Download Sample Billing Invoice Template for Easy and Professional Invoicing

Creating accurate and professional payment requests is a crucial task for businesses of all sizes. The right document format can help ensure timely payments, prevent misunderstandings, and streamline your financial workflow. With a well-organized structure, you can clearly communicate essential details such as amounts due, payment terms, and other key information your clients need.

Streamlining the invoicing process is possible with the use of customizable document formats that cater to your specific needs. Whether you’re a freelancer, small business owner, or large corporation, having a ready-to-use solution saves time and reduces errors in your financial transactions. These customizable formats provide consistency while maintaining professionalism in all communications with clients.

By using pre-designed formats, you can focus on the core aspects of your work rather than spending unnecessary time on layout and structure. A well-crafted document makes it easier for clients to process payments, improving overall efficiency in your business operations. Adopting a systemized approach to billing helps you maintain a polished and reliable financial record.

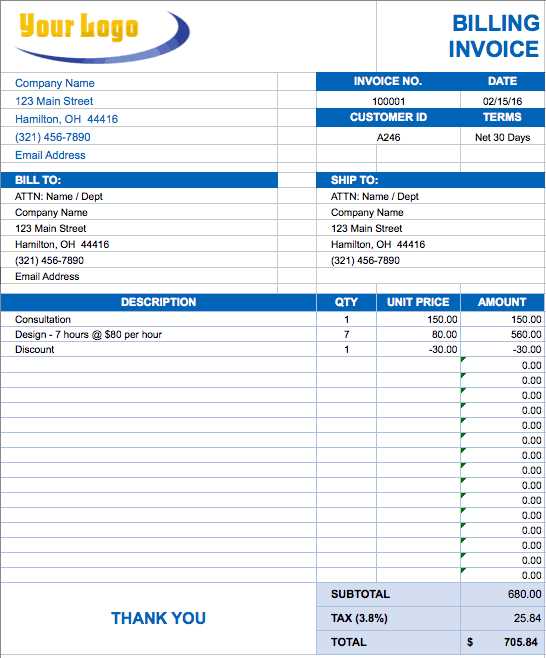

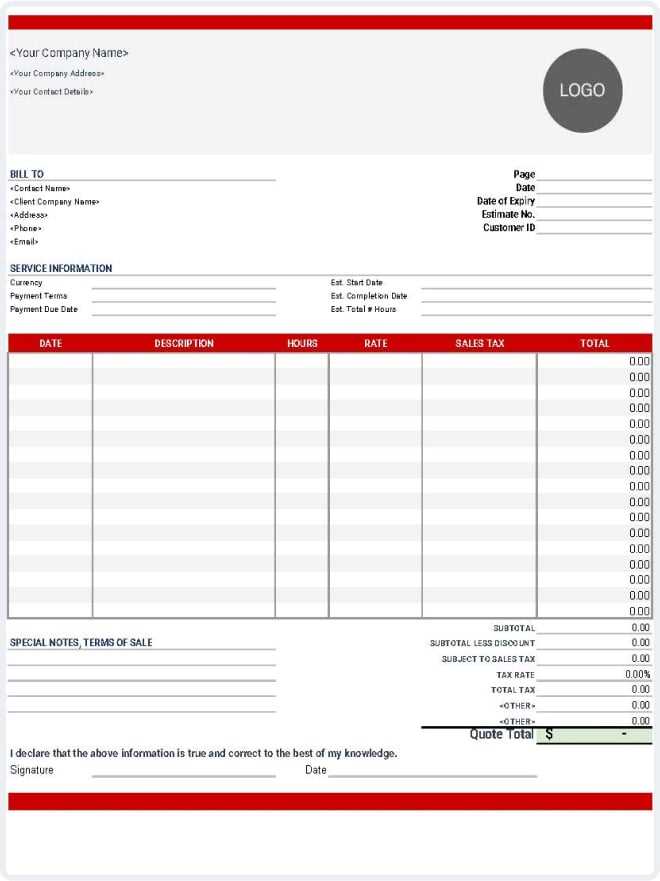

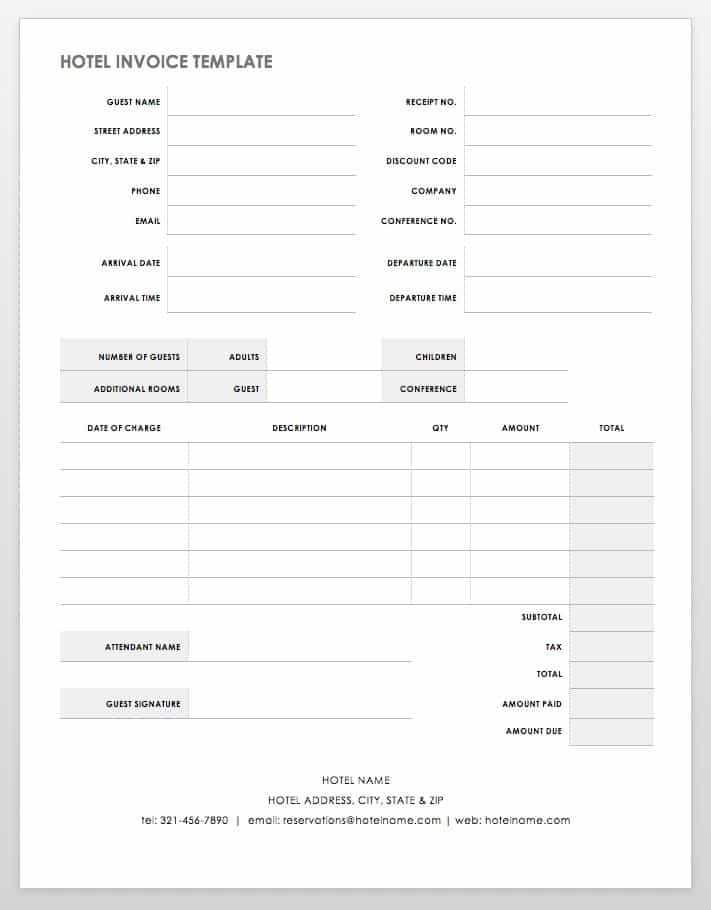

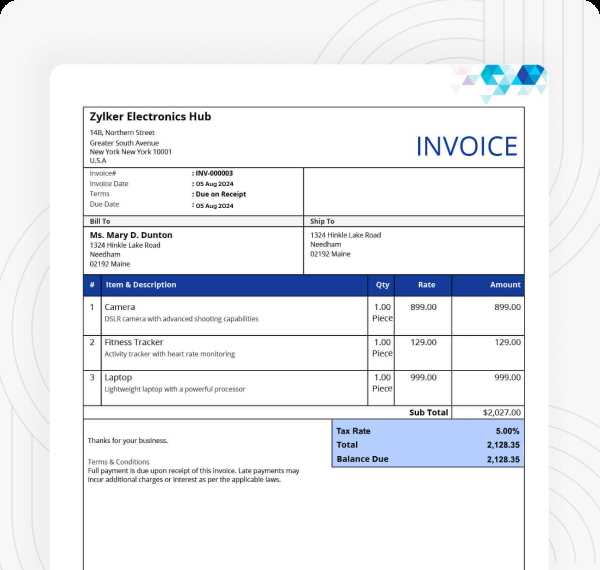

Sample Billing Invoice Template Overview

When it comes to managing payments and ensuring smooth financial transactions, having the right document format can make all the difference. A well-structured document helps both parties–service providers and clients–understand the details of the payment, including amounts owed, services rendered, and the expected timeline for settlement. This ensures that all necessary information is presented in a clear and organized way, minimizing confusion and errors.

