Free Editable Invoice Template for Simple and Professional Invoicing

Running a business requires efficient tools to manage payments, and one of the most essential aspects is generating professional billing records. Having a reliable method to create and modify these documents can save time and ensure accuracy in your financial transactions. Whether you’re a freelancer, small business owner, or part of a larger organization, the ability to quickly craft customized payment requests is crucial.

When it comes to business paperwork, using pre-designed forms that can be adjusted to meet specific needs is a game-changer. By utilizing flexible options, you can add personal branding, adapt the structure, and ensure all necessary details are included in a clear and professional manner. These documents are vital for maintaining transparency and fostering trust with clients and partners.

With the right resources, producing tailored billing statements can be a seamless task. Streamlined processes not only save time but also reflect your attention to detail and commitment to professional standards. Whether you’re invoicing for products, services, or consultations, having the ability to modify your documents is an asset that will simplify your financial management.

Free Editable Invoice Template Benefits

Using customizable billing documents offers several advantages that can significantly improve your workflow and efficiency. When you have the ability to personalize each payment record according to the needs of your business or clients, it leads to a more streamlined process. Such flexibility enhances accuracy and professionalism, making transactions smoother and reducing the chance of errors.

Time and Cost Efficiency

One of the primary benefits of using flexible payment forms is the time saved in the creation process. Instead of drafting new records from scratch each time, you can easily adapt pre-designed structures, allowing you to focus on other aspects of your business. Additionally, you eliminate the need for costly accounting software or hiring external professionals, reducing overhead expenses.

Enhanced Professionalism and Branding

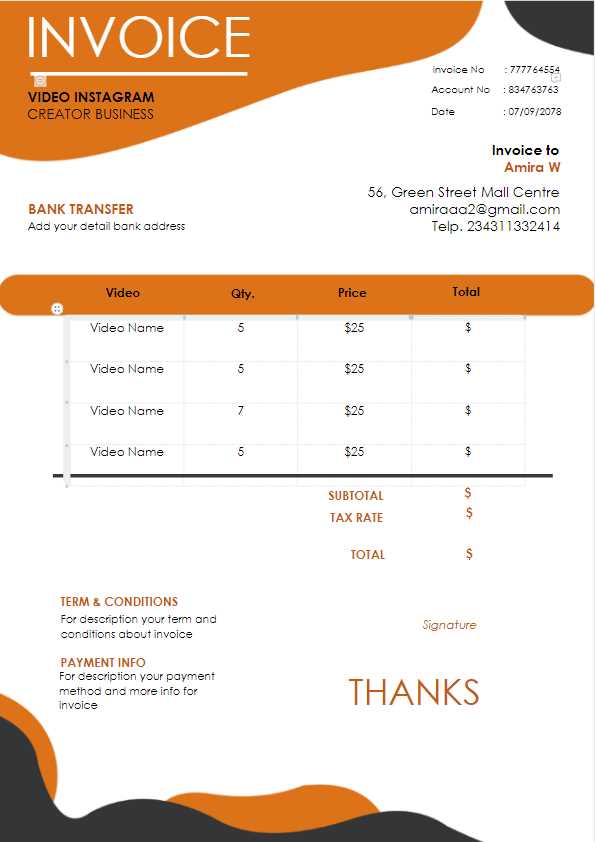

Customizable documents allow you to include your company’s branding elements, such as logos, color schemes, and contact information. This not only creates a cohesive and professional appearance but also strengthens your brand identity. A well-designed billing statement reflects positively on your business, helping to establish trust and credibility with clients.

By utilizing these flexible solutions, you ensure that every financial interaction with clients is clear, professional, and efficient, all while saving both time and money in the process.

Why Use an Editable Invoice Template

In today’s fast-paced business world, having the ability to quickly generate accurate and professional billing records is essential. Customizable financial documents allow you to adapt the structure, content, and design to fit your specific needs, ensuring that every transaction is clear and well-organized. Whether you’re a freelancer or a large enterprise, the flexibility of modifying your billing documents can save time, enhance accuracy, and improve client relationships.

