Effective Payment Invoice Email Template for Professional Billing

In business, clear and effective communication is crucial, especially when it comes to financial transactions. Sending professional documents to request payment is an essential part of maintaining a good relationship with clients and ensuring smooth operations. However, crafting these documents from scratch every time can be time-consuming and prone to errors.

Using a well-structured approach for these communications can significantly improve efficiency and reduce misunderstandings. A well-crafted message not only conveys the necessary details but also reflects the professionalism of your business. Having a standardized method allows you to save time and maintain consistency across all client interactions.

By focusing on clarity, brevity, and the right tone, businesses can easily manage outstanding balances while ensuring their clients feel valued and informed. A reliable system for these requests helps both parties stay on track and ensures a smooth transaction process every time.

Why You Need a Payment Invoice Email Template

Consistency and efficiency are key when managing financial communications with clients. Using a structured approach for requesting payments not only saves time but also helps maintain a professional image. Whether you are a small business or a large enterprise, having a predefined format to send reminders and requests ensures that nothing is missed and that all necessary information is communicated clearly.

Time Efficiency and Streamlined Processes

Having a ready-to-use document for payment requests allows you to focus on your core business operations instead of spending time drafting messages from scratch. It eliminates the need to search for the right format each time, streamlining your workflow. A quick, consistent process helps reduce delays and keeps your business operations running smoothly.

Improved Professionalism and Clarity

By using a structured format, you create a consistent and professional image. Clients are more likely to respond positively to well-organized, clear messages that leave no room for confusion. Consistency in your communications not only reflects positively on your brand but also ensures clients have all the necessary details to complete the transaction promptly.

How to Create an Effective Template

Creating an efficient document for requesting payment involves careful planning and attention to detail. The goal is to ensure all necessary information is clearly presented while maintaining a professional tone. A well-designed structure minimizes confusion and helps the recipient easily understand the purpose of the message, speeding up the payment process.

Include Essential Information

To ensure your request is clear, make sure to include all relevant details such as the total amount due, due date, and any applicable payment instructions. Clarity is crucial, so break down the information in a straightforward and organized manner. Avoid overloading the recipient with excessive details–focus on what is necessary for the transaction to take place smoothly.

Maintain a Professional Tone

The way you communicate with clients reflects your business’s professionalism. Use polite language and maintain a courteous tone, even if you are following up on an overdue balance. Respectful communication fosters better relationships and encourages prompt payments. Make sure your request sounds neutral and friendly, rather than demanding or harsh.

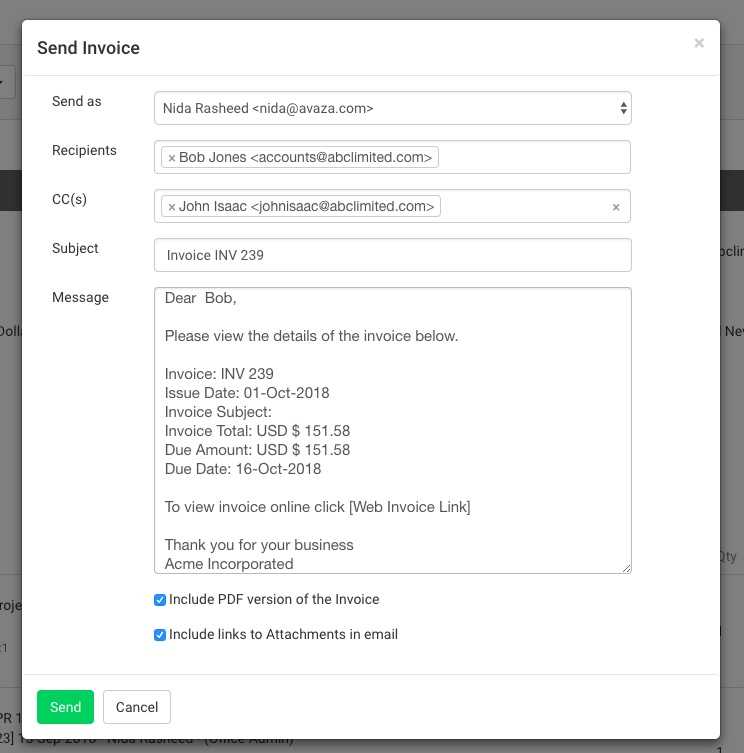

Customizing Your Payment Invoice Email

Personalizing your communication can make a significant impact on how clients perceive your professionalism and attention to detail. Customization allows you to tailor each request according to the specific needs of the client, making the message feel more direct and relevant. By adding personalized elements, you can enhance client satisfaction and improve response rates.

