Example Invoice Templates for Effortless Billing and Professional Invoicing

For any business, maintaining a smooth and efficient billing process is crucial to ensure timely payments and foster professionalism. One of the most effective ways to achieve this is by using structured and easily customizable documents. These resources not only save time but also help in creating consistent and clear communication with clients.

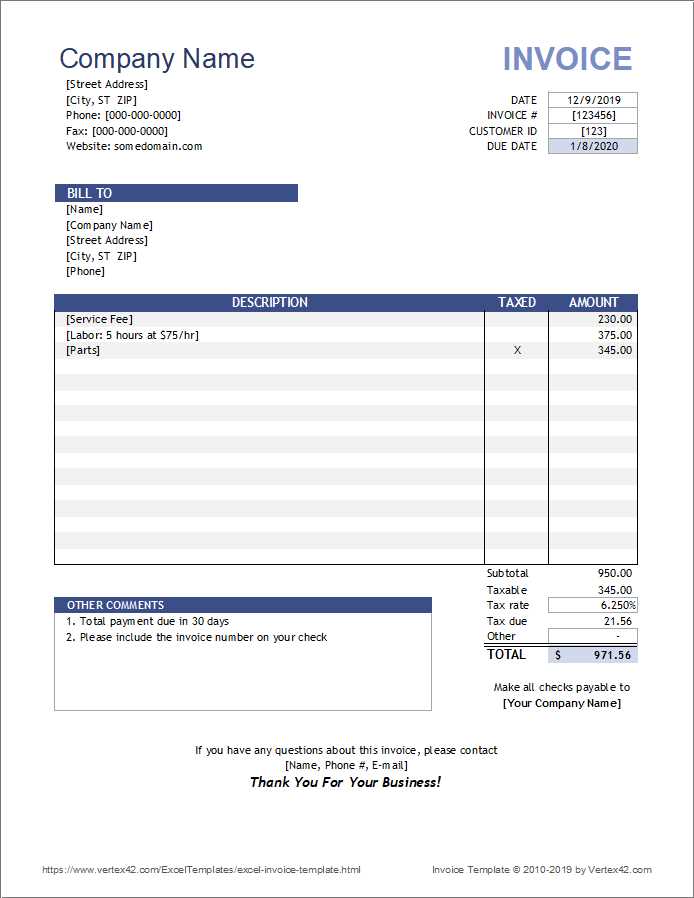

By leveraging well-designed formats, you can quickly generate payment requests that include all the necessary details, such as amounts, services provided, and payment terms. This allows for greater accuracy, reduces errors, and helps clients understand the financial expectations at a glance.

With a wide variety of editable layouts available, you can tailor your billing forms to suit your specific needs, whether you’re a freelancer, a small business owner, or part of a large company. Using a streamlined approach ensures that each transaction is handled professionally, making a lasting impression on your customers.

Example Invoice Templates for Your Business

For any business, creating clear, professional payment requests is essential to maintain proper cash flow and avoid misunderstandings with clients. Whether you’re a freelancer, a small business owner, or part of a larger company, having access to well-designed documents makes the billing process simpler and more efficient. These ready-to-use formats can be customized to reflect your brand while ensuring all necessary details are included in every transaction.

Key Features of Professional Billing Documents

When selecting a layout for your business, it’s important to consider the following features to ensure that your documents are both functional and professional:

- Clarity: The information should be presented clearly and concisely to avoid any confusion.

- Customizability: Choose formats that allow you to adjust elements like company details, payment terms, and item descriptions.

- Legal Compliance: Make sure the document includes necessary legal elements such as tax numbers or business registration information, depending on your region.

- Brand Consistency: Incorporate your company’s logo, colors, and fonts to create a cohesive brand experience.

How to Choose the Right Layout

Selecting the right format depends on the nature of your business and the complexity of the services or products you provide. Consider these options based on your needs:

- Simple Payment Request: Ideal for small businesses and freelancers with straightforward transactions.