Key Features of a Professional Document Format

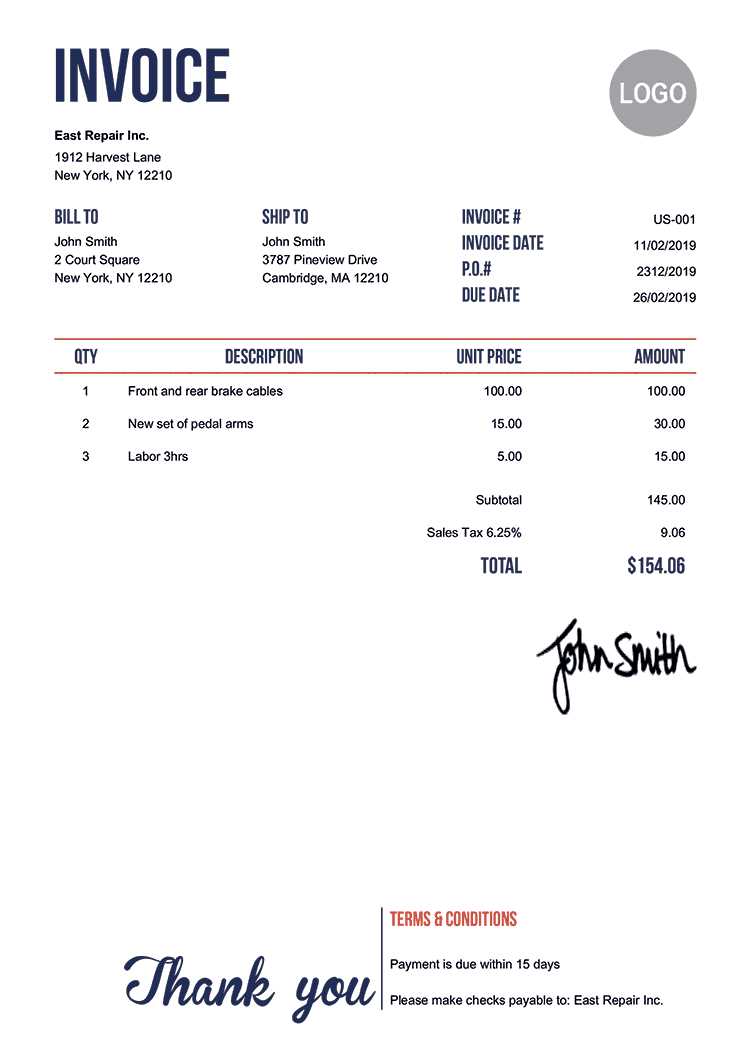

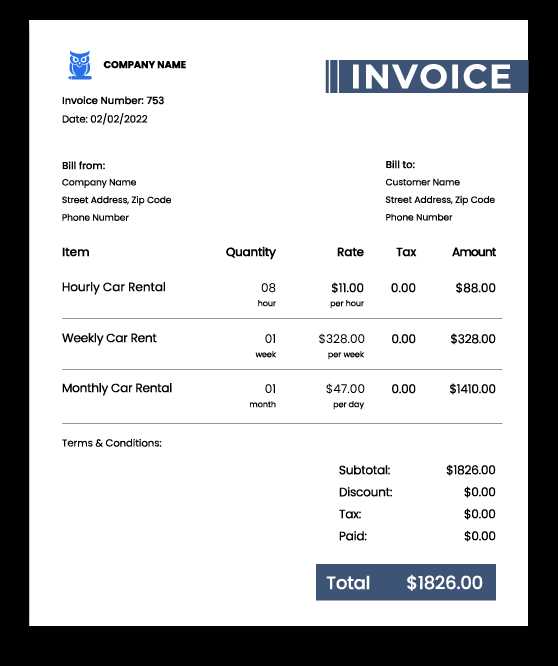

A high-quality document for requesting payment should include several important elements. These typically consist of sections for contact information, a detailed list of services or goods provided, and the total amount due. Additionally, payment terms such as due dates, late fees, and accepted payment methods should be clearly outlined. The document must also maintain a clean and organized appearance to reflect the professionalism of the sender.

Why Use Pre-Designed Formats

Using a pre-designed structure not only saves time but also ensures that you don’t miss critical details. Pre-made formats provide a consistent layout that can be easily adjusted to fit your business needs. They are especially helpful for small business owners or freelancers who need to generate multiple documents quickly without compromising on quality. This approach minimizes the risk of mistakes, making it easier to maintain a positive relationship with clients while ensuring smooth financial operations.

Why Use a Billing Invoice Template

Using a well-structured document for requesting payments can significantly streamline financial transactions between businesses and clients. Having a consistent format in place helps ensure clarity, reduces errors, and saves valuable time. By utilizing a ready-made layout, businesses can focus on the content of the payment request rather than worrying about formatting and design every time.

There are several reasons why adopting a pre-made document format is beneficial:

- Consistency: A standardized structure ensures that all the necessary details are included every time. This minimizes the risk of forgetting important information such as payment terms, amounts, or contact details.

- Time Efficiency: With a pre-designed format, there’s no need to start from scratch for each transaction. You can quickly input relevant information and send it off to clients without unnecessary delays.

- Professional Appearance: A polished, consistent document reflects well on your business. It shows that you value organization and professionalism, which can positively impact your relationship with clients.

- Legal Protection: Properly formatted documents with clear terms and conditions help protect both parties in case of disputes. A well-organized request makes it easier to prove what was agreed upon, reducing misunderstandings.

- Customization: Many pre-designed formats allow easy customization. You can tailor them to your business needs, ensuring the document fits your brand while maintaining its professional integrity.

In summary, using a structured document for payment requests not only simplifies your workflow but also helps maintain a professional image and ensures that all critical information is communicated effectively.

Key Elements of an Effective Invoice

An effective document for requesting payment is essential for ensuring timely and accurate transactions. It needs to clearly communicate all the necessary details to avoid confusion and facilitate smooth processing. A well-organized format contains key information that helps both the sender and the recipient understand the expectations for payment without ambiguity.

To create an effective payment request, several key elements must be included:

- Sender’s Information: Include your business name, address, phone number, and email address. This makes it easy for clients to contact you if needed and ensures they know who is issuing the request.

- Recipient’s Details: Clearly display the name and contact information of the client or company being billed. This ensures there’s no confusion about who the payment is directed to.

- Unique Reference Number: Assign a unique identifier or reference number to each document. This helps both you and the client keep track of individual transactions and simplifies record-keeping.

- Detailed List of Services or Products: Provide a clear breakdown of what is being billed. Each item or service should have a description, quantity, rate, and total cost to ensure transparency.

- Total Amount Due: Clearly state the total amount owed. Include any applicable taxes, discounts, or additional charges to avoid confusion.

- Payment Terms: Include the due date and any late fees or early payment discounts. This sets clear expectations regarding when payment is expected and the consequences of missing the deadline.

- Accepted Payment Methods: Specify the methods of payment you accept, whether it’s bank transfer, credit card, or online payment systems. This helps clients choose the most convenient option.

