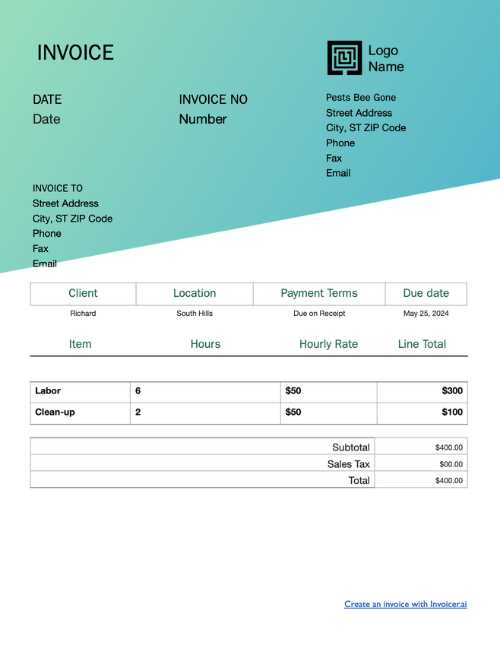

Pest Control Invoice Templates for Efficient Billing

Managing finances efficiently is a critical aspect of running any service-based business. Clear, professional documentation helps maintain smooth transactions and strengthens client trust. One of the most important tools in this process is having the right system in place for invoicing, ensuring that all transactions are accurately recorded and promptly processed.

Professionally designed billing documents not only make it easier to track services rendered, but also set a positive tone for client relationships. Whether you’re handling recurring tasks or one-time jobs, having a standardized format for your billing can save valuable time and reduce errors. In addition, customized documents can reflect your brand, enhancing your overall professional image.

Creating a streamlined invoicing system allows service providers to focus on delivering quality work while leaving the administrative tasks to automated solutions. By adopting an efficient approach to billing, businesses can minimize disputes, improve cash flow, and ensure that all charges are transparent and justified. This guide will explore how to optimize this aspect of your operations, offering insights into creating and utilizing the right billing documents for your business needs.

Understanding Service Billing Documents

Proper documentation of services provided is essential for maintaining transparency in business transactions. When it comes to charging clients for completed work, having a clear and well-structured document is key to ensuring both parties are on the same page. These documents serve as a formal request for payment and must include specific details to avoid misunderstandings and facilitate prompt payments.

Key Elements of Effective Billing Documents

Clarity and accuracy are paramount when creating these documents. The client must be able to easily identify what services were provided, the cost of each service, and the total amount due. Including clear itemizations helps clients understand exactly what they are paying for and can prevent disputes down the line. Information such as service dates, payment terms, and any additional charges should be easily accessible and presented in a straightforward manner.

Building Trust Through Professional Documentation

Using well-designed billing documents not only aids in tracking payments but also plays a crucial role in building trust with clients. A professional appearance demonstrates that the business is organized and serious about its operations. This can positively impact client retention and encourage timely payments, as clients are more likely to respond to clearly outlined, formal requests. By maintaining a consistent format, businesses can establish a reputation for reliability and professionalism in their dealings.

Why Use Billing Documents for Service-Based Businesses

For any service-oriented business, having an efficient way to generate and manage payment requests is crucial. The process of billing can become time-consuming and prone to errors if done manually each time. Using pre-designed formats can save significant time, increase accuracy, and ensure consistency across all transactions. It simplifies the creation process, reduces mistakes, and makes communication with clients clearer and more professional.

Time-Saving Benefits

One of the primary reasons to adopt a structured system for billing is the amount of time it saves. When using ready-made structures, the essential information is already organized, allowing business owners to quickly input the required details. This eliminates the need to start from scratch each time a new payment request is needed. As a result, businesses can focus more on their core operations while maintaining a smooth financial workflow.

Consistency and Professionalism

Using a consistent format ensures that every document looks professional and follows the same structure. This can help establish trust with clients, as they will know what to expect in terms of content and presentation. A professional appearance can also enhance the company’s credibility, contributing to stronger client relationships.

| Benefit | Explanation |

|---|---|

| Time Efficiency | Pre-designed formats allow quick and easy entry of service details, reducing preparation time. |

| Accuracy | Automated systems help minimize human errors, ensuring correct charges and payment details. |

| Professionalism | Consistent, well-organized documents convey a polished image and foster client trust. |

| Brand Representation | Customizable formats allow businesses to reflect their branding, enhancing overall business identity. |

Benefits of Professional Billing Document Design

Designing high-quality payment requests can have a profound impact on your business operations. A well-structured document does more than just convey the amount due; it enhances the client experience and reflects the professionalism of your business. Properly designed documents are clear, easy to read, and help ensure that all necessary details are included, reducing the risk of misunderstandings and delays in payment.