- Itemized Billing: Useful for businesses offering a range of products or services, requiring detailed breakdowns.

- Recurring Billing: A perfect solution for subscription-based models or ongoing contracts.

By using a suitable layout, you ensure that every transaction is processed smoothly, and clients are always aware of the terms and amounts due.

Why Use Invoice Templates for Billing?

Efficient and accurate billing is essential for the smooth operation of any business. Using standardized forms to request payment can streamline the process, reduce errors, and ensure that all necessary information is included every time. Pre-designed billing formats allow businesses to focus on delivering their products or services rather than spending time creating documents from scratch.

Time-Saving and Efficiency

One of the biggest advantages of using ready-made formats is the significant amount of time saved. Instead of manually creating each document, businesses can quickly input the relevant details and send out payment requests. This efficiency not only speeds up the process but also reduces the likelihood of mistakes, ensuring that the information is always accurate and consistent.

Consistency and Professionalism

Utilizing well-structured forms ensures that your billing process is uniform and professional. Customers will appreciate receiving clear, easy-to-read payment requests that include all essential details, such as the amount owed, services rendered, and payment terms. This consistent approach helps establish trust and portrays your business as organized and reliable.

By implementing standardized forms, businesses can enhance customer satisfaction, improve cash flow, and focus on growing their operations, all while ensuring that the billing process remains smooth and efficient.

