Download Free Invoice Design Templates for Easy Customization

When running a business, having the right tools for invoicing is essential. Professional-looking billing statements not only help you get paid on time but also reinforce your brand identity. Customizable documents that can be tailored to your needs are a valuable resource, streamlining the process of generating clear and accurate charges for your products or services.

Finding the right resources to create these essential documents doesn’t have to be complicated. With a wide range of customizable formats available online, you can easily personalize your billing records to meet your specific requirements. These tools allow for seamless editing and quick adjustments, ensuring that your financial paperwork reflects your business’s unique style.

Whether you’re a small business owner, freelancer, or part of a larger organization, having access to high-quality, easy-to-use resources for creating your charges will save time and reduce errors. Embrace the efficiency and professionalism that comes with streamlined billing practices, and keep your operations running smoothly.

Why Use Free Invoice Templates

Running a business involves many tasks, and managing your financial documents should not be a source of stress. Having access to ready-made, customizable formats can make the entire billing process much easier and faster. By using professional-quality resources, you can ensure your records are well-organized, clear, and accurate, which helps build trust with your clients.

Key Benefits of Using Pre-Designed Billing Documents

- Time-saving: With a ready-to-use structure, you can eliminate the need to start from scratch each time you create a new bill. This allows you to focus on other important aspects of your business.

- Consistency: A uniform format ensures that all your documents look polished and professional, maintaining a consistent brand image across all your paperwork.

- Customization: Many resources allow for easy adjustments, so you can tailor the document to match your company’s specific needs without much effort.

- Cost-effective: Avoid spending money on specialized software or hiring a designer when you can access high-quality options at no cost.

How These Resources Help Small Businesses

For small business owners and freelancers, using professional-looking billing forms can have a significant impact on how clients perceive your business. By presenting clear and well-structured charges, you not only improve payment processes but also give your business a more established, credible appearance. Additionally, with no financial investment required, these tools are perfect for businesses that are just getting started or looking to streamline their operations.

Top Benefits of Customizable Invoices

Having the ability to modify your billing documents offers significant advantages for businesses of all sizes. Customizable records provide flexibility, allowing you to adjust important details such as branding, payment terms, and itemized charges. This customization not only enhances professionalism but also helps ensure accuracy in your financial transactions.

Enhanced Professional Appearance

Personalized billing records that reflect your company’s branding–such as logo, colors, and fonts–help to create a cohesive and professional look. When clients receive a polished and well-organized document, it boosts your credibility and fosters a sense of trust in your business. Customization allows you to present a cohesive identity that sets your business apart from competitors.

Improved Efficiency and Accuracy

- Tailored to Your Needs: Customizable documents let you add or remove sections that are specific to your business model, such as additional taxes, discount fields, or shipping charges, ensuring that every detail is captured accurately.

- Reduced Errors: With the ability to input preset details, you minimize the chance of making mistakes that could lead to payment delays or confusion with clients.

- Easy Adjustments: Custom formats allow you to make quick adjustments to pricing or details without starting from scratch each time, speeding up the billing process and saving you time.

By offering flexibility in creating your documents, these tools provide greater control over your financial records, helping you stay organized while maintaining a professional appearance that is tailored to your unique business needs.

How to Access Free Billing Document Resources

Finding and using high-quality resources for creating professional billing records has never been easier. Many websites offer easy access to ready-made, customizable documents that can be edited to suit your business needs. Whether you are looking for simple formats or more advanced layouts, these resources allow you to streamline your billing process without spending money on expensive software.

Steps to Access These Resources

- Search for Reliable Platforms: Begin by searching for trustworthy websites that specialize in providing business documents. Look for sites with positive reviews and a wide range of options to ensure you’re getting high-quality resources.

- Select the Format You Need: Once on a platform, browse through various categories and pick the style or structure that fits your business. Whether you’re a freelancer or run a larger organization, you will find formats that cater to your specific needs.

- Register or Sign Up (if needed): Some websites may ask you to create a free account in order to access their collection. Signing up is typically quick and ensures you can track and manage your downloaded files.

- Access and Save: After choosing your desired format, simply click on the link to access the file. Many sites offer documents in PDF, Word, or Excel formats, which can be saved directly to your computer or cloud storage.

