Download the Best Marketing Invoice Template for Easy Billing

Managing payments and ensuring timely compensation is crucial for businesses offering creative or professional services. A streamlined approach to billing helps maintain clarity and professionalism, saving time for both providers and clients. By using a well-structured document, service providers can avoid confusion and reduce administrative tasks, allowing them to focus on delivering exceptional work.

Effective billing solutions enable businesses to track services rendered, ensure clients understand the costs involved, and keep everything organized. A customized billing structure ensures that all necessary details are included, reducing the risk of misunderstandings or delays in payment. With the right format, you can easily adjust to various project types and client needs.

Whether you’re a freelancer, agency, or small business, implementing a consistent and clear payment system is essential. The right billing tool helps maintain smooth cash flow and fosters positive relationships with clients, all while promoting professional integrity.

Marketing Invoice Template Overview

When running a service-based business, clear and organized billing documents are essential for smooth transactions. These documents help establish trust and transparency with clients by providing a breakdown of the work performed and the associated costs. Using a structured format ensures that all necessary details are captured in a professional and easy-to-understand way, facilitating quicker payments and reducing the chances of disputes.

Why Structured Billing Documents Matter

Professionally designed billing statements offer several advantages for both service providers and clients. They not only provide a record of the services rendered but also outline payment terms, deadlines, and other crucial information. This clarity prevents misunderstandings and ensures all parties are on the same page regarding costs and expectations.

