Top Invoice Templates for QuickBooks Online to Enhance Your Billing Efficiency

Managing business transactions efficiently is a key component of success, and having the right tools can make a significant difference. The process of generating and sending financial documents can often become tedious and prone to errors, especially when done manually. Using digital solutions to create professional and consistent paperwork simplifies this process, saving time and reducing mistakes.

With the right set of tools, you can easily create customized documents that not only reflect your brand but also ensure accuracy in every detail. By automating various aspects of the billing cycle, businesses can focus on growth while maintaining a smooth flow of payments. These tools help you stay organized and ensure that your clients receive professional-looking records that meet industry standards.

Whether you’re running a small business or managing a larger enterprise, the ability to quickly generate well-structured financial documents can have a positive impact on your overall operations. With the help of modern digital solutions, handling invoicing and related tasks has never been more straightforward and efficient.

Invoice Templates for QuickBooks Online

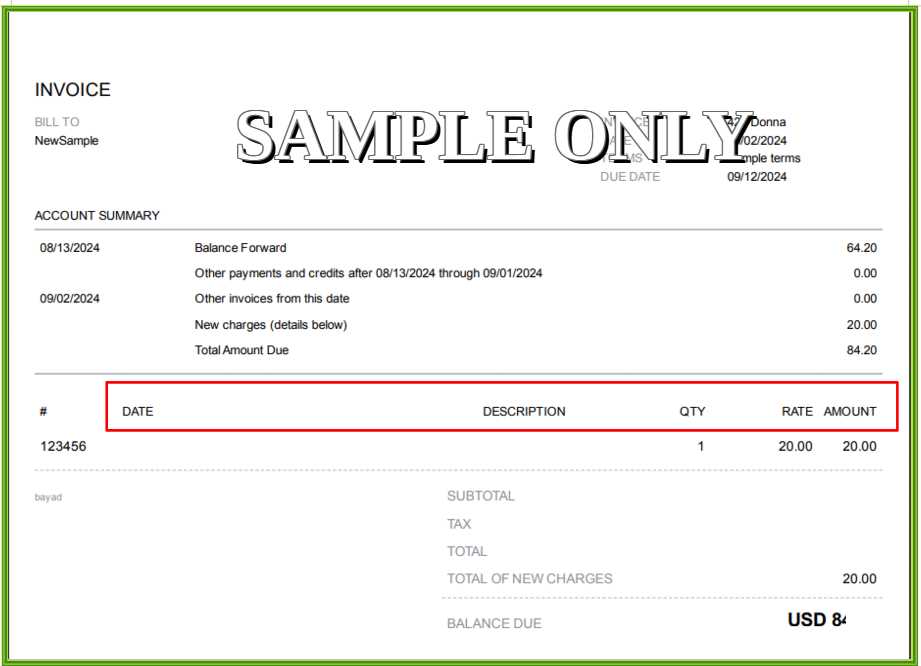

Effective billing solutions are essential for businesses of all sizes. Using pre-designed formats can help streamline the process, ensuring consistency and professionalism in every transaction. With the right tools, businesses can quickly create detailed documents that are customized to their needs, saving time and minimizing errors.

These ready-made formats offer a variety of layouts suitable for different industries and business requirements. They can be easily adapted to reflect your company’s branding, including logos, colors, and personalized messages. The ability to adjust these designs ensures flexibility while maintaining a high standard of presentation for your clients.

Furthermore, automating the process of generating and sending out financial records ensures that nothing is overlooked. By integrating payment tracking and due date reminders, businesses can keep a close eye on their cash flow and ensure timely payments. With this approach, you can focus more on running your business, while your billing tasks are handled seamlessly in the background.

Why Choose QuickBooks for Invoicing

For businesses looking to simplify their billing process, selecting the right platform is crucial. A reliable solution not only saves time but also reduces the chances of errors. With the right system, you can automate key tasks, maintain consistency, and ensure all necessary details are included in your financial documents.

Efficiency and Accuracy

One of the main advantages of using this tool is its ability to automate much of the billing process. By eliminating manual entry, you reduce the likelihood of mistakes and ensure that each transaction is recorded accurately. This leads to fewer discrepancies, quicker payments, and better financial oversight.