Things to Keep in Mind

- Ensure Compatibility: Make sure the resource you select is compatible with the software you plan to use for editing, whether it’s Microsoft Word, Excel, or Google Docs.

- Double-check Customization Options: Before saving, review whether the format allows for easy edits, such as adding your logo, adjusting prices, or including specific payment terms.

By following these simple steps, you can quickly access high-quality billing documents and save time while maintaining a professional approach to managing your business finances.

Choosing the Right Template for Your Business

When selecting the right document format for your business, it’s important to consider several factors that align with both your brand and operational needs. A well-chosen format can not only improve the clarity of your financial records but also reflect the professionalism of your company. Customizable options give you the flexibility to adjust details, ensuring that every aspect of the document suits your specific requirements.

Factors to Consider

- Industry-Specific Needs: Different industries may require distinct layouts. For example, a freelance graphic designer may prefer a minimalistic style, while a contractor might need a more detailed, itemized layout to reflect their services.

- Branding and Visual Identity: Choose a format that allows you to incorporate your logo, colors, and fonts. This ensures that your document maintains consistency with your brand and presents a professional appearance.

- Functionality: Make sure the format includes all the necessary fields, such as payment terms, item descriptions, and taxes. This ensures the document is practical and helps avoid any future confusion with clients.

Why Flexibility Matters

Opting for a flexible format ensures that you can make future adjustments easily. For example, you may need to alter payment terms or add a new service in the future. Having a customizable option makes these changes seamless and efficient, saving you time and effort in the long run. A format that adapts to your evolving needs provides long-term value for your business.

Step-by-Step Guide to Editing Billing Documents

Customizing a billing record for your business is an essential skill that can save you time and help maintain consistency across your financial documents. Whether you’re adjusting prices, adding new sections, or including specific client details, the process is straightforward with the right tools. This guide will walk you through the necessary steps to edit your document and ensure it reflects your business needs accurately.

Step 1: Choose Your Editing Tool

- Microsoft Word or Excel: Ideal for simple text editing and formatting, these programs allow easy changes to the layout and structure of the document.

- Google Docs or Sheets: A cloud-based option that enables easy collaboration and access from any device, ensuring you can edit your document wherever you are.

- Design Software (Canva, Adobe Spark): These tools provide more customization options for a polished, visually appealing result, perfect for businesses that need an attractive layout.

Step 2: Customize Essential Details

- Company Information: Start by adding your business name, logo, and contact details. This ensures that your branding is consistent across all your records.

- Client Information: Add the client’s name, address, and any other relevant contact information to personalize the document and make it clear who the bill is directed to.

- Billing Details: Adjust the itemized list of products or services provided, including prices, quantities, and any applicable taxes or discounts.

- Payment Terms: Specify the payment due date, methods accepted, and any additional instructions to avoid confusion with clients.

Step 3: Review and Finalize

- Check for Accuracy: Double-check all the entered details, such as amounts, dates, and payment terms, to ensure everything is correct before sending it out.

- Formatting: Adjust the alignment, font size, and style to make the document clear and easy to read. Ensure it looks professional and well-organized.

- Save and Export: Save your document in the appropriate file format (e.g., PDF, Word) for easy sharing and printing.

Once these steps are completed, your document will be ready to send to clients, ensuring that your billing process is both efficient and professional.

Free vs Paid Billing Document Formats: Which is Better

When selecting a structure for your business’s financial records, one of the first decisions you’ll face is whether to go with a cost-free option or invest in a paid resource. Both choices have their advantages, but understanding what each offers will help you determine which best suits your needs. The right decision can impact not only the appearance of your documents but also the efficiency of your billing process.

Advantages of Cost-Free Resources

- Zero Initial Cost: The most obvious benefit is that no money is required to access these resources. This is ideal for small businesses, startups, or freelancers working with limited budgets.

- Quick Access: Free resources are often easy to find and can be accessed immediately. Whether you need to send out a billing statement urgently or need a quick solution, these tools can help.

- Basic Functionality: While they might not have the advanced features of paid versions, many free options are fully functional for basic billing purposes and can be easily customized to fit your needs.