Increased Client Confidence

When clients receive polished and professional payment requests, it gives them confidence in the quality of your services. A well-organized document demonstrates that your business pays attention to detail and values professionalism. This can build trust and improve client relationships, encouraging repeat business and positive referrals. By investing in design, you’re showing that you care about both the services you provide and the way you communicate with your clients.

Improved Payment Processing

Clear and concise documents make it easier for clients to understand what they are being charged for, which in turn speeds up the payment process. Clients are more likely to pay on time if the information is easy to interpret and free from ambiguity. A clean design that highlights important details–such as the total amount, due date, and payment methods–ensures that there is no confusion about what is owed and when it should be paid.

In addition, a professionally designed document can reduce the need for follow-up inquiries or clarifications, helping you maintain a smooth cash flow and saving time for both you and your clients.

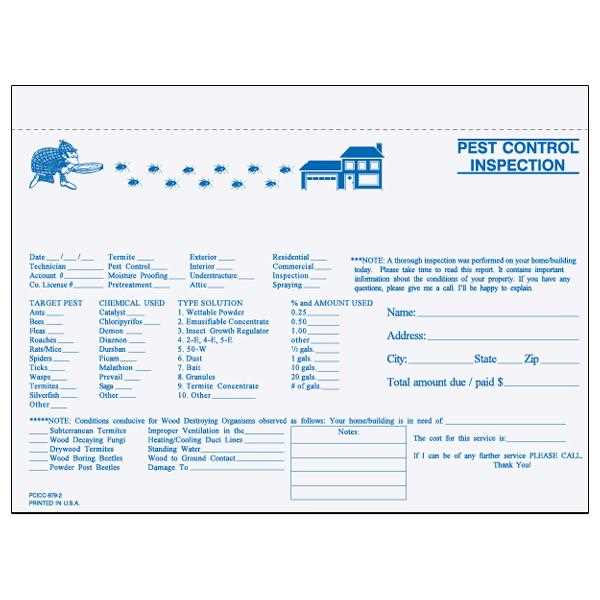

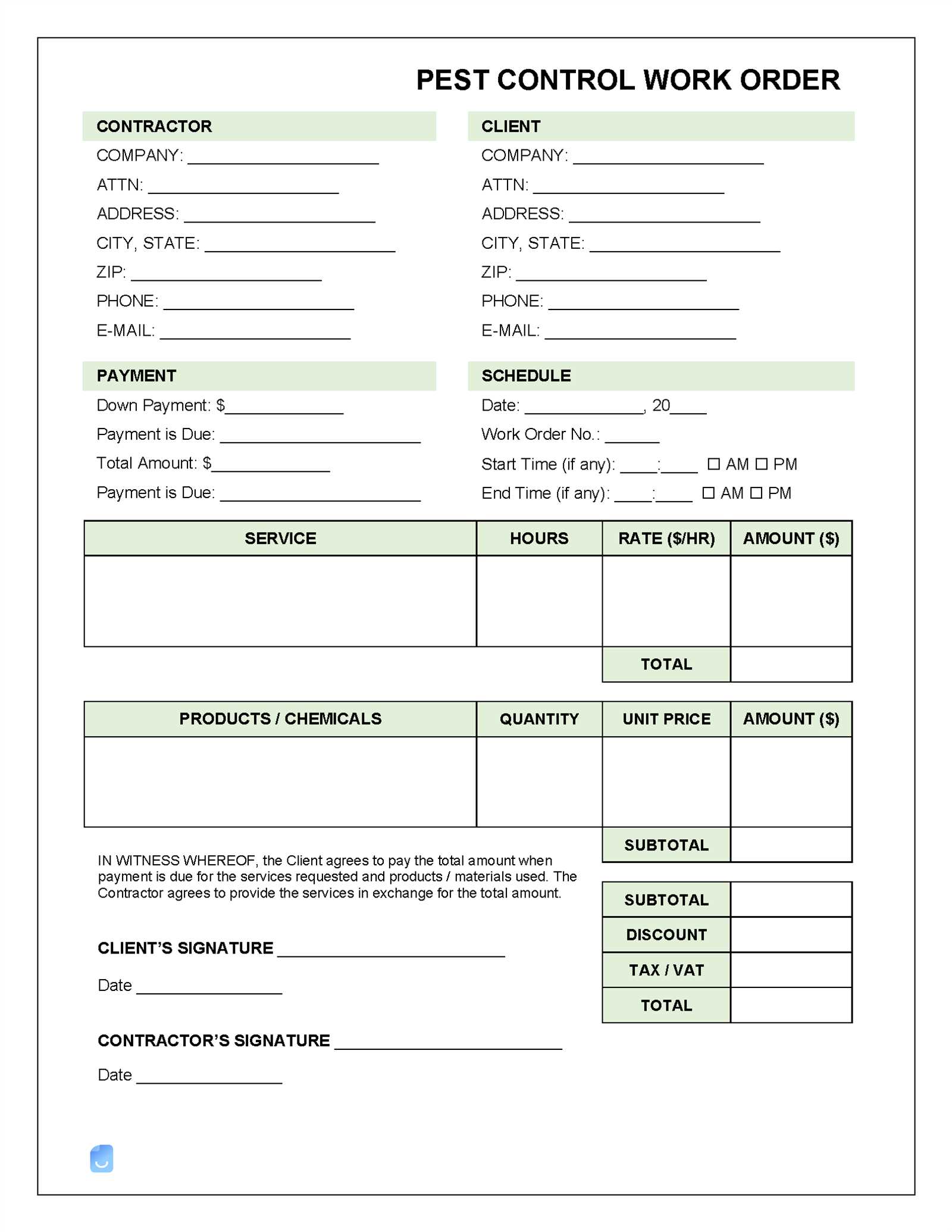

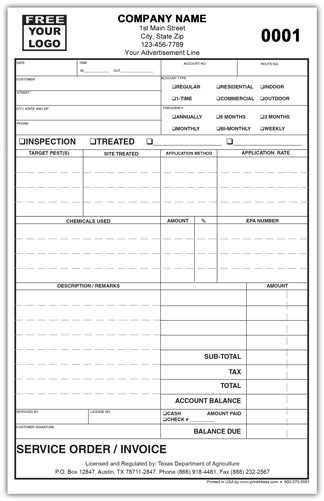

Essential Information to Include on Billing Documents

To ensure clarity and avoid confusion, it’s crucial that every payment request includes key information. The more transparent and detailed the document is, the less likely it is that there will be disputes over charges or delays in payment. A complete and well-organized document sets clear expectations for both the service provider and the client, making the transaction process smoother.

Key Details to Include

Here are the most important elements that should be featured on every payment request:

- Business and Client Information – The document should clearly display the service provider’s name, address, and contact details, along with the client’s information for easy reference.

