Free Invoice Template Word Download for Easy Customization

Managing finances and keeping track of transactions is an essential part of running any business. One of the most efficient ways to ensure smooth financial operations is by using ready-made documents for billing. These documents allow you to maintain a professional appearance while simplifying the process of requesting payment for your services or products.

By leveraging accessible tools and customizable formats, you can create customized payment requests in minutes. Whether you are a freelancer, small business owner, or a large corporation, having a reliable and straightforward method for creating these documents is crucial for maintaining consistency and professionalism in your business dealings.

Tailoring these documents to suit your needs is easier than ever. With just a few modifications, you can align the document with your specific requirements, ensuring that it reflects your brand and meets the expectations of your clients. This simple approach saves time and reduces the risk of errors, allowing you to focus on what truly matters – growing your business.

Free Invoice Template Word Download

For small businesses and freelancers, having access to ready-to-use documents for requesting payments can save valuable time and ensure a professional approach to billing. These pre-designed files provide a convenient way to handle the creation of essential financial paperwork, allowing users to focus on growing their business rather than getting bogged down by administrative tasks. With various formats available, finding the right one for your needs is easier than ever.

Benefits of Using Pre-Formatted Documents

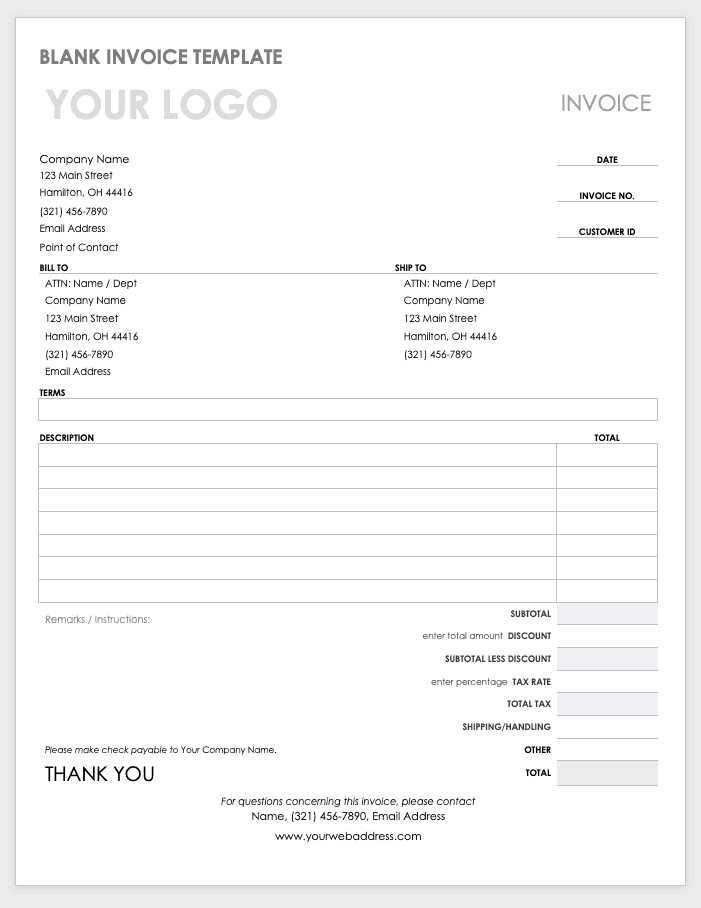

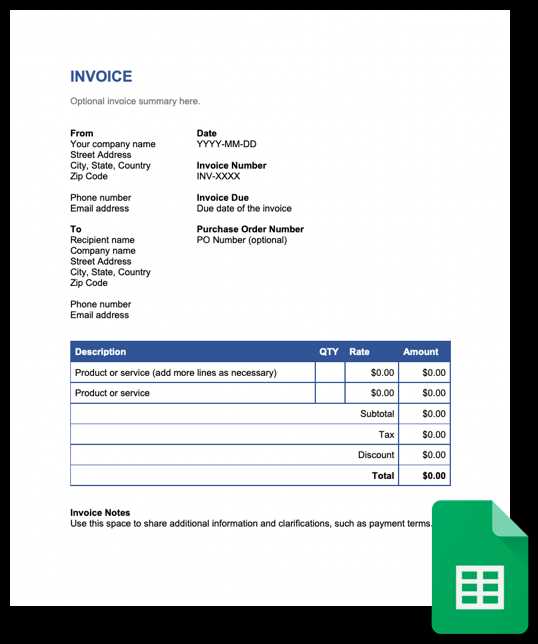

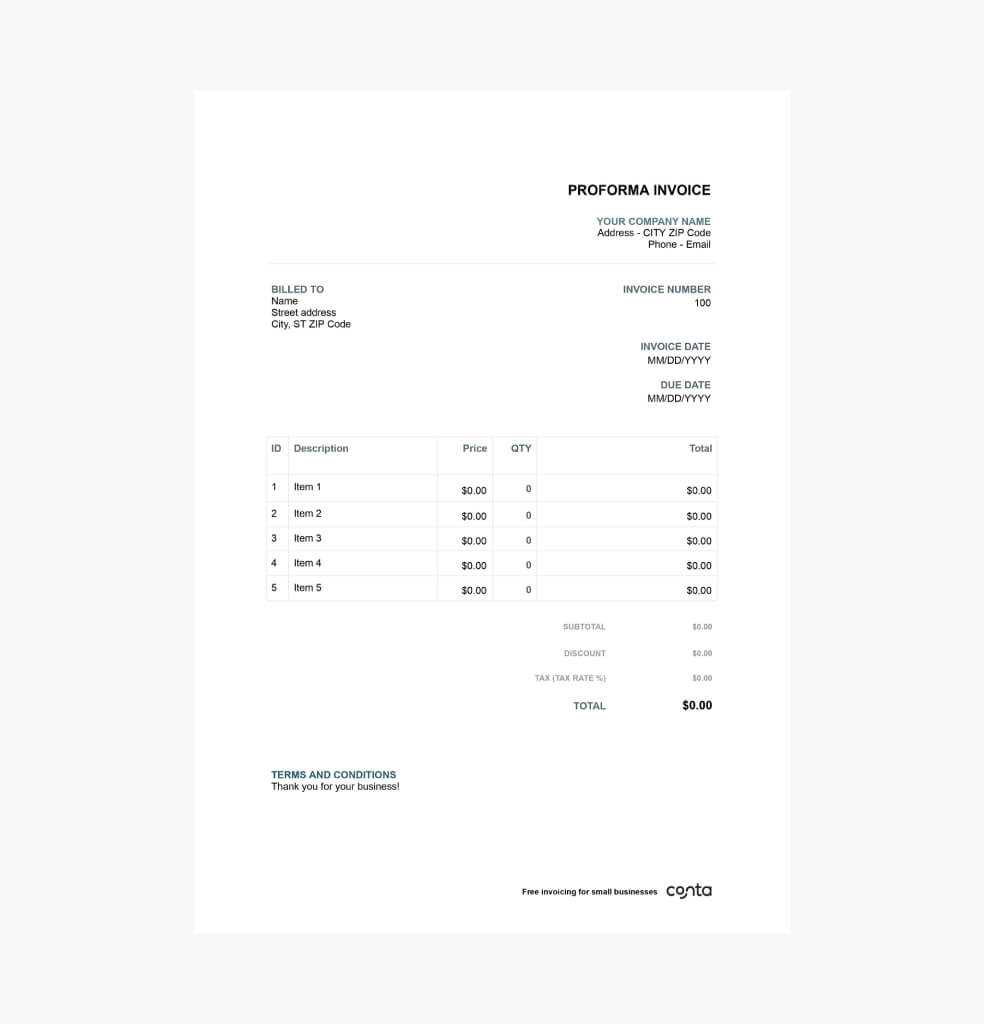

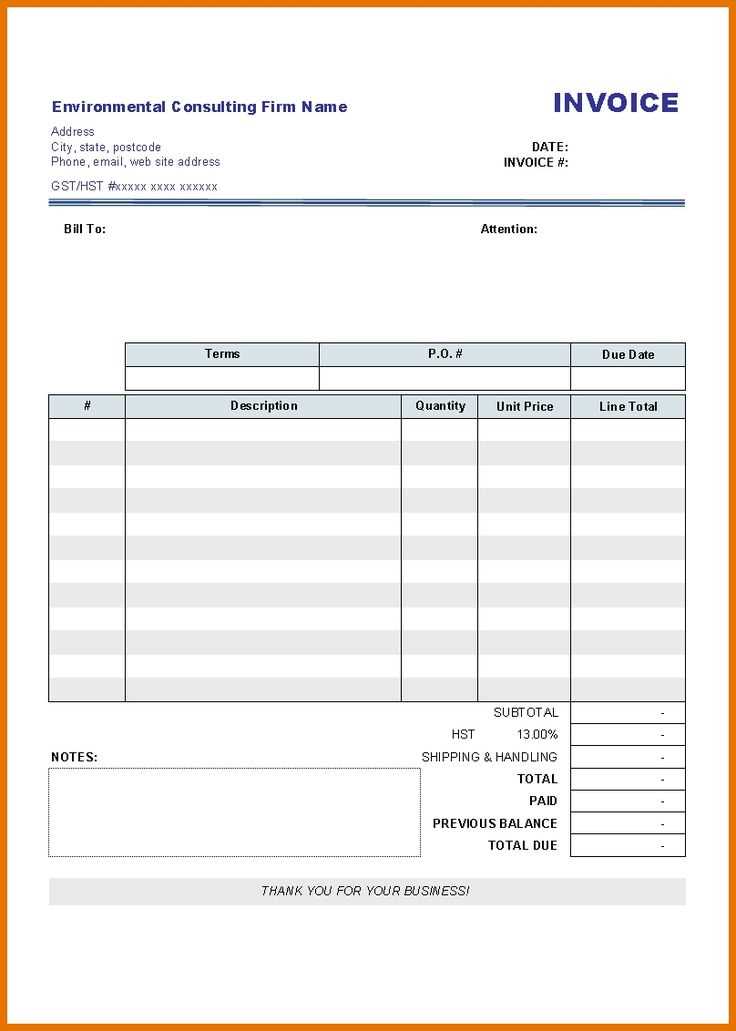