Benefits of Paid Options

- More Advanced Features: Paid resources often come with more customizable fields, better formatting options, and additional features like automated calculations and built-in payment tracking.

- Professional Look: Paid formats are often designed by experts, meaning they tend to have a more polished and sophisticated appearance, which can be an important factor for larger businesses or those aiming to project a high-end image.

- Customer Support: With a paid option, you may receive support for any issues or customization questions you may have, which can be crucial if you’re dealing with complex billing systems.

Ultimately, the choice between free and paid resources depends on the complexity of your needs and the resources available to you. If your business is in its early stages or has straightforward billing requirements, free options are a solid starting point. However, if you need advanced functionality and professional-quality formatting, investing in a paid solution may offer better value in the long run.

Best Platforms for Downloading Billing Document Formats

Finding the right place to access high-quality resources for your business records can be crucial for maintaining professionalism and efficiency. There are various platforms available that offer a range of customizable formats, each with unique features to suit different business needs. Whether you’re looking for simplicity or advanced functionality, here are some of the best websites where you can find what you need.

Top Platforms to Explore

- Canva: A popular graphic design platform that offers a wide range of professional-quality options. Canva provides both basic and advanced tools for customization, with an easy-to-use interface perfect for creating personalized business documents.

- Microsoft Office Templates: If you’re already using Word or Excel, Microsoft’s official site offers a variety of structured formats that you can quickly customize. These options are reliable and integrate well with the Microsoft ecosystem.

- Google Docs/Sheets: Google offers simple yet customizable formats through their Docs and Sheets platforms. With the added benefit of cloud access and collaboration, Google’s resources are convenient for teams working remotely or across multiple devices.

- Template.net: This platform provides a large collection of professional documents for various industries. The site allows for easy editing and provides various formats, from basic to more detailed options, all available with a few clicks.

- FreshBooks: A business-focused platform that includes templates as part of its cloud accounting services. FreshBooks allows users to quickly generate documents that can be tailored for specific needs, and it also offers additional features like automatic tracking and payment reminders.

Additional Considerations

- Ease of Use: Choose a platform that is intuitive and easy to navigate, especially if you’re not familiar with design tools. Look for options that offer drag-and-drop customization and simple editing features.

- Compatibility: Ensure that the formats are compatible with the software you already use. Whether it’s Microsoft Office, Google Workspace, or specialized design programs, compatibility is key for smooth integration into your workflow.

- Customization Features: Consider the level of flexibility each platform offers. Platforms with advanced features allow you to make changes to the layout, fields, and branding, ensuring the document reflects your business identity.

Each platform has its unique strengths, so choose one based on your specific needs, whether you prioritize ease of use, customization options, or integration with your current business tools.

Common Billing Document Mistakes to Avoid

Creating accurate and professional-looking financial records is crucial for maintaining a good relationship with your clients and ensuring smooth transactions. However, there are several common mistakes businesses make when preparing these documents. Avoiding these errors can save you time, reduce confusion, and help you present a more polished image to your clients.

Key Mistakes to Watch Out For

- Unclear or Missing Information: Always ensure that key details, such as your business name, client information, payment terms, and item descriptions, are clearly visible. Missing or unclear details can cause confusion and delays in payment.

- Inconsistent Formatting: Using different fonts, font sizes, or colors can make your document look unprofessional. Stick to a consistent style to ensure readability and a polished look.

- Incorrect or Missing Amounts: Double-check all numerical values, such as prices, taxes, and totals, to avoid costly mistakes. A single error in the amount can lead to client disputes or payment delays.

- Ambiguous Payment Terms: Make sure that payment deadlines, accepted methods, and late fees (if applicable) are clearly stated. Vague or missing payment terms can lead to misunderstandings with clients.

- Overcomplicated Layout: Keep the layout simple and easy to follow. Avoid cluttering the document with excessive details that may distract from the essential information. An overly complex layout can confuse clients and delay the payment process.

How to Prevent These Mistakes

- Review Before Sending: Always proofread the document before finalizing it. Check for any missing information, spelling errors, or formatting inconsistencies.

