Professional Invoice Template for Electrical Work

Managing financial transactions efficiently is crucial for any contractor, especially when dealing with various types of services. Properly formatted billing statements not only help in keeping track of payments but also contribute to building trust and credibility with clients. By using a structured document, you can ensure clarity and accuracy in each charge, whether you’re working on small repairs or large-scale installations.

Having a ready-made document that fits your specific needs can save time and reduce errors. With customizable options available, you can adjust every detail, from the list of services to the final amount due. A professional-looking statement reflects your commitment to providing high-quality service and gives your business a polished appearance.

Whether you’re just starting out or have years of experience, adopting a streamlined process for billing is essential for maintaining a smooth financial workflow. This approach can minimize misunderstandings, improve communication with clients, and ultimately ensure timely payments for your efforts.

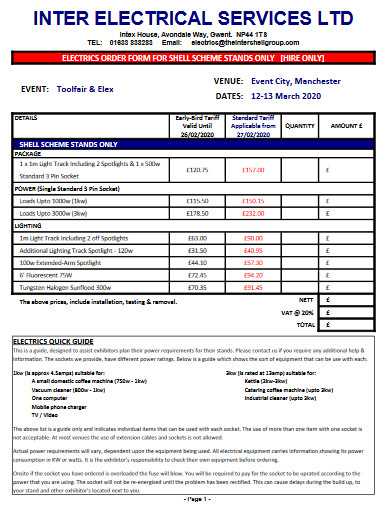

Why Use an Organized Billing System for Contractors

When managing payments in the service industry, clear documentation is essential. Having a structured approach ensures accuracy and helps maintain a professional image. By utilizing a pre-designed document, you can quickly adapt it to different job types while ensuring all relevant details are covered. This saves time and prevents any important information from being overlooked.

Using a standardized format also allows you to maintain consistency across all transactions. Whether you’re invoicing a one-time repair or an ongoing project, a uniform system ensures that both you and your clients are on the same page regarding charges, deadlines, and payment methods. Additionally, consistency can help in tracking your earnings, making it easier to manage finances and handle taxes.

Furthermore, a well-organized billing document reduces the likelihood of errors. By automatically filling in the necessary fields, the chances of mistakes such as miscalculations or missing information are minimized. This not only increases efficiency but also enhances customer satisfaction, as clients appreciate the clarity and professionalism of a properly documented payment request.

Benefits of Customizable Billing Formats

Having the flexibility to adjust your financial documents according to specific needs offers significant advantages. Customizable formats allow contractors to modify key elements, ensuring that each transaction is clearly represented and all relevant details are included. Whether it’s altering the layout, adding custom fields, or adjusting the design, this adaptability ensures that your documents align with the unique nature of each job.

Tailor Documents to Specific Jobs

With adjustable formats, you can easily tailor your documents to reflect the specifics of any given job. Whether it’s a small repair or a complex installation, you can quickly change the way you present charges, materials, and labor costs. This level of customization makes it easier to ensure accuracy and relevance in every financial statement, providing a clear and professional overview for your clients.

Enhance Professional Image

A customized format allows you to reflect your brand identity, ensuring that your documents stand out. You can add your company logo, adjust the color scheme, and modify the layout to match your overall business branding. This attention to detail creates a polished, professional impression that can build trust and encourage prompt payment from clients.

Key Elements of a Contractor Billing Document

To ensure that your financial documents are clear, comprehensive, and professional, certain details must always be included. These key elements not only help communicate the charges effectively but also ensure that both you and your client are on the same page. Whether you’re handling a small job or a large-scale project, it’s crucial to outline all necessary information to avoid confusion and facilitate smooth payment processing.

