Essential Project Management Invoice Template for Streamlined Billing

In the world of delivering client-focused work, clear and professional financial documentation is crucial. The process of billing should not only reflect the value of the services rendered but also ensure smooth transactions for both parties. An efficient billing system minimizes confusion, accelerates payments, and helps maintain strong client relationships. This section will guide you through the essentials of creating accurate, effective bills that support your workflow and financial goals.

Having a standardized approach to invoicing offers several benefits: it saves time, ensures consistency, and reduces the risk of errors. Customizable solutions allow professionals to tailor documents to their specific needs, whether for a one-time project or long-term engagements. By focusing on key elements, such as clarity in service description and payment terms, you can avoid common pitfalls and present yourself as a reliable and organized partner.

Mastering this aspect of your business not only improves the client’s experience but also positively impacts your cash flow. Whether you’re a freelancer or part of a larger team, understanding how to effectively document financial transactions is essential for success. With the right tools, managing payments becomes a seamless part of your overall project execution process.

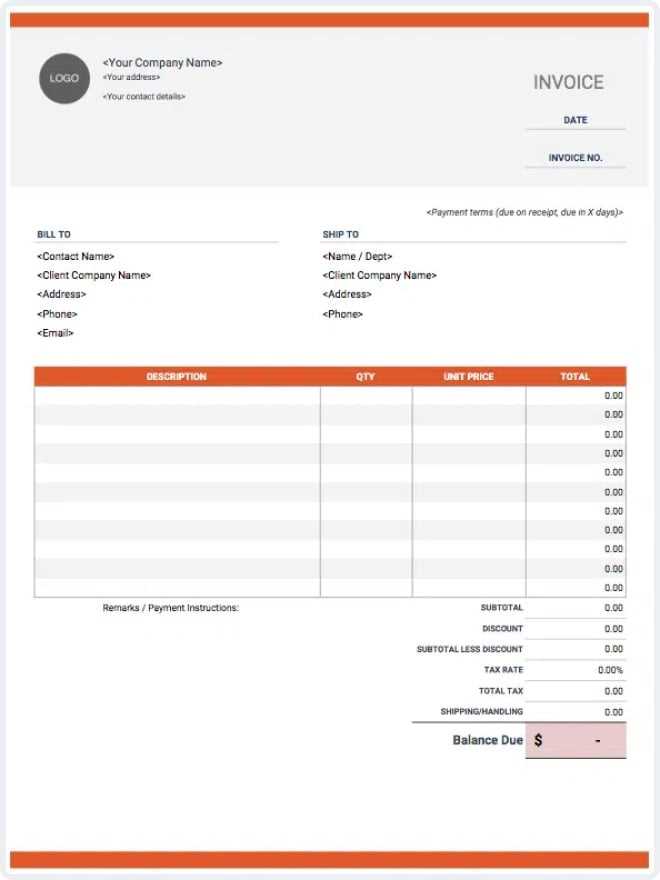

Project Management Invoice Template Overview

Efficient billing is a cornerstone of any business relationship, ensuring both parties are aligned on the value of services provided and payment expectations. A well-organized document that outlines services, costs, and terms of payment can greatly streamline this process. This section explores the essential elements that make up an effective financial document, helping you maintain professionalism and accuracy with every transaction.

The purpose of such a document is not just to request payment, but to communicate clearly with clients, offering them a transparent breakdown of the work performed. It can be customized to fit various needs, from hourly services to fixed-price deliverables, and can be adapted as your business evolves. Understanding how to create and use this tool will empower you to manage your financials more effectively, ensuring timely and accurate payments.

Key Sections of a Billing Document

An effective billing statement typically includes several critical sections to ensure clarity and completeness. These key components help both the service provider and the client understand exactly what has been delivered and what is due. Below are the common sections found in such documents:

| Section | Description |

|---|---|

| Header Information | Includes business name, contact details, and client information. |

| Service Breakdown | Details of the work completed, including dates, descriptions, and rates. |

| Payment Terms | Clarifies due dates, late fees, and preferred payment methods. |

| Subtotal and Total | Lists the total amount due, including any taxes or additional charges. |

Advantages of Using a Structured Format

Adopting a standardized format for your financial documents not only enhances professionalism but also saves time and reduces errors. With a set structure, you can quickly fill in the required details without worrying about missing important information. This consistency also ensures that clients can easily understand and process the details of each document you send, leading to smoother transactions and fewer disputes.

