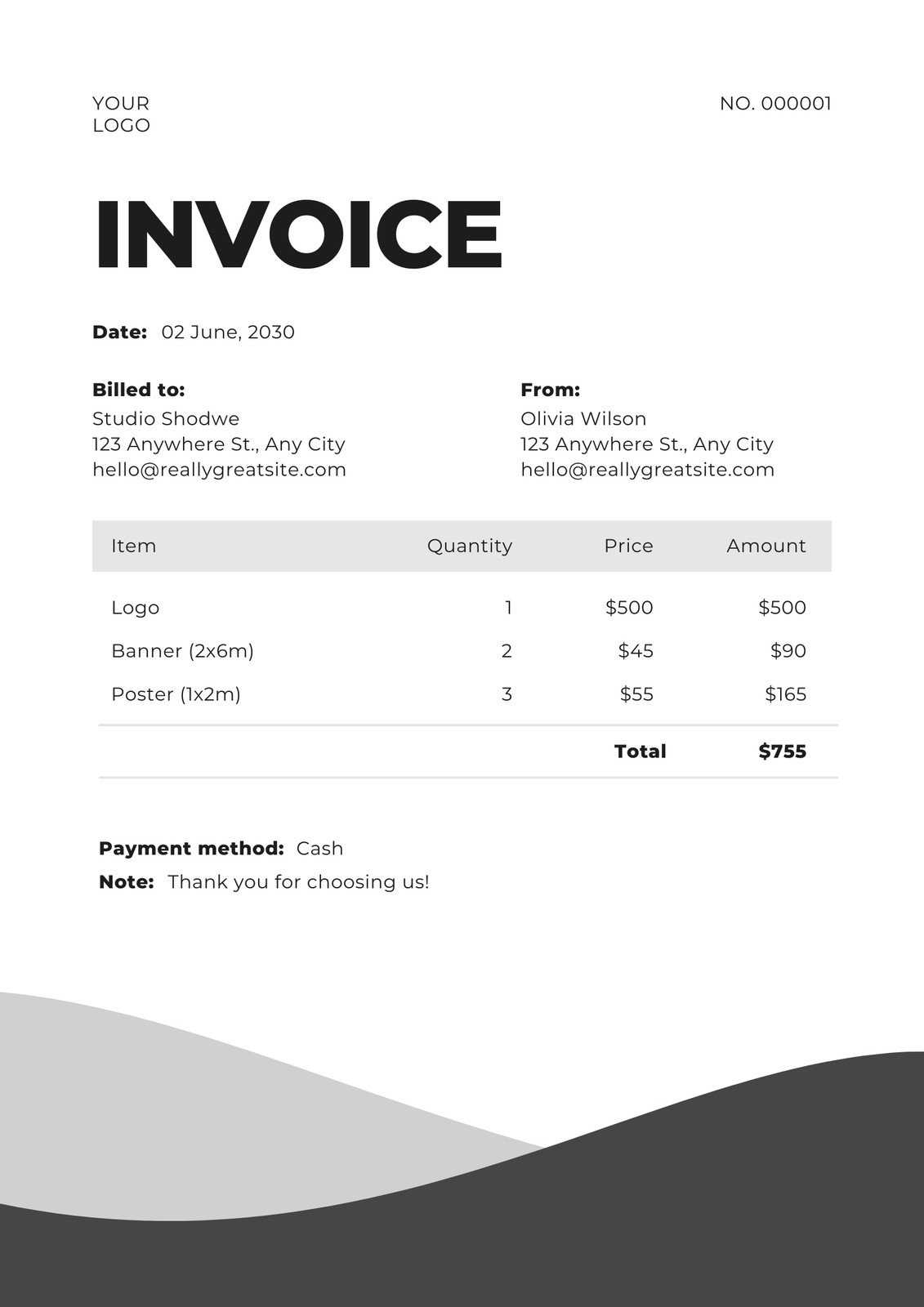

Computer Services Invoice Template for Easy Billing

When running a technical support or maintenance business, it is essential to have a clear and professional way to request payment for the work done. A well-structured billing document helps maintain transparency and ensures that both you and your clients are on the same page regarding fees and payment terms.

To streamline the process, many opt for a pre-designed format that can be easily customized to suit the specifics of each transaction. This approach not only saves time but also reduces errors, making your business look more organized and reliable. A professional billing document can also serve as a record of completed tasks and an essential tool for financial tracking.

Customizing such documents is straightforward, allowing you to adapt them to various types of engagements. By incorporating key details like the scope of work, payment terms, and contact information, you ensure that all necessary information is included in an easy-to-read format. Whether you’re invoicing for a one-time job or recurring work, a clear billing document is indispensable for smooth business operations.

