How to Create a Custom Invoice Template in QuickBooks Online

In today’s fast-paced business environment, having a streamlined and professional way to bill clients is essential. Customizing your billing documents not only enhances your brand image but also helps ensure that all necessary details are clearly communicated. Whether you’re a freelancer, small business owner, or part of a larger enterprise, creating invoices that reflect your unique needs can save time and reduce errors.

By tailoring your billing structure to match your company’s standards, you can include all relevant information in an organized and visually appealing format. This approach not only ensures accuracy but also creates a more polished and trustworthy appearance for your clients. With the right tools, designing these documents to fit your workflow becomes a simple task.

Designing tailored billing formats involves more than just aesthetics. It’s about making sure that the information is accessible, easy to understand, and aligned with your business processes. Whether you need to adjust payment terms, include discounts, or reflect your branding, the ability to modify your forms will improve efficiency and client satisfaction.

Custom Invoice Template QuickBooks Online

Creating personalized billing documents is essential for any business looking to maintain professionalism and improve operational efficiency. With the right tools, businesses can design their financial forms to suit specific needs, ensuring clarity and consistency in communication with clients. Tailoring these documents not only enhances the overall experience but also saves time and reduces the risk of mistakes.

Why Tailoring Your Billing Documents Matters

Customizing your financial forms allows you to reflect your brand identity and ensure all relevant information is included in a structured format. Here are some key benefits:

- Professional Appearance: Personalized documents help establish a strong, trustworthy image with clients.

- Consistency: Consistent formatting ensures that every transaction follows the same structure, reducing confusion.

- Flexibility: Tailoring your forms lets you adjust for specific business requirements such as unique payment terms or service details.

- Efficiency: Once set up, these documents can be quickly generated for each transaction, saving time in the long run.

How to Design Your Billing Forms

Most modern accounting tools offer an easy-to-use interface for modifying your billing documents. Follow these steps to get started:

- Access the Document Editing Section: Go to your settings and locate the area where you can modify the appearance of your billing forms.

- Select a Pre-Designed Layout: Choose a basic layout that suits your business needs, then begin to customize it further.

- Add Your Branding: Include your company logo, color scheme, and other elements that reflect your brand’s identity.

- Adjust Payment Information: Make sure fields like payment due dates, terms, and discounts are clearly outlined.

- Save and Apply: Once you’ve tailored the document to your liking, save your design and start using it for all future transactions.

By taking the time to personalize your billing documents, you ensure that each interaction with your clients is professional, clear, and efficient. Tailoring these forms is an easy way to build trust, streamline your process, and make a lasting impression with every transaction.

Why Custom Templates Matter for Your Business

Personalizing your financial documents is more than just about aesthetics–it’s about improving functionality, streamlining communication, and reinforcing your brand identity. A well-designed billing structure ensures that all necessary details are presented clearly, making it easier for your clients to understand payment terms and for your team to track transactions. Tailored documents reflect the unique needs of your business and can help build trust with clients by showing professionalism and attention to detail.

First Impressions Matter: The way you present your payment requests can set the tone for client relationships. Clean, well-organized forms that reflect your business’s personality create a positive first impression and help establish credibility. When your financial documents are professional and easy to read, it shows clients that you are detail-oriented and committed to quality service.

Improved Efficiency: Using a personalized format allows you to eliminate the need to re-enter standard details for every transaction. By having a standardized structure, you save time and reduce the possibility of errors. Whether you include payment terms, service descriptions, or tax information, having these pre-set makes future interactions faster and more consistent.

Enhancing Client Experience: Tailored documents allow for greater clarity, which is essential for client satisfaction. A form that clearly outlines payment expectations, service details, and other important information makes it easier for clients to process and pay their bills on time. This improves the overall experience and increases the likelihood of timely payments.

Consistency Across Transactions: When your financial forms maintain a consistent design, clients know exactly what to expect with each interaction. This consistency helps avoid confusion and builds trust, as clients can rely on familiar formatting and information. Having a professional, standardized layout for each transaction also enhances your internal processes, making record-keeping and reporting much simpler.

Benefits of Using QuickBooks Online for Invoices

Utilizing digital tools to handle financial transactions offers significant advantages for businesses of all sizes. These platforms provide powerful features that not only simplify billing but also help maintain accurate records, save time, and reduce errors. By switching to an automated system, businesses can focus more on their core operations while ensuring that all client interactions are handled smoothly and professionally.

Key Advantages of Automation

Here are some of the main benefits that businesses can experience by switching to automated billing systems:

| Benefit | Description |

|---|---|

| Time-Saving | Automation reduces the need for manual entry, allowing businesses to generate documents quickly and consistently. |

| Accuracy | By eliminating human errors, digital tools ensure that all data is correctly entered and maintained, reducing the chance of mistakes. |

| Easy Access | Cloud-based systems allow users to access their records from anywhere, making it easier to manage finances on the go. |

| Integration | These platforms seamlessly integrate with other business tools, ensuring all financial data is aligned across departments. |

| Customization | Users can personalize documents, including fields, branding, and terms, to match their business needs and client expectations. |

Enhanced Client Experience

Automated systems improve the client experience by ensuring that all financial documents are accurate, timely, and easy to understand. This leads to fewer disputes and a faster payment process, strengthening relationships with clients and ensuring that your business remains organized and professional.

