Clothing Invoice Template for Efficient Billing and Business Management

Managing payments and keeping financial records in order is crucial for any business, especially in the fashion industry. Whether you’re selling apparel, accessories, or custom designs, having a structured system for documenting transactions can save time, reduce errors, and ensure professional communication with clients.

Efficient financial documentation not only helps maintain clear accounts but also simplifies tax reporting and improves cash flow. A well-organized billing system provides your customers with all the necessary details about their purchases and demonstrates your professionalism. With the right format, you can easily track sales, handle payments, and stay on top of your business’s financial health.

Using ready-made solutions to generate these records allows you to focus more on growing your brand and less on the administrative side of things. Customizable forms tailored to your specific needs can help you maintain consistency while adapting to different transactions.

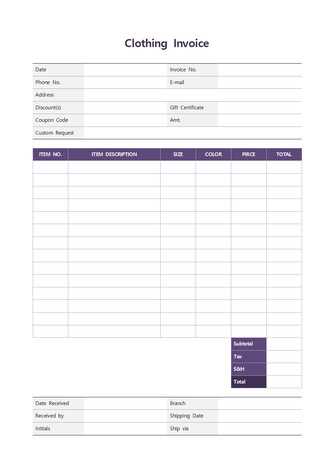

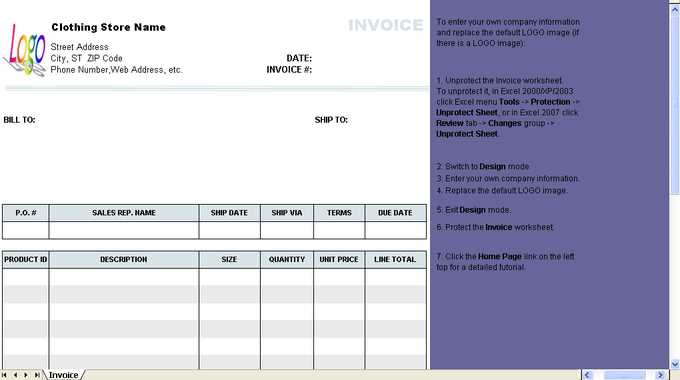

Clothing Invoice Template Overview

In any business, especially in the fashion industry, keeping clear records of each transaction is essential for smooth operations. Having a structured document to outline the details of each sale allows you to track payments, manage orders, and maintain transparency with your clients. A well-organized format provides both you and your customers with a clear understanding of the items sold, the total cost, and the payment terms.

Structured billing forms help ensure that every important piece of information is captured, from the buyer’s details to the items purchased, along with applicable taxes and shipping charges. These documents not only serve as proof of the transaction but also help establish a professional rapport with your clients by showing attention to detail.

When looking for an efficient solution, it is important to choose a customizable design that aligns with your business needs. The right document format can streamline the process, making it easy to generate and send records quickly, allowing you to focus on other areas of your business.

Why You Need an Invoice Template

Efficient financial management is vital for every business, and having a standardized document to record transactions is an essential part of that. Using a pre-structured format not only saves time but also reduces the chances of errors, ensuring that both you and your customers are on the same page. By relying on a ready-made design, you can easily maintain consistency in your billing process and avoid confusion when it comes to payments.

Benefits of Using a Pre-Designed Format

- Time-saving: Creating a new document for each transaction can be time-consuming. A set format allows for quick customization, making it easier to generate professional records without starting from scratch.

- Professionalism: A polished, standardized record improves the way you present your business. It shows customers that you are organized and serious about your operations.

- Consistency: With a ready-made structure, all of your records will look the same, helping to establish a recognizable system for your clients and internal tracking.

- Accuracy: Having a fixed format ensures that all necessary details, such as product names, quantities, prices, and taxes, are included every time, reducing the risk of missing information.

How It Helps With Record Keeping

A standardized document plays a crucial role in maintaining accurate financial records. By using a consistent layout, you can easily track sales, monitor outstanding payments, and keep an organized history of your transactions. This will be particularly helpful when preparing for tax filing, audits, or assessing business performance over time.

How to Customize a Clothing Invoice

Personalizing your billing documents is essential to ensure they reflect your brand’s identity while meeting the unique needs of your business. Customization allows you to include relevant details that align with your services, ensuring each transaction is clearly documented and professionally presented. With the right adjustments, you can create a document that not only serves its purpose but also reinforces your brand’s image with clients.

