Free Sample Invoice Template Excel for Easy and Professional Billing

Managing financial transactions efficiently is crucial for any business. One of the most important aspects of this process is preparing clear and accurate billing documents. These records ensure both professionalism and transparency when dealing with clients. With the right tools, generating these documents can be simple and quick, even for those with minimal experience in accounting.

By using an easy-to-edit digital format, you can create tailored invoices that suit your specific needs. This allows you to focus on growing your business while keeping your financial records organized. Whether you’re an entrepreneur, freelancer, or small business owner, having a reliable system in place for creating professional documents will save you time and reduce errors.

Customization is key when it comes to billing. Tailor each document to include necessary details such as your business information, payment terms, and itemized costs. With the right approach, you can streamline your entire billing process and improve both the speed and accuracy of your financial reporting.

Sample Invoice Template Excel Overview

Creating billing documents can be a time-consuming task, especially when you need to ensure accuracy and professionalism. Having a reliable and easily customizable tool for generating these records is crucial for streamlining the financial management process. Using a pre-designed format allows businesses to quickly input the necessary details, reduce human error, and maintain consistency across all transactions.

The right digital solution offers the flexibility to modify essential sections, such as payment terms, business information, and itemized charges. This approach not only saves time but also ensures that your documents are aligned with industry standards. By leveraging such tools, both small businesses and large organizations can manage their finances more effectively.

Key Features of a Customizable Billing Document

These customizable formats typically offer various fields that can be filled in with specific details relevant to each transaction. The ability to change the layout, adjust tax calculations, and track payment statuses are among the most useful features. Additionally, many formats are designed to be user-friendly, making them accessible to those with little to no experience in accounting software.

