Caricom Commercial Invoice Template for Streamlined Trade

In international trade, accurate and consistent documentation plays a crucial role in ensuring that transactions are smooth and compliant with regional requirements. This type of record helps businesses maintain transparency, expedite processing, and avoid common pitfalls that can arise from incomplete or inconsistent data. With the right format, companies can simplify their operations while meeting regulatory expectations.

Developing a structured document outline is key to supporting efficient trade practices across borders. By following a standardized model, businesses can streamline transactions, reduce errors, and save time. Understanding how to design this essential document allows companies to avoid delays and costly mistakes, ensuring all relevant information is presented clearly and effectively.

This guide offers insights into creating a reliable layout for transaction records used in trade, outlining essential details and best practices. Whether you’re a small business or a large enterprise, learning to customize and correctly format these documents will help you stay compliant and organized in every exchange.

Understanding the Caricom Commercial Invoice

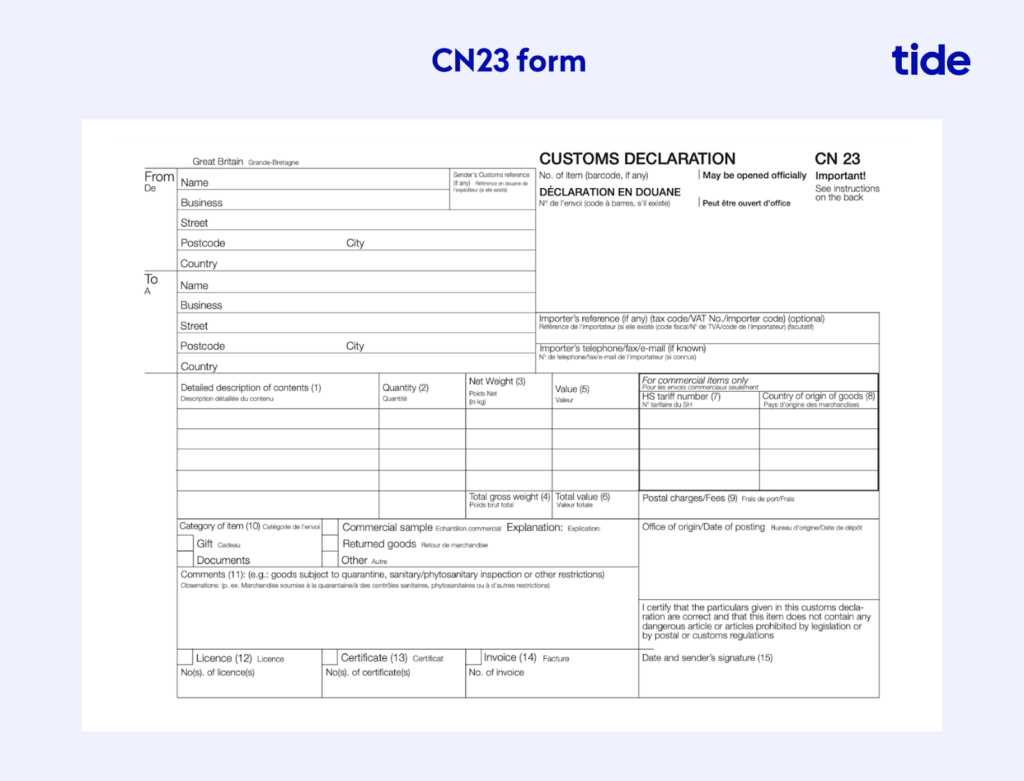

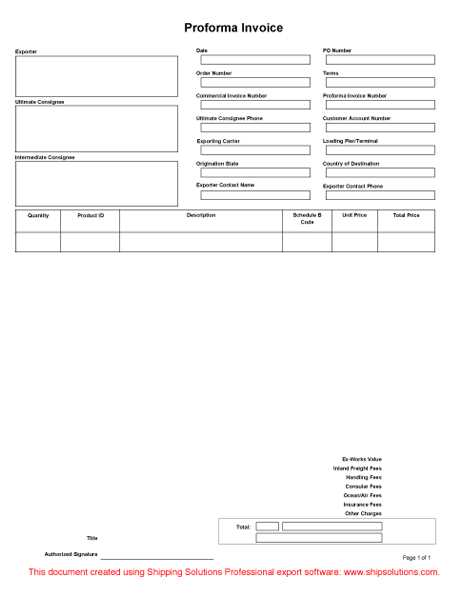

For any business involved in cross-border transactions, structured documentation is essential. This type of form provides a detailed summary of goods, outlining essential information for smooth transit and regulatory checks. Clarity and accuracy in this record support faster customs processing and ensure that every party in the transaction chain has the necessary details to move goods efficiently.

While completing these records, companies must include specific data points to ensure compliance. By adhering to a recognized format, they can minimize errors, expedite processing, and simplify communication with customs officials. The following sections break down the main elements to consider when preparing this type of document.

Core Components of Trade Documentation

| Field | Description | |||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Exporter Details | Information about the sender, including name, address, and registration details. | |||||||||||||||||||||||||||||||||||

| Consignee Information | Data about the recipient, specifying the destination and necessary contact details. | |||||||||||||||||||||||||||||||||||

Description of Goods

Why Businesses Need an Invoice TemplateOrganized documentation is essential for companies engaged in international trade, especially when dealing with multiple shipments and cross-border regulations. A structured format provides a reliable way to capture all necessary details, ensuring accuracy and consistency across each transaction. By adopting a standard layout, businesses can streamline their operations, reduce errors, and enhance their credibility with both clients and regulatory bodies. Having a predefined format allows for faster preparation and less room for mistakes, as well as easier reference for both sellers and buyers. It creates a clear record of transactions, minimizing misunderstandings and simplifying communication between all parties involved. Below are some of the key reasons why a standardized document structure is invaluable for companies handling regular exports or imports. Advantages of Using a Consistent Layout

|