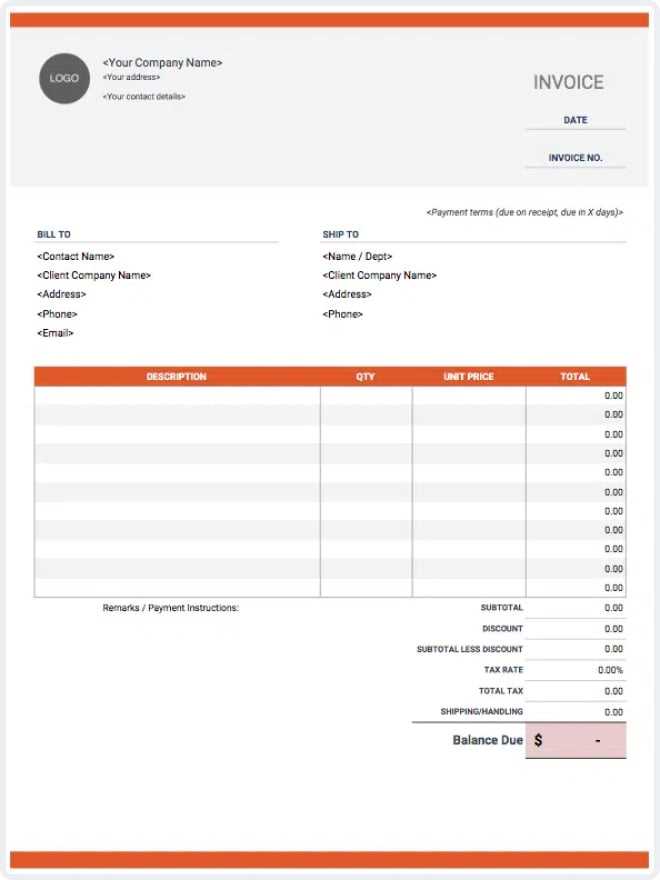

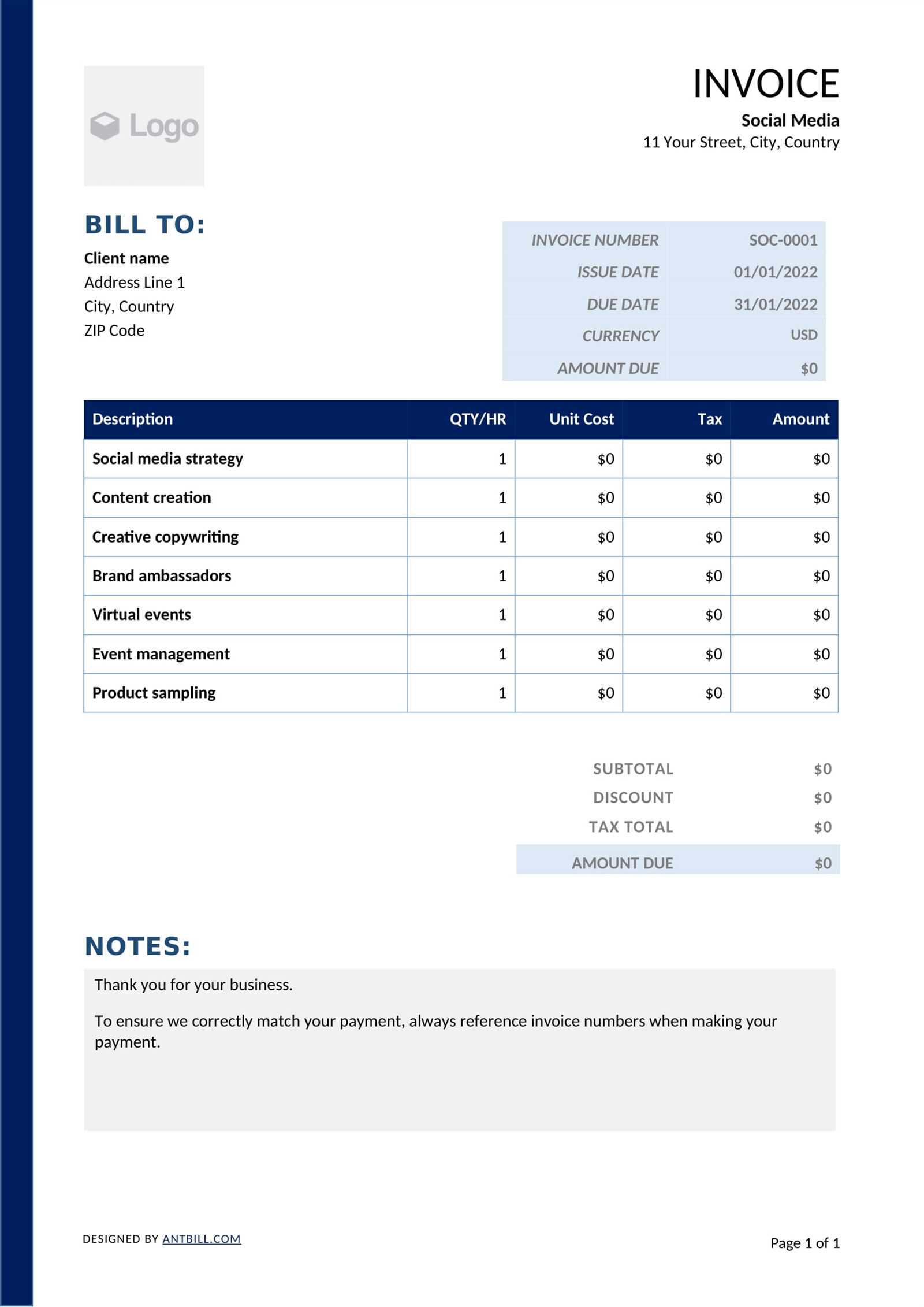

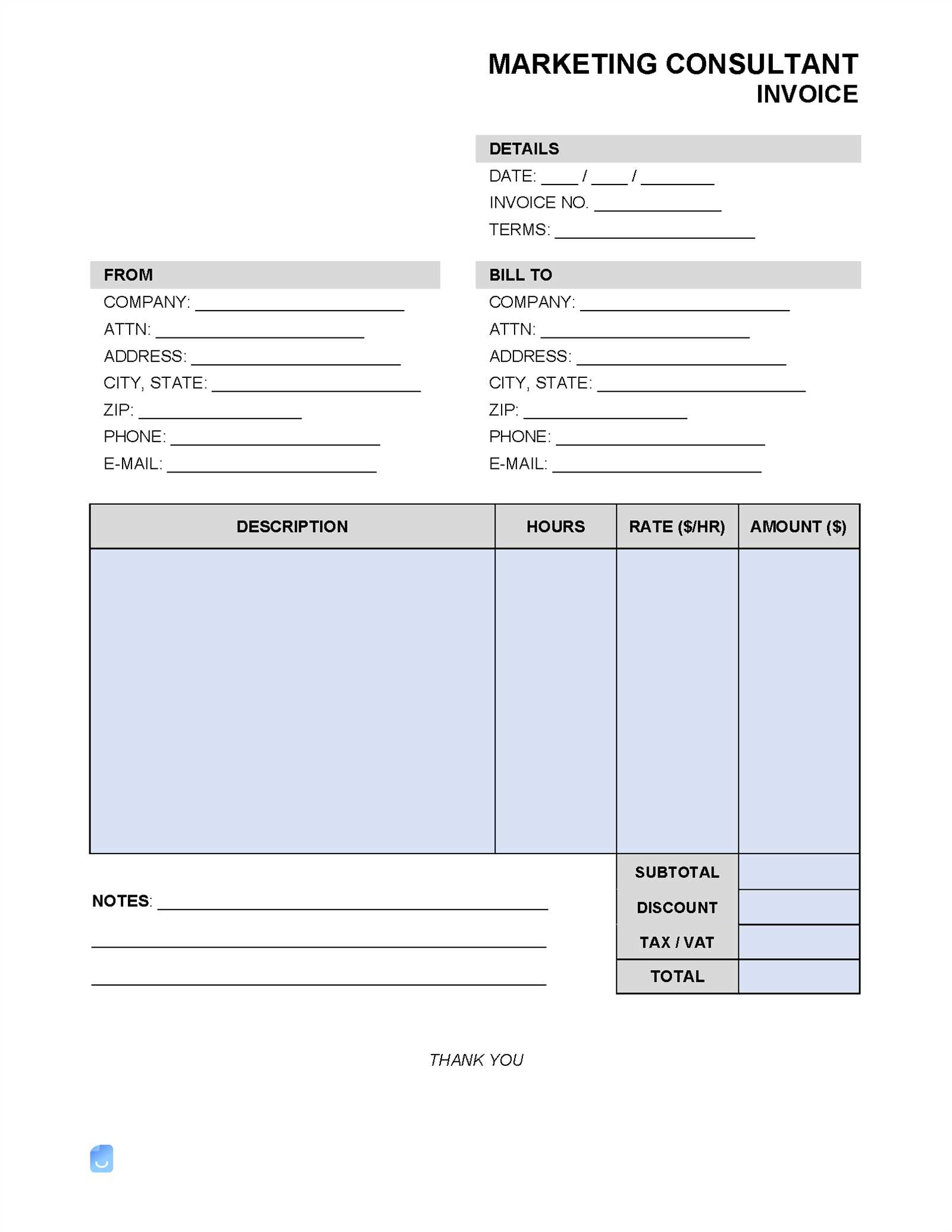

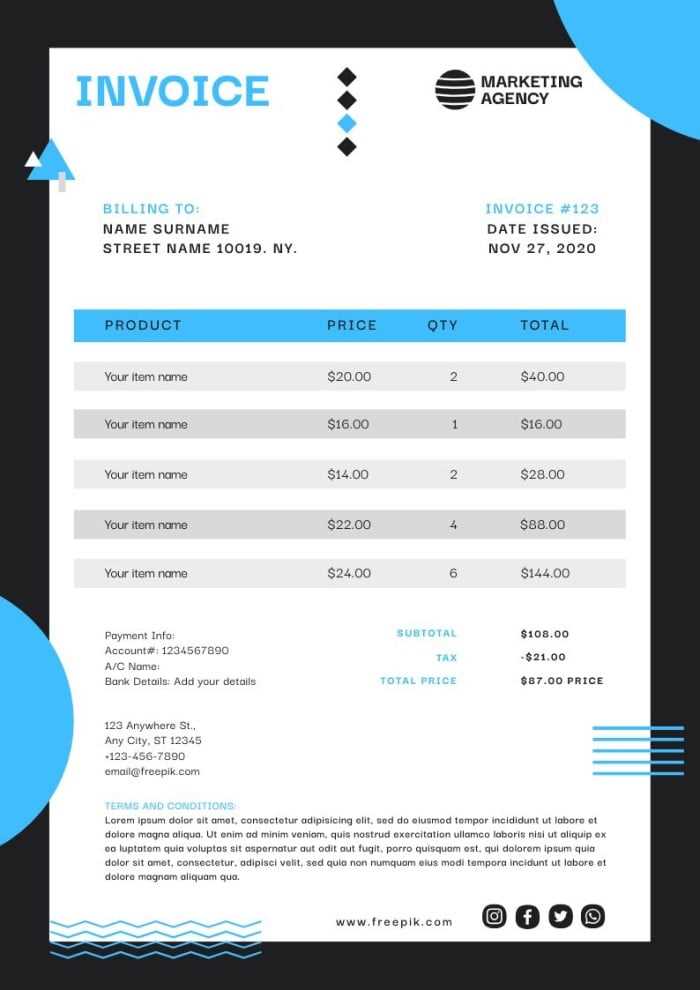

Key Elements to Include in Your Billing Document

A well-constructed billing statement should contain several key elements. These elements help to ensure that the document is comprehensive, accurate, and easy to process for clients. The most common sections typically include:

| Section | Description |

|---|---|

| Client Information | Name, address, and contact details of the client. |

| Service Details | Clear description of services rendered, including dates and hours worked. |

| Costs and Rates | Breakdown of charges, hourly rates, or fixed fees for services. |

| Payment Terms | Payment due dates, late fees, and accepted methods of payment. |

| Tax Information | Applicable taxes, including sales tax or VAT, if relevant. |

Including all of these sections ensures that both you and your client have a complete understanding of the transaction, helping avoid confusion or delays in payment processing.

Why Use a Marketing Invoice Template

Efficiently managing client payments is essential for any business providing professional services. A consistent and well-organized payment document can significantly streamline your billing process, reducing administrative tasks and ensuring accurate records. Instead of creating a new document for each transaction, a pre-designed format allows you to quickly fill in relevant details, saving you time and effort while maintaining professionalism.