Benefits of Customizable Invoice Designs

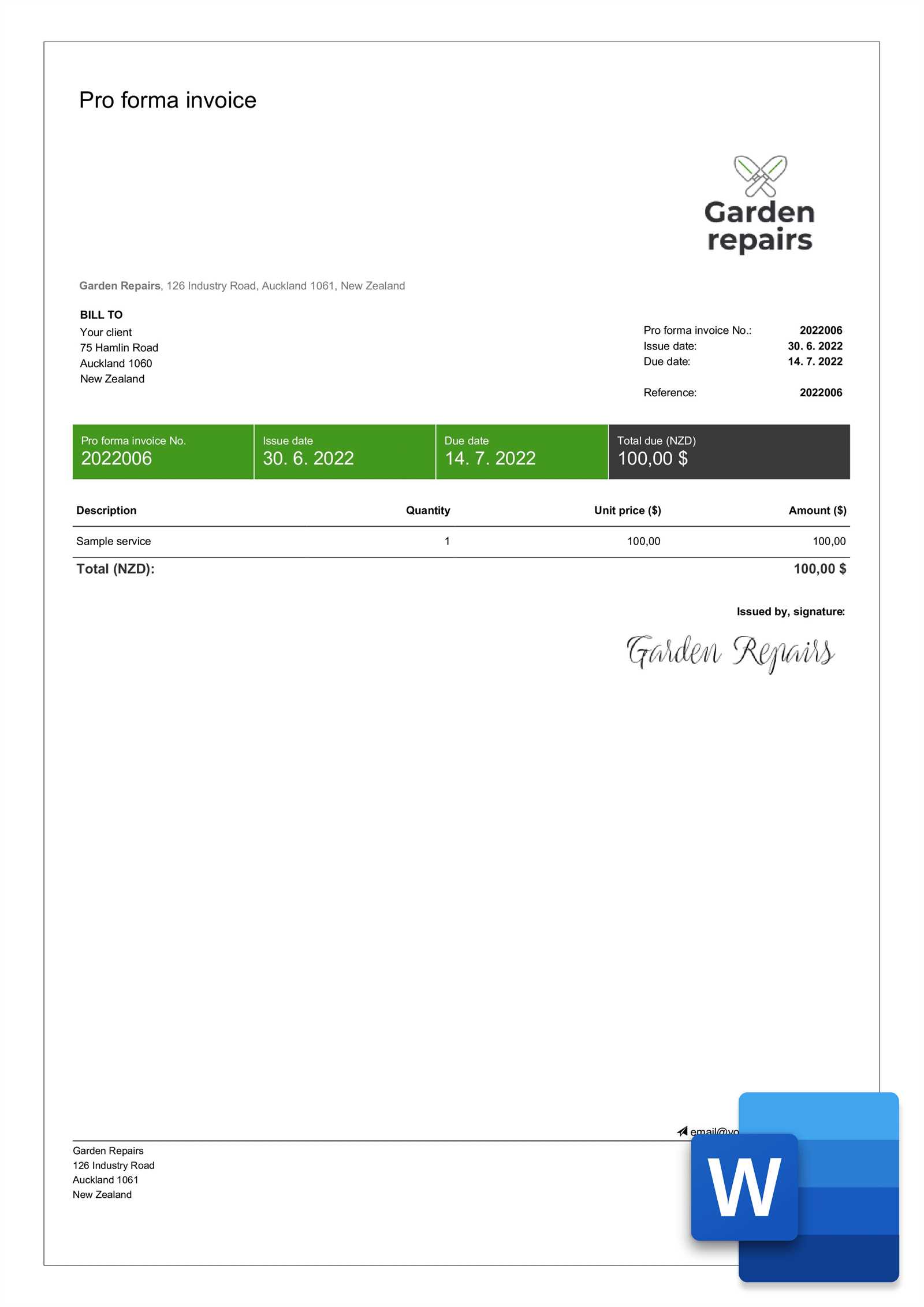

Having the ability to personalize billing forms is a significant advantage for any business. Customizable designs allow you to tailor the structure and appearance of your payment requests to match your unique needs and brand identity. This flexibility not only enhances the look of your documents but also ensures that they contain all the relevant information in a clear and professional manner.

Enhanced Branding and Recognition

One of the key benefits of adjusting the layout and style of your billing forms is the opportunity to incorporate your company’s branding elements. By adding your logo, company colors, and fonts, you create a consistent experience for your clients that reflects your business identity. This attention to detail helps build brand recognition and portrays your company as professional and well-organized.

Tailored Information for Specific Needs

Custom designs allow you to include specific fields and details relevant to your business model. Whether you need to display unique tax information, specific payment terms, or additional contact information, these forms can be adjusted to fit your exact requirements. This level of customization ensures that your payment requests are as clear and complete as possible, reducing confusion and potential errors.

By embracing customizable layouts, businesses can not only streamline their billing process but also improve the customer experience, build trust, and present a polished, professional image every time a payment request is sent out.

Choosing the Right Invoice Template

Selecting the appropriate billing form is crucial to ensuring that your payment requests are both professional and efficient. The layout you choose should not only reflect your business’s identity but also meet the specific needs of your operations. With a variety of styles and formats available, it’s important to consider factors such as simplicity, functionality, and customization options when making your decision.

Consider Your Business Type

The first step in choosing the right format is understanding the nature of your business. For example, freelancers or small service-based businesses may require a simpler design, while product-based companies or large enterprises may need a more detailed layout with itemized sections. Understanding what information needs to be displayed will guide you in selecting a structure that is both effective and easy to use.

Customization and Flexibility

Another important factor to consider is how customizable the form is. A good layout should allow you to easily modify the details to fit your needs, whether it’s adding a company logo, adjusting payment terms, or including specific legal information. The more flexible the design, the better it will suit a wide range of transactions and customer preferences.

By carefully evaluating your business requirements and the features offered by different layouts, you can choose the one that best streamlines your billing process while presenting a professional image to clients.

Free Invoice Templates for Startups

For startups, managing finances efficiently is a key component of long-term success. One of the first steps in setting up a solid financial system is creating a reliable method for sending payment requests. Fortunately, there are numerous free, customizable solutions available that allow entrepreneurs to create professional documents without the need for expensive software or design expertise.

Why Free Solutions Work for Startups

For a new business, keeping costs low while maintaining professionalism is essential. Free billing solutions offer an accessible way to create structured and effective payment forms without the burden of additional expenses. These forms can be easily tailored to reflect the startup’s branding, while ensuring that all critical information is included, such as the payment amount, terms, and service details.

