Invoice Without GST Template for Simple Billing

In today’s fast-paced business environment, streamlining administrative tasks is essential for success. One area that often requires attention is the process of issuing payment requests. Using a straightforward method to document financial transactions can save time and reduce errors. By creating a consistent approach to generating payment forms, business owners can ensure accuracy and professionalism in their financial dealings.

For many businesses, especially those that do not deal with tax charges, having a flexible and easy-to-use system for generating payment documents becomes a practical necessity. This system allows entrepreneurs to focus on the growth of their business while ensuring all necessary financial records are accurately kept. By choosing the right tools, creating a well-organized form for each transaction becomes a quick and efficient task.

Effective record-keeping is key to maintaining a smooth workflow and avoiding misunderstandings with clients. Having a reliable way to issue statements ensures clarity in financial exchanges, helping businesses stay organized and compliant with legal requirements. Using ready-made forms provides a hassle-free solution that is both functional and professional.

Invoice Without GST Template

For businesses operating in environments where tax rates are not applied to specific transactions, having a streamlined and efficient system to create payment records is essential. The ability to easily generate documentation that reflects the agreed amounts without additional charges ensures smooth transactions. This type of system saves time and ensures consistency, while also avoiding unnecessary complexity in business operations.

Benefits of Using a Simplified Form

Using a straightforward form offers several advantages. First, it reduces the chances of errors by clearly presenting only the relevant details, such as the total amount due and the items or services provided. This makes it easier for both the provider and the customer to understand the payment structure. Additionally, it speeds up the process of creating and sending payment requests, helping businesses maintain a professional image.

Customizing Your Payment Record

Personalization options allow businesses to tailor their financial documentation to their needs. With customizable fields, a business can easily add its branding, terms of service, and any other relevant details. This not only improves the clarity of the transaction but also helps maintain consistency across all payment-related documents, contributing to a more organized financial system.

Understanding Invoice Without GST

In certain business transactions, there may be no need to include tax charges, especially when goods or services are exempt or the business does not qualify for tax collection. In these cases, creating a payment request becomes simpler, focusing only on the actual amounts owed for the products or services rendered. This approach ensures that both parties understand the exact payment details without the added complexity of tax calculations.

Such forms typically include the essential transaction information, like the cost of the goods or services, payment terms, and contact details. This method simplifies accounting and helps maintain clarity for both the supplier and the customer. By eliminating tax-related fields, the form becomes more straightforward, making it a practical tool for businesses not subject to tax obligations.

Why Use a GST-Free Invoice

For businesses that do not need to collect tax, creating simplified payment records is often more efficient and less time-consuming. This approach eliminates the need for complex tax calculations and ensures that only the relevant financial details are included. By using this method, businesses can focus on the core aspects of the transaction and ensure that both parties clearly understand the amounts due.

Advantages of Simplified Payment Records

- Faster processing: Without the need for tax-related fields, generating documents becomes quicker and easier.

- Improved clarity: The document focuses solely on the cost of goods and services, making it easier to read and understand.

- Lower administrative burden: By avoiding tax inclusion, businesses reduce the complexity of maintaining records and submitting reports.

- Compliance simplicity: For businesses that are exempt from tax obligations, these forms meet requirements without unnecessary information.

When to Use a GST-Free Record

- When providing goods or services that are exempt from tax.

- When your business is not required to register for tax collection.

- For small-scale businesses or startups with low turnover.

Key Components of a Simple Invoice

A well-organized payment document is essential for clear communication between the seller and buyer. It should present all necessary details in a straightforward format, ensuring both parties can easily review the transaction. The document must include the core elements that reflect the amount owed, the services or goods provided, and the payment terms, ensuring accuracy and minimizing confusion.

The key components of a basic payment record include:

- Contact Information: Details such as the seller’s name, address, and contact number, along with the buyer’s information, help in identifying both parties.

- Transaction Date: The date when the goods or services were provided, ensuring that both parties are aligned on the timeline of the transaction.

- Product/Service Description: A clear list of items or services offered, including quantities and individual prices, provides transparency in the transaction.

- Total Amount Due: The final sum to be paid, often broken down into subtotal, discounts, and additional charges if necessary.

- Payment Terms: Information on the payment schedule, due dates, and any late fees or early payment discounts that apply.

Benefits of Using a Template

Having a pre-designed format for creating payment documents offers significant advantages for businesses. It ensures consistency, saves time, and reduces errors, all while maintaining a professional appearance. By using a structured approach, businesses can avoid the hassle of starting from scratch each time, streamlining the entire process of documenting transactions.

Time Efficiency

One of the major benefits of utilizing a structured format is the time saved in preparing documents. Rather than creating each payment record from the beginning, a ready-made framework can be easily customized with the necessary details. This allows businesses to focus on their core activities while ensuring all important information is included in the final document.

