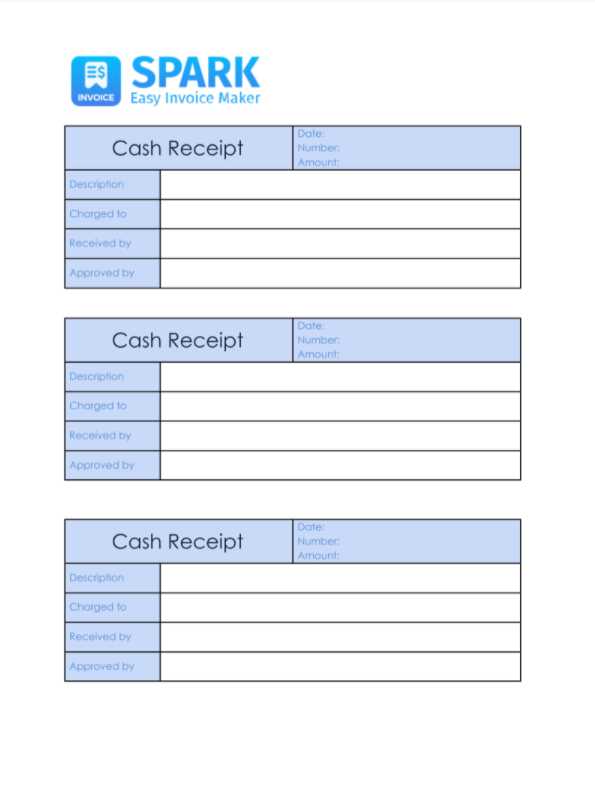

Cash Payment Invoice Template for Quick and Accurate Billing

For any business, clear and accurate financial documentation is crucial for maintaining smooth operations. One of the essential tasks in business transactions is providing clients with proper receipts for their purchases. A well-structured receipt form ensures both the seller and the buyer are on the same page, preventing confusion and aiding in record-keeping.

When it comes to creating such documents, having a reliable and easy-to-use format can make all the difference. The right structure not only helps in presenting clear terms but also improves the speed and efficiency of the overall process. By using a standardized approach, businesses can save time, avoid errors, and ensure a professional appearance for every transaction.

Whether you’re a freelancer, small business owner, or part of a larger enterprise, implementing a clear and organized method for documenting exchanges can streamline financial management. This guide will help you understand how to craft a document that suits your needs and simplifies your workflow.

Why Use a Document for Recording Financial Transactions

Using a structured document for tracking financial exchanges is essential for maintaining clarity and organization. It allows businesses to efficiently record each transaction while providing a transparent record for both parties involved. This method ensures that no details are overlooked and helps in minimizing errors during the process.

Streamlined Process for Quick Transactions

With a pre-designed format, businesses can quickly generate accurate records without having to start from scratch every time. This speeds up the billing process, especially in high-volume transactions, allowing for faster exchanges and improved customer satisfaction.

Professionalism and Consistency

Using a standardized method adds a level of professionalism to your business dealings. It reflects attention to detail and enhances the credibility of your brand. A consistent approach also reduces the likelihood of confusion, ensuring that each transaction is documented in the same way.

Benefits of Customizable Document Formats

Customizable formats provide businesses with the flexibility to adapt records to their specific needs. Tailoring each document ensures that it aligns with the unique requirements of a business, such as including specific details, adjusting the layout, or adding branding elements. This level of personalization not only enhances clarity but also ensures that all essential information is included for every transaction.

One of the key advantages of a customizable format is the ability to quickly adapt to changing business environments. Whether you need to adjust for different regions, clients, or regulatory requirements, a flexible system allows for easy modifications, saving time and reducing errors.

| Benefit | Description |

|---|---|

| Branding Opportunities | Customizable formats allow businesses to incorporate their logo, colors, and specific design elements, creating a cohesive brand identity. |

| Flexibility | Adapting the document structure based on individual business needs ensures that all necessary information is clearly presented. |

| Efficiency | A tailored approach speeds up the documentation process, reducing the time spent on creating and adjusting records. |

How to Create a Financial Transaction Record

Creating a clear and concise document for tracking financial exchanges is crucial for both businesses and clients. The process involves including the right information to ensure that all aspects of the transaction are properly recorded. By following a systematic approach, you can ensure accuracy and efficiency in each entry.

