Interactive Invoice Template for Seamless Billing

Creating professional and adaptable financial documents can streamline the way you handle transactions and improve communication with clients. By utilizing modern solutions, businesses can design personalized records that cater to their specific needs, ensuring accuracy and clarity.

Modern tools offer a wide range of customization options, allowing users to tailor documents easily. Whether you’re invoicing for services or products, these solutions provide a level of flexibility that traditional formats simply cannot match. The ability to include payment details, tax calculations, and specific terms enhances the overall functionality.

By adopting such approaches, companies not only save valuable time but also create documents that reflect their unique branding. With user-friendly designs and intuitive features, managing financial records becomes an effortless task, benefiting both businesses and their clients.

Interactive Invoice Template Benefits

Utilizing customizable financial documents offers numerous advantages for businesses looking to enhance efficiency and professionalism. These tools simplify the process of creating precise and personalized records, ensuring that all necessary information is accurately presented without the need for manual adjustments.

One of the key benefits is time-saving. By using automated solutions, companies can quickly generate well-organized documents that meet specific requirements. This reduces the amount of time spent on manual data entry, allowing businesses to focus on more important tasks.

Another advantage is the improved accuracy that comes with such systems. By automating calculations and ensuring the correct inclusion of important details, the chances of errors decrease significantly. This leads to more reliable financial documents that can help build trust with clients and partners.

Additionally, these modern tools offer increased flexibility. Businesses can easily adapt their records to reflect changing terms, pricing structures, or services. Whether dealing with recurring payments or unique contracts, the ability to modify key components makes these documents versatile and scalable.

How to Create Custom Invoices

Designing tailored billing documents requires an understanding of the essential elements that should be included to ensure clarity and professionalism. By following a few key steps, you can craft documents that suit your specific business needs while maintaining accuracy and consistency across all transactions.

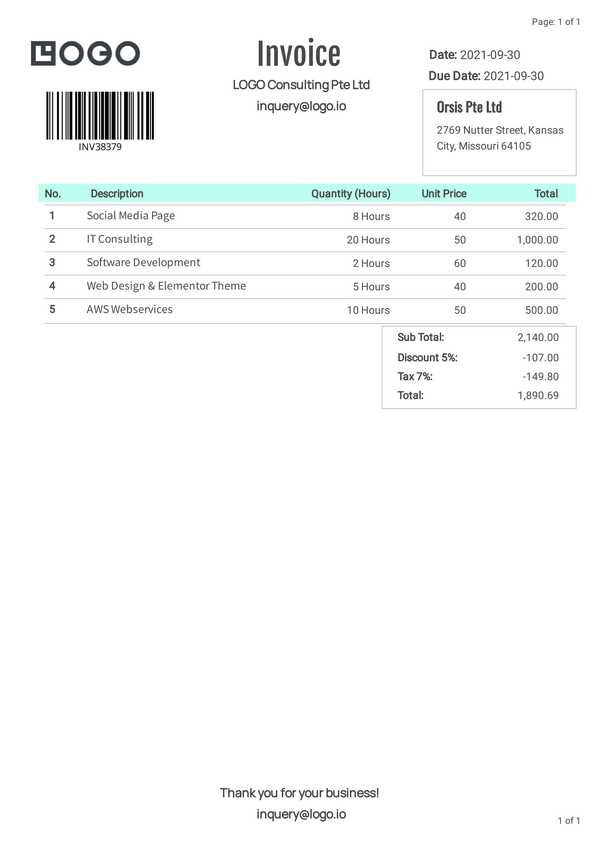

Step-by-Step Guide

To begin, you must gather all the relevant details for the document. This typically includes the client’s information, a detailed list of services or products provided, payment terms, and any taxes or discounts applied. Using software or digital tools, you can easily structure this data in a way that is both functional and visually appealing.