Save Time and Effort

By utilizing a standardized document, you eliminate the need to manually structure each bill from scratch. This approach helps automate much of the process, allowing you to focus on other essential aspects of your business. With pre-set sections and an intuitive layout, you can easily add service details, costs, and client information without worrying about formatting or layout issues.

Enhance Professionalism

Using a ready-made billing format provides consistency, giving your documents a polished and uniform appearance. This not only helps build trust with clients but also reinforces your professionalism. A clear, easy-to-read bill reduces the chance of errors or confusion, ensuring both you and your client are aligned on expectations and payment terms.

Consistency and reliability are key to maintaining strong client relationships. A pre-designed system ensures you always send well-organized, accurate bills, which can improve your chances of getting paid on time and avoid unnecessary follow-ups.

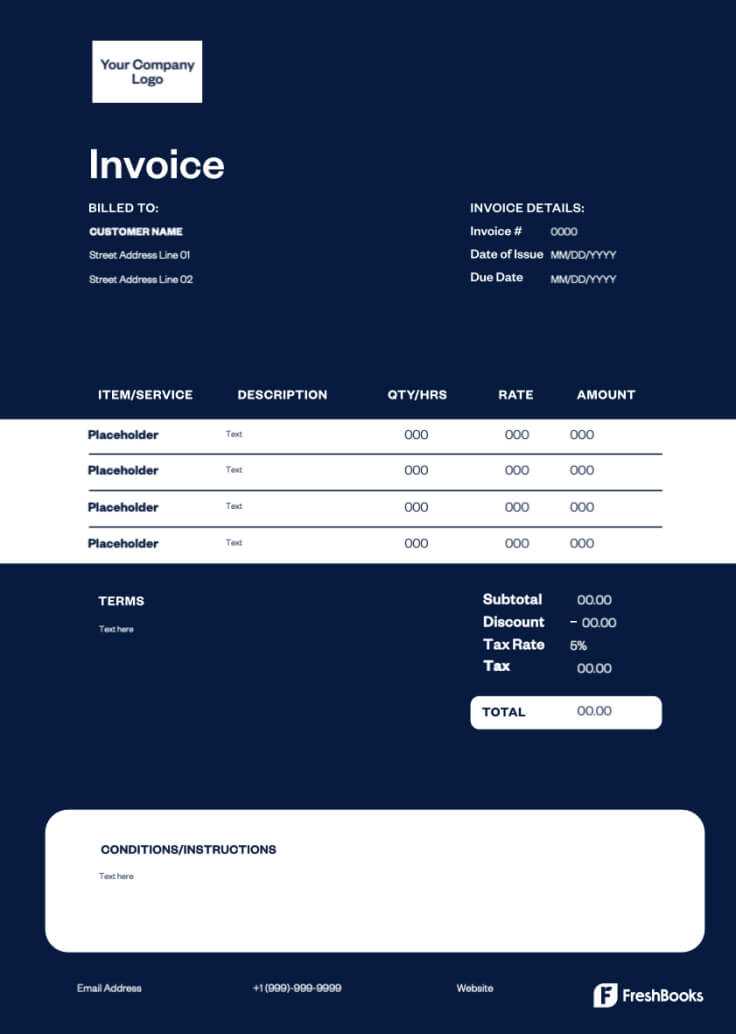

Key Features of a Good Invoice

A well-designed billing document is more than just a list of charges; it serves as a clear record of the transaction between a service provider and their client. For such a document to be effective, it must contain specific details that ensure accuracy, transparency, and easy processing. Key features help avoid misunderstandings, streamline payments, and foster trust between both parties.

