How to Use Zoho Invoice Template for Efficient Billing

Managing financial transactions smoothly is crucial for any business. Using a well-organized system for generating payment requests can save time and reduce errors. Many tools are available today to simplify the process of creating professional documents for billing clients.

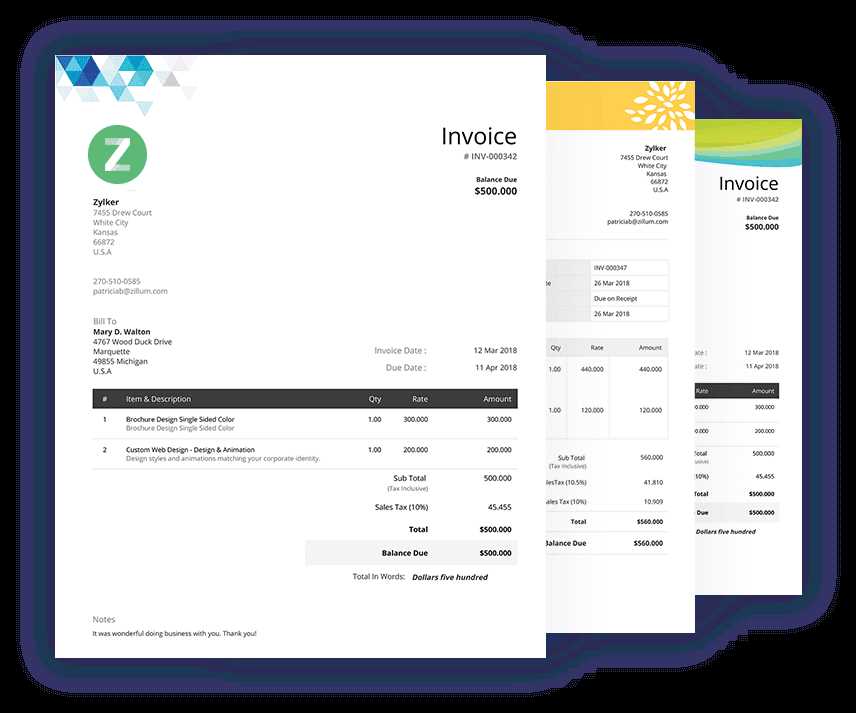

One of the best ways to enhance your billing process is through customizable documents that can be tailored to suit your specific needs. With the right solution, you can automate repetitive tasks and create documents that reflect your brand’s identity. These solutions often offer easy-to-use options that allow you to add your logo, adjust layouts, and incorporate essential details like due dates and payment terms.

In this article, we’ll explore the benefits of using such systems, how to create customized documents, and the tools that make this possible. Whether you are a small business owner, freelancer, or part of a larger organization, having access to streamlined financial management tools is essential for efficiency and professionalism.

Comprehensive Guide to Zoho Invoice Templates

Creating professional payment requests is an essential part of running a business. Having the right tools at your disposal allows you to design and customize documents that meet your specific needs while maintaining a polished and organized appearance. With the help of advanced features, you can streamline the entire billing process and ensure accuracy every time.

In this guide, we will walk you through the key features and benefits of customizable billing documents. By the end of this section, you’ll have a clearer understanding of how to utilize these tools effectively and tailor them to your business processes.

- Easy to use interface for quick customization

- Ability to personalize with your branding elements such as logos and colors

- Options to adjust fields for various types of transactions

- Automated reminders and payment tracking to stay on top of due dates

- Secure and seamless integration with other business management tools

By using a solution that offers these features, you can not only save time but also maintain a high level of professionalism with minimal effort. Let’s explore how these tools can benefit different types of users and businesses.

Why Choose Zoho for Invoicing

When it comes to managing financial documentation, selecting the right platform can significantly impact the efficiency of your business operations. A robust system can simplify the process of generating, customizing, and tracking your financial records, allowing you to focus more on growing your business and less on administrative tasks. Choosing a solution that offers flexibility, ease of use, and integration capabilities is essential for any organization.

The platform we will discuss provides a comprehensive suite of features designed to streamline billing tasks. From automating repetitive processes to offering a user-friendly interface, it ensures that your financial documents are professional, accurate, and sent in a timely manner. This tool is built to accommodate businesses of all sizes, whether you’re a freelancer or part of a larger corporation.

With this platform, you can easily customize documents to reflect your business’s unique style, set payment reminders, and even automate follow-up messages to clients. These features save valuable time and reduce the risk of errors, making it a great choice for business owners who want to manage their billing seamlessly.

Key Features of Zoho Invoice Templates

When choosing a system for creating and managing financial documents, it’s important to consider the features that can simplify your tasks and enhance your workflow. A well-designed solution offers a variety of tools that help you create professional, accurate, and customizable records, all while saving time and minimizing errors.

Below are some of the most valuable features that make this platform stand out when it comes to generating financial documents:

- Customization Options: Personalize your documents with your brand logo, colors, and preferred layout styles to maintain a consistent business identity.

- Automation Tools: Set up recurring billing and automatic reminders to streamline your processes and ensure payments are never missed.