Essential Elements to Modify

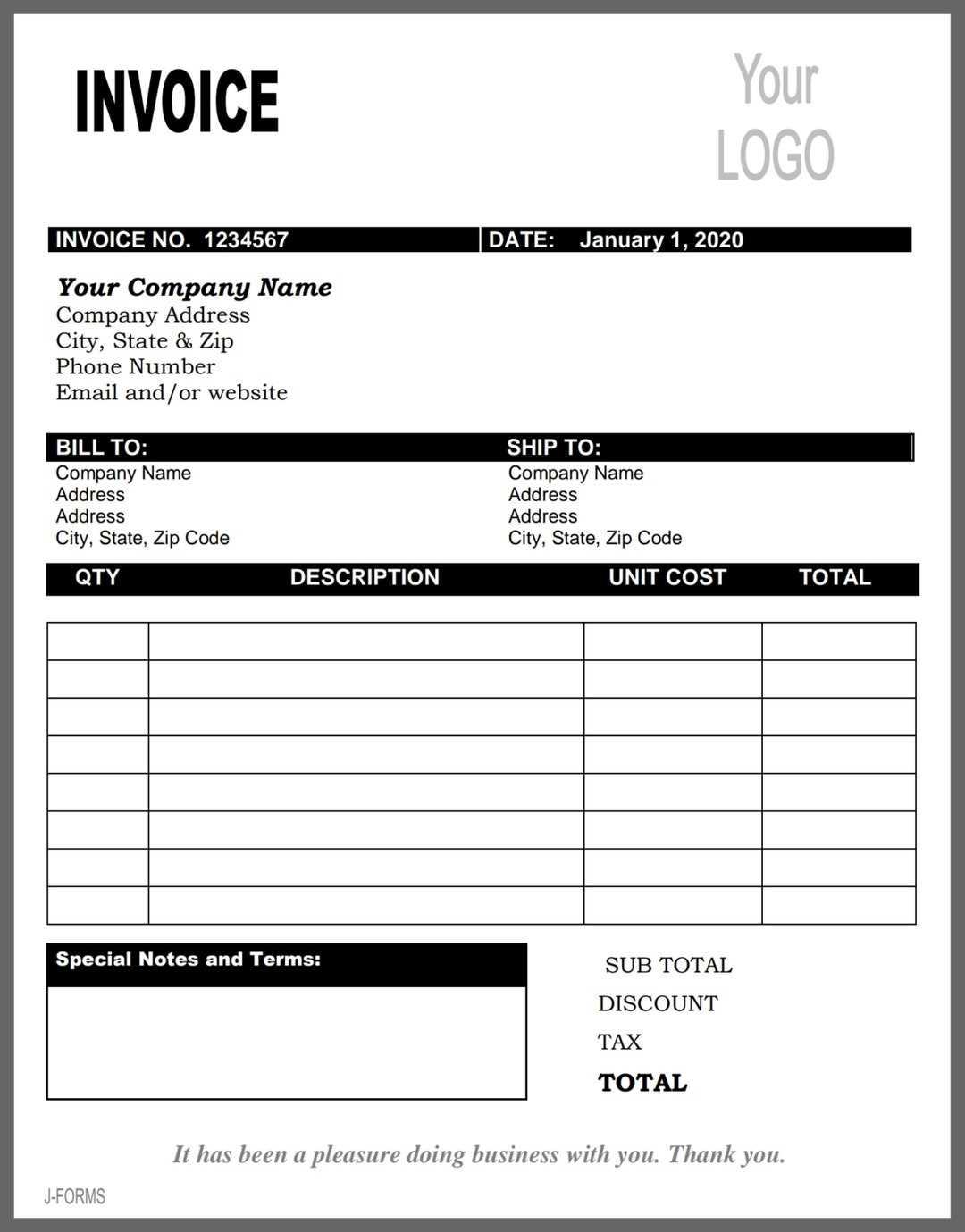

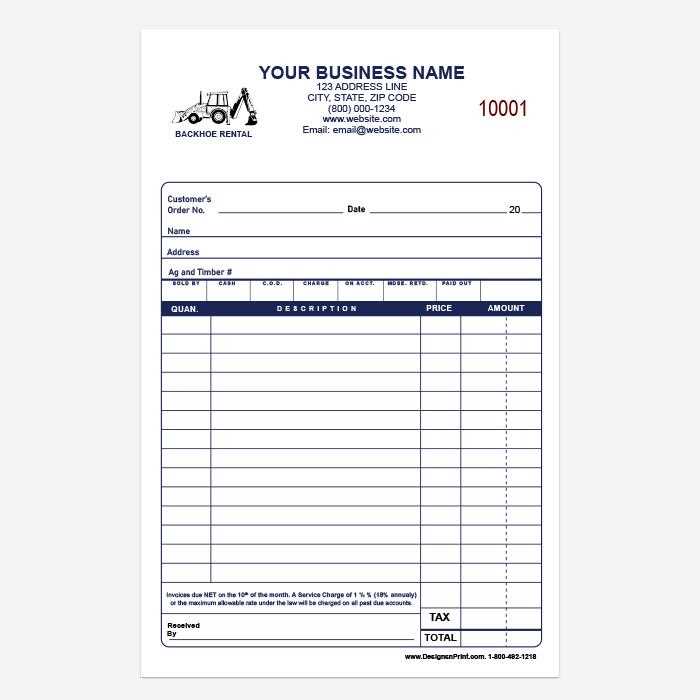

- Business Information: Ensure that your business name, address, phone number, and website are prominently displayed. This makes it easy for customers to contact you for future orders or queries.

- Client Details: Include space for the customer’s name, address, and contact information to personalize each record and make future follow-ups easier.

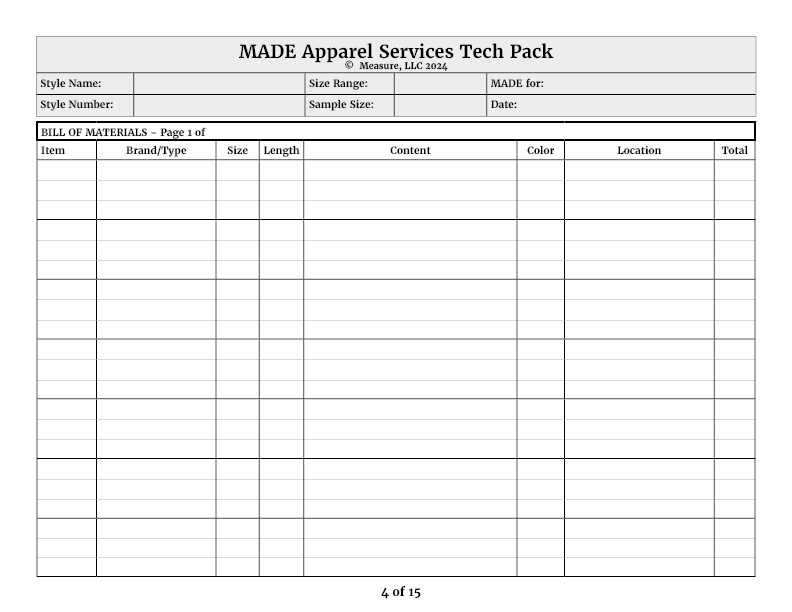

- Product Descriptions: Tailor the fields to capture the specifics of each item sold, including size, color, and quantity, to ensure clarity on both sides.

- Payment Terms: Clearly define the due date, accepted payment methods, and any discounts or late fees to avoid confusion and ensure timely payments.

Tools for Customizing Your Document

There are several tools available that can help you modify your billing documents. Many software solutions offer built-in customization options, allowing you to add logos, adjust the layout, and select color schemes that match your brand’s aesthetic. For simpler options, online platforms provide easy-to-use forms that allow you to fill in the necessary details and download the completed document. Whether you prefer desktop software or cloud-based tools, there is a solution suited to your needs.

Key Elements of a Clothing Invoice

When creating a billing document for your fashion business, it’s important to include specific details to ensure accuracy and clarity. Each section of the document serves a unique purpose, from providing basic information to outlining transaction specifics. These elements not only help maintain organized records but also ensure transparency and professionalism in your communication with clients.

| Element | Description |

|---|---|

| Business Information | Includes your company name, address, contact number, and email. This helps clients identify who is sending the document and how to reach you. |

| Client Details | Customer’s name, address, and contact details should be clearly displayed to personalize the document and facilitate any future correspondence. |

| Product/Service Description | List the items or services provided with clear descriptions, quantities, unit prices, and total amounts. This ensures both parties understand what was purchased. |

| Payment Terms | Clearly define when payment is due, accepted methods of payment, and any discounts or penalties for late payments. |

| Invoice Number | A unique number for each document helps track transactions and maintain orderly records for both the business and the customer. |

| Tax Details | Include applicable taxes (such as sales tax) to show the final amount due and ensure tax compliance. |

| Total Amount Due | Clearly display the total amount payable, including any taxes and additional fees, for a transparent financial summary. |

Including all of these key elements ensures that the document is comprehensive, reducing the potential for confusion and providing both you and your clients with the necessary information for record-keeping and payment processing.

