Simple Contractor Invoice Template for Efficient Billing

Managing financial transactions is a crucial part of running any independent business. When it comes to requesting payment for services rendered, having a clear, well-organized document is essential. This not only helps maintain professionalism but also ensures prompt payment. Whether you are offering one-time or ongoing services, a properly structured billing document can make all the difference in keeping your operations smooth and efficient.

A well-designed billing statement should contain all necessary details, including work descriptions, rates, and payment terms. By incorporating essential elements, you can avoid confusion and potential disputes with clients. Creating these records doesn’t need to be complicated, and there are easy ways to format your documents to make them both functional and professional.

In this guide, we will explore practical tips for designing billing records that are straightforward yet comprehensive. You will learn how to organize the key components, personalize your document, and even handle overdue payments with ease. With the right approach, you can streamline your financial workflow and build trust with your clients.

Simple Billing Document Guide

Creating a clear and organized payment request is essential for maintaining professionalism and ensuring smooth financial transactions. A well-structured document not only provides clarity for both parties involved but also helps avoid misunderstandings and delays. This guide will walk you through the essential steps and components required for crafting an effective document that communicates all necessary details in a concise manner.

Key Elements to Include

When designing a billing document, certain elements must be present to ensure all information is clear and complete. Below are the primary sections you should include:

- Your Business Information: Make sure to list your name, address, phone number, and email to make it easy for clients to reach you.

- Client’s Details: Include the client’s name, company (if applicable), and contact information to personalize the document.

- Service Description: Detail the work completed, including dates, tasks, and any specifics of the agreement. This helps prevent confusion about what the client is paying for.

- Payment Terms: Clearly state the due date for payment, accepted payment methods, and any late fees or penalties if applicable.

- Amount Due: Specify the total cost, including any applicable taxes or fees, in a clear and easy-to-understand format.

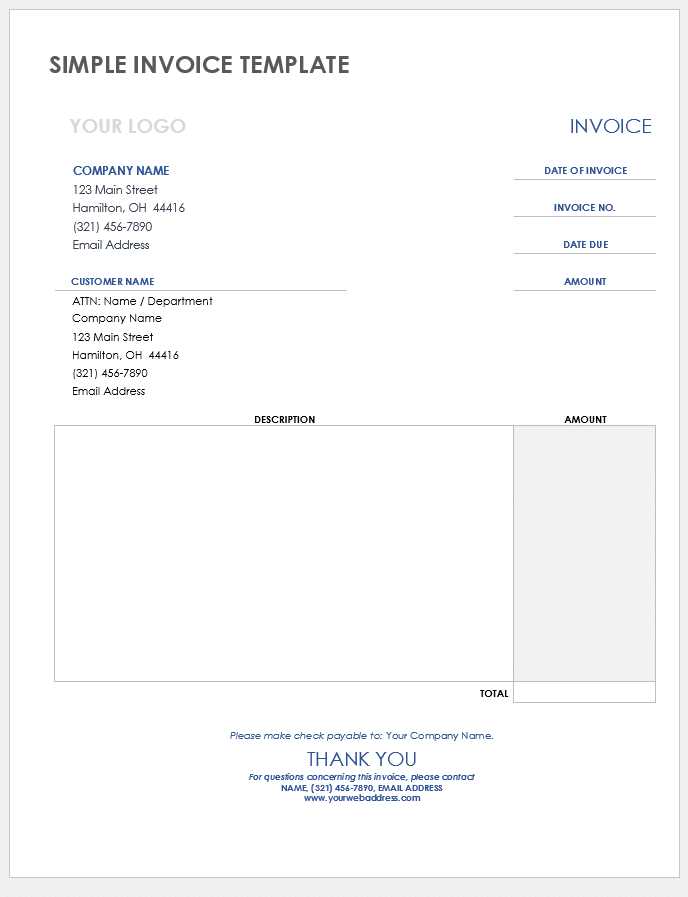

How to Format the Document

The layout of your payment request plays a big role in its effectiveness. A clean, easy-to-read document improves professionalism and helps ensure prompt payment. Keep these formatting tips in mind:

- Use a Professional Font: Choose a readable, standard font like Arial or Times New Roman, and avoid excessive styling.

- Include a Clear Title: Make the purpose of the document obvious by including a title like “Payment Request” or “Service Bill” at the top.

- Break Up the Information: Use bullet points or tables to break up sections, making it easier for the reader to follow the details.

- Ensure Accurate Calculations: Double-check your figures and ensure they align correctly with the services and agreed rates.

By following these guidelines, you can create a document that not only looks professional but also helps facilitate smoother and quicker transactions with your clients.

What is a Billing Document for Freelancers

A billing document is an essential tool for freelancers and independent workers to request payment for their services. It is a formal record that outlines the work completed, payment terms, and other important details. This document helps ensure both parties are on the same page regarding the financial exchange and provides a clear reference for any future questions or disputes.

Purpose of a Billing Document

The main objective of this document is to communicate the details of the services provided and to formally request payment from the client. It acts as a legal record and can be used to track financial transactions, ensure timely payments, and maintain a professional relationship with clients.

- Clarity: It ensures that both the freelancer and client agree on the amount owed and the services provided.

- Professionalism: A well-crafted document enhances the freelancer’s image and builds trust with clients.

- Tracking: It serves as a reference point for both parties in case of payment delays or disputes.