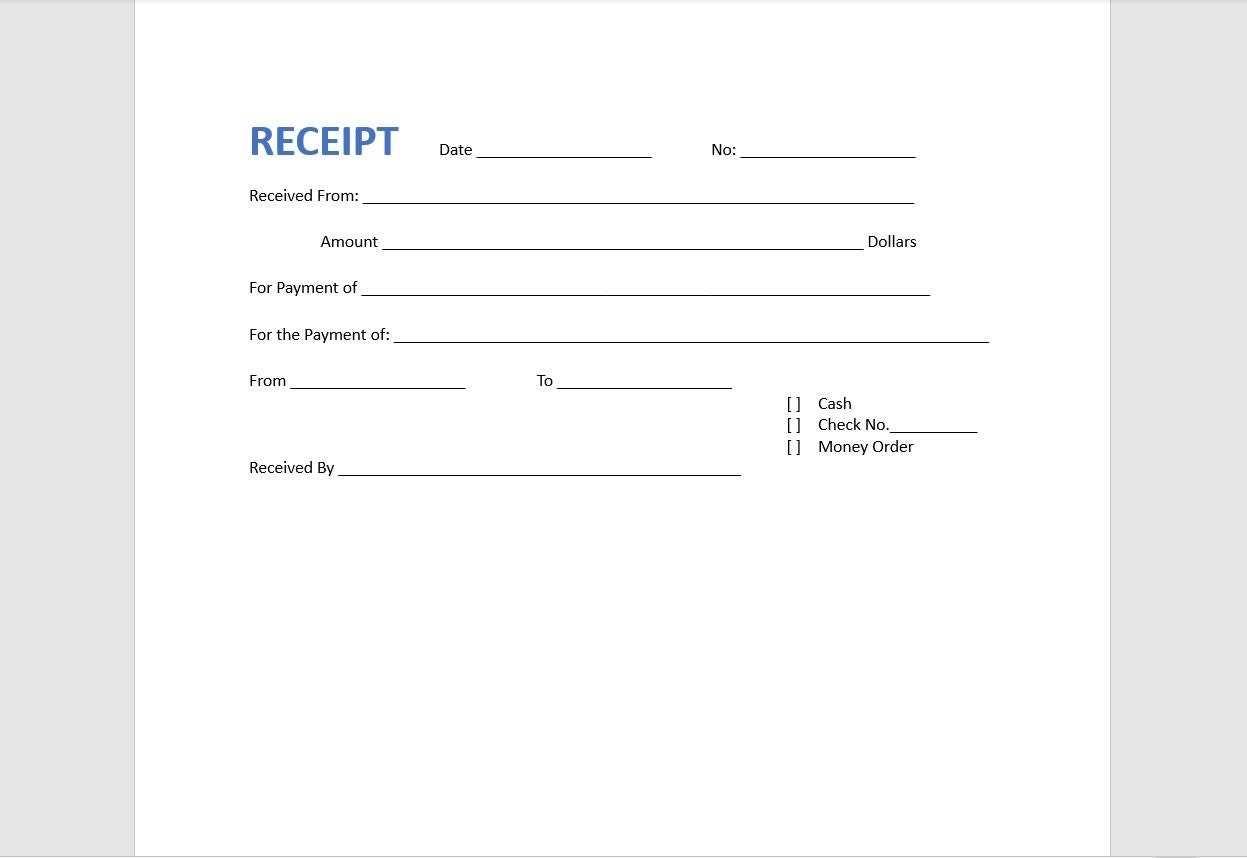

Step-by-Step Guide

To create an effective document, follow these simple steps:

- Gather Information: Ensure you have all necessary details such as the names of the buyer and seller, transaction date, and the amount exchanged.

- Choose a Format: Select a layout that is easy to read and captures all relevant information, such as item descriptions or services provided.

- Include Key Elements: Incorporate essential sections like transaction number, terms of agreement, and contact information.

- Review and Save: Double-check all details for accuracy before saving or sending the document to the client.

Optional Customizations

You can further personalize your document by adding specific details, such as:

- Company logo or branding elements

- Payment method options

- Additional notes or terms of service

These customizations can help make your documentation more professional and tailored to your business needs.