Incorporating Client Information

Including the recipient’s name, business details, or specific transaction information helps create a more individualized experience. A personal touch makes the client feel valued and ensures they can easily identify the purpose of the message. Always double-check that the client’s information is accurate to avoid any potential confusion.

Adjusting the Tone for Your Audience

Different clients may require different tones in communication. For some, a formal tone is necessary, while for others, a more casual approach might be appropriate. Adapting your style to suit the relationship you have with the client helps to maintain a good rapport. Be mindful of the language used and aim for a tone that reflects your business’s values while remaining clear and respectful.

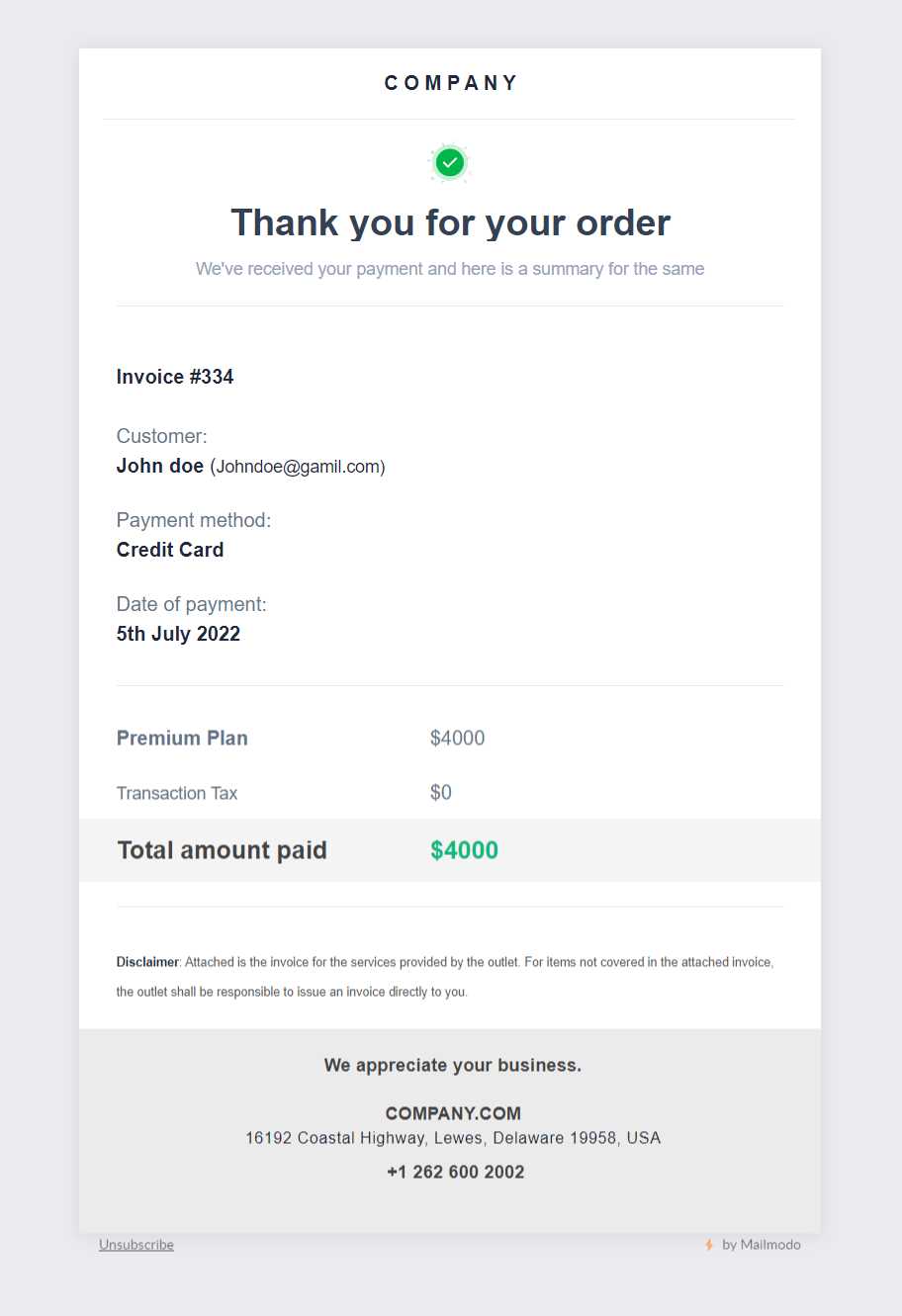

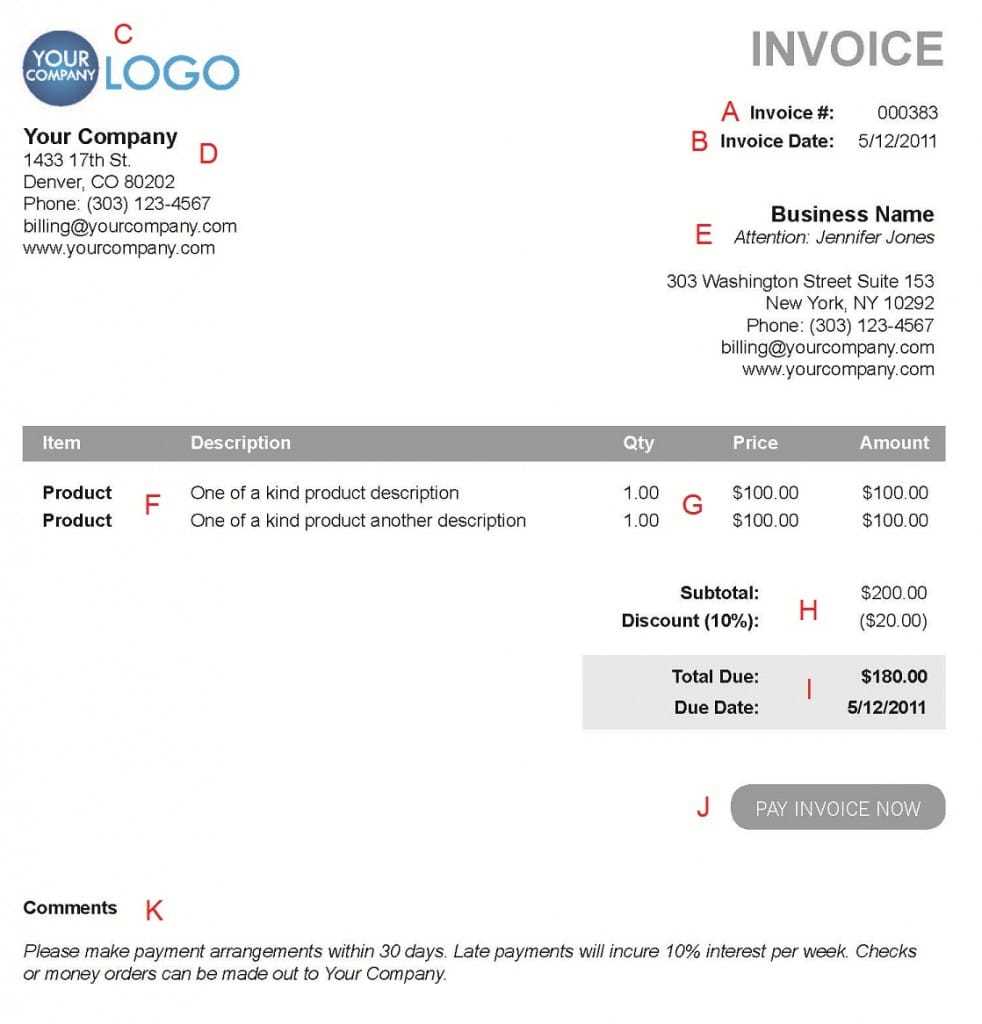

Key Elements of a Professional Invoice

When requesting payment from clients, it’s important to ensure that all necessary information is presented in a clear, concise, and professional manner. A well-organized request not only helps clients understand what is due but also builds trust and encourages prompt action. The right elements are essential to ensure that your communication is both effective and professional.

Essential Contact Information

One of the first things to include is both your business’s contact details and those of the client. This includes names, addresses, and any relevant reference numbers. Having accurate contact information ensures that the document reaches the right person and that any follow-up communication can be easily tracked.

Clear Breakdown of Amount Due

Providing a detailed breakdown of what is being charged is crucial for transparency. Clearly list the services or products, their quantities, and the agreed-upon price. Transparency in the cost breakdown helps to avoid misunderstandings and ensures that the client understands exactly what they are paying for. Additionally, including any applicable taxes or discounts is important for maintaining clarity and professionalism.

Best Practices for Invoice Email Subject Lines

The subject line of a communication requesting payment is the first thing a client sees, and it plays a crucial role in ensuring your message is opened and acted upon. A strong subject line should be clear, concise, and informative, motivating the recipient to open the message promptly. The right approach can set the tone for a positive transaction experience.

Keep It Short and Direct

Subject lines should be brief and to the point, ideally under 50 characters. A long or unclear subject line may be overlooked or marked as spam. Clarity and brevity are key to making sure the recipient understands the purpose of the message at a glance. For example, a subject like “Outstanding Balance Due: $250” is clear, specific, and hard to ignore.

Personalize When Possible

Adding personalized details, such as the client’s name or reference number, can help the subject stand out and feel more relevant. A personalized subject line creates a sense of importance and shows that the message is not a generic communication. Personalization increases engagement and fosters better relationships with clients.

