Recruitment Agency Invoice Template for Efficient Billing

Managing financial transactions in a staffing business requires accuracy and clarity to ensure smooth operations. Setting up a consistent and clear billing system is essential for keeping track of service fees, client payments, and due dates. A well-structured format simplifies this process, helping businesses stay organized and maintain healthy cash flow.

For many in this industry, the use of adaptable layouts can significantly streamline payment tracking. By adopting a tailored billing framework, service providers can establish trust and transparency with clients. This approach minimizes errors and clarifies each transaction, making it easier to manage multiple accounts with ease.

Additionally, a thoughtfully designed format provides benefits beyond simple record-keeping. It offers a professional presentation that reflects the business’s reliability, reinforcing its credibility. A systematic approach to documentation also helps align financial practices with industry standards, ensuring all records are accurate and compliant.

Understanding the Basics of Invoicing

At the core of effective financial management lies a solid grasp of billing fundamentals. For businesses that frequently work with clients, establishing clear records of each transaction is essential. These documents not only detail the scope of services provided but also set expectations around payment, due dates, and terms. By creating a clear and consistent process, businesses can ensure transparency and foster stronger client relationships.

Key Elements of a Standard Billing Document

Each financial record should include essential details to avoid confusion and ensure payments are processed smoothly. A well-structured document contains:

- Identification Information: Include the names or logos of both parties involved to maintain professional presentation and easy identification.

- Service Description: A clear breakdown of each service provided, along with associated fees and any applicable taxes.

- Payment Terms: Detailed terms that outline payment deadlines, methods, and any applicable penalties for late payments.

Common Types of Billing Formats

To meet varying business needs, there are several common layouts that service providers can consider. Each format offers specific advantages:

- Itemized Format

Essential Components of an Invoice

Creating a comprehensive and organized billing document is key to maintaining clear financial interactions with clients. Each element in the document serves to clarify the details of services rendered, the amount owed, and terms of payment. By including all necessary components, businesses can help ensure prompt and accurate payments, minimize disputes, and build trust with clients.

Core Information to Include

Every well-structured billing document should contain fundamental details to provide clarity and avoid potential issues. Here are the key elements:

- Company and Client Identification: Clear identification of both parties, often including names, addresses, and contact details. This reinforces transparency and provides an official look.

- Description of Services: A concise yet detailed outline of each task or service performed, ensuring the client understands what they are being charged for.

- Unique Document Number: Assign a unique reference code or number to each document, allowing easy tracking and reference in case of questions or follow-ups.

- Dates: Include the issue date and, if applicable, a due date. Clear dates help both parties stay aware of payment

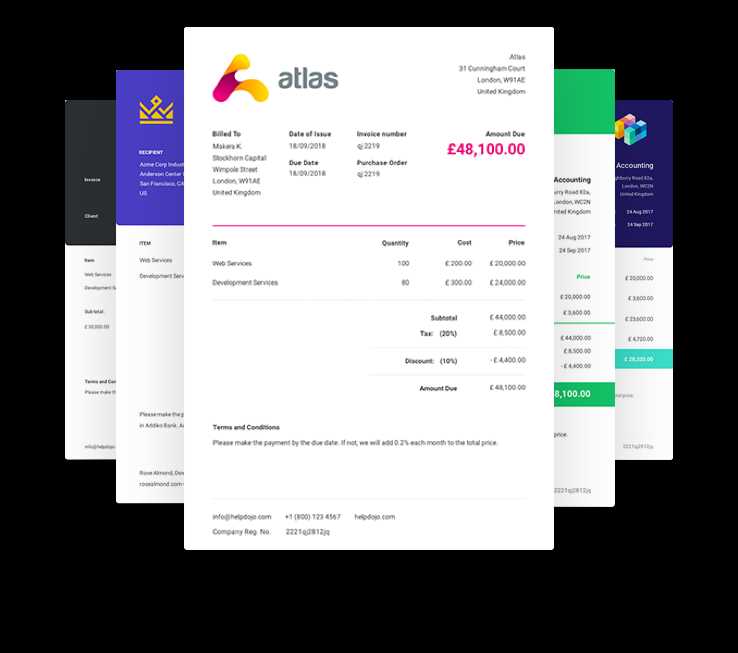

Benefits of Using Invoice Templates

Implementing pre-designed billing formats offers a streamlined approach to managing financial transactions. These ready-made structures help save time, reduce errors, and maintain consistency in documentation. For businesses handling frequent payments, having an organized format enhances productivity and helps build trust with clients by ensuring that all necessary details are clearly presented.