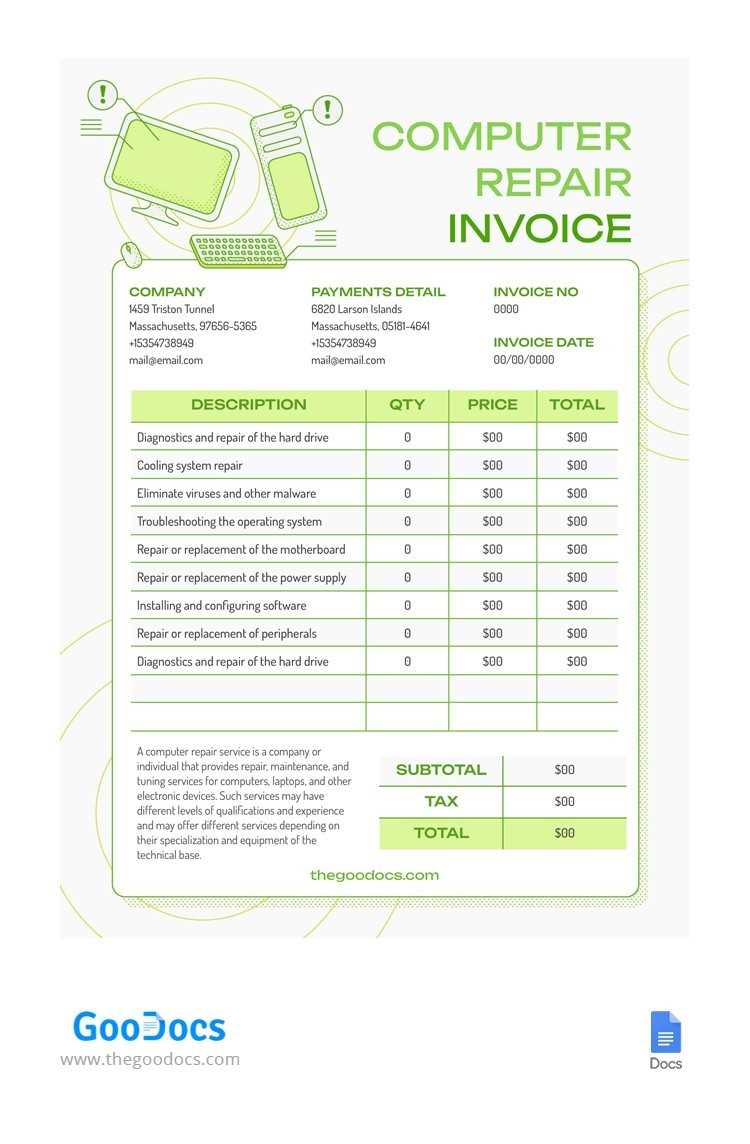

Creating a Billing Document for Technical Work

Establishing a clear and organized billing document is essential for businesses involved in technical support or repairs. It helps ensure that both parties involved in the transaction understand the scope of work and the financial terms. A well-crafted document improves professionalism and can contribute to smoother business operations by clearly listing the services rendered and the corresponding charges.

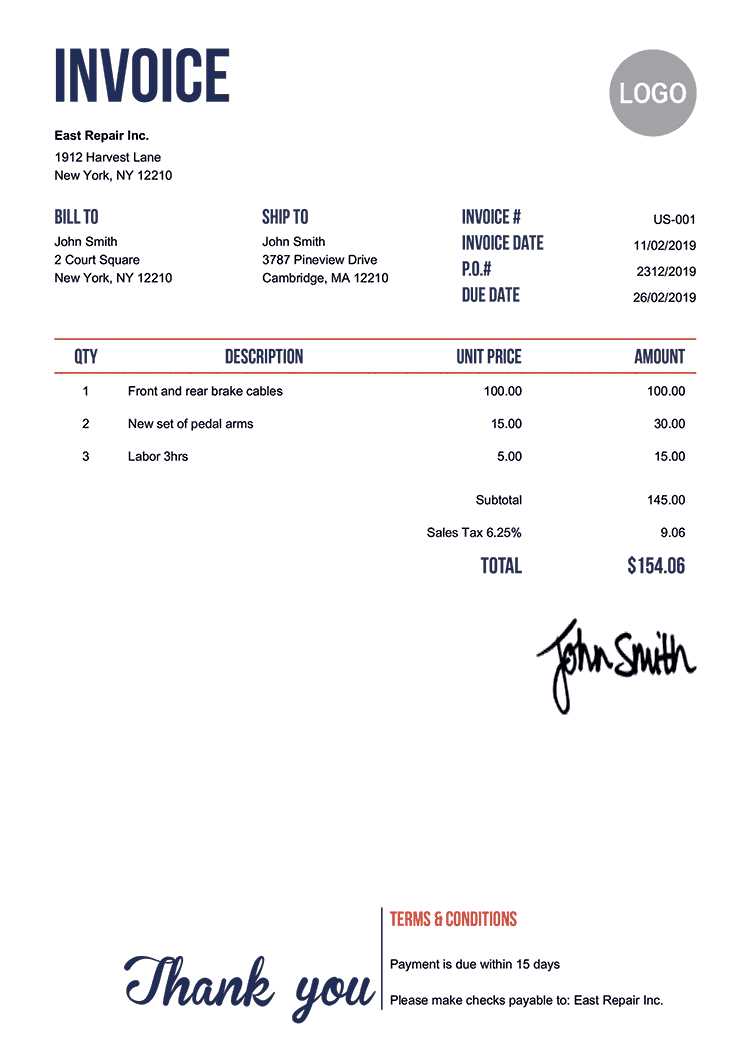

To create an effective billing document, consider the following key elements:

- Client Information: Include the client’s full name, company (if applicable), and contact details.

- Work Details: Provide a brief description of the tasks completed, including the duration of the work and any specific actions performed.