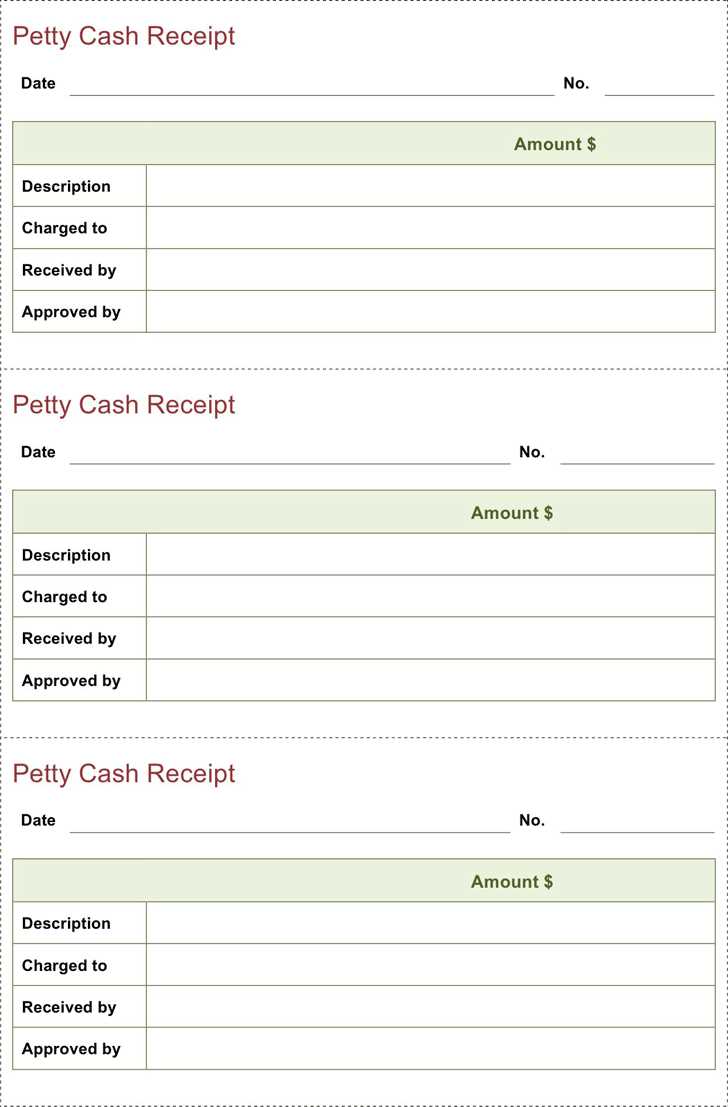

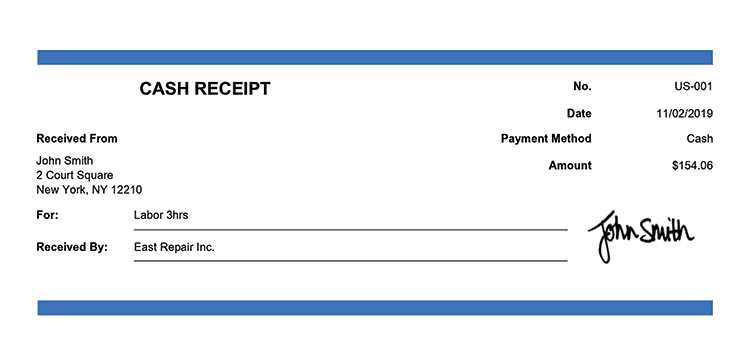

Essential Elements of a Financial Transaction Record

When creating a document to track a financial exchange, it is important to include specific information that ensures clarity and avoids misunderstandings. A well-structured record helps both parties confirm the terms and details of the transaction, minimizing the risk of errors and providing a useful reference for future transactions.

Here are the key components to include in such a record:

- Transaction Date: Clearly indicate when the transaction took place to provide a timeline of events.

- Unique Reference Number: Assign a specific number or code to each record for easy identification and tracking.

- Buyer and Seller Details: Include the full names and contact information of both parties involved.

- Item or Service Description: Provide a detailed list of products or services exchanged, including quantities and unit prices if applicable.

- Amount Transferred: Specify the exact amount of money involved in the exchange, along with any applicable taxes or additional fees.

- Terms of Agreement: Mention any relevant conditions or agreements, such as delivery schedules or warranties.

- Payment Method: Clearly state how the transaction was completed (e.g., cash, bank transfer, check).

- Signature: A space for signatures from both parties to confirm the accuracy of the record.

Including these essential elements ensures that your documentation is comprehensive, accurate, and legally sound, providing a clear record for both the seller and the buyer.