Why You Need an Invoice Template

Having a consistent and professional way to request payment is essential for any service-based business. A structured document not only helps maintain clear communication with clients but also ensures that all the important details are covered without omissions or errors. Whether you’re handling one-time projects or ongoing work, using a standardized form can significantly simplify the billing process and prevent confusion down the line.

By relying on a set format, you eliminate the guesswork and time spent on creating a new document each time you need to request payment. This approach not only saves you time but also reinforces your professionalism. It demonstrates to clients that you are organized and serious about your work, which can enhance trust and encourage prompt payment. Additionally, a well-designed financial statement helps you track your earnings and manage cash flow more effectively.

Consistency is one of the biggest benefits of using a pre-designed structure. With every detail already accounted for, you can ensure that all of your documents follow the same format, avoiding mistakes or discrepancies. This uniformity fosters confidence in your clients and supports a smooth transaction process, allowing you to focus more on delivering quality work rather than managing paperwork.

Streamlining your payment requests is another key advantage. Once you’ve set up the necessary components in your billing format, you can quickly modify and send the documents without starting from scratch each time. This increases your productivity and helps you maintain a steady cash flow, which is crucial for keeping your business running smoothly.

Key Features of an Effective Invoice

A well-designed financial document should contain all the necessary information to avoid misunderstandings and ensure prompt payments. To achieve this, it needs to be clear, comprehensive, and professional. The following features are essential for creating an effective document that serves both your business needs and the expectations of your clients.

- Clear Header Information: Always include your business name, contact details, and the client’s information at the top of the document. This helps both parties easily identify the document and ensures that it’s directed to the correct recipient.

- Accurate Service Description: Break down the services provided, including dates and specific deliverables. This section helps the client understand exactly what they are being billed for and eliminates any ambiguity.

- Transparent Rates and Charges: Include detailed pricing for each service or task performed. Whether charging hourly or by project, clarity here prevents disputes over the final amount.

- Payment Terms and Deadlines: Clearly outline payment expectations, such as due dates, accepted payment methods, and any applicable late fees. This establishes the timeline for the transaction and ensures both parties are aligned.

- Subtotal and Total Amount: Include a breakdown of costs (before and after taxes, if applicable) and the final amount due. This gives the client a clear understanding of how the total was calculated.

- Professional Design: A clean, easy-to-read layout contributes to a more positive impression and ensures that key details stand out. A well-structured design reflects your professionalism and can encourage timely payment.

By including these key elements in your financial documents, you ensure that clients receive the necessary information in a clear and organized manner. This reduces the chance for errors, disputes, or delays and helps establish a trustworthy and efficient business process.

Customizing Your Invoice Template

Personalizing your billing documents to reflect your brand and specific business needs is essential for creating a professional image and ensuring clarity. By customizing the layout, content, and structure, you can streamline the process, making it easier for both you and your clients. This flexibility allows you to add or remove sections based on the nature of your work, ensuring that all necessary information is included and easy to understand.

Start by adjusting the design elements such as logos, color schemes, and fonts to align with your business identity. This not only enhances the visual appeal of the document but also makes it more recognizable and aligned with your overall branding. A customized design can leave a lasting impression on clients and contribute to a sense of professionalism and consistency across all communication channels.

Next, tailor the content to match the specifics of the services you offer. If you work on different types of tasks or offer multiple pricing models, ensure the layout is flexible enough to accommodate these variations. You might also want to include additional fields such as project codes, milestones, or specific notes that can help your client better understand the scope and billing of the work.

Finally, keep in mind the importance of maintaining a balance between customization and simplicity. While it’s important to make the document your own, avoid cluttering it with unnecessary information or overly complex designs that might confuse the client. The goal is to make it clear, professional, and easy to process, ensuring quick and hassle-free payments.

