Commercial Invoice Printable Template for Quick and Easy Billing

Efficient documentation is a cornerstone of any successful business transaction. Whether you’re managing sales, services, or freelance work, having a structured and easy-to-use system for generating receipts and payment requests is crucial. A well-organized billing format ensures clarity, prevents confusion, and streamlines the payment process for both you and your clients.

Customizable billing forms are essential for businesses that need to send clear and precise financial statements. These forms not only simplify the administrative work but also help maintain professionalism in every transaction. By tailoring your document to match your company’s needs, you can ensure consistency and avoid common mistakes.

Using a pre-designed, ready-to-use format makes creating these documents quick and hassle-free. With a little personalization, they become a powerful tool for managing your finances, saving time, and enhancing your business’s credibility. In this article, we will explore the different features that make these forms highly functional and how you can use them effectively in your daily operations.

Understanding Professional Billing Document Formats

When managing business transactions, having a standardized document to request payments or confirm financial agreements is essential. These documents help both businesses and clients maintain transparency, ensuring there are no misunderstandings about amounts owed, payment terms, or the nature of the services or goods provided.

Ready-made formats for these financial documents offer flexibility and consistency, making the process of creating accurate statements much simpler. By using a pre-designed structure, businesses can focus more on the details of the transaction, while the format itself handles the layout and essential fields.

Here are some key reasons why these forms are valuable:

- Time Efficiency: Pre-formatted layouts reduce the time needed to create each document from scratch.

- Consistency: Using a standardized design ensures all your financial documents look professional and follow the same format.

- Customization: These documents can be adapted to fit the specific needs of different businesses and industries.

- Accuracy: Pre-designed fields help minimize errors in data entry and ensure that all required information is included.

By understanding the benefits and structure of these financial documents, businesses can improve their accounting processes and maintain better relationships with clients. Proper use of these forms enhances efficiency, minimizes mistakes, and increases professionalism in every transaction.

What is a Professional Billing Document Format?