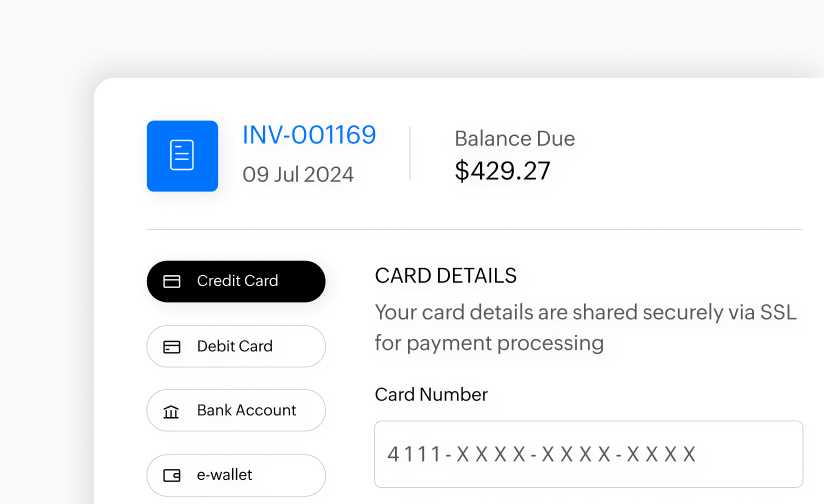

- Multiple Payment Methods: Offer clients a variety of payment options, making it easier for them to pay and improving cash flow.

- Real-Time Tracking: Monitor the status of each financial record, from creation to payment, to stay updated on outstanding amounts.

- Mobile Access: Manage your documents on-the-go with a mobile-friendly platform that lets you access and modify records anytime, anywhere.

- Integration with Other Tools: Seamlessly connect with accounting software and other business tools for a more cohesive financial management system.

These features combine to create a powerful and efficient solution for managing your business’s financial documentation. Whether you’re handling a few transactions or managing a larger client base, these tools provide the flexibility and automation needed to keep everything running smoothly.

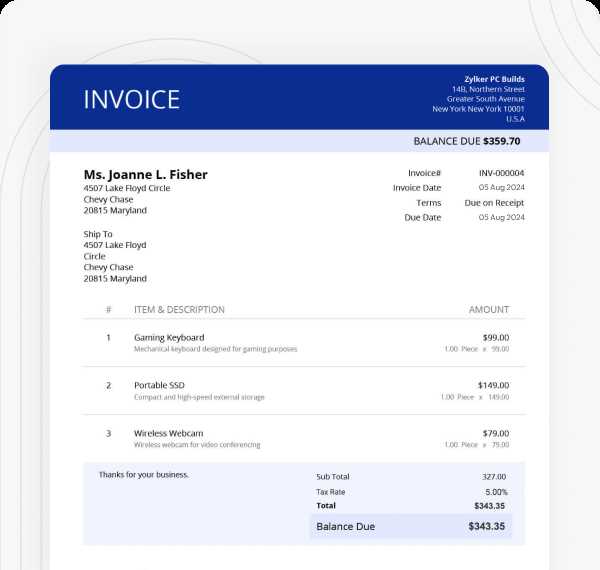

How to Create a Custom Invoice

Creating personalized billing documents is essential for maintaining a professional image and ensuring that all necessary details are included. With the right tools, you can easily design and customize these records to meet the specific needs of your business. This allows for clear communication with clients and ensures that all transactions are documented accurately.