Key Advantages of Customizable Billing Records

There are several reasons why businesses rely on flexible billing formats. Below are some of the most notable benefits:

| Benefit | Description |

|---|---|

| Time-Saving | Quickly modify existing documents rather than creating new ones from scratch. |

| Consistency | Ensure all records follow a consistent format, boosting professionalism. |

| Branding | Incorporate logos, colors, and contact details to create a personalized appearance. |

| Accuracy | Reduce the risk of errors by adjusting and reviewing each entry before finalizing. |

Improving Client Relationships

When you present a professional, well-structured billing statement, clients are more likely to trust your business and feel confident in your services. The ability to include personalized details such as payment terms or additional notes helps maintain transparency and clear communication, which is key to fostering positive long-term relationships.

How to Customize Your Invoice Template

Personalizing your billing document allows you to tailor it to your business needs while maintaining professionalism. Customization offers the flexibility to add or remove sections, adjust the design, and include specific details that are important for your clients. Whether you are using a word processor, spreadsheet, or specialized software, knowing how to modify your document efficiently can save you time and enhance the clarity of your records.

Basic Adjustments for Professional Results

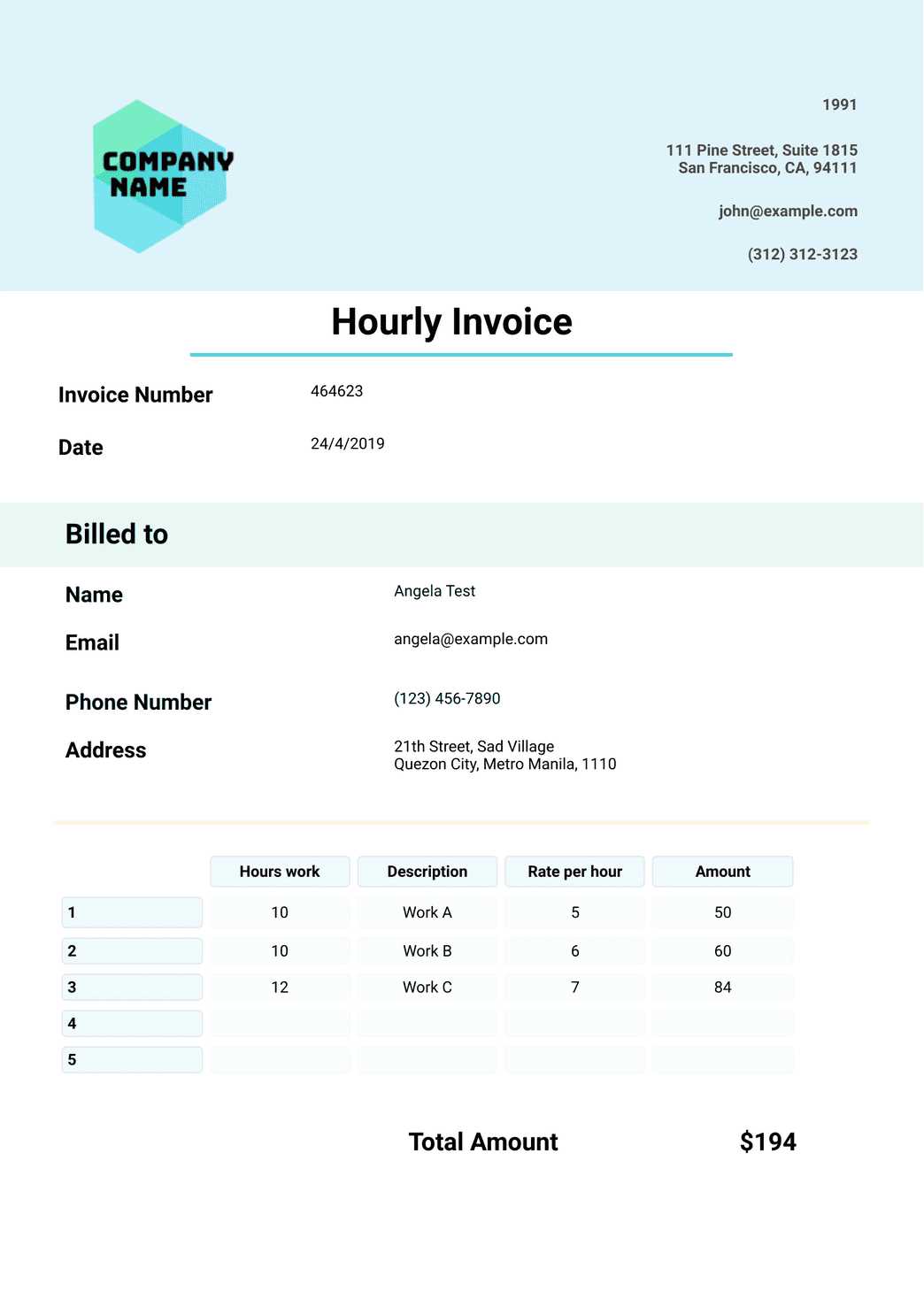

The first step in customizing your payment record is to ensure all necessary information is included. Start by adjusting the header to include your business name, logo, and contact details. This helps establish your identity right away. You should also ensure that your client’s name, address, and transaction date are clearly visible. These key details will make your document easy to understand and process.

Design and Layout Modifications

To make your record visually appealing and aligned with your branding, consider adjusting the layout. You can change fonts, colors, and add borders or sections for better organization. Some important design elements to focus on are the placement of the payment terms, itemized list of services or products, and total amounts due. A clean and organized layout not only makes the document easier to read but also conveys professionalism to your clients.

By tailoring your financial documents, you can ensure that each one reflects your business standards while meeting the specific needs of your clients, improving both efficiency and professionalism in every transaction.

Key Features of a Good Invoice

A well-structured billing document not only ensures that your clients understand the details of the transaction but also helps maintain a professional image for your business. For a document to be effective, it must clearly present essential information, be easy to read, and provide all the details needed for smooth payment processing. Below are some key features that every good billing document should include:

- Business Information: Always include your business name, address, phone number, and email address at the top of the document for easy contact.

- Client Information: Make sure the recipient’s name, company (if applicable), and contact details are listed correctly.

- Unique Reference Number: A unique identifier for each transaction or record helps track payments and manage your accounting system effectively.

- Clear Itemization: List the products or services provided, including quantities, descriptions, unit prices, and any applicable taxes or discounts.

- Payment Terms: Clearly state the due date, payment methods accepted, and any late fees that may apply for overdue payments.

- Total Amount Due: The final amount due should be clearly highlighted, making it easy for clients to identify the payment they need to make.

- Additional Notes: Include any other important information, such as special instructions, warranties, or terms and conditions of the transaction.

By incorporating these essential features, you ensure that your billing document is not only comprehensive and easy to understand but also helps avoid any confusion or delays in payment. A good record reflects your professionalism and builds trust with your clients.

Where to Find Free Invoice Templates

For businesses and freelancers looking for a quick and cost-effective way to generate professional billing documents, there are a variety of resources available online. Many websites offer ready-made forms that can be customized to suit your needs, saving you time and money on design and formatting. These resources can be found through several platforms, each providing different options depending on your requirements.

1. Online Document Creation Platforms: Websites like Google Docs and Microsoft Office Online offer a range of templates that are easy to modify. These platforms often allow you to store and share your documents online, which can be convenient for businesses on the go.

2. Template Marketplaces: Numerous online marketplaces, such as Canva and Envato Elements, offer pre-designed forms that can be downloaded and tailored to your preferences. While some may require a subscription, many provide free versions that are suitable for everyday use.

3. Accounting Software Providers: Some accounting tools, like Wave and Zoho Invoice, offer free versions of their platforms, which include customizable billing forms as part of their services. These options often come with additional features to help you manage your finances more efficiently.

By exploring these platforms, you can quickly find suitable documents that meet your business’s needs and adapt them to fit your specific style and requirements. Whether you prefer a simple format or a more detailed design, there are plenty of free resources available to help you create professional and efficient records.