Setting Up Payment Terms in Emails

Clearly defining and communicating payment terms in a request is essential for ensuring that both you and your client are on the same page regarding deadlines, fees, and other conditions. By outlining these terms effectively, you reduce the chance of misunderstandings and encourage prompt processing of the transaction. Including well-defined terms in your message helps set expectations and creates a smooth process for both parties.

Key Elements of Payment Terms

When detailing the terms, it is important to include several key components to ensure everything is transparent and understood. Below are the most common elements that should be addressed:

| Term | Description |

|---|---|

| Due Date | Specify when the payment is expected to be completed. Clear deadlines help avoid delays. |

| Late Fees | If applicable, mention any penalties for delayed payments to encourage timely action. |

| Accepted Payment Methods | Indicate which methods of payment are accepted (e.g., bank transfer, credit card, etc.). |

| Reference Numbers | Include any reference numbers or identifiers to make the transaction easier to track. |

Why Clear Payment Terms Matter

Setting up clear and understandable payment terms not only protects your business but also builds trust with your clients. It ensures there are no ambiguities regarding expectations and minimizes the need for follow-up. Clear payment terms help foster professional relationships and encourage timely settlements, contributing to better cash flow management.

Common Mistakes to Avoid in Invoice Emails

While crafting a request for payment, small oversights can lead to confusion, delayed responses, or even disputes. Avoiding common mistakes ensures that your message is clear, professional, and effective. Being mindful of these errors helps establish trust with your clients and promotes timely action on outstanding balances.

Missing or Incorrect Information

One of the most critical mistakes is failing to include all the necessary details. Missing important information, such as the amount due, due date, or payment methods, can cause delays and confusion. Always double-check that all relevant data is accurate and complete before sending the message. This ensures that the recipient has everything needed to process the request efficiently.

Using an Unprofessional Tone

It’s important to maintain a polite and respectful tone, even if you’re following up on a past due balance. Using a harsh or demanding tone can damage your relationship with the client and reduce the likelihood of a timely payment. Ensure that your communication remains courteous and neutral, even in situations where a payment has been delayed.

Failure to Personalize the Message

Sending a generic, impersonal message can make the recipient feel undervalued. Including specific details about the transaction, such as the client’s name or reference numbers, shows that you’ve tailored the message to their particular situation. Personalizing your communication can enhance the client’s experience and improve the chances of a prompt response.

Not Setting Clear Payment Terms

Without clear terms, clients may not understand the urgency or the expectations for the payment. Always specify the due date, any late fees, and accepted payment methods. Clear payment terms set proper expectations and help avoid misunderstandings down the line.

How to Add a Personal Touch to Invoices

While sending a request for payment is a standard procedure, adding a personal touch to your communication can strengthen your client relationships and enhance their experience. Personalizing your messages shows clients that you value them beyond just the transaction and helps maintain a positive, professional rapport. A few thoughtful adjustments can make a big difference in how your business is perceived.

Use the Client’s Name

Including the client’s name at the beginning of the message or within the subject line immediately creates a more personalized tone. It shows that the communication is specifically for them, rather than being a generic, automated request. Addressing the recipient directly helps build a sense of familiarity and strengthens the connection between you and your clients.

Include a Thank-You or Appreciation

Expressing gratitude, even in a professional setting, can go a long way in building goodwill. A simple “thank you for your continued business” or “we appreciate your prompt attention to this matter” can convey your respect and appreciation. Showing appreciation for your client’s business makes the interaction feel less transactional and more like a partnership.

Provide a Personalized Note

Including a brief, friendly note in the message can help humanize the interaction. For example, you could mention a recent conversation, acknowledge a milestone, or simply wish the client well. This helps transform a routine transaction into a more meaningful exchange, creating a more lasting impression. Just be sure to keep the tone appropriate for your relationship with the client.

Ensuring Clarity in Payment Requests

Clear communication is key when requesting compensation for services or products. Ambiguity or confusion in your message can lead to delays, misunderstandings, or even disputes. By presenting your request in a straightforward and transparent manner, you can make the process smoother for both you and your client. A well-structured request helps ensure that both parties understand the terms and conditions, reducing the likelihood of any issues arising.

Break Down the Details

One of the most effective ways to ensure clarity is by breaking down the charges and expectations into easily understandable sections. Clearly list the amounts owed, any applicable taxes, and the payment due date. Organizing the information in a logical and structured way helps the recipient quickly grasp the details and take the necessary action without confusion.

Avoid Complex Language and Jargon

Using overly technical or complex language can create unnecessary barriers for your clients. Keep your wording simple, direct, and free from jargon that might not be familiar to everyone. Clear, plain language is the most effective way to communicate, ensuring that there are no misunderstandings regarding what is owed or how to settle the balance.

