Home Depot Invoice Template for Easy Billing

Having a reliable and easy-to-use format for billing is essential for anyone who handles transactions regularly. Whether you’re a freelancer, contractor, or business owner, organizing payments efficiently is a key part of managing finances. Using a structured document can ensure accuracy, consistency, and professionalism when dealing with clients.

Pre-designed formats are widely available, offering flexibility and saving time when creating a detailed payment request. These formats can be adapted to meet the specific needs of your business, helping you streamline your operations. They often include necessary fields like dates, amounts, and descriptions, allowing for clear communication.

Utilizing these tools not only simplifies the billing process but also aids in maintaining records for future reference. With a few adjustments, such a document can fit various industries, ensuring both reliability and clarity in each transaction.

Understanding the Importance of Invoice Templates

Effective billing plays a critical role in any business transaction, ensuring that both parties are on the same page regarding the services or goods provided and the payment terms. A standardized document for detailing payments is crucial, as it enhances professionalism, improves accuracy, and simplifies the accounting process. Without a proper structure, errors in billing can lead to misunderstandings, delayed payments, and unnecessary confusion.

Here are some reasons why having a well-structured document format is essential:

- Clarity: A clear and organized structure makes it easy for both the sender and recipient to understand the payment details.

- Consistency: Using the same format for all transactions ensures that your billing system remains uniform and professional.

- Time-saving: Pre-designed documents save valuable time by eliminating the need to create a new billing record from scratch for every transaction.

- Legal Protection: A properly formatted document serves as evidence in case of disputes, protecting both parties.

- Automation: With the right structure, you can automate the process, making it faster and more efficient for repeated tasks.

Incorporating these benefits into your business operations can streamline your workflow, improve communication with clients, and enhance your overall financial management. By using an efficient structure, you ensure that all necessary information is included while maintaining a high level of professionalism and organization in your transactions.

How to Customize a Billing Document

Adapting a pre-designed billing document to suit your specific needs is a simple process that can significantly improve your workflow. Customizing allows you to add personalized details, adjust formatting, and ensure that all necessary fields are present to align with your business model. This flexibility enables you to maintain a professional appearance while accommodating the unique aspects of each transaction.

Follow these steps to personalize your document:

- Modify Header Information: Start by including your business name, logo, and contact details at the top. This makes the document immediately recognizable and establishes your brand.

- Adjust Client Details: Ensure that each recipient’s name, address, and contact information are correctly listed. This helps in avoiding any confusion and ensures that the document reaches the right person.

- Include Specific Service/Product Details: Replace generic descriptions with specific details related to the goods or services provided. Include quantities, unit prices, and any other relevant information that pertains to the transaction.

- Set Payment Terms: Clearly outline the payment terms, including due dates, late fees, and any other conditions. Customizing this section ensures that both parties are clear on expectations.

- Customize Formatting: Adjust fonts, colors, and overall layout to match your brand’s style. A visually appealing document reflects professionalism and can make a positive impact on your clients.

Once you’ve made the necessary adjustments, save the customized document for future use. This allows for faster billing in future transactions, saving you time and reducing the chance for errors.

Key Features of Billing Documents

Effective billing documents include several key elements that ensure clarity and accuracy in financial transactions. These features help both the sender and recipient understand the specifics of the payment and terms, reducing the potential for confusion. A well-structured document is essential for maintaining professional standards and ensuring that all required information is clearly presented.