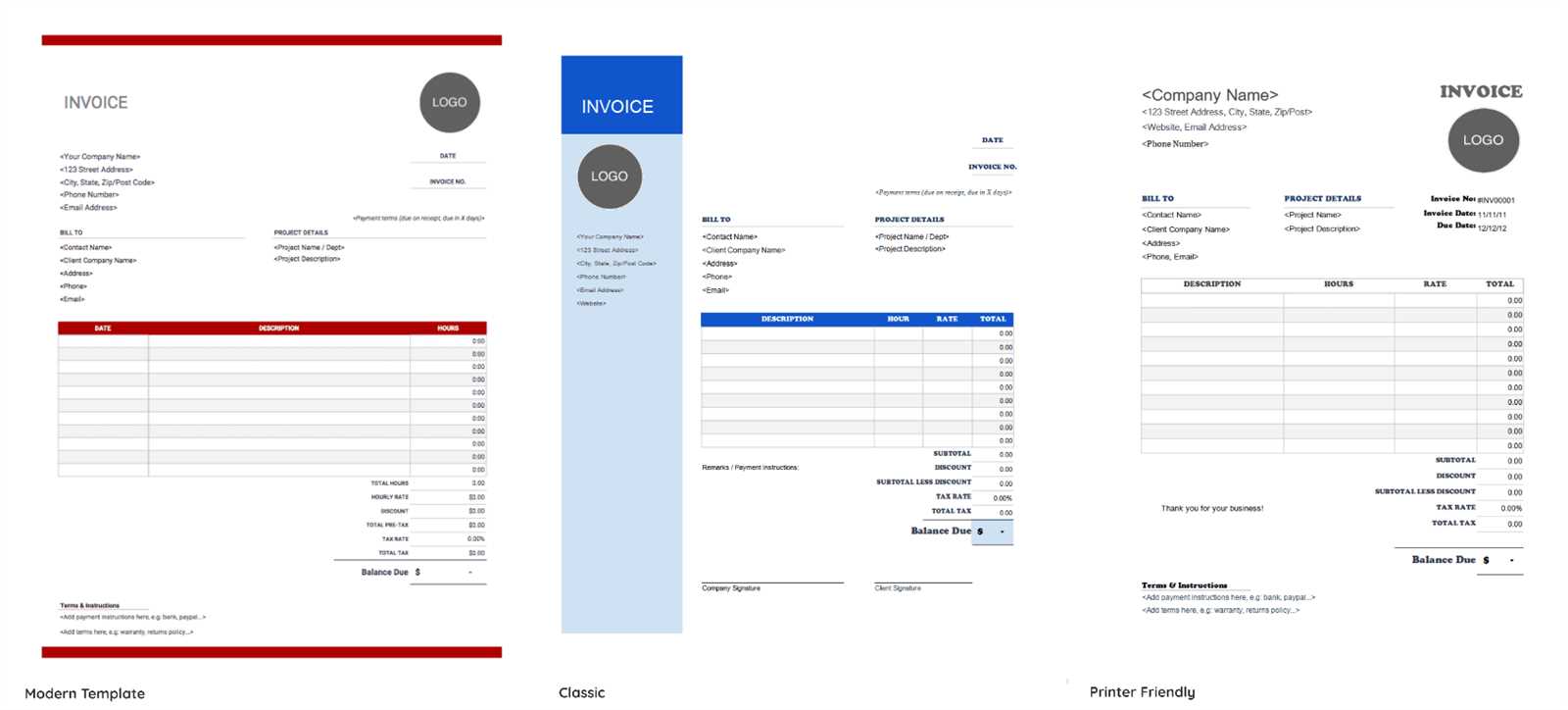

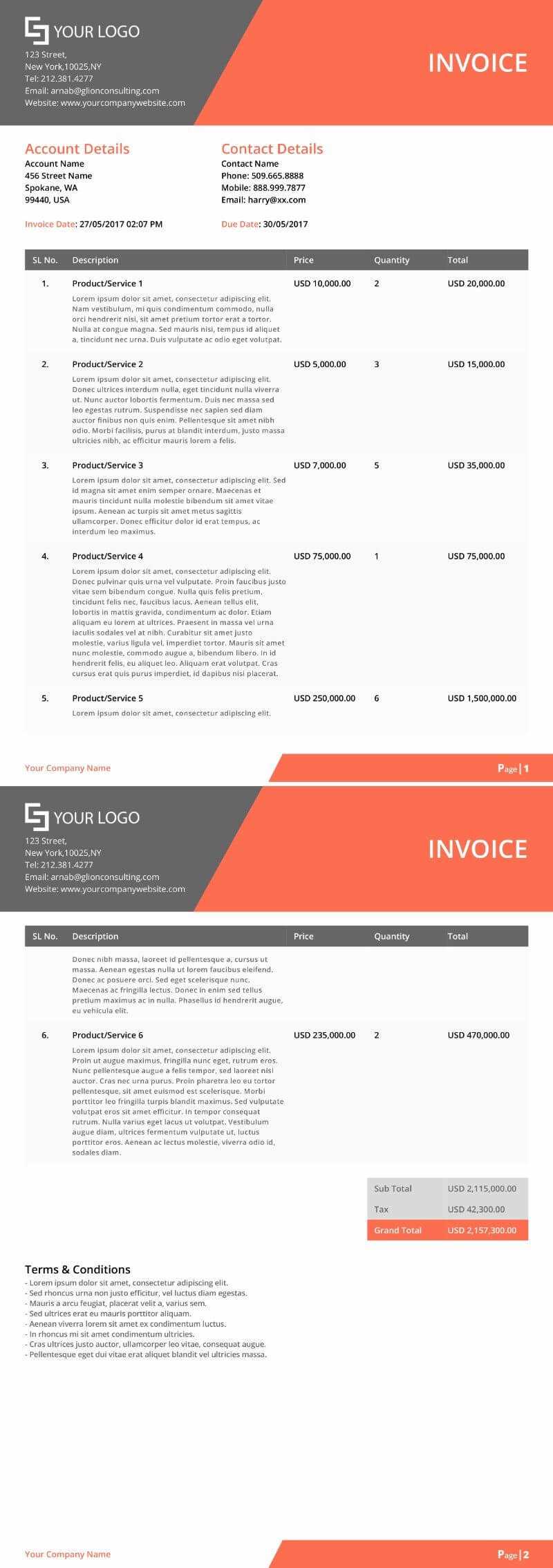

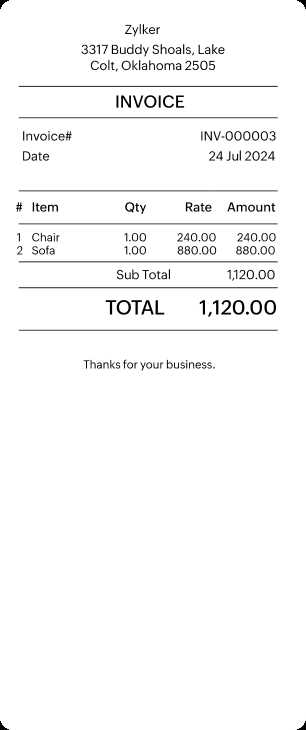

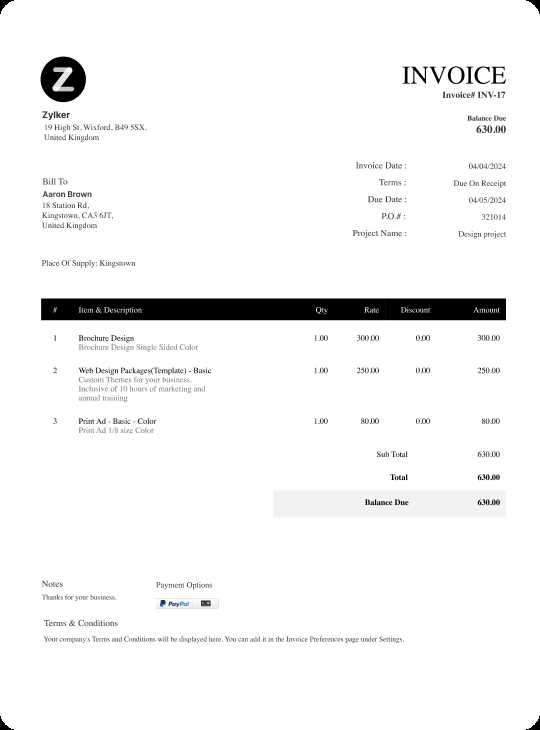

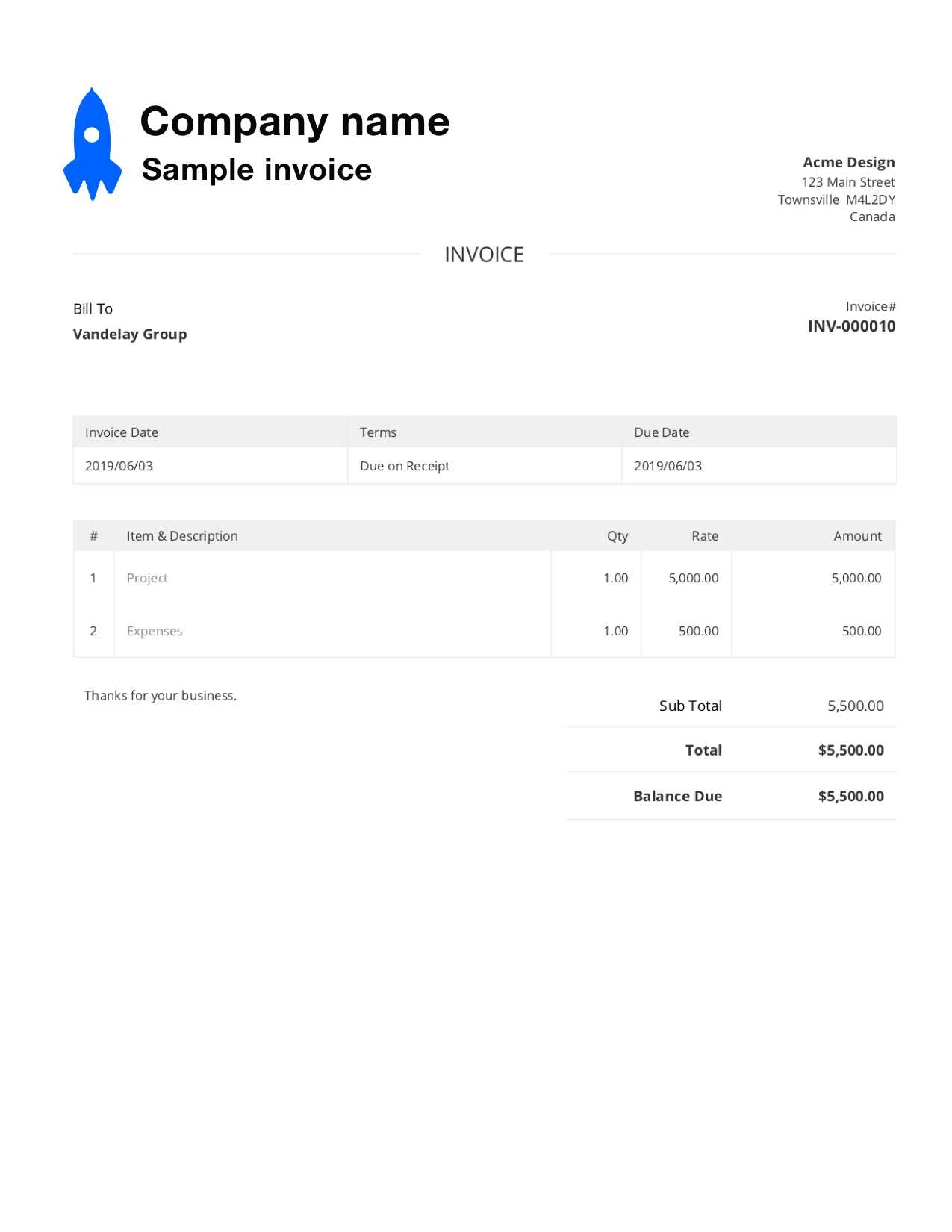

Step 1: Select a Format

The first step in customizing your billing document is choosing the right format. This typically involves selecting a layout that suits your business type and the level of detail you wish to include. Whether you prefer a simple, clean design or a more detailed layout with itemized descriptions, most platforms offer various styles to choose from.

Step 2: Customize the Content

Once you’ve selected your format, the next step is to customize the content. Add your business name, logo, and contact details to ensure your brand is represented clearly. Include fields for the client’s name, address, and any other necessary details such as project descriptions, payment terms, and due dates. You can also set up specific line items for services rendered or products sold.

By following these steps, you can create a customized billing document that reflects your business’s identity while ensuring that all the important information is presented clearly and professionally.

Streamlining Payments with Zoho Templates

Efficient management of payments is crucial for maintaining smooth cash flow in any business. By using the right system for generating payment requests, you can automate several key aspects of the payment process, reducing manual effort and ensuring timely transactions. The right tools offer not only customization but also automation features that can significantly speed up billing cycles and improve overall efficiency.

With advanced features, you can automate follow-up reminders for clients, set up recurring billing schedules, and offer multiple payment options. These capabilities ensure that payment processes are smoother and more predictable, allowing you to focus on growing your business rather than chasing overdue amounts.

By streamlining your payment management through automation, you reduce the chances of human error, and enhance the client experience, all while saving valuable time that can be directed toward other important business tasks.