Tracking Payments with Email Invoices

Tracking outstanding balances and managing transactions can become overwhelming without an organized system. By using digital requests to collect funds, you can simplify the tracking process and keep accurate records. Properly monitoring payments ensures that nothing slips through the cracks, helping you maintain a healthy cash flow and timely updates on transactions.

One way to stay on top of payments is by incorporating tracking features into your communications. This can include requesting confirmation of receipt, setting up automated reminders for overdue balances, or using payment links with real-time updates. These strategies not only help you track the status of each transaction but also keep the process smooth and efficient for both parties.

Additionally, using tools that integrate with your accounting system can help you automatically update records once payment is received. This reduces the risk of errors and eliminates the need for manual tracking. With clear records and timely updates, you’ll have greater control over your financial processes and can focus more on growing your business.

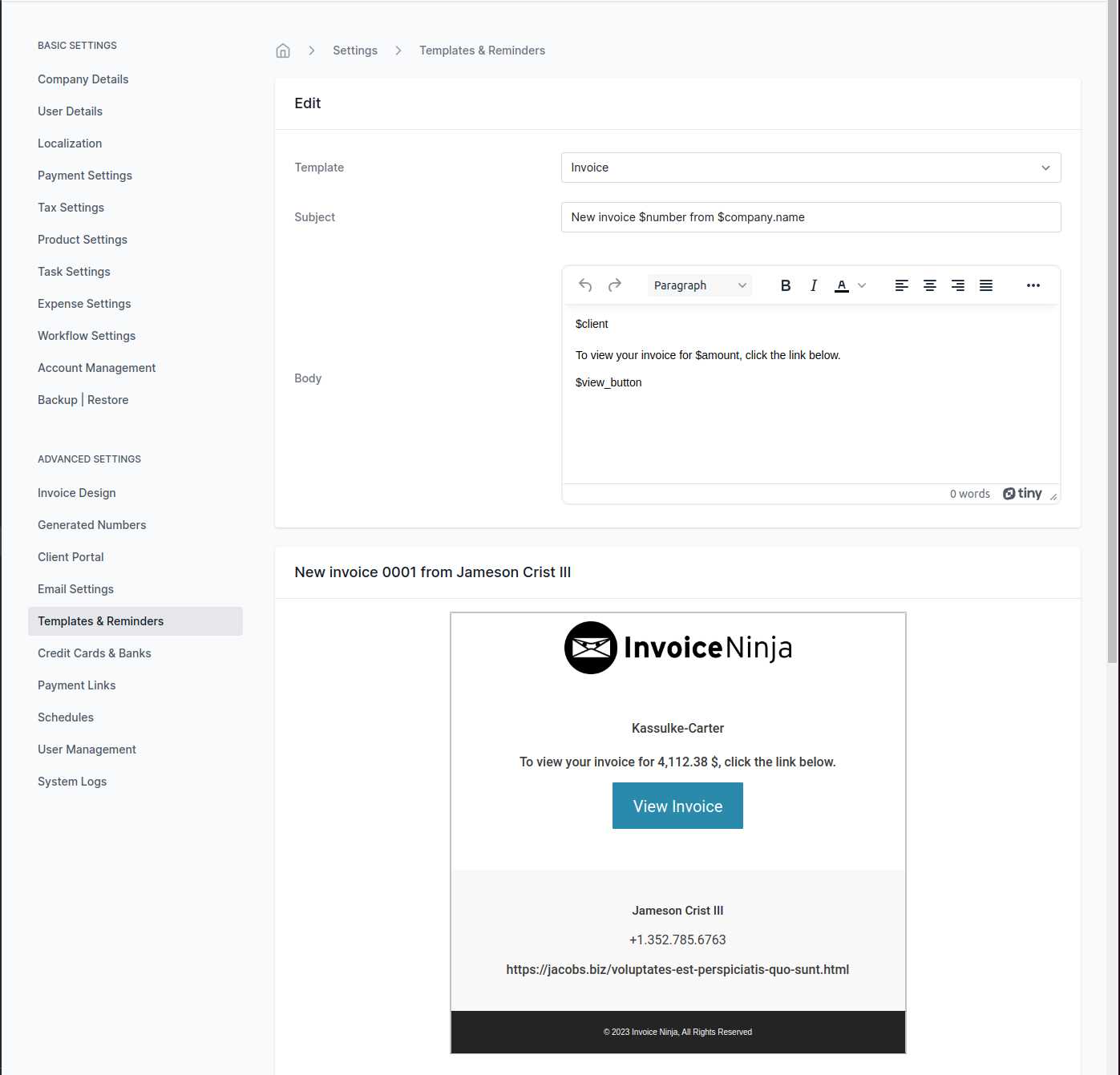

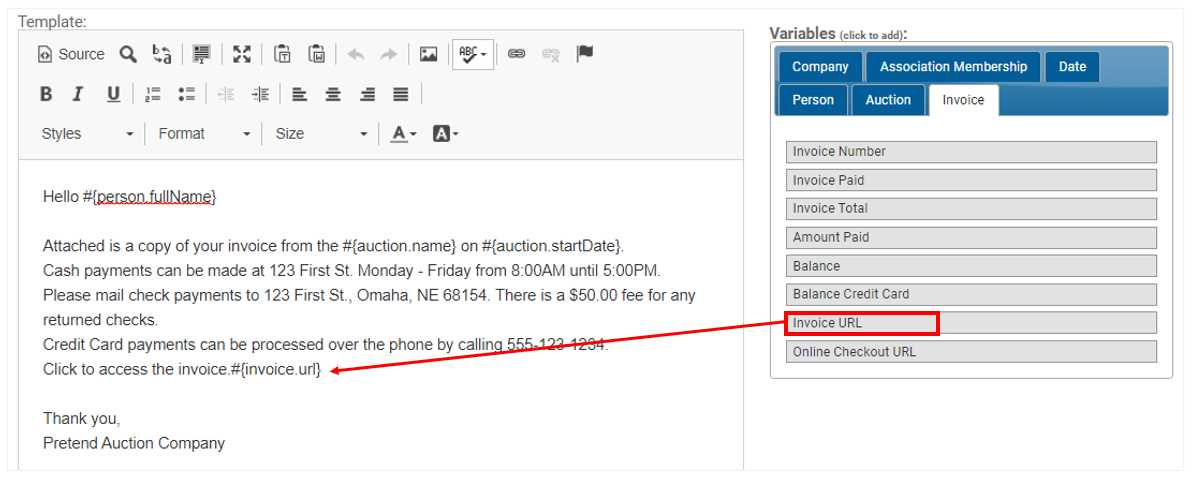

Automating Invoice Emails for Efficiency

Managing financial requests manually can be time-consuming, especially when dealing with multiple clients and transactions. Automating the process allows businesses to streamline their operations, save valuable time, and reduce the risk of human error. By setting up automated systems to send reminders and requests for compensation, you can ensure consistency and efficiency in your workflow.

Automated systems can handle a variety of tasks, such as sending initial requests, reminders for overdue balances, and even generating follow-up communications. Automation not only saves time, but it also ensures that nothing is overlooked, and that clients are reminded about pending balances in a timely and consistent manner. This process frees up resources so you can focus on other important aspects of your business.

Additionally, by integrating payment tracking with automated communications, you can keep a close eye on each transaction’s status. This allows for faster responses to any issues, ensuring a smoother and more transparent transaction process. Automating these processes helps maintain professional relationships and encourages prompt action, all while reducing administrative burdens.

Legal Considerations for Payment Invoices

When requesting compensation from clients, it is essential to ensure that your communications comply with relevant laws and regulations. Legal considerations help protect both parties by clearly outlining the terms of the transaction and ensuring that the process is fair and transparent. By addressing these factors upfront, you can avoid legal disputes and maintain a professional and compliant approach to financial transactions.

Clearly Stating Payment Terms

One of the most important legal aspects is to define payment terms in a clear and explicit manner. This includes specifying the due date, any late fees, and the acceptable methods of payment. Clearly outlining the terms helps both parties understand their obligations and minimizes the risk of misunderstandings or disputes over deadlines or charges.

Complying with Local Regulations

Depending on your location and the client’s location, there may be specific laws or tax requirements that must be followed. These could include the need to charge sales tax or other fees, or specific language that must be included in the communication. Being aware of local legal requirements ensures that your documents are fully compliant and reduces the likelihood of penalties or legal issues down the line.