- Notes or Special Instructions: If applicable, include any additional information that might be relevant, such as specific payment instructions or reminders.

Including these key elements ensures that your payment requests are clear, professional, and efficient, reducing the chances of misunderstandings or delayed payments.

How to Customize Your Invoice Template

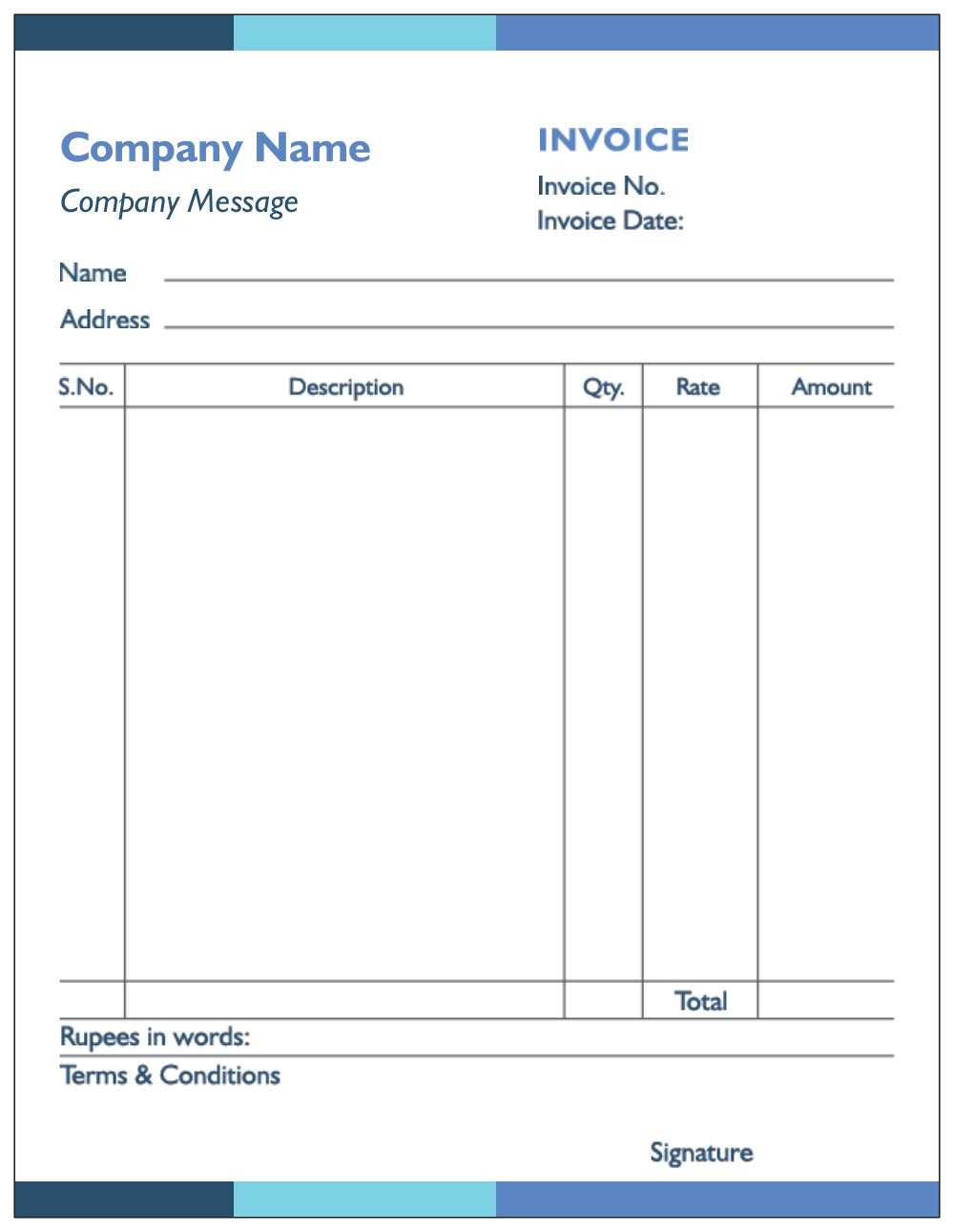

Customizing your payment request document ensures it reflects your business identity while maintaining clarity and professionalism. Tailoring the format to suit your specific needs can make the process more efficient, improve client relations, and streamline your financial management. Whether you need to add your logo or adjust the layout to match your brand, customization allows you to create a document that aligns with your unique requirements.

