Download PayPal Invoice Template for Easy and Efficient Billing

Managing financial transactions efficiently is essential for any business. Whether you’re a freelancer, small business owner, or large enterprise, having a professional method for requesting and processing payments can save you time and reduce errors. A well-structured document that outlines the services or products provided, along with payment instructions, is crucial for maintaining smooth financial operations.

In this guide, we’ll explore how to create and personalize a billing document that suits your needs. You’ll learn how to customize it, incorporate essential details like pricing and taxes, and ensure that it reflects your brand’s professionalism. With the right approach, you can simplify your payment process and enhance communication with clients.

Efficient billing helps you stay organized and ensures you’re compensated on time. By leveraging easy-to-use resources, you can quickly generate and manage your financial documents, keeping everything transparent and streamlined.

PayPal Invoice Template Download Guide

Creating professional payment requests is a key part of managing your finances effectively. With the right tools, you can quickly generate a document that outlines the amount due, services rendered, and payment instructions. This section will guide you through the process of creating a customizable payment document that fits your needs and helps you manage your transactions with ease.

Choosing the Right Payment Document

Before you begin, it’s important to consider the type of document that best suits your business. You’ll want something that not only looks professional but also includes all the necessary details such as itemized costs, taxes, payment terms, and contact information. The document should be simple to use, customizable, and easy for your clients to understand and process.

Steps to Obtain and Personalize Your Document

Once you’ve identified the ideal structure for your request, you can start by obtaining a customizable version. Many platforms provide easy-to-use forms that can be tailored to your specifications. After obtaining the document, focus on personalizing it with your company’s details, logo, and payment instructions. Be sure to adjust the fields for each transaction, ensuring that the document is both accurate and specific to each customer.

Efficiency is key when handling multiple transactions. By having a pre-built framework in place, you can minimize the time spent on administrative tasks and focus more on growing your business. These customizable resources help maintain consistency and professionalism in every interaction.

Why Use a PayPal Invoice Template?

Having a structured payment request document is essential for smooth business transactions. Instead of creating each one from scratch, using a pre-designed, customizable format ensures consistency, accuracy, and professionalism. This resource allows you to quickly generate a document that contains all necessary details, saving you valuable time and effort while improving your financial workflow.

Advantages of Using a Pre-designed Payment Document

By utilizing a ready-made structure for your payment requests, you can easily streamline your billing process. A well-organized document not only looks more professional but also minimizes the risk of mistakes, ensuring all required information is included in each request. This leads to quicker payment processing and clearer communication with clients.

Key Benefits at a Glance

| Benefit | Explanation |

|---|---|

| Time Efficiency | Pre-designed documents save you the hassle of creating one from scratch for every transaction. |

| Consistency | Ensure all your payment requests follow the same structure, making them easily recognizable to clients. |

| Accuracy | A well-structured format reduces the chance of errors in key details such as amounts, dates, and terms. |

| Professionalism | Presenting a polished document fosters trust and reflects positively on your business. |

With these advantages in mind, using a pre-designed document simplifies your administrative tasks, allowing you to focus on growing your business and maintaining healthy client relationships.

How to Customize Your PayPal Invoice

Customizing your payment request document is crucial for reflecting your brand and ensuring all relevant details are included. A personalized layout can make a significant impact on the clarity and professionalism of your financial communications. This section will guide you through the key steps to tailor your document to your business needs and preferences.

Steps to Modify Your Payment Request Document

The first step in customization is adjusting the general layout. Start by adding your company’s logo, contact information, and any branding elements that will make the document feel more official. Afterward, ensure that you have clear fields for essential details such as service descriptions, payment amounts, and due dates.

Incorporating Additional Information

Depending on your business model, you might need to include additional sections, such as discounts, taxes, or specific payment terms. Ensure clarity in these areas to avoid confusion. You can also create fields for personalized notes or instructions, providing clients with any relevant details or terms that apply to the current transaction.

Once you’ve made the necessary adjustments, review your document to confirm that all fields are correctly filled in for each individual request. This attention to detail will not only help streamline your billing process but also maintain professionalism in your communications.

Benefits of Using PayPal Invoices

Utilizing a structured and efficient billing document offers numerous advantages for businesses. Not only does it enhance the overall payment experience, but it also simplifies the transaction process, ensuring that all details are clearly presented. In this section, we’ll explore the key benefits that come with using a professional, customizable payment request form for your business needs.

