Download Free Invoice Template in Excel Format

Managing financial transactions and keeping records in an organized manner is crucial for any business. Having the right structure to handle payments ensures smooth operations and prevents errors. By utilizing structured documents, business owners can efficiently track sales, services, and client payments with ease.

There are various ways to create professional documents for financial purposes, but using ready-made, adaptable options can save significant time and effort. These solutions help maintain consistency and allow quick adjustments based on specific needs. With just a few modifications, a basic structure can be transformed into a comprehensive tool for managing financial data.

Many resources offer customizable options that suit different business sizes and types. Whether you’re a freelancer or managing a larger company, these ready-to-use formats help streamline the billing process, ensuring that all necessary details are included. With minimal input, you can create well-organized records that are both clear and professional.

Why Use Excel for Invoices

When it comes to creating professional documents for tracking business transactions, certain software provides a perfect balance of flexibility, accessibility, and efficiency. One of the most popular tools for this task is a spreadsheet program, which offers numerous advantages over traditional manual methods or more complex accounting systems.

Using a spreadsheet allows for easy organization and modification of financial details, making it a preferred choice for many small business owners and freelancers. Here are some key reasons why it is an excellent option for managing payment records:

- Customizable Layouts: With a spreadsheet, you can quickly adjust the structure to suit your needs, ensuring that all relevant data is included in a clear and concise format.

- Cost-Effective: Many spreadsheet programs are widely available at no additional cost, providing businesses with an affordable solution for managing financial documents.

- Automation Features: Built-in functions allow for automated calculations, saving time on manually adding totals and applying taxes or discounts.

- Easy Tracking and Updates: You can instantly update figures, add or remove information, and track outstanding payments, all in one place.

- Widely Compatible: Spreadsheets can be opened and edited on various devices, making it easy to access financial data from anywhere.

By using a spreadsheet program, businesses can create polished and accurate financial records while retaining the flexibility to adapt as their needs evolve. This makes it an ideal choice for anyone looking to simplify their financial tracking and ensure consistency in their documents.

Benefits of Free Invoice Templates

Using pre-designed formats to handle business transactions offers numerous advantages for individuals and companies. These ready-made documents can significantly streamline financial record-keeping, allowing for quick adaptation and customization to suit specific needs without requiring extensive design or formatting skills.

Here are some of the key benefits of utilizing these ready-made resources:

- Time Savings: With a pre-made structure, there is no need to start from scratch, enabling businesses to quickly create professional documents without wasting time on layout design.

- Consistency: Pre-designed documents maintain a consistent format across all financial records, ensuring that every transaction is organized in the same clear, professional manner.

- Simple Customization: These ready-made formats are highly adaptable, allowing users to quickly modify details like business name, pricing, and services offered to fit their unique requirements.

- Cost-Efficient: Since many of these resources are offered at no cost, they provide a budget-friendly way to manage financial paperwork without additional expenses for software or design services.

- Accuracy: Pre-designed structures often include essential fields and categories, reducing the risk of missing important details and improving overall accuracy in financial records.

By leveraging these readily available options, business owners can focus more on their core activities while ensuring that their financial documents remain organized, professional, and accurate. This approach not only saves time but also enhances the efficiency of handling transactions.