Best Software for Editing Invoices

To effectively manage billing and ensure professional documentation, using the right software can greatly streamline the process. Many tools offer customization options that allow you to quickly adjust details, design, and format according to your business needs. Whether you’re a freelancer, small business owner, or part of a large organization, selecting the right platform can save you time and ensure accuracy in your financial records.

Top Tools for Customizing Billing Documents

- QuickBooks: Known for its user-friendly interface, QuickBooks allows you to create, customize, and manage financial records with ease. It also integrates with other accounting features for comprehensive financial management.

- FreshBooks: Ideal for freelancers and small businesses, FreshBooks offers simple tools for customizing payment requests. Its features include time tracking, expense management, and automated reminders for clients.

- Zoho Books: Zoho provides a flexible and affordable solution, offering highly customizable formats and easy integration with other accounting tools. It is great for businesses looking for both simplicity and advanced features.

- Wave: A free platform with a clean design and easy-to-use features, Wave allows you to create customized billing documents and keep track of payments. It is particularly useful for small businesses on a budget.

- Microsoft Excel or Google Sheets: For businesses that prefer a more hands-on approach, Excel and Google Sheets offer full flexibility. You can design your own layout, integrate formulas, and customize your records without relying on specialized software.

Choosing the Right Tool for Your Business

When selecting the right software, consider factors like ease of use, customization options, integration with other financial tools, and your business’s specific needs. The right platform will not only make document creation faster but also help maintain consistency and accuracy in your billing process.

How to Add Your Logo to an Invoice

Including your company logo on billing documents not only reinforces your brand identity but also enhances the overall professionalism of your paperwork. By adding your logo, you make the document immediately recognizable and create a more cohesive look across all client-facing materials. The process of incorporating your logo can vary depending on the tool or software you’re using, but the basic steps are similar across most platforms.

Steps to Add a Logo to Your Document

- Step 1: Prepare Your Logo: Ensure your logo is high quality and saved in an appropriate file format (e.g., PNG, JPEG, or SVG). The image should be clear and sized to fit the layout without overwhelming the document.

- Step 2: Open Your Document: Whether you’re using a word processor, spreadsheet, or invoicing software, open the document you want to customize.

- Step 3: Insert the Logo: Most platforms will have an “Insert Image” or “Add Logo” button. Use this option to upload and place your logo in a prominent location, typically at the top of the page or in the header.

- Step 4: Resize and Position: Once the logo is inserted, adjust its size to ensure it fits well within the header. Make sure it is aligned properly with the rest of your contact details.

- Step 5: Save the Document: After positioning the logo and ensuring the document looks balanced, save your work. If you plan to use the same layout in the future, consider saving it as a template for easy access.

Tips for a Professional Look

- Keep it Simple: Choose a logo size that’s large enough to be recognizable but not so big that it distracts from the rest of the content.

- Maintain Consistency: Use the same colors and fonts in your documents as those in your logo to create a unified brand experience.

- Position Strategically: Place the logo in a location that doesn’t interfere with important details such as the recipient’s information or payment terms.

By following these simple steps, you can quickly add your logo to any document and enhance your brand’s visibility and professionalism.

Creating Professional Invoices in Minutes

Generating high-quality billing records doesn’t have to be a time-consuming task. With the right tools and a few simple steps, you can quickly create professional documents that are clear, accurate, and ready for distribution. By utilizing ready-made structures and focusing on essential details, you can streamline the process and ensure your clients receive well-organized payment requests.

To create professional documents in just a few minutes, follow these straightforward steps:

| Step | Description |

|---|---|

| 1. Choose a Platform | Use an online tool or software that provides pre-designed forms, such as a spreadsheet or invoicing application, to save time on formatting. |

| 2. Fill in Key Details | Enter the basic information like your business details, client’s name, payment amount, and services rendered. |

| 3. Add Personalization | Customize the document with your logo, colors, and any other branding elements to give it a professional and personal touch. |

| 4. Review and Finalize | Quickly check for any errors or missing details before finalizing the document. Ensure clarity and accuracy. |

| 5. Save and Send | Save the document in a suitable format (PDF is commonly used) and send it to your client via email or through your preferred method. |

With the right tools and an organized approach, you can have a polished and accurate billing document ready in no time. This efficiency not only saves you time but also helps maintain professionalism in every transaction.

