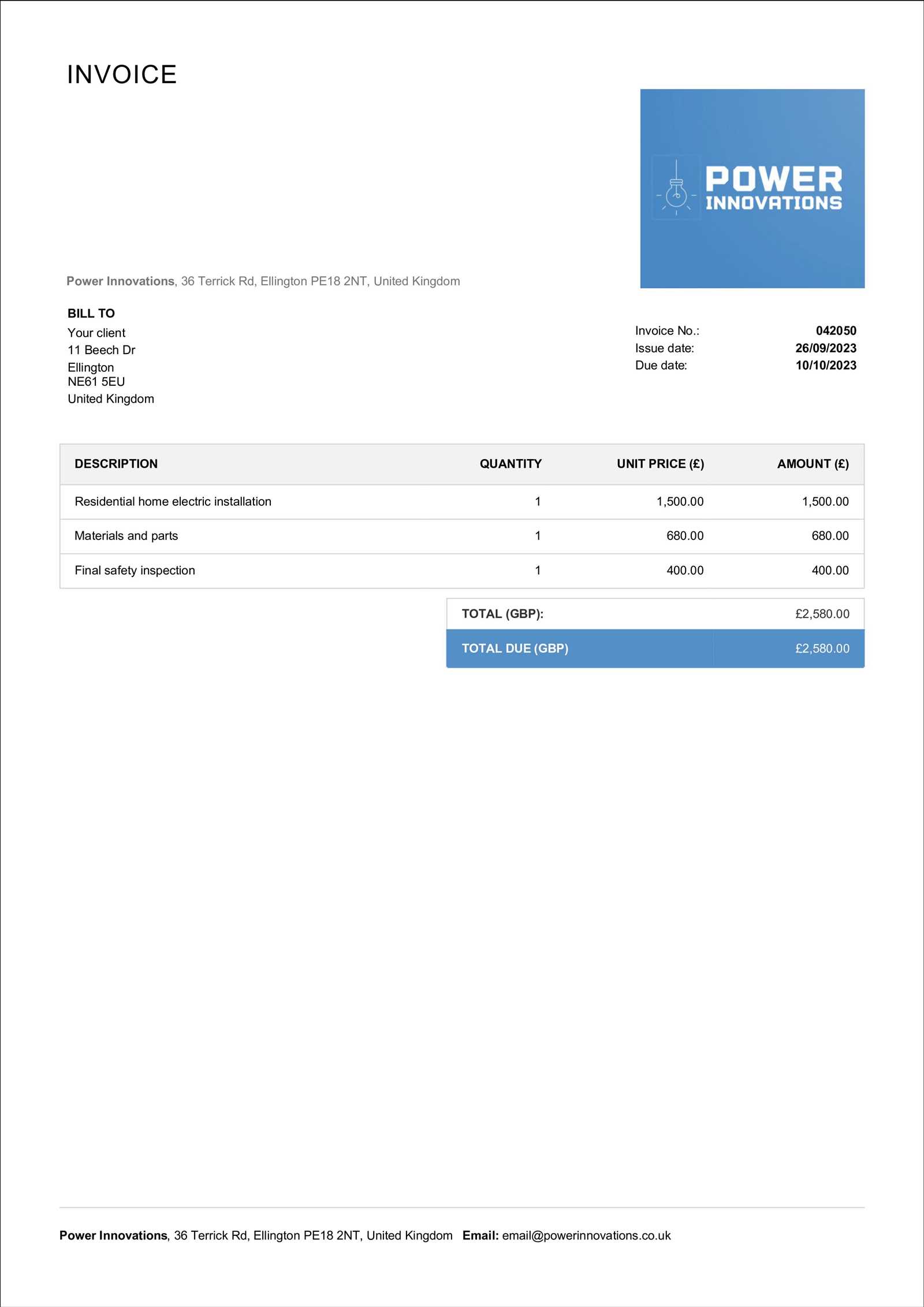

Electrical Service Invoice Template for Easy Billing and Professional Invoicing

When running a business, particularly in the trades, maintaining a clear and efficient system for requesting payments is crucial. Having a well-organized and easy-to-understand billing system not only improves cash flow but also enhances customer trust. A formal billing document ensures both parties are on the same page regarding the services provided and the amount due. This is especially important for businesses offering on-site work or personalized solutions, where accuracy and professionalism are essential.

A good billing document can be customized to fit the specific needs of the business, streamlining the process for both the provider and the client. By incorporating all necessary details–such as labor charges, materials used, and payment deadlines–it reduces the chances of confusion or disputes. Whether you’re managing a small team or operating independently, the right format can help you present your charges clearly and efficiently, saving time and improving your financial management.

Effective billing ensures that you get paid on time and builds credibility in the eyes of your clients. With the right tools and approach, creating these documents becomes a simple yet powerful part of your business operations.

Billing Document Overview

For any business that provides specialized work or on-site solutions, having a structured method for documenting payments is essential. A professional billing document serves as an official request for compensation, outlining the work completed, materials used, and the amount owed. It not only ensures clarity between the business and the client but also helps maintain smooth financial operations. This section covers the importance of a well-organized billing document and its core components.

Why a Professional Billing Document Matters

A clear, well-designed billing statement helps prevent misunderstandings between the provider and the customer. By including detailed descriptions of the tasks performed and the charges incurred, it sets expectations for both parties. It also serves as a legal record, which can be essential in case of disputes. The right document promotes professionalism and encourages timely payments, which is key for business sustainability.

