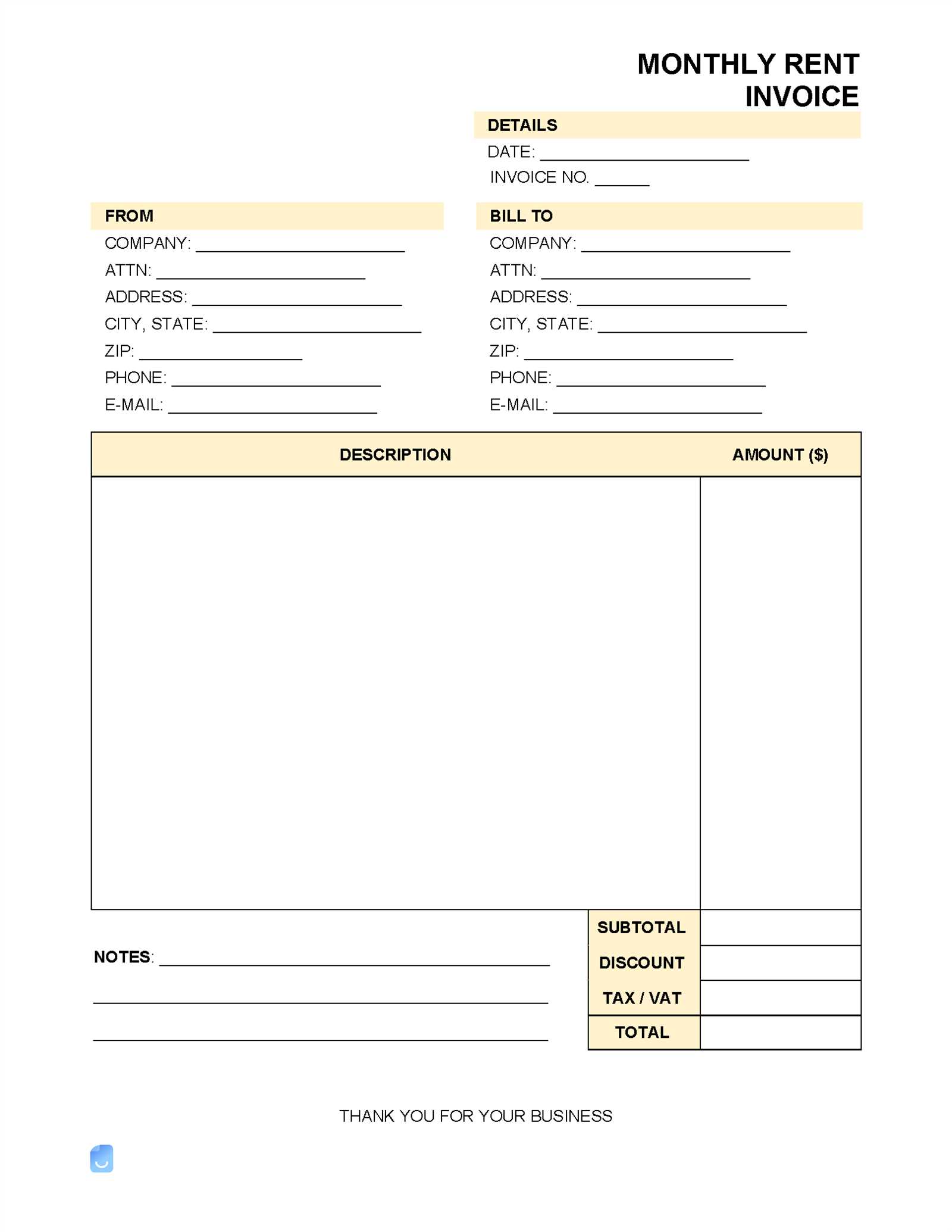

Word Monthly Rent Invoice Template for Simple Billing

Efficiently managing financial transactions with tenants is a key aspect of property management. Having a clear, well-structured document to outline payment details can help avoid misunderstandings and ensure smooth business operations. Whether you’re a landlord or property manager, knowing how to create a formal statement for payments is essential.