How It Works

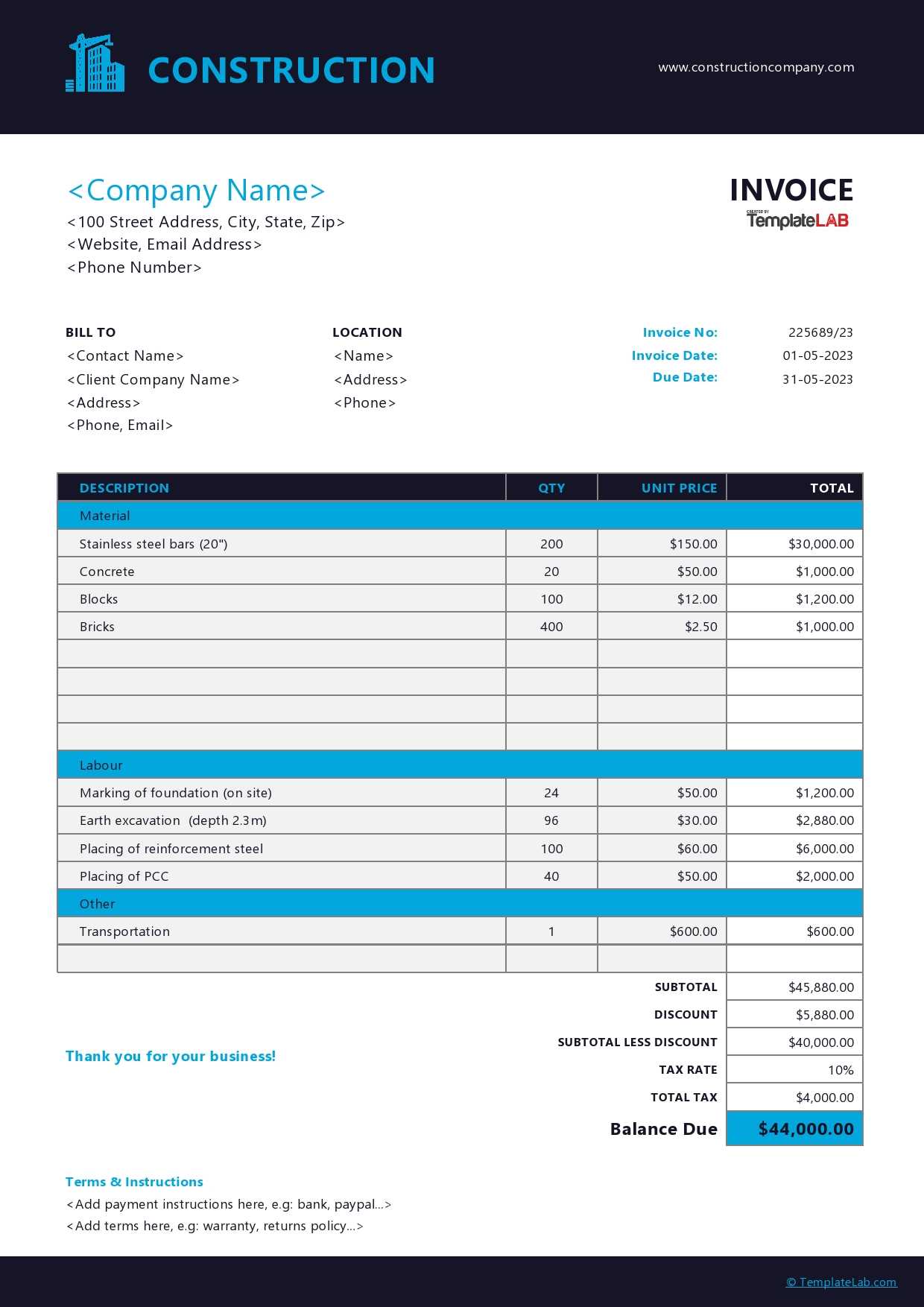

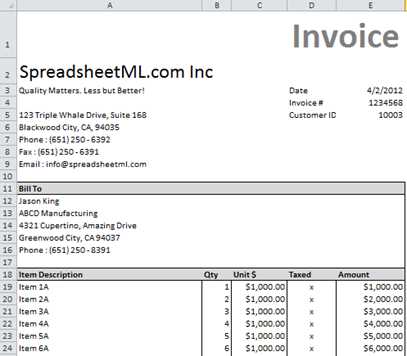

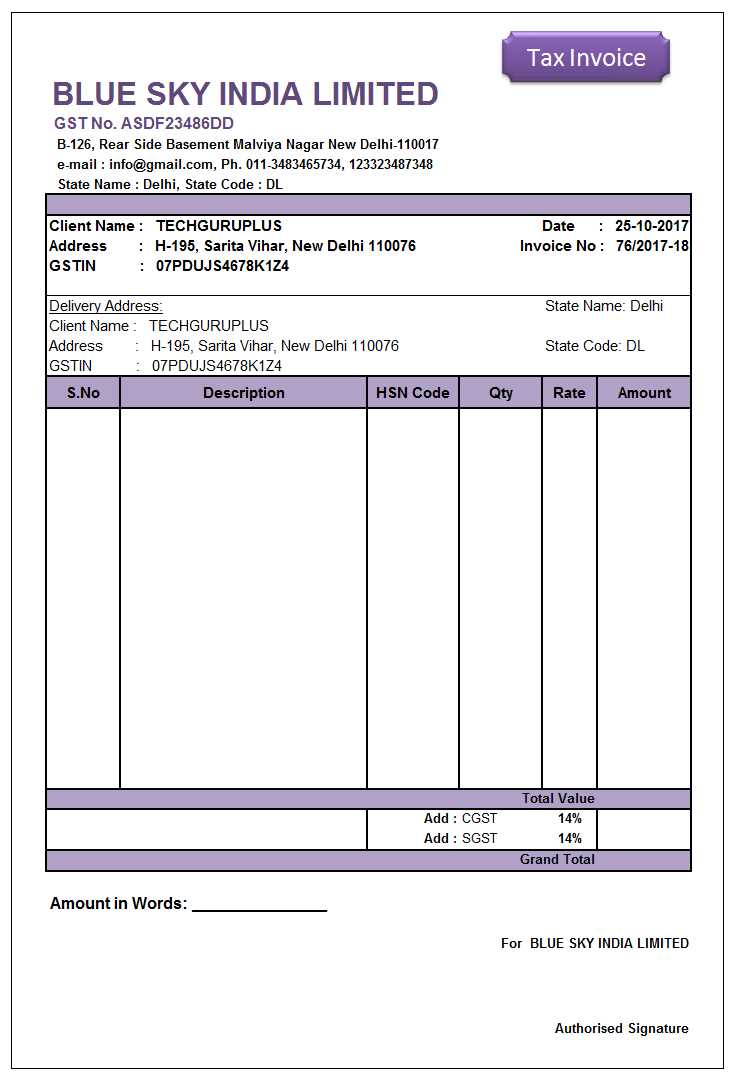

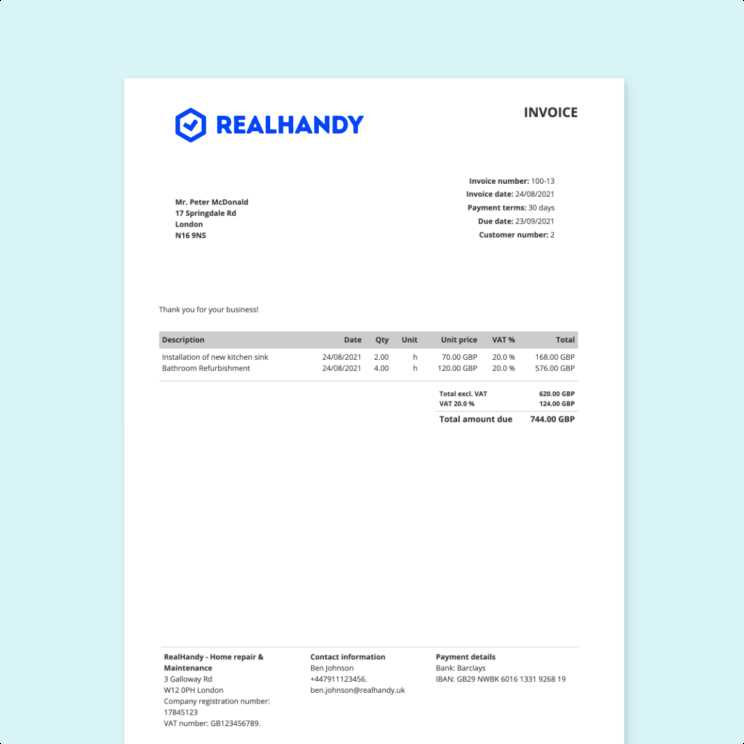

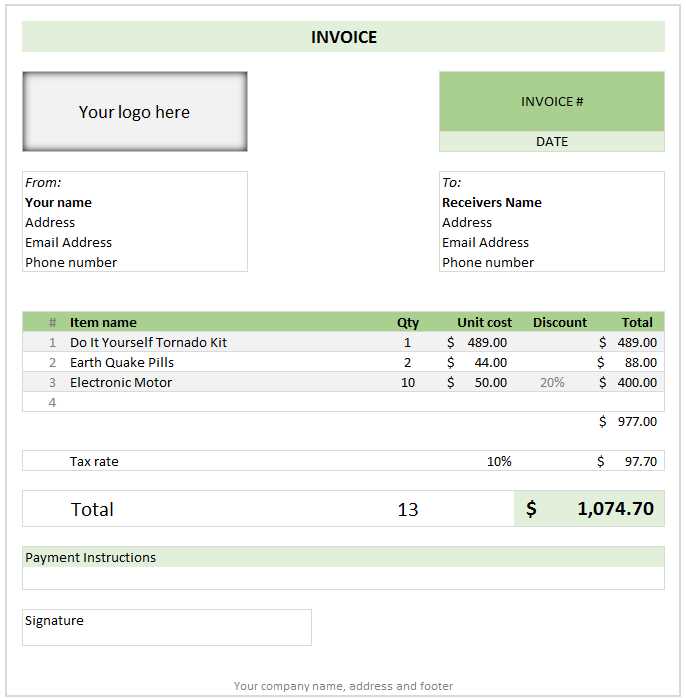

Using a pre-designed structure allows for quick edits and personalized adjustments. Below is an example of how a basic structure might look, showcasing common sections in these types of documents:

| Section | Purpose |

|---|---|

| Business Information | Includes company name, contact details, and tax information. |

| Client Details | Displays customer name, address, and contact information. |

| Itemized List | Describes products or services provided with costs. |

| Payment Terms | Specifies due dates, late fees, and accepted payment methods. |

| Totals | Shows the calculated total amount due, including taxes. |

This structure ensures that all necessary information is included and presented clearly, helping businesses maintain a professional appearance and ensuring their clients understand all relevant details of the transaction.