Designing Professional Invoices Easily

Creating polished and professional payment documents doesn’t have to be a time-consuming task. With the right tools, you can quickly design custom records that reflect your brand identity while including all the necessary details for seamless transactions. The key is to use a system that offers flexibility in design, ensuring your documents stand out and make a positive impression on clients.

Choose a Clean and Simple Layout

A well-organized structure is the foundation of a professional document. Choose a layout that is easy to navigate, with clear sections for essential details such as client information, items or services provided, and payment terms. Keep the design clean and straightforward to ensure that your clients can easily review the necessary information.

Incorporate Your Branding

Customizing your records to reflect your brand is an effective way to enhance professionalism. Add your business logo, select colors that align with your brand’s visual identity, and choose fonts that are clear and legible. Personalizing these elements will give your documents a cohesive look and reinforce your brand presence with every transaction.

With these simple steps, you can easily design documents that are both professional and visually appealing, ensuring a smooth and polished experience for both you and your clients.

Integrating Zoho Invoice with Your Business

For a business to run efficiently, it’s essential to have a streamlined system where all tools work together seamlessly. Integrating your billing and payment processes with your existing business systems can save time, reduce errors, and increase productivity. When your financial documents are directly connected with other business management tools, everything from client communication to accounting becomes more synchronized and manageable.

One of the primary advantages of integrating a billing system with your business tools is automation. You can set up automatic data syncing between platforms, ensuring that every payment request and financial record is updated in real-time. This eliminates the need for manual entry and helps prevent inconsistencies. Moreover, this integration can enhance communication with clients by sending automatic reminders or notifications based on pre-set conditions.

Additionally, integration with other systems such as customer relationship management (CRM) or accounting software can provide a more cohesive workflow. For example, customer details can be automatically pulled from your CRM, making it easy to create personalized and accurate payment records. With these integrated features, businesses can manage everything from client communication to financial tracking in one unified platform, resulting in improved efficiency and fewer administrative tasks.

Time-Saving Benefits of Using Templates

Time is one of the most valuable resources for any business, and automating routine tasks can significantly reduce time spent on administrative work. Customizable document designs allow for quick generation of important records without starting from scratch each time. With ready-made formats, you can create professional, accurate documents in just a few clicks, saving valuable time and effort.

Eliminate Repetitive Work

One of the major time-saving benefits of using a customizable solution is the ability to eliminate repetitive tasks. Rather than manually entering details every time you need to generate a document, you can use pre-set formats that automatically populate client information, product descriptions, and pricing. This helps reduce human error while speeding up the creation process.

Increase Efficiency with Automation

Templates can be integrated with automated features that allow you to streamline the entire workflow. By setting up recurring billing, automatic reminders, and follow-up messages, you can manage your business more efficiently. These automated processes free up time to focus on higher-priority tasks, such as expanding your client base or improving services.

Using these pre-designed solutions not only speeds up your workflow but also ensures consistency and professionalism, allowing you to deliver documents faster without compromising quality.

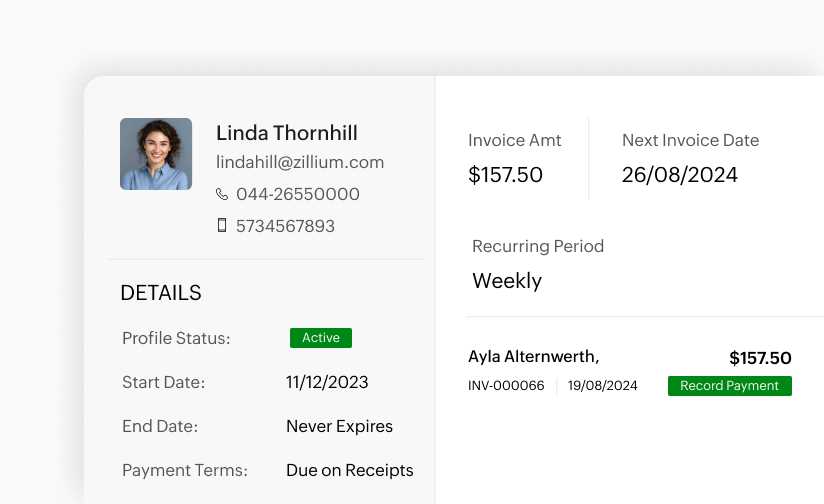

How to Automate Invoice Generation

Automating the creation of financial documents can significantly reduce the time and effort required for routine tasks. By setting up systems that automatically generate and send payment requests, businesses can ensure consistency and efficiency. This allows you to focus more on the core activities of your business while maintaining accuracy in your financial documentation.

To automate document generation, start by selecting a platform that offers automation features such as recurring billing and custom scheduling. You can set specific criteria, like client details or payment cycles, so that new documents are generated automatically at the right time. This reduces manual input and ensures that your records are consistently up to date.

Step 1: Choose the right platform with built-in automation tools that integrate well with your business’s needs. This will help streamline your operations and make generating documents faster and easier.

Step 2: Set up recurring billing for regular clients or services. Define the frequency (weekly, monthly, quarterly) and input the necessary details once, and the system will automatically generate the documents at the set intervals.

Step 3: Enable payment reminders to automate follow-ups, reducing the need for manual tracking and communication. Automated reminders will help ensure clients are informed of outstanding amounts without having to remember to send them yourself.

By automating this process, your business can stay organized, reduce human errors, and save valuable time, ensuring that all financial records are generated accurately and on time.