Customization and Flexibility

Another key benefit is the ability to easily tailor financial documents to suit your specific needs. You can adjust layouts, add company branding, and customize fields to match the exact information you need to include. This level of flexibility makes the platform adaptable to a variety of industries and business types.

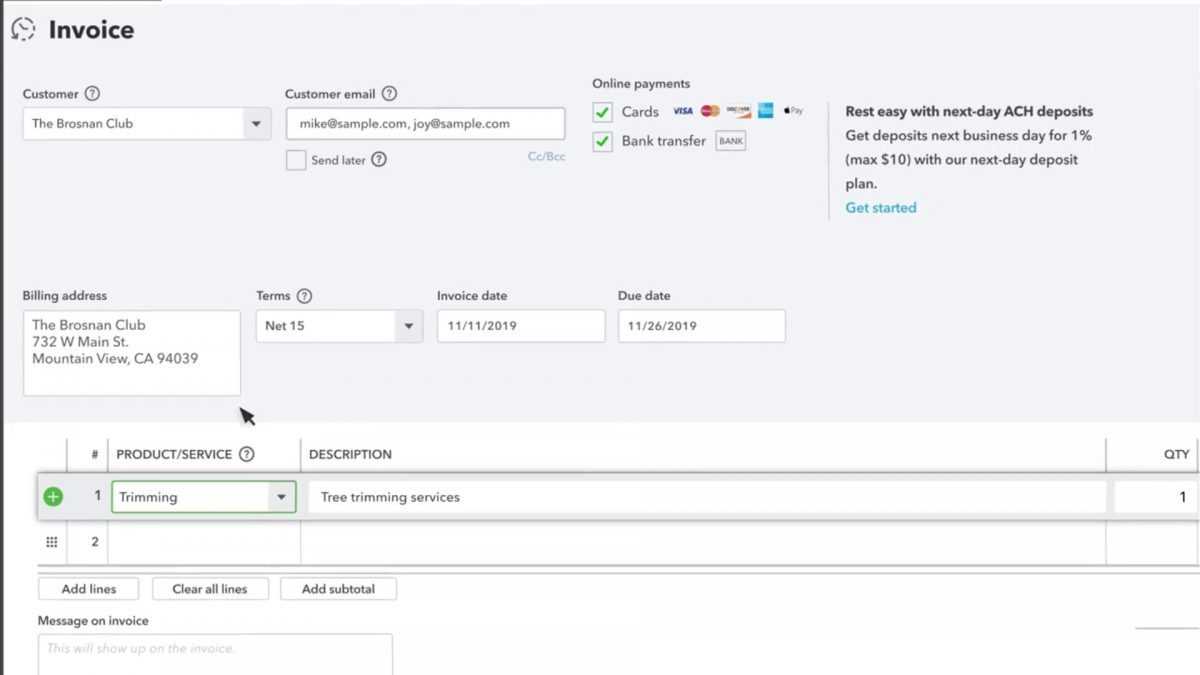

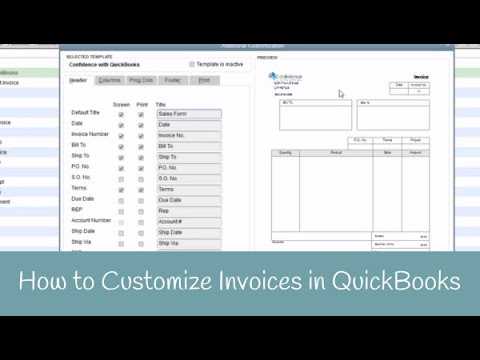

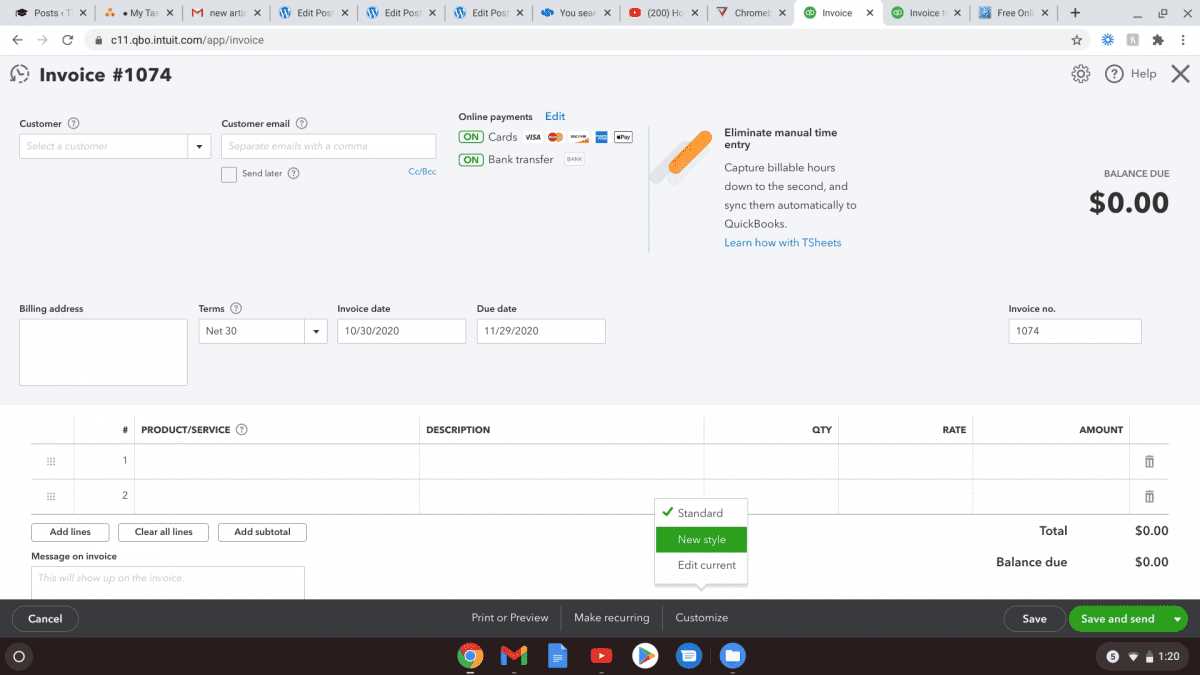

How to Customize Your Invoice Templates

Personalizing your financial documents allows you to create professional, branded records that reflect your business identity. Customization options ensure that each document you send is tailored to your unique needs while maintaining consistency. By adjusting various elements, you can provide a seamless and personalized experience for your clients.

Adjusting Layout and Design

Many platforms offer a range of layout options that can be modified to fit your style. You can change fonts, colors, and section placements, such as headers, item descriptions, and payment information. The ability to integrate your company logo and other visual elements strengthens your brand recognition and ensures a cohesive look across all documents.

Adding or Removing Fields

Customizing the fields on your documents allows you to include only the most relevant information. Depending on your business type, you may need to add specific details such as customer IDs, tax information, or additional terms and conditions. You can also remove unnecessary fields to keep your documents clean and concise.

| Element | Customizable Option |

|---|---|

| Logo | Upload your business logo to appear on each document |

| Text Fields | Edit sections for payment terms, item descriptions, and more |

| Colors | Adjust background and text colors to align with your brand |

| Layout | Rearrange fields to prioritize the most important information |

With these customization options, you can create a polished and professional look while ensuring that all the necessary details are clearly displayed for your clients. A well-tailored document not only enhances your business image but also contributes to better communication and smoother transactions.

Creating Professional Invoices in QuickBooks

Creating polished and accurate financial records is essential for maintaining a professional image and ensuring smooth transactions. By using the right tools, you can easily generate documents that are not only accurate but also aligned with your brand’s aesthetic. This approach helps foster trust and promotes timely payments, all while reducing the risk of errors.