Using pre-designed documents helps maintain consistency and professionalism in all your financial interactions. Customizable formats allow you to personalize the layout, details, and branding elements, ensuring the document meets your business requirements. These files are designed to be user-friendly, offering flexibility while maintaining essential components that are legally required in payment requests.

How to Access and Customize Documents

Accessing these ready-to-use files is simple, and most are available without cost. Once you have the document, editing it to suit your specific needs is straightforward. Whether you need to adjust contact information, itemize services, or apply specific payment terms, the customizable sections make it easy to tailor the content. This flexibility ensures that you can present a clear and organized statement, enhancing communication with your clients.

Customization made easy means you don’t have to start from scratch every time you need to create a payment request. You can quickly modify the file to match different projects, clients, or payment schedules. This efficiency reduces errors and accelerates your billing cycle.

How to Download an Invoice Template

Obtaining ready-to-use documents for creating payment requests is a simple and quick process. With numerous platforms offering access to customizable files, you can easily find a format that suits your needs. Once you identify a suitable option, getting started is just a few clicks away.

Here are the basic steps to access and use these helpful resources:

- Visit a reliable website that provides pre-designed files for financial purposes.

- Browse through the available options and choose a format that fits your business requirements.

- Click on the link to obtain the document. The file will either be accessible directly on the site or through a prompt for saving to your device.

- Save the file to your computer or cloud storage for easy access whenever you need it.

Once the file is saved, you can proceed to open it and begin customizing the content for your specific needs. Modifying the document is simple, allowing you to add your business details, set payment terms, and adjust other necessary fields.