Clarity and Accuracy

One of the most important aspects of any billing document is clarity. Every detail, from the services provided to the total amount due, should be easy to read and understand. Accuracy is equally important, as errors in pricing or missing information can lead to delays and confusion. Double-checking the details before sending ensures that everything is correct and prevents unnecessary back-and-forth.

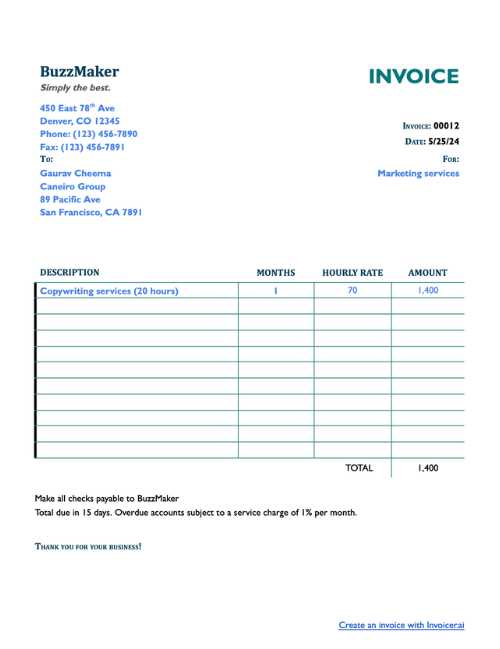

Comprehensive Service Breakdown

A strong billing document includes a clear breakdown of services rendered. This might involve listing the hours worked, tasks completed, or specific deliverables provided. Including this level of detail ensures clients fully understand what they are being charged for, which minimizes disputes and improves the overall client experience. For ongoing projects, specifying rates and timeframes is particularly important to avoid confusion over the scope of work.

Additionally, a good document will typically contain payment terms, including due dates and any penalties for late payments, along with contact information in case of questions. These features create a professional and transparent billing experience, ensuring that both you and your client are on the same page.

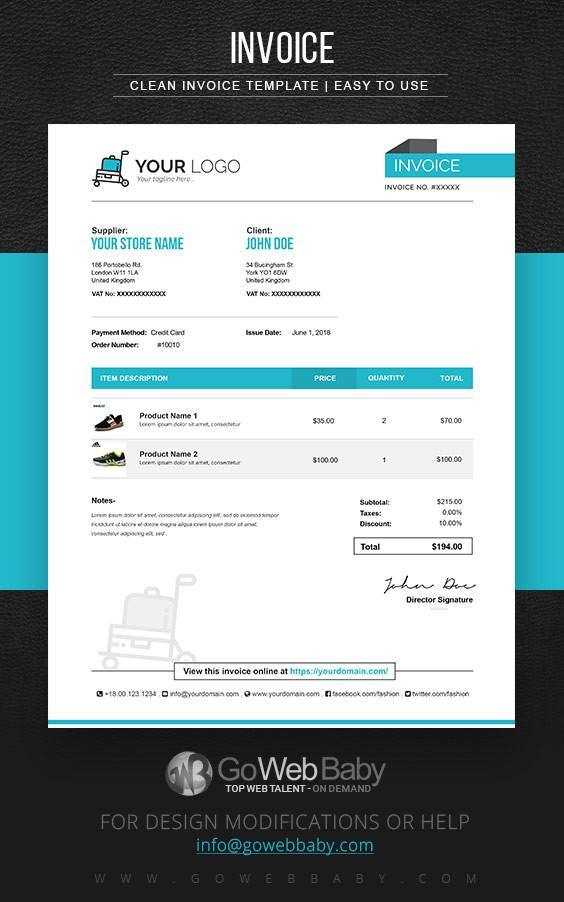

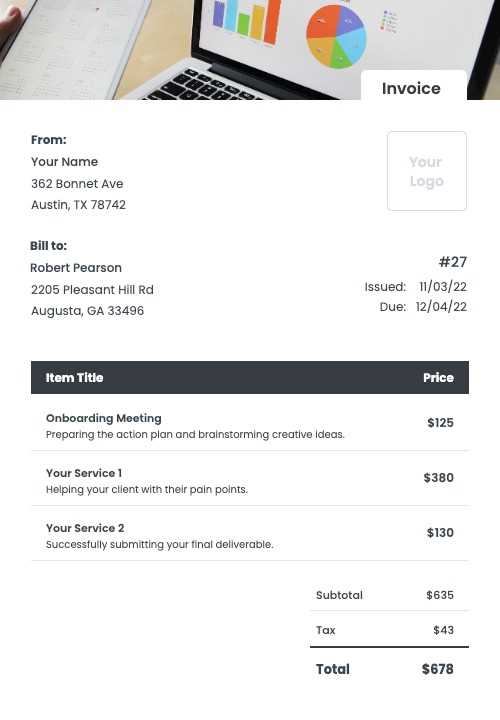

How to Customize Your Invoice

Personalizing your billing document to fit your business needs is essential for creating a professional and streamlined experience. Customization allows you to reflect your brand, adjust to various client requirements, and ensure that all relevant details are included for smooth transactions. A well-tailored document helps maintain consistency across all your transactions and provides clients with a clear understanding of your services and payment terms.