Benefits of Using Invoice Templates

Using a standardized format for generating billing documents brings numerous advantages to your business. It simplifies the process, reduces errors, and ensures that each transaction is recorded consistently. By relying on pre-designed structures, you can streamline operations, saving valuable time and effort while maintaining a professional image with your clients.

Efficiency and Time-Saving

One of the primary benefits of using a pre-structured form is the time saved in creating each record. Rather than starting from scratch every time, you can quickly input the relevant details and generate a polished document in just a few minutes. This efficiency allows you to focus on other aspects of your business, like sales and customer relationships, rather than administrative tasks.

Consistency and Accuracy

With a set layout, every document you issue will contain the same fields and structure, ensuring consistency in how you present your transactions. This not only creates a more professional appearance but also helps reduce the likelihood of missing or incorrect information. Accurate records lead to fewer disputes and smoother interactions with clients.

Additional benefits include enhanced tracking and record-keeping, as you can easily store and retrieve documents for future reference or audits. Using a ready-made solution can also help ensure that your business complies with legal and tax requirements, as important elements like tax rates and terms are included in the structure.

Choosing the Right Invoice Format

Selecting the appropriate document layout for billing purposes is crucial for ensuring clarity and professionalism. A well-chosen format helps both your business and your clients understand the details of the transaction without confusion. The right structure should be functional, easy to customize, and capable of meeting your specific business needs.

Factors to Consider

- Business Type: Consider whether your company sells physical goods, provides services, or both. Different types of businesses may need to highlight different pieces of information, such as product specifications, service descriptions, or hours worked.

- Client Preferences: Some clients may prefer a simple document with only essential information, while others might require more detailed billing. It’s important to consider the expectations of your customer base.

- Ease of Use: Choose a format that is easy for you to customize and modify, especially if your products or services vary from one transaction to another. Flexibility in adjusting the document is key to ensuring that each sale is accurately represented.

- Legal and Tax Compliance: Make sure the format you choose complies with any local regulations regarding billing, taxes, and record-keeping. This will help you avoid mistakes or omissions that could lead to legal or financial issues.

Types of Formats to Explore

There are several types of document formats available to suit different needs. For small businesses, simple layouts with basic fields might be sufficient, while larger companies may benefit from more sophisticated designs with integrated payment options or automated tax calculations. It’s important to balance simplicity with functionality to ensure the final document serves both administrative and customer-facing purposes effectively.

Common Mistakes in Clothing Invoices

While generating billing records may seem straightforward, there are several common pitfalls that businesses often encounter. Even small errors in these documents can lead to confusion, delayed payments, or even legal issues. By being aware of these frequent mistakes, you can avoid them and ensure your financial documents are clear, accurate, and professional.

Common Errors to Avoid

- Missing or Incorrect Contact Information: Failing to include up-to-date contact details for both your business and the client can lead to confusion and delays. Make sure the names, addresses, and phone numbers are accurate and clearly displayed.

- Unclear Product Descriptions: Vague or incomplete descriptions of products or services can create misunderstandings. Be specific about item names, sizes, colors, and quantities to avoid discrepancies.

- Inaccurate Pricing: Typos or incorrect pricing information are among the most common mistakes in billing documents. Double-check the unit prices and totals to ensure they align with agreed-upon amounts.

- Missing Payment Terms: Not specifying payment due dates or the accepted methods can cause delays in payments. Always make sure to outline when and how payments are expected.

- Omitting Tax Information: If your sales are subject to taxes, be sure to include the appropriate tax rates and amounts. Omitting tax details can create confusion and lead to compliance issues.

- Incorrect or Missing Invoice Numbers: Failing to assign unique invoice numbers can make it difficult to track transactions. A proper numbering system is essential for accurate record-keeping and tracking payments.

How to Prevent These Mistakes

- Double-check Details: Always review the document before sending it to ensure all information is accurate.