How to Use Project Management Invoices

Effectively using a billing document is key to ensuring smooth financial transactions with your clients. It’s not just about sending a request for payment; it’s about providing clear, accurate, and timely information that reflects the work completed. Understanding how to properly fill out and send these documents is crucial for maintaining a professional image and ensuring prompt payment.

The first step is to clearly document all the services rendered, including a detailed description, dates, and rates. For example, if you’ve worked on multiple tasks, each one should be listed with the corresponding fee. This level of detail helps avoid any confusion and ensures that clients understand exactly what they are paying for.

Next, always double-check the payment terms. Include clear instructions on how and when the payment is due, as well as any penalties for late payments. This helps set expectations upfront and minimizes the chances of delays. Clients appreciate knowing exactly what to expect when it comes to payment deadlines, so make sure this section is straightforward and easy to understand.

Lastly, always keep a record of sent documents. Tracking each bill you issue is essential for your financial records. Many invoicing tools offer features to help you monitor the status of your requests–whether they’ve been viewed, paid, or require follow-up. By keeping accurate records, you can stay organized and follow up on overdue payments more effectively.

By following these steps, you’ll be able to use your billing forms as an efficient tool to manage your cash flow and maintain clear communication with clients. The goal is to ensure that both parties have a mutual understanding of the work completed and the payment expected, minimizing disputes and delays in payment.

Common Mistakes in Invoice Creation

While creating a billing document may seem straightforward, there are several common errors that can lead to confusion, delays, or disputes with clients. These mistakes can affect your professionalism, as well as your cash flow. Recognizing and avoiding these issues will help you ensure smooth transactions and maintain strong client relationships.

One frequent mistake is failing to provide clear descriptions of the services rendered. If clients cannot understand exactly what they are being charged for, they may question the accuracy of the charges or delay payment. Always ensure that each task is thoroughly described, including the date it was performed, to avoid confusion.

Another common issue is incorrect or missing payment terms. Not specifying the due date, accepted payment methods, or late fee policies can lead to misunderstandings about when and how to pay. It’s important to set clear expectations from the outset so that both you and your clients know exactly what is required.

Inconsistent formatting or layout can also create problems. If the document is hard to read or lacks structure, clients may overlook important details, such as the total amount due or payment instructions. A clean, organized layout is crucial for making sure that all key information is easily accessible and understood.

Lastly, overlooking taxes or additional charges can result in financial discrepancies. If taxes or extra fees are applicable, always include them in the breakdown, and make sure they are clearly marked to avoid confusion. Failing to account for these elements can cause delays or disputes when the client realizes the discrepancy.

By being mindful of these common mistakes and taking steps to avoid them, you can ensure that your financial documents are accurate, clear, and professional, leading to smoother transactions and faster payments.

Best Practices for Invoicing Clients

Creating and sending billing documents is an essential part of running any service-based business. To ensure you get paid on time and maintain positive relationships with your clients, it’s important to follow best practices in your invoicing process. By adopting the right approach, you can minimize errors, reduce confusion, and help your clients process payments smoothly.

- Send Invoices Promptly: Issue your financial requests as soon as the work is completed or according to your agreed-upon timeline. Delays in sending the request can result in late payments, which may disrupt your cash flow.

- Be Clear and Detailed: Always include a detailed breakdown of services, hours worked, and rates. The more specific and transparent you are, the less likely your client will have questions or concerns about the charges.

- Set Clear Payment Terms: Clearly state when payments are due, what methods are accepted, and any penalties for late payments. This will set clear expectations and help avoid misunderstandings later on.

- Make It Easy to Pay: Include multiple payment options whenever possible. Offering flexible methods like bank transfers, credit card payments, or online platforms can make it easier for clients to pay quickly.

- Follow Up on Overdue Payments: Don’t hesitate to send reminders if payments are delayed. A polite follow-up message or call can prompt clients to take action and settle their accounts.

- Keep Records Organized: Store copies of all billing documents and track the status of each request. This helps you monitor overdue payments and ensures that you have the information needed for future reference.

By following these best practices, you can create a more efficient billing process that helps maintain professional relationships, improves cash flow, and ensures that your business gets compensated for the work it performs.