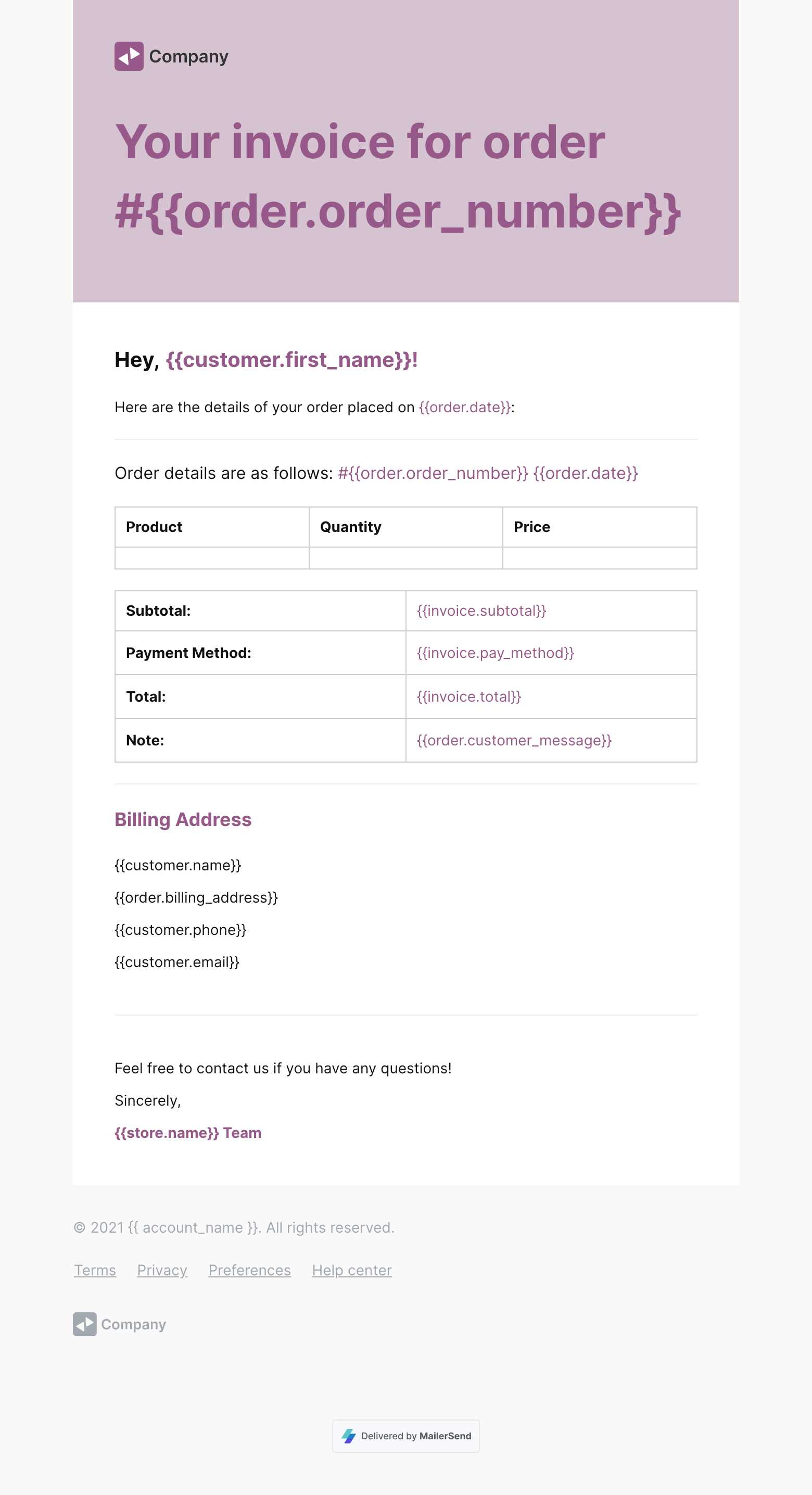

Why Professional Email Formatting Matters

The way you present your request for compensation plays a significant role in how it is perceived by the recipient. Proper formatting helps ensure that your message is clear, organized, and easy to read, which can increase the likelihood of a timely response. A well-structured communication not only improves readability but also reinforces your professionalism and credibility.

Enhancing Readability and Clarity

Professional formatting allows you to present essential details in a clear and structured manner. Using paragraphs, bullet points, and headings helps break down complex information, making it easier for the recipient to understand the key elements of the request. Easy-to-read formatting ensures that your message is absorbed quickly and minimizes the chances of confusion or overlooked details.

Reflecting Your Brand’s Image

The way you format your communication reflects the quality of your business and your attention to detail. Consistency in formatting, including font style, color, and layout, creates a polished and professional image. Well-organized communication shows that you are serious about your business and respect your clients’ time and attention, which can foster trust and strengthen business relationships.