Using customizable documents designed to meet your specific needs can simplify the process. These formats allow you to input relevant details such as tenant information, payment amounts, and due dates, making the task of documenting transactions straightforward and professional.

Crafting a personalized document ensures that all necessary information is clearly presented, reducing errors and promoting timely payments. This method not only helps in keeping financial records organized but also contributes to building a professional relationship with your tenants.

Word Monthly Rent Invoice Template Guide

Creating a well-organized document for payment requests is a crucial task for property owners. Having a standardized format not only simplifies the process of managing transactions but also ensures clarity for both parties involved. This guide will help you understand the steps to create a reliable and professional document that meets your specific needs.

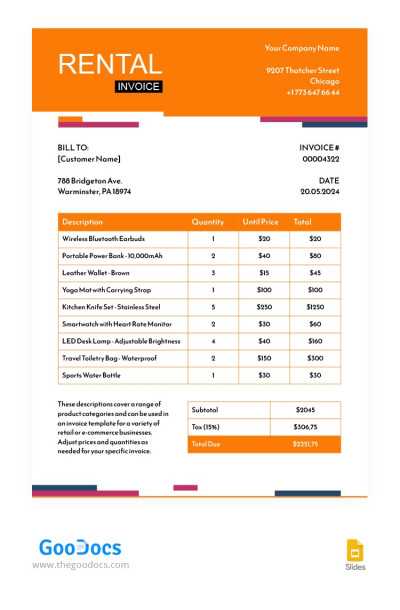

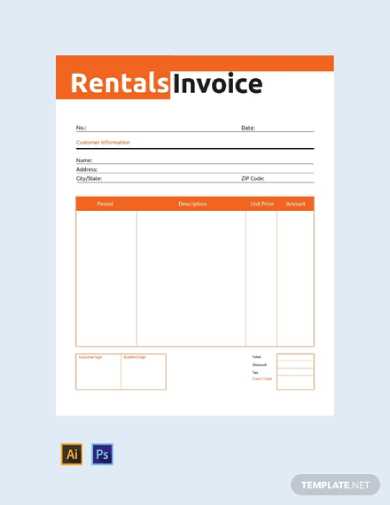

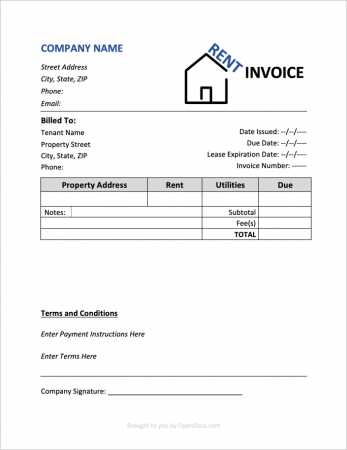

Designing an efficient format involves choosing the right structure to include all essential details such as the tenant’s information, payment amount, due date, and any applicable late fees. Customizing this format to reflect your business style will help create a sense of professionalism and transparency.

With the proper setup, you can easily generate consistent records for every payment cycle. Whether you’re handling multiple tenants or a single lease agreement, this approach makes it easier to track finances and ensure that all details are accurate and up to date.

