Seamstress Invoice Template for Professional and Easy Billing

For those offering custom sewing services, having a structured way to bill clients is essential for maintaining professionalism and ensuring timely payments. A clear, well-organized document that outlines the details of the work completed and the agreed-upon costs helps both the service provider and the client stay on the same page. This not only facilitates smoother transactions but also promotes trust and transparency in business relationships.

Creating a professional billing document can be time-consuming, but with the right tools, it becomes much simpler. Many professionals turn to customizable solutions that allow them to generate these documents quickly and efficiently. By using pre-designed formats, you can focus more on your craft while ensuring your financial transactions are managed with precision and clarity.

In this guide, we’ll explore various aspects of setting up a billing system for your sewing business, from essential elements to include, to helpful resources that make the process easier. Whether you’re just starting or looking to improve your current system, understanding the best practices for billing will help streamline your operations and keep your business running smoothly.

Seamstress Invoice Template Overview

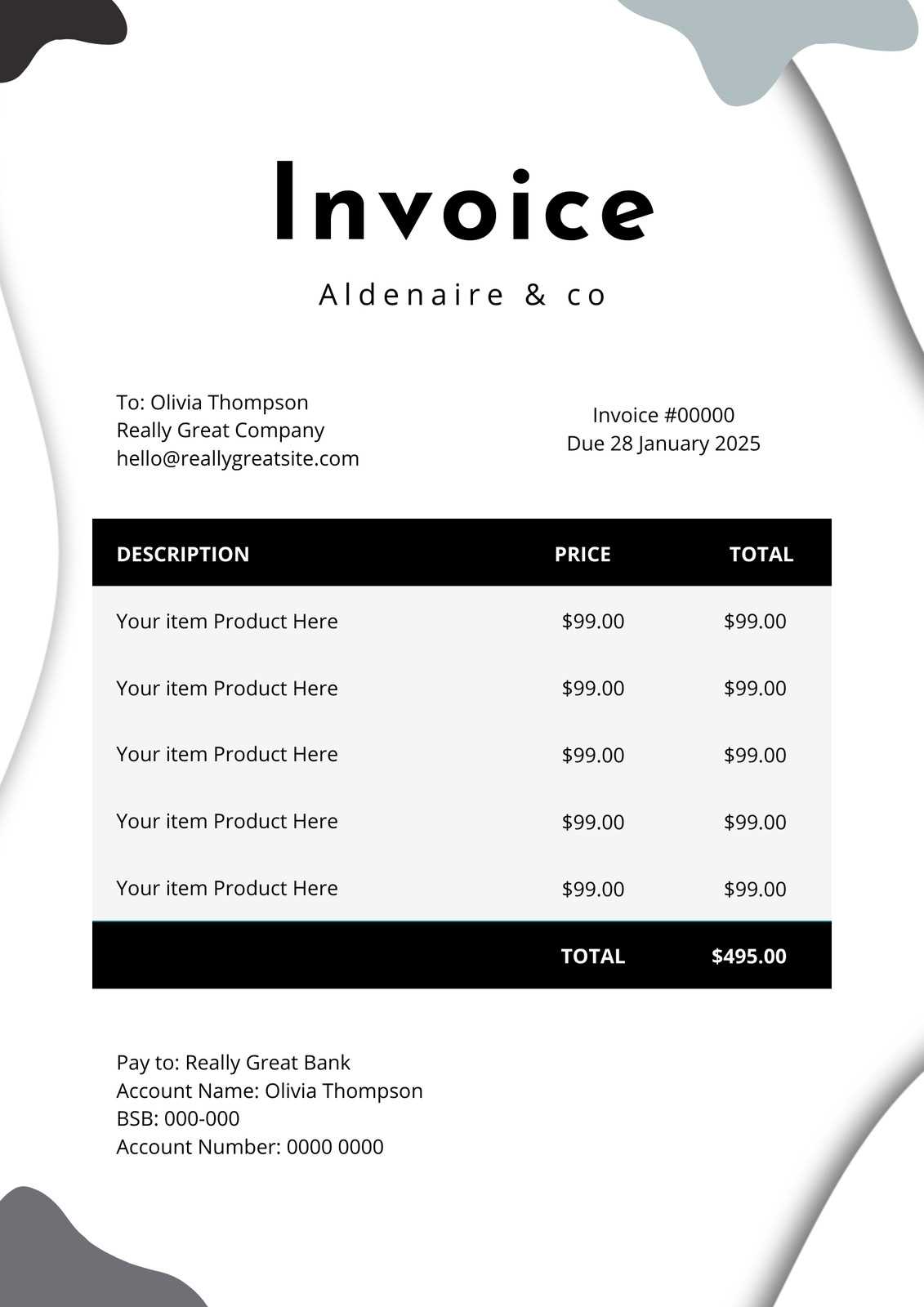

For any professional offering tailoring and sewing services, keeping track of financial transactions is crucial for maintaining a successful business. A well-structured billing document not only helps you communicate the costs of your services clearly but also ensures that clients understand exactly what they are being charged for. With a pre-designed billing format, you can streamline this process, saving time and minimizing the chance of errors in your financial records.

