Free Medical Invoice Template for Word

Managing financial records in any business is crucial for smooth operations, and this is especially true in the healthcare sector. Properly documenting services rendered and payments due helps maintain clarity, ensuring both patients and providers are on the same page. With the right tools, generating accurate and professional billing records becomes a simple and efficient task.

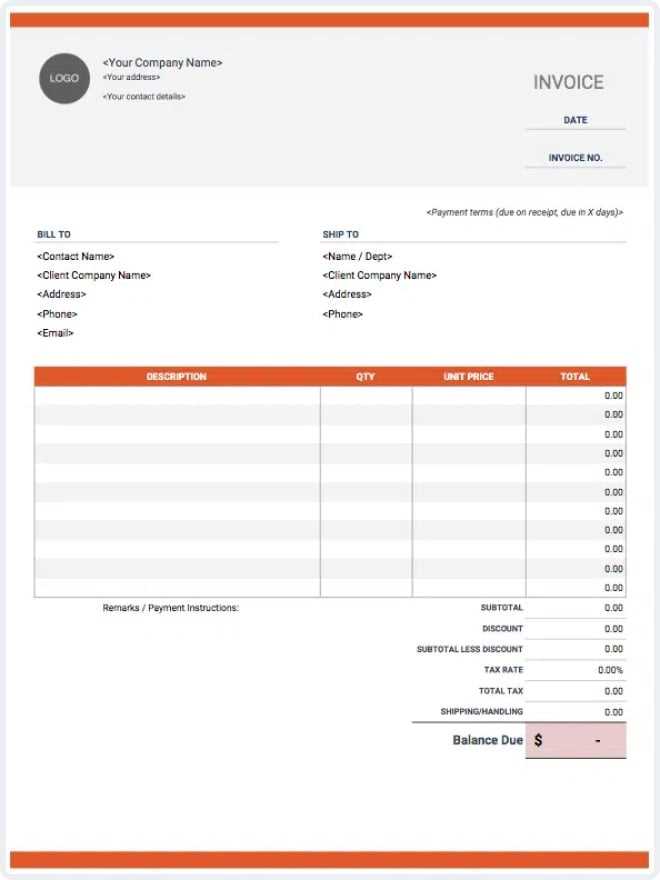

One of the most effective ways to streamline this process is by using customizable solutions that suit your unique needs. Pre-designed documents allow for easy modification, saving time and effort when creating detailed statements. These documents can be tailored to include specific information such as patient details, treatment descriptions, and payment terms.

In this article, we will explore how to create such documents with ease. Whether you are just starting or looking to improve your current billing system, you will find helpful advice on how to efficiently design, format, and personalize your records to meet both professional standards and legal requirements.

Free Medical Invoice Template for Word

When it comes to managing billing in any professional service, having a reliable and simple method for generating records is essential. A ready-made document that can be quickly customized is invaluable for businesses looking to save time and maintain consistency. This is especially true in healthcare, where accuracy and efficiency are key. By using a pre-designed document, you can quickly produce statements that are clear, accurate, and professional-looking.

Benefits of Using a Pre-Designed Document

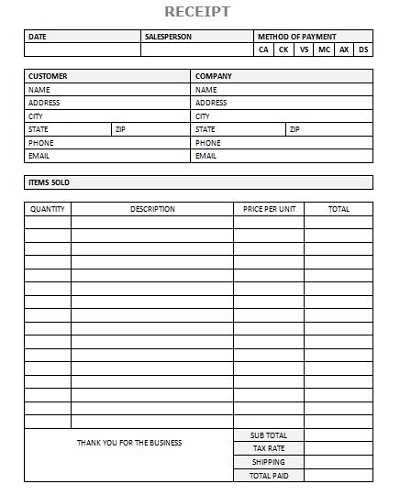

One of the main advantages of using a pre-formatted document is the time it saves. Instead of starting from scratch, you can focus on filling in the necessary details, such as patient information, treatment descriptions, and payment amounts. This approach not only reduces errors but also ensures that your records follow a standardized format that can be easily understood by both clients and accounting teams.

How to Use and Customize the Document

Customizing your document is straightforward. After downloading the file, you can add your business information, adjust the layout to your preferences, and include any specific payment terms or additional sections. With a few simple edits, the document becomes fully aligned with your branding and billing practices. You can easily save, print, or send the completed record to clients, all while keeping a consistent look across all your financial documentation.