- Use Clear Sections: Organize the document into clear sections (such as contact information, items, and totals) to improve readability and ensure that all the relevant details are easy to find.

- Use Reliable Tools: Choose tools that allow you to create accurate and professional documents. Many platforms include built-in checks and guidelines to prevent common errors.

By avoiding these mistakes and following best practices, you can create billing documents that are not only clear and professional but also efficient, helping to maintain smooth and effective client relationships.

How to Customize Billing Documents for Branding

Customizing your business documents to reflect your brand identity is an essential step in maintaining a professional image. Personalizing these records not only helps make them more recognizable to your clients but also reinforces the overall branding of your business. By adding key elements such as logos, colors, and fonts, you ensure that your documents are consistent with your company’s visual identity.

Key Elements to Include for Branding

- Company Logo: The logo is one of the most important elements of your branding. Ensure it’s prominently placed at the top of the document, where clients can easily spot it. This reinforces brand recognition each time the document is viewed.

- Color Scheme: Match the document’s color scheme with your company’s primary colors. Using consistent colors throughout your records helps create a cohesive and polished look, making your business appear more professional and unified.

- Custom Fonts: Choose fonts that align with your brand’s personality. Whether it’s modern, traditional, or creative, the right font style will help convey your business’s character. Stick to one or two fonts to maintain readability and avoid a cluttered appearance.

- Tagline or Slogan: If your business has a tagline or slogan, consider including it at the bottom or in the header of your document. This adds a personal touch and further emphasizes your business identity.

Steps to Customize Your Document

- Choose the Right Platform: Select a tool that allows you to easily adjust these elements. Platforms like Canva, Microsoft Word, or Google Docs offer intuitive options for adding logos, changing colors, and selecting fonts.

- Upload Your Logo: Insert your logo at the top of the page, ensuring it’s high-quality and appropriately sized. This is often the first element a client will notice, so make sure it’s clear and sharp.

- Adjust Colors: Use your brand’s primary and secondary colors for headings, borders, and background accents. Be mindful of the document’s overall legibility and don’t overuse bright colors that could distract from the content.

- Update Font Styles: Select fonts that match your business’s style guide. Keep them simple and professional, ensuring they’re easy to read and consistent throughout the document.

- Preview and Edit: After making adjustments, always preview your document to ensure that the branding elements are consistent and don’t overpower the important content. Make any necessary changes before finalizing the document.

By customizing your billing documents to align with your brand, you not only make your communications more professional but also help to reinforce your business’s identity with ever

How to Ensure Your Billing Documents Are Professional

Creating a polished and professional financial record is essential for maintaining a positive relationship with your clients. Well-structured documents reflect your attention to detail and commitment to quality. Whether you’re a freelancer or running a larger business, ensuring that your records appear professional can help build trust and promote timely payments. Here are some key steps to ensure your documents meet high standards.

Key Elements of a Professional Document

- Clear and Accurate Information: Ensure that all critical details, such as business name, contact information, and client specifics, are included and accurate. This minimizes confusion and avoids delays in processing payments.

- Consistent Formatting: Use a uniform layout with consistent fonts, spacing, and colors. This not only makes the document easier to read but also gives it a polished, cohesive look.

- Professional Language: Use formal language that is polite and to the point. Avoid slang or overly casual phrases, as professionalism in tone enhances your business reputation.

- Properly Organized Sections: Structure your document with clear headings and organized sections, such as contact information, services provided, payment terms, and totals. A well-organized document is easier to follow and prevents errors.

Steps to Enhance Professionalism

- Double-Check Accuracy: Always proofread your document to ensure that all details, such as dates, amounts, and addresses, are correct. Errors can undermine your professionalism and cause delays.

- Use High-Quality Graphics: If including logos or images, ensure they are high resolution. Low-quality graphics can make your document appear unprofessional and may distract from the overall message.

- Ensure Legibility: Choose legible fonts and appropriate font sizes for all sections. Ensure that your document is easy to read on any device, whether printed or viewed digitally.

- Set Clear Payment Terms: Make payment instructions clear, including due dates, accepted methods, and penalties for late payments. Transparent payment terms reduce misunderstandings and foster smoother transactions.