Features to Look for in Free Solutions

When choosing a free billing form, there are several important features to consider:

- Ease of Use: Look for simple, user-friendly layouts that allow you to quickly input your business information.

- Customizable Fields: Ensure the form lets you modify key areas like payment terms, service descriptions, and contact details.

- Professional Appearance: Even free forms should be well-designed and visually appealing to reflect the professionalism of your startup.

By using free billing forms that meet these criteria, startups can focus on growing their business without worrying about administrative complexities or unnecessary expenses.

How to Personalize Your Invoice

Personalizing your billing form is an important step in making your business stand out and ensuring that each payment request reflects your unique identity. Customization not only enhances professionalism but also helps build trust and recognition with clients. By adjusting key elements, you can tailor the document to better suit your needs and present a cohesive image of your brand.

Start by incorporating your business logo, colors, and fonts into the design. This simple addition makes your payment request instantly recognizable and reinforces your company’s visual identity. You can also personalize the content by including specific payment terms, project descriptions, and other details that are unique to each transaction.

Additionally, consider adjusting the layout to highlight important information. For example, placing your contact details or payment methods prominently ensures that clients can quickly find the necessary information. Customizing the look and feel of your billing documents helps set a professional tone and improves your client’s overall experience with your business.

Key Elements to Include in an Invoice

To ensure that your payment requests are clear and comprehensive, it is essential to include all necessary details that both you and your clients need. A well-structured document will prevent confusion and help facilitate timely payments. While the specific requirements may vary depending on your business or industry, there are several key components that should always be present to ensure clarity and professionalism.

Essential Information for Clear Communication

Start by including your business name, address, and contact information at the top of the document. This allows clients to easily identify where the request is coming from and how to get in touch if needed. Also, ensure you add the recipient’s information, including their name and address, so that there is no ambiguity about who the payment is intended for.

Payment Details and Terms

It is crucial to outline the financial details clearly. List the items or services provided, their quantities, and the agreed-upon price for each. Additionally, make sure to specify the total amount due and any applicable taxes. Be sure to include payment terms, such as the due date and accepted payment methods, to avoid any misunderstandings. For longer-term projects or ongoing services, you may also include installment details or a schedule for payments.

By ensuring that these key elements are included in every billing request, you can help ensure a smooth and professional transaction process for both you and your clients.

How to Make Your Invoices Look Professional

Creating a polished, professional payment request is crucial for maintaining a positive relationship with your clients. A well-designed document not only reflects your business’s professionalism but also enhances trust and clarity. To ensure that your billing forms stand out and leave a lasting impression, it’s important to focus on both design and content.

Start by choosing a clean, easy-to-read layout with consistent fonts and spacing. Avoid cluttering the document with too much information or distracting elements. The more straightforward and organized the document looks, the more likely clients will appreciate its professionalism. Incorporating your business logo and using your brand’s colors can also add a personal touch and reinforce your identity.

In addition to a clean design, ensure that all necessary details are included and correctly formatted. Clear headings, itemized descriptions, and accurate financial information will make it easier for clients to review and understand the charges. Using professional language and a polite tone in your payment terms will help foster a positive relationship while making sure the expectations are clear.

By focusing on both the visual appeal and clarity of your payment requests, you create an impression of competence and reliability that can lead to more efficient transactions and stronger client relationships.

Printable Invoice Templates for Offline Use

While digital transactions are becoming increasingly common, there are still many situations where a physical payment request is needed. Whether you’re meeting a client in person, working in areas with limited internet access, or simply prefer to manage paperwork offline, having a printable billing form can be a valuable tool. These forms can be filled out manually or printed and handed to clients, offering a reliable alternative to digital formats.