How to Create a Rent Invoice

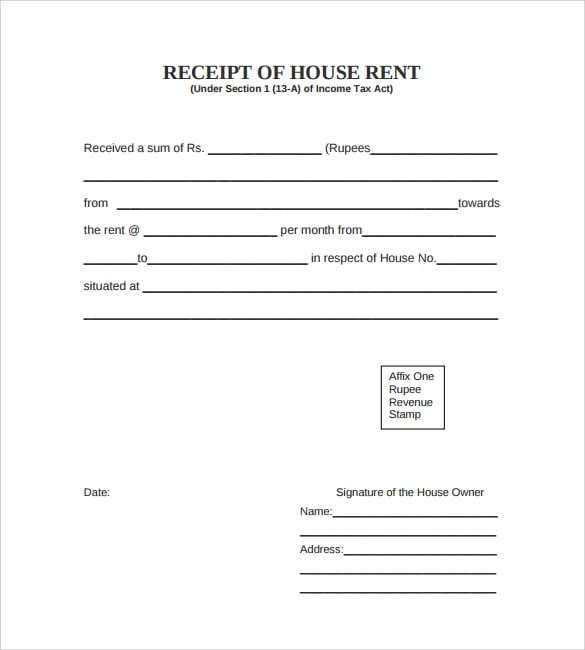

Creating a formal document for payment requests involves organizing key information clearly and concisely. The primary goal is to ensure that both the tenant and the property owner have a mutual understanding of the amount due and the payment terms. By following a few simple steps, you can easily generate a professional document that serves both as a reminder and a record of the transaction.

Key Information to Include

Essential elements for a comprehensive payment request include the tenant’s name, the property address, the payment amount, and the payment due date. It’s also important to clearly state the rental period covered by the document and any applicable fees, if necessary.

Customizing for Your Needs

Personalization of the format ensures that the document suits your specific requirements. You can adjust the design, layout, and included details to fit your business model, whether you manage multiple properties or only a few tenants. This approach helps create consistency across all your payment records.

Customizing Your Rent Invoice Template

Personalizing your payment request format ensures that it aligns with your specific needs and business style. Customization allows you to adjust the layout, content, and overall design to create a document that is both functional and professional. By tailoring the format to your preferences, you can streamline the payment process for both you and your tenants.

Design and Layout Adjustments

Altering the design of the document can significantly impact its readability and overall presentation. You can choose to add or remove specific sections, such as payment methods, late fees, or lease details, depending on what is most relevant to your rental agreements. The more straightforward the design, the easier it is for tenants to understand the details at a glance.

