Free Bakery Invoice Template in Word Format for Easy Billing

Managing finances efficiently is crucial for any small business, especially when it comes to handling client payments. Using pre-designed documents to record transactions can save valuable time and ensure accuracy. With the right tools, business owners can simplify the process, reduce errors, and maintain a professional appearance in their financial dealings.

Professionals in the food industry often face the challenge of quickly generating sales records and ensuring proper tracking of customer orders. An organized billing system allows businesses to keep track of products sold, quantities, prices, and payment terms seamlessly. These customizable files can be tailored to suit individual business needs and requirements.

Whether you’re running a small local shop or expanding into a larger operation, adopting an efficient method of documenting sales can make all the difference. The ease of use, flexibility, and cost-effectiveness of such solutions can help you focus more on delivering quality products to your customers rather than getting bogged down in administrative tasks.

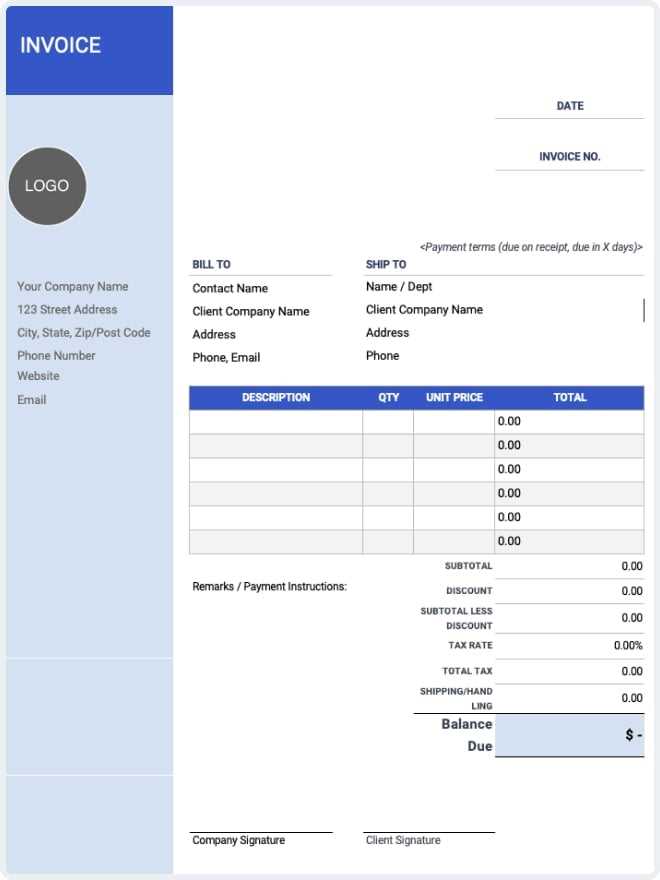

Free Bakery Invoice Template Word

For any small business, especially those in the food industry, having a reliable and professional document for tracking sales and payments is essential. A structured document helps manage customer orders, outline pricing, and ensure clarity in financial transactions. Customizable forms allow business owners to quickly generate and adjust the necessary paperwork based on their needs, saving time and reducing the risk of errors.

Using editable files provides a straightforward way to maintain consistent records. These customizable forms can be filled out and tailored to include all relevant information, from product names and quantities to pricing and payment details. Additionally, businesses can easily adjust the design and layout of the document to reflect their brand or personal preferences, adding a professional touch to every transaction.

By choosing a user-friendly format, business owners can create and manage their sales records without needing advanced software or technical skills. These practical documents are accessible, allowing anyone to stay organized while keeping operations running smoothly. Having a well-organized system not only improves efficiency but also helps build trust with customers, as it demonstrates attention to detail and professionalism.

Why Use a Bakery Invoice Template

Using a pre-designed document to track sales and payments can streamline your business operations and ensure accuracy. These ready-to-use forms save time by eliminating the need to create financial records from scratch, allowing you to focus on what matters most: running your business. A well-structured document also helps maintain consistency and professionalism, essential when dealing with customers and partners.