Consistency and Professionalism

Using a uniform structure across all transactions helps establish a sense of professionalism. It ensures that every document looks organized and adheres to the same format, which builds trust with clients. Consistent formatting also helps reduce mistakes and makes it easier to locate relevant details when reviewing past records.

| Benefit | Explanation |

|---|---|

| Time-Saving | Pre-designed formats allow businesses to quickly fill in transaction details without starting from scratch. |

| Professional Appearance | A uniform structure helps establish credibility and trustworthiness with clients and partners. |

| Accuracy | Using a fixed layout reduces the likelihood of errors by ensuring all necessary fields are included. |

How to Create a GST-Free Invoice

Creating a payment request that does not include tax charges is a straightforward process, especially for businesses that are not required to collect taxes. The document should be simple and clear, outlining the goods or services provided and the total amount due, while omitting any tax-related fields. This ensures clarity for both the seller and the buyer, keeping the focus on the cost of the transaction itself.

Follow these steps to create a tax-exempt payment record:

| Step | Action |

|---|---|

| 1 | Include the names and contact information of both the seller and the buyer. |

| 2 | List the products or services provided, including quantities and individual prices. |

| 3 | Provide the total amount due, ensuring it reflects the full cost of the transaction. |

| 4 | Clearly state payment terms, including any deadlines or conditions for payment. |

| 5 | Leave out any sections related to tax, as this transaction is exempt from such charges. |

Common Mistakes to Avoid in Invoices

When creating payment documents, it’s essential to ensure accuracy and completeness. Small errors can lead to confusion, payment delays, or even disputes. Being aware of common mistakes and avoiding them will help maintain clear communication with clients and ensure smooth financial transactions.

Some frequent errors to avoid include:

- Missing or Incorrect Contact Information: Always ensure the seller’s and buyer’s names, addresses, and contact details are correct and up-to-date.

- Omitting Payment Terms: Be sure to include clear terms for payment deadlines and penalties for late payments to avoid confusion.

- Incorrect Totals: Double-check all calculations to ensure the total amount due reflects the correct sums of individual charges and discounts.

- Failure to Itemize Products or Services: Clearly list each item or service, including quantities and unit prices, to avoid misunderstandings.

- Not Providing a Unique Reference Number: Every payment document should have a distinct reference number for easy tracking and organization.

Customizing Your Invoice Template

Personalizing your payment document can enhance its professionalism and ensure it reflects your business’s unique identity. Customization allows you to add relevant details that cater to your specific needs while keeping the document easy to read and understand. From adding logos to adjusting layout and content, these modifications can make a significant difference in how clients perceive your business.

Here are a few tips to effectively tailor your document:

- Incorporate Your Branding: Add your company logo, colors, and font styles to align the document with your brand’s visual identity.

- Modify Layout and Structure: Organize the content in a way that prioritizes the most important information, such as total amounts and payment deadlines, while keeping secondary details clear but secondary.

- Adjust Fields as Needed: Depending on the nature of your business, you may want to add or remove specific sections. For instance, if you provide long-term contracts, include payment schedules.

- Add Notes or Instructions: Personalize the document by adding custom notes or payment instructions for your clients, such as payment methods or reminders.

- Ensure Consistency: Maintain a consistent style and format across all documents to reinforce your brand’s professionalism and streamline administrative tasks.

