Free Videography Invoice Template for Easy Billing

Managing financial transactions in the creative industry can be a challenging task, but having a well-structured billing document is essential for smooth operations. Whether you’re offering video production, editing, or other related services, clear and professional payment requests ensure both you and your clients are on the same page. Properly designed forms not only enhance your professional image but also streamline the entire process, reducing misunderstandings and potential delays.

In this guide, we will explore how to create an efficient billing form that fits the needs of your business. With the right structure, you can easily communicate all the important details like service charges, due dates, and payment instructions. A well-prepared document serves as a clear record for both parties, making financial management much easier in the long run.

Whether you’re a seasoned expert or just starting out in the industry, using the right tools to simplify billing will help you focus more on your creative work and less on administrative tasks. Let’s look at how to develop an effective document and the tools that can assist in making the process as smooth as possible.

Free Videography Invoice Template for Professionals

For those working in the video production industry, creating clear and concise billing documents is an important part of maintaining professionalism and ensuring timely payments. Having a standard format that can be easily customized for each project allows you to manage finances efficiently and present your services in a polished manner. A well-designed billing form ensures that all necessary details are included and avoids confusion for both you and your clients.

Benefits of Using a Pre-Designed Billing Form

One of the main advantages of using a pre-built document for your payment requests is the ability to save time. With a structure already in place, you can quickly fill in the project details, service fees, and other necessary information, ensuring that each bill looks professional and is ready for submission without any delay. It also allows you to maintain consistency across all your projects, enhancing your reputation and making financial tracking easier.

How a Customized Document Improves Your Workflow

When working with different clients or multiple projects, flexibility is key. A customizable form allows you to adjust specific sections based on the work you’ve completed and the unique needs of each project. You can easily modify the terms, include additional charges for extra services, and adjust the payment due date. This flexibility helps keep your workflow organized, so you can focus on what you do best–creating high-quality video content.

By adopting a customizable billing format, you ensure that your financial transactions are handled in a professional, efficient manner, giving your clients confidence in your services and helping you get paid on time.

How to Create a Billing Document for Your Video Services

Creating a proper payment request is essential for any professional in the video production industry. This document serves as an official record of the services provided, including all necessary details for payment. It helps clients understand what they are being charged for and provides a clear timeline for when payment is expected. Crafting a well-structured form not only boosts your credibility but also helps ensure timely payments and smooth financial transactions.

Key Information to Include in Your Payment Request

A comprehensive and clear billing document should include several critical pieces of information. These elements ensure both you and your clients are aligned on the terms of the payment. Be sure to include the following:

- Client Information: The client’s name, company name, and contact details.

- Service Description: A detailed list of the services provided (e.g., filming, editing, equipment rental, etc.).

- Payment Amount: The total cost for services, broken down if necessary.

- Due Date: The date by which the payment is expected.

- Payment Methods: Accepted payment options such as bank transfer, PayPal, etc.

- Terms and Conditions: Any additional terms, such as late fees or discounts for early payment.

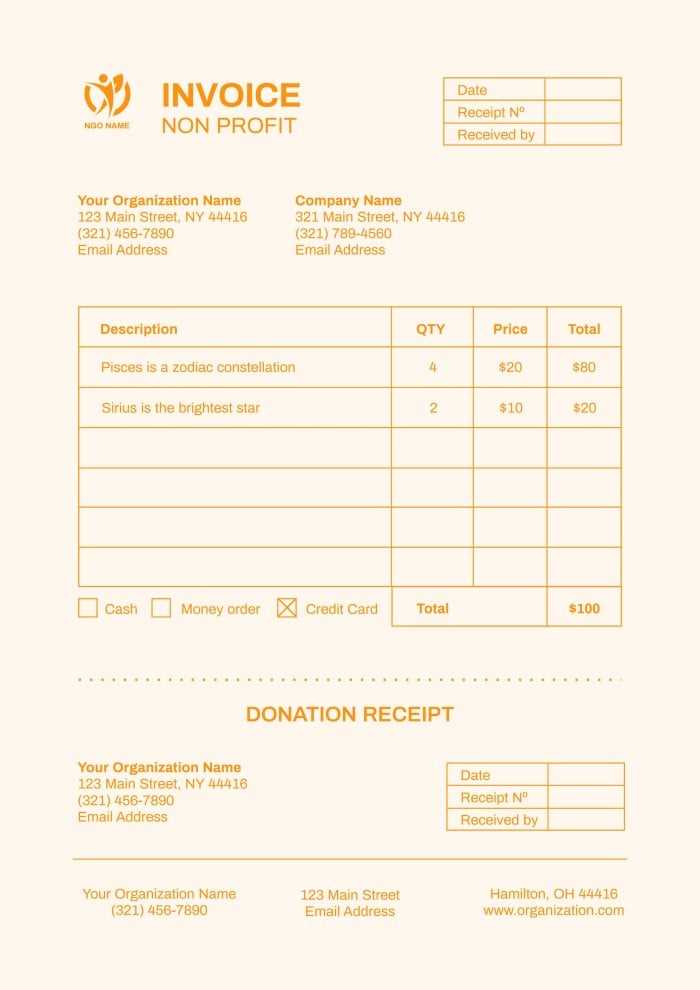

Steps to Create Your Document

Follow these simple steps to create a professional payment request:

- Select a Format: Choose whether you’ll use a word processor, spreadsheet, or specialized billing software to create your document.

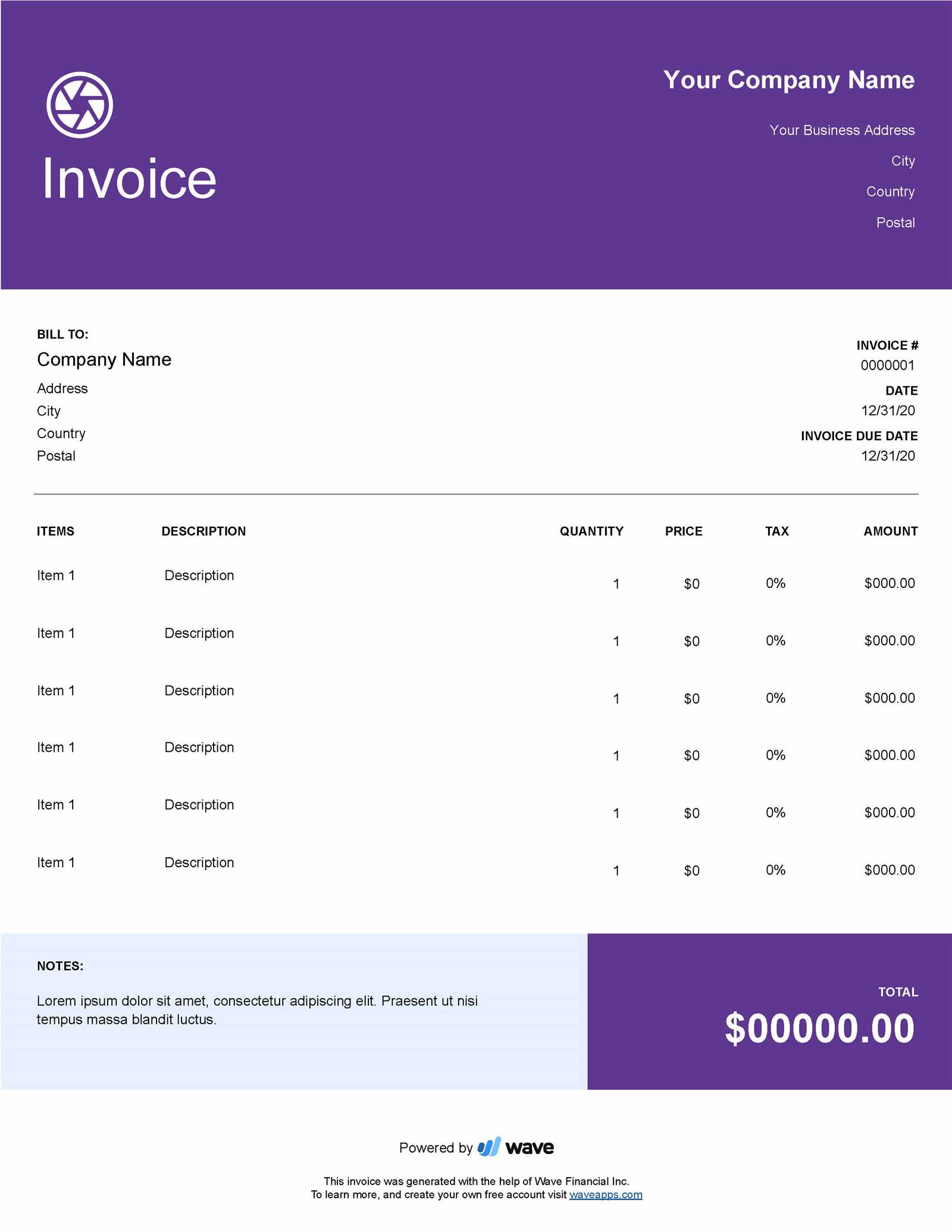

- Include Your Branding: Add your logo, business name, and contact information at the top to reinforce your professional image.