- Payment Terms: Clearly outline when and how the payment should be made, along with any late fees or discounts for early payments.

- Pricing: Break down the costs for each service or hour worked, ensuring that the charges are transparent.

- Taxes and Additional Fees: If applicable, include any taxes or extra charges related to the work done.

- Payment Methods: List the accepted methods of payment, such as bank transfer, credit card, or online payment services.

Once the essential details are outlined, focus on formatting the document for clarity and easy navigation. Use a clean layout with clearly labeled sections to ensure the document is simple to read and professional in appearance. This makes it easier for clients to review and for you to track payments and work completed.

Whether you are handling a one-off project or ongoing work, this approach will help you create a document that is both practical and professional, ensuring smoother transactions and fewer disputes.

Why You Need an Invoice Document

Having a pre-designed structure for billing is essential for any business. It not only simplifies the process of requesting payment but also ensures that all important details are included, reducing the chances of confusion or missed information. A consistent approach to creating billing records improves professional image and makes financial transactions smoother.

Here are some reasons why using a standardized billing record is important:

Time-Saving Efficiency

With a ready-made structure, you can quickly generate accurate billing records, saving valuable time that could otherwise be spent on manual formatting. The consistency of using a set format eliminates the need to re-create the document from scratch each time you complete a job or project.

Minimizing Errors

A fixed layout helps ensure that no essential information is left out. By following the same structure every time, you reduce the likelihood of forgetting key details like payment terms or work descriptions.

| Benefit | Impact |

|---|---|

| Time Savings | Faster processing of payment requests |

| Consistency | Builds a professional reputation |

| Clarity | Reduces confusion for both parties |

| Accuracy | Prevents missing or incorrect information |

Overall, using a standa

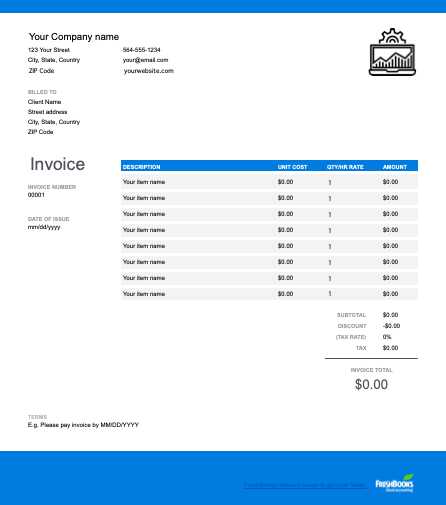

Key Elements of a Professional Billing Document

To ensure clarity and professionalism, a billing document should include all necessary information in a well-organized manner. Each section plays a crucial role in making sure both parties understand the terms and expectations surrounding the transaction. The following elements are essential for a complete and effective billing record.

| Element | Description |

|---|---|

| Contact Information | Include the names, addresses, and phone numbers of both the sender and recipient. |

| Unique Reference Number | A unique identifier for the transaction, helping to track payments and jobs. |

| Work Description | Clear details on the tasks or work completed, including any materials used or hours worked. |

| Payment Terms | Specify when payment is due and any terms for late payments or early discounts. |

| Price Breakdown | List the individual costs for each service or task performed, with a total at the end. |

| Payment Methods | Outline accepted methods of payment (e.g., bank transfer, credit card, online payment systems). |

| Taxes and Fees | Include applicable taxes and additional fees, if any, based on the agreement. |

Incorporating these key elements helps ensure that the billing process is smooth, professional, and transparent. By making sure all necessary information is present and easy to understand, you avoid confusion and enhance your professional reputation.

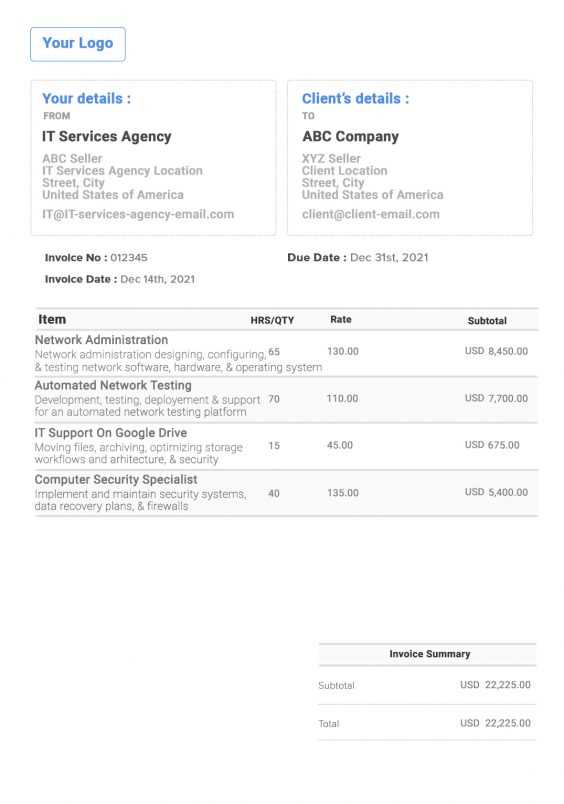

Customizing Your Document for IT Work

When creating a billing document for technical projects, it’s important to adjust the structure to meet the unique requirements of the work you perform. Customization allows you to clearly reflect the specifics of each job, from the type of support provided to the materials used, and to present this information in a professional, easy-to-understand format. A tailored document not only improves client communication but also streamlines your billing process.