Common Mistakes to Avoid in Invoices

Even a small mistake in your billing documents can lead to confusion, delays in payment, and a loss of credibility with clients. To ensure your financial records are clear, professional, and effective, it’s essential to avoid common errors. By paying attention to key details and staying organized, you can create error-free documents that help maintain smooth transactions.

Here are some common mistakes to watch out for:

| Mistake | Impact | How to Avoid |

|---|---|---|

| Incorrect or Missing Client Details | Leads to confusion and delayed payments if the wrong contact information is used. | Always double-check the client’s name, address, and contact details before sending. |

| Missing Payment Terms | Causes misunderstandings regarding due dates, late fees, and payment methods. | Clearly state payment due dates, accepted methods, and any penalties for overdue payments. |

| Failure to Include a Unique Reference Number | Can result in difficulties tracking payments and reconciling accounts. | Use a unique reference number or ID for every billing record to easily track and match payments. |

| Unclear Item Descriptions | Leads to confusion about what is being charged for, which can delay payment. | Provide clear and concise descriptions of products or services, including quantities and rates. |

| Incorrect Totals or Calculations | Can cause frustration for clients and affect trust if totals are wrong. | Double-check all numbers, and use automatic formulas if possible to avoid errors in calculations. |

By avoiding these common mistakes, you can create accurate, clear, and professional documents that will make the payment process smoother for both you and your clients.

How to Include Payment Terms on Invoices

Clearly outlining the terms of payment in your billing records is crucial for setting expectations and ensuring timely payments. Without proper payment terms, clients may be unsure about when and how to pay, which can lead to misunderstandings or delays. By specifying clear, concise payment conditions, you help your clients understand exactly what is expected, making the transaction smoother for both parties.

Key Payment Terms to Include

- Due Date: Clearly specify the date by which payment must be received. For example, “Due by [Date]” or “Payment due within 30 days of receipt.”

- Late Fees: If applicable, include information on any penalties for late payments, such as a flat fee or a percentage of the total amount due.

- Accepted Payment Methods: Specify the ways clients can make payments, such as bank transfer, credit card, or online payment platforms like PayPal.

- Discounts for Early Payment: If you offer discounts for early payment, mention the percentage or amount that can be deducted if payment is made before the due date.

- Partial Payments: If you allow partial payments, outline the terms for such payments, including the schedule or specific amounts due at each stage.

How to Format Payment Terms Effectively

- Highlight the Terms: Place payment terms in a prominent section of the document, such as the footer or below the list of services/products, to ensure they are easy to find.

- Be Clear and Concise: Use straightforward language and avoid jargon. For example, instead of “Accounts must be settled in a timely manner,” write “Payment is due within 30 days from the date of receipt.”

- Use Consistent Language: Make sure all payment-related terms are consistently stated across all your records to avoid confusion.

Including clear and detailed payment terms is an essential part of professional business practices. It not only helps your clients stay informed but also protects your interests by ensuring timely compensation for your services or products.

Tracking Payments with Editable Invoices

Keeping track of payments is essential for maintaining healthy cash flow and staying organized. A well-structured billing record can help you monitor the status of each transaction and quickly identify any overdue payments. By having a clear system in place, you can easily update and track payment progress, ensuring that no outstanding amounts go unnoticed.

Steps to Effectively Track Payments

- Include a Payment Status Field: Always add a section or column indicating the payment status, such as “Paid,” “Pending,” or “Overdue.” This helps you quickly identify which transactions need attention.

- Use Unique Reference Numbers: Assigning a unique reference number or ID to each transaction makes it easier to track payments across different platforms or accounting software.