Time-Saving and Efficiency

Using structured layouts greatly reduces the time required to generate financial documents. Rather than creating a new format each time, businesses can simply fill in the necessary details, saving valuable time and resources. This efficiency also minimizes the likelihood of mistakes, as standardized formats ensure that essential information is always included.

Improved Professionalism and Consistency

A standardized format presents a polished and consistent image to clients. Consistent documentation reassures clients that the business is well-organized and detail-oriented, fostering confidence in the relationship. Additionally, these docume

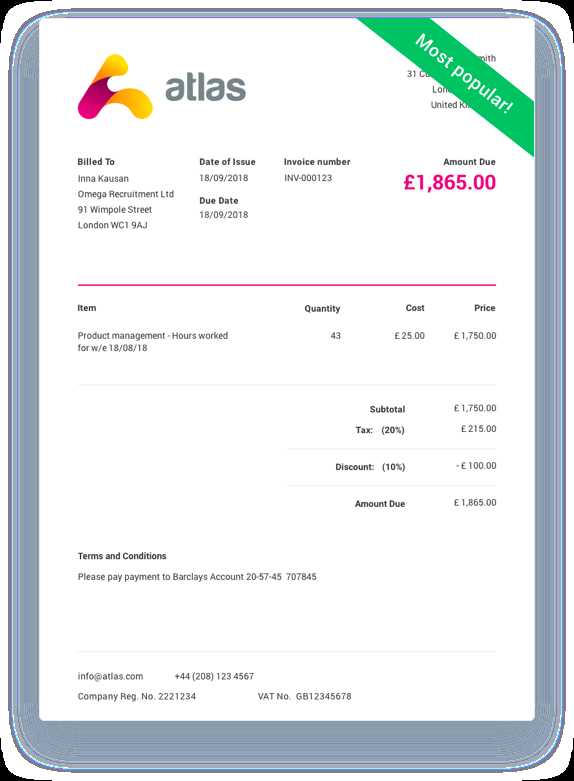

How to Customize Your Invoice

Personalizing billing documents helps businesses reflect their unique brand while ensuring that essential details meet client expectations. Customization allows for the inclusion of specific branding elements, flexible formats, and tailored information that align with the needs of each client or project. A customized approach not only adds a professional touch but also helps make each document clear and accessible.

Incorporating Branding Elements

Adding logos, brand colors, and specific fonts can make a billing document look more professional and consistent with other client-facing materials. These visual elements help the document stand out, while also providing an additional layer of brand recognition. A well-branded format leaves a positive impression and strengthens the overall identity of the business.

Adjusting Layout and Content

Each client may have unique requirements, and adjusting the for

Common Mistakes in Invoice Formatting

While creating billing documents may seem straightforward, certain formatting errors can lead to delays in payment or misunderstandings with clients. Avoiding these common mistakes helps ensure that each document is clear, accurate, and professional, supporting smoother transactions and better client relations.

Omitting Key Information

One of the most frequent errors is failing to include all necessary details. A well-structured document should provide a complete picture of the transaction to avoid client confusion. Missing information may lead to payment delays or disputes, so be sure to avoid the following omissions:

- Lack of Unique Reference Number: Without a unique identifier, tracking individual transactions becomes challenging, especially when dealing with multiple clients.

- Missing Contact Information: Always provide a contact for questions, making it easy for clients to address any uncertainties directly.

- Unclear Payment Terms: Ensure due dates, accepted payment methods, and any penalties for late

Professional Design Tips for Invoices

A well-designed financial document plays a crucial role in enhancing the professionalism of your business communications. A clean, organized layout not only makes it easier for clients to understand but also reinforces your brand identity. Incorporating effective design principles ensures that your document is both functional and visually appealing, contributing to a positive client experience.

Use a Clean, Structured Layout

Ensure that the layout is easy to follow by organizing information logically. Key sections like contact details, payment terms, and amounts due should be clearly delineated for quick reference. Avoid clutter by using adequate spacing between sections and focusing on essential details.

Incorporate Your Branding

Including your company logo, brand colors, and consistent fonts helps reinforce your business identity. This creates a more cohesive and professional look that aligns with other client-facing documents, building trust and recognition.

Consider Typography and Readability

Choose easy-to-read fonts and appropriate font sizes. Headings should stand out, and the body text should be legible, even in printed form. Avoid overly decorative fonts that could compromise clarity.

Design Element Recommendation Font Style Use clear, professional fonts like Arial, Helvetica, or Times New Roman. Font Size Ensure the font size is large enough for easy reading, especially for the main body (10-12px). Colors Use brand colors for highlights, but maintain a neutral background to ensure readability. Spacing Leave enough padding between sections to avoid overcrowding and make the document easier to scan. Following these tips will result in documents that look professional and polished, creating a lasting positive impression and facilitating clear communication with clients.