Steps for Personalizing Your Payment Request

There are several ways to adapt a pre-designed structure to better fit your business needs:

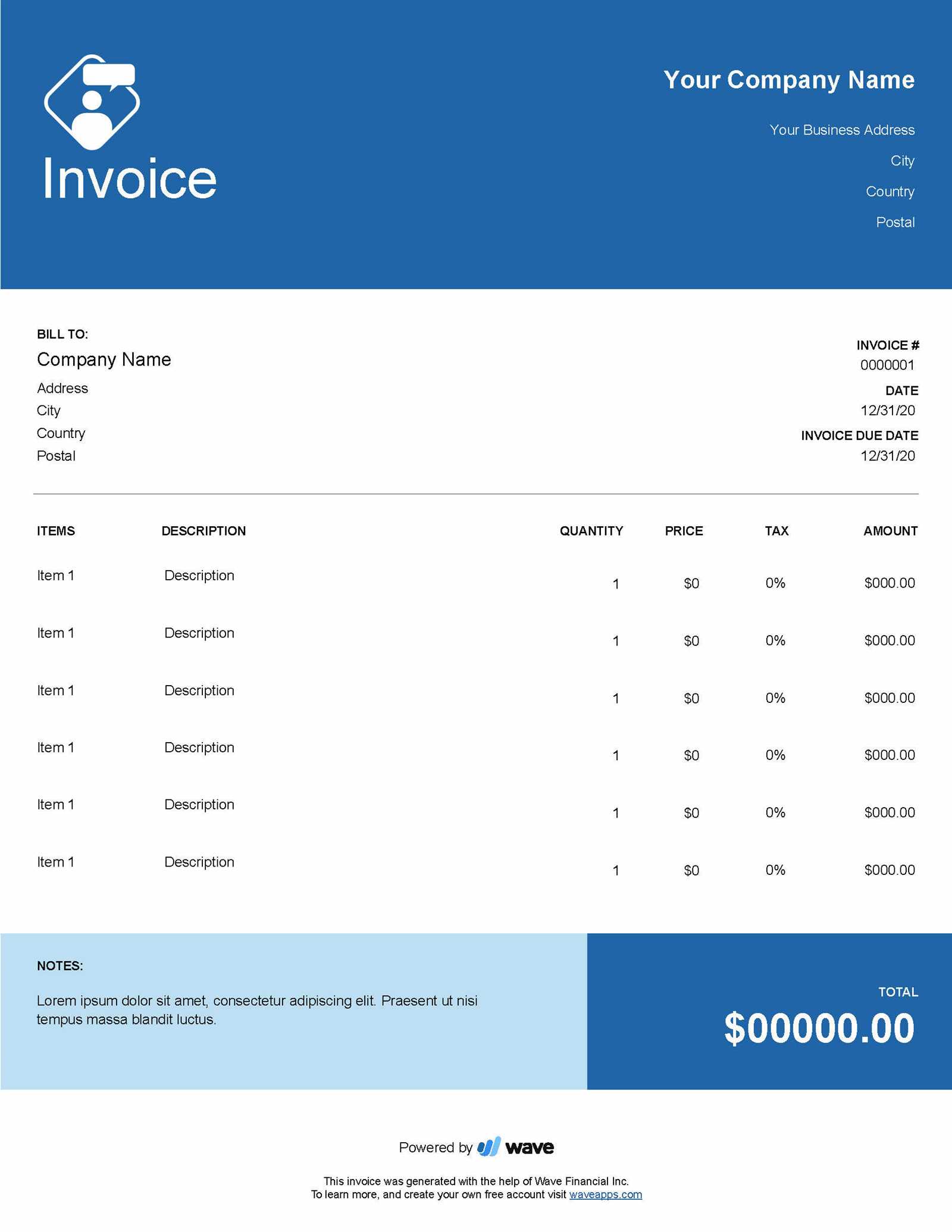

- Incorporate Your Brand Identity: Add your company logo, choose your brand’s color scheme, and use a font style that reflects your business image. This makes your payment request look more professional and aligned with your brand.

- Adjust Section Layouts: If certain sections are more relevant to your business, feel free to reorder or add new sections. For example, you may need extra space for project details, time logs, or purchase order numbers.

- Modify Terms and Conditions: If your payment terms differ from standard templates, you can change the payment methods, due dates, or late fee policies to match your business practices.

- Include Custom Information: Add additional fields that are specific to your services or industry, such as reference numbers, product codes, or descriptions of custom services provided.

- Choose Your Currency and Tax Options: Ensure the document reflects the correct currency for international clients and includes tax rates that comply with local regulations.

Using Digital Tools for Customization

Many software programs and online platforms offer easy-to-use tools that allow you to modify and personalize your document. These platforms provide a user-friendly interface where you can drag and drop elements, choose templates, and save multiple versions of your customized requests for future use. By utilizing such digital solutions, you can quickly create professional-looking documents without needing advanced design skills.

Customizing your payment request format not only improves your workflow but also helps reinforce your company’s professionalism and credibility with clients.

Top Benefits of Using Invoice Templates

Using a standardized structure for payment requests can offer numerous advantages for businesses, regardless of their size or industry. By adopting a pre-designed format, you save time, reduce errors, and enhance the overall professionalism of your financial documents. Whether you’re a freelancer or running a large enterprise, these ready-made layouts streamline the process of creating accurate and clear payment requests.