Core Features of a Well-Structured Billing Document

The most effective documents include several important elements: client information, detailed descriptions of work done, costs for materials and labor, payment terms, and due dates. These elements ensure that the recipient fully understands the charges and the expectations for payment. In addition, clear payment instructions and options can improve the chances of receiving payment promptly. Customization is also important, allowing businesses to reflect their branding and provide a personal touch while maintaining professionalism.

Billing Document Overview

For any business that provides specialized work or on-site solutions, having a structured method for documenting payments is essential. A professional billing document serves as an official request for compensation, outlining the work completed, materials used, and the amount owed. It not only ensures clarity between the business and the client but also helps maintain smooth financial operations. This section covers the importance of a well-organized billing document and its core components.

Why a Professional Billing Document Matters

A clear, well-designed billing statement helps prevent misunderstandings between the provider and the customer. By including detailed descriptions of the tasks performed and the charges incurred, it sets expectations for both parties. It also serves as a legal record, which can be essential in case of disputes. The right document promotes professionalism and encourages timely payments, which is key for business sustainability.

Core Features of a Well-Structured Billing Document

The most effective documents include several important elements: client information, detailed descriptions of work done, costs for materials and labor, payment terms, and due dates. These elements ensure that the recipient fully understands the charges and the expectations for payment. In addition, clear payment instructions and options can improve the chances of receiving payment promptly. Customization is also important, allowing businesses to reflect their branding and provide a personal touch while maintaining professionalism.