Important Information to Include

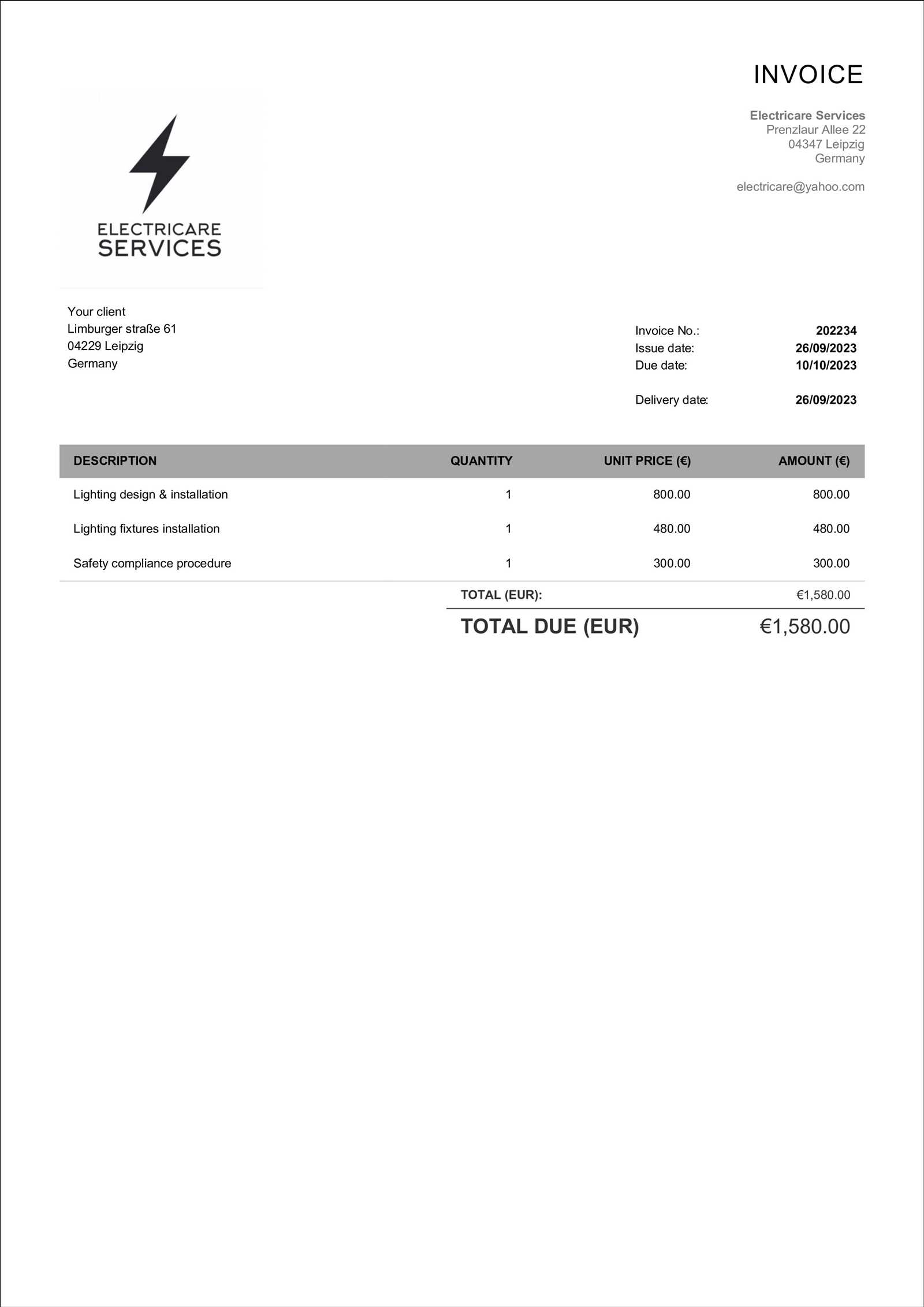

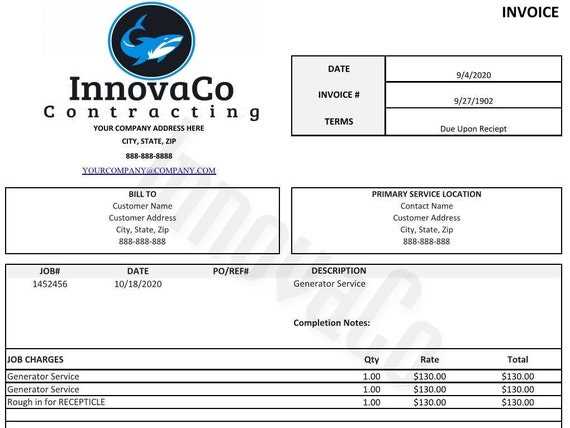

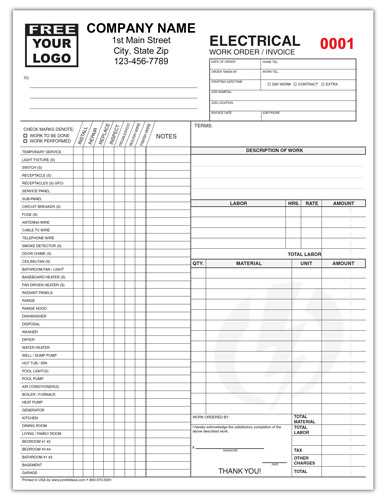

- Contact Information: Include your business name, address, phone number, and email address, as well as your client’s details.

- Job Description: Provide a brief overview of the services rendered, detailing tasks performed and materials used.

- Dates of Service: Clearly state the start and completion dates of the project to avoid any misunderstandings about the timeline.

- Itemized List of Charges: Break down each cost, including labor, materials, and any additional fees, to show full transparency.

- Total Amount Due: Summarize the total cost of the job, ensuring it reflects all charges accurately.

- Payment Terms: Include payment instructions, deadlines, and any late fees or penalties for overdue amounts.

Optional Additions for Clarity

- Payment Method: Specify accepted methods of payment, such as bank transfer, check, or credit card.

- Project Reference Number: Use a unique identifier to easily track jobs and payments, especially for long-term contracts.

- Notes or Terms: Add any important notes or special terms related to the agreement or warranty conditions.