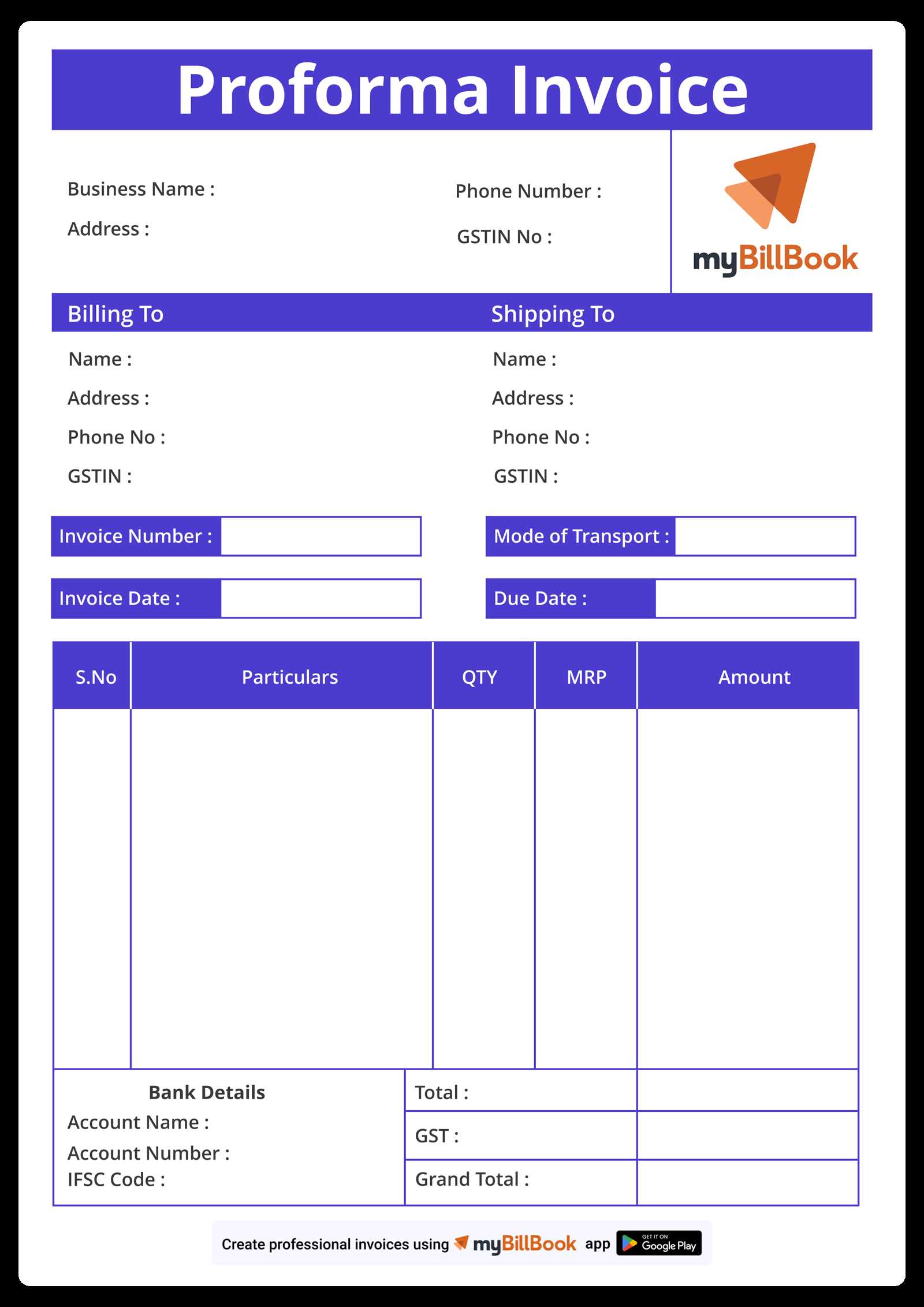

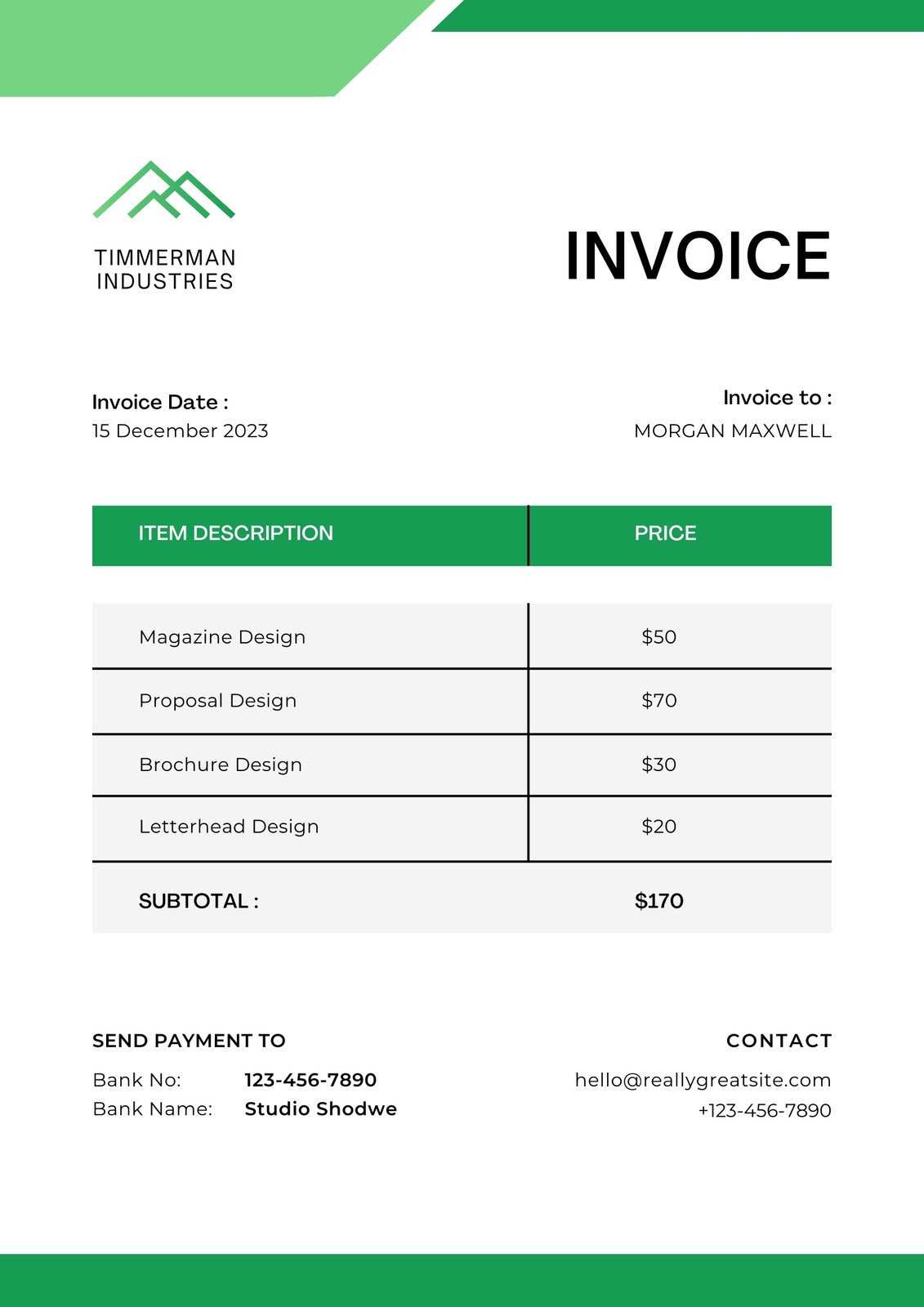

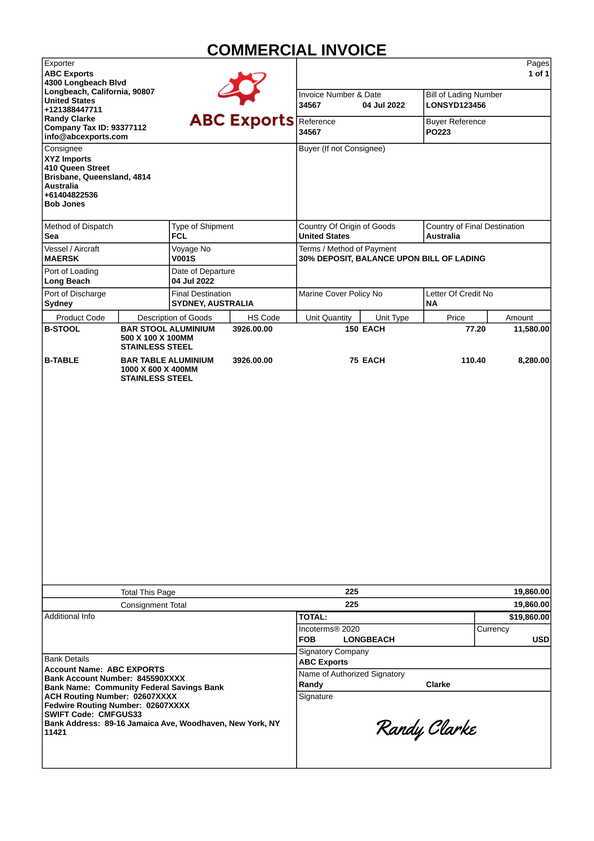

A professional billing document is a formal record used by businesses to request payment for goods or services provided. It includes all the necessary information about the transaction, such as the items sold, their prices, quantities, and payment terms. This type of document serves as proof of the agreement between the business and the client, ensuring clarity and minimizing disputes.