When selecting a site, ensure that the resources provided are trustworthy and offer formats that can be easily edited. This will save time in the long run and prevent unnecessary complications when preparing financial paperwork.

Top Benefits of Using Word Templates

Using pre-designed files for creating business documents provides a wide range of advantages that streamline administrative tasks. These ready-made solutions offer both efficiency and flexibility, helping businesses save time and ensure accuracy in their paperwork. When choosing the right format for your needs, many users prefer using editable documents that can be customized quickly and easily.

Time-Saving and Convenient

One of the key benefits of these pre-designed formats is the significant time savings they provide. Instead of creating a document from scratch, you can start with a professional layout and simply modify the details. This is especially useful when dealing with repetitive tasks, such as preparing payment requests for multiple clients. The time you save on formatting and design can be better spent on other essential business activities.

Customization and Flexibility

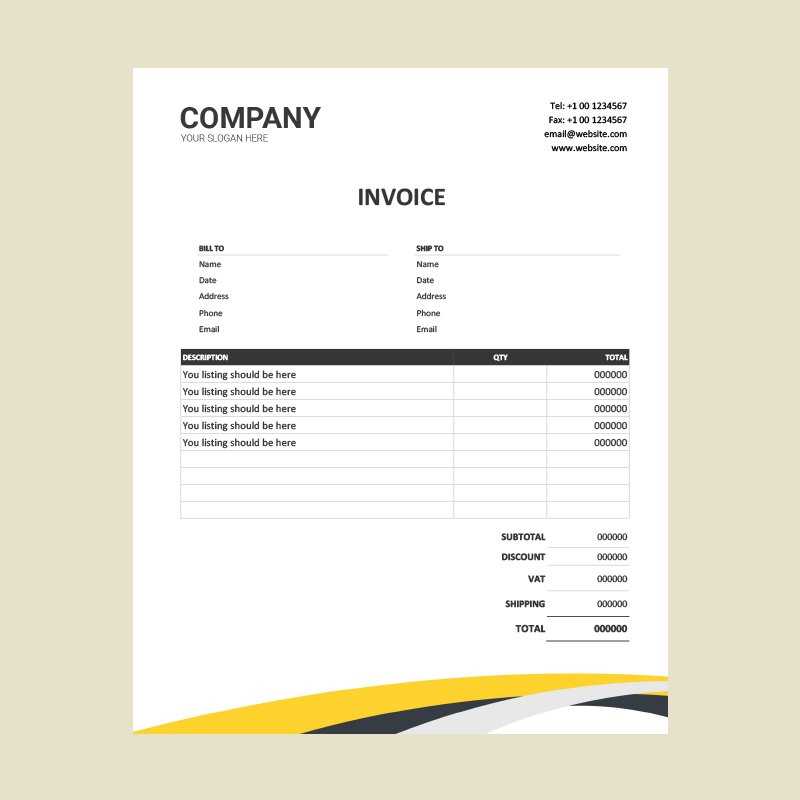

Customizability is another major advantage of using these editable files. Whether you’re tailoring the document for a specific client, adjusting payment terms, or incorporating your brand elements, the flexibility of these files ensures that the final document meets your unique needs. With just a few changes, you can adjust fonts, logos, and layout to match your business’s identity, making the document both professional and personal.

Consistency and Professionalism are also enhanced by using pre-designed files. With a consistent format across all your business documents, you create a cohesive, professional image that builds trust with clients. It also reduces the chance of errors, ensuring that all important information is included and formatted correctly each time.

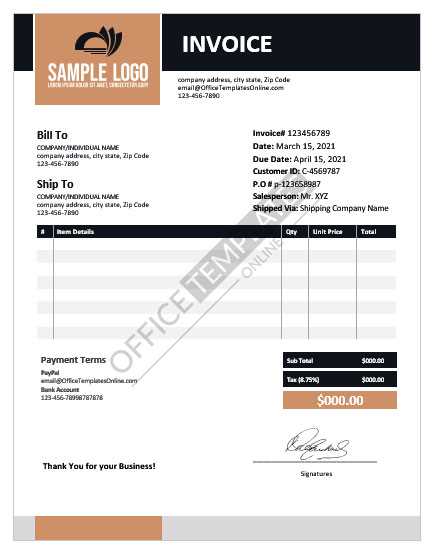

Customizing Your Free Invoice Template

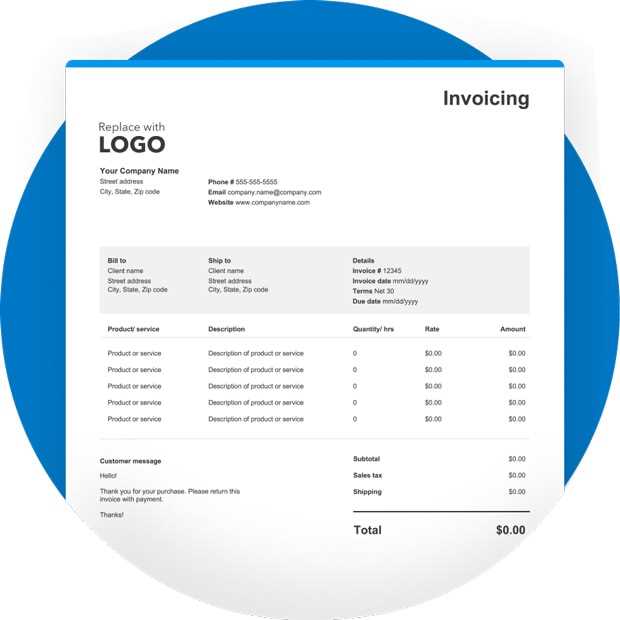

Once you’ve selected a suitable document for your billing needs, customizing it to align with your business requirements is the next step. Personalization allows you to adapt the layout, adjust sections, and incorporate your branding elements, ensuring that the final document reflects your unique style and meets client expectations. This process is quick and easy, thanks to the flexibility of editable files.

