Locum Invoice Template Word for Professional Billing

For healthcare professionals and freelance workers, managing financial records efficiently is key to maintaining smooth operations. Having the right tools for generating accurate billing statements can make a significant difference in timely payments and professional image. Customizable documents offer flexibility, allowing individuals to tailor them according to specific needs and work arrangements.

By using editable formats, it’s easy to include all the essential details such as service descriptions, dates, payment terms, and contact information. This ensures that each bill reflects the work completed and meets both personal and legal requirements. With an organized approach, professionals can streamline their administrative tasks, freeing up time to focus on their core responsibilities.

How to Use a Billing Document Format

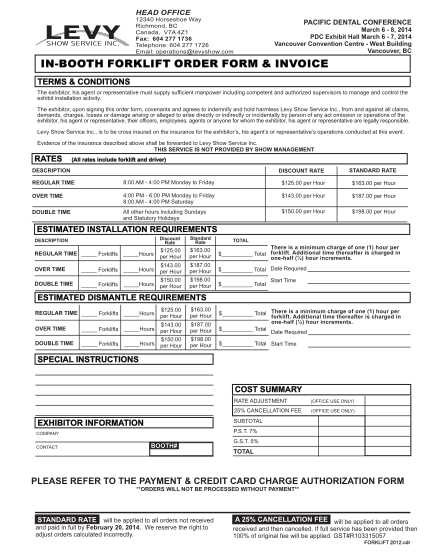

Creating billing statements using an editable document format can simplify the process and ensure all necessary details are included. By following a few simple steps, you can customize your records to reflect the specific terms of your agreement with clients. This method helps to create clear and professional-looking statements that are easy to understand and process.

To get started, open the document format on your computer. Most modern software allows you to customize fields like service description, payment amount, and contact information. The layout is designed to ensure everything is aligned and presented in a logical order, making it easier for clients to review and process payments.

Below is an example of a typical layout to include in your document:

| Service Description | Date | Rate | Total Amount |

|---|---|---|---|

| Consultation | 10/11/2024 | $150 | $150 |

| Follow-up Appointment | 12/11/2024 | $100 | $100 |

Once the document is filled out, save it in your preferred format, whether it’s as a PDF or another editable option. This allows for easy sharing with clients via email or physical copies, ensuring everything is clearly stated for smooth transactions.

Benefits of Using a Document Format

Using an editable document format for generating billing statements offers several advantages that improve efficiency and professionalism. Such formats allow for easy customization, ensuring that all necessary details are included without the need to manually adjust each section for every client. Whether you’re working with one or multiple clients, having a standardized format can save significant time and reduce errors.

Time Efficiency and Flexibility

One of the main benefits is the time saved when creating records. Instead of starting from scratch each time, you can use a pre-designed structure that only requires filling in specific information. This helps streamline the process and ensures consistency across all documents. Furthermore, you have the flexibility to adjust the format whenever necessary, such as adding new fields or changing the layout.

Professional Appearance

With a structured format, your documents appear more organized and polished, which helps maintain a professional image. A well-organized document with clearly labeled sections for work performed, amounts due, and payment terms not only looks more credible but also makes it easier for clients to understand and process your requests. This contributes to faster payment processing and fewer misunderstandings.