- Record Payment Dates: Track when each payment is made by adding a field for the payment date. This will help you reconcile your accounts and avoid any confusion.

- Send Payment Reminders: If a payment is overdue, send a polite reminder to your client, referencing the original document and providing them with clear instructions on how to settle the amount due.

Tools for Tracking Payments

- Accounting Software: Platforms like QuickBooks, FreshBooks, and Wave allow you to track payments automatically and send reminders when payments are due.

- Spreadsheets: If you prefer a more manual approach, a spreadsheet can be a simple and effective way to track payment status by creating columns for amounts due, amounts paid, and due dates.

- Bank and Payment Processor Reports: Use your bank or online payment processor’s reports to reconcile payments with your records, ensuring you capture every transaction.

By incorporating these practices, you can efficiently manage and track all payments, making sure that no transaction slips through the cracks. A reliable tracking system allows you to focus on growing your business while maintaining financial clarity.

How to Save Time with Invoice Templates

Creating professional billing records can often be a time-consuming process, especially if you are starting from scratch every time. However, by using pre-designed structures, you can significantly reduce the time spent on document creation. These ready-made formats allow you to focus on adding relevant information rather than formatting, saving you hours in the long run. With just a few modifications, you can quickly generate accurate and well-organized payment requests.

Benefits of Using Pre-designed Structures

- Faster Creation Process: Pre-designed structures eliminate the need to manually format each document, enabling you to focus on entering key details such as client names, services provided, and amounts due.

- Consistency: Using a consistent layout ensures that your documents maintain a professional appearance every time. This can enhance your brand image and make your billing process more reliable.

- Minimize Errors: With a set format, you reduce the risk of missing important information or making formatting mistakes, leading to fewer corrections and faster processing.

- Customizable for Different Needs: Pre-designed structures allow for quick adjustments, whether you need to add a new service, change payment terms, or update contact information.

How to Maximize Time Savings

| Action | Time Saved |

|---|---|

| Save Common Details | By saving your business information and frequently used items in the structure, you only need to input client-specific data. |

| Automate Calculations | Many platforms allow for automatic calculation of totals, taxes, and discounts, reducing manual effort and errors. |

| Use Cloud Storage | Save your documents in the cloud for quick access and editing from anywhere, making the process faster even when you’re on the go. |

By implementing these strategies, you can streamline your billing process and make document creation faster and more efficient, leaving you with more time to focus on growing your business.

Legal Aspects of Invoice Design

Designing billing documents that comply with legal requirements is crucial to ensure that transactions are clear, enforceable, and transparent. A well-structured document not only serves as a professional tool for requesting payment but also acts as a legal record in case of disputes or audits. Certain elements must be included in these records to comply with tax laws, consumer protection regulations, and industry standards. Understanding the legal aspects of document design helps safeguard your business and fosters trust with clients.

Essential Legal Elements to Include

| Legal Requirement | Description |

|---|---|

| Business Information | Your legal business name, address, and registration number (if applicable) should be clearly visible. This ensures that your client knows who is providing the goods or services. |

| Client Information | Always include the client’s full name or business name, address, and contact details for proper identification and communication. |

| Itemized List of Goods or Services | Each product or service provided should be clearly listed with descriptions, quantities, and individual prices. This helps both parties understand what is being billed and provides clarity in case of disputes. |

| Payment Terms | Clearly state the due date, payment methods, and any late fees or penalties. This provides transparency on when payment is expected and what actions will be taken if payment is delayed. |

| Tax Information | Include any applicable tax identification numbers, as well as the correct tax rate and amount for each item or service. This ensures compliance with local tax laws. |

| Invoice Number | Each document should have a unique identification number for tracking and reference purposes. This is critical for accounting and record-keeping, and it’s often a legal requirement in many jurisdictions. |

Additional Legal Considerations

- Comply with Local Regulations: Ensure your billing documents meet the specific legal requirements of the country or region in which you operate. Regulations regarding taxation and business information can vary significantly between locations.