When designing your documents, it’s important to focus on clarity and ease of understanding. Clear formatting and well-organized information make it easier for your clients to review and process payments quickly. Moreover, including all necessary details–such as payment terms, itemized charges, and contact information–ensures that the document serves its purpose effectively.

| Element | Purpose |

|---|---|

| Business Logo | Enhance your brand visibility and create a professional impression |

| Client Details | Ensure clarity on who is being billed, including full contact information |

| Itemized Charges | Provide clear breakdowns of services or products for easy reference |

| Payment Terms | Specify deadlines and payment instructions to avoid confusion |

| Tax Information | Include applicable taxes for transparency and compliance |

By focusing on these key elements, you can generate documents that meet both your business needs and your clients’ expectations. A well-structured record not only speeds up payment processing but also enhances the professionalism of your interactions, which is crucial for building lasting business relationships.

Best Practices for Using Invoice Templates

Crafting clear and efficient billing documents is essential for maintaining professional relationships and ensuring prompt payment. A well-structured document not only presents the necessary information concisely but also reflects positively on your business image. Below are key guidelines to enhance the effectiveness of your billing layouts.

Focus on Clarity and Organization

Ensure that each document is easy to read by grouping similar information together. Use bold headers or distinct sections for details like client information, services rendered, and payment terms. This approach helps the recipient find essential details quickly and reduces the chance of errors.

Maintain Consistency in Format

Utilize a consistent format to build familiarity with your clients, which can streamline future interactions. Keep your text style, font size, and section layout uniform across all billing documents. Clear, consistent formatting not only makes documents look professional but also minimizes the chance of misunderstandings regarding costs or services.

Lastly, always review each document before sending. A final check ensures

Key Features of QuickBooks Invoice Templates

Modern business documentation tools offer a variety of features to streamline billing and enhance accuracy in client transactions. These pre-built document layouts help customize and simplify the creation of professional, organized statements that are both easy to understand and visually appealing.

Customizable Layout Options

One of the standout aspects is the flexibility in layout design, allowing you to adjust various elements to better match your brand. You can adapt fonts, colors, and logo placement to create a cohesive look that aligns with your business identity, giving each statement a personalized touch.

Automated Calculation Features

Automatic calculation capabilities make creating accurate documents easier by eliminating manual errors. This feature includes automatic tax, discount, and total calculations, which can save time and ensure that all details are correct before sending to clients.

Using these features helps present a

How to Automate Invoices with QuickBooks

Automating billing tasks can save time and reduce repetitive work, helping businesses maintain a consistent cash flow. With customizable tools, it’s possible to schedule and manage recurring statements, ensuring they are sent out regularly without manual effort.

Set Up Recurring Billing

To automate billing, start by configuring recurring entries for clients who receive regular services or products. By setting predefined schedules, you ensure that documents are generated and dispatched automatically on specified dates, reducing the risk of missed payments and allowing you to focus on other priorities.

Use Automated Reminders

Enabling reminder notifications helps keep clients informed about upcoming or overdue payments. This feature can send personalized follow-ups to customers, encouraging timely responses and fostering a smoother transaction process. Customized reminders are a reliable way to maintain communication and improve collection efficiency.

Integrating Payments with QuickBooks Invoices

Incorporating payment options directly into billing documents can significantly streamline the transaction process, making it easier for clients to settle balances promptly. With integrated payment solutions, businesses can offer multiple methods for customers to complete their payments quickly and securely.

Enable Various Payment Methods

Allowing diverse payment options, such as credit cards, bank transfers, or digital wallets, enhances convenience for clients. By providing these choices directly within the document, you can improve the chances of receiving payments faster and reduce delays in the collection process.