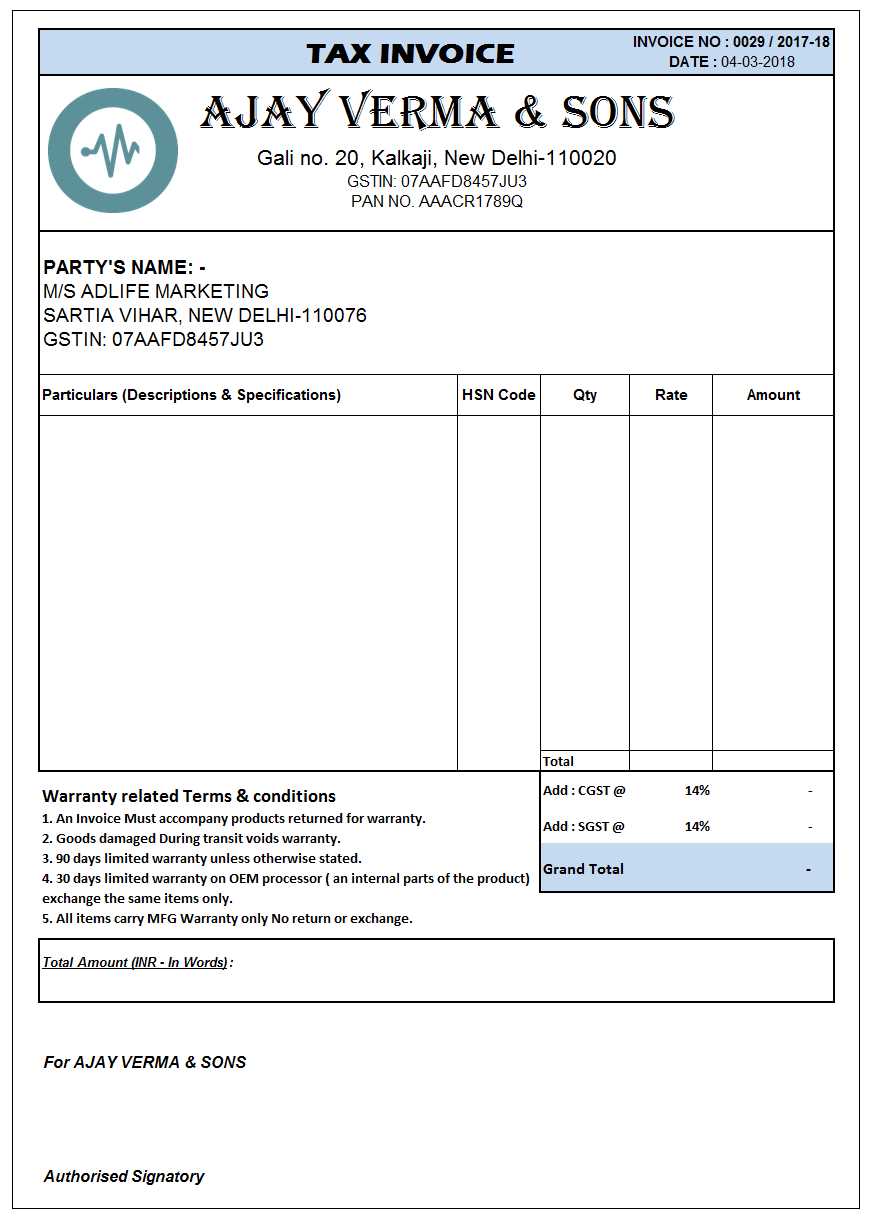

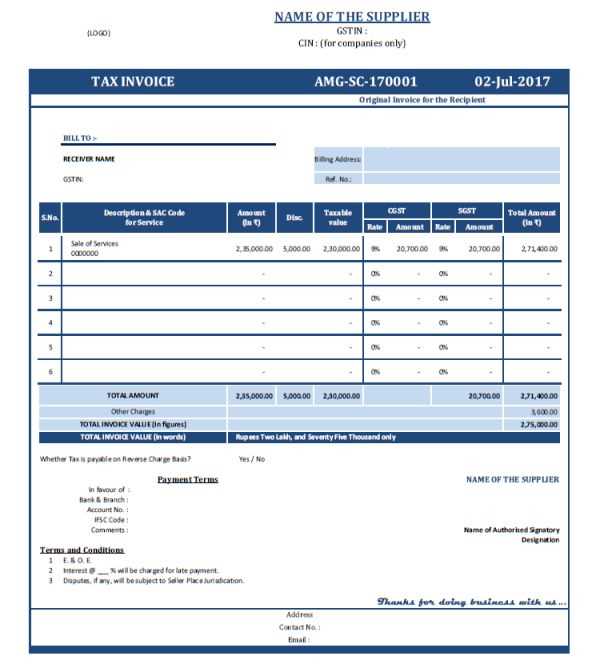

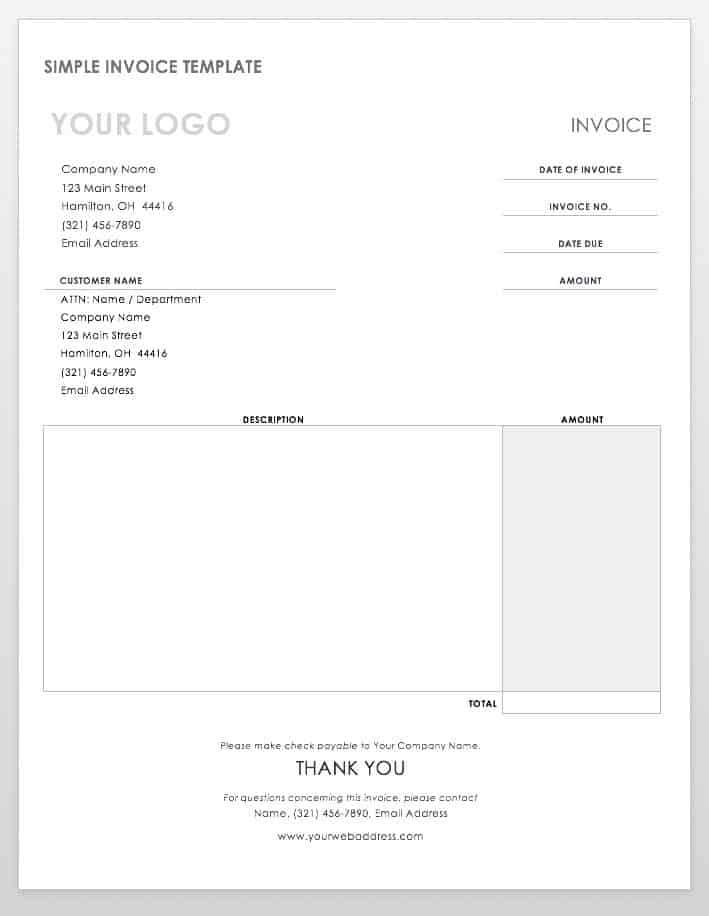

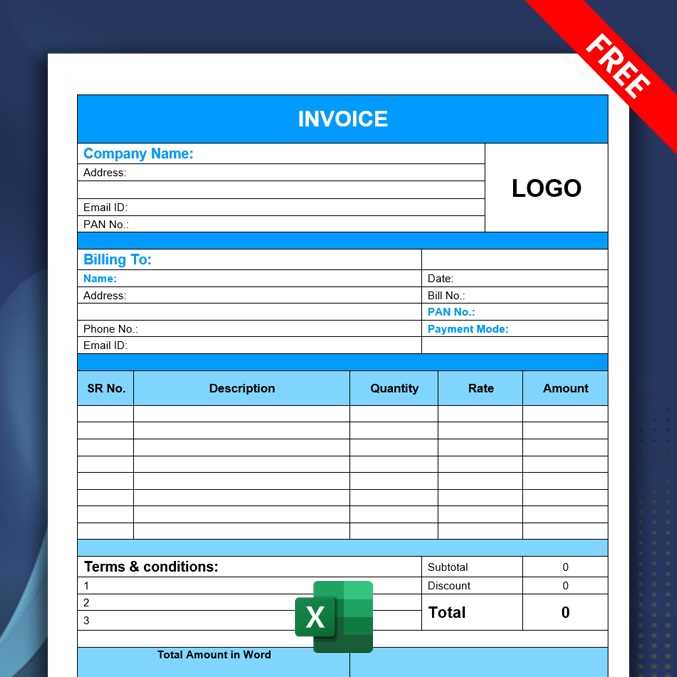

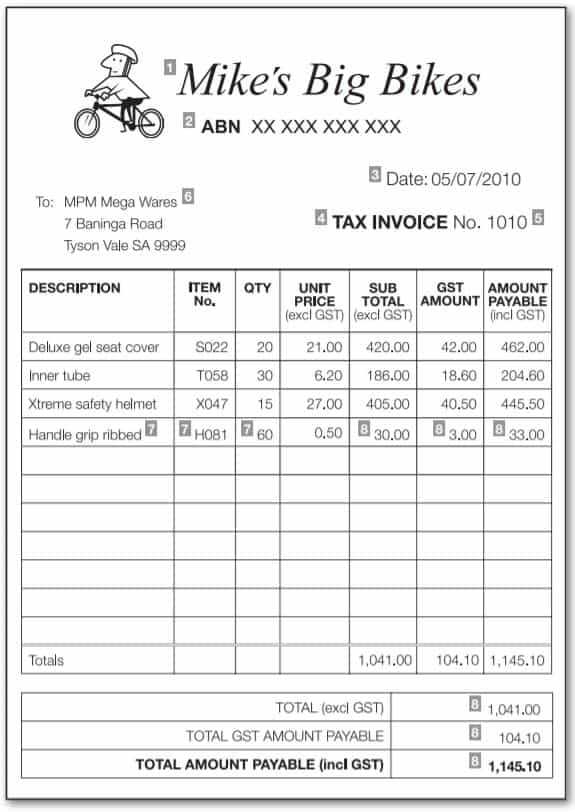