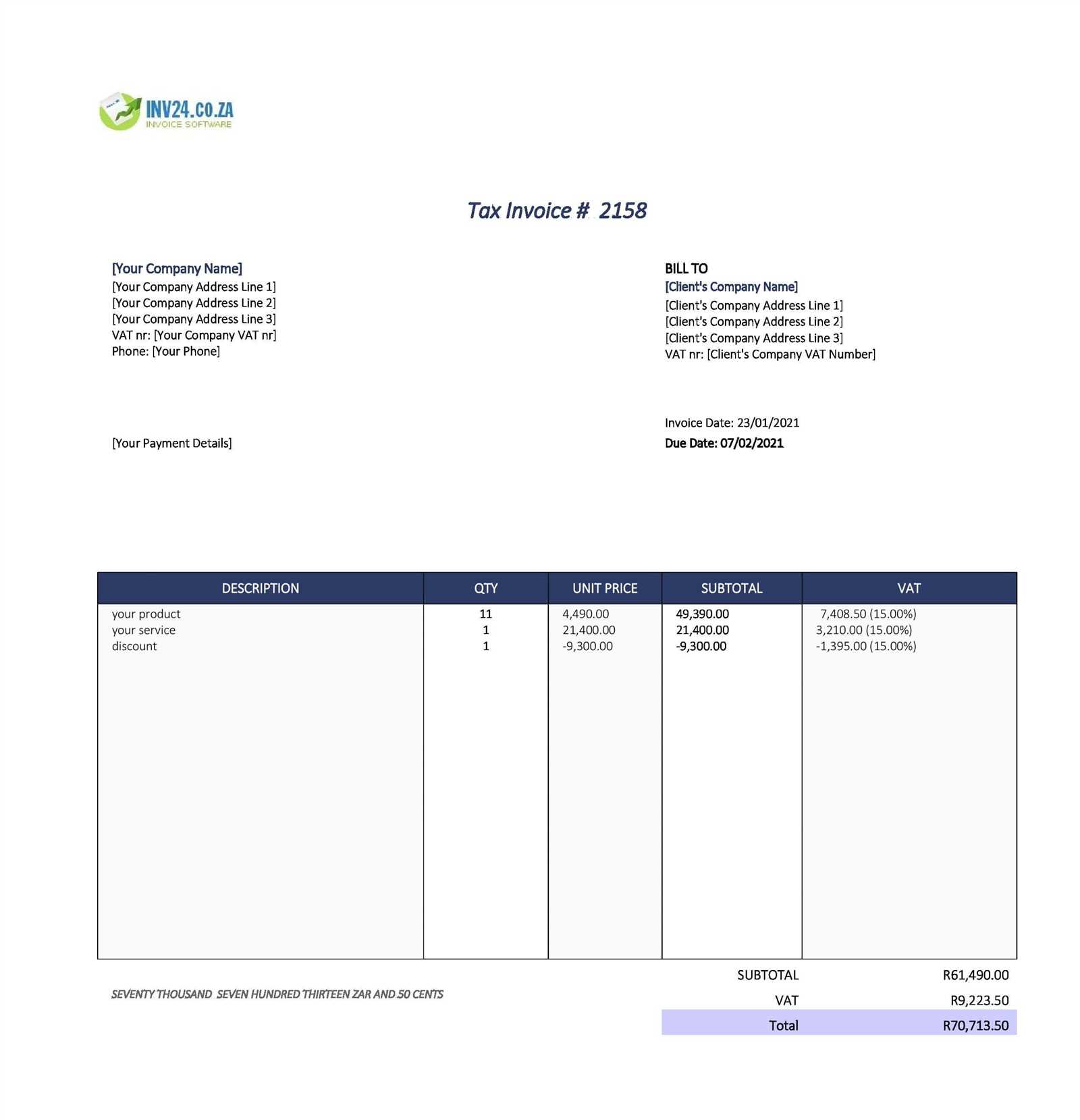

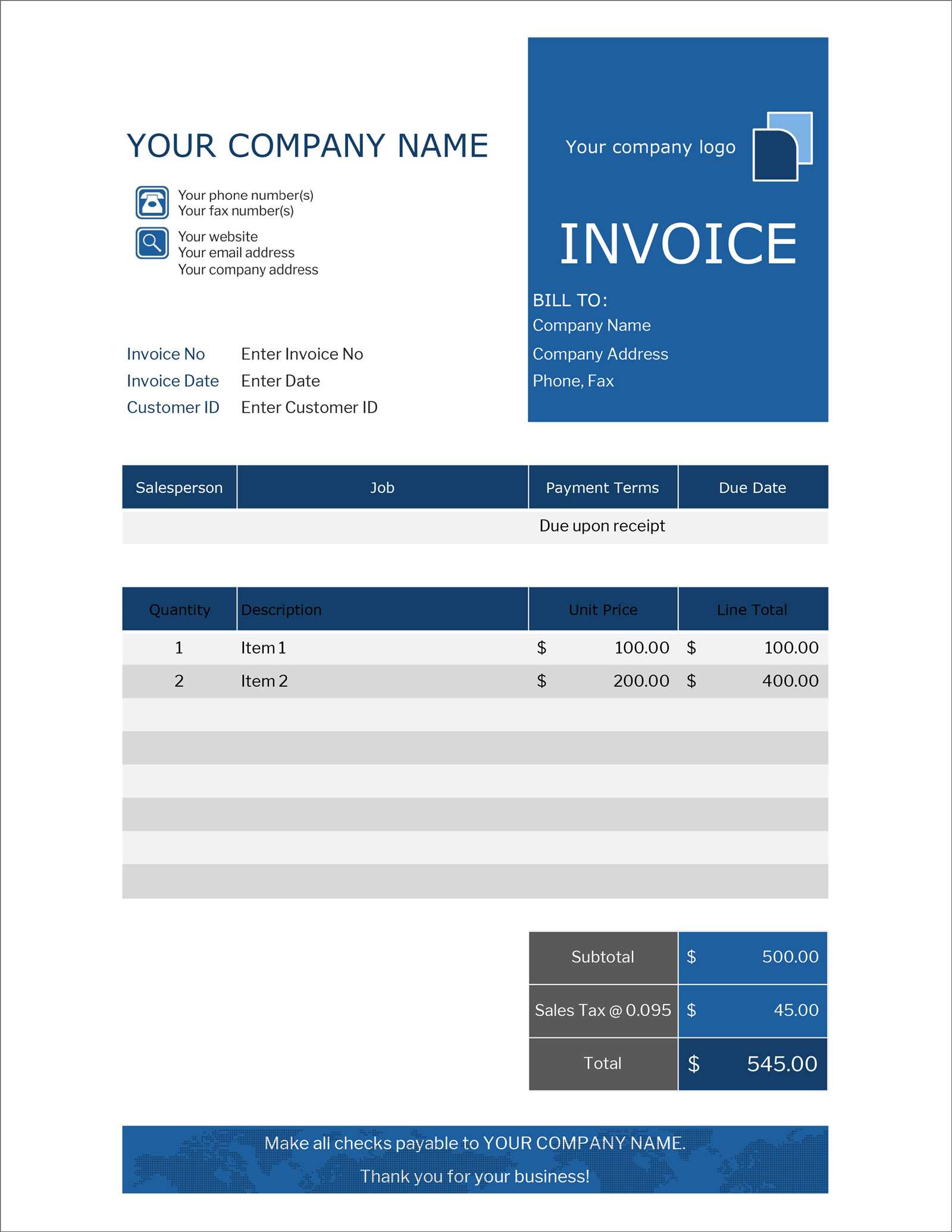

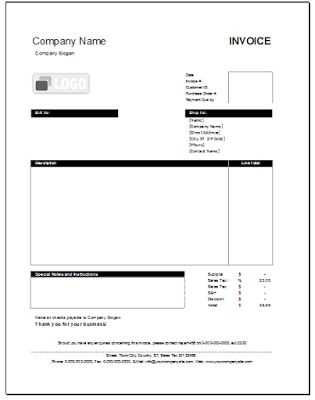

How to Customize Your Invoice

Personalizing your financial documents is a crucial step in making them suitable for your business needs. Customization allows you to adjust the structure, content, and appearance to better reflect your brand and the specific services or products you offer. With a few simple adjustments, you can ensure that every document meets your standards and communicates important details clearly to your clients.

Key Elements to Modify

When personalizing your document, it’s important to focus on certain core elements to ensure that all necessary information is included and displayed effectively. Here are the key areas to customize:

| Element | Description |

|---|---|

| Business Information | Include your company name, contact details, and logo to ensure that your clients can easily reach you for any inquiries. |

| Client Details | Provide your client’s name, address, and any other necessary identification information to ensure clarity in the transaction. |

| Itemized List | Break down the products or services provided, including quantities, prices, and totals, to give a clear overview of the transaction. |

| Payment Terms | Clearly outline when payments are due and any late fees or discounts that apply, ensuring both parties are aware of the terms. |

Making Adjustments

Once you’ve identified the key elements to adjust, you can easily modify the layout and design of your document. Many software tools offer simple drag-and-drop functionality to move sections around, change fonts, and add branding colors. Additionally, you can insert fields for automatic calculations, such as taxes, totals, or discounts, to make the process even more efficient.

Customizing your documents in this way not only makes them look more professional but also helps to ensure that all relevant information is included. This attention to detail fosters trust and transparency in your business relationships.

Choosing the Right Template for Business

Selecting the appropriate format for your business documents is essential to ensure consistency, professionalism, and clarity in your financial records. Different businesses have varying needs based on the type of services or products they provide, and finding a format that aligns with these requirements will help streamline operations. The right document structure can enhance communication, improve organization, and ultimately save time.