Step-by-Step Guide to Customizing Templates

Personalizing your financial forms ensures that all necessary details are presented clearly and professionally. By adjusting the structure and appearance of your documents, you can create a seamless experience for both you and your clients. This guide will walk you through the simple process of tailoring your forms to suit your business needs, saving time while ensuring accuracy and consistency in your billing system.

Accessing the Document Editing Section

To begin, you need to access the area where you can modify your financial forms. Follow these steps:

- Log in to your account: Start by logging into your account and navigating to the settings area.

- Find the document settings: Locate the section dedicated to managing forms and templates. This might be under a “Billing” or “Documents” category.

- Select the form to modify: Choose the document type you wish to customize, such as a payment request or service agreement.

Making Modifications

Once you’re in the editing section, you can start tailoring the layout and content. Here’s how to do it:

- Choose a layout: Select from available pre-designed structures that best suit your business style. You can always modify them further.

- Adjust fields: Change or add fields to match your specific needs, such as payment terms, service descriptions, or client details.

- Add your branding: Personalize your document with your logo, company colors, and other branding elements to maintain consistency across all communications.

- Preview your document: Always preview the form before saving it to ensure that everything looks as expected and that all information is accurate.

Once you have made the necessary adjustments, save the form, and start using it for all future transactions. This simple process can significantly improve the professionalism and efficiency of your billing system, ultimately leading to better client relationships and smoother business operations.

Understanding QuickBooks Online Invoice Settings

Managing your billing system efficiently requires a deep understanding of the available settings that control how your financial documents are structured and presented. These settings allow you to define critical aspects of your billing process, such as payment terms, tax calculations, and client information. Knowing how to adjust these options ensures that your documents are accurate, professional, and aligned with your business needs.

Key Settings to Customize

Here are some important settings you can adjust to tailor your documents:

- Payment Terms: Set default payment terms, such as due dates or specific conditions like discounts for early payments or late fees for overdue balances.

- Tax Settings: Specify your tax rates and rules, making sure your documents include the correct tax calculations based on your location and the services you offer.

- Client Information: Ensure that each document automatically populates with the correct client details, including billing address, contact information, and purchase history.

- Numbering System: Choose how your documents will be numbered. You can set a sequential numbering system or customize it to match your organizational preferences.

- Default Language and Currency: If you work with international clients, make sure to adjust the language and currency settings to match their preferences.

Additional Options for Personalization

In addition to the basic settings, there are other ways to further personalize your financial forms:

- Logo and Branding: Add your company logo and select a color scheme that aligns with your brand, ensuring your documents look professional and consistent.

- Message Customization: Add personalized messages or notes to the header or footer of your documents, such as thank-you messages or special instructions for clients.

- Attachments: You can attach documents, such as contracts or receipts, directly to your billing forms, providing clients with all relevant information in one place.

By mastering these settings, you can ensure that your billing process is both accurate and reflective of your business’s unique needs. Whether it’s adjusting tax rates, setting payment terms, or adding your logo, these options allow for a high degree of flexibility and professionalism in managing your financial transactions.

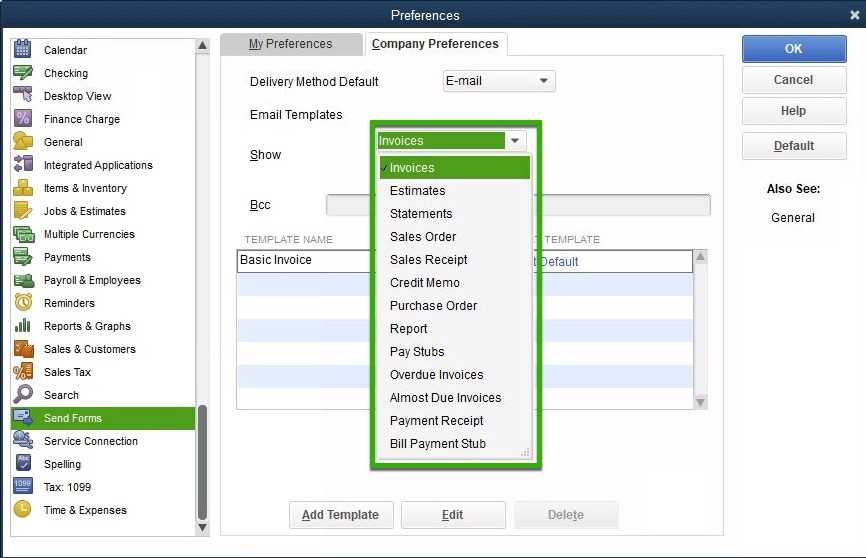

How to Access Invoice Templates in QuickBooks

To personalize your billing forms and enhance the overall efficiency of your financial processes, it’s essential to know where to find and modify the templates in your accounting software. These tools provide easy access to pre-designed structures that can be adjusted to fit your business needs, allowing you to create professional documents quickly and without errors.