Key Advantages for Your Business

By using a customizable and automated payment request document, businesses can enjoy several benefits that enhance both efficiency and professionalism. From faster payments to better record keeping, these documents provide a streamlined approach to financial transactions. Below, we outline the major advantages:

| Benefit | Description |

|---|---|

| Faster Payment Processing | Automated payment requests enable clients to process payments quickly, reducing delays. |

| Enhanced Professionalism | Clear, well-structured documents project a professional image, fostering trust and credibility. |

| Time Savings | Pre-designed and customizable forms save time by eliminating the need to create payment requests from scratch. |

| Improved Record Keeping | Detailed and organized requests make it easier to track transactions and maintain accurate records for accounting purposes. |

| Transparency | Clear itemization of services and costs helps avoid confusion and ensures that both parties are on the same page. |

Additional Perks

Aside from these core benefits, using a pre-structured document can also offer advantages in terms of customization, ease of use, and integration with other tools. These features allow you to tailor your documents to fit your specific business needs while keeping the process simple and intuitive.

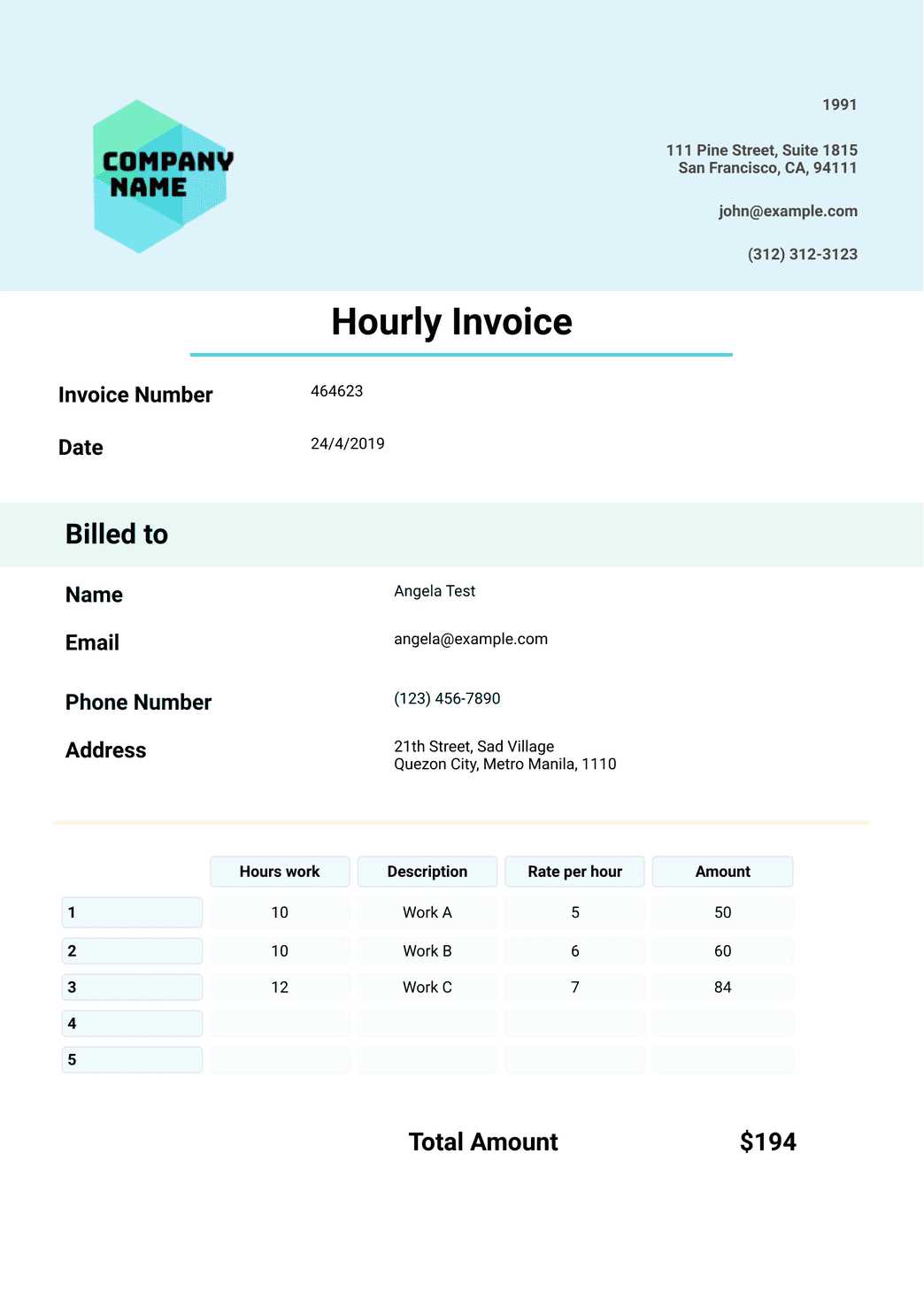

Choosing the Right PayPal Template

Selecting the appropriate structure for your payment request is essential to ensuring clear communication with clients and streamlining your financial processes. The right format should not only meet your business requirements but also reflect your brand’s image. This section will guide you through the factors to consider when choosing the ideal document format for your transactions.

