How to Customize Zoho Books Invoice Template for Your Business

In today’s fast-paced business environment, handling financial transactions efficiently is crucial for maintaining a smooth operation. Whether you’re a freelancer, a small business owner, or part of a larger organization, having a streamlined process for generating and managing payment requests is essential. The right tools can make this process faster, more accurate, and professional, allowing you to focus on growth rather than paperwork.

Customizable features are key when choosing the right platform for managing client payments. The ability to adjust layouts, set payment terms, and integrate payment methods helps ensure that each bill meets your specific business needs. A well-designed system can also reduce human errors, track overdue payments, and offer transparency to your clients, ultimately improving the overall customer experience.

In this article, we will explore how modern billing solutions can be tailored to suit your business, offering you a flexible and user-friendly way to manage transactions. From customizing your design to automating recurring payments, the right approach can help you save time, reduce administrative overhead, and enhance your professional image.

Zoho Books Invoice Template Overview

Managing payment requests is an essential aspect of running any business. An efficient system for creating and organizing billing documents not only saves time but also ensures professionalism and accuracy. The right tool offers various options for customization, allowing businesses to tailor documents to their brand and operational needs. This section explores the key features and functionalities available for generating and managing these documents, focusing on the flexibility and customization that these systems provide.

Key Features

The system provides several customizable options that allow you to adjust the layout, include logos, define payment terms, and apply taxes. Each option can be configured to match your specific business requirements, making the process more streamlined and less time-consuming.

| Feature | Description |

|---|---|

| Customization | Adjust layouts, fonts, and colors to match your brand identity. |

| Payment Terms | Set specific payment deadlines and terms for each client. |

| Tax Configuration | Automatically calculate and apply taxes based on local regulations. |

| Recurring Invoices | Set up automatic billing for recurring services or subscriptions. |

Benefits of Using a Customized Billing System

Implementing a tailored solution brings numerous advantages. Not only does it improve efficiency by automating tasks like calculating totals and applying discounts, but it also ensures consistency across all client interactions. In addition, it helps reduce human error, ensuring that each document generated is accurate and professional. The ability to share these documents instantly with clients further enhances communication and speeds up the payment cycle.

Why Choose Zoho Books for Invoicing

When it comes to managing business transactions, having a reliable and user-friendly platform is crucial. A powerful system not only simplifies the creation of payment requests but also integrates other financial tools, offering a complete solution for managing client interactions. The right choice can help automate tasks, save time, and ensure professional communication with clients.

Key Reasons to Choose This Platform

There are several compelling reasons why this platform stands out for managing billing processes. From advanced customization options to seamless integrations, it provides businesses with all the necessary tools for smooth and efficient financial management.

- Ease of Use: Intuitive interface designed for non-technical users.

- Comprehensive Customization: Flexibility to tailor documents according to your business needs.

- Automation Features: Automate repetitive tasks like generating regular billing documents or reminders.

- Accurate Financial Tracking: Track payment statuses, due dates, and outstanding amounts with ease.

- Integrated Payment Solutions: Offer your clients multiple ways to make payments directly from the billing document.

How It Enhances Your Workflow

One of the standout features of this system is its ability to integrate seamlessly with other tools, allowing for a smooth flow of data between various business functions. Whether you need to sync with accounting software or manage client records, the platform helps eliminate errors and redundant tasks, streamlining your overall workflow.

- Automated reminders ensure that clients never miss a payment deadline.

- Real-time syncing keeps all records up to date across multiple devices.

- Data security features protect sensitive financial information.

These features help businesses maintain a professional image while improving internal efficiency, ultimately leading to faster payments and stronger client relationships.

Key Features of Zoho Books Invoice

Efficient financial management requires more than just creating documents for payment requests. The right system should offer a range of features that simplify this process, from customizing documents to automating tasks. These capabilities not only save time but also ensure that all transactions are handled professionally and accurately.