- Use Software or Pre-made Structures: Many software tools offer built-in error checks to prevent common mistakes.

- Keep a Template or Checklist: Having a checklist of key details to include can help ensure consistency and reduce errors.

By paying attention to these common issues, you can ensure your billing documents are always accurate, complete, and professional, reducing the risk of misunderstandings and improving payment efficiency.

Free vs Paid Invoice Templates

When choosing a layout for your billing documents, you may face the decision between using free or paid options. Both have their own advantages and disadvantages, and understanding these differences can help you select the best solution for your business. Free formats are often easily accessible, while paid designs tend to offer more features and customization options, but at a cost.

Advantages of Free Formats

- Cost-effective: The most obvious benefit is that free solutions come at no expense, making them an ideal choice for startups and small businesses on a tight budget.

- Quick Access: Free options are readily available on many platforms, allowing you to start generating documents right away without the need for a purchase or subscription.

- Basic Features: Many free layouts include all the essential fields and sections required for a functional document, making them sufficient for simple transactions and businesses that don’t require advanced features.

Benefits of Paid Solutions

- Customization: Paid options often provide more flexibility in design and layout. You can tailor documents to fit your brand’s style, which helps in maintaining consistency across your communications.

- Additional Features: Paid layouts often come with built-in functions, such as automatic tax calculations, payment tracking, and even integration with accounting software, saving you time and effort.

- Customer Support: With a paid option, you are more likely to have access to customer support in case you encounter any issues with your document layout or functionality.

- Professionalism: Premium designs usually have a more polished, sophisticated look, which can enhance your company’s image and impress clients with high-quality, well-organized billing records.

Ultimately, the choice between free and paid options depends on the scale of your business, the complexity of your transactions, and your specific needs. If you are just starting out or only need basic functionality, a free option might be enough. However, as your business grows or if you require more advanced features, a paid solution could be worth the investment.

How to Design a Professional Invoice

Designing a professional billing document is essential for establishing trust with clients and ensuring clarity in every transaction. A well-designed form not only presents information in an organized way but also reflects the quality and professionalism of your business. The key to creating an effective document lies in balancing aesthetic appeal with functionality, ensuring that all necessary details are easy to find and understand.

Key Design Principles

- Clarity and Simplicity: Keep the layout clean and simple. Avoid cluttering the document with unnecessary graphics or excessive text. Clear, legible fonts and well-spaced sections help make the details easily readable for both you and your client.

- Consistency: Ensure that your branding elements, such as logo, color scheme, and font style, are consistent across all business materials. This creates a cohesive brand image and reinforces professionalism.

- Logical Structure: Arrange the sections logically. Typically, business details come first, followed by client information, a list of goods or services provided, payment terms, and the total amount due. This structure makes it easy for clients to review the document quickly.

Essential Elements to Include

- Company and Client Information: Your business name, address, and contact details should be clearly visible, along with your client’s details, to ensure easy reference.

- Transaction Details: Include item descriptions, quantities, unit prices, and total amounts for each product or service provided. This transparency helps prevent disputes over charges.

- Payment Terms: State the due date, acceptable payment methods, and any late fees or discounts. This sets clear expectations and encourages prompt payments.

- Tax Information: Include tax rates and amounts to ensure compliance and transparency with your client regarding the final amount due.

By following these guidelines, you can create a professional document that not only looks great but also serves its purpose of providing accurate, comprehensive details for every transaction.

Understanding Invoice Numbering System

Having a clear and organized numbering system for your billing documents is essential for maintaining accurate records and ensuring smooth financial operations. A consistent approach to numbering helps you easily track transactions, prevent confusion, and streamline your accounting processes. It also plays a critical role in legal and tax compliance, as it creates a traceable, unique record for each transaction.

A well-structured numbering system typically involves sequential numbers, but can also include prefixes, suffixes, or date references to provide further context. For example, you might use a combination of numbers and letters to distinguish between different departments or types of transactions. Regardless of the format you choose, consistency is key to maintaining an organized system that is easy to manage and reference.

In addition to improving internal organization, a proper numbering system can also help customers identify their documents more easily, fostering a professional image and building trust with your clients.

Tips for Accurate Billing in Fashion

Accurate billing is essential in the fashion industry, where transactions often involve numerous product variations, sizes, colors, and pricing structures. Proper documentation ensures that clients are charged correctly, reduces the risk of disputes, and maintains your business’s professionalism. By following a few simple guidelines, you can streamline your billing process and avoid common errors.