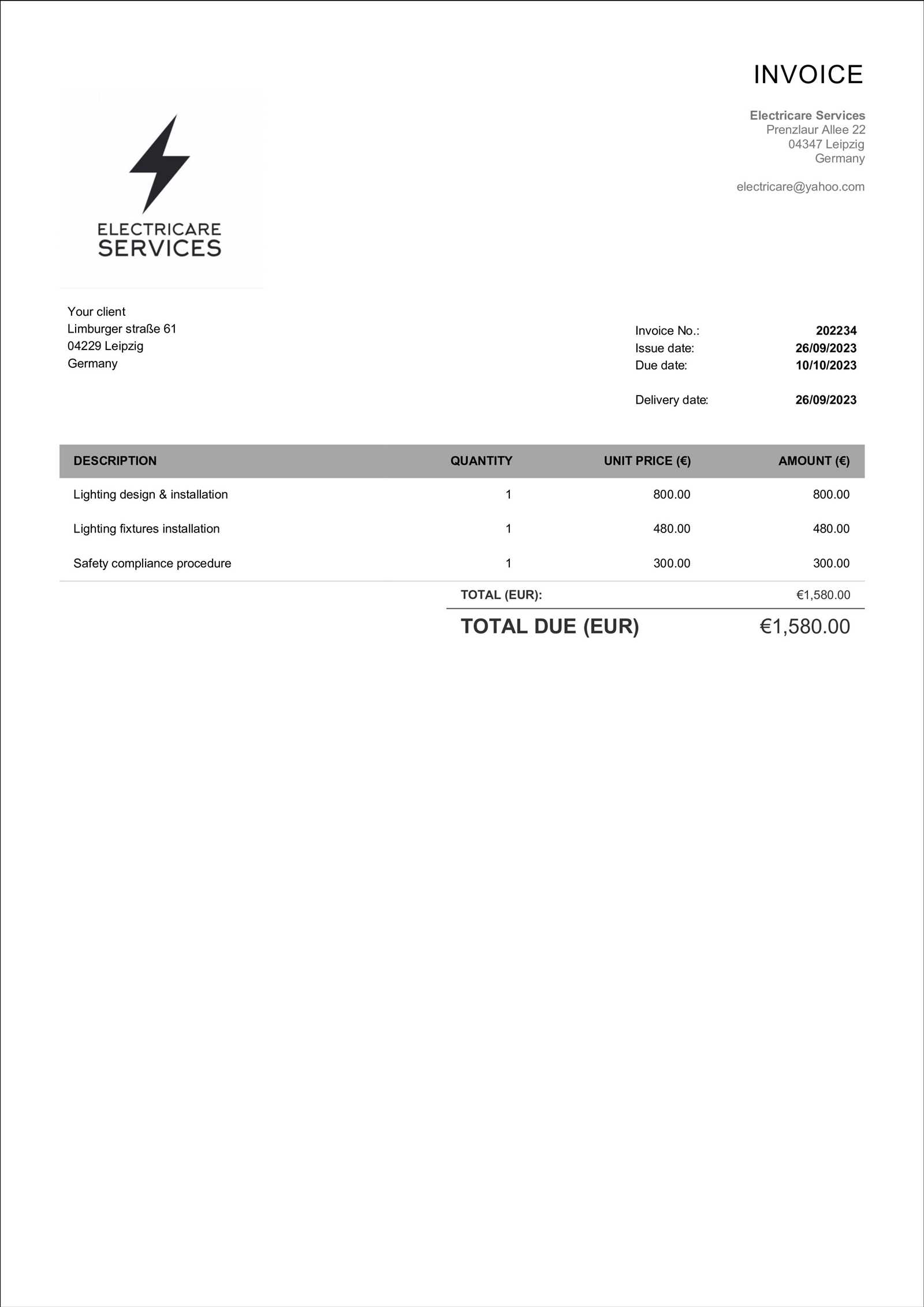

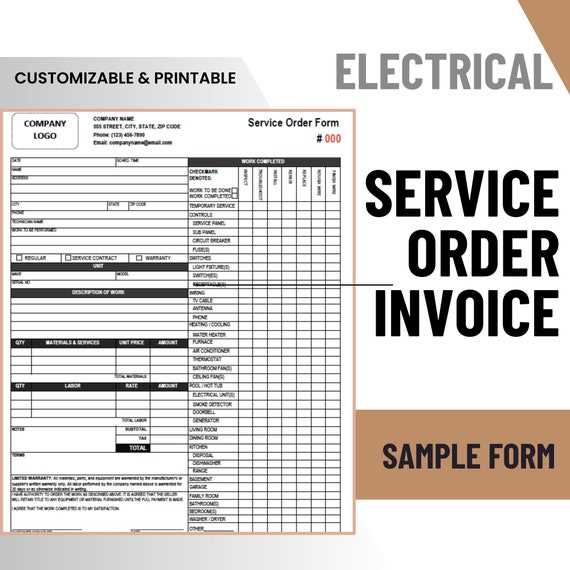

Key Elements of a Billing Document

To ensure clarity and prevent confusion, a well-organized billing document should include several essential components. These elements not only provide a comprehensive breakdown of the work completed and the amount due but also foster transparency between the provider and the client. In this section, we’ll explore the critical components that every professional billing document should include to be effective and easy to understand.

Essential Information for Accurate Billing

At a minimum, a billing document should contain the following key details: the client’s contact information, a description of the services or tasks provided, the charges for labor and materials, and the payment due date. These elements ensure that both the business and the client are aligned on the terms of the transaction. Including itemized descriptions of tasks helps avoid disputes, and specifying payment expectations promotes timely settlement.

Additional Features to Enhance Professionalism

In addition to the basic details, it’s beneficial to include payment terms such as late fees, preferred payment methods, and any other relevant conditions. Adding a unique reference number or invoice number helps keep records organized. Additionally, providing your business logo and contact details can help reinforce your brand’s professionalism and build client trust. A well-structured billing document reflects the quality of the work performed and encourages prompt payment.

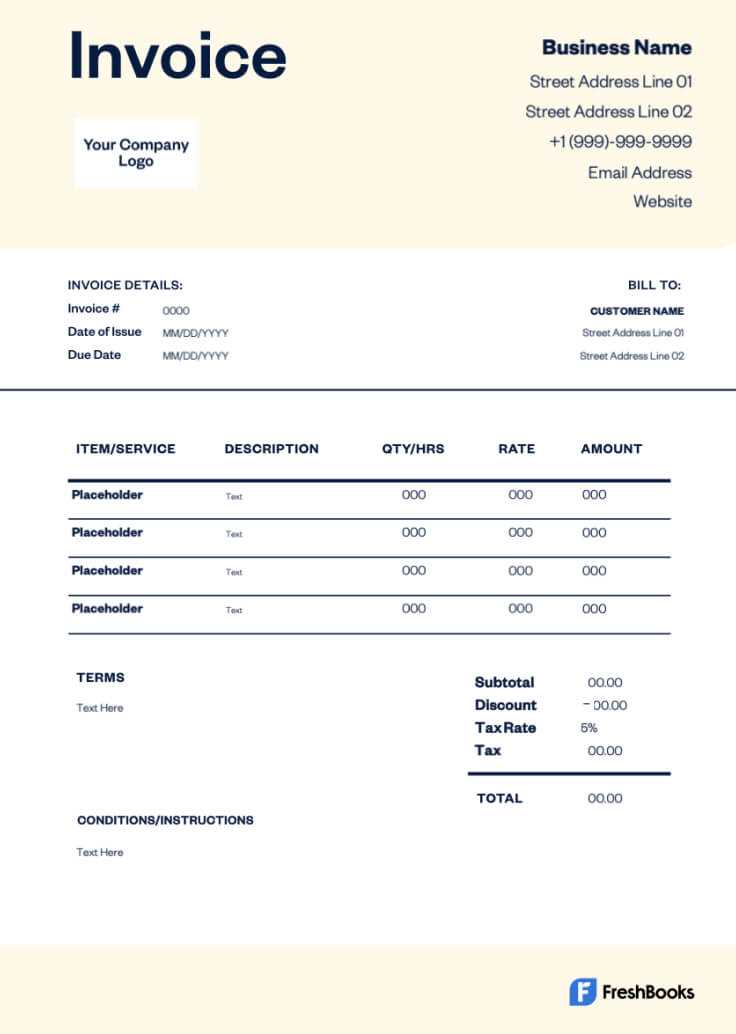

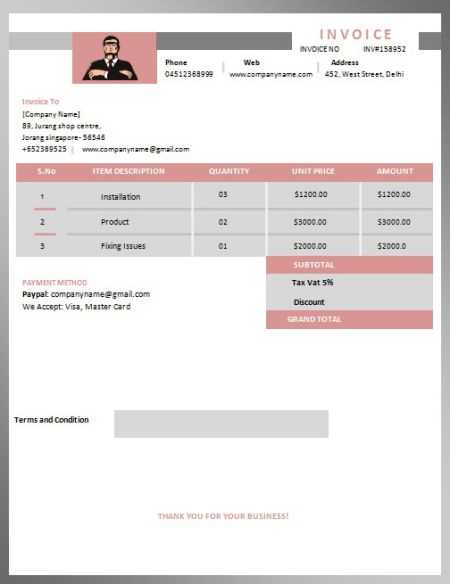

How to Customize Your Billing Document

Personalizing a billing document can make a significant difference in how professional and effective your communications with clients are. Customization allows you to tailor the document to your business needs while maintaining a consistent brand image. Whether you’re working with a simple design or using advanced software, there are several ways to adjust the format to better suit your business and client expectations.