Benefits of Using Pre-Formatted Documents

- Time efficiency: Pre-made forms allow you to quickly input information, reducing the time spent on administrative tasks.

- Consistency: Using the same format for every transaction ensures all necessary details are included and presented uniformly.

- Professionalism: Customizable forms give your business a polished appearance and improve your customer’s experience.

- Accuracy: A structured layout helps reduce errors, ensuring all key details are recorded correctly, from product quantities to prices.

How It Helps Your Business

Having an organized system for documenting transactions enhances your ability to track sales, manage inventory, and monitor cash flow. It also helps with creating detailed reports for tax purposes or future analysis. With a reliable structure in place, you can avoid misunderstandings and provide clear, transparent records for customers.

Benefits of Using Word for Invoices

Choosing a flexible and widely used program to create your financial documents offers numerous advantages. The simplicity and accessibility of this software allow for easy customization and quick generation of sales records, making it an ideal tool for small business owners. Whether you need to make adjustments, add logos, or change the format, the software provides all the necessary tools to meet your needs.

Ease of Use and Accessibility

- Simple Interface: The intuitive design makes it easy for anyone, even with minimal technical knowledge, to create and modify documents.

- Widely Compatible: Most devices support this program, meaning you can access and edit your records from anywhere.

- Customizable Layouts: Easily adjust the design and content to fit the unique requirements of your business.

Cost-Effective and Time-Saving

- No Extra Costs: Most users already have access to this software, meaning no additional investment is necessary for document creation.

- Fast to Set Up: Quickly create a professional-looking document without spending hours on formatting or design.

- Instant Adjustments: Make immediate changes to your sales records without needing specialized software or skills.

How to Customize a Bakery Invoice

Customizing your sales document allows you to better align it with your brand and specific business needs. Whether you want to include your company logo, adjust the layout, or modify the fields to reflect the products you sell, the process is straightforward and can be done without any specialized software. Below is a simple guide on how to personalize your transaction records effectively.

Key Customization Steps

Follow these steps to adjust your financial records according to your preferences:

- Personalize the Header: Add your business name, logo, and contact information at the top of the document to make it professional and unique.

- Adjust the Item Details: Modify the table to fit the products or services you offer. Include the necessary columns such as product description, quantity, and price.

- Set Payment Terms: Clearly define the payment methods, due dates, and any applicable discounts or late fees.

- Format the Design: Change fonts, colors, and the general layout to match your business style and brand identity.

Example of a Customizable Sales Record

| Item Description | Quantity | Unit Price | Total |

|---|---|---|---|

| Chocolate Cake | 2 | $15.00 | $30.00 |

| Vanilla Cupcakes | 6 | $3.00 | $18.00 |

| Total | $48.00 |

By following these steps and using a flexible structure, you can create a clear and professional document that reflects your business operations and branding style. Customization ensures that each transaction is tailored to your unique needs while maintaining a polished and organized look.

Where to Find Free Bakery Templates

For small business owners, accessing pre-designed documents can significantly reduce the time spent on creating financial records. There are several places online where you can download ready-to-use forms that meet your needs. Whether you’re looking for a simple structure or something more detailed, these resources provide convenient and customizable options for your business transactions.

Popular Websites Offering Free Resources

- Microsoft Office Templates: A wide range of customizable files is available directly from the official site, offering both basic and professional designs.

- Google Docs: Google’s cloud-based system also offers editable sales forms that can be accessed from anywhere, making it easy to work on documents on the go.

- Template Websites: Websites like Template.net and Vertex42 offer various free business forms that you can download and modify according to your needs.

Other Helpful Resources

- Industry-Specific Forums: Many online communities and forums dedicated to small business owners often share useful resources, including free templates.

- Business Blogs and Websites: Blogs that cater to small businesses often provide downloadable forms as part of their content, offering real-world examples and advice.