- Break Down Services: Clearly list each service provided, along with the corresponding cost for transparency.

- Set Payment Terms: Specify the due date and any late fee policies, making sure both parties are aware of the terms.

- Review for Accuracy: Double-check the document to ensure all information is correct before sending it to the client.

By following these guidelines, you’ll ensure that your payment requests are clear, professional, and help maintain a smooth financial relationship with your clients.

Essential Elements of a Billing Document for Video Services

A well-constructed payment request ensures both clarity and professionalism when it comes to managing financial transactions in the video production industry. It’s important to include all relevant details so that both the service provider and the client are fully aware of the charges, payment terms, and expectations. Having a standardized format that covers all the key elements can save time, reduce confusion, and help maintain a positive working relationship.

There are several critical components that every payment request should include to ensure it is both comprehensive and clear. These elements protect both parties, provide legal clarity, and create a smooth process for handling finances.

- Business Information: The name of your company, contact details, and business address should be included at the top to establish your professional identity.

- Client Information: Be sure to include the name, address, and contact details of the client receiving the services.

- Detailed List of Services: Break down the services provided, including hours worked, specific tasks, and any additional charges, so the client understands what they are paying for.

- Service Dates: Include the dates the services were rendered to ensure there is no confusion about when the work was completed.

- Amount Due: Clearly state the total amount owed, along with any taxes or additional charges.

- Payment Due Date: Indicate when the payment is expected to be made, helping to avoid late payments or misunderstandings.

- Payment Methods: Specify how the client can make the payment, whether via bank transfer, credit card, or other methods.

- Terms and Conditions: Outline any payment policies, such as late fees, early payment discounts, or specific contractual terms that apply to the project.

By ensuring that these key elements are present, you will create a professional, effective document that clearly communicates the financial terms to your clients, promoting trust and transparency.

Benefits of Using a Pre-Designed Billing Document

Using a pre-designed document for billing can simplify the process of managing your financial transactions and make your business operations more efficient. When you have a consistent, structured format to follow, you reduce the risk of errors and ensure that all necessary information is included every time you create a request. This not only saves you time but also presents a more professional image to your clients, fostering trust and encouraging prompt payments.

Key Advantages of a Structured Payment Request

There are several benefits to using a standardized form for your payment requests. These advantages range from time-saving to ensuring greater accuracy in your financial communications. Below are some of the main reasons why adopting a pre-made billing structure can be beneficial for your business:

| Benefit | Description |

|---|---|

| Time-Saving | Pre-designed documents allow you to quickly fill in client details and services rendered, eliminating the need to start from scratch each time. |

| Consistency | Using the same format ensures uniformity across all your billing records, helping maintain a professional image and making it easier to track payments. |

| Accuracy | By following a consistent structure, you reduce the chance of missing critical information, such as payment terms or service descriptions. |

| Professional Appearance | Clients will appreciate the polished and organized look of your documents, enhancing your reputation as a reliable and detail-oriented service provider. |

| Reduced Errors | Templates help prevent common mistakes, such as leaving out important payment terms or service charges, which can lead to confusion or delays in payments. |

How It Improves Efficiency

Having a pre-designed structure reduces the administrative burden, allowing you to focus more on your core work. It also helps ensure that your records are clear and easy to understand for both you and your clients, making financial management less time-consuming and more accurate.