Essential Elements

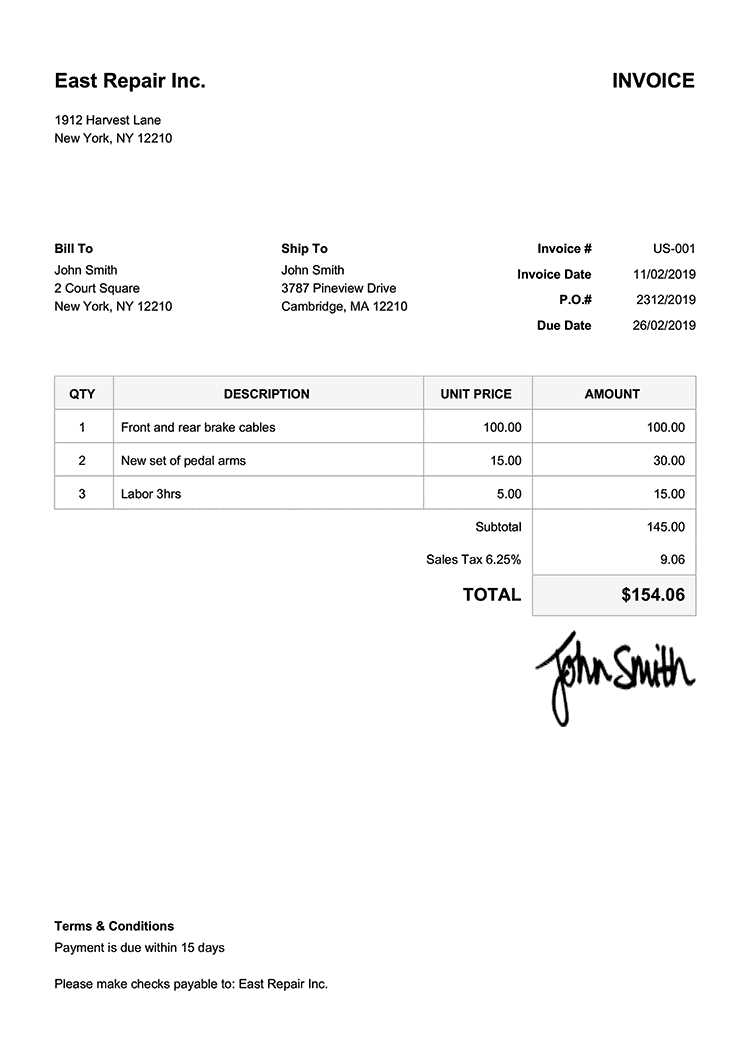

Make sure to include these core components in your billing records:

| Element | Description |

|---|---|

| Client Information | Name, address, contact details |

| Services/Products | A detailed list with descriptions and prices |

| Payment Terms | Due date, payment methods accepted |

| Tax/Discounts | Applicable tax rate or any discounts offered |

By incorporating these details, your records will not only look professional but also ensure transparency for your clients. Customizing your documents based on your business’s unique requirements allows you to deliver clear and efficient billing solutions with ease.

