Basic Invoice Template Excel for Simple and Professional Invoicing

Managing financial records can be a time-consuming task, especially when creating and tracking customer payments. Having a well-structured and easy-to-use tool for generating billing documents can significantly reduce the time spent on administrative tasks. By using a reliable solution, you can ensure that your payments are recorded accurately and that your clients receive clear, professional documents in a timely manner.

There are numerous ways to create financial statements, but many businesses find that a straightforward spreadsheet is one of the most effective methods. These documents not only allow for customization but also make calculations easier, reducing the risk of errors. Whether you’re a freelancer, small business owner, or part of a larger enterprise, mastering this process can help you maintain a smooth workflow and foster better relationships with your clients.

Streamlining your billing process with a simple system provides a range of benefits. It saves time, ensures consistency, and can even improve cash flow management. With the right structure in place, you’ll be able to produce professional documents with ease and confidence.

Basic Invoice Template Excel: A Complete Guide

Creating professional financial documents doesn’t have to be complex. With the right structure, you can easily generate clear and accurate statements to send to your clients. A well-organized system can save time, reduce errors, and ensure that payments are tracked efficiently. In this guide, we’ll walk you through the process of setting up a simple yet effective financial document that will meet your business needs.

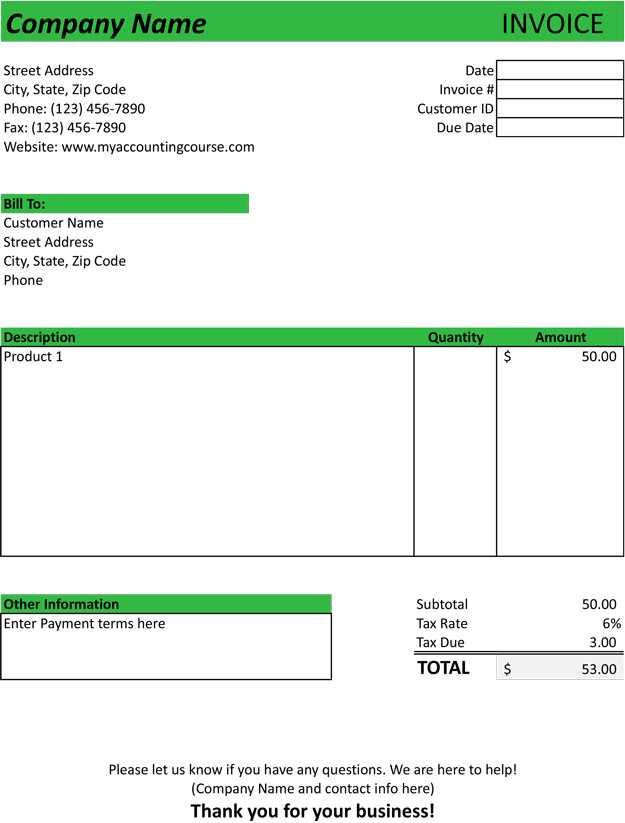

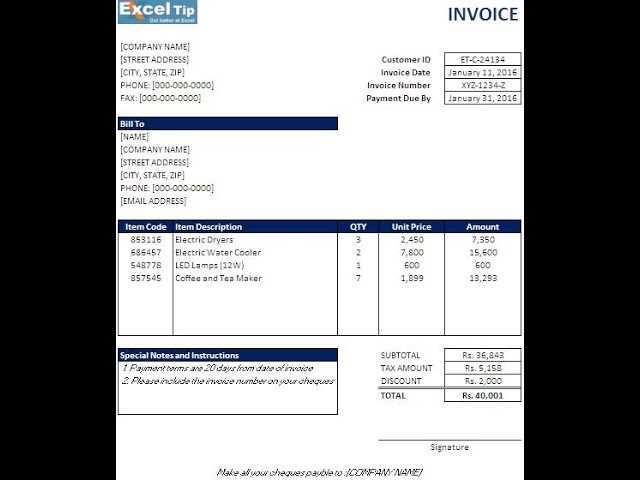

Start by understanding the key components that make up a financial statement. These include details like client information, services or products provided, amounts, and payment terms. A structured spreadsheet helps you keep track of all these elements without needing advanced software. By using an organized layout, you can easily customize the document for each client and avoid repetitive tasks.