Important Considerations for Accurate Billing

- Double-check Product Details: Make sure each item is clearly described with all necessary attributes such as size, color, and quantity. This prevents confusion over what is being billed.

- Review Prices: Ensure that the correct prices for each product or service are listed. This includes checking for discounts, promotions, and taxes.

- Keep Track of Returns and Exchanges: Adjust your billing for returned or exchanged items to prevent incorrect charges.

- Provide Clear Payment Terms: Make payment deadlines and acceptable methods clear to your clients to avoid misunderstandings.

How to Structure Your Billing Information

A clear layout can make your billing document easier to understand. Here’s a suggested structure for organizing your billing details:

| Section | Details |

|---|---|

| Product Information | Include item names, descriptions, sizes, colors, and quantities to ensure clarity for both you and your client. |

| Pricing | List individual item prices, applicable discounts, and taxes. Ensure the total reflects the correct amount after adjustments. |

| Payment Terms | Clearly state payment due dates, methods of payment, and any penalties for late payments to set expectations. |

| Returns and Adjustments | Document any returns, exchanges, or adjustments made to the original order and ensure they are reflected in the final amount. |

By following these tips and maintaining attention to detail, you can create accurate, clear, and professional billing documents that improve your business operations and enhance customer satisfaction.

Integrating Billing Documents with Accounting

Integrating billing documents with your accounting system can significantly streamline financial management, reduce errors, and save time. By connecting your business’s sales records with its accounting software, you ensure that all financial transactions are accurately recorded and easily accessible. This integration simplifies tax calculations, financial reporting, and client payment tracking, ultimately contributing to smoother business operations.

When your billing records are aligned with your accounting system, information flows seamlessly between the two, allowing for automatic updates and reducing the need for manual data entry. This minimizes the risk of discrepancies between sales figures and accounting reports. Additionally, automation makes it easier to track outstanding payments, manage cash flow, and ensure that all income and expenses are properly accounted for.

Benefits of Integration

- Time-Saving: Automating data entry between your billing documents and accounting software saves hours of manual work each week, allowing you to focus on other aspects of your business.

- Accuracy: Reduces the likelihood of human errors in recording transactions and ensures that your financial records are always up to date.

- Streamlined Reporting: Integration allows you to generate detailed financial reports quickly and accurately, making it easier to assess your business’s performance and plan for the future.

- Tax Compliance: With everything synced, tax calculations are more straightforward, helping you avoid mistakes when filing taxes and ensuring compliance with local regulations.

How to Integrate Your Systems

- Use Compatible Software: Many modern accounting platforms and billing tools are designed to work together. Choose a software package that supports integration with the tools you already use for billing.

- Set Up Automatic Syncing: Enable automatic syncing between your sales documents and accounting software to ensure real-time updates without manual intervention.

- Monitor Data Accuracy: Regularly check that the information transferring between systems is correct, and resolve any discrepancies promptly to avoid future issues.

Integrating billing processes with your accounting system not only enhances operational efficiency but also improves financial transparency, making it easier to monitor your business’s performance and manage day-to-day finances.

How to Send Billing Documents Efficiently

Sending billing records in an efficient manner is crucial for maintaining smooth cash flow and ensuring timely payments. By streamlining the process of generating and dispatching your sales documents, you can save time, reduce errors, and improve communication with your clients. Whether you are working with one customer or handling multiple transactions, efficiency in this area is key to keeping your operations running smoothly.

In order to send these records efficiently, it’s important to choose the right tools, organize your workflow, and follow best practices for client communication. Utilizing automated systems, clear communication channels, and digital formats can all contribute to a faster, more organized billing process.

Best Practices for Sending Billing Records

- Automate Document Generation: Use software that allows for quick creation of billing documents. With templates and automated fields, you can create accurate records in minutes without having to input the same information repeatedly.

- Use Digital Delivery Methods: Sending documents via email or using an online portal ensures faster delivery and reduces the risk of lost or delayed mail. Make sure the document is in a universally accepted format, such as PDF, to maintain professionalism and ease of access for your clients.

- Send Immediately After Completion: To avoid delays, send out the billing documents as soon as the transaction is completed. This ensures that clients are aware of their responsibilities right away and prevents any unnecessary follow-up delays.