Here are the key benefits of using a standardized document for requesting payments:

- Time Efficiency: A pre-built format allows you to quickly generate documents without having to start from scratch each time. With just a few edits, you can create a customized payment request, freeing up more time for other tasks.

- Consistency: Consistency in your payment requests helps build trust with clients. By using the same format for every transaction, you ensure that all the necessary details are included, making it easier for clients to understand and process payments.

- Professional Appearance: A polished and uniform document reflects well on your business. Clients are more likely to take your financial requests seriously when they are presented in a clear, professional manner.

- Accuracy: Using a structured layout helps minimize the risk of missing important information or making mistakes. The consistency of the format ensures that you include all relevant details, from pricing to payment terms.

- Reduced Errors: Pre-made layouts often have built-in formulas or fields that automatically calculate totals and taxes. This reduces the likelihood of manual errors, helping ensure your requests are accurate.

- Customizability: Many ready-made formats allow you to customize the layout to suit your specific needs. You can add your branding, adjust the structure, or modify payment terms to align with your business practices.

- Legal Protection: A well-structured document can serve as a legal record of the terms agreed upon between you and your client. Clear terms, payment due dates, and itemized charges help protect both parties in case of any disputes.

Incorporating a pre-designed format for your payment requests ensures efficiency, accuracy, and professionalism, while also saving you time and reducing the risk of errors. It’s a simple solution that can make a significant difference in the way you manage your finances.

Free vs Paid Billing Invoice Templates

When it comes to creating payment requests, businesses often face the decision of whether to use a free or paid solution. Both options come with their own set of advantages and drawbacks, depending on the specific needs of your business. While free layouts can be appealing for their cost-effectiveness, paid versions often offer more advanced features and greater customization options. Understanding the differences between these two choices can help you make an informed decision on which option best suits your requirements.