Key Customization Options

To create a billing document that reflects your unique business, consider the following adjustments:

- Logo and Branding: Add your company’s logo and use your brand’s colors to make the document visually cohesive with your overall business image.

- Client Details: Customize the section that lists client information, ensuring it aligns with the specific data you collect, such as contact number or email.

- Payment Terms: Adjust the payment terms to reflect your business’s practices, such as the due date, accepted payment methods, or penalties for late payments.

- Work Descriptions: Customize how you describe the tasks performed. Make the descriptions as detailed as necessary to avoid ambiguity.

- Itemized Costs: Add specific line items for materials and labor. This breakdown helps clients understand exactly what they’re paying for.

Advanced Customization Tips

For a more tailored approach, you can also explore the following:

- Automated Calculations: Use software that allows automatic calculation of totals and taxes to reduce errors and save time.

- Unique Reference Numbers: Add invoice or job numbers for easier tracking and referencing of past transactions.

- Legal Information: Include any required legal disclaimers or business registration details for added credibility.

By adjusting these components, you can create a billing document that reflects your business’s professionalism and operational needs, making it more effective in securing timely payments from clients.

Benefits of Digital Invoice Templates

In today’s fast-paced business environment, managing financial documents efficiently is crucial. The adoption of electronic document formats provides numerous advantages over traditional paper-based methods. Whether it’s streamlining processes, ensuring accuracy, or improving communication, digital solutions offer a wide array of benefits to businesses of all sizes.

Improved Efficiency and Speed

One of the key advantages of using electronic formats for billing is the significant increase in operational efficiency. Businesses can create, edit, and send documents in a matter of minutes, eliminating the delays associated with manual paperwork. Additionally, automatic data input and pre-set fields ensure accuracy, reducing the time spent on correcting errors.

- Instant creation and delivery of documents

- Minimal time spent on revisions

- Reduction in errors due to automation

Cost-Effective and Environmentally Friendly

By switching to digital formats, companies can save on materials such as paper, ink, and postage. Furthermore, these electronic methods help reduce a business’s carbon footprint, promoting environmentally sustainable practices. The cost savings on physical resources, combined with the reduction in manual labor, make digital solutions highly economical.

- Lower operational costs

- Less reliance on physical materials

- Support for green initiatives

Adopting a digital approach not only simplifies tasks but also enhances accuracy and sustainability, offering long-term benefits for businesses looking to modernize their financial workflows.

Essential Information to Include on Invoices

To ensure smooth financial transactions and avoid misunderstandings, it’s crucial to include specific details in all business documents related to payments. These key elements not only help in maintaining transparency but also contribute to a professional appearance and streamline the payment process for both parties involved.

Key Contact and Business Information

It’s essential to clearly display the contact details of both the sender and the recipient. This includes the full name, business name, address, and phone number. Additionally, providing an email address for further communication can facilitate quicker resolution of any queries.

- Business Name and logo

- Sender’s and recipient’s contact information

- Payment due date

Clear Breakdown of Charges

Clearly outlining all items or services provided, including quantity, rate, and total cost, ensures there is no confusion. Each charge should be detailed so the recipient understands exactly what they are paying for. Using itemized lists for every product or task makes this section easier to read and comprehend.

- Description of goods or tasks

- Quantity and unit cost

- Taxes or additional fees

By including these necessary details, you not only create a more efficient transaction process but also help build trust with your clients, ensuring that all parties are on the same page regarding payment terms and expectations.

Common Mistakes in Electrical Invoices

While preparing financial documents for clients, it’s easy to overlook certain details that can lead to confusion or delays in payment. Small errors in these documents can cause misunderstandings, affect cash flow, and harm professional relationships. Identifying and avoiding these mistakes is crucial to ensure a smooth billing process.

Incorrect or Missing Contact Information

One of the most common issues is failing to include complete and accurate contact details. Missing phone numbers, email addresses, or incorrect business information can delay communication and complicate the payment process.

- Omitting client’s details or using outdated contact information

- Incorrect business name or address

- Failure to include a clear payment contact for inquiries

Lack of Itemization or Detail

Another frequent mistake is not providing enough details about the work performed. Failing to break down the costs and outline the specific tasks or materials involved can leave clients confused and reluctant to pay promptly.

- Not providing clear descriptions of each task or product

- Missing quantities or unit prices

- Not listing any additional charges such as taxes or fees

Incorrect Calculation of Amounts

Errors in calculations can quickly lead to disputes. Simple mistakes such as miscalculating totals, taxes, or discounts are often overlooked, but they can create unnecessary complications.

- Wrong tax rates applied

- Incorrect totals or addition mistakes

- Failure to apply discounts or promotions correctly

By being mindful of these common mistakes, businesses can ensure that they maintain professionalism and foster trust with clients, helping to ensure that payments are processed on time and without unnecessary issues.