Why Use Excel for Invoice Creation

Choosing the right tool for creating billing documents is essential for streamlining financial processes and maintaining accuracy. Many businesses rely on flexible, widely available software to handle their record-keeping needs. A popular choice for generating such records is spreadsheet software, which provides users with a powerful, customizable platform for organizing and calculating transaction details.

One of the main advantages of using this type of software is its ease of use. The familiar grid layout allows users to quickly input information, perform calculations, and adjust the format as needed. Additionally, users can save and store their records in a structured way, making it easy to track payments and outstanding balances over time.

Customizability is another significant benefit. With spreadsheet tools, you can modify templates to fit the unique needs of your business. Whether you need to add new fields, adjust tax rates, or incorporate your company’s branding, the flexibility of these tools makes it simple to create professional documents that align with your specific requirements.

Furthermore, these programs support automation of common tasks, such as calculating totals or generating sequential document numbers. This functionality can save time and reduce errors, allowing businesses to focus on other aspects of their operations. The ability to quickly update and adjust documents without starting from scratch is another reason why so many professionals turn to spreadsheet software for billing needs.

Benefits of Customizable Invoice Templates

Using a flexible structure for creating financial documents offers numerous advantages for businesses of all sizes. Customizable designs enable users to tailor every aspect of their records, ensuring that each one meets specific needs while maintaining professionalism. By adjusting layouts, sections, and formulas, companies can create streamlined and accurate documents without relying on generic formats.

One key benefit is personalization. Customizable formats allow businesses to incorporate their own branding, including logos, color schemes, and unique fonts, which helps reinforce the company’s identity. This not only makes the documents look professional but also enhances brand recognition for clients and partners.

Increased Efficiency and Time-Saving

Another significant advantage is the ability to automate calculations and track payments effortlessly. By setting up formulas, users can quickly generate totals, tax amounts, and discounts without manual entry, reducing the likelihood of errors. This automation speeds up the process, allowing businesses to focus on other important tasks.

Adaptability for Different Use Cases

The adaptability of these structures makes them suitable for a variety of industries and business models. Whether you are a freelancer, small business owner, or part of a larger corporation, having a tailored solution ensures that all necessary information is included and that your records are clear and easy to understand. The ability to adjust the document as needed for specific transactions ensures that each interaction with clients is as smooth and professional as possible.

How to Download an Invoice Template

Downloading a customizable format for creating billing records is a simple process that can significantly improve the efficiency of your financial tasks. These pre-designed structures are available from numerous sources, offering various styles and functionalities. With just a few clicks, you can access a ready-to-use document that fits your business needs.

To download a suitable structure, follow these easy steps:

- Choose a Trusted Source – Look for websites or platforms that offer secure and reliable files. Popular document-sharing platforms, business websites, or even dedicated online tools often provide high-quality resources.

- Pick a Suitable Design – Browse through the available options and choose one that fits your business style and requirements. Make sure it includes necessary fields like client information, item descriptions, and payment terms.

- Download the File – Once you’ve selected the right option, click the download link. Depending on the website, the file may come in various formats, such as a spreadsheet or word processor file.

- Save to Your Device – After downloading, save the file to a secure location on your device. It’s recommended to store it in an organized folder for easy access when you need to create a new document.

Some platforms may also require you to sign up for an account or provide a small fee for premium designs, but many free options are available as well. Make sure to check the compatibility of the downloaded file with your preferred software before starting to use it.

Once downloaded, you can immediately start customizing the document according to your needs, adding business details, modifying the layout, or incorporating additional calculations.