- Use Clear Subject Lines and Messages: When emailing your clients, ensure that the subject line clearly identifies the purpose of the message (e.g., “Payment Due for Recent Purchase”). Include a polite reminder in the body of the message along with any relevant payment details.

Organizing Your Billing Workflow

- Track Sent Documents: Keep a record of all documents sent and the date they were dispatched. Using an accounting or project management tool can help automate this process and prevent any documents from slipping through the cracks.

- Set Up Payment Reminders: If a client hasn’t paid by the due date, use automated systems to send polite reminders, reducing the effort needed for manual follow-ups.

- Consolidate Records: Make sure all relevant details, such as due dates, payment amounts, and transaction information, are clearly organized in your system. This will make it easier to track payments and manage future follow-ups.

By using the right tools and following efficient practices, you can ensure that your billing process is smooth, timely, and professional, contributing to better customer relations and a more organized business.

Legal Considerations for Billing Documents

When generating and sending billing records, it’s crucial to ensure that all legal requirements are met. Proper documentation not only facilitates business transactions but also helps protect your rights and those of your clients. Failing to comply with legal standards can lead to disputes, delayed payments, or even legal consequences. It is essential to be aware of the key legal elements that should be included in your billing documents and understand the regulations surrounding them.

Key Legal Elements to Include

- Business Information: Always include your company’s legal name, address, and contact details. This ensures that the document is recognized as a valid business transaction and helps prevent confusion about the entity involved.

- Client Information: Include accurate client details, including their name and address, to clearly identify the party responsible for the payment.

- Payment Terms: Specify the payment due date, any applicable late fees, and the acceptable methods of payment. This helps clarify expectations and avoid future disputes over payment deadlines.

- Tax Information: If applicable, include details on sales tax or VAT. Ensure the correct tax rate is applied based on the location of the transaction, as tax regulations vary by region and industry.

- Itemized List of Products/Services: Break down the goods or services provided with clear descriptions, quantities, unit prices, and totals. This transparency is essential in case of discrepancies or returns.

Compliance with Local Laws

- Consumer Protection Laws: Depending on your location, there may be consumer protection regulations that dictate how billing documents should be structured, including refund policies, warranty terms, and returns procedures.

- Record Keeping: Many jurisdictions require businesses to keep records of all financial transactions for a specified period. Ensure that your system complies with these retention requirements to avoid legal issues.

- Currency and Language Requirements: Be mindful of the legal requirements for currency notation and language when dealing with international clients. Always use the correct currency symbol and ensure that the language used is clear and appropriate for the region.

By adhering to these legal considerations, you can minimize risks and ensure that your business maintains its professionalism and compliance with relevant regulations.

Managing Payments Through Billing Documents

Efficiently managing payments is a vital aspect of running a successful business. Properly structured billing records help ensure timely payments, improve cash flow, and maintain strong customer relationships. By clearly outlining payment terms, due dates, and amounts owed, you can reduce confusion and encourage clients to settle their accounts promptly. Additionally, integrating your billing process with payment systems can streamline collections and minimize manual tracking efforts.

Tracking and Organizing Payments

- Clear Payment Terms: Include precise payment deadlines, accepted payment methods, and any applicable late fees. Setting clear expectations helps clients understand their responsibilities and reduces the chances of delayed payments.

- Monitor Outstanding Payments: Keep a record of all transactions and track unpaid amounts. Use automated systems to send reminders for overdue balances, reducing the need for manual follow-up.

- Offer Multiple Payment Options: Make it easier for clients to pay by providing various payment methods, such as credit cards, bank transfers, or online payment platforms. The more convenient the process, the more likely customers are to pay on time.

Dealing with Late Payments

- Polite Payment Reminders: Send friendly reminders before and after the payment due date to encourage prompt payment. Include details on how much is owed, the due date, and the payment method.

- Late Fees: Clearly state any late fees that will be applied if payments are not made on time. This provides an incentive for clients to pay promptly and helps compensate for the time spent chasing overdue amounts.

- Flexible Payment Plans: If necessary, offer installment plans or negotiate payment terms to accommodate clients who may be experiencing financial difficulties. Clear communication and flexibility can help maintain a positive working relationship.

By managing payments effectively through well-organized billing records and clear communication, you can ensure a smooth payment process and maintain healthy business operations.