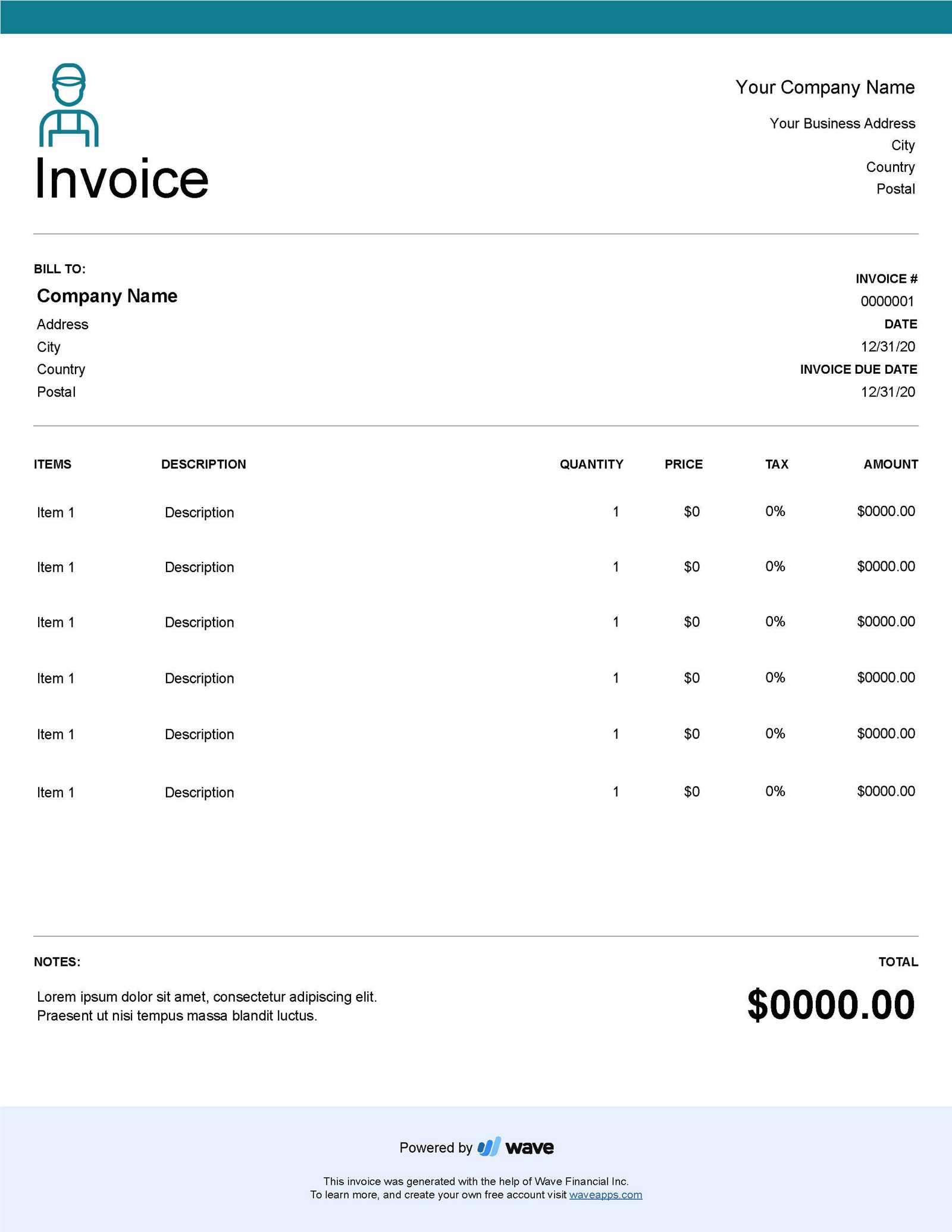

How to Create a Billing Document for Services

Creating a detailed and accurate payment request is essential for ensuring proper compensation and avoiding misunderstandings with clients. A well-constructed document outlines all the services provided, the materials used, and the total amount due, giving both parties a clear understanding of the costs involved. The process is straightforward and can be customized to suit each job’s specifics.

Follow these steps to create a professional and effective billing statement:

- Start with Your Business Information: Include your company name, contact details, and logo. Make sure the client knows who the bill is from and how to reach you for any inquiries.

- Enter Client Details: Provide the client’s name, address, and contact information. This ensures the document is personalized and identifies the recipient clearly.

- Describe the Services Provided: Break down the tasks completed during the job. List each activity and include any materials or equipment used, with corresponding costs.

- List Payment Terms: Clearly state when the payment is due, any applicable discounts, and penalties for late payments. This transparency helps avoid confusion later.

- Summarize the Total Amount: Add up all charges and provide a final amount due. Make sure the client can easily see how the total was calculated.

- Include Payment Instructions: Specify how the client should pay, such as bank transfer details, online payment options, or check instructions.

Once the document is completed, review it for any errors or missing details. A clear and professional bill helps ensure that you receive timely payments and maintain positive relationships with clients.

Choosing the Right Billing Format for Contractors

Selecting an appropriate billing format is crucial for contractors to maintain professionalism and ensure accuracy in their transactions. A well-suited document not only helps in presenting charges clearly but also saves time and reduces the risk of errors. When choosing a format, it’s essential to consider factors like customization options, layout, and the specific requirements of the job at hand.

Factors to Consider When Selecting a Billing Format

- Customization Flexibility: Choose a layout that allows easy editing for different projects. You may need to adjust for varying labor hours, material costs, or additional fees depending on the job.

- Clear Structure: Look for a format that organizes information logically, making it easy for both you and your clients to follow. Important details such as services rendered, costs, and payment terms should be easily identifiable.