Customizing Your Billing Document

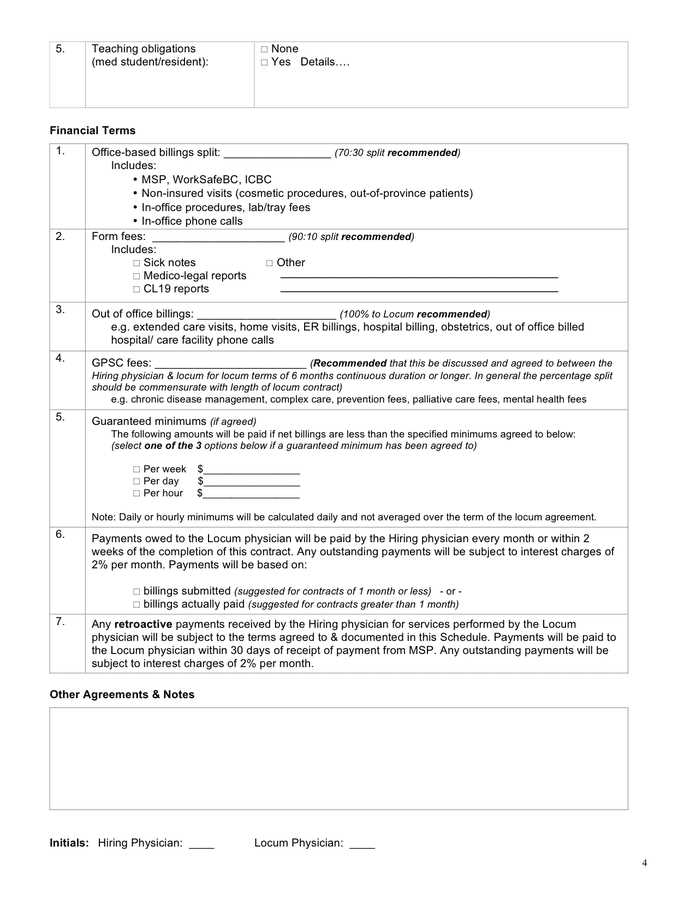

When preparing billing records, it’s essential to tailor them to meet the specific needs of your work arrangement. By adjusting the document layout, content, and fields, you can ensure that all relevant details are accurately captured and aligned with the terms agreed upon with your clients. This custom approach not only helps with clarity but also ensures compliance with any contractual or legal requirements.

Adjusting Layout and Structure

Start by modifying the layout to fit the type of services provided. Depending on the agreement, you might want to emphasize certain sections, such as hourly rates or payment deadlines. Using an adjustable format allows you to easily move fields around, add extra rows, or even change fonts and colors to make the document clearer or more visually appealing.

Including Key Details

Ensure that all essential details are included in the billing document, such as the client’s contact information, service dates, and breakdown of charges. It’s also helpful to add any applicable tax or discount information, depending on your arrangement. The following example illustrates a possible breakdown of services:

| Service Description | Quantity | Rate | Total |

|---|---|---|---|

| Consultation | 1 hour | $150 | $150 |

| Follow-up Consultation | 1 hour | $120 | $120 |

Once you’ve customized the document with all the relevant information, you can save it and send it to your clients in the format that works best for them.

