Proforma Commercial Invoice Template for Streamlined Business Transactions

When conducting business transactions, accurate and clear documentation is crucial for both the seller and the buyer. Properly formatted documents ensure smooth communication, transparency, and efficient processing of orders. These documents help outline the terms of the deal and provide a clear record of the goods or services involved.

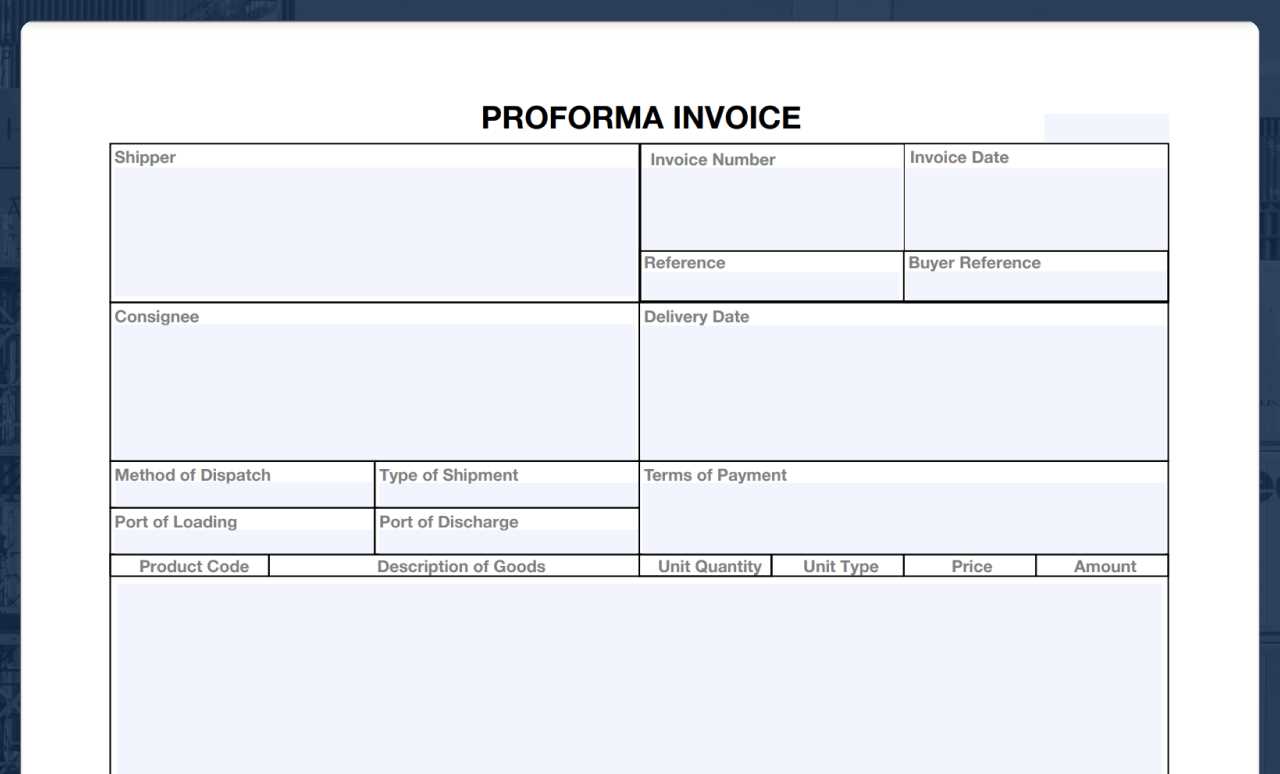

One of the most important documents used in international trade is a preliminary version of a sales agreement, often required for customs clearance and logistical purposes. Such a document outlines the transaction details, including pricing, delivery terms, and item descriptions, providing a snapshot of the sale before the final agreement is made. Using a well-structured version of this document can simplify the process and avoid misunderstandings.

In this article, we will explore how to create a reliable and customizable version of this critical business form. With a well-designed version, businesses can avoid common errors, ensure compliance with international regulations, and streamline their transactional processes.

Proforma Commercial Invoice Template Overview

In international trade and business transactions, clear and detailed documentation plays a vital role in ensuring smooth and efficient dealings. A preliminary sales document serves as a preview of the final transaction details, allowing both parties to review key elements before finalizing the sale. This document can be used for customs clearance, payment agreements, and as a reference for future invoicing.