Factors to Consider When Selecting a Format

When deciding on a payment request format, consider the nature of your business and the level of detail you need to include. If your transactions involve simple services or products, a minimalistic format may suffice. However, if your business requires itemized breakdowns, taxes, or additional terms, you’ll want a more comprehensive layout. Customizability is also important, as it allows you to adjust the document to your preferences and ensure that it fits your specific needs.

Ensuring User-Friendliness and Professionalism

The structure you choose should be easy for both you and your clients to navigate. Clear sections, intuitive design, and professional appearance are key aspects to look for. A well-organized document enhances credibility and improves the likelihood of timely payments, while an overly complex or cluttered design can lead to confusion or missed details.

Step-by-Step Invoice Creation Process

Creating an effective payment request document is a straightforward process when broken down into clear, manageable steps. By following a structured approach, you can ensure that all essential information is included and that the document is professional and easy to understand. This guide will walk you through the essential stages of building a well-organized payment form for your business.

Start by selecting a suitable format that fits your needs. Whether you choose a simple or more detailed design, the goal is to ensure that it allows for easy customization. Once you have the base structure, follow these steps:

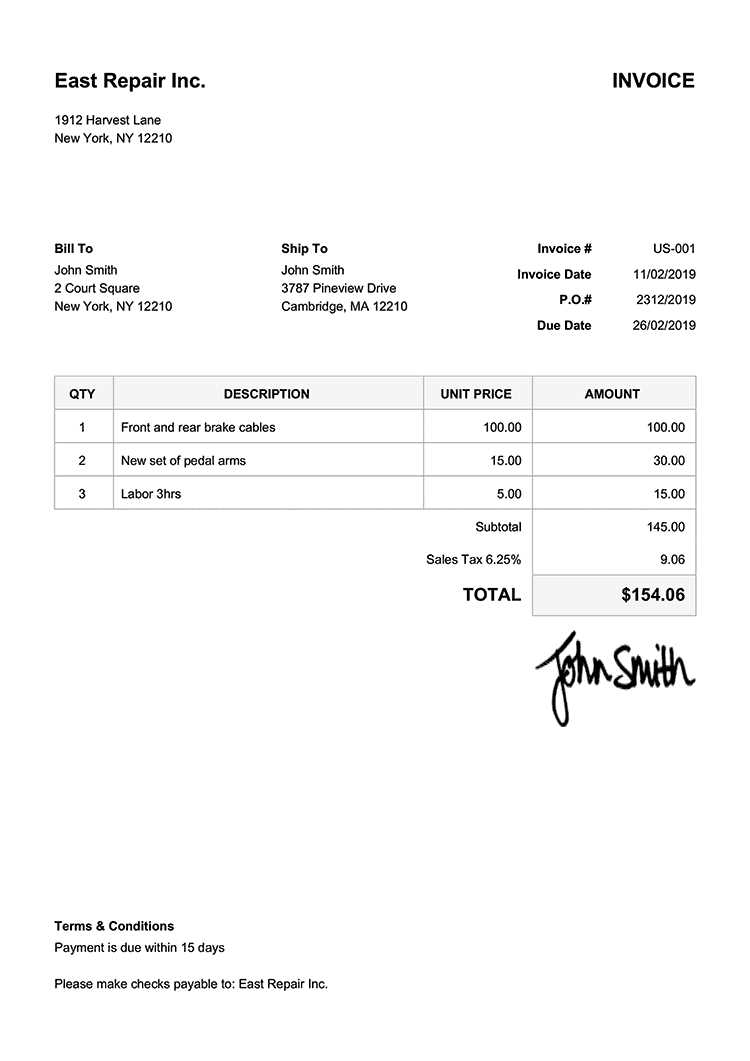

1. Add Your Business Information: Include your company name, contact details, and logo. This ensures that the document represents your brand and provides your client with all necessary contact information.

2. Enter Client Information: Clearly list the client’s name, address, and other relevant contact details. This helps to personalize the request and makes it easy for both parties to identify the transaction.

3. Describe the Products or Services: Itemize the goods or services provided, ensuring that each is clearly described along with the corresponding price.

4. Include Payment Terms: Define payment methods, due dates, and any late fee policies to avoid confusion later.

5. Add Additional Information: If necessary, include any relevant notes, discounts, or tax information to ensure transparency in the transaction.

6. Double-Check for Accuracy: Before finalizing, review all the fields for completeness and accuracy. Small errors can lead to delays or misunderstandings.

By following these steps, you will create a clear and professional payment request that will help streamline your financial transactions and maintain good client relations.

Free PayPal Invoice Templates Online

There are numerous resources available online that offer customizable and free documents to help streamline your payment process. These resources are especially useful for small businesses and freelancers looking for an easy way to create professional payment requests without investing in expensive software. In this section, we will explore where to find these free formats and how to make the most of them.