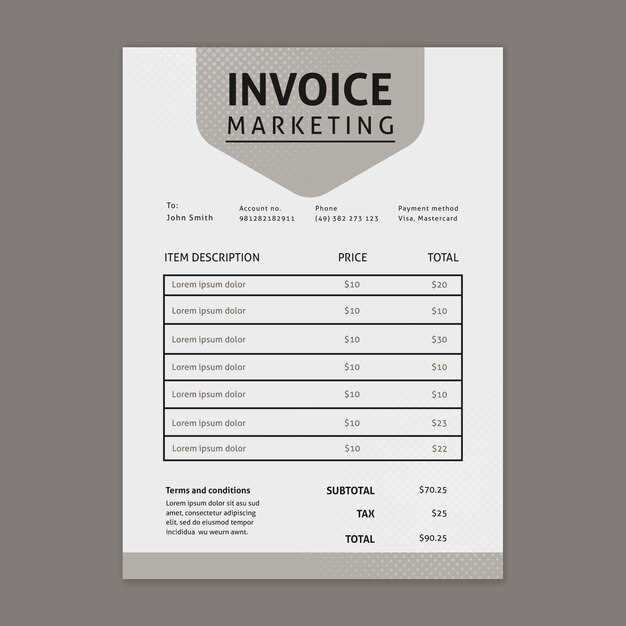

Adjust the Layout and Design

The design of your document should reflect the professionalism of your business. You can easily customize the layout to include your logo, business name, and contact information. This personalization enhances your brand visibility and ensures that your document is easily recognizable. Additionally, make sure to choose a clean and simple layout that prioritizes legibility, with sections clearly separated for easy navigation.

Include Specific Details for Each Client

Every client is different, so it’s essential to customize the content for each transaction. Include client-specific details, such as their name, address, and any particular services requested or terms agreed upon. Adjust the pricing sections to reflect agreed-upon rates, whether they are hourly, flat fees, or based on project milestones. By tailoring the document in this way, you ensure that each client receives accurate and relevant information, which increases the likelihood of timely payments.

Customizing your document doesn’t just improve clarity but also makes your business appear more organized and professional, reinforcing trust and reliability in your client relationships.

Best Practices for Invoice Design

The design of your billing document plays a crucial role in how your client perceives both the transaction and your professionalism. A well-organized, clear, and visually appealing layout ensures that all essential details are easy to find, helping avoid confusion and delays. Following best practices in design will not only improve the client experience but also speed up the payment process.

Prioritize Clarity and Simplicity

The first rule of good design is simplicity. A clean, minimalist approach will ensure that the most important information stands out. Avoid clutter and unnecessary details that may distract from the core message. Your goal is for the client to quickly understand what they are being charged for and when payment is due. Organizing information into sections and using adequate spacing helps make the document more readable.

Incorporate Your Branding Elements

While keeping the design simple, make sure your document reflects your business identity. Including your logo, business name, and contact details in a consistent manner across all documents reinforces your brand image. This adds a layer of professionalism and helps clients quickly recognize your business when they receive your document.

| Design Element | Best Practice |

|---|---|

| Header | Include your logo, business name, and contact details for easy recognition. |

| Typography | Use legible fonts, ensuring the text is easy to read, even in smaller sizes. |

| Color Scheme | Stick to neutral colors with minimal accent colors for a professional look. |

| Section Dividers | Use clean lines or subtle shading to divide different sections clearly. |

| Footer | Include payment instructions and terms, with your contact details in the footer. |

By following these best practices, you create a document that is not only functional but also visually appealing, ensuring a smooth experience for both you and your clients.

Essential Information for Marketing Invoices

For a billing document to be effective, it must contain all the necessary details to avoid confusion and ensure smooth transactions. Including the right information not only provides clarity but also helps maintain a professional relationship with clients. A comprehensive record of the services provided, costs, and payment terms ensures transparency and prevents delays in payments.

Key Elements to Include

Each document should cover the following essential points to ensure accuracy and completeness:

| Element | Description |

|---|---|

| Client Information | Include the client’s full name, address, and contact details to clearly identify them. |

| Service Description | Provide a clear breakdown of the services rendered, specifying dates and any deliverables. |

| Pricing and Rates | List the costs associated with the services, including hourly rates or fixed fees. |

| Payment Terms | Clearly state payment deadlines, late fees, and accepted payment methods. |

| Tax Information | Include applicable taxes, such as VAT or sales tax, if relevant for the transaction. |

| Unique Reference Number | Provide a unique reference or identification number for easy tracking and future reference. |

By incorporating these details, you help avoid any misunderstandings or disputes and create a clear, professional document that clients can easily process. Ensuring that every important element is included will speed up payment and reinforce your reliability as a service provider.

Choosing the Right Template for Your Business

Selecting the right billing document layout is essential for ensuring smooth transactions and maintaining a professional image. The ideal format should reflect the unique needs of your business and align with how you interact with clients. Choosing the right structure helps simplify your workflow, reduces errors, and ensures your clients have all the necessary details in a clear and organized manner.

Factors to Consider When Choosing a Layout

When selecting a suitable format for your business, there are several factors to keep in mind:

- Industry Type: Consider your industry’s requirements. Some fields may need more detailed breakdowns, while others might focus on project milestones or hourly rates.

- Client Preferences: Some clients prefer very detailed documents, while others may request simple summaries. Understand your client’s needs and adjust accordingly.

- Brand Consistency: Your document should align with your overall branding, including color schemes, fonts, and logo placement. Consistency in design builds trust.

- Ease of Use: The layout should be easy for you to fill in and for your clients to read. Look for formats that are customizable and straightforward.

- Legal Compliance: Depending on your location, you may need to include certain legal terms or tax details. Make sure the structure you choose allows for this flexibility.

Where to Find the Right Layout

There are various sources where you can find layouts that suit your business needs:

- Online Platforms: Many online services offer free or paid pre-designed options that you can easily customize.

- Software Programs: Popular accounting software often comes with built-in templates tailored to different industries.

- Freelance Designers: If you need something unique, working with a designer to create a custom layout can help align the document perfectly with your branding.

By carefully evaluating these factors and selecting the best option, you can ensure that your billing process remains efficient, professional, and well-suited to your specific business needs.

How to Save Time with Invoices

Efficient billing processes are crucial for saving time and reducing the administrative burden on your business. By streamlining your approach to creating and managing payment documents, you can focus more on delivering quality services and less on paperwork. A smart, organized system allows you to automate tasks, eliminate errors, and speed up the entire billing cycle.