- Professional Design: Select a design that reflects your business’s brand image. Whether it’s a clean and minimal layout or a more detailed format, ensure that it conveys professionalism and trustworthiness.

- Inclusion of Legal Terms: Ensure the format includes space for any necessary legal clauses or warranties relevant to your services, protecting both you and your client.

- Payment Flexibility: Opt for a format that allows you to specify various accepted payment methods and clear payment terms to avoid confusion.

Where to Find the Right Format

- Online Platforms: Many websites offer free and paid customizable options tailored to contractors. These can be adjusted to fit specific needs and often include built-in features like tax calculations.

- Software Programs: Accounting software often comes with pre-designed options that integrate seamlessly with other business tools, helping streamline your financial processes.

- Designing Your Own: If you have specific requirements, consider creating your own format. This gives you full control over the content and design, but it may require more time and effort.

By carefully considering these factors, you can select a billing format that ensures clarity, saves time, and presents your business in the best light possible.

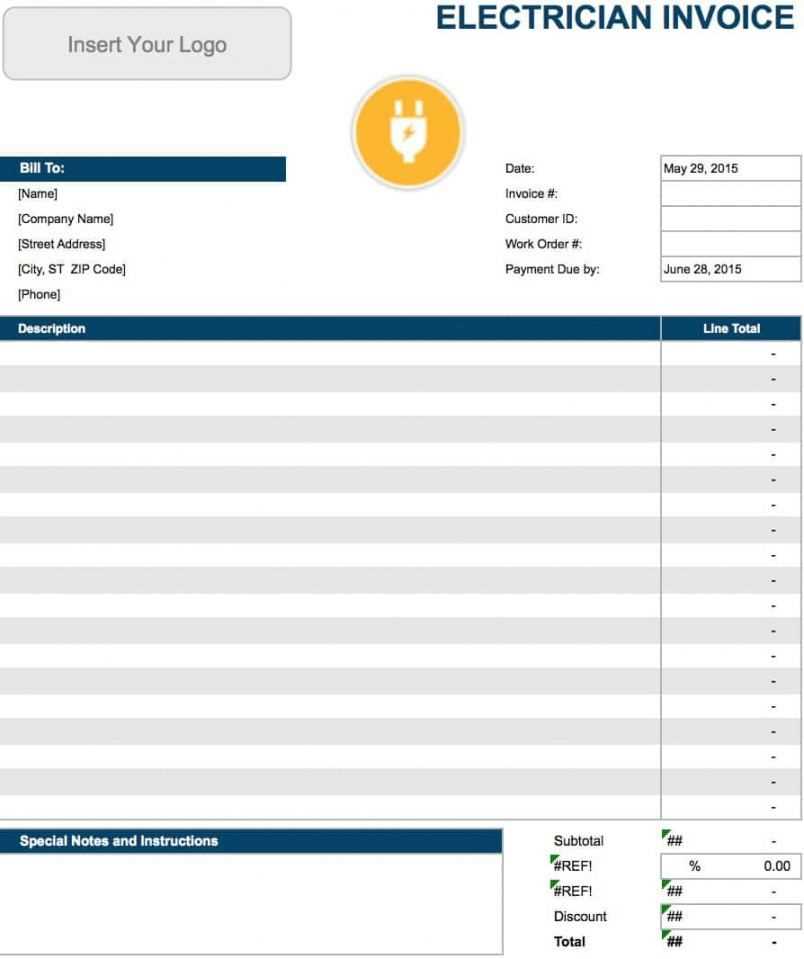

Top Features to Look for in Billing Formats

When choosing a billing format for your business, it’s important to focus on features that improve efficiency, clarity, and professionalism. A well-designed document can save you time, reduce errors, and help present a more polished image to clients. The right options will streamline the process, allowing you to manage transactions with ease and confidence.

Key Features to Ensure Accuracy and Efficiency

- Itemized Breakdown: A clear, detailed list of services and materials used is essential for transparency. This allows clients to easily understand what they are being charged for, preventing confusion or disputes.

- Customizable Fields: The ability to adjust details such as dates, hourly rates, or specific tasks ensures that the format can be used for a wide range of projects without needing major revisions.

- Tax Calculation Support: Built-in options for adding taxes based on your location or industry help avoid mistakes and ensure compliance with local regulations.

- Professional Layout: A clean, easy-to-read design gives a professional appearance and makes the document more user-friendly, which can enhance your client’s experience.

- Payment Terms Section: A clearly defined section outlining payment due dates, accepted payment methods, and any penalties for late payments helps set expectations and fosters timely transactions.

Additional Features for Enhanced Functionality

- Automatic Calculations: Automatic summing of costs, taxes, and totals reduces manual errors and saves time, especially when dealing with multiple line items.

- Brand Customization: The ability to add your business logo, contact information, and colors ensures that the format aligns with your company’s branding, making it look professional and cohesive.

- Multi-Currency Support: If you work with international clients, having an option to display amounts in different currencies can be incredibly helpful for clarity and professionalism.

Choosing a format with these key features will not only simplify your billing process but also ensure that your documents are accurate, clear, and aligned with your business needs.