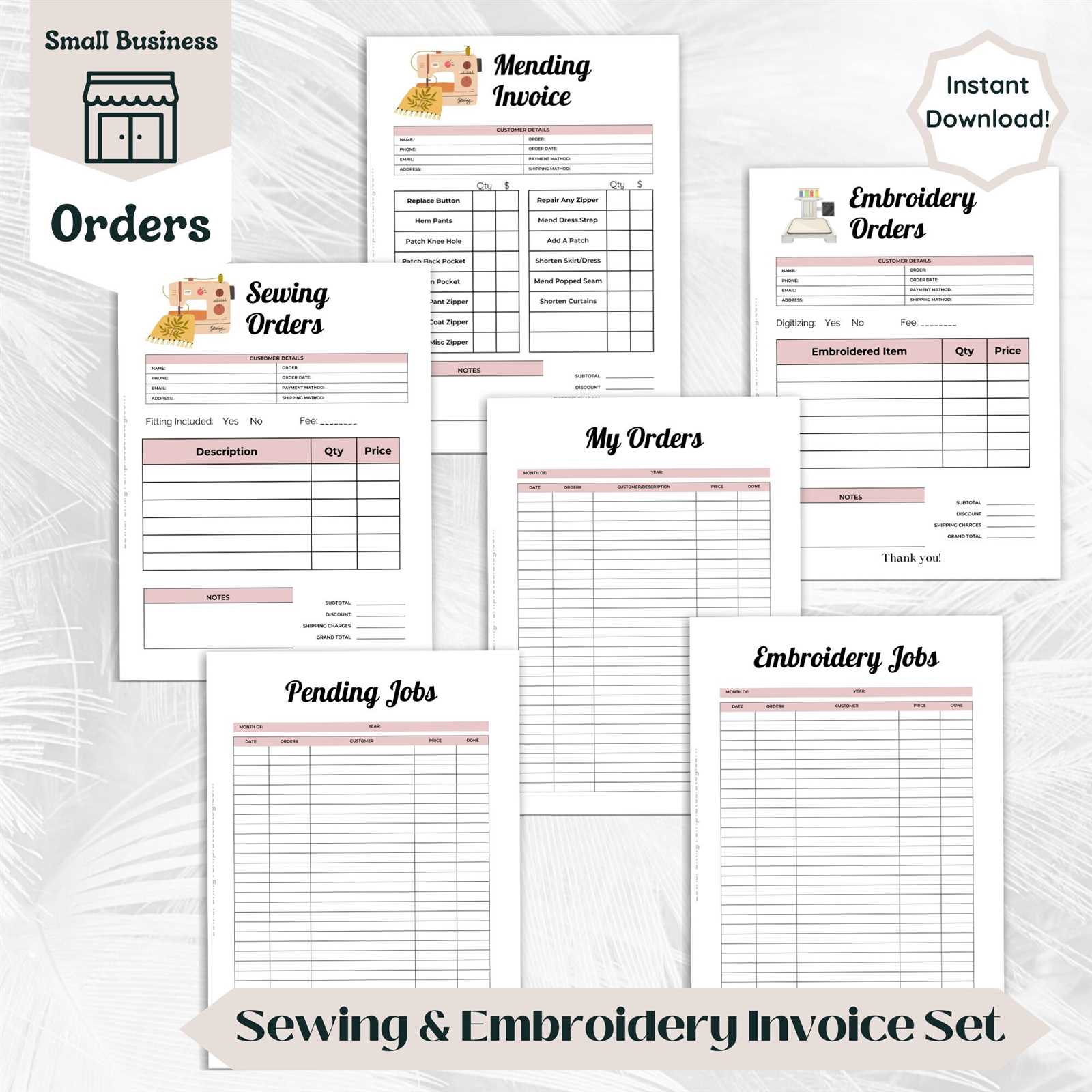

Such a document typically includes all the necessary details of the work performed, the materials used, and the total cost, including any taxes or additional charges. By using a customizable format, you can easily adjust it to fit your specific business needs, whether you are handling simple repairs, custom orders, or large-scale projects. This flexibility helps you maintain a professional appearance while ensuring that the payment process is as efficient and transparent as possible.

What Is a Seamstress Invoice?

A formal billing document used by professionals in the sewing industry serves as a detailed record of the work completed, costs involved, and payment expectations. This document acts as a clear summary for clients, outlining the services provided, the amount due, and any relevant terms or conditions. By having such a record, both the service provider and the client have a mutual understanding of the agreement and can ensure smooth financial transactions.

Key Elements of a Billing Document

The billing document typically includes the following essential information:

- Contact Information: Both the service provider’s and the client’s names, addresses, and contact details.

- Service Description: A detailed list of the tasks completed, including any materials used and the labor involved.