Here are some factors to consider when choosing the right format for your business needs:

| Factor | Considerations |

|---|---|

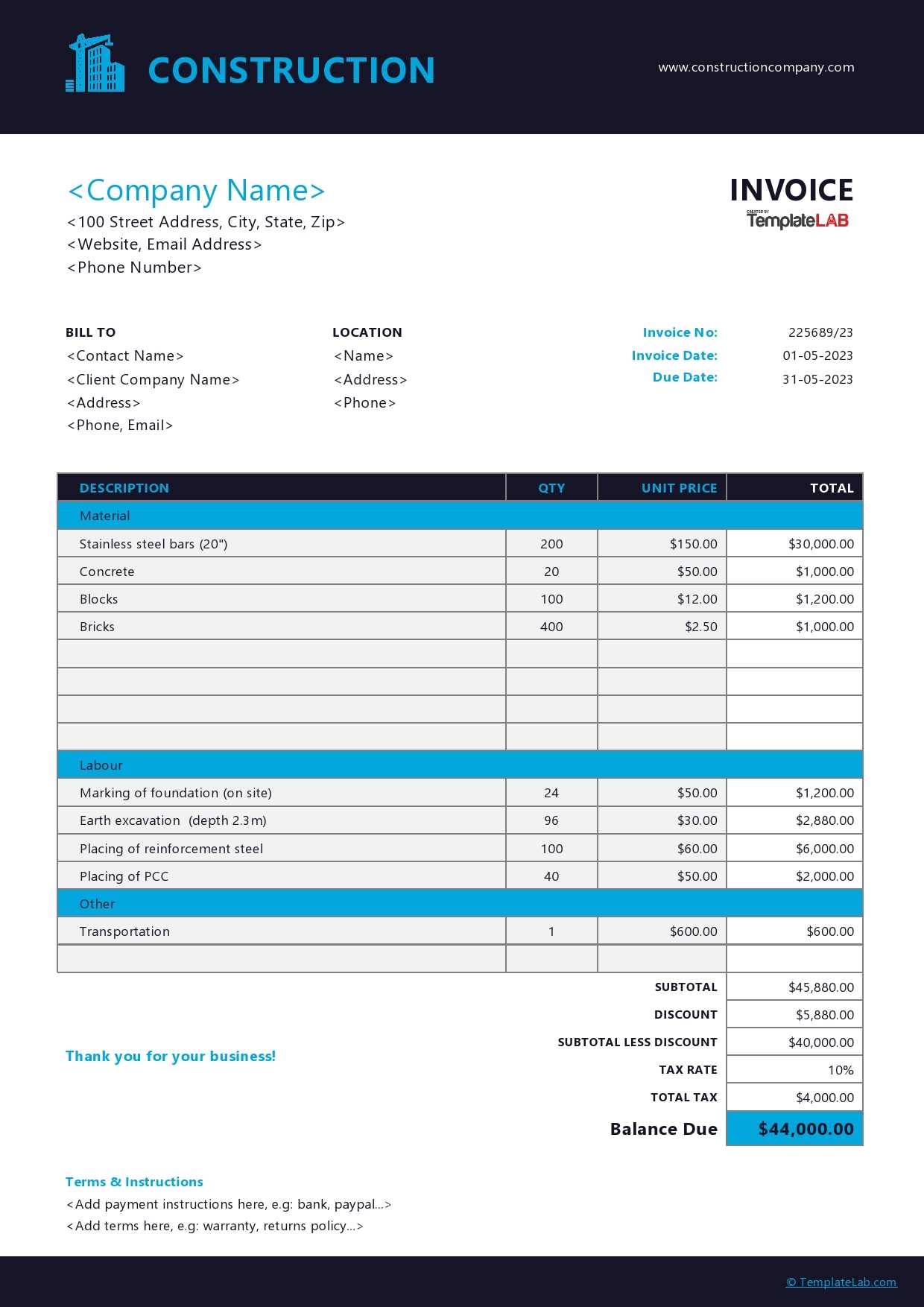

| Business Type | Choose a structure that aligns with the services or products you offer. For example, service-based businesses may need more detailed descriptions of labor, while product-based businesses should focus on itemized lists. |

| Customization Needs | Ensure that the format is flexible enough to accommodate the specific data you need, such as payment terms, taxes, or discounts, without overcrowding the document. |

| Branding | Select a structure that allows for easy integration of your company logo, color scheme, and fonts to reflect your brand identity. |

| Automation Features | If you require automatic calculations, ensure the format supports formulas for tax, totals, and other financial elements. |

| Ease of Use | The chosen format should be user-friendly, allowing quick adjustments to meet changing business needs without requiring advanced technical skills. |

By considering these factors, you can select a format that is not only easy to use but also enhances the overall efficiency of your financial documentation. A well-chosen structure can improve the professionalism of your business and ensure smooth interactions with clients and partners alike.

Where to Download Invoice Templates

Finding the right resources to create professional business documents can be a time-consuming process, but there are numerous reliable platforms that offer ready-to-use formats for all kinds of financial transactions. These resources can save significant time, ensuring that business owners can focus on other aspects of their operations. Many of these options are available at no cost and provide simple, customizable structures that suit various business needs.

Here are some of the best places to access these resources:

- Online Document Platforms: Many websites specialize in offering free or paid customizable document structures. Platforms like Microsoft Office Online or Google Docs provide easy-to-edit options that can be modified to fit specific business requirements.

- Business Websites: Various websites dedicated to small businesses offer free downloadable resources, including business blogs and financial advisory sites, which often feature pre-designed formats tailored for specific industries.

- Accounting Software Providers: Many accounting and invoicing software companies offer customizable documents as part of their services. These may be available with limited functionality on a trial basis, or as part of the software’s features.

- Public Sharing Platforms: Websites like Google Drive and Dropbox often have user-uploaded collections of business documents, including those suitable for financial record-keeping, that are accessible for free.

By leveraging these platforms, you can quickly find and access the ideal format that suits your business needs, allowing you to maintain a high level of professionalism and organization in your financial documentation.