How It Works

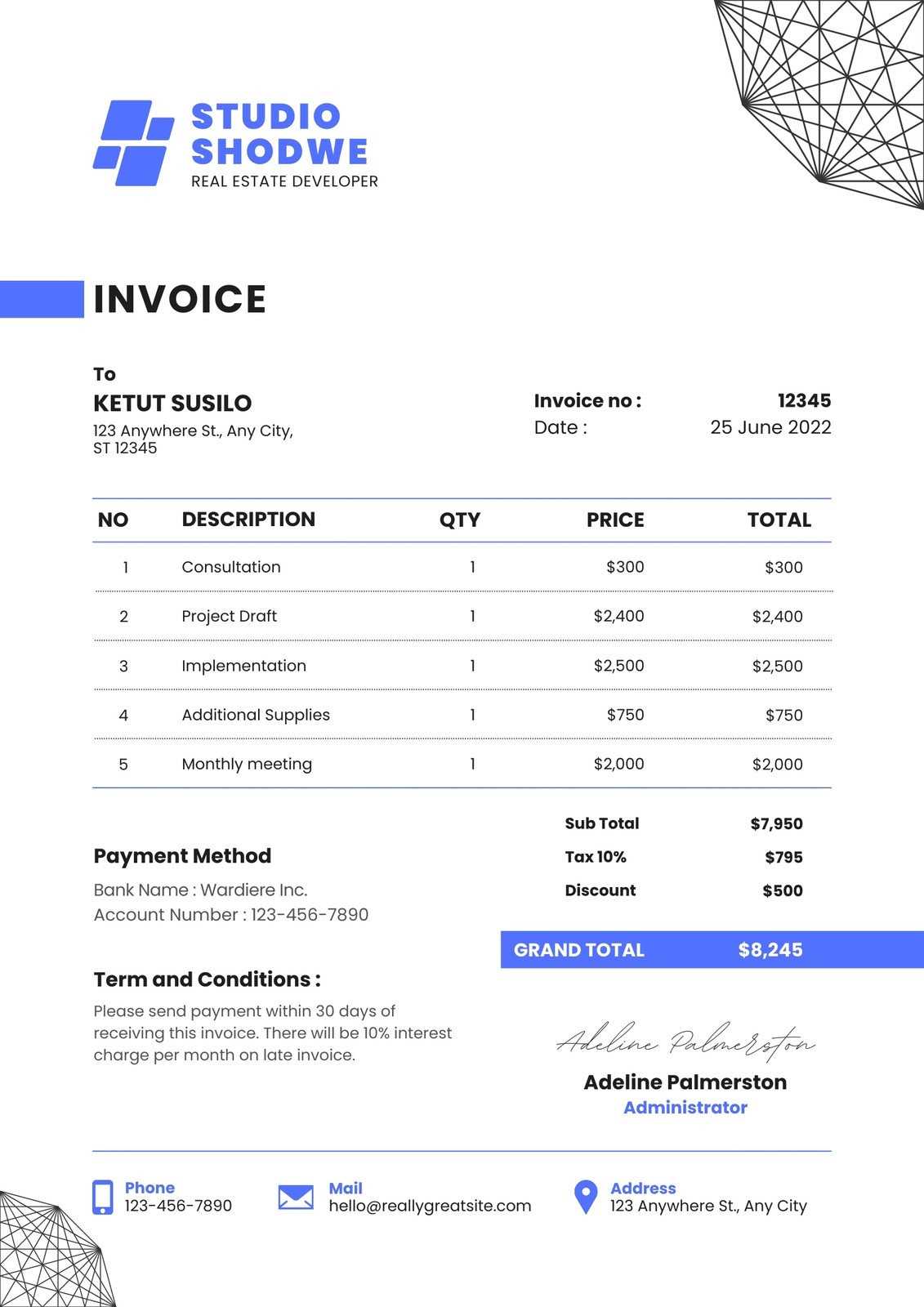

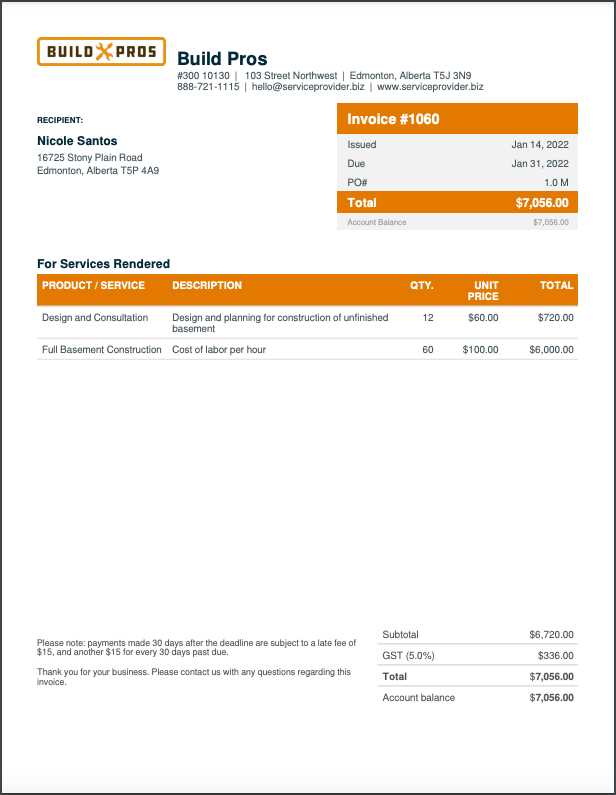

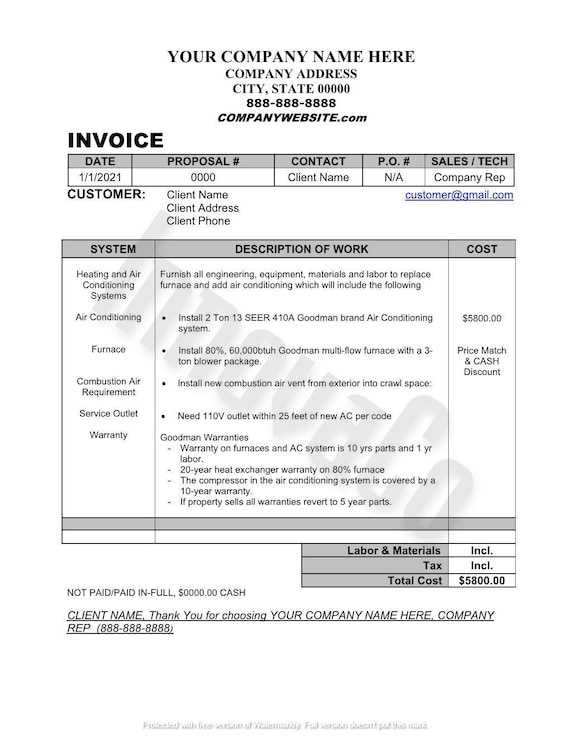

A standard billing document typically includes the freelancer’s contact information, the client’s details, an itemized list of services or tasks completed, and the total amount due. The document may also outline payment methods and deadlines. Freelancers can create this document from scratch or use pre-designed layouts for ease and efficiency.

- Itemized Breakdown: Clearly listing individual services and their corresponding charges helps avoid confusion.

- Payment Instructions: Including details like payment methods and due dates simplifies the payment process for clients.

- Terms of Agreement: Stating the agreed terms up front can prevent misunderstandings later on.

Ultimately, the purpose of such a document is to ensure that the process of requesting and receiving payment is straightforward and transparent, providing both parties with the necessary information to complete the transaction smoothly.

Why Use a Basic Billing Document Design

Using a basic design for payment requests can significantly streamline your workflow, making it easier to track services, manage payments, and maintain professional communication with clients. A straightforward format ensures clarity, reduces errors, and saves time, which is especially important when managing multiple projects or clients. By adopting a simple approach, you can focus on the essentials without getting bogged down by unnecessary complexities.

Efficiency and Time-Saving

A clean, easy-to-follow layout allows you to quickly fill in the necessary information without spending time formatting or customizing the document. This simplicity saves both time and effort, allowing you to focus on your work rather than the administrative side of your business.

- Quick Setup: Pre-designed documents with basic fields make it easy to generate payment requests in a matter of minutes.

- Minimal Editing: A straightforward structure means fewer elements to modify, reducing the chances of mistakes.

- Speedy Distribution: Once completed, a basic design allows for rapid sending and processing of payments.

Improved Accuracy and Professionalism

Using a simplified structure can help you avoid errors, ensuring that all essential details are included and correctly formatted. A well-organized document fosters trust and reflects professionalism, helping to build strong relationships with clients.

- Clear Information: A straightforward format makes all details, such as services rendered and payment terms, easy to read and understand.

- Consistency: By using a uniform style for all your billing documents, clients will immediately recognize your work as professional and reliable.

- Reduced Confusion: The simplicity of the format reduces the likelihood of misunderstandings regarding payment amounts or due dates.

Ultimately, adopting a basic approach to payment requests helps streamline your business operations, saving time, reducing errors, and maintaining a professional appearance with minimal effort.

Benefits of Customizing Your Billing Document

Customizing your payment request provides a range of advantages that can enhance both the effectiveness and professionalism of your financial communications. Tailoring the layout and details to fit your specific business needs allows you to create a document that resonates with your clients, reflects your brand, and simplifies the payment process. With a personalized approach, you can improve clarity, strengthen your brand identity, and boost your credibility.

Enhancing Professional Image

A customized billing document helps convey a sense of professionalism and attention to detail. By incorporating your company logo, contact information, and brand colors, you present a polished, consistent image to your clients. This can be especially valuable in establishing trust and reinforcing your brand identity in every interaction.

- Brand Recognition: Including your logo and brand elements makes your documents easily recognizable and strengthens your brand presence.

- Professional Appeal: Custom designs reflect a higher level of professionalism, which can foster better relationships with clients.

- Consistency: By using a uniform look across all your business documents, clients will see a cohesive and reliable brand.

Improved Clarity and Communication

Customizing your payment request allows you to organize the information in a way that best suits your services and client expectations. You can create sections, add explanatory notes, or highlight important terms to make sure everything is clearly communicated. This clarity helps to avoid misunderstandings and ensures that clients are fully informed about what they’re paying for and when to pay.

- Personalized Details: You can adjust the format to highlight specific information relevant to the client or project.

- Clear Breakdown: Custom fields allow you to itemize services, rates, and taxes in a way that is easy to understand.

- Clear Payment Terms: You can emphasize payment deadlines, methods, and penalties, ensuring both you and your client are on the same page.

Ultimately, a customized approach to billing not only improves the way you present your financial documents but also helps streamline the process, making transactions smoother and more professional for both you and your clients.

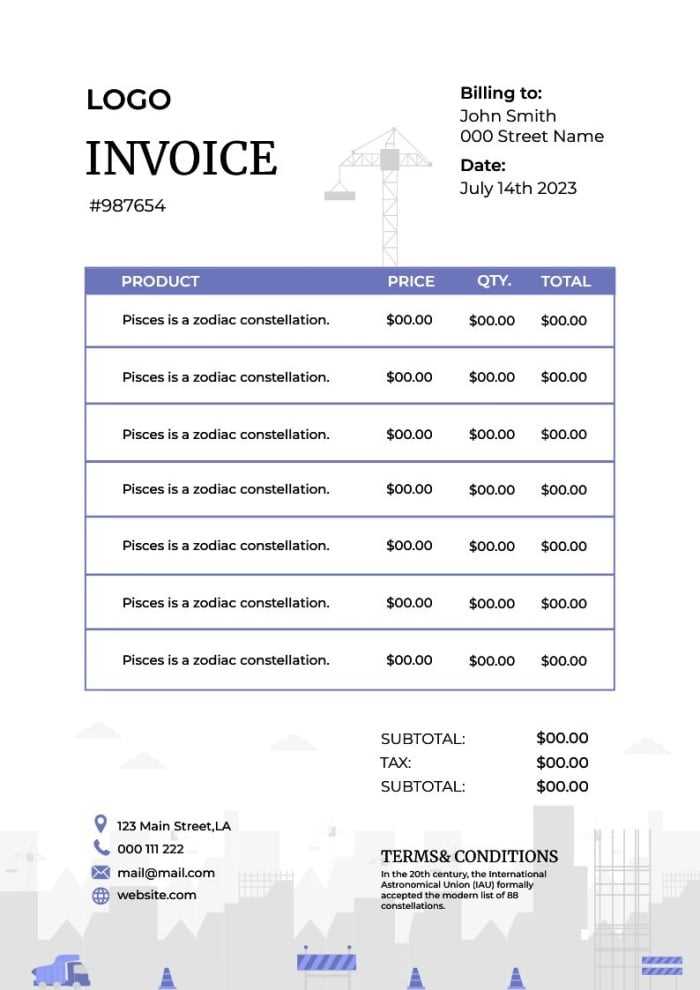

Key Elements of a Billing Document

To create an effective payment request, it’s essential to include several key components that provide clarity and ensure both parties understand the terms of the transaction. A well-structured document not only communicates important financial details but also helps avoid confusion or misunderstandings. By including the right elements, you can streamline the process and ensure your client has all the information needed to process payment promptly.