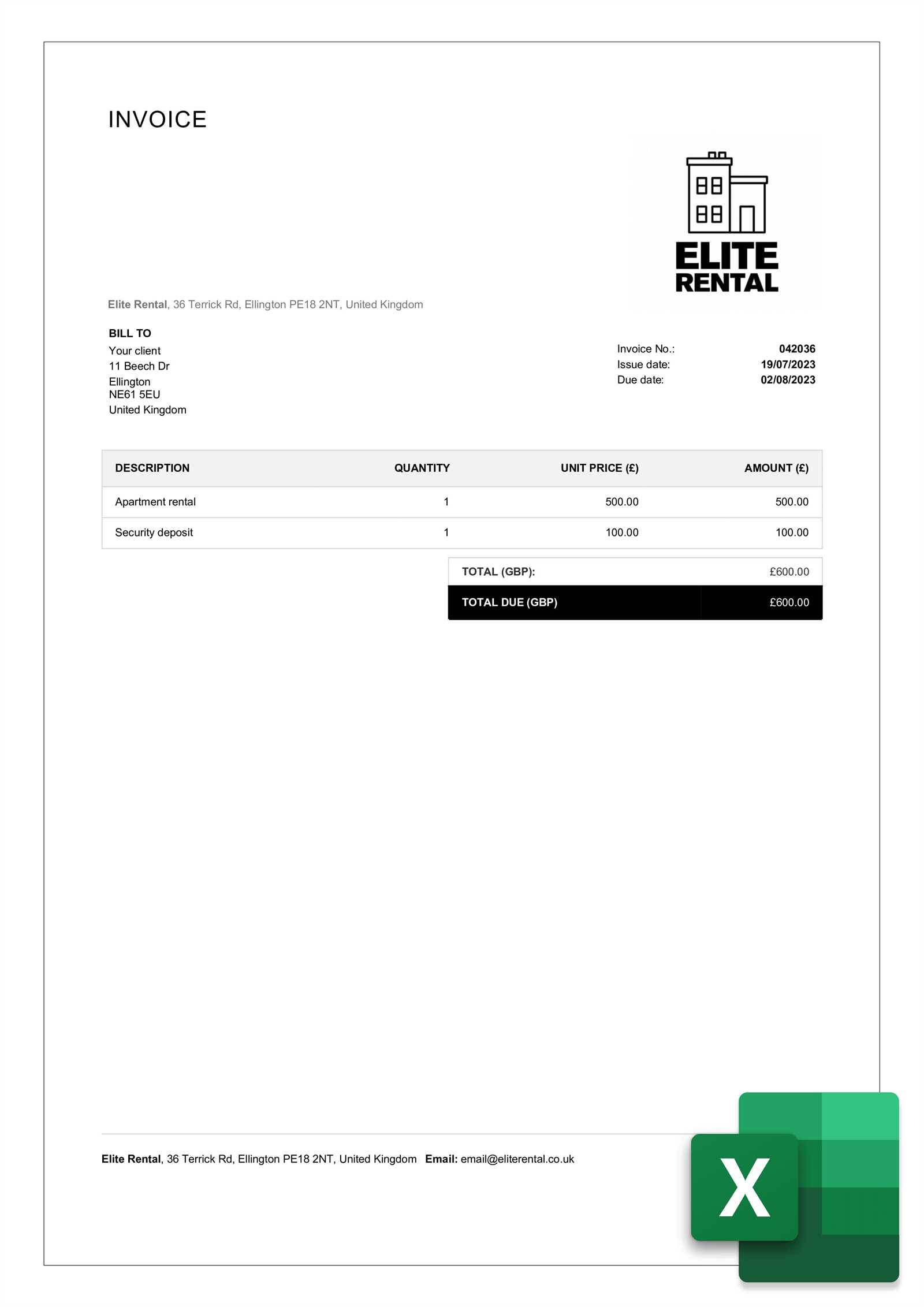

Incorporating Your Business Branding

Incorporating your business logo or contact information into the format can help make the document more personalized and professional. Adding these elements ensures that your payment request reflects your brand, creating a consistent and trustworthy experience for tenants.

Benefits of Using Word for Invoices

Utilizing a word processing software for creating payment requests offers several advantages. It provides flexibility, ease of customization, and the ability to create professional-looking documents quickly. This method allows you to design and modify documents according to your preferences, ensuring that every transaction is well-documented and organized.

Easy Customization and Editing

Customization is one of the key benefits when using a word processor. You can effortlessly adjust the layout, content, and format, ensuring that your documents meet your specific needs. Whether you need to update payment details or add specific terms, editing is simple and efficient.

Professional Appearance

Formatting tools in word processing programs enable you to create visually appealing and professional documents. Clear sections, neat alignment, and well-chosen fonts can elevate the look of your payment requests, helping to establish trust with your tenants.

Essential Elements of a Rent Invoice

When creating a document for payment requests, it’s important to include all necessary information to ensure clarity and avoid confusion. A well-structured document should cover all the key details of the transaction while maintaining a professional appearance. These essential elements help both the property owner and tenant understand their responsibilities and the terms of the agreement.

Key Information to Include

Each payment request should clearly display the following details:

- Tenant Information: Name, address, and contact details.

- Property Details: Address of the leased property.

- Amount Due: Total amount for the current billing period.

- Due Date: The deadline for payment.

- Payment Methods: Accepted methods for payment (e.g., bank transfer, check, etc.).

- Late Fees: Any additional charges for late payments.

Additional Considerations

Including the following optional elements can further clarify the payment terms:

- Lease Period: Specify the start and end dates of the lease period covered by the payment.

- Payment Instructions: Clear directions on how tenants can make the payment.

- Tenant’s Signature: Space for the tenant’s acknowledgment or confirmation.

Steps to Add Tenant Information

Including accurate tenant details is a crucial part of creating a payment request document. Ensuring that all personal and contact information is properly listed helps avoid any confusion or errors in the transaction process. Properly formatted tenant information provides a clear point of reference for both the landlord and the tenant.