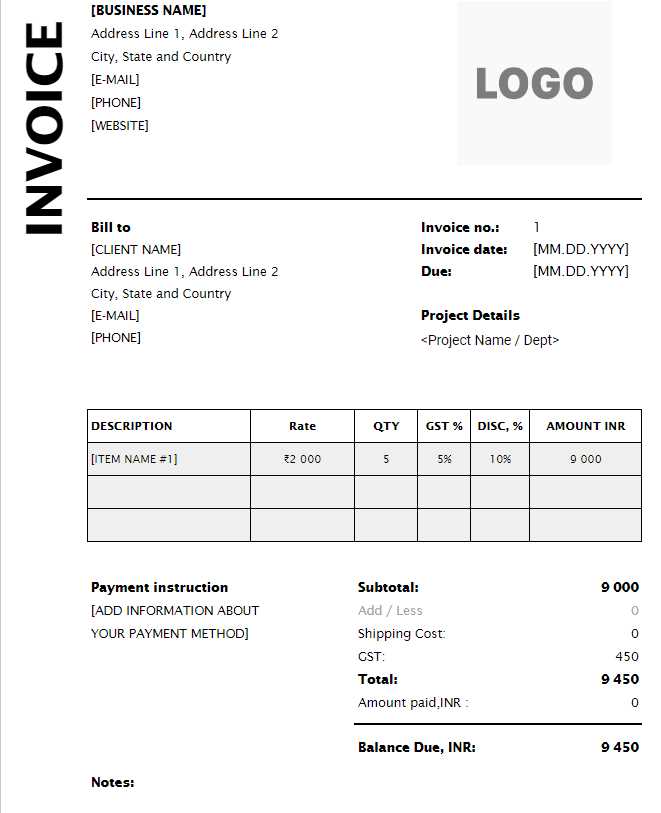

Customizing Your Billing Document

Personalizing your billing document is an important step in making sure it reflects both your business’s unique style and the specific needs of each project. By adjusting the structure, design, and content, you can create a document that’s tailored to your services and offers a clear and professional presentation to clients. Customization helps you stand out while ensuring that all necessary details are included and aligned with your brand identity.

To ensure your payment requests are both effective and personalized, consider making the following adjustments:

- Branding: Include your company logo, business name, and contact details at the top. This reinforces your professional image and makes the document instantly recognizable as coming from you.

- Service Descriptions: Tailor the descriptions of the services you’ve provided to match the unique aspects of each project. This allows your clients to clearly understand what they’re being billed for.

- Payment Terms: Adjust the payment terms to suit different client agreements. For example, you might offer different payment schedules or discounts depending on the nature of the project or client relationship.

- Layout: Modify the layout to make it more visually appealing or easier to read. A clean and well-organized design will help ensure the document is user-friendly and professional.

- Additional Charges: If you have additional fees for rush orders, extra services, or other specifics, make sure these are clearly itemized and explained.

Customizing your payment document ensures that it works for your specific business and provides the flexibility to adapt to different projects, while still maintaining consistency and professionalism in your communications with clients.

Free Tools for Generating Billing Documents

There are numerous online tools available that can help simplify the process of creating and managing payment requests. These tools range from basic, easy-to-use options to more advanced platforms with customizable features. Using such resources can save you valuable time, reduce the likelihood of errors, and ensure your financial records remain consistent and professional.

Here are some popular tools that can help you generate billing documents quickly and efficiently:

| Tool | Features | Best For |

|---|---|---|

| Wave | Simple interface, automatic calculations, customizable fields, and cloud storage. | Small businesses and freelancers looking for an easy-to-use and free solution. |

| Zoho Invoice | Customizable templates, recurring billing, and multi-currency support. | Freelancers and growing businesses who need professional features with no cost. |

| PayPal | Instant billing, integration with PayPal payments, and invoice tracking. | Anyone already using PayPal for payments, looking for a quick billing solution. |

| Invoice Generator | Pre-designed layouts, simple to fill out, no sign-up required. | Freelancers who need a straightforward, no-fuss billing tool. |

| Google Docs | Customizable templates and easy document sharing, can be used offline. | Those who prefer a simple, flexible solution with the option for collaboration. |

By using these tools, you can quickly create customized payment requests that suit your business needs, while maintaining professionalism and efficiency. Most of these platforms also offer cloud storage and tracking, which can help you stay organized and keep your financial records up to date.

How to Avoid Common Billing Mistakes

Handling financial transactions professionally is crucial to maintaining positive relationships with clients and ensuring timely payments. However, there are several common mistakes that can lead to confusion, delayed payments, or even lost revenue. Understanding these pitfalls and knowing how to avoid them can help streamline your billing process, improve client satisfaction, and ensure your business runs smoothly.

Ensure Accuracy in Service Details

One of the most frequent mistakes when creating payment requests is the omission or inaccuracy of service descriptions. When clients receive a document that lacks clarity or details about the services rendered, they may question the charges or delay payment. To avoid this, always provide a clear breakdown of what was completed, including hours worked, specific tasks, and any additional services. This not only protects your interests but also helps clients understand exactly what they are being billed for.

Double-Check Payment Information

Another common error is providing incorrect payment instructions. This can lead to delays and missed payments, especially if clients are unsure how to proceed. Make sure the following details are always accurate:

- Bank Account Details: Ensure that your account number and routing number (if applicable) are correctly listed.

- Payment Methods: Specify all available payment methods clearly, whether it’s credit card, bank transfer, or online payment platforms.

- Due Date: Clearly indicate the payment due date, so there is no confusion about when the amount should be settled.

Taking the time to verify that all payment information is correct before sending out your request will save you from unnecessary back-and-forth communication and ensure that payments arrive on time.

Use Clear Terms and Conditions

Another mistake many service providers make is not including clear terms and conditions for payments. Whether it’s late fees, discounts for early payment, or other special terms, it’s important to spell them out explicitly. This helps set expectations and avoid misunderstandings. Having well-defined payment terms also demonstrates professionalism and can help reduce disputes or delays in receiving payment.