How to Create a Billing Document

Creating a professional billing record involves several key steps to ensure accuracy and clarity. Whether you’re handling healthcare services or any other type of business, having a structured approach makes the process easier. Here’s how you can go about it:

- Gather Necessary Information

- Client’s name and contact details

- Services provided and descriptions

- Dates of service

- Amount charged for each service

- Payment terms and due date

- Choose a Layout

- Decide whether you want a detailed or a simple format

- Include sections like itemized charges, total amount due, and payment instructions

- Format for Easy Readability

- Use clear headings and bold text for important details

- Maintain a clean and organized layout with enough space between sections

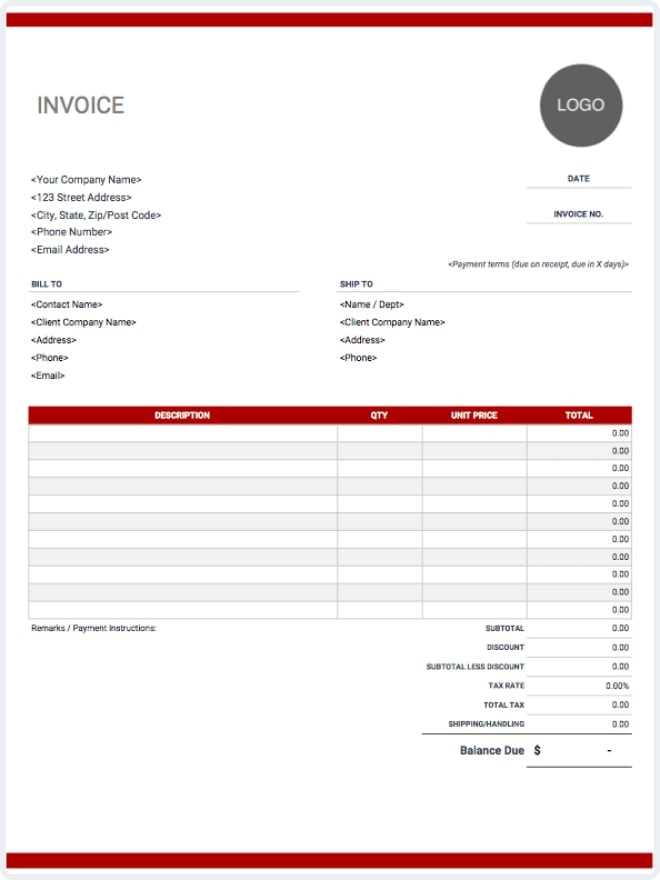

- Customize Your Branding

- Add your business logo and contact information

- Ensure the colors and fonts match your brand identity

By following these steps, you can easily create a comprehensive and professional record that accurately reflects the services provided and is easy for clients to understand. With a few clicks, your document will be ready to be sent and paid, keeping both you and your clients satisfied with the process.

Benefits of Using a Template

Using a pre-designed document offers a range of advantages, particularly when it comes to improving efficiency and maintaining consistency. By starting with a ready-made structure, you can focus on personalizing the content rather than spending time on formatting. Here are some of the key benefits of using a structured approach:

Time Savings

- Quickly generate professional records without needing to format each document from scratch.

- Streamline the process by focusing only on inputting relevant data such as service details and payment terms.

- Reduce the time spent creating invoices, allowing you to focus on other aspects of your business.

Professional Appearance

- Ensure that every document follows a consistent and polished format, reflecting your business’s professionalism.

- Pre-designed layouts often include essential elements, such as clear headings and itemized sections, improving readability.

- Using a structured format guarantees that no critical information is omitted, presenting a comprehensive and easy-to-understand document.

In addition to saving time and ensuring a polished look, using a structured document reduces the risk of errors. This helps you maintain a high level of accuracy, which is crucial for effective billing and client trust. With minimal effort, you can ensure your documents are both professional and efficient.

Customizing Your Billing Document

Personalizing your billing records is an important step to ensure that they align with your business needs and branding. By adjusting various sections, you can create a document that not only looks professional but also includes all the necessary details specific to your services. Customizing allows you to add your company’s identity and tailor the content to meet client expectations.

Adding Business Information

Including your company’s name, address, contact details, and logo is an essential part of customization. This ensures that your clients can easily reach out if they have any questions about the charges. It also makes your document look more polished and professional.

Itemizing Services and Charges

One of the key aspects of customization is specifying the services provided along with the corresponding costs. It’s essential to present this information in a clear and organized manner, so clients can easily understand what they are being charged for.

| Service | Description | Cost |

|---|---|---|

| Consultation | Initial consultation for health assessment | $100 |

| Treatment | Follow-up treatment session | $150 |

| Procedure | Minor surgical procedure | $300 |

By organizing the charges in this manner, clients can quickly assess the breakdown of costs, ensuring transparency and reducing the chances of misunderstandings. Customization also allows you to adjust payment terms, due dates, and other relevant information, further personalizing the document to your specific needs.