Adding Your Business Details

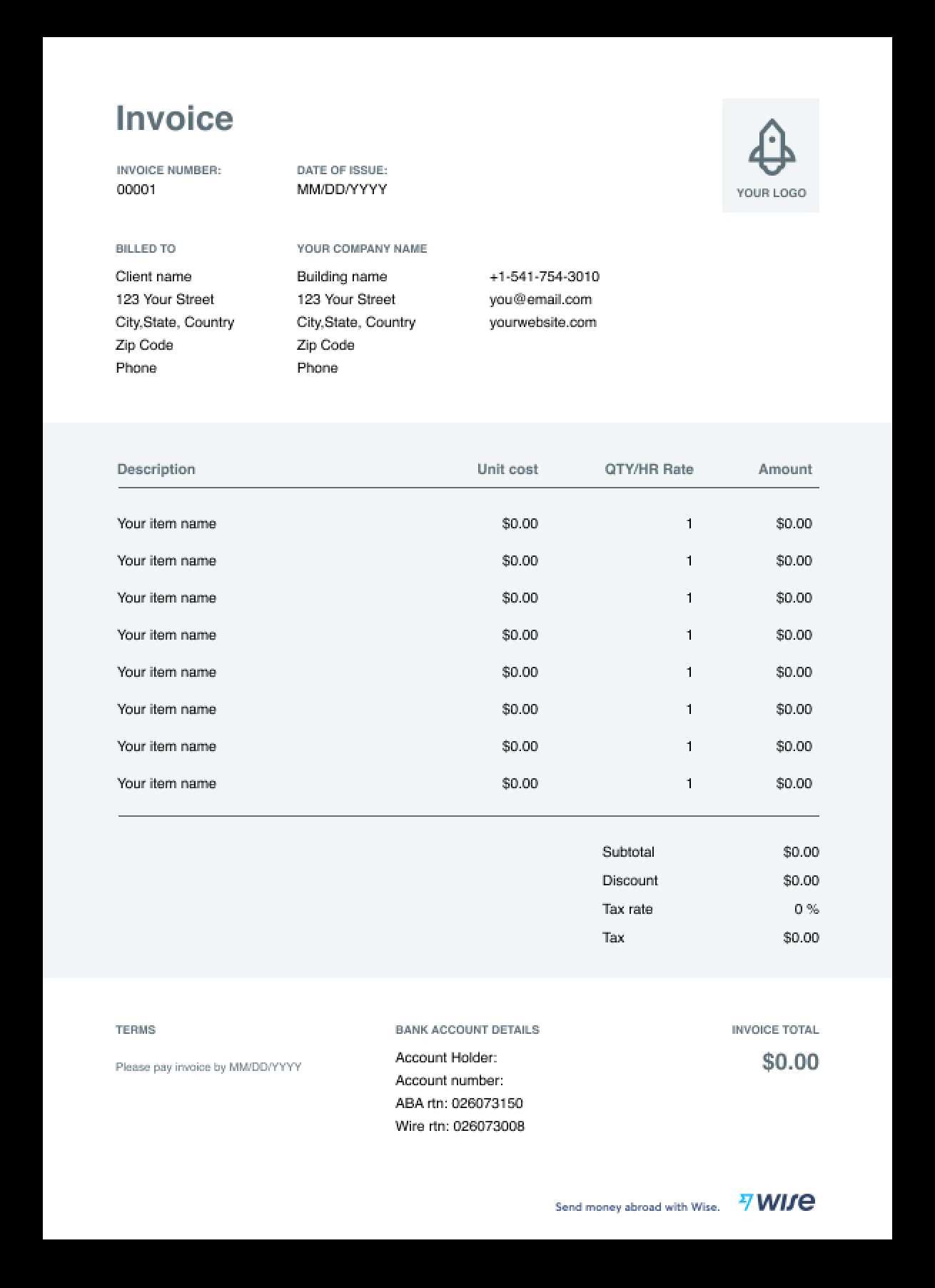

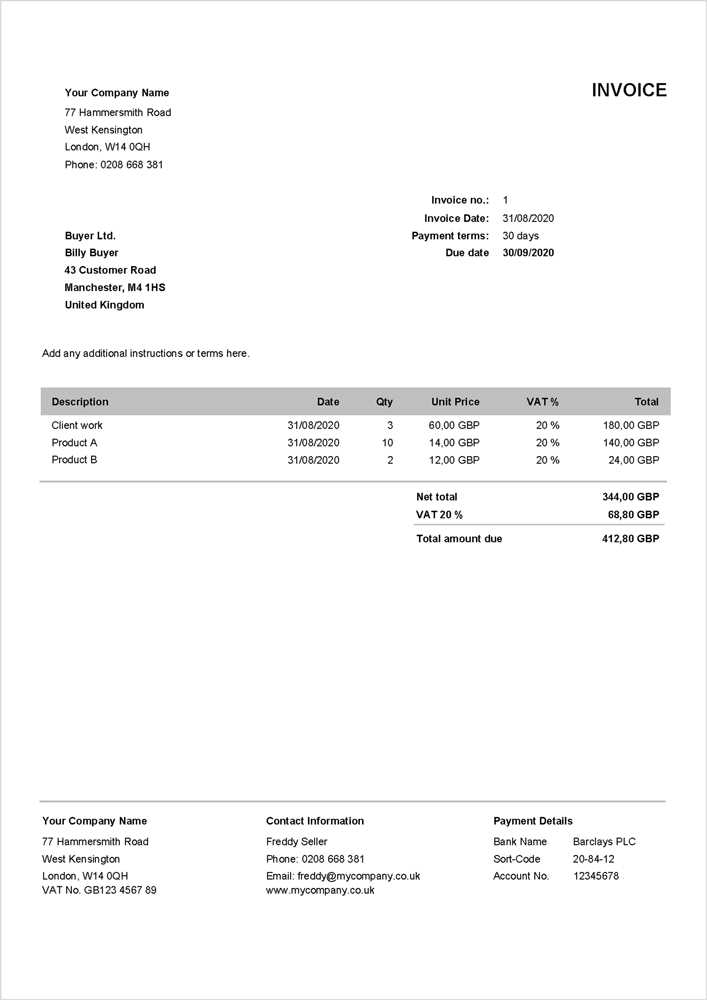

The first modification you’ll likely make is adding your business information. This typically includes your company name, address, contact number, and email. Ensuring these details are accurate and consistent is important, as it helps clients identify your business and establishes trust. Including your logo can also enhance brand recognition and make the document appear more professional.