Exploring these resources will help you find the right solution for your business and save time on creating financial documents from scratch.

Key Features of an Invoice Template

When creating a sales record, certain elements are essential to ensure clarity, accuracy, and professionalism. A well-designed document not only tracks the transaction details but also helps convey important information to your clients. Understanding the key features of an effective document will allow you to streamline your billing process and maintain organized financial records.

Essential Information to Include

- Business Details: Your company name, address, phone number, and email should be clearly visible at the top of the document to ensure your client can contact you easily.

- Customer Information: Include the client’s name, contact details, and shipping address if applicable. This helps maintain accurate records and ensures the correct delivery of goods or services.

- Transaction Information: Clearly list the products or services provided, including quantities, unit prices, and total amounts to ensure transparency and prevent disputes.

- Payment Terms: Specify the payment methods accepted, due dates, and any late fees or discounts for early payment to set expectations and avoid confusion.

Formatting and Usability

- Itemized Breakdown: A clear, itemized list of charges allows clients to see exactly what they are being billed for, helping to prevent misunderstandings.

- Simple and Clean Layout: Use a straightforward layout that is easy to read and navigate. A clutter-free design ensures that important details stand out.

- Automated Calculations: Including sections that automatically calculate totals and taxes will reduce the likelihood of errors and speed up the process of filling out the document.

These features help ensure that your transaction records are professional, clear, and easy for both you and your clients to understand, ultimately enhancing your business’s credibility and efficiency.

How to Edit a Word Invoice Template

Editing a pre-designed sales document allows you to tailor it to the specific needs of your business. Whether you want to adjust the layout, update product details, or add your company’s branding, the process is straightforward and doesn’t require specialized skills. Here’s a step-by-step guide on how to modify your financial documents for a polished and professional look.

Steps to Edit Your Sales Document

- Open the Document: Start by opening the file in your preferred software that supports document editing.

- Adjust Business Information: Replace any placeholder text with your company name, address, and contact details. Ensure this information is accurate and prominently displayed at the top.

- Update Client Details: Enter the customer’s information, including their name, address, and contact information, so the document reflects the correct recipient.

- Modify Product and Pricing: Update the list of items or services provided, making sure to adjust quantities, prices, and totals as needed.

- Customize Payment Terms: Review and, if necessary, modify payment methods, due dates, and any other relevant terms to suit your business practices.

- Branding and Design: Add your company logo, adjust the font, or change the color scheme to make the document align with your brand identity.

Additional Tips for Effective Customization

- Check for Accuracy: Double-check all fields to ensure that prices, taxes, and totals are correct.

- Use Consistent Formatting: Maintain a uniform font size, style, and spacing to ensure the document is easy to read and professional-looking.

- Save for Future Use: After editing, save the file as a reusable template, so you don’t have to repeat the same process every time.

By following these simple steps, you can quickly and easily customize your financial documents, ensuring that they meet your business requirements while looking polished and professional.

Save Time with Pre-made Invoice Forms

For busy business owners, creating sales documents from scratch can be a time-consuming task that takes valuable resources away from core business activities. Pre-designed forms eliminate the need to start from zero, allowing you to quickly generate professional records with just a few clicks. These ready-made solutions can save significant time while ensuring accuracy and consistency in your financial reporting.

Using pre-built documents gives you the freedom to focus on what matters most, such as serving customers and growing your business. Instead of manually entering the same details over and over again, you can simply fill in the relevant fields. This not only speeds up the process but also reduces the chances of making errors in the data.

By incorporating these forms into your workflow, you’ll streamline administrative tasks and improve overall productivity, all while maintaining a professional appearance in your financial dealings.

Tips for Creating Professional Invoices

Creating clear and professional sales documents is essential for maintaining strong relationships with clients and ensuring smooth business operations. A well-designed document not only facilitates faster payments but also reflects the quality and reliability of your business. Here are some practical tips to help you create polished, professional records every time.