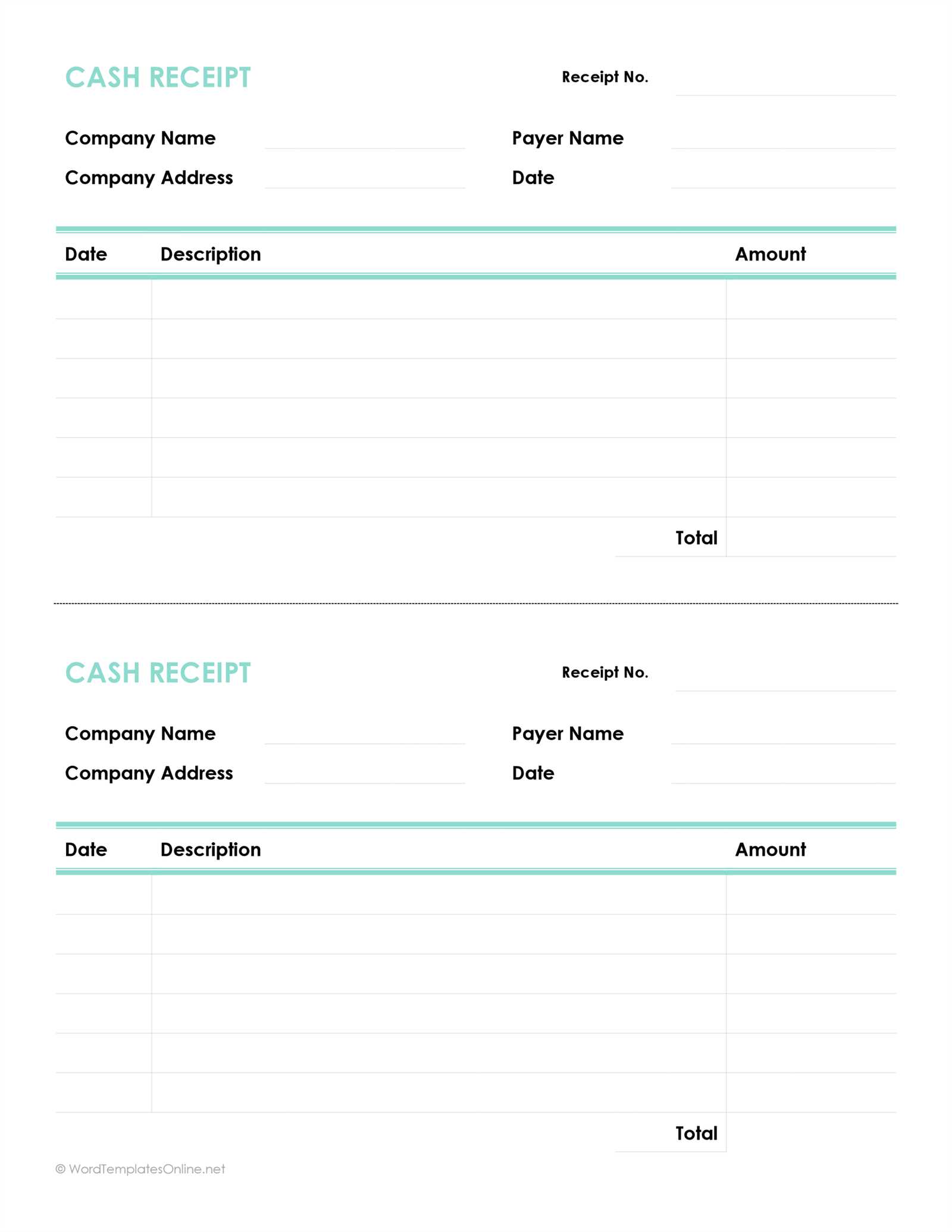

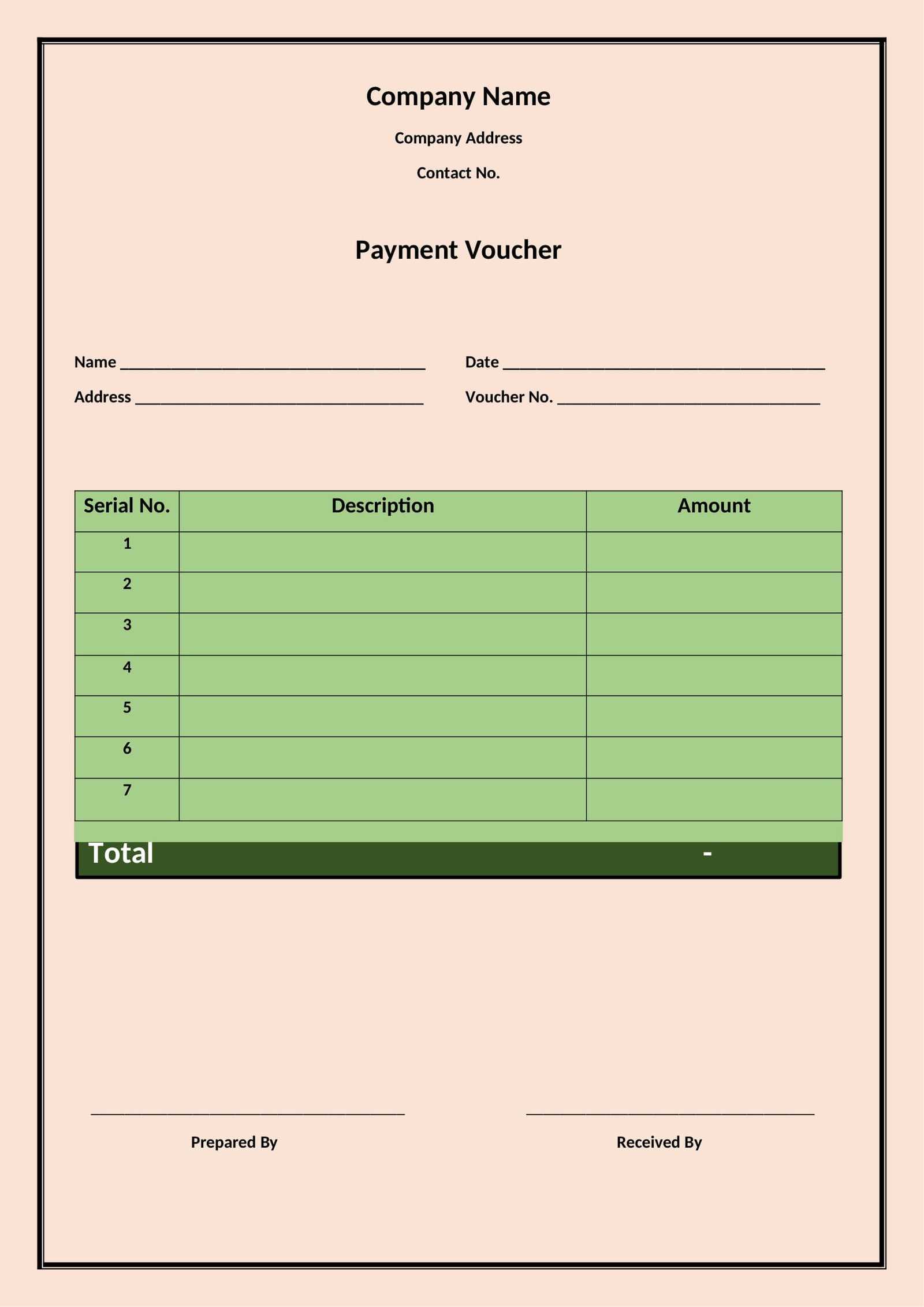

Designing a Simple Financial Transaction Record

Creating an easy-to-read and professional-looking document for tracking transactions can be simple and efficient. The key to designing an effective record is to ensure that it clearly displays the most important details while maintaining a clean and organized layout. A minimalist design with the right structure can make the document both functional and visually appealing.