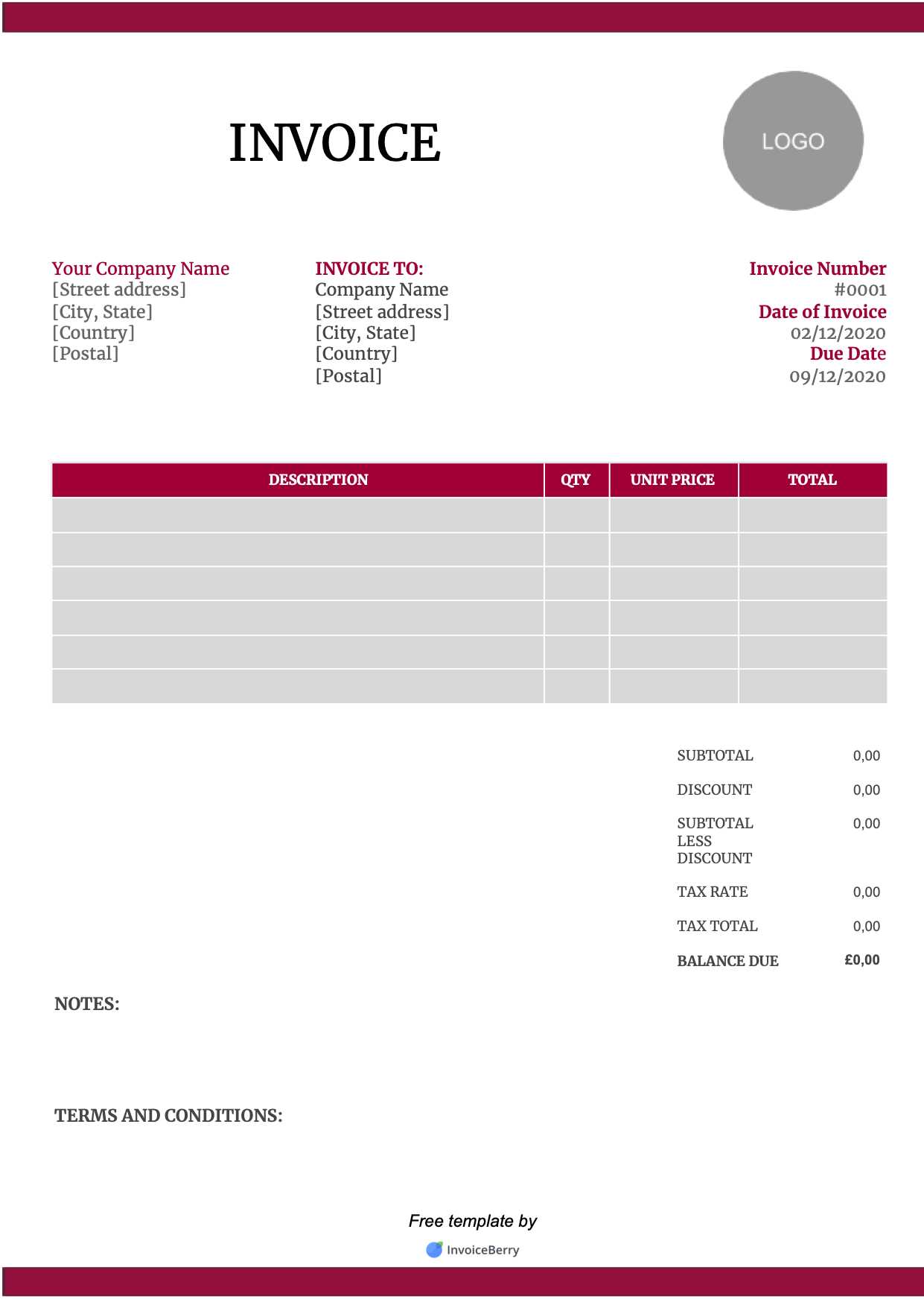

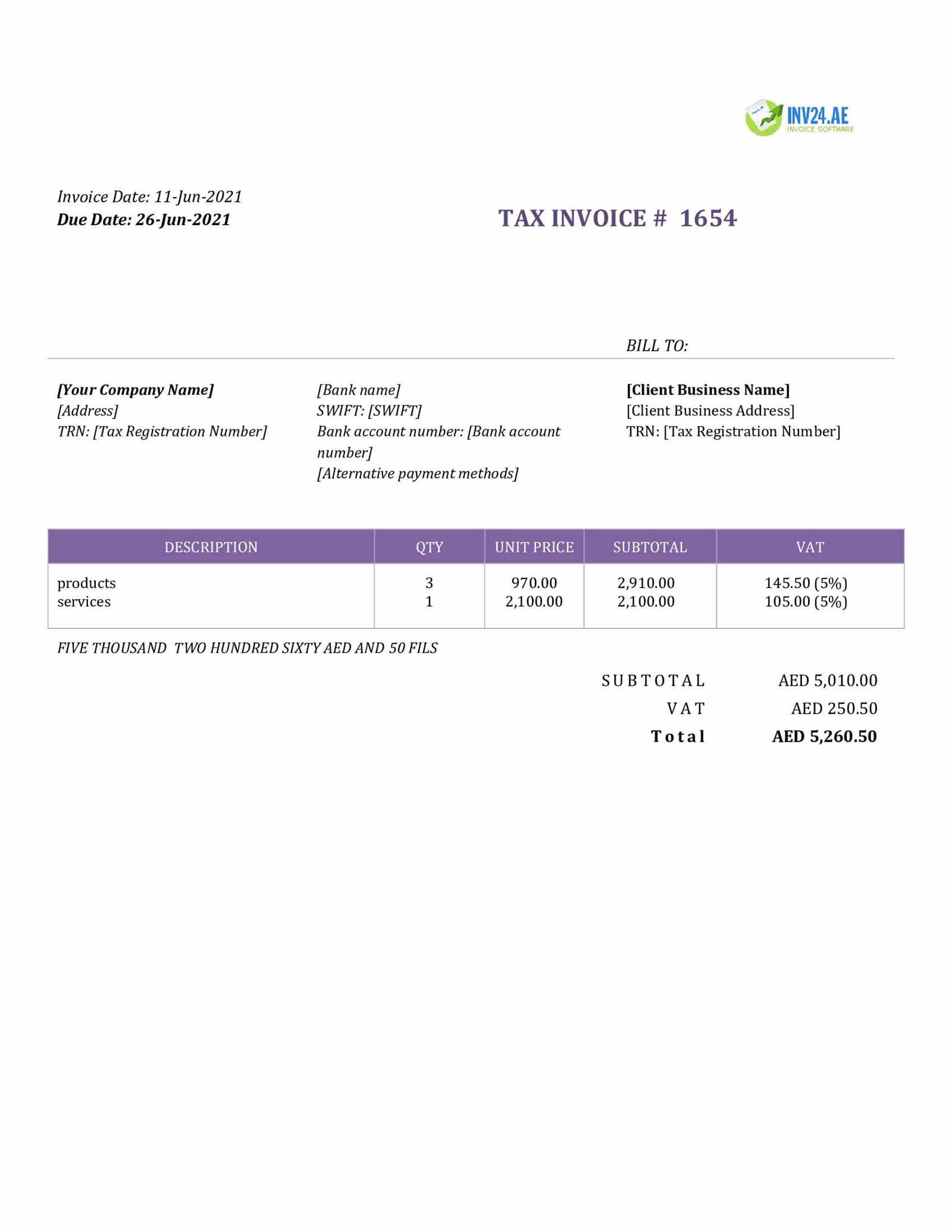

Essential Features of an Invoice Template

When creating professional billing documents, certain key features are necessary to ensure that the information is organized, clear, and easy to understand. These elements not only improve the functionality of the document but also help to maintain consistency and accuracy throughout the payment process.

To ensure that your documents serve their purpose effectively, make sure they include the following important components:

| Feature | Description |

|---|---|

| Header | Business name, logo, and contact information should be clearly displayed. |

| Client Details | Name, address, and contact information of the customer or client. |

| Itemized List | Clear breakdown of services/products, quantity, unit price, and total cost. |

| Payment Terms | Due date, accepted payment methods, and any late fee policies. |

| Tax and Discounts | Clearly show applicable taxes and any discounts that apply to the total. |

| Footer | Space for additional notes, terms, or thanks to the client. |

These features ensure that your documents are comprehensive, professional, and provide all the necessary information for your clients. Incorporating these elements into your billing system will improve the efficiency and accuracy of your transactions.

Why Choose Interactive Over Static Templates

In today’s fast-paced business environment, choosing dynamic solutions over traditional, fixed-format documents can offer significant advantages. Interactive documents allow users to make real-time adjustments, automate tasks, and create more personalized experiences, all of which help improve workflow and efficiency.

Here are some key reasons why dynamic solutions are preferable to static ones:

- Customization: With dynamic documents, users can easily adjust fields, add new sections, or update information as needed, offering greater flexibility compared to static formats that require manual edits each time.

- Automation: These tools can automate calculations, such as totals, taxes, and discounts, reducing the risk of errors and saving valuable time.

- Data Integration: Unlike static formats, dynamic solutions can pull data directly from other systems, ensuring that records are always up to date without needing to re-enter information.

- Improved User Experience: Clients and recipients can interact with the document, such as by selecting payment methods or entering custom notes, creating a more personalized and efficient experience.

- Time Savings: The automation and ease of editing make it faster to create and process documents, freeing up time for other business tasks.

By choosing dynamic over static solutions, businesses can improve accuracy, reduce administrative work, and ensure a smoother, more professional interaction with clients and partners.

