How to Create a Template for Rental Invoices

Efficient billing is a crucial aspect of managing a leasing business. Ensuring clear and professional documentation helps build trust with clients and maintain smooth financial transactions. Creating an organized record of payments, terms, and services is essential for any business that rents out goods or properties.

Creating accurate and customizable documents for each transaction can save time, reduce errors, and improve communication. Whether you are renting out equipment, properties, or any other items, having a reliable method to structure payment details is key. These records also serve as a legal safeguard in case of disputes.

In this guide, you’ll learn how to design and manage well-structured documents that meet both your business needs and legal requirements. From including necessary information to ensuring clarity, this approach helps businesses maintain professional standards while simplifying administrative tasks.

Understanding Rental Invoice Templates

Effective financial documentation plays a significant role in business operations. A well-structured document used for tracking payments ensures both parties are clear on the terms of their agreement. This type of document serves as a detailed record of the transaction and is essential for maintaining transparency and professionalism.

Key Features of a Comprehensive Document

A strong document should include specific elements to make it both useful and legally valid. The following are essential components:

- Contact Information – Clear details about both the service provider and the client.

- Description of Services – Detailed information about what is being provided, including duration and quantities.

- Payment Terms – Clear explanation of the payment schedule, including due dates and late fees.

- Amount Due – The total cost associated with the goods or services, broken down if necessary.

Why Structure Matters

The format of this document impacts its usability and professionalism. A disorganized record can lead to confusion, delays, or even disputes. Having a consistent structure makes it easier to create new records while also ensuring that nothing important is omitted.

By carefully planning out each detail, businesses can ensure they create documents that meet both operational needs and regulatory requirements.

Benefits of Using a Rental Invoice

Proper documentation for financial transactions is vital for maintaining clear communication and ensuring smooth operations. By utilizing structured records to track charges, both businesses and clients benefit from improved transparency and accountability. Such records not only help manage payments but also provide a reliable reference for future transactions.

Enhanced Professionalism

Maintaining a consistent format for each transaction reinforces a business’s professional image. When clients receive well-organized documents, it builds confidence in the service provider. A clear and polished document helps convey a sense of reliability, which is essential for retaining customers and attracting new ones.

Improved Financial Tracking

Having a system for documenting financial transactions allows businesses to easily track incoming and outgoing payments. Regularly updated records simplify accounting tasks, making it easier to monitor cash flow, manage budgets, and prepare for tax season. This also helps in identifying overdue payments and sending timely reminders to clients.

Additionally, structured records provide a clear history of transactions, which is helpful for resolving any disputes or discrepancies that may arise in the future.

Key Elements of a Rental Invoice

Creating clear and comprehensive financial documents is essential for maintaining smooth transactions. Each document should contain specific details to ensure both parties understand the terms and the total amount due. A properly structured record can help avoid confusion and disputes, ensuring all aspects of the agreement are covered.

Essential Information for Every Record

To create a complete and professional document, certain components must always be included:

- Contact Information – Names, addresses, and contact details of both the service provider and the client.

- Transaction Date – The date when the agreement was made or when services were rendered.

- Description of Services – A clear breakdown of what was provided, including duration, quantities, or any other relevant details.

- Amount Due – The total charge for the services, clearly stated and broken down if necessary.

- Payment Terms – Information about when payment is due and any applicable late fees or discounts.

- Unique Reference Number – A specific number or code that identifies the transaction, useful for future reference or tracking.

Why These Elements Matter

Each of these components ensures clarity and provides a legal reference in case of disputes. Accurate documentation reduces misunderstandings and helps businesses manage their financial operations effectively. When each detail is outlined clearly, it benefits both the client and the provider, fostering trust and smooth communication.

How to Customize Rental Invoice Templates

Adapting financial records to match the specific needs of your business is essential for creating a seamless process. Personalizing these documents allows you to reflect your brand and ensure they include all necessary details relevant to each transaction. By adjusting the format and content, you can make these records more efficient and easier to manage.