Key Tenant Details to Include

Here are the essential pieces of information you should include when adding tenant details to your document:

| Field | Description |

|---|---|

| Name | The full name of the tenant(s) responsible for the payment. |

| Address | The address of the leased property. |

| Contact Information | Phone number or email address for communication. |

| Tenant ID | If applicable, include a unique identifier for each tenant. |

Formatting Tenant Information

Make sure that each field is clearly separated, allowing easy identification. This is especially important when dealing with multiple tenants or properties. Consistent formatting ensures the document is easy to read and helps maintain professionalism.

Incorporating Payment Terms in Word

Clearly outlining payment terms in a document helps ensure both the landlord and tenant are aligned on expectations and deadlines. Defining these terms reduces misunderstandings and provides a reference point for both parties regarding when payments are due, how they should be made, and any penalties for late payments.

Payment terms should be easy to understand and include specific details that clearly communicate the agreed-upon conditions. This includes specifying the due date, acceptable payment methods, any grace periods, and potential fees for late payments. Having these terms clearly outlined not only enhances professionalism but also sets clear boundaries for both parties.

Including such terms in your document adds a layer of transparency and accountability. The more precise these details are, the less room there is for confusion, ensuring smooth and timely transactions throughout the agreement.

Managing Multiple Rent Invoices

Handling multiple payment requests can be a challenge, especially when dealing with various tenants or properties. It’s important to maintain a system that allows for easy tracking and organization of each document. This ensures that no details are overlooked and that all transactions are properly recorded.

Tips for Streamlining the Process

To effectively manage several payment documents, consider implementing the following strategies:

- Use Consistent Formatting: Apply the same layout and structure for all documents to make them easier to review and compare.

- Track Due Dates: Keep a clear record of payment deadlines for each tenant to avoid confusion.

- Organize by Tenant or Property: Sort payment records based on tenant names or property addresses to maintain clarity.

- Record Payments Promptly: Make sure to update records as soon as a payment is made to stay on top of financials.

Utilizing Digital Tools

Using digital tools or software for organizing and tracking multiple payment requests can significantly improve efficiency. These tools allow for automatic reminders, easy document generation, and secure storage, helping landlords stay organized and focused on managing their properties.

Saving and Sharing Rent Invoices Easily

Efficiently saving and sharing payment requests is essential for maintaining an organized system, especially when managing multiple properties or tenants. By using simple tools and strategies, you can quickly store important documents and share them with the relevant parties whenever needed. This not only saves time but also helps in keeping everything well-documented and easily accessible for future reference.

There are several methods available to ensure easy storage and sharing of documents. Saving files in commonly used formats like PDF or using cloud-based storage solutions can make it simpler to access and distribute the information. Cloud storage also offers the benefit of backup and security, reducing the risk of losing important data.

Sharing documents can be done seamlessly via email or online platforms, making it easy to send payment requests directly to tenants. Additionally, these digital formats can be stored for long-term access, ensuring a paperless and more sustainable approach to managing payment records.

Choosing the Right Template for Your Needs

Selecting the appropriate document format is crucial for efficiently managing payment records. The right structure ensures clarity, professionalism, and ease of use. Depending on your requirements, you may need a more detailed or simplified layout, with specific sections to address particular needs such as payment terms, due dates, or tenant information.

Factors to Consider When Choosing

When selecting the ideal document format for your purposes, consider the following factors:

- Customization: Ensure that the layout allows you to make necessary changes easily, such as adjusting amounts or adding additional terms.

- Clarity: Choose a design that clearly separates sections, such as tenant details, payment amounts, and deadlines, to avoid confusion.

- Professionalism: The format should look clean and polished, representing your business in a professional manner.

- Ease of Use: Select a format that is simple to fill out, whether you are using it on a regular basis or for one-time use.

- Compatibility: Ensure that the format works well with the software and devices you use, whether digital or printed.

By keeping these factors in mind, you can choose a structure that best meets your needs, whether you’re managing a few properties or a larger portfolio of tenants.