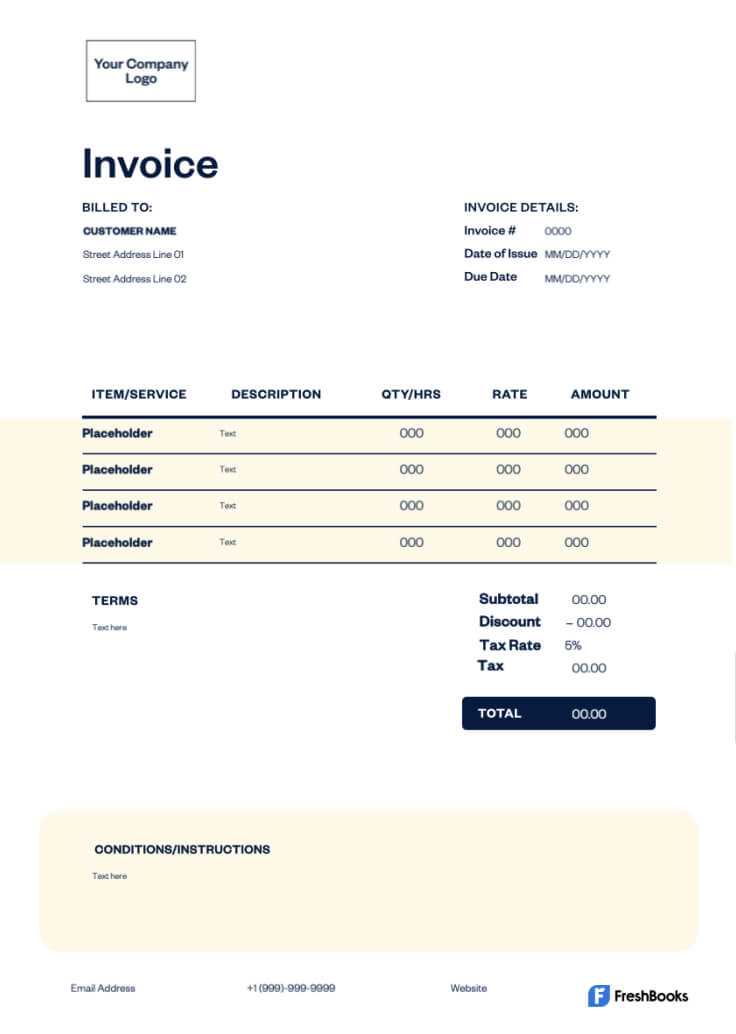

Key Elements of a Billing Record

When creating a billing document, there are several essential components that must be included to ensure that all necessary information is clear and accessible. These elements help both the service provider and the client understand the charges, terms, and any relevant details about the transaction. Here are the key elements that should always be present in a professional billing record:

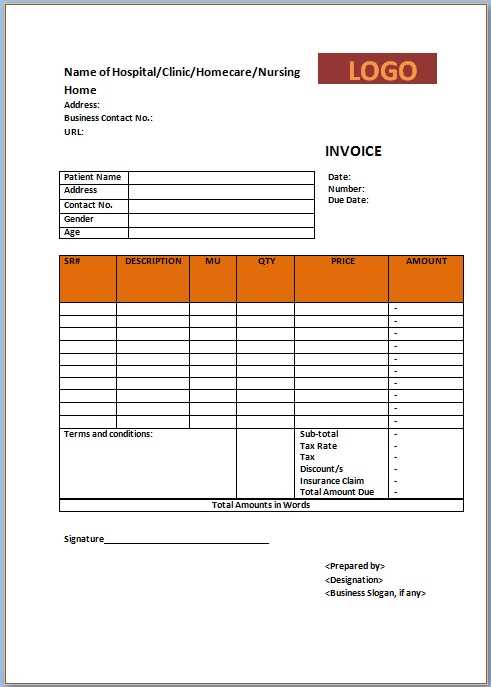

1. Contact Information

Including both the service provider’s and the client’s contact details is essential. This section should feature the provider’s business name, address, phone number, and email, along with the client’s name and contact details. Clear identification of both parties ensures there is no confusion about who is responsible for payment.

2. Description of Services

Each service provided should be listed separately with a detailed description. This helps clarify the work performed and justifies the corresponding charges. Including the date of service is also important for both record-keeping and payment tracking.

3. Payment Terms and Amount Due

Clearly stating the payment terms is crucial to avoid any misunderstandings. This includes the total amount due, any applicable taxes, and payment deadlines. The terms should also mention any late fees or discounts for early payment, if applicable.

4. Unique Invoice Number

Each billing record should have a unique reference number to facilitate tracking and record-keeping. This number helps both parties easily identify the transaction for future reference.

5. Payment Instructions

Provide clear instructions on how the payment should be made. This can include bank account details, payment platform links, or other methods of payment. Being specific in this section helps the client complete the transaction promptly.

Including these key components in every billing document ensures that both the provider and client have a clear understanding of the transaction, reducing confusion and the chances of disputes. It also helps maintain professional and organized business practices.