Key Features of a Billing Document

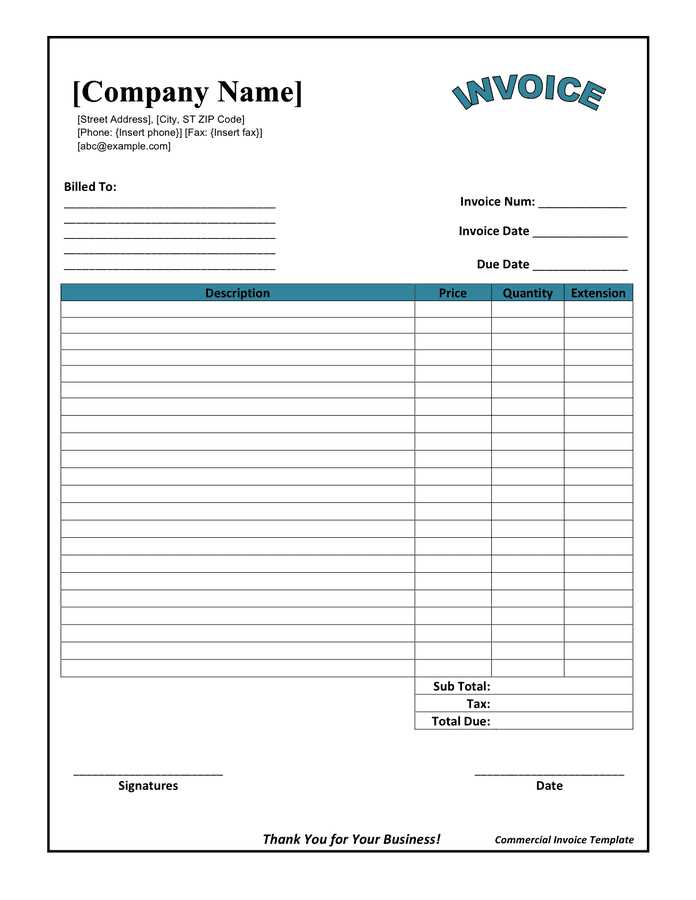

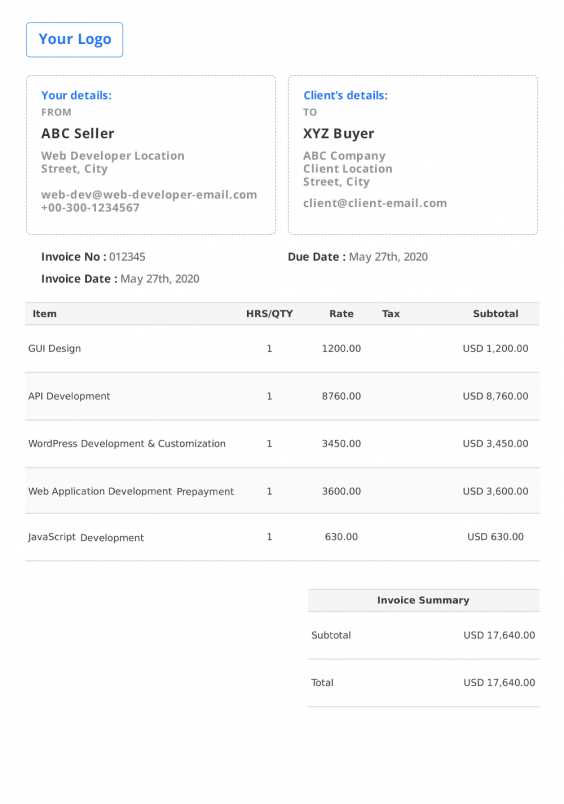

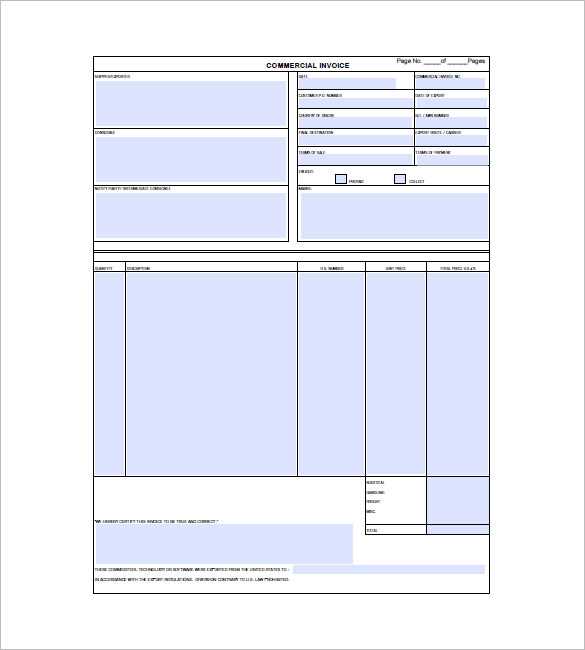

A well-designed billing document typically contains several essential components that help both parties keep track of the transaction details. These include:

- Contact Information: The names, addresses, and contact details of both the seller and the buyer.

- Description of Goods or Services: A clear breakdown of what was sold, including any relevant product or service codes.

- Payment Terms: Information about the total amount due, payment due date, and any applicable taxes or discounts.

- Unique Identification Number: A reference number or code that helps both parties track and reference the transaction.

- Signature: An optional field for both parties to sign, confirming the agreement.

Why Use a Standardized Format?

Using a standardized layout ensures that all the critical information is included in an organized way. This consistency helps reduce errors, speeds up the process of creating billing documents, and makes it easier to manage multiple transactions over time. Additionally, businesses can customize the layout to reflect their brand identity, while still maintaining the necessary structure for clarity and compliance.

Benefits of Using Printable Invoices

Using standardized billing documents offers numerous advantages for businesses of all sizes. These pre-structured forms streamline the process of requesting payments, helping to reduce administrative time and ensure accuracy in each transaction. With a clear format, businesses can provide clients with professional, easy-to-read statements, fostering better communication and smoother operations.

Time and Efficiency

One of the key benefits of using ready-made billing forms is the time saved during the creation process. These documents eliminate the need to start from scratch for every transaction. By simply filling in the necessary information, businesses can quickly generate an accurate and professional document.

Consistency and Accuracy

With a pre-set layout, these documents ensure that all required fields are included and presented in a logical, organized manner. This reduces the risk of missing critical information and improves the overall accuracy of each statement.

| Benefit | Description |

|---|---|

| Time-saving | Quickly generate accurate documents with minimal effort. |

| Professional Appearance | Consistent design boosts business credibility and client trust. |

| Reduced Errors | Predefined fields ensure all relevant details are included, minimizing mistakes. |

| Customizability | Easily adjust the document to meet specific needs and branding guidelines. |

Incorporating a structured approach to your payment requests not only boosts efficiency but also helps maintain professionalism. Whether you’re managing small-scale operations or large volumes of transactions, using these documents can enhance your workflow and improve client relations.

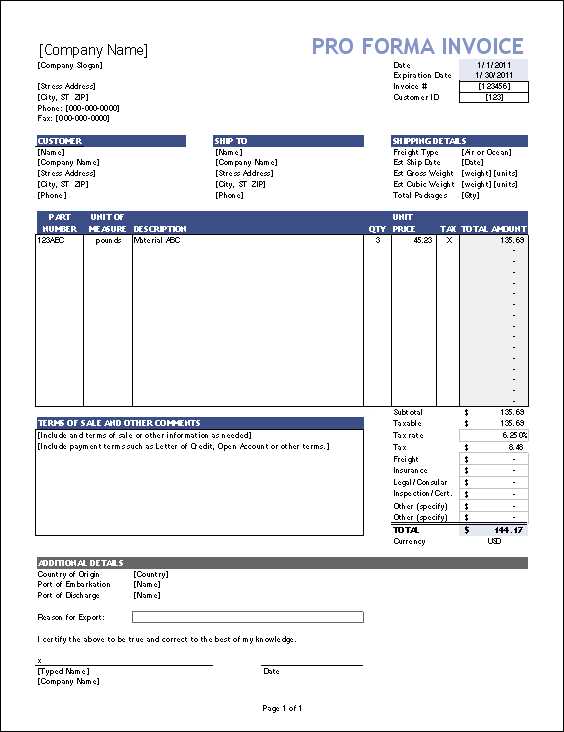

How to Customize a Billing Document Format

Customizing a billing document is a straightforward process that allows businesses to tailor the layout and content to meet their specific needs. Personalizing the document ensures it reflects your company’s branding and includes all necessary details relevant to your business transactions. Whether you’re adding your logo, adjusting the layout, or modifying the fields, customization helps create a professional and consistent appearance for all your payment requests.

The customization process generally involves a few simple steps:

- Adjust Layout: Modify the arrangement of key sections such as the contact details, product descriptions, and payment terms to suit your preferences.

- Add Branding: Incorporate your company’s logo, color scheme, and fonts to make the document match your brand identity.

- Modify Field Labels: Customize field titles like “item description” or “payment due date” to ensure clarity and relevance for your industry.

- Include Payment Instructions: Clearly outline your preferred methods of payment, terms, and any late fees or discounts.

- Additional Information: Add sections for specific business needs, such as delivery instructions, tax numbers, or custom notes for clients.

Customization tools are often included in many software programs or online platforms, allowing businesses to make quick adjustments without requiring design skills. Even without specialized software, simple word processors or spreadsheet programs can help create an effective, personalized document.

Once the document is customized, businesses can save it as a template for future use, ensuring that the layout and branding remain consistent across all transactions.

Key Elements of a Billing Document

A well-structured billing document is essential for clear communication between businesses and clients. It outlines the transaction details, ensuring that both parties are aware of the amount due, the services or goods provided, and any other relevant terms. The key elements of such a document not only help in maintaining transparency but also support legal and financial compliance.

Essential Components

Every billing document should contain the following elements to ensure completeness and clarity:

- Business and Client Information: Full names, addresses, and contact details of both the seller and the buyer.

- Unique Reference Number: A distinct code or number to identify the transaction for tracking purposes.

- Itemized List: A clear breakdown of the goods or services provided, including quantities, unit prices, and total costs.

- Payment Terms: Details about the total amount due, applicable taxes, discounts, and the payment due date.

- Terms and Conditions: Specific payment instructions, penalties for late payments, and any applicable warranties or returns policies.