Customization is one of the main advantages of using a spreadsheet. You can modify fields to match your specific business requirements, whether that involves adjusting taxes, adding discounts, or including payment instructions. The ability to personalize each document ensures that it aligns with your branding while maintaining professionalism in every transaction.

Efficiency is another major benefit. Once you’ve set up your structure, generating new statements becomes a simple matter of inputting new data. The system can automatically calculate totals, apply taxes, and even track the due date for payments. This not only saves time but also reduces the risk of errors that could occur when doing these tasks manually.

In this section, we will show you how to create and modify such a system, step-by-step, ensuring that you have all the tools needed to manage your financial documents effectively. Whether you’re a small business owner or an independent contractor, this straightforward approach will help you maintain organized and accurate records with ease.

Why Use an Excel Invoice Template?

Using a structured document to manage billing and payments offers significant advantages for both businesses and freelancers. Instead of relying on manual calculations and paperwork, you can streamline the entire process with a digital solution that keeps your records organized and up to date. The benefits of using a customizable tool for generating financial records are numerous, from time savings to improved accuracy in your transactions.

Here are several reasons why choosing a spreadsheet solution is a smart decision:

- Ease of Use: With simple tools and a clear layout, spreadsheets are intuitive to set up and manage, even for those with minimal technical experience.

- Customizability: You can easily modify fields and designs to fit your business needs, allowing for personal branding and adjustments to pricing or terms.

- Automated Calculations: Pre-set formulas in the spreadsheet can instantly calculate totals, taxes, and discounts, saving you from manual errors and reducing the time spent on administrative tasks.

- Cost-Effective: Most spreadsheet software is free or comes at a low cost, making it an affordable solution for small businesses and individuals.

- Track and Organize: Spreadsheets allow you to track payments, monitor due dates, and store records for easy retrieval when needed.

By using this type of tool, you not only increase productivity but also present a professional appearance to clients. Whether you are sending out monthly statements or one-time charges, a consistent and reliable system ensures that you maintain a strong financial organization.

In the following sections, we’ll explore how you can create, customize, and optimize your document to suit your particular needs, enabling you to take full advantage of all the benefits this solution offers.

Top Features of Basic Invoice Templates

When it comes to creating financial documents, certain features can make the process much simpler and more efficient. A well-designed document solution should offer flexibility, ease of use, and the ability to handle multiple tasks with minimal effort. Below, we explore some of the key elements that make these tools effective for managing payments, client information, and business transactions.

Customization Options

One of the greatest advantages of using this type of system is the ability to customize the document to suit your specific needs. You can adjust the layout, change fonts, add your business logo, and modify fields to reflect the nature of your services. Whether you need to add extra rows for additional items or change the format of the dates, flexibility is key to maintaining professionalism and tailoring documents to your brand.

Automatic Calculations and Totals

Another valuable feature is the automatic calculation of totals, taxes, and discounts. With pre-programmed formulas, you can quickly generate accurate totals without having to manually add figures. This minimizes the chance of human error and speeds up the process of creating and sending documents to clients. You simply enter the necessary data, and the tool handles the rest, making it especially useful for businesses that deal with fluctuating prices or need to calculate tax rates.

Tracking and Organizing Payments is another vital function. Many systems allow you to input payment statuses, track when bills are paid, and even set up reminders for overdue payments. This helps you maintain a clear overview of your financial standing and reduces the need for separate tracking tools.