- Service Description – Each service provided should be listed with a brief description, including the date or period the service was rendered.

- Pricing and Quantity – The cost of each service, as well as the number of units (if applicable), should be clearly stated, allowing clients to understand exactly what they are paying for.

- Total Amount Due – The total cost for all services should be prominently displayed, so the client knows exactly what they owe.

- Payment Terms – This includes the due date, accepted payment methods, and any late fees or discounts for early payment.

- Invoice Number – A unique reference number for each document helps track payments and ensures no confusion with future requests.

Additional Information for Clarity

- Tax Information – If applicable, tax rates or exemptions should be clearly listed to ensure the client understands the breakdown of costs.

- Notes or Terms of Service – Adding any important notes, such as warranty information or terms of service, can prevent misunderstandings later on.

Including these key details not only ensures accuracy but also helps build a transparent and professional relationship with clients.

How Billing Documents Save Time

One of the most significant challenges in running a service-based business is managing administrative tasks efficiently. Creating billing documents from scratch for each transaction can be a time-consuming process, especially when dealing with multiple clients. By using pre-structured formats, businesses can drastically reduce the time spent on paperwork, allowing more focus on core operations and customer service.

Streamlined Workflow

Pre-designed formats eliminate the need to manually structure every document. Once the necessary details are entered, the rest of the information is automatically organized, allowing businesses to quickly generate payment requests. This streamlined workflow reduces the amount of repetitive work, making it easier to handle large volumes of transactions in less time.