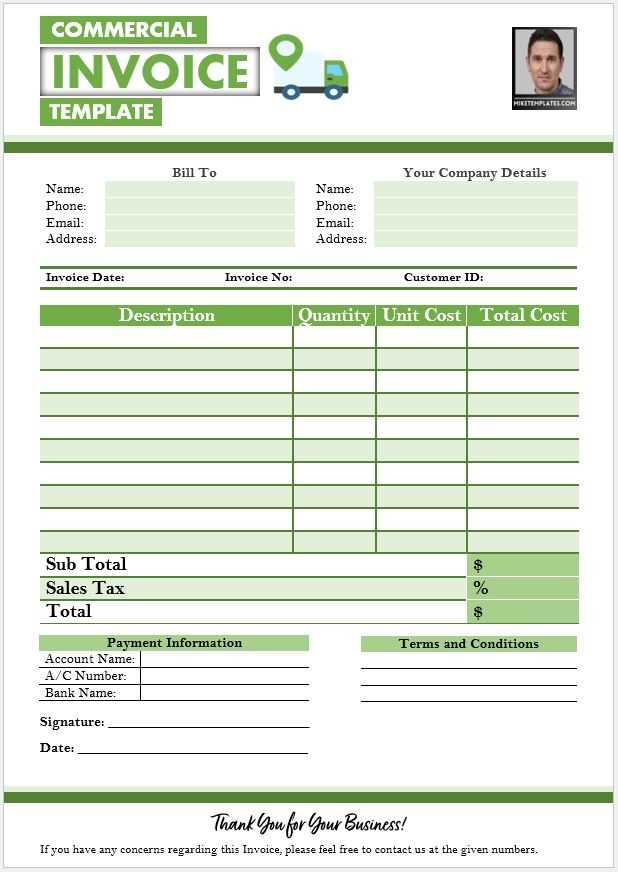

Additional Information

In some cases, a billing document may also include additional details that can help clarify the terms of the transaction:

- Shipping Information: If applicable, shipping costs and delivery details may be included, such as expected delivery date and address.

- Notes or Special Instructions: Any additional notes, such as custom instructions or personalized terms, can be added to ensure that both parties understand the agreement.

- Signatures: Some documents may include spaces for the buyer and seller to sign, confirming agreement to the terms of the transaction.

By incorporating these key elements into your billing document, you create a clear, professional record of the transaction that can help prevent misunderstandings and ensure timely payments.

Best Practices for Creating Billing Documents

Creating accurate and professional billing documents is essential for maintaining smooth business operations. A well-crafted document not only ensures that you are paid promptly but also establishes trust and professionalism with your clients. By following best practices, businesses can avoid common mistakes, reduce the risk of disputes, and maintain consistency across all financial records.

Here are some best practices to follow when creating billing documents:

- Be Clear and Detailed: Provide a comprehensive breakdown of all goods or services provided, including quantities, prices, and descriptions. Clear details minimize confusion and prevent clients from questioning the charges.

- Use a Consistent Format: Always use the same layout and structure for all billing documents. This helps clients easily recognize and understand your documents, while also making it easier for you to manage records.

- Check for Accuracy: Ensure that all information, such as dates, amounts, and client details, is accurate. Mistakes in these areas can cause delays in payment or damage your reputation.

- Include Payment Terms: Clearly state the due date, payment methods, and any late fees or discounts. Make sure these terms are easy to find and understand.

- Keep It Professional: Use your company’s branding, such as logos, colors, and fonts, to create a cohesive and polished look. A professional design reinforces your brand and builds credibility.

Review and Proofread your documents before sending them to ensure there are no errors. A quick review can help catch any missing information or incorrect data, preventing issues later on. It’s also helpful to save your billing documents in a format that is easy to share and store, such as PDF.

By adopting these best practices, you can improve your billing process, ensure clarity with your clients, and streamline your financial workflows.

Common Mistakes in Billing Documents

Even the most experienced businesses can make mistakes when creating payment requests. These errors can cause delays in payments, misunderstandings with clients, and even affect the overall professionalism of the business. Identifying and avoiding common mistakes is essential to ensure smooth transactions and maintain good relationships with clients.

Common Errors in Billing Documents

Below are some of the most frequent mistakes businesses make when preparing billing statements:

- Incorrect Contact Information: One of the most basic errors is providing inaccurate or incomplete details for the buyer or seller, such as wrong addresses or missing contact numbers.

- Missing or Incorrect Dates: Not including the correct date of issue or due date can lead to confusion about when payment is expected.

- Unclear Descriptions: Vague or incomplete descriptions of products or services can lead to disputes. Always ensure that each item is described clearly and in detail.

- Inaccurate Amounts: Mistakes in pricing or missing charges (like tax or delivery fees) can cause issues. Double-check all calculations before finalizing the document.

- Missing Payment Terms: Failing to include payment methods, due dates, and any penalties for late payment can result in confusion or delayed payments.

How to Avoid These Mistakes

To minimize these common errors, here are a few tips:

- Double-check details: Review the contact information, dates, and amounts before sending the document.

- Use automation tools: Billing software can help reduce human error by automatically filling in consistent details, like client information and pricing.

- Set clear expectations: Always outline clear payment terms and ensure they are easily visible in the document.

- Proofread: A thorough review before sending ensures that you spot any mistakes that might have been overlooked.

By avoiding these common mistakes, businesses can create clear, accurate, and professional documents that streamline the payment process and enhance client relationships.

Why Ready-Made Documents Save Time

Creating accurate billing records from scratch for every transaction can be time-consuming and prone to errors. Ready-made forms that are pre-structured with essential fields save significant amounts of time by allowing businesses to quickly input transaction details without having to worry about the document layout or formatting. These ready-to-use solutions streamline the entire process, making it more efficient and less stressful.

Eliminating Manual Formatting

One of the most time-consuming aspects of creating payment requests is formatting the document. When using pre-designed forms, this step is eliminated. The structure is already set, with designated spaces for client information, items, prices, and payment terms. This means you can focus on the details, such as the transaction information itself, rather than spending time adjusting the layout or aligning text.

Consistency and Efficiency

With a ready-made format, businesses can ensure that each document follows a consistent structure. This consistency reduces the time needed to review and adjust each statement, as the same fields and sections are always present. Additionally, businesses don’t have to re-enter commonly used information like contact details, payment terms, or tax rates. By saving these as default fields, you can create a new document in just a few minutes.

Automation tools that work in tandem with these forms can further speed up the process. These tools can pre-fill repetitive fields, calculate totals, and even generate unique reference numbers automatically. This reduces manual input, further saving time and ensuring accuracy.

Ultimately, using these pre-structured formats frees up valuable time for businesses, allowing them to focus on more critical tasks like customer relations or managing other operational activities.

Choosing the Right Billing Document for Your Business

Selecting the appropriate structure for your billing documents is a crucial decision for any business. The right format not only ensures clear communication with clients but also supports smooth financial management. Different industries and business models may require slightly different layouts and information, so it’s important to choose a style that best fits your needs and operations.

When evaluating different formats, consider the following factors:

| Factor | Description |

|---|---|

| Industry Requirements | Certain industries may require specific details on their billing documents, such as tax ID numbers or compliance statements. Ensure your form includes these elements. |

| Document Complexity | If you provide complex services or sell a wide range of products, a more detailed form may be necessary to list each item, its description, and any applicable fees. |

| Branding | Your document should reflect your business’s identity. Choose a format that allows customization with your logo, colors, and font style. |

| Payment Terms | Make sure the format allows you to clearly display your payment terms, including due dates, late fees, and payment methods. |

| Ease of Use | The layout should be simple and intuitive, enabling quick entry of necessary information without confusion. |

By considering these factors, you can ensure that your billing forms align with your business goals, improving both the efficiency of your financial processes and your relationship with clients. A well-chosen format will save time, reduce errors, and create a more professional image for your company.