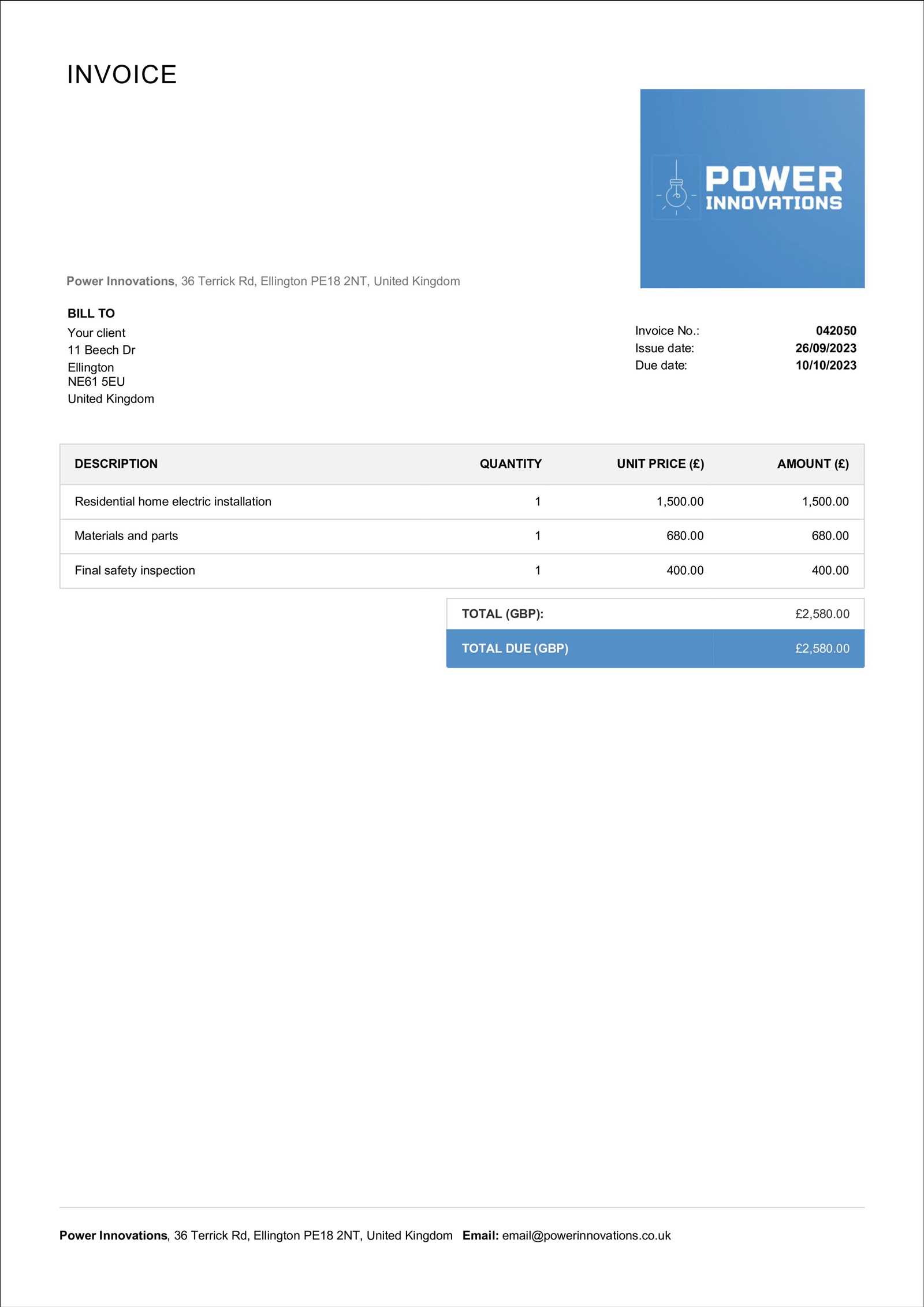

How to Add Taxes to Billing Documents

Adding taxes to your financial documents is a crucial step in ensuring compliance with local laws and providing transparency to your clients. Calculating the correct tax rate based on the services or goods provided ensures that both you and your clients understand the full amount due. This step can be easily managed with the right approach and tools.

Steps to Add Taxes

- Determine the Applicable Tax Rate: Research the tax rates in your region or industry. The rate may vary depending on the location of your business or the client, as well as the type of service provided.

- Calculate the Tax Amount: Once you know the applicable rate, multiply the total charges by the tax rate to determine the tax amount. For example, if your total is $500 and the tax rate is 8%, the tax will be $40.

- Include Tax Information Clearly: Make sure the tax is listed as a separate line item, clearly labeled, so that the client can easily identify the tax amount being added to the total cost.

- Check for Exemptions: Some services or materials may be exempt from tax depending on local regulations. Make sure to adjust your calculations accordingly if any exemptions apply.

Tips for Accuracy and Compliance

- Use Software or Online Tools: Consider using accounting software or automated tools to calculate taxes accurately. These tools can also ensure compliance with up-to-date tax laws and make the process faster.

- Stay Updated on Tax Changes: Tax rates can change frequently, so it’s important to stay informed about any updates in your area to avoid undercharging or overcharging clients.