Key Design Elements

When designing a basic record, consider the following aspects:

- Clear Title: Start with a simple heading that indicates the nature of the document, such as “Transaction Record” or “Receipt of Exchange.”

- Easy-to-Read Fonts: Use legible fonts with a professional appearance. Avoid cluttering the document with too many font styles.

- Logical Layout: Arrange the key information in a structured format, such as a table or bullet points, for clarity.

- Space for Signatures: Leave space for signatures to confirm the accuracy of the details provided.

Essential Information to Include

Ensure the document contains all necessary details while keeping it simple:

- Transaction date and reference number

- Parties involved and contact details

- Description of exchanged goods or services

- Total amount and payment method

By following these guidelines, you can design a functional yet straightforward document that serves its purpose without unnecessary complexity.

Common Mistakes to Avoid in Transaction Documentation

When creating a document to record financial exchanges, it’s important to avoid common errors that can lead to confusion, delays, or disputes. Small mistakes can have a significant impact on both the business and the client, so it’s essential to be thorough and precise when documenting transactions.

Here are some of the most frequent mistakes to avoid:

- Missing Essential Information: Failing to include key details like the transaction date, buyer and seller information, or the amount exchanged can lead to complications down the line.

- Incorrect or Incomplete Descriptions: Inaccurately describing the goods or services provided can cause misunderstandings. Always ensure the descriptions are clear and complete.

- Omitting Terms and Conditions: Not including payment terms, delivery details, or warranty information can lead to confusion or legal issues in the future.

- Errors in Amounts: Simple arithmetic mistakes, such as miscalculating totals or taxes, can create discrepancies between what was agreed upon and what is being charged.

- Failure to Number Documents: Not assigning a unique reference number to each record can make it difficult to track and manage multiple transactions.

- Not Including Contact Information: Always include the contact information of both parties involved in case there are any issues or questions after the transaction.

By avoiding these common mistakes, you can ensure that your documentation is accurate, clear, and professional, minimizing potential issues and making the process smoother for everyone involved.