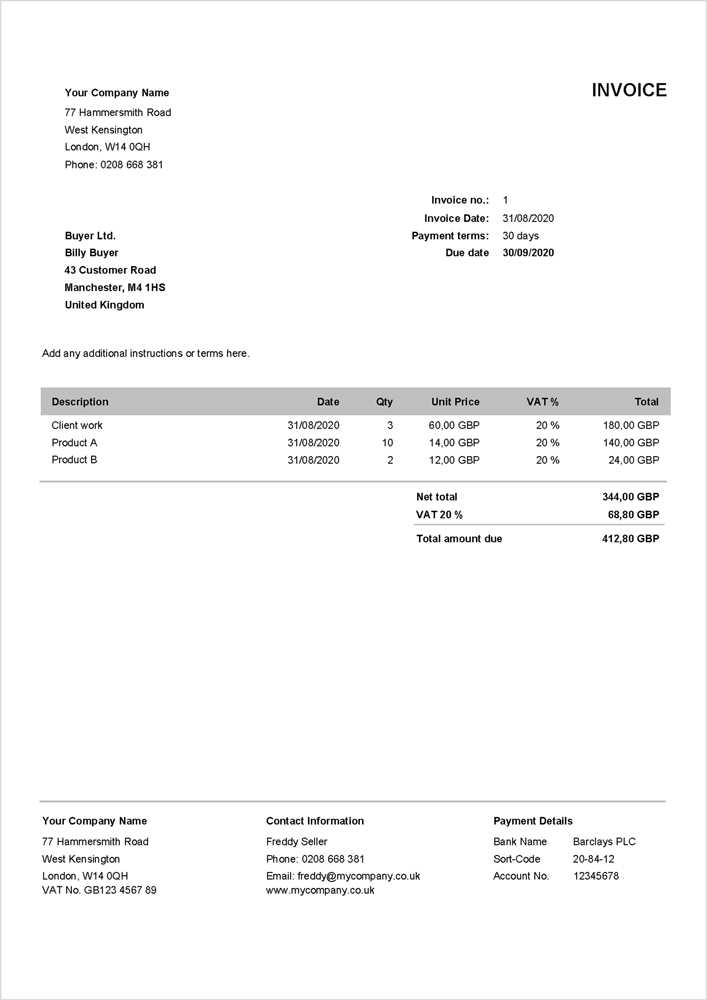

Key Details to Include in Billing Records

When creating a billing document, it’s important to ensure that all necessary information is included to make the record clear, professional, and legally compliant. Including the right details ensures that both you and your client have a mutual understanding of the services provided and the terms of payment. The following are essential elements that should be present in any financial document.

- Client Information: Always include the client’s name, address, and contact details to ensure the document is easily identifiable and traceable.

- Your Information: Provide your own contact details, including your business name (if applicable), address, and phone number.

- Service Description: A clear breakdown of the services you provided, including dates and hours worked, ensuring there’s no confusion about the work performed.

- Payment Terms: Clearly outline payment due dates, accepted methods, and any applicable late fees or discounts for early payment.

- Tax Information: Include any relevant taxes, such as sales tax or VAT, ensuring your clients know the total amount due.

It’s also important to include an invoice number for easy reference, especially if you’re managing multiple clients. This helps maintain organized records and simplifies tracking of payments.

Optional Information

- Purchase Order Number: If your client requires one, ensure it’s listed to avoid any delays in processing your payment.

- Payment Instructions: Include specific details on how payments should be made, whether through bank transfer, cheque, or online platforms.

Including all these details ensures clarity and avoids any confusion, allowing for smoother transactions and faster processing of payments.

Formatting Tips for Professional Appearance

Creating a well-organized and visually appealing document is essential for maintaining a professional image. Proper formatting not only makes your document easy to read but also ensures that all necessary information is clearly presented. By using consistent fonts, spacing, and layout, you can create a polished and professional appearance that instills confidence in your clients.

One of the most important aspects of formatting is maintaining clarity. A clean layout with well-defined sections makes it easier for clients to quickly understand the details of the services provided and the payment terms. Avoid clutter by using adequate spacing and breaking down information into clearly labeled sections.

Below is an example of how to structure the document to ensure a clean and professional appearance:

| Service | Date | Amount |

|---|---|---|

| Consultation | 10/11/2024 | $150 |

| Follow-up Session | 12/11/2024 | $120 |

In this example, each service is clearly separated with its respective date and cost, making it simple for the client to verify the details. Keep the text aligned to the left and use bold fonts for headings to make them stand out.

Additionally, remember to use consistent font styles and sizes throughout the document. Arial or Times New Roman in size 10-12 is a standard, professional choice for business documents. Be mindful of margins and ensure there’s enough space between different sections to avoid overcrowding.

Common Mistakes to Avoid in Billing Records

When creating financial documents, it’s important to ensure that all information is accurate and presented clearly. Small errors can lead to confusion, delayed payments, or misunderstandings with clients. By avoiding common mistakes, you can ensure that your billing records are professional and effective, streamlining the payment process.

Missing or Incorrect Information

One of the most frequent mistakes is omitting or providing incorrect details. Always double-check the following elements:

- Client Information: Ensure the correct name, address, and contact details are included.

- Service Descriptions: Provide clear and accurate descriptions of the services provided, including dates and hours worked.

- Payment Terms: Specify the due date, payment methods, and any late fees or discounts.

Formatting Issues

Improper formatting can make a document difficult to read or cause confusion. Here are a few formatting errors to avoid:

- Cluttered Layout: Ensure there’s enough spacing between sections to avoid an overcrowded appearance.

- Inconsistent Fonts: Use a single font throughout the document for a professional look. Stick to standard fonts like Arial or Times New Roman.

- Unclear Table Structure: When using tables, ensure that the columns and rows are aligned properly, and the information is easy to follow.

By paying attention to these details, you can avoid mistakes that may delay payments or cause confusion with your clients. Always review your document before sending it to ensure everything is correct and clearly presented.