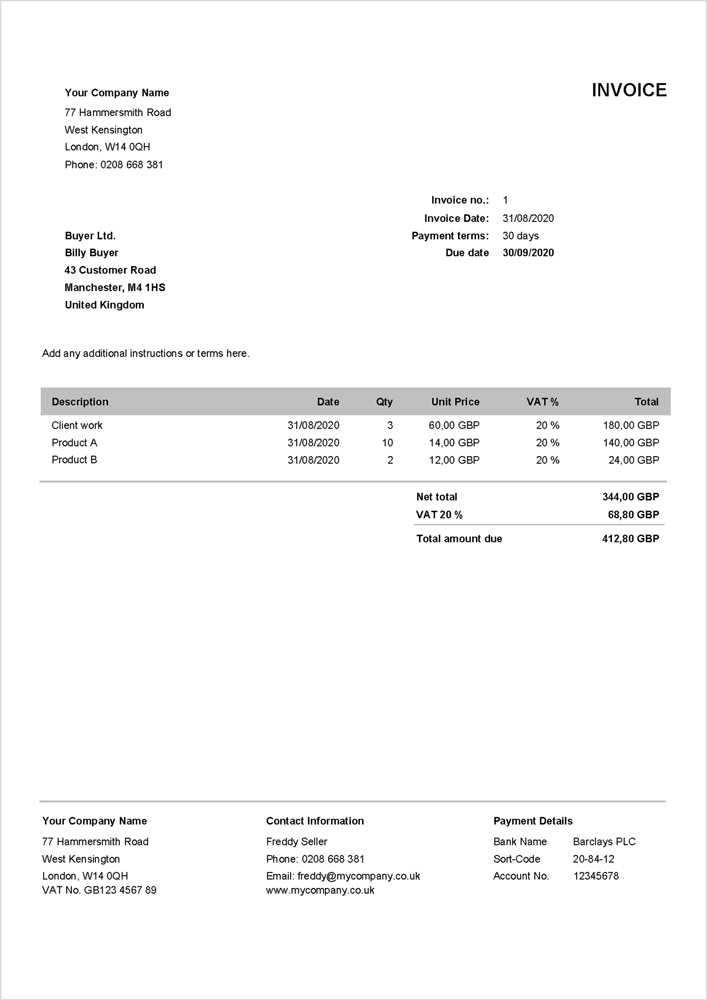

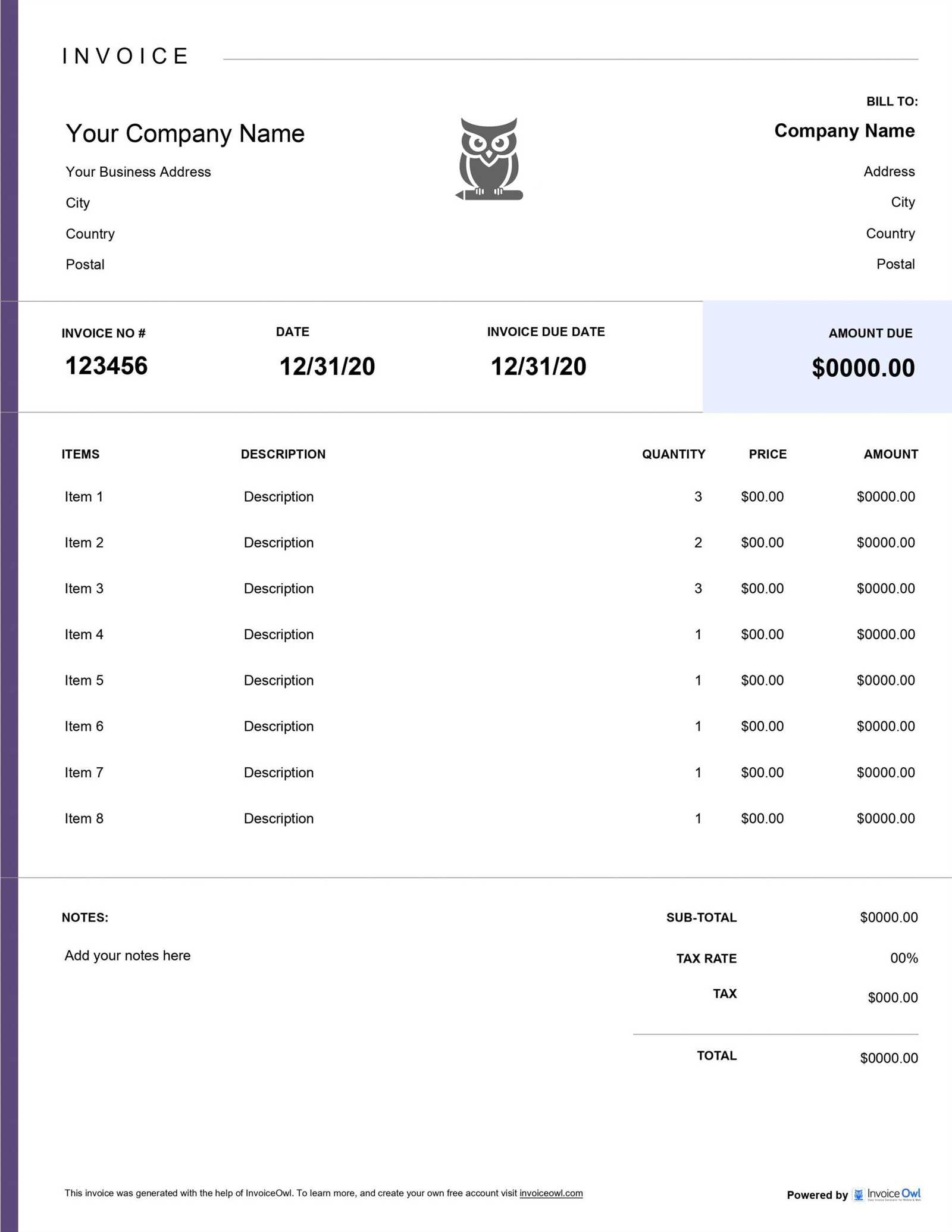

Key Features of a Good Invoice Template

Creating accurate and professional billing records requires a well-organized structure that includes all the necessary information for both the business and the client. A well-designed document not only ensures clarity but also helps reduce errors in financial tracking. The right structure should include essential sections that are easy to understand and modify, providing a seamless experience for users.

A good document format should be clean, easy to navigate, and include all relevant fields such as itemized charges, client details, and payment terms. Additionally, it should allow for quick customization so users can adjust the layout and content as needed to meet their specific requirements.

Essential Sections to Include

The most important elements to include are:

- Business Information – Clearly display your company’s name, contact details, and tax information.

- Client Details – Include the client’s name, address, and other relevant contact information.

- Itemized List – Provide a detailed breakdown of products or services, including descriptions and costs.

- Payment Terms – Specify the payment due date, late fees, and accepted payment methods.

- Total Amount – The final sum, including any taxes or discounts, should be clearly displayed.

Design and Usability Considerations

In addition to the content, the format should be easy to read and visually appealing. The use of clear headings, well-spaced sections, and consistent fonts helps improve legibility. It should also allow for quick adjustments and ensure that calculations (like taxes or discounts) are automatically updated when values change.