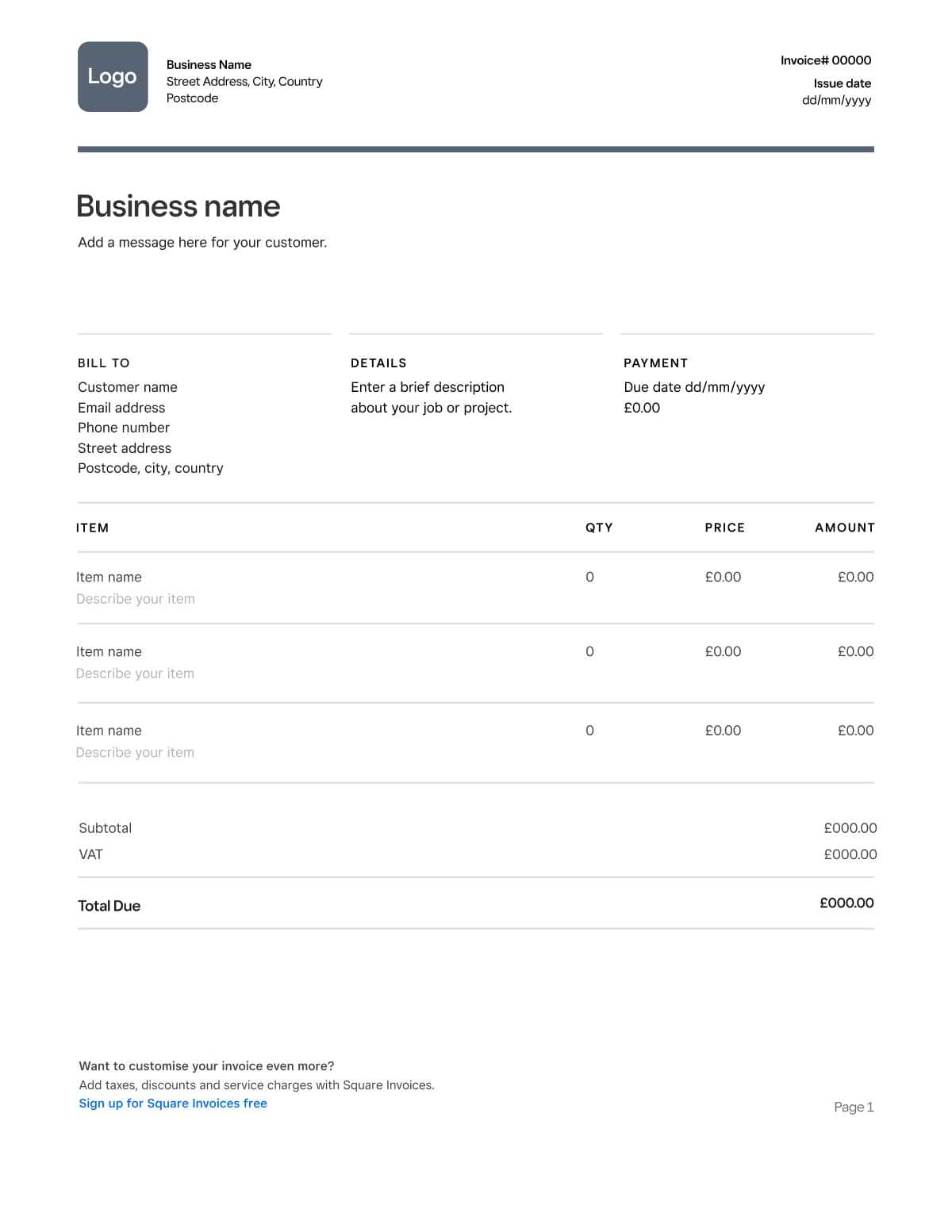

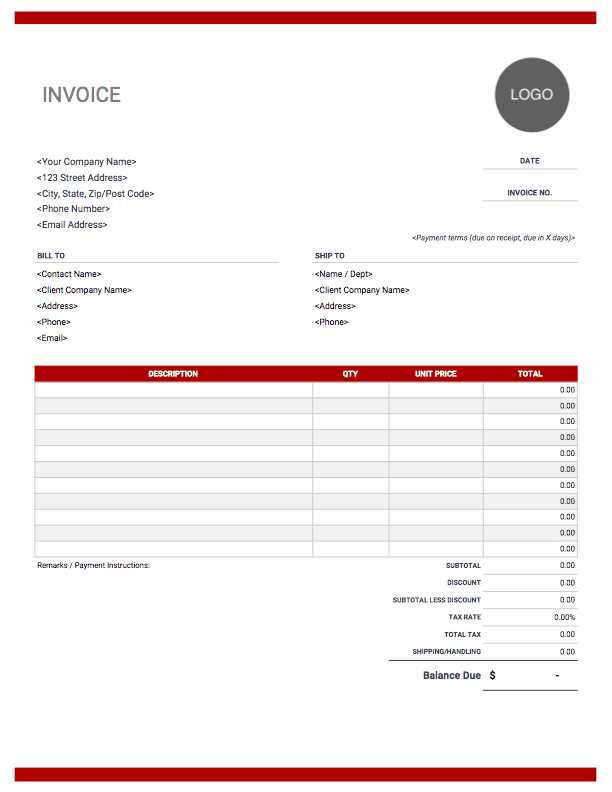

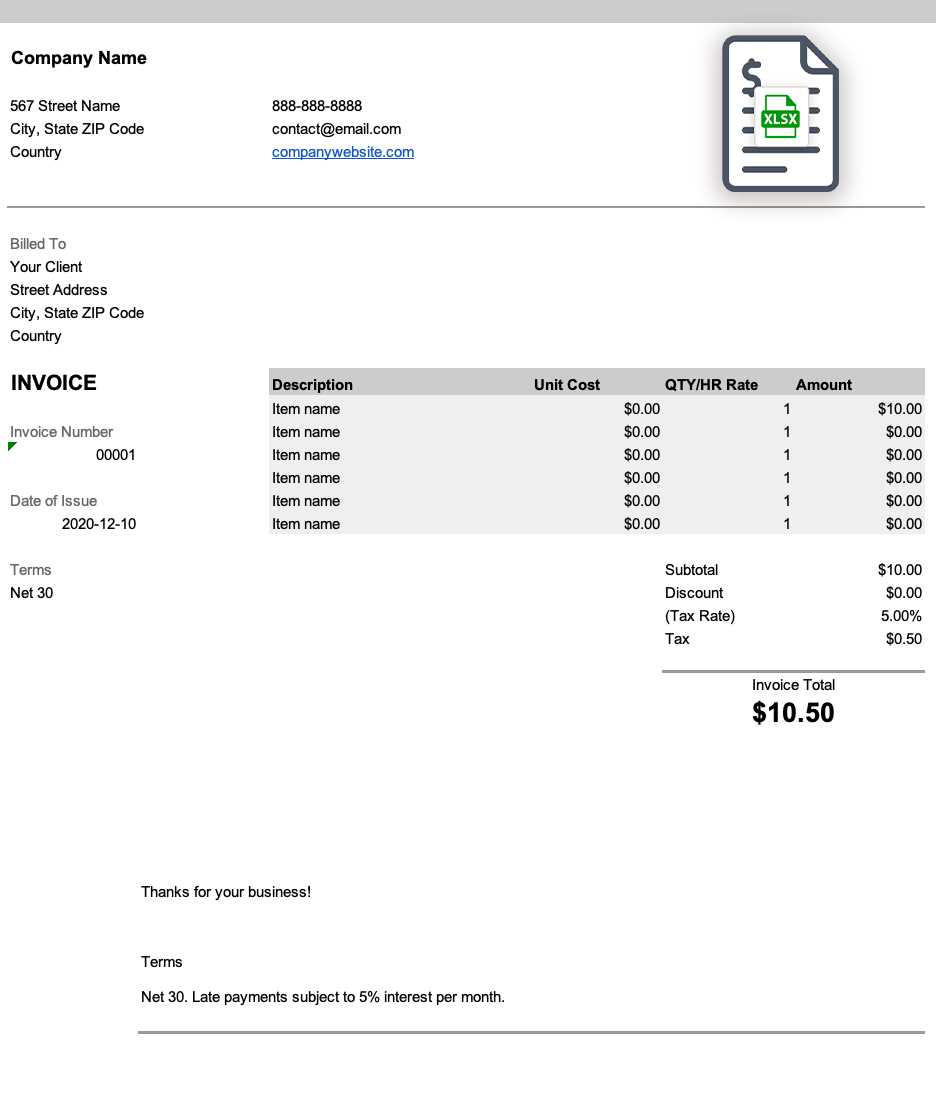

Creating Professional Invoices in Excel

Creating well-structured financial documents is essential for maintaining professionalism and ensuring clear communication with clients. Using spreadsheet software allows you to quickly generate organized and visually appealing documents that reflect your business’s standards. By leveraging built-in tools and functions, you can automate calculations and ensure accuracy in every record.

Key Steps to Creating Documents

Follow these steps to create a polished and professional document in a spreadsheet program:

- Set Up Basic Structure: Begin by creating columns for essential information such as item descriptions, quantities, unit prices, and totals. These sections will serve as the foundation for your financial details.

- Incorporate Your Branding: Customize the layout by adding your company logo, business name, and brand colors. This adds a professional touch and makes the document easily identifiable as part of your business.

- Ensure Proper Calculations: Use formulas for automatic calculations, such as totals, taxes, and discounts. This will reduce the chance of errors and save time.

- Review and Edit: Double-check the document for accuracy before sending it to your client. Ensure that all information is clear and properly formatted.