Finding the Document Settings

To get started with adjusting your financial documents, follow these steps to access the relevant settings in your accounting software:

- Log in to Your Account: First, sign in to your account using your credentials.

- Navigate to the Settings Area: Once logged in, locate the settings or preferences section, typically found in the main dashboard or menu.

- Access the Documents Section: Within the settings area, find the section dedicated to managing financial forms. This section may be labeled as “Billing,” “Documents,” or “Sales Forms.”

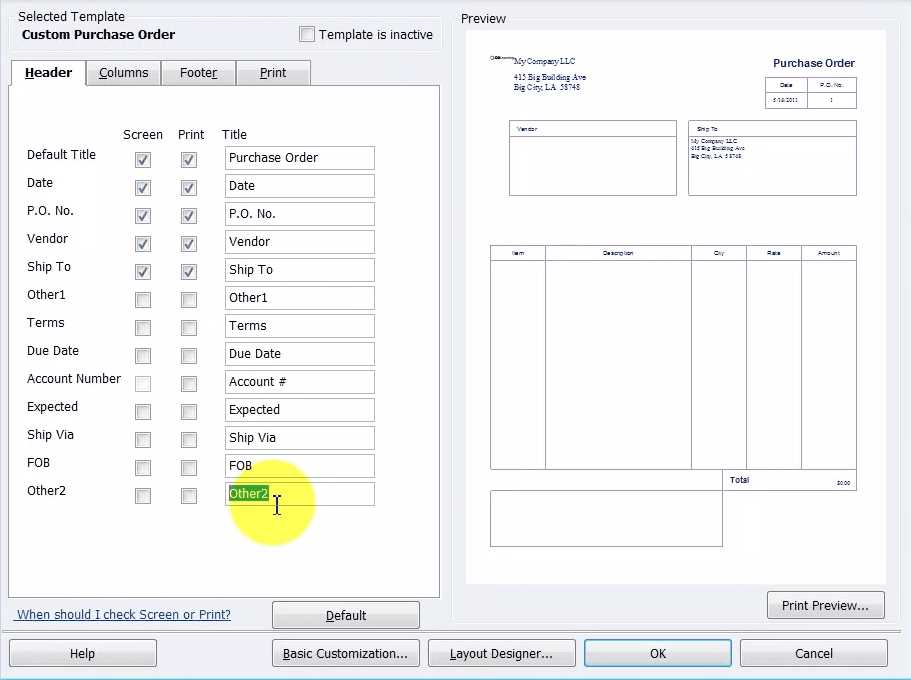

Selecting and Modifying a Document Layout

Once you are in the right section, you can easily browse through various pre-built options. Here’s how to adjust the layout:

- Choose a Pre-Designed Layout: Select a basic layout that fits your business requirements. There are typically several options to choose from, each designed to suit different industries or purposes.

- Modify Fields: Adjust the fields to reflect specific business needs, such as adding payment terms, service descriptions, or client details.

- Save Your Changes: After making adjustments, be sure to save your updated layout. This will ensure that your changes are applied to all future documents generated using this design.

Accessing and customizing these forms is a straightforward process that helps ensure your financial documents are aligned with your company’s unique preferences and requirements. Whether you need to adjust text, layout, or other details, this flexibility makes it easier to create professional documents that reflect your brand and business style.