Reduced Errors and Revisions

When using standardized formats, businesses are less likely to make mistakes. These structures are designed to include all the essential elements, ensuring nothing is left out. This not only reduces errors but also minimizes the time spent on revisions and follow-up communication with clients. A well-organized document decreases the likelihood of misunderstandings and delays, speeding up the overall payment process.

| Benefit | Explanation |

|---|---|

| Time Efficiency | Pre-designed formats allow for quick input of data, eliminating the need to start from scratch every time. |

| Consistency | Standardized documents ensure that every request is structured the same way, reducing time spent on formatting. |

| Minimized Errors | Automated systems help reduce mistakes, preventing delays caused by revisions or client inquiries. |

| Faster Payments | Clear and accurate documents make it easier for clients to understand the payment terms, leading to quicker processing. |

By adopting a pre-structured approach to billing, businesses can save time, reduce manual work, and improve cash flow, all while maintaining professionalism and accuracy.

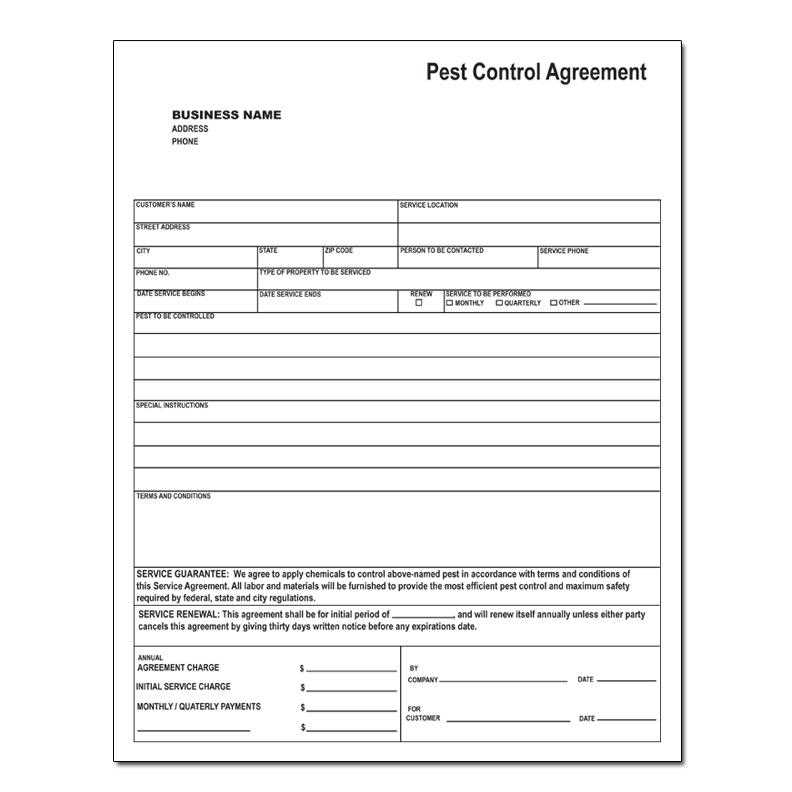

Creating Customized Billing Documents

For any service provider, having the ability to personalize payment requests is essential for maintaining a professional image and catering to the unique needs of each client. Customizing your payment documents allows you to reflect your business’s brand, provide detailed breakdowns of services, and ensure that all necessary information is easily accessible to clients. Tailored documents can improve client satisfaction and help avoid confusion about charges.

Steps to Customize Billing Requests

Here are the key steps to creating a personalized document that suits your business needs:

- Include Branding Elements – Add your business logo, name, and contact information at the top of the document. This helps establish your brand and makes your requests instantly recognizable to clients.

- Customize Service Descriptions – Ensure that the details of each service are clearly described, including the date of completion and any special instructions or warranties. This shows professionalism and helps clients understand exactly what they are paying for.

- Specify Payment Terms – Include your payment policies, such as due dates, accepted payment methods, and any late fees or discounts for early payments. This prevents misunderstandings and sets clear expectations.

- Add a Personal Touch – Include a brief note thanking the client for their business or reminding them of any upcoming services. Personalizing your documents can improve customer relations and promote future engagement.

- Ensure Legal Compliance – Depending on your location or industry, you may need to include specific tax information, business registration details, or disclaimers. Make sure your document complies with any local regulations.

Tools for Customization

To create custom billing documents efficiently, many businesses rely on specialized software or online tools. These tools often allow you to choose from pre-made designs, add your own information, and save the documents in various formats. Some of the most popular options include:

- Invoice creation software with drag-and-drop features

- Cloud-based platforms for easy access and sharing

- Word processors or spreadsheet programs with customizable formats

By tailoring each document to your specific needs, you not only enhance the client experience but also build a strong and consistent business identity that clients will recognize and trust.