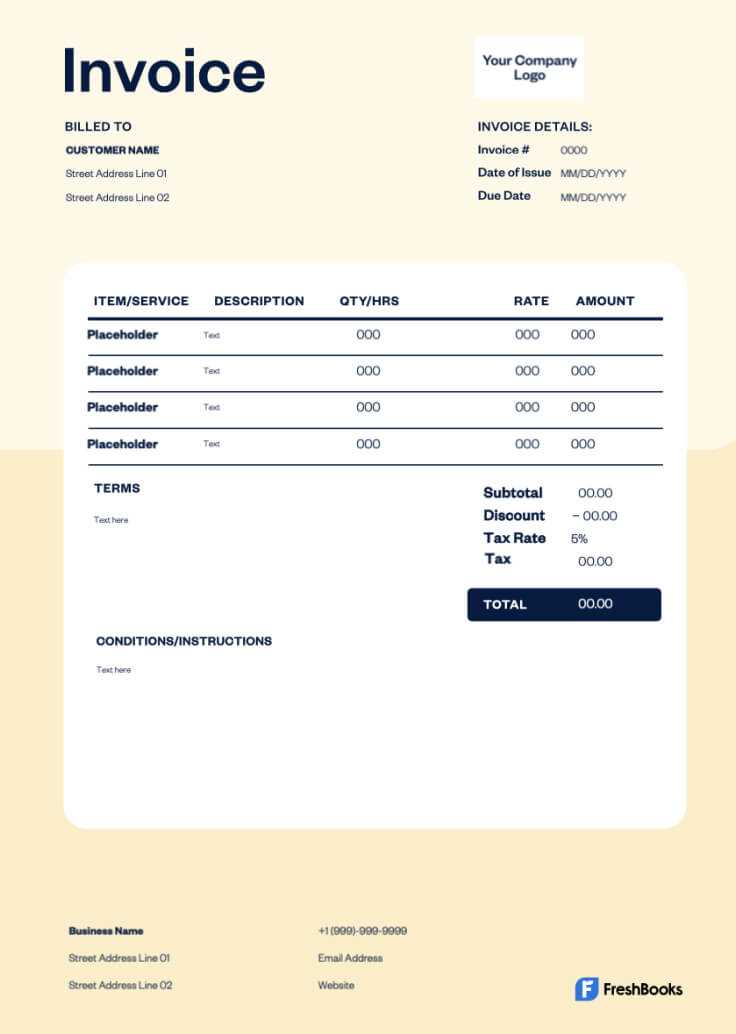

Best Tools for Customizing Invoices

Choosing the right tools for creating and personalizing financial documents is crucial for streamlining your business operations. The best software solutions provide flexibility, ease of use, and a range of customization options that allow you to generate professional records quickly and efficiently.

Top Software Solutions for Customization

Several digital platforms are available for designing tailored billing documents. These tools typically allow users to adjust layouts, add personalized branding, and even integrate payment systems directly into the document. Here are some of the best options available:

- FreshBooks: A popular accounting solution that offers easy-to-use design features, FreshBooks allows users to customize the layout and add company logos, payment links, and personalized terms.

- Zoho Invoice: Zoho provides advanced customization options with a drag-and-drop editor that helps businesses create highly specific billing records while incorporating tax rates and discount calculations.

- QuickBooks: Known for its powerful invoicing tools, QuickBooks enables users to personalize documents with various templates, adding branding elements and automated fields for more accurate billing.

- Canva: While primarily a design tool, Canva offers a range of customizable document templates, making it perfect for businesses looking to create visually appealing financial records with ease.

Why These Tools Stand Out

These solutions stand out due to their combination of usability and powerful features. Whether you’re looking for simple customization or more advanced functionality, these tools can help you create documents that reflect your brand and meet your business needs.