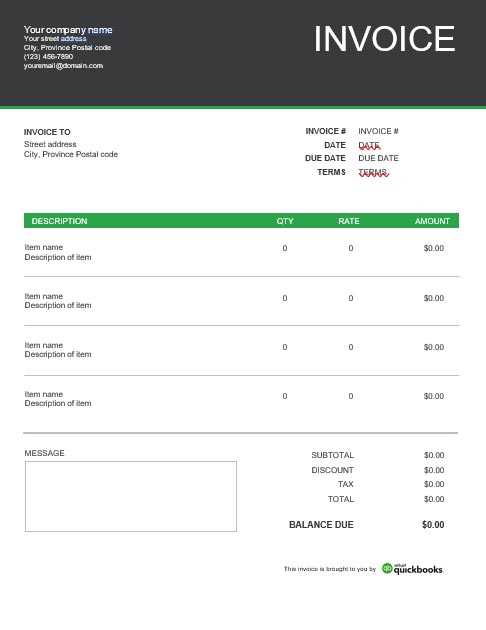

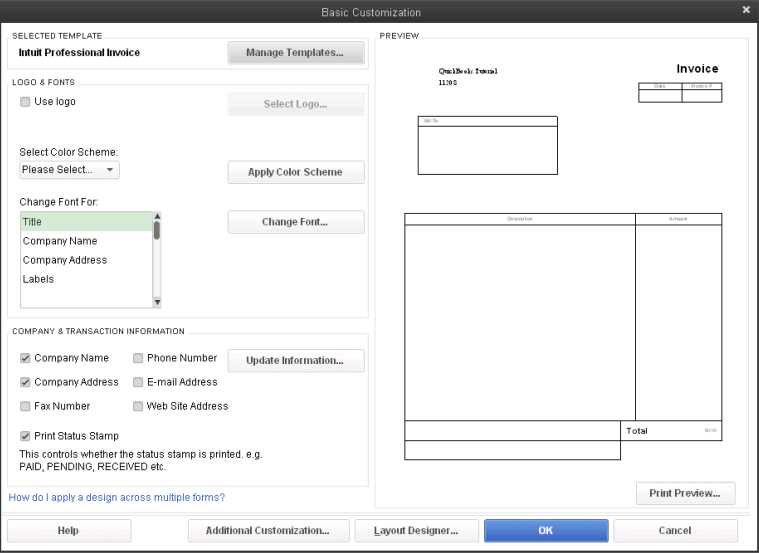

Designing an Invoice Template for Your Brand

Creating billing documents that reflect your brand identity is a powerful way to leave a lasting impression on clients. By incorporating your company’s visual style into these forms, you enhance the professionalism of your communication and reinforce your brand’s consistency. Whether you’re sending out payment requests, purchase orders, or receipts, a well-designed document can help make your business stand out.

Key Elements to Include for Branding

When designing your forms, focus on the following elements to ensure that they align with your company’s image:

- Logo: Adding your company logo to the top of the document ensures that your clients instantly recognize your brand and reinforces your visual identity.

- Color Scheme: Choose a color palette that reflects your business’s branding guidelines. Consistent use of colors across all documents helps create a unified and professional look.

- Font Choice: Select easy-to-read fonts that match the tone of your business. Use a combination of bold or larger fonts for headings and clear, smaller fonts for body text to maintain readability.

- Contact Information: Ensure that your contact details, such as your phone number, email, and website, are prominently displayed, making it easy for clients to reach you when necessary.

- Tagline or Slogan: If applicable, include your company’s tagline or slogan to further personalize the document and enhance your brand’s message.

Steps to Implement Your Branding

Follow these simple steps to add your branding elements to the forms:

- Select a Base Layout: Start with a clean, professional layout that suits your business needs. Many platforms offer basic designs to help you get started.

- Upload Your Logo: Upload your logo file and position it at the top of the form, ensuring it is clearly visible but not overwhelming.

- Adjust Colors: Change the colors of headings, borders, and other elements to match your company’s brand guidelines.

- Set Fonts: Choose appropriate fonts that reflect your business’s personality–be it formal, modern, or playful.

- Preview and Save: Once your branding is applied, preview the document to make sure it looks polished and professional, then save your changes.

By carefully designing your forms to match your brand’s style, you create a cohesive and professional experience for your clients. This not only helps reinforce your brand identity but also ensures that all your business communications are aligned and consistent.