Benefits of Using Printable Forms

Printable billing forms offer the advantage of flexibility. You can use them during in-person meetings, at trade shows, or for clients who prefer paper records. They also serve as backup options in case of technical issues or network failures, ensuring that you can still conduct business without interruption. Moreover, a physical copy can be kept for personal records, making it easier to track and manage finances offline.

How to Create and Use Printable Documents

To create an effective printable billing form, ensure that it includes all the necessary information, such as your business details, payment terms, and itemized services or products. You can customize the form to match your branding, making it look professional and consistent. Once designed, print it out on high-quality paper to give a polished look, ensuring it holds up well in the client’s hands.

Having a readily available physical version of your payment request helps ensure that you are always prepared, no matter where you are working or who you’re interacting with. It’s an essential tool for maintaining professionalism and efficiency in any situation.

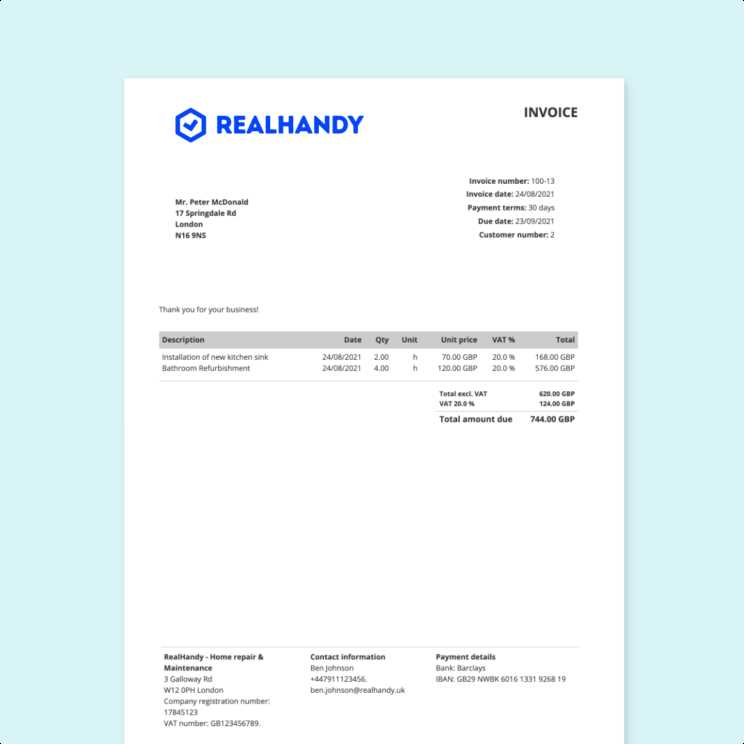

Digital Invoice Templates for Quick Payments

In today’s fast-paced business environment, speed and convenience are crucial for maintaining smooth transactions. Using digital payment request forms allows businesses to send accurate billing details instantly and receive payments more quickly. These electronic forms streamline the billing process and eliminate the delays often associated with manual paperwork, making it easier for both businesses and clients to complete transactions efficiently.

Advantages of Digital Formats

One of the biggest benefits of digital forms is the ability to send them directly to clients via email or other online platforms, eliminating the need for physical delivery. Clients can review the details and make payments immediately, often through integrated online payment systems. This can significantly shorten the payment cycle, allowing businesses to maintain better cash flow and avoid delays that come with mailing physical forms.

How to Maximize Efficiency with Digital Forms

To make the most of digital billing documents, ensure that they are easy to fill out and submit. Customizable fields for client information, services rendered, and payment terms make the form more flexible and suitable for different types of transactions. Additionally, incorporating clickable payment links or QR codes allows clients to pay directly from the document, making the process seamless and reducing the chances of payment delays.

By using digital formats, businesses can accelerate the payment process, improve accuracy, and reduce administrative overhead, leading to a more efficient billing system that benefits both parties.