User-Friendly Interface is an essential aspect of these documents. Even if you’re not familiar with advanced financial software, you’ll find these solutions easy to navigate. Most systems are designed with simplicity in mind, offering a straightforward layout that minimizes the learning curve and allows you to get started immediately.

These features make document generation much less time-consuming and ensure that you remain organized and professional when dealing with clients and payments.

How to Customize Your Invoice in Excel

Customizing your financial document to match your specific business needs is essential for presenting a professional image to your clients. By adjusting the layout, adding important details, and ensuring that the format aligns with your branding, you can create a personalized and efficient tool for managing transactions. Below are some simple steps you can follow to tailor your document to reflect your unique requirements.

Start by adjusting the structure to include the necessary sections for your business. You can add rows for additional services, modify columns for product details, or include extra fields for client-specific information. Customizing these sections ensures that each document is relevant and fits the context of the transaction.

Here’s an example of how you can structure the key information:

| Item Description | Quantity | Unit Price | Total |

|---|---|---|---|

| Service/Product 1 | 1 | $50 | $50 |

| Service/Product 2 | 2 | $30 | $60 |

| Total | $110 | ||

Adjusting the layout can help make your document easier to read. Consider resizing columns to fit the content properly, or changing the font size to improve clarity. You can also use different colors to highlight important sections, such as the total amount due or the payment terms. This can make the document look more professional and organized.

Another important customization is the addition of your business logo, contact information, and payment terms. Include these details in the header or footer to reinforce your brand identity and ensure clients have easy access to all the relevant information. Customizing these sections makes your document not only functional but also visually appealing.

By following these steps, you’ll be able to quickly create a document that fits your business needs, reflects your professionalism, and makes it easier to communicate with your clients about payments and services.

Step-by-Step Instructions for Creating an Invoice

Creating a professional document to request payment for goods or services can be done with ease, provided you follow a simple structure. By organizing essential details and ensuring clarity, you can craft a document that not only serves its purpose but also reflects a polished image of your business. The process involves gathering information, formatting it in a clear way, and customizing it to fit the specific transaction.

1. Gather the Necessary Information

The first step is to collect all the relevant details. These include your contact information, the client’s details, a description of the products or services, and payment terms. Having all of this organized beforehand will save time and ensure accuracy.

2. Design the Layout

Once you have all the details, the next task is to structure them in a clean and readable format. Here is an example of how to set up the content:

| Field | Details |

|---|---|

| Your Company Name | XYZ Corporation |

| Client Name | John Doe |

| Service/Product Description | Web Development Services |

| Amount | $1500 |

| Due Date | 30th November 2024 |

Make sure each section is clearly labeled, and use sufficient space between the different parts to enhance readability. The goal is to make it easy for the recipient to find key information quickly, like the amount due and payment instructions.

By following these steps, you’ll be able to create a professional and organized document that ensures clear communication and fosters smooth business transactions.

Benefits of Excel Over Other Invoice Tools

When it comes to creating financial documents, there are many software options available, each offering unique features. However, one of the most popular and effective tools remains a widely accessible spreadsheet program. Compared to specialized platforms, this option provides flexibility, ease of use, and a range of functionalities that make it an ideal choice for both small businesses and larger organizations.

- Customizability: The ability to adjust layouts, formulas, and styling ensures that each document meets the specific needs of your business. Unlike other tools with fixed formats, you can create a completely tailored design.

- Cost-effectiveness: Most spreadsheet software comes at a minimal cost or is often already included as part of an office suite, making it an economical option compared to paid invoice-generating programs.

- Easy Data Management: With built-in functions for calculations and data tracking, you can easily manage your finances, automate totals, and even track payment status over time without the need for external systems.

- Universal Compatibility: Spreadsheet files can be easily shared, opened, and edited across different devices and platforms, making collaboration and document distribution hassle-free.

- Familiarity: Many people are already familiar with spreadsheet programs, which reduces the learning curve associated with adopting other, more complex tools.