Additional Tips for Professionalism

- Clear and Concise Descriptions: Use simple language and break down the services or products provided to avoid confusion.

- Use Consistent Formatting: Keep fonts, font sizes, and text alignment uniform across the document to maintain a professional appearance.

- Highlight Key Information: Bold or underline important details such as totals, payment terms, or due dates to make them stand out.

By following these steps, you can ensure that your financial documents are both professional and easy to understand. This will not only impress your clients but also improve your business’s reputation for accuracy and attention to detail.

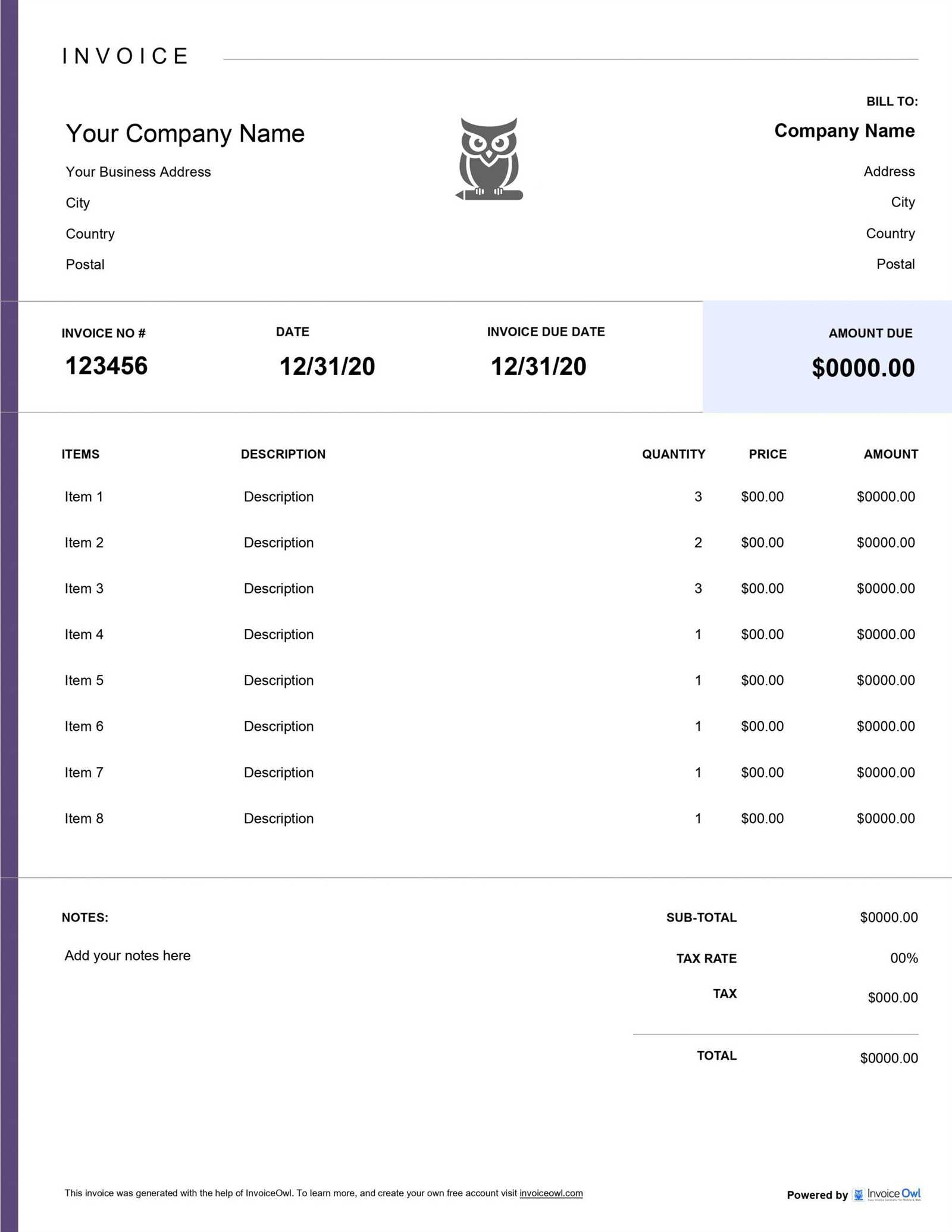

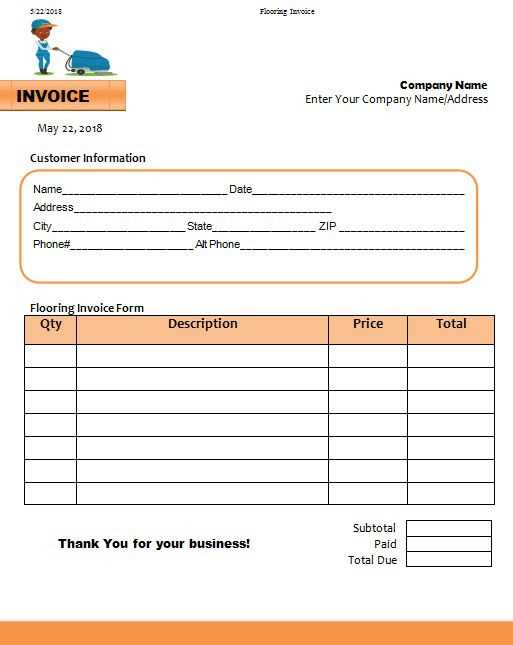

Understanding Invoice Layouts

When creating business documents for financial transactions, it’s essential to understand how to organize and display information clearly and efficiently. A well-structured layout helps ensure that all necessary details are presented in a logical order, making it easy for both you and your clients to review the document. Knowing how to arrange key elements such as business details, product or service descriptions, and payment information is vital for professionalism and clarity.