How to Format Rent Invoice in Word

Formatting a payment document properly is essential for clarity and professionalism. Whether you’re creating a document for personal use or business purposes, a well-organized layout ensures that all critical details are easily accessible and clear. The right structure makes it easier for the recipient to understand the information at a glance, including payment amounts, deadlines, and other important details.

Start with the basics: When setting up your document, begin by including essential information, such as the tenant’s details, payment terms, and total amounts due. This section should be clearly formatted so that each item stands out and is easily identifiable.

Next, consider the layout: Use sections and headings to separate different parts of the document. Common sections include the tenant’s name and contact details, the property address, a list of charges, and a section for payment instructions. You can also add a footer with terms and conditions, payment instructions, and due dates.

To enhance readability, use bullet points or numbered lists for items like charges or payment instructions. Keep the text clear and concise to ensure the recipient can easily follow the document’s structure. A simple and professional design goes a long way in creating a polished and effective payment request.

Adding Due Dates and Payment Methods

Clearly indicating payment deadlines and available payment options is crucial for ensuring smooth transactions. This information helps both the issuer and the recipient to avoid confusion, streamline the process, and set clear expectations. By providing this essential information, you also minimize the chances of delayed payments or misunderstandings.

Specify the due date: Clearly state when the payment should be made. This ensures that the recipient knows exactly when to settle the outstanding balance. It’s important to format the due date in a way that leaves no room for interpretation, using terms like “Due by” or “Payment required by” followed by a specific date.

Offer multiple payment options: Providing various methods of payment, such as bank transfers, credit card payments, or digital payment systems, makes it more convenient for the recipient. This flexibility helps to accommodate different preferences and can contribute to timely payments.

Including these details in a clear and straightforward manner not only encourages prompt payments but also builds trust by setting professional standards for communication. Whether you prefer online systems or traditional methods, it is essential that the recipient has the necessary tools to complete the transaction on time.

Tracking Rent Payments with Templates

Keeping track of payments is a vital aspect of managing financial records, especially when dealing with multiple tenants or properties. A well-organized system allows you to monitor received payments, outstanding balances, and due dates efficiently. Using structured documents to track these payments can simplify the process and help you stay on top of your finances.

Key Components for Tracking Payments

To ensure effective tracking, consider including the following details in your document:

- Tenant Information: Keep accurate records of the tenant’s name, address, and contact details for quick reference.

- Payment Amount: Clearly display the amount due for each period to avoid any confusion regarding the outstanding balance.

- Payment Dates: List the payment dates and any late fees incurred for overdue payments.

- Balance Remaining: Always keep an updated record of any outstanding balance that needs to be settled.

By maintaining these details in a well-structured document, you can easily track and review payments. Additionally, having a clear record helps ensure accuracy, provides transparency for your tenants, and simplifies financial audits if needed.

Common Mistakes to Avoid in Rent Invoices

When preparing a payment request document, it’s important to avoid certain common errors that could lead to confusion or delays. Small mistakes can affect the clarity and professionalism of the document, which might result in misunderstandings with the recipient or delays in payment. Ensuring accuracy and attention to detail in these documents can save time and reduce complications.

Common Mistakes to Watch Out For

- Incorrect or Missing Payment Amount: Always ensure that the total amount due is clearly stated and accurately calculated. Errors in the amount can lead to confusion and disputes.

- Omitting Payment Terms: Clearly specifying payment terms, such as due dates and late fees, is essential. Without these details, recipients may not know when to pay or what penalties apply for overdue amounts.

- Failure to Include Proper Contact Information: Make sure that the document includes your contact details, such as phone numbers or email addresses, in case the recipient needs to reach you for any clarifications.

- Unclear Breakdown of Charges: If there are multiple charges, it’s important to list them individually. Providing a detailed breakdown ensures transparency and helps the recipient understand how the total was calculated.

- Using Ambiguous Terms: Avoid vague language. Terms like “miscellaneous charges” or “other fees” can cause confusion. Be specific and clear about each charge or service provided.