By focusing on these elements, you can create billing records that not only look professional but also encourage prompt and smooth financial transactions. Every detail contributes to the impression your business makes on clients.

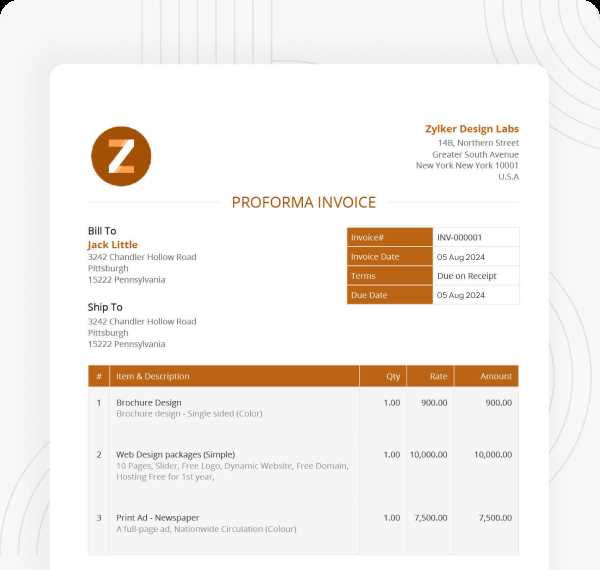

Essential Elements of a Good Billing Document Layout

A well-structured financial document not only helps ensure smooth transactions but also reflects the professionalism of your business. To create a document that serves its purpose efficiently, it’s essential to include all the necessary elements that make it easy to understand and process. A good layout enhances readability, reduces errors, and makes the payment process more straightforward for your clients.

Key Components of a Well-Structured Document

- Business Information: Your business name, logo, and contact details should be clearly displayed at the top. This helps establish your identity and provides clients with an easy way to reach you if needed.

- Client Details: Include the client’s name, address, and contact information. Ensuring this section is accurate reduces confusion and ensures the document is directed to the right person or organization.

- Unique Document Number: A unique reference number helps you keep track of records and makes it easier for clients to refer to specific transactions when needed. It also adds a level of professionalism and organization.

- Clear Itemized List: Break down the products or services provided in a clear, itemized list. This helps the client understand exactly what they are being charged for and prevents any disputes about the charges.

- Subtotal, Taxes, and Total: Clearly display the subtotal before taxes, the tax amount, and the total amount due. These should be easy to spot and well-organized for transparency.

- Payment Terms and Due Date: Clearly state the payment terms, including the due date and any late fees that may apply. This helps set expectations for both parties and encourages timely payment.

- Payment Instructions: Specify the accepted payment methods (e.g., bank transfer, PayPal, credit card) and provide all necessary account details to facilitate quick and easy payments.

Additional Features to Enhance Clarity

- Simple, Consistent Layout: Keep the layout simple and uncluttered. Avoid using too many fonts or colors, as this can distract from the important information. A clean, professional layout improves readability and reduces errors.

- Clear Formatting: Use headings, bullet points, and tables to separate different sections clearly. This organization allows clients to quickly find the information they need.

- Optional Notes Section: Consider including an additional section for special instructions or notes. This could be useful for adding messages about discounts, delivery times, or other relevant information.

By incorporating these key components and focusing on clarity and organization, you can create documents that not only look professional but also function seamlessly, ensuring smooth i

How to Automate Billing Document Creation Using Pre-Designed Formats

Automating the creation of financial records is a powerful way to save time and reduce errors. By utilizing pre-built structures, you can quickly generate consistent and accurate documents without having to manually input the same information each time. Automation not only speeds up the process but also ensures that every document is formatted correctly and contains all the necessary details, allowing you to focus on other important tasks.

Steps to Automate Your Document Creation

- Choose the Right Tool: Select a platform or software that allows for easy customization and automation. Many accounting and billing software programs offer pre-designed formats that can be automated with minimal effort.

- Input Recurring Details: Set up templates with your business name, contact information, and payment terms already filled in. This eliminates the need to re-enter the same data every time a new document is created.

- Automate Client Information: Use your client database to automatically populate details such as their name, address, and unique identification number. This ensures accuracy and saves time on data entry.