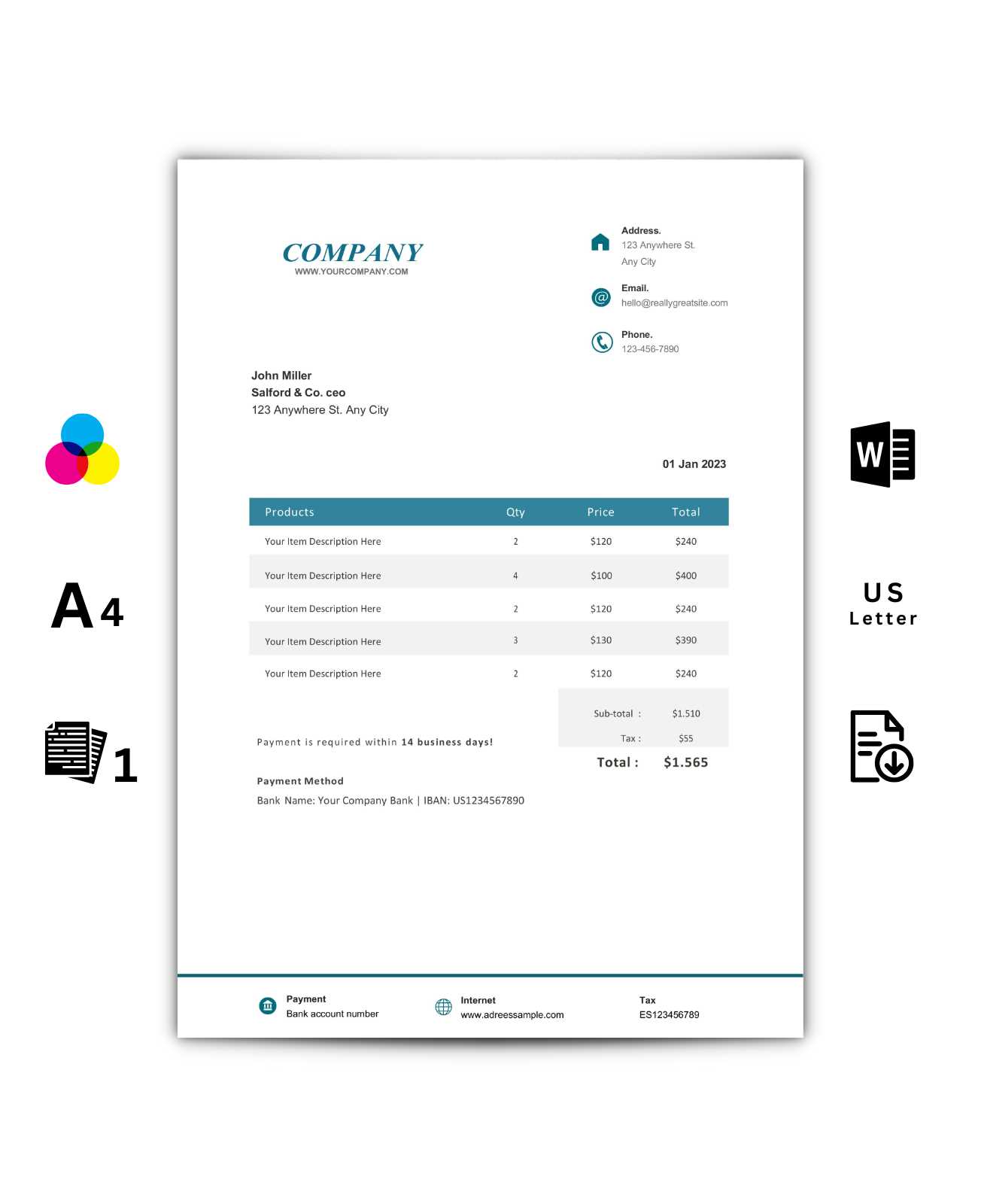

How to Format Billing Records in Word

Properly formatting your billing documents is essential to ensuring they look professional and are easy to understand. A well-organized layout not only helps the client quickly identify key information but also creates a positive impression of your business. Here’s how you can format your records effectively:

Step-by-Step Formatting Process

- Start with a Clean Layout

- Open a new document and set the page size to your preferred format (e.g., letter or A4).

- Adjust the margins to ensure there is adequate space on all sides for readability.

- Choose a clear, legible font such as Arial or Times New Roman, and set the size to 10 or 12 points for body text.

- Include Essential Details

- At the top of the page, place your business name, address, phone number, and email, followed by the client’s information.

- Insert a unique document number for reference and the date of issue.

- Organize the Service Details

- Create a table to clearly list each service provided, with columns for the description, date of service, and cost.

- Ensure that the total amount is calculated correctly and displayed at the bottom of the table for clarity.

Final Adjustments

- Payment Terms

- Include a section for payment terms, specifying the due date and any applicable late fees or early payment discounts.

- Review and Save

- Once you’ve formatted the document, review it for accuracy and completeness.

- Save the file in a format that’s easy to share, such as PDF, for sending to clients.

By following these simple formatting steps, you can create clear and professional billing documents that are easy for both you and your clients to manage.