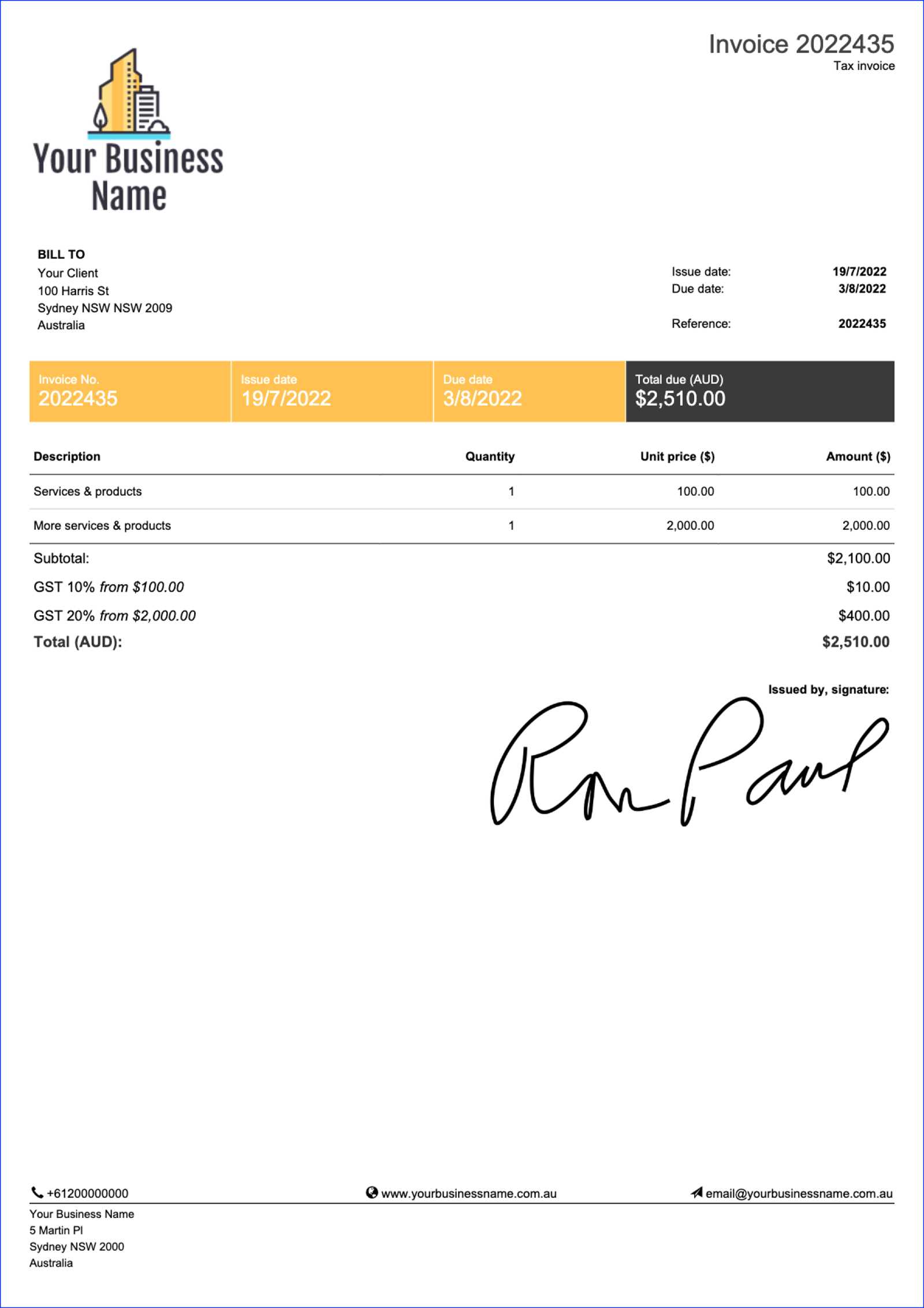

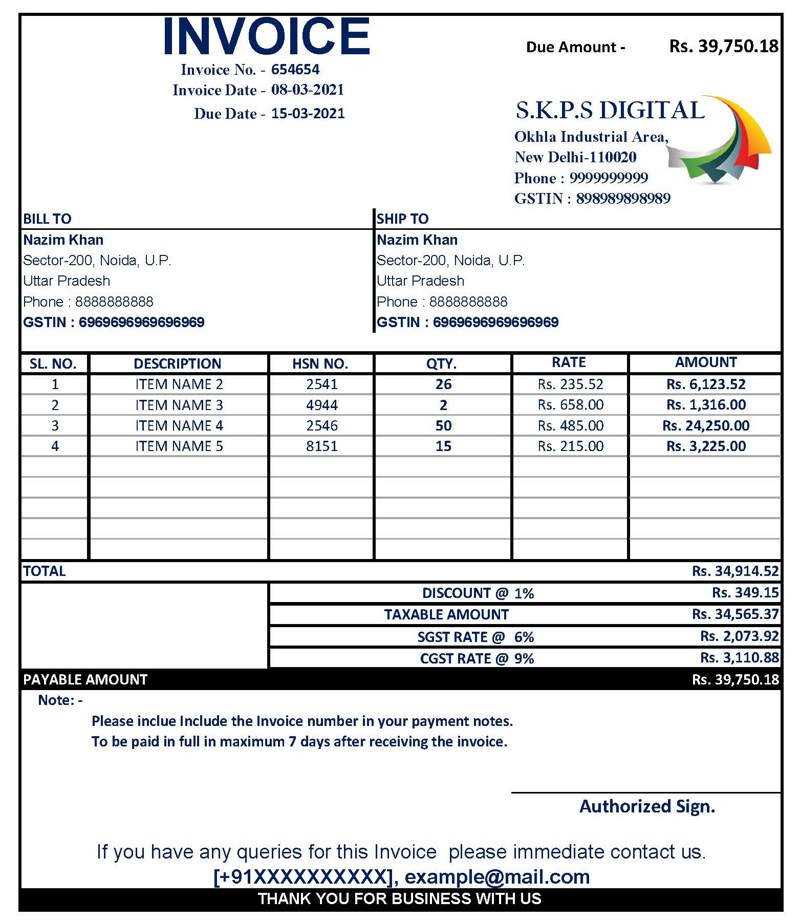

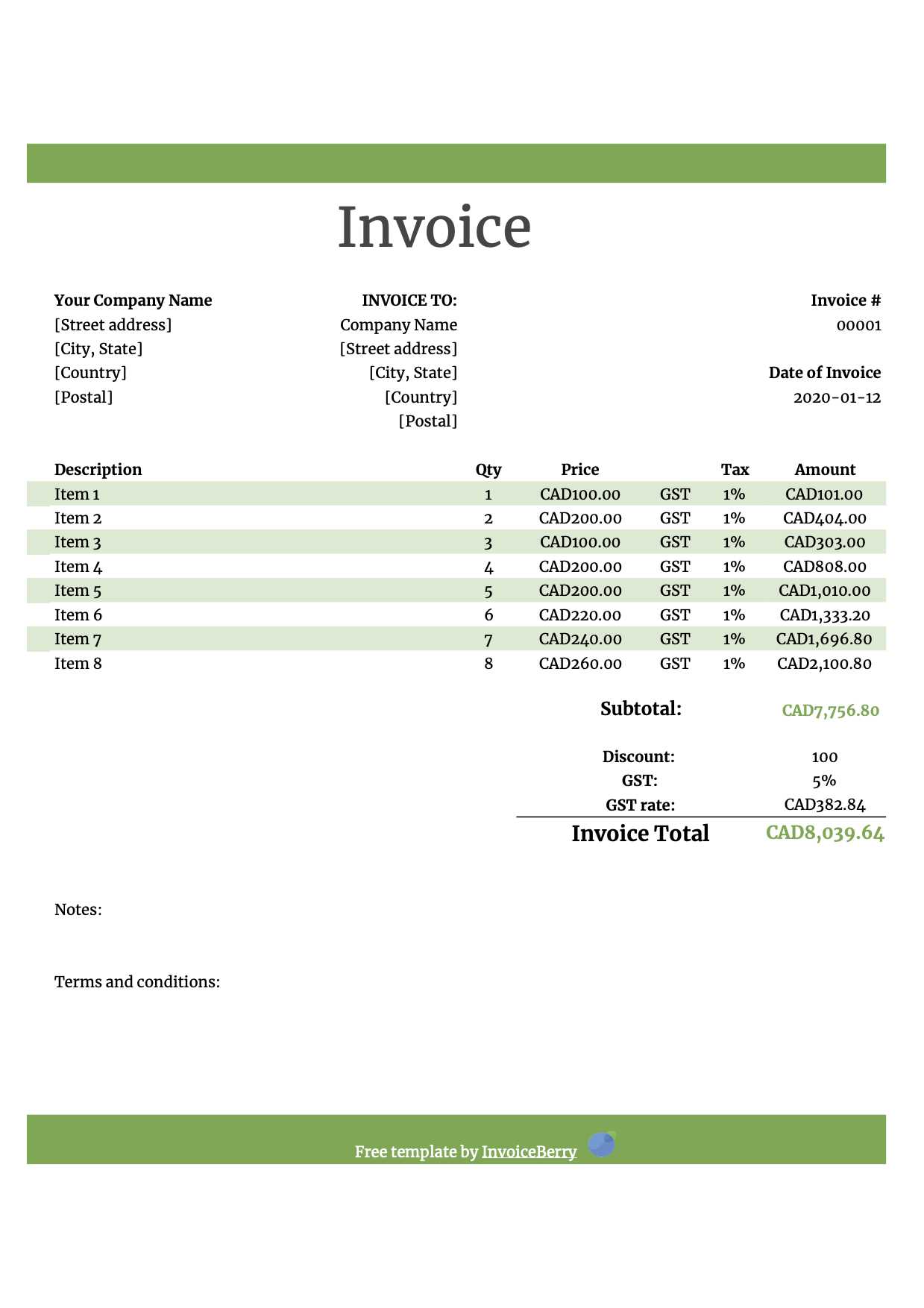

Examples of GST-Free Invoice Templates

There are several ways to structure a payment document depending on the nature of your business and the specific details you need to include. Whether you run a small business or a large enterprise, having a clear and well-organized format can help streamline your financial processes. Below are some examples of how such documents can be designed to be both functional and professional.