Core Components of a Layout

A successful structure typically includes several important sections. Understanding what goes where and why helps make the document more readable and functional:

- Business Information: At the top of the document, clearly list your company name, address, and contact details. This provides clients with easy access to your information in case they need to reach out.

- Client Details: Below your business information, include your client’s name, address, and any reference number related to the transaction. This makes it easy to match the document with your client’s records.

- Transaction Breakdown: Organize the list of products or services provided, including quantities, descriptions, unit prices, and totals. Clear itemization ensures transparency and avoids confusion.

- Payment Information: Clearly state the total amount due, payment terms, and any relevant dates, such as due dates or payment deadlines. This section ensures both parties are on the same page regarding financial expectations.

Design Considerations

Beyond the content, the visual design of the layout is also critical for readability. Simplicity and clarity should always be prioritized, with consistent formatting and alignment. Here are some additional tips:

- Spacing and Alignment: Make sure there’s enough space between different sections to avoid overcrowding. Align text and numbers for a clean, organized appearance.

- Fonts and Colors: Use professional fonts and avoid using too many different colors. Stick to a minimal color palette that complements your business branding.

- Headers and Footers: Use headers to highlight key sections and footers to include any legal disclaimers or additional instructions.

By understanding and utilizing a clear, professional layout, you not only improve the document’s aesthetic but also enhance its functionality, making it easier to understand and process for all parties involved.

Tips for Efficient Invoice Management

Managing financial documents effectively is crucial for maintaining smooth business operations and ensuring timely payments. A well-organized approach helps prevent errors, avoid missed deadlines, and track financial transactions more easily. By implementing efficient practices, businesses can enhance their cash flow and maintain better relationships with clients.

Organize and Track Your Documents

To keep everything in order, it’s essential to set up a reliable system for organizing your financial records. This ensures that each document is easy to find and reference when needed:

- Use Folder Systems: Create separate folders for each client or transaction type. You can choose digital folders or physical ones based on your preferences. Organizing by date or client name will help you quickly locate any document.

- Numbering System: Assign a unique number to each document for easy tracking. This also helps to prevent duplicates and ensures that every transaction is accounted for correctly.

- Use Cloud Storage: Cloud-based systems allow you to store and access your records from anywhere, providing additional security and easy sharing options with your team or clients.

Automate Where Possible

Automation can significantly improve your document management system. Implementing software or tools to automate key tasks will save time and reduce human error:

- Automated Reminders: Set up automatic reminders for payment due dates to ensure you never miss a deadline. This helps keep cash flow steady and maintains positive client relationships.

- Recurring Documents: If your business involves regular transactions with the same clients, consider using automated tools to generate similar documents automatically, reducing the need to create them from scratch each time.

- Integrated Payment Systems: Use payment platforms that integrate directly with your document management system. This can help speed up processing and make it easier to track payments as they are made.

Review and Follow-Up

Regular review of your financial documents is essential to identify any discrepancies or issues early on. Setting aside time each week or month to go over records will ensure everything is up to date:

- Double-Check for Accuracy: Before sending out or filing any document, double-check all details to avoid mistakes in amounts, dates, or client information.

- Follow Up on Unpaid Transactions: If payments are overdue, promptly follow up with clients. Having a clear follow-up process can help you recover unpaid amounts more efficiently.

By implementing these strategies, you can improve the efficiency of your document management system, streamline your workflow, and ensure that financial transactions are always handled in a timely and professional manner.

How Excel Templates Save Time

Creating documents for transactions and financial purposes can often be time-consuming, especially when you have to start from scratch every time. Using pre-designed structures can significantly speed up the process by providing a ready-made framework for entering key information. By relying on organized, customizable setups, you reduce the need for repetitive formatting, calculations, and design work.

Quick Setup and Customization

One of the most notable advantages of using pre-structured systems is how quickly they allow you to begin entering data. Instead of designing the layout and configuring formulas each time, everything is already in place, ready to be tailored to your specific needs:

- Pre-Configured Layout: Most systems come with organized fields for client details, product descriptions, and payment terms. This saves you from having to manually set up each section every time.

- Customizable Fields: While the basic structure is already in place, you can easily modify it to suit your business’s requirements, ensuring that you always have the right information included without having to start over.

- Consistent Formatting: The formatting is already applied, reducing the need for adjusting fonts, colors, or alignment each time you create a new document. This ensures that all your documents are visually consistent.

Automatic Calculations and Reductions in Error

Pre-designed systems often include built-in formulas for calculating totals, taxes, discounts, and other important values. This helps eliminate manual calculation errors and saves time:

- Instant Calculations: With formulas already in place, totals are calculated automatically as you enter data, saving you from doing math manually.

- Minimized Errors: Since the calculations are automated, the chance of human error is greatly reduced, ensuring that you’re always working with accurate figures.

- Time Savings on Repetitive Tasks: You don’t need to waste time recalculating values every time a document is created, as everything is already set up for you.

By using pre-designed structures, you can spend less time on administrative tasks and focus more on your core business activities, leading to greater productivity and efficiency overall.

Essential Elements of an Invoice

Creating accurate and professional financial documents requires including several key components that ensure both clarity and legality. Each section plays a vital role in providing essential information for both the service provider and the client. Understanding these core elements can help you structure your documents efficiently, ensuring that all necessary details are communicated properly.