Key Information for Recruitment Invoices

When creating a billing document for services provided, certain details are essential for clarity and smooth processing. Ensuring that the key components are included helps both the service provider and the client understand the terms and conditions, avoiding delays and potential disputes. The following information is crucial to ensure accuracy and professionalism in each transaction.

Essential Elements to Include

Each financial statement should be comprehensive and structured, containing these vital details:

- Client Information: Include the full name, business name, and contact details of the recipient.

- Service Details: Clearly describe the services rendered, including the scope, dates, and any specific terms of engagement.

- Payment Terms: Outline due dates, late payment fees, and accepted methods of payment.

- Total Amount Due: Provide a detailed breakdown of the charges, including any taxes or additional fees.

- Unique Reference Number: Assign a unique identifier for easier tracking and reference.

Additional Information for Clarity

Beyond the basic details, these extra components can add further value and prevent misunderstandings:

- Discounts or Special Offers: If applicable, include information on discounts given or any promotional terms.

- Contact for Queries: Add a contact number or email address for clients to reach out with any questions about the charges.

- Company Branding: Use your logo and business colors to give the document a professional appearance and reinforce your brand identity.

By ensuring that all these details are present, the billing document will not only be clear and effective but also serve as a professional representation of your business.

Creating Clear Payment Terms

Establishing transparent and concise payment conditions is crucial for both parties involved in a transaction. By clearly outlining how and when payments should be made, you can minimize confusion and ensure timely compensation for the services provided. Clear terms also help maintain a professional relationship and prevent potential misunderstandings down the line.

Key Elements of Payment Terms

To avoid disputes and ensure clarity, include these important elements in your payment guidelines:

- Due Date: Specify a clear and reasonable deadline for when the payment is expected.

- Accepted Payment Methods: Indicate the preferred methods of payment, whether it’s bank transfer, credit card, or another option.

- Late Payment Penalties: Clearly define any fees or interest charges that will be applied if the payment is not made on time.

- Early Payment Discounts: If offering a discount for early payments, be sure to mention the exact terms and timeline.

Additional Considerations

Providing further details can also improve the understanding of your payment terms:

- Payment Reminders: Indicate if reminders will be sent before the due date or if a grace period is allowed.

- Currency: Specify the currency in which the payment should be made to avoid confusion if dealing with international clients.

- Refund and Return Policy: In some cases, it may be beneficial to include your refund or return policy, especially for service-based engagements.

By ensuring your payment terms are well-defined and easy to understand, you can streamline the financial aspects of your business and foster a stronger client relationship.

Tracking Payments and Due Dates

Monitoring payments and ensuring deadlines are met is a crucial part of managing any transaction. By staying on top of due dates and confirming payments, you can avoid delays, prevent financial discrepancies, and maintain a smooth workflow. Efficient tracking not only helps in organizing finances but also ensures that the services provided are compensated promptly.

Effective Tracking Methods

To manage due dates and payments effectively, consider using the following strategies:

- Automated Reminders: Set up automatic reminders to notify both parties of upcoming due dates, preventing missed payments.

- Payment Management Software: Utilize software tools that can track the status of each transaction, including pending and completed payments.

- Spreadsheets: If you prefer a more hands-on approach, use spreadsheets to monitor payments, marking due dates and payment statuses.

Dealing with Late Payments

In case a payment is delayed, it is important to follow up appropriately:

- Polite Communication: Reach out to clients with a friendly but firm reminder, specifying any penalties if applicable.

- Grace Periods: Offer a short grace period to accommodate clients who might need additional time to complete the payment.

- Escalation Procedure: In extreme cases, establish a clear process for escalating late payments, such as involving legal or financial assistance.

By adopting these tracking methods and handling overdue payments carefully, you can ensure that your transactions remain organized and efficient.

Streamlining Billing for Staffing Agencies

Optimizing the billing process for businesses that provide temporary labor services is essential to ensure accuracy and efficiency. A well-organized system can minimize errors, improve cash flow, and reduce administrative burdens. By automating and simplifying the financial procedures, these organizations can focus on delivering quality service while maintaining a smooth financial operation.

Automating Billing Procedures

Automation is key to eliminating manual errors and speeding up the billing process. Here are a few ways to automate the system:

- Automated Billing Software: Use software that generates and sends payment requests automatically based on time entries or service agreements.

- Recurring Payment Setup: For long-term clients, setting up recurring billing schedules can simplify the process and reduce the risk of missed payments.

- Integration with Time Tracking Tools: Link time management systems with billing platforms to directly transfer hours worked into invoices, reducing administrative work.