Automate Repetitive Tasks

One of the best ways to save time is by automating the creation of payment documents. With the right software or pre-designed formats, you can quickly generate new records by simply entering key details such as the client’s name, services rendered, and payment amount. Many tools offer features like saving client information, which allows you to create documents with just a few clicks, rather than re-entering the same data every time.

Use Pre-set Details and Structures

By using a standardized format that includes pre-set sections for your contact information, service breakdowns, and payment terms, you can avoid spending time designing a new document from scratch. Consistently using the same layout not only saves you time but also ensures that every document you send is clear, organized, and professional.

Additionally, keeping customizable templates for different types of services or clients will further speed up the process. Once you have your basic format in place, you can make small adjustments as needed, reducing the time spent on each individual bill.

By incorporating these time-saving strategies, you can reduce administrative workload and maintain a more efficient, effective workflow for your business.

Benefits of Professional Invoicing

Using a professionally designed billing system brings significant advantages to any business, especially when it comes to client relationships and cash flow management. A well-structured, clear document not only facilitates smoother transactions but also fosters trust, improves your reputation, and ensures timely payments. It goes beyond just tracking what is owed; it sets the tone for your business and reinforces your credibility.

Enhanced Trust and Credibility

When you send clear, professional documents to your clients, it shows that you are organized and serious about your business. A polished document reflects your attention to detail and your commitment to maintaining a professional image. This builds trust with your clients, who are more likely to pay promptly when they see that you are reliable and professional.

Faster Payment Processing

A well-crafted payment record speeds up the payment process by clearly outlining what the client owes and when it is due. With all relevant details organized in one document–such as services rendered, pricing, and payment terms–clients can easily process the information and pay without needing clarification or follow-up. This minimizes delays, ensuring your cash flow remains consistent.

| Benefit | Description |

|---|---|

| Professional Image | A clear, well-organized document reflects your business’s professionalism, building credibility with clients. |

| Efficient Payment Collection | Clear billing details make it easier for clients to understand what they owe, speeding up payment processing. |

| Legal Protection | Accurate records provide a strong legal foundation in case of disputes or payment issues. |

| Time Savings | Using pre-structured formats reduces time spent on paperwork, letting you focus on your business operations. |

By investing in a professional billing system, you not only improve your internal efficiency but also build stronger, more trusting relationships with your clients, leading to greater business success in the long run.

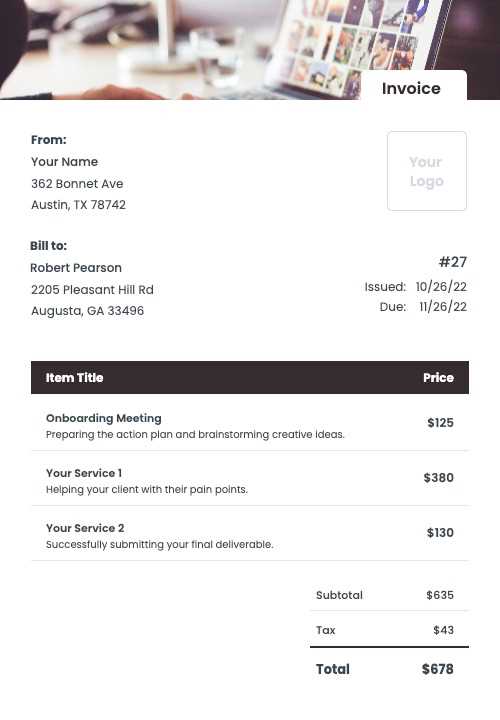

How to Add Taxes to Your Invoice

Including taxes in your billing documents is essential for ensuring compliance with local laws and providing transparency to your clients. The process of adding taxes requires careful calculation and clear presentation to avoid confusion. Knowing how to properly apply taxes to your transactions not only ensures accuracy but also helps maintain professionalism and trust with your clients.

Steps to Add Taxes to Your Billing Document

Here are the basic steps to follow when adding taxes to your payment records:

- Understand the Tax Rate: Research the appropriate tax rate for your location and industry. This can vary depending on your region and the type of service you offer. Common taxes include sales tax, VAT, or service tax.

- Determine the Taxable Amount: Identify the total amount that will be taxed. This typically includes the cost of services or products but may exclude certain fees, depending on the local tax laws.

- Calculate the Tax: Multiply the taxable amount by the applicable tax rate to determine how much tax is owed.

- List the Tax Separately: Clearly display the tax amount on the document, distinct from the base cost of services. This helps clients easily identify the tax charge and understand the total amount due.

- Include Tax Identification Information: If necessary, include your tax identification number (TIN) or VAT number on the document for legal compliance.

Example of How Taxes Appear on a Payment Document

Here is a simple example of how to structure the tax section on your document:

| Item Description | Amount |

|---|---|

| Service Fee | $1,000 |

| Tax (8%) | $80 |

| Total Due | $1,080 |

By following these steps, you can ensure that taxes are properly included, helping you stay compliant and maintain clear communication with your clients.

Common Mistakes to Avoid in Invoicing

Even the most experienced professionals can make errors when creating payment documents, which can lead to delays, misunderstandings, and sometimes lost revenue. Ensuring that your billing process is error-free is crucial for maintaining strong client relationships and ensuring timely payments. Being aware of common mistakes can help you streamline your workflow and avoid costly oversights.

Incorrect or Missing Details

One of the most frequent mistakes is omitting important details or entering incorrect information. This can range from misspelled client names to incorrect billing amounts or payment terms. Even minor errors can cause confusion and lead to delayed payments. It’s essential to double-check all information before sending out the document. Common oversights include:

- Incorrect contact information for the client

- Missing service descriptions or incomplete breakdowns

- Wrong payment terms, such as due dates or late fees

Failure to Include Taxes or Fees

Another common mistake is forgetting to add applicable taxes or additional fees. If taxes or surcharges are not clearly specified, your client might question the total amount due or refuse to pay. Always ensure that the appropriate tax rates and extra fees (such as shipping, handling, or administrative charges) are included and clearly indicated on the document. Failing to include this information can cause delays in payment or require time-consuming follow-up.