- Cost Breakdown: A clear outline of the pricing for each service and material, along with the total amount due.

- Payment Terms: Information on due dates, accepted payment methods, and any late fees or discounts.

Why It’s Important

Using this document ensures that clients have a precise understanding of what they are paying for, which helps avoid confusion or disputes. Additionally, it provides a professional appearance and creates a paper trail for record-keeping and tax purposes. A well-crafted billing statement can enhance your business credibility, making it easier to manage payments and track financial records efficiently.

Importance of Professional Invoices for Sewers

For those offering tailoring or custom sewing services, issuing a formal billing document is a key aspect of maintaining a professional reputation and ensuring smooth financial operations. A professional record not only helps clients understand the full scope of the work done but also reflects the quality and reliability of the service provided. Without a clear billing system, businesses risk confusion, delayed payments, and potential misunderstandings with clients.

Benefits of a Professional Billing Record

Using a properly structured document for each transaction offers several key advantages:

- Clarity and Transparency: Clients are presented with a detailed breakdown of the work completed, making it easier to understand the pricing and any additional charges.

- Trust and Credibility: A formal document shows that you are organized and serious about your business, which builds trust with your clients.

- Financial Organization: It helps keep your business records clear and organized, making tax reporting and financial tracking more efficient.

Enhancing Customer Relationships

Delivering a well-designed and clear billing statement not only helps with payments but also strengthens your relationship with clients. It conveys professionalism, making clients feel more confident in your work and more likely to return for future services. It also allows for a better customer experience by reducing potential confusion over charges and payment terms.

How to Create an Invoice for Sewing Services

Creating a formal billing document for tailoring or sewing services requires careful attention to detail. It should clearly reflect the services provided, the cost breakdown, and payment terms. A well-organized record not only ensures timely payment but also enhances professionalism, which is key to maintaining strong client relationships. Below are the essential steps to follow when creating such a document.

Steps to Create a Billing Document

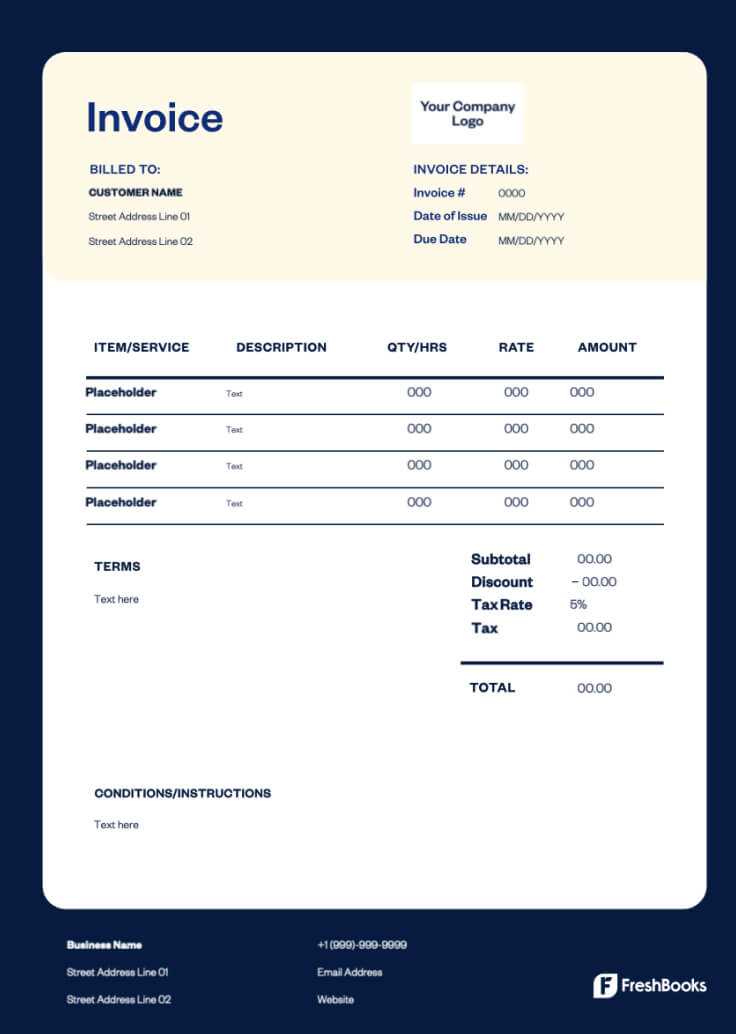

Follow these steps to ensure your billing record is comprehensive and professional:

- Step 1: Start with your business name, address, and contact details, followed by your client’s information.

- Step 2: Assign a unique reference number to each document for easy tracking.

- Step 3: Include a description of the work completed, specifying any materials used and the labor involved.

- Step 4: List the costs for each item or service provided, including any applicable taxes or additional charges.

- Step 5: Specify payment terms, including due dates and accepted payment methods.