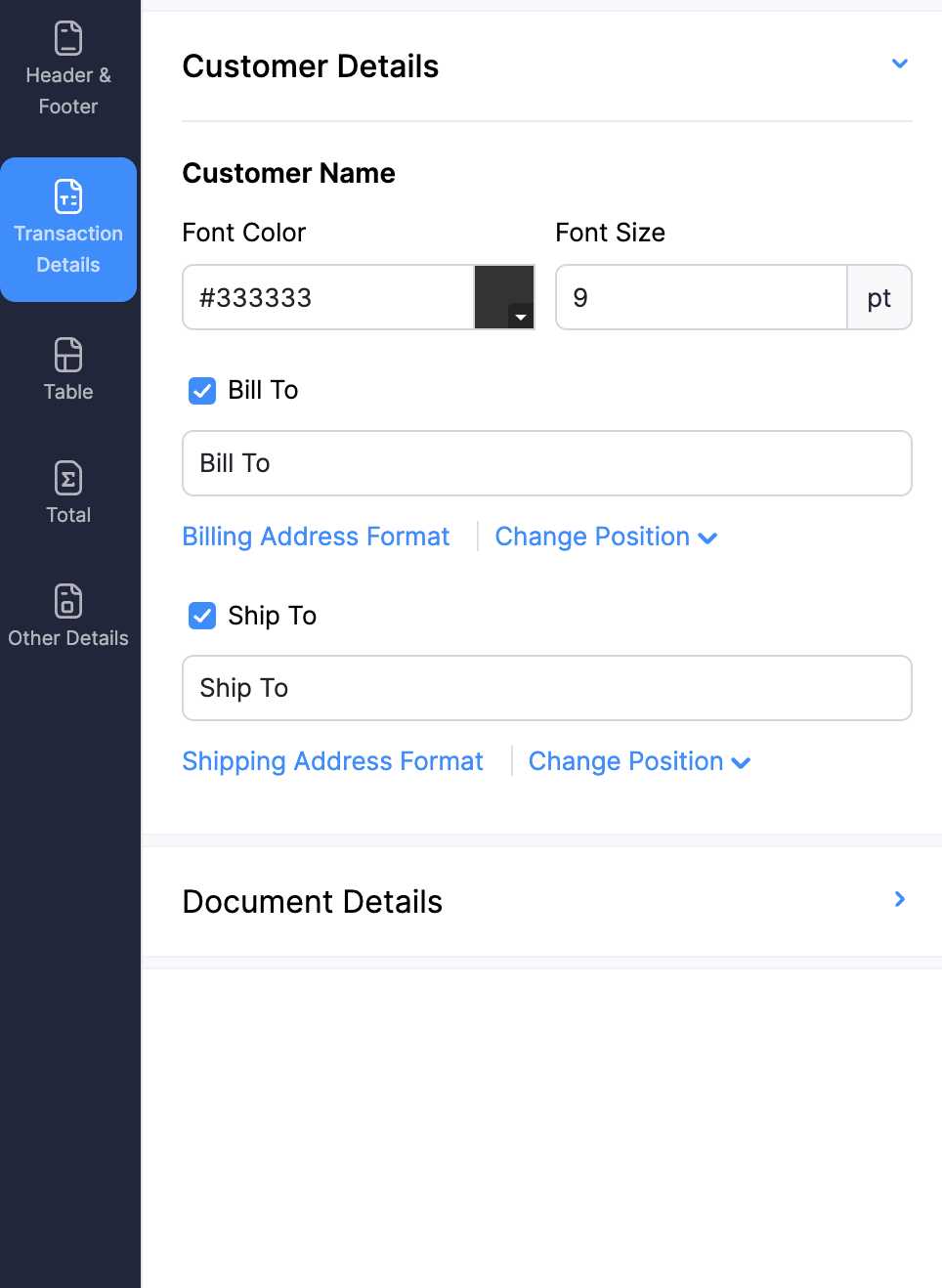

Customization and Personalization

One of the standout features of this system is its flexibility in document design. Businesses can fully tailor the layout to match their branding, making each document unique and professional. This includes options to add logos, adjust fonts, and even select specific color schemes to align with the company’s identity.

- Branding: Insert your company logo and business details.

- Document Styling: Choose from various templates or create a completely custom layout.

- Custom Fields: Add extra fields to capture specific information needed for your transactions.

Automation and Efficiency

Automating repetitive tasks is another key feature that enhances workflow efficiency. This system allows businesses to set up recurring billing cycles, automatically generate documents, and send them to clients without manual intervention. This reduces the risk of errors and ensures that every transaction is processed on time.

- Recurring Payments: Automatically create and send billing documents at regular intervals.

- Payment Reminders: Set reminders to notify clients about overdue payments.

- Seamless Integration: Integrate with other tools for automatic syncing of payment data.

These features help businesses reduce administrative overhead, improve accuracy, and offer a more professional experience to clients, making financial management easier and more reliable.