Adapting for Different Types of Projects

Different types of technical work may require varying levels of detail. For example, if you are providing troubleshooting or maintenance, it’s important to list any repairs made, time spent, and any necessary parts. For consulting or setup tasks, focus on the specific areas of expertise provided, along with time and resources spent on each task.

Incorporating Specific Costs and Fees

One key customization is in how you break down costs. Depending on the nature of the work, you may need to include:

- Hourly Rates: If work is billed by time, list the number of hours worked along with the hourly rate.

- Flat Fees: If charging a fixed price for a specific task, make sure to clearly indicate this amount.

- Material Costs: If applicable, detail any hardware or software costs that were incurred during the job.

By personalizing the document to fit the specifics of each task, you ensure that your clients understand exactly what they are being charged for, which builds trust and reduces potential misunderstandings.

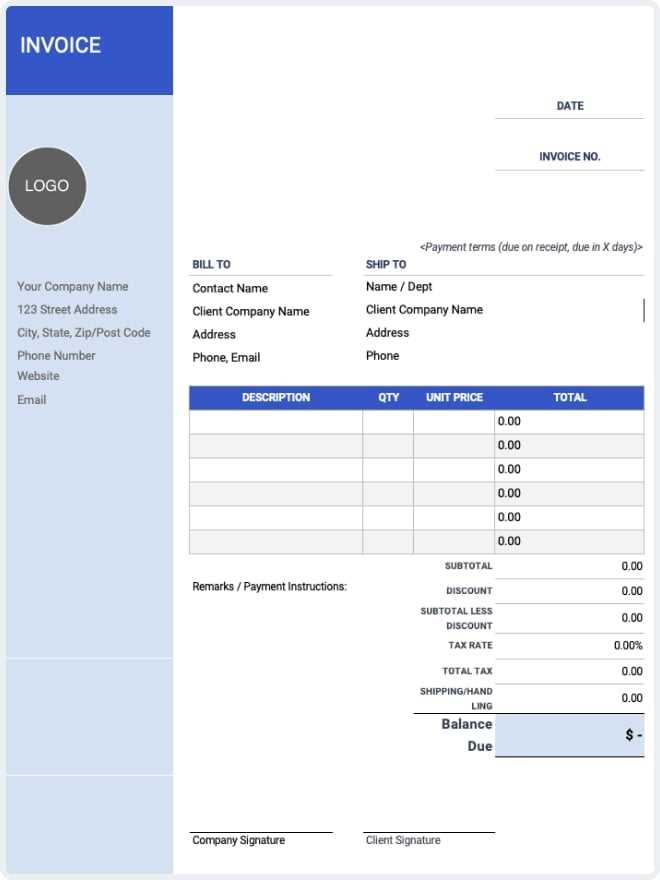

Best Practices for Designing Billing Documents

Creating a well-designed billing document goes beyond just listing charges. It’s about ensuring that all essential information is presented clearly and professionally. The layout should be simple to navigate, with important details easy to find. By following a few key design principles, you can create a document that not only looks polished but also enhances communication and payment clarity.

1. Keep It Clean and Simple

A cluttered document can confuse clients and make it harder for them to understand the charges. Use plenty of white space and avoid overloading the document with unnecessary details. Prioritize clarity by organizing sections logically, such as placing contact information at the top, followed by work descriptions, pricing, and payment terms.

2. Use Clear Section Headings

Label each section clearly, so clients can quickly find what they are looking for. Use bold or larger font sizes for headings like “Work Description”, “Pricing Breakdown”, and “Payment Terms.” This simple organization ensures that the document is not only functional but also professional in appearance.

3. Focus on Readability

Choose easy-to-read fonts and maintain a consistent style throughout the document. Avoid overly decorative fonts, as they may distract from the content. A clean, modern font with a readable size (typically 10-12pt) helps ensure the document is easy to read at a glance.

4. Incorporate Branding Elements

Including your logo and company colors can help reinforce your brand identity and make the document feel more official. Just be sure not to overdo it–keep branding subtle and professional to maintain focus on the essential information.

5. Make the Payment Instructions Clear

Clearly outline how and when payment is expected. Provide details like bank account information, accepted payment methods, and due dates. This eliminates any confusion and ensures that your client knows exactly how to settle the bill.

Choosing the Right Billing Format

Selecting the appropriate structure for your payment request is crucial to ensuring both clarity and ease of use. The format you choose should align with your business needs, the preferences of your clients, and the type of work being completed. A well-organized structure not only facilitates smoother transactions but also helps maintain a professional image.

Digital vs. Paper-Based Formats

One of the first decisions you’ll need to make is whether to use a physical or digital document. Digital formats offer the advantage of quick delivery, easy storage, and often come with features such as automated calculations and customizable fields. On the other hand, paper-based documents may be preferred by clients who are not as familiar with digital tools or who prefer traditional methods of communication.

Customizable vs. Standardized Layouts

A customizable structure allows you to tailor each document to reflect the specifics of the job. This format is ideal for businesses that handle a variety of tasks, as it enables flexibility in the level of detail provided. For businesses with simpler, more standardized work, a pre-designed layout might be more efficient, helping you save time while maintaining a professional appearance.

