Free Voiceover Invoice Template for Effortless Billing

Managing payments and ensuring accurate financial documentation is crucial for freelancers in creative fields. A well-structured document for requesting payment not only simplifies transactions but also enhances professionalism. With the right approach, tracking earnings and handling finances becomes a streamlined process that benefits both the service provider and the client.

For those working in voice and audio production, having a clear and easy-to-use payment request format is essential. Whether you’re an experienced professional or just starting out, using a well-designed document can help you avoid confusion, ensure timely payments, and maintain positive relationships with clients. Customizing this financial tool to suit your specific needs can make a significant difference in how smoothly your business operates.

In this guide, we’ll explore the key components of a payment request form tailored for audio services, how to create one efficiently, and the advantages it offers in simplifying billing. With just a few adjustments, you can ensure that your financial processes are as polished as your creative work.

Why You Need a Billing Document Format

As a freelancer or small business owner, managing payments can be a challenge without a clear and organized way to request compensation for your services. A professional financial document ensures that you communicate the necessary details to your clients, minimizing misunderstandings and speeding up the payment process. Without one, you risk delays, confusion, and even disputes, which can hurt your reputation and cash flow.

Clarity and Professionalism

Using a well-structured billing document helps you present your work and charges in a straightforward and professional manner. It conveys your business’s credibility and reinforces your commitment to delivering high-quality service. This clarity can encourage clients to pay promptly, as they know exactly what they’re being billed for and when the payment is due.

Efficiency and Time-Saving

Having a ready-made format for billing means you don’t need to create one from scratch each time. With all the necessary fields pre-defined, you simply fill in the details relevant to the project. This efficiency saves you time, allowing you to focus more on your work rather than administrative tasks. Additionally, automating or using consistent formats for payment requests helps maintain accuracy and reduces the risk of mistakes.

By utilizing a clear and organized financial document, you ensure smooth transactions and protect your business interests. It’s an essential tool for staying organized, professional, and on top of your finances.

Benefits of Using a Billing Document Format

Adopting a pre-designed payment request format offers several advantages for freelancers and small business owners. By using a structured document, you streamline the payment process, reduce errors, and save valuable time. This approach not only simplifies your administrative tasks but also enhances the professionalism of your business operations.

One key benefit is the reduction in time spent creating payment requests from scratch. With a standardized format, you can quickly fill in the necessary information, ensuring consistency across all transactions. This efficiency leads to faster processing and fewer delays, which in turn improves cash flow and reduces stress.

Additionally, a well-organized payment request format enhances clarity. Clients can easily understand the breakdown of services, rates, and due dates, leading to fewer misunderstandings or disputes. This transparency fosters trust and builds stronger, more reliable client relationships, encouraging timely payments and repeat business.

How to Customize a Billing Document

Personalizing a payment request format to fit your unique business needs can make the process of getting paid smoother and more professional. Customization allows you to tailor the document with specific details that reflect the nature of your services, making it clearer for clients and ensuring that all the necessary information is included. Whether you are adjusting the layout, adding company branding, or modifying the structure, customization helps create a seamless experience for both you and your clients.

Adjusting the Structure

When creating your payment request, it’s important to adjust the layout to suit your business. You can organize sections by client information, service details, rates, and payment terms. This way, the document is both easy to understand and easy to navigate. A clean and well-organized structure not only saves time but also shows your attention to detail.