Sample Breakdown

Here’s an example of what a detailed billing document might look like:

| Description | Unit Price | Quantity | Total |

|---|---|---|---|

| Custom dress alteration | $50.00 | 1 | $50.00 |

| Fabric (2 yards) | $10.00 | 2 | $20.00 |

| Total | $70.00 |

By following these steps and using a clean, organized format, you can create a professional and effective billing record that makes it easier for clients to understand the charges and for you to keep track of payments.

Essential Information to Include in Your Invoice

When creating a billing document for your tailoring or sewing services, it’s important to ensure that all necessary details are included. A clear and thorough record not only helps avoid confusion but also improves the chances of prompt payment. The document should outline the services provided, the cost breakdown, and payment expectations. Below are the key elements that should always be included in such a record.

Key Details to Include

- Business Information: Include your business name, address, phone number, and email for easy communication.

- Client Information: List the name, address, and contact details of the person receiving the service.

- Service Description: Clearly describe the work completed, including any materials used, the type of service provided, and labor involved.

- Cost Breakdown: List the price for each service or material provided, ensuring the total amount is clearly visible.

- Payment Terms: Include the due date, accepted payment methods, and any late fees or discounts if applicable.

- Unique Reference Number: Assign a unique number to each document for better organization and tracking.

Sample Breakdown

Here is an example of how to organize the information clearly:

| Description | Unit Price | Quantity | Total |

|---|---|---|---|

| Custom dress alteration | $45.00 | 1 | $45.00 |

| Fabric (3 yards) | $12.00 | 3 | $36.00 |

| Total | $81.00 |

Including these details ensures that the document is comprehensive and easy to understand, reducing the likelihood of disputes and ensuring timely payments.

Benefits of Using a Billing Document Format

Utilizing a pre-designed billing structure for your tailoring or sewing business can offer significant advantages. A ready-made format simplifies the process of creating accurate and professional financial records, saving you valuable time and reducing the chances of errors. By using such a structure, you can ensure consistency in your documents, which helps maintain a professional appearance and supports smoother financial transactions with clients.

Key Advantages

- Time Efficiency: A pre-made structure eliminates the need to create a document from scratch each time, allowing you to focus more on your work.

- Professional Appearance: Using a standardized format ensures your documents look polished, which can boost your credibility with clients.

- Consistency: Having a set structure helps ensure that all necessary details are included in every record, reducing the likelihood of missing important information.

- Reduced Errors: With the layout already set, the risk of accidentally leaving out key details or making calculation mistakes is minimized.

- Easy Customization: Many of these formats are customizable, allowing you to adjust them based on specific services or client needs.

Sample Breakdown

Here’s an example of how a structured document can simplify the billing process:

| Description | Unit Price | Quantity | Total |

|---|---|---|---|

| Custom dress hem | $30.00 | 1 | $30.00 |

| Fabric (2 yards) | $15.00 | 2 | $30.00 |

| Total | $60.00 |

By using this pre-designed structure, you can easily ensure that your documents are clear, accurate, and professional every time, leading to more efficient business operations and stronger relationships with clients.

How to Customize a Billing Document Format

Customizing a pre-designed billing structure for your tailoring or sewing business allows you to adapt the document to your specific needs, ensuring that it reflects your unique services and business practices. Personalizing the format can improve its relevance and make it easier to use for each client or project. By adjusting certain elements, you can create a more efficient and professional financial record that suits your style and operational requirements.

Steps to Customize Your Billing Document

Here are the main steps to follow when modifying a pre-built billing format:

- Modify Header Information: Change the document header to include your business name, logo, and contact details. Ensure that the client’s name and address fields are clearly labeled.

- Adjust Service Descriptions: Tailor the service sections to match the types of work you offer, whether it’s custom clothing, repairs, or alterations. Add more specific categories if necessary.

- Set Your Rates: Input your pricing structure for different services and materials. This can be adjusted depending on the complexity of the task or your pricing model.

- Include Payment Terms: Customize the payment terms to reflect your preferred payment methods, deadlines, and late fees, if applicable.

- Additional Notes: Include any special terms, such as discounts for early payment or a reminder for clients to confirm appointments before starting work.

Example of a Customized Section

Here’s how a section might look after customization:

- Service Provided: Custom evening gown alteration

- Materials Used: Silk fabric (3 yards), decorative lace

- Labor Costs: $30/hour, 4 hours of work

- Total Amount: $220.00 (materials + labor)

- Payment Due: 30 days from the date of issue

By following these steps, you can ensure that your billing document meets your specific needs and reflects your business practices accurately. Customization not only saves time but also helps maintain a professional image and clear communication with clients.

Understanding Payment Terms on Your Billing Document

Clear and well-defined payment terms are essential for both service providers and clients. These terms outline the expectations for payment, including when it is due, the method of payment, and any potential penalties or discounts. Setting clear terms helps prevent misunderstandings and ensures that the financial transaction is completed smoothly and efficiently. By including specific details in your document, you provide your clients with the information they need to settle the bill in a timely manner.