- Set Up Product/Service Catalogs: If you offer the same products or services, create a catalog that can be linked to the document creation system. This allows you to quickly add itemized lists without having to type them out each time.

- Configure Payment Reminders: Set up automated reminders for upcoming due dates or overdue payments. This feature helps ensure timely collections and minimizes the need for manual follow-ups.

Tools for Automating the Process

- Accounting Software: Platforms like QuickBooks, FreshBooks, and Xero allow you to automate document creation and integrate with other financial tools for seamless workflow management.

- Spreadsheet Automation: Using advanced features in Google Sheets or Excel, you can set up formulas and scripts to automatically calculate totals, taxes, and even populate client details from a linked spreadsheet.

- Online Billing Systems: Tools like Zoho Invoice or Wave allow users to create recurring billing cycles, customize documents, and set up automatic generation and delivery of financial records.

By leveraging automation tools, you can not only streamline your business processes but also reduce human error and ensure consistency across all your financial documents. The time saved can then be invested in growing your business and focusing on more strategic activities.

Legal Requirements in Billing Documents

When creating financial records for your business, it is essential to ensure that they comply with legal regulations. Failing to include necessary information or not adhering to local laws could lead to penalties, disputes, or delays in payments. To avoid such issues, it’s important to be aware of the legal requirements for all the documents you issue. These requirements can vary depending on the country, industry, or type of business, but certain elements should be universally included to ensure compliance and transparency.

Key Legal Elements to Include

- Business Identification Information: Most jurisdictions require businesses to provide their official name, address, and tax identification number (TIN) or business registration number. This is crucial for verifying the legitimacy of the business and ensuring proper taxation.

- Client Details: To avoid confusion and disputes, the recipient’s name, address, and contact details must be clearly listed. This is particularly important for proper record-keeping and any potential future legal actions or audits.

- Unique Reference Number: Each document should have a unique identification number, allowing both the business and client to track the transaction. This helps with accurate record-keeping, auditing, and managing payments.

- Date of Issue: The date on which the document is created is crucial. It marks the official start of the transaction and may also impact payment terms, such as due dates or interest rates on overdue amounts.

- Payment Terms: Clear terms regarding payment due dates, late fees, and accepted methods of payment are essential for legal clarity. Specific instructions for payment (e.g., bank account details) should also be included to avoid any ambiguity.

- Tax Details: Depending on the region, businesses are required to display applicable tax rates, such as sales tax, VAT, or GST. Including this information ensures that the document is compliant with local tax laws and helps the client understand the full breakdown of charges.

- Itemized List of Products/Services: A detailed description of the goods or services provided, including quantities and rates, is often required. This transparency helps prevent misunderstandings and provides a clear breakdown of charges.

Additional Considerations

- Currency and Amounts: Clearly state the currency used, especially in international transactions, to avoid any confusion regarding the amount owed. Ensure all numerical values are correct and formatted consistently.