How to Calculate Fees Accurately

Accurately determining the correct amount to charge for services is crucial for both service providers and clients. Proper calculation ensures fairness, avoids disputes, and helps maintain clear financial records. To calculate fees, it’s essential to account for various factors, including hours worked, rates agreed upon, and any additional charges or discounts that may apply.

Understanding Hourly and Daily Rates

The most common method for calculating fees is based on an hourly or daily rate. To calculate your fee, first determine the agreed-upon rate for your services. Then, multiply that rate by the total number of hours or days worked. For example, if you charge $100 per hour and worked 8 hours, your total fee would be:

$100 x 8 hours = $800

For daily rates, simply multiply the daily rate by the number of days worked. For example, if your daily rate is $700 and you worked for 5 days, your total would be:

$700 x 5 days = $3500

Including Additional Charges

In some cases, additional charges may apply, such as travel expenses or materials used during the service. Ensure these are calculated separately and added to the final amount. For example, if travel expenses amount to $50 and materials cost $100, these should be added to the total:

$800 (base fee) + $50 (travel) + $100 (materials) = $950

Make sure these additional charges are clearly outlined on the document so clients can easily verify them.

By following these steps, you can ensure that your fees are calculated accurately, leading to smooth transactions and satisfied clients.

Adding Tax Information to Your Billing Record

Including tax information in your billing record is essential for both legal compliance and transparency with your clients. Accurately calculating and displaying taxes ensures that both parties understand the total cost of the services rendered. Depending on your location and the type of service provided, different tax rates and rules may apply, so it’s important to incorporate these details correctly.

First, verify the applicable tax rate for your region. This may be a flat rate, or it could vary based on the nature of the service or the client’s location. Ensure that the tax rate is clearly specified and calculate the amount by multiplying the total charge by the appropriate rate.

How to Calculate Tax

To calculate the tax on a service, follow these steps:

- Step 1: Add up the total amount for the services provided.

- Step 2: Apply the tax rate. For example, if the total amount is $500 and the tax rate is 10%, the tax amount would be:

$500 x 0.10 = $50

Including Tax Information on Your Document

Once you’ve calculated the tax, list it separately in your billing record to avoid confusion. Clearly label the tax amount and show the total with and without tax, as demonstrated below:

| Service Description | Amount | Tax (10%) | Total |

|---|---|---|---|

| Consultation | $500 | $50 | $550 |

By including tax information in this way, clients can easily understand the breakdown of charges and verify the total amount due. Make sure to clearly state any applicable tax rates to avoid potential disputes and ensure transparency.

Why Choose Word for Billing Documents

When it comes to creating professional financial records, selecting the right software can make a significant difference. One of the most popular choices is a word processing program, due to its user-friendly interface, flexibility, and extensive features. Using this software allows you to easily design and customize your billing documents to suit your needs, making it an excellent option for those looking for a simple yet effective solution.

Easy Customization and Editing

One of the main advantages of using a word processing tool is the ease with which you can customize your documents. Whether you need to adjust the layout, add your company logo, or change the fonts, this software offers a wide range of options. You can quickly edit any section, ensuring that your records reflect the most current information or meet specific requirements.

Compatibility and Accessibility

Another benefit is the high level of compatibility with different devices and operating systems. Most people have access to this software, making it easy for clients or partners to open and view your documents without compatibility issues. Additionally, these documents can be saved in various formats, including PDF, which ensures they can be shared and printed with ease.

Overall, using a word processing tool for creating your financial records offers the right balance of flexibility, accessibility, and customization to ensure that your billing documents are both professional and easy to manage.

Managing Multiple Clients with One Document

Handling various clients with a single document structure can greatly improve efficiency and consistency. By using a standardized format for each transaction, you can streamline the process while ensuring that all the necessary details are included for every client. This approach eliminates the need for creating a new record from scratch each time, saving you time and reducing the chance of errors.

To manage multiple clients effectively, customize your structure so that essential information such as client names, services provided, and payment terms are easily interchangeable. This allows you to quickly adapt the document to fit the specific needs of each client while maintaining a consistent and professional appearance.

Utilizing Placeholders for Easy Updates

One of the most effective methods is to use placeholders for key information such as client name, service description, and amount due. These placeholders can be quickly updated for each client without changing the overall structure of the document. This saves you from the repetitive task of adjusting the layout and ensures a smooth, efficient process for managing multiple clients.