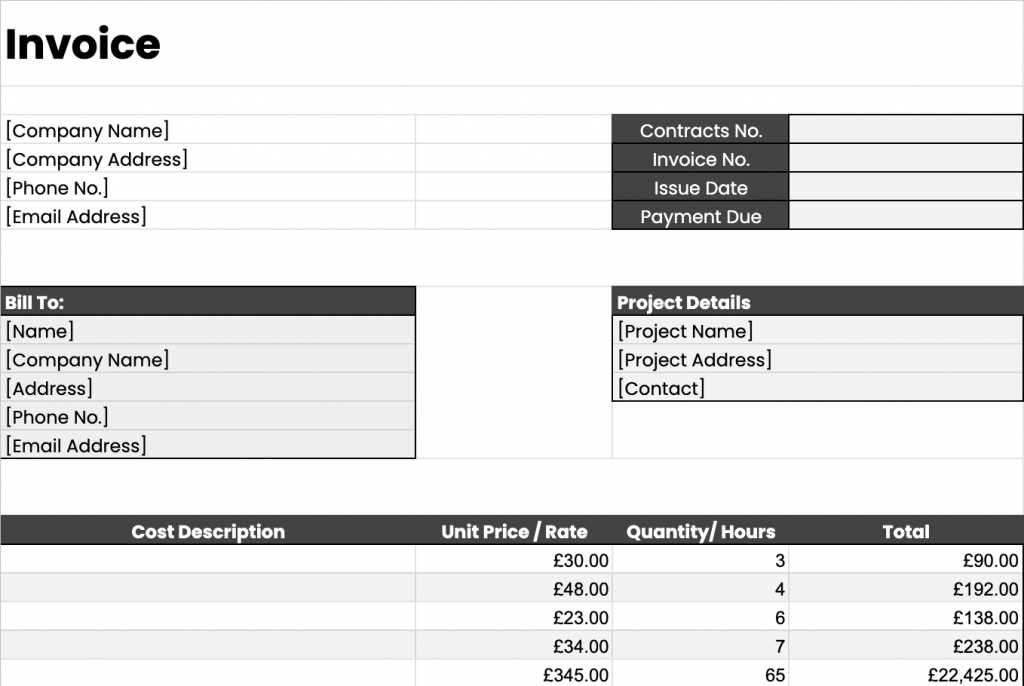

Tracking Project Hours with Invoices

Accurately recording and billing the hours spent on tasks is essential for both freelancers and businesses offering time-based services. By tracking the time spent on each phase of the work, you can ensure that your compensation reflects the effort and resources involved. A well-organized system for documenting time ensures transparency, reduces errors, and helps you avoid undercharging or overcharging clients.

Effective Time Tracking Methods

To make time tracking easier and more accurate, it’s important to choose a reliable method that works best for your workflow. There are several tools and strategies you can use:

- Time Tracking Software: Using specialized software or apps allows you to record hours in real-time, which can later be automatically transferred to your financial records. This method is highly efficient and reduces human error.

- Manual Logs: If you prefer a more hands-on approach, keeping a detailed log of your hours worked can be an effective option. You can track time using spreadsheets or simple notebooks and later transfer the information into your billing forms.

- Project Milestones: For larger tasks, breaking the work down into milestones can help you track hours more precisely. Assigning hours to specific phases of the work ensures that you capture every aspect of the task.

Incorporating Time Records into Billing Documents

Once you’ve tracked your hours, it’s important to accurately integrate them into your payment requests. A detailed breakdown will show the client how their money is being spent and help avoid disputes.

- List the Hours by Task: Clearly indicate the amount of time spent on each individual task or service. This will help clients understand exactly how their funds are being allocated.

- Include Date and Duration: For each entry, specify the date and the number of hours worked. This gives the client a clear view of when the work was done and how much time was spent.

- Be Transparent About Rates: Ensure that your hourly rate is clearly stated next to each task. This allows clients to easily calculate the cost based on the time spent, ensuring no misunderstandings about the total charge.

By effectively tracking and documenting hours worked, you can create a more accurate and transparent billing process, which improves client trust and enhances your business’s professionalism.