By being mindful of these errors, you can ensure a smoother and more efficient billing process, helping you avoid confusion, maintain professionalism, and speed up your payment collection.

Invoice Software vs Templates

When it comes to creating billing documents, businesses have two primary options: using specialized software or relying on pre-designed layouts. Both methods have their advantages, but the choice ultimately depends on the complexity of your needs, the size of your business, and how much time you can dedicate to the billing process. Understanding the differences between these two approaches can help you make an informed decision on which one best suits your workflow.

Advantages of Using Software

Invoice management software offers a range of features that can automate and streamline the entire billing process. Some of the key benefits include:

- Automation: Software often allows you to automate recurring invoices, reducing the need for manual data entry and saving time on repetitive tasks.

- Customization: Many software options let you easily tailor your documents with company branding, personalized fields, and dynamic calculations.

- Tracking and Reporting: Advanced features include automatic tracking of payments, overdue invoices, and the generation of financial reports for better management of cash flow.

- Integration: Software can integrate with other tools, such as accounting software or payment gateways, streamlining your entire business process.

Advantages of Using Pre-designed Layouts

On the other hand, using a pre-designed layout can also be an effective option, especially for small businesses or individuals who don’t need the complexity of dedicated software. The benefits of using ready-made documents include:

- Cost-Effective: Templates are often free or come at a low cost, making them a great option for businesses with limited budgets.

- Simplicity: Pre-designed formats are straightforward to use, requiring little to no technical expertise. They are ideal for those who need quick, no-fuss billing solutions.

- Flexibility: While less automated, templates offer flexibility in design, allowing you to create a personalized document quickly without the need for software installation or subscriptions.

Choosing between software and pre-designed formats depends on the scale of your business and the complexity of your needs. If you are looking for automation, integration, and advanced features, software may be the better option. However, if you prefer simplicity and cost-effectiveness, a well-designed layout might be all you need.

How to Send Your Billing Document

Sending a payment request to your clients is as important as creating it. The way you deliver your billing document can impact how quickly it is processed and paid. A professional approach ensures that clients understand the details clearly, making it easier for them to complete their payment on time. Choosing the right method of delivery and following up when necessary can help ensure that your finances are in order.

Best Ways to Send Your Billing Document

Here are the most common methods for delivering your payment request to clients:

- Email: Sending a billing document via email is the most widely used method today. It’s fast, efficient, and allows you to attach the document directly for easy download. Be sure to include a clear subject line and a polite message in the body of the email.

- Online Payment Platforms: Many businesses use online platforms (such as PayPal, Stripe, or others) to send payment requests. These services often allow for easy integration with your accounting system, and you can add a payment link directly in the document.

- Physical Mail: While less common in the digital age, some businesses may still prefer to send paper copies of their billing documents, especially for clients who do not use email or online payment systems.

What to Include When Sending a Billing Request

Regardless of the method you choose, make sure to include the following key information when sending your billing document:

- Clear Payment Terms: Be explicit about when the payment is due and any late fees that might apply.

- Instructions for Payment: If necessary, provide details on how the client can pay–whether through a bank transfer, online platform, or other methods.

- Contact Information: Always include your contact details in case the client has questions or needs clarification.

Once sent, remember to track the status of the payment. If needed, follow up with a friendly reminder before the payment due date to ensure timely processing. The more organized and professional you are in your approach, the more likely it is that clients will respect the process and make payments on time.

When to Send Your Billing Document

Timing is a critical element when it comes to sending payment requests. Sending it at the right time not only ensures that your clients have enough time to process the payment, but also improves the likelihood of prompt payment. Delaying or rushing this step can lead to confusion or missed deadlines, affecting your cash flow. Understanding the best time to send a billing document will help streamline your financial processes and keep your business running smoothly.

After Completing the Work

The most common time to send a payment request is immediately after the work has been completed or the goods have been delivered. This is the moment when the client is most engaged and likely to pay. Sending the document promptly shows professionalism and reinforces the idea that payment is due for the services or products provided.

Monthly or Recurring Schedules

If you offer ongoing services or subscriptions, it’s helpful to establish a regular billing schedule. Sending a payment request on a set date each month ensures that both you and your clients are aligned on when payments are expected. This consistency can make it easier for clients to manage their finances and for you to maintain steady cash flow.

By sending payment documents at the right time, you can maintain a smoother billing cycle and reduce the chances of delayed payments or misunderstandings. Make sure to follow up if needed and keep a clear record of when each document is sent and received.

Tracking Payments and Due Dates

Effective tracking of payments and due dates is essential for maintaining healthy cash flow and ensuring that your business operates smoothly. Keeping an organized record of when payments are due, when they’ve been made, and any outstanding balances can prevent financial issues and reduce confusion. By staying on top of these details, you can take timely action to resolve any payment delays and keep your operations on track.

Methods for Tracking Payments

There are several methods available for tracking payments and monitoring due dates, whether you use software or simple spreadsheets. Key strategies include:

- Digital Tools: Many businesses use accounting software or online platforms to automatically track payments, generating reminders for upcoming due dates and keeping a record of all transactions.

- Manual Tracking: If you prefer to handle things manually, maintaining an organized spreadsheet can help you keep track of payment statuses. Be sure to update it regularly to avoid missing any details.

- Payment Gateway Integration: Using an integrated payment system can automate the tracking process, as payments are recorded in real-time when clients pay online.