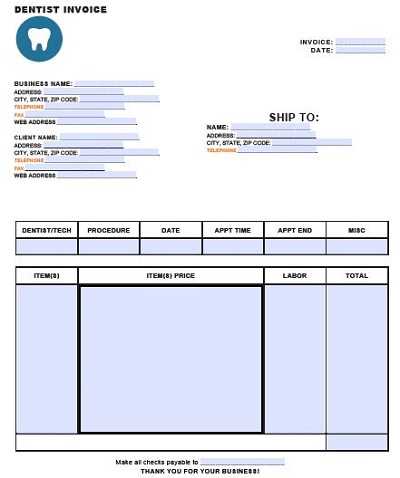

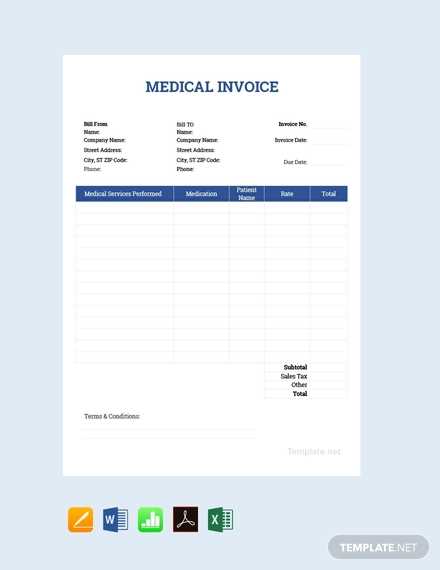

Download Invoice Templates Online

Finding the right format for your billing records is easier than ever with the abundance of pre-designed layouts available online. These ready-to-use options can save you time and effort, allowing you to quickly generate professional documents tailored to your needs. By downloading these files, you can ensure that your billing process is efficient and consistent every time.

Where to Find High-Quality Templates

There are various websites offering customizable billing record formats, suitable for different business types. Whether you are looking for a basic design or a more detailed format, you can find options that align with your preferences. Popular sources for downloading include:

- Business and Accounting Websites

- Many financial service websites provide free, editable billing layouts designed for professional use.

- These formats often come with customizable fields to input service descriptions and prices.

- Office Suite Providers

- Major software platforms like Google Docs or Microsoft Office offer downloadable layouts that are easy to personalize.

- These are particularly convenient if you already use these tools for your business.

Why Choose Pre-Formatted Options?

Opting for a pre-designed file saves you valuable time while ensuring that your documents maintain a professional appearance. Customizing these options allows you to add specific details relevant to your business, while the structure of the file ensures all necessary components are included, such as client information, service breakdown, and payment terms.

With these online resources, you can instantly access well-organized layouts that streamline your billing process and help you stay consistent with your documentation. Downloading a ready-to-use file is a simple and effective way to manage your business’s billing needs.

Why Choose Word for Billing Documents

Using a word processing software to create your billing records offers several advantages, making it a popular choice for businesses of all sizes. With its ease of use and flexibility, this platform provides a range of tools that allow you to customize your documents quickly and efficiently, ensuring they meet your specific needs while maintaining a professional appearance.

Ease of Customization

One of the primary reasons for choosing word processing software is the ease of customization. You can effortlessly adjust fonts, layouts, and colors to match your company’s branding. Additionally, it’s simple to add or remove sections as required, such as extra fields for specific services or payment terms, providing full flexibility over the document’s content.

Compatibility and Accessibility

Documents created in word processing programs are highly compatible with most devices and platforms. You can easily share your records via email or upload them to cloud services, making it convenient for both you and your clients to access and manage billing information from anywhere. Additionally, the ability to save the files in different formats, such as PDF or DOCX, ensures that your records are accessible across various systems.

By choosing word processing software for creating billing documents, you streamline your workflow while benefiting from user-friendly tools and broad compatibility. This makes it an ideal solution for businesses looking for an efficient way to manage their billing operations.

Top Features of a Billing Document Layout

A well-structured billing document is more than just a list of services and costs; it includes specific features that ensure clarity, accuracy, and professionalism. These features help both service providers and clients understand the details of the transaction, making the payment process smoother and more efficient. Below are some key features that every effective billing document should include.

Essential Components of a Billing Record

To ensure a billing document is comprehensive and professional, certain components must be included. These elements ensure that both parties have all the necessary information for a clear understanding of the transaction.

| Feature | Description |

|---|---|

| Contact Information | The names, addresses, and phone numbers of both the service provider and the client to facilitate communication. |

| Service Breakdown | A detailed description of each service provided, including the date and associated costs for transparency. |

| Payment Terms | Clear terms regarding the payment due date, late fees, or discounts for early payment to avoid confusion. |

| Unique Identification Number | A reference number to help easily track the document for future reference and organization. |

| Payment Instructions | Clear guidelines on how to make the payment, whether through bank transfer, check, or other methods. |

Additional Features for Convenience

In addition to the essential elements, many billing records also include additional features to enhance usability and clarity.