Adding Taxes and Additional Fees

Including taxes and additional charges in your financial documents is essential for ensuring that all costs are accounted for and your business is properly compensated. Whether it’s sales tax, service fees, or other applicable charges, clearly outlining these expenses helps maintain transparency and avoids confusion with clients. Knowing how to correctly calculate and display these amounts can ensure that both you and your clients understand the total cost of the services rendered.

How to Calculate and Add Taxes

When applying taxes, it’s important to know the applicable rates and the specific requirements of your location or industry. Different regions and services may have varying tax laws. Here are a few tips for properly incorporating taxes:

- Check Local Tax Rates: Ensure that you’re applying the correct tax rate for the area in which you’re operating or where your client is located. Tax laws can differ greatly depending on jurisdiction.

- Specify Tax Amounts Clearly: Include a separate line for taxes, clearly indicating the rate applied and the total tax amount. This ensures your client understands the breakdown of costs.

- Include Tax ID Numbers: If required, provide your business’s tax identification number to comply with legal regulations and add legitimacy to your billing process.

Additional Charges and Fees

In some cases, beyond the basic services rendered, additional charges may apply. These could include fees for late payments, special requests, or rush orders. Being transparent about these fees helps prevent disputes and ensures that clients know exactly what to expect. Some common additional charges include:

- Late Payment Fees: If payments are not received by the due date, adding a late fee is a standard practice. Be sure to specify the fee and the timeframe for when it will be applied.

- Rush Fees: If a client requests expedited service, consider adding a rush fee to cover the additional time or resources required to complete the work faster.

- Service Fees: These can include administrative costs, processing fees, or other small charges that are incurred during the completion of the task.

- Material or Equipment Charges: If specific tools, materials, or equipment are used to complete the work, be sure to include these costs as additional charges if applicable.

By accurately adding taxes and additional fees, you can ensure that your billing is clear, comprehensive, and professional. Always double-check your calculations and ensure that each fee is justified and explained, which helps in fostering trust and transparency with your clients.

Choosing the Right Template Format

Selecting the appropriate format for your billing documents is crucial for maintaining a professional appearance and ensuring clarity. The format you choose will affect how easily your clients can read and process the document, as well as how efficiently you can fill it out and track payments. A well-structured document not only looks more professional but also enhances communication and helps avoid errors in billing.

Factors to Consider When Choosing a Format

There are several key aspects to consider when selecting the right format for your billing needs:

- Ease of Use: Choose a format that allows you to quickly and easily input data. A template with fields for all essential information (e.g., service description, payment terms, and client details) will save you time and ensure consistency across all documents.

- Professional Design: The format should reflect your business identity. Whether you choose a minimalist design or one with more visual elements, it should align with your brand and maintain a professional tone.

- Customization Options: The format should be flexible enough to accommodate your specific billing needs. For example, if you offer multiple pricing models or charge for additional services, the document should allow you to easily modify and add new sections as needed.

- Compatibility: Ensure that the format is compatible with the tools or software you are using. If you rely on digital tools to create and send your documents, make sure the format is easily editable and compatible with your chosen platform (e.g., Word, Excel, or online invoicing tools).

Common Formats to Consider

There are a few popular options when it comes to choosing a billing format, depending on your preferences and workflow:

- PDF: A PDF format is widely accepted and preserves the layout across different devices and platforms. It ensures that your document looks the same when viewed by your client, regardless of the device they are using.

- Word or Excel Documents: If you need a format that is easy to customize and update, Word or Excel files can be convenient. They allow you to quickly modify fields, update prices, or make other changes to suit each client or project.

- Online Tools: Online invoicing tools and platforms often provide pre-designed formats that are easy to use, with built-in features like automatic tax calculations, payment tracking, and client management.

By carefully selecting the right format, you can create a streamlined process for creating, sending, and tracking your billing documents. This will not only save you time but also contribute to a professional and efficient transaction process with your clients.

Integrating Invoices with Project Management Tools

Seamlessly combining your financial documentation process with the tools used to manage and track your tasks can significantly improve efficiency and reduce errors. By integrating billing with your task or workflow management software, you can automate many aspects of the invoicing process, saving time and ensuring accuracy. This integration helps streamline the transition from completed tasks to payment requests, making the entire process smoother for both you and your clients.