The following sections should be present in any billing document to ensure completeness and accuracy:

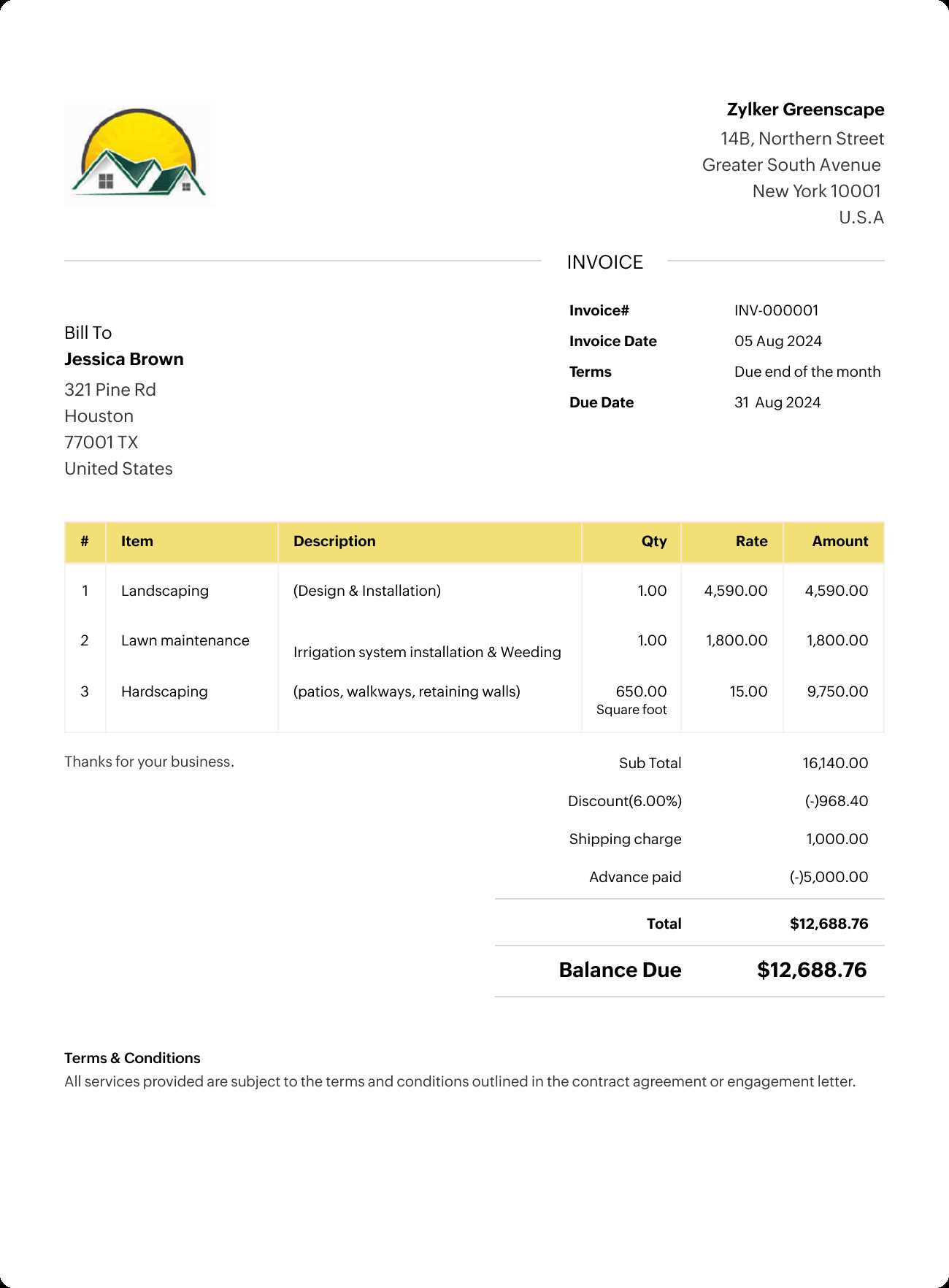

| Element | Description |

|---|---|

| Your Information | Include your name, business name, address, phone number, and email address. This ensures clients can easily contact you if necessary. |

| Client Information | Include the client’s name, company (if applicable), and contact information to clearly identify the recipient of the payment request. |

| Document Title | Label the document clearly (e.g., “Payment Request,” “Bill for Services”) to avoid any confusion about its purpose. |

| Itemized List of Services | Provide a detailed breakdown of the services rendered, including descriptions, quantities, rates, and dates of service. This helps clients understand exactly what they are paying for. |

| Total Amount Due | Summarize the total amount due, including taxes or additional charges, if applicable. Ensure this figure is accurate to avoid disputes. |

| Payment Terms | Specify the due date, accepted payment methods, and any late fees or penalties for overdue payments. |

| Unique Reference Number | Assign a unique number to each billing document for easy tracking and reference, especially useful for future correspondence or accounting purposes. |

Including these key elements ensures your payment request is complete, professional, and easy to understand. This not only helps to avoid confusion but also promotes timely payments, fostering better client relationships and smoother business operations.

How to Create a Payment Request from Scratch

Creating a payment request from scratch is an important skill for freelancers and small business owners. It allows you to have complete control over the format and content of the document, ensuring it meets your specific needs. By following a few simple steps, you can create a clear, professional document that helps you get paid on time and reduces the risk of misunderstandings.

Step-by-Step Guide to Creating a Payment Request

Start by gathering all the necessary information for the document. You’ll need details about the work performed, the client’s information, and the payment terms. Here’s how to structure your request:

- Include Your Contact Information: At the top of the document, list your name, business name (if applicable), address, phone number, and email.

- Client Information: Next, include the client’s name, business (if applicable), and contact details for reference.

- Provide an Itemized List of Services: Describe the services rendered with dates, quantity, and pricing. This helps the client understand what they are being charged for.

- Specify Payment Amount: Clearly show the total amount due. Include any applicable taxes, fees, or discounts as needed.

- Set Payment Terms: State the payment due date, accepted methods, and any late fees or penalties for overdue payments.

- Add a Unique Reference Number: This will help both you and your client track the document for future reference.

Finalizing Your Document

After gathering all the information, format it clearly. Use headings, bullet points, or tables to break up the sections and make the document easy to read. Double-check for accuracy, especially the totals and client details. Once you’ve reviewed everything, you can save the document in a professional format like PDF to maintain its integrity when sending it to the client.

Creating a payment request from scratch ensures you have full control over how your financial transactions are presented, helping to maintain professionalism and clarity throughout the process.

Common Mistakes in Billing Documents

Even with the best intentions, it’s easy to make mistakes when preparing payment requests. Small errors can lead to delays in payment, confusion with clients, or even damage to your professional reputation. Understanding the most common mistakes made when creating these documents can help you avoid issues and ensure smoother transactions. Below are some of the frequent pitfalls to watch out for.

One common mistake is failing to include all necessary details, such as the itemized list of services, agreed-upon rates, or payment deadlines. Incomplete information can lead to misunderstandings or disputes. Another frequent issue is not clearly indicating payment terms or methods, which can leave clients uncertain about how and when to pay.

Additionally, errors in calculations–whether it’s the total amount, taxes, or discounts–can create confusion and slow down the payment process. Not proofreading the document for mistakes before sending it is also a major issue. Clients may find errors unprofessional, and it could cause unnecessary delays while you rectify the information.

Finally, sending the document without a clear title or reference number can make it difficult for both you and the client to track the payment. A lack of proper organization could lead to payments being missed or misplaced, further complicating the financial process.

By being mindful of these common mistakes, you can create more accurate and professional billing documents that promote smoother transactions and better relationships with your clients.

How to Format Your Billing Document

Proper formatting is key to making your payment request both professional and easy to understand. A well-organized layout ensures that all the necessary information is clearly visible, reducing the risk of confusion or missed details. It also helps clients quickly process the request and makes it easier for both parties to track the transaction in the future.

Essential Formatting Tips

When creating a payment request, it’s important to follow a consistent and logical structure. Here are some formatting tips to ensure your document is clear and easy to navigate:

- Use Clear Headings: Break up the document into sections with distinct headings such as “Services Provided,” “Amount Due,” and “Payment Terms” to make it easy to follow.