Many platforms provide free options that can be easily tailored to your business needs. These documents typically come with pre-set fields for essential information such as payment amounts, descriptions, and terms. Some even allow you to integrate your branding for a more professional look. Below, we list some popular options for obtaining these free resources:

| Platform | Features |

|---|---|

| Invoice Generator | Free, customizable documents with easy-to-fill fields and professional design. |

| Canva | Wide range of customizable designs with drag-and-drop functionality for branding. |

| Zoho Invoice | Free templates that integrate with accounting software for easy tracking and management. |

| Microsoft Office Templates | Simple and free options available in Word and Excel, offering basic customization. |

| Google Docs | Free, easy-to-use documents with templates that can be shared and edited collaboratively. |

These free resources are an excellent starting point for anyone looking to improve their billing process. Whether you’re a freelancer or a small business owner, these tools can save you time and help ensure that your transactions are both professional and efficient.

PayPal Invoice Templates for Businesses

For businesses of all sizes, having a reliable and professional way to request payments is essential to maintaining smooth financial operations. Whether you’re a freelancer, a small business, or a large company, using an organized and customizable document can streamline your billing process, reduce errors, and create a consistent experience for clients. This section explores how businesses can benefit from using ready-made structures for their payment requests and how to customize them for specific needs.

When running a business, it’s important to have a document that not only outlines the services provided but also communicates professionalism and trust. Customizable payment documents allow you to easily include key information such as your company logo, contact details, payment terms, and itemized pricing. By offering clear payment instructions and details, you can reduce confusion and speed up payment processing.

Businesses with recurring clients can also benefit from using pre-designed resources that ensure consistency in billing. Invoices that reflect your brand’s identity and match your communication style help strengthen your reputation and build trust with clients. Additionally, with features such as automated calculations for taxes, discounts, and shipping, these forms help save time and improve accuracy.

Tailoring these documents to your specific business needs is a great way to ensure that they reflect the nature of your services, whether you’re providing a one-time product or ongoing service. You can also add personalized notes to enhance the client relationship and include important details or terms for payment.

Automating Invoice Generation with PayPal

Automating the creation and delivery of payment requests can save businesses time and reduce the risk of errors. By integrating automated systems, you can streamline your financial processes, ensuring that each transaction is billed promptly and accurately. This section explores how automation can simplify your billing process, improve efficiency, and enhance the customer experience.

With automation, you no longer have to manually create a payment request for each transaction. Once set up, the system can generate and send customized payment documents based on predefined criteria, such as client details, services rendered, and pricing. This helps eliminate repetitive tasks and allows you to focus more on growing your business. Below, we highlight the core features of automating payment request generation:

| Feature | Benefit |

|---|---|

| Recurring Payment Requests | Automated billing for subscription-based services or repeat customers, reducing manual effort. |

| Customizable Fields | Easily personalize each document with client information, pricing, and service details for accuracy. |

| Payment Integration | Automatically link payment methods, making it easier for clients to pay directly from the document. |

| Automatic Reminders | Send reminders for unpaid balances, ensuring timely payments without additional effort. |

| Tracking and Reporting | Track the status of each payment request, making it easier to monitor cash flow and maintain records. |

By automating the generation of payment documents, businesses can improve operational efficiency, reduce administrative workload, and maintain a consistent, professional approach to client transactions. This automation ensures that clients receive their payment requests promptly and with all necessary details, enhancing the overall business relationship.