Benefits of Integration

When financial documents are connected to your task tracking system, several advantages arise:

- Time-Saving Automation: Integration allows data to flow automatically between your project management system and your billing records. For example, hours worked or milestones completed can be directly translated into the billing document without the need for manual entry.

- Improved Accuracy: Automatically transferring data minimizes human error, such as incorrectly calculating hours or forgetting to include certain tasks. This ensures that the financial document is accurate and consistent with the work completed.

- Faster Billing: When the information is readily available and automatically updated, you can send billing documents promptly, which leads to quicker payments and reduces delays.

- Better Tracking: Integration allows you to track both the progress of your tasks and the status of your payments in one place. This centralization helps keep your financial records organized and up-to-date.

Tools for Integrating Financial Documents

There are several popular tools and platforms that can help integrate billing with task tracking. These tools provide built-in functionalities to streamline the entire process:

- Time-Tracking Software: Many time-tracking tools, such as Harvest or Toggl, integrate with project management platforms and allow you to directly convert your tracked hours into billing documents.

- All-in-One Project Management Platforms: Tools like Asana, Trello, or Monday.com offer integrations with accounting or billing software, enabling automatic generation of financial documents from completed tasks or milestones.

- Accounting Software: Platforms like QuickBooks, FreshBooks, and Xero provide integrations with task management tools, helping you create and send financial documents directly from within the same system.

By integrating your billing system with project tracking software, you can enhance productivity, reduce errors, and improve the overall client experience. This seamless connection saves time, reduces administrative work, and ensures that the information used for invoicing is both up-to-date and accurate.

Automating Invoice Generation for Efficiency

Automating the process of creating billing documents can save significant time and effort, allowing you to focus on other essential aspects of your business. By leveraging automation tools, you can reduce the manual work involved in generating payment requests, ensuring consistency and accuracy every time. This streamlined approach enhances overall efficiency and ensures that clients receive timely, professional billing statements without the need for repetitive tasks.

Benefits of Automating the Billing Process

When you automate the creation of your payment requests, several key advantages arise that help to improve your workflow:

- Time Savings: Automating repetitive tasks like populating service details, client information, and payment terms significantly reduces the time spent on each document. This allows you to focus on other high-priority activities while still maintaining a steady cash flow.

- Consistency and Accuracy: Automated systems help ensure that all billing documents follow the same format, include accurate details, and comply with any tax regulations. This reduces the likelihood of errors and inconsistencies.

- Faster Turnaround: With automation, you can generate and send financial documents immediately upon completing a task or reaching a milestone. This helps speed up the billing cycle and accelerates payment collection.

- Improved Client Satisfaction: Clients appreciate receiving clear, professionally formatted documents without delays. Automation ensures that you can meet their expectations and provide a seamless payment experience.

Tools for Automating Billing Creation

Several tools are available to help automate the generation of payment requests, making it easier to manage your finances and improve efficiency:

- Accounting Software: Platforms like QuickBooks, FreshBooks, or Xero offer automated billing features. These tools allow you to set up recurring billing schedules, automatically track time and expenses, and generate payment requests with minimal input.

- Project Management Tools: Many project tracking platforms, such as Monday.com, Asana, or Trello, integrate with invoicing tools, enabling you to create payment documents directly from the tasks completed or hours logged in the system.

- Dedicated Billing Apps: Specialized apps like Zoho Invoice or Bill.com can automate the creation, tracking, and sending of billing documents based on the data you input. These tools often include features for recurring invoices, tax calculations, and integration with payment gateways.

By integrating these tools into your workflow, you can automate the process of creating and sending payment requests, making the entire billing cycle faster, more reliable, and easier to manage. Automation allows you to focus on growing your business while ensuring that financial documentation remains accurate and timely.

Ensuring Clear Payment Terms on Invoices

Establishing clear and precise payment terms in your financial documents is essential for maintaining good relationships with clients and ensuring timely payments. Clearly outlining when and how payments should be made helps avoid misunderstandings and delays, creating a smoother transaction process. By specifying details such as due dates, late fees, and accepted payment methods, you make it easier for clients to understand their obligations and for you to collect payment on time.