Steps to Personalize Financial Documents

To tailor these records effectively, follow these key steps:

- Choose a Flexible Format – Select a layout that can be easily modified to include various types of information, whether you’re billing for services or leasing equipment.

- Insert Your Branding – Add your company logo, color scheme, and contact details to make the document reflect your business identity.

- Adjust Sections Based on Needs – Modify the document’s sections to suit different scenarios, such as adding extra fields for payment terms or specific product details.

- Ensure Legibility – Keep the layout simple and easy to read, ensuring important information like due dates, amounts, and contact details stand out.

Tools for Customization

Many software tools and platforms allow for easy adjustments to financial documents. Whether using word processors or specialized accounting software, these tools typically offer templates that can be customized with your unique business requirements. Some platforms even allow automatic updates based on the client’s details or previous agreements, saving time and ensuring consistency.

Why Accuracy is Crucial in Invoices

Ensuring precision in financial documentation is fundamental for smooth business operations. Accurate records not only prevent errors in billing but also foster trust between service providers and clients. Small discrepancies can lead to misunderstandings, delayed payments, or even legal disputes, making accuracy a key factor in maintaining positive business relationships.

Impact on Business Reputation

Inaccurate documents can damage a company’s credibility. When clients notice errors in charges or payment terms, it can lead them to question the professionalism of the business. A well-detailed and accurate record reflects reliability and builds client confidence, helping to secure long-term partnerships.

Financial and Legal Risks

Incorrect details in a financial document can result in financial losses or legal issues. Overcharging or undercharging can create unnecessary complications, while missing or incorrect terms may lead to contract disputes. By ensuring every figure, date, and detail is accurate, businesses can avoid costly mistakes and reduce the likelihood of costly legal or financial repercussions.

Common Mistakes to Avoid in Rental Billing

When managing billing for leased items or services, it’s easy to overlook small details that can lead to larger issues down the road. Even minor errors can result in payment delays, client dissatisfaction, or financial discrepancies. By understanding and avoiding these common mistakes, businesses can ensure smooth transactions and maintain strong client relationships.

Failure to Include Key Information

Omitting essential details, such as payment terms, service descriptions, or amounts due, can lead to confusion and disputes. Always make sure that the document clearly outlines:

- Service provided – A detailed description of what was rented or leased, including duration and quantities.

- Payment terms – Clearly defined due dates and any additional charges, like late fees.

- Contact information – Both parties’ contact details for easy communication if needed.

Inconsistent or Incorrect Amounts

One of the most significant mistakes in billing is inaccurate calculations. This could include miscalculating the total, forgetting to include taxes, or incorrectly applying discounts. Double-check all figures to ensure accuracy and avoid potential discrepancies. Overcharging or undercharging can damage trust with clients and create complications in financial tracking.

Ignoring Legal or Regulatory Requirements

Every business must comply with local laws regarding billing practices. Failure to account for legal obligations, such as tax regulations or required contract terms, can lead to penalties or disputes. It is important to stay informed about the legal requirements that apply to your business and ensure your documents reflect these rules.

Choosing the Right Template for Your Business

Selecting the appropriate document structure for your business is an important step in streamlining your billing process. The right format ensures that all necessary details are included, reduces errors, and enhances the overall professionalism of your financial records. A well-suited structure can also save time and make it easier to track transactions consistently.

When choosing a format, consider factors such as the complexity of your services, the volume of transactions, and the level of customization required. A simple structure may be sufficient for small businesses with basic transactions, while larger operations or those offering varied services may need a more detailed and flexible layout.

Additionally, think about whether you need to integrate the document with accounting software or manage recurring billing. The right structure will meet your specific operational needs while ensuring that all essential details, such as payment terms, amounts due, and service descriptions, are clearly outlined.