Key Elements of Payment Terms

When crafting payment terms for your billing record, make sure to include the following:

- Due Date: Specify the date by which payment must be made. This could be a set number of days from the date of the document or a specific calendar date.

- Accepted Payment Methods: Clearly state how clients can pay, whether it’s by cash, credit card, bank transfer, or online payment platforms.

- Late Payment Fees: Indicate any additional charges if the payment is not made by the due date, such as a percentage of the total amount or a fixed fee.

- Early Payment Discounts: Offer incentives for clients who pay before the due date, such as a small percentage off the total amount due.

- Deposit Requirements: If applicable, specify if a deposit is required before work begins, and the percentage or amount expected.

Sample Payment Terms

Here’s an example of how payment terms might be structured in your billing document:

| Payment Term | Details |

|---|---|

| Due Date | 30 days from the date of the billing document. |

| Late Fee | A 5% fee will be applied for payments received after the due date. |

| Early Payment Discount | 3% discount for payments made within 10 days of receipt. |

| Accepted Payments | Bank transfer, credit card, or PayPal. |

Including clear payment terms ensures transparency and makes it easier for clients to understand what is expected of them. By being explicit about deadlines and fees, you help avoid confusion and encourage prompt payment.

How to Set Rates for Sewing Services

Setting appropriate rates for your tailoring or sewing services is a key factor in building a successful business. The price you charge must reflect the quality of your work, the complexity of the tasks, and the time and resources required. Properly determining your rates ensures you cover your costs, make a profit, and stay competitive in your market. It’s important to strike a balance between being fair to clients and valuing your skills and time adequately.

To set your rates effectively, consider the following factors:

- Hourly Rate: For tasks that require an uncertain amount of time, such as alterations or custom projects, charge based on an hourly rate. Be sure to calculate the time it takes to complete common tasks to set a reasonable rate.

- Material Costs: For any project requiring fabrics, trims, or other materials, include the cost of those items in your pricing. Make sure to mark up the price to cover procurement and handling.

- Complexity of the Project: More intricate tasks, such as custom designs or detailed embroidery, should be priced higher due to the additional skill and time required.

- Location and Market: Research what others in your area are charging for similar services. This will give you an idea of the local market rate and help you remain competitive.

- Experience and Expertise: If you have advanced skills or years of experience, you may be able to charge higher rates than someone who is just starting out.

To further clarify your rates, consider providing clients with an estimate before beginning work. This will ensure that both parties understand the scope of the work and the cost involved, avoiding any misunderstandings when it comes time to pay.

By carefully evaluating these factors, you can set fair and profitable rates that reflect the value of your services while remaining competitive in the market.

Using Billing Documents for Tax Purposes

Accurate financial records are essential when it comes to managing your business taxes. By maintaining proper records of your transactions, including the work you perform and the payments you receive, you can ensure that you’re compliant with tax laws and avoid issues during tax season. A well-organized system for documenting payments and expenses will make it easier to calculate your income and deductions, and will help you track your financial performance throughout the year.

Why Billing Records Are Important for Taxes

- Proof of Income: A clear record of all payments received serves as proof of your business income, which is necessary for reporting to tax authorities.

- Expense Tracking: Billing documents can help you track materials, supplies, and other business-related expenses that can be deducted from your taxable income.

- Audit Protection: Having well-documented transactions can protect you in the event of an audit. It shows that your business operates transparently and that you are accurately reporting your financial situation.

- Tax Deductions: Proper records make it easier to identify deductible expenses, such as materials, business travel, and office supplies, which can reduce your overall taxable income.

How to Use Billing Documents for Tax Reporting

When preparing for tax season, make sure your billing documents include the following key elements:

- Clear Payment Details: Include the full amount received, any taxes charged, and the date of payment.

- Expenses and Materials: Document the cost of any materials or supplies purchased for client work, as these can be deducted from your business income.

- Record Keeping: Store all billing records and receipts for a set number of years, as required by tax authorities, to ensure you have access to them if needed for tax filings or audits.

By keeping detailed and accurate financial records throughout the year, you will make tax filing much easier, reduce the risk of errors, and ensure that you take full advantage of available deductions.

Best Practices for Sending Your Billing Document

Sending a billing document professionally and promptly is crucial for maintaining good relationships with clients and ensuring timely payment. A well-managed process for dispatching your records not only reflects positively on your business but also minimizes delays and confusion. By following a few best practices, you can streamline the process, avoid errors, and encourage quick payment from your clients.

Key Steps for Sending Your Billing Document

- Send Promptly: Always send the billing document as soon as the work is completed or the milestone is reached. Delaying the delivery can cause confusion and lead to late payments.

- Check for Accuracy: Before sending, double-check the details, such as the services provided, the total amount, payment terms, and client information. Mistakes can lead to disputes and delays.

- Use Clear Language: Avoid jargon or unclear terms. Ensure that your clients understand exactly what they are being charged for and the deadline for payment.