Key Elements of Payment Terms

When outlining payment terms, it is important to include the following details to ensure clarity and prevent confusion:

- Due Date: Clearly state when payment is expected. Providing a specific date (e.g., “Payment due within 30 days from the date of the document”) helps set clear expectations and creates a firm deadline for the client.

- Payment Methods: Indicate the accepted methods of payment, such as bank transfers, credit cards, or online payment systems. This ensures that clients are aware of the options available to them and can choose the most convenient one.

- Late Payment Fees: Include a statement regarding late fees, if applicable. This can be a fixed amount or a percentage of the total due after the due date has passed. Clear communication of late fees helps discourage delayed payments.

- Discounts for Early Payment: If you offer a discount for early payment, make sure to specify the percentage and the time frame within which it is valid. For example, “5% discount if paid within 10 days.”

- Partial Payments: If you allow clients to make partial payments, clearly state the terms of these arrangements, such as how many installments are allowed and the deadlines for each payment.

Best Practices for Communicating Payment Terms

To ensure that your clients fully understand the payment expectations, follow these best practices:

- Be Transparent: Always be upfront about your payment terms, including any potential late fees or discounts. Ambiguity can lead to confusion and missed payments.

- Use Simple Language: Avoid overly complex jargon. Use straightforward, easy-to-understand language to ensure that clients can easily grasp the terms.

- Highlight Key Information: Emphasize important details like the due date and payment methods. You can bold or underline these elements to make them stand out on the document.

- Reiterate Payment Terms in Correspondence: When discussing projects or sending reminders, reiterate the payment terms to reinforce understanding and encourage timely payment.

By providing clear, detailed, and transparent payment terms in your financial documents, you help foster trust with your clients and reduce the chances of late or missed payments. This clarity sets the foundation for a smooth and professional business relationship.

How to Handle Late Payments and Invoices

Dealing with overdue payments is an inevitable part of any business. Late payments can disrupt cash flow and create unnecessary stress. However, managing overdue accounts efficiently and professionally is crucial to maintaining healthy client relationships while ensuring you receive compensation for your services. Clear communication, structured follow-ups, and understanding when and how to apply penalties can help you address late payments effectively.

Steps to Take When Payments Are Late

When a payment becomes overdue, it’s important to handle the situation carefully to preserve your business’s reputation and relationship with the client:

- Send a Reminder: Start with a polite reminder email or message as soon as the payment is overdue. Gently remind the client of the agreed-upon payment terms and provide all necessary details, such as the outstanding amount and the due date.

- Offer Flexible Payment Options: If the client is facing financial difficulties, consider offering a payment plan or extending the due date. This can help maintain goodwill while still ensuring that you receive payment over time.

- Communicate Regularly: Stay in touch with the client throughout the late payment period. Regular communication helps keep the issue top of mind for the client and shows that you are actively following up on the matter.

- Apply Late Fees: If your payment terms include a penalty for late payments, apply it as stipulated in your agreement. This can serve as both an incentive for the client to pay promptly and a compensation for the delay.

When to Take Further Action

If reminders and communication don’t lead to payment, you may need to take more serious steps:

- Escalate to a Collection Agency: If the payment remains outstanding after multiple reminders, you may consider working with a collection agency to recover the funds. Be sure to assess the cost-effectiveness of this step and the potential impact on your client relationship.

- Legal Action: As a last resort, consider pursuing legal action if the overdue amount is significant and other methods have failed. Consult a legal professional to understand your options and the steps involved in recovering funds through legal means.

- Reevaluate Future Business with the Client: If a client repeatedly misses payments, you may need to reconsider future work arrangements. For future projects, you could implement upfront payments or set stricter payment terms to reduce the likelihood of overdue accounts.

Handling late payments effectively requires a bala

Securing Invoice Data and Privacy

Ensuring the confidentiality and security of financial documents is essential in today’s digital landscape. These documents often contain sensitive client information, including payment details, personal data, and transaction histories, which need to be protected from unauthorized access or theft. Implementing strong security measures not only helps safeguard your business and client trust but also ensures compliance with data protection regulations.