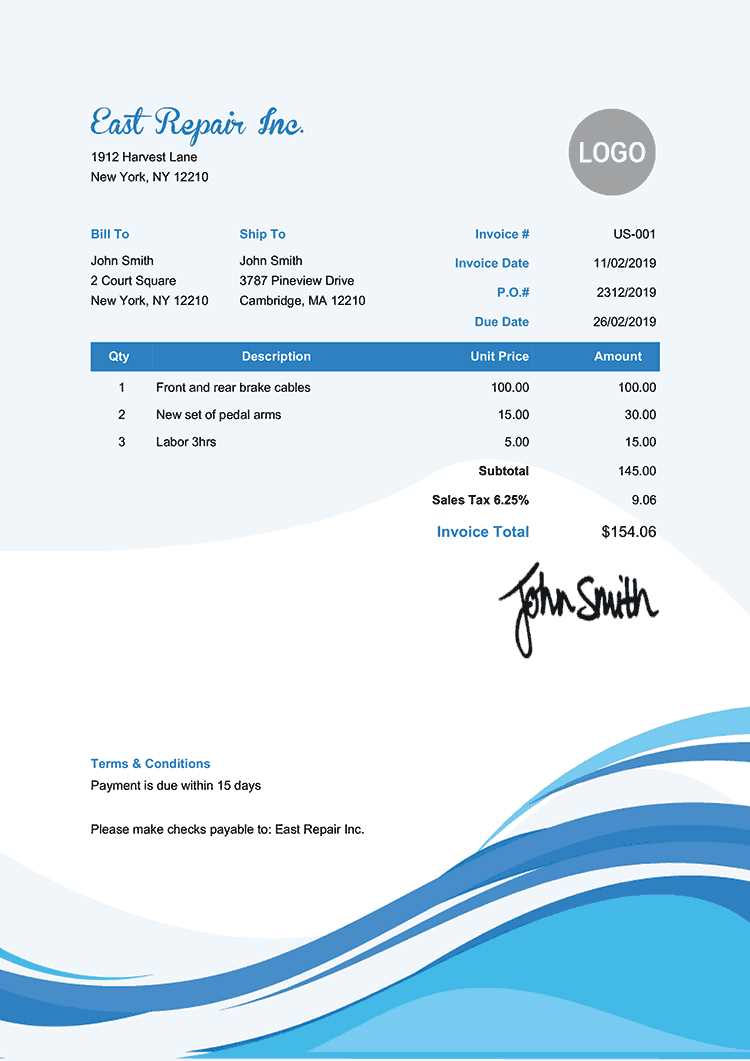

Step-by-Step Guide to Invoice Design

Designing professional billing documents requires attention to detail and organization. By following a structured approach, you can create clear, effective records that are easy for clients to understand and process. This step-by-step guide will walk you through the key stages of creating well-designed financial documents.

Here is a simple process to help you create an efficient and professional billing record:

- Step 1: Choose a Platform or Tool – Select a design tool or software that suits your business needs. This could range from specialized accounting software to general design platforms like Canva or Google Docs.

- Step 2: Define the Layout – Determine the structure of your document. Decide where each element will be placed, such as your business name, client information, itemized list of services, and total amount due.

- Step 3: Add Branding – Include your logo, company name, and contact details at the top of the document. Personalizing the design with your brand colors and fonts makes your document look professional and consistent.

- Step 4: Include Key Information – Ensure that the following sections are included:

- Client’s contact information

- A list of services/products with descriptions and pricing

- Payment terms, including due date and acceptable methods

- Applicable taxes or discounts

- Step 5: Automate Calculations – Use the available tools to automate calculations for totals, taxes, and discounts. This helps avoid errors and speeds up the process of creating the document.

- Step 6: Review and Finalize – Double-check the details for accuracy. Ensure that all information is correct, the formatting is consistent, and the document is clear. Once satisfied, save or export the document in your desired format.

By following these steps, you can create a clean, professional, and effective billing document that meets both your business needs and your clients’ expectations.

Common Mistakes to Avoid in Invoices

Creating accurate and professional billing documents is essential for maintaining smooth business operations and building trust with clients. However, even the most experienced professionals can make mistakes that can lead to confusion, delays, or payment issues. Being aware of common pitfalls can help you avoid them and ensure your documents are clear and effective.

Common Errors to Watch Out For

Here are some of the most frequent mistakes that businesses should avoid when creating billing records:

- Missing or Incorrect Contact Information: Failing to include your business’s contact details or providing incorrect client information can delay communication and payments. Ensure that both your contact info and your client’s details are accurate and up-to-date.

- Unclear Payment Terms: Vague payment terms or an unclear due date can lead to confusion and late payments. Clearly state the payment deadline, the methods accepted, and any penalties for late payments.

- Omitting Item Descriptions: Leaving out details such as product descriptions or the nature of the services provided can result in misunderstandings. Always provide clear descriptions and quantities to avoid disputes.

- Incorrect Calculations: One of the biggest errors is miscalculating totals, taxes, or discounts. Double-check your math and use automated tools to minimize errors.

- Not Including a Unique Number: Each billing document should have a unique identifier, such as an invoice number. This helps both you and your client keep track of payments and avoid confusion.

- Unprofessional Formatting: A cluttered or inconsistent layout can make your document hard to read. Keep your design simple and well-organized, using clear headings, bullet points, and spacing to make it easy for clients to review the details.

How to Avoid These Mistakes

By taking the time to carefully review each document, using automated tools for accuracy, and following best practices for design and organization, you can avoid these common mistakes. The more accurate and professional your records are, the smoother your payment process will be, leading to stronger relationships with your clients.

Automating Invoices for Business Efficiency

Automating the creation and management of financial documents can significantly enhance business operations. By reducing manual tasks, businesses can save time, minimize errors, and ensure that billing records are generated on time. Automation streamlines processes, making it easier to stay on top of payments and maintain consistency in document handling.

Benefits of Automation in Billing

Integrating automation into your billing system provides several key advantages:

- Time Savings: Automating the process allows you to focus on other important business tasks. Once set up, automated systems generate and send records automatically, reducing the need for manual intervention.

- Reduced Human Error: By automating calculations and data entry, you minimize the risk of mistakes in totals, taxes, or client information. This leads to more accurate records and smoother transactions.

- Consistency and Professionalism: Automated documents follow a consistent format, ensuring that all records sent to clients are uniform and professional. This helps maintain your brand’s image.

- Faster Payments: With automated reminders and payment links, clients are more likely to receive and act on documents promptly, speeding up the payment process.

- Improved Cash Flow: By sending out documents on time and following up automatically, businesses can improve their cash flow and reduce delays in receiving payments.

How to Automate Billing Processes

There are several ways to integrate automation into your billing system:

- Use Accounting Software: Many accounting platforms, such as QuickBooks, FreshBooks, and Xero, offer automation features like recurring billing, automated reminders, and customizable templates for generating records.

- Set Up Automated Payment Reminders: Most billing platforms allow you to set reminders for unpaid bills, ensuring clients are prompted to make payments before deadlines pass.

- Link to Payment Systems: Integrating a payment gateway with your billing system allows clients to pay directly from the document, streamlining the process and reducing the chances of delays.