Avoiding these common mistakes will help you maintain clear and professional communication, leading to smoother transactions and stronger relationships with tenants or clients.

Using Word for Professional Billing

Creating clear and professional billing documents is essential for maintaining smooth business operations and building trust with clients. By using a structured format, you ensure that all necessary details are included and that the document conveys professionalism. A well-crafted document not only ensures prompt payment but also helps in maintaining accurate records for future reference.

Using a word processing application for generating these documents offers several advantages. It allows you to easily customize content, incorporate specific business information, and format the document to suit your needs. You can also save and store your documents for future use, ensuring consistency in all your billing communications.

Why Word is Ideal for Billing Documents

Here are some key reasons why word processing software is an excellent tool for billing:

- Customizability: Word processing programs allow you to adjust fonts, text size, and layout, making it easy to create a document that reflects your branding and style.

- Ease of Use: With simple features like tables and bullet points, you can organize the billing information in a clear and easy-to-read format.

- File Accessibility: Files are easy to store and share digitally, ensuring you can send them via email or print them whenever necessary.

- Professional Appearance: The ability to format the document properly ensures it looks polished and official, leaving a positive impression on the recipient.

Incorporating these features into your billing process helps streamline operations and enhances the overall experience for both you and your clients.

How to Update Your Invoice Template

Keeping your billing documents up to date is essential for maintaining accuracy and professionalism. Regularly revising your document ensures that all necessary information is included and correctly presented, reflecting any changes in your business or payment procedures. By updating your document, you help avoid confusion and make sure that both you and your clients are on the same page regarding financial matters.

Updating the structure and content of your billing format can be a straightforward process. Whether it’s adding new fields, adjusting payment terms, or refreshing the design to align with your current branding, the goal is to make the document clear, comprehensive, and functional.

Steps to Revise Your Billing Format

Follow these steps to keep your billing documents fresh and relevant:

- Review Current Information: Start by checking if all business details are correct, such as contact information, tax numbers, and bank account details.

- Update Payment Terms: If there have been any changes in your payment policies, such as due dates or late fees, be sure to reflect them in your document.

- Modify Design Elements: Consider updating fonts, colors, or layout for better clarity and a more modern look. This ensures the document aligns with your current business aesthetics.

- Include New Fields: If you offer new services or need to track additional information, add relevant fields, like service descriptions or new charges.

- Save Versions: When updating, it’s a good practice to save different versions, so you can easily reference previous formats if needed.

By following these steps, you can ensure that your billing documents remain professional, clear, and consistent, reducing the risk of errors and improving your client relations.

Why Rent Invoices Are Important for Landlords

For property owners, ensuring that payments are received accurately and on time is crucial for maintaining cash flow and legal compliance. Using detailed payment documents is an essential part of the rental process, serving as an official record of the financial agreement between the property owner and tenant. These documents not only help in tracking payments but also safeguard the interests of both parties involved.

Issuing clear and precise payment documents offers a range of benefits for landlords. It provides a professional means to confirm the terms of each transaction, sets expectations for payment deadlines, and can be used in case of disputes or legal proceedings. By consistently using well-organized records, landlords can ensure they meet their obligations while maintaining transparency with tenants.

Key Benefits for Landlords

- Legal Protection: A well-detailed payment record serves as proof of the agreed-upon terms and can be used as evidence if disputes arise regarding payment dates or amounts.

- Clear Communication: Providing a structured breakdown of payments helps tenants understand exactly what they are paying for, reducing misunderstandings.

- Better Financial Management: Regularly issued payment records allow landlords to efficiently track outstanding amounts, making it easier to manage finances and stay on top of payments.

- Professionalism: Using formal payment documents enhances the landlord’s professional image, signaling to tenants that the rental arrangement is taken seriously.

- Tax Purposes: Detailed records are also valuable when it comes to tax reporting, as they provide a clear history of income and deductions related to the property.

By providing structured and accurate payment documents, landlords can ensure smoother transactions, avoid potential conflicts, and maintain a high level of professionalism throughout the leasing period.