Simple Service-Based Structure

This format is ideal for service providers who want to keep things straightforward. It includes the necessary details like the service description, hours worked, and rate, along with the total amount due. Since no tax is included, the final sum is clear and precise.

- Client Information: Name, Address, and Contact Details

- Service Details: Description of services provided

- Payment Terms: Due date and payment methods

- Total Amount Due: The full amount to be paid

Product-Based Structure

This layout works best for businesses that sell physical products. It includes columns for product names, quantities, unit prices, and a total amount due, with a clear final figure without tax. This format helps maintain transparency and ensures customers know exactly what they are paying for.

- Product Description: List of items sold

- Quantity: Number of units

- Price per Unit: Price for each individual product

- Total Amount: The final amount to be paid

How to Save Time with Templates

Using pre-designed formats for billing or financial documents can significantly reduce the time spent on administrative tasks. By having a ready-made structure, you can easily fill in the necessary information without worrying about creating a new layout each time. This streamlined approach helps increase productivity and ensures consistency across all documents.

Quick Data Entry: With pre-built formats, most of the fields are already structured, so you only need to input specific details such as customer names, amounts, and dates. This eliminates the need for repetitive formatting.

Consistency Across Documents: Templates ensure that all your records look the same, maintaining a professional appearance and reducing the chance of errors in your formatting.

Time-Saving Features: Some templates even come with automatic calculations for totals or discounts, which can save time and minimize mistakes. With a few clicks, you can generate an accurate document ready to send out.

When to Use a GST-Free Invoice

There are specific situations in which it is necessary or beneficial to issue documents that do not include tax. These instances often occur when the business or transaction does not fall under the standard tax system or when the buyer is exempt from paying tax. Understanding when to use these documents ensures proper compliance and avoids unnecessary charges.

Small Businesses and Startups: For businesses that are not registered for tax purposes, these documents are used to reflect transactions without adding tax, ensuring that the pricing remains straightforward and transparent.

Non-Taxable Goods or Services: Certain goods or services are exempt from tax. In such cases, a document can be generated without any tax components to reflect the correct pricing for both the seller and the buyer.

Transactions with Exempt Customers: If the recipient of the goods or services is exempt from tax–such as certain non-profit organizations, government bodies, or international customers–using these documents avoids applying an unnecessary tax charge.

Difference Between GST and Non-GST Invoices

Understanding the distinction between documents that include tax and those that do not is essential for businesses and customers. The primary difference lies in whether tax is applied to the total amount or not, and how this affects both the seller and the buyer. Each type serves a specific purpose depending on the nature of the transaction and the parties involved.

- Tax Inclusion: Documents that include tax show the tax rate applied to the goods or services provided. This is reflected in the total price, where the tax is added to the base cost.

- Non-Taxable Transactions: In contrast, documents without tax display only the cost of the goods or services, with no additional charges for tax. These are used in situations where tax is not applicable.

- Legal Requirements: For businesses that are required to charge tax on their sales, it is mandatory to issue documents that include tax. On the other hand, when the transaction is exempt from tax, a document without tax will be issued.

- Clarity for Recipients: Customers receiving documents that include tax will be aware of the tax amount paid. For those receiving documents without tax, they will not see any tax information as the price is calculated without any tax considerations.

Managing Your Invoices Efficiently

Efficiently organizing and tracking your financial documents is crucial for maintaining a smooth business operation. Proper management ensures timely payments, reduces errors, and allows you to stay on top of your financial records. Implementing an effective system can simplify the entire process, making it more streamlined and less prone to mistakes.

Key Strategies for Efficient Management

- Automate Your Processes: Using software that automatically generates and tracks documents can save valuable time and reduce human error. Many systems also allow for easy customization based on your needs.

- Organize Files Digitally: Digital storage makes it easier to locate and manage documents. Utilize cloud storage or accounting software to keep everything in one place, with secure access and backup options.

- Maintain Consistency: Consistency in format and details ensures that no information is missed. Set clear rules for the layout and required information, and stick to them every time.

Benefits of Organized Management

- Quick Retrieval: Well-organized records allow for easy access when needed, whether for auditing purposes or client reference.

- Improved Cash Flow: Timely follow-ups and clear documentation improve cash flow by reducing delays in payment.

- Tax Readiness: When it comes time for tax filing, having organized records simplifies the process and ensures compliance with regulations.