Organizing Client-Specific Information

While maintaining a consistent document format, it’s important to clearly separate each client’s information. This can be done by creating distinct sections or using tables to differentiate between the various clients. Additionally, always make sure to save each document with a unique file name to keep track of your records and avoid confusion.

By using this method, you can efficiently manage multiple clients, keep your records organized, and reduce the time spent on administrative tasks.

Saving and Editing Your Billing Record

Keeping your financial documents organized and up-to-date is essential for maintaining smooth operations. After creating your billing record, it’s important to save it properly and be able to easily make adjustments when necessary. Whether you’re correcting errors, updating payment details, or making minor changes, knowing how to save and edit your document efficiently is key to managing your financial transactions.

How to Save Your Document

When saving your billing record, choose a file format that ensures easy access and sharing. The most common formats include the default document format (such as .docx) and PDF, which makes the document viewable on most devices without alteration. Always use a clear, descriptive filename that includes relevant details, such as the client’s name or the service date, to easily locate the document later.

For example, save your file as:

| File Name Example |

|---|

| John_Doe_Consultation_April_2024.docx |

How to Edit Your Record

To edit your document, simply open it in your chosen word processor and make the necessary adjustments. For instance, if the service rate changes or you need to correct a client’s details, update the fields accordingly. If you’re using placeholders for certain details, these can be easily updated with new information without altering the structure of the entire document.

After making changes, ensure you save the updated version with the same filename or a new one, depending on whether you want to preserve the original record or keep track of multiple versions.

By saving and editing your billing record efficiently, you can maintain accurate financial documentation and ensure that every transaction is properly managed and up-to-date.

How to Send Billing Records Efficiently

Sending your financial records in a timely and efficient manner is crucial to ensuring prompt payments. By using the right methods and tools, you can streamline the process and avoid unnecessary delays. This section outlines some best practices for sending your billing documents to clients, so that they receive all the necessary information quickly and in the correct format.

Choosing the Right Delivery Method

One of the first decisions to make is how to send your records. Email is often the most efficient way to share documents, as it allows for immediate delivery and provides a reliable way to keep track of when the document was sent. If you choose to send your document via email, ensure that you attach the file in a universally accessible format, such as PDF, to prevent any issues with file compatibility.

Providing Clear Instructions and Deadlines

When sending your document, it’s important to include any necessary instructions or information regarding payment deadlines. Be sure to clearly state the payment terms and specify the date by which payment is expected. This eliminates confusion and helps your client understand when to settle the amount. Additionally, consider adding a polite reminder or follow-up notice if the payment is overdue.

By following these steps and ensuring that your financial records are sent in a clear, timely, and professional manner, you will help maintain smooth business operations and foster positive relationships with your clients.

Tracking Payments from Freelance Work

Monitoring payments from freelance or temporary work is essential for maintaining accurate financial records and ensuring timely compensation. Whether you’re working with multiple clients or handling a series of projects, having a clear system for tracking payments helps you stay organized and avoid missing any due amounts. This section provides guidance on how to efficiently track the payments you receive and keep your financial records up to date.

Using a Payment Tracking System

One effective way to track payments is by creating a simple payment tracking system. This can be done using a spreadsheet or a dedicated accounting tool where you can log each payment, including the client’s name, the amount received, and the date of payment. You can also mark whether the payment is pending or completed to easily monitor outstanding balances.

| Client Name | Amount Due | Amount Paid | Payment Date | Status |

|---|---|---|---|---|

| John Smith | $500 | $500 | April 10, 2024 | Completed |

| Sarah Green | $750 | $0 | Pending | Awaiting Payment |

Setting Payment Reminders

For clients who haven’t yet paid, it’s essential to send timely reminders. Setting up automated reminders or creating a manual system to follow up on pending payments can help ensure that you receive your compensation on time. Include the payment due date, the amount outstanding, and any relevant invoice details to make it easy for the client to process the payment.

By maintaining an organized system for tracking payments, you can reduce the risk of missed payments and ensure that all financial transactions are documented properly.