Track Payments in Real Time

Real-time tracking lets you monitor when a client

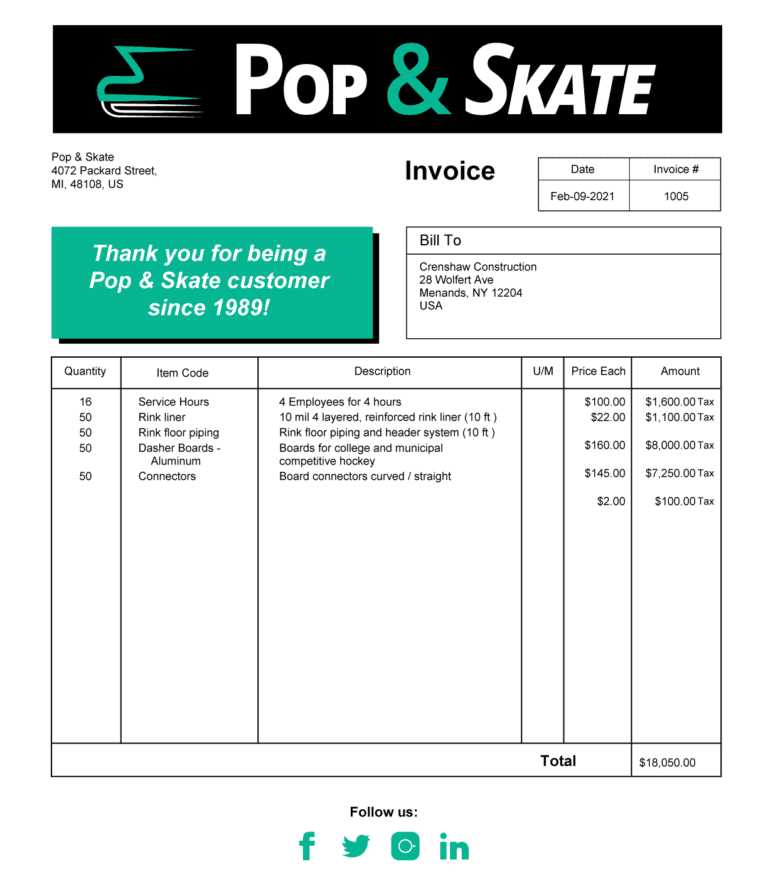

Designing Invoices for Different Industries

Each industry has unique billing requirements, from specific data fields to style preferences, that reflect the nature of its transactions. Tailoring financial documents to suit industry standards not only adds professionalism but also ensures clarity for clients who may have specialized billing needs.

Customize Layouts for Clear Communication

Creating an effective layout requires attention to detail and an understanding of what clients in each field expect. Here are a few examples of how different industries can benefit from tailored billing designs:

- Healthcare: Include detailed service descriptions, codes, and payment breakdowns to align with insurance requirements and medical billing standards.

- Construction: Provide itemized lists of labor, materials, and project stages to give clients a transparent view of project costs and timelines.

- Freelance & Creative Services: Emphasize a clear scope of work, rates, and terms. A minimalistic design with a section for project milestones can add clarity.

- Retail & E-commerce:

Common Mistakes to Avoid in Invoices

Billing errors can lead to delays, misunderstandings, and even strained client relationships. Ensuring accuracy and attention to detail when creating financial documents is essential for a smooth transaction process. Below are common mistakes to watch out for and strategies to avoid them.

Mistake Description How to Avoid Missing or Incorrect Dates Omitting transaction or due dates can confuse clients and delay payments. Always double-check that all dates are correctly added, especially payment terms. Incorrect Contact Information Providing the wrong contact or company details can result in un How to Track Invoice Status in QuickBooks

Monitoring the progress of your billing documents is essential for maintaining cash flow and staying updated on client payments. Using built-in tracking features, businesses can quickly check the status of each document, making it easier to follow up and manage pending transactions.

- View Document Status: Open the billing dashboard to see a summary of each document’s current state. Status indicators, such as “sent,” “viewed,” or “paid,” provide a quick overview of where each stands in the payment process.

- Send Reminders: For outstanding amounts, utilize the automated reminder feature. This option allows you to send customized follow-ups to clients, encouraging timely responses and minimizing overdue balances.

- Filter by Status: Use the filter options to display only specific cate

Using Invoice Templates for Recurring Billing

Automating regular payments can save time and reduce administrative tasks, especially for businesses providing subscription services or ongoing projects. By setting up recurring billing, you ensure consistent and timely payments while maintaining strong client relationships.

Setting Up Automatic Billing Cycles

With recurring billing features, you can configure regular cycles that match the terms agreed with each client. Whether weekly, monthly, or quarterly, this setup eliminates the need to recreate billing documents repeatedly, allowing you to focus more on core tasks. Ensure that the timing aligns with your clients’ schedules to encourage prompt payments.