Key Information to Include

The following elements are critical for creating a complete document:

| Element | Description |

|---|---|

| Business Details | Include your company’s name, address, phone number, and email. This is essential for clients to reach out for inquiries or payment issues. |

| Client Information | Provide your client’s full name or company name, along with their contact information, ensuring they can be easily identified and contacted. |

| Unique Reference Number | Assign a unique reference number to help track and manage transactions, making it easier for both parties to reference the document. |

| Itemized List | Provide a detailed description of the goods or services provided, including quantities, prices, and any applicable taxes or discounts. |

| Total Amount Due | Clearly state the total amount due, ensuring that it reflects the sum of the items, taxes, and any other charges. |

| Payment Terms | Outline the payment method, due date, and any applicable late fees or discounts for early payment. |

| Legal and Compliance Information | If required, include legal disclaimers, business registration numbers, or tax information that ensures compliance with local regulations. |

Importance of Proper Organization

Ensuring that each section is organized and easily identifiable helps to avoid confusion and ensures that all necessary details are included. Well-structured documents not only improve professionalism but also reduce the chances of misunderstandings or disputes over payments. Proper organization helps create transparency between the business and the client, fostering trust and clear communication.

Invoice Template vs Custom Invoices

When it comes to creating documents for business transactions, there are two main approaches: using a pre-designed structure or crafting a personalized version from scratch. Both methods offer distinct advantages depending on the nature of your business and the level of customization you require. Understanding the differences between these two approaches can help you decide which method is best suited for your needs.

Pre-Designed Structures

Pre-designed structures are ready-made formats that can be quickly filled in with the necessary details. These offer several benefits:

| Advantages | Considerations |

|---|---|

| Time Efficiency | These structures are quick to set up and use, which can save valuable time on administrative tasks. |

| Consistency | Using a consistent format for all documents ensures uniformity across your business records. |

| Ease of Use | With predefined fields, the process of entering data is simple and intuitive, reducing the risk of errors. |

However, while these ready-made structures are practical, they may not allow for much flexibility when it comes to more specific business needs or branding requirements.

Custom-Built Documents

On the other hand, crafting a custom version allows for full control over the layout, design, and included details. Here are some key benefits:

| Advantages | Considerations |

|---|---|

| Complete Customization | You can tailor every aspect of the document, including the layout, design, and included fields, to suit your unique needs. |

| Branding | Custom versions offer an opportunity to reflect your company’s branding and aesthetic, making the document more personalized. |

| Flexibility | These documents can accommodate special terms, conditions, or complex pricing structures that might not fit into a standard layout. |

Creating a custom version requires more time and effort, especially if you need to set up calculations or design elements from scratch. However, this approach offers greater flexibility and allows you to better align the document with your business processes and visual identity.

Ultimately, the choice between using a pre-designed structure or creating a custom version depends on your business’s specific needs and priorities. If speed and consistency are essential, a pre-designed structure might be the best option. On the other hand, if customization, flexibility, and branding are more important, creating a personalized version could be more beneficial.

Common Mistakes in Invoice Creation

When creating financial documents for your business, it’s easy to overlook certain details or make mistakes that can cause confusion and delay payments. Even small errors can lead to complications, so it’s important to ensure every aspect of your document is accurate and clear. Below are some of the most common mistakes businesses make and tips on how to avoid them.

1. Missing or Incorrect Contact Information

One of the most common errors in financial documents is failing to include accurate contact details for both parties involved. This can delay communication and lead to misunderstandings. Ensure the following are correct:

- Your business name, address, phone number, and email.

- The client’s full name, company name (if applicable), address, and contact information.

2. Lack of Clear Payment Terms

Clearly defining the payment terms is crucial. Without clear instructions on when the payment is due or how it should be made, clients may delay or fail to submit payments on time. Always include:

- The due date for the payment.

- The accepted methods of payment (bank transfer, credit card, etc.).

- Late payment penalties, if applicable.

3. Overlooking Item Descriptions

Another common mistake is providing vague or incomplete descriptions of the goods or services provided. Be specific and thorough in listing each item, including:

- The name of the product or service.

- The quantity or duration of the service.

- The price per unit or hour, as applicable.

- Any additional fees, taxes, or discounts that apply.

4. Incorrect Calculations

Errors in adding up totals or calculating taxes can lead to significant problems. Double-check all math, including:

- Subtotal calculations.

- Tax rates and their application.

- Overall total, including any applicable discounts or extra charges.

5. Failing to Include a Unique Reference Number

Without a unique reference number, it becomes difficult to track payments or resolve issues that may arise. Always include a reference number on your document to help both you and your clients stay organized.

6. Not Following Legal Requirements

In some regions, businesses are legally required to include specific information, such as tax registration numbers or specific legal disclaimers. Ensure your document complies with local regulations by including all necessary legal information.

7. Missing a Professional Layout

The layout of the document can impact its readability and overall professionalism. Avoid clutter and ensure the layout is clean and easy to follow. A professional-looking document can enhance your business’s image and help establish trust with clients.

By paying attention to these common mistakes and taking the time to correct them, you can ensure your documents are accurate, clear, and professional, which will help streamline the payment process and prevent misunderstandings.

How to Track Payments in Excel

Tracking payments accurately is a crucial task for any business. With proper tracking methods in place, you can stay on top of your financial status, ensuring that all transactions are recorded and payments are received on time. Using spreadsheet software offers a simple and effective way to monitor payments, providing easy access to data and useful tracking tools. Below, we explore how to effectively track payments and manage your cash flow using a spreadsheet.

1. Set Up a Payment Tracking Sheet

Creating a payment tracking sheet requires a few essential columns to organize information clearly. Here are the key elements to include:

- Client Name: Record the name of the customer making the payment.

- Transaction Date: Include the date when the payment was received.

- Amount Paid: List the total payment amount.

- Payment Method: Specify how the payment was made (e.g., credit card, bank transfer, etc.).

- Outstanding Balance: Keep track of any remaining amount due, if applicable.

- Status: Mark the payment as “Paid,” “Pending,” or “Overdue” for easy reference.

2. Automate Calculations for Efficiency

To simplify the tracking process, you can use built-in functions to automate calculations. Here are some key tips:

- Sum Function: Use the SUM function to calculate the total payments received over a period, helping you track your cash flow.

- Conditional Formatting: Apply conditional formatting to highlight overdue payments or mark when a payment is complete, making it easier to manage deadlines.

- Remaining Balance Calculation: Use simple subtraction formulas to automatically update any remaining balances when a payment is recorded.

3. Monitor Payment Trends Over Time

Tracking payments over time can help you identify trends and plan better for the future. Create a summary sheet that consolidates data from different periods to analyze:

- Monthly Totals: Keep track of monthly payments to evaluate seasonal trends or business cycles.

- Client Payment History: Track which clients are consistent payers and which ones tend to delay payments.

- Average Payment Time: Calculate how long it typically takes for clients to settle their accounts.

With a well-organized tracking system, you can ensure timely payments and stay ahead of any financial issues. By automating calculations and monitoring trends, you can focus more on growing your business while maintaining solid cash flow management.