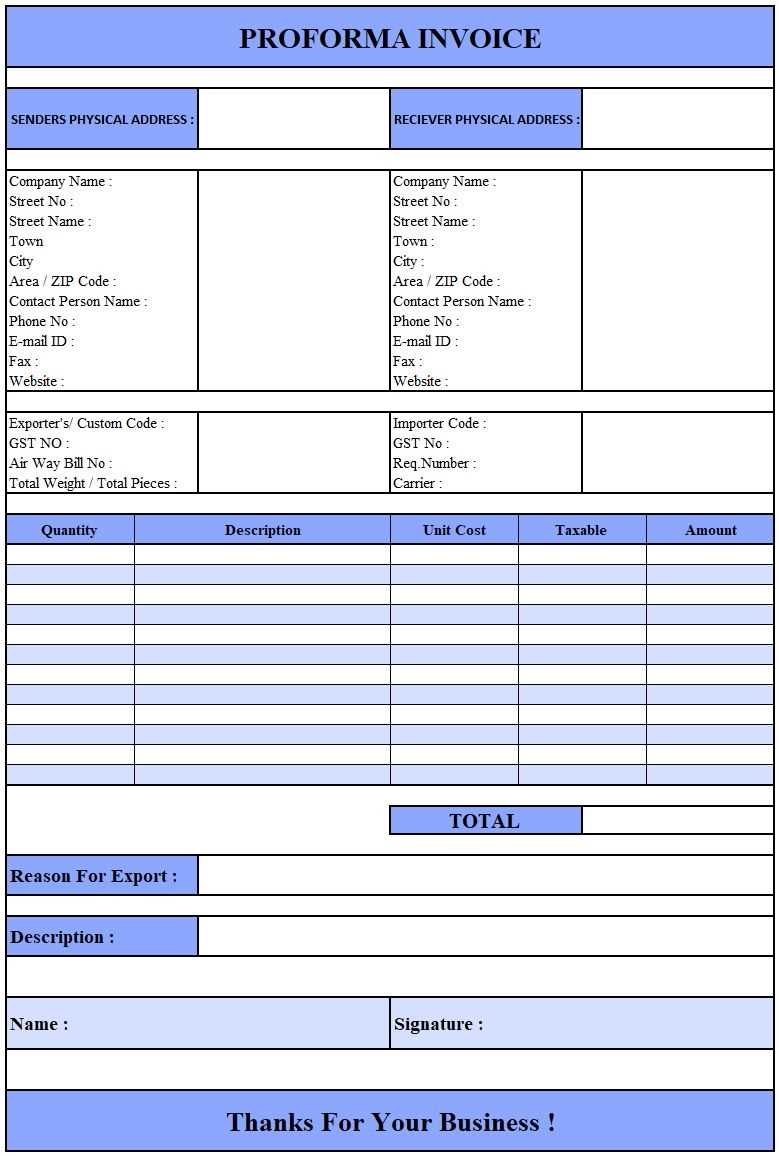

How to Create an Invoice in Zoho

Creating a professional payment document is a simple and essential task for any business. With the right platform, the process can be fast, efficient, and customizable. This section will guide you through the steps of generating a payment request, from setting up the necessary details to customizing the layout according to your needs.

Step-by-Step Guide

Follow these easy steps to create a payment document quickly and accurately:

- Login and Access the Billing Section: Begin by logging into your account and navigating to the section for managing transactions or payments.

- Create a New Document: Select the option to create a new payment request or transaction record.

- Enter Client Information: Fill in the details of the client, including their name, address, and any other relevant contact information.

- Specify the Products or Services: Add the products or services being billed, including quantities, rates, and descriptions.

- Set Payment Terms: Define the due date, payment terms, and any applicable discounts or taxes.

- Review and Customize: Double-check all details for accuracy. If needed, customize the document layout, add a logo, and adjust the appearance to fit your brand.

- Save and Send: Once everything looks good, save the document and send it directly to your client via email or provide a download link.

Additional Tips

- Recurring Billing: For regular clients, you can set up automatic billing to generate documents at fixed intervals.

- Tax Settings: Make sure your tax rates are set correctly for different regions or services.

- Payment Gateway Integration: Allow clients to make payments directly from the document through integrated payment options.

By following these steps, you can easily create a professional, accurate, and customized payment request that will streamline your business transactions and maintain a consistent, polished image for your clients.

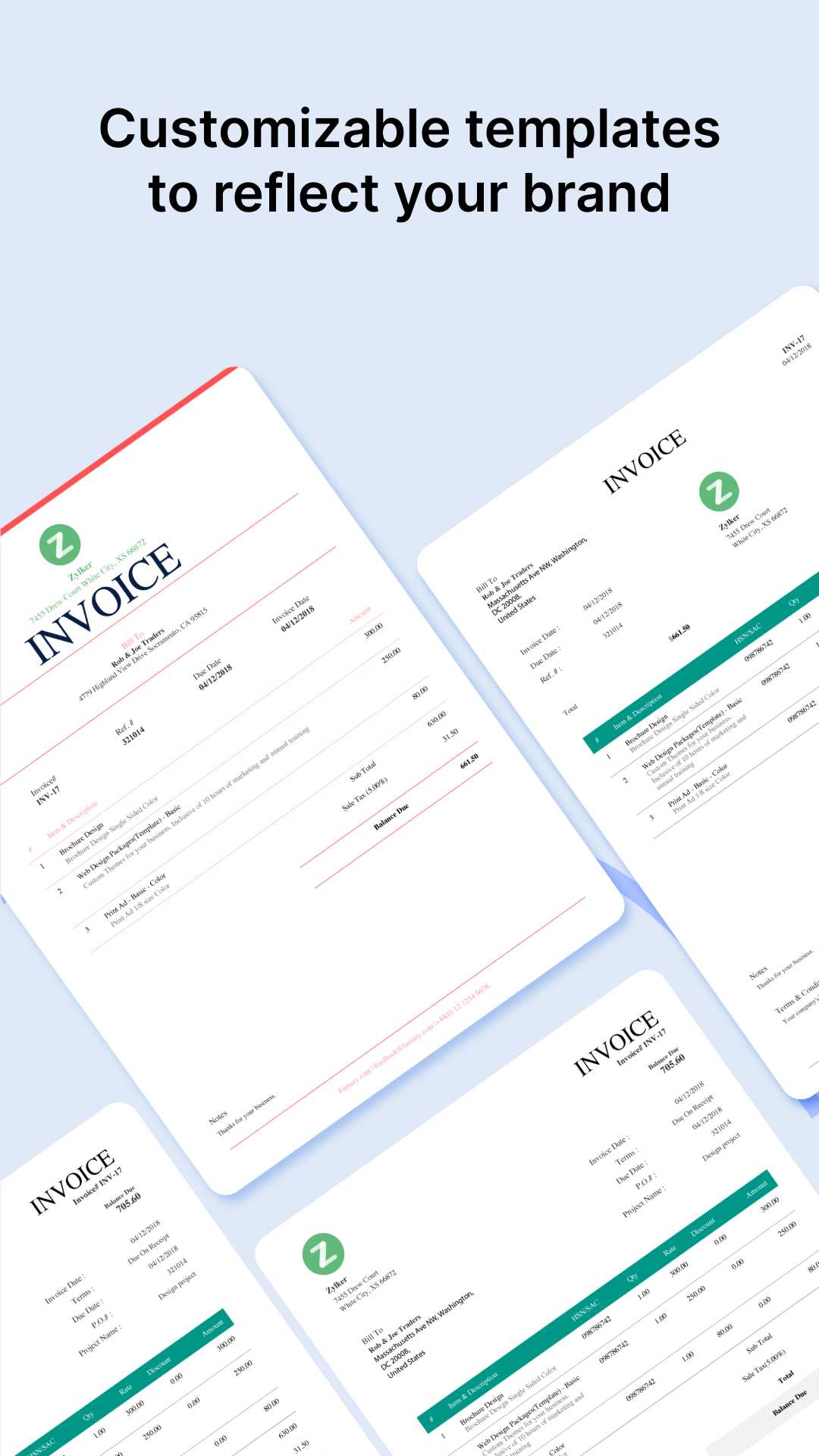

Customizing Your Invoice Layout

Personalizing the appearance of your billing documents is essential for creating a consistent and professional brand image. A well-designed document not only enhances client relationships but also ensures that the details are presented clearly and effectively. The layout should reflect your company’s style while providing all the necessary information in an organized way.