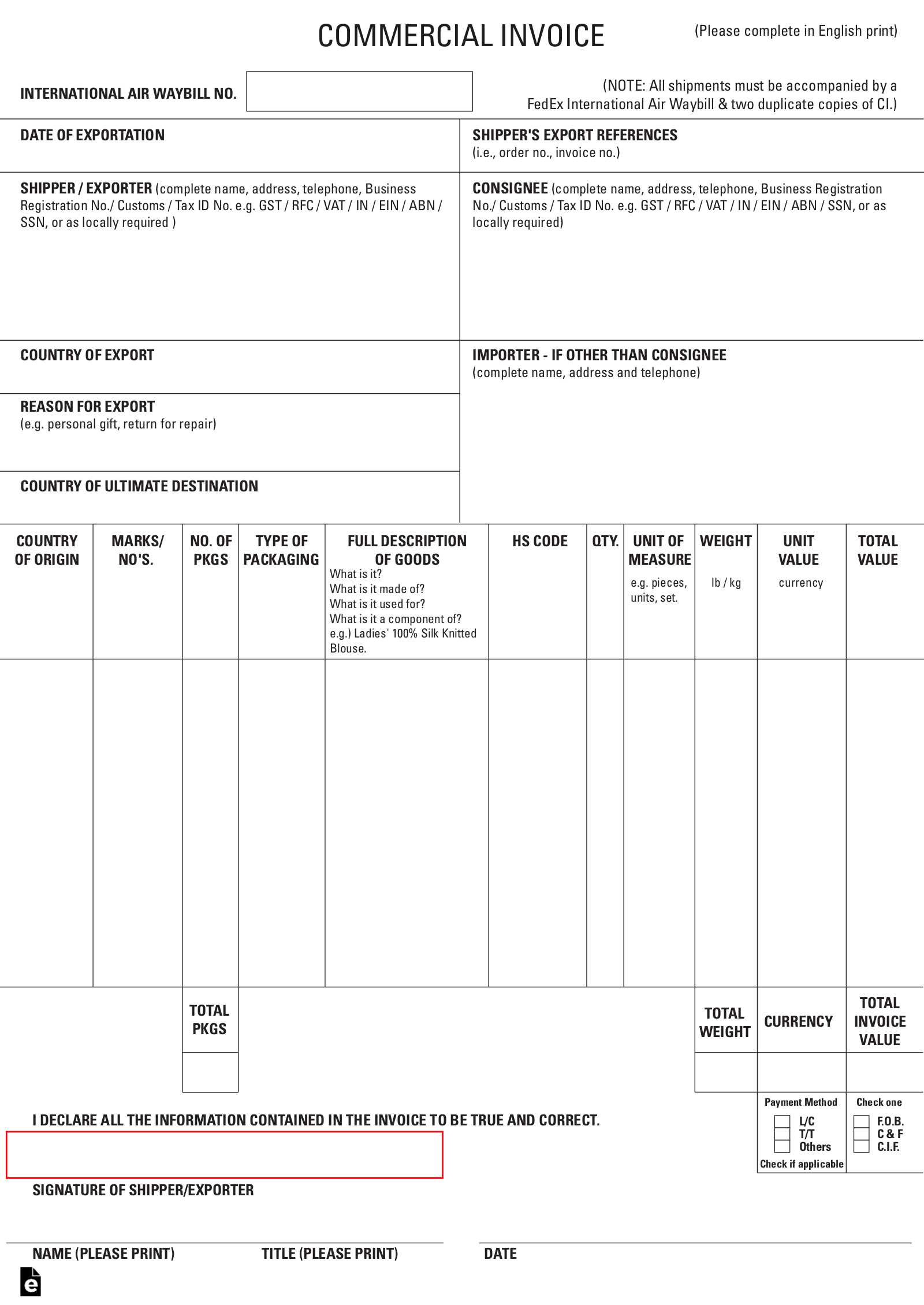

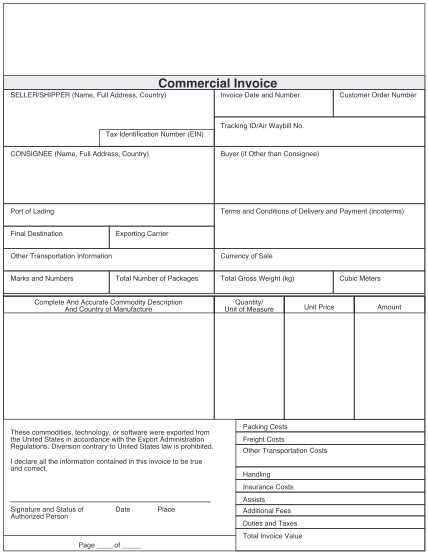

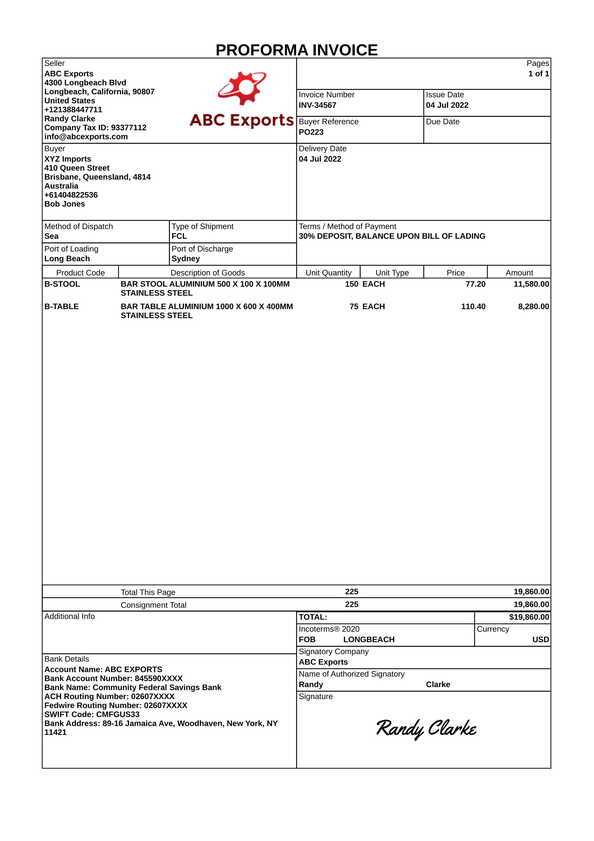

Such a document typically includes the following essential details:

- Seller and buyer information: Names, addresses, and contact details of both parties involved in the transaction.

- Description of goods or services: A detailed breakdown of items or services being sold, including quantities, specifications, and values.

- Pricing details: Total cost of the goods or services, including unit prices, discounts, and applicable taxes.

- Delivery terms: Shipping methods, delivery dates, and any conditions attached to the delivery process.

- Payment terms: Information on payment methods, due dates, and any advance payments or deposits required.

Using a well-structured version of this document ensures that both parties have a clear understanding of the transaction. It also helps avoid disputes and enhances trust in the business relationship. With an easily customizable format, companies can tailor the document to meet specific needs and ensure compliance with international trading regulations.

What is a Proforma Invoice

A preliminary business document used to outline the terms of a sale before the final agreement is completed is crucial for both parties involved. This document acts as a “draft” version of the final sales agreement, providing an overview of the key aspects of the transaction such as pricing, quantity, and delivery details. It helps ensure that both the seller and buyer are on the same page prior to finalizing the deal.

Typically, this document is issued to the buyer for review and can be used for various purposes, such as securing financing, preparing for customs clearance, or determining the terms of payment. It is important to note that it is not a request for payment, but rather a statement of intent and a summary of the transaction details.

- Purpose: Used for providing a preview of the transaction details before the final deal is made.

- Non-binding: It is not a final demand for payment but rather a declaration of intent.

- Purpose for Buyers: Can be used to facilitate customs clearance or secure financing for international transactions.

- Purpose for Sellers: Assures the buyer of the transaction’s legitimacy and gives them an overview of what to expect.

In essence, this document provides an official record of what is being sold, the agreed-upon prices, and the terms of delivery, without yet being legally binding. It is often a key document in international trade to ensure that both parties have a clear understanding of the deal before it becomes official.

Key Elements of a Proforma Invoice

To create a comprehensive document outlining the details of a business transaction, certain key components must be included to ensure clarity and accuracy. These essential elements provide a snapshot of the sale and help both the seller and buyer understand the terms of the deal. Below are the core aspects that should always be part of such a document:

- Seller and Buyer Information: This includes the full names, addresses, and contact details of both parties involved in the transaction. It ensures that both parties can be easily reached if necessary.

- Item Description: A clear list of the goods or services being sold, including item numbers, specifications, and quantities. Each product or service should be described in detail to avoid any confusion.

- Pricing Details: The cost for each item or service, along with any applicable taxes, discounts, or additional fees, should be clearly outlined. Total cost calculations should also be included to give an accurate overview of the financials.

- Shipping and Delivery Terms: Details about how the goods will be shipped, expected delivery dates, and the method of transportation should be provided. If there are any shipping charges or terms, they should be stated clearly.

- Payment Terms: Information on how payment is expected (e.g., wire transfer, letter of credit), due dates, and whether any deposits or advance payments are required.

- Validity Period: The date range during which the terms of the agreement are valid. This ensures that the buyer understands when the offer is subject to change or expiration.

Including these key elements in a transaction document not only helps ensure both parties have a clear understanding of the deal but also provides the necessary information for logistical and financial arrangements. By clearly outlining these aspects, businesses can avoid misunderstandings and ensure smoother processes.

When to Use a Proforma Invoice

There are specific situations in business transactions where it is essential to issue a preliminary document that outlines the terms of the sale before the final agreement is completed. This type of document serves as an initial proposal that provides key details about the goods or services, delivery terms, and pricing. It is often used to inform both the buyer and the seller about the transaction before official payment or shipment takes place.