- Organize Information with Tables: Use tables to clearly display itemized services, rates, and totals. This helps both you and the client quickly reference the details.

- Keep it Simple: Stick to a clean, professional font (such as Arial or Times New Roman) and avoid cluttering the document with unnecessary design elements.

- Highlight Important Dates: Make due dates, payment deadlines, and other key dates stand out by bolding them or placing them in a separate section.

- Include a Reference Number: Assign a unique number to each request for easy tracking and future reference.

Visual Appeal and Readability

The visual presentation of your document is just as important as the content itself. A clean and well-structured format enhances readability and makes the entire payment process feel more professional.

- Spacing: Ensure there is enough space between sections and elements to avoid a cramped or overwhelming look.

- Use Bullet Points: Bullet points or numbered lists can be effective for organizing services, payment terms, and other important details.

- Avoid Overuse of Colors: While it’s fine to use colors for branding, avoid overloading the document with bright, distracting colors. Stick to a few neutral tones that enhance, not overwhelm, the content.

By following these formatting guidelines, you can create a payment request that is both visually appealing and easy for your clients to process. A well-formatted document not only ensures that your request is clear but also helps maintain a professional image throughout your business transactions.

How to Include Payment Terms Effectively

Clearly stating payment terms in your billing document is crucial for ensuring that both you and your client are on the same page regarding expectations. Well-defined terms help avoid confusion, delays, and misunderstandings by specifying when and how payments should be made, as well as any penalties for late payments. Including payment terms in an organized and straightforward manner is essential for maintaining a professional relationship and ensuring timely compensation.

Here are the key elements to include when outlining your payment terms:

| Payment Term | Description |

|---|---|

| Due Date | Clearly state the exact date by which the payment is expected. This helps set a clear deadline for your client and prevents ambiguity. |

| Accepted Payment Methods | Specify the payment methods you accept (e.g., bank transfer, credit card, PayPal). This ensures the client knows how they can fulfill their obligation. |

| Late Fees | If applicable, include any penalties for late payments, such as a percentage increase for overdue payments after a certain period. |

| Early Payment Discounts | If you offer discounts for early payment, clearly state the terms. For example, “2% discount if paid within 10 days.” |

| Additional Charges | List any extra charges that may apply, such as administrative fees, service charges, or interest on overdue amounts. |

When writing payment terms, keep them concise and easy to understand. Avoid overly complex language that might confuse the client. Use simple, direct phrasing to ensure that your expectations are clearly communicated.

Additionally, consider positioning the payment terms in a prominent place within the document, such as at the end of the itemized list or in a separate section dedicated to payment details. This ensures the client can easily find and review the terms before making any payment.

By effectively including payment terms, you provide your client with the information they need to process the payment on time, helping to avoid delays and maintain positive business relationships.

Ensuring Professional Appearance of Your Billing Document

Creating a polished and professional billing document is essential for making a positive impression on your clients. A well-designed request not only helps convey your services clearly but also reflects your business’s credibility and attention to detail. By focusing on a few key aspects, you can ensure that your document looks clean, organized, and authoritative, helping to build trust with your clients and facilitating a smooth transaction process.

The first step in achieving a professional appearance is consistency. Use a clean, readable font such as Arial or Times New Roman, and avoid using overly decorative styles. Stick to standard font sizes and make sure headings are easy to distinguish from the body text. This consistency will make your document easy to read and professional in appearance.

Key Aspects to Focus On:

- Brand Identity: Incorporate your business logo, name, and contact details at the top of the document. This reinforces your brand identity and makes the document easily recognizable.

- Alignment and Spacing: Ensure all text is properly aligned, and use adequate spacing between sections to create a clean layout. Avoid overcrowding any part of the document to maintain readability.

- Colors and Design: Use colors sparingly. While it’s fine to add a touch of your brand colors, overusing them can make the document look cluttered. Stick to neutral or professional tones for a refined look.

- Headers and Subheadings: Use bold or slightly larger fonts for headings to break the content into digestible sections. This improves navigation and helps the client quickly find key information.

- Formatting for Clarity: Organize financial details in a clear, itemized manner. Use tables or bullet points to separate items and totals, ensuring there is no ambiguity about charges.

- Consistency in Terminology: Be consistent in the language you use. Ensure that terms like “due date,” “payment terms,” and “services rendered” are used throughout in the same way to avoid confusion.

Finally, proofread your document carefully before sending it to ensure there are no spelling, grammar, or numerical errors. Mistakes can undermine your professionalism and make the client question the accuracy of the document. Once you’re confident that everything is correct, save the document in a secure format (like PDF) to preserve its layout and ensure it can be easily accessed and printed by your client.

By paying attention to these details, you can ensure that your billing document looks professional and organized, contributing to a positive and efficient business transaction process.

Managing Billing Documents with Online Tools

With the rise of digital solutions, managing payment requests has become more streamlined and efficient. Online tools allow you to create, send, and track your financial documents with ease, reducing the time spent on administrative tasks and improving overall organization. These platforms not only simplify the process but also provide additional features to help you stay on top of your payments and client interactions.

Here are some key benefits of using online tools for managing your financial documents:

- Automation: Many online tools allow you to automate the creation and delivery of payment requests, saving time and minimizing the chance of human error.

- Customizable Templates: Most platforms offer customizable layouts, so you can create documents that suit your business needs while maintaining a professional look.

- Tracking and Reporting: Online tools often provide tracking features that allow you to monitor whether your payment request has been viewed, paid, or is overdue.

- Secure Payment Integration: Some platforms integrate with payment gateways, enabling clients to pay directly from the billing document using credit cards, bank transfers, or other methods.

- Cloud Storage: Storing documents online ensures they are safely backed up and can be accessed from any device, reducing the risk of losing important files.

- Efficiency and Speed: Sending documents electronically is much faster than using traditional methods, ensuring quicker payments and smoother transactions.

By incorporating online tools into your billing process, you can save time, reduce mistakes, and enhance the overall experience for both you and your clients. Whether you’re a freelancer or a small business owner, these digital solutions offer a convenient and effective way to manage your payment requests.

Best Practices for Billing Document Delivery

Delivering payment requests in a professional and timely manner is crucial for ensuring that you receive payment promptly. How you send your billing documents can affect how quickly your client processes the payment and whether any confusion arises. By following a few best practices, you can ensure that your billing documents are received, reviewed, and paid without unnecessary delays.

First, always send your payment request in a format that is both professional and easy to access. PDF files are widely accepted because they preserve the document’s formatting and can be opened on virtually any device. Avoid sending documents in editable formats like Word files, as they may raise concerns about the integrity of the information.

Here are a few best practices for delivering your payment requests:

- Send Documents via Email: Email is the fastest and most convenient way to deliver your payment requests. Make sure to include a clear subject line (e.g., “Payment Request for Services Rendered”) to ensure it catches your client’s attention.

- Follow Up: If you haven’t received a response within a few days, don’t hesitate to send a polite reminder. Following up shows professionalism and ensures the request isn’t overlooked.

- Include Clear Instructions: If your client needs to take any specific actions to make a payment, such as transferring funds or providing additional information, include these instructions clearly in the document or the email body.

- Keep Records: Store copies of all payment requests and any correspondence related to them. This ensures you have a complete record in case there are disputes or questions later on.

- Use a Professional Email Address: Always send payment requests from a business email address rather than a personal one. This adds to the professional image of your business and ensures that the email is taken seriously.

- Verify Client’s Contact Details: Before sending the document, double-check that you have the correct email address or other contact information for your client to avoid delivery issues.

By following these best practices, you can make the process of delivering payment requests smoother, reduce the risk of delays, and maintain a professional relationship with your clients.

How to Track Paid and Unpaid Billing Documents

Keeping track of which payment requests have been paid and which are still outstanding is essential for managing cash flow and maintaining a smooth business operation. Without an effective system in place, it can be easy to lose track of pending payments, which could result in late fees, misunderstandings, or missed revenue. By setting up a tracking system, you can stay on top of your finances and ensure that no payment slips through the cracks.

Here are some methods and best practices to effectively track both paid and unpaid documents:

- Create a Dedicated Tracking System: Using a spreadsheet or a digital tool specifically designed for managing payments allows you to organize billing details in one place. You can create columns for the date of issue, due date, payment status, client name, and amount, making it easier to track progress.

- Mark Status Clearly: For each request, indicate whether it is “paid” or “unpaid” by using color codes or status labels. For example, green for paid and red for unpaid. This quick visual aid helps you see at a glance which payments are pending.

- Use Accounting Software: There are many software programs and apps that can help track payments, send reminders, and generate reports. These tools automate the process, saving you time and reducing the risk of oversight.

- Set Up Payment Reminders: If a payment becomes overdue, set up reminders through email or within your accounting software. A polite follow-up can often encourage clients to pay promptly.