Incorporating Branding Elements

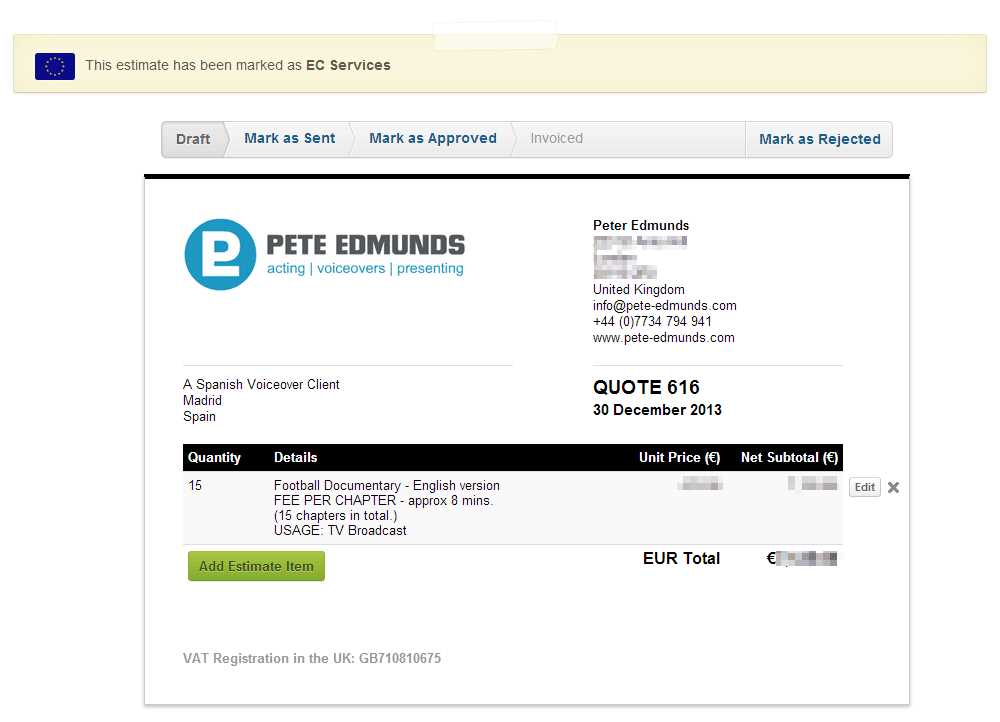

Adding your company’s logo, color scheme, and contact details to the document is an excellent way to reinforce your brand identity. Including your business name and website link creates consistency across all client communications. Strong branding can help your documents stand out and make a lasting impression, adding a level of professionalism that encourages clients to take your payment requests seriously.

Customizing your payment document format is a simple yet powerful way to enhance professionalism, improve organization, and make the billing process easier for everyone involved.

Essential Information in Payment Request Documents

For a payment request to be effective, it must contain all the necessary details to ensure that the client understands exactly what services are being billed and how the payment should be made. A well-constructed document includes key information that helps avoid confusion, speeds up the payment process, and establishes clear expectations between the service provider and the client.

At a minimum, the document should include the following essential elements:

Client and Service Provider Information

Include both your own contact details and those of the client. This ensures that there are no mix-ups or delays in communication. The service provider’s name, address, phone number, and email address should be clearly listed, as well as the client’s full name or company name and their contact information. This is vital for maintaining accurate records and for the client to reach out if needed.

Detailed Service Breakdown

Clearly list the services provided, including a brief description, the hours worked (if applicable), and the rate charged for each service. This transparency not only helps the client understand exactly what they are paying for but also minimizes the risk of disputes over pricing or scope of work. Include any additional costs, such as revisions or rush charges, to provide a comprehensive view of the total amount due.

Payment Terms and Due Date

Set clear expectations by specifying when the payment is due and any terms for late fees or discounts. Include payment methods, such as bank transfer, PayPal, or credit card, and any necessary instructions to complete the transaction. A well-defined payment timeline encourages prompt payment and reduces the likelihood of delays.

By including these key details, you create a clear and professional financial request that benefits both you and your clients, ensuring a smooth transaction and timely compensation for your work.

Tips for Creating Professional Payment Requests

Crafting a well-designed and professional payment request is essential for maintaining a positive relationship with clients and ensuring timely compensation. A clear, organized document reflects your business’s professionalism and helps clients easily understand the services rendered and the amount due. By following a few key principles, you can create payment requests that promote trust and facilitate smooth transactions.