Billing Document for Small Businesses

For small businesses, maintaining a professional and organized approach to financial transactions is essential. One of the most important tools in this process is a well-structured billing document. A properly designed sales record not only facilitates timely payments but also helps maintain clarity in your financial reporting. By using an effective billing format, small business owners can ensure that they are paid promptly while presenting a professional image to clients.

Creating a customized billing record is an efficient way to track sales, manage payments, and maintain accurate records. Whether you are a freelancer, a boutique owner, or a service provider, having a streamlined document that clearly outlines your services, products, and payment terms is crucial to your business’s success.

Key Components of a Billing Record for Small Businesses

- Business Information: Include your business name, address, and contact details. This helps clients identify the source of the document and facilitates communication if needed.

- Client Information: Clearly list the client’s name, address, and other relevant contact details to avoid confusion and ensure that payments are directed to the correct party.

- Detailed List of Products/Services: Break down each product or service provided, including descriptions, quantities, and individual prices. This ensures transparency and helps avoid disputes over what was sold.

- Payment Terms: Outline payment deadlines, acceptable payment methods, and any applicable discounts or late fees. Providing these details up front can help set clear expectations.

- Total Amount Due: Calculate and display the total amount due, including taxes, discounts, and shipping costs if applicable. A clear total reduces misunderstandings and encourages prompt payments.

Benefits of Using a Billing Record for Small Businesses

- Professional Appearance: A well-organized document shows clients that your business is professional and trustworthy, which can foster stronger relationships and increase client retention.

- Efficient Record Keeping: Keeping detailed records of all transactions helps ensure that your financial data is accurate and easily accessible for tax purposes and financial planning.

- Faster Payments: Clear billing documents make it easier for clients to understand what they owe and how to pay, helping you receive payments more quickly.

- Legal Protection: Proper documentation can protect your business in case of disputes, as it provides a clear record of the transaction and agreed-upon terms.

For small businesses, using a structured and professional billing document is an essential step in managing finances efficiently, building trust with clients, and ensuring smooth business operations.

Top Tools for Creating Billing Documents

Creating professional and accurate billing records is a crucial part of managing any business. Whether you’re a freelancer, small business owner, or large enterprise, using the right tools can streamline the process, save time, and ensure consistency. From basic templates to advanced software, there are various tools available to help you generate clear and precise documents that facilitate easy payment processing.

The best tools offer customizable features, automation, and integration with accounting systems, which allow you to create documents quickly and efficiently. Here’s a look at some of the top tools for creating billing documents that suit different business needs.

Top Tools for Generating Billing Records

- QuickBooks: A popular choice for small businesses, QuickBooks offers an intuitive platform for generating, sending, and tracking billing documents. It also integrates with accounting software to keep your financial records in sync.

- FreshBooks: Known for its ease of use, FreshBooks allows users to create professional-looking documents and automatically track payments. It’s especially helpful for freelancers and service providers who need simple, reliable invoicing solutions.

- Zoho Invoice: A cloud-based tool offering free and paid plans, Zoho allows users to create and send custom billing records, track time, and automate payment reminders. It’s a great choice for businesses looking for a scalable solution.

- Wave: Wave is a free invoicing and accounting software that’s perfect for small businesses. It offers customizable documents, recurring billing, and simple payment tracking, making it an excellent option for entrepreneurs on a budget.

- Invoice Ninja: Ideal for freelancers and small business owners, Invoice Ninja provides a variety of templates and features such as online payment integration, recurring billing, and expense tracking. It has both free and premium versions.

- PayPal: While PayPal is primarily a payment platform, it also allows users to create and send professional billing documents directly from their accounts. This is perfect for businesses that already use PayPal for payment processing.

Choosing the Right Tool for Your Business

- Consider Your Business Size: Larger businesses with complex needs may benefit from tools like QuickBooks or FreshBooks, while smaller businesses or freelancers may find Wave or Zoho more cost-effective and simple to use.

- Look for Automation: Tools with automated reminders, recurring billing, and payment tracking can save time and reduce errors, making them ideal for businesses with a large volume of transactions.

- Evaluate Integration Options: Choose tools that integrate with your existing accounting or payment systems, ensuring a seamless workflow and reducing manual data entry.

- Check for Customization: Look for tools that allow you to fully customize the design and content of your billing documents to match your brand and meet client expectations.

By selecting the right tool to create your billing documents, you can simplify the process, maintain professionalism, and focus on growing your business while ensuring smooth transactions with clients.