Invoice Template for Freelancers and Contractors

Freelancers and independent contractors often manage multiple clients, each with different payment terms and project details. To ensure that billing is clear, accurate, and professional, it’s important to use a structured document that covers all necessary aspects of the transaction. A well-organized payment request not only helps maintain a smooth cash flow but also reinforces the freelancer’s credibility with clients.

A good billing document for freelancers should include all the essential information, such as contact details, a breakdown of services provided, and the payment due. Below is an example layout that freelancers and contractors can use to create effective payment requests:

| Item Description | Rate | Quantity | Total |

|---|---|---|---|

| Service/Project Name | $50/hour | 10 hours | $500 |

| Additional Service | $30/hour | 5 hours | $150 |

| Subtotal | $650 | ||

| Tax (10%) | $65 | ||

| Total Due | $715 | ||

This structure clearly outlines the services provided, their corresponding rates, and the total amount due. Including tax calculations and payment terms ensures that clients have all the necessary information to process the payment correctly and on time.

By using such a format, freelancers and contractors can ensure that their billing documents are professional, easy to understand, and complete, helping to maintain strong, transparent relationships with clients.

Adjusting Templates for Different Industries

Different industries have unique requirements when it comes to billing. A one-size-fits-all approach is not always effective, as various sectors may require specific details to be included in their payment requests. Adjusting the structure and content of these documents to meet the demands of your industry ensures that clients receive clear, comprehensive, and accurate records, which can improve payment efficiency and reduce misunderstandings.

For example, service-based businesses might focus more on hourly rates, project descriptions, and labor charges, while product-based companies would emphasize itemized lists of goods sold, quantities, and unit prices. Creative professionals such as graphic designers or writers might also include terms for copyright ownership or usage rights, which are not necessary for other industries.

Customizing for Different Business Models

When tailoring a payment document, consider the specific needs of your business type:

- Retail: Include detailed descriptions of each item sold, along with SKU numbers, quantities, and unit prices.

- Consulting: Break down your consulting services by hours worked or project phases, along with any travel or expenses incurred.

- Construction: Provide a detailed list of materials, labor costs, and equipment used, along with the time spent on each task.

- Creative Services: Mention specific terms like copyright ownership, licensing agreements, or the scope of work.

Key Considerations for Different Sectors

While customizing your document, always ensure that the basic components–such as your business information, client details, and payment terms–are present. However, consider adding any additional fields or sections that are relevant to your industry. For example, in the tech sector, you may need to include software version numbers or maintenance agreements, while in the healthcare sector, patient information and insurance details could be necessary.

By adjusting the structure and content of your billing forms to match your industry’s requirements, you create documents that are more relevant, clear, and professional, leading to faster payments and better client relationships.

How to Save Time with Invoice Templates

Streamlining your billing process is essential for running an efficient business. By using a pre-structured format for payment requests, you can significantly reduce the time spent on administrative tasks. These ready-made documents help automate many aspects of the process, allowing you to focus on more important business activities while ensuring consistency and accuracy in every transaction.

Key Ways to Save Time

- Pre-filled Information: Once you set up a basic document with your business and client details, it’s easy to reuse and update the information without starting from scratch each time. This cuts down on repetitive data entry.

- Faster Client Processing: With a standard format, clients are familiar with your payment requests, making it easier for them to process and pay quickly. Clear, concise forms lead to fewer questions and less back-and-forth.

- Customizable Fields: By using adaptable layouts, you can quickly adjust sections for different projects, whether you’re billing hourly rates, product sales, or package deals. This flexibility saves time when you’re handling various types of work.

- Automated Calculations: Including built-in calculations for totals, taxes, and discounts speeds up the creation of your documents, reducing the chance of human error and ensuring accurate billing every time.

Additional Time-Saving Tips

- Integration with Accounting Software: Linking your billing documents to accounting platforms can streamline the process of tracking payments and generating reports, saving you time on manual data entry.

- Digital Submission: Sending your payment requests electronically allows for instant delivery, eliminating postal delays and speeding up the process for both you and your clients.