Keep the Layout Clean and Simple

One of the most important aspects of a professional payment request is its layout. A clean, simple design allows your client to quickly find important details without feeling overwhelmed. Avoid cluttering the document with unnecessary information, and use plenty of white space to make it easy to read. Group related information together, such as services provided and payment terms, to make the document flow logically.

Be Clear and Specific with Details

Ensure that all the relevant details are clearly stated. This includes your contact information, the client’s details, a breakdown of services rendered, applicable rates, and the payment due date. Specificity helps eliminate any ambiguity, reducing the likelihood of disputes or confusion. Clearly itemizing charges and including any extra costs, such as taxes or rush fees, will give clients a complete view of the total amount due.

Professional Branding and Design

Incorporate your branding elements, such as your logo, business name, and color scheme, into the document. This not only makes the payment request look more polished but also reinforces your brand identity. A branded document gives your business a cohesive and professional appearance that builds trust with clients.

Set Clear Payment Terms

Make sure to clearly state when the payment is due and what methods are accepted. Include any late fees or discounts for early payment to encourage timely transactions. By being upfront about your payment terms, you help prevent delays and set expectations from the start, creating a more predictable cash flow for your business.

By following these tips, you can create payment requests that are not only professional but also effective in ensuring you are paid promptly and accurately. A well-crafted document goes a long way in maintaining positive client relationships and streamlining your business operations.

Choosing the Right Payment Request Format

Selecting the appropriate format for your payment request is crucial to ensure clarity and professionalism. The format you choose should reflect your business style while providing all the necessary details for smooth transactions. Whether you opt for a simple, minimalistic approach or a more detailed, structured layout, the format must be easy to understand and meet your specific needs.

Consider Your Client’s Preferences

When deciding on a format, it’s important to consider the preferences of your clients. Some clients may prefer a more traditional, printed document, while others might appreciate the convenience of a digital format that can be quickly reviewed and processed. Offering a format that works for both you and your client can help ensure prompt payments and avoid any confusion.

Decide Between Simple or Detailed Layout

Another consideration is how much detail you want to include in the document. A simple layout may include only essential information such as your name, the client’s name, services provided, and the amount due. On the other hand, a more detailed format might break down hours worked, individual rates, and additional expenses. Choose a layout that aligns with the complexity of your services and the level of detail your client expects.

Digital vs. Paper Formats

While digital formats are becoming increasingly popular for their ease of use and quick delivery, some businesses still prefer paper documents for official records or legal purposes. If you work with clients who need paper copies, ensure that your chosen format can be printed easily and looks professional on paper as well as on screen. Alternatively, if you primarily work with digital clients, a well-organized PDF or an online payment request can be the most efficient option.

Choosing the right format is an essential step in creating a professional financial document that meets both your needs and your clients’ expectations. Consider these factors carefully to ensure smooth transactions and foster positive client relationships.

Billing Document Format for Beginners

If you’re just starting out in the business world, especially in creative industries, it can feel overwhelming to handle financial paperwork. However, having a straightforward, easy-to-use payment request form is essential for ensuring you’re paid accurately and on time. For beginners, it’s important to focus on simplicity and clarity while also ensuring the document covers all necessary details.

Key Elements to Include

As a beginner, you don’t need a complicated format. Focus on the following essential elements to create a professional and effective payment request:

- Your contact information: Include your name, address, phone number, and email address.

- Client’s details: Make sure to list your client’s name, address, and contact information.

- List of services provided: Include a brief description of the services you provided along with the date and the quantity (e.g., hours worked).

- Rates and amounts: Clearly state the cost of each service or hourly rate, and show the total amount due.

- Payment terms: Specify the due date and acceptable payment methods (bank transfer, PayPal, etc.).

- Payment due date: Clearly list when the payment is expected to be completed.

Tips for Beginners

As you start creating your own payment request documents, keep these tips in mind:

- Keep it simple: Don’t overcomplicate things. A clean, simple document that’s easy to read will help you appear professional.

- Use templates: As a beginner, it’s helpful to use a ready-made format. You can easily find free or low-cost templates online to make the process quicker.