Comparison of Free and Paid Options

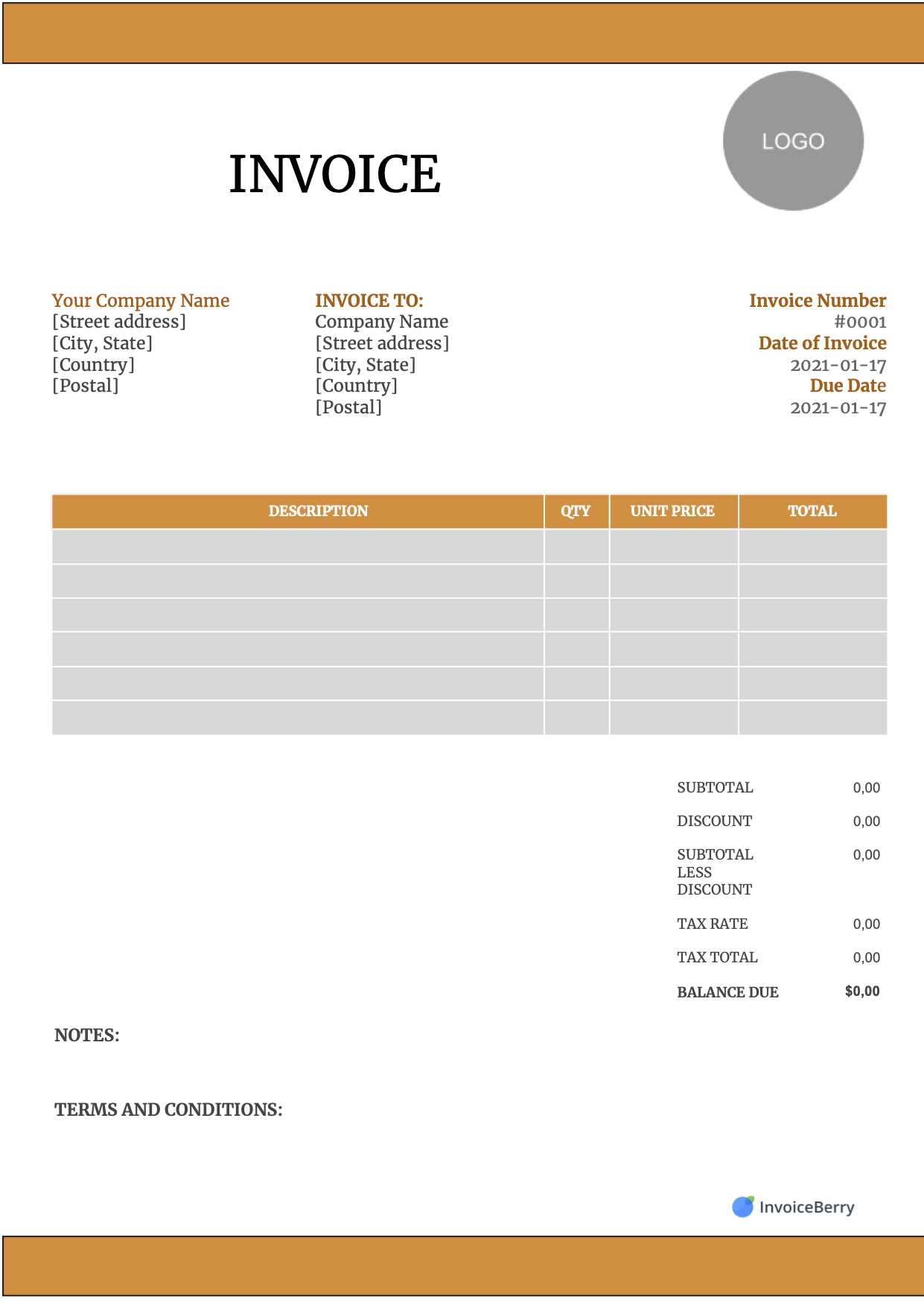

Here is a comparison between free and paid formats for payment requests to highlight the key differences:

| Feature | Free Formats | Paid Formats |

|---|---|---|

| Cost | Free | Varies (usually a one-time or subscription fee) |

| Customization | Limited | High (custom logos, design, fields) |

| Design Quality | Basic | Professional, polished, and often brand-specific |

| Features | Basic features only | Advanced features such as tax calculations, multiple currency support, and more |

| Support | Limited or no support | Customer support and assistance |

| Updates | Occasional updates, if any | Regular updates and improvements |

Which Option is Right for You?

Choosing between free and paid solutions ultimately depends on the needs of your business. Free options are a great starting point for small businesses or freelancers on a tight budget. They can help you quickly generate requests without any upfront cost. However, as your business grows, you may find that the limitations of free layouts become a hindrance, especially when you need more flexibility or advanced features.

Paid options are a better fit for businesses that require greater customization, more advanced functionality, or ongoing support. They are ideal for larger companies or those that want to maintain a consistent brand identity across all their financial documents.

Common Mistakes in Invoice Creation

Creating accurate and professional payment requests is essential for maintaining good relationships with clients and ensuring timely payments. However, many businesses make common errors when drafting these documents, which can lead to confusion, delayed payments, or even legal issues. Recognizing and avoiding these mistakes can help ensure smooth transactions and a better overall experience for both parties.

Frequent Errors in Payment Requests

Here are some of the most common mistakes made when creating payment documents:

- Missing or Incorrect Contact Information: Failing to include or incorrectly listing contact details–either for your business or your client–can lead to confusion and delay. Ensure all addresses, phone numbers, and email addresses are accurate and complete.

- Omitting Key Details: Sometimes important information such as itemized services, tax rates, or the total amount due is left out. Be sure to include a detailed breakdown of all charges to avoid misunderstandings.

- Not Including a Unique Reference Number: Every payment request should have a unique identifier to track it easily. Without a reference number, both you and your client might have trouble referencing past transactions, which can lead to disputes or delays.

- Unclear Payment Terms: Failing to specify payment due dates, late fees, or acceptable payment methods can cause confusion. Always clearly state when payment is due and any penalties for overdue amounts.