- Terms and Conditions: Some regions require specific l

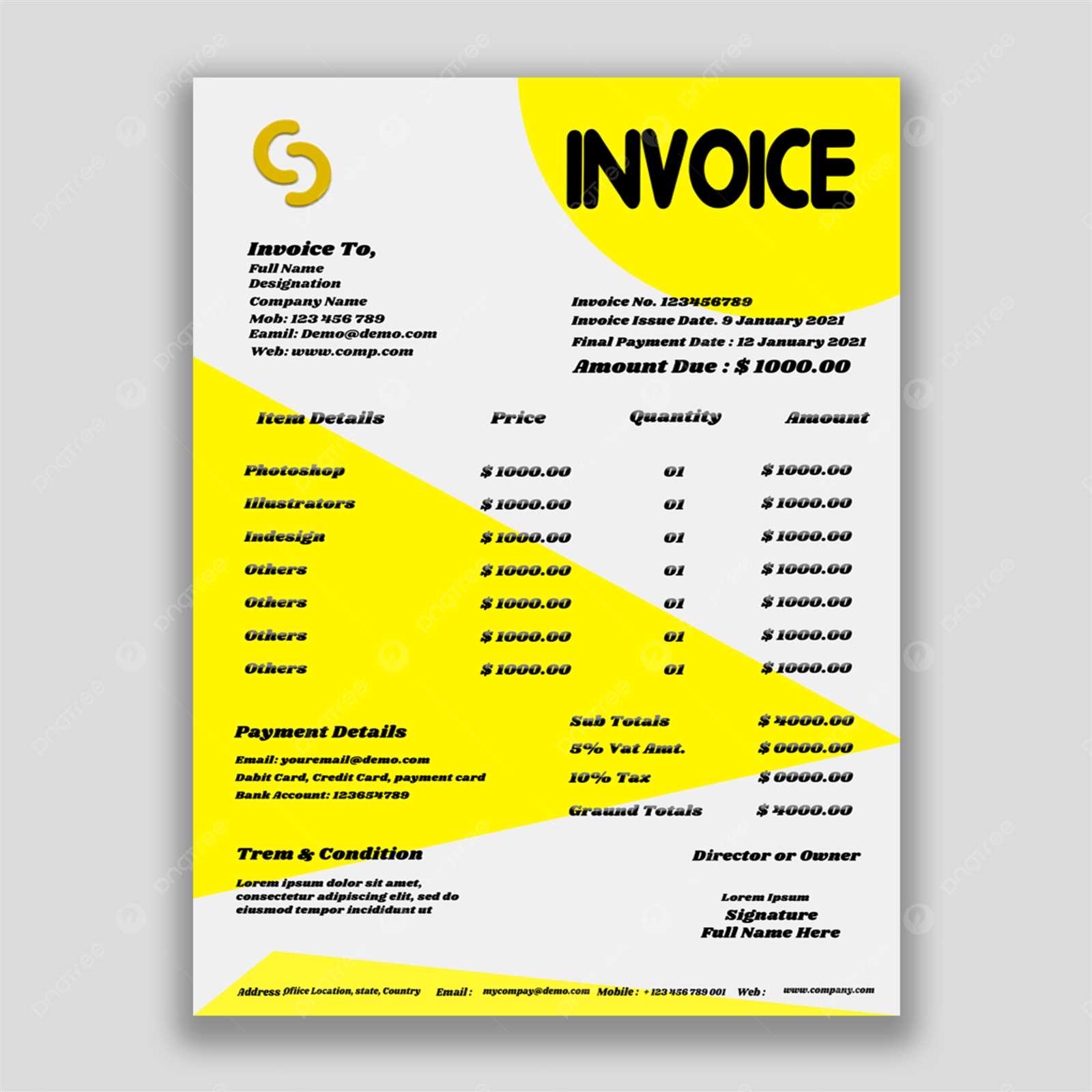

Top Billing Document Trends for 2024

As businesses continue to adapt to changing technologies and customer expectations, the way financial documents are presented is evolving. In 2024, businesses are moving toward more modern, streamlined, and professional layouts that not only improve functionality but also enhance the overall client experience. By incorporating contemporary design trends, you can create more visually appealing and effective billing documents, making it easier for clients to understand the details and stay engaged with your business.

Key Trends to Watch

- Minimalist Layouts: Clean, uncluttered designs that focus on clarity and ease of use continue to rise in popularity. This trend emphasizes the importance of white space, simple typography, and well-organized sections.

- Bold Typography: Using strong, legible fonts not only makes the document easier to read but also adds a touch of modernity and style. Bold headings and clear fonts help highlight key details like payment terms and totals.

- Interactive Elements: With more businesses going digital, interactive elements such as clickable links for payment methods, due dates, and client portals are becoming more common in online financial records.

- Personalization: Tailoring the layout to reflect a company’s unique branding and visual identity has become a significant trend. Using company colors, logos, and other personalized elements can help create a cohesive experience for clients.