Adjusting the Structure and Content

Another key customization is adjusting the structure of the document to suit specific transactions. You may need to add or remove fields, change the way products or services are listed, or include additional sections like taxes or payment terms. These files are designed to be flexible, so you can make modifications as necessary without affecting the overall format.

Customization enhances clarity by allowing you to ensure all required information is included. Whether you need to highlight important dates, break down costs more clearly, or add payment instructions, the ability to tailor the document makes the billing process smoother for both you and your clients.

Efficient modifications save you time and help maintain accuracy in your documents, which ultimately reduces the likelihood of mistakes and disputes, leading to better client relationships.

Why Choose Word Over Other Formats

When it comes to creating business documents, choosing the right format can make a significant difference in terms of ease of use and flexibility. Among the many options available, certain formats stand out for their simplicity and widespread compatibility. For many users, selecting an editable file format like a Microsoft-based document proves to be a practical and efficient choice.

Compatibility and Accessibility

One of the main reasons many opt for this format is its universal compatibility. Microsoft Office software is widely used across different devices and platforms, making it easy to open, edit, and share documents with clients or team members. This ensures that no matter where the document is accessed, it will maintain its format and functionality, which is not always the case with other types of files.

Ease of Editing and Customization

Another advantage is the ease of customization. Files in this format are highly editable, allowing users to quickly make changes such as adding logos, adjusting layouts, or editing text. The tools provided are user-friendly, enabling anyone from beginners to professionals to create polished documents without the need for advanced skills. This flexibility saves both time and effort compared to other more rigid formats.

Simple formatting also helps streamline the creation process. Users can easily adjust margins, font sizes, and overall structure with just a few clicks, ensuring the document looks exactly how they envision it. In comparison, other formats may require more complex procedures for even minor adjustments.

Enhanced user control makes this format ideal for those looking to create professional-looking documents quickly, with minimal technical barriers and maximum convenience.

Simple Steps to Edit Invoice Templates

Editing pre-designed business documents is a straightforward process that can be completed in just a few minutes. Whether you need to adjust the layout, update client details, or change payment terms, making these modifications is easy and efficient. Here’s how to quickly edit an existing document to suit your needs.

Step 1: Open the Document

The first step is to open the file using an appropriate software application. Most devices are equipped with programs that support these editable formats, making it simple to get started. Once opened, the document will appear in its default layout, ready for customization.

Step 2: Modify Key Information

Begin by updating the most important sections, such as your business name, contact details, and client information. This is typically located at the top or in the header of the document. Ensuring that these details are accurate and up-to-date is crucial for smooth communication with your clients.

Make any necessary adjustments to the body of the document, including adding specific items or services provided, pricing, and payment instructions. You can also modify the payment due date and any terms relevant to the transaction.

Step 3: Adjust Layout and Style

Next, make any layout adjustments that will enhance readability and clarity. This can include changing fonts, colors, or rearranging sections to suit your preferences. Adding your company logo and other branding elements can also help reinforce your business identity.

Final touches may include checking for consistency in formatting, ensuring that all the necessary fields are filled out, and that there are no errors. Once satisfied with the changes, save the document, and it’s ready to send or print.

Save Time with Ready-Made Invoice Templates

Creating billing documents from scratch can be a time-consuming process, especially when you need to manage multiple transactions. Using pre-designed documents allows you to streamline this task, reducing the time spent on formatting and structuring the layout. By utilizing ready-made formats, you can focus on the content rather than the design, speeding up your workflow significantly.

With these ready-to-use solutions, all the essential sections are already in place, allowing you to simply enter the specific details for each transaction. This means no more worrying about the structure, alignment, or placement of text–everything is already optimized for clarity and professionalism.

Pre-designed documents help avoid repetitive work, as they can be reused for multiple clients or projects. Once you have your business details in place, you can easily generate new documents by updating only the relevant information. This efficiency not only saves you time but also ensures consistency across all your paperwork.

Moreover, with a few quick adjustments, you can tailor each document to reflect your brand’s identity, adding logos, colors, and custom messages as needed. The ability to make these changes in a matter of minutes ensures that you can handle your billing tasks quickly and professionally without any unnecessary delays.

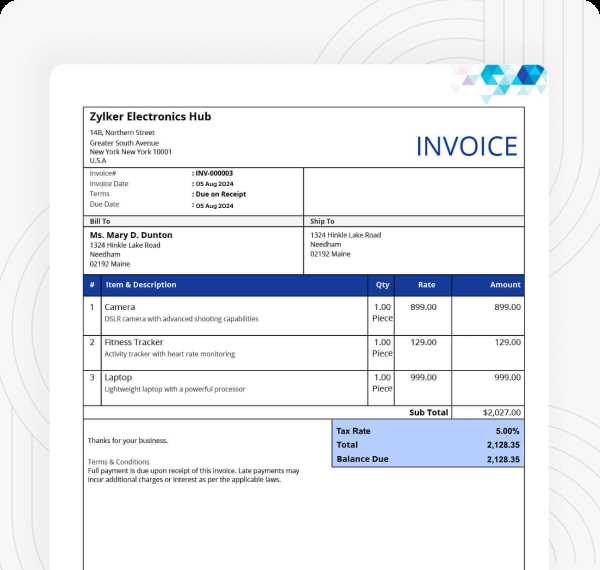

How to Create a Professional Invoice

Creating a polished and professional billing document is crucial for any business, as it reflects your brand’s reputation and helps ensure timely payments. A well-structured request for payment provides clarity and makes it easier for your clients to understand the services provided, the total amount due, and the payment terms. Here’s a step-by-step guide on how to craft an effective and professional payment request.