- Include Tax Identification Number: Some regions require businesses to include their tax identification number (TIN) or VAT number on their billing documents. Check local regulations to ensure compliance.

By following these steps, you can confidently add taxes to your billing documents, ensuring clarity for your clients and compliance with tax regulations.

Billing Document Design Tips for a Professional Look

Creating a polished and well-organized financial document is essential for building trust and credibility with your clients. The design of the document plays a crucial role in conveying professionalism, clarity, and attention to detail. By focusing on simplicity, consistency, and functionality, you can create a document that reflects your business’s commitment to quality and enhances the overall client experience.

Here are some design tips to ensure your billing documents make a positive impression:

- Use a Clean and Simple Layout: Avoid clutter and ensure that all important information is easy to find. A well-structured format with clearly defined sections helps clients quickly understand the charges and terms.

- Incorporate Your Branding: Include your logo, company colors, and fonts that align with your brand identity. A consistent visual appearance enhances professionalism and makes your documents instantly recognizable.

- Use Clear Headings and Subheadings: Break the document into sections with bold, easy-to-read headings. This makes it easier for clients to navigate through different details such as services provided, materials used, and payment terms.

- Keep Fonts Professional: Stick to classic fonts like Arial, Times New Roman, or Helvetica for readability. Avoid using too many different fonts or overly decorative styles, as

Best Practices for Contractor Billing

Managing financial transactions effectively is essential for ensuring that both you and your clients have a clear understanding of charges and expectations. By implementing best practices in how you structure and present payment documents, you can avoid confusion, reduce the risk of errors, and improve cash flow. Consistency, transparency, and professionalism are key components of successful billing in the service industry.

Here are some best practices to help streamline your billing process and maintain a positive relationship with clients:

- Be Clear and Transparent: Provide a detailed breakdown of all services rendered, materials used, and additional costs. Transparency helps avoid disputes and builds trust between you and your clients.

- Set Clear Payment Terms: Clearly state when payment is due, what payment methods are accepted, and any late fees that may apply. This avoids misunderstandings and ensures that clients know what to expect.

- Send Documents Promptly: Issue your billing statements as soon as possible after the completion of a project. The sooner the client receives the document, the sooner they can process payment.

- Keep It Professional: Ensure that all financial documents are well-organized, free of errors, and maintain a professional tone. A well-crafted document reflects your attention to detail and commitment to quality.

- Follow Up When Necessary: If payments are overdue, don’t hesitate to follow up politely. Sending a gentle reminder can encourage timely payments and prevent delays.

- Use Technology: Consider using accounting or invoicing software to automate and track payments. These tools can streamline the billing process and reduce human error, helping you focus on your business.

By following these best practices, you’ll not only improve the efficiency of your billing process but also foster stronger relationships with your clients, ensuring smooth transactions and a positive reputation for your business.

Automating Your Billing Process

Streamlining the process of creating and sending payment requests can significantly improve efficiency and reduce the chances of errors. By automating your billing system, you can save time on manual tasks, ensure that all details are accurately included, and maintain consistent communication with your clients. This also helps you stay organized, track payments, and focus on other aspects of your business.

Here are some ways to automate your billing process effectively:

- Use Accounting Software: Modern accounting platforms offer automated billing features that allow you to create, send, and track payment requests with just a few clicks. Many of these tools integrate with other business functions, such as expense tracking, payroll, and reporting, helping you stay on top of your finances.

- Set Up Recurring Payments: If you have clients who require ongoing services, consider setting up recurring billing schedules. This way, you can automatically generate and send payment requests at set intervals, saving time and ensuring that you’re paid on schedule.

- Enable Payment Gateways: Many invoicing systems integrate with online payment platforms, allowing clients to pay via credit card, bank transfer, or other methods directly from the document. This makes it easier for clients to settle their balances quickly and conveniently.

- Customize Automated Reminders: Set up automatic reminders for clients with outstanding balances. You can program notifications to be sent before or after a payment due date, keeping the process on track without having to manually follow up each time.

- Track Payment Status Automatically: Many automated systems let you monitor when payments are received and which clients still owe money. This can help you quickly identify any overdue balances and manage your cash flow more effectively.

Automating your billing process not only saves time but also ensures greater accuracy and consistency in your financial management. By adopting the right tools, you can handle payments more efficiently and maintain better control over your business finances.

How to Track Payments for Jobs

Keeping track of payments is a critical aspect of managing any service-based business. By monitoring payment statuses, you can ensure timely cash flow, identify overdue accounts, and maintain good relationships with clients. Establishing a reliable method for tracking payments will help you stay organized and avoid confusion as you manage multiple projects.

Methods for Effective Payment Tracking

There are several ways to efficiently track payments for completed projects. The best approach depends on the size of your business, the volume of transactions, and the tools you prefer to use. Here are some strategies to consider:

- Manual Tracking: For smaller operations, you can use spreadsheets to manually record payments. This is an affordable method but requires careful attention to ensure all details are entered correctly.

- Accounting Software: Many businesses use software that integrates tracking and financial management. These tools automatically update payment statuses and can even send reminders to clients with overdue balances.