Common Mistakes in Billing Document Creation

Creating accurate and professional payment requests is essential for smooth financial transactions. However, there are several common errors that can lead to confusion, delays, or even disputes with clients. These mistakes can also reflect poorly on your business and harm your relationship with clients. Understanding these pitfalls and avoiding them will help ensure that your payment documents are clear, accurate, and effective.

Key Mistakes to Avoid

Here are some of the most frequent errors businesses make when preparing payment requests:

- Missing or Incorrect Client Information – Failing to include accurate contact details for both your business and the client can lead to confusion or delays in payment. Always double-check names, addresses, and contact information before finalizing any document.

- Unclear Service Descriptions – Vague or incomplete descriptions of services provided can leave clients unsure about what they are paying for. Be specific about the tasks performed, including dates and quantities if necessary.

- Omitting Payment Terms – Without clear payment terms, clients may be unsure about when payment is due, accepted methods, or any penalties for late payments. Make sure to include the due date, payment options, and any late fee policies.

- Inconsistent Pricing – Changing pricing or offering discounts without clearly stating them in the document can lead to confusion. Always include the exact price for each service, and any applicable taxes, and ensure your totals are correct.

- Not Including a Unique Reference Number – Every payment request should have a unique identifier. Without it, tracking payments or referencing specific transactions can become challenging, particularly in the case of disputes.

- Failure to Proofread – Simple mistakes such as typos or incorrect calculations can undermine the professionalism of your document. Always review your work before sending it to ensure accuracy.

How to Avoid These Mistakes

Accuracy is essential when creating payment documents. Double-check client details, service descriptions, pricing, and payment terms to ensure that everything is correct. If necessary, ask a colleague or use software that helps spot errors and ensure consistency.

Professionalism should also be a priority. A well-organized, clear, and precise document helps build trust with clients and ensures that payments are processed without unnecessary delays.

Top Features of an Effective Billing Document

An effective payment request goes beyond just displaying the amount due. It serves as a clear, professional record of the services provided and sets the stage for smooth transactions between a business and its clients. The most impactful billing documents combine clarity, organization, and accuracy to ensure both parties understand the charges and expectations. A well-designed document not only simplifies payment but also promotes trust and reliability.

Key Characteristics of a Well-Designed Document

Here are the top features that should be included in any well-constructed payment request:

| Feature | Importance |

|---|---|

| Clear Business and Client Information | Including accurate contact details for both parties helps avoid confusion and ensures easy communication. |

| Service Description and Date | Detailed descriptions of the services provided and the date of completion ensure both sides are on the same page regarding what was delivered. |

| Itemized Pricing | Breaking down the costs for each service allows the client to understand exactly what they are paying for and prevents disputes. |

| Payment Terms and Due Date | Clearly stating payment deadlines and accepted methods helps avoid delays and misunderstandings. |

| Unique Reference Number | A unique reference number makes it easier to track and manage multiple transactions, helping avoid mix-ups. |

| Tax Information | If applicable, displaying tax rates and amounts ensures compliance with legal requirements and provides transparency in billing. |

By including these features, businesses can create documents that are not only easy for clients to understand but also reflect a high level of professionalism, helping to ensure timely payments and positive client relationships.

Choosing the Right Billing Software

Selecting the appropriate software for generating payment requests is crucial for streamlining business operations. The right tool can automate the process, ensure accuracy, and provide a professional look for your documents. With numerous options available, it’s essential to choose software that not only fits your business size and needs but also integrates smoothly with other tools you use for accounting and customer management.

When evaluating different software solutions, consider factors such as ease of use, customization options, pricing, and customer support. Additionally, it’s important to look for features that allow for automated reminders, tracking of payments, and secure data storage. By investing in the right software, you can improve your workflow, reduce errors, and maintain a high level of professionalism in your business transactions.

Best Practices for Accurate Billing

Ensuring accuracy in billing is fundamental to maintaining a smooth financial operation and a strong relationship with clients. Mistakes in payment requests can lead to delays, confusion, or disputes, all of which can negatively impact cash flow and client satisfaction. By following best practices for generating billing documents, businesses can avoid common errors and create clear, professional requests that promote timely payments and trust.

To maintain accuracy in your billing process, it’s important to be diligent at every step. Double-check all client information, service descriptions, pricing, and payment terms. Additionally, using automated tools or software that helps organize and calculate details can further reduce human error and ensure consistency across all payment requests.

