Include phone numbers, email addresses, or other communication channels for follow-up.

- Client ID or Reference Number: If applicable, include any unique identifiers for easy tracking and record-keeping.

Best Practices for Organizing Client Information

While it’s important to capture all relevant details, it’s equally important to present them in a clean and structured format. Consistency and clarity help avoid confusion and ensure that every document is professional and easy to read.

- Use clear labels: Clearly mark each section (e.g., “Client Name,” “Billing Address”) to separate the information.

- Maintain consistency: Use the same format for client information across all documents for easy comparison and tracking.

- Prioritize key details: Place the most important client information, like nam

Using Templates to Track Payments

Tracking payments efficiently is a critical aspect of managing any business. By utilizing pre-designed formats, you can easily record and monitor client payments, ensuring that nothing slips through the cracks. These tools allow you to stay organized, helping you quickly identify outstanding balances, due dates, and payment statuses. With the right structure, you can streamline your financial management process and maintain better control over your cash flow.

How Templates Help with Payment Tracking

Payment tracking formats typically include sections for recording transaction details, including payment amounts, due dates, and payment statuses. By using a consistent format for each transaction, you can keep an accurate record of payments received and those still pending, making it easier to follow up with clients when necessary.

Payment Due Date Amount Due Amount Paid Payment Status 15/11/2024 $500 $500 Paid 30/11/2024 $750 $0 Pending 05/12/2024 $300 $150 Partial Benefits of Payment Tracking Templates

Using a structured format helps avoid confusion and ensures that you stay on top of each payment. It allows for easy identification of overdue balances and simplifies follow-up with clients. Moreover, having an organized record helps with financial planning and can be beneficial during audits or tax season.

- Improved organization: Keep payment records in one place for easy access.

- Clear overview: Quickly identify which payments have been made and which are overdue.

- Efficient follow-up: Automate reminders for unpaid or overdue amounts.

How to Add Your Branding to Billing Documents

Incorporating your brand identity into financial documents is a key step in maintaining a professional image. By adding your logo, colors, and other branding elements, you ensure that every transaction reflects your business’s unique style. This not only helps with brand recognition but also builds trust and credibility with your clients. A well-branded document can leave a lasting impression and make your business stand out in a competitive market.

Key Elements of Branding

There are several components you can integrate into your billing documents to effectively showcase your branding. These elements should be strategically placed to ensure the document remains clear and professional while still reflecting your brand’s identity.

- Logo: Place your business logo at the top of the document, preferably in the header section, to ensure visibility.

- Brand Colors: Use your brand’s color palette for headings, borders, or background shading to create a cohesive look.

- Fonts: Apply your business’s standard fonts to headings or important sections to maintain consistency across all materials.

- Tagline or Slogan: If applicable, include your business’s tagline to further reinforce your brand’s messaging.

Best Practices for Consistent Branding

While it’s important to include branding elements, it’s also crucial to maintain a balance between aesthetics and functionality. Too much branding can clutter the document, making it difficult to read or detracting from important details.

- Keep it simple: Focus on key elements like your logo and brand colors, and avoid overloading the document with excessive design elements.

- Ensure legibility: Make sure text contrasts well with your brand colors to maintain readability, especially for essential information.

- Consistent design: Use the same branding style across all documents to create a unified appearance for your business communications.

Best Practices for Sending Billing Documents

Sending financial documents to clients in a professional and efficient manner is crucial for maintaining good business relationships and ensuring timely payments. Following best practices not only helps prevent delays but also demonstrates your commitment to professionalism. By adopting a clear and consistent approach, you can streamline the process, reduce errors, and improve cash flow.

Steps for Effective Document Delivery

When sending billing documents, it’s important to keep track of key details to ensure smooth processing. These details include sending timelines, communication methods, and following up on overdue payments. Below are some best practices to follow when sending financial documents.

Action Description Recommended Timeline Send Promptly Ensure the document is sent as soon as the service is provided or the goods are delivered to avoid delays. Immediately after completion of service or delivery. Use Clear Subject Lines When sending via email, use a clear subject line to ensure the recipient knows it’s a billing document. When first sending the document. Provide Payment Instructions Include clear and concise payment methods and instructions in the document. Every time you send a document. Set a Due Date Clearly state the due date for payment to help avoid confusion or delays. Always include a due date. Follow-Up on Overdue Payments Send reminders for overdue payments and provide options for resolving the matter quickly. 5-7 days after the due date if payment is not received. Key Considerations for Sending Documents

Beyond the basic actions, it’s important to consider how and when to send your financial documents. Choosing the right delivery method, following up regularly, and ensuring accuracy are all key factors in making sure your payments are processed without delay.

- Email vs. Physical Delivery: Decide on the best method based on client preferences or contract terms.

- Track Communication: Use email tracking tools or delivery confirmation to ensure your document was received.

- Clear Documentation: Double-check that all information is correct before sending to avoid delays caused by errors.

How to Protect Billing Data

Ensuring the security of financial data is critical for maintaining privacy and protecting both your business and clients from fraud or unauthorized access. With sensitive information such as payment details, client addresses, and transaction amounts being shared, it’s important to take steps to safeguard this data. Implementing security measures can prevent data breaches and keep your business operations smooth and trustworthy.

Best Practices for Data Protection

There are several actions you can take to ensure that the data shared in your financial documents remains safe and secure. These measures not only protect your business but also enhance your reputation with clients who value their privacy.

- Use Password Protection: Always password-protect your documents before sending them, especially if they contain sensitive client information.

- Secure File Sharing: Use encrypted platforms for sharing documents, such as secure email services or cloud storage solutions that offer end-to-end encryption.

- Limit Access: Restrict access to sensitive billing information to authorized personnel only. Ensure that only those who need the data have permission to view or modify it.

- Regularly Update Software: Keep all software, including email clients and accounting programs, up to date with the latest security patches to protect against vulnerabilities.

Advanced Data Protection Techniques

If you’re looking to implement a higher level of security for your financial documents, consider these advanced techniques:

- Two-Factor Authentication: Enable two-factor authentication (2FA) on accounts used to manage or access billing records. This adds an additional layer of security by requiring a second form of verification.

- Data Encryption: Encrypt all sensitive data both during transmission and while stored on your systems to prevent unauthorized access even in the event of a breach.

- Backup and Recovery: Regularly back up all important documents and set up secure recovery options in case of data loss or corruption.

By implementing these practices, you can protect sensitive client and business data, reduce the risk of fraud, and maintain the trust of your customers. Proper security measures are essential in the digital age, where the threat of data breaches is always present.