Customizing the layout of your payment documents allows you to adjust elements such as the header, footer, and the arrangement of items within the document. This can include adding logos, modifying fonts, or adjusting the alignment to suit your preferences and business requirements. The ability to personalize the layout ensures that your documents not only look professional but also align with your company’s identity.

Key Customization Options

| Customization Option | Description |

|---|---|

| Logo Placement | Place your company logo in the header to ensure brand visibility. |

| Font Styles | Choose fonts that reflect your brand’s identity while ensuring readability. |

| Field Arrangement | Customize the order of fields like product description, quantity, and total to suit your preferences. |

| Color Scheme | Modify the color of text, borders, and backgrounds to match your business’s branding. |

| Additional Information | Add custom fields for specific details such as purchase order numbers or special terms. |

By adjusting these elements, you can create a billing document that is not only functional but also aligned with your company’s professional image. Customizing the layout allows for better presentation and greater flexibility in the way you communicate with your clients, ultimately contributing to a stronger brand presence.

Adding Your Logo to Invoices

Including your company logo in billing documents is a simple yet effective way to reinforce your brand identity and maintain a professional appearance. A well-placed logo not only makes the document look polished but also helps clients recognize your business immediately. Customizing your financial documents with your logo can enhance client trust and contribute to a consistent brand experience.

Steps to Add a Logo

Follow these straightforward steps to add your logo to payment requests:

- Prepare Your Logo: Ensure that your logo is in an acceptable format (e.g., PNG, JPG, or SVG) and has a transparent background for better integration.

- Access the Customization Settings: Navigate to the document customization section in your platform and find the option for adding a logo.

- Upload the Logo: Upload your logo file from your computer or cloud storage, ensuring it meets the recommended size for optimal display.

- Adjust the Placement: Choose the location where you want your logo to appear (typically at the top of the document). You can adjust its size and alignment to fit the overall layout.

- Save and Review: After uploading and positioning the logo, save your changes and preview the document to ensure it looks professional and aligned with your brand.

Best Practices for Logo Placement

To ensure your logo enhances the document without overwhelming it, consider the following tips:

- Top Left or Center: Placing the logo at the top left or centered gives it prominence without cluttering the document.

- Keep It Simple: Use a high-resolution image that is not too large or too small, so it remains clear and crisp on all devices.

- Avoid Overcrowding: Leave enough space around the logo so it does not compete with other important details like payment amounts or terms.

Adding your logo is a simple but powerful way to maintain brand consistency and present a professional image to your clients. By following these guidelines, you can create visually appealing billing documents that support your business’s identity.

Setting Up Payment Terms in Zoho

Establishing clear and consistent payment terms is essential for any business to maintain healthy cash flow and avoid confusion with clients. By setting up specific conditions for payment deadlines, discounts, and penalties, businesses can ensure that both parties are on the same page when it comes to expectations. This also helps in managing finances efficiently and avoiding overdue payments.

Customizing payment terms in your billing documents allows you to define how and when clients should settle their accounts. From net payment deadlines to early payment discounts or late fees, setting up these terms can be done quickly and tailored to your needs. The following table outlines the most common payment terms and their uses:

| Payment Term | Description |

|---|---|

| Net 30 | Payment is due within 30 days from the issue date of the document. |

| Due on Receipt | Payment is expected immediately upon receiving the document. |

| Early Payment Discount | Offer a discount if the client pays before a specified date (e.g., 2% off if paid within 10 days). |

| Late Fee | Charge an additional fee for overdue payments, usually as a percentage of the outstanding balance. |

| Custom Terms | Create unique terms based on specific agreements or client needs, such as installment plans or partial payments. |

By establishing these terms upfront, you create a clear and professional framework for financial transactions, which can ultimately reduce misunderstandings and streamline the payment process. Setting up these conditions can usually be done once, with the option to apply them to each document you create, ensuring consistency in all future transactions.

How to Add Taxes to Zoho Invoices

Adding taxes to billing documents is a necessary step to ensure compliance with local tax regulations and to accurately reflect the total amount owed by clients. Different regions and services may have varying tax rates, which is why it’s important to be able to apply the correct tax amount to each payment request. This section will guide you through the process of adding taxes to your billing documents quickly and correctly.

Steps to Add Taxes

Follow these steps to include taxes in your payment requests:

- Access Tax Settings: Start by navigating to the settings or customization section of the platform. Look for the tax settings or tax management options.

- Create a New Tax Rate: If you don’t have a predefined tax rate, you can create one by entering the tax name (e.g., “Sales Tax”) and the applicable percentage or fixed amount.

- Assign Taxes to the Document: When creating a new payment request, select the relevant tax rate that applies to the client or service being billed.

- Apply Taxes to Specific Items: You can choose to apply taxes to all items on the list or specify which ones should be taxed.