Best Practices for Rental Invoice Design

Designing a clear and professional document for tracking payments and services is crucial for maintaining smooth business operations. A well-structured and visually appealing record not only reflects your brand’s professionalism but also enhances clarity for both the client and the service provider. By following best practices, you can ensure that all necessary details are easily accessible, reducing the risk of misunderstandings and delays.

Key Design Elements to Consider

To create an effective and professional document, consider including the following design features:

- Clear Branding – Incorporate your company logo, business name, and contact information in a prominent location to establish trust and recognition.

- Consistent Layout – Use a logical structure, with sections clearly marked for easy navigation. Keep the layout consistent across all records to simplify the process for both your team and clients.

- Readable Fonts – Use professional, legible fonts for all text. Avoid overly decorative fonts that may reduce readability.

- Highlight Key Information – Ensure important details like amounts due, payment dates, and services provided stand out by using bold text, borders, or color contrast.

How to Maintain Clarity and Consistency

To maintain clarity, make sure to leave enough white space around key sections to prevent the document from feeling cluttered. A clean design with sufficient spacing between sections ensures that the information is easy to digest. Additionally, consistency in font choices, color schemes, and section headers across all documents will create a cohesive and professional look.

Setting Payment Terms on Rental Invoices

Establishing clear and straightforward payment terms is essential for ensuring timely payments and maintaining smooth business transactions. By clearly communicating when and how payments should be made, both parties can avoid confusion and potential disputes. Whether it involves setting deadlines, specifying accepted payment methods, or outlining penalties for late payments, having well-defined terms helps create a transparent and professional relationship.

Essential Payment Conditions to Include

There are several key aspects to consider when setting payment terms:

- Due Date – Clearly specify the date by which the payment must be made. This helps manage expectations and encourages timely settlement of debts.

- Accepted Payment Methods – List the payment options you accept, such as credit cards, bank transfers, or checks. This ensures that both parties know how the transaction will be processed.

- Late Payment Penalties – Specify any late fees or interest that will be applied if payment is not made on time. This can serve as an incentive for clients to pay promptly.

- Discounts for Early Payment – Offering discounts for early payments can encourage quicker transactions, benefiting both your cash flow and the client.

Why Payment Terms Matter

Clearly stated payment terms help prevent misunderstandings and ensure that both parties are on the same page regarding financial expectations. By outlining due dates, fees, and accepted payment methods, businesses can reduce the risk of delays and encourage more efficient financial operations. Well-established terms also demonstrate professionalism, strengthening relationships with clients and promoting trust.

How to Include Taxes in Your Invoice

Including taxes in financial records is an essential aspect of ensuring compliance with local tax laws and providing transparency to clients. By clearly outlining the applicable tax rates and amounts, businesses can avoid confusion and guarantee that both parties understand the final cost of the transaction. Properly displaying taxes also helps maintain accuracy in financial tracking and reporting.

Understanding Tax Rates and Calculations

Before adding taxes to any financial document, it’s important to understand the tax rate that applies to the transaction. This rate may vary depending on factors such as location, type of service, and the client’s tax status. Here’s how to include taxes properly:

- Determine the applicable tax rate – Research the tax laws relevant to your region or industry. This may include sales tax, VAT, or other specific charges.

- Calculate the tax amount – Multiply the applicable rate by the total amount of the services provided. Ensure you are charging the correct amount based on local tax regulations.

- Show taxes clearly – Display the tax amount separately from the base price. This helps your client see exactly what they are being charged and why.

Why Transparency Matters

Being transparent about taxes not only helps in maintaining compliance but also builds trust with your clients. Clear communication of taxes avoids disputes and surprises when it comes time to settle the payment. It ensures that clients understand the breakdown of charges and can easily confirm the legitimacy of the transaction.

Automating Rental Invoice Generation

Automating the process of creating billing documents can significantly improve efficiency, reduce human error, and streamline your business operations. By using software or tools that generate these documents automatically, you can save time and ensure that every transaction is recorded accurately without the need for manual input. This process is especially valuable for businesses with recurring billing or a high volume of transactions.