- Be organized: Always maintain a record of the requests you’ve sent, payments received, and outstanding amounts.

- Check for accuracy: Before sending the request, double-check the details for any errors, including rates, amounts, and contact info.

Starting with a simple and clear payment request form will not only help you stay organized but also give your business a professional edge. Once you’re comfortable, you can begin to refine your approach and add more advanced features as needed.

Free Billing Request Formats Available Online

For those starting out or looking to streamline their payment process, using a free pre-designed financial document can be an excellent way to save time and ensure accuracy. Numerous websites offer easy-to-download formats that can be customized to fit your specific needs. These free resources allow you to focus on your work while ensuring that you still maintain a professional appearance in your financial communications.

Advantages of Using Free Formats

Opting for a free document layout offers several benefits for freelancers and small business owners:

- Cost-effective: Free options allow you to get started without spending money on expensive software or paid designs.

- Ease of use: Many online options come with pre-filled sections that only require you to input specific details, making the process quick and easy.

- Customization: Even free layouts often allow for basic customization, such as adding your logo, adjusting the design, and modifying fields to suit your business needs.

- Professional design: These documents are often created by professionals, ensuring that your financial requests look polished and credible.

Where to Find Free Billing Formats

Several websites offer free formats, with the option to download in various file types such as PDF, Word, or Excel. Some popular platforms include:

- Canva: Canva offers easy-to-use templates that can be fully customized online, with no design experience required.

- Invoice Generator: This website lets you quickly create a professional payment request with customizable fields.

- Zoho: Zoho provides a variety of free, editable templates that can be tailored to your specific service offerings.

- Microsoft Office: Microsoft Office’s online suite also includes free document templates that can be customized in Word or Excel.

Using free formats can significantly speed up your billing process and help you maintain a consistent, professional appearance in your financial transactions.

Automating Payment Requests for Efficiency

Automating the process of creating and sending payment requests can save a significant amount of time, reduce errors, and improve overall business efficiency. By setting up an automated system, you can streamline your billing process and ensure that clients receive timely and accurate financial documents without having to manually create each one. Automation can also help track payments, send reminders, and manage recurring billing without additional effort.

Benefits of Automation

Implementing an automated billing system offers several advantages:

- Time-saving: Once set up, automation eliminates the need to manually create and send each payment request, freeing up time for other important tasks.

- Consistency: Automation ensures that every payment request looks the same and contains all the necessary details, reducing the likelihood of errors or missing information.

- On-time payments: With automated reminders, you can prompt clients to pay on time, reducing the chances of overdue payments.

- Improved record-keeping: Automated systems can help you keep track of all transactions, making it easier to manage your finances and maintain accurate records for tax purposes.

- Professionalism: Automated payment requests can be customized to reflect your brand, ensuring that clients receive consistent, polished documents that reinforce your business’s image.

How to Automate Your Billing Process

To automate your payment requests, consider the following steps:

- Choose an automation tool: There are several tools available, such as FreshBooks, QuickBooks, or Zoho, that can help you automate your billing process. These platforms often come with pre-built templates, allowing you to quickly generate and send financial documents.

- Set up recurring billing: For clients on retainer or subscription-based services, set up automatic billing cycles. This way, payment requests are generated and sent on a predetermined schedule without needing manual input.

- Customize reminders: Configure automatic reminders for upcoming or overdue payments. These can be sent via email, ensuring clients are always aware of their financial obligations.

- Integrate with payment gateways: Linking your automated system with online payment processors, such as PayPal or Stripe, allows for easy online payments directly from the request, streamlining the transaction process.

By automating your payment request system, you can eliminate administrative burdens, reduce the chances of human error, and ensure that your financial transactions are handled efficiently and professionally.

Payment Request Format for Freelancers

As a freelancer, creating a clear and professional document for requesting payment is crucial to ensuring timely and accurate compensation. This financial document should reflect the services you’ve provided, the agreed-upon rates, and payment terms. Using a well-structured format helps to avoid confusion and sets clear expectations with clients. Below is an example of how to structure your financial request for maximum clarity and professionalism.