Customizing Billing Documents for Specific Needs

Every business has unique requirements when it comes to generating payment records. Customizing these documents ensures that they align perfectly with your business processes, helping you present the right details in a professional manner. Whether you need to include specific fields, adjust the layout, or add personalized branding, having the ability to modify these documents can streamline your operations and improve client communication.

Adjust Layouts and Fields

Tailoring the structure of your documents is key to meeting your specific needs. You can modify the layout to include additional information such as project descriptions, payment terms, or customer notes. This flexibility allows you to prioritize what’s most important to your business and provide clients with clear, relevant details in every document you send.

Brand Your Documents

Branding is essential for creating a consistent business image. Customizing the appearance of your payment records allows you to incorporate your logo, choose company colors, and select fonts that reflect your business identity. Personalizing these visual elements not only enhances your professionalism but also reinforces your brand’s presence every time you send a document.

By adjusting both the content and appearance of your documents, you can create a system that perfectly suits your business operations, ensuring that your clients always receive accurate and personalized records in a format they can easily understand.

Setting Up Payment Reminders

Timely payment reminders help ensure that clients stay informed about their outstanding balances and due dates, reducing the chances of delayed payments. Setting up automated alerts can save time and reduce manual follow-ups, providing both you and your clients with a clear understanding of when payments are due. With the right system, you can easily configure reminders based on your preferred schedule, ensuring that no payments are missed.

Configuring Reminder Frequency

By setting up automatic payment reminders, you can determine when clients should receive notifications about upcoming or overdue payments. Most platforms allow you to set reminders at different intervals, such as a few days before the due date, on the due date itself, or a few days after the due date has passed.

| Reminder Type | Timing |

|---|---|

| First Reminder | 3 Days Before Due Date |

| Second Reminder | On the Due Date |

| Third Reminder | 5 Days After Due Date |

Personalizing Your Messages

Personalizing reminder messages can help maintain a professional relationship while ensuring that the tone is appropriate for your brand. You can adjust the message’s language, specify payment details, or even add a polite note requesting the timely settlement of outstanding balances. Customizing these messages ensures that clients receive clear, friendly, and professional reminders tailored to your business.

By automating and personalizing your payment reminders, you can improve cash flow management, reduce overdue payments, and maintain positive relationships with your clients.