Essential Information

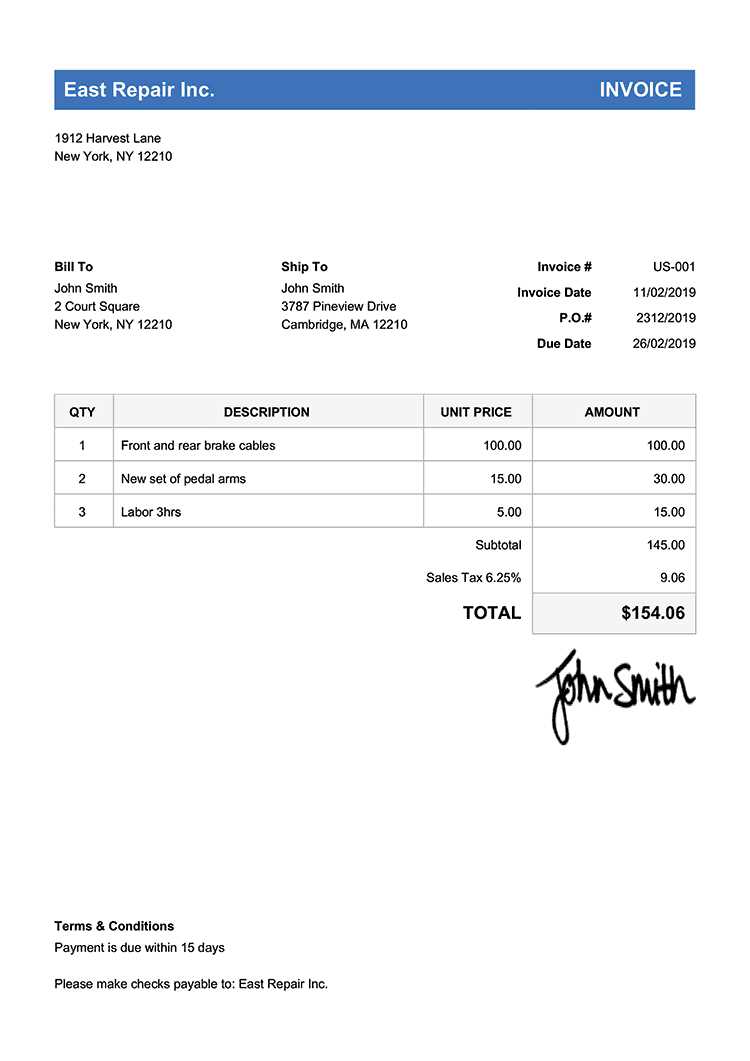

Detailed Payment Breakdown: A comprehensive list of the products or services provided, including quantities, unit prices, and total costs, is crucial. This transparency helps the recipient understand exactly what they are being charged for.

Clear Payment Terms

Due Dates and Late Fees: Including clear payment deadlines and any applicable penalties for overdue payments helps set expectations and ensures that payments are made on time. Clear terms can help avoid misunderstandings and encourage timely transactions.

By incorporating these key features into your financial documents, you ensure both professionalism and efficiency in your billing process, which fosters trust and smooth business operations.

Step-by-Step Guide to Filling Out Billing Documents

Filling out a billing document correctly is essential to ensure that all necessary details are included and that the payment process runs smoothly. Each section of the document serves a specific purpose, from detailing the goods or services provided to setting clear payment terms. Below is a step-by-step guide to help you complete a billing document accurately.

1. Add Business and Client Information

The first step is to include the necessary information for both parties involved in the transaction. This includes your business details and those of the recipient, ensuring that the document reaches the right person.

| Section | Details to Include |

|---|---|

| Your Business | Business name, address, phone number, and email |

| Client Information | Client name, address, phone number, and email |

2. Provide a Detailed List of Products or Services

The next section involves clearly listing the items or services provided. For each item, include the quantity, unit price, and total cost. This section should provide enough detail to prevent any confusion or disputes regarding the charges.

| Item | Quantity | Unit Price | Total Cost |

|---|---|---|---|

| Product A | 2 | $50 | $100 |

| Service B | 1 | $200 | $200 |

Once you’ve filled out these sections, review the document carefully before sending it to ensure all information is accurate and complete.

Common Mistakes to Avoid in Document Creation

When preparing a billing document, small errors can lead to confusion, delays, or even disputes. Ensuring accuracy and completeness is crucial to maintaining professionalism and facilitating smooth transactions. Below are some common pitfalls to watch out for when creating these important records.

1. Missing Contact Information

Failing to include the proper contact details for both parties can lead to confusion and delays. Always ensure that the business and recipient’s name, address, phone number, and email are clearly listed.

2. Incorrect Dates

Dates are vital in a billing document, especially the transaction date and payment due date. Incorrect or missing dates can create confusion and result in late payments. Double-check that all dates are accurate and reflect the terms agreed upon.

3. Overlooking Payment Terms

Not specifying payment terms or omitting important details like late fees or discounts can lead to misunderstandings. Clearly outline when payments are due and any penalties for delays. This ensures both parties are aligned on expectations.

4. Lack of Detailed Descriptions

Using vague descriptions for products or services can cause confusion. Each item listed should have a clear and precise explanation, including quantities, unit prices, and the total cost for transparency.

By avoiding these common mistakes, you can ensure that your documents are accurate, clear, and professional, making the billing process more efficient and minimizing potential conflicts.

Benefits of Using Billing Formats

Utilizing pre-designed billing formats brings several advantages to businesses and individuals alike. These documents streamline the payment process, making transactions more efficient, professional, and error-free. Whether you’re handling one-off projects or ongoing client relationships, the use of such formats ensures consistency and clarity in your financial dealings.

Time Efficiency

Speed Up the Process: By using a ready-made document, you save time on creating a new one from scratch for each transaction. This allows you to focus more on other aspects of your business, enhancing overall productivity.

Professional Appearance

Enhance Credibility: A well-organized document presents a polished image to clients, which can build trust and strengthen professional relationships. The consistency in format reflects attention to detail and commitment to high standards.

In addition to saving time and improving your professional image, using these formats helps to reduce errors, maintain accurate records, and ensure that all necessary information is included in each transaction.