- Choose the Right Format: Send your document in a format that is easy for clients to open and read, such as PDF. This ensures that the document will look the same regardless of the device used to view it.

- Include Payment Instructions: Provide clear instructions on how clients can pay, including your preferred payment methods and any relevant details like account numbers or payment links.

Sending via Email vs. Postal Mail

While email is typically the fastest and most efficient method, there are situations where sending a physical copy may be more appropriate. Consider these factors:

- Email: Emailing your document allows for immediate delivery and can be tracked for confirmation. It’s perfect for clients who are accustomed to digital transactions.

- Postal Mail: Some clients may prefer a hard copy or have issues with email. For these clients, mailing a printed version can build trust and ensure receipt of the document.

By adhering to these best practices, you create a seamless process for both you and your clients, encouraging timely payment and enhancing your professional reputation.

Tips for Ensuring Timely Payment

Receiving timely payments is essential for maintaining cash flow and ensuring the sustainability of your business. While it’s important to provide quality services, it’s equally important to set clear expectations with clients regarding payment. By following a few simple strategies, you can reduce the risk of delays and ensure your clients settle their bills promptly.

Effective Strategies for Prompt Payments

- Set Clear Payment Terms: From the outset, clearly define payment deadlines, methods, and late fees. Having well-communicated terms helps clients understand their obligations and reduces confusion.

- Send Reminders: Don’t hesitate to send polite reminders a few days before the payment is due, and follow up promptly if the payment is overdue. Gentle nudges can encourage timely payments without being pushy.

- Offer Convenient Payment Methods: Make it as easy as possible for clients to pay by offering multiple payment options such as bank transfers, credit cards, or online payment platforms.

- Request Deposits or Prepayments: For larger projects, consider requesting a deposit upfront to secure the work. This reduces the likelihood of non-payment upon completion.

- Build Trust with Clear Documentation: Always provide clients with accurate and detailed records of the work performed. Transparent and professional documents make it easier for clients to pay without delay.

Sample Payment Terms and Deadlines

Here’s an example of a simple payment structure that encourages timely settlement:

| Payment Term | Details |

|---|---|

| Due Date | Payment is due within 30 days of receipt. |

| Late Fee | A 5% fee will be applied to any amount unpaid after the due date. |

| Early Payment Discount | Receive a 2% discount if the full amount is paid within 10 days. |

By implementing these strategies and establishing clear payment terms, you can reduce late payments and maintain a steady cash flow for your business.

Digital vs Paper Billing Documents

When it comes to managing financial transactions, business owners have to choose between digital or paper formats for their billing documents. Each method has its own set of advantages and challenges. The choice depends on various factors, such as convenience, cost, security, and client preferences. Understanding the benefits and drawbacks of both options will help you determine which works best for your business.

Advantages of Digital Billing Documents

- Speed and Efficiency: Sending digital records is almost instantaneous, allowing you to quickly deliver the document to clients and avoid delays.

- Cost-Effective: Digital records eliminate the need for printing, paper, and postage, which can save you money over time.

- Environmentally Friendly: Reducing paper usage helps decrease your environmental impact, supporting more sustainable business practices.

- Easy Storage and Access: Digital documents are easier to store and organize, and can be accessed anytime without needing physical storage space.

- Better Tracking: With email or online platforms, you can track when a client receives and opens the document, helping you stay on top of payments.

Advantages of Paper Billing Documents

- Client Preferences: Some clients may prefer receiving a physical copy, especially those who are not tech-savvy or prefer hard copies for their own record-keeping.

- Professional Appearance: A physical, well-designed billing document can feel more official to some clients, adding a personal touch to the transaction.

- Security Concerns: While digital documents are generally secure, some clients may feel more comfortable with paper, as it’s harder to hack or manipulate a physical document.

- No Internet Access Required: Paper documents can be used without internet access, making them suitable for clients or businesses in remote locations with limited connectivity.

Which Option is Best for Your Business?

Ultimately, the choice between digital and paper records depends on your business’s needs and your client base. Some businesses use a combination of both, offering digital documents for clients who prefer speed and paper documents for those who value a more traditional approach. Consider the following when making your decision:

- Do your clients prefer receiving documents electronically or by mail?

- What is your budget for document management (printing, mailing, etc.)?

- Are you looking for an environmentally friendly option?

- How quickly do you need to send and track payments?

By weighing these factors, you can choose the most suitable method to meet both your business needs and those of your clients.

How Billing Documents Improve Professionalism

Maintaining a high level of professionalism in your business practices is essential for building trust with clients and standing out in a competitive market. One key aspect of professionalism is providing clear, organized documentation for every service rendered. Using properly structured billing documents not only ensures transparency in financial transactions but also enhances your overall business image, creating a more trustworthy and reliable reputation with your clients.