Steps to Secure Financial Data

There are several key practices you can follow to secure the data included in your financial documents:

- Use Strong Encryption: Ensure that all digital records are encrypted both during transmission and storage. Encryption makes it difficult for unauthorized individuals to access or read the data, even if they intercept the document.

- Implement Secure Payment Gateways: When handling online payments, use reliable and secure payment platforms that comply with industry standards (such as PCI-DSS). These platforms ensure that payment details are safely processed and stored.

- Limit Access to Sensitive Data: Only allow authorized personnel to access financial documents. Use user roles and permissions within your accounting or billing software to restrict access to sensitive information.

- Regularly Update Software: Keep your accounting software, security systems, and any related tools up to date with the latest patches and security fixes. This helps protect against known vulnerabilities that could be exploited by attackers.

Best Practices for Client Privacy

In addition to securing your own data, it’s crucial to respect and protect the privacy of your clients:

- Obtain Client Consent: Before collecting or sharing any personal information, ensure that you have obtained consent from your clients. This could include agreeing to how their data will be stored and used.

- Store Data Securely: Any sensitive client data, such as billing addresses or contact details, should be stored in a secure, encrypted system that adheres to privacy regulations like GDPR or CCPA.

- Use Anonymous Data When Possible: If possible, avoid storing personally identifiable information unnecessarily. Use generalized or anonymized data to minimize privacy risks.

By taking these steps, you can ensure that both your financial records and client data are protected from unauthorized access, reducing the risk of data breaches and maintaining the trust of your clients. Data security and privacy are not only about technology but also about building a culture of responsibility and accountability within your business.

Improving Cash Flow with Better Invoicing

One of the most critical factors in maintaining a healthy business is consistent cash flow. By streamlining and improving the process of billing clients, you can ensure that payments are received promptly, reducing delays and financial strain. A well-organized billing system not only accelerates payments but also minimizes errors and disputes, leading to better financial stability. In this section, we’ll explore how optimizing your billing practices can significantly improve cash flow and keep your operations running smoothly.

Key Strategies to Improve Cash Flow

Effective financial document management is crucial for accelerating cash flow. The following strategies can help ensure timely payments and reduce cash flow gaps:

- Clear and Detailed Documentation: Ensure that every billing statement is accurate, including precise service descriptions, rates, and total amounts. This reduces the chance of confusion or disputes that could delay payment.

- Faster Billing Process: Send out billing documents promptly, ideally as soon as a task or service is completed. The quicker a client receives a billing request, the sooner they can process payment.

- Set Clear Payment Terms: Establish clear terms regarding due dates, payment methods, and late fees. Clients are more likely to pay on time if they know what is expected of them from the outset.

- Offer Multiple Payment Options: Make it easy for clients to pay by offering various payment methods such as bank transfers, credit card payments, or online payment systems like PayPal or Stripe.

Tracking Payments and Reducing Delays

To maintain a healthy cash flow, it’s essential to keep track of your outstanding payments and follow up on overdue accounts. Here are some tips for reducing delays:

- Automated Reminders: Set up automated reminders for clients as the payment due date approaches, and send follow-up reminders if payment is delayed.

- Offer Early Payment Discounts: Encourage clients to pay early by offering a small discount. This can motivate clients to settle their bills more quickly and improve your cash flow.

- Use Escalation Procedures: For persistent late payers, develop a procedure for escalating the issue, such as applying late fees or involving a collections agency if necessary.

Sample Billing and Payment Timeline

Here’s an example of a billing and payment cycle that ensures faster payments and improved cash flow:

| Action | Timing |

|---|---|

| Complete Service or Task | Immediately |

| Generate and Send Billing Statement | Within 24 hours |

| Reminder Sent (if applicable) | 3-5 days before due date |

| First Follow-Up for Overdue Payment | 5-7 days after due date |

| Second Follow-Up for Overdue Payment | 14-21 days after due date |

| Apply Late Fee or Other Action | 30 days after due date |

By adopting these strategies, you can reduce the time it takes to collect payments and improve your business’s overall cash flow. This leads to more predictable revenue, greater financial flexibility, and a smoother operation overall.