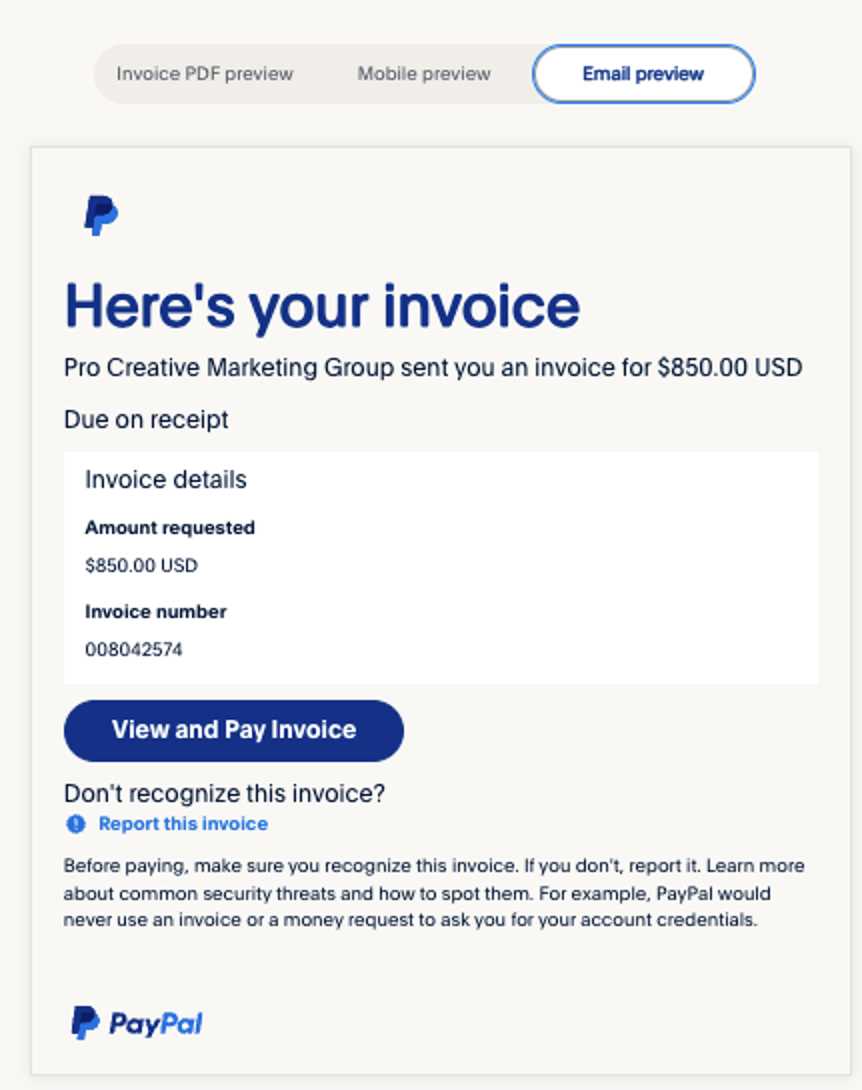

How to Send PayPal Invoices to Clients

Once you have created a professional payment request, the next step is sending it to your clients. A smooth and efficient delivery process helps ensure timely payments and keeps communication clear. This section outlines the steps to send your payment requests to clients, ensuring they receive the necessary information and can easily complete their transactions.

There are several ways to send a payment request, and the method you choose may depend on the tools or platforms you use. The process is generally simple, but it’s important to follow a few key steps to ensure the document reaches your client in a timely and professional manner. Below are the steps to follow when sending payment documents to clients:

- Prepare the Document: Ensure that all fields in your payment request are filled in accurately. Double-check the client’s details, service descriptions, pricing, and payment terms before proceeding.

- Choose the Delivery Method: You can send your payment request via email, through an online payment platform, or directly through your accounting or invoicing software. Each method will allow you to attach or share a link to the payment document.

- Include a Clear Subject and Message: In the email or message accompanying the payment request, include a subject line that indicates the nature of the document (e.g., “Payment Request for Services Rendered”). Be sure to include a polite note explaining the contents of the document and any necessary instructions for payment.

- Attach or Link the Payment Document: Attach the document directly to the email or include a secure link for easy access. Make sure the file format is accessible to the client (e.g., PDF, Word, or Excel).

- Send and Confirm: Once you’ve sent the payment request, confirm that your client has received it. Follow up with a polite reminder if necessary.

Additional methods to consider for sending your payment request:

- Sending through online payment systems that allow direct billing and payment processing

- Using client management software that integrates with payment processing tools

- Creating an online portal where clients can access and manage their payments

By following these steps, you can ensure that your payment requests are delivered clearly and professionally, improving the chances of receiving payments on time. Maintaining consistent and transparent communication is key to a smooth transaction process.

Integrating PayPal Invoices with Accounting Software

Integrating your payment requests with accounting software can significantly streamline your business’s financial management. This integration allows for seamless tracking of transactions, automated record-keeping, and accurate reporting. By syncing your billing documents with your accounting system, you can reduce the risk of errors, save time, and maintain up-to-date financial records with minimal effort.

Benefits of Integration

Connecting your billing system with accounting software offers several advantages. First, it automates the process of recording payments, ensuring that your financial records are updated in real-time. This helps reduce manual data entry and eliminates the risk of missed payments or errors in reporting. Additionally, it enables businesses to generate comprehensive financial reports that include all payment transactions in one place.

Steps to Integrate Billing Documents with Accounting Tools

Many accounting platforms offer built-in integrations with payment processing systems, making the connection simple and efficient. Here’s how you can integrate your payment system with your accounting software:

- Select an Accounting Platform: Choose software that fits your business needs, such as QuickBooks, Xero, or FreshBooks. Many of these platforms support automatic integration with billing systems.

- Link Your Billing System: Connect your payment request service with your accounting software through the software’s integration settings or via a third-party connector tool.

- Customize Settings: Adjust your integration settings to automatically import payment details, such as client names, amounts, and due dates, into your accounting system.