The Impact of Clear Billing Records

When you send detailed and well-organized billing records to clients, it communicates that you are serious about your business and respectful of their time and investment. Some of the ways clear financial documentation boosts professionalism include:

- Transparency: Clients can easily understand the costs associated with your services, reducing misunderstandings or disputes.

- Accountability: A formal billing system holds you accountable for all transactions, ensuring you don’t overlook any details and that clients are treated fairly.

- Consistency: By using standardized billing methods, clients know what to expect with each project, building trust through consistency.

- Improved Communication: Well-structured documents facilitate better communication, as they clearly outline what has been done, what is owed, and when payment is expected.

Example of Professional Billing Structure

Here’s an example of how a clear billing document can improve client trust and business professionalism:

| Service Provided | Description | Amount |

|---|---|---|

| Custom Alteration | Adjustment to hem length as per client request | $50.00 |

| Embroidery | Personalized embroidery on jacket | $30.00 |

| Total | – | $80.00 |

Providing such detailed records shows that you value your clients’ business and are committed to offering clear, high-quality services. When clients receive well-organized billing documents, they are more likely to return for future projects and recommend your services to others.

Common Mistakes to Avoid in Billing Documents

When managing financial transactions for your business, accuracy and clarity are essential to ensure that clients are billed correctly and promptly. Mistakes in financial records can lead to confusion, delayed payments, or even disputes. Understanding the common errors made when preparing these documents can help you avoid them, streamline your workflow, and maintain a professional image with clients.

Top Mistakes to Watch Out For

- Missing or Incorrect Contact Information: Always double-check that your name, business name, and contact details are correct, as well as those of your client. Incorrect or outdated information can lead to misunderstandings and delays.

- Ambiguous Descriptions of Services: Failing to provide clear descriptions of the work performed can confuse clients about what they are being charged for. Make sure each service or product is described in detail.

- Incorrect Payment Amounts: Simple math errors or omitting taxes can result in incorrect charges. Double-check all totals and ensure taxes and fees are included properly.

- Unclear Payment Terms: Always specify the due date and any late payment penalties. Lack of clarity regarding payment deadlines can lead to confusion about when payments are expected.

- Failure to Include Payment Instructions: Don’t forget to provide clear payment options and details. Make sure clients know exactly how and where to send their payments.

- Not Following Up: Some business owners forget to follow up if a payment is overdue. It’s important to send polite reminders to ensure timely payments and avoid delays.

How to Avoid These Mistakes

To avoid these common mistakes, always use a checklist to ensure that all required information is included and accurate before sending out any billing document. It is also a good idea to use digital tools or software to help you create professional and error-free records. Automated systems can help track payments and remind you of due dates, reducing the risk of human error.

By being diligent and proactive, you can ensure that your financial transactions are handled smoothly and that your clients have a positive experience with your business.

How to Track Payments with Your Billing Documents

Effectively tracking payments is crucial for maintaining financial clarity and ensuring that your business operates smoothly. A well-structured billing record not only helps you request payments but also allows you to monitor the status of those payments. By keeping track of paid and outstanding amounts, you can prevent errors, avoid late payments, and maintain a solid relationship with your clients.

Methods for Payment Tracking

There are various ways to track payments, and choosing the right method depends on your business needs and preferences. Here are some common methods:

- Manual Tracking: For small businesses, a simple spreadsheet or paper record can be effective for keeping track of payments. You can log the date the payment was received, the amount paid, and any balance remaining. However, this method can become time-consuming as your client base grows.

- Digital Payment Systems: Many online payment platforms provide automated tracking features. These systems can send you notifications when a payment is received, automatically update your records, and offer payment history reports.

- Accounting Software: Professional accounting software allows you to generate detailed reports, track client payments, and keep all financial records in one place. Many of these programs also offer reminders for overdue payments, ensuring nothing is overlooked.

How to Make Payment Tracking Easier

In order to effectively track payments, it’s essential to keep your billing documents organized and up-to-date. Here are some tips to help simplify the process:

- Include Clear Payment Due Dates: Make sure that your billing documents have clear due dates. This helps both you and your clients stay on the same page regarding when payments should be made.

- Track Partial Payments: If clients make partial payments, always keep track of the amounts paid and the remaining balance. This way, you can easily follow up on any outstanding amounts.

- Use Payment References: When a payment is made, include a reference number or code that matches the corresponding billing document. This will help you track payments and match them to the right transaction quickly.

By choosing the right tools and methods for tracking payments, you can ensure that your business remains organized and financially healthy. Consistent monitoring also reduces the risk of missed payments and fosters stronger relationships with your clients.

Tools and Software for Billing Documents

Managing financial records and client payments can be time-consuming, but the right tools and software can simplify the process. From creating professional records to tracking payments, modern solutions offer a wide range of features to enhance your workflow. Whether you’re a small business owner or a freelancer, utilizing the right digital tools can help ensure that your records are accurate, consistent, and easy to manage.