Sample Structure of a Payment Request

A freelancer’s payment request typically includes several key sections, which should be presented clearly for the client’s review. Here’s an example format that covers the essential details:

| Section | Description |

|---|---|

| Your Information | Your name, business name (if applicable), and contact details (phone, email, address). |

| Client Information | Client’s name, company name (if applicable), and contact details (phone, email, address). |

| Services Provided | List of services rendered, including the date(s) and hours worked (if applicable). |

| Rate and Total Amount Due | Breakdown of individual rates (e.g., hourly or project-based) and the total amount due for services. |

| Payment Terms | Due date for payment, payment methods accepted, and any late fees or early payment discounts. |

| Notes or Additional Information | Any additional terms, such as rush fees, taxes, or notes for the client. |

This format ensures all necessary information is included, making it easy for clients to understand the breakdown of the charges and the timeline for payment. It also helps maintain a professional appearance, which can build trust and improve client relationships.

How to Calculate Service Rates on Payment Requests

When it comes to creating a payment request, one of the most important aspects is accurately calculating the rates for the services you provided. Whether you charge by the hour, by project, or through another pricing model, ensuring that your rates are clear and correct is essential for maintaining professionalism and transparency with your clients. Below, we will explore how to calculate service rates and incorporate them into your billing documents effectively.

Different Pricing Models

There are several ways to structure your rates depending on the nature of your work and client preferences. The most common pricing models include:

- Hourly Rate: Charging based on the amount of time spent working on a project.

- Flat Rate: A fixed price for completing a specific task or project, regardless of time.

- Per Unit Rate: Charging for services based on a defined unit (e.g., per script, per word, or per minute).

Calculating Your Rate and Total Amount Due

Once you have decided on your pricing model, calculating the total amount due is relatively simple. Below is an example of how to break down the calculation for each model:

| Pricing Model | Calculation Example | Total Due |

|---|---|---|

| Hourly Rate | Rate per hour x Number of hours worked | $50/hour x 10 hours = $500 |

| Flat Rate | Fixed fee for the entire project | Project fee = $800 |

| Per Unit Rate | Rate per unit x Number of units | $100 per script x 3 scripts = $300 |

In each case, it’s important to clearly indicate the rate and the total amount due on your payment request. This helps to avoid confusion and ensures that clients understand exactly what they are being charged for.

By selecting the appropriate pricing model and clearly outlining the rates on your financial documents, you can ensure both you and your client are on the same page, and payments are processed smoothly and promptly.

Common Mistakes in Payment Requests

When creating a payment request, it’s easy to overlook important details that can lead to confusion, delayed payments, or even disputes. Many freelancers and small business owners make avoidable mistakes when drafting financial documents. Recognizing these common errors can help you ensure that your payment requests are clear, professional, and effective.

Key Mistakes to Avoid

- Missing or Incorrect Contact Information: Failing to include accurate contact details for both yourself and the client can cause confusion or delays in communication.

- Unclear Payment Terms: Not specifying payment deadlines, late fees, or acceptable payment methods can lead to misunderstandings. Always be explicit about when and how you expect to be paid.

- Omitting Project Details: If the services rendered aren’t described clearly, it can lead to disputes over what was actually delivered. Always include a detailed breakdown of the work completed.

- Incorrect Rates or Calculations: Double-check that your hourly rates, project fees, and totals are accurate. Small errors in calculations can cause frustration for clients and delay payments.

- Failure to Include a Unique Reference Number: Without a unique reference number or invoice ID, it can be difficult for both you and the client to track payments, especially if you have multiple ongoing projects.

- Not Including a “Thank You” or Polite Closing: A simple expression of gratitude, like “Thank you for your business,” can enhance your professionalism and foster positive client relationships.

How to Avoid These Errors

To avoid these mistakes, take time to review your financial documents before sending them. Use a checklist to ensure all necessary details are included, and consider using a pre-designed layout that organizes the information logically. Paying attention to these elements can help you maintain professionalism and ensure timely payments.