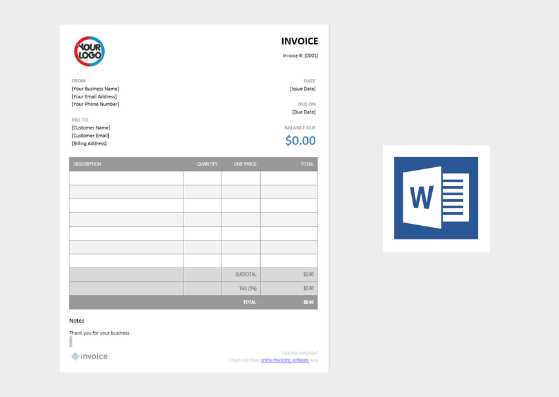

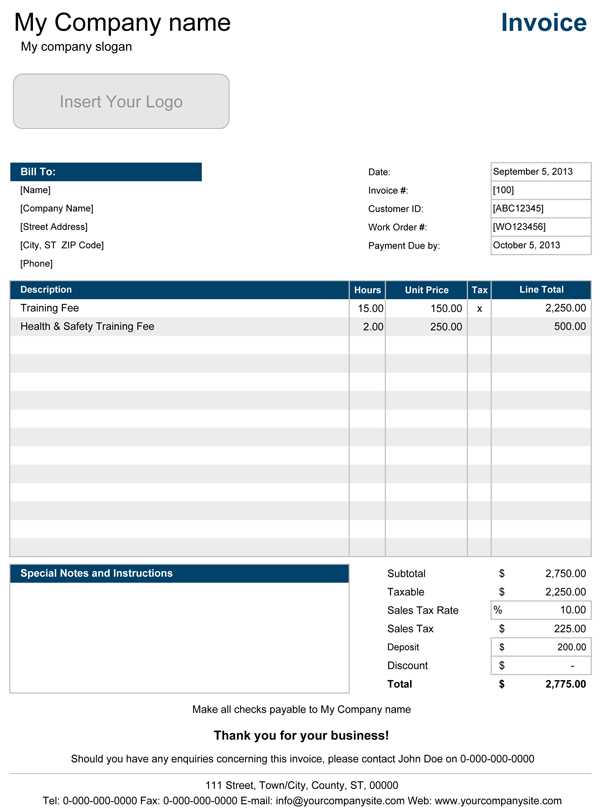

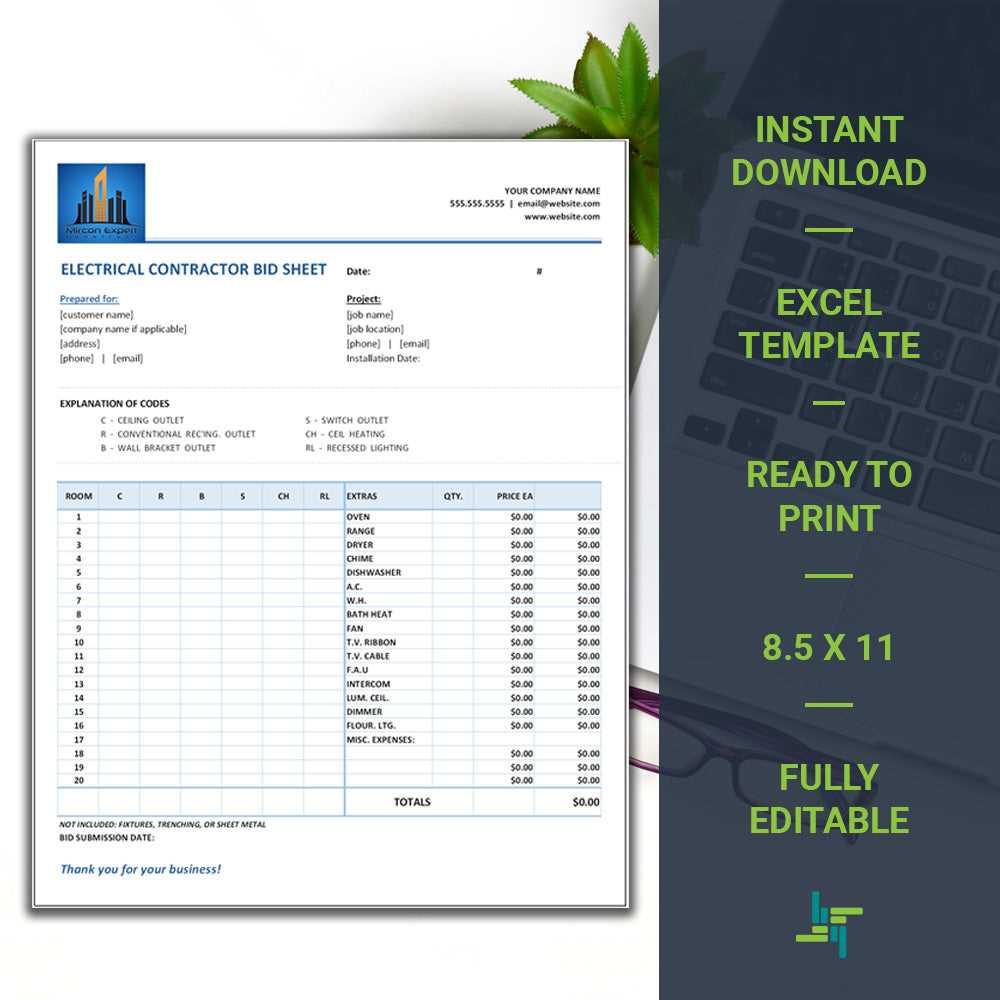

How to Choose the Right Template

Selecting the appropriate format for your financial documents is a critical step in ensuring smooth transactions and maintaining a professional image. The right layout can enhance clarity, reduce errors, and streamline the overall process. It is important to consider several factors when choosing the best structure to suit your business needs.