By utilizing pre-made formats for payment requests, you can reduce the time spent on administrative tasks, minimize errors, and ensure consistent professionalism. This efficiency translates into quicker payments and more ti

Common Mistakes in Invoice Creation

When preparing payment requests, even small errors can lead to confusion, delayed payments, or damage to your professional reputation. Ensuring accuracy and clarity is essential for smooth transactions and strong client relationships. Below are some common mistakes businesses often make when creating billing documents, along with tips on how to avoid them.

Frequent Errors to Watch For

- Missing Contact Information: Failing to include your business name, address, or contact details can cause delays or confusion, especially if a client needs to reach you for clarification.

- Incorrect Payment Terms: Not clearly stating the due date or the payment method can lead to late payments or misunderstandings. Always include precise terms, such as “net 30 days” or “due upon receipt.”

- Omitting Detailed Descriptions: A vague or incomplete breakdown of services or products can leave clients unsure about what they are being charged for, potentially causing disputes.

- Calculating Errors: Simple mistakes in adding totals, taxes, or discounts can make your document appear unprofessional. Always double-check your calculations to ensure accuracy.

- Using Generic Documents: Generic, unbranded forms lack a personal touch and may not inspire the confidence that a professional, well-tailored document can. Customize your request to reflect your business identity.

How to Avoid These Mistakes

- Proofreading: Before sending, always proofread your document for any errors in spelling, math, or missing information. A second set of eyes can also help spot issues you may have missed.

- Use of Automated Tools: Consider using accounting software or automated tools that can reduce human error, ensure consistency, and save time when generating documents.

- Clear Formatting: Keep your document clean and easy to read. Properly spaced fields, bold headers, and organized sections help clients understand the details at a glance.

By avoiding these common mistakes and paying attention to the details, you can create more effective, accurate, and professional payment requests that foster trust and improve cash flow.

How to Automate Invoice Generation

Automating the creation of payment requests can save valuable time, reduce errors, and ensure consistency across all client transactions. With the right tools and systems in place, businesses can generate accurate and professional documents in just a few clicks. This allows you to streamline your billing process and focus more on growing your business rather than managing administrative tasks.

Steps to Automate the Process

To begin automating your billing process, consider these key steps:

- Choose the Right Software: Accounting software or specialized invoicing platforms offer automation features that can quickly generate forms based on pre-set data. These tools can pull in client details, services rendered, and payment terms to create personalized requests without manual input.

- Integrate with Your Client Database: By connecting your billing system to your customer database, you can automatically pull in client information, reducing the need to manually input details every time you generate a document.

- Set Recurring Billing: If you have clients with regular, ongoing contracts or subscription services, setting up automated recurring billing ensures that payment requests are generated and sent on a set schedule, reducing the risk of missing any deadlines.

- Customize Templates for Automation: Once you’ve set up automated systems, make sure to design and save customized formats for different types of work. This allows the system to select the appropriate format based on the service or product, ensuring accuracy and consistency every time.

Additional Automation Features

- Automatic Payment Reminders: Many automation tools include features for sending payment reminders to clients, which helps reduce late payments and improves cash flow.

- Online Payment Integration: Some automated systems integrate directly with online payment platforms, allowing clients to make payments directly from the document, speeding up the transaction process.

- Reporting and Analytics: Automated systems often include tools for tracking payment statuses, generating reports, and monitoring overall financial performance, allowing for better business planning.

By automating the generation of payment requests, you can improve operational efficiency, reduce administrative burden, and ensure that your billing process is always accurate and timely. This not only saves you time but also enhances client satisfaction and ensures a smoother cash flow.

Best Software for Invoice Template Customization

Customizing your billing documents to match your brand and specific needs is essential for presenting a professional image to your clients. With the right software, you can easily modify the design, layout, and content of your payment requests to reflect your business style, all while ensuring they meet the necessary legal and financial requirements. Below are some of the best tools that can help you create personalized and polished documents with ease.