How to Handle Late Payments on Billing Documents

Dealing with delayed payments is a common challenge for businesses, but handling them properly can help maintain positive relationships with clients while ensuring that you receive timely compensation for your services. Clear communication and well-defined payment terms are essential in addressing late payments effectively. However, when payments are delayed, it’s crucial to follow a structured approach to resolve the situation professionally.

Steps to Take When Payments Are Late

If you find that a client has missed a payment deadline, here are the steps you can take to handle the situation:

- Review Payment Terms – Before taking any action, ensure that your payment terms were clearly outlined in the original document. This includes the due date, payment methods, and any penalties for late payments.

- Send a Polite Reminder – Often, late payments are the result of simple oversight. Send a friendly reminder email or message to inform the client that payment is overdue. Include the original amount, due date, and payment options to make it easy for them to settle the bill.

- Offer Payment Flexibility – If the client is facing financial difficulties, consider offering an extended deadline or a payment plan. Being flexible can help maintain a good relationship while ensuring you eventually receive payment.

- Apply Late Fees – If your payment terms include a late fee, apply it once the grace period has passed. Be sure to communicate the fee clearly to the client, explaining the reason for the charge and how it is outlined in your terms.

- Escalate the Matter if Needed – If the payment continues to be delayed despite reminders, you may need to escalate the issue. Contact the client directly to discuss the situation and consider other options, such as involving a collections agency or pursuing legal action if the debt remains unpaid.

Preventing Future Late Payments

To reduce the likelihood of delayed payments in the future, consider implementing the following strategies:

- Clearly Define Payment Terms – Make sure your payment terms are transparent and easy to understand, including due dates, late fees, and acceptable payment methods.

- Invoice Promptly – Send payment requests as soon as the service is completed, so clients are reminded to pay on time.

- Automate Payment Reminders – Set up automated reminders for clients before and after the payment due date to ensure they don’t forget.

By following these steps, you can address late payments professionally while maintaining strong business relationships and ensuring that your cash flow remains steady.

Automating Your Billing Process

Automating the process of generating and sending payment requests can significantly improve efficiency, reduce errors, and save time for your business. By using software or digital solutions, you can streamline repetitive tasks, such as data entry, calculations, and follow-ups, allowing your team to focus on higher-priority tasks. Automation not only makes the billing process faster but also helps maintain consistency and professionalism in all of your financial documentation.

Key Benefits of Automation

Here are some key advantages of automating your billing process:

| Benefit | Description |

|---|---|

| Time Efficiency | Automating repetitive tasks such as creating and sending documents reduces the amount of time spent on manual work. |

| Accuracy | With automated calculations and pre-set templates, you reduce the risk of human error in pricing, tax calculations, and totals. |

| Consistency | Automating ensures that all payment requests are formatted the same way, with all necessary details included, every time. |

| Improved Cash Flow | Automation allows for timely reminders and follow-ups, increasing the chances of on-time payments and improving overall cash flow. |

| Professionalism | Automated billing systems help maintain a polished and consistent brand image by using professional-looking documents and formats. |

How to Get Started with Automation

To begin automating your billing process, choose software that integrates well with your business needs. Look for features such as:

- Pre-built billing document formats

- Automatic tax and discount calculations

- Payment tracking and reminders

- Customizable design and branding options

- Integration with accounting software

By implementing automation, you can create a more efficient, accurate, and reliable billing system that enhances your business operations and client satisfaction.

Free vs Paid Billing Document Solutions

When choosing the right solution for creating payment requests, businesses often face the decision between free and paid options. Both have their pros and cons, and the best choice depends on the specific needs of the business, its size, and the complexity of its financial processes. Free options can be a great way to start, while paid solutions may offer advanced features that are more suited to growing businesses or those with specific requirements.

Advantages of Free Solutions

Free billing document options can be an excellent choice for small businesses or individuals just starting out. These solutions typically come with basic features and templates that are easy to use and help you create professional-looking documents quickly. Some key benefits include:

- No upfront costs: Free options are often a budget-friendly choice, especially for small businesses with limited financial resources.

- Ease of use: Most free solutions are user-friendly, allowing even those with limited technical skills to create and send payment requests without hassle.

- Basic customization: While free options may be limited, they often allow for basic customization like adding your logo and contact information.

Benefits of Paid Solutions

Paid solutions, on the other hand, typically come with more advanced features, better customization options, and additional support. They are designed for businesses that need more than just basic billing capabilities and want a more professional or branded look. Key benefits of paid solutions include:

- Advanced customization: Paid tools often allow you to fully customize documents to align with your brand, including fonts, colors, and layouts.