With these advantages, it’s easy to see why this approach remains a top choice for creating clear, organized, and professional financial documents in a flexible and efficient manner.

Free Downloadable Excel Invoice Templates

Many small business owners and freelancers look for convenient and cost-effective ways to create professional financial documents. Fortunately, there are several resources available online that offer ready-made formats for free download. These resources can save time and effort, providing you with a structure to organize your details and ensuring that your document meets common industry standards.

1. What to Expect in a Free Downloadable Template

Free downloadable options typically include a simple and clean layout, with pre-designed fields to input relevant information such as item descriptions, quantities, and pricing. These formats help streamline the process of creating a document without requiring advanced software skills or a custom design from scratch.

| Feature | Details |

|---|---|

| Pre-built Fields | Name, date, payment terms, itemized list |

| Automatic Calculations | Totalling amounts and taxes |

| Simple Formatting | Clear and professional design with space for customization |

| Compatibility | Works with most spreadsheet programs |

2. Where to Find Free Downloadable Files

There are numerous websites offering these free formats, often with a variety of styles to choose from, depending on your business needs. Many resources allow you to download these files without any hidden fees or subscriptions, making it easy to get started right away.

Using these downloadable options, you can quickly create organized, accurate, and professional documents that help ensure smooth transactions and enhance your business’s credibility.

Common Mistakes to Avoid in Invoices

When creating financial documents for payment requests, even small errors can lead to confusion, delays, or misunderstandings. It is crucial to ensure accuracy and clarity in every aspect of the document. By being mindful of common pitfalls, you can maintain professionalism and streamline the payment process.

1. Missing or Incorrect Contact Information

One of the most frequent mistakes is omitting important details such as your business name, address, or contact information. Not including the correct recipient’s details can also cause delays in processing the payment. Always double-check that both parties’ names, addresses, phone numbers, and email addresses are correct and clearly listed.

2. Unclear Payment Terms

Clearly stating payment terms is essential to avoid confusion. Failing to specify due dates, late fees, or acceptable payment methods can result in delays. Always define the following:

- Due date: Ensure the client knows when payment is expected.

- Late fees: If applicable, specify penalties for overdue payments.

- Accepted payment methods: Indicate if payments should be made via bank transfer, credit card, or other methods.

Ambiguity in payment terms can lead to disputes or delayed payments, so make these terms clear from the beginning.

3. Incorrect Calculations

Even minor errors in summing up totals or taxes can lead to unnecessary issues. Using automated formulas to calculate totals, taxes, and discounts helps avoid mistakes. Double-checking the math is crucial, as inaccuracies may create mistrust or force you to issue corrections later.

4. Failing to Include a Unique Reference Number

Each document should have a unique reference or identification number to ensure easy tracking and organization. Without it, clients may have trouble referencing a specific document, and you may face difficulty in managing payments, especially if you have a large volume of transactions.

5. Lacking a Clear Description of Goods or Services

Vague or unclear descriptions of products or services can lead to confusion. Ensure that each item or service is thoroughly described with quantities, unit prices, and relevant details. Providing clear descriptions helps both parties understand exactly what is being paid for and prevents potential disputes.

By avoiding these common mistakes, you will improve your financial document accuracy and professionalism, ensuring smoother transactions and stronger client relationships.

How to Add Taxes and Discounts in Excel

Calculating taxes and applying discounts is a crucial part of managing payment documents. By automating these calculations within a spreadsheet, you can avoid errors and save time. Understanding how to set up formulas for taxes and discounts will help ensure your documents are accurate and reflect the correct final amount due.

1. Adding Taxes

To calculate tax, you’ll need to apply a simple formula. First, determine the tax rate and then multiply it by the total amount of the goods or services. Here’s how you can set it up:

- Enter the total amount in a cell (e.g., A1).

- Enter the tax rate in another cell (e.g., B1). For example, 10% would be 0.10.

- In a new cell, input the formula:

=A1*B1to calculate the tax amount. - To get the final total, use

=A1+A2, where A2 contains the tax amount.