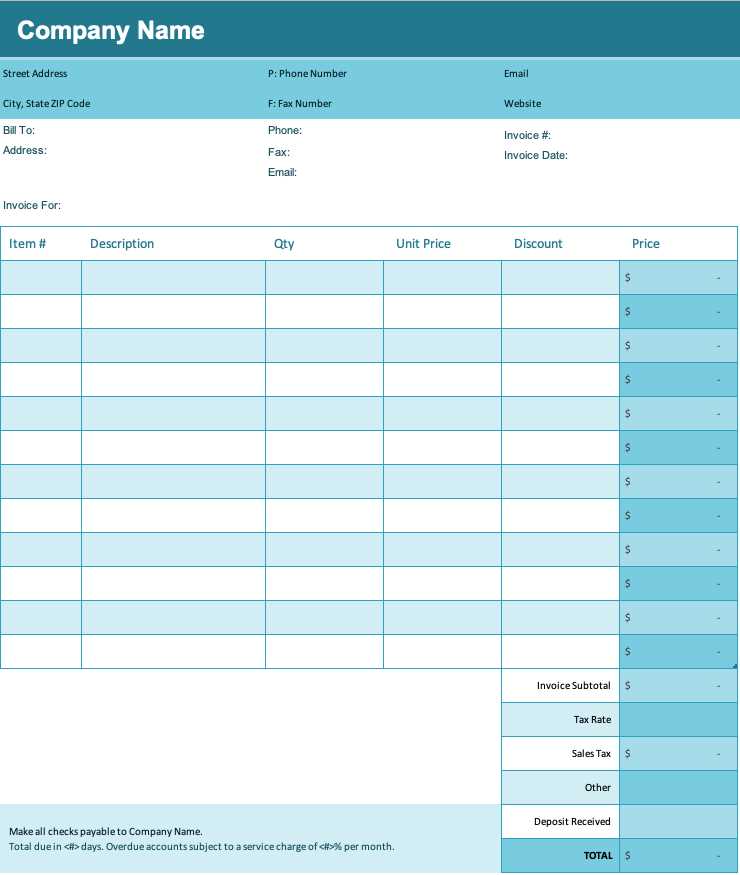

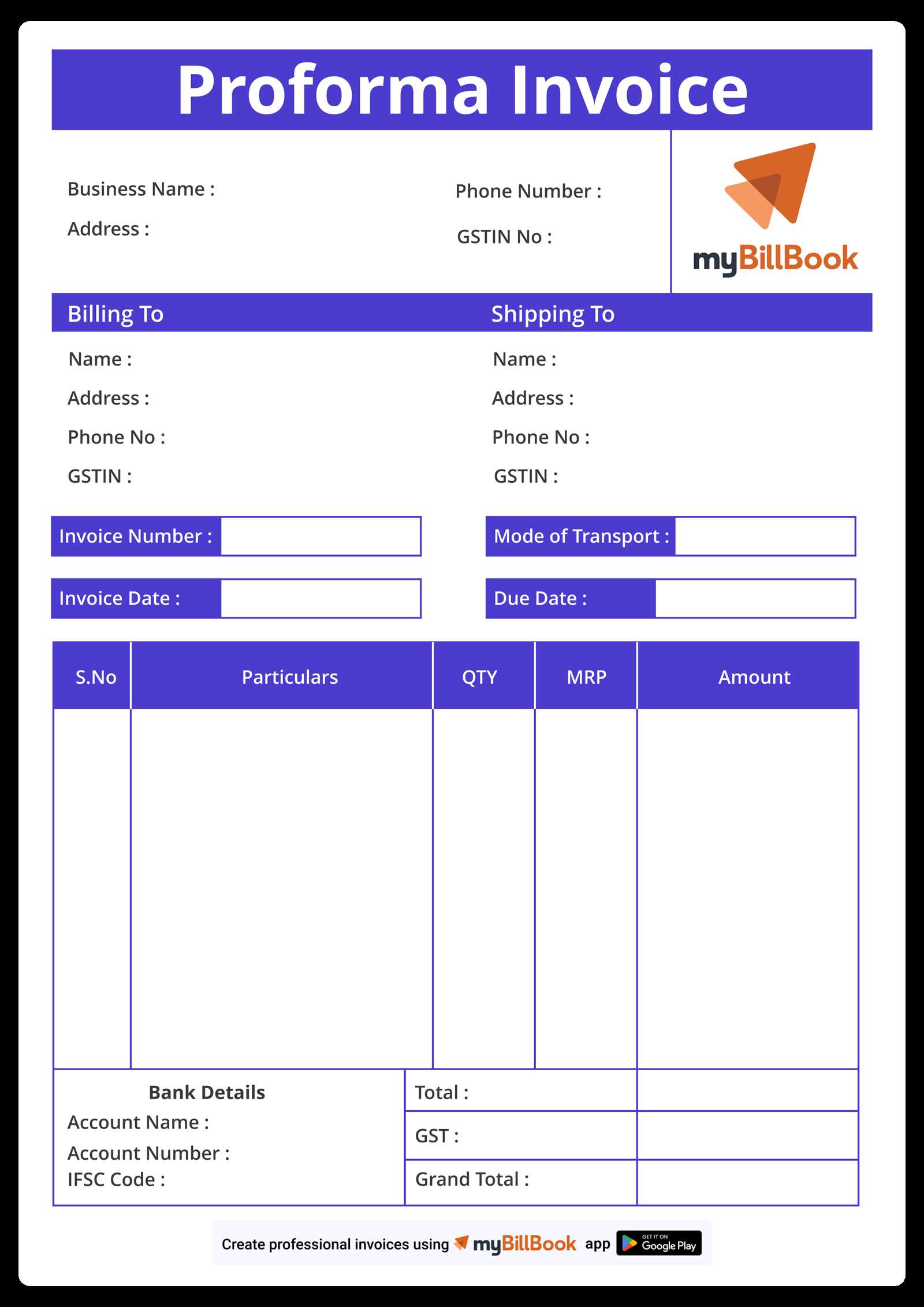

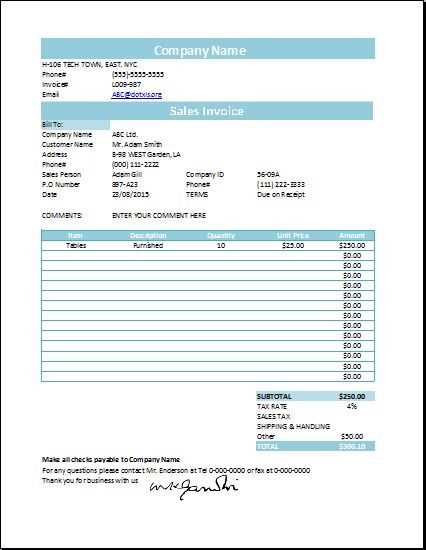

Steps to Customize Your Invoice

Customizing your billing document ensures it accurately reflects your business style, complies with legal requirements, and meets the specific needs of each transaction. By making small adjustments to the format, layout, and content, you can create a document that looks professional and is easy to understand. Here are the essential steps to personalize your record and ensure it is both functional and tailored to your brand.

Step 1: Update Business Information

The first thing to modify is your company’s details. Make sure to include:

- Company Name – Add the full name of your business or your name if you’re a freelancer.

- Contact Information – Include your phone number, email address, and physical address.

- Tax Identification Number – This is especially important for legal and tax purposes.

Step 2: Adjust Document Layout and Style

Next, personalize the layout to match your brand’s aesthetics. Adjust the following:

- Logo – Insert your company’s logo to maintain brand consistency.

- Fonts and Colors – Modify fonts and colors to align with your corporate branding or personal preference.