By avoiding these common mistakes, you’ll ensure that your payment process is smooth, efficient, and professional, allowing you to focus more on delivering great service to your clients.

How to Add Payment Terms to Your Billing Document

Clearly outlining payment terms in your billing document is essential for setting expectations and ensuring timely compensation for your work. Including specific conditions regarding payment methods, due dates, and penalties for late payments helps avoid misunderstandings and promotes transparency between you and your clients. Having clear terms protects both parties and contributes to a smoother transaction process.

Here are some key elements to consider when adding payment conditions to your financial document:

- Payment Due Date: Always specify the exact date by which the payment should be made. This eliminates any ambiguity and gives your clients a clear deadline to work with.

- Accepted Payment Methods: List all the payment options you accept, such as bank transfer, credit card, or online platforms. This makes it easier for clients to pay in the most convenient way for them.

- Late Fees: If applicable, include any penalties for overdue payments. Be specific about the late fee structure, whether it’s a flat fee or a percentage of the total amount due.

- Early Payment Discounts: If you offer discounts for early settlement, make sure to highlight this in the document. Clearly state the discount percentage and the conditions (e.g., “5% off if paid within 7 days”).

- Payment Installments: If you’re allowing the client to pay in multiple installments, outline the payment schedule and amounts clearly. Specify due dates for each installment to avoid confusion.

By including these elements in your billing document, you create a clear framework for how payments should be handled, helping both you and your client avoid surprises and ensure that the financial side of your work proceeds smoothly.

Why You Need Clear Payment Details

Providing clear and concise payment information in your financial documents is essential for ensuring smooth transactions between you and your clients. Ambiguity around payment terms can lead to confusion, delays, or disputes, which can ultimately affect your cash flow and business reputation. By outlining precise details, you create a professional environment where both parties understand their obligations, helping to avoid misunderstandings and fostering trust.

Helps Avoid Delays and Confusion

When the payment details are unclear, clients may hesitate or delay payment simply because they are unsure about how to proceed. Whether it’s about which payment method to use or when exactly the payment is due, lack of clarity can cause unnecessary delays. By specifying payment methods, due dates, and any other important terms, you reduce the chances of late payments and ensure that both you and your client are on the same page from the start.

Builds Professionalism and Trust

Having well-defined payment terms demonstrates your professionalism and attention to detail. It reassures your clients that you are organized and serious about your business. Clear payment instructions help build trust, as clients are more likely to feel comfortable working with someone who communicates effectively and sets clear expectations from the outset.

By taking the time to provide transparent payment details, you help foster a more efficient, respectful, and professional relationship with your clients, which can lead to more successful business transactions and long-term partnerships.

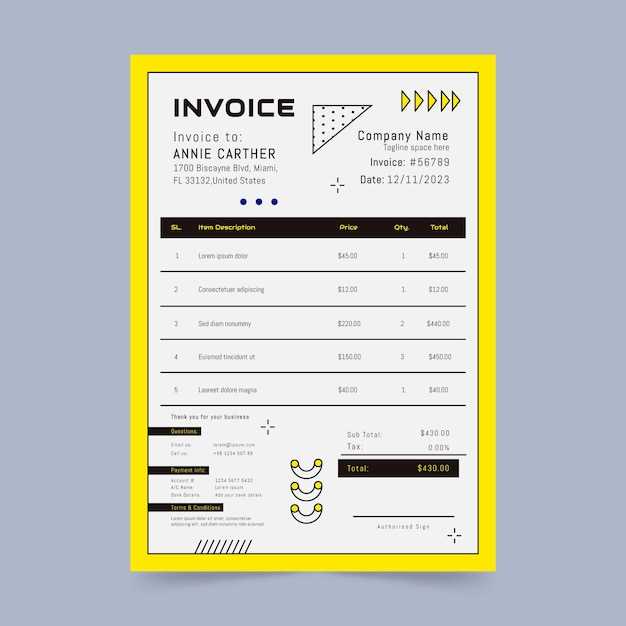

Best Practices for Professional Billing Documents

Creating professional billing documents is an essential skill for any business. A well-structured and clear document not only ensures timely payments but also promotes a positive, trustworthy image to clients. By following best practices, you can minimize mistakes, avoid misunderstandings, and make the payment process smooth for both you and your customers.

Here are some of the most important practices to follow when crafting your payment requests:

- Clarity and Simplicity: Keep your document easy to read and free from unnecessary clutter. Use clear language, well-organized sections, and a consistent format to ensure all essential details are immediately visible.

- Include Complete Contact Information: Always list your full business name, address, phone number, email, and website (if applicable). Additionally, make sure the client’s contact details are accurate.