Step 1: Include Your Business Information

Your business details should be prominently displayed at the top of the document. This includes your business name, logo, address, contact number, and email. It’s also a good idea to include your business registration number, if applicable, as this adds to the professionalism of the document.

Step 2: Add Client Information

Ensure that the recipient’s details are clearly stated, including their name, company name (if applicable), address, and contact information. Properly addressing your clients adds a personal touch and reduces the chance of confusion.

Step 3: Clearly List the Services or Products

Next, outline the specific services or products you provided. For each item, include the following:

- Description of the service or product.

- Quantity or number of hours worked.

- Unit price or rate per hour/item.

- Total amount for each service or product.

Step 4: Specify Payment Terms and Due Date

Be sure to clearly define the payment terms. Include details like payment methods accepted, any discounts or late fees, and most importantly, the due date for payment. Having these terms clearly outlined ensures both you and your client are on the same page, avoiding confusion or delays in payment.

Step 5: Review and Finalize

Before sending, review the document to ensure all information is correct. Check for accuracy in the amounts, dates, and contact details. A clear, error-free document not only helps in getting paid promptly but also strengthens your professional image.

Once finalized, you can save or print the document and send it to your client, confident that it represents your business professionally and effectively.

Essential Elements of an Invoice

To ensure a smooth transaction and maintain professionalism, certain key components must be included in any billing document. These elements not only provide clarity for both you and your client but also help ensure that the request for payment is processed correctly and efficiently. Below are the most important sections to include in a well-structured document.

1. Business and Client Information

The first section should contain both your business details and the client’s information. This is crucial for identification and easy communication. Key details to include:

- Your Business Name and Contact Information: Make sure to include your company name, address, email, and phone number.

- Client’s Name and Contact Information: Include the client’s name, company (if applicable), and their contact details.

- Unique Document Number: A reference number helps both parties track the document for future reference.

2. Description of Goods or Services

Detailing what has been provided is vital for transparency. Each product or service should be listed separately with the following:

- Item Description: A clear description of the product or service provided.

- Quantity: Specify the amount or number of items or hours worked.

- Unit Price: State the price per unit or rate for the service offered.

- Total Amount: Calculate the total cost for each item or service.

3. Payment Details

Make sure to include the terms for payment to avoid any confusion. Important aspects to include:

- Due Date: Clearly state when payment is expected.

- Payment Methods: Indicate which payment methods are accepted (e.g., bank transfer, credit card, etc.).

- Late Fees (if applicable): If your terms include a late fee, this should be outlined as well.

4. Additional Notes or Terms

If there are any special instructions, conditions, or additional details relevant to the transaction, this section is the place to include them. This can include:

- Discounts or Promotions: Any discounts that were applied to the order.

- Custom Payment Terms: For example, installment plans or early payment discounts.

- Other Conditions: Any warranties, return policies, or legal terms that apply to the transaction.

Ensuring that all these essential elements are present in your document not only ensures smooth processing but also helps maintain clear and professional communication between you and your clients.

Where to Find Quality Free Templates

Finding high-quality, pre-designed documents for business use is easier than ever. Many online platforms offer a variety of customizable formats at no cost, allowing you to create professional-looking billing requests in just a few steps. These resources cater to businesses of all sizes, offering solutions that can be tailored to meet specific needs.

Some of the best places to find these ready-made solutions include:

- Online Office Suites: Popular office software providers often offer a range of professionally designed formats that are easy to access and modify. These services typically provide free versions with basic functionalities, making them perfect for small businesses and freelancers.

- Design Websites: Many graphic design websites feature customizable layouts for business documents. While these sites often provide paid options, they also offer a selection of high-quality, no-cost formats that can be edited to fit your needs.

- Document Sharing Platforms: Websites that specialize in file sharing and storage often have extensive libraries of templates contributed by users and professionals. These can be easily accessed and are typically available in a variety of formats to suit your preferences.

- Business Resource Blogs: Numerous blogs dedicated to business tools and resources frequently offer free downloadable files. These sites not only provide document designs but also offer tips and guides on how to customize them effectively for your business.

Exploring these resources will give you access to a wide range of options, helping you find exactly what you need. By utilizing these sources, you can quickly create professional, well-organized documents that will help streamline your billing process.

Common Mistakes to Avoid in Invoices

Creating accurate and professional billing documents is crucial to maintaining good client relationships and ensuring timely payments. However, mistakes can easily slip through the cracks, leading to confusion or delays. To avoid complications, it’s essential to be mindful of common errors that can occur when preparing payment requests. Below are some of the most frequent issues and how to prevent them.

1. Missing or Incorrect Contact Information

One of the most common mistakes is failing to include complete and accurate contact details for both your business and the client. This can lead to misunderstandings, delayed payments, or difficulty in reaching the right person for payment processing. Always double-check that the name, address, phone number, and email address are correctly listed.

2. Lack of Clear Payment Terms

Not clearly outlining the payment terms is another mistake that can cause confusion. If the due date, payment method, or any late fees aren’t specified, it becomes harder for the client to understand what is expected. Be sure to include clear instructions, including the due date and acceptable payment methods, as well as any penalties for late payments.

3. Incorrect Amounts or Calculations

Errors in pricing or calculations are some of the most critical mistakes you can make, as they can lead to disputes and delayed payments. Always double-check that the amounts for each product or service are correct and that the final total adds up properly. A simple miscalculation can undermine your credibility.

4. Failing to Include a Unique Reference Number

A unique reference number is essential for tracking and organizing your documents. Without it, it becomes difficult for both you and your client to reference the transaction in the future. Always assign a distinct number to each document for easy identification.