Clear and Detailed Billing Statements

Providing clarity in each statement helps clients understand what they are being charged for, improving the chances of timely payment. Ensure your statements include:

- Breakdown of Services: List all services and hours worked to offer transparency.

- Due Dates: Clearly highlight payment due dates to avoid confusion.

- Payment Methods: Specify all available payment options to accommodate clients’ preferences.

By streamlining the billing process, businesses can ensure quicker payments, enhance client relationships, and reduce administrative overhead.

Tips for Accurate Billing Records

Maintaining precise financial records is essential for smooth business operations and effective client relationships. Accuracy in tracking transactions helps prevent disputes, ensures timely payments, and provides valuable insights for future budgeting. By following some best practices, businesses can ensure their records are clear, consistent, and easy to manage.

Keep Detailed Documentation

For every service provided or project completed, ensure there is a record that includes:

- Service Descriptions: Be specific about what was delivered to avoid confusion later.

- Time Logs: Record the exact hours worked, dates, and the responsible individuals to prevent discrepancies.

- Agreements: Store copies of any signed contracts or terms that outline pricing and services.

Use Consistent Formats

Having a standard format for all records allows for easier review and comparison. This can include:

- Uniform Data Entry: Make sure all information is entered in a consistent style (e.g., date formats, currency, service names).

- Template Utilization: Utilize a well-structured format for each document, which simplifies the tracking of payments, services, and other details.

Review Records Regularly

Regular checks and reconciliations help catch any errors early. Set aside time weekly or monthly to:

- Verify Transactions: Ensure all transactions are properly recorded and correspond with your payment logs.

- Update Outstanding Payments: Track unpaid balances and follow up on overdue amounts promptly.

By following these practices, businesses can reduce errors, improve their financial management, and ensure timely and accurate billing.

Best Practices for Client Communication

Effective communication with clients is key to maintaining strong relationships and ensuring a smooth workflow. Clear, transparent, and timely exchanges help prevent misunderstandings and ensure that both parties are on the same page. Adopting consistent communication strategies will enhance client trust and lead to better business outcomes.

Be Clear and Concise

When discussing terms, services, or expectations, it’s important to use clear language. Avoid jargon or ambiguous terms that may confuse clients. Here are some tips to maintain clarity:

- Use Simple Language: Keep the language straightforward to ensure that all parties understand the details.

- Avoid Overloading with Information: Focus on the most important aspects to prevent overwhelming the client.

- Clarify Complex Points: When discussing complicated matters, break them down into smaller, easy-to-understand parts.

Be Responsive and Timely

Clients appreciate quick responses, especially when it comes to inquiries or issues that need resolution. To maintain effective communication:

- Respond Promptly: Aim to reply to emails or calls within 24 hours to show that you value their time.

- Set Expectations for Response Times: Let clients know when they can expect a response, especially for non-urgent matters.

- Proactively Update Clients: Keep them informed on progress or any delays to avoid unnecessary surprises.

Maintain Professionalism

It’s essential to keep a professional tone in all communications, regardless of the situation. Consider the following:

- Be Polite and Courteous: Respectful language builds trust and shows clients that you are committed to providing excellent service.

- Maintain a Positive Tone: Even when addressing challenges, a positive and solution-oriented approach makes communication more effective.

Using Technology for Better Communication

Leveraging tools can make communication more efficient. Consider integrating platforms that provide structured communication and ease of use:

Tool Benefit Email Management Helps track communication history and send formal updates efficiently. Project Management Tools Allows for real-time updates and sharing of documents, reducing the need for constant back-and-forth. Instant Messaging Provides quick and informal channels for quick clarifications and minor questions. By adhering to these practices, businesses can establish strong, lasting relationships with clients, improve service delivery, and foster a positive working environment.

Managing Multiple Client Invoices

Handling numerous client transactions efficiently is essential for maintaining a well-organized financial system. When managing payments from various clients, it’s important to have a structured approach to ensure no details are overlooked. A streamlined process helps avoid confusion and ensures timely processing and collection of funds.

Organizing Client Information

To manage several clients effectively, it’s crucial to have a centralized system that keeps track of each client’s financial details. This can include payment amounts, due dates, and any special terms. A well-organized client list is key to staying on top of multiple transactions. Here are some key elements to track:

Client Name Amount Due Due Date Status Client A $500 15th August Unpaid Client B $750 22nd August Paid Client C $300 30th August Unpaid Automating the Process

One of the most effective ways to manage multiple transactions is through automation. By using software or digital tools that track deadlines, payments, and client details, businesses can reduce the risk of errors and delays. Key benefits of automation include:

- Reminder Notifications: Automated reminders can be sent to clients before payments are due, reducing the chances of late payments.