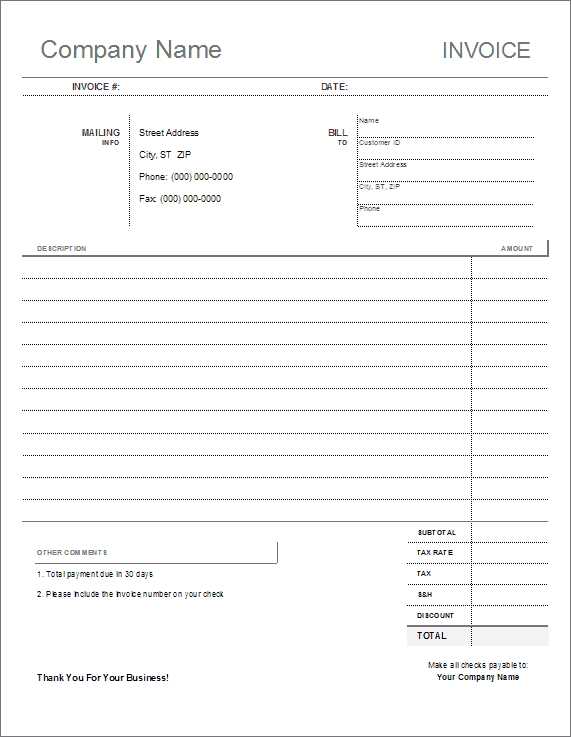

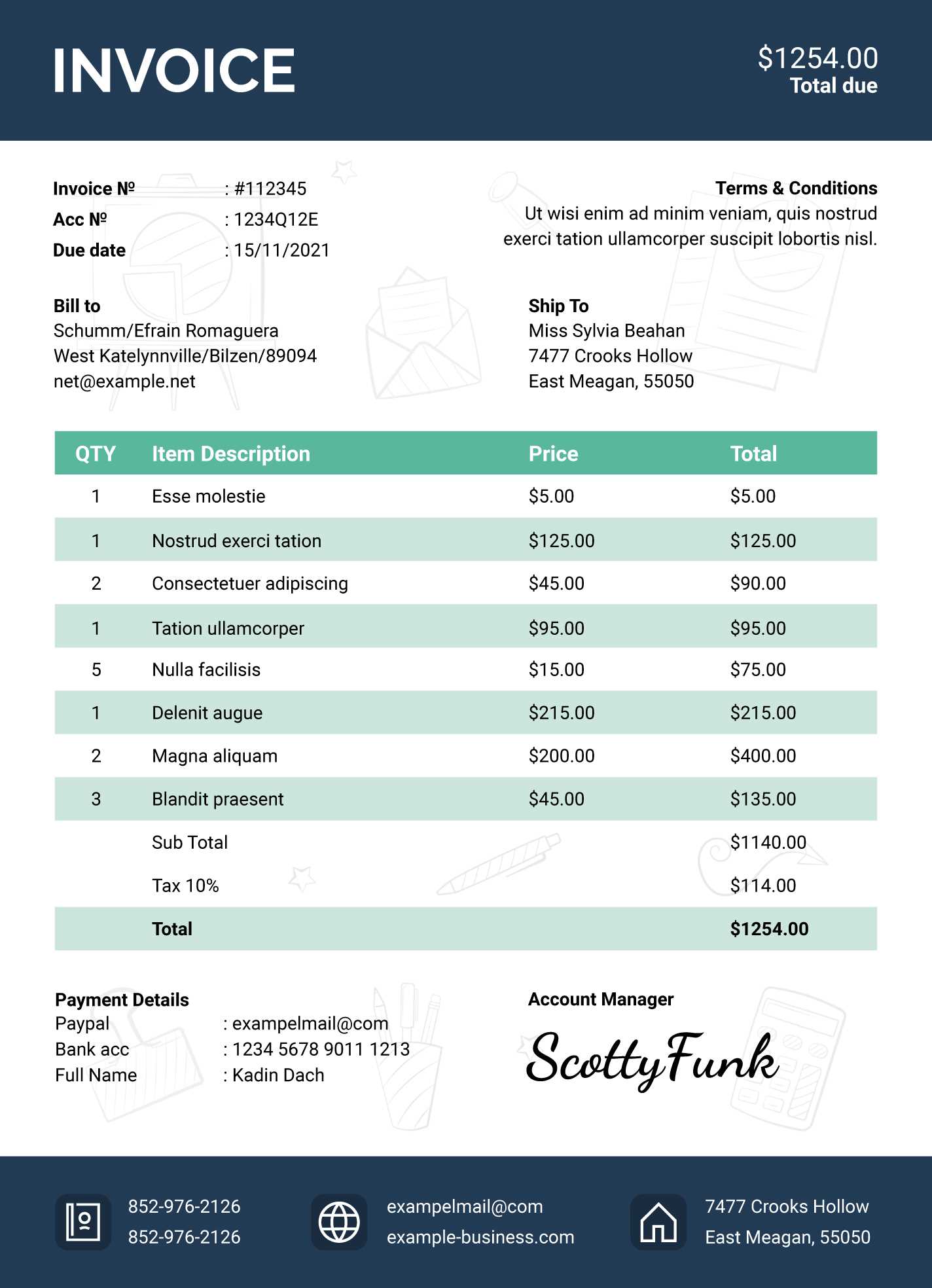

How to Add Branding to Your Billing Document

Incorporating your brand identity into your billing documents is an excellent way to create a consistent, professional image for your business. By personalizing the design, you ensure that every interaction with your client reinforces your company’s values and aesthetic. Customizing the look of your financial documents helps build brand recognition and trust, making your business appear more polished and cohesive.

Steps to Add Branding

Here are some simple yet effective ways to integrate your brand into your billing statements:

- Logo: Always include your company’s logo at the top of the document. This reinforces brand identity and makes the document easily recognizable to your clients.

- Colors: Use your company’s brand colors throughout the document. This can include text, headings, or borders, ensuring that the document matches your other marketing materials.

- Fonts: Use the same fonts that appear on your website, business cards, or promotional materials. Consistent typography helps create a unified brand experience.

- Tagline or Slogan: If your business has a slogan or tagline, consider adding it to your document. This can be placed beneath the company logo or in a footer, subtly reinforcing your brand message.

- Custom Header and Footer: Include a branded header or footer with your contact information, website, or social media handles. This helps clients know where to reach you and further connects the document to your business identity.

Why Branding Matters

Adding branding to your billing documents does more than just make them look professional. It strengthens your business’s credibility, builds client trust, and creates a lasting impression. A well-designed document shows that you take pride in your business and are committed to providing a seamless customer experience from start to finish.

By taking the time to personalize your payment requests with brand elements, you are ensuring that each communication with your client contributes to the overall image you want to project.

Ensuring Accuracy in Your Billing Details

Accuracy is critical when preparing billing documents, as even small mistakes can lead to confusion, delayed payments, or disputes with clients. Ensuring that all details are correct from the outset helps maintain professionalism, builds trust, and ensures smooth financial transactions. Careful attention to the finer details, such as pricing, dates, and client information, is essential for both you and your clients to be on the same page.

Here are some steps to ensure the accuracy of your billing documents:

- Double-check Client Information: Verify that the client’s name, address, and contact details are correct before sending the document. Incorrect details could result in delays or the document being returned.

- Review Product or Service Details: Make sure each item or service is clearly described, with accurate quantities and unit prices. This helps avoid misunderstandings about what the client is being charged for.

- Verify Payment Terms: Ensure that the payment due date, accepted payment methods, and any late fees or discounts are clearly stated and free of errors.

- Check Tax and Additional Charges: Confirm that applicable taxes, shipping costs, and any other fees are correctly calculated and included in the final total. Small errors in calculations can cause significant problems.

- Confirm Total Amount: Review the final amount due to ensure that all items, discounts, taxes, and fees are correctly added up. This will help prevent any disputes about the payment amount.

Proofread and Review each document carefully before sending it out. Having a second person review the document can also be helpful, as they may spot errors that you might have missed.