Customize for Client-Specific Needs

Different clients might have unique requirements, such as custom descriptions or varying amounts. Tailor each document to reflect these specifics before initiat

Benefits of Online Invoicing in QuickBooks

Switching to digital billing methods provides numerous advantages for businesses, enhancing efficiency, reducing paperwork, and improving communication with clients. Below are key benefits that highlight why many companies prefer digital billing solutions.

Benefit Description Faster Payment Processing Electronic documents allow clients to review and pay instantly, reducing delays often associated with traditional methods. Improved Record-Keeping All transactions are saved and organized in one platform, making it easy to access past Managing Client Information with QuickBooks

Efficiently organizing client details is crucial for accurate records, smooth transactions, and personalized communication. A centralized system for handling client data allows businesses to quickly access essential information, helping maintain strong, professional relationships.

Centralized Database for Client Records

Using a single platform for client data storage provides immediate access to essential details, such as contact information, payment history, and transaction preferences. This centralization reduces time spent searching for individual records and ensures consistency across all documents and communications.

Customizable Client Profiles

Each client can be assigned unique attributes, allowing for tailored interactions and more accurate billing. Custom fields can be added to track additional details like tax information, preferred payment methods, or specific discounts. This adaptability supports better client relationships by addressing individual needs efficiently.

Managing client details effectively leads to improved accur

How to Add Taxes to QuickBooks Invoices

Adding taxes to billing documents is essential for businesses operating in regions with sales tax requirements. Properly applying taxes ensures compliance and accurate charges for your clients, making the entire process smoother for both parties.

Setting Up Tax Rates

Before applying taxes to transactions, it’s important to configure the appropriate tax rates within your system. Most platforms allow users to define different rates based on location or product type. Setting these up in advance ensures consistency across all future transactions.

Applying Taxes to Client Charges

Once tax rates are set, taxes can be automatically applied to transactions as they are created. Simply select the relevant tax rate for each line item, or configure your system to apply the correct rate automatically based on the client’s location or the products being billed.

Step Description 1. Enable Tax Tracking Navigate to your settings and enable tax tracking options to apply taxes on future documents. 2. Add Tax Rates Create custom tax rates for different regions or tax categories to match your business’s needs. 3. Apply Tax to Items Select the relevant tax rate for each item or service, ensuring accuracy in client billing. 4. Review and Send Double-check all calculations and send the completed document to the client. By setting up tax rates and applying them to transactions, businesses ensure that they comply with tax laws while providing accurate charges to clients, streamlining the entire billing process.

Improving Cash Flow with QuickBooks Invoicing

Efficiently managing payments is crucial for maintaining a healthy cash flow within a business. By automating and streamlining the billing process, companies can accelerate revenue collection and reduce delays, ultimately improving their financial stability.

Automation of Billing Process

Automating the creation and sending of bills helps eliminate manual errors and delays. With an automated system, businesses can quickly send accurate billing documents to clients as soon as services or products are delivered. This reduces the time between completing a job and receiving payment, improving cash flow.

Timely Payment Reminders

Integrating automated reminders for overdue payments encourages clients to settle their balances promptly. These reminders can be customized based on the due date, ensuring clients are notified before the payment becomes overdue. This proactive approach reduces late payments and supports a steady cash flow.

By using automation tools and timely reminders, businesses can significantly enhance their cash flow, allowing for smoother operations and better financial planning.

Exporting and Sharing Invoices in QuickBooks

Sharing billing documents with clients and colleagues is a crucial part of streamlining business operations. Being able to quickly export these documents in various formats ensures smooth communication and allows for easy record-keeping. Efficient exporting options can help businesses stay organized and responsive.

Exporting such documents to formats like PDF allows for easy sharing through email or other digital platforms. Additionally, businesses can provide clients with accessible copies of their billing details, facilitating faster payments and reducing administrative overhead.

For further collaboration, some platforms also offer direct sharing options, allowing users to send documents to clients or team members without leaving the platform. This reduces the need for external tools and simplifies the process.