- Integration with accounting software: Many paid solutions integrate with accounting or CRM systems, automating processes such as payment tracking and reporting.

- More features: Paid options typically offer additional features such as recurring billing, detailed analytics, and customer management tools.

- Better customer support: Paid services often include dedicated customer support, ensuring you can get help whenever needed.

Choosing between free and paid solutions depends on the needs of your business. If you’re just starting and need basic functionality, free solutions may suffice. However, as your business grows, investing in a paid solution could provide the additional features and support needed to streamline your processes and enhance your client experience.

How to Design Your Own Billing Documents

Creating custom billing documents allows you to have full control over how your payment requests appear, giving you the opportunity to reflect your brand’s identity and maintain a professional image. Designing your own documents means you can tailor them to your specific business needs, whether that’s including custom fields, logos, or unique formats. This guide will help you understand the key components of a well-designed payment request and how to create one that suits your business.

Key Elements of a Custom Payment Request

When designing your own payment document, certain essential elements should always be included to ensure clarity and professionalism. Here are the key components to focus on:

- Business Information: Always include your business name, address, and contact details, as well as your logo if applicable. This makes it easy for clients to recognize and reach out to you.

- Client Information: Clearly list the client’s name, address, and contact details to ensure proper identification and to avoid confusion.

- Itemized List of Services: Break down the services you provided, including the description, quantity, unit price, and total for each item. This provides transparency for the client and makes it easier for them to understand the charges.

- Total Amount Due: Clearly state the total amount due, including any applicable taxes, fees, or discounts. This helps clients quickly identify the final amount they owe.

- Payment Terms: Include the due date, accepted payment methods, and any late fees for overdue payments. Being transparent about your terms can prevent delays and disputes.

Design Tips for Professional Documents

When designing your own documents, there are several design tips to keep in mind that will ensure your payment requests are visually appealing and easy to read:

- Consistency: Use consistent fonts, colors, and layout across all documents. This helps maintain a professional look and reinforces your brand identity.

- Simple Layout: Keep the layout clean and uncluttered. Use headings, bullet points, and white space effectively to make the document easy to follow.

- Readable Fonts: Choose clear, legible fonts that are easy to read. Avoid overly decorative fonts that can make the document difficult to scan.

- Highlight Important Information: Use bold or larger fonts for key details like the total amount due and due date to ensure these stand out for the client.

By following these guidelines, you can create personalized payment requests that not only look professional but also help facilitate smooth transactions with your clients. Designing your own documents gives you the flexibility to make them as simple or as detailed as needed, ensuring they reflect your business’s unique style and needs.

Legal Requirements for Billing Documents

When creating payment requests, it is essential to understand the legal requirements that govern them to ensure compliance with local tax laws and business regulations. Proper documentation helps protect both businesses and clients by ensuring that all details are transparent and verifiable. There are several key elements that need to be included in these documents, and failing to include them could lead to legal complications, fines, or disputes.

Key Legal Elements for Billing Documents

Every payment document should contain certain legal elements to be considered valid. These are the basics that must appear in your document to comply with business regulations:

- Business Identification: Include the full name of your business, registered address, and tax identification number (TIN). This helps verify the legitimacy of your business and its tax obligations.

- Client Information: Clearly list the name and contact details of the client receiving the services, along with their billing address. This ensures that the payment document can be linked to the correct party.

- Itemized List of Services: A clear breakdown of the services provided or products sold, including descriptions, quantities, and pricing. This transparency helps both parties understand the agreed-upon charges.

- Tax Information: Include any applicable taxes, such as sales tax or VAT, clearly shown as separate line items. The document should also state the tax rate applied and the total tax charged.

- Payment Terms and Conditions: Specify the due date, acceptable payment methods, and any late fees or penalties for overdue payments. Clear payment terms prevent confusion or disputes about payment deadlines.

- Invoice Number: Every payment document should be assigned a unique identification number to help track and organize financial records efficiently.

Regional Differences and Compliance

The legal requirements for billing documents may vary depending on the country or region where your business operates. It’s crucial to familiarize yourself with local laws, tax codes, and industry-specific regulations to ensure full compliance. For example, some regions may require additional details, such as customer VAT numbers for international transactions, while others may mandate specific language or formats for payment documents.

- Know Local Tax Laws: Understand the tax obligations for your area, including tax rates, exemptions, and documentation requirements.

- Follow Industry Standards: Certain industries may have additional rules for documenting services, such as licensing requirements or safety certifications for specific work.