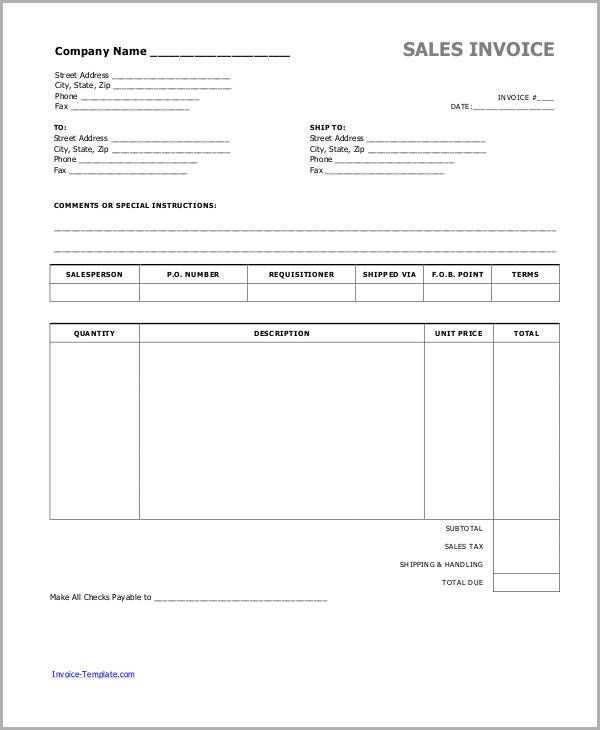

Choosing the Right Document for Your Needs

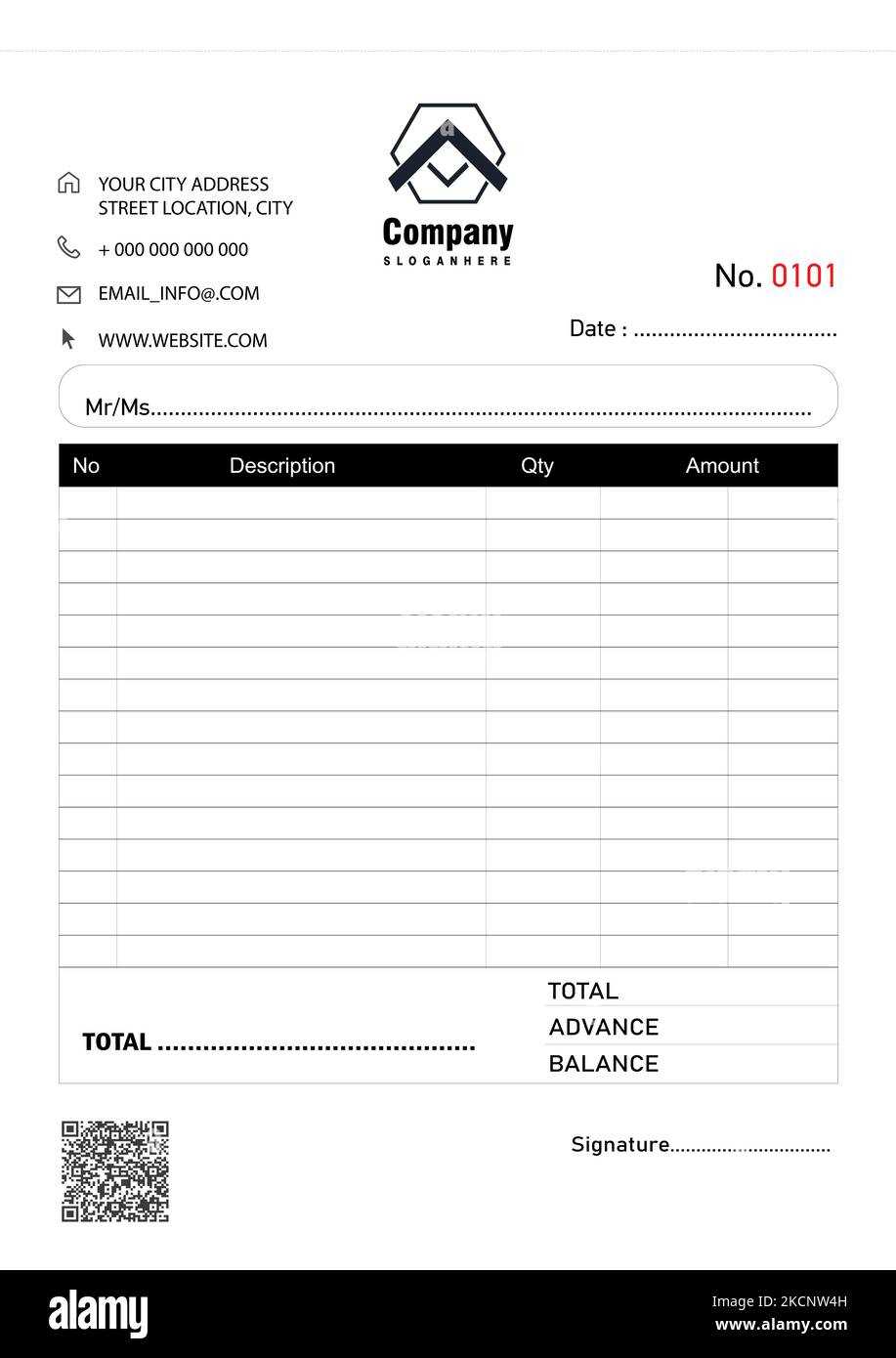

Selecting the appropriate format to track financial transactions is an essential task for ensuring smooth and accurate record-keeping. Whether you’re managing personal exchanges or running a business, the right choice can make the process more efficient and professional. By understanding your specific needs, you can select a format that best suits your situation.

Factors to Consider

When choosing a suitable format, keep the following factors in mind:

- Business Type: Different industries may have unique requirements, such as additional legal terms, taxes, or item specifications.

- Complexity of Transactions: Simple transactions may require a straightforward document, while more complex exchanges may need detailed descriptions and multiple sections.

- Customization Options: Choose a format that allows you to personalize the layout, add your branding, and include any necessary details specific to your business.

- Frequency of Use: If you’re generating records regularly, select a system that streamlines the process and saves you time on every new document.

Popular Options to Consider

There are a variety of options available, such as:

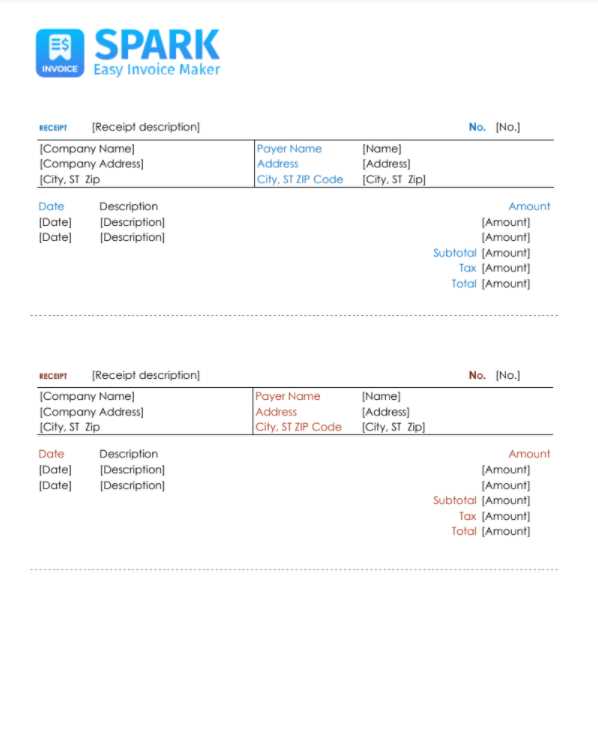

- Pre-designed digital formats for quick customization

- Basic handwritten forms for smaller businesses or personal transactions

- Advanced software that automates the process and integrates with other business tools

By understanding your needs and evaluating the available choices, you can ensure that you select a format that will help you stay organized and professional in every transaction.