By automating these aspects, businesses can increase efficiency, improve accuracy, and reduce the administrative burden associated with managing billing records.

How Interactive Templates Improve Client Experience

Modernizing financial documents enhances the way clients interact with and process their billing records. Providing a seamless, user-friendly experience allows clients to access, review, and manage their payments with ease, making the entire transaction process smoother and more efficient. The ability to offer customizable features, immediate updates, and integrated payment options leads to greater satisfaction and trust.

Benefits for Clients

When billing documents are designed to be user-friendly and adaptable, they provide several key benefits that improve the overall client experience:

- Ease of Navigation: Clients can easily understand and navigate through the document, with clearly defined sections, interactive elements, and user-friendly interfaces.

- Faster Payments: Integrated payment options and automatic reminders streamline the process, making it easier for clients to complete transactions promptly.

- Real-Time Updates: Clients can view real-time changes or updates to their payment status, discounts, or taxes directly in the document, reducing confusion and ensuring transparency.

- Personalized Information: With the ability to personalize their billing documents, clients can quickly find the information they need, such as their specific service details, payment due dates, and historical records.

Features Enhancing Client Experience

Here are some features that contribute to a more engaging and efficient experience for clients:

| Feature | Benefit |

|---|---|

| Clickable Payment Links | Clients can pay directly from the document, simplifying the transaction process. |

| Editable Fields | Clients can quickly adjust or add details, such as addresses or payment terms, to suit their preferences. |

| Automatic Updates | Changes to totals, discounts, or taxes are immediately reflected in the document, offering clarity and real-time accuracy. |

| Mobile-Friendly Design | Clients can easily view and manage documents on any device, improving accessibility and convenience. |

By adopting these interactive features, businesses can not only improve the client experience but also foster long-term relationships built on convenience, transparency, and professionalism.

How to Integrate Payment Options

Integrating seamless payment options into financial documents makes the transaction process easier for both businesses and clients. By offering multiple payment methods directly within the document, you can improve client satisfaction, encourage faster payments, and streamline cash flow management. This integration allows clients to pay conveniently, without having to navigate external systems or websites.

Steps to Integrate Payment Options

Follow these steps to successfully integrate payment methods into your billing records:

- Select Payment Gateways: Choose reliable payment processors like PayPal, Stripe, or Square, which offer secure transactions and support multiple payment methods, including credit cards, bank transfers, and mobile payments.

- Enable Clickable Payment Links: Embed links in your financial documents that direct clients to a secure payment page. This allows them to pay directly from the document without navigating through multiple pages.

- Include QR Codes: For mobile users, add QR codes that clients can scan with their smartphones to complete payments quickly and securely.

- Offer Subscription or Recurring Payment Options: For ongoing services, set up automated recurring billing, allowing clients to make regular payments without needing to manually submit new transactions each time.

Best Practices for Integration

To ensure a smooth and secure experience for both you and your clients, consider these best practices when integrating payment methods:

- Ensure Security: Always choose payment processors that use secure encryption methods to protect sensitive client data during transactions.

- Provide Multiple Payment Methods: Offer a variety of payment options, including credit cards, digital wallets, and bank transfers, to accommodate different client preferences.

- Test Payment Links: Before sending out documents to clients, test all payment links and methods to ensure they work properly and provide a smooth transaction experience.

- Include Clear Instructions: Provide clear instructions within the document, guiding clients on how to make payments and explaining the steps involved.

By integrating these payment options into your documents, you not only improve efficiency but also enhance the overall experience for your clients, making it easier for them to process payments on time and in the method most convenient for them.