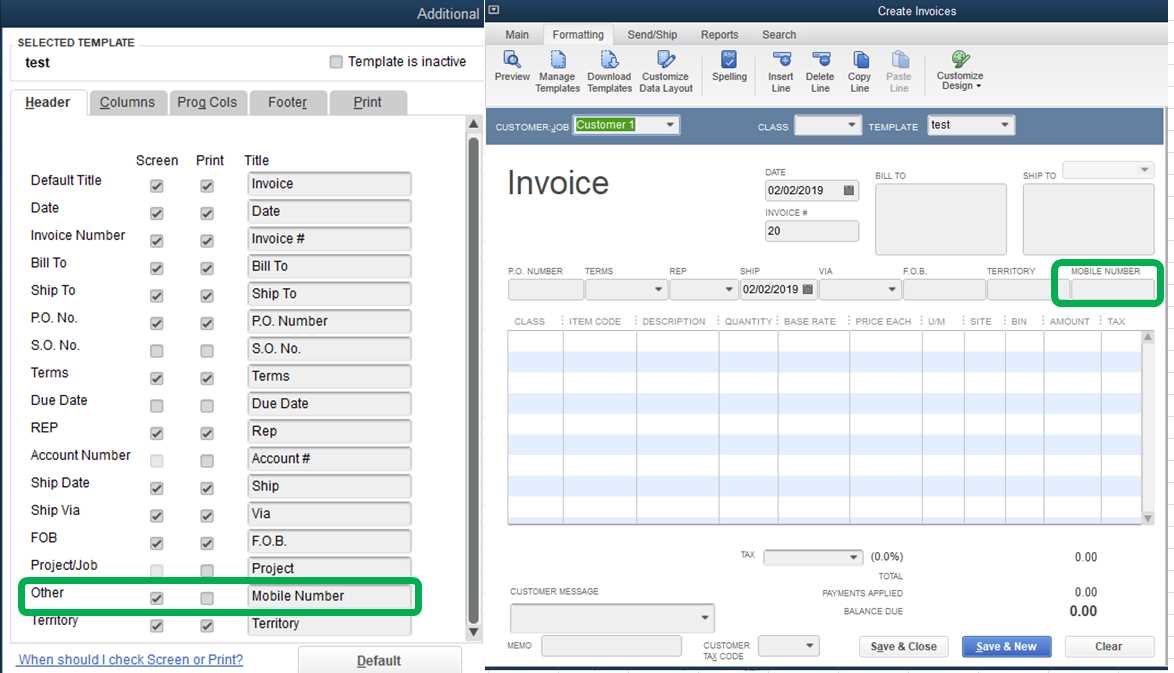

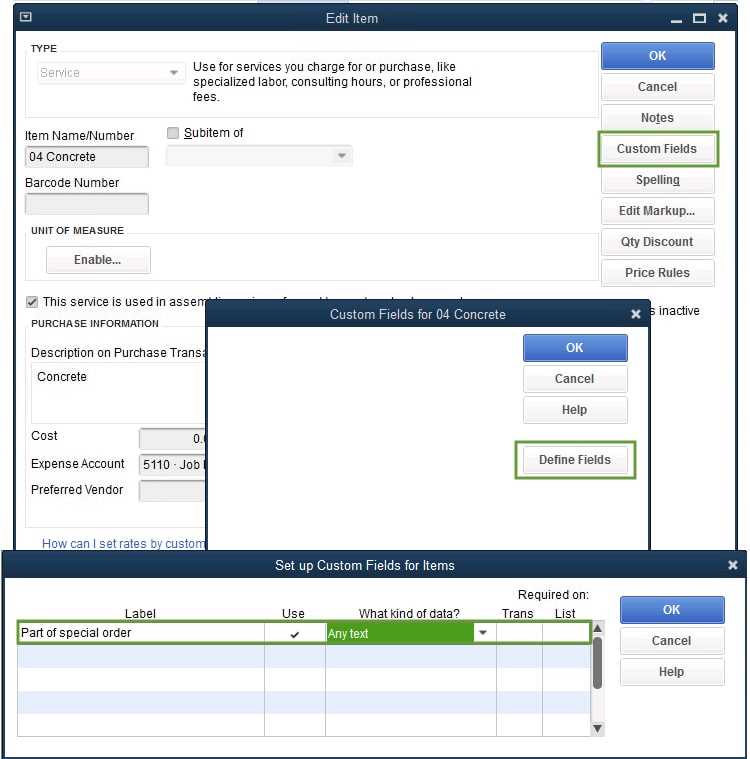

Customizing Fields in QuickBooks Invoice

Adjusting the fields in your financial documents allows you to tailor them to better suit the unique needs of your business. By customizing the sections where client details, payment terms, item descriptions, and other important information appear, you ensure that your documents are not only accurate but also fully aligned with your workflow. This flexibility helps streamline your billing process and ensures that every transaction is captured correctly.

Most accounting systems provide a straightforward way to modify these fields, giving you control over what information is displayed and how it is organized. Whether you need to add extra lines for specific services, include personalized messages, or adjust the placement of certain details, these settings can be easily updated to reflect your specific requirements.

Here’s how to customize the fields in your documents:

- Access the Field Settings: Go to the settings section of your software and locate the area where you can manage document fields.

- Modify Basic Information: Add or remove fields such as client names, addresses, or purchase order numbers to ensure that all necessary details are captured.

- Adjust Item Descriptions: Tailor the item description fields to include the specific services or products you offer, along with relevant pricing details.

- Set Payment Terms: Include or adjust payment due dates, discounts, or late fee information to ensure clients have all the necessary terms upfront.

- Insert Additional Notes: Add custom fields for special instructions, thank you messages, or any other relevant notes for your clients.

By taking the time to modify the fields in your documents, you can create more tailored, clear, and efficient financial forms that meet both your business needs and your clients’ expectations.

How to Add Company Logo to Invoices

Including your company logo on financial documents is a simple yet effective way to strengthen your brand identity and maintain a professional appearance. Your logo serves as a visual marker that immediately identifies your business, making your documents easily recognizable and helping to build trust with clients. Fortunately, adding your logo to your billing forms is a straightforward process.

Follow these steps to add your company logo to your documents:

- Log in to Your Account: Start by logging into your business management platform with your account credentials.

- Navigate to the Document Settings: Go to the settings section where you manage your financial forms. This is typically found under “Sales” or “Billing” options.

- Choose the Document Layout: Select the type of document you want to update, such as a billing statement or payment request.

- Upload Your Logo: Look for an option to add or upload an image. Choose the file that contains your company’s logo and upload it. Make sure the image is clear and high-quality to avoid distortion.

- Adjust Logo Position: Once uploaded, you can adjust the positioning of the logo within the document. Typically, logos are placed in the header section, either centered or aligned to the left or right.

- Save Your Changes: After ensuring your logo looks great on the document, save the changes to apply them to future transactions automatically.

By following these simple steps, you can easily incorporate your company logo into your financial forms, reinforcing your brand’s presence and ensuring that all communications are professional and consistent.

Best Practices for Professional Invoices

Creating professional billing documents is crucial for maintaining a positive relationship with your clients and ensuring timely payments. Well-organized, clear, and error-free forms not only help your clients understand the details of their transactions but also reflect the professionalism of your business. Following a few key best practices can enhance the appearance and effectiveness of your financial communications.

Essential Elements to Include

Every financial document should have certain critical elements to ensure clarity and completeness. The following components are necessary for a professional-looking form:

- Clear Contact Information: Always include both your business’s and the client’s contact details, including names, addresses, phone numbers, and email addresses. This ensures easy communication if there are any questions.