- Payment Records: Always keep a record of when payments are received, the method of payment (check, bank transfer, cash), and any related transaction details. This ensures transparency and reduces confusion.

Sample Payment Tracking Table

Here is an example of how you can structure your payment tracking using a simple table format:

Client Name Job Description Amount Due Payment Received Payment Date Outstanding Balance John Doe Residential Wiring $500 $500 10/01/2024 $0 Jane Smith Lighting Installation $350 $200 10/05/2024 $150 Robert Brown Panel Upgrade $750 $0 Pending $750 By maintaining a clear and organized record like the one above, you can easily track when payments are made, identify outstanding balances, and take the necessary steps to ensure timely payment. This method will help prevent misunderstandings and keep your financials in check.

Common Mistakes in Billing Documents

Errors in financial documents can lead to confusion, payment delays, or disputes with clients. It’s essential to carefully review each document before sending it out to ensure accuracy. Small mistakes can have significant consequences, affecting cash flow and your professional reputation. In this section, we’ll explore some of the most common mistakes that can occur when creating payment requests for services.

Common Errors to Avoid

- Incorrect Client Information: Always double-check the client’s name, address, and contact details. Mistakes in this area can cause delays and may appear unprofessional.

- Missing or Incorrect Payment Terms: If payment deadlines or accepted payment methods are unclear, it can lead to confusion and delayed payments. Be sure to clearly state when the payment is due and how it can be made.

- Omitting Taxes or Fees: Failing to include applicable taxes or fees can result in unexpected financial shortfalls. Always calculate taxes and any additional charges accurately, and list them separately on the document for transparency.

- Unclear Descriptions of Services: Providing vague or incomplete descriptions of the services or products provided can lead to misunderstandings. Ensure that each service is clearly outlined, including quantities and rates.

- Failure to Include a Unique Reference Number: Without a unique reference number, tracking and organizing financial records becomes difficult. Always assign a number to each document for easy reference and record-keeping.

- Not Double-Checking Totals: A simple math error can lead to significant discrepancies. Ensure that totals, including taxes and any adjustments, are correct before sending out the document.

How to Prevent These Mistakes

- Use Automated Tools: Consider using accounting software or invoicing platforms that automatically calculate totals, taxes, and generate payment reminders. This reduces the risk of human error.

- Review Documents Thoroughly: Always take time to carefully review each document before sending it out. Having a second set of eyes can help catch mistakes you might have missed.

- Standardize Your Format: Develop a consistent format for your documents. This ensures that all the necessary information is included every time, reducing the likelihood of omissions.

By being mindful of these common mistakes and taking steps to avoid them, you can improve the accuracy and professionalism of your financial documents and foster positive relationships with your clients.

Legal Requirements for Billing Documents

When creating financial documents for services rendered, it’s essential to comply with local laws and regulations to ensure that both you and your clients are protected. Legal requirements often vary depending on your location and the nature of the services provided, so it’s crucial to understand what information needs to be included to avoid potential legal issues. Failing to adhere to these requirements can lead to penalties, disputes, or even issues with tax authorities.

Here are some common legal requirements you should be aware of when preparing your payment requests:

- Business Identification Details: Most jurisdictions require that you include your business name, address, and contact details. This helps ensure that the recipient knows exactly who is requesting payment.

- Tax Identification Number: Depending on your location, you may be required to include a tax identification number (TIN) or VAT number on all formal financial documents. This helps ensure proper tax reporting and compliance.

- Clear Breakdown of Charges: Many regions require a detailed breakdown of all charges, including services provided, materials used, and applicable taxes. This helps prevent confusion and ensures that clients understand exactly what they are paying for.

- Payment Terms: Legal guidelines often stipulate that you must clearly specify the payment terms, such as due date, late fees, and accepted payment methods. This helps to protect both parties in case of disputes regarding payment.

- Date of Issue and Payment Due Date: Most legal systems require that you specify both the date the document is issued and the due date for payment. This is essential for establishing a timeline and ensuring that payments are made promptly.

- Currency and Amounts: The total amount due must be stated clearly, with the currency being specified if you’re dealing with international clients. This ensures that there is no ambiguity about the payment to be made.

- Client Information: It’s important to include the client’s full name or company name and their contact details. This ensures that the document is personalized and legally tied to the specific client.

Complying with legal requirements not only protects your business but also establishes a professional image. To avoid legal complications, stay informed about the specific regulations in your region and industry and make sure that all required information is included in your financial documents.

Managing Multiple Billing Documents for Large Projects

When working on large-scale projects, it’s common to handle multiple payment requests throughout the course of the job. Whether the project spans several months or involves multiple phases, managing numerous financial documents can become complex. Proper organization and efficient tracking are key to ensuring smooth operations and timely payments. In this section, we’ll explore strategies to handle multiple documents and maintain control over your finances while managing large projects.

Here are some essential tips for managing multiple payment documents in the context of extensive jobs:

- Break Down the Project into Phases: For larger projects, consider dividing the work into clearly defined phases. You can issue payment requests at the completion of each phase, ensuring that both you and the client have a clear understanding of the work completed and the payments owed.

- Use a Master Record: Keep a comprehensive record of all transactions related to the project. This master list should include the details of each document issued, the amounts paid, and any outstanding balances. This will allow you to quickly reference the status of the project’s payments.