Common Scenarios for Using a Preliminary Document

Here are some common situations where this document should be used:

| Scenario | Description |

|---|---|

| Customs Clearance | When shipping goods internationally, customs may require an advance declaration of the sale’s details. This document can help with the clearance process by providing the necessary information. |

| International Transactions | In cross-border transactions, this document provides an official confirmation of the sale’s terms, which can be used to arrange financing, shipping, and regulatory approvals. |

| Financing and Bank Loans | When seeking financing or a loan to fund a transaction, a buyer may need to present this document to financial institutions to demonstrate the legitimacy of the deal. |

| Price Confirmation | This document can be used to confirm pricing and terms before finalizing the deal, allowing both parties to agree on the terms and avoid any surprises later on. |

When It Should Not Be Used

While this document is useful in many situations, it is not intended to replace a formal agreement or payment request. It should not be used in the following cases:

- When the buyer is ready to make a final purchase and pay immediately.

- If the transaction terms have already been agreed upon and no further discussion is required.

- For recurring transactions where terms remain the same.

In conclusion, a preliminary document should be used when there is a need to outline transaction details, secure financing, or assist with customs procedures, but it should not be considered a final or binding sales contract.

Benefits of Using Proforma Invoices

Utilizing a preliminary document in business transactions offers several advantages, especially when dealing with international shipments or complex sales. This document acts as a reference point that clearly outlines the terms of the deal before any final commitments are made. It helps both the seller and buyer ensure they are aligned on key transaction aspects, improving overall clarity and reducing the likelihood of disputes.

Advantages for Sellers

- Clarity of Terms: By outlining the deal in advance, sellers can avoid misunderstandings related to pricing, delivery, and payment terms.

- Better Communication: It facilitates clear communication between the seller and the buyer, ensuring that both parties are on the same page before the final sale.

- Pre-sale Confirmation: This document acts as a confirmation that both parties agree on the transaction terms, providing a reference in case any issues arise during the process.

- Financial Planning: Sellers can use it to gauge the buyer’s ability to proceed with the transaction, especially if financing or credit terms are involved.

Advantages for Buyers

- Verification of Pricing: Buyers can review the pricing and terms before making a final commitment, ensuring there are no unexpected costs or changes.

- Preparation for Customs: In international trade, this document is often required for customs clearance, allowing the buyer to prepare the necessary paperwork in advance.

- Budgeting and Financial Planning: Buyers can use the document to plan for payments and ensure they have the necessary funds to complete the transaction.

- Security and Confidence: Having a clear outline of the transaction terms provides buyers with greater confidence in the deal, reducing the risk of fraud or miscommunication.

In summary, a preliminary sales document can significantly enhance the efficiency of a transaction by improving transparency, reducing risk, and fostering trust between both parties. It is a valuable tool for ensuring that all terms are agreed upon and understood before proceeding with the final sale.