- Detailed Service Breakdown: Be specific about the services provided. Include descriptions of tasks performed, hours worked, rates, and any additional costs. This transparency helps avoid confusion and supports trust between you and your client.

- Payment Methods and Terms: Clearly state how you expect to be paid and provide multiple payment options if possible. Include any necessary details for online transfers, checks, or other methods. Also, outline due dates and any fees for late payments.

- Use Sequential Numbering: Number your documents sequentially to keep track of all transactions and make it easier for both you and your clients to refer to specific records. This helps with organization and future references.

- Proofread Before Sending: Always double-check your documents for errors before sending them to clients. Simple mistakes, like incorrect amounts or missing details, can cause unnecessary delays in payment.

By adhering to these best practices, you’ll not only improve your payment process but also strengthen your reputation as a reliable and professional business partner.

Improving Cash Flow with Billing Documents

Effective management of your financial documents is crucial to maintaining a steady cash flow in any business. Well-structured payment requests not only ensure that you get paid promptly but also help you track outstanding amounts and anticipate future revenue. By streamlining the billing process and implementing smart strategies, you can minimize delays and improve your overall financial health.

Here are several ways in which proper financial documentation can positively impact your cash flow:

- Clear Payment Terms: Clearly defined payment terms help clients understand exactly when payments are due and the consequences of delays. This reduces the likelihood of late payments, which can disrupt your cash flow.

- Prompt Billing: Send out your documents as soon as possible after completing a project or providing a service. The sooner you request payment, the sooner you’ll receive it, allowing your business to maintain a steady stream of income.

- Itemized Breakdown: Offering a detailed breakdown of services and associated costs helps clients understand the value they are receiving. Transparency promotes faster payments and reduces the chances of disputes.

- Follow-Up Reminders: Sending polite reminders before and after the due date helps ensure payments are not forgotten. This simple step can significantly improve your collection rate.

- Early Payment Discounts: Offering discounts for early settlement incentivizes clients to pay faster. This approach not only benefits your cash flow but can also strengthen client relationships.

By incorporating these strategies into your billing process, you can create a more predictable revenue stream and improve the overall financial stability of your business.

Tracking Payments and Due Dates

Efficiently tracking payments and monitoring due dates is vital to maintaining a healthy cash flow and ensuring that your business operations run smoothly. Without proper tracking, it’s easy to lose sight of which payments are outstanding or overdue, leading to financial uncertainty. Implementing a reliable system to track payment progress and deadlines helps you stay organized, minimize late payments, and maintain strong client relationships.

Why Tracking is Crucial

By actively tracking payments and due dates, you ensure that no payment is overlooked and that clients are reminded of their obligations. A solid tracking system allows you to:

- Ensure Timely Payments: Stay on top of when payments are due, reducing the risk of overdue amounts and late fees.

- Identify Late Payments: Quickly identify which clients have missed payments, allowing you to follow up promptly.

- Improve Cash Flow: Regular tracking helps ensure that funds are received when expected, making it easier to plan for business expenses.

Methods for Effective Tracking

There are several ways to track payments and deadlines effectively. Below are some methods you can use to stay on top of your financial records:

- Spreadsheets: Simple spreadsheets can be customized to track due dates, amounts, and payment status. Using columns for each of these factors helps you stay organized.

- Accounting Software: Many accounting platforms offer built-in features to automatically track payments, set reminders for due dates, and generate reports on outstanding balances.

- Manual Follow-Up: Regularly reviewing your payment records and following up with clients through email or phone can be an effective way to ensure payments are made on time.

By utilizing these methods, you can ensure your business runs smoothly, with timely payments and accurate tracking, which ultimately supports your financial stability.

How to Handle Late Payments in the Creative Industry

Late payments are an unfortunate reality in many businesses, especially in creative fields where clients may sometimes delay payment for services rendered. However, it’s important to approach this situation professionally to maintain good relationships while ensuring that your business continues to thrive. Effectively managing overdue payments can help reduce financial stress and encourage prompt payments in the future.

Here are some strategies to help you handle late payments efficiently and professionally:

1. Establish Clear Payment Terms

The best way to avoid delays is to set clear expectations from the start. When outlining your payment conditions, be specific about:

- Due dates: Specify when the payment is due (e.g., “Net 30” or “payment due within 30 days of service completion”).

- Late fees: If you charge penalties for overdue payments, make sure to mention this in your terms.

- Accepted payment methods: List all options for how clients can make payments, including bank transfers, credit card payments, or online platforms.

Having these terms agreed upon upfront sets a professional tone and helps avoid confusion later on.