- Record Keeping: Automation ensures that all transaction records are up-to-date and stored in an organized manner.

- Efficiency: It saves time by handling repetitive tasks such as sending receipts or generating reports.

By implementing these strategies, businesses can keep track of all client payments effectively and maintain a clear financial overview, ensuring smooth operations and timely payments.

Benefits of Digital Invoicing Tools

Utilizing digital solutions for handling financial records offers numerous advantages over traditional manual methods. By adopting modern tools, businesses can streamline their processes, reduce human errors, and enhance overall efficiency. These digital systems provide faster processing, improved accuracy, and better organization, making it easier to manage transactions and keep track of financial details.

One of the key benefits of digital solutions is their ability to automate repetitive tasks, such as generating records and sending payment reminders. This reduces the amount of time spent on administrative duties, allowing for more focus on core business activities. Additionally, digital tools often integrate with other systems, providing seamless workflows that save time and effort in managing financial documentation.

Another advantage is the ability to easily store and retrieve financial information. With a digital system, past records can be accessed with just a few clicks, improving accessibility and reducing the risk of losing important documents. The system can also ensure that records are organized according to relevant categories, making it simpler to find the information when needed.

Overall, adopting digital tools for managing financial transactions not only enhances operational efficiency but also contributes to better decision-making through accurate and easily accessible data.

Ensuring Compliance in Financial Documentation

Maintaining accurate and legally compliant financial records is essential for any business. By following the relevant laws and regulations, organizations ensure that their financial practices are transparent and free from errors or disputes. Proper documentation is not only a sign of professionalism but also crucial for meeting legal obligations and avoiding penalties.

Key Elements for Compliance

To ensure that financial records comply with applicable standards, several key components must be considered:

Element Description Accuracy Ensure all amounts are correctly calculated and match the services rendered. Timeliness Documents should be created and submitted within the required timeframes. Transparency Clearly state the details of all transactions, including payment terms and conditions. Record Retention Keep financial documents for the necessary duration as required by law. Staying Updated with Legal Changes

Regulations regarding financial documentation can change over time, so businesses must stay informed about new rules. Regularly reviewing industry standards and legal requirements helps prevent potential non-compliance. Consulting with a legal expert or utilizing updated software tools can also aid in ensuring that all records are up-to-date and accurate.

By prioritizing compliance, businesses protect themselves from legal challenges, build trust with clients, and ensure that their financial operations run smoothly and transparently.

Choosing the Right Document Format

Selecting the appropriate structure for billing documents is crucial for smooth business transactions. The format you choose determines how easy it is for both parties to understand the details and handle the payment process efficiently. A clear and well-organized document reduces confusion and ensures timely payments.

Factors to Consider When Choosing a Format

When deciding on the best structure for your financial documents, consider the following factors:

- Clarity: The document should present the details in a simple, easy-to-read manner.

- Customization: The format should allow you to add specific details that suit your business needs, such as service descriptions or terms of payment.

- Consistency: Choose a format that you can use consistently for all transactions to maintain uniformity across your financial records.

- Professionalism: The format should reflect your brand and create a professional impression.

Popular Formats for Billing Documents

There are various formats to choose from depending on your business type and preferences. Below are some of the most commonly used formats:

- Simple Format: Suitable for smaller businesses with straightforward transactions, it usually includes basic details such as the amount due, payment terms, and service description.

- Detailed Format: Used by larger businesses or those requiring more detailed breakdowns. It may include multiple sections for different services, taxes, and additional fees.

- Digital Format: Ideal for businesses that prefer electronic transactions. This format may include fillable fields and automated calculations for efficiency.

By considering these factors and formats, you can choose the best structure that aligns with your business goals and facilitates smooth financial exchanges with your clients.

Improving Cash Flow with Timely Billing

Effective management of cash flow is critical to maintaining the financial health of any business. One of the key strategies for achieving this is ensuring that payments are requested promptly and processed without unnecessary delays. By adopting timely billing practices, businesses can reduce outstanding balances and ensure a steady stream of income.

To improve cash flow, it’s important to establish a clear and consistent schedule for sending payment requests. This not only keeps your accounts receivable up to date but also sets expectations with clients regarding when payment is due. The quicker you request payment, the faster you will receive funds, which can be reinvested into your business operations.

Another aspect of timely billing is reducing errors. Accuracy in the details, including amounts, dates, and payment terms, is essential for avoiding disputes that could cause delays in payment. A simple, well-organized request helps clients process payments more quickly, contributing to a more efficient cash flow cycle.