Key Tips for Effective Sales Records

- Use Clear and Readable Fonts: Choose simple, legible fonts for all text to ensure easy reading. Avoid overly decorative fonts that might distract from important information.

- Include Complete Contact Information: Always include your business name, address, phone number, and email at the top of the document. This ensures your client can easily reach you if necessary.

- Organize Information Logically: Group related items together, such as customer details, product descriptions, and payment terms. A well-structured layout makes the document easier to follow and more

Free Bakery Invoice Templates for Small Businesses

Small business owners in the food industry can greatly benefit from using ready-made documents for tracking sales and managing transactions. Pre-designed forms allow you to quickly generate professional-looking records, reducing the time spent on administrative tasks and ensuring accuracy in every sale. Whether you run a small café, a local pastry shop, or any other food-related business, having access to such documents simplifies your billing process and enhances your business’s efficiency.

These forms can be customized to fit your specific needs, offering flexibility for businesses of any size. They often include sections for detailing products sold, pricing, payment terms, and customer contact information, ensuring that all necessary details are captured clearly and concisely.

Example of a Customizable Sales Record

Product Description Quantity Unit Price Total Price Chocolate Muffins 10 $2.50 $25.00 Glazed Donuts 12 $1.75 $21.00 Total $46.00 By using such forms, small businesses can maintain accurate and detailed sales records while saving time. This also helps present a professional image to customers, showing that your business is organized and reliable.

How to Organize Your Bakery Billing

Efficiently managing your sales records is essential for maintaining smooth business operations and ensuring that your customers are satisfied. Organizing your billing system not only helps you keep track of transactions but also ensures that you can easily access financial data when needed. A well-structured approach allows you to streamline your workflow, reduce errors, and maintain transparency with clients.

To organize your billing process effectively, it’s important to implement a few key strategies. This includes creating consistent, detailed records for each sale, setting clear payment terms, and using a reliable system to track outstanding payments. By following these steps, you can ensure that your business runs smoothly and that your financial records are both accurate and easy to access.

Steps to Organize Your Sales Records

- Create a Consistent Format: Use the same layout for all your records. Consistency helps reduce confusion and ensures all important details are included in each document.

- Keep Detailed Information: Record all necessary information, such as customer name, product description, quantities, prices, and total amounts, to ensure accuracy.

- Set Payment Terms Clearly: Define payment due dates, accepted payment methods, and any applicable discounts or late fees upfront to avoid misunderstandings.

- Use a Tracking System: Implement a simple tracking system to monitor unpaid bills and due dates. This could be as simple as a spreadsheet or a more advanced software tool.

Benefits of an Organized Billing System

- Faster Payments: Clear records and payment terms encourage prompt payments from customers.

- Reduced Errors: Having a structured system reduces the likelihood of mistakes when processing orders or tracking payments.

- Better Financial Tracking: With organized sales records, you can easily assess your revenue and plan for taxes or other financial obligations.

By organizing your sales records in a methodical way, you can improve your business’s cash flow, reduce administrative burdens, and maintain a professional image with your clients.

Easy Steps to Use Invoice Templates

Using pre-designed sales documents can significantly simplify your billing process and save valuable time. These ready-made files provide a structured format where you only need to input the necessary details. Whether you’re handling a single transaction or creating multiple records, following a few simple steps will help you generate professional documents quickly and efficiently.

Steps to Use Pre-designed Sales Forms

- Download or Open the Form: First, find and open the pre-designed form that suits your business needs. You can download one from a trusted website or open a template within your software.

- Enter Your Business Information: Fill in your company name, address, and contact details. This will personalize the document and ensure your clients know how to reach you.

- Fill Out Customer Details: Input the client’s name, billing address, and any other necessary information such as phone numbers or email addresses.

- List Products or Services: Include the description, quantity, and price for each item or service sold. Ensure the details are accurate to avoid confusion.