Regardless of the format chosen, ensure that it is easy to navigate and understand. A clear, well-structured document minimizes confusion and accelerates payment processing, ultimately contributing to better client relationships and smoother operations.

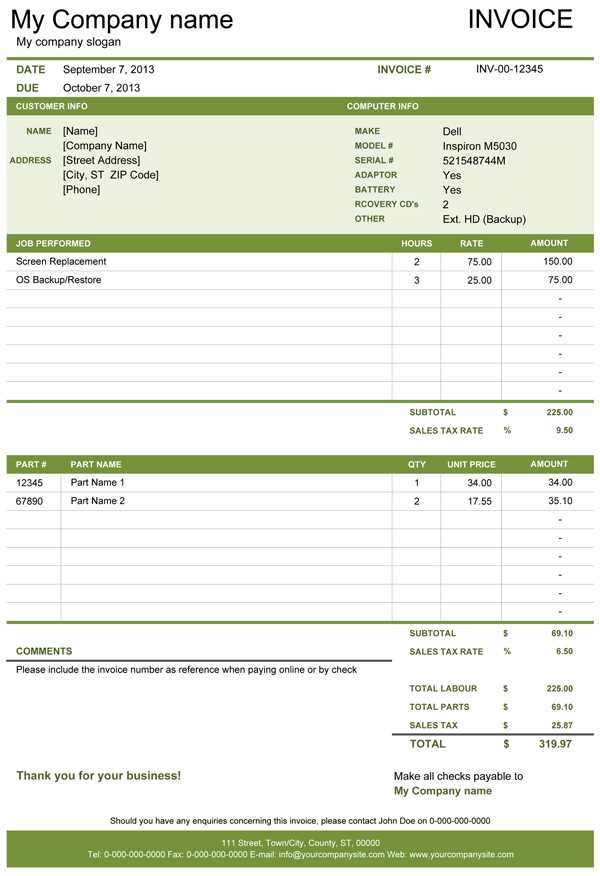

How to Include Work Descriptions

Providing clear and detailed descriptions of the work completed is essential for both transparency and professional communication. When clients receive an itemized list of tasks, they can easily understand the work involved, the value provided, and the cost breakdown. It also helps to prevent any confusion or disputes about what was delivered.

Be Specific and Clear

Each task should be described in clear, unambiguous language. Avoid vague terms and be specific about what was done, including the tools, materials, and methods used if relevant. For example, instead of writing “fix issue,” describe it as “diagnosed and repaired network connectivity problem” to give clients a clear picture of the work performed.

Break Down Complex Jobs

For more complex projects, break down the work into smaller, manageable parts. This not only helps in justifying the charges but also demonstrates your thorough approach to each aspect of the job. If a task involved multiple steps, such as troubleshooting followed by repairs and testing, list each stage separately so the client knows exactly what was done at each phase.

Example:

- Network Setup: Installation of routers and switches, configuration of IP addresses.

- Issue Resolution: Diagnosed and repaired slow internet connection caused by faulty wiring.

- System Optimization: Updated software and cleared system cache to improve device performance.

By clearly listing all aspects of the job, you show your client the value of your work, foster trust, and reduce the likelihood of misunderstandings.

Setting Payment Terms and Conditions

Establishing clear payment terms and conditions is crucial for both protecting your business and ensuring smooth transactions. By defining when and how payments are due, you set expectations for your clients and prevent potential misunderstandings. Clear terms also help you manage cash flow effectively and maintain professional relationships.

Define Payment Deadlines

One of the most important aspects of payment terms is setting a specific due date. This allows clients to understand when payment is expected and ensures that you are paid in a timely manner. Some businesses may choose to give a set period after the completion of the work, such as 14, 30, or 60 days, depending on their payment cycle.

- Immediate Payment: Payment is due as soon as the work is completed.

- Net Payment Terms: Payment is due within a set number of days (e.g., 30 days after completion).

- Installment Payments: For larger projects, payments can be divided into multiple installments.

Include Late Payment Penalties

It is essential to clarify what will happen if payment is not made by the due date. Late payment penalties can serve as a deterrent and motivate clients to pay promptly. You can outline a fixed fee for each overdue day or a percentage of the total amount. Be sure to communicate these terms in a professional manner, so clients are aware of the consequences.

- Fixed Fee: A fixed late fee added after a certain number of days past due.

- Interest Charges: A percentage charge on the overdue amount, applied daily or monthly.

Having well-defined payment terms protects your business and ensures transparency, helping both parties manage expectations and avoid confusion in the future.

Including Contact Information on Billing Documents

Including accurate and complete contact details on any billing document is essential for maintaining effective communication with clients. It ensures that your clients know how to reach you in case of any queries or issues regarding the charges, and it enhances the professionalism of your business. Clear contact information builds trust and ensures smooth business operations.

Key Details to Include:

- Your Business Name: Clearly state your company’s full name or your personal business name.

- Address: Include your physical business address or the address where payments can be sent.

- Phone Number: Provide a contact number where clients can reach you for urgent matters.

- Email Address: List a professional email address for communication related to billing or general inquiries.

- Website (optional): If applicable, include your business website for more information or support.