2. Send Friendly Reminders

If a payment becomes overdue, the first step is to send a polite reminder. It’s important to remain professional and friendly in your communication, as the delay could be due to oversight rather than any ill intent. A friendly reminder should include:

- The invoice number and date.

- The amount due and any outstanding fees.

- A gentle request for payment, along with your preferred payment methods and due date.

Sometimes, simply reminding clients of their obligation can prompt a quick resolution.

3. Be Firm but Professional

If the payment is still delayed after a reminder, it’s important to take a firmer approach, while still maintaining professionalism. You can send a second reminder with a stronger tone, mentioning any agreed-upon late fees or interest charges. You might also consider offering a payment plan if the client is experiencing financial difficulties.

4. Use Legal Measures If Necessary

In extreme cases where multiple reminders have been ignored, you may need to resort to legal action. This could involve sending a formal letter of demand or working with a collections agency. However, this should always be a last resort after all attempts to resolve the matter amicably have been exhausted.

By handling late payments with professionalism and transparency, you can minimize the impact on your business and continue to maintain positive relationships with your clients.

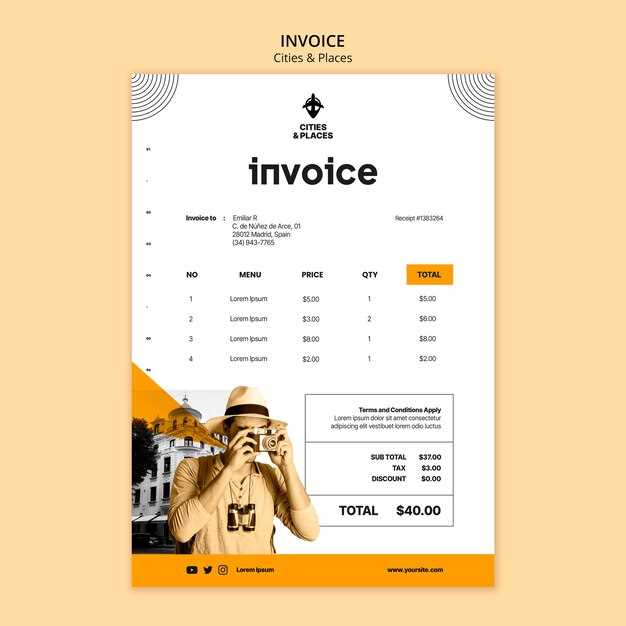

Creating a Billing Document for Video Editing Services

When it comes to requesting payment for video editing work, having a detailed and well-organized billing document is essential. A comprehensive document not only ensures that you get paid on time but also sets a professional tone for your services. Properly itemized information, clear terms, and transparent pricing can help build trust with your clients and reduce confusion about charges.

Here are the key elements to include when creating a payment request for video editing services:

Key Components to Include

When preparing a billing document for editing services, you should include the following essential details:

- Client Information: Ensure that both your name or business name and the client’s contact details are clearly stated at the top of the document.

- Project Details: Provide a description of the work completed, including the scope of editing services, hours worked, and any additional tasks performed, such as color correction, sound mixing, or special effects.

- Itemized Charges: Break down the costs for each aspect of the service, including editing rates per hour, any flat fees, or additional charges for specific edits (e.g., graphics, animation). This transparency helps avoid confusion and sets clear expectations.

- Payment Terms: Clearly define payment due dates, any late fees, and accepted methods of payment. You can also offer discounts for early payment if desired.

Example of an Itemized Breakdown

Below is an example of how an itemized breakdown for a video editing project might look:

| Description | Rate | Hours | Total |

|---|---|---|---|

| Basic editing (cutting and trimming) | $50/hr | 5 | $250 |

| Color correction | $40/hr | 2 | $80 |

| Sound mixing and enhancements | $30/hr | 3 | $90 |

| Subtotal | $420 | ||

| Tax (10%) | $42 | ||

| Total Due | $462 | ||

By following these guidelines and including detailed information, you’ll ensure that your clients understand exactly what they are paying for, which can lead to smoother transactions and stronger professional relationships.

How to Use a Digital Billing Document

Digital billing documents have become an essential tool for modern businesses, making the payment process quicker, easier, and more efficient. Using an electronic version of your payment request can streamline your workflow, reduce paperwork, and ensure that your clients receive professional and clear documentation. By following a few simple steps, you can easily customize and send these digital documents to clients in just a few clicks.

Steps to Use a Digital Billing Document

To get started with a digital document, follow these steps:

- Choose a Reliable Platform: Select a software or tool that suits your needs. Many online platforms offer customizable options, where you can input your business details, client information, and services provided.

- Customize Your Document: Start by entering the essential details, such as the client’s name, the description of services rendered, and any agreed-upon rates. You can often personalize the document with your logo, colors, and fonts to reflect your brand.