- Regularly Review Your Records: At the end of each week or month, review your payment records to see if there are any overdue payments. This proactive approach helps you stay ahead of potential payment delays.

- Track Payment Methods: Keep note of the payment methods used (bank transfer, credit card, PayPal, etc.) and confirm the payment has been received through the appropriate channel.

By maintaining a clear and organized system for tracking payments, you can easily distinguish between those that have been settled and those that need follow-up. This ensures your business stays on top of its financial commitments and helps you avoid delays in cash flow.

Importance of Clear Billing Descriptions

Providing detailed and precise descriptions for each item listed in your billing document is critical for avoiding confusion and ensuring that your client understands exactly what they are paying for. When descriptions are unclear or vague, it can lead to disputes, delayed payments, or misunderstandings. By clearly outlining the services or products provided, you promote transparency and establish trust with your client.

Here are several reasons why clear descriptions are essential:

- Prevents Misunderstandings: Clear and detailed descriptions ensure that both parties are on the same page regarding what was delivered. This reduces the risk of the client questioning the charges later on.

- Builds Professionalism: A well-organized and easy-to-understand billing document reflects your professionalism and attention to detail, enhancing your reputation with clients.

- Supports Faster Payment Processing: When clients can easily identify and understand the charges, they are more likely to pay promptly, as there are fewer uncertainties to address.

- Avoids Disputes: By providing precise descriptions, you leave little room for clients to contest the charges, as the scope of work or delivered products is well documented.

- Helps in Record Keeping: Detailed descriptions are useful for your own records. They provide a clear history of services provided, which can be important for tax purposes or future reference.

To create effective descriptions, be specific and use clear language. Avoid jargon or overly technical terms unless they are necessary for explaining the service. Ensure that each charge is easily identifiable and corresponds to the work completed. A well-described billing document is a sign of professionalism that fosters good client relationships and encourages timely payments.

How to Add Taxes to Billing Documents

When creating payment requests, it is often necessary to include taxes on the goods or services you provided. Including taxes correctly is crucial for legal compliance and for ensuring that your client is fully informed of the total amount due. Depending on the tax laws in your region or the type of service you provide, you may need to calculate and add a specific percentage to your charges. Understanding how to include taxes properly will help you avoid confusion and maintain professionalism.

Here are the key steps to follow when adding taxes to your billing documents:

- Identify the Tax Rate: Before applying any tax, you must know the applicable tax rate for your products or services. Different regions and types of goods or services may have varying tax rates, so it’s essential to verify the correct percentage.

- Calculate the Tax Amount: Once you know the tax rate, calculate the amount to be added by multiplying the subtotal by the tax rate. For example, if your subtotal is $500 and the tax rate is 10%, the tax amount would be $50.

- Separate the Tax Line: Clearly list the tax amount as a separate line item on your document. This ensures transparency and makes it easy for your client to see the breakdown of charges.

- Specify the Tax Type: If applicable, mention the specific type of tax being applied (e.g., sales tax, VAT, service tax) to ensure clarity. This can also be helpful for your client’s own record-keeping or accounting purposes.

- Ensure Accuracy: Double-check that the tax has been calculated correctly and that the total amount reflects the tax-inclusive price. Mistakes in tax calculations can lead to confusion and delayed payments.

By following these steps, you can ensure that taxes are applied accurately and clearly on your billing documents. This not only helps with compliance but also provides your clients with a transparent and professional breakdown of charges. Additionally, make sure to keep track of tax rates and regulations, as they can change over time and may vary depending on location.

What to Do If a Payment Is Late

Late payments are a common challenge for many businesses, but they need not become a source of stress. When payments are overdue, it’s essential to handle the situation professionally to maintain a good relationship with your clients while ensuring that you are compensated for your work. By taking a systematic approach, you can minimize disruptions to your cash flow and encourage timely payments in the future.

Here are the steps you should take if a payment has not been made on time:

- Review the Terms: Before reaching out to your client, double-check the payment terms specified in your agreement. Ensure that the due date has passed and that no payment has been made, keeping in mind any grace periods that may have been included.

- Send a Friendly Reminder: Start with a polite reminder email or message, reiterating the due amount and the date it was due. Often, clients simply forget, and a gentle nudge can resolve the issue quickly.

- Offer Payment Options: If your client is having trouble making the full payment, offer flexible payment options, such as partial payments or extended terms. This can help them manage their cash flow while ensuring you eventually receive the full amount.

- Follow Up with a Formal Letter: If the friendly reminder does not work, send a more formal follow-up letter. Be clear and professional, and include any details that might encourage the client to act–such as late fees or interest charges if they are stipulated in your agreement.

- Contact Your Client Directly: If there has still been no response, try contacting your client by phone or through a video call. Direct communication can help clear up any issues and may prompt immediate action.

- Consider Late Fees or Interest: If your agreement allows for it, you can charge a late fee or interest on the overdue amount. Be sure to communicate this policy clearly and include it in your future contracts to prevent late payments from becoming a recurring issue.

- Seek Legal Advice or Collection Services: As a last resort, if all efforts to collect the payment have failed, consider legal action or hiring a collections agency. However, this should be a final step, as it can damage your business relationship.

While dealing with late payments can be frustrating, handling them in a professional and calm manner is key to resolving the issue quickly. By keeping communication lines open, offering flexibility, and adhering to the terms of your agreement, you can encourage timely payments and protect your business interests.

Legal Aspects of Billing Documents

When creating billing documents for services or products rendered, it is important to consider the legal requirements that govern these transactions. A well-structured document not only ensures timely payments but also protects both parties in case of disputes. Understanding the legal aspects of billing is crucial to ensure compliance with tax laws, contractual obligations, and other regulations that might apply to your business activities.

Here are some key legal elements to keep in mind when preparing your billing documents:

- Clear Terms and Conditions: Always include the agreed-upon payment terms, such as due dates, interest on late payments, and any specific conditions tied to the payment. These terms should be outlined in your initial agreement with the client and reflected in the document.

- Tax Compliance: Depending on your location and type of business, taxes may need to be added to the total amount. Ensure you include the correct tax rate and provide a breakdown of the tax applied, such as sales tax, VAT, or other applicable charges. This ensures compliance with local tax laws.

- Client and Business Information: Both the client’s and your business’s details should be clearly listed. This includes legal names, business registration numbers, contact information, and tax identification numbers, if required. This helps establish the authenticity of the transaction.

- Contractual Obligations: Make sure that the billing document aligns with the terms agreed upon in the contract. If there are any discrepancies between the work provided and the payment amount, this can lead to legal challenges. The document should match the scope and value of the work agreed to.

- Late Fees and Penalties: If your contract specifies penalties for late payments, ensure these are clearly mentioned in the billing document. Clearly state the amount or percentage of the penalty and when it will be applied if the payment is overdue.

- Payment Methods: Specify the acceptable methods of payment (bank transfer, credit card, cheque, etc.) and any related details. This minimizes confusion and ensures that both parties are clear on how payments should be made.

- Dispute Resolution: Include a clause that outlines the process for resolving payment disputes. This may include mediation, arbitration, or legal action if necessary. Having a dispute resolution process outlined in advance can save time and money if any issues arise.

By addressing these legal aspects in your billing documents, you can protect both your interests and those of your clients. Ensuring that all relevant information is clear and legally compliant can prevent misunderstandings and legal issues, helping your business maintain strong, professional relationships with clients.