How to Save Time with Pre-Designed Formats

Using pre-made formats for your billing documents can drastically reduce the time spent on administrative tasks. Instead of creating a new document from scratch every time, you can quickly fill in the necessary details, streamlining the entire process. This time-saving approach allows you to focus on core business activities, improving overall efficiency.

Automating Repetitive Tasks

Fill-in-the-Blanks: With a standardized format, the only adjustments required are updating the specific details for each transaction. This eliminates the need to start from scratch for every client, saving time with each new billing cycle.

Consistency in Format

Standardized Layout: By using the same structure for every transaction, you create a consistent process that can be completed more efficiently. This consistency helps you quickly locate the fields that need updating and avoids unnecessary formatting work.

| Step | Time Saved |

|---|---|

| Use pre-filled fields | Save time on data entry |

| Standardize layout and design | Reduce formatting time |

| Automate calculations (if applicable) | Eliminate manual math |

By incorporating pre-designed formats, you streamline your workflow, reduce repetitive tasks, and significantly cut down on the time spent creating each document, making your business operations more efficient.

What Information Should Be Included

To ensure a smooth and transparent transaction, a billing document should contain specific details that both parties need for clarity and proper record-keeping. By including the necessary information, you ensure that the recipient knows exactly what they are being charged for, and you make it easier to track payments and handle any discrepancies that may arise.

Here’s a list of essential information to include:

- Your Business Details: Include your company name, address, phone number, and email for contact purposes.

- Recipient Information: Clearly state the name, address, and contact details of the person or company receiving the goods or services.

- Unique Document Number: Assign a unique reference number to each document for tracking and record-keeping purposes.

- Transaction Date: Mention the date when the goods or services were provided, helping both parties keep track of timing.

- Payment Due Date: Clearly state the due date for payment, as well as any penalties or late fees that may apply if the payment is delayed.

- Itemized List of Products/Services: Provide a clear breakdown of the goods or services provided, including quantities, unit prices, and total amounts.

- Subtotal and Total Amount: Include both the subtotal (before taxes or discounts) and the final amount due, including any applicable taxes or discounts.

- Payment Methods Accepted: Specify the ways in which the recipient can make payment, such as credit card, bank transfer, or online payment methods.

Including all these details helps ensure that both parties are fully informed about the transaction, streamlines the payment process, and prevents potential misunderstandings.

Best Practices for Professional Billing Documents

Creating a polished and professional billing document is essential for maintaining trust and ensuring smooth business operations. Following best practices ensures clarity, accuracy, and consistency, while also strengthening your company’s image. Here are some effective strategies to consider when preparing such documents.

1. Maintain Clear and Organized Layouts

Structure and readability: A well-structured layout not only looks professional but also makes it easier for both parties to quickly review the document. Make sure to use a clean, consistent design, with headings and sections clearly labeled for easy navigation.

- Use a simple, professional font for readability.

- Organize information in sections (e.g., business details, transaction summary, payment information).

- Ensure there is enough white space between sections to avoid clutter.

2. Include All Relevant Information

Comprehensive content: Ensure the document contains all essential details, from business contact information to itemized descriptions of goods or services. Omitting key information can lead to confusion or disputes down the road.

- Include your business and recipient’s contact details.

- Provide clear descriptions of the products or services delivered.

- List the payment terms and due dates explicitly.

3. Use Consistent Formatting

Brand consistency: Maintaining consistent formatting across all billing documents strengthens your business’s identity and ensures that your documents are instantly recognizable. This includes using the same font, colors, and layout styles for every transaction.

- Use a consistent color scheme that aligns with your business brand.

- Standardize headings and subheadings to create uniformity.

- Ensure that all numerical data (e.g., totals, prices) is formatted consistently.

By adhering to these best practices, you’ll be able to produce professional and effective billing documents that foster trust and clarity, while also enhancing the overall customer experience.

How to Use Pre-Designed Formats for Multiple Projects

Using pre-designed formats for different projects offers a consistent and efficient way to manage multiple tasks simultaneously. These ready-made documents provide a standardized structure, allowing you to quickly adapt them for various projects without needing to start from scratch each time. This method saves both time and effort, while ensuring that all essential details are always included.

Here’s how to use pre-designed formats for managing different projects:

- Customize the Document for Each Project: Modify the template by adjusting client names, project descriptions, and specific details for each new task. This helps maintain consistency while allowing flexibility to accommodate varying needs.

- Standardize Key Information: Use the same basic structure across all projects, including fields like payment terms, itemized services, and contact information. This reduces the risk of missing essential data.

- Maintain Project-Specific Sections: While the overall layout can remain consistent, add or remove sections based on the unique requirements of each project, such as different pricing models or specific terms and conditions.

- Keep Track of Multiple Documents: Create a naming system or numbering structure that helps you track different documents related to various projects, making it easy to retrieve them when necessary.