Automation allows businesses to set up templates with predefined fields, such as customer details, services provided, payment terms, and tax calculations. Once set up, the system can automatically populate these fields based on the transaction data, producing a finalized document in just a few clicks.

Benefits of Automation

- Increased Efficiency – Automating the generation of these documents speeds up the process, allowing businesses to handle more transactions in less time.

- Consistency and Accuracy – Automation eliminates the risk of human error, ensuring that every record is generated correctly with the appropriate details, such as amounts, dates, and client information.

- Improved Client Experience – Clients receive their billing documents promptly and in a professional format, improving communication and customer satisfaction.

How to Implement Automation

To automate the creation of billing documents, businesses can use software solutions that integrate with their accounting or customer management systems. Many platforms offer customizable templates that automatically fill in the necessary information. It’s essential to choose a tool that aligns with your business needs, such as the frequency of transactions and the complexity of the services provided.

Tracking Payments with Rental Invoices

Monitoring payments is crucial for maintaining a healthy cash flow and ensuring that financial records are accurate. By keeping track of payments related to services or products provided, businesses can identify outstanding balances, prevent missed payments, and ensure that clients are meeting their financial obligations on time. This process is particularly important for managing long-term agreements or recurring transactions.

To effectively track payments, it’s important to have a clear system in place for recording the status of each transaction. This includes noting when payments are made, partial payments, and overdue amounts, as well as setting up reminders for follow-up actions when necessary.

Best Practices for Tracking Payments

- Maintain a detailed payment log – Keep a record of each transaction, including payment dates, amounts, and any relevant notes. This helps with both tracking and reporting.

- Use software for automated updates – Many accounting and billing platforms can automatically update payment statuses and generate reminders for overdue amounts, making the process more efficient.

- Set clear payment deadlines – Include payment due dates on all financial documents, making it easy for both parties to know when the payment is expected.

- Regularly follow up on overdue payments – If a payment is missed, proactively follow up with clients using automated systems or manual reminders to resolve the issue quickly.

Why Consistent Tracking is Essential

By consistently monitoring payments, businesses can avoid cash flow issues and keep operations running smoothly. Having a clear record of outstanding amounts and payment history allows for quick identification of any potential issues, enabling proactive management of financial relationships and reducing the likelihood of disputes.

Handling Late Payments and Fees

Late payments can be a significant issue for businesses, affecting cash flow and potentially leading to financial strain. To address this challenge, it’s important to establish clear terms and enforce penalties for overdue payments. Handling late fees with professionalism and consistency ensures that clients understand the importance of timely payments while maintaining a strong business relationship.

Incorporating late fees into your billing process can act as both a deterrent and a reminder for clients to meet their payment obligations. However, it’s crucial to clearly communicate these terms upfront, so clients are aware of the consequences of missing deadlines.

Steps for Managing Late Payments

- Define clear payment terms – Ensure your clients know the expected payment due date and the penalty for missing it. Terms should include the grace period, the interest rate for late payments, and when penalties will apply.

- Send reminders – If a payment is overdue, send a polite reminder that includes details about the amount due, any applicable late fees, and the new payment deadline.

- Apply late fees consistently – Stick to your terms and apply penalties when necessary. Consistency helps to reinforce the importance of meeting payment deadlines.

- Offer flexible payment options – Consider providing payment plans or alternate methods for clients who may be struggling to meet the payment deadlines but are otherwise reliable.

Communicating Late Fees Effectively

When implementing late fees, clear communication is key. It’s important to inform clients of the penalties upfront and remind them of these terms before the due date. If a payment becomes overdue, a polite but firm follow-up is essential to ensure clients are aware of the situation and the potential impact on their account.

Legal Considerations for Rental Invoices

When managing financial transactions, it’s crucial to understand the legal aspects that govern the creation and use of billing documents. These documents not only serve as a record of the transaction but also protect both parties involved by setting clear terms and conditions. Ensuring that your billing practices align with local laws and regulations can prevent disputes and ensure that payments are legally enforceable.