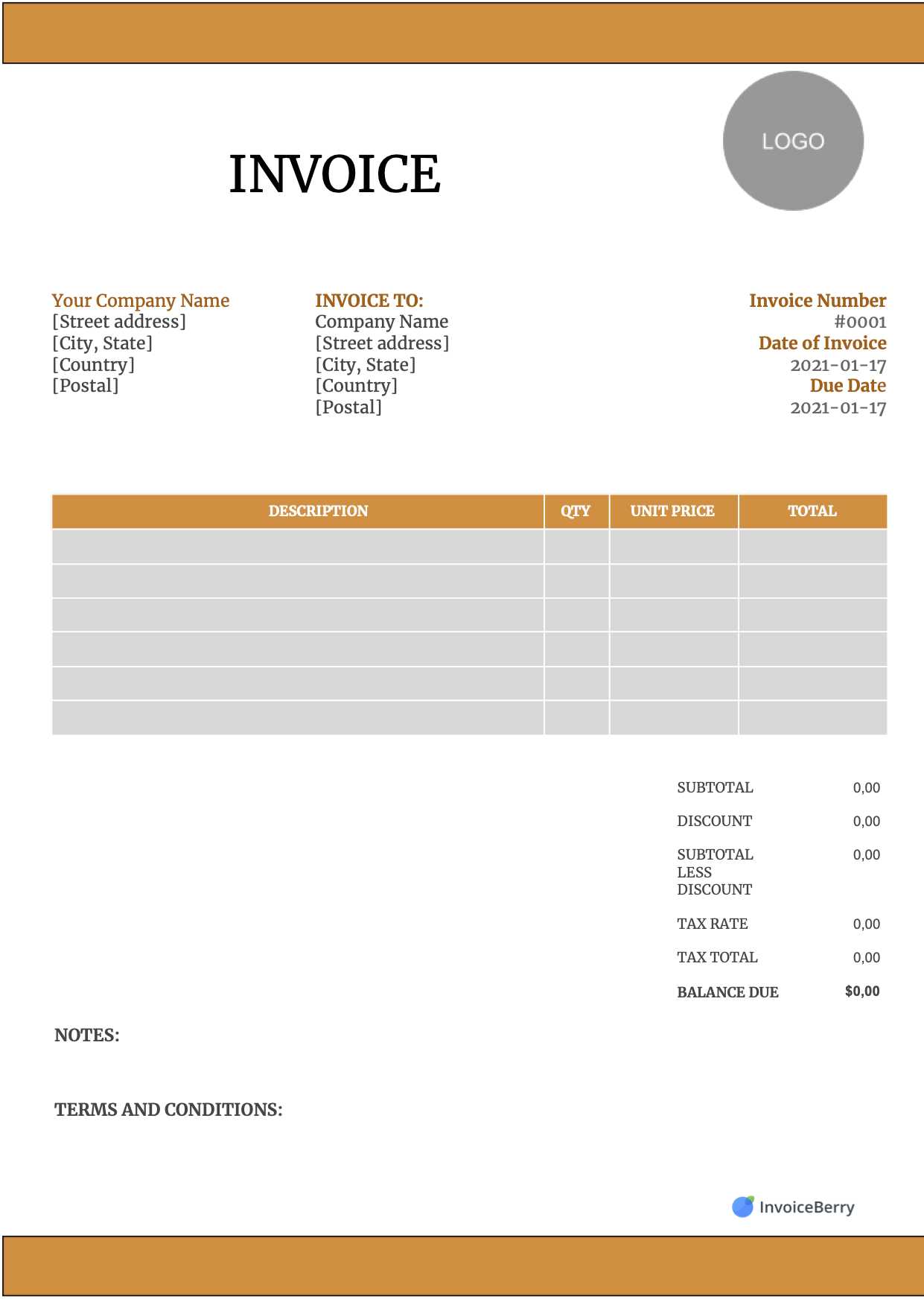

Choosing the Right Invoice Format

Selecting the appropriate layout for your financial documents is essential to ensure clarity, professionalism, and ease of use. The right structure can help your clients quickly understand the details of the transaction, making the payment process more straightforward. Whether you’re aiming for simplicity or a more detailed breakdown, the format you choose plays a key role in the efficiency of your business operations and customer experience.

When deciding on the best format for your documents, consider factors such as your business type, client needs, and the complexity of the services or products provided. A clear, organized format will not only reduce confusion but also help build trust and improve the overall interaction between you and your clients.

Here are some common options to consider:

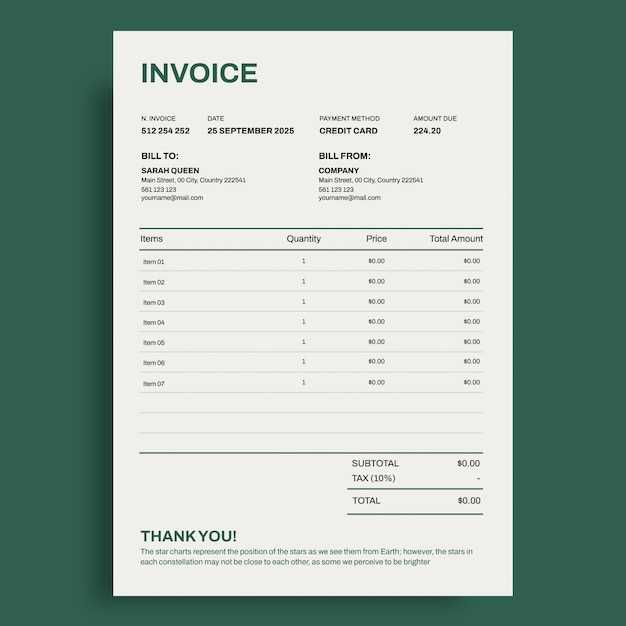

- Simple and Clean: Ideal for businesses with straightforward transactions, this format features clear sections with minimal design, focusing on essential details like payment amounts, due dates, and client information.

- Itemized Format: Best for businesses offering multiple products or services, this layout breaks down the charges in a detailed manner, helping clients understand exactly what they are being billed for.

- Recurring Format: Suitable for subscription-based services, this format automatically includes payment frequency and details of recurring charges, making it easy for clients to see their ongoing commitments.

- Professional and Branded: This format often includes company logos, custom colors, and a more polished look to reflect the brand identity. It works well for businesses that want to maintain a high level of professionalism and strengthen their brand presence in client communications.

Choosing the right format ensures your financial documents are not only functional but also help establish a positive impression, making it easier for clients to process payments quickly and with confidence.

Invoice Template Security Considerations

When managing financial documents, ensuring the security of sensitive information is crucial. These documents often contain personal and financial details, making them prime targets for cyberattacks. Safeguarding the data within these records helps protect both your business and your clients from potential breaches and fraud. Adopting the right security practices is essential to maintaining trust and ensuring compliance with data protection regulations.

There are several key aspects to consider when securing your billing documents:

- Data Encryption: Always use encryption when sending documents electronically. This ensures that any sensitive information, such as payment details or personal data, is protected from unauthorized access during transmission.

- Secure Storage: Store your financial records in a secure, password-protected system. Avoid saving them in unprotected formats or on shared devices, which increases the risk of unauthorized access.

- Access Control: Limit access to financial documents to only those employees who need it. Implement role-based access controls to reduce the chances of internal security breaches.

- Regular Audits: Conduct periodic audits of your document management systems and processes. This helps identify any potential vulnerabilities and ensures that security measures are up-to-date and effective.