Design Features for 2024

Trend Description Benefits Minimalism Simple, clean layouts with ample white space and easy-to-read fonts. Improves clarity, reduces visual clutter, and makes the document easier to process. Bold Typography Using strong fonts to make headings and totals stand out. Enhances readability and directs attention to important details like amounts due. Interactive Features Incorporating clickable payment links or integration with payment portals. Provides convenience for clients and encourages quicker payments. Personalization Customizing documents with your business’s branding elements like logo and colors. Builds brand consistency and fosters a stronger connection with clients. Staying current with these trends can make your financial documents not only more functional but also visually appealing. By incorporating these trends into your document creation process, you can enhance professionalism, streamline payment collection, and improve client engagement. Whether you’re looking to modernize your billing process or make a lasting impression, these trends provide an excellent starting point for busi

How Free Billing Documents Save Time and Money

Efficiently managing financial records is a critical aspect of running a successful business. Creating professional documents from scratch can be time-consuming and costly, especially for small businesses or freelancers with limited resources. However, using pre-designed formats available online can drastically reduce the time spent on document creation while maintaining a professional appearance. This approach not only saves time but also helps in minimizing unnecessary expenses associated with hiring graphic designers or purchasing expensive software.

Time-Saving Benefits

- Quick Setup: With pre-made formats, businesses can instantly create professional documents by simply filling in necessary information. This eliminates the need to design a document from scratch, allowing more time to focus on core business activities.

- Consistent Layout: Using ready-made structures ensures that every document adheres to a consistent and professional format. This consistency saves time by eliminating the need to manually adjust layouts or styles with each new document.

- Automated Calculations: Many pre-designed formats come with built-in fields for calculating totals, taxes, and other charges automatically. This reduces the time spent on manual calculations and helps ensure accuracy.

Cost-Saving Advantages

- No Design Costs: By using ready-to-go formats, businesses avoid the need to hire graphic designers or invest in expensive design software, which can be a significant cost-saving, especially for startups or small enterprises.

- Reduced Errors: Pre-made formats come with standardized structures that reduce the risk of missing critical information or making formatting errors. Fewer mistakes mean fewer corrections, saving both time and resources.

- Eliminates Printing Costs: Many businesses still rely on printed copies of their financial documents. Pre-designed formats allow for quick and easy digital distribution, reducing the need for paper and ink, which translates to savings on printing costs.

By using pre-made formats for your financial documents, you can streamline your workflow, ensure consistency, and significantly reduce overhead costs. This approach allows small businesses and freelancers to operate more efficiently and professionally without sacrificing quality or breaking the bank.

How to Store and Organize Your Billing Documents

Effective organization of financial records is crucial for any business. Whether you are a freelancer, a small business owner, or part of a larger enterprise, having a systematic approach to storing and organizing these records can save you time and effort when it comes to accessing and managing your documents. A well-organized record-keeping system also helps ensure compliance with legal requirements, streamlines tax filing, and makes it easier to track payments and outstanding balances.

Best Practices for Storing Financial Records

- Digital Storage: Store your documents digitally in cloud-based platforms or on secure servers. This ensures easy access from anywhere and reduces the risk of losing important paperwork. Cloud storage also allows for backup copies, preventing the loss of data due to technical failures.

- Organize by Categories: Set up folders and subfolders based on different categories such as clients, payment status, and time periods (e.g., monthly or yearly). This allows you to quickly find any document without sifting through piles of files.

- Labeling and Tagging: Use clear and consistent naming conventions for your documents. For example, you might label documents with the client name, date, and document type. This will help ensure that even if you have a large number of records, each document can be quickly identified.

- Backup and Security: Keep regular backups of all your important files and ensure they are encrypted or password-protected. This adds an extra layer of security in case of data breaches or accidental deletions.

Physical Record Organization

- File Folders: If you prefer physical copies, invest in high-quality file folders and label them clearly. Separate documents by client or year and keep them in dedicated sections or cabinets for easy retrieval.

- Use of Scanning Technology: Consider scanning physical documents and saving them digitally. This not only saves physical space but also ensures that your records are backed up and easy to access.

- Indexing Systems: For businesses with large volumes of paperwork, creating an indexing system can be highly beneficial. Use a reference number or a date-based system to index your records, making it easier to cross-reference documents when needed.

By adopting a systematic approach to organizing your financial records, you will improve your workflow, reduce the risk of errors, and make it easier to meet legal obligations. Whether you prefer physical or digital storage methods, ensuring that your records are well-organized will help you run your business more efficiently and effectively.