- Keep Accurate Records: Retaining copies of all billing records is essential for tax reporting, audits, and potential legal disputes. Many countries require businesses to keep records for a certain number of years.

- Clear Dispute Resolution Terms: If necessary, include a section outlining the steps for resolving payment disputes, including how both parties will communicate and what actions can be taken if payment is not made in a timely manner.

Designing billing documents with legal considerations in mind can protect your business from potential conflicts and ensure smooth transactions with your clients. By including all required details and adhering to relevant laws, you safeguard your financial interests while maintaining a professional and trustworthy image.

Customizing Invoices for Different Industries

Each industry has unique requirements when it comes to requesting payment. Whether you’re in consulting, retail, or construction, the details included in a billing document can vary significantly based on the nature of the services or goods provided. Customizing your documents ensures they reflect the specific needs of your business and help maintain professionalism and compliance with industry standards. A tailored approach not only streamlines communication with clients but also reduces the chances of disputes or payment delays.

Industry-Specific Modifications

| Industry | Key Modifications |

|---|---|

| Consulting | Include detailed descriptions of services rendered, the hours worked, and the hourly rate. Payment terms often include milestones or retainer-based billing. |

| Retail | Include product descriptions, SKU numbers, quantities, and individual prices. The document should also mention any discounts or promotions applied to the purchase. |

| Construction | Include detailed breakdowns of materials used, labor charges, and phases of the project. It may also include a payment schedule based on project milestones or completion stages. |

| Freelance Services | Provide a clear breakdown of work done, including project deliverables and hourly rates. Consider adding space for client approvals or notes for tracking progress. |

| Hospitality | Provide itemized lists of services like room rentals, meals, or additional amenities. Include taxes, service charges, and possibly cancellation policies if applicable. |

Why Customization is Important

- Industry Relevance: Different industries have specific needs that require particular details in billing records, helping to avoid confusion and ensuring clients understand the charges.

- Professional Appearance: Customizing your documents demonstrates attention to detail and enhances your reputation, showcasing that your business understands the industry’s standards.

- Legal and Tax Compliance: Certain industries may have legal requirements, such as specific tax rates or licensing information, that need to be reflected in the billing documents.

By tailoring your billing documents to the specific needs of your industry, you ensure that you meet both client expectations and regulatory requirements, making the process smoother for everyone involved.

How to Organize Your Invoicing System

Having a well-organized billing system is essential for ensuring that your payment requests are processed efficiently and accurately. Whether you’re running a small business or managing a large enterprise, a structured approach to generating, tracking, and managing your documents can help streamline your financial operations. An effective system reduces errors, minimizes delays, and enhances client relationships by maintaining clear communication regarding payment expectations.

Steps to Set Up an Organized Billing System

| Action | Purpose |

|---|---|

| Centralize Your Records | Store all your financial documents in one easily accessible location, whether it’s a cloud-based platform or an organized file system. This helps keep everything in order and allows for quick retrieval when needed. |

| Automate Recurring Charges | For clients with regular payments, set up automated billing to save time and reduce manual entry. This can also reduce the risk of forgetting to send a payment request on time. |

| Establish Clear Filing Systems | Create folders and subfolders to categorize payment records by client, project, or date. This ensures you can easily locate specific documents when reconciling accounts or handling disputes. |

| Set Payment Terms in Advance | Clearly define payment terms for each client upfront, such as due dates, accepted payment methods, and late fees. This helps avoid confusion and sets clear expectations for both parties. |

| Track Payments Regularly | Monitor the status of payments, noting which have been received and which are still outstanding. This helps you follow up promptly with clients who have not yet paid, reducing the chance of overdue balances. |

Benefits of a Structured System

- Improved Cash Flow: By staying organized, you ensure that payments are received on time, which directly impacts the financial health of your business.

- Better Client Relationships: A clear and transparent system can improve trust with your clients, as they will appreciate your professionalism and attention to detail.

- Faster Reconciliation: With everything neatly organized, reconciling payments with your financial records becomes easier, saving you time during tax season or financial audits.