Consider Your Business Needs

Before choosing a format, it’s essential to assess the specific requirements of your business. Different industries or types of transactions may require certain features or details. Tailoring the structure to match the way you work will help make the document more effective and user-friendly.

- Does your business require itemized lists or general summaries?

- Are payment terms or due dates a priority for clients?

- Do you need space for additional notes or custom messages?

Look for Customizability and Flexibility

The best layout should offer flexibility, allowing you to easily adjust fields, add custom elements, or update sections as needed. Whether you’re including additional charges, discounts, or special terms, the format should allow you to modify it without hassle.

- Ensure the structure allows for easy updates and edits

- Look for pre-designed sections that can be easily customized

- Consider a layout that fits your business’s branding (logos, color schemes, etc.)

Check for Compatibility and Integration

Consider whether the structure works well with your existing tools. Compatibility with accounting software or payment platforms can streamline your workflow, making it easier to generate and send documents automatically.

- Ensure compatibility with accounting systems or payment processors

- Choose a format that is easily exportable to various file types (PDF, Excel, etc.)

- Look for options that allow for cloud-based storage or easy sharing

By taking into account your business’s unique requirements, ensuring ease of customization, and checking for system compatibility, you can select a layout that simplifies your billing process and promotes professional interactions with clients.

Steps for Creating an Invoice from Scratch

Creating a payment document from scratch can seem like a daunting task, but by following a clear, step-by-step approach, you can ensure that all necessary details are included and formatted properly. This process helps avoid confusion, ensures accuracy, and enhances professionalism, making transactions smoother for both you and your clients.

Step 1: Add Your Business Information

Begin by including all relevant information about your company. This includes your business name, address, phone number, and email. If applicable, also include your business registration number or tax ID. This ensures the client can easily contact you and identify your business.

- Business Name and logo

- Address and contact information

- Tax Identification Number (if required)

Step 2: Include Client’s Information

Next, make sure to clearly list the client’s details. This helps to personalize the document and avoid any confusion, especially if you are dealing with multiple clients or projects. The more specific you are with the recipient’s details, the less chance there will be of errors.

- Client’s Name

- Client’s Address

- Contact Information (phone number or email)

Step 3: List the Products or Work Completed

Provide a detailed breakdown of the goods delivered or tasks completed. Be as specific as possible, including quantities, unit costs, and a brief description of each item or task. This ensures the client understands what they are being charged for.

- Item Description or task performed

- Quantity and unit cost

- Total amount for each item or task

Step 4: Specify Payment Terms

Clearly state the payment terms to avoid confusion later. Include the due date for payment, any late fees, and acceptable methods of payment (such as bank transfer, credit card, or online payment). This helps set expectations and ensures timely processing of payments.

- Payment Due Date

- Late Fees (if applicable)

- Accepted Payment Methods

Step 5: Calculate the Total Amount Due

Ensure that all calculations are accurate. Add up all individual amounts, apply any discounts, add applicable taxes, and provide the total amount due. Double-check these numbers to avoid errors that could cause issues later.

- Subtotal (before taxes

How to Handle Multiple Services on One Invoice

When dealing with a variety of tasks or products in a single transaction, it’s important to clearly distinguish between each item to avoid confusion and ensure transparency. Properly listing multiple charges ensures the client understands what they are being billed for, while also making it easier to track different elements of the overall cost.

Step 1: Break Down the Items or Tasks

Start by listing each individual task or product separately. Be as specific as possible, including a brief description of each task or item, along with quantities and rates. This not only provides clarity for the client but also allows you to track what was provided more effectively.

- Clear Descriptions of each task or item

- Quantity or number of units

- Unit Price for each item or task

Step 2: Group Similar Items Together

If multiple items are related, consider grouping them together under a common heading. This can help the client quickly identify the nature of the work and see how related items contribute to the total cost.

- Group similar items or tasks for clarity

- Label each group with a clear title (e.g., “Materials,” “Labor,” “Equipment”)

- Include subtotals for each group

Step 3: Apply Discounts or Special Rates When Needed

If you’re offering any discounts, promotional rates, or bundled pricing, be sure to clearly indicate this for each relevant group or item. Clearly stating the reduction applied helps ensure the client understands how the final amount was determined.

- Specify discounts applied to particular tasks or products

- Include promotional offers where applicable

- List final pricing after discounts

Step 4: Total All Amounts Separately and Clearly

After breaking down the individual components, make sure to calculate the total for each section (if applicable), then provide a final overall amount. This step ensures the client can easily see how each task or product contributes to the final price.

- Subtotal for each item or task

- Apply applicable taxes or additional fees

- Final total with all charges and discounts included

By following these steps, you create a transparent and organized document that allows your clients to clearly understand the breakdown of costs. Handling multiple tasks or products in this manner reduces the chance of errors and promotes trust, ensuring smoother transactions and stronger business relationships.

Invoice Format: Best Practices for Clarity

Ensuring clarity in your financial documents is key to avoiding misunderstandings and promoting a smooth payment process. A well-organized layout helps clients easily understand the details of the transaction, from the breakdown of charges to payment terms. Implementing best practices in formatting can make the document more readable and professional, fostering better communication and timely payments.

1. Use a Clean, Structured Layout

A clear and logical structure is crucial for making the document easy to navigate. Avoid clutter and use enough white space to separate different sections. Group similar information together and use headers to make each part easily identifiable.