These contact details should be easy to find and placed prominently on the document, typically at the top or in a designated section. This makes it easy for clients to address any questions they may have or to send payments in a timely manner. Having all necessary contact information readily available ensures that your interactions with clients remain smooth and efficient.

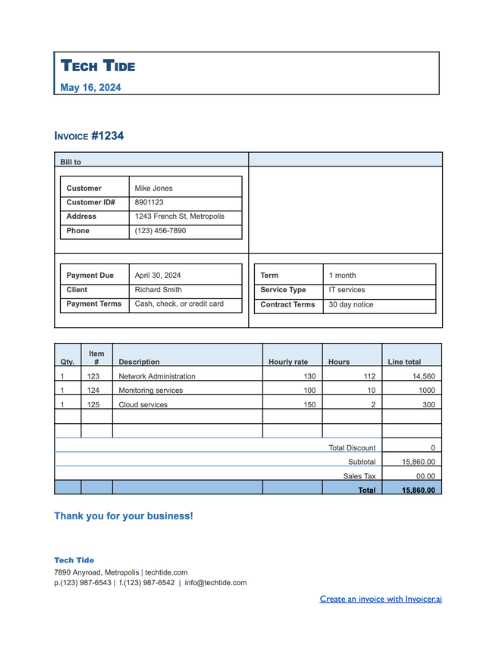

Tracking Hours and Service Charges

Accurately tracking the time spent on each task and corresponding charges is essential for providing transparent billing and ensuring fair compensation. By carefully documenting hours worked and the rates charged for each activity, you can avoid misunderstandings and ensure that both you and your clients are on the same page. This practice not only helps maintain trust but also supports efficient financial management for your business.

To simplify the process, it is helpful to break down tasks into specific hours worked and the applicable rate for each task. This allows you to provide a clear, itemized breakdown of charges, making it easier for clients to understand the value of your work.

| Task Description | Hours Worked | Hourly Rate | Total Charge |

|---|---|---|---|

| System Setup | 2 | $50 | $100 |

| Network Troubleshooting | 1.5 | $60 | $90 |

| Software Installation | 3 | $45 | $135 |

| Total | $325 |

Tracking hours in this manner ensures that all charges are clear and justified, and it allows you to quickly identify any discrepancies if they arise. It also helps in maintaining an organized system that simplifies future work and billing processes.

Incorporating Taxes and Discounts

Properly applying taxes and discounts is crucial for maintaining accurate billing and ensuring compliance with legal requirements. By including taxes and offering discounts when applicable, you provide your clients with a clear and transparent breakdown of the total amount due. This helps both parties understand the exact financial details and ensures fairness in all transactions.

Adding Taxes

When applicable, taxes should be calculated based on the relevant local, state, or federal tax rates. Ensure that the tax rate is clearly stated on the billing document to avoid confusion. You should also specify the type of tax applied, whether it is sales tax, VAT, or any other form of taxation.

- Sales Tax: Typically applied to goods and services, based on a percentage of the total amount.

- VAT (Value-Added Tax): A consumption tax added to the value of products or services at each stage of production.

- Other Local Taxes: Some regions may require specific taxes based on the type of transaction or service provided.

Offering Discounts

Discounts are a great way to incentivize early payments or reward loyal clients. When including discounts, make sure they are applied correctly and are clearly labeled on the document. Be transparent about the conditions for the discount and any expiration dates.

- Percentage Discount: A specific percentage off the total amount (e.g., 10% off).

- Fixed Amount Discount: A fixed dollar amount deducted from the total (e.g., $50 off).

- Early Payment Discount: A discount for clients who pay before a specified due date.

Both taxes and discounts should be listed clearly, so your clients understand how the final total is calculated. Properly incorporating these elements ensures a transparent and professional billing experience for both you and your clients.

How to Add a Payment Section

A well-structured payment section is essential for ensuring clarity regarding how clients should pay for the work completed. It provides important details about the payment process, including methods of payment, due dates, and any necessary instructions. This section helps avoid confusion and ensures that transactions are completed smoothly and on time.

Key Elements to Include

When designing the payment section, there are several key elements you should include to make the process as straightforward as possible for your clients:

- Total Amount Due: Clearly state the final amount the client is required to pay after all adjustments, such as taxes or discounts, have been applied.

- Due Date: Indicate the date by which the payment is due. This helps set expectations and encourages timely payment.

- Accepted Payment Methods: List all payment methods you accept, such as credit cards, bank transfers, or online payment platforms (e.g., PayPal, Stripe).

- Payment Instructions: Provide any specific instructions for submitting payments, including account details or links to online payment portals.

- Late Payment Penalties: If applicable, mention any late fees or interest charges that will be added if payment is not received by the due date.

Example Layout

Here is an example of how you can structure the payment section:

- Total Amount Due: $500

- Due Date: December 15, 2024

- Accepted Methods: Credit Card, Bank Transfer, PayPal

- Payment Link: [Insert Payment Portal Link]

- Late Fee: $25 for every 7 days past due date

By providing clear, organized, and complete payment details, you can ensure that clients are able to easily process their payments without any confusion, promoting smoother business operations and fostering good client relationships.

Ensuring Clear Invoice Layout

A well-organized and clear layout is crucial for any billing document. It ensures that all necessary information is easy to find, helping both the issuer and the client understand the financial details without confusion. A well-structured design enhances professionalism and promotes smoother transactions.