- Sync Regularly: Ensure that your system syncs regularly to keep your financial records up to date and reflect all recent transactions.

With this integration in place, your financial operations will run more smoothly, allowing you to focus on growing your business while ensuring accuracy in your records.

Tracking Payments with PayPal Invoices

Tracking payments efficiently is crucial for maintaining accurate financial records and ensuring timely cash flow. With the right system in place, businesses can easily monitor the status of each transaction, from initial creation to final payment. This section will guide you through the process of tracking payments effectively using a payment request system.

How Payment Tracking Works

Once a payment request is sent, it’s important to have a method to track whether the payment has been completed, is pending, or overdue. Many payment systems offer built-in features that automatically update the status of each payment. By integrating this feature with your business’s accounting tools, you can instantly know the payment status and take necessary actions such as sending reminders or confirming payments.

Steps to Track Payments

Here’s how you can efficiently track payments using automated systems:

- Use Tracking Features: Many payment services provide tools to track whether a payment has been successfully completed or is still pending. Check the status through your payment platform or accounting software.

- Set Payment Reminders: If the payment is overdue, use the reminder feature to automatically send a follow-up message to the client, keeping the payment process on track.

- Monitor Payment Reports: Regularly review payment reports provided by your system. These reports give you a detailed overview of all transactions, including amounts, dates, and any outstanding balances.

- Reconcile with Your Accounts: Ensure that each payment is reflected correctly in your accounting system. This helps keep records accurate and supports better financial decision-making.

By leveraging these features, businesses can minimize the risk of missed payments and stay on top of their financial obligations. This not only improves cash flow but also provides a clearer overview of your business’s financial health.

How to Add Taxes and Discounts

Including taxes and discounts in your payment requests is essential for providing transparency to your clients and ensuring accurate billing. Whether you’re applying sales tax, offering a promotional discount, or factoring in any other special conditions, adding these elements ensures that both you and your client are on the same page regarding the final amount due. This section will guide you through the process of adding taxes and discounts to your payment documents.

Adding Taxes to Your Payment Request

Taxes are often a standard component of business transactions, and it’s crucial to calculate them correctly to avoid any future discrepancies. You can add taxes either as a fixed rate or a percentage of the total amount. Below are the steps to incorporate tax into your documents:

- Determine the applicable tax rate based on your location or the client’s location.

- Calculate the tax amount by applying the tax rate to the subtotal of your products or services.

- Add a clear line item showing the tax amount and specify the tax rate, so the client understands the calculation.

Applying Discounts to Your Payment Request

Offering discounts is a great way to incentivize early payments or reward loyal clients. You can apply a fixed amount or a percentage-based discount. Here’s how to include discounts in your payment requests:

- Determine the discount amount or percentage you wish to apply to the subtotal or individual items.

- Clearly list the discount as a separate line item with a description (e.g., “10% Discount” or “Seasonal Promotion”).

- Ensure that the final total reflects the discount by reducing the subtotal accordingly.

Example of Adding Taxes and Discounts

| Description | Amount |

|---|---|

| Product/Service Total | $100.00 |

| Tax (5%) | $5.00 |

| Discount (10%) | -$10.00 |

| Total Due | $95.00 |

By following these steps, you can easily add taxes and discounts to your payment documents. This

Common Mistakes to Avoid in Invoices

Creating accurate payment requests is essential for ensuring timely payments and maintaining professional relationships with clients. Even small mistakes can lead to confusion, delayed payments, or dissatisfaction. This section highlights the most common errors businesses make when preparing payment documents and offers tips on how to avoid them.

1. Incorrect or Missing Client Information

Ensuring that your client’s details are accurate is crucial for smooth transactions. Errors in contact information or billing addresses can cause confusion and delay the payment process. Here’s what to watch out for:

- Double-check the client’s name, address, and contact information.

- Ensure that the billing address matches the one used for payment processing.

- Verify that all email addresses and phone numbers are correct, especially if you’re sending the payment document digitally.

2. Failing to Include Clear Payment Terms

Failure to specify clear payment terms can lead to misunderstandings or late payments. Clients should always know when the payment is due, and under what conditions. Avoid these mistakes:

- Clearly state the payment due date.

- Include details about accepted payment methods and any associated fees.

- Outline any late payment penalties or interest rates to encourage timely payment.

3. Not Including Proper Descriptions for Products or Services

Clients should understand exactly what they are being charged for. Vague or incomplete descriptions can lead to confusion and disputes. To avoid this:

- Provide detailed descriptions of each item or service you’re billing for.

- Include quantities, unit prices, and any applicable additional charges (e.g., shipping or handling fees).

- Ensure that every service or product is clearly labeled with the correct date and terms.