- Consult Legal Professionals: If you’re unsure about the legal requirements for your billing process, consult with a legal or accounting professional to ensure that your documents meet all necessary criteria.

By following the legal requirements for billing documentation, businesses can avoid potential issues and ensure their financial records are accurate, transparent, and compliant with applicable laws.

How Billing Documents Improve Client Relationships

Effective and well-structured payment documents play a crucial role in fostering strong and lasting relationships with clients. By providing clear, professional, and easy-to-understand billing statements, businesses can enhance trust and transparency, which ultimately leads to better client satisfaction and loyalty. The way you present your financial documents can have a significant impact on how clients perceive your business and their overall experience.

Building Trust through Clarity

One of the main ways that well-designed payment documents improve client relationships is by ensuring clarity and transparency. When clients receive detailed and easy-to-read payment statements, it reduces confusion and provides them with a clear breakdown of what they are paying for. This transparency shows that your business values honesty and communication, which helps build trust.

- Detailed Breakdown: Clients appreciate seeing exactly what they are paying for, including specific services, quantities, and costs. This detailed information fosters a sense of security, as there are no hidden fees or ambiguous charges.

- Clear Payment Terms: By clearly stating payment deadlines, accepted methods, and penalties for late payments, you reduce the likelihood of misunderstandings and disputes.

- Professional Presentation: Well-organized and professionally designed billing documents create a positive impression, reinforcing the perception that your business is reliable and competent.

Streamlining the Payment Process

Efficient payment processes are essential for maintaining good client relationships. By using standardized and easy-to-understand payment documents, businesses make it easier for clients to pay on time and without complications. Simplifying the payment process reduces friction and frustration, leading to faster payments and fewer delays.

- Faster Payments: When clients have clear instructions and a professional-looking document, they are more likely to settle their accounts quickly. This helps maintain healthy cash flow and reduces the likelihood of overdue payments.

- Convenient Reminders: Many billing systems offer automated reminders for upcoming or overdue payments. These reminders, when done respectfully, help clients remember their obligations without feeling pressured or inconvenienced.

- Enhanced Client Experience: A seamless, straightforward payment experience contributes to overall client satisfaction, making them more likely to return for future business or recommend your services to others.

In the end, using well-crafted payment documents is more than just about collecting money–it’s about creating a positive and professional experience that encourages trust, transparency, and ongoing collaboration. When clients feel respected and well-informed, they are more likely to develop a long-term, positive relationship with your business.

Customizing Billing Documents for Specific Services

Tailoring your payment documents for different types of services is essential for creating a professional and personalized experience for your clients. Customization allows you to add relevant details that reflect the nature of each service, ensuring clarity and accuracy in every transaction. Whether you’re offering one-time projects or ongoing services, adjusting your document format to match the specific requirements of each job can help streamline communication and improve client satisfaction.

Adapting to Service-Specific Needs

When providing diverse services, it’s crucial to modify your billing documents to highlight the relevant aspects of each service. A customized approach ensures that the client can quickly understand what they’re paying for and how the charges are structured. Here are some examples of how you can adapt your documents for different service types:

- One-Time Services: For single-service transactions, emphasize the specific service rendered, any one-time fees, and clear details of the work completed. This gives the client an itemized breakdown of the job.

- Recurring Services: If the work is ongoing, include fields for the frequency of service, payment schedule, and any discounts for long-term agreements. This helps clients understand the terms of their subscription or recurring payments.

- Custom Services: For tailored or bespoke services, such as specialized work or unique projects, ensure that the billing document includes detailed descriptions and any custom pricing based on the specifics of the job.

Enhancing Professionalism through Customization

Customizing your documents for each service also helps present a more professional image. It demonstrates to your clients that you take their unique needs into consideration and are willing to offer a personalized experience. This can help build stronger client relationships, increase trust, and position your business as attentive and detail-oriented.

- Branding: Incorporating your business logo, colors, and fonts into each document helps maintain a consistent brand identity and fosters a sense of professionalism.

- Clear Descriptions: Customizing descriptions for each specific service ensures that the client understands exactly what they are paying for, eliminating confusion and reducing potential disputes.

- Additional Details: Adding relevant notes, such as maintenance recommendations or warranties for certain services, can enhance client trust and demonstrate a comprehensive approach to customer care.

By customizing your payment documents for specific services, you create a more tailored and professional experience that helps ensure client satisfaction, builds trust, and reflects the uniqueness of each service you provide. This at