Key Design Elements for Clarity

When creating a clear layout, focus on organizing the content logically and making the document visually appealing. Here are some essential design elements to consider:

- Header Section: The header should include your business name, logo, and contact information, as well as the recipient’s details. This section should be prominent for easy identification.

- Clear Itemization: List services or goods provided with detailed descriptions and corresponding costs. Break down each item to avoid ambiguity.

- Consistent Formatting: Use consistent fonts, spacing, and alignment throughout the document. Ensure the text is legible, with enough space between sections to create a clean look.

- Easy-to-Read Amounts: Highlight the total amount due, making it bold or using a larger font. This helps clients focus on the most important financial information.

- Footer Information: The footer should include payment instructions, terms and conditions, and contact information for any follow-up questions.

Effective Use of White Space

White space, or negative space, is a powerful tool for ensuring clarity. It prevents the document from appearing cluttered and makes it easier for readers to navigate. Properly spaced sections and adequate margins allow for a more professional appearance and help guide the reader’s eye through the document.

- Margins: Ensure there is enough space around the edges of the document.

- Section Spacing: Leave sufficient space between each section to distinguish different parts of the document.

- Text Blocks: Break down large paragraphs into smaller chunks of text, making them easier to read.

By prioritizing organization, readability, and appropriate use of space, you can create a billing document that is not only functional but also professional and easy for clients to understand.

Common Mistakes to Avoid in Invoices

Creating a billing document might seem straightforward, but there are several common pitfalls that can cause confusion, delays, and potential disputes. Ensuring accuracy and clarity is essential for smooth transactions and maintaining professional relationships with clients. Avoiding these common errors will help you create documents that are both effective and professional.

1. Missing Essential Details

One of the most frequent mistakes is failing to include all necessary information. A document lacking important details such as contact information, payment terms, or a proper breakdown of charges can create confusion and delay payments. Make sure to include:

- Client’s full name and contact details

- Service descriptions and quantities

- Total amount due

- Payment instructions and due date

2. Incorrect or Inconsistent Amounts

Another mistake to watch out for is the miscalculation of amounts. Double-check your figures to ensure that the sums are correct, including taxes and any discounts. If the amounts are inconsistent or incorrect, clients may question the validity of the document and delay payment.

- Review itemized charges carefully

- Check for proper tax and discount calculations

- Ensure totals match the individual line items

3. Lack of Clear Payment Terms

If your billing document doesn’t clearly outline the payment terms, it can lead to misunderstandings. Specify due dates, accepted payment methods, and any late fees or penalties for overdue payments. Without this clarity, clients may be uncertain about when and how to pay, which can result in delays.

4. Using Unprofessional Language

While it’s important to maintain a friendly and approachable tone, using overly casual or unprofessional language can damage your reputation. Keep the language formal and clear, avoiding slang or jargon that could be misinterpreted.

5. Poor Formatting and Organization

Finally, a messy or disorganized document can be frustrating for both parties. Avoid using inconsistent fonts, poor spacing, or overwhelming amounts of text. Instead, aim for a clean and structured format that makes it easy f

Tools for Creating Invoice Templates

Designing billing documents can be streamlined with the right tools. Whether you are looking to build your own from scratch or use pre-designed structures, there are numerous resources available to make the process easier and more efficient. Choosing the right tool can save time and ensure that your documents look professional and meet all necessary requirements.

1. Online Invoice Generators

Online generators are user-friendly and often come with customizable features that allow you to quickly create professional-looking billing documents. These platforms typically offer drag-and-drop interfaces and pre-designed formats that can be tailored to fit your needs.