- Layout – Ensure that sections like the itemized list, totals, and payment terms are clear and easy to read.

Step 3: Personalize the Content

Now, tailor the content to suit the specific transaction:

- Client Information – Include the name, address, and contact details of the client or customer.

- Item Descriptions – Clearly describe the products or services provided, including quantities and prices.

- Payment Terms – Specify due dates, late fees, and acceptable payment methods (e.g., bank transfer, credit card, etc.).

- Additional Information – Add any extra details, such as special discounts, shipping costs, or terms of service.

Step 4: Automate Calculations

To reduce errors and save time, use formulas for automatically calculating totals, taxes, and discounts. For instance:

- Tax Calculation – Use a simple formula to calculate the sales tax based on the subtotal.

- Discounts – Automatically apply discounts to the total based on predefined percentages.

- Total Amount – Ensure that the final amount reflects all charges, taxes, and deductions.

By following these steps, you can create a personalized, professional document that stream

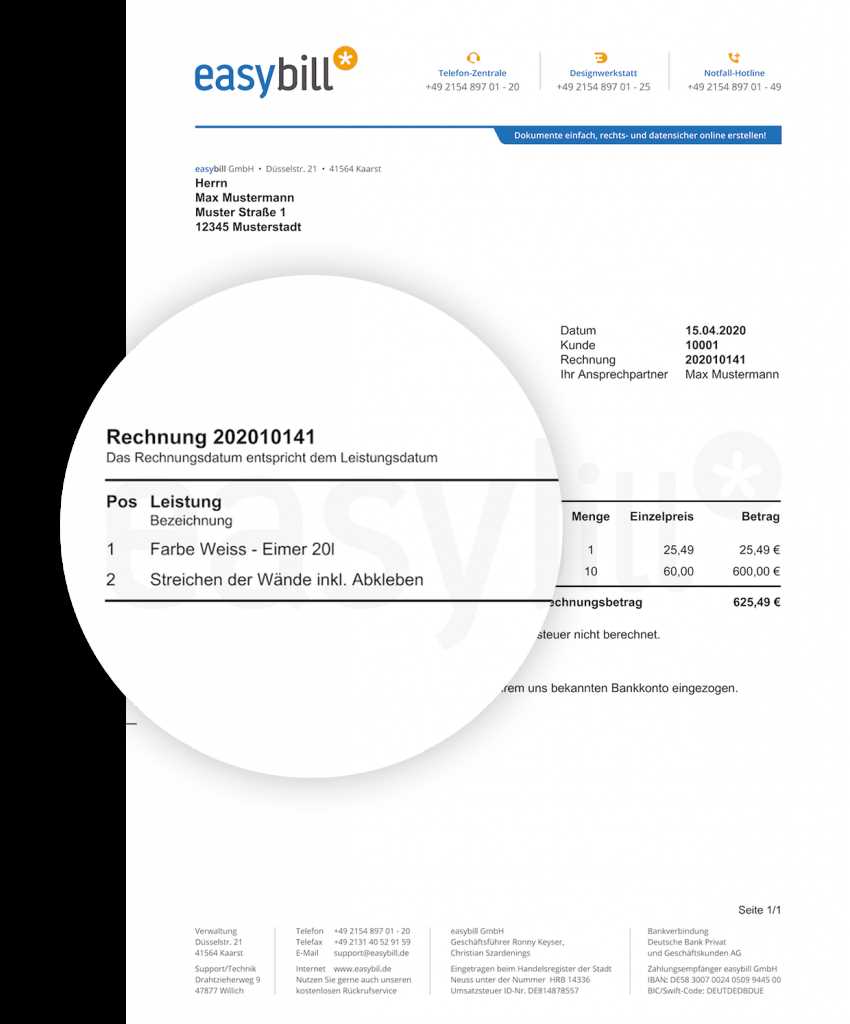

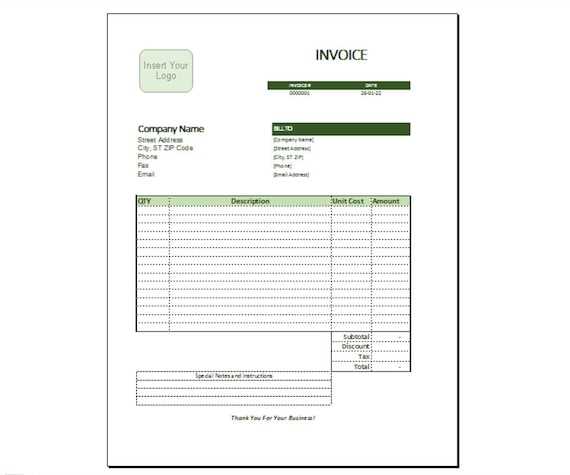

Adding Business Information to Your Invoice

Including accurate and clear business information in your billing records is essential for building trust and ensuring the smooth processing of transactions. This section provides the details that identify your company, facilitate communication, and ensure compliance with legal and tax regulations. Properly displayed business information also makes the document look more professional and reinforces your brand identity.

When adding business details to your record, make sure to include the following key elements:

- Company Name – Always list your business’s legal name as it appears on official documents or contracts.

- Logo – If applicable, insert your company’s logo at the top of the document to enhance brand recognition.

- Address – Include the physical address of your business, especially if it’s relevant for shipping or legal purposes.

- Phone Number – Provide a contact number where clients can reach you for any questions or clarifications.

- Email Address – Include a professional email address for correspondence related to the transaction.

- Tax Identification Number (TIN) – This is important for tax purposes and to confirm your legitimacy as a registered business entity.

- Website URL – If you have a company website, including the link can help clients quickly access more information about your business.

It is also a good idea to place this information prominently at the top or in a header section so that it is easy for clients to find. This helps ensure clarity and provides a professional touch to your billing documents. By including all the necessary business details, you not only stay compliant but also project a trustworthy image to your clients.