5. Missing Details for Products or Services

When listing what was provided, be sure to include detailed descriptions of the products or services. Vague or incomplete entries can lead to confusion or disputes. Ensure that the quantity, description, and price are clearly stated to avoid misunderstandings.

6. Not Reviewing the Document Before Sending

Finally, failing to thoroughly review the document before sending it is a major mistake. Small errors can easily go unnoticed, so it’s essential to proofread everything for accuracy, including spelling, grammar, and formatting. A polished and professional document shows your attention to detail and helps maintain your business’s reputation.

By avoiding these common mistakes, you can ensure that your payment requests are clear, accurate, and professional, reducing the likelihood of disputes and helping to maintain smooth business operations.

How to Save and Share Your Invoice

Once your billing document is ready, it’s important to save and share it efficiently with your clients. Properly saving the file ensures that you have a record of the transaction for future reference, while sharing it promptly guarantees that your client receives the payment request on time. Below are the key steps to save and share your document correctly.

1. Saving Your Document

Before sending the document, make sure it is saved in the appropriate format. The most commonly used formats are PDF and DOCX, but you should select one that is easiest for both you and your client to handle. PDFs, for example, are ideal for preserving the formatting and ensuring that the document appears the same on any device.

- Save in a clear, organized folder: Keep all your documents in a designated folder for easy access and record-keeping.

- Give it a descriptive name: Name the document with a unique identifier, such as the client’s name or invoice number, followed by the date or service description for easy reference.

- Backup your file: It’s always a good idea to back up important documents in the cloud or on an external drive in case of technical issues.

2. Sharing Your Document

Once your document is saved, the next step is to share it with your client. Here are a few options to consider:

- Email: The most common method for sharing a document is via email. Attach the file to a well-crafted email, including a brief message explaining the content and any action needed from the client.

- Cloud Storage Links: If the file is too large or if you want to ensure your client can access it at any time, you can upload it to cloud storage services like Google Drive, Dropbox, or OneDrive and share the link with them.

- File Sharing Services: Use secure file-sharing platforms to provide a direct link to the document, ensuring that the recipient can easily access it while keeping the file protected.

Timely sharing helps ensure that the payment request is received and processed without unnecessary delays. Always confirm receipt with your client to avoid any miscommunication or missed payments.

What Makes a Good Invoice Template

A well-structured billing document is essential for maintaining professionalism and ensuring clarity between you and your client. A good document serves not only as a request for payment but also as a clear record of the services provided and the terms of the transaction. Here are the key features that make a billing document effective and professional.

1. Clear and Organized Layout

One of the most important elements of any document is its layout. A clean, organized design helps both you and your client easily navigate the content. Key features include:

- Well-Defined Sections: Separate sections for the business and client details, list of services or products, and payment terms help keep the document clear and easy to read.

- Logical Flow: Information should be arranged in a logical order, starting with the business details and ending with the payment instructions or terms.

- Legible Fonts: Use simple, readable fonts and adequate spacing to ensure the document is easy on the eyes and professional in appearance.

2. Comprehensive Information

While a clean design is essential, the content is just as important. A good billing document should provide all the necessary details to avoid confusion or mistakes. This includes:

- Complete Business and Client Information: Ensure all names, addresses, and contact details are included so both parties can easily identify each other.

- Clear Descriptions of Goods or Services: List each product or service provided, along with their corresponding prices, quantities, and any applicable taxes or discounts.

- Accurate Payment Terms: Clearly state the due date, accepted payment methods, and any penalties for late payments.

3. Professional Branding

A good document should reflect your brand’s identity. Customizing your document with your company’s logo, colors, and other branding elements can create a polished and professional appearance. This adds credibility to the transaction and strengthens your company’s identity in the client’s eyes.

4. Customizability

Flexibility is another important feature of a good billing document. The ability to easily customize the document to fit different clients or projects is crucial. This includes the ability to:

- Adjust Layout: Modify sections to add or remove details depending on the scope of the project.

- Update Pricing and Terms: Easily change prices, payment terms, or other details without disrupting the overall design.

By incorporating these elements, you can create a billing document that is both functional and professional, helping ensure smooth and timely transactions.

How to Tailor Templates for Your Business

Customizing pre-designed documents to fit your business needs can save time and ensure consistency across your transactions. By adjusting the structure, design, and content of a standard document, you can create something that reflects your brand, meets client expectations, and aligns with your operational requirements. Here’s how you can easily tailor ready-made formats for your specific business needs.

1. Adjust the Design to Match Your Brand

The first step in customizing a document is to make it look like it belongs to your business. Include your company’s logo, colors, and font choices to match your branding. This adds professionalism and makes the document feel cohesive with your other business materials. Additionally, customize the layout to align with your aesthetic or the preferences of your target audience.

2. Add Specific Service or Product Information

Every business has its own unique offerings. Make sure your document accurately reflects the products or services you provide. Adjust the list sections by adding the relevant descriptions, quantities, pricing, and any other specifics that apply to your business. If you offer discounts or special packages, create fields that will allow you to highlight them clearly for the client.

3. Customize Payment Terms and Conditions

Payment terms can vary widely depending on your industry and client relationships. Be sure to adjust the payment due dates, methods, and any late fees to suit your business practices. Some businesses may offer installment payments, while others may require immediate payment or provide discounts for early settlement. Make these terms clear and adjust them for each client or transaction type.

4. Include Legal or Compliance Information

Some industries require specific legal disclaimers or compliance-related information in their documentation. If your business operates under certain regulations, ensure that the necessary terms, disclaimers, or privacy policies are included in your document. This might involve adding a section for terms and conditions, return policies, or other legally required information.

5. Save Multiple Versions for Different Purposes

Different types of transactions may require different formats. For instance, the details you need to include for a project-based service might differ from those required for a product sale. By saving different versions of your document for different purposes, you can quickly tailor them to fit the specific nature of the business transaction.