How to Edit a Financial Transaction Record

Editing a document that tracks a financial exchange is a straightforward task, but it requires attention to detail to ensure all the necessary information is accurately updated. Whether you need to modify existing details or add new sections, the process can be done efficiently with the right tools and steps.

Steps to Edit Your Document

Follow these steps to make sure your record is updated properly:

- Open the Document: Start by opening the file where your current transaction record is saved. Ensure it is in an editable format (e.g., Word, Excel, or a compatible software).

- Update Basic Information: Check if the date, buyer and seller details, and other key elements need to be changed.

- Adjust Transaction Details: Modify descriptions, quantities, or prices based on the most current information.

- Recalculate Totals: If the amounts change, be sure to update the totals, taxes, and any additional charges. Verify your calculations for accuracy.

- Review Terms and Conditions: Ensure that any contractual terms, delivery schedules, or payment deadlines are still applicable and accurate.

Tools for Editing

Depending on your preferences, you can use various tools to edit your record:

- Word processing software (e.g., Microsoft Word, Google Docs)

- Spreadsheet programs for calculations (e.g., Microsoft Excel, Google Sheets)

- Online editing platforms with templates for easy modification

By following these steps and utilizing the right tools, you can easily make the necessary changes to your transaction record, ensuring it remains accurate and up-to-date.

Free Transaction Record Formats and Resources

There are many free resources available for creating detailed financial records, offering a variety of formats and designs to meet different business needs. These free options can save time and help ensure that your documents are professional and organized without the need for expensive software.

Here are some valuable resources and formats that can be used to create effective transaction documentation:

- Online Platforms: Websites like Google Docs, Canva, and Zoho offer free customizable layouts that can be easily edited and downloaded.

- Free Document Editors: Free tools like Microsoft Word or Google Sheets provide templates that you can use to create your own financial records, with built-in features for calculations.

- Template Libraries: Many websites host free libraries with various formats designed for small businesses or personal use. These resources often provide ready-made options that only require you to add your specific details.

- Downloadable PDFs: Some websites offer free downloadable PDFs, which you can fill out manually or digitally for quick transactions.

By taking advantage of these free resources, you can create professional and accurate transaction documents with minimal effort and at no cost.

Legal Considerations for Financial Transaction Records

When creating and managing financial records for transactions, it is crucial to adhere to legal requirements to ensure compliance with local and international regulations. These documents often serve as proof of agreements and payments, and failing to meet legal standards can lead to disputes or issues with taxation authorities.

Here are some key legal considerations to keep in mind:

| Consideration | Explanation |

|---|---|

| Legal Validity | The document must meet the legal standards of your jurisdiction. In some countries, it is required to include specific details such as the date, description of goods or services, and full addresses of involved parties. |

| Tax Compliance | Ensure that all applicable taxes are correctly stated. Depending on your location, taxes such as VAT or sales tax may need to be included and clearly indicated on the document. |

| Record-Keeping | Financial records should be kept for a certain period for audit and tax purposes. This period varies by country and jurisdiction, but usually, it’s between 3 to 7 years. |

| Legal Language | In some cases, it may be necessary to include specific terms and conditions or legal language outlining the agreement, especially for larger transactions or business agreements. |

Adhering to these legal requirements not only protects both parties involved in the transaction but also ensures that you are prepared in case of an audit or dispute. Always stay informed about the legal obligations relevant to your specific location and business type.

How to Manage Transaction Records

Properly managing records of transactions is essential for maintaining financial organization and compliance. These documents are crucial for tracking business activities, ensuring accurate bookkeeping, and preparing for potential audits. Effective management helps prevent errors, reduces the risk of fraud, and improves overall financial transparency.

Steps to Effectively Manage Transaction Records

- Maintain Detailed Information: Always record the specifics of each transaction, including the date, involved parties, and itemized services or goods. This ensures that every record is complete and clear.

- Organize by Category: Keep records sorted by type of transaction, such as services rendered, products sold, or other relevant categories. This makes it easier to locate and review specific transactions when needed.

- Use Digital Tools: Consider using accounting software or digital spreadsheets to store and manage records. These tools can automate calculations, generate reports, and help track transactions more efficiently.

- Monitor Regularly: Regularly review your records to ensure that all entries are accurate and up-to-date. This practice helps catch errors early and ensures that your financial documentation remains consistent.

- Backup Records: Always back up your records to prevent data loss due to technical issues. Use cloud storage or external hard drives for additional security.

Best Practices for Storing Transaction Records

- Secure Storage: Whether physical or digital, ensure that records are stored in a secure location to prevent unauthorized access.