- Logo and Branding – Including your business logo and colors to make the document look professional and consistent with your brand.

- Terms and Conditions – Optional section outlining any policies related to payments, refunds, or other relevant conditions.

- Digital Payment Options – Easy-to-access links or instructions for digital payments, such as PayPal or bank transfers, increasing convenience for clients.

By including these key features, a billing document can serve as both a functional and professional tool, ensuring smooth transactions and clear communication between service providers and their clients.

Saving Time with a Ready-Made Layout

Using a pre-designed layout can significantly reduce the time spent creating documents from scratch. These ready-made solutions allow businesses to focus on the essential details rather than spending valuable time formatting or organizing information. By choosing an existing structure, you can streamline the process, making it more efficient and less stressful.

With a ready-made layout, you don’t have to worry about aligning sections, adjusting fonts, or ensuring consistency across the document. Everything is already set up, which allows you to quickly add the specific details you need, such as service descriptions, costs, and client information. This time-saving feature is particularly helpful for busy professionals or small businesses looking to manage their paperwork without wasting time on formatting tasks.

Efficiency Boost – Using a pre-built layout not only saves time but also ensures that the final document looks professional and polished. The consistency and organization provided by these layouts help you maintain a high standard for all your documents, creating a positive impression with clients and partners.

Customizable for Your Needs – While a ready-made layout provides a solid foundation, it can also be customized to suit your specific needs. You can easily modify it to reflect your business’s unique requirements while retaining the time-saving benefits of a pre-designed structure.

Tips for Professional Document Design

Creating a professional-looking document is essential for establishing credibility and building trust with clients. A well-designed document can make a positive impact, making the content more accessible and easier to understand. Here are some practical tips to ensure your documents maintain a polished, professional appearance while remaining clear and organized.

1. Keep It Simple and Clean – A cluttered document can overwhelm the reader. Use a simple, clean layout with plenty of white space. Avoid unnecessary graphics or complicated elements that could distract from the main information. Focus on clarity and legibility to ensure your message is easily communicated.

2. Use Consistent Fonts and Colors – Choose a professional font that is easy to read, such as Arial or Times New Roman. Stick to a maximum of two font types (one for headings and one for body text) to create a cohesive look. Additionally, use a consistent color scheme that aligns with your brand’s identity. Avoid using too many different colors, as it can make the document look disorganized.

3. Prioritize Key Information – Organize your document so that the most important details stand out. Use bold headings, bullet points, or tables to separate sections and make critical information easily scannable. This can help your clients quickly locate the details they need, whether it’s the payment amount or due date.

4. Add a Professional Header and Footer – A well-placed header with your logo and business contact information adds a professional touch. The footer can be used to include additional details, such as payment terms, contact information, or a company slogan. This not only improves the overall design but also ensures your business details are always visible to your clients.

5. Ensure Readability Across Devices – As many clients may view your document on different devices, it’s important to ensure the design remains readable and accessible across all platforms. Keep the layout responsive, using larger fonts for better readability on mobile screens, and avoid overly complicated designs that might not translate well to smaller devices.

By applying these design tips, you can create a visually appealing and effective document that reflects professionalism and promotes trust with your clients.

How to Add Payment Details to an Invoice

Including clear and concise payment information is crucial for ensuring that your clients understand how and when to pay. Properly outlining payment instructions can help avoid misunderstandings and ensure timely transactions. Here are some effective steps to follow when adding payment details to a document.

Steps to Add Payment Information

- State the Total Amount Due: Begin by listing the total amount owed by the client. Make it bold or larger to ensure it stands out and is easy to identify.

- Specify Accepted Payment Methods: Include a list of all available payment options, such as bank transfer, credit card, PayPal, or check. This gives the client flexibility in how they can settle their bill.

- Include Payment Instructions: Provide any necessary details on how to make the payment, such as your bank account number, PayPal address, or any specific instructions for using a particular method.

- Set a Due Date: Clearly state the payment due date. This helps avoid late payments and sets expectations for when the payment should be made.

- Late Payment Fees: If applicable, mention any late payment fees or interest charges that may apply if payment is not received by the due date. This encourages timely payments.

- Include Contact Information: Ensure that clients know how to reach you in case they have questions regarding the payment process. This could include your email, phone number, or other communication channels.

Formatting Payment Details

- Clear Section for Payment Details: Ensure that the payment section is easy to find. It’s often helpful to separate it with a line or place it at the bottom of the document.

- Use Bullet Points: Organize payment methods and instructions using bullet points for better readability and to make the process more user-friendly.

- Bold Important Information: Highlight key information, such as the total amount, due date, and accepted payment methods, to ensure it catches the client’s attention.

By following these steps and ensuring all payment details are clearly listed, you can make the process smooth for both you and your clients, improving the likelihood of timely payments and minimizing confusion.