By leveraging pre-designed formats across various projects, you not only ensure consistency but also streamline the process, saving valuable time and resources that can be better allocated to other important tasks.

Understanding Payment Terms in Billing Documents

Payment terms are a crucial element of any financial document, as they define when and how payment is expected for goods or services rendered. By clearly outlining these terms, both the provider and the client can avoid misunderstandings, ensuring a smooth transaction process. These terms help manage cash flow, set expectations, and can even influence the timeliness of payments.

Here are some common payment terms you may encounter:

| Term | Description |

|---|---|

| Net 30 | Payment is due 30 days after the date of the document. |

| Due on Receipt | Payment is required immediately upon receiving the document. |

| Net 60 | Payment is due 60 days after the document date. |

| Prepayment | Full payment must be made before any services or goods are delivered. |

| Installment Payments | Payments are split into multiple smaller payments over a set period. |

| Section | Details |

|---|---|

| Header | Company name, logo, contact details |

| Client Information | Client name, address, contact information |

| Itemized List | Description of products or services, quantity, unit price, total |

| Total Amount | Subtotal, tax, total due |

| Footer | Payment terms, due date, contact info |

Maintaining consistency in document formats not only improves clarity and efficiency but also ensures that your billing processes are organized and professional, making it easier for both you and your clients to stay on top of payments and obligations.

How to Automate Billing Document Creation

Automating the creation of billing documents can save time, reduce human error, and ensure consistency. By utilizing software tools or systems designed for this task, businesses can streamline the process of generating accurate and professional documents. Automation helps eliminate the repetitive tasks of manually entering details, which can be tedious and prone to mistakes. Here’s how to implement automation effectively.

Steps to Automate Document Creation

Follow these steps to set up an automated system for creating your billing documents:

- Choose the Right Software: Select software or platforms that can automatically generate documents based on predefined parameters such as customer information, item details, and payment terms. Popular tools include accounting software, CRM platforms, and specialized document generation tools.

- Set Up Templates: Customize templates within your chosen software. These templates will act as the blueprint for your documents, ensuring uniformity in design and content.

- Integrate Data Sources: Link your automation software with other systems you use, such as your CRM, order management system, or inventory software. This integration will automatically pull the required data (e.g., customer name, product details) into your billing documents.

- Define Triggers and Schedules: Set up triggers for when billing documents should be generated. These triggers can include completing a project, confirming a sale, or reaching a certain date. You can also schedule automatic document creation at regular intervals (e.g., weekly or monthly).

Benefits of Automating Billing Documents

Automating the process of generating documents brings several advantages:

- Improved Efficiency: Automation significantly speeds up the creation process, allowing you to generate documents in seconds instead of hours.

- Reduced Errors: With automated systems pulling data directly from your integrated sources, you minimize the chances of human error in pricing, dates, and customer details.

- Consistency: Automation ensures every document follows the same format and structure, maintaining professionalism and clarity.

- Time Savings: By eliminating manual document creation, you free up valuable time to focus on other important tasks in your business.

By implementing automation, businesses can not only increase their operational efficiency but also improve the accuracy and timeliness of their billing processes, leading to better customer satisfaction and smoother financial management.

Top Resources for Free Billing Document Templates

For businesses looking to streamline their billing processes, accessing free resources for creating professional documents is essential. Many platforms offer customizable templates that can be used for a variety of purposes, from service-based businesses to retail transactions. These free resources can save time, reduce errors, and ensure consistency across all generated documents. Below are some top options for downloading or using free billing documents.

Best Platforms for Free Document Templates

- Microsoft Office Templates: Microsoft offers a wide range of customizable templates through Word and Excel. These templates are easy to modify, and you can personalize them with your company logo, payment terms, and itemized lists.

- Google Docs: Google Docs provides free, easy-to-use templates that can be accessed and edited directly in the cloud. This allows for real-time collaboration and quick updates to any document, making it a great option for teams.

- Canva: Canva is a design tool that offers free and paid templates for all types of documents, including billing formats. With its user-friendly drag-and-drop interface, you can create personalized, visually appealing documents.

- Invoice Generator: A free online tool that allows you to fill in the necessary information and instantly generate a billing document. It offers a variety of templates and allows you to download them in multiple formats.

Why Use These Free Resources?

- Customization: These platforms provide a variety of templates that can be tailored to suit your business needs, allowing you to add your branding, adjust item details, and set payment terms.

- Cost-effective: Accessing free resources helps you avoid paying for specialized software or services, which can be beneficial for small businesses and startups operating on a budget.

- Efficiency: Using ready-made templates saves you time, allowing you to quickly create professional documents without having to design from scratch.

By utilizing these free resources, businesses can ensure that their billing documents are not only accurate but also visually appealing and easy to understand, which can improve client satisfaction and streamline administrative work.