- Regular Updates: Continuously update your records as transactions occur to avoid falling behind on documentation.

- Follow Legal Guidelines: Ensure that your record-keeping methods comply with local tax laws and accounting regulations.

By implementing these strategies, you can streamline the process of managing financial documents, leading to better organization and efficiency in your business operations.

Transaction Documents for Small Businesses

For small businesses, managing financial documentation effectively is key to maintaining organized records and ensuring smooth operations. Using structured forms to document exchanges not only helps with bookkeeping but also streamlines the process of keeping track of income and expenses. These records serve as essential tools for business owners to monitor cash flow, stay organized, and maintain transparency with clients and tax authorities.

Customizable records for small businesses are designed to be simple yet comprehensive, ensuring that all necessary details are included without overwhelming users. By adopting a standardized format, small business owners can ensure consistency across their financial transactions, making it easier to track and reference documents as needed.

Whether you’re a freelancer, consultant, or small retailer, having a consistent method for documenting transactions provides clarity and professionalism. These organized forms also facilitate faster processing and reduce the risk of mistakes, ensuring that your business stays on top of financial obligations and is prepared for audits or financial reviews.

Improving Document Accuracy and Efficiency

In any business, maintaining accurate records is essential for financial clarity and operational efficiency. Ensuring the correctness of transaction documents not only prevents errors but also helps businesses avoid costly mistakes in the future. A streamlined process for generating and managing these records is crucial for maintaining smooth operations, reducing administrative overhead, and enhancing overall productivity.

There are several ways businesses can enhance both the accuracy and efficiency of their record-keeping processes. By implementing structured formats and automated tools, business owners can significantly reduce the risk of human error, ensuring that all essential details are correctly recorded. In addition, adopting digital solutions can help save time and resources, enabling businesses to focus on more important tasks.

Best Practices for Enhancing Document Accuracy

- Double-check Details: Always verify the accuracy of information such as amounts, dates, and client details to prevent mistakes.

- Use Clear Descriptions: Ensure that each item or service is described in clear and concise terms to avoid confusion.

- Leverage Automation: Utilize software that automatically fills in standard fields, reducing manual entry and minimizing errors.

- Set Consistent Formats: Standardize your document formats so all necessary information is consistently included in each record.

Strategies for Increasing Efficiency in Record Management

- Implement Templates: Use pre-designed structures that reduce the time needed to create documents from scratch.

- Digitize Records: Store documents electronically for quick access, backup, and sharing.

- Integrate with Accounting Systems: Connect your record management system with accounting software to automatically update financial data.

- Maintain Regular Updates: Keep records updated in real time to prevent backlogs and ensure accuracy.

By following these practices, businesses can not only improve the accuracy of their records but also enhance their overall efficiency in managing financial transactions.

Integrating Formats with Accounting Software

In today’s digital age, businesses are increasingly relying on software solutions to streamline their operations and manage financial records efficiently. Integrating structured formats with accounting software can significantly improve the accuracy and speed of financial management. This integration ensures seamless data transfer, reduces the chances of manual errors, and provides a more effective way to track all financial activities.

By linking predefined structures with accounting systems, businesses can automate several aspects of their financial processes. For instance, it allows for automatic population of fields like amounts, dates, and client information. This not only saves time but also ensures consistency across all records, which is essential for accurate reporting and analysis.

Benefits of Integration

- Time-saving: Automating data entry reduces the need for repetitive manual input, saving valuable time.

- Consistency: Integration ensures that data across different platforms remains consistent, reducing the risk of errors.

- Real-time Updates: Transactions are automatically reflected in the system, providing up-to-date financial information at all times.

- Better Reporting: Accurate and timely data flow enables more reliable financial reporting, helping businesses make informed decisions.

How to Implement Integration

- Choose Compatible Software: Ensure that your accounting software supports integration with the format management system.

- Set Up Data Sync: Configure automatic data syncing between the systems to ensure smooth operation.

- Test the Integration: Conduct tests to verify that all fields are being transferred correctly and that there are no discrepancies.

- Train Your Team: Ensure that your staff is well-versed in using the integrated systems to maximize efficiency.

Integrating structured formats with accounting software can make a significant impact on operational efficiency, accuracy, and financial transparency for businesses of all sizes.

Best Practices for Sending Invoices

Effectively sending financial documents is essential for maintaining professional relationships and ensuring timely transactions. Adhering to best practices when dispatching these records helps to ensure clarity, reduce errors, and facilitate smoother communication between businesses and clients. It is important to follow a structured approach to not only meet legal requirements but also foster trust and transparency in financial dealings.

One of the first steps is to ensure that all necessary information is accurately included in each document, such as the correct client details, transaction amounts, and deadlines for completion. A professional appearance also goes a long way in presenting a trustworthy image. Additionally, sending documents in a timely manner is key, as delays can cause confusion or financial setbacks for both parties.

Consistency is another important factor. Keeping a consistent format helps clients easily understand the contents of the document and ensures that nothing is overlooked. Furthermore, it’s vital to offer various delivery options, whether it’s through email, digital platforms, or traditional mail, to meet clients’ preferences and ensure convenience.