4. Miscalculating Totals

Mathematical errors are one of the most common mistakes that can undermine the credibility of your payment documents. Make sure to:

- Double-check all calculations, including taxes, discounts, and totals.

- Use automated tools or software to help calculate totals, especially if dealing with large or recurring invoices.

- Clearly break down charges so the client can verify the amounts easily.

5. Forgetting to Include Contact Information

Your contact details should always be easy to find. If a client has questions or issues with the payment, they need to know how to get in touch with you. Always include:

- Your business name and address.

- Phone number, email address, and website (if applicable).

- Any customer service or support details, should your client need assistance with the payment process.

6. Using Unprofessional or Unclear Language

Clear, professional language sets the right tone for your payment requests. Avoid the use of informal language, jargon, or overly complicated terms. To ensure professionalism:

- Keep language clear and concise.

- Use formal terms for payment and due dates (e.g., “Due Upon Receipt” or “Net 30”).

- Avoid vague or ambiguous statements that could lead to confusion.

7. Not Providing a Summary of Charges

Without a detailed breakdown, clients might question the accuracy of the payment request. Always include a summary section at the bottom of your document to recap:

- The total amount due.

- The breakdown of costs, including taxes, discounts, and additional charges.

- Payment instructions and deadlines.

By avoiding these common mistakes, you can create clear, accurate, and professional payment documents that facilitate faster payments and improve client satisfaction.

Using PayPal Invoices for International Payments

When dealing with clients from different countries, managing cross-border transactions can be complex. Currency conversions, varying tax rates, and international payment methods are just a few of the challenges businesses face. However, using a reliable online payment system can simplify the process and ensure smooth, secure transactions across borders. This section explores how to efficiently handle international payments through digital payment requests.

One of the major advantages of using a digital payment system is its ability to facilitate transactions in multiple currencies. Whether you’re working with a client in Europe, Asia, or anywhere else, international payments can be processed with ease, allowing for seamless financial interactions. Additionally, many digital systems come equipped with tools that automatically convert currency, ensuring that both you and your clients are on the same page regarding the amount due.

Key Benefits of Using Digital Payment Systems for International Transactions

Digital payment systems offer several key advantages when managing international payments:

- Multiple Currency Support: Many payment platforms allow you to send and receive payments in various currencies, which reduces the complexity of manual conversions and exchange rate concerns.

- Automatic Currency Conversion: Integrated tools can automatically convert payment amounts into your preferred currency, saving time and ensuring accuracy.

- Global Reach: With an international payment system, you can send requests and receive payments from clients anywhere in the world, expanding your business’s market.

- Security and Compliance: These platforms adhere to global security standards and regulations, making international transactions safe and compliant with international laws.

How to Ensure Smooth Cross-Border Transactions

When sending payment requests to international clients, consider these tips to ensure a smooth transaction:

- Specify the Currency: Always indicate the currency in which the payment should be made. This helps avoid confusion and ensures both parties are aware of the expected amount.

- Include Clear Payment Instructions: Be explicit about how clients can make their payments, whether through direct bank transfer, credit cards, or other online payment options.

- Consider Taxes and Fees: Take into account any additional fees or taxes that may apply to international transactions, such as VAT, and clarify these in the payment request.

- Review Payment Processing Times: International payments can sometimes take longer to process, especially when dealing with currency conversions or cross-border regulations. Always inform your client of expected processing times.

By leveraging these tools and practices, you can make international transactions much easier for both you and your clients, ensuring that payments are processed correctly and promptly, no matter where the client is located.

Tips for Professional Invoice Design

A well-designed payment request not only ensures that your clients understand the charges clearly but also helps maintain a professional image for your business. The design of your payment documents should be clean, organized, and easy to read. A professional layout builds trust and sets the tone for positive client relationships. Below are some key tips for creating a visually appealing and functional payment request.

1. Keep It Clean and Simple

A cluttered design can confuse your clients and make important details hard to find. Use plenty of white space and organize information logically to make the document easy to navigate. Here’s how to achieve this:

- Use simple fonts that are easy to read.

- Avoid excessive graphics or colors that distract from the essential details.

- Separate different sections with clear headings, such as “Item Description,” “Subtotal,” and “Total Due.”

2. Consistent Branding

Your payment requests should reflect your company’s branding and overall design aesthetic. A consistent look across all business documents helps reinforce your brand identity. Consider these elements:

- Use your company’s logo, colors, and fonts in the header or footer.

- Ensure that your contact details (e.g., business name, phone number, website) match the branding used on your other communications.

- Make sure your design aligns with your brand’s tone, whether it’s formal, casual, or creative.

3. Clear and Structured Layout

A structured, organized layout ensures your clients can quickly understand what they’re being charged for and when the payment is due. Here’s how to achieve that:

- Use a table to display itemized charges, making it easy for the client to see the individual costs.