Top Tools for Customization

Several software solutions offer flexibility in designing and personalizing billing documents. Here are a few popular options:

- QuickBooks: Known for its user-friendly interface, QuickBooks offers customizable billing formats that can easily be adjusted to suit various industries. You can add your logo, choose from multiple layout options, and create recurring billing schedules to save time.

- FreshBooks: FreshBooks provides easy-to-use tools that let you customize every aspect of your payment requests, including colors, fonts, and fields. It also integrates with other tools like PayPal and Stripe to simplify the payment process.

- Zoho Invoice: Zoho Invoice offers a wide range of customization features, from altering field names to adjusting the document’s overall design. It also allows you to automate client communications and track payment status easily.

- Wave: Wave is a free, cloud-based solution that provides basic customization options, such as adding business details, logos, and customized messages, while keeping things simple for users with smaller operations.

Why Customization Matters

Being able to personalize your billing documents is important for several reasons. Customization helps maintain consistency across all client interactions and reinforces your brand identity. Additionally, personalized billing documents make it easier for clients to identify important information, such as payment terms or service details, which can reduce the chances of misunderstandings or disputes.

By choosing the right software for customizing payment documents, businesses can enhance their professional image, improve client experience, and streamline their overall billing process.

Tips for Sending Invoices Promptly

Timely delivery of payment requests is essential for maintaining smooth cash flow and fostering professional relationships with clients. Delays in sending these documents can lead to late payments, confusion, and a negative perception of your business. By implementing efficient practices and utilizing the right tools, you can ensure that your payment requests are sent promptly and consistently.

Effective Strategies for Fast Delivery

Here are some tips to help you send payment requests without delay:

- Set a Standard Process: Establish a clear, repeatable process for creating and sending payment requests. Whether it’s after project completion or on a set schedule, having a routine in place will help ensure no document is overlooked.

- Automate Billing: Use software to automate the creation and sending of payment requests. With automation, documents can be generated and sent immediately upon completion of a service or milestone, saving time and reducing the risk of forgetfulness.

- Use Digital Delivery: Sending payment requests electronically ensures instant delivery. Whether via email or through an online platform, digital submissions are faster and more reliable than traditional mail, which can cause delays.

- Include All Details from the Start: Avoid back-and-forth emails by ensuring that your payment request is complete and clear the first time. Include all necessary details, such as descriptions, amounts, and due dates, to prevent unnecessary delays in client approvals.

- Stay Organized: Keep a log of your issued payment requests and their due dates. A simple tracking system will help you stay on top of upcoming deadlines and ensure that no payment request is forgotten.

Maximizing Efficiency with Digital Tools

- Payment Integration: Use platforms that allow clients to pay directly from the payment request, reducing the time between sending and receiving payments.

- Set Up Payment Reminders: Automate reminders to clients before and after the due date. A gentle nudge can help ensure timely payments and prevent overdue accounts.

By following these strategies, you can eliminate unnecessary delays and ensure that your payment requests are sent promptly. This not only improves your cash flow but also enhances your professionalism and strengthens client trust.

Tracking Payments with Invoice Templates

Monitoring payments effectively is a crucial aspect of maintaining financial stability in any business. Proper tracking ensures that you stay on top of pending payments, identify overdue accounts, and manage cash flow efficiently. By organizing payment records within structured documents, you can easily track the status of each transaction and take timely actions if necessary.

One of the best ways to keep track of payments is by integrating clear, consistent tracking features into your billing documents. This allows you to monitor the status of every transaction from the moment a payment request is sent to when the amount is received. Key details, such as payment due dates, amounts, and status (paid or pending), should be prominently displayed to simplify the process.

Additionally, consider including columns for payment method, transaction reference numbers, and notes for any communication with clients. This level of detail helps prevent confusion and ensures transparency, making it easier to follow up with clients when payments are delayed.

With the right system in place, tracking payments becomes more organized and less time-consuming, helping you maintain financial accuracy and improve client relationships.