This method will automatically calculate the tax whenever you change the total or tax rate, ensuring accuracy.

2. Applying Discounts

To apply a discount, you can use a similar approach. The discount amount is subtracted from the total before calculating the final price. Here’s a step-by-step guide:

- Enter the total amount in a cell (e.g., A1).

- Enter the discount rate in another cell (e.g., B1). For example, for a 20% discount, input 0.20.

- In a new cell, input the formula:

=A1*B1to calculate the discount amount. - Subtract the discount from the total:

=A1-A2to get the discounted amount.

This will allow you to adjust the discount easily, and the document will update the final price automatically.

3. Combining Taxes and Discounts

If both taxes and discounts apply, first calculate the discount and subtract it from the total. Then calculate the tax on the discounted amount. Here’s how:

- Calculate the discount:

(where A1 is the total and A2 is the discount rate). - Subtract the discount from the total:

. - Then calculate the tax on the new amount:

, where B1 is the tax rate. - Finally, add the tax to the discounted amount:

.

Best Practices for Professional Invoices

Creating clear, organized, and well-structured documents for payment requests is essential for maintaining a professional image and ensuring smooth financial transactions. Adopting the right practices will help you avoid misunderstandings and ensure clients can process payments without delays. Here are key strategies to follow when drafting such documents.

1. Include All Necessary Information

To avoid confusion and ensure prompt payment, it’s crucial to include the following details:

- Your business details: Include your full company name, address, phone number, and email.

- Client details: Clearly list the client’s name or company name, along with their contact information.

- Document reference number: Every document should have a unique ID number for easy tracking and referencing.

- Itemized list of goods or services: Provide clear descriptions, quantities, and unit prices for everything you are billing for.

- Payment terms: State the due date, applicable late fees, and acceptable payment methods.

2. Keep the Layout Clean and Professional

The visual clarity of your document is just as important as the content. A clean and well-organized layout can make your request look more polished and ensure your client can quickly find all the necessary information. Here are a few tips:

- Use a consistent font style and size: Ensure readability by using a professional, easy-to-read font, and avoid cluttering the page.

- Highlight key information: Use bold or italics for important elements such as due dates, amounts, and reference numbers.

- Leave ample space: Ensure there is enough spacing between sections, making the document easy to follow.

Adopting these best practices will help you create effective documents that not only streamline your business processes but also promote a professional image to your clients.

How to Track Payments Using Excel Invoices

Tracking payments efficiently is vital for maintaining financial clarity and ensuring timely follow-ups. By integrating simple tracking methods into your financial documents, you can monitor paid and outstanding amounts, streamline cash flow management, and avoid potential discrepancies. Using spreadsheet software allows you to automate calculations and track payments with minimal effort.

1. Set Up a Payment Tracking System

The first step is to create a system within your document to track the status of payments. Here’s how you can structure it:

- Create a “Payment Status” column: Label it to show whether a payment is pending, paid, or overdue. This will allow you to easily monitor the status of each request.

- Add a “Payment Date” column: Include the date when a payment is received. This helps in tracking and verifying payment timelines.

- Include a “Balance Remaining” column: This shows the outstanding amount if only part of the total has been paid, or zero if the payment is complete.

2. Automate Payment Updates with Formulas

Using simple formulas can help automatically update the payment status and remaining balance as you enter payment details. Here are a few useful formulas:

- Payment Status Formula: Use an IF statement to automatically update the payment status based on the balance. For example,

=IF(C2=0, "Paid", "Pending"), where C2 is the cell containing the remaining balance. - Balance Formula: Subtract any partial payments from the total amount. For example,

=A2-B2, where A2 is the total amount and B2 is the amount paid.

By setting up these formulas, you can automatically track whether payments are complete or if any outstanding amounts are due, ensuring accurate and up-to-date records.