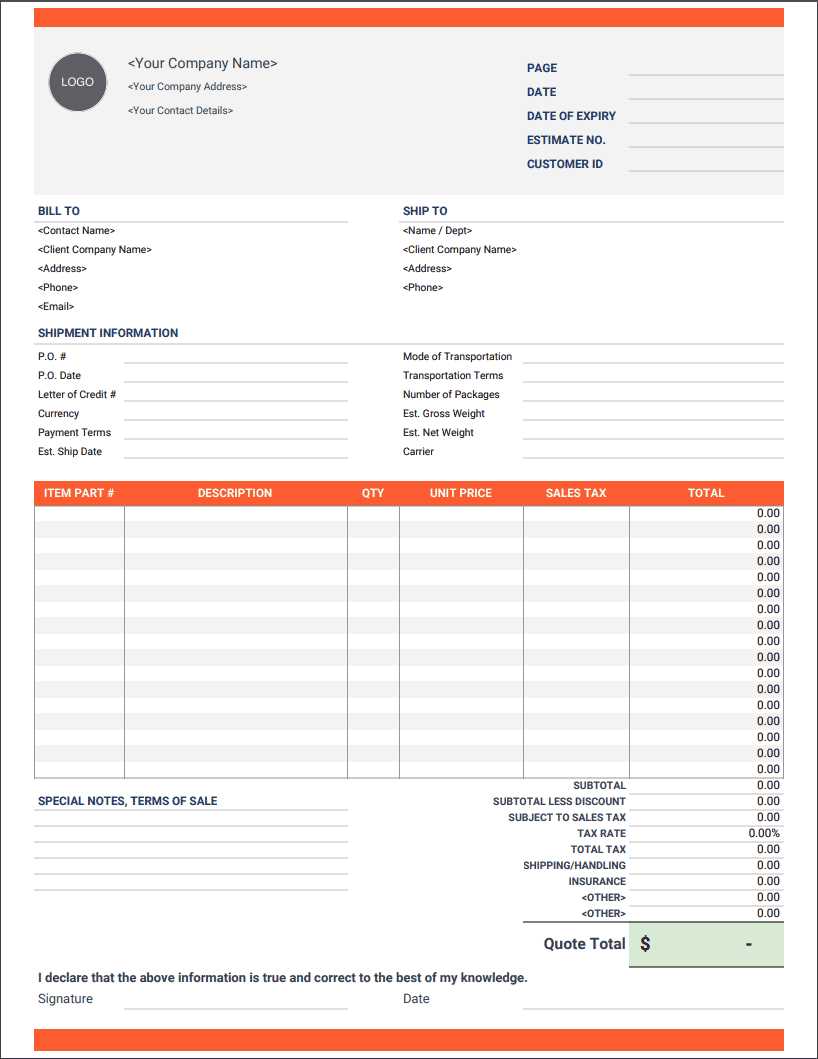

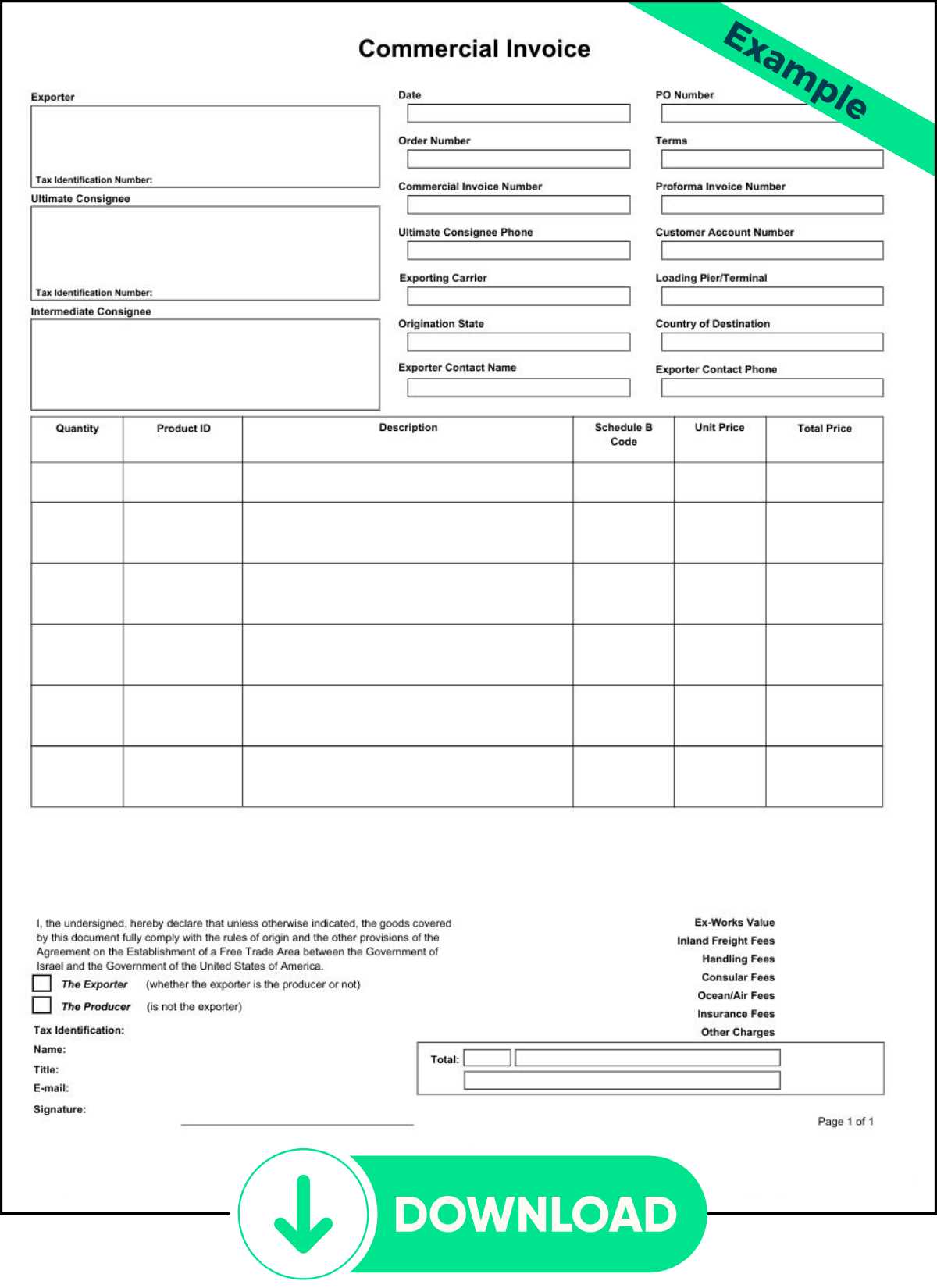

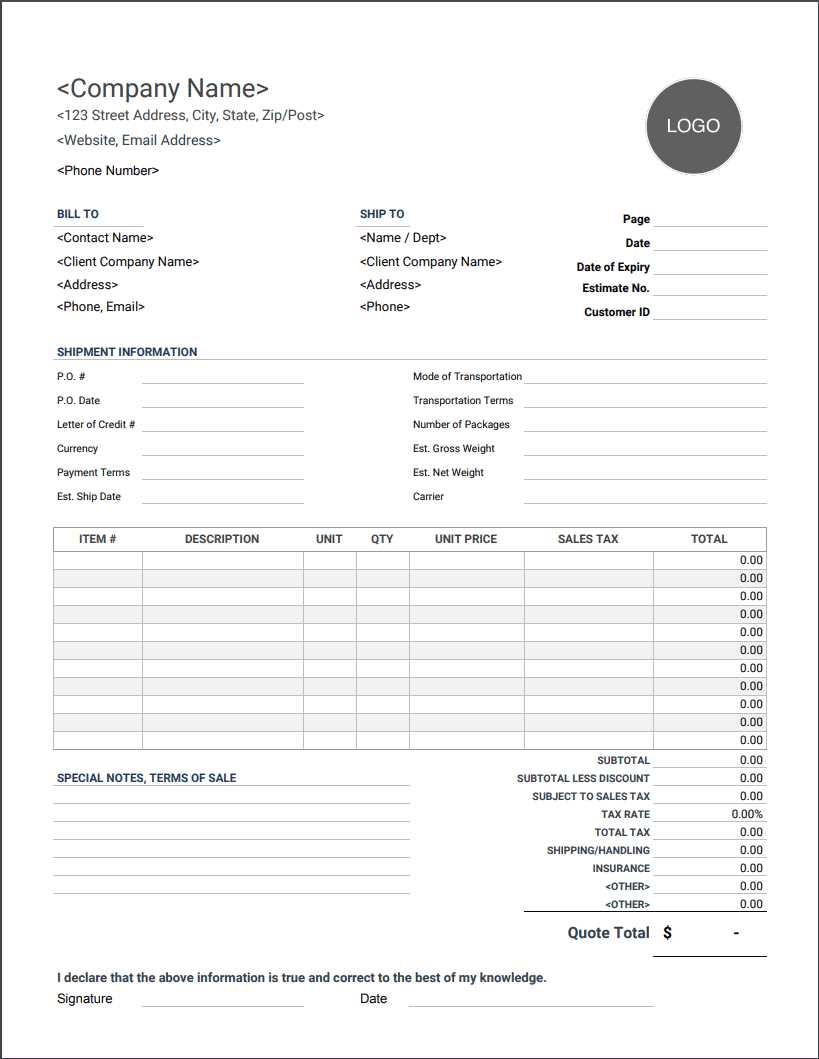

How to Customize an Invoice Template

Customizing a business document to fit the specific needs of a transaction is an essential part of the process. This allows companies to reflect their brand, tailor the content to the specific deal, and ensure all necessary information is included. Personalizing this document not only helps to present a professional image but also enhances clarity and ensures both parties are aligned on the terms of the transaction.

Steps for Customization

When adjusting a business document for a particular transaction, follow these key steps:

- Include Relevant Business Information: Begin by adding the correct company details such as the name, address, phone number, and email. Make sure both the seller’s and buyer’s contact details are listed.

- Detail the Transaction: Clearly describe the goods or services being exchanged, including product names, quantities, unit prices, and total amounts. Provide as much detail as needed to avoid confusion.

- Specify Terms of Payment: Define the agreed-upon payment methods and due dates. If applicable, include any advance payments, installments, or deposits that are required.

- Define Delivery Details: Make sure to list the shipping method, delivery address, expected delivery date, and any associated costs.

Branding and Formatting

To further personalize the document, consider including the following elements:

- Company Logo: Including your company’s logo adds a professional touch and reinforces your brand identity.

- Custom Footer or Header: A custom header or footer with your business slogan or additional contact information can make the document feel more personal and polished.

- Color Scheme: Use your company’s color scheme to make the document visually consistent with your branding.

By carefully customizing this document, businesses can improve communication with clients, avoid errors, and present a professional image that reflects their standards and values. Tailoring the document to the transaction ensures that all important details are captured and understood by all parties involved.