- Ensure that the total amount due is prominently displayed, making it easy to spot.

- Clearly show payment due dates and terms to avoid confusion.

4. Use a Professional Font

Typography plays a critical role in the readability and professionalism of your document. Choose fonts that are clear and formal. Avoid using overly decorative or hard-to-read fonts. Some recommended fonts include Arial, Helvetica, or Times New Roman for a clean, professional look.

5. Include a Detailed Summary of Charges

Providing an itemized list of charges helps prevent disputes and clarifies exactly what the client is paying for. Make sure your document includes:

- A clear breakdown of each product or service, along with its price.

- The total cost, including taxes and any applicable fees.

- A discount section if applicable, showing how any reductions are calculated.

6. Add Payment Instructions

Including clear instructions for how the client can complete the payment is vital. Specify the acceptable payment methods (e.g., credit card, bank transfer, online payment), and if necessary, include relevant account or payment details. Be sure to explain any payment process

Best Practices for Invoice Management

Effective management of payment requests is essential for maintaining a smooth cash flow and fostering positive relationships with clients. A well-organized approach ensures timely payments, minimizes errors, and keeps your financial records accurate. This section highlights key practices that can help you efficiently handle your payment documents and ensure that both you and your clients are satisfied with the process.

1. Maintain a Clear and Consistent System

Having a clear system for creating, tracking, and organizing payment requests is crucial for ensuring accuracy and efficiency. Follow these steps to stay organized:

- Establish a standardized format for all payment requests, so clients know what to expect each time.

- Use sequential numbering for each document to prevent duplication and ensure you can easily reference past records.

- Store all documents in a secure and accessible system, whether it’s cloud-based or local, to ensure you can quickly find past records when needed.

2. Set Clear Payment Terms

Clear payment terms help avoid confusion and ensure that both parties know when and how payments should be made. Be sure to include:

- Specific due dates for each payment.

- Accepted payment methods, whether via bank transfer, credit card, or online services.

- Late payment penalties or interest fees, if applicable, to encourage timely payments.

3. Automate Reminders and Follow-Ups

Manually tracking overdue payments can be time-consuming. Automating reminders can save you time and ensure that clients are promptly reminded when payments are due. Set up automatic follow-up reminders for:

- Upcoming payment deadlines.

- Overdue balances, with a friendly reminder that includes a payment link.

Automating this process ensures that no payment is missed and helps maintain professional communication with clients.

4. Regularly Review and Reconcile Financial Records

Regularly reviewing and reconciling your financial records helps ensure that all payments are accurately tracked and that no discrepancies occur. This involves:

- Matching payments to specific requests to ensure nothing is overlooked.

- Checking that the payment amounts align with what was agreed upon.

- Identifying any discrepancies early on so that issues can be resolved before they escalate.

5. Offer Multiple Payment Methods

Offering multiple payment options makes it easier for clients to settle their balances quickly. Consider providing a variety of methods, such as:

- Bank transfers.

- Credit and debit card payments.

- Online payment systems like digital wallets or mobile payment solutions.

By offering flexibility, you increase

How to Download and Save PayPal Invoices

Managing your payment requests efficiently involves keeping records that are easily accessible and properly stored for future reference. Being able to save digital receipts is essential for keeping your financial documents organized, tracking your business transactions, and ensuring compliance with tax regulations. In this section, we’ll guide you through the process of retrieving and saving your payment requests in a way that simplifies your workflow and maintains your financial records securely.

Steps to Retrieve and Save Payment Documents

Follow these steps to locate and save your payment requests:

- Log in to Your Account: Begin by signing into your online account where you manage your financial transactions.

- Access the Transaction History: Navigate to the section of your account that lists past transactions. This is often found under “Activity” or “Transaction History” tabs.

- Locate the Desired Transaction: Scroll through your transaction history or use search filters to find the specific payment record you need to retrieve.

- Select the Payment Record: Click on the transaction to view the detailed payment request. This will provide a breakdown of the charges, payment details, and other relevant information.

- Choose the Download Option: Most platforms will provide an option to download a PDF or a similar format of the payment record. Look for a “Download” or “Export” button on the transaction page.

- Save the Document: Once you’ve selected the download option, choose a location on your computer or cloud storage to save the file. Ensure the file name is descriptive for easy reference later.

Organizing and Storing Payment Documents

Proper organization is key to maintaining an efficient filing system for your financial records. Here are some tips to help you manage your saved documents:

- Create a Folder Structure: Organize your records by year, client, or project. This will make it easier to locate documents when needed.

- Use Descriptive File Names: Include details such as the client name, date, and payment amount in the file name to help you quickly identify the document.

- Regularly Back Up Files: To prevent data loss, back up your saved files on an external drive or cloud service.

By following these steps, you can ensure that your financial records are well-organized and easily accessible whenever you need them.