- Formatting Issues: A poorly formatted request can be difficult to read and may come across as unprofessional. Use clear fonts, structured sections, and consistent alignment to ensure the document is easy to navigate.

- Errors in Calculations: Simple math errors–like miscalculating totals, taxes, or discounts–can lead to disputes and delayed payments. Always double-check your calculations or use automated tools to ensure accuracy.

- Not Accounting for Taxes: Failing to include applicable taxes or incorrectly applying tax rates can result in issues with clients or even tax authorities. Make sure to understand local tax laws and reflect them correctly on your payment requests.

How to Avoid These Mistakes

To minimize errors in your payment requests, take the time to double-check all details before sending them out. Implement a checklist to ensure all necessary information is included, and consider using digital tools to automate calculations and formatting. The more organized and accurate your documents are, the more smoothly your payment process will run.

How to Properly Format an Invoice

Properly formatting a payment request is crucial to ensuring clarity, professionalism, and efficiency in financial transactions. A well-structured document helps both the sender and recipient easily understand the details of the payment, which leads to faster processing and fewer mistakes. The layout should be clean, organized, and easy to follow, with each section clearly defined and properly aligned.

Here is a guide to help you format your document for maximum effectiveness:

| Section | Details to Include | |||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Header | Include your business name, logo, and contact information (address, phone number, email). | |||||||||||

| Recipient Information | List the name, company (if applicable), and contact details of the person or company being billed. | |||||||||||

| Document Title | Clearly label the document as a “Payment Request,” “Receipt,” or similar title. | |||||||||||

| Unique Reference Number | Assign a unique identifier or reference number for easy tracking and record-keeping. | |||||||||||

| Service/Product Breakdown | Provide a detailed list of goods or services provided, with clear descriptions, quantities, unit prices, and totals. | |||||||||||

| Best Practices for Invoice Design

Designing a payment request document that is both functional and professional is key to ensuring smooth transactions and fostering positive relationships with clients. A well-designed document not only improves the client’s experience but also ensures that important details are clear and easy to understand. The layout, typography, and overall presentation can make a significant difference in how your communication is received. Key Design Principles