How to Track Payments Using Formats

Tracking payments efficiently is a critical aspect of managing your business finances. By using organized formats for your financial requests, you can easily keep track of paid and unpaid amounts, ensuring that no transactions are overlooked. Whether you use an online tool or a manual method, maintaining accurate records of payments helps you stay on top of your cash flow and avoid any confusion with clients.

How to Set Up Payment Tracking

To track payments effectively, you need a system that allows you to record key details. Many payment tracking formats include columns for the status of each payment (paid, pending, overdue), as well as space to add payment dates, amounts, and method of payment. Below is an example of how to set up a payment tracking section:

| Payment Due Date | Amount Due | Amount Paid | Payment Status | Payment Date | Payment Method |

|---|---|---|---|---|---|

| July 1, 2024 | $500 | $500 | Paid | July 5, 2024 | Bank Transfer |

| July 15, 2024 | $300 | $0 | Pending | N/A | N/A |

Tips for Efficient Payment Tracking

Here are a few additional tips to ensure your tracking system remains effective:

- Update regularly: Keep your payment tracking format updated with the latest payment status to avoid missing any important details.

- Include unique reference numbers: Assign a unique ID or number to each payment request, making it easier to identify and cross-reference payments.

- Set up automatic reminders: Many platforms offer features to send reminders to clients for pending payments, which helps ensure timely payments.

- Monitor overdue payments: Flag overdue payments so you can take follow-up action promptly, whether through a gentle reminder or a formal notice.

By effectively tracking your payments using these methods, you ensure that your business stays organized, and your clients remain aware of their payment obligations, reducing the risk of overdue balances.

Legal Considerations for Payment Requests

When creating a financial document for services rendered, it’s important to consider the legal aspects to ensure that the terms are clear, enforceable, and comply with relevant laws. A well-structured payment request not only protects your business but also helps avoid disputes and ensures both you and your clients understand the agreed-upon terms. Below are key legal considerations that should be addressed when drafting these financial documents.

Key Legal Elements to Include

To ensure your financial documents are legally sound, include the following essential elements:

- Clear Payment Terms: Specify the payment amount, due date, and accepted payment methods. Including late fees and any early payment discounts can prevent future misunderstandings.

- Client’s Legal Name and Contact Information: Always ensure that the correct legal name of the client or business is used to avoid confusion or disputes later.

- Service Description: Provide a detailed breakdown of the services provided. This should include specific dates, deliverables, and a clear description of the work performed.

- Legal Notice or Terms: If applicable, include a brief statement on your rights to collect payments, applicable taxes, and any other relevant legal terms, such as jurisdiction or venue for dispute resolution.

- Dispute Resolution Clause: If there is a disagreement over payment, include a clause outlining how disputes will be resolved (e.g., through mediation or arbitration) and which laws will govern the agreement.

Additional Legal Considerations

- Tax Compliance: Ensure your financial document complies with tax regulations. Depending on your location, you may need to charge sales tax, VAT, or other applicable taxes. Make sure these are clearly itemized on the document.

- Intellectual Property Rights: If your services involve intellectual property (such as scripts, designs, or other creative work), it’s important to clarify the ownership rights and licensing terms in the payment request.

- Record-Keeping: Retain copies of all payment requests and correspondence for tax purposes, potential audits, or future disputes. Keeping organized and accurate records can help protect your legal interests.

By addressing these legal elements in your payment requests, you create a more professional and legally secure framework for your transactions. This reduces the chances of misunderstandings and provides a clear process for both you and your clients to follow.

Improving Client Relationships with Payment Requests

Managing client relationships effectively is essential for the long-term success of any business. One often overlooked aspect of fostering strong client connections is how you handle payment requests. A well-crafted financial document can not only ensure that you get paid on time but also improve communication, professionalism, and trust with your clients. Below are ways to enhance your client relationships through thoughtful, transparent, and polite payment requests.