- Accurate Date and Numbering: Ensure that each document has a clear date and unique identifier. This helps with tracking and future reference.

- Detailed List of Goods or Services: Break down each item or service provided along with its price. Provide a clear description to avoid any confusion or misunderstandings.

- Payment Terms: Include the due date, accepted payment methods, and any late fee policies. Clearly state your payment terms to avoid any payment delays.

- Legal or Tax Information: If applicable, make sure to include relevant tax rates or business registration numbers to ensure compliance with local regulations.

Formatting Tips for Maximum Impact

The way you present your financial forms plays a huge role in how they are perceived. Follow these formatting tips to ensure your documents look polished:

- Keep it Simple: Avoid clutter by using a clean layout with plenty of white space. A well-organized document is easier to read and looks more professional.

- Use Readable Fonts: Stick to professional fonts like Arial, Helvetica, or Times New Roman. Ensure that the text size is legible and consistent throughout the document.

- Highlight Key Information: Use bold text for headings or important details like payment due dates or totals to draw attention to the most crucial aspects of the document.

- Brand Consistency: Incorporate your business’s branding elements, such as logo and colors, to create a cohesive and recognizable appearance.

By following these best practices, you can create financial documents that not only look professional but also help you maintain smooth and efficient business operations. Clear communication, attention to detail, and consistent formatting will leave a lasting impression on your clients and enhance your company’s credibility.

Automating Invoice Creation in QuickBooks Online

Streamlining your billing process through automation can save time and reduce errors, allowing you to focus on growing your business. By automating the creation of financial documents, you can ensure that each transaction is recorded accurately and that clients receive their payment requests on time. Automation tools enable you to set up recurring transactions, apply predefined payment terms, and generate documents with minimal manual effort.

Setting Up Recurring Transactions

One of the most effective ways to automate your billing process is by setting up recurring transactions for clients with regular orders. Here’s how to get started:

- Identify Recurring Clients: Review your client list to identify those with ongoing services or subscription-based products.

- Create Recurring Profiles: In the settings section, create recurring profiles for these clients, specifying the frequency (weekly, monthly, etc.) and the details of the services provided.

- Automate Payment Terms: Set the payment due date, any early payment discounts, or late fees so that they automatically apply to each document created.

- Save and Enable Automation: Once your settings are configured, save the profile. The system will automatically generate and send payment requests according to the schedule you’ve set.

Benefits of Automating Billing Documents

Automating the creation of your financial documents offers several advantages:

- Time Savings: No need to manually create documents for each client or transaction. Once set up, the system takes care of it for you.

- Consistency: Automation ensures that your documents are generated with the same format, payment terms, and information every time, reducing human error.

- Improved Cash Flow: By sending invoices promptly and automatically, you improve the chances of timely payments and maintain a steady cash flow.

- Efficiency: Automation allows you to handle multiple clients and transactions with minimal effort, which is especially beneficial for businesses with a high volume of recurring orders.

By setting up automation for your billing process, you can create a more efficient and organized system that ensures accuracy, reduces manual work, and enhances your cash flow management.

Adding Payment Terms to Your Templates

Including clear and precise payment terms in your billing documents is essential for ensuring that both you and your clients are on the same page when it comes to financial expectations. By outlining specific terms such as due dates, late fees, or early payment discounts, you help avoid confusion and encourage timely payments. Adjusting these terms within your documents allows you to streamline the process and create a professional and transparent agreement with each transaction.

Types of Payment Terms to Consider

There are several types of payment terms you can incorporate into your forms, depending on the nature of your business and your relationship with clients:

- Net Terms: This specifies the number of days after which payment is due. For example, “Net 30” means that the payment is due within 30 days of the document date.

- Early Payment Discount: Offering a discount for early payment, such as “2% discount if paid within 10 days,” can encourage faster payments.

- Late Fees: To incentivize timely payments, you may choose to apply a late fee after a certain grace period, like a percentage charge for overdue payments.

- Installment Plans: For larger amounts, you might offer clients the option to pay in installments, specifying the amount and due dates for each installment.

How to Add Payment Terms

Adding payment terms to your documents is a simple process. Follow these steps to include them:

- Access the Settings: Navigate to the section where you manage your business documents and settings.

- Locate Payment Settings: Look for an option related to payment terms or payment methods, usually found in the document or sales settings section.

- Choose or Create Terms: Select from pre-existing payment term options or create your own. Be specific about the due date, discounts, and late fee policies.

- Apply Terms to Documents: Once the terms are set, ensure that they are automatically added to every relevant document you generate, so they are always clearly communicated to your clients.

By setting up and including payment terms in your documents, you establish clear expectations with your clients, which can help streamline payment processes and improve cash flow management for your business.

Incorporating Tax and Discount Information

Including tax and discount details in your billing documents is crucial for maintaining transparency and ensuring that clients are fully aware of the costs associated with their transactions. Accurately calculating and clearly displaying these charges helps avoid confusion and fosters trust between you and your clients. Whether you are applying sales tax or offering a promotional discount, these elements should be presented clearly to ensure proper communication and compliance.