3. Visualize Outstanding Payments

To make tracking even easier, consider using conditional formatting to highlight overdue payments. For example:

- Highlight overdue payments: Set up a rule to change the cell color to red if the “Payment Date” has passed and the payment status is still “Pending.” This will help you quickly identify overdue amounts.

- Track payment progress: Use color coding or progress bars to visualize how much of the total has been paid, helping you track the payment flow.

With these strategies, you can efficiently manage your financial records, reduce manual errors, and ensure that every payment is accounted for in real-time.

Design Tips for Eye-Catching Invoices

Creating visually appealing financial documents is not just about aesthetics–it also plays a crucial role in ensuring your message is clear and your brand stands out. A well-designed document reflects professionalism, grabs attention, and makes the payment process easier for clients. Here are some design tips to help you craft documents that are both functional and attractive.

1. Use a Clean, Simple Layout

A cluttered document can be overwhelming and difficult to navigate. Keep the layout simple, using clear sections and enough white space to make the information easy to read. Consider the following:

- Clear headers: Use bold or larger fonts for section titles, such as “Contact Information” or “Payment Details.”

- Consistent alignment: Ensure that all text is aligned neatly. For example, align amounts to the right and descriptions to the left for easy scanning.

- Logical flow: Organize the content in a way that guides the reader through the document in a logical order–from the sender’s details to the payment terms.

2. Incorporate Your Branding

Your document should reflect your business’s branding to make it recognizable and professional. Here are some ways to add your personal touch:

- Logo placement: Include your logo at the top or in a prominent position to reinforce your brand identity.

- Brand colors: Use colors from your brand palette to create consistency with other materials. Be sure to balance colors so the document remains professional and easy to read.

- Font style: Choose fonts that align with your brand’s voice. Stick to two or three complementary fonts for a clean look.

3. Make Important Information Stand Out

Highlighting key details can help clients quickly locate important information like the total amount due or the payment due date. Consider these techniques:

- Bold or highlight key figures: Use bold fonts or shaded cells for the total amount, due date, or other critical data.

- Use borders or shading: Apply light borders or shaded boxes around sections such as the item list or payment summary to make them stand out.

- Clear section breaks: Use lines or subtle background shading to separate different sections of the document, such as billing details, services provided, and payment instructions.

4. Optimize for Readability

While visual appeal is important, readability should always come first. To improve legibility:

- Use a legible font size: Ensure the text is large enough to read easily, especially important information like the payment amount.

- Avoid excessive fonts and colors: Too many fonts or bright colors can be distracting. Stick to a professional look with a maximum of two fonts and a few colors.

- Provide clear instructions: Make sure payment instructions, including accepted methods and due dates, are straightforward and easy to locate.

By following these design tips, you can create professional, visually appealing documents that not only look great but also help facilitate smooth transactions and build stronger relationships with your clients.

How to Automate Invoice Calculations in Excel

Automating calculations within financial documents can save you valuable time, reduce human error, and ensure accuracy in your records. By using formulas and built-in functions in spreadsheet software, you can quickly calculate totals, taxes, discounts, and balances without having to manually update each figure. Here’s how you can set up automated calculations to make your documents more efficient.

1. Set Up the Basic Structure

Before diving into formulas, it’s important to create a well-organized layout. Typically, this will include columns for item descriptions, quantities, unit prices, and totals. Make sure each piece of information has its own column, so the software can easily reference it for calculations.

- Column A: Item Description

- Column B: Quantity

- Column C: Unit Price

- Column D: Total Price

2. Automate the Calculation of Total Price

To automatically calculate the total price for each item, use a simple multiplication formula. In the “Total Price” column (Column D), input the following formula for the first row (starting in row 2):

=B2*C2

This will multiply the quantity (Column B) by the unit price (Column C), giving you the total price for that item. Drag the formula down for all items to apply it to the rest of the rows.