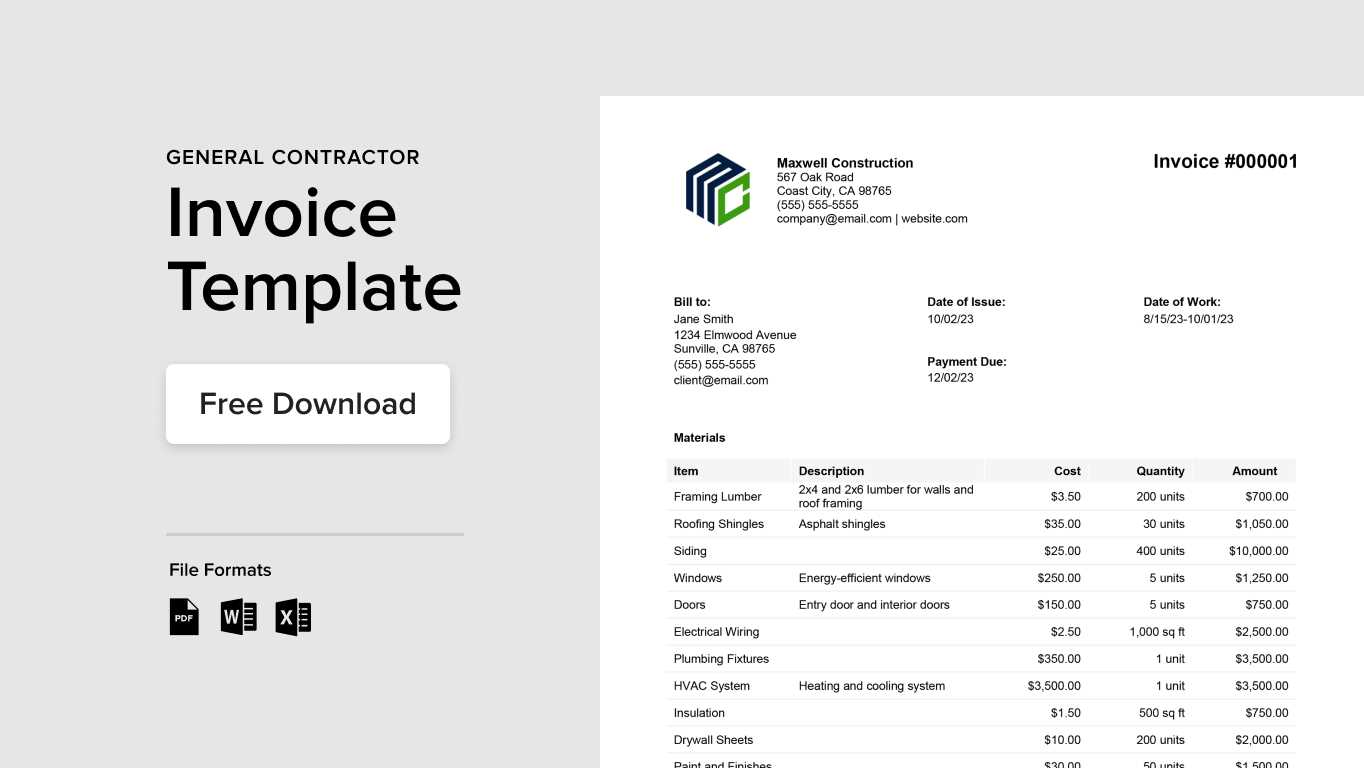

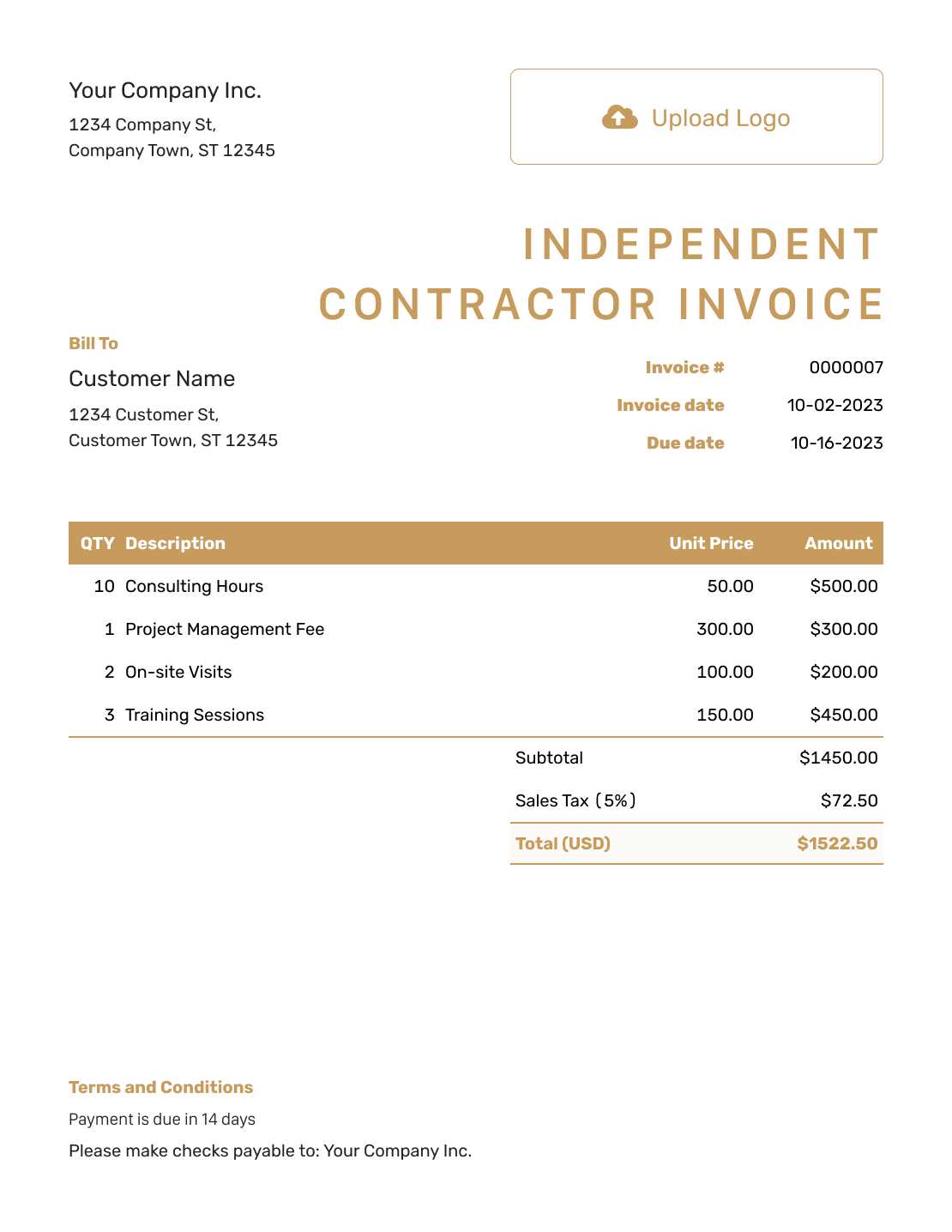

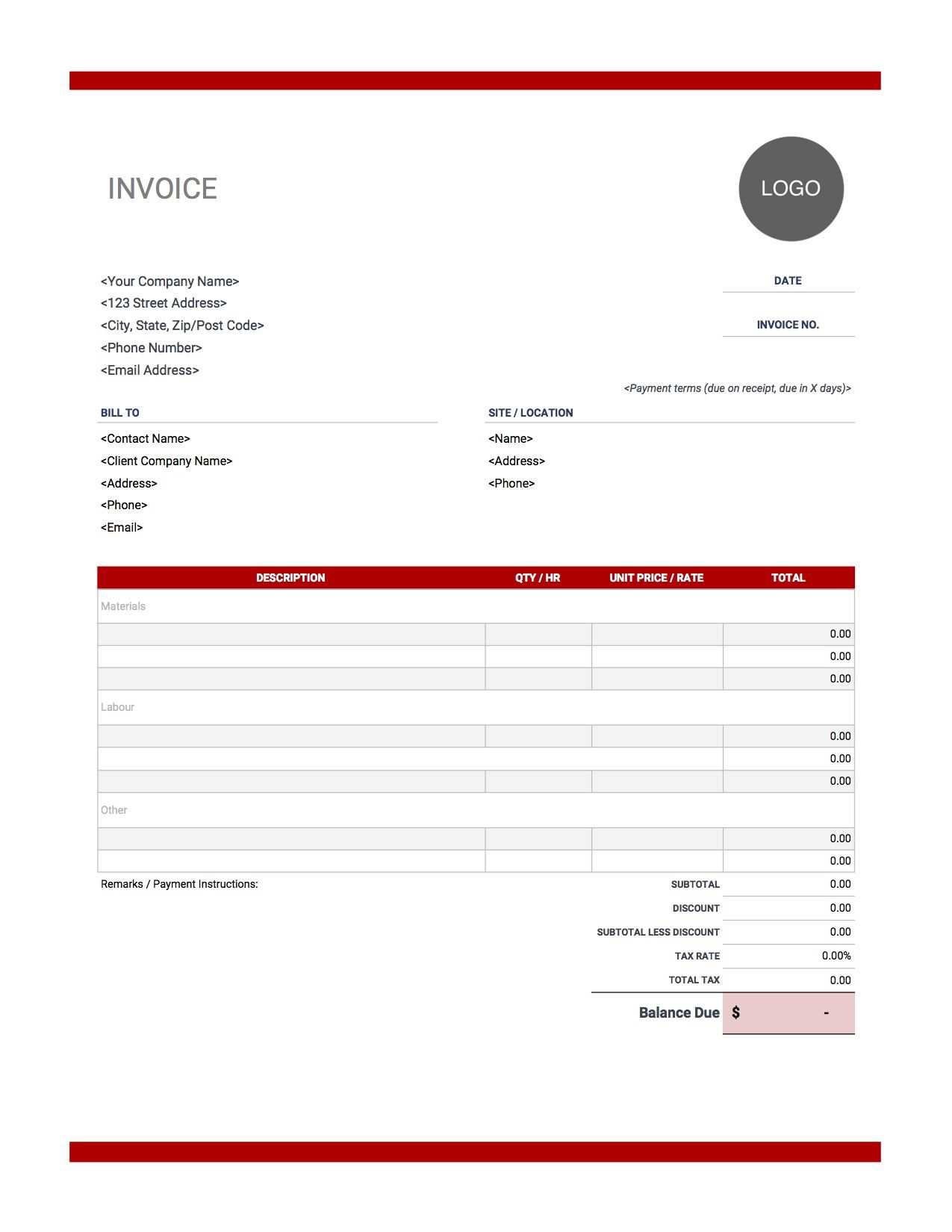

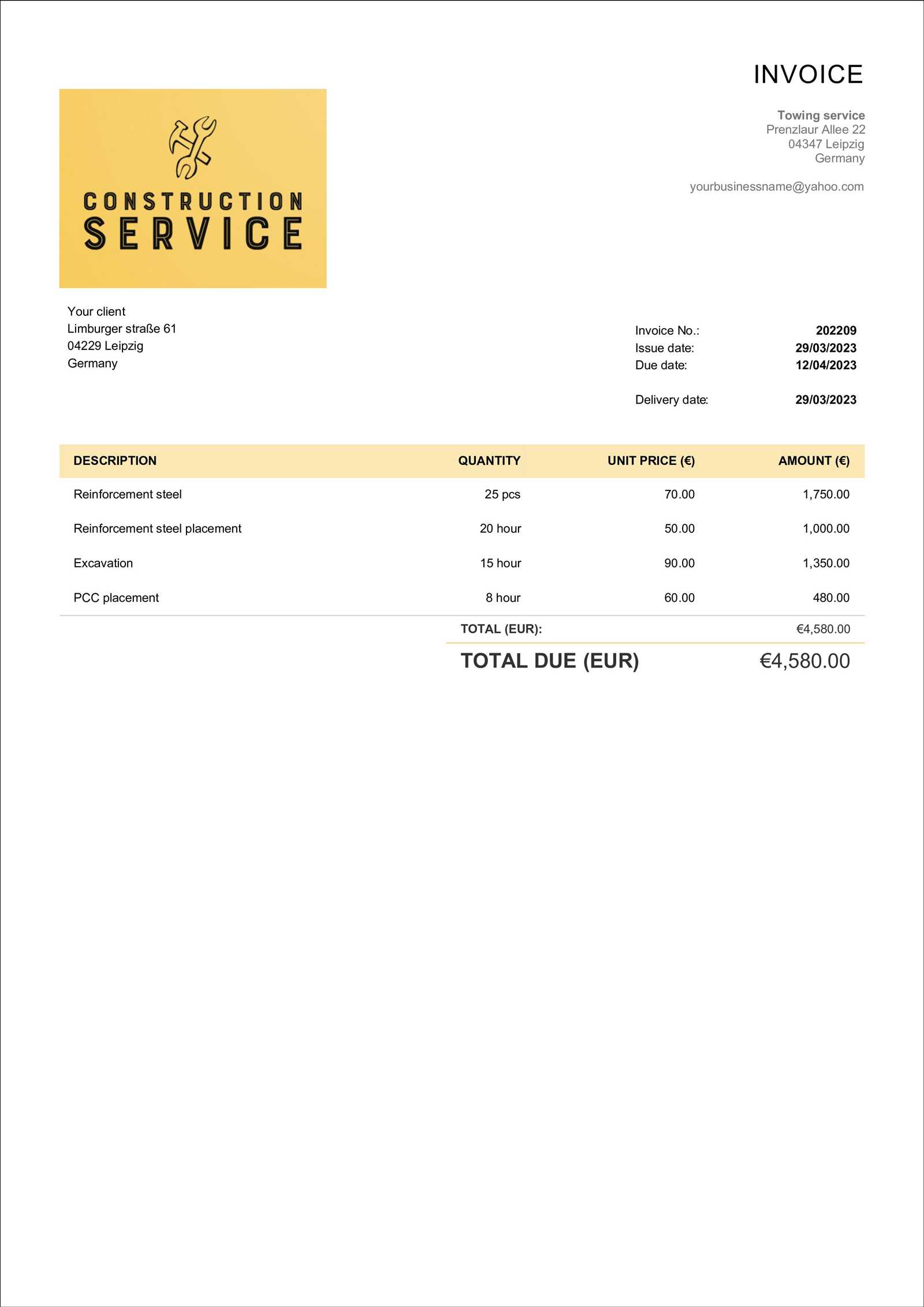

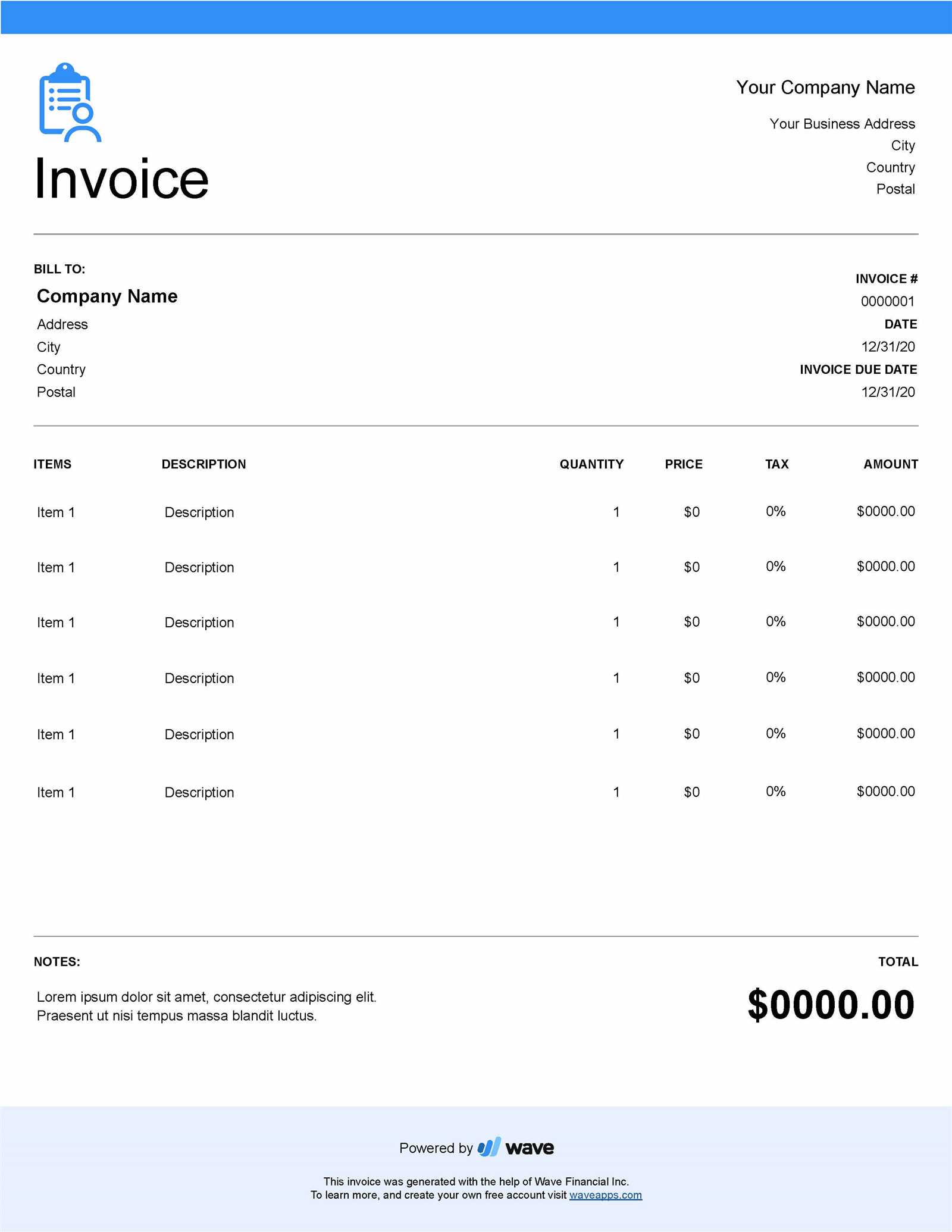

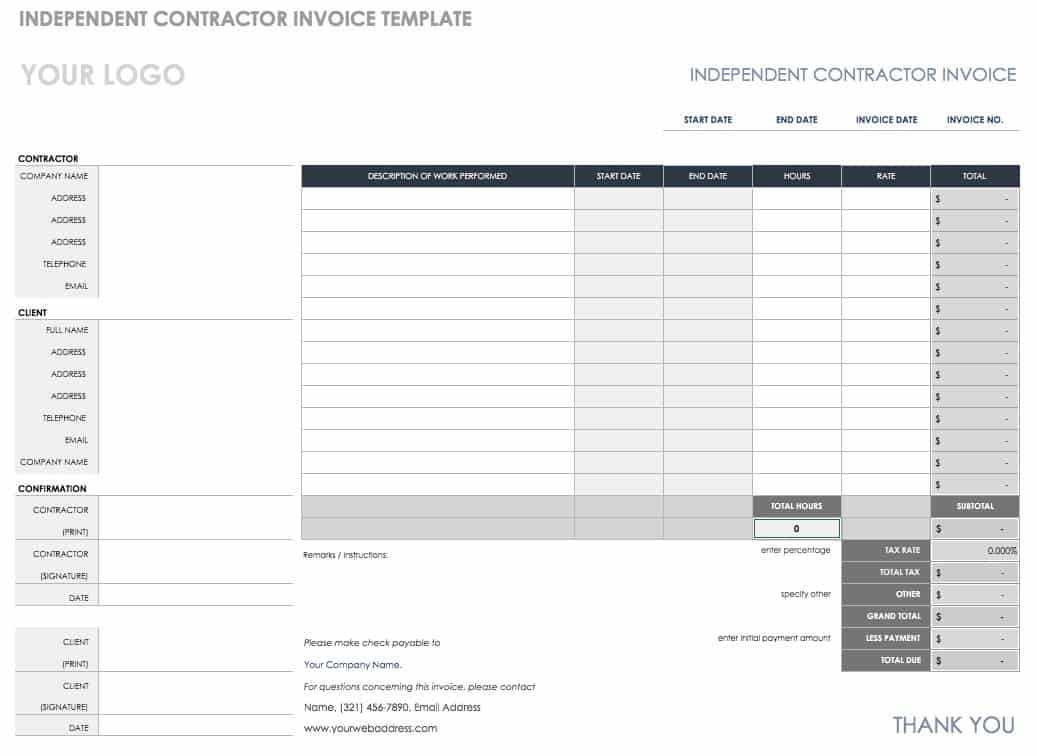

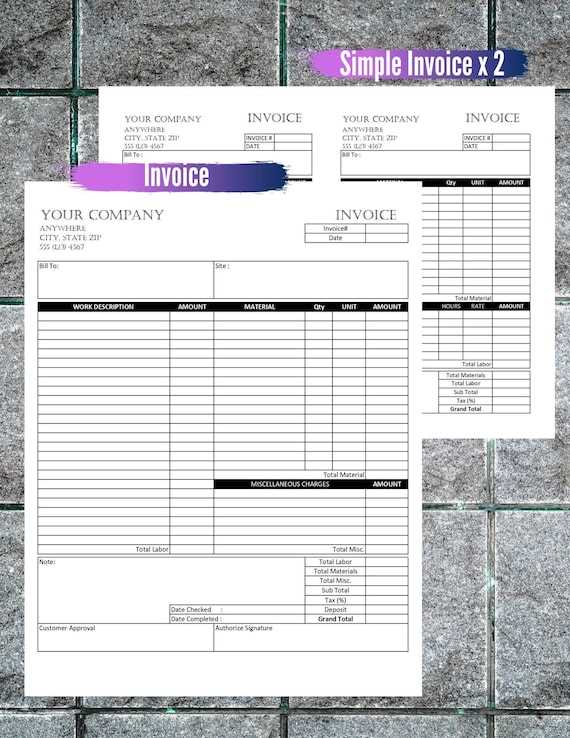

Free Resources for Billing Document Templates

Creating a well-structured payment request document doesn’t have to be expensive or time-consuming. There are numerous free resources available online that can help you generate professional-looking forms without the need for advanced design skills or software. These resources provide customizable templates, allowing you to input your business details, client information, and services rendered, while ensuring that the document meets all necessary requirements.