- Save and Review: After applying the tax, review the document to ensure that the tax is correctly calculated and reflected in the total amount.

Types of Taxes You Can Add

- Sales Tax: A common tax on goods and services, often applied at the point of sale.

- VAT (Value-Added Tax): A consumption tax placed on a product whenever value is added at each stage of the supply chain.

- GST (Goods and Services Tax): A broad-based tax on goods and services that is applied in many countries.

- Custom Tax Rates: If your business operates in multiple regions, you can create custom tax rates for each location or client type.

By following these steps, you can ensure that taxes are applied correctly to all your transactions. This not only helps in staying compliant with tax laws but also ensures that clients are billed accurately, minimizing any potential disputes over tax charges.

Automating Recurring Invoices in Zoho

For businesses that provide ongoing services or subscriptions, manually creating payment documents for each billing cycle can be time-consuming and prone to errors. Automating this process ensures that clients are billed on time, every time, without requiring constant manual intervention. This feature saves time and helps maintain consistency and professionalism in client communication.

Steps to Automate Recurring Billing

Follow these simple steps to set up recurring payment requests for your clients:

- Navigate to the Recurring Section: Go to the recurring billing or subscription settings in your platform.

- Create a New Recurring Document: Select the option to create a new recurring payment request. Choose the client, set the service details, and the frequency of billing (e.g., weekly, monthly, or yearly).

- Set Payment Terms: Specify the payment due date, any taxes, and discounts that should apply to each billing cycle.

- Choose a Start Date: Set the start date for the first recurring payment request, and select how long the recurring cycle will last (if applicable).

- Review and Activate: Double-check all the details and activate the recurring billing cycle. The system will automatically generate and send the documents as scheduled.

Benefits of Automating Recurring Payments

- Time Savings: No need to manually create and send payment requests each billing cycle.

- Consistency: Ensure that payments are processed on time without the risk of forgetting or missing any cycle.

- Improved Cash Flow: Regular billing ensures predictable income and helps businesses plan their finances better.

- Client Convenience: Clients don’t have to worry about receiving documents late, and they benefit from having a set payment schedule.

By automating the recurring payment process, businesses can focus on their core activities while ensuring that all transactions are handled smoothly and efficiently. This feature helps build trust with clients by offering predictable and consistent billing practices.

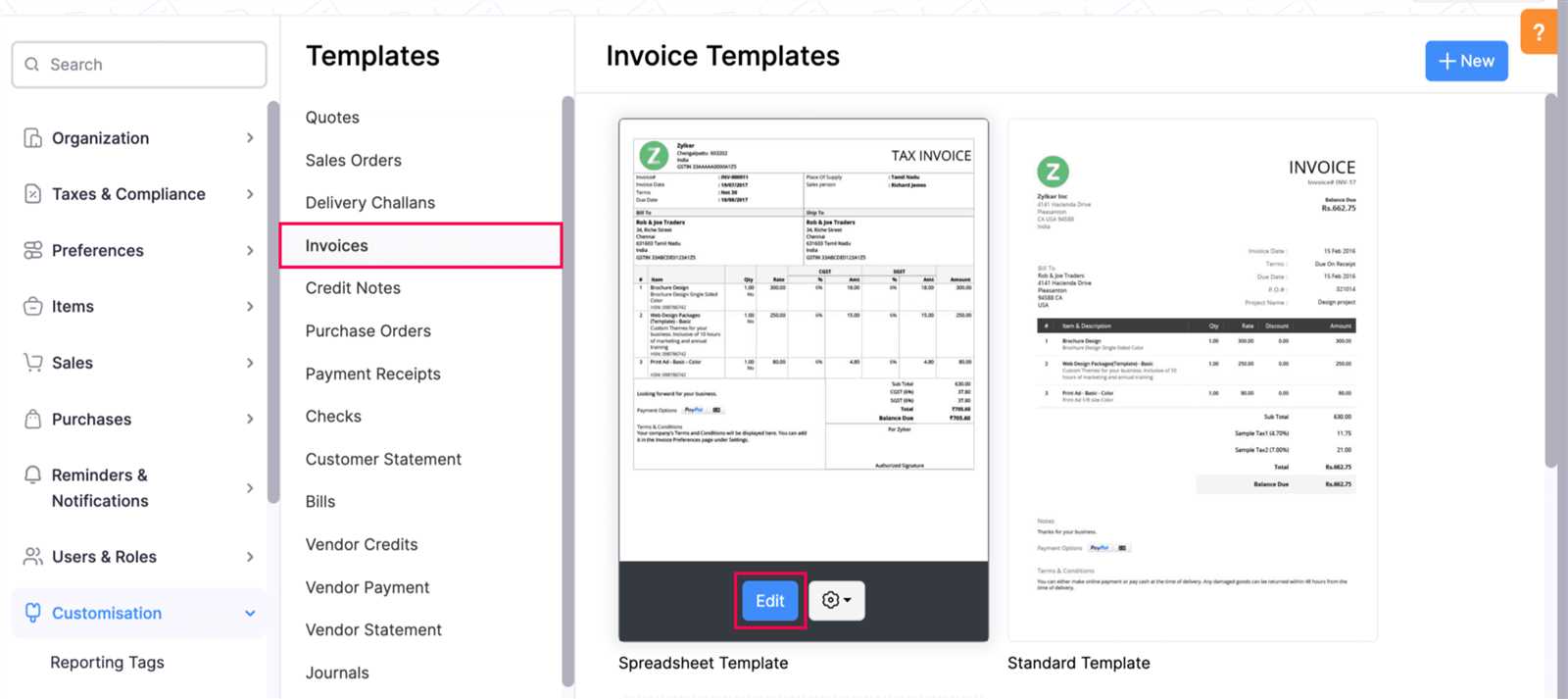

Managing Multiple Invoice Templates

Businesses often deal with a variety of clients, services, and billing scenarios, which means they may need different styles and formats for their payment requests. Managing multiple document layouts is crucial to ensure that each client receives a personalized and professional document that aligns with their specific needs or industry standards. Having different billing document designs can also help streamline workflows and maintain a consistent image across various transaction types.