3. Calculate the Subtotal

The next step is calculating the subtotal, which is the sum of all individual total prices. In the cell where you want the subtotal to appear, use the SUM function:

=SUM(D2)

This will sum the values in the “Total Price” column (D2 to D10, or however many rows you have). Adjust the range as needed.

4. Add Taxes Automatically

To calculate tax automatically, you can multiply the subtotal by the applicable tax rate. In a new cell, input the following formula to calculate the tax amount:

=D11*0.10

In this example, D11 is where the subtotal is located, and “0.10” represents a 10% tax rate. Adjust the rate based on your local tax percentage.

5. Apply Discounts Automatically

If your business offers discounts, you can automate this step as well. If you want to apply a discount to the subtotal, use the following formula in a new cell:

=D11-(D11*0.15)

This formula will subtract 15% from the subtotal (D11). Change “0.15” to reflect the discount percentage you wish to apply.

6. Calculate the Final Total

Finally, calculate the final amount due by adding the tax and subtracting the discount (if applicable). In a new cell, use the following formula:

=D11+D12-D13

Where D11 is the subtotal, D12 is the tax, and D13 is the discount. This will give you the final total that the client owes.

By setting up these automated calculations, you’ll ensure that each document is accurate, easy to update, and free from manual errors–streamlining the billing process and improving efficiency in your workflow.

Secure and Organize Your Invoice Files

Maintaining well-organized records of financial documents is crucial for both business efficiency and security. Proper management ensures that important paperwork is easy to locate when needed and protected from unauthorized access. Whether you’re dealing with payment receipts, billing statements, or transaction summaries, an effective filing system can make a significant difference in how smoothly your operations run.

Protection Measures

Securing your records involves more than just keeping them in a safe location. Digital files need to be protected from hacking, unauthorized access, and accidental deletion. Here are some strategies to safeguard your documents:

- Use strong passwords for file storage systems or cloud platforms.

- Enable two-factor authentication wherever possible.

- Regularly back up your files to avoid data loss.

- Encrypt sensitive documents to add an extra layer of protection.

Organizational Strategies

A well-structured filing system simplifies access and retrieval, especially when dealing with a large number of financial records. Consider the following tips to organize your files effectively:

- Create folders by year, month, or client name to make sorting easier.

- Use clear, consistent naming conventions for each document.

- Implement a version control system to track changes or updates.

- Regularly review and archive outdated documents to keep your system streamlined.

Invoice Templates for Different Business Types

Each business operates differently, and as a result, the financial documentation required will vary. Tailoring your billing statements to fit your industry ensures clarity and efficiency. Depending on the nature of your services or products, the structure and design of your records may differ, but all should maintain professionalism and transparency for both parties involved.