Top Tools for Creating and Managing Billing Records

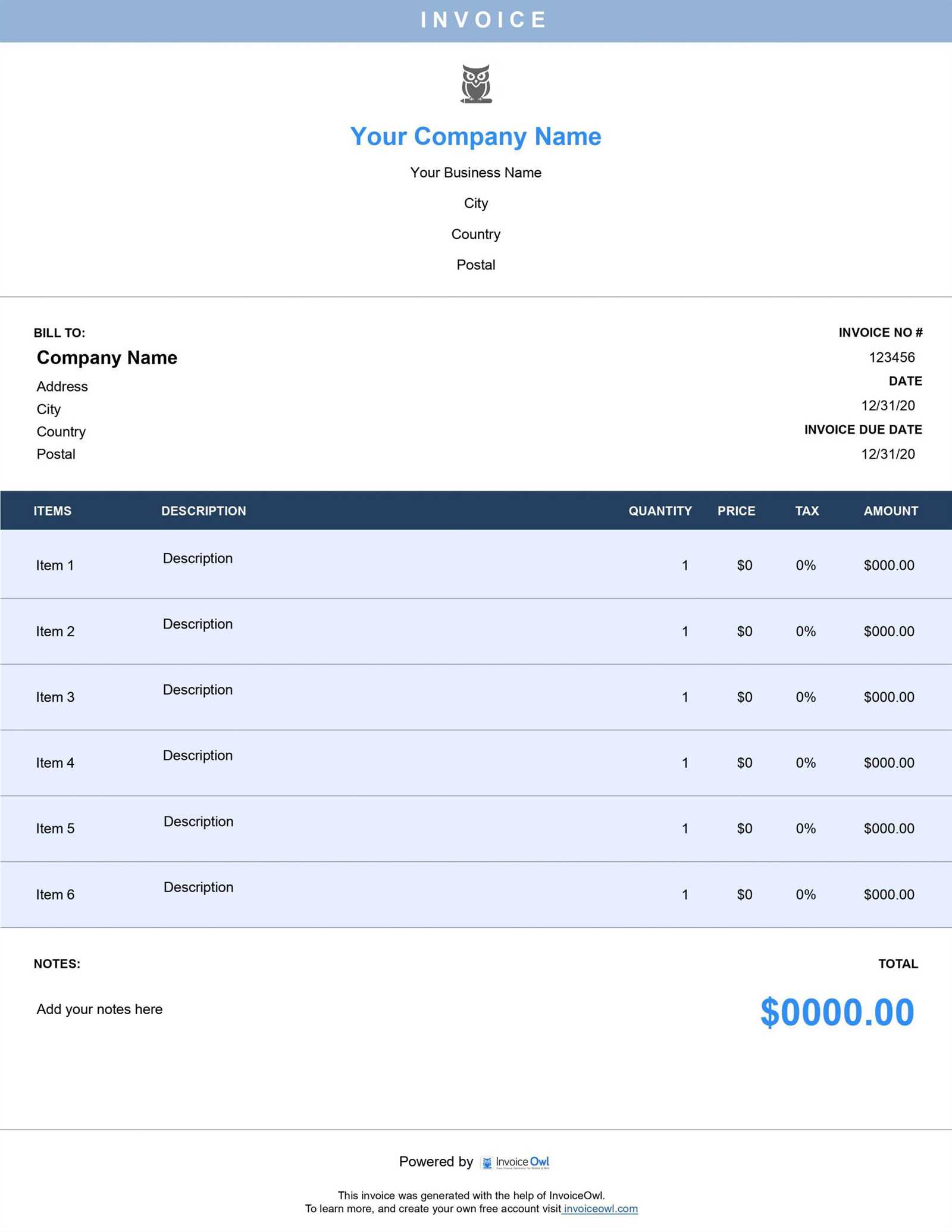

Here are some popular tools and software that can help you create and manage your billing documents effectively:

| Tool/Software | Features | Best For |

|---|---|---|

| QuickBooks | Comprehensive accounting, invoicing, payment tracking, and reporting tools. | Small businesses and freelancers who need an all-in-one accounting solution. |

| Wave | Free software with invoicing, payment processing, and accounting features. | Freelancers or small businesses on a budget looking for easy-to-use software. |

| FreshBooks | Automated billing, time tracking, payment reminders, and client management features. | Service-based businesses that need time tracking and billing integration. |

| Zoho Books | Cloud-based accounting, automated workflows, and project-based billing. | Small businesses and teams that need customized billing options and easy client management. |

| PayPal Invoicing | Simple billing, payment tracking, and integration with PayPal for easy payments. | Freelancers or businesses that want quick, hassle-free payment processing. |

Choosing the Right Tool for Your Business

When selecting a tool or software, consider your specific needs, such as the number of clients you manage, the complexity of your services, and your budget. Some businesses may prefer more advanced features like project tracking or recurring billing, while others may only need basic functionality like creating and sending payment requests.

By using the right software, you can automate many aspects of your financial management, reducing errors, saving time, and ensuring timely payments from clients. These tools also help you maintain organized records,