By paying attention to detail and verifying all the elements, you can ensure that your billing documents are accurate, clear, and professional. This minimizes the risk of payment delays and helps build a strong, trustworthy relationship with your clients.

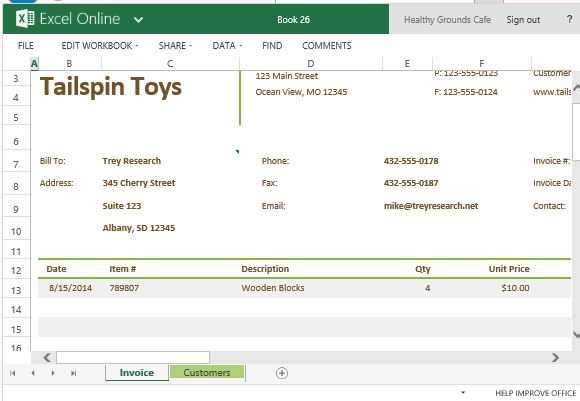

When to Use PDF or Excel Formats

Choosing the right file format for your billing documents is important for both functionality and convenience. Different formats offer unique advantages depending on your needs–whether it’s for ease of editing, sharing, or ensuring document integrity. Two of the most common formats for business documents are PDF and Excel. Understanding when to use each can help streamline your workflow and ensure your documents meet the needs of your clients and your internal processes.

When to Use PDF Format

The PDF format is ideal when you need to ensure that your document appears exactly as you intend across all devices, without any risk of accidental editing or formatting changes. PDFs preserve the layout, fonts, and branding, making them perfect for final versions of documents.

- Finalizing Documents: PDFs are perfect for sending out finalized billing records that should not be altered. Once created, a PDF cannot be easily edited, which ensures that all details remain unchanged.

- Professional Appearance: With PDF, you can include your branding, logos, and custom design elements, ensuring a professional and polished presentation.

- Universal Compatibility: PDFs can be opened on virtually any device, which makes it easy to send and share documents with clients regardless of the software they use.

- Legal and Secure: When a document needs to serve as an official or legal record, PDFs are often preferred because they maintain document integrity and can be encrypted or password-protected for added security.

When to Use Excel Format

Excel is more suitable for documents that require frequent updates, calculations, or data analysis. Unlike PDFs, Excel files are fully editable, making them a great choice for ongoing projects or documents that need to be adjusted over time.

- Data Analysis and Calculations: If your document contains numerous calculations, such as pricing, taxes, or discounts, Excel is the better choice. It allows you to easily make changes and recalculate totals as needed.

- Editable Records: Excel is useful when you need to make updates or adjustments before finalizing the document. It’s perfect for internal use or when creating drafts before sending the final version.

- Tracking and Sorting Data: Excel provides powerful tools for sorting, filtering, and tracking various data points. It’s particularly helpful when managing large volumes of transactions and keeping records organized.

- Collaboration: If multiple people need to access and edit the document, Excel allows easy collaboration. Team members can add their input, make changes, and track revisions in real-time.