- Specify Payment Terms: Clearly define the payment due date, the acceptable methods of payment, and any discounts or late fees that apply.

- Review and Save: Double-check that all information is correct, and then save the document. If needed, print or send it electronically to your client.

Additional Tips for Using Sales Forms

- Customize the Design: While the structure remains the same, feel free to adjust the colors, fonts, and layout to align with your brand’s style.

- Save for Future Use: Once you’ve completed the form, save it as a reusable template for future transactions, saving time on repetitive tasks.

- Stay Consistent: Always use the same layout for consistency. This makes your business appear more professional and organized.

By following these easy steps, you can create clear, accurate, and professional sales documents in no time, ensuring your business operations run smoothly.

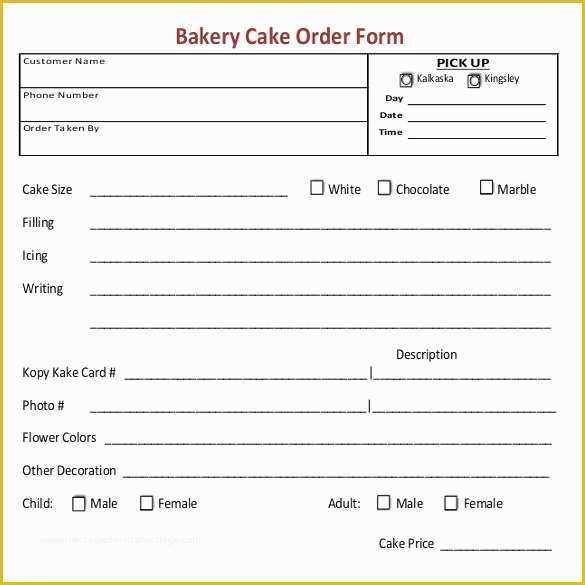

How to Add Bakery Product Details

When creating a sales record, accurately listing the products or goods sold is essential for transparency and clarity. Whether you are selling pastries, cakes, or other items, providing detailed descriptions ensures that the customer understands exactly what they are being billed for. Properly formatted product information helps maintain professionalism and prevents any confusion regarding the transaction.

Steps to Add Product Details

- Describe the Product Clearly: Include a brief but clear description of each item. For example, instead of just writing “cake,” specify “Chocolate Fudge Cake” or “Vanilla Cupcakes.” This helps your clients easily identify what they purchased.

- Indicate the Quantity: Specify the number of items or units being sold. This ensures that the customer understands how much of each product was purchased.

- Include Unit Pricing: Clearly state the price per unit or serving. This breakdown helps customers see how the total is calculated and ensures there are no surprises.

- Show Total Price: Multiply the quantity by the unit price to display the total amount for each product. This provides transparency and helps clients track the value of their purchase.

Example of Detailed Product Information

Product Description Quantity Unit Price Total Price Chocolate Fudge Cake 1 $20.00 $20.00 Vanilla Cupcakes 6 $2.50 $15.00 Total $35.00 By including detailed product information in your sales records, you ensure transparency, help customers understand their purchase, and maintain a professional image for your business.

Understanding Invoice Terms and Codes

When managing sales documents, it’s crucial to understand the various terms and codes used within them. These terms not only provide clarity but also ensure that both parties involved in the transaction–whether the seller or the buyer–are on the same page regarding payment expectations and conditions. Familiarizing yourself with common terms and codes will help streamline communication, prevent confusion, and improve the overall professionalism of your business transactions.

Common Terms in Sales Documents

- Due Date: The date by which the payment must be made. It’s essential to state this clearly to avoid delays and misunderstandings.

- Net Terms: These specify the number of days within which payment should be made. For example, “Net 30” means the buyer must pay within 30 days of the transaction.

- Subtotal: The total amount for goods or services before taxes or any additional charges are applied. This figure helps the client understand the cost breakdown.