- Set Clear Milestones: Establish milestones with your client that correspond to specific points in the project. These milestones can then trigger payment requests, helping to ensure that payments are made in a timely manner as work progresses.

- Utilize Project Management Tools: Consider using project management software that integrates financial tracking. These tools allow you to manage multiple projects simultaneously, keeping a running total of payments received and outstanding amounts, which makes it easier to stay on top of each project’s financials.

- Organize by Date and Client: When managing multiple projects, keep a separate file or folder for each client or project. Sorting payment documents by project or date can help prevent confusion and reduce the chances of misplaced or duplicated records.

- Regularly Review Outstanding Balances: Make it a habit to review the status of all outstanding payments. This allows you to address any overdue balances promptly, and ensures that no payments are missed as the project progresses.

By implementing these practices, you can keep your financial records organized, minimize confusion, and ensure that payments are made promptly throughout the duration of large-scale projects. The key is to maintain clarity, consistency, and proactive communication with your clients.

How to Edit and Update Your Billing Document

As your business grows and evolves, it’s important to periodically review and update your payment request documents to ensure they reflect any changes in your services, rates, or business structure. Keeping your financial records up-to-date not only ensures consistency and accuracy but also helps maintain a professional image with your clients. In this section, we’ll explore how to make necessary updates and edits to your documents effectively.

Here are some key steps to follow when editing and updating your payment requests:

- Review Your Business Information: Ensure that all your contact details, such as your business name, phone number, email address, and physical address, are accurate and current. This is crucial for maintaining clear communication with your clients.

- Update Service Descriptions: If you’ve expanded your services or changed the nature of your offerings, make sure the descriptions of the services you provide are up-to-date. This will prevent misunderstandings about the work you’ve completed and the charges associated with it.

- Adjust Rates and Fees: If you’ve changed your pricing structure, ensure that the new rates are reflected on your documents. Be sure to update hourly rates, flat fees, material costs, or any other charges you might include.

- Include Legal and Tax Information: Make sure that all required tax information, such as tax rates, VAT numbers, and other legal details, are present and accurate. This helps ensure compliance with local regulations and avoids potential issues with authorities.

- Modify Payment Terms: Review and update your payment terms to reflect any changes in your policies, such as payment due dates, late fees, or accepted payment methods. This ensures your clients are aware of the current expectations when it comes to payments.

- Check for Consistency: It’s essential to maintain a consistent layout and style across all documents. Review the overall design to ensure the formatting remains professional, with clearly labeled sections and a logical flow of information.

- Ensure Clear Contact Information: Always check that your contact details are prominently displayed and easy for clients to find. This helps avoid delays in communication if a client has questions or needs clarification on the charges.

Updating and editing your payment request documents doesn’t have to be a complex task. By regularly reviewing and adjusting them to reflect changes in your services, rates, and policies, you’ll ensure that your documents remain accurate, professional, and in line with your business needs.

Why Accurate Billing Documents Matter for Electricians

When providing services to clients, having accurate and well-prepared billing documents is crucial to ensure smooth financial transactions and maintain a professional image. Whether you’re handling residential projects or larger commercial contracts, the clarity and precision of your payment requests can significantly impact your business’s cash flow and reputation. Accurate documents not only reflect the work done but also protect both you and your clients in case of disputes.

Benefits of Accurate Billing Documents

- Builds Trust with Clients: Clear, accurate documents demonstrate professionalism and reliability. Clients are more likely to trust a service provider who provides detailed and error-free records of the work completed, as it reduces the chance of misunderstandings or disputes.

- Ensures Timely Payments: When documents are precise and easy to understand, it’s easier for clients to process payments on time. Detailed billing helps clarify exactly what is being paid for, reducing the risk of delayed or missed payments.

- Minimizes Errors and Discrepancies: A well-structured payment request reduces the likelihood of mistakes, such as incorrect charges or missed items. This can help avoid unnecessary back-and-forth communication with clients over billing discrepancies.

- Supports Legal Protection: Accurate records provide a clear trail of all services rendered, which is essential in case of legal disputes. If clients question the charges or refuse to pay, a detailed document can serve as evidence in any legal or contractual matter.

- Aids in Tax Compliance: Maintaining accurate records is vital for tax purposes. Proper documentation ensures that you are reporting the correct income, as well as any applicable taxes, which can prevent issues with tax authorities.

How to Ensure Accuracy

- Use a Consistent Format: Establish a standard format for your billing documents that includes all necessary details, such as service descriptions, pricing, taxes, and payment terms. This consistency makes it easier to generate accurate records for each client.

- Double-Check All Details: Before sending out a payment request, always review the document for errors. Ensure that the dates, amounts, client details, and service descriptions are all accurate.

- Keep Detailed Records: Maintain comprehensive records of the services performed, including the hours worked, materials used, and any other relevant information. This will help you create accurate billing documents and track the financials of each project.

In summary, taking the time to create accurate billing documents will save you time, reduce potential issues, and help build stronger relationships with your clients. It’s a small investment that pays off in the long run by improving cash flow, increasing client satisfaction, and protecting your business’s reputation.