How to Add Tax Information

When adding tax information, it’s important to calculate the right tax rate for your region and apply it correctly to the amounts being billed. Here are the key steps to include tax information:

- Set Tax Rates: Depending on your location, ensure that the appropriate sales tax rate is configured in your settings. This can often be done by selecting your region or entering a custom rate.

- Apply Tax to Items: For each product or service, make sure that tax is correctly applied based on your region’s rules. This can include sales tax, VAT, or other applicable taxes.

- Show Tax Clearly: Ensure that tax amounts are itemized separately, making it easy for clients to see the tax applied and understand how it affects the total amount due.

How to Add Discount Information

Discounts can be an excellent way to encourage early payments or reward loyal clients. Clearly stating the discount terms on your billing documents will help clients understand how to take advantage of these offers:

- Specify Discount Type: Discounts can be a percentage or a fixed amount. Ensure that the discount type is clearly indicated, and the total discounted amount is calculated correctly.

- Define Discount Conditions: If applicable, include terms such as “10% discount for payments made within 10 days” or any other criteria clients must meet to qualify for the discount.

- Display Discount Clearly: Like tax information, discounts should be itemized separately on the document so that clients can easily identify the reduced price.

By accurately incorporating tax and discount details into your forms, you make sure that clients understand their financial obligations and can easily verify the final amounts. Properly displaying this information also helps prevent misunderstandings and encourages timely payments.

Previewing and Testing Your Custom Template

Before finalizing your billing forms and sending them out to clients, it’s essential to review and test the layout and design. This step ensures that everything appears as expected, from the placement of your business logo to the proper formatting of client details and payment terms. Testing also helps catch any potential issues, such as misplaced text or incorrect calculations, that might affect the professionalism and clarity of your documents.

Steps to Preview Your Document

To ensure your financial documents meet your standards, follow these steps to preview and make adjustments where necessary:

- Open Preview Mode: Most systems offer a preview feature that allows you to view the document exactly as it will appear to clients. Access this feature before finalizing any changes.

- Check Layout and Design: Ensure that all elements, such as text, logos, and payment details, are properly aligned and visually appealing. Look for sufficient white space and readability.

- Confirm Text and Information: Verify that all client details, service descriptions, and payment terms are correctly displayed. Double-check for any spelling or grammatical errors.

Testing for Accuracy

Testing is an important part of the process to ensure that your forms are not only visually appealing but also accurate. Here’s how to test the functionality:

- Use Sample Data: Create test entries using sample client information and services to ensure that everything, including tax calculations, discounts, and totals, is computed correctly.

- Test Various Scenarios: Test multiple scenarios, such as applying discounts or adding multiple items, to see how the document adapts and how the totals are calculated.

- Review Mobile and Print Versions: Preview the document on different devices to ensure it looks good both digitally and when printed. Test how it appears on mobile screens and ensure that no information is cut off.

By carefully previewing and testing your documents, you ensure that your clients receive accurate, professional, and error-free billing forms every time. This attention to detail helps build trust and makes your business operations more efficient.

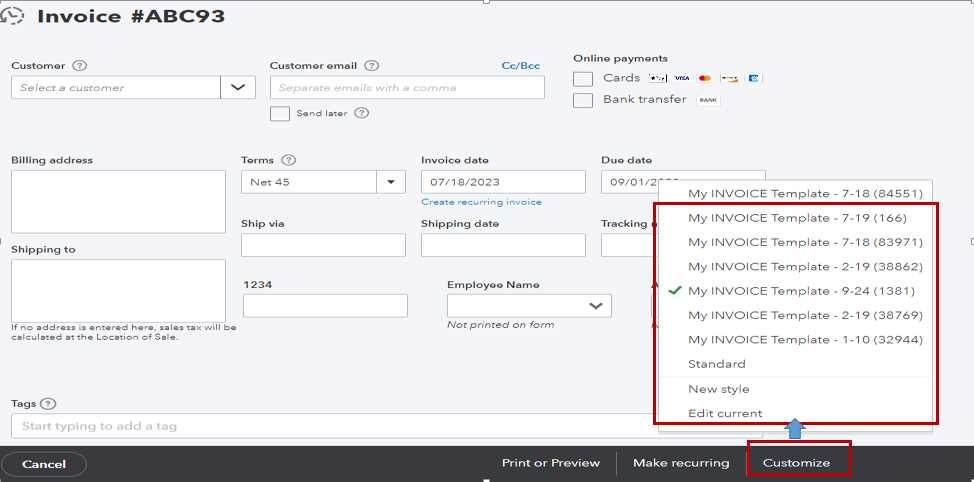

Saving and Applying Your Custom Template

Once you’ve designed your billing document and configured all necessary elements, it’s crucial to save your work for future use. This ensures that you can apply the same layout, formatting, and settings to all future documents without having to start from scratch. By saving and applying your personalized settings, you streamline the process of creating and sending documents to clients while maintaining consistency in your business communications.

How to Save Your Document Design

Saving your newly created design is a simple process, but it’s important to follow the right steps to ensure that it’s easily accessible for future use:

- Choose a Descriptive Name: When saving your design, choose a name that clearly identifies the document’s purpose or the client type it’s meant for. This will make it easier to locate later.