- Header section: Include your business and client details at the top.

- Itemization: List each task or product separately with clear descriptions.

- Footer: Provide payment details, due dates, and contact information at the bottom.

2. Consistent Formatting and Fonts

Consistency in fonts, font sizes, and styles makes the document look polished and professional. Stick to one or two simple fonts for the body text and headings, and avoid overly decorative styles that can distract from the key information.

- Use one font family throughout the document for a cohesive look.

- Bold or highlight section titles to differentiate them from the body text.

- Ensure font size is legible and uniform for easy reading.

3. Highlight Key Information

Important details, such as due dates, payment terms, and the total amount due, should be easy to spot. Use bold text or larger font sizes to emphasize these sections, making sure the client can quickly find the information they need.

- Highlight the due date and payment terms to avoid confusion.

- Bold the total amount due so it stands out at a glance.

- Use separators like lines or boxes to distinguish important sections.

4. Provide a Detailed Breakdown

Providing a detailed breakdown of charges not only ensures transparency but also helps prevent disputes. Be specific with descriptions, quantities, rates, and any applicable taxes or discounts.

- Itemize each charge with a brief but clear description.

- List quantities and unit prices for each item or task.

- Include taxes and fees separately so clients can easily identify them.

5. Ensure Easy Navigation with Clear Sections

Organize the document into clear sections that make it easy for the reader to find relevant information. Use headers to distinguis

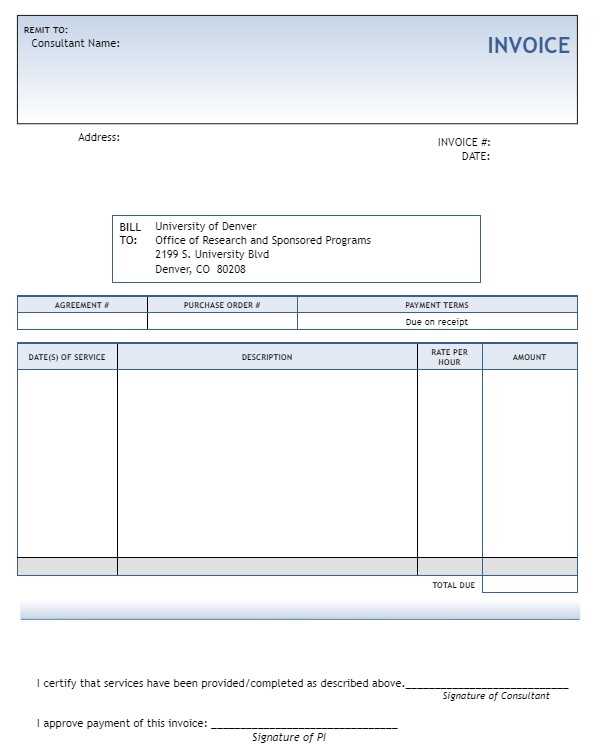

How to Add Payment Terms to Your Invoice

Clearly stating payment terms is essential for maintaining transparency and ensuring timely payment. This section outlines when and how payments should be made, along with any additional conditions such as late fees or discounts for early payment. Including precise payment terms can help avoid confusion and set clear expectations between you and your client.

1. Specify the Payment Due Date

It’s important to clearly state the date by which the payment is expected. This helps your client understand when the payment should be made and reduces the risk of delays. Be specific and unambiguous about the due date.

Description Example Due Date Payment is due within 30 days from the date of the document. Alternative phrasing Payment must be received by [MM/DD/YYYY]. 2. Define Accepted Payment Methods

Be clear about which payment methods you accept to avoid any confusion. Common options include bank transfers, credit cards, checks, and online payment systems. Specify any details necessary for the client to make the payment, such as bank account information or links to online payment platforms.

Payment Method Details Bank Transfer Bank account details: [Account Number], [Sort Code], [Bank Name] Credit Card Accepted cards: Visa, MasterCard, American Express Online Payment Pay via PayPal: [PayPal Email] 3. Include Late Payment Fees or Discounts

Specify the consequences of late payments and any early payment discounts you may offer. This encourages timely payments and can be an incentive for clients to settle their balances sooner. Clearly mention the percentage or amount added as a late fee and the discount provided for early settlement.

Condition Details Late Payment Fee A fee of 5% will be added to the total amount for every 15 days past the due date. Early Payment Discount A 10% discount will be applied if payment is made within 7 days of the issue date. 4. Set Clear Terms for Installments or Partial Payments

Tracking Payments Using Invoice Templates

Keeping track of payments is an essential part of managing business finances. Using a well-structured document allows you to monitor whether payments have been made, identify outstanding amounts, and maintain accurate records. This process helps you stay organized and ensures that no payment is overlooked.

1. Include Payment Status on Each Document

One of the simplest ways to track payments is by adding a payment status field to your document. This allows you to easily see if the payment is pending, partially paid, or completed. Keeping this information updated helps you quickly assess the status of each transaction.

Description Example Status Pending Partial Payment 50% paid, remaining balance: $[Amount] Paid Payment completed: $[Amount], paid on [MM/DD/YYYY] 2. Track Payment Dates and Amounts

Another effective method is to record payment dates and amounts directly on the document. This not only helps with financial planning but also provides a detailed history of each transaction, making it easier to follow up if payments are delayed.