- Reduced Risk of Errors: A systematic approach helps to minimize mistakes, such as double billing or forgetting to send a payment request, ensuring more accurate financial records.

By setting up an organized system for handling payment requests, you can streamline your operatio

Enhancing Your Business Image with Invoices

Your billing documents are often the final point of contact between you and your clients, making them a crucial element of your overall business image. A well-designed and professional-looking document reflects the quality of your business and the attention to detail you provide. When clients receive clear, organized, and polished payment requests, it can enhance their perception of your brand and build trust, leading to stronger long-term relationships.

Key Ways to Improve Your Brand Image Through Billing Documents

- Consistency in Design: Using a consistent and professional layout for all your payment records creates a cohesive brand identity. This means using the same fonts, colors, and logos that reflect your brand’s personality and style.

- Clear and Simple Structure: A cluttered or confusing billing document can leave a negative impression. Keep it simple and straightforward, ensuring that every client can easily understand the charges and payment terms without unnecessary complexity.

- Personalized Details: Customizing the content of your billing document with client-specific details such as project names, personalized messages, or tailored services can make clients feel valued and appreciated.

- High-Quality Visuals: Incorporating your company’s logo and using high-quality images or design elements can reinforce your brand’s professionalism and make your billing document stand out as a polished, corporate item.

- Transparent Payment Terms: Clearly stating payment expectations, due dates, and penalties for late payments shows your business is organized and fair. This transparency fosters trust and reduces confusion or disputes.

Benefits of a Professional Billing Appearance

- Building Client Trust: A professional billing document shows that you take your business seriously, which can increase client confidence in your services.

- Encouraging Timely Payments: Well-organized and professional requests are more likely to be taken seriously, motivating clients to pay on time.

- Establishing a Strong Brand Identity: Every point of contact with your clients contributes to the image of your brand. A sleek, professional billing system strengthens your reputation and helps distinguish you from competitors.

- Improved Client Satisfaction: Clients appreciate efficiency and clarity, and delivering high-quality billing documents enhances their overall experience with your business.

Incorporating professionalism into your billing process not only improves the client experience but also contributes to the overall success of your business. By paying attention to detail and presenting your payment requests in a polished, professional way, you can leave a lasting positive impression and build strong, lasting relationships with your clients.

Tips for Ensuring Accurate Invoice Information

Accuracy in your billing documents is essential for maintaining professionalism and avoiding confusion or disputes with clients. Ensuring the correct details on your payment requests not only helps streamline your financial processes but also establishes trust with your customers. Whether you’re dealing with complex services or simple product sales, paying attention to the smallest details can prevent costly mistakes and ensure smooth transactions.

Key Areas to Double-Check Before Sending

| Area to Check | Why It’s Important |

|---|---|

| Client Information | Correct client names, addresses, and contact information help prevent miscommunications and ensure the payment is properly directed. |

| Service or Product Descriptions | Clear, detailed descriptions of what was provided avoid confusion and help justify the charges in case clients need clarification. |

| Quantities and Rates | Verify the quantity of goods or services provided, along with the agreed-upon pricing. Mistakes here can lead to disputes over the total amount due. |

| Tax and Discount Calculations | Ensure taxes, discounts, or any special pricing are applied correctly. Errors in these calculations can lead to financial discrepancies. |

| Due Date and Payment Terms | Clearly state the payment due date and any penalties for late payments. This helps set expectations and encourages timely payments. |

Additional Tips for Accurate Billing

- Double-Check Figures: Always cross-check totals and calculations before finalizing the document to avoid errors in amounts owed.

- Use Standardized Formats: By using consistent formats for dates, numbers, and descriptions, you minimize the risk of misinterpretation and confusion.

- Automate Where Possible: Use automated tools to generate payment requests that automatically pull data from your records, reducing the risk of human error.

- Proofread Thoroughly: Before sending, proofread the entire document to catch any minor mistakes that may have been overlooked during the initial creation.

By taking the time to carefully review all aspects of your payment requests, you ensure that the information presented is clear, correct, and professional. This not only speeds up the payment process but also helps build strong, positive relations