Legal considerations can include contract terms, tax regulations, and data protection laws. By following the proper procedures and including necessary legal clauses, businesses can avoid legal complications and provide a clear framework for their financial agreements. It’s important to stay informed about the legal requirements in your jurisdiction to ensure compliance and reduce risks associated with non-payment or misunderstandings.

Creating Recurring Rental Invoices

For businesses with clients who make regular payments, automating billing can save time and reduce errors. Recurring billing allows businesses to automatically generate and send financial documents at set intervals, ensuring timely payments without the need for manual processing each time. This approach is commonly used for subscription-based services or ongoing agreements where the terms remain consistent over a specified period.

Setting up recurring payments involves creating a structure where charges are automatically calculated and billed based on a defined schedule. This can include monthly, quarterly, or annual cycles, depending on the nature of the service provided. The key to effective recurring billing is ensuring that the payment terms, amounts, and frequency are clearly outlined in advance.

Setting Up Recurring Billing

To implement recurring charges successfully, businesses need to define the frequency and amount of each payment. Using automated tools can simplify the process, ensuring that clients are billed consistently and accurately. Below is an example of how a simple recurring payment schedule might look:

| Service | Amount | Frequency | Start Date | Next Payment |

|---|---|---|---|---|

| Equipment Lease | $250 | Monthly | 01/01/2024 | 01/02/2024 |

| Storage Space | $500 | Quarterly | 01/01/2024 | 01/04/2024 |

Benefits of Recurring Billing

Recurring billing offers several benefits to businesses, including:

- Consistency – Regular billing cycles ensure a predictable cash flow for the business.

- Efficiency – Automating the process reduces administrative work and human error.

- Convenience – Clients appreciate the ease of automatic payments, ensuring they don’t miss any due dates.