Common Mistakes to Avoid in Invoices

Ensuring that your billing documents are clear, accurate, and professional is essential for maintaining a good relationship with your clients. Avoiding common errors in these documents can prevent confusion, delays, and disputes. Below are some of the most frequent mistakes and how to avoid them.

Frequent Errors to Watch Out For

- Incorrect Client Information: Double-check the client’s name, address, and contact details. Incorrect information can delay payments or cause the document to be ignored.

- Missing or Wrong Payment Terms: Clearly outline the payment due date, as well as any penalties for late payments. Failure to include this information can lead to confusion or late payments.

- Omitting a Detailed Breakdown: Always provide a clear list of services or products, including quantities and prices. Failing to do so might leave the client unsure about what they are being charged for.

- Overlooking Tax Information: If applicable, make sure to include taxes such as sales tax or VAT. Not specifying the tax rate or amount could result in misunderstandings and complications during payment.

- Using Unclear Payment Instructions: Ensure your payment methods are specified clearly. Whether you’re accepting bank transfers, credit cards, or online payments, make the process as easy and straightforward as possible.

- Not Including an Invoice Number: An invoice number is critical for both record-keeping and referencing. Missing this key piece of information can make it difficult to track payments and manage your records effectively.

- Typos and Mathematical Errors: Always proofread your document for any mistakes, whether in spelling, grammar, or calculations. Errors in the totals or incorrect calculations can damage your professional reputation.

How to Avoid These Mistakes

- Review Carefully: Always review your document before sending it. Even small mistakes can result in delays or questions from your client.

- Use a Standardized Format: A consistent format helps minimize errors and makes your documents look professional. Stick to a template that includes all the necessary information.

- Seek Feedback: If possible, ask a colleague or assistant to review the document to catch any errors you might have missed.

By being mindful of these common mistakes, you can ensure that your billing process runs smoothly and that you maintain a professional image with your clients.

Setting Up Your Business Details in Word

When creating any document for your company, including billing or transactional records, it is essential to include all necessary business details clearly and professionally. These details help establish trust with your clients and ensure that the documents are properly processed. This section will guide you through how to organize and set up your business information effectively.

Key Business Information to Include

- Company Name: Always display your official business name prominently at the top of the document. This is your first point of identification.

- Contact Information: Include your business address, phone number, and email. This makes it easy for clients to get in touch if necessary.

- Tax Identification Number: Depending on your location, you may need to provide a tax ID or business registration number for official purposes.

- Banking Details: If clients need to make payments through a bank transfer, include your bank account details, such as account number and bank name, ensuring that they are clear and easy to understand.

Tips for Organizing Your Business Details

- Use a Standard Format: Organize your information in a clear, structured layout so that clients can easily find the details they need.

- Keep Your Details Updated: Regularly review your contact information and update any changes to ensure accuracy.

- Highlight Important Information: For critical data like your tax ID or payment details, use bold or underlined text to make these stand out.

By properly setting up and maintaining your business information in documents, you ensure smooth communication and facilitate prompt payments from clients.

Making Billing More Efficient

In today’s fast-paced business environment, streamlining billing processes is crucial for saving time and reducing errors. By utilizing the right strategies and tools, you can improve the accuracy and speed of your financial transactions. This section explores ways to enhance your billing efficiency and ensure smooth financial operations.

Implementing Automated Systems

Automation plays a key role in reducing the manual effort involved in billing. With automated software, you can easily generate documents, track payments, and send reminders, all while minimizing human error.

- Automated Reminders: Set up automatic reminders for clients to ensure timely payments and reduce follow-ups.

- Recurring Billing: If your business model includes regular payments, automate the process to avoid repeated data entry.

- Tracking Features: Use software that tracks unpaid or overdue amounts and provides reports on outstanding balances.

Standardizing Formats and Procedures

Standardization of billing documents and processes ensures that all relevant information is captured accurately and consistently. This approach also minimizes the chance of errors or missing details.

- Consistent Layouts: Create uniform documents for all transactions, making it easier for clients to review and understand charges.

- Clear Descriptions: Ensure that all items and services are described in clear, concise language to avoid confusion.

- Payment Terms: Clearly state payment due dates and methods of payment to avoid misunderstandings.

By adopting these strategies, you can make your billing process more efficient, saving time, reducing errors, and ensuring better cash flow management.