By following these steps, you’ll be able to create a consistent and personalized document that enhances your professional image, facilitates better communication with clients, and streamlines your business processes.

Using Invoice Templates for Freelancers

For freelancers, managing client relationships and maintaining a smooth workflow is essential. One of the most important aspects of this is sending clear and professional payment requests. Using pre-designed billing documents can save freelancers valuable time and ensure they present themselves professionally. These ready-made formats provide an easy and efficient way to bill clients without starting from scratch every time.

1. Streamlining the Billing Process

For freelancers, every project often involves different clients, services, and payment terms. Having a ready-to-use structure simplifies the process of creating customized payment requests for each project. This allows you to focus on the work itself while ensuring that all necessary details–such as service descriptions, hourly rates, or agreed-upon amounts–are included every time without error.

2. Maintaining Professionalism

Using a structured document reflects professionalism and builds trust with clients. By customizing your document with your branding, contact details, and clear payment instructions, you send a message that you are organized and committed to your work. This can help create a positive first impression and foster long-term client relationships.

For freelancers, the ability to quickly generate and send billing requests ensures that no payment is missed, reducing administrative overhead. Additionally, maintaining consistency in your billing helps prevent confusion and potential disputes, ensuring a smoother payment process.

3. Tailoring to Client Needs

One of the advantages of using a pre-made format is the flexibility it offers. Freelancers can easily adjust the document based on the specific requirements of each project or client. Whether you’re providing services for a one-time project or an ongoing retainer, you can modify details like payment schedules, taxes, or discounts to meet client expectations and agreements.

In summary, using pre-designed billing documents helps freelancers stay organized, save time, and maintain professionalism. By customizing these documents, freelancers can effectively manage their business transactions and ensure timely payments while focusing on their creative work.

Why Templates Improve Billing Efficiency

Efficient billing is critical to maintaining healthy cash flow and positive client relationships, especially for small businesses and freelancers. One way to streamline the process is by using pre-designed billing formats that help save time, reduce errors, and improve consistency. These ready-made structures offer a simple and effective way to handle billing tasks without reinventing the wheel each time. By implementing a structured format, businesses can ensure that key details are consistently included, making the billing process quicker and more accurate.

1. Reducing Time Spent on Document Creation

Creating a billing document from scratch for every client can be time-consuming and repetitive. By using a pre-structured format, you eliminate the need to build a new document every time you complete a project. This not only speeds up the process but also ensures that you can focus on the most important aspects of your work rather than administrative tasks. A ready-made structure enables you to quickly input project details, adjust pricing, and finalize the document in a fraction of the time.

2. Minimizing Errors and Improving Accuracy

When billing is done manually, there’s always the risk of forgetting key details or making simple mistakes, such as incorrect calculations or missing contact information. Pre-designed formats ensure that all necessary fields are included and organized in a logical manner, reducing the likelihood of errors. This level of consistency helps maintain the professionalism of your business, builds trust with clients, and prevents potential confusion that could delay payments.

Consistency is another key benefit of using a structured format. Every billing document you create follows the same layout and includes the same essential information, ensuring uniformity across all client interactions. This approach improves communication and reduces misunderstandings related to payment terms, services rendered, or total amounts owed.

3. Streamlining Client Communication

By using a standardized structure, you can easily communicate important information to clients. Details such as service descriptions, payment due dates, and accepted methods of payment are consistently presented, making the transaction transparent and easy to understand. This clarity helps clients process payments faster, as they don’t need to spend time figuring out the details of the document.

In conclusion, using a structured format for billing improves efficiency by saving time, reducing errors, and maintaining consistency. It simplifies the entire process, allowing businesses to focus on growth and client satisfaction, while ensuring timely and accurate payments.

Legal Requirements for Invoice Templates

When creating billing documents for your business, it’s essential to ensure they meet legal standards. Many countries and jurisdictions have specific requirements that dictate what must be included in a payment request. These rules are designed to protect both businesses and clients, ensuring transparency, preventing fraud, and facilitating proper financial reporting. Failing to adhere to these regulations can lead to delays in payments, legal disputes, or even fines.

1. Key Information to Include

Regardless of the type of document, there are certain pieces of information that must be present for the document to be legally valid. These details include:

- Business Details: Your business name, address, and contact information should be clearly visible on the document. In some jurisdictions, including a tax identification number (TIN) may also be required.

- Client Information: The client’s name and address must be included to identify the recipient of the services or goods provided.

- Unique Identification Number: Each billing document should have a unique number for tracking purposes. This number ensures that both you and your client can reference the transaction easily in case of disputes or audits.

- Description of Goods or Services: A detailed list of what was provided, including quantities, unit prices, and any additional fees or discounts.

- Tax Information: If applicable, you must include relevant tax rates, tax amounts, and the total amount due, showing the tax calculations clearly.

- Payment Terms: It is essential to specify when the payment is due, the accepted methods of payment, and any late fees that may apply if the payment is delayed.

2. Compliance with Local Laws and Regulations

Different countries or regions may have specific legal requirements for billing documents. For instance, in the European Union, VAT (Value Added Tax) must be listed separately, while in the United States, businesses may need to include the sales tax amount for certain transactions. Additionally, certain industries, such as healthcare or finance, may have their own rules for what must be included in billing documents.

To stay compliant, make sure you research and understand the regulations that apply to your business and jurisdiction. This will help you create billing documents that meet legal standards and avoid potential issues down the line.

3. Keeping Records for Legal and Tax Purposes

Legally, businesses are required to keep accurate records of all financial transactions for a certain period, often ranging from three to seven years depending on the jurisdiction. Having a proper, legally compliant billing system in place makes it easier to organize and store these records. This ensures that you can produce accurate records in case of audits or disputes.

In conclusion, ensuring your billing documents meet legal requirements not only helps your business stay compliant but also fosters trust with your clients. By including all the necessary information and understanding local regulations