Building Trust through Clarity and Professionalism

When creating a payment request, the clarity of the information you present can have a significant impact on your relationship with the client. By providing clear and detailed financial documents, you demonstrate professionalism and transparency, which in turn builds trust. The more specific and easy to understand your requests are, the less likely there will be confusion or disputes.

| Section | Benefit for Client Relationship |

|---|---|

| Clear Breakdown of Services | Clients appreciate knowing exactly what they are paying for, which helps avoid misunderstandings. |

| Polite Language and Tone | Using a courteous and friendly tone fosters a positive atmosphere and shows that you value the client’s business. |

| Payment Flexibility | Offering different payment methods or installment options can make the process more convenient and increase client satisfaction. |

| Timely and Consistent Follow-ups | Sending reminders when needed shows that you are organized and proactive, and it reduces the chances of late payments. |

Setting Clear Expectations

Setting clear expectations about payment terms from the beginning helps to avoid any confusion. By outlining the payment due date, accepted methods of payment, and any late fees, you ensure that both you and your client are aligned on the financial aspects of the agreement. It also shows that you are serious about your business and value timely payments.

In addition to financial clarity, maintaining a respectful tone in your financial documents helps strengthen your relationship with clients. Thanking them for their business and expressing appreciation for their prompt payment shows that you value their partnership and are willing to go the extra mile to maintain a positive, ongoing relationship.

Ultimately, improving your payment request processes and ensuring they are professional and considerate will not only result in smoother transactions but also foster a more positive and lasting relationship with your clients.

Billing Formats for International Projects

When working with clients across different countries, it’s important to adapt your financial documentation to meet international standards. A well-structured billing format for cross-border projects not only ensures that you are paid correctly but also facilitates smooth communication between you and clients from different cultural and legal backgrounds. Adapting your billing approach for international projects involves considering currency differences, tax requirements, and payment methods commonly used in various regions.

One of the most important factors in creating an effective international billing system is understanding the diverse requirements and expectations of clients in different countries. For instance, clients in the European Union may expect to see VAT (Value Added Tax) included in the total, while clients in the United States may not. Additionally, international transactions might require different currencies, so it’s essential to provide clear conversion rates or list prices in multiple currencies to avoid confusion.

Moreover, the method of payment is also a significant consideration. While some clients may prefer traditional wire transfers, others may request payments via platforms like PayPal, TransferWise, or other global financial services. Make sure to offer multiple payment options to ensure ease of transaction for clients from different parts of the world.

Ultimately, having an adaptable billing system that accounts for international requirements is key to maintaining professionalism and ensuring that you are paid on time and in full for your services. Being proactive in addressing these considerations will build trust with your international clients and help streamline the payment process for both parties.

How Payment Requests Boost Your Business

Effective financial documents play a crucial role in the growth and sustainability of any business. By using organized and professional payment requests, you not only ensure timely compensation for your work but also establish credibility with clients. A well-structured billing system can improve client trust, streamline cash flow, and enhance your overall business reputation. Here’s how clear and well-crafted payment requests can directly benefit your business.

Building Trust and Professionalism

One of the primary advantages of using organized payment requests is that they communicate professionalism. A clear, well-designed document shows clients that you take your business seriously and are committed to transparency. This fosters trust, making clients more likely to return for future projects or recommend your services to others. Consistency in how you present financial details–such as payment terms, amounts, and deadlines–also reinforces your reliability, which is key to establishing long-term business relationships.

Streamlining Cash Flow and Reducing Delays

By implementing a structured approach to billing, you make it easier to track payments, follow up on overdue amounts, and manage your cash flow. When clients receive a clear breakdown of costs and payment expectations, it minimizes confusion and reduces the risk of late or missed payments. This consistency in how you request payment helps avoid misunderstandings, ensuring that you get paid promptly and can reinvest the funds into your business to fuel its growth.

Additionally, the more professional and organized your financial requests, the more likely you are to maintain positive relationships with clients, leading to repeat business and referrals. In this way, efficient payment processes can become a catalyst for broader business success.