- Include Payment Details: Ensure that the due date, payment methods, and any late fees are clearly outlined. Providing this information in advance reduces confusion and helps facilitate a timely payment.

- Review and Edit: Always double-check the document for errors before sending it. Look for missing details, incorrect charges, or any other discrepancies that could lead to issues later on.

- Send Electronically: Once everything is in place, send the digital document via email or through an online payment system. Most platforms allow you to send the document directly from the tool, making the process quick and hassle-free.

Advantages of Digital Billing Documents

Using an electronic version of your billing document offers several benefits, such as:

- Efficiency: It saves time by eliminating the need for printing and mailing physical copies, allowing you to send documents instantly.

- Professional Appearance: A well-designed digital document looks clean and polished, leaving a positive impression on clients.

- Tracking and Organization: Digital documents can be easily tracked and stored, ensuring that you have an organized record of all transactions.

- Easy Payments: Some digital systems even integrate with payment gateways, allowing clients to pay directly through the document with just a few clicks.

By incorporating a digital system into your billing process, you can save time, enhance professionalism, and improve your overall payment collection process.

Tips for Freelance Videographers on Billing

As a freelance professional in the creative industry, managing payments efficiently is crucial to maintaining a steady income and ensuring smooth business operations. Properly managing your payment requests not only helps you get paid on time but also reflects your professionalism and strengthens your relationship with clients. Below are some essential tips for freelancers to handle payment requests with ease and accuracy.

1. Set Clear Payment Terms from the Start

It’s important to establish clear expectations with your clients regarding payment terms before starting any project. Be sure to specify:

- Payment Due Dates: Clearly mention when payments are expected, whether it’s upon completion, in installments, or after a specific milestone.

- Accepted Payment Methods: Let your clients know the methods you accept, such as bank transfers, credit cards, or digital payment platforms like PayPal.

- Late Fees: If applicable, inform clients about any penalties for overdue payments. This can encourage timely payments and protect your cash flow.

2. Use Detailed Descriptions for Services Rendered

When creating your payment requests, it’s essential to be as detailed as possible about the services you provided. This transparency helps avoid confusion and clarifies the value of your work. For example, if you provided editing services, include the hours spent editing, any specific tasks such as color grading or sound mixing, and any special requests made by the client.

Itemized billing gives your clients a clear understanding of how the total amount was calculated, which can prevent disputes down the line.

3. Keep Records Organized

Tracking all of your payments and pending amounts is critical to staying on top of your finances. Use digital tools or software to keep your records organized, making it easy to reference past jobs, check payment statuses, and follow up on overdue amounts. Regularly reviewing your records will also help you prepare for tax season and maintain financial clarity.

Being proactive with your records ensures that you stay on top of your business and can easily manage incoming and outgoing payments.

By following these tips, you can streamline your billing process and focus on what you do best–creating exceptional work for your clients.

Staying Organized with Billing Documents

Maintaining an organized system for tracking and managing your billing requests is crucial to running a smooth and efficient business. By using standardized and structured documents, you can ensure that all your transactions are documented clearly and professionally, helping you stay on top of payments and reducing the chance of errors or confusion. Keeping things organized also enables better communication with clients and makes financial tracking easier for your business.

Why Organization Matters

Staying organized with your billing process offers numerous benefits, such as:

- Faster Payment Processing: Clear and consistent documents help clients process payments without delay, ensuring that you get paid on time.

- Reduced Errors: A structured format reduces the likelihood of mistakes in billing, like incorrect amounts or missing details, which can cause misunderstandings.

- Better Record Keeping: Organized billing helps keep track of payments, outstanding amounts, and client history, which is useful for future reference and tax purposes.

- Professional Image: Well-organized documents reflect professionalism, making clients feel more confident in working with you again in the future.

How to Stay Organized

Here are some tips to help you keep your billing documents organized:

- Use Consistent Formats: Whether you use digital tools or manual documents, try to stick to a consistent format for each billing request. This helps avoid confusion and makes it easy to locate specific information when needed.

- Categorize and Label Files: Create a system for storing documents, whether it’s by client name, date, or project type. Use clear file names that make it easy to search and retrieve your records.

- Automate When Possible: Use software or online tools that offer automation features, such as generating documents or sending reminders for overdue payments. This reduces the amount of time you spend managing each transaction manually.

- Track Due Dates: Always note the payment due date clearly on each document and keep track of all outstanding amounts in a central location. This will help you follow up promptly and stay on top of your cash flow.

By adopting these organizational strategies, you can streamline your billing process, enhance your professionalism, and reduce the stress associated with payment collection.