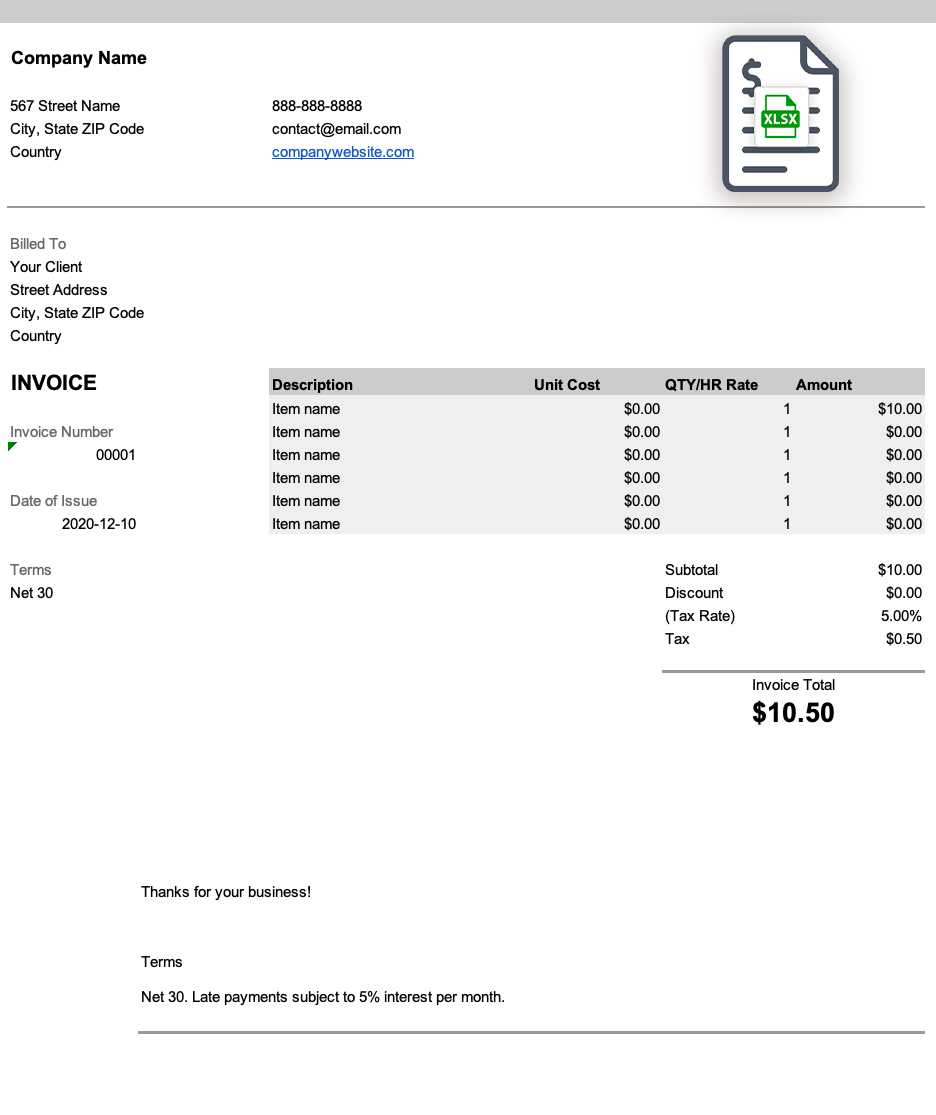

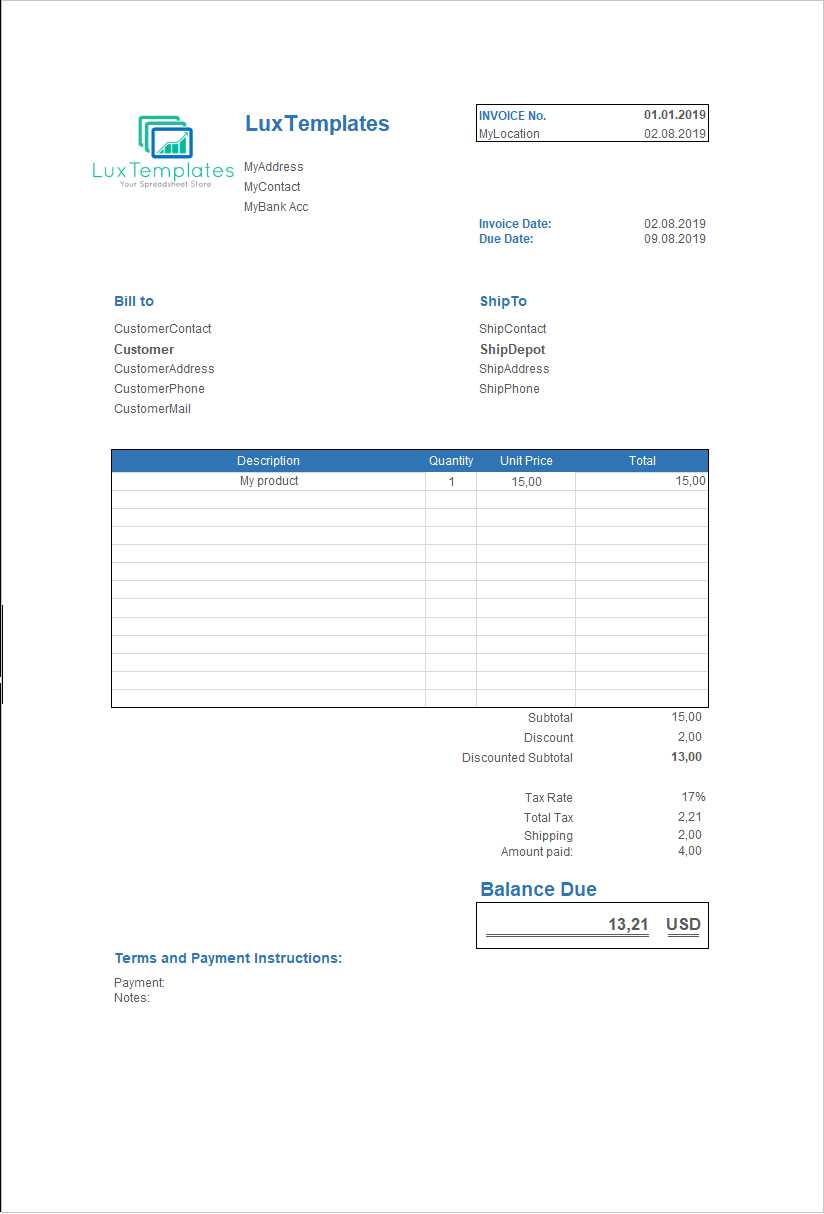

Tracking Payments with Excel Invoices

Effectively monitoring payments is essential for maintaining healthy cash flow and ensuring that no outstanding amounts are overlooked. A well-structured billing document can help you track payment status, due dates, and any remaining balances. With a few simple adjustments, you can integrate payment tracking features directly into your records, giving you full control over your financial data.