In conclusion, use PDF when you need a secure, non-editable format

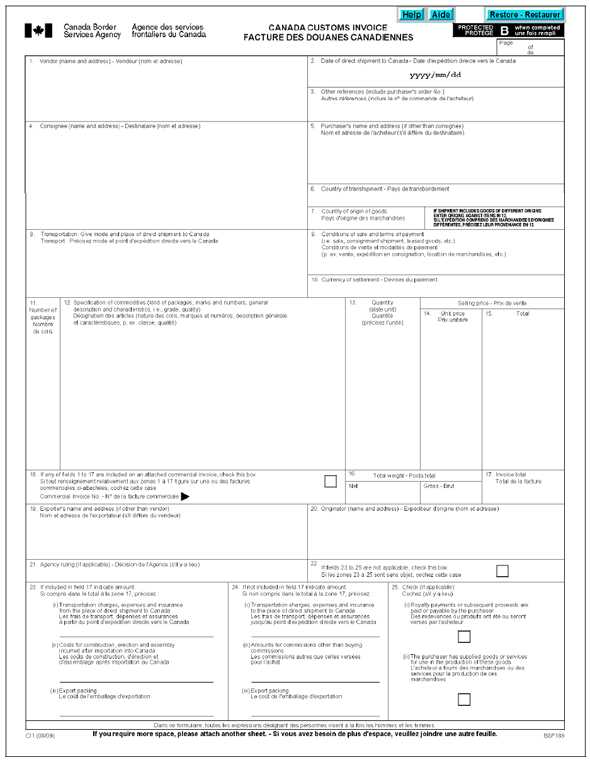

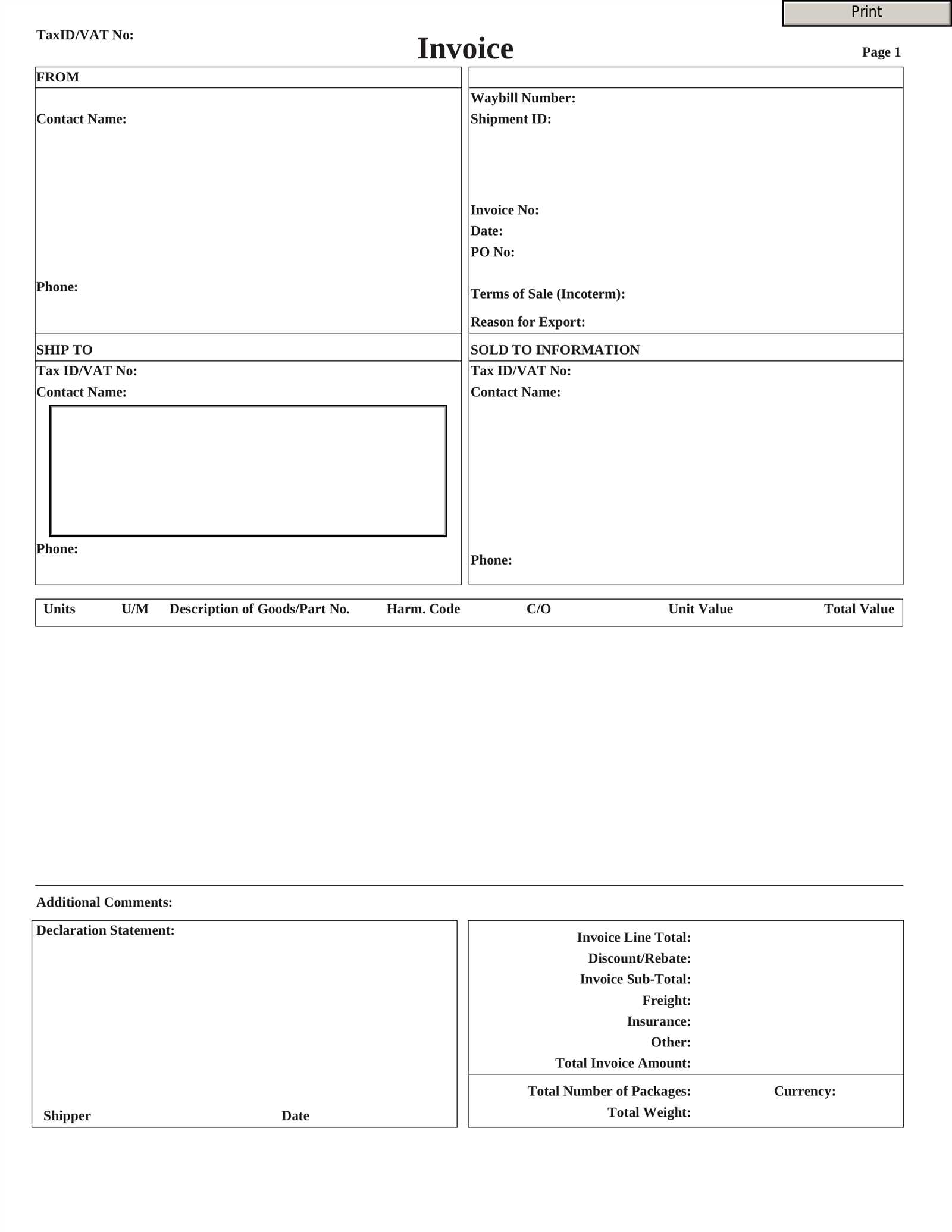

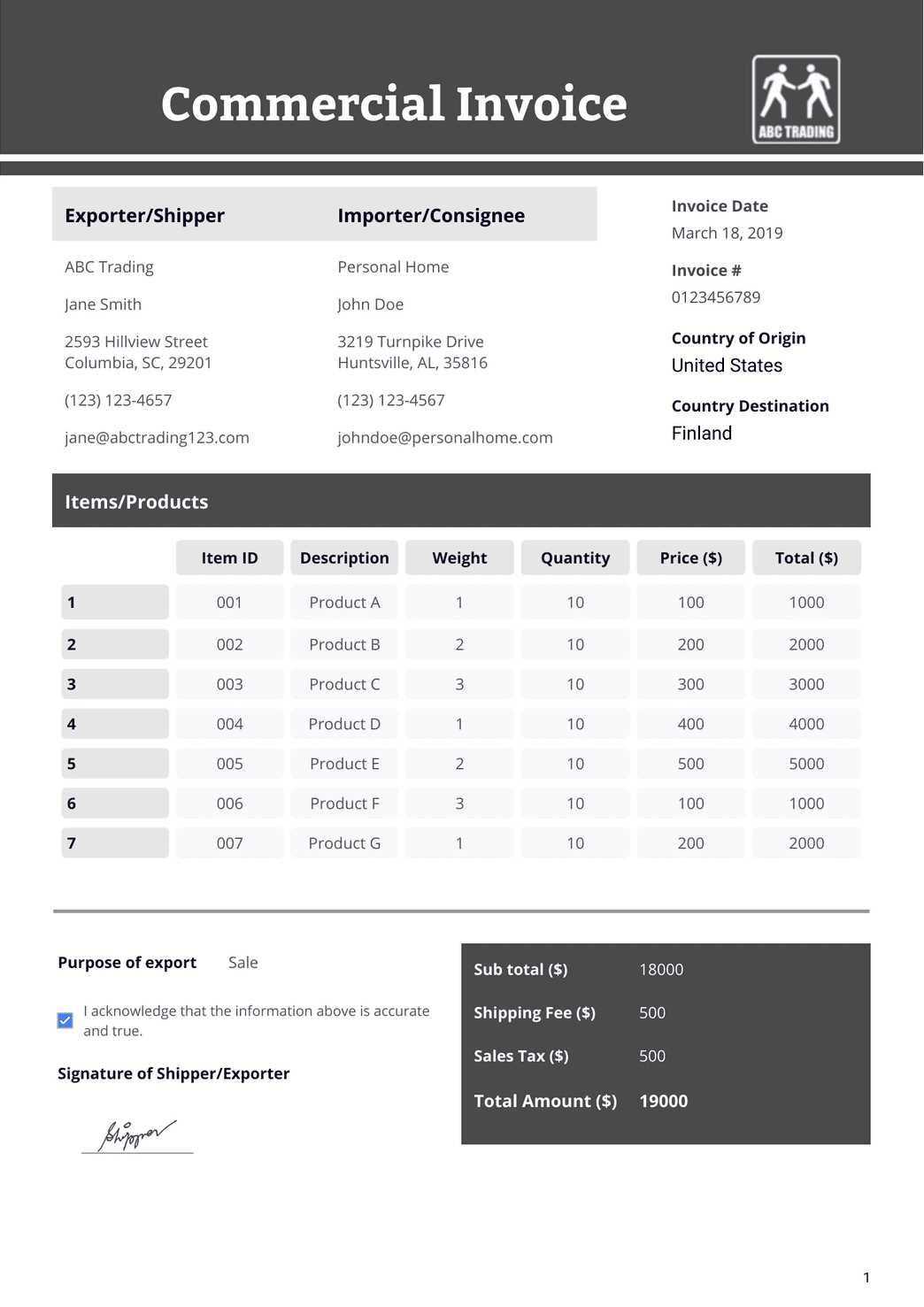

Legal Requirements for Billing Documents

When creating payment records, it is crucial to ensure that the document complies with the legal and regulatory requirements of both local and international laws. A proper billing document not only ensures smooth transactions but also helps avoid disputes or legal complications. Different countries and regions may have specific requirements about the information that needs to be included and the format in which it should be presented. Understanding these legal obligations is essential for businesses that operate in a regulated environment or deal with cross-border transactions.

Key Legal Elements to Include

To ensure that your payment records are legally compliant, certain essential details should be included in every document. These include:

- Transaction Date: The date the payment request is issued, which helps define the payment period and establishes a timeline for both parties.

- Seller’s Information: The seller’s full legal name, business address, and contact information are essential for identification and can be used for legal purposes if needed.

- Buyer’s Information: Similarly, the buyer’s details (including name, address, and contact) must be accurately stated to establish the recipient of the goods or services.

- Description of Goods or Services: A detailed description of what is being sold or provided, including the quantity, unit price, and total cost. This provides transparency and avoids potential misunderstandings.

- Tax Identification Number: In many countries, businesses are required to include their tax identification number (TIN) to comply with tax regulations and to be able to report transactions accurately.

- Payment Terms: Clear payment terms, including due dates, late fees, and accepted payment methods, must be outlined to avoid confusion and ensure the buyer understands when and how to pay.

- Currency and Total Amount: Clearly stating the currency used in the transaction and ensuring that the total amount is correct is essential for both parties to avoid errors.

- VAT or Sales Tax Information: Many countries require that the VAT (Value Added Tax) or sales tax amount be clearly shown. This is especially relevant for international transactions.

International Considerations

When dealing with international transactions, there are additional legal factors to consider:

- Customs Information: For cross-border sales, it is essential to include customs declarations and any necessary documentation related to import/export laws.

- Language and Currency: In international transactions, the document may need to be provided in the local language of the buyer and with the correct currency and conversion rates.

- Compliance with Local Regulations: Each country has its own legal requirements for trade and tax documentation. It is crucial to ensure that you are familiar with the rules of the country in which the transaction takes place.

By adhering to these legal requirements, businesses can ensure that their billing documents are legally valid and reduce the risk of disputes, audits, or non-compliance penalties. Always stay informed about the specific rules

Billing Document Software vs Physical Versions

When it comes to managing billing documents, businesses have two primary options: using software designed to create and manage them digitally or opting for physical, printable versions. Each approach offers distinct advantages depending on your specific needs and business practices. Digital solutions often provide enhanced functionality and efficiency, while physical versions can offer a more traditional, tangible approach to handling transactions. Understanding the benefits and limitations of both methods can help you choose the best fit for your business operations.

Software-based Solutions are designed to streamline the process of creating and managing billing records. These tools typically offer automation features, allowing you to easily generate new documents with pre-filled information, track payments, and store records digitally. With the added benefits of cloud-based storage and integration with other business tools (such as accounting software), this approach is ideal for businesses that handle a high volume of transactions or need to access records from multiple locations.