- Watermarking: Adding watermarks to your documents can act as a deterrent to unauthorized distribution and copying, especially if you are sharing confidential information with external parties.

By considering these security practices, you can greatly reduce the risk of data breaches and ensure that your financial documents remain safe and secure, fostering trust between you and your clients.

Benefits of Digital vs Printable Invoices

When it comes to creating and managing billing records, businesses often face the decision of whether to use digital or printed documents. Each method offers distinct advantages, depending on your business needs, client preferences, and operational efficiency. The choice between digital and printable records is an important consideration for improving workflow, reducing costs, and enhancing client experience.

Here are the key benefits of each approach:

Advantages of Digital Documents

- Cost-Effective: Digital records eliminate the need for paper, ink, and postage, reducing operational costs for your business.

- Instant Delivery: Sending electronic documents allows you to deliver them instantly to clients, speeding up the billing and payment process.

- Environmentally Friendly: Reducing paper usage by opting for digital methods contributes to sustainability efforts, lowering your environmental impact.

- Easy Storage and Retrieval: Storing documents digitally allows for efficient organization and easy access to past records, which can be quickly retrieved whenever needed.

- Automation: Many digital solutions offer automated processes, such as recurring billing or reminders, saving time and effort on manual tasks.

Advantages of Printable Documents

- Physical Record: Printed documents provide a tangible record that some clients may prefer, especially if they don’t engage with digital tools frequently.

- Customizable Formats: Print formats offer flexibility in design and layout, allowing businesses to create physical records tailored to specific branding or client needs.

- Client Trust: For some clients, receiving a physical document can create a sense of professionalism and formality, boosting trust in the transaction.

- No Digital Barriers: Printable documents are ideal for clients who may not have access to digital devices or prefer to handle paperwork offline.

While both methods have their advantages, many businesses are increasingly opting for digital documents due to their convenience, cost savings, and efficiency. However, understanding your client’s preferences and specific business needs will help determine the best choice for your operations.

Maintaining Consistency Across Invoices

Consistency in business documentation is essential for creating a professional image and ensuring clarity. When you use similar formats, structures, and designs across all financial records, you enhance your brand’s recognition and streamline the communication process. By establishing uniformity in your documents, you make it easier for clients to understand details and avoid confusion or errors.

Here are some key strategies to maintain consistency in your billing documents:

Standardizing Layout and Design

Having a standardized design ensures that each document looks uniform and professional. This includes the use of consistent colors, fonts, and logos. A cohesive design helps create a strong brand identity and reinforces trust with clients.

Uniform Information Structure

Ensure that all key information appears in the same order on every document. This includes client details, service descriptions, payment terms, and amounts. A consistent layout helps clients easily find what they need, improving the overall user experience.

| Element | Standard Placement |

|---|---|

| Company Logo | Top Left |

| Client Information | Top Right |

| Service Details | Centered Below Header |

| Total Amount | Bottom Right |

| Payment Terms | Bottom Center |

Consistency in information layout ensures that both you and your clients can quickly review important details, reducing mistakes and misunderstandings.

By maintaining a standardized approach in both design and structure, your business can achieve better organization, improved client satisfaction, and a more professional overall appearance in all financial interactions.

How to Save Time with Templates

Efficient document creation is essential for maintaining productivity in any business. By using pre-designed formats, you can significantly reduce the time spent on repetitive tasks, allowing you to focus on other critical areas. These ready-to-use structures help eliminate the need to start from scratch, making the process smoother and faster.

One of the key benefits of utilizing pre-set designs is automation. Once you’ve set up a standardized structure, you only need to input relevant information, eliminating the need for redesign or reformatting each time. This method not only saves time but also ensures consistency across all your business records.

- Speedy Setup: With templates, you can easily fill in the necessary fields without worrying about formatting, reducing the time spent on document creation.

- Consistency: Pre-designed structures ensure that all documents follow the same format, creating a consistent and professional appearance.

- Efficiency: Templates allow you to quickly adapt and send documents, cutting down on the time between generating and dispatching them to clients.

Incorporating templates into your workflow can also help reduce human error. With set sections and clearly defined spaces for information, you are less likely to overlook or forget key details, making your business processes more accurate and reliable.

Overall, using pre-designed formats is an excellent way to streamline your document creation process, boost productivity, and maintain high-quality communication with clients and partners. It’s an investment in both time and professionalism that pays off quickly.

Customizing Templates for Different Industries

Different industries have unique requirements when it comes to documenting transactions and communicating with clients. Customizing pre-designed structures to fit the specific needs of various sectors can improve accuracy and efficiency. Tailoring these formats allows businesses to include industry-relevant information, ensuring clarity and consistency across all communications.

For example, service-based industries may prioritize detailed descriptions of work performed, while product-based businesses might need to focus more on quantities, pricing, and inventory details. Understanding the nuances of your industry ensures that the final output meets both legal and customer expectations.

- Professional Services: Include sections for hours worked, service descriptions, and hourly rates to clearly communicate the value provided.

- Retail: Emphasize itemized lists, quantities, and pricing, offering a transparent view of what the customer is purchasing.

- Construction: Custom formats may include fields for labor costs, materials, and project milestones to track progress and costs.

By customizing your document layout, you can align your business processes with industry standards and regulations. These adjustments enhance communication with clients, increase professionalism, and ensure compliance with any industry-specific requirements.

Ultimately, the ability to customize documents according to industry needs provides a more streamlined and personalized experience for both businesses and their customers. This flexibility leads to more efficient processes and better overall customer satisfaction.