Payment Date Amount Paid Remaining Balance [MM/DD/YYYY] $[Amount] $[Remaining Amount] [MM/DD/YYYY] $[Amount] $[Remaining Amount] By incorporating these tracking methods into your documents, you can streamline your payment monitoring process, reduce the risk of missed payments, and maintain clearer financial records for your business.

Using Invoices for Professional Branding

Incorporating branding elements into billing documents can significantly enhance a company’s professional image. This practice not only helps in establishing a cohesive brand identity but also leaves a lasting impression on clients. Effective use of design, color schemes, and logos can transform ordinary financial documents into powerful marketing tools.

Key Elements of Branded Billing Documents

To effectively utilize billing documents for branding, it’s essential to focus on certain key elements. These include the consistent use of company colors, logos, and fonts. Additionally, incorporating a professional layout that aligns with the overall brand aesthetic can reinforce the company’s image.

Element Description Company Logo Incorporate the company’s logo at the top for instant recognition. Color Scheme Use brand colors to create a cohesive and professional look. Typography Select fonts that match the company’s branding guidelines. Layout Ensure the document layout is clean and professional, reflecting the company’s style. Benefits of Branded Billing Documents

Using branded billing documents offers several advantages. It enhances brand visibility and professiona

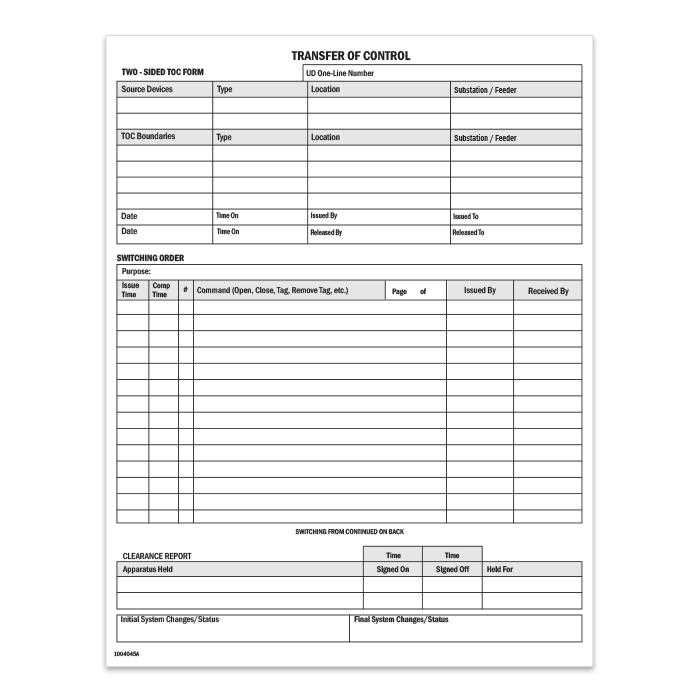

Legal Requirements for Electrical Service Invoices

Compliance with legal standards is crucial when issuing billing documents for professional services. Ensuring that all mandatory details are included not only helps in maintaining transparency but also protects both the provider and the client from potential disputes. Adhering to these requirements is essential for legal and financial accountability.

Mandatory Information

Billing documents must contain specific details to meet legal criteria. This includes the full name and address of both the service provider and the client. Additionally, a unique reference number should be assigned to each document for identification and tracking purposes.

Service Description and Rates

Each document must provide a clear and detailed description of the services rendered, along with the corresponding rates. It is essential to itemize the tasks performed to avoid any ambiguity. The total amount due, including any applicable taxes, should be clearly stated.

Payment Terms and Conditions

Outlining the terms of payment is another critical aspect. This includes the due date, accepted payment methods, and any late fee policies. Providing this information helps in setting clear expectations and ensures timely payments.

Below is a summary table

Integrating Invoice Templates with Accounting Software

Integrating billing documents with financial management systems streamlines the accounting process, ensuring accuracy and efficiency. This integration helps in automating data entry, reducing errors, and providing real-time updates, which are crucial for maintaining accurate financial records. Proper integration can save time and resources, allowing businesses to focus on core activities.

Benefits of Integration

Connecting billing documents with accounting systems offers several advantages. It ensures that all financial transactions are automatically recorded, reducing the need for manual data entry. This leads to fewer mistakes and greater consistency in financial reporting. Additionally, it facilitates quicker reconciliation of accounts, helping businesses stay on top of their finances.

Steps for Successful Integration

To effectively integrate billing templates with accounting software, businesses should follow a few key steps. First, choose a compatible financial management system that supports integration. Next, customize the billing documents to match the format required by the software. Finally, regularly update and synchronize the data to ensure all financial information is current and accurate.

Improving Efficiency with Automated Invoices

Implementing automated billing solutions can significantly enhance business operations by streamlining the invoicing process. Automation reduces manual tasks, minimizes errors, and accelerates the overall workflow. This shift allows businesses to allocate resources more effectively and focus on growth and client satisfaction.

Advantages of Automation

Automated billing systems offer numerous benefits, including increased accuracy and speed. By eliminating manual data entry, the risk of human error is greatly reduced. Automation ensures that bills are generated and sent out promptly, leading to quicker payments and improved cash flow. Moreover, automated systems can handle large volumes of transactions effortlessly, making them ideal for growing businesses.

Implementing Automated Solutions

To successfully implement automated billing, businesses should follow a structured approach. First, select a reliable software solution that meets the company’s needs. Next, integrate the system with existing accounting and customer relationship management (CRM) tools to ensure seamless data flow. Finally, train staff to use the new system effectively, ensuring they understand its features and benefits.

Key Features to Consider

When choosin