Physical Versions, on the other hand, offer a more straightforward, no-frills approach. Businesses using physical documents often generate them by hand or through desktop publishing software, print them out, and mail or hand-deliver them to clients. These versions are useful for businesses with fewer transactions or those that prefer a paper trail. They also provide a tangible copy that can be filed and stored offline, which may be required for legal or tax purposes in some jurisdictions.

Here are some key differences between these two options:

- Automation and Speed: Software tools can automate many parts of the process, such as calculating totals, taxes, and applying discounts. This saves time compared to manually filling out forms.

- Customization: Digital solutions often offer greater flexibility for design and functionality, allowing you to easily customize fields and layouts to match your brand.

- Record Keeping: With software, records are stored digitally, making it easy to search, organize, and retrieve past documents. This is especially beneficial for businesses with large databases or ongoing projects.

- Tangibility: Printable versions provide a physical document that some clients may prefer to receive, particularly in industries where paper documentation is still the norm.

- Legal Compliance: Certain industries or jurisdictions may require that businesses maintain paper records for compliance purposes, making physical copies necessary for some organizations.

Ultimately, the choice between software-based solutions and physical versions depends on your business needs, client preferences, and operational efficiency. Businesses that handle a high volume of transactions may benefit from digital tools, while smaller operations or those with specific regulatory requirements may find printable options more suitable.

How to Send Printed Billing Documents Effectively

Sending physical billing documents may seem like an old-fashioned approach in today’s digital world, but it remains a crucial method for certain businesses and clients who prefer or require paper copies. To ensure that your documents reach clients efficiently and professionally, it’s important to follow best practices when mailing or delivering physical documents. This process not only helps maintain clarity and professionalism but also ensures that your client receives the necessary details for timely payment.

Here are some steps to ensure that your physical billing records are sent effectively:

- Use Professional Letterhead: Print your document on professional letterhead that includes your company’s logo, address, contact information, and other branding elements. This gives your document a polished, official appearance and helps clients recognize your business immediately.

- Ensure Accuracy: Double-check all the details in the document, including the client’s information, item descriptions, pricing, and due dates. Mistakes can lead to confusion or delayed payments, so accuracy is crucial before mailing.

- Use High-Quality Paper: Printing your documents on high-quality, durable paper not only looks more professional but also ensures that the document holds up during transit. Choose paper that doesn’t easily tear or get damaged.

- Include Clear Instructions: If there are any specific payment instructions, terms, or details that need attention, make sure they are clearly visible in the document. This ensures your client understands exactly what is required of them to complete the transaction.

- Choose Secure Delivery: When sending important billing documents, opt for a secure and reliable delivery service. For large transactions, consider using registered mail or a courier service that provides tracking and delivery confirmation. This ensures the document reaches the right person and provides a record of receipt.

- Include a Payment Slip or Return Envelope: If applicable, include a return envelope or payment slip to make it easier for your client to send payment back. Providing an easy method for them to submit payment can help expedite the process.

By following these steps, you can ensure that your printed billing records are sent professionally and efficiently. Whether you are sending them to clients who prefer paper or need to meet specific legal requirements, a well-handled mailing process can improve your overall customer experience and help secure prompt payment.

Managing Multiple Billing Document Formats

As businesses grow, they often need to manage different types of payment records to meet varying client needs, industries, and internal processes. Whether you have clients that require specific formats, different pricing structures, or a variety of service offerings, keeping track of multiple document formats can become complex. However, with the right organization and tools, managing several different types of payment records can be streamlined and efficient.

To handle multiple document formats effectively, businesses should focus on a few key strategies:

- Standardize Core Information: Despite variations in design or structure, certain key details–such as payment terms, service descriptions, and pricing–should remain consistent across all versions. Standardizing this core information helps maintain accuracy and reduces the chances of errors when creating different document formats.

- Use Software for Automation: Using software to generate different types of documents allows you to create and save multiple formats for various purposes. Automation ensures consistency and reduces the time spent on manual entry. You can set up custom fields, adjust layouts, and pre-fill necessary information for each specific use case.

- Organize Your Templates: If you use physical records or multiple digital files, make sure to create a clear filing system. Group documents based on client, project type, or service offering. This will help you locate and update them quickly as needed, ensuring efficiency when managing various formats.

- Keep Your Brand Consistent: Regardless of the format or design, all documents should reflect your company’s brand identity. Use your logo, color scheme, and consistent fonts across different versions to create a professional and cohesive appearance.

- Stay Organized with Version Control: If you regularly update document formats to adapt to new regulations, pricing, or branding, ensure that you have a version control system in place. Keep track of each document’s version and maintain backups to avoid confusion when using older or outdated records.

- Tailor for Client Preferences: Some clients may prefer a more detailed breakdown, while others prefer a simple summary. Understanding these preferences allows you to customize your document formats to suit each client’s needs, making the payment process smoother and more efficient.

By adopting these best practices for managing multiple document formats, you can ensure that your business runs smoothly and efficiently, even when dealing with a variety of different records. Whether using software tools or manual filing systems, a structured approach will help you stay organized and reduce errors, ultimately improving both client satisfaction and your workflow.

How to Track Paid and Unpaid Billing Records

Managing and tracking the payment status of your billing records is essential for maintaining a smooth cash flow and ensuring that you are paid on time. Whether you use a digital tool or a manual system, staying organized helps you quickly identify outstanding balances and take necessary actions to follow up on unpaid records. Clear tracking methods reduce errors, prevent missed payments, and improve communication with clients.

Effective Ways to Track Payment Status

There are several ways to track paid and unpaid billing records effectively. By implementing a consistent tracking system, you can stay on top of your finances and avoid missing important payment deadlines.

- Use Accounting Software: Many businesses use accounting or invoicing software that automatically tracks payments. These tools typically allow you to mark records as paid or unpaid, set reminders for due dates, and generate reports to view your financial status at a glance.

- Create a Payment Log: If you prefer a manual system, create a log or spreadsheet to record the status of each billing record. Include key details such as the client’s name, amount due, payment date, and method of payment. This allows you to visually track the payment status for each client.

- Set Up Payment Reminders: Set automated reminders for both you and your clients. When using software, you can schedule reminders to notify clients of upcoming payment deadlines or past due balances. For manual tracking, ensure that you mark the due date and follow up accordingly.

- Communicate with Clients: Regular communication with clients is key when tracking payment statuses. Send reminders about upcoming or overdue payments and ensure that clients have the correct information to complete their payments. A polite, professional approach can help maintain good relationships while encouraging prompt payment.

- Use Color-Coding or Status Tags: If you’re using a spreadsheet or digital system, color-coding or applying status tags can help visually identify paid versus unpaid records. For example, you could highlight paid records in green and unpaid records in red, or use status indicators like “Paid,” “Unpaid,” or “Pending.” This makes it easy to review your records at a glance.

Taking Action on Unpaid Records

Tracking unpaid records is only part of the process. It’s important to act promptly to ensure payments are made. Here are some steps to follow when dealing with unpaid bills:

- Send Reminder Notices: After a payment becomes overdue, send a friendly reminder. You can send a follow-up email or letter, providing details about the outstanding amount and requesting payment.

- Offer Payment Plans: If a client is unable to pay the full amount upfront, offer installment plans or payment extensions. This shows flexibility and increases the likelihood of getting paid in full over time.

- Escalate the Situation: If repeated reminders are unsuccessful, escalate the matter to a collection agency or consider legal action. Ensure that all attempts to collect payment are documented to support any necessary legal procedures.

By keeping a clear record of payments, following up on overdue balances, and staying proact