- Simple to use with no design skills required

- Pre-built templates for fast creation

- Customizable fields for specific client requirements

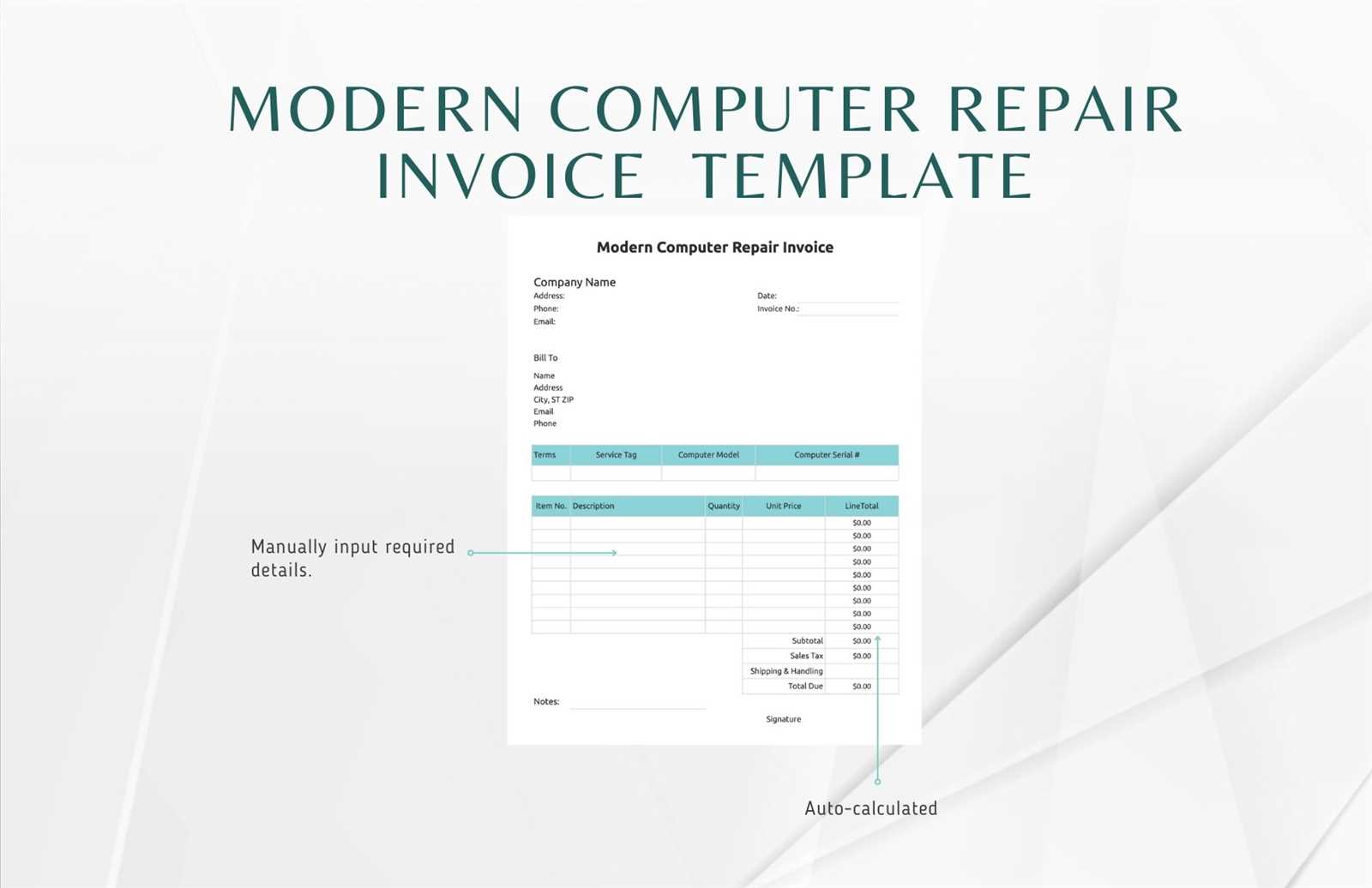

2. Spreadsheet Software

Spreadsheet programs like Microsoft Excel and Google Sheets are powerful tools for creating customized billing documents. They allow for complete control over formatting, calculations, and the addition of formulas for taxes, discounts, or totals. These tools are ideal if you need to track multiple entries or generate recurring documents with similar data.

- Advanced calculations for totals and taxes

- Flexibility to create unique layouts

- Integration with other software for easier management

By utilizing these tools, you can create documents that are not only visually appealing but also functional and efficient, helping you manage your billing process more effectively.

Benefits of Digital Invoice Templates

Utilizing electronic billing documents offers several advantages that traditional paper forms simply cannot match. These digital formats are more than just a convenience–they can improve efficiency, reduce errors, and streamline your financial processes. With a wide range of customizable features, they help businesses maintain consistency and enhance professionalism.

Time Efficiency is one of the primary benefits of using digital billing systems. By using pre-designed layouts, you can quickly generate new documents, saving both time and effort. These tools also allow for easy reuse of previously entered information, reducing the need for manual data entry.

Cost-Effective solutions are another reason many businesses prefer electronic documents. The need for paper, printing, and postage is eliminated, which leads to significant cost savings over time. Additionally, digital files can be stored and accessed anytime, which minimizes the need for physical storage space.

Accuracy and Precision are enhanced with digital documents as they allow for automatic calculations. This helps reduce human error and ensures that all entries are correct. Some digital platforms even offer real-time tracking and validation of figures like taxes and discounts, further minimizing mistakes.

Eco-Friendly is an important factor in today’s business world. Moving away from paper-based systems contributes to reducing your carbon footprint. Digital records are easy to store and share electronically, helping protect the environment while keeping your business practices modern and sustainable.

Incorporating these digital solutions into your workflow not only enhances operational efficiency but also positions your business as forward-thinking and adaptable to modern practices.

Ensuring Legal Compliance in Invoices

When creating billing documents, it’s essential to adhere to legal requirements to avoid complications. Different countries and regions have specific rules regarding the information that must be included, how taxes should be handled, and the format in which the document is presented. Ensuring compliance not only protects your business but also builds trust with clients, demonstrating professionalism and transparency.

One key area to focus on is ensuring that all required information is included. For example, businesses are typically required to provide clear details on the seller’s identity, the buyer’s information, the description of products or services provided, and the total amount due. Including all mandatory data minimizes the risk of legal disputes and ensures that your documents meet the standards set by local authorities.

Another important factor is managing taxes correctly. Many regions have specific rules regarding the collection of sales tax or VAT. Ensuring that these are accurately calculated and displayed is crucial to remain compliant with tax regulations. It’s also necessary to include the correct tax identification numbers if required by law.

Finally, it’s important to stay updated on the laws governing billing and payments in your area. As regulations change, staying informed and adapting your processes is essential to avoid penalties or fines. By prioritizing compliance, you can ensure that your business operates smoothly, while avoiding potential legal challenges.