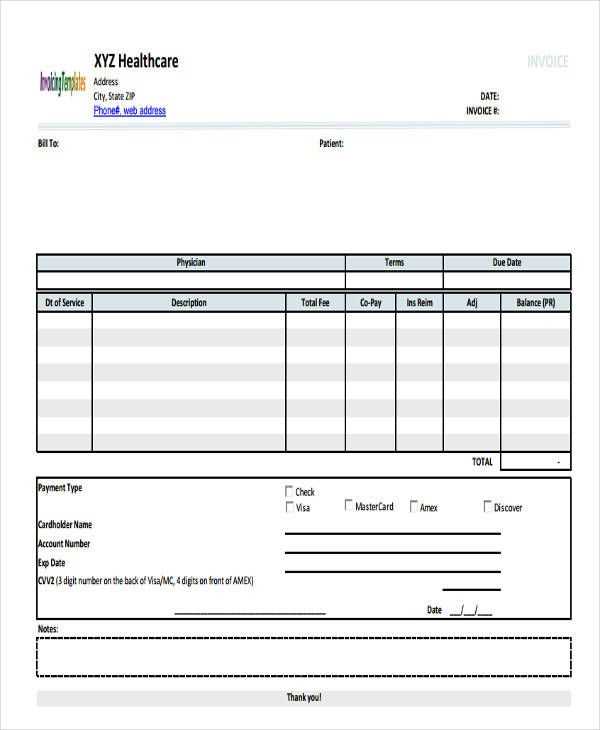

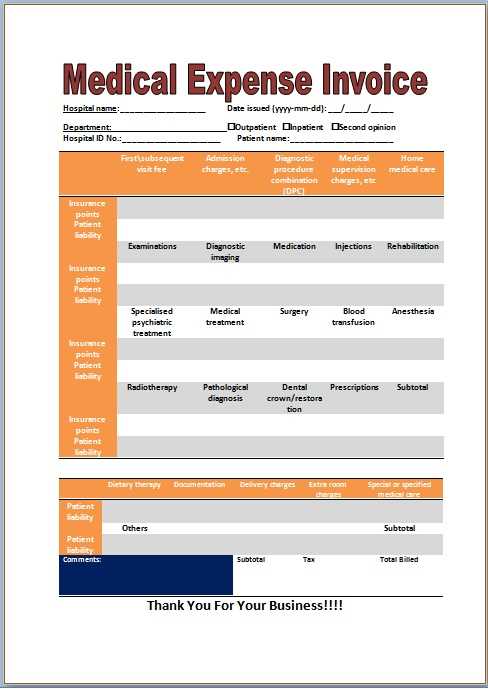

Legal Requirements for Medical Invoices

When handling billing for healthcare services, it is important to comply with various legal regulations to ensure accuracy and avoid potential legal issues. These requirements help maintain transparency and protect both providers and clients in financial transactions. This section outlines the key legal considerations when creating such documents.

Essential Information to Include

There are certain details that must be included in each billing document to meet legal standards. These elements are crucial for both regulatory compliance and to provide clear information to the payer.

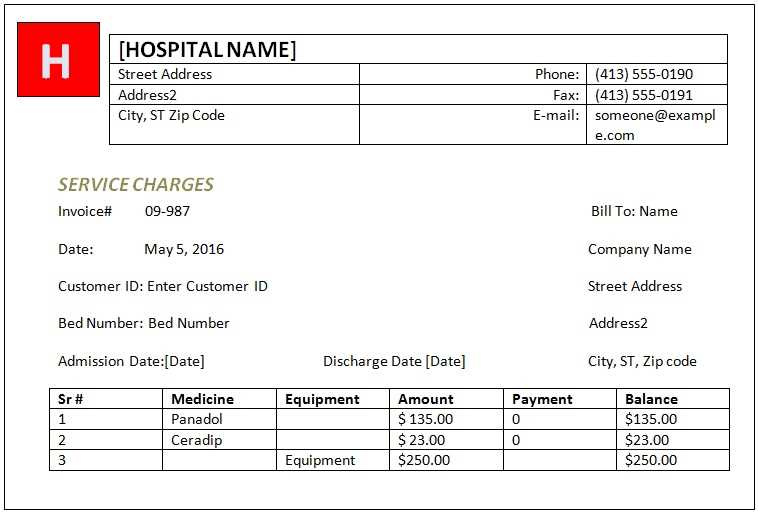

- Provider’s Information: Include the name, address, and contact details of the service provider or institution.

- Patient’s Information: Ensure the patient’s name, contact details, and identification number (if applicable) are listed accurately.

- Service Description: Clearly state the services provided, including the date of service and the nature of the treatment or consultation.

- Itemized Charges: List each charge separately, including rates for services rendered, medications, and other expenses.

- Tax Information: If applicable, specify tax charges based on local laws and regulations.

Compliance with Health Regulations

In some regions, healthcare providers must comply with specific health regulations that govern how financial documents are issued and stored. This can include restrictions on the disclosure of sensitive patient information and requirements for maintaining records for a specific duration.

- Confidentiality Standards: Ensure that all patient data is handled in accordance with privacy laws, such as HIPAA (Health Insurance Portability and Accountability Act) in the United States.

- Payment Terms: Clearly define the payment deadlines, methods of payment, and penalties for late payments, in line with the provider’s policies.

- Record Keeping: Retain copies of all billing documents for the required length of time as per the applicable legal requirements in your jurisdiction.

By following these guidelines and staying informed about local regulations, healthcare providers can ensure their billing processes are legally sound, minimizing potential risks and fostering trust with patients.