By using a spreadsheet, you can easily update and manage payment statuses for each transaction. These digital records allow you to track whether a payment has been received, if there are any outstanding amounts, and when a payment is due. Additionally, formulas can be set up to automatically calculate totals, track partial payments, and even send reminders for overdue amounts.

Essential Payment Tracking Features

To efficiently track payments, the following features should be included in your document:

- Payment Status Column – Add a column that indicates whether a payment has been “Paid”, “Pending”, or “Overdue”.

- Due Date – Ensure that a specific due date is mentioned for each transaction to help you stay on top of payments.

- Amount Paid – Track how much the client has paid so far, including partial payments if applicable.

- Remaining Balance – A formula can calculate the difference between the total amount and what has been paid, helping you quickly identify outstanding amounts.

- Payment Method – Track how the payment was made (e.g., bank transfer, credit card, cash).

Example Payment Tracking Table

Here’s an example of how a payment tracking section might look in your document:

| Transaction ID | Client Name | Due Date | Total Amount | Amount Paid | Remaining Balance | Status | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 001 | John Doe | 2024-11-30 | $500 | $500 | $0 | Paid | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 002 | Jane Smith | 2024-12-15 | $300 | $150 | $150 | Partial | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| How to Calculate Taxes in Excel Invoices

Calculating taxes accurately is an essential part of any financial document, ensuring that both you and your clients are clear on the amounts owed. Adding tax calculations to your records helps you maintain transparency and ensures compliance with local tax laws. By using formulas in a spreadsheet, you can easily automate the process and reduce the risk of errors. To calculate taxes on a transaction, you’ll need to know the applicable tax rate and apply it to the total cost of the goods or services being billed. This can be done using simple mathematical formulas that can be adjusted based on the specific needs of each client or region. Basic Tax Calculation FormulaThe basic formula to calculate taxes involves multiplying the total amount by the tax rate. Here’s how you can structure it:

For example, if the total amount is $200 and the tax rate is 10%, the tax amount would be $20, and the final amount due would be $220. Example Calculation TableBelow is an example of how you might structure your billing record with tax calculations:

In this example, the tax is calculated based on a 10% rate applied to the subtotal of each item. You can adjust the tax rate based on your specific requirements and local laws. By setting up Setting Up Invoice Numbers AutomaticallyAutomatically generating unique identification numbers for each transaction is an important feature for maintaining organized and accurate financial records. By setting up an automated numbering system, you ensure that every billing document has a distinct reference number, preventing duplicates and helping you easily track all issued records. This system also saves time and effort by eliminating the need to manually assign numbers to each new document. One of the simplest ways to set up automatic numbering is by using the built-in features of your spreadsheet software. A dynamic formula can be applied to automatically generate sequential numbers, ensuring that each new document is assigned a unique identifier. This not only simplifies the process but also helps with compliance and audits, as each record is traceable and clearly labeled. How to Set Up Automatic NumberingTo set up an automatic numbering system, follow these steps:

Example of Automatic Numbering SetupHere’s a simple example of how the numbering could work in a billing document:

Which Tool is Best for Your Business?Each tool has its strengths and weaknesses, depending on your business’s size, transaction volume, and complexity. Spreadsheets are a great choice for smaller businesses or freelancers who need a low-cost and flexible solution. However, as your business grows, you might find dedicated Saving and Exporting Your Excel InvoiceOnce you’ve completed your billing document, it’s essential to save and export it properly to ensure it’s easily accessible and shareable with clients. Proper file management helps maintain a clear record of your financial transactions, while exporting your document in the right format ensures compatibility with email clients and online payment systems. Whether you need to send it as a PDF for professional presentation or keep it in an editable format for future use, understanding how to save and export your document efficiently is key. How to Save Your Document

Saving your file in the right format is crucial for both security and ease of access. Here’s how to do it:

How to Export Your DocumentExporting your document in the right format ensures that it can be easily shared with clients or colleagues. Here’s how to do it:

By saving and exporting your billing documents correctly, you can ensure that they are both professionally presented and easy to share with clients, improving your workflow and maintaining organized financial records. Common Mistakes in Invoice CreationCreating billing documents may seem straightforward, but there are several common pitfalls that can lead to confusion or delays in payment. Whether you are new to managing financial records or simply want to improve your process, avoiding these mistakes can help maintain professionalism, prevent errors, and ensure timely payments. Understanding where issues commonly arise will enable you to streamline your workflow and enhance client satisfaction. In this section, we will explore some of the most frequent mistakes made when preparing billing documents, and provide tips on how to avoid them in the future. 1. Missing or Incorrect Client Information

One of the most critical mistakes is failing to include the correct details for the client. Missing information such as the business name, address, or contact details can delay communication and payments. Ensure that all client data is accurate and up-to-date before sending the document.

2. Inaccurate Pricing and CalculationsErrors in pricing, discounts, or tax calculations are among the most common mistakes. A small miscalculation can lead to overcharging or undercharging a client, which may result in disputes or delayed payments.

3. Lack of Clear Payment TermsNot clearly stating payment terms can lead to misunderstandings. Ensure that your payment terms (such as due date, late fees, and accepted payment methods) are explicitly mentioned to avoid confusion and delays in receiving payments.

4. Not Including Unique Document Numbers

Failing to assign a unique identifier to each document can create confusion and make it difficult to track payments and maintain organized records. Every billing document should have a unique number for easy reference.

5. Forgetting to ProofreadSmall mistakes in spelling, grammar, or formatting can undermine the professionalism of your billing documents. Taking the time to proofread and ensure everything is correct will help create a positive impression.

6. Incorrect File FormatSending documents in the wrong format can lead to compatibility issues, especially when clients or payment systems cannot open or read your file. Always save and export documents in a commonly accepted format, such as PDF.

|