Common Mistakes in Proforma Invoices

When preparing a preliminary document for a business transaction, errors can lead to confusion, delays, or even disputes between the parties involved. These mistakes often arise from simple oversights or misunderstandings of the information that should be included. Being aware of these common errors can help businesses avoid complications and ensure that the document is accurate and effective.

- Incorrect or Missing Contact Information: Failing to include accurate business details, such as the correct names, addresses, and contact numbers for both the buyer and the seller, can cause communication problems and delays in the process.

- Unclear Product Descriptions: Vague or incomplete descriptions of the products or services being sold can lead to confusion about the transaction’s scope. It’s crucial to list item names, quantities, specifications, and any relevant codes clearly.

- Inaccurate Pricing or Calculations: Mistakes in pricing, such as missing taxes, discounts, or incorrect unit prices, can create misunderstandings. Double-checking the total amounts and unit prices ensures clarity and prevents disputes.

- Ambiguous Payment Terms: Not specifying payment terms clearly, including due dates, payment methods, and any advance payments or installments, can lead to confusion and delay the transaction.

- Omitting Shipping and Delivery Information: Failing to outline delivery terms, including the method of shipment, expected delivery dates, and associated costs, can result in confusion about when and how goods will be delivered.

- Missing Validity Period: If no expiration date is included, the document may be considered open-ended, leading to potential changes in terms after the transaction is initiated. A clear validity period should always be stated.

By carefully reviewing and addressing these common mistakes, businesses can improve the accuracy and effectiveness of their preliminary agreements. Ensuring that all the necessary details are included and correctly stated helps prevent misunderstandings and facilitates smoother transactions.

Legal Considerations for Proforma Invoices

When preparing a preliminary sales document, it is crucial to understand the legal implications it may have in different jurisdictions and for various types of transactions. Although this document is typically not legally binding like a final agreement, certain legal aspects must be taken into account to ensure compliance and to avoid potential disputes. The document’s role as a reference for the terms of sale means that it can influence the relationship between buyer and seller, particularly in international trade.

Key Legal Aspects to Consider

While this document is usually used for informational purposes, it can still carry weight in certain legal situations. Here are some factors to consider:

| Legal Factor | Explanation |

|---|---|

| Jurisdiction | Understand which country’s laws govern the sale. Different countries may have unique rules regarding what must be included in such documents for them to be accepted for customs or regulatory purposes. |

| Binding Terms | Clearly state that the document is not a binding sales contract unless explicitly stated. Without a clear disclaimer, some may mistakenly consider it an official agreement. |

| Customs Compliance | For international transactions, the document may be required for customs clearance. Ensure that all necessary details are provided, such as accurate product descriptions and the correct value of goods. |

| Payment Terms | Legal disputes may arise if payment terms are unclear. Specify whether the transaction requires an advance payment, deposit, or full payment, and outline the timeline. |

Ensuring Legal Safety

To minimize legal risks, businesses should follow these guidelines:

- Accuracy and Transparency: Always ensure that the document accurately reflects the agreed-upon terms between the buyer and seller. Misleading or incomplete information could lead to legal challenges.

- Clear Disclaimers: Include a disclaimer that clarifies the non-binding nature of the document unless agreed otherwise. This will help avoid confusion over its legal weight.

- Compliance with Local and International Laws: Make sure the document meets the requirements of the countries involved, especially regarding taxes, duties, and other regulatory obligations.

- Consult Legal Professionals: For complex transactions or international sales, consulting with a legal expert is advisable to ensure compliance and avoid legal pitfalls.

In conclusion, while this document is primarily an informal outline of the transaction, businesses should approach it with care. Understanding the legal context and ensuring proper documentation can prevent complications and facilitate smoother transac

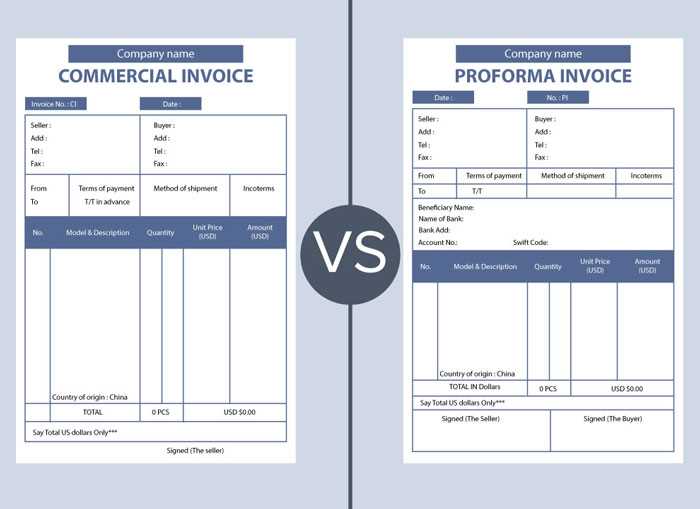

Difference Between Proforma and Final Invoices

While both documents are used to outline the details of a transaction, they serve different purposes and hold varying degrees of legal significance. Understanding the distinction between a preliminary document and a final document is essential for both buyers and sellers, as it affects the expectations, payment terms, and overall transaction process.

Key Differences

There are several notable distinctions between the preliminary and final versions of the sales document, each affecting how they are used and the role they play in the transaction. Below is a comparison:

| Aspect | Preliminary Document | Final Document |

|---|---|---|

| Purpose | To outline potential terms and provide an estimate of costs and conditions. | To serve as the official request for payment after the goods or services have been delivered. |

| Legality | Not legally binding, mainly for informational and planning purposes. | Legally binding document, confirming the completed transaction and payment due. |

| Amount | Reflects estimated prices or a quote, subject to change. | Contains final and confirmed amounts that must be paid. |

| Payment Terms | May include suggested payment terms but are not enforceable until a formal agreement is signed. | Includes definite payment due dates, terms, and conditions of settlement. |

| Usage | Used primarily in international transactions to assist with customs, budgeting, and planning. | Used for the final billing and collection of payment for goods or services rendered. |

Conclusion

Both the preliminary and final documents play vital roles in the process of buying and selling. The preliminary version is useful for outlining the general terms and confirming interest, while the final version is the official document that legally binds the parties involved. Understanding when and how each type is used helps avoid confusion and ensures smooth, successful transactions.

How Proforma Invoices Help Customs Clearance

In international trade, clearing goods through customs can be a complicated and time-consuming process. One essential document used to facilitate this process is the preliminary sales document, which outlines key details of the transaction before the final payment or shipment occurs. This document plays a critical role in ensuring that goods are processed efficiently and in compliance with local and international regulations.

By providing customs authorities with a clear and accurate outline of the transaction, this document helps avoid delays and ensures that all required fees, taxes, and duties are assessed properly. It acts as a vital tool for verifying the value of goods, their classification, and the terms of shipment, making the clearance process smoother for both buyers and sellers.

Key Benefits for Customs Clearance

- Clear Transaction Details: The document includes essential information such as product descriptions, quantities, and the estimated value, which helps customs officers assess whether the goods are eligible for import and if any taxes or duties apply.

- Accurate Duty Assessment: By listing the value of the goods and the type of merchandise being shipped, this document allows for more accurate calculations of customs duties and taxes, reducing the risk of overpayment or underpayment.

- Regulatory Compliance: Ensuring that all required data is provided upfront, including the country of origin and intended destination, helps comply with international trade regulations and reduces the risk of delays due to incomplete paperwork.

- Facilitates Import/Export Process: Customs authorities use this document to quickly verify the authenticity of shipments and their compliance with national laws, leading to a faster clearance process and quicker delivery times.

In summary, this preliminary document not only provides transparency and clarity for the buyer and seller but also serves as a critical tool in ensuring that goods can pass through customs quickly and without issues. Having an accurate and detailed version of this document helps avoid unnecessary delays, ensuring that the goods reach their final destination as smoothly as possible.

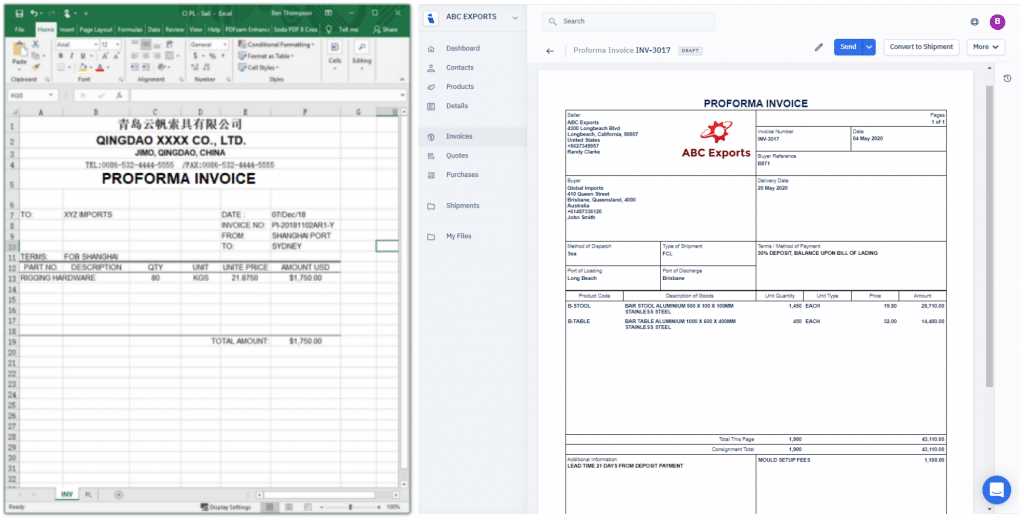

Template Formats and Compatibility

When creating or using a preliminary transaction document, choosing the right format and ensuring compatibility with different systems and platforms is crucial for smooth processing. Different file formats can offer distinct advantages depending on the needs of the user and the requirements of the transaction. Ensuring that the format chosen is universally accessible and compatible with various software tools helps avoid unnecessary complications during the transaction process.

Common File Formats

There are several widely used file formats for creating and sharing preliminary transaction documents. Each format has its own strengths and may be preferred in different business contexts.

- PDF (Portable Document Format): This is one of the most common formats for creating professional documents. It ensures that the document’s layout and content remain consistent across devices and operating systems, making it ideal for sharing between parties.

- Excel (.xls, .xlsx): This format is useful for documents that require frequent updates or calculations. It allows for easy editing and tracking of numerical data, and is particularly useful for businesses that need to work with large volumes of information.

- Word (.doc, .docx): A widely used format for creating editable documents. It is ideal for detailed descriptions and allows for easy modifications, though it may not preserve formatting across different systems as reliably as PDF.

- CSV (Comma-Separated Values): A text-based format typically used for documents that need to be processed by spreadsheet applications. It’s especially suitable for large amounts of itemized data, thoug

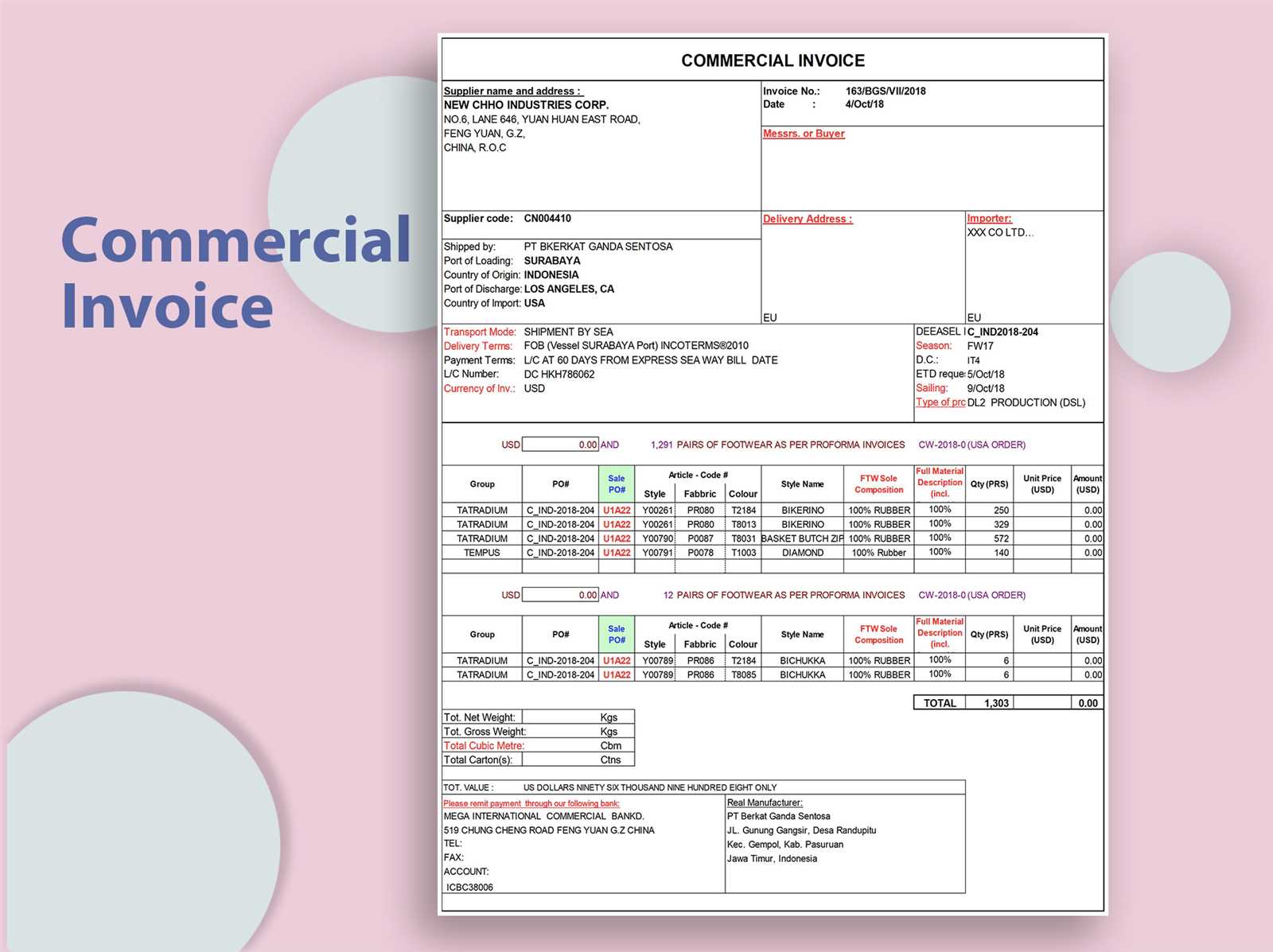

Proforma Invoice for International Trade

In the realm of global commerce, a preliminary sales document serves as an essential tool to outline the terms of a transaction before the actual exchange of goods or services. This document plays a key role in providing the buyer with a clear understanding of the costs involved, while also offering vital details for customs clearance and other logistical considerations. It is a crucial part of international trade, ensuring both parties are aligned on key aspects of the agreement.

In cross-border transactions, having a comprehensive and accurate record of the transaction’s terms is necessary for several reasons. These documents are used to verify the value and nature of goods being shipped, assess the correct taxes and duties, and expedite customs processing. By detailing the agreed-upon prices, product descriptions, and shipping terms, the document facilitates smoother international trade operations.

Why This Document is Vital in Global Trade

- Facilitating Customs Clearance: By outlining essential details such as the product’s value, origin, and description, this document helps expedite the customs process, ensuring the goods are cleared for entry into the importing country without unnecessary delays.

- Clarifying Payment Terms: The document provides clear terms regarding payment expectations, helping both parties avoid misunderstandings about costs, deadlines, and conditions before the transaction is finalized.

- Supporting Risk Management: This document can serve as a reference for managing risks in international trade, offering details that can assist in disputes, claims, or misunderstandings that may arise during shipment or payment stages.

- Compliance with International Regulations: Many countries require detailed transaction documentation for compliance with their customs and trade regulations. This preliminary document helps ensure all requirements are met.

Ultimately, a well-prepared document for international trade can lead to a more seamless and transparent process. By providing both the buyer and seller with a clear understanding of the trade’s terms, it helps build trust and ensures the efficient movement of goods across borders.

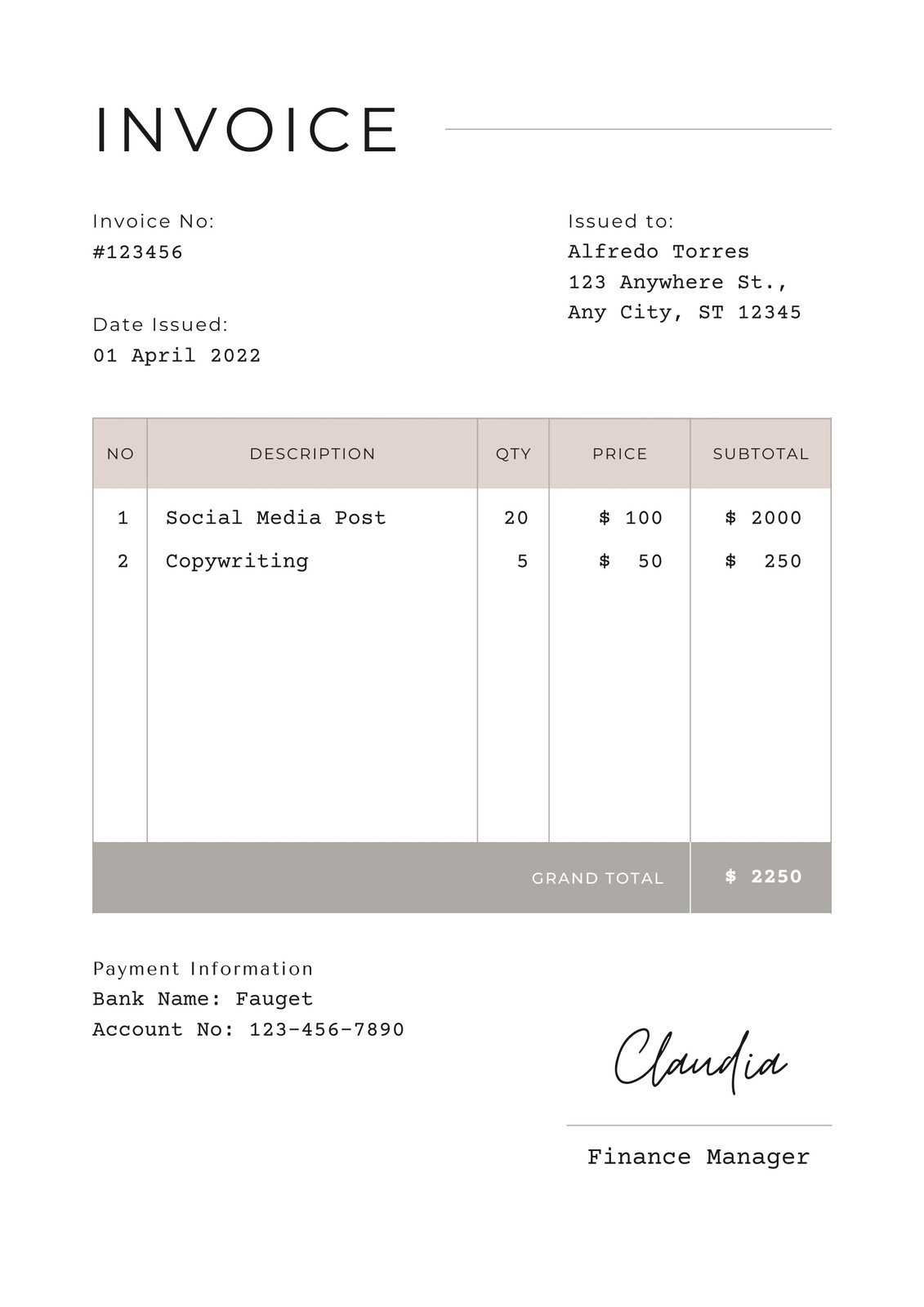

How to Calculate Invoice Amounts

When determining the total due for a transaction, it’s essential to break down all components involved in the cost calculation. Whether you are billing for goods or services, a clear method for computing the final amount ensures transparency and accuracy for both parties involved. This process requires careful attention to the base price, additional charges, and applicable taxes, among other factors, to arrive at the correct figure.

Steps to Calculate the Total Amount

The process of calculating the total amount for a transaction typically involves the following steps:

- Start with the Base Price: This is the cost of the goods or services being provided before any additional charges or taxes. It is the agreed-upon amount between the buyer and the seller.

- Add Additional Charges: Depending on the terms of the transaction, there may be additional costs such as shipping, handling, or special services that need to be added to the base price. Be sure to list all extra charges clearly.

- Apply Taxes: Depending on the jurisdiction, taxes may be applicable. These could include value-added tax (VAT), sales tax, or customs duties. Make sure to calculate the correct tax rate and apply it to the total cost.

- Include Discounts: If any discounts or promotions apply to the transaction, subtract them from the total amount. This will ensure that the buyer is paying the correct discounted price.

Example Calculation

For instance, if you are selling a product priced at $100, adding a shipping fee of $20, and a 10% sales tax, the calculation would proceed as follows:

- Base price: $1

Commonly Asked Questions About Proforma Invoices

When engaging in business transactions, especially in international trade, there are often many questions about the preliminary documents that outline the terms and conditions of a sale. These documents can be confusing for both new and seasoned business owners. This section aims to answer some of the most frequently asked questions to help clarify their purpose and usage in various business contexts.

Frequently Asked Questions

- What is the purpose of this preliminary document?

It serves as a detailed agreement between the buyer and the seller, outlining the cost of goods or services, payment terms, and other transaction specifics before the actual sale occurs. - Is this document legally binding?

No, this document is not legally binding. It is typically used for informational purposes and helps both parties understand the proposed terms. A formal contract or agreement is required for legal obligations. - Can this document be used for customs clearance?

Yes, in international trade, this document is often required by customs to help determine the value of goods and verify the details of the shipment. - Do I need to pay taxes based on the amount listed?

The amount listed in this document may not reflect the final tax amount, as taxes can change depending on the destination country’s regulations. This document is typically used to estimate costs, but the final tax calculation may differ.

Other Common Questions

- How should I fill out the document?

Be sure to include accurate descriptions of the goods or services, their quantities, prices, and any additional fees such as shipping or handling. It should also outline payment terms, delivery dates, and any other details that the buyer and seller have agreed upon. - Can this document be amended?

Yes, if there are changes in the transaction terms, this document can be revised to reflect the updated information. It’s important that both parties agree to any changes made.

These frequently asked questions are designed to help businesses understand the practical uses and limitations of this document. By answering these concerns, companies can ensure they use the document correctly, avoiding confusion or errors in future transactions.

Steps for Creating a Proforma Invoice

Creating a preliminary document that outlines the terms of a sale is an essential task for businesses, especially in international trade. This document serves as an initial agreement between the buyer and seller, helping to establish the pricing, terms, and conditions before the actual transaction is completed. Here are the steps you can follow to create an effective and clear document for your business transactions.

Step 1: Gather All Necessary Information

The first step in creating a detailed preliminary document is to gather all the required details. This includes:

- Buyer and seller information: Name, address, and contact details of both parties.

- Detailed description of goods or services: Clearly outline the items, including specifications, quantity, and unit price.

- Payment terms: Define how and when the payment will be made, including payment methods and due dates.

- Shipping details: Include the shipping method, delivery dates, and any additional charges.

Step 2: Include Key Terms and Conditions

Once you have all the essential details, include terms and conditions that clarify both parties’ responsibilities and expectations. Key points to consider:

- Validity period: Specify how long the preliminary document is valid for, as prices and terms may change over time.

- Delivery conditions: Clearly define the delivery process, responsibilities for damage, or loss during shipping.

- Legal disclaimers: If applicable, include legal clauses that limit liability and provide additional protection for both parties.

Step 3: Review and Finalize

Before finalizing the document, review all the information to ensure it is accurate. Double-check quantities, prices, and payment terms. Ensure there are no discrepancies that could cause confusion later. Once everything is reviewed, both parties should agree to the details outlined in the document.

Step 4: Provide a Copy to Both Parties

After the document is completed, provide a copy to both the buyer and the seller for reference. This can be done electronically or in paper format, depending on the preferences of both parties.

By following these steps, you can create a comprehensive document that provides clarity and understanding for all parties involved in the transaction, ensuring that there are no misunderstandings and that the terms of the deal are clearly communicated.

Using Software for Proforma Invoices

In today’s digital age, creating preliminary documents for business transactions is made easier with the help of specialized software. These tools streamline the process, reduce errors, and improve efficiency by automating many of the steps involved in preparing and managing documents. Whether you are handling local or international transactions, using software to create this type of document can offer significant advantages.

Advantages of Using Software

Using software to create transactional documents provides numerous benefits for businesses:

- Time-saving: Software can automatically populate fields, calculate totals, and apply taxes, reducing manual input and speeding up the process.

- Accuracy: Automated calculations and predefined templates help minimize human error, ensuring the document is accurate and consistent.

- Customization: Many software programs allow you to customize the layout, design, and content to match your brand, giving the document a professional and personalized touch.

- Compliance: Software often includes features that help you stay compliant with industry regulations, tax laws, and international shipping standards.

Popular Software Options for Creating Business Documents

There are many software options available that are designed to simplify the creation of business documents:

- Accounting software: Platforms like QuickBooks, Xero, or FreshBooks offer built-in tools to generate transaction documents, including estimates, receipts, and contracts.

- Document management software: Solutions such as Zoho Docs and PandaDoc provide cloud-based templates and collaboration features, which are useful for teams working on international deals.

- Excel and Google Sheets: For those who prefer more control, spreadsheet programs allow users to create custom documents and automate calculations through formulas.

By integrating software into your workflow, businesses can save time, enhance accuracy, and improve the overall professionalism of their documentation processes. This technology helps ensure that all relevant details are captured accurately while reducing the chances of miscommunication or mistakes in the transaction process.

How to Protect Your Invoice Data

Protecting sensitive business information is crucial in maintaining trust with clients and partners. Documents that contain financial details, transaction information, and personal data must be secured to prevent unauthorized access and data breaches. Here are essential steps you can take to safeguard your business documents and the sensitive data they contain.

1. Use Secure Platforms

Ensure that the software or platform you’re using to create and store business documents is secure. Look for platforms that provide:

- Encryption: Data encryption is essential for protecting documents while they are stored or transmitted over the internet.

- Two-factor Authentication: Enable two-factor authentication (2FA) for accounts that handle sensitive information to add an extra layer of protection.

- Access Controls: Limit access to financial documents to authorized personnel only, and set permissions to control who can view or edit sensitive data.

2. Protect Your Physical Documents

For businesses that still maintain physical copies of important documents, it is essential to implement secure storage and handling procedures. This may include:

- Locked Cabinets: Store physical copies in locked cabinets or safes to prevent unauthorized access.

- Shredding: Always shred outdated or unnecessary documents to ensure sensitive information is completely destroyed.

3. Regular Backups and Data Recovery

Regular backups are a vital part of any data protection plan. By storing copies of business documents in secure offsite or cloud locations, you can ensure that data can be recovered in the event of a cyberattack or hardware failure. Consider implementing:

- Automated Backups: Schedule automatic backups for your files to ensure that copies are always available.

- Cloud Storage: Store backups in secure cloud services, which offer both encryption and accessibility from multiple devices.

4. Use Strong Passwords

Utilizing strong, unique passwords for online accounts and document management systems is one of the simplest and most effective ways to prevent unauthorized access. Follow best practices for creating secure passwords:

- Complex Passwords: Use a combination of upper and lowercase letters, numbers, and special characters to create a strong password.

- Password Managers: Consider using a password manager to generate and store complex passwords safely.

By implementing these strategies, businesses can significantly reduce the risk of unauthorized access to their critical documents, protecting both their financial interests and their clients’ data.

- What is the purpose of this preliminary document?