Legal Considerations for Non-GST Invoices

When managing financial documents that do not include specific tax charges, it is essential to be aware of the legal requirements that apply. Complying with these regulations ensures that your records remain legitimate and that you avoid potential penalties or issues with tax authorities. Proper documentation is key in proving your business’s tax status and ensuring transparency in your transactions.

Key Legal Aspects to Consider

- Tax Exemption Status: If your business or a particular product/service is exempt from certain taxes, it is important to clearly state this status in the relevant documents. Failure to do so could lead to confusion or disputes about tax obligations.

- Accurate Record-Keeping: Even when taxes are not applied, it is crucial to maintain accurate and thorough records of all transactions. These records may be required for audits or financial reviews by authorities.

- Clear Communication: Clearly communicate to your clients why certain charges are excluded from tax and ensure they understand that no additional taxes are due. This can help avoid future misunderstandings.

Consequences of Non-Compliance

- Fines and Penalties: Failure to comply with the correct tax documentation could lead to fines and penalties. Authorities may scrutinize your financial records if discrepancies are found.

- Legal Disputes: Incorrect handling of tax exemption or tax-free transactions could result in legal issues with clients or regulatory bodies.

- Loss of Trust: If clients or customers perceive that proper procedures are not being followed, it could damage your reputation and their trust in your business.

How to Track Payments on Invoices

Effectively monitoring the payments received for your financial documents is essential to maintaining clear and accurate records. By implementing a structured system, you can easily track outstanding balances, ensure timely payments, and avoid discrepancies in your accounting. This process also helps in identifying clients who consistently pay on time and those who may need reminders or follow-ups.

Methods for Tracking Payments

- Manual Record-Keeping: For smaller businesses, a simple ledger or spreadsheet can be used to log payments. Make sure to note down the payment date, amount, and the method of payment for each transaction.

- Accounting Software: Many businesses use accounting tools that automatically track payments. These platforms can sync with your bank account, categorize transactions, and provide real-time updates on balances.

- Payment Platforms: If you accept online payments, using a payment gateway or platform can help track payments easily. Most of these services provide detailed reports that show which payments have been made and which are pending.

Best Practices for Managing Payments

- Set Clear Payment Terms: Always specify the payment deadlines and methods clearly. This helps avoid confusion and sets expectations from the start.

- Use Payment Reminders: If payments are overdue, consider sending polite reminders or follow-up emails to encourage prompt payment.

- Reconcile Regularly: Regularly reconcile your payment records with your bank statements to ensure that there are no discrepancies or missed payments.

Best Practices for Invoice Design

Designing clear and professional financial documents is crucial for ensuring smooth transactions and maintaining good client relations. The layout should be user-friendly, easy to read, and contain all necessary information. A well-organized structure reduces the likelihood of misunderstandings and helps in quick processing of payments.

Key Elements of Effective Design

- Clear Branding: Include your company logo, business name, and contact details prominently at the top. This helps with professional presentation and makes it easy for clients to recognize the document as an official communication.

- Readable Font: Use simple, clean fonts that are easy to read. Avoid decorative fonts that could make the document hard to understand. Consistent font size for headers and content ensures clarity.

- Organized Layout: Group related sections together. For example, clearly separate customer details, itemized listings, totals, and payment instructions. Use borders or shading to create distinct sections without overwhelming the reader.

Enhancing Functionality with Design

- Consistent Numbering: Ensure each document has a unique identifier. A sequential numbering system helps track records and reduces confusion during audits.

- Detailed Breakdown: Provide clear item descriptions, including quantity, unit price, and total cost. This transparency ensures clients can understand what they are paying for.

- Payment Instructions: Clearly indicate how and where payments should be made. Including payment terms and accepted methods can speed up the payment process.

Visual Appeal and Professionalism

- Minimalist Design: While creativity can enhance the look, avoid cluttering the document with unnecessary design elements. A clean, minimalist approach ensures that key information stands out.

- Consistent Colors: Use a limited color palette that aligns with your business brand. This creates a cohesive and professional appearance without distracting from the content.

Where to Download Free Templates

Finding reliable and easy-to-use resources for creating financial documents is essential for both small businesses and freelancers. A variety of platforms offer ready-made forms that are customizable, professionally designed, and available at no cost. Here are some recommended sources where you can find downloadable layouts that suit different needs and industries.

| Platform | Description | File Formats |

|---|---|---|

| Microsoft Office | Microsoft’s official site offers a wide range of customizable document forms that integrate seamlessly with Word and Excel. | DOCX, XLSX |

| Google Docs and Sheets | Google provides a selection of professionally designed forms accessible directly through Google Docs and Sheets, which are great for collaborative work. | Google Docs, Google Sheets |