When creating a payment request, follow these best practices to enhance clarity, professionalism, and ease of use:

Additional Tips for Improved Design

By following these best practices, you can create a payment request that not only looks good but also ensures all essential information is clearly communicated. A well-designed document fosters trust and makes it easier for clients to pay promptly, ultimately contributing to a smoother business operation. Tips for Ensuring Invoice Accuracy

Ensuring the accuracy of your payment requests is essential to prevent delays, disputes, and confusion. Small errors, such as incorrect pricing, missing details, or miscalculations, can lead to misunderstandings with clients and may even impact your cash flow. By following best practices and implementing a systematic approach, you can significantly reduce the risk of mistakes and maintain a professional reputation. Here are some valuable tips to help ensure the accuracy of your payment documents:

By carefully reviewing and cross-checking each detail, you can avoid common mistakes and present an accurate, professional payment request. Accuracy not only helps ensure timely payments but also maintains your credibility and trust with clients. Integrating Payment Terms in Your Invoice

Clearly defined payment terms are essential for setting expectations between you and your clients. Including these terms in your payment requests helps avoid misunderstandings and ensures that both parties are aligned on the timeline and conditions for payment. By outlining payment details such as due dates, late fees, and acceptable methods, you can create a smooth, transparent transaction process. Here are the key components to include when integrating payment terms into your documents:

Clearly integrating payment terms in your payment requests not only sets expectations but also protects both parties in case of disputes. Make sure these terms are easy to read, and consider highlighting them to ensure they are not overlooked by your clients. Automating Invoice Generation with TemplatesAutomating the creation of payment requests can save valuable time, reduce human error, and increase efficiency in your business processes. By using predefined structures, you can quickly generate professional documents without having to manually enter repetitive information. This allows you to focus on more critical aspects of your business while ensuring that each payment request remains accurate and consistent. Benefits of AutomationAutomating the process of generating payment documents brings several advantages, including:

How Automation WorksAutomating payment request generation typically involves the use of software or online tools that allow you to create pre-designed layouts. These tools often have the following features:

By adopting automation, businesses can streamline their payment processes, reduce administrative overhead, and maintain a high level of accuracy and professionalism in their transactions. Whether you’re a small business owner or managing a larger company, automating payment request generation is a smart and scalable solution. How to Save Time with TemplatesUsing predefined structures for creating financial documents is an excellent way to streamline your workflow and save valuable time. By having a standard layout ready for each transaction, you can quickly input the necessary information without starting from scratch each time. This eliminates repetitive tasks, reduces errors, and enables you to focus on more critical aspects of your business. Here are some key ways in which predefined structures can help save time:

By incorporating predefined formats into your financial workflows, you can streamline the entire process of creating, sending, and managing payment requests. This not only saves you time but also enhances the efficiency of your business operations. Managing Multiple Invoice Versions

Managing different versions of payment documents is crucial for businesses that handle various types of transactions, clients, or pricing models. Whether you are dealing with customized service agreements, different payment terms, or multi-tiered pricing, maintaining organized and accurate versions ensures consistency and prevents confusion. A streamlined system for handling these versions helps you quickly generate the correct document for any specific situation without having to create one from scratch every time. Here are some effective strategies for managing multiple versions of your payment documents:

Effectively managing multiple versions not only improves workflow but also reduces the risk of errors and confusion. By organizing your documents, keeping track of changes, and automating where possible, you can ensure that each version is accurate, up to date, and relevant to the specific needs of your clients or business transactions. Creating a Professional Invoice Template

Crafting a professional payment request document is key to establishing trust and credibility with clients. A well-designed document not only ensures clarity and accuracy but also reflects the quality and reliability of your business. The structure of your payment document should be clear, organized, and easy to understand, highlighting all necessary details in a polished format. Here are some key elements to consider when creating a professional document layout:

By including these essential components, you can create a payment document that not only looks professional but also functions effectively in communicating all necessary details to your clients. A well-organized document helps foster good business relationships, ensures timely payments, and minimizes the risk of errors or misunderstandings. How to Choose the Right Template for Your Business

Choosing the right structure for creating financial documents is crucial for maintaining efficiency and professionalism in your business. The ideal layout will depend on the nature of your operations, the type of services or products you offer, and the preferences of your clients. A well-suited structure not only saves time but also ensures that every document you send is clear, accurate, and aligned with your business standards. Factors to Consider When Selecting a Document StructureWhen selecting a format for your payment documents, keep these key factors in mind:

Tips for Selecting the Best Format

Here are some additional tips to guide you in selecting the right document format:

By carefully evaluating these factors, you can choose the most effective structure for your business needs. Whether you’re managing a small business or a large enterprise, the right format will help you stay organized, maintain professionalism, and improve client satisfaction. |