Setting Up Excel for Invoicing

Organizing your billing process with a spreadsheet program can significantly streamline your workflow. By setting up an efficient system within your chosen software, you can quickly generate professional records that track transactions, payments, and due amounts. Here’s how you can create a functional structure for managing payments and keeping accurate financial records.

1. Create a Clear Structure

Start by organizing your worksheet with the essential categories needed for tracking business transactions. The following components are vital:

- Client Information: A section for customer details, including name, address, and contact information.

- Service/Item Description: A column where you can list the products or services provided.

- Quantity and Unit Price: Columns to record the amount sold and price per unit, allowing for accurate calculation of totals.

- Total Amount: A calculated column that sums up the values of the services or products provided.

- Payment Due Date: The specific date when the payment should be made.

- Payment Status: A column to indicate whether the payment has been made, is pending, or overdue.

2. Use Formulas for Automatic Calculations

To minimize errors and improve efficiency, use basic functions within your software for automatic calculations. This saves you time when creating records and ensures consistency:

- Multiplication Formula: Use the multiplication formula (Quantity × Unit Price) to calculate the total for each item or service automatically.

- SUM Function: Employ the SUM function to add up the total amount for all items in a row or column.

- Subtraction for Balance: If needed, use subtraction formulas to calculate the outstanding balance after receiving a payment.

3. Design for Readability and Professionalism

It’s important to ensure that the structure is not only functional but also clear and easy to read. Here are some tips for designing your sheet:

- Bold Headers: Use bold text for headings to clearly distinguish different sections of the worksheet.

- Color Coding: Apply light background colors to different rows or columns to enhance readability and help visually organize information.

- Clear Borders: Add borders around each section for a clean, professional look.

4. Automate Record Keeping

To further enhance your billing system, you can automate certain actions to minimize manual work:

- Drop-down Menus: Use drop-down lists to quickly select payment status, reducing the chance of human error.

- Data Validation: Set up rules that restrict input errors, such as ensuring the payment date is always in the correct format.

- Conditional Formatting: Use conditional formatting to highlight overdue payments or unpaid amounts, making it easy to follow up with clients.

By setting up a clear, organized system with these steps, you can simplify the management of financial records and improve efficiency in your business operations.

Free Resources for Invoice Templates

There are numerous resources available online that offer pre-designed billing formats and tools to help streamline your financial processes. Whether you are a small business owner or a freelancer, these platforms can help you create professional documents quickly and efficiently, without the need for expensive software. Below are some of the best places to find these useful resources.

1. Online Platforms with Free Tools

Many websites provide completely accessible options for generating and customizing billing documents. These platforms often allow you to create tailored records by filling in required details in an easy-to-use interface. Some popular options include:

- Google Docs: Offers a variety of simple and customizable document designs that can be used for transaction records and receipts.

- Zoho Invoice: A cloud-based platform with multiple layouts and the ability to send records directly from the platform to your clients.

- Wave: A free service that helps you create billing documents, track expenses, and manage accounting tasks with ease.

2. Downloadable Formats from Trusted Sources

If you prefer to use a traditional spreadsheet program for creating your financial documents, there are numerous downloadable options available that can save you time. These resources are generally compatible with most software, such as Google Sheets and Microsoft Office. Look for:

- Microsoft Office Online: A trusted provider of business tools, Microsoft offers numerous free resources to generate records in various formats.

- Template.net: A site offering a range of downloadable files that are ready to use, offering customization for various industries.

- Vertex42: A site that specializes in spreadsheets, offering well-designed and functional tools for managing finances and transactions.

3. Specialized Communities and Forums

Community-driven platforms often feature downloadable files and templates that are created by other users, providing additional inspiration and resources. You can check forums and social media groups dedicated to business administration or accounting for personalized recommendations. Some valuable sites to consider are:

- Reddit: Subreddits like r/smallbusiness and r/entrepreneur often feature recommendations and shared resources from fellow entrepreneurs.

- Business Forums: Sites like Small Business Forums and My Entrepreneur Forum allow users to exchange free resources, including document templates and organizational tools.

Using these free platforms and resources can help you stay organized, reduce the time spent on administrative tasks, and maintain a professional image when dealing with clients and customers.

Best Practices for Using Templates

Using pre-designed formats can greatly streamline your business operations and ensure consistency in your financial documentation. However, to maximize the effectiveness of these resources, it’s important to follow best practices that maintain professionalism, accuracy, and efficiency. Below are key strategies to consider when working with these tools.

1. Customize for Your Business

One of the most important aspects of using ready-made formats is tailoring them to fit your unique needs. This ensures that the document aligns with your brand’s identity and business requirements. Key steps include:

- Adjusting fields: Make sure all fields are relevant to your industry, adding or removing categories as needed.

- Branding: Add your company logo, address, and contact information to maintain a professional appearance.

- Consistency: Use consistent fonts, colors, and styles to create a cohesive look that reflects your brand’s identity.

2. Double-Check Accuracy

Even with pre-made formats, it’s crucial to ensure that the information you enter is correct. Incorrect details can cause confusion and lead to missed payments or disputes. To avoid mistakes:

- Review the details: Always double-check dates, amounts, and client details before finalizing the document.

- Ensure proper calculations: If your document includes numbers or totals, make sure that they are accurate and match your records.

- Proofread: A quick proofread can help catch any typos or formatting errors that may have slipped through.

3. Keep It Simple

While it’s important to make your documents professional, keeping them clear and simple is equally vital. Complex layouts can confuse clients or lead to missed information. Best practices include:

- Minimalist design: Avoid clutter by using straightforward layouts with clear headings and enough spacing between sections.

- Clear language: Use simple, concise language to ensure that clients can easily understand the document’s content.

- Easy navigation: Group related information together to help clients quickly find the details they need.

4. Save and Back-Up Your Work

After customizing your documents, it’s essential to save and store them securely for future use. This ensures you can easily access past records and avoid having to recreate documents each time. Tips for managing your files include:

- File naming conventions: Name files systematically, including the client’s name and the date to make it easy to locate them later.

- Cloud storage: Use cloud storage services to keep your documents accessible and secure from any location.

- Backup copies: Regularly back up your work to avoid data loss and ensure your files are safe.

5. Automate Where Possible

Many software tools allow for automation within the ready-made structures. Automation can save time and reduce the potential for human error. For automation:

- Pre-fill common information: Set up fields that auto-populate with client details, payment terms, or previous transaction data.

- Recurring documents: For clients with regular payments, create recurring formats that automatically generate at specified intervals.

- Track payments: Use integrated systems that can automatically update payment statuses and generate reports for you.

By following these best practices, you can improve your workflow, save time, and present professional, polished records every time.