Legal Requirements for Billing Documents

Understanding the legal requirements for financial documents is essential for freelancers and contractors to ensure compliance with tax laws and avoid potential legal issues. Every professional must ensure that their billing documents meet specific legal standards, such as proper documentation, correct details, and adherence to local regulations. This section outlines the key legal elements you should include in your financial records to make sure they are both accurate and legally sound.

Essential Information to Include

There are several mandatory details that should be included in your financial records to ensure they are legally valid. These details ensure clarity and transparency in your business transactions:

- Business Information: Your full name (or company name), address, and contact details must be clearly listed.

- Client Information: Include the client’s full name, business name (if applicable), and contact details.

- Unique Reference Number: Assign a unique identification number to each billing document for tracking purposes.

- Description of Services: Provide a clear description of the work or services provided, including the time spent, dates, and rates.

- Payment Terms: Specify the payment due date, payment methods, and any penalties for late payment.

- Tax Information: Clearly state the applicable tax rates, including sales tax or VAT, if applicable.

Adhering to Local Regulations

In addition to the basic details, make sure that your billing documents meet the specific legal requirements of your country or region. This can include:

- Compliance with local tax codes and business regulations.

- Including relevant tax identification numbers, such as VAT or sales tax numbers, where required.

- Properly reflecting the correct rate of tax applied to your services.

By ensuring that your financial documents include all the necessary legal details and comply with local regulations, you protect yourself from potential legal issues and ensure smooth business operations.

Automating Billing Creation in Document Software

Efficiently generating billing documents can save significant time and reduce human error. By automating the creation process, professionals can streamline repetitive tasks, ensuring consistency and accuracy. This section explores methods to set up automatic document generation, allowing users to quickly create custom billing documents with minimal effort. The use of built-in tools and features in document software can significantly improve efficiency, especially for those managing multiple clients or projects.

Using Fields and Macros

One of the easiest ways to automate document creation is through the use of fields and macros. These tools allow users to input dynamic data that automatically populates the document when certain parameters are met. For example, fields can automatically fill in the date, client details, or payment amounts, while macros can automate the formatting and structure of the entire document.

| Function | Description |

|---|---|

| Fields | Automatically update information such as dates, amounts, or client names based on input parameters. |

| Macros | Automate repetitive tasks like document formatting, adding headers, and including predefined content. |

Setting Up Templates for Automation

Another way to automate document creation is by setting up predefined layouts. Templates can include placeholders for dynamic information, reducing the need to manually adjust formatting each time a document is created. Once set up, these templates can be easily reused, saving time while ensuring consistency in your billing records.

By utilizing these automation tools, professionals can reduce the amount of manual work involved in document creation, allowing more time to focus on other important tasks.

Alternatives to Word Templates for Billing Documents

While document software like Word is a popular tool for creating billing documents, there are various other options available that can offer additional features and efficiencies. These alternatives often come with built-in functionalities designed specifically for creating and managing financial records, offering a more streamlined approach. This section will explore some of the best alternatives to traditional document-based templates for generating billing records.

Cloud-Based Accounting Software

Cloud-based accounting tools are becoming increasingly popular for managing billing processes. These platforms provide automated solutions for generating, sending, and tracking payments without the need for manual input. They often include pre-designed billing formats, integration with payment gateways, and the ability to manage client data efficiently.

- QuickBooks: Known for its ease of use and integration with other financial tools, QuickBooks automates the entire billing cycle from creation to payment reminders.

- FreshBooks: Offers a user-friendly interface with customizable billing options, time-tracking features, and automated reminders for clients.

- Xero: A cloud accounting platform that provides flexible invoicing options, customizable designs, and automatic syncing with bank accounts.

Online Invoice Generators

If you prefer a more straightforward approach without the need for accounting software, online invoice generators offer a simple and efficient solution. These tools often provide templates that can be customized with just a few clicks. You can generate and send documents directly from the platform, without the hassle of formatting and setup.

- Zoho Invoice: A free and user-friendly tool for generating invoices, complete with customization options, reminders, and reports.

- Invoice Simple: Provides a fast way to create professional billing documents online with easy-to-use templates.

- PayPal Invoicing: Allows businesses to send billing documents directly from their PayPal account, with integrated payment features.

By using these alternatives, businesses can improve their billing workflows, saving time and ensuring that their financial documents are always up-to-date and accurate.