How to Manage Multiple Document Designs

Here’s how to set up and organize different billing document layouts for various use cases:

- Create Different Layouts: Start by creating unique designs for different types of transactions (e.g., one for product sales, another for services, or a third for subscription-based services).

- Assign Templates to Specific Clients: Once layouts are created, assign them to specific clients or groups of clients. This ensures that each client receives the most appropriate document design based on their relationship with your business.

- Customize Fields for Each Template: Customize the fields in each layout to include only the relevant details for each transaction type. For example, a product sale template may include serial numbers, while a service template might include work hours or project milestones.

- Save and Update Regularly: Once you have set up multiple layouts, ensure that you save each one and update them as needed to reflect changes in your pricing, terms, or business branding.

Benefits of Using Multiple Document Designs

- Tailored Client Experience: Clients will appreciate receiving a payment request that reflects their specific service or purchase type, improving communication and professionalism.

- Brand Consistency: Different layouts allow businesses to align their branding with client expectations while maintaining consistency across all documents.

- Efficiency: Managing multiple designs helps you quickly select the appropriate format for each client, speeding up the billing process.

- Flexibility: Businesses can easily adapt to various industries or customer preferences by offering a variety of designs and content options.

By managing multiple layouts, businesses can ensure that each billing document is customized and professional, meeting the specific needs of their clients while improving workflow efficiency and brand consistency.

How to Track Invoice Status

Tracking the progress and status of payment requests is crucial for maintaining cash flow and ensuring that clients adhere to payment terms. By monitoring the status of each document, businesses can identify overdue payments, follow up with clients when necessary, and manage their financial records more effectively. Whether a payment has been made, is still pending, or is overdue, having a system to track these details helps streamline the entire billing process.

Steps to Track Payment Request Status

Here’s how you can easily track the status of your payment documents:

- Access the Transaction Dashboard: Begin by logging into the platform where your payment documents are stored and navigate to the section that displays all created documents.

- Filter by Status: Use filtering options to view payment requests based on their status, such as “Paid,” “Pending,” “Overdue,” or “Partially Paid.”

- Check Payment Dates: Review the due dates and payment dates to quickly assess which documents have been paid on time and which are still awaiting payment.

- Automated Notifications: Set up automated reminders and notifications for clients whose payments are overdue. This can be done by configuring reminders to be sent at specific intervals before or after the due date.

- Review Detailed History: For each payment request, review the full history of actions taken, such as when the document was created, when it was sent, and whether the client has opened or paid it.

Types of Payment Status

Here are some common statuses you can track:

- Paid: Indicates that the client has successfully paid the total amount on time.

- Pending: The payment request has been sent but has not yet been paid.

- Overdue: The payment has not been received by the due date, and the client should be contacted for payment.

- Partially Paid: The client has made a partial payment, and the remaining balance is still due.

- Unsent: The payment request has been created but not yet sent to the client.

By keeping track of the status of all your payment documents, you can take timely action, reduce the risk of late payments, and ensure that your business maintains smooth financial operations. A clear view of your payment status allows you to stay organized and proactive in managing your accounts.

Sharing Invoices with Clients

Once a payment request is created, the next important step is to share it with the client in a way that ensures clarity and prompt payment. How you deliver these documents can impact both client relations and the overall payment process. Efficient sharing options streamline communication, reduce delays, and enhance the professionalism of your business.

Methods to Share Payment Requests

There are several effective ways to share your billing documents with clients, each offering different benefits:

- Email: One of the most common and direct methods. Simply send the document as an email attachment, ensuring it is in a widely accessible format like PDF.

- Client Portal: Many businesses provide their clients with access to a secure online portal where they can log in and view or download their payment documents.

- Link Sharing: You can generate a secure link to the document and send it to clients via email, text message, or any other preferred communication method. This allows clients to access the document online at their convenience.

- Printed Copy: For clients who prefer physical documents, printing and mailing a hard copy can still be an effective method, though it may take longer.

Best Practices for Sharing Payment Documents

To ensure that the sharing process goes smoothly and professionally, consider the following best practices:

- Double-Check Contact Information: Before sending, make sure that the client’s contact details, such as email or phone number, are up-to-date and accurate.

- Include a Clear Subject Line: When sending an email, include a subject line that clearly indicates the purpose of the message, such as “Payment Request for [Service/Product Name] – Due [Date].”

- Offer Multiple Formats: Providing your client with a PDF or a downloadable document ensures they can access the request on different devices without compatibility issues.

- Follow Up: If the client hasn’t responded or made the payment within the set period, it’s essential to send a polite reminder or follow-up message.

By using these methods and practices, you can make the payment request process simple, transparent, and efficient, encouraging timely payments and fostering a strong professional relationship with your clients.