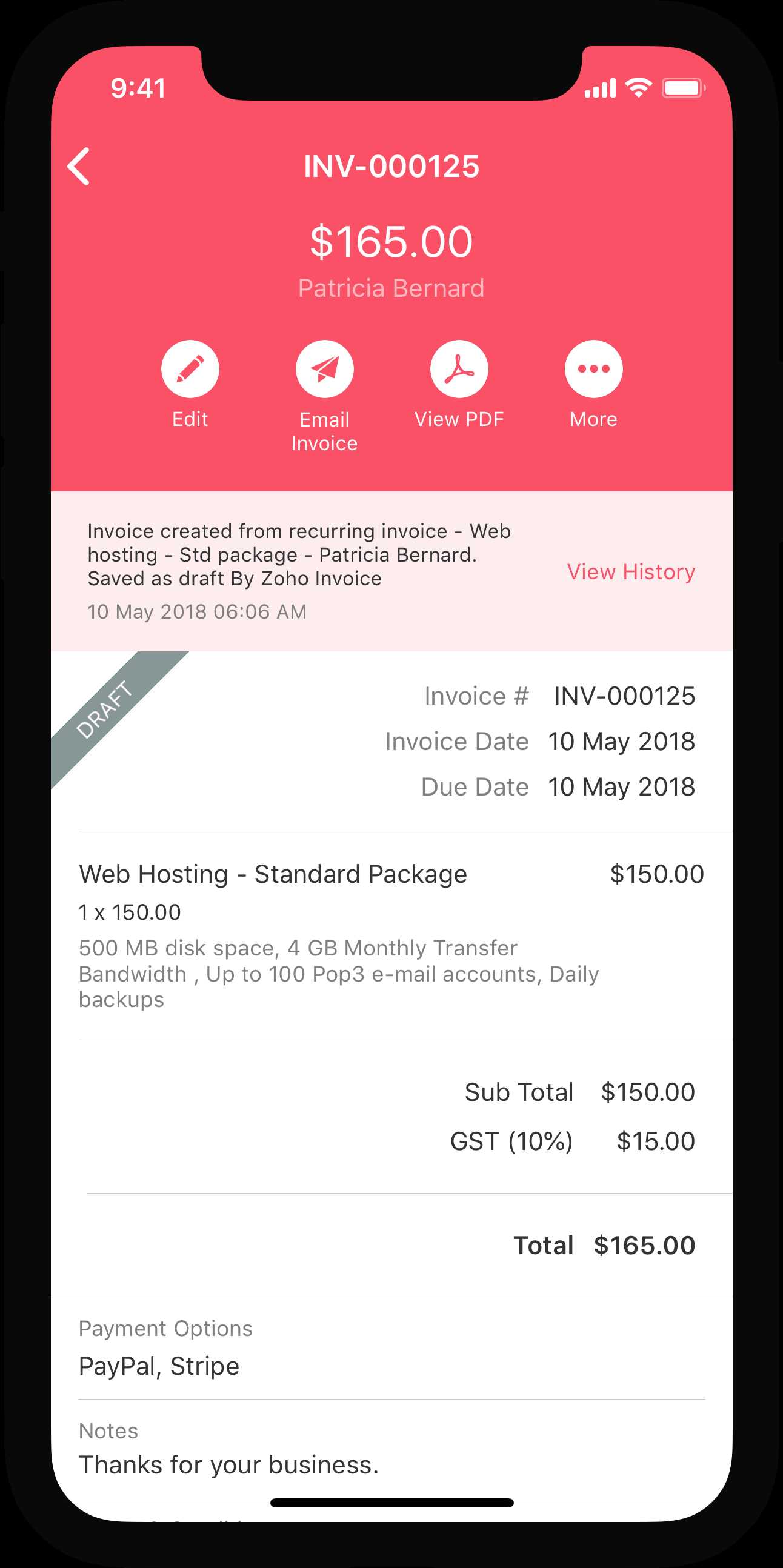

Mobile App for Managing Billing Records

Managing financial documents on the go has become easier with mobile applications designed specifically for business owners and teams. These apps enable you to access and update important records, track payments, and send reminders from anywhere, using only your smartphone or tablet. Whether you’re in the office or on the move, having the ability to manage your financial tasks efficiently can improve productivity and help you stay organized.

Mobile apps for managing financial records offer a range of features that help simplify your workflow:

- Access Anywhere: Manage your financial documents anytime and anywhere, as long as you have an internet connection.

- Track Payments: Monitor payment statuses and receive notifications when a client has paid or when a due date is approaching.

- Send Documents Quickly: Generate and send records to clients directly from your mobile device, reducing the time spent on administrative tasks.

- Customization Options: Personalize your financial documents with branding, fields, and layout adjustments directly through the mobile app.

- Real-Time Syncing: Keep your mobile and desktop platforms in sync, ensuring your information is always up to date.

With a mobile app for managing your financial records, you can stay on top of your business finances, ensuring smooth operations and timely payments, no matter where you are.

Tracking Billing Document Status

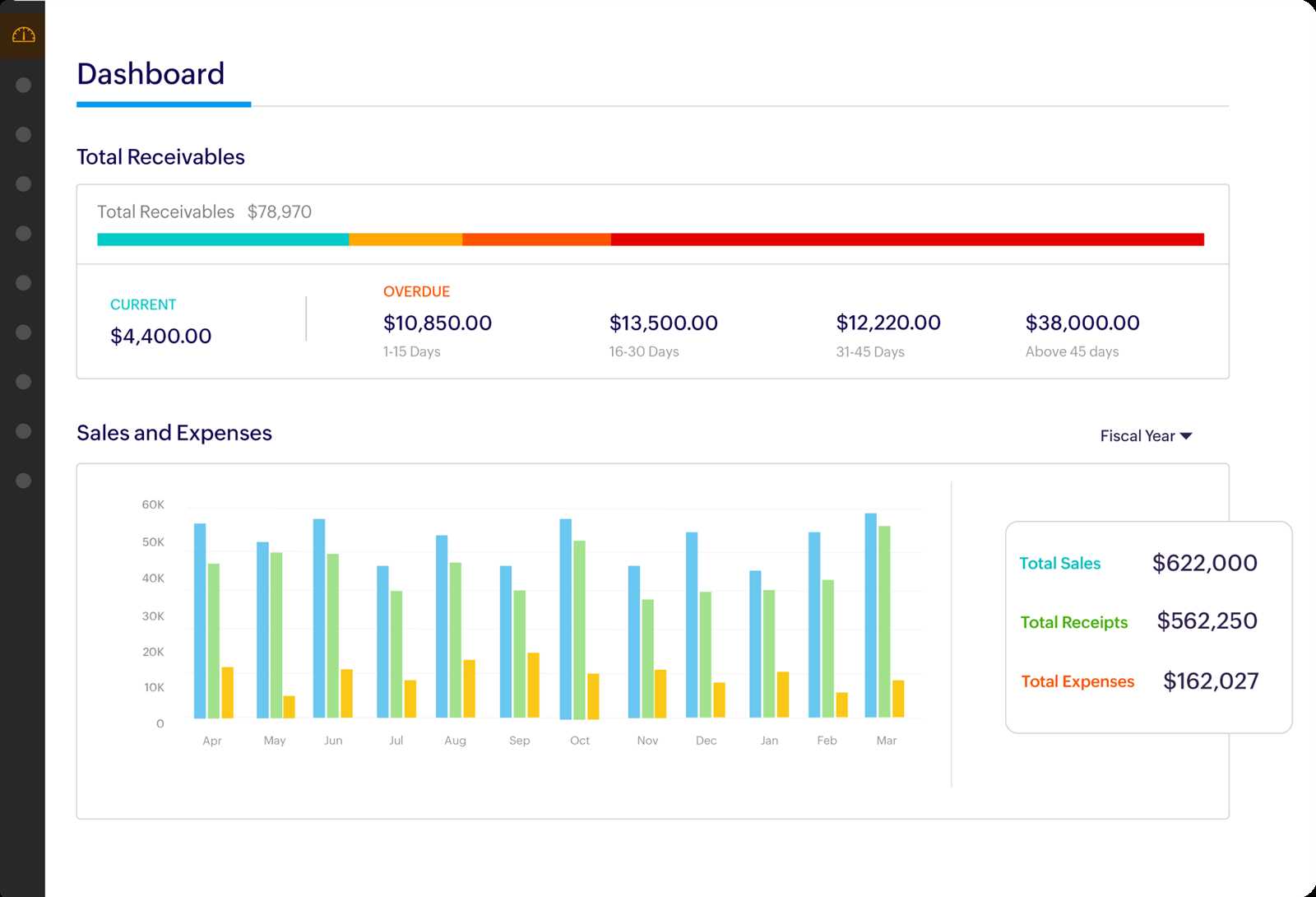

Monitoring the status of payment records is essential for maintaining accurate financials and ensuring that clients fulfill their obligations on time. By tracking the progress of these documents, businesses can identify outstanding payments, follow up promptly, and keep everything organized. A well-structured tracking system enables businesses to stay informed about pending transactions and avoid any potential delays in cash flow.