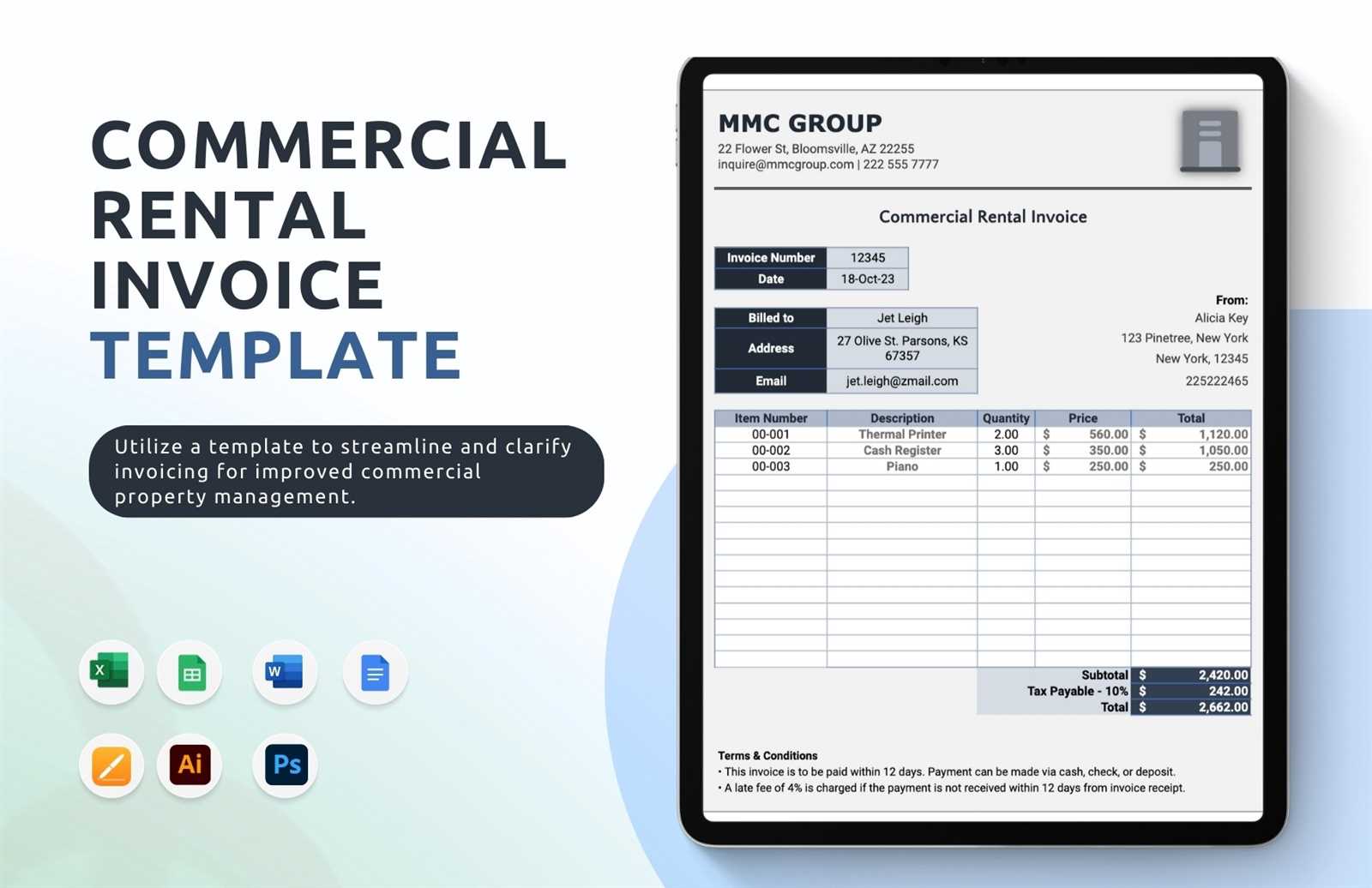

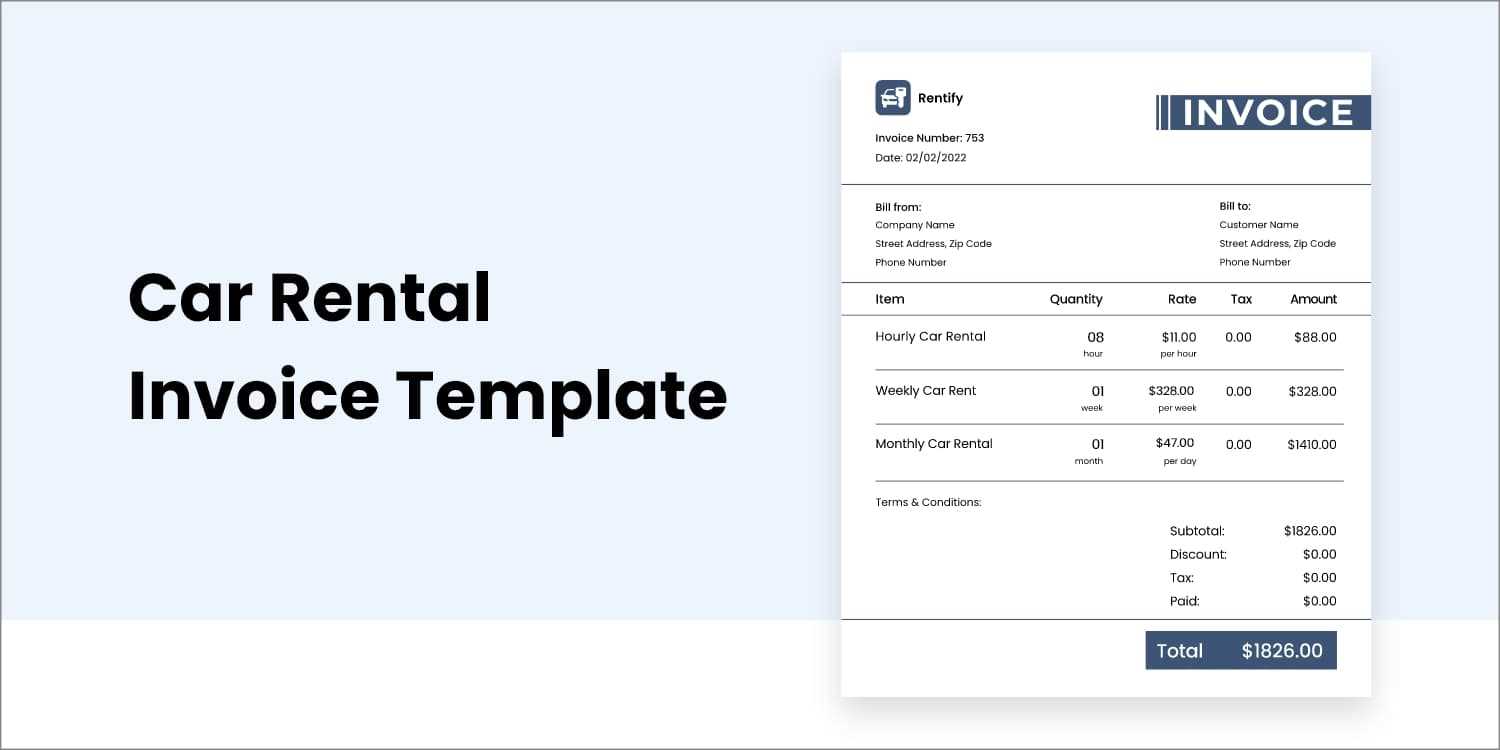

Examples of Rental Invoice Templates

To streamline the process of managing financial transactions, businesses often utilize structured documents to itemize services or goods provided, the payment terms, and any additional details necessary for clarity. These documents serve as formal records that both the provider and the client can reference. Below are examples of common formats used for such documents, each tailored for different types of agreements or services.

Depending on the business model, the format and content of these documents may vary, but they typically include essential details such as itemized charges, dates, and payment terms. Below are a few examples that businesses can customize to suit their needs:

| Service | Charge | Quantity | Unit Price | Total Amount |

|---|---|---|---|---|

| Equipment Lease | Monthly Payment | 1 | $100 | $100 |

| Service Fee | One-time Fee | 1 | $50 | $50 |

| Total | $150 | |||

In this example, a basic service agreement is shown, where each service is broken down into charges and quantities. This format is ideal for businesses that offer one-time services or periodic agreements with a clear breakdown of what the client is paying for. The table simplifies the calculation and ensures transparency for both parties involved.

How to Send Rental Invoices Professionally

Sending a formal document for services provided is a key part of maintaining professionalism in business transactions. It not only helps you get paid on time but also strengthens your brand reputation. To ensure that your communication is effective and efficient, there are several best practices to follow when delivering these financial records to clients.

Steps to Send a Professional Billing Document

- Personalize Your Communication: Always address the recipient by name and reference the services or goods they received. This adds a personal touch and ensures clarity.

- Choose the Right Delivery Method: Use professional channels like email or a business platform to send your document. Ensure that the format is easy to open, such as a PDF file, to avoid any compatibility issues.

- Provide Clear Instructions for Payment: State the payment terms clearly, including the due date, acceptable payment methods, and any late fees for overdue payments.

- Follow Up When Necessary: If the payment is not made by the due date, send a polite reminder to ensure timely settlement. Keep your tone friendly and professional.

Tips for Ensuring Professionalism

- Double-check the Details: Before sending the document, verify that all the details, including amounts and dates, are accurate. This minimizes confusion and prevents disputes later.

- Maintain Consistency: Use the same format and language every time you send a document to create a cohesive, professional image.

- Keep It Simple: Avoid cluttering your communication with excessive information. Stick to the essentials that your client needs to know for the payment process.

By following these best practices, you can ensure that each transaction is handled professionally and efficiently, fostering trust and encouraging prompt payments.