Integrating with Payment Gateways

Integrating your billing platform with online payment systems makes it easier for clients to pay their dues quickly and securely. Payment gateways streamline the payment process by allowing clients to pay directly through their preferred method, such as credit cards, debit cards, or e-wallets. This integration not only simplifies the transaction process but also improves cash flow and reduces the time spent manually tracking payments.

Steps to Integrate Payment Gateways

Here’s how you can integrate a payment system with your billing platform:

- Select a Payment Gateway: Choose a payment provider that suits your business needs, considering factors like transaction fees, supported countries, and currencies.

- Connect the Gateway: Most platforms offer easy integration with popular gateways like PayPal, Stripe, or Square. Simply go to the payment settings section and select your chosen gateway to link it with your account.

- Set Payment Methods: Once connected, configure the accepted payment methods (credit card, bank transfer, e-wallets, etc.) that you want to offer to your clients.

- Customize Payment Options: Tailor the payment experience by adding custom fields or notes on the payment page, ensuring it reflects your business identity and transaction requirements.

- Test the Integration: Before using the gateway for live transactions, run a few test payments to make sure everything is working smoothly.

Benefits of Integration

- Faster Payments: With online payment processing, payments can be received instantly, reducing delays in the payment cycle.

- Increased Client Convenience: Clients can pay using their preferred methods, which encourages faster and more frequent payments.

- Reduced Errors: Automated payment processing reduces the risk of errors associated with manual payment tracking and entry.

- Enhanced Security: Payment gateways use advanced encryption to protect sensitive customer data, offering peace of mind for both you and your clients.

- Better Cash Flow Management: Immediate payment processing ensures timely funds, which can help you maintain smooth business operations.

By integrating your billing system with a payment gateway, you simplify the payment process, reduce administrative work, and enhance customer satisfaction. This integration is a valuable tool for businesses looking to streamline their financial operations and provide clients with a seamless payment experience.

How to Set Up Discount Options

Offering discounts is a powerful tool for businesses looking to attract new customers, retain existing ones, and encourage faster payments. By providing flexible discount options, you can incentivize clients to take advantage of promotional offers or pay early. Setting up discount options allows you to automate this process and ensure that clients receive the correct pricing without the need for manual adjustments each time.

Steps to Set Up Discounts

Follow these steps to configure discount options for your business:

- Navigate to Discount Settings: Start by accessing the settings or pricing section within your billing platform where discount rules can be created and applied.

- Choose Discount Type: Select the type of discount you wish to offer. Common options include percentage-based discounts or fixed-amount discounts. You can also offer discounts based on specific conditions such as early payment or bulk purchases.

- Set Discount Criteria: Define the conditions under which the discount will apply. For example, you can set discounts for clients who pay within a certain number of days, for first-time customers, or for orders over a specific amount.

- Apply Discounts to Specific Items: You can choose whether to apply the discount to the entire bill or to specific products or services. This flexibility allows you to target particular offerings in your catalog.

- Save and Activate: Once you have configured the discount rules, save your settings and make them active so that they automatically apply to future transactions.

Types of Discounts You Can Offer

- Early Payment Discount: Offer clients a discount if they pay their bill before a specified due date, encouraging prompt payment.

- Volume-Based Discount: Provide a discount for clients who purchase in larger quantities or place bulk orders.

- Seasonal Discount: Create promotional offers tied to specific times of the year, such as holiday sales or end-of-season discounts.

- Referral Discount: Reward clients who refer new customers with discounts on their next purchase.

Setting up discount options not only enhances client satisfaction but also helps businesses increase sales, encourage repeat business, and improve overall cash flow. With automated discount systems in place, you can ensure that the right pricing is applied each time, making the billing process more efficient and less prone to errors.

Tips for Professional Invoice Design

A well-designed payment document not only helps convey professionalism but also ensures that the information is clear and easy to understand for clients. Whether you’re sending a one-time request or managing recurring billing, the design plays a key role in creating a positive impression and encouraging timely payments. A clean, well-structured layout can enhance communication and minimize confusion about payment terms, amounts, and due dates.

Key Elements of a Professional Design

When designing your payment documents, consider the following tips to create a polished and functional layout:

- Keep it Simple: Use a clean and minimalist design with plenty of white space to avoid clutter. This ensures that important details, such as amounts and payment terms, are easily readable.

- Branding Consistency: Include your business logo, brand colors, and font styles to maintain consistency with your overall branding. A well-branded document reinforces your company’s image and professionalism.

- Clear Sections: Organize your document into clearly defined sections–such as contact information, payment breakdown, and terms–to help clients navigate the content effortlessly.

- Readable Fonts: Use fonts that are easy to read, even at small sizes. Avoid using overly decorative or complex fonts that could make the document harder to understand.

- Highlight Key Information: Make sure critical details, such as total amounts due, due dates, and payment instructions, stand out visually. You can use bold text, larger font sizes, or boxes to emphasize these points.

- Use Logical Layout: Ensure that the document flows logically–beginning with your business and client information, followed by the payment breakdown, and ending with the payment due date and methods. This ensures a smooth reading experience.

Additional Design Tips

- Include Payment Methods: Provide clear instructions for how clients can make payments, whether it’s through credit card, bank transfer, or an online payment platform.

- Ensure Mobile Compatibility: Many clients will view documents on mobile devices, so make sure the design is responsive and easy to read on various screen sizes.

- Legal Details: If necessary, include any relevant legal disclaimers or tax information in small print, ensuring they don’t clutter the main sections but remain accessible for clients to review.

A professional design not only helps clients feel more confident about your business but also enhances the efficiency of your billing process. A thoughtfully designed payment document will likely be easier for clients to understand and process, which can lead to quicker payments and stronger professional relationships.