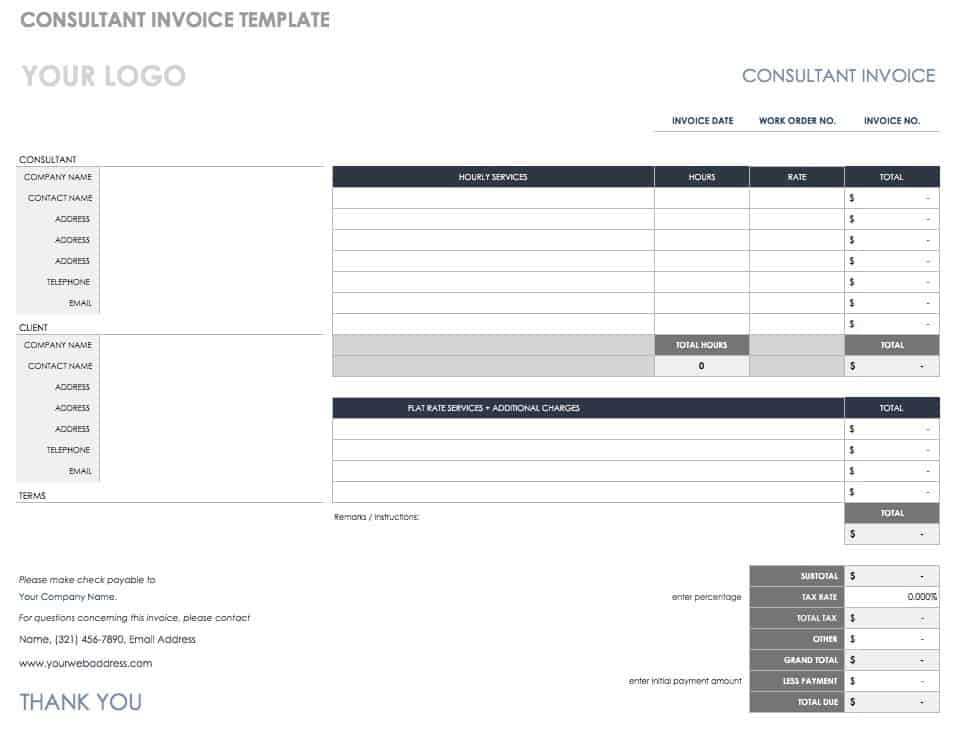

For Service Providers: When offering services, your documents need to reflect the scope of the work completed, including hours worked, hourly rates, or specific project milestones. This helps clients understand the charges and ensures that no detail is overlooked.

- Include a clear description of services rendered.

- Specify hourly or flat rates, as well as the time spent on each task.

- List any additional expenses or costs that may apply.

For Product Sellers: If your business revolves around selling goods, your records should detail the items sold, quantities, unit prices, and total amounts. These statements should also account for taxes or shipping fees when applicable, giving a full breakdown of the transaction.

- Provide a list of items with itemized prices.

- Include any applicable tax rates and shipping charges.

- Consider offering discounts or promotions, if relevant.

For Freelancers and Contractors: Independent professionals may require more personalized records. A clear itemization of services provided, along with deadlines or completion dates, ensures that clients are fully informed about what they are being charged for.

- List specific tasks completed or milestones reached.

- Set clear payment terms, including deadlines and late fees.

- Provide contact details for any follow-up or clarification.

Understanding the nuances of your industry will help you craft documents that are not only easy to understand but also in line with what your clients expect. Customizing your financial records to fit your business type promotes professionalism and minimizes confusion.

How to Send Excel Invoices to Clients

Once your financial record is ready, sending it to clients promptly is essential for smooth transactions. The way you deliver these documents can impact the client’s experience and ensure timely payments. Digital delivery is one of the most efficient methods, and there are a few steps you can follow to ensure that the file reaches its destination securely and in the correct format.

Step 1: Prepare the Document

- Ensure all details are accurate, including client information, amounts, and payment terms.

- Review the file for any errors or missing data.

- Make sure the document is well-organized and professional in appearance.

Step 2: Choose the Delivery Method

There are several ways to send the file to your client. The best method depends on the client’s preferences and the type of relationship you have with them.

- Email: The most common and convenient method. Attach the file to a professional email and include a brief message summarizing the payment details.

- Cloud Sharing: If the file is too large or if you prefer to keep it accessible for both parties, you can upload it to a cloud service like Google Drive, Dropbox, or OneDrive, and share the link.

- Secure Portal: If your business uses a secure online platform, you can upload the document there, ensuring added security and easy access for the client.

Step 3: Add a Cover Message

- Write a clear, polite message explaining the contents of the document and the payment instructions.

- Be sure to mention the due date and any other important information such as late fees or discounts.

- If applicable, offer assistance or a contact point for any questions the client may have.

Step 4: Follow-Up

- If you do not receive payment by the due date, send a polite reminder email.

- Include the original document or a link to it, and reaffirm the payment instructions and deadlines.

- Consider offering flexible payment terms for loyal clients or in cases of financial hardship.

By following these steps, you can streamline your billing process and ensure that your clients receive clear, accurate documentation while maintaining a professional and efficient workflow.