Here are some of the best free resources where you can find useful billing document templates:

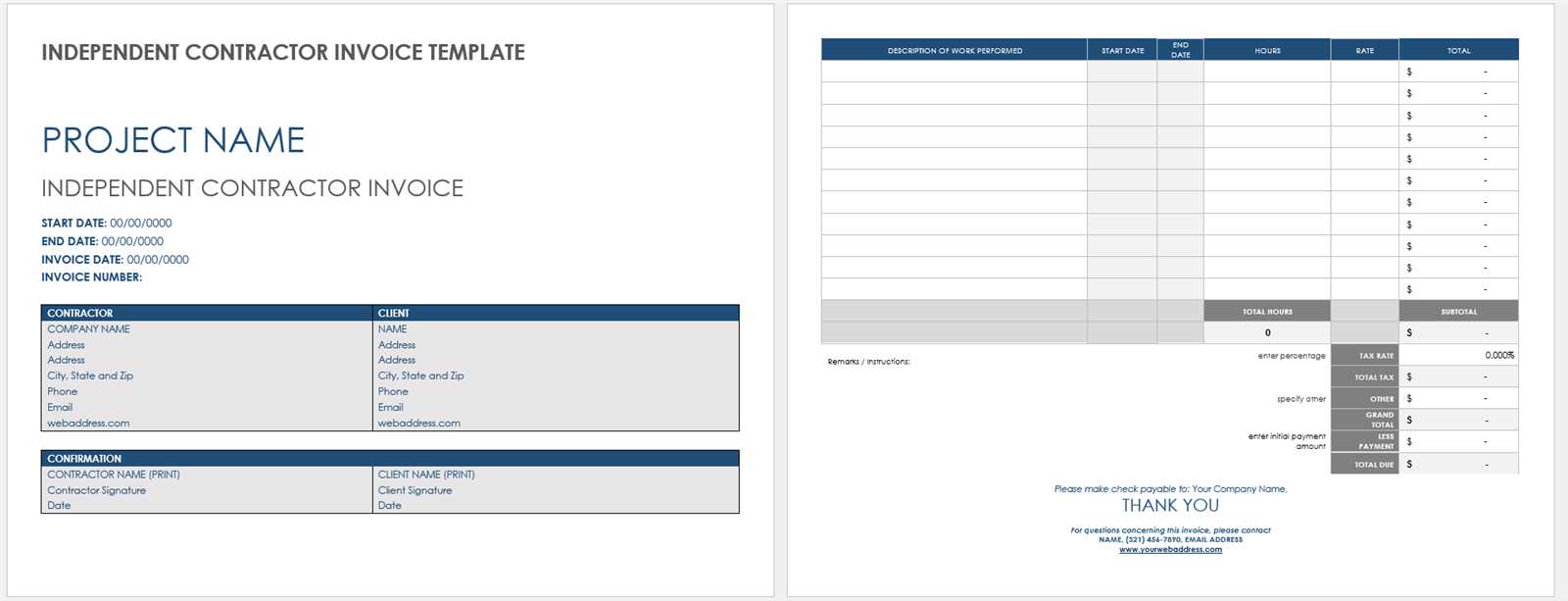

1. Google Docs and Microsoft Word Templates

Both Google Docs and Microsoft Word offer a variety of free, customizable templates that can be easily adapted to your needs. These word processing programs allow you to modify the layout, text, and overall design to suit your business style. They are user-friendly and provide basic templates that can be a great starting point for creating your payment request documents.

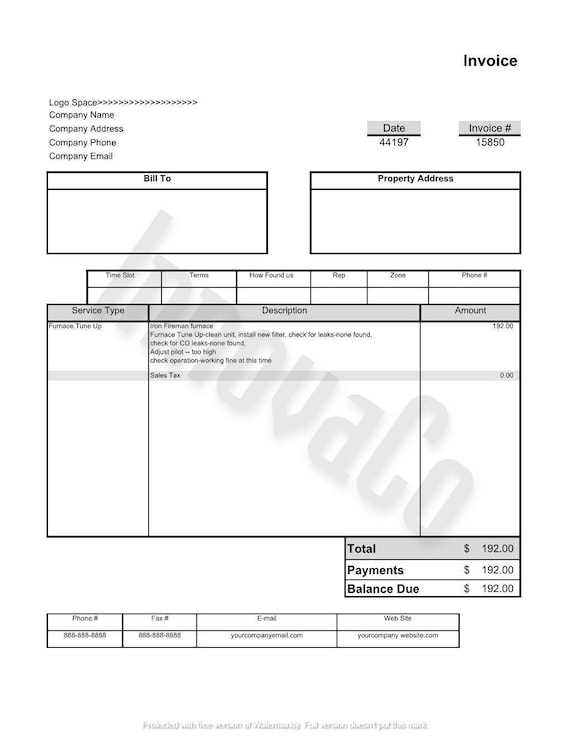

2. Online Template Generators

There are many websites that offer free online tools to generate payment request documents. These sites typically allow you to fill in your details directly into a form, and they will automatically create a well-organized document for you to download or send electronically. Some popular platforms include:

- Invoice Generator: A free online tool that helps create a basic billing document quickly. It lets you customize fields, add logos, and choose your currency and payment methods.

- Zoho Invoice: Offers free invoicing for small businesses and freelancers, with templates that are customizable and suitable for different industries.

- FreshBooks: Provides simple, free templates for generating payment requests, with an option to upgrade for additional features like time tracking and project management.

These resources can help save time while ensuring your documents are accurate and professional. Whether you prefer working in a word processor or using an online generator, these free tools make it easy to create customized billing documents that align with your business needs.