Tracking Payment Document History

Keeping track of your billing records is crucial for maintaining accurate financial records, monitoring payments, and ensuring that all transactions are properly documented. By tracking the history of your payment documents, you can easily access past transactions, identify any outstanding payments, and resolve any discrepancies. A well-organized history helps streamline financial reporting, manage client relationships, and maintain a transparent workflow.

Benefits of Tracking Payment History

Maintaining an organized history of all your billing documents offers several advantages:

- Quick Access to Past Records: Easily review past transactions and find any document when needed, whether for reference, client queries, or tax purposes.

- Monitor Payment Status: Stay updated on whether payments have been completed, are pending, or overdue, helping you take timely actions if necessary.

- Resolve Disputes: If a client raises an issue about a payment, you can quickly refer to the history for accurate details and resolve the matter efficiently.

- Improve Financial Planning: Historical records provide a clearer view of your cash flow, helping you make better decisions about budgeting and forecasting.

How to Track Payment Document History

To effectively track the history of your payment documents, follow these steps:

- Access the History Section: Most billing platforms have a dedicated section where all past documents are stored. Locate this section in your account settings or dashboard.

- Filter by Date or Client: Use filters to quickly find the records you need, whether by specific dates, clients, or payment status. This makes it easier to locate a particular document.

- Review Payment Status: For each document, check the payment status to see whether it has been paid, is awaiting payment, or is overdue. This will help you prioritize follow-ups.

- Download or Print Records: If necessary, download or print past payment records for offline access or record-keeping purposes. Most platforms offer these options in various formats such as PDF or CSV.

By efficiently tracking your payment document history, you can streamline your financial operations, reduce the risk of errors, and stay on top of your business transactions. This organized approach provides a more professional and hassle-free experience for both you and your clients.

How to Export Billing Documents

Exporting your billing records allows you to create backups, share them with stakeholders, or analyze financial data in external tools like spreadsheets. By exporting these documents, you can easily manage your finances offline, keep detailed reports, or use them for tax filing and audits. Most platforms offer simple ways to export your records in a variety of formats, including PDF, CSV, or Excel files.

Steps to Export Your Billing Documents

Follow these steps to export your records quickly and efficiently:

- Navigate to the Billing Section: Start by accessing the section where your payment documents are stored, typically found in the dashboard or document management area.

- Select the Documents to Export: Choose whether you want to export all records or filter by date, client, or payment status. This allows you to customize the export based on your needs.

- Choose the Export Format: Select the file format that works best for your needs. Common options include PDF for document-style exports, CSV or Excel for data-heavy reports, or even TXT for basic text exports.

- Download or Send the Files: Once you’ve chosen the appropriate format, download the exported file to your computer or share it directly with clients, accountants, or financial teams.

Why Export Billing Documents?

- Data Backup: Keep a secure offline backup of your important records in case of technical issues with the platform or other emergencies.

- Detailed Reporting: Exporting records allows you to analyze your finances in detail, generate customized reports, and gain insights into your business performance.

- Sharing with Stakeholders: Easily share billing information with clients, team members, or financial advisors in an accessible and understandable format.

- Tax Filing and Compliance: Exporting records in a clear, structured format makes it easier to prepare for tax filing, audits, or legal requirements.

By exporting your billing documents, you gain flexibility and control over how you manage and share your financial records. Whether for backup, analysis, or reporting purposes, this simple process can improve the efficiency and security of your business operations.

Benefits of Using a Structured Billing Document Layout

Utilizing a pre-designed and customizable billing layout can significantly streamline the invoicing process for businesses of all sizes. Such layouts help ensure consistency, professionalism, and accuracy, making the payment process smoother for both clients and business owners. Whether you’re a freelancer or managing a large company, an efficient billing system can enhance client satisfaction, improve cash flow, and reduce errors in financial transactions.

Key Advantages of Using a Pre-Designed Billing Layout

Here are some of the main benefits of incorporating a structured layout for your payment documents:

- Time Efficiency: Pre-designed layouts allow you to generate and send invoices quickly. With automatic fields for client information and item details, much of the manual work is eliminated.

- Consistency and Professionalism: A uniform design ensures that every document sent out maintains a professional look, which helps in building credibility and trust with your clients.

- Customization Options: You can tailor the layout to reflect your branding, such as adding your company logo, color schemes, or custom terms. This gives a personalized touch while maintaining functionality.

- Error Reduction: By automating fields like client information, item descriptions, and totals, the chances of human error are minimized. This ensures that all details are accurate and that no crucial information is overlooked.

- Streamlined Payment Tracking: Many platforms that offer structured billing layouts include built-in tools to track the payment status. This makes it easier to monitor outstanding invoices and follow up on overdue payments.

How a Structured Layout Enhances Your Billing Process

| Feature | Benefit |

|---|---|

| Customization | Helps align with brand identity and create a personalized experience for clients. |

| Automation | Reduces manual work and speeds up document creation by auto-populating information. |

| Professional Design | Provides a polished, business-ready appearance, boosting client confidence. |

| Error-Free Calculations | Ensures accurate total amounts and taxes, reducing the risk of disputes. |

| Easy Tracking | Offers built-in tracking tools for monitoring overdue payments and pending invoices. |

By incorporating a well-designed and efficient billing document layout, businesses can optimize their invoicing workflow, save time, and create a better experience for clients. This system not only ensures that all the necessary information is included but also helps businesses maintain a high level of professionalism and transparency in their financial dealings.