- Save to Your System: Once you’re satisfied with the design, save the document settings in your account or system to ensure that it can be applied to future transactions without needing to recreate it.

- Confirm Saving Location: Make sure the design is saved in a location that’s easy to find, whether it’s within a specific folder or under the “Saved Designs” section of your system.

Applying Your Saved Design to New Documents

Now that your design is saved, you can easily apply it to new documents whenever needed. Here’s how:

- Select the Design: When creating a new document, choose the saved design from your available options or select it from the template list to apply it to your new document.

- Ensure Consistency: After applying the design, review the document to confirm that all settings, such as client details, payment terms, and calculations, are correctly incorporated and aligned with your original design.

- Make Quick Edits: If needed, you can quickly adjust certain aspects of the design (such as adding new items or modifying payment terms) without changing the overall layout or style.

By saving and applying your document design, you make your billing process more efficient and consistent, ensuring that every communication with your clients is professional and streamlined.

Common Issues with QuickBooks Invoice Templates

When working with business documents, it’s not uncommon to encounter challenges that affect the final output. Issues can arise in various areas, including layout, calculations, or incorrect formatting. Identifying and resolving these problems early ensures that your documents are professional, accurate, and easy to understand for your clients. Below, we will explore some of the most frequent issues that users face and how to address them effectively.

Layout and Formatting Problems

Sometimes, even if the content is correct, the way it appears on the document can cause confusion. Common layout and formatting issues include:

- Text Misalignment: Items such as product descriptions, prices, and totals might not align properly, leading to a messy or unprofessional appearance. Ensure that all fields are evenly spaced and aligned to avoid these issues.

- Incorrect Font or Style: Using inconsistent fonts or font sizes can make your documents look cluttered. Stick to one or two fonts and maintain consistent sizing for headers, body text, and totals.

- Cluttered Design: A document that feels too crowded can be difficult for your clients to read. Avoid overloading the page with too much information or too many decorative elements. Ensure there is sufficient white space for clarity.

- Page Breaks: If your documents are long, page breaks may occur at awkward points, causing text or tables to be cut off. Make sure page breaks are set correctly and that information isn’t split unnecessarily.

Calculation and Data Entry Issues

Another common set of problems involves the accuracy of the financial data, such as totals, taxes, or discounts. These issues can lead to errors that may affect client trust and payment timelines:

- Incorrect Totals: Ensure that the system is properly calculating totals, including taxes, discounts, and any additional fees. Double-check that all line items are accounted for and that mathematical formulas are correct.

- Missing or Misapplied Tax Rates: If taxes are not applied correctly, this can result in incorrect amounts being shown. Be sure that tax rates are set according to your local regulations and that they are applied to the relevant items.

- Discounts Not Displayed Properly: Sometimes, discounts may not be shown clearly or might not be calculated automatically. Ensure that discount fields are included and function as expected.

- Inconsistent Data Fields: If the information about your products or clients is missing or incorrect, this can cause confusion. Always ensure that client names, addresses, and other relevant details are up to date.

By addressing these common issues early, you can improve the accuracy and professionalism of your documents, making them more efficient and trustworthy for your clients.

Improving Client Experience with Custom Invoices

Providing clients with clear, well-organized billing documents can greatly enhance their experience with your business. A professional and personalized approach not only builds trust but also ensures that clients fully understand their financial obligations, which can lead to faster payments and stronger business relationships. By customizing the look and feel of your billing forms, you can make a lasting impression and improve the overall client experience.

Benefits of Tailored Billing Documents

When you personalize your billing forms, you offer more than just a transaction record – you create an experience that reflects your brand and fosters better communication. Here are some ways that tailored documents can positively impact your clients:

- Brand Recognition: Including your business logo, colors, and fonts on your billing documents helps reinforce your brand identity, making your communications more recognizable and professional.

- Clarity and Transparency: Clear layouts with well-structured information allow clients to easily review the details of their charges, taxes, and discounts, leading to fewer questions and misunderstandings.

- Increased Credibility: A polished, branded document helps establish trust and demonstrates that you are organized and reliable, improving your reputation with clients.

- Enhanced Client Relationship: Personalizing the document with the client’s name or specific details about their order or service creates a more personal touch, showing that you value them as an individual.

How to Improve the Client Experience

Here are several strategies to enhance the client experience through well-designed and personalized billing forms:

- Consistent Layout: Make sure your layout is consistent and easy to read. Proper use of headers, columns, and white space helps clients quickly scan through the details without confusion.

- Itemized Information: Clearly break down charges, including individual items, quantities, and prices. This transparency helps clients understand exactly what they are paying for.

- Payment Instructions: Make the payment process as simple as possible by providing clear instructions. This might include payment methods, due dates, and any available payment plans.

- Personalized Messaging: Adding a personalized thank you note or payment reminder can help build a positive relationship and encourage timely payments.

By focusing on these elements, you can create a more engaging and professional experience for your clients, encouraging better communication, faster payments, and a stronger overall relationship.