- Tax Rate: The percentage of tax applied to the total amount. It’s important to clearly state this to avoid confusion regarding the final payment amount.

Common Codes Used in Billing

- COD (Cash on Delivery): This indicates that payment is due upon delivery of goods or services, rather than in advance or on a later due date.

- PO Number (Purchase Order Number): This unique identifier is issued by the buyer to track orders and payments. It helps both parties keep records aligned.

- GST (Goods and Services Tax): A tax levied on goods and services in certain countries, typically listed separately in the transaction.

- R/O (Return Order): This refers to an item or product that has been returned, often impacting the overall amount due for payment.

By becoming familiar with these terms and codes, you can create more transparent and efficient transactions, helping build trust with clients and maintaining clarity throughout the billing process.

Improving Accuracy with Automated Templates

In business, precision is key, especially when it comes to financial records. Manually creating sales documents can often lead to human error, whether through missed details or miscalculations. By utilizing automated systems, you can greatly reduce the risk of errors, ensuring that all the data entered is correct and consistent every time. Automated tools can simplify the creation process and help maintain a high level of accuracy, ultimately saving time and minimizing mistakes in your business’s financial records.

How Automation Enhances Accuracy

- Eliminates Manual Data Entry: Automated systems can pull product details, pricing, and customer information directly from your inventory or database, reducing the chance of typographical errors.

- Prevents Calculation Errors: Automated formulas ensure that totals are calculated correctly, including taxes, discounts, and totals, preventing the possibility of miscalculation.

- Consistency Across Documents: With automated documents, the format and layout remain the same each time, helping to ensure uniformity and professionalism in every transaction.

- Real-Time Updates: When your inventory or pricing changes, automated systems can reflect these updates immediately, ensuring that your sales documents always have the most up-to-date information.

Benefits of Using Automated Systems

- Time Efficiency: Automation speeds up the document creation process, freeing up time for other important tasks in your business.

- Reduced Human Error: By minimizing manual input, automation significantly lowers the chance of mistakes in your records.

- Improved Client Relationships: Accurate and timely documents help build trust with clients, as they are confident that the charges they receive are correct and clear.

By embracing automated systems for your sales documentation, you not only improve the accuracy of your records but also enhance overall business efficiency and professionalism.

Common Mistakes to Avoid with Invoices

Accurate and professional financial documents are crucial for maintaining strong relationships with clients and ensuring timely payments. However, even the most experienced businesses can fall into common pitfalls when preparing billing records. By being aware of these mistakes, you can take steps to avoid them, ensuring your records are clear, concise, and error-free. Simple oversights can lead to confusion, delayed payments, and damaged professional reputations.

Here are some of the most frequent mistakes people make when preparing sales documents and how to avoid them:

- Missing Contact Information: Failing to include essential details such as your business name, address, phone number, and email can cause delays in communication and payment.

- Incorrect Client Details: Always double-check your client’s name, address, and other contact information. Small errors in client details can result in misplaced payments or disputes.

- Unclear Payment Terms: If the payment terms are vague or not specified, clients may delay payments. Always state the due date, accepted payment methods, and any applicable late fees or discounts clearly.

- Not Including Tax Information: If your sale is taxable, be sure to include the tax rate and the total amount charged. Failing to do so can lead to misunderstandings and legal issues.

- Errors in Item Descriptions: Ensure that each item or service is clearly described and priced correctly. Misleading or unclear descriptions can confuse your clients and may result in payment disputes.

- Forgetting to Include a Unique Reference Number: Every sales document should have a unique reference number for tracking purposes. Missing reference numbers can make it difficult to manage payments and inventory.

- Not Following a Consistent Format: If your records have inconsistent formatting, it can confuse clients and make it harder for both parties to track and process payments efficiently.

By being mindful of these common mistakes, you can ensure that your documents are accurate, professional, and easy to understand, helping you maintain smooth transactions and good client relationships.