Checking Payment Status

Most systems offer a simple way to track the status of payment records, allowing you to view whether a document is pending, paid, or overdue. With just a few clicks, you can check real-time updates and receive alerts for any changes to the payment status.

Automated Notifications

Automated notifications make it easy to stay on top of payment statuses. With automated reminders for unpaid or overdue records, businesses can streamline their follow-up process and ensure timely payment settlements. These notifications can be set based on customizable triggers such as due dates or payment confirmations.

Tracking the status of billing documents helps businesses maintain smooth operations and ensures that no payment goes unnoticed. By automating alerts and monitoring progress, you can maintain better control over your finances and avoid unnecessary delays.

Integrating Billing Management with Accounting Software

Integrating billing management systems with accounting software streamlines financial operations by ensuring that all payment records and financial transactions are automatically synchronized. This integration eliminates the need for manual data entry, reducing errors and saving valuable time. By linking these two systems, businesses can achieve a seamless workflow that connects invoicing, payments, and accounting tasks in one unified platform.

Benefits of Integration

Integrating your payment management system with accounting software offers a range of advantages:

- Automated Data Sync: Automatically transfer payment data to your accounting system, ensuring up-to-date financial records.

- Reduced Errors: Minimize the risk of human error by eliminating duplicate data entry between systems.

- Improved Cash Flow Tracking: Track payments and outstanding balances in real time, giving you better control over your finances.

- Time Efficiency: Save time by automating routine accounting tasks, such as reconciling payments and updating financial reports.

How to Set Up the Integration

Setting up the integration between your billing and accounting systems is typically straightforward. Most platforms offer built-in integrations or APIs to link both systems seamlessly. The steps may include:

- Connecting your billing system to your accounting software via a secure integration tool or API.

- Mapping data fields between the two systems, such as customer details, payment amounts, and transaction dates.

- Testing the integration to ensure that data is correctly syncing between both systems.

- Setting up automatic synchronization for ongoing updates.

By integrating your billing management with accounting software, you can enhance the accuracy, efficiency, and transparency of your financial operations, ensuring that everything from payments to taxes is well-organized and up to date.

Best Practices for Billing Document Design

A well-designed payment record not only looks professional but also enhances clarity and ensures that all necessary information is easy to find. When creating a billing document, it’s crucial to balance aesthetics with functionality, making sure that the layout is simple yet comprehensive. Effective design can reduce confusion, help clients understand the charges, and streamline payment processes.

Essential Design Tips

To create clear and effective payment records, follow these best practices:

- Keep It Clean and Simple: Avoid clutter by using ample white space and clear headings to organize information.

- Use Consistent Fonts and Colors: Stick to a few easy-to-read fonts and a consistent color scheme to maintain a professional appearance.

- Ensure Readability: Use large enough font sizes for important details like the amount due and due date, so they are easy to spot.

- Include Clear Payment Instructions: Provide clear and concise instructions for clients on how to complete their payments, including available methods.

Key Information to Include

Each billing document should clearly communicate the necessary details to avoid confusion. Be sure to include the following elements:

- Customer name and contact information

- Document reference number for easy tracking

- A detailed breakdown of services or products provided

- Total amount due, including any taxes or discounts

- Payment terms and due date

- Contact details for customer inquiries

By adhering to these design practices, you ensure that your payment records not only look professional but also convey the essential information clearly, helping your business maintain smooth transactions and positive client relationships.

Billing Solutions for Freelancers and Small Businesses

For freelancers and small business owners, managing payments and maintaining professional documentation is essential for smooth operations. Streamlining financial processes can save time, reduce errors, and ensure timely payments. With the right tools, such as a comprehensive billing system, businesses can create and send detailed records with ease, helping to maintain transparency and foster trust with clients.

Benefits of Using a Billing Solution

Freelancers and small business owners can benefit from an efficient system designed to handle invoicing, payment tracking, and more. Here are some key advantages:

- Easy Customization: Tailor your records to suit your branding with customizable fields and professional design options.

- Automated Reminders: Automatically send payment reminders to clients, reducing the need for manual follow-ups.

- Time-Saving Features: Templates and automation allow users to create documents quickly, minimizing administrative tasks.

- Tax Calculation: Simplify the process of calculating and applying taxes to your records, ensuring accuracy and compliance.

- Integrated Payment Options: Enable clients to pay directly through integrated payment gateways, improving cash flow.

Key Features for Freelancers and Small Businesses

A comprehensive billing solution can significantly enhance the efficiency of financial tasks. Below are some essential features that benefit freelancers and small business owners:

| Feature | Benefit |

|---|---|

| Customizable Branding | Personalize your records with logos, colors, and unique layouts to match your business identity. |

| Recurring Billing | Automate regular payments for clients with recurring billing options, saving time on repeated tasks. |

| Multi-currency Support | Accept payments from clients worldwide with multi-currency support for international transactions. |

| Client Portal | Provide clients with a portal where they can view and manage their payment records, improving customer experience. |

| Detailed Reporting | Access real-time financial reports to track income, expenses, and outstanding payments. |

These features make it easier for freelancers and small businesses to manage financial transactions, ensuring a professional approach and better client relationships. By using a reliable billing system, businesses can focus on growth while maintaining organized and efficient operations.