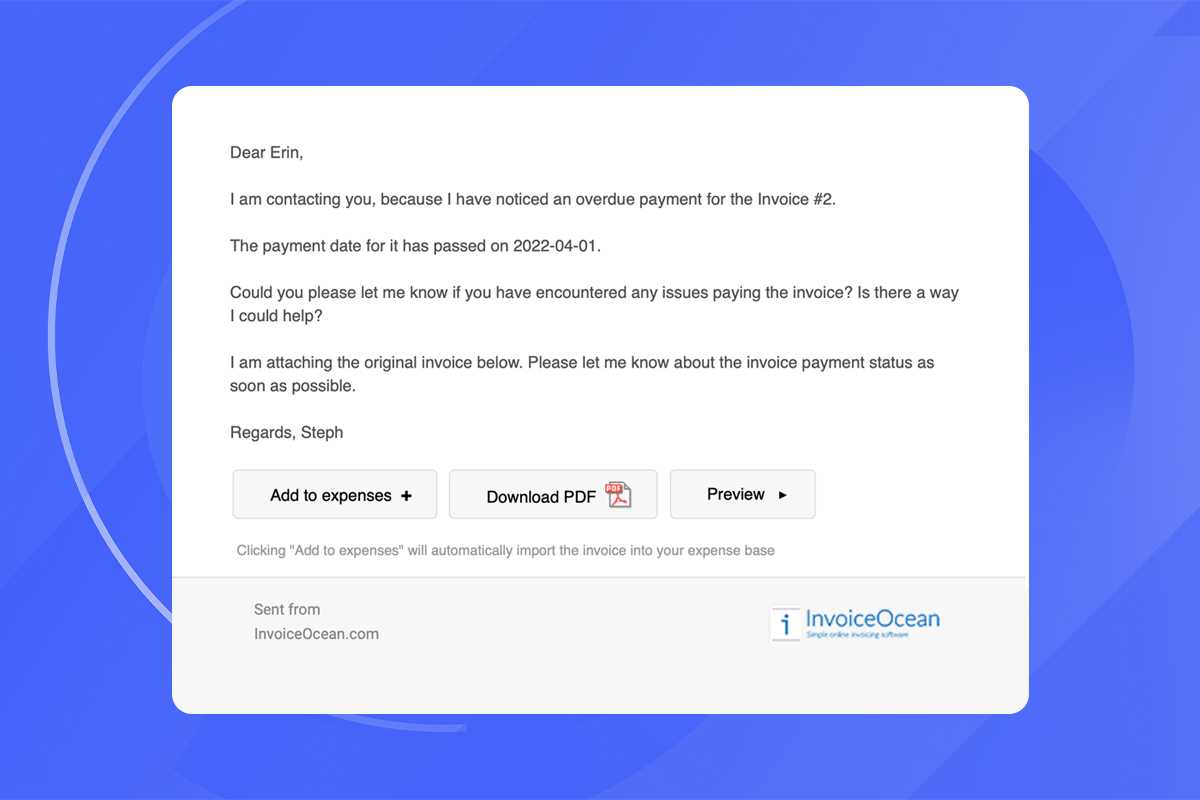

Responding to Unpaid Invoice Emails

When a payment is overdue, it’s important to handle the situation professionally and diplomatically. Responding to an outstanding balance request with a calm, clear, and polite tone can help maintain a good business relationship, while also encouraging prompt resolution of the matter. A well-crafted response shows your professionalism and ensures that both parties are aligned in terms of expectations and next steps.

Acknowledging the Delay

It’s important to first acknowledge the situation without jumping to conclusions or being accusatory. Simply confirming that you have received the communication about the outstanding balance and expressing understanding can help ease tension. Acknowledging the delay in a respectful manner sets the tone for a constructive conversation. Remaining empathetic to any potential issues the client may have faced is key to maintaining a positive business relationship.

Clarifying Next Steps and Payment Terms

Once the situation is acknowledged, clearly outline the next steps. This includes re-confirming the agreed-upon payment terms, such as the due date, any penalties, or acceptable payment methods. By gently reminding the client of these terms, you can ensure there is no confusion moving forward. Providing clear instructions on how to resolve the issue helps guide the client towards prompt action.

Integrating Payment Links in Invoice Emails

Making it as easy as possible for clients to settle their balances can significantly improve the efficiency of your transactions. One of the most effective ways to streamline the payment process is by incorporating direct links that allow clients to complete their transactions with just a few clicks. By including these links, you remove the need for manual transfers, reducing delays and making the experience smoother for both you and your clients.

When integrating payment links into your communications, it’s essential to ensure that the process is seamless, secure, and easy to follow. Providing clear instructions and options can help clients make the payment quickly, without unnecessary confusion. Below are some tips for effectively incorporating payment links into your requests:

- Choose a Trusted Payment Gateway: Select a reliable and secure payment platform that your clients are comfortable using.

- Highlight the Payment Link: Make the link easy to find by placing it prominently within the message, such as near the top or after the payment details.

- Provide Clear Instructions: Include step-by-step instructions on how to use the payment link, especially if the process is unfamiliar to your client.

- Offer Multiple Payment Options: If possible, provide clients with several payment methods to choose from, ensuring more flexibility.

- Set Payment Confirmation Notifications: Make sure your system sends a confirmation once the transaction is completed, providing clients with peace of mind.

Including a payment link not only accelerates the collection process but also demonstrates that you are committed to providing an efficient and modern experience for your clients. By reducing barriers to completing a transaction, you enhance your professionalism and encourage timely payments.