Example of Payment Tracking Table

Here is a simple example of how to organize your payment tracking system:

| Client | Amount Due | Due Date | Payment Status | Payment Date |

|---|---|---|---|---|

| Client A | $1,000 | 2024-11-10 | Paid | 2024-11-05 |

| Client B | $500 | 2024-11-15 | Pending | – |

| Client C | $750 | 2024-11-12 | Overdue | – |

In this example, you can quickly see the status of each payment and follow up on overdue accounts. Maintaining this level of organization allows you to respond promptly and professionally to any issues that may arise.

Tracking payments and due dates is essential to keeping your business’s finances organized and ensuring timely cash flow. Whether you use automated software or manual systems, the key is consistency and regular monitoring to avoid payment delays or misunderstandings.

Tips for Clear Payment Terms

Clear and concise payment terms are essential to avoid misunderstandings and ensure timely payments. When your clients know exactly what is expected in terms of payment deadlines, methods, and conditions, it makes the process smoother for both parties. Being upfront about payment expectations helps build trust and professionalism, while reducing the likelihood of disputes or late payments.

Key Elements of Clear Payment Terms

Here are some important elements to include when outlining your payment terms:

- Payment Due Date: Clearly state the exact date when the payment is expected. This eliminates any confusion about when the payment should be made.

- Accepted Payment Methods: Specify the methods of payment you accept, such as bank transfers, credit cards, or online platforms. This ensures that your client knows how to pay without needing to ask.

- Late Payment Penalties: If you charge late fees, include this information in your payment terms. A small penalty for overdue payments can encourage clients to pay on time.

- Discounts for Early Payments: Consider offering a small discount for early payments. This can incentivize clients to pay sooner and helps improve cash flow.

- Currency: If you work with international clients, specify the currency in which payment should be made to avoid confusion.

Example of Payment Terms

Here is an example of how clear payment terms might appear on your billing document:

| Payment Term | Details |

|---|---|

| Due Date | November 15, 2024 |

| Accepted Methods | Bank Transfer, Credit Card, PayPal |

| Late Fee | 5% per week after due date |

| Early Payment Discount | 2% discount if paid within 7 days |

| Currency | USD |

By clearly outlining these terms in your payment documents, you reduce the chances of delays or confusion and create a more efficient billing process. Transparency in your payment policies also enhances your professional reputation, making it easier to maintain positive client relationships.

Creating Recurring Invoices for Clients

For businesses that offer ongoing services or products, setting up regular payment requests can save significant time and effort. Recurring payment arrangements allow you to automate the billing process, ensuring that both you and your clients are always on the same page regarding payment schedules. By setting up these requests in advance, you can focus more on providing quality services while maintaining steady cash flow.

How Recurring Payments Work

Recurring payments typically follow a fixed schedule and cover an agreed-upon amount. This can apply to monthly subscriptions, maintenance contracts, or any service that requires periodic billing. The key to success with recurring billing is clarity: both you and your client should be aware of the frequency, amount, and terms associated with the payment.

Steps to Create Recurring Billing Documents

Follow these steps to set up recurring payment requests for your clients:

- Set Payment Frequency: Choose how often the payment should be made (weekly, monthly, quarterly, etc.). Be sure to align this with the nature of the service or product being provided.

- Agree on Amounts: Clearly state the payment amount that will be charged for each period. This ensures transparency and prevents misunderstandings about pricing.

- Establish Start and End Dates: Define the start date for the recurring payments, and if applicable, the end date or renewal terms. For example, a one-year contract might require a payment every month, beginning on the contract start date.

- Set Payment Methods: Specify how payments will be made. This could include automatic bank transfers, credit card payments, or online payment systems like PayPal.

- Automate the Process: Use accounting software or online tools to set up automated recurring billing. This ensures payments are requested on time without manual intervention.

Example of a Recurring Payment Schedule

Here’s an example of how recurring billing information might appear on your documents:

| Client | Amount Due | Frequency | Start Date | Next Payment Date |

|---|---|---|---|---|

| Client A | $500 | Monthly | 2024-11-01 | 2024-12-01 |

| Client B | $1,200 | Quarterly | 2024-11-15 | 2025-02-15 |

Wi

How to Handle Late Payments Efficiently

Late payments are an unfortunate but common challenge for many businesses. They can disrupt cash flow and create unnecessary stress. However, having a clear strategy in place to handle overdue accounts can minimize their impact. By taking proactive steps, setting clear expectations, and maintaining professionalism, you can efficiently manage late payments and keep your financial operations on track.

1. Set Clear Payment Terms from the Start

The first step in preventing late payments is to establish clear payment terms at the beginning of your relationship with a client. Clearly outline the due dates, accepted payment methods, and any late fees in your agreement or on your billing documents. This helps set expectations and provides a reference point in case a payment is delayed.

2. Send Payment Reminders

If the payment due date has passed, don’t hesitate to send a polite reminder. Often, clients simply forget about their obligations, and a gentle nudge can resolve the issue. You can send a friendly reminder email a few days after the due date, then follow up with more frequent reminders if needed.

3. Offer Flexible Payment Options

Sometimes clients are late because of cash flow issues. Offering flexible payment plans or partial payments can help resolve the situation without straining the client-business relationship. By providing options, you increase the likelihood of receiving payment without causing frustration on either side.

4. Implement Late Fees

Having a late fee policy can act as an incentive for clients to pay on time. Ensure that the late fees are clearly stated in your original agreement or payment terms. This can include a flat fee or a percentage of the outstanding amount charged after a certain period. However, it’s important to apply these fees consistently to avoid creating confusion or ill will.

5. Escalate the Issue When Necessary

If payments continue to be delayed despite reminders and offers of flexibility, it may be time to escalate the issue. Start by directly contacting the client to discuss the situation. If that doesn’t resolve the problem, you may need to consider working with a collections agency or taking legal action. However, this step should be a last resort, as it can strain business relationships.

By having a system in place and maintaining